UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07840 |

|

Schroder Series Trust |

(Exact name of registrant as specified in charter) |

|

875 Third Avenue, 22nd Floor New York, NY | | 10022 |

(Address of principal executive offices) | | (Zip code) |

|

Schroder Series Trust P.O. Box 8507 Boston, MA 02266 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-464-3108 | |

|

Date of fiscal year end: | October 31, 2012 | |

|

Date of reporting period: | October 31, 2012 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Schroder Mutual Funds

October 31, 2012 | Annual Report |

| |

| Schroder North American Equity Fund Schroder U.S. Opportunities Fund Schroder U.S. Small and Mid Cap Opportunities Fund Schroder Emerging Market Equity Fund Schroder International Alpha Fund Schroder International Multi-Cap Value Fund Schroder Global Quality Fund Schroder Total Return Fixed Income Fund Schroder Absolute Return EMD and Currency Fund |

Table of Contents

Letter to Shareholders | 1 |

| |

Management Discussion and Analysis | 3 |

| |

Schedules of Investments | |

| |

North American Equity Fund | 25 |

| |

U.S. Opportunities Fund | 34 |

| |

U.S. Small and Mid Cap Opportunities Fund | 37 |

| |

Emerging Market Equity Fund | 40 |

| |

International Alpha Fund | 43 |

| |

International Multi-Cap Value Fund | 45 |

| |

Global Quality Fund | 61 |

| |

Total Return Fixed Income Fund | 72 |

| |

Absolute Return EMD and Currency Fund | 82 |

| |

Statements of Assets and Liabilities | 88 |

| |

Statements of Operations | 90 |

| |

Statements of Changes in Net Assets | 92 |

| |

Financial Highlights | 96 |

| |

Notes to Financial Statements | 100 |

| |

Report of Independent Registered Public Accounting Firm | 116 |

| |

Information Regarding Review and Approval of Investment Advisory Contracts | 117 |

| |

Disclosure of Fund Expenses | 121 |

| |

Trustees and Officers | 123 |

| |

Notice to Shareholders | 125 |

Proxy Voting (Unaudited)

A description of the Funds’ proxy voting policies and procedures is available upon request, without charge, by visiting the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov, or by calling 1-800-464-3108 and requesting a copy of the applicable Fund’s Statement of Additional Information or on the Schroder Funds website at http://www.schroderfunds.com, by downloading the Funds’ Statement of Additional Information. Information regarding how the Funds voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request by calling 1-800-464-3108 and on the SEC’s website at http://www.sec.gov.

Form N-Q (Unaudited)

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

December 5, 2012

Dear Shareholder:

The world economy continues to face a period of sluggish growth and recent data has supported this view with surveys on the manufacturing sector broadly softening. In part, this has been driven by a fading inventory cycle which had rebounded after last year’s supply chain disruptions.

Meanwhile, the lack of resolution in the Euro crisis continues to plague activity and sentiment with the expectation of a Spanish bailout keeping markets in anticipation. However, the tail risk in this region has been reduced given the recent intervention by the European Central Bank (ECB). The ECB President Mario Draghi said that he would do “whatever it takes” to save the Euro and he has followed up with a plan to buy bonds in potentially unlimited amounts.

Global monetary policy is set to remain accommodative with central banks in the major developed economies expected to keep interest rates low for an extended period. This is underscored by the Fed’s intention to maintain current rates until mid-2015. The US central bank has also recently announced Quantitative Easing (QE) 3, which is worth $40 billion per month of mortgage-backed security purchases. At the same time, the ECB has moved a step further with its commitment in buying peripheral European debt. In the UK, the Bank of England has expanded asset purchases this year and is expected to provide additional stimulus further down the road. For emerging central banks, such as China, we expect to see more cuts in interest rates and bank reserve ratios.

While the cyclical growth dynamics over the last three months have continued to disappoint, investors are likely to continue searching for yield as interest rates remain pinned to the floor. This is expected to push investors along the risk curve in 2013 into credit and higher yielding equities.

Having been at the heart of the financial crisis, the housing market in the US is showing signs of life with starts and sales picking up significantly. Stronger residential investment and construction employment will help the recovery. However, having shrunk to a fraction of its previous size, the housing sector’s ability to impact wider GDP has been diminished. Furthermore, the upswing does not seem to have been driven by mortgage borrowing as households continue to de-leverage. For a revival in mortgage lending we will probably need to see a sustained rise in house prices as negative equity is one of the key factors holding back the willingness and ability to take on more debt. Home prices have fallen significantly in the US, pushing many households underwater such that the value of their mortgage exceeds the value of their property.

While we expect the US to avoid the “fiscal cliff” with a deal being achieved in Congress before year-end, we still expect a tightening of fiscal policy of 1.5% of GDP in 2013. Given recent evidence of the increased power of fiscal policy to hit growth, this will still be a significant dampener on activity.

In addition, with several countries currently tightening fiscal policy together, external demand is also likely to be weak, limiting the ability of the economy to grow through the export channel. This effect is often enhanced by a fall in the exchange rate of the country tightening fiscal policy, an effect which is likely to be muted or even absent when several countries are tightening their budgets simultaneously. This suggests that even with a fiscal tightening of 1.5% of GDP, the US economy will struggle to grow much above 2% in 2013 and the outcome could be worse.

We remain constructive on equities where we favor high quality companies with strong balance sheets, as these companies are more likely to continue paying dividends. We still favor the US and UK on a relative basis because of their defensive, lower beta characteristics.

In comparison, our stance on other markets is broadly neutral. Both Pacific ex Japan and emerging markets are exposed to downside risk to global and Chinese growth, though lower inflation in the emerging region we expect will provide greater room for monetary and fiscal stimulus.

Meanwhile, we have become less negative on European equities given attractive valuations and reduced risks from the region resulting from the ECB’s commitment in buying peripheral European bonds. On Japan, the recent stimulus measures by the authorities have to be balanced with the strength of the yen, which puts a cap on the export-driven equity market.

1

As we stated in the Funds’ Semi-Annual Report, in this type of environment, we believe that the investor who maintains a diversified portfolio — both across asset classes and geographic borders — should be able to weather the bumpy periods better than those who have high concentrations in one or two sectors or regions. We encourage you to consult with your financial advisor to ascertain whether your current mix of investments is suitable for your long-term objectives.

Again, we thank you for including Schroders in your financial plan and we look forward to our continued relationship.

| Sincerely, |

| |

|

|

| |

| Mark A. Hemenetz, CFA |

| President |

The views expressed in the following report were those of each respective Fund’s portfolio management team as of the date specified, and may not reflect the views of the portfolio managers on the date this Annual Report is published or any time thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice; investors should consult their own investment professionals as to their individual investment programs. Certain securities described in these reports may no longer be held by the Funds and therefore may no longer appear in the Schedules of Investments as of October 31, 2012.

2

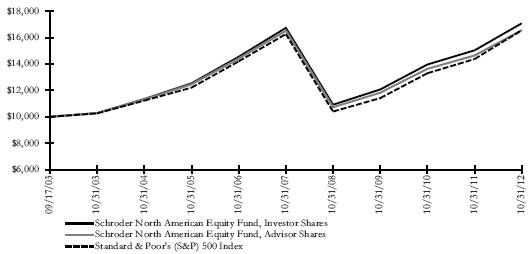

Schroder North American Equity Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder North American Equity Fund (the “Fund”) rose 13.59% (Investor Shares) and 13.04% (Advisor Shares). For the same twelve-month period, the S&P 500 Index (the “Index”) rose by 15.21%.

Market Background

US equity markets enjoyed solid gains overall for the year ended October 31, 2012, as improving economic indicators boosted sentiment. Investors shrugged off lingering concerns about European debt and Chinese growth as the US unemployment rate eased, house prices and consumer confidence rose and Gross Domestic Product (GDP) data moved in the right direction.

Despite market volatility in the fourth quarter of 2011, US equities proved the best performing region overall. Improving employment, consumer confidence, and services and manufacturing data buoyed sentiment. In addition, confidence rose on the back of some good corporate earnings results and the coordinated action taken by the US Federal Reserve Bank and five other major central banks to ease the dollar funding pressure.

The optimism extended into the first quarter of 2012 with US equities recording their strongest first-quarter gains since 1998. The US labor market added nearly three quarters of a million jobs over the quarter, boosting hopes for the global economic growth outlook.

Sentiment subsequently began to deteriorate as concerns about economic and fiscal stability in peripheral Europe and worries of a slowdown in China re-emerged, while the looming US “fiscal cliff” and weakening demand raised fears that the US economy would be unable to return to a more robust rate of growth in the near term.

However, in a continued bid to bring down long-term interest rates, the Federal Open Market Committee agreed to extend ‘Operation Twist’, while the Fed’s launch of a third round of quantitative easing towards the end of the period boosted confidence and helped to secure positive equity market returns over the period as a whole.

Cyclical sectors benefited from growing risk appetite over the period. House-builders and building-related companies outperformed, along with banking stocks, retailers and oil-services names. Pockets of risk aversion also supported traditionally defensive stocks, such as tobacco companies, pharmaceuticals and telecommunications.

Portfolio Review

Both the Fund and Index delivered absolute gains over the period, although the Fund’s returns lagged the Index. Weaker stock selection among media, retail and machinery holdings, along with the Fund’s larger relative exposure to resource and mining stocks, accounted for the majority of this performance gap.

In terms of contributors, real estate stocks outperformed while good performance by biotechnology and managed healthcare companies offset underperforming healthcare providers. The Fund’s underweight allocation to utilities stocks also added value as this sector underperformed the market.

Outlook

The Fund remains well diversified in a broad range of opportunities across the market, and we believe it is structured to perform across a broad range of market environments. Multiple investment strategies are spread across a large number of small stock positions to capture broad themes and limit stock-specific risk while top down risks (such as those arising from region and sector positions) are carefully managed.

Within cyclical parts of the market, we prefer technology stocks, specifically semiconductors and hardware. Consumer discretionary remains an underweight within the Fund’s portfolio.

Within defensives, we are overweight healthcare favouring healthcare equipment and service providers. The Fund continues to hold an underweight allocation to utilities.

Within resources, we retain a preference for energy but selectively favour mining stocks that demonstrate very high levels of profitability.

In addition, the Fund’s strategy remains focused on higher-quality companies within financials.

3

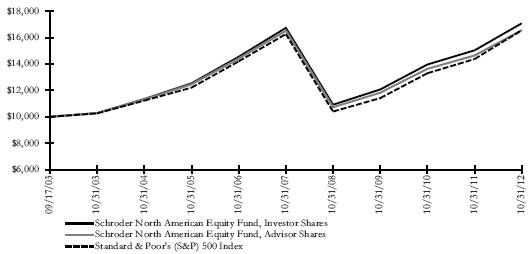

Comparison of Change in the Value of a $10,000 Investment in the Schroder North American Equity Fund

Investor and Advisor Shares vs. the Standard & Poor’s (S&P) 500 Index.

The S&P 500 Index is a market capitalization value weighted composite index of 500 large capitalization U.S. companies and reflects the reinvestment of dividends.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Annualized

Since Inception | |

Schroder North American Equity Fund — | | | | | | | |

Investor Shares | | 13.59 | % | 0.40 | % | 6.05 | %(b) |

Advisor Shares | | 13.04 | % | 0.04 | % | 5.68 | %(c) |

Standard & Poor’s (S&P) 500 Index | | 15.21 | % | 0.36 | % | 5.68 | % |

(a) | Average annual total return. |

(b) | The Investor Shares commenced operations on September 17, 2003. |

(c) | The Advisor Shares commenced operations on March 31, 2006. The performance information provided in the above table for periods prior to March 31, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares. |

“Total Return” is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

Apple | | 4.2 | % |

ExxonMobil | | 3.3 | |

Chevron | | 1.8 | |

Microsoft | | 1.7 | |

International Business Machines | | 1.7 | |

* Excludes Short-Term Investment.

Sector Allocation

Sector | | % of Net Assets | |

Information Technology | | 17.8 | % |

Financials | | 14.8 | |

Healthcare | | 13.8 | |

Energy | | 10.9 | |

Industrials | | 9.9 | |

Consumer Staples | | 9.9 | |

Consumer Discretionary | | 8.7 | |

Materials | | 3.1 | |

Telecommunication Services | | 2.5 | |

Utilities | | 1.8 | |

Short-Term Investment | | 6.5 | |

Other Assets and Liabilities | | 0.3 | |

4

Schroder U.S. Opportunities Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder U.S. Opportunities Fund (the “Fund”) rose 10.00% (Investor Shares) and 9.76% (Advisor Shares) compared to the Russell 2000 Index (the “Index”), a broad-based basket of stocks with characteristics similar to the Fund’s portfolio, which rose 12.08%.

Market Background

The one-year period had divergent sub-periods which could be characterized as “risk on/risk off”. The period began rather quietly (i.e., “risk off”) as returns for November and December 2011 were both close to flat. Once the calendar turned, the market rose sharply for the first three months of the year (“risk on”) with a return for the Index of 12.44%. There was optimism about the US economy until April when concerns rose about the slow pace of recovery in the jobs market in tandem along with worries about US consumer spending combined with renewed worrisome headlines from Europe. As a result, the market returned to a “risk off” posture and pulled back fairly sharply in April and May. A positive return in June led to a full second quarter return of -3.47% for the Index. Investors began asking whether this was a replay of the market pullback in the second and third quarters of 2011. The third quarter began with a decline in July but August and September returns were good and the full quarter return, as measured by the Index, was 5.25%. Then in October the market hit another skid, with the Index dropping by 2.17%. In general, macroeconomic news has played a powerful role this year. Global events such as the sovereign debt crisis in Europe, slowing economic growth in China and domestic developments such as slow US Gross Domestic Product (GDP) growth, actions by the Federal Reserve and the Presidential and Congressional elections all had market impact at points during the year.

Portfolio Review

The Fund underperformed the Index for the year ending October 31, 2012. Underperformance was driven in part by changing market conditions and by portfolio holdings. The impact of beta clearly varied by sub-period.

Over the twelve-month reporting period, higher beta stocks outperformed lower beta issues. The Fund’s investment style leads us to overweight the lower beta segments of the Index and underweight high beta. Interestingly, capitalization was much less of a factor than it has been in some other periods. There was no clear pattern of returns across the capitalization deciles.

From a sector/stock perspective, the Fund suffered from poor stock selection in financials with the biggest detractor being our underweight in real estate investment trusts (REITs). The Fund’s exposure was 2.6% over the year while the industry weight was 8.7%. REITs rose by 19.6% as investors sought yield-oriented stocks. Another key detractor in financials was in banking, where an underweight and lagging stock selection combined to create a relative performance drag on the Fund. Value was added on mortgage-oriented and savings and loan companies, with Fund’s holding in Ocwen Financial rising by 166.0%. The other key detractor was the Fund’s cash holding which averaged 9.85% during the year. In a market rising by 12.07%, minimal returns available to cash were a drag on overall returns.

On the positive side, the Fund saw significant value added by stock selection in the healthcare, technology and utility sectors. In health care, the Fund benefitted from holdings in MedAssets and Parexel International; in technology from AboveNet and Kenexa and in utilities Cleco was an important contributor. MedAssets helps hospitals and health care systems in cost management by operating a group purchasing organization and also offers cost and revenue management consulting and analytical tools. Parexel International is a contract research organization offering clinical trial management services to biopharmaceutical and pharmaceutical companies. AboveNet, a communications technology concern, and Kenexa, a provider of human relations management software, both received takeover offers during the year. Cleco is an electric utility engaged in generation and transmission of electricity within Louisiana with an attractive return on equity and growth path.

Outlook

We have expressed concerns over the past year about high levels of expected earnings from Wall Street. That concern remains as analysts are projecting 21% earnings growth for small cap stocks in 2013. Given a generally slow growth economy and the unresolved issues surrounding the “fiscal cliff” we believe those estimates to be optimistic at the least. We do believe that the actions of the Federal Reserve extending their low rate horizon into mid-2014 to 2015 have clearly indicated a background that is more hospitable to risk assets. The negative at the time of this writing is the difficulties in Washington coming to resolution on fiscal cliff issues. Without question, both sides have difficult compromises to make on taxes and spending, but it is important for the country that a resolution be found within a reasonable time frame.

5

Comparison of Change in the Value of a $10,000 Investment in

the Schroder U.S. Opportunities Fund — Investor and Advisor Shares vs. the Russell 2000 Index.

The Russell 2000 Index is a market capitalization weighted broad-based index of 2,000 small capitalization U.S. companies.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Ten Years Ended

October 31, 2012 (a) | |

Schroder U.S. Opportunities Fund(b)(c) — | | | | | | | |

Investor Shares | | 10.00 | % | 1.80 | % | 11.00 | % |

Advisor Shares | | 9.76 | % | 1.55 | % | 10.74 | %(d) |

Russell 2000 Index | | 12.08 | % | 1.19 | % | 9.58 | % |

(a) | Average annual total return. |

(b) | Effective May 1, 2006, the combined advisory and administrative fees of the Fund increased to 1.00% per annum. If the Fund had paid such higher fees during prior periods, the returns of the Fund would have been lower. |

(c) | The portfolio manager primarily responsible for making investment decisions for the Fund assumed this responsibility effective January 2, 2003. The performance results for periods prior to January 2, 2003 were achieved by the Fund under a different portfolio manager. |

(d) | The Advisor Shares commenced operations on May 15, 2006. The performance information provided in the above table for periods prior to May 15, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares. |

“Total Return” is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

IDACORP | | 1.9 | % |

Waste Connections | | 1.6 | |

Applied Industrial Technologies | | 1.6 | |

Packaging Corp. of America | | 1.5 | |

NorthWestern | | 1.5 | |

* Excludes Short-Term Investment.

Sector Allocation

Sector | | % of Net Assets | |

Consumer Discretionary | | 18.7 | % |

Financial Services | | 15.0 | |

Producer Durables | | 12.9 | |

Healthcare | | 12.3 | |

Technology | | 10.2 | |

Materials & Processing | | 9.9 | |

Utilities | | 5.4 | |

Other Energy | | 4.3 | |

Consumer Staples | | 1.9 | |

Investment Company | | 0.5 | |

Short-Term Investment | | 9.3 | |

Other Assets and Liabilities | | (0.4 | ) |

6

Schroder U.S. Small and Mid Cap Opportunities Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder U.S. Small and Mid Cap Opportunities Fund (the “Fund”) rose 8.41% (Investor Shares) and 8.07% (Advisor Shares) compared to the Russell 2500 Index (the “Index”), a broad-based basket of stocks with characteristics similar to the Fund’s portfolio, which rose 13.00%.

Market Background

The one-year period had divergent sub-periods which could be characterized as “risk on/risk off”. The period began rather quietly (i.e., “risk off”) as returns for November and December 2011 were both close to flat. The Fund kept pace for these two months. Once the year turned, the market rose sharply for the calendar quarter (“risk on”) with a return for the Index of 12.99%. There was optimism about the US economy until April when concerns rose about the slow pace of recovery in the jobs market in tandem along with worries about US consumer spending combined with renewed worrisome headlines from Europe. The market returned to a “risk off” posture and began to slide in April and pulled back sharply in May. A positive return in June led to a full second quarter return for the Index of -4.14%. Investors began asking whether this was a replay of the market pullback in the second and third quarters of 2011. The third quarter began with a decline in July but August and September returns were good and the Index’s full quarter return was 5.57%. Then in October the market hit another skid, dropping by 1.05%. In general, macroeconomic news has played a powerful role this year. Global events such as the sovereign debt crisis in Europe, slowing economic growth in China and domestic developments such as slow US GDP growth, actions by the Federal Reserve and the Presidential and Congressional elections all had market impact at points during the year.

Portfolio Review

The Fund underperformed the Index for the year ending October 31, 2012. Underperformance was driven in part by changing market conditions and by portfolio holdings. Impact of beta clearly varied by sub-period.

Over the twelve-month reporting period, higher beta stocks outperformed lower beta issues. The Fund’s investment style leads us to overweight the lower beta segments of the Index and underweight high beta. Interestingly, capitalization was much less of a factor than it has been in some other periods. There was no clear pattern of returns across capitalization deciles.

From a sector/stock perspective, the Fund suffered from poor stock selection in financials with the biggest detractor being our underweight in real estate investment trusts (REITs). The Fund’s exposure was 2.8% over the year while the industry weight was 8.3%. REITs rose by 19.5% as investors sought yield-oriented stocks. So the significant underweight accounted for approximately one-third of our lag in the sector. Another key detractor in financials was in the bank industry, where an underweight and lagging stock selection combined to create a relative performance drag on the Fund. Key stock detractors included People’s United Financial and Reinsurance Group of America in the insurance industry. The Fund added value in the financial data and systems industry with its holding in Verisk Analytics which rose by 45.4%. The company provides key risk data services to the insurance industry. The other key detractor was the Fund’s cash holding which averaged 9.06% during the year. In a market rising by 13.00%, minimal returns available to cash were a drag on overall returns.

On the positive side, the Fund saw significant value added by stock selection in the technology and materials & processing sectors. In technology the Fund’s biggest contribution came from AboveNet, a communications technology company which received a takeover offer. In the materials & processing sector a key driver of outperformance was the Fund’s exposure to two gold stocks: Yamana Gold and Royal Gold. Yamana Gold is a producer with mines throughout the Americas; Royal Gold is a royalty company.

Outlook

We have expressed concerns over the past year about high levels of expected earnings from Wall Street. That concern remains as analysts are projecting 21% earnings growth for small cap stocks in 2013. Given a generally slow growth economy and the unresolved issues surrounding the “fiscal cliff” we believe those estimates to be optimistic at the least. We do believe that the actions of the Federal Reserve extending their low rate horizon into mid-2014 to 2015 have clearly indicated a background that is more hospitable to risk assets. The perceived negative at the time of this writing is the difficulties in Washington coming to resolution on fiscal cliff issues. Without question, both sides have difficult compromises to make on taxes and spending, but it is important for the country that a resolution be found within a reasonable time frame.

7

Comparison of Change in the Value of a $10,000 Investment in the Schroder U.S. Small and Mid Cap Opportunities

Fund Investor and Advisor Shares vs. the Russell 2500 Index.

The Russell 2500 Index is a market capitalization weighted broad based index measuring the performance of the 2500 smallest companies in the Russell 3000 Index, which represents approximately 70% of the total market capitalization of the Russell 3000 Index.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Annualized Since

Inception (b) | |

Schroder U.S. Small and Mid Cap Opportunities Fund — | | | | | | | |

Investor Shares | | 8.41 | % | 1.72 | % | 4.88 | % |

Advisor Shares | | 8.07 | % | 1.43 | % | 4.61 | % |

Russell 2500 Index | | 13.00 | % | 2.06 | % | 3.54 | % |

(a) | Average annual total return. |

(b) | From commencement of fund operations on March 31, 2006. |

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

Waste Connections | | 2.2 | % |

Amdocs | | 2.1 | |

Crown Holdings | | 1.9 | |

Ross Stores | | 1.9 | |

Questar | | 1.9 | |

* Excludes Short-Term Investment.

Sector Allocation

Sector | | % of Net Assets | |

Financial Services | | 17.1 | % |

Consumer Discretionary | | 15.9 | |

Healthcare | | 12.3 | |

Materials & Processing | | 11.1 | |

Technology | | 10.4 | |

Producer Durables | | 10.3 | |

Other Energy | | 7.0 | |

Utilities | | 3.5 | |

Consumer Staples | | 2.9 | |

Auto & Transportation | | 1.9 | |

Telecommunication Services | | 0.3 | |

Short-Term Investment | | 7.8 | |

Other Assets and Liabilities | | (0.5 | ) |

8

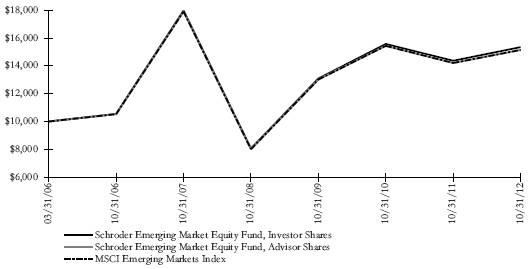

Schroder Emerging Market Equity Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder Emerging Market Equity Fund (the “Fund”) gained 6.77% (Investor Shares) and 6.57% (Advisor Shares), compared to the Morgan Stanley Capital International Emerging Markets Index (the “Index”), a broad-based basket of international stocks, which rose 2.63% during the same period.

Market Background

Global equity markets rallied over the year ending October 31, 2012. Earlier in the period, markets were boosted by the implementation of the second phase of the European Central Bank’s (ECB’s) Long Term Refinancing Operation (LTRO) and the approval of a second bailout for Greece. However, global markets suffered as Spain entered into recession and electoral uncertainty in France and Greece unsettled market participants. Sentiment has since improved and markets have been supported by an easing of electoral uncertainty in Greece, firmer US and Chinese data and positive policy action in the eurozone and the US. In Europe, the ECB announced an unlimited sovereign bond purchasing programme to provide support for weak peripheral European economies. In the US, the Fed launched its third round of quantitative easing (QE3). The Index also rallied during the period but underperformed the MSCI World Index.

Emerging Asia was the strongest performing region over the period. The Philippine market strongly outperformed its regional peers. Growth has been resilient and the central bank’s inflation targeting regime has successfully contained inflation within its target range of 3-5%. Both Moody’s and Standard & Poor’s upgraded the country’s sovereign debt rating over the period to one notch below investment grade. Thailand was also a strong performer as the economy rebounded from widespread flooding in the second half of 2011 due to high levels of foreign direct investment and government spending, although recently this recovery appears be losing momentum. Malaysia outperformed with robust growth throughout the period, supported by the effects of the Economic Transformation Program and a cash stimulus created by pre-election government spending. The Chinese equity market outperformed the Index. Market sentiment was supported by selective policy easing, evidence of a soft landing for the economy and more recently, signs of stabilisation and even improvement in some sectors of the economy. Indonesia also outperformed, benefiting from its perceived lack of sensitivity to the eurozone crisis. Growth remained resilient throughout the period and both Fitch and Moody’s upgraded Indonesian sovereign debt to investment grade status. South Korea also outperformed. At the start of the period data releases were generally positive but the global slowdown and the deceleration in Chinese growth have weighed on the Korean economy more recently, particularly on the export sector. On the domestic front, the government announced several stimulus measures during the period to provide support for the domestic economy. Taiwan underperformed the Index. As an export-dependent economy, Taiwan was adversely affected by the global slowdown over the fiscal period, experiencing a technical recession in the second half of 2011. India underperformed as weakness in the rupee, elevated inflationary pressure and political gridlock weighed on returns.

The Europe, Middle East and Africa (EMEA) markets marginally outperformed wider emerging markets. The Turkish equity market performed strongly, benefiting from supportive global liquidity over the period and some improvement in the size and quality funding of the current account deficit. Egypt was also a strong performer, reflecting an easing of political risk. The Muslim Brotherhood emerged as the main party in the parliamentary elections and their presidential candidate, Mohammed Mursi, was sworn in as the country’s first democratically-elected civilian president. Both elections took place peacefully. In addition, sentiment has been supported by a variety of regional loans and the prospect of an International Monetary Fund (IMF) loan. The combination of this financial aid is expected to help support the country’s international reserves. Hungary outperformed as the market was supported by policy stimulus from eurozone authorities throughout the period. There were expectations for most of the period that Hungary would enter into a standby loan facility with the IMF, although this looks increasingly unlikely. South Africa’s outperformance was aided by resilient domestic consumption. However, industrial action in the mining sector, which is a key component of South Africa’s exports and is already under pressure due to the global slowdown, weighed on sentiment toward the end of the period. Poland underperformed, reflecting a slowing growth environment impacted by a wide fiscal deficit as well as slowing investment and consumption. The Czech Republic underperformed wider emerging markets. Annual growth was negative in the first two quarters of 2012 and domestic demand has been hampered by fiscal austerity and pension system reforms. Macroeconomic data releases were generally downbeat over the period, reflecting concerns about the economy’s exposure to developed Europe. The Russian market also underperformed. Electoral uncertainty weighed on the market at the beginning of the period as both parliamentary and presidential elections were marred by political unrest. The deteriorating investment environment, which is characterised by continuing capital outflows, has also weighed on sentiment. On the inflation front, the delay in utility hikes were supportive during the first half of 2012 but their implementation in June, combined with a poor Russian harvest, means inflation has been rising and is likely to remain structurally high going forward.

The emerging Latin American markets underperformed, dragged down by poor performance from Brazil. The Brazilian market was negatively affected by the slowdown in China’s economy and government interference in various sectors throughout the period, most notably in the banking and electricity sectors. The central bank reduced the SELIC rate from 11.5% to 7.25% over the period and the government announced a variety of stimulus measures designed to support the domestic economy. Colombia performed strongly over the period, supported by robust domestic growth at the beginning of the period. Concerned about an over-heating economy, the central bank raised interest rates during the period from 4.5% to 5.25%. Interest rates have since been lowered back to 4.75% owing to

9

slowing domestic and global demand as well as improved inflation figures. Mexico also outperformed. Mexican growth has been resilient and on going expansion in the auto-related industry has helped boost the manufacturing sector. On the political front, Pena Nieto won the presidential elections in July 2012, which raised the prospect of reform to improve long-term growth. Despite continued unrest in the mining sector, Peru’s equity market outperformed its regional and wider emerging market peers supported by a robust growth environment. Sentiment was also supported by Moody’s upgrade of the country’s debt rating in August 2012. Chile underperformed. The slowdown in Europe and China has dampened demand for Chile’s exports, copper in particular. Recent weakness in metal prices has also weighed on the market.

Portfolio Review

Fund performance was ahead of the Index for the twelve-month period ended October 31, 2012. Both country allocation and stock selection added to returns. In terms of country selection, the Fund benefited from its overweight positions in Thailand and Turkey, both of which outperformed as well as its underweight position in India. This was slightly offset by the underweight position to South Africa which outperformed and our underweight position in Mexico (which we held for most of the period when the market outperformed). Stock selection was strongly positive, most notably in Brazil (overweight Cia de Concessoes Rodoviarias, Lojas Renner, Ultrapar Participacoes and BR Properties; underweight OGX), Taiwan (overweight Taiwan Semiconductor Manufactoring and Asustek Computer; underweight HTC), Thailand (overweight CP ALL and Kasikornbank: underweight Banpu as well as positive foreign vs. local line premium/discount timing effects), Korea (overweight Samsung Electronics and LG Household & Health Care), Indonesia (overweight Semen Gresik Persero and XL Axiata; underweight Bumi Resources), Russia (overweight LUKOIL and Globaltrans Investment) and South Africa (overweight Naspers, Mr Price Group and Imperial Holdings). Stock selection decisions in China (overweight Dongfeng Motor Group and Baidu) detracted from returns.

Outlook

There remains plenty to worry about in the developed world including the impact of a prolonged period of debt deleveraging and fiscal austerity, together with solvency and competitiveness issues in the eurozone. However, over the near term markets could be supported by encouraging data releases from the US, signs of stabilization in Chinese growth and some indication that policy stimulus measures, alongside limited market pressure, look to be buying policymakers time in the eurozone. Emerging markets have outperformed their developed peers more recently and stronger fundamentals, together with attractive valuations, we believe continue to attract strong investor interest.

Sentiment looks to have improved in the US following an improvement in the housing sector and better-than-expected payroll numbers. Stronger residential investment and construction employment should prove supportive for the overall economy, although the contribution of the housing sector to Gross Domestic Product (GDP) has diminished and households continue to deleverage. Market sentiment in the US is likely to come under increasing pressure as the ‘fiscal cliff’ approaches although a resolution between parties is ultimately expected to be agreed upon. While Schroders’ economics team believes the full impact of automatic tightening measures will be avoided, they still anticipate policy to tighten by 1.5% of nominal GDP at the beginning of 2013. Data releases in the eurozone continue to be weak and leading indicators of economic activity suggest growth will deteriorate further in 2013. There has been little sign of policy response to tackle the underlying structural issues facing the eurozone and there remains an underlying sense that the situation needs to deteriorate before sufficient pressure leads authorities to implement a more lasting policy response. However, the combination of stimulus measures and politics make it increasingly difficult to judge when structural issues in the eurozone could come to a head. Our economics team forecasts global, US and eurozone GDP growth over 2013 to be similar to 2012 at 2.5%, 1.8% and -0.7% respectively.

The strong structural case for emerging markets is intact and valuations remain attractive trading on 10.2X price to earnings ratio and supported by earnings growth of above 10%. Concerns in emerging markets have been chiefly confined to the degree of slowdown in China, although recent data releases have shown signs of stabilization and in some cases, such as exports and Purchasing Managers Index, an improvement in the economy. While the Chinese political transition process is on the verge of commencing and new leaders will be appointed soon, it remains somewhat a judgment call as to the whether politicians will try to, and be successful at, pushing through reforms, not least as many of the required reforms could adversely affect vested interests in local government and state owned enterprises. We continue to believe there are significant tail risks facing the developed world.

10

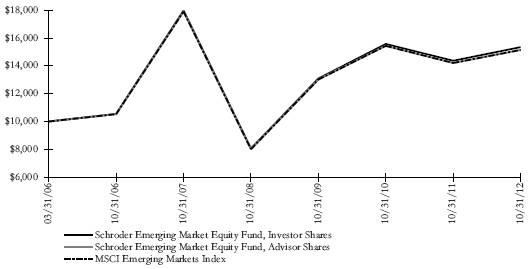

Comparison of Change in the Value of a $10,000 Investment in the Schroder Emerging Market Equity Fund

Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI) Emerging Markets Index.

The MSCI Emerging Markets Index is an unmanaged market capitalization index of companies representative of the market structure of emerging countries in Europe, the Middle East, Africa, Latin America and Asia. The Index reflects actual buyable opportunities for the non-domestic investor by taking into account local market restrictions on share ownership by foreigners.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Annualized

Since

Inception (b) | |

Schroder Emerging Market Equity Fund — | | | | | | | |

Investor Shares | | 6.77 | % | (3.13 | )% | 6.72 | % |

Advisor Shares | | 6.57 | % | (3.30 | )% | 6.51 | % |

MSCI Emerging Markets Index | | 2.63 | % | (3.47 | )% | 6.11 | % |

(a) | Average annual total return. |

(b) | From commencement of fund operations on March 31, 2006. |

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

Samsung Electronics | | 6.2 | % |

China Construction Bank Class H | | 2.4 | |

Taiwan Semiconductor Manufacturing | | 2.3 | |

LUKOIL ADR | | 2.3 | |

Hyundai Motor | | 2.2 | |

* Excludes Short-Term Investment.

Geographic Allocation

| | % of Net Assets | |

Asia/Far East | | 59.8 | % |

Latin America | | 18.9 | |

Europe | | 13.9 | |

Africa | | 2.6 | |

Mid-East | | 1.8 | |

Short-Term Investment | | 3.0 | |

Other Assets and Liabilities | | 0.0 | |

11

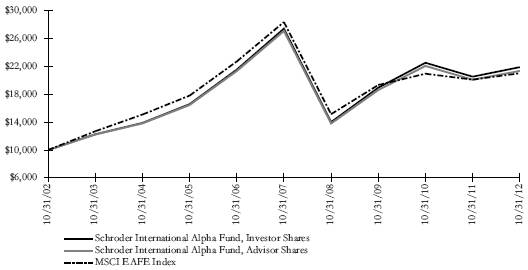

Schroder International Alpha Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder International Alpha Fund (the “Fund”) gained 6.67% (Investor Shares) and 6.32% (Advisor Shares) compared to the Morgan Stanley Capital International EAFE Index (the “Index”), a broad-based basket of international stocks, which rose 4.61%.

Market Background

Although the twelve months saw healthy gains in the global equity markets, the period was also characterized by intense volatility and sudden shifts in investor sentiment as macro and political news unfolded, not always as expected, with Europe dominating the scene. The uncertain outcome of the European crisis and the periods of unsustainably high bond yields in “peripheral” Europe caused caution and, at times, fear amid investors. At some points, this resulted in a disconnect between market movements and company fundamentals.

During the final quarter of 2011, markets re-gained a degree of calm after the preceding quarter of extreme volatility when the European debt crisis reached a climax. Markets began 2012 well, boosted by encouraging US economic data and cash injections by central banks. However, by April volatility returned to the markets as the liquidity boost from the European Central Bank’s (“ECB’s”) Long-Term Refinancing Operation’s program faded, and prospects of a Greek exit from the euro were rising. This coincided with a downturn in indicators of global economic activity and continued fears of a hard landing in China.

Since then, political and economic progress in the eurozone, signs of recovery in the US housing sector, and the announcement by central banks globally of substantial supportive measures, meant the environment stabilized and discussions around growth initiatives resurfaced. In particular, the ECB’s pledge to “do whatever it takes” to support the eurozone and the announcement of QE3 had a positive impact on equities.

Portfolio Review

From a sector perspective, utilities and consumer staples were the most significant drivers of outperformance. In utilities, Centrica and United Utilities Group outperformed as investors valued consistent returns in an environment of low visibility. United Utilities Group has made successful financing and operational improvements under a new CEO which has been reflected in results. In consumer staples, beverage companies Diageo and Anheuser-Busch InBev outperformed and were among the top three contributors in the portfolio. At a stock level, Samsung Electronics was also a standout performer, with its handset sales taking market share in the crucial mid-range smartphone category.

Healthcare and materials detracted. In the latter, Atlas Iron suffered from a deterioration in iron ore prices in response to slowing growth in China. We believe investors have been overly focussed on the short-term; we believe Chinese growth has bottomed and as growth ticks up this will support iron ore prices. Indeed a recent recovery in prices has seen Atlas Iron outperform is the last two months.

From a regional perspective, Continental Europe (consumer staples, underweight to telecoms) and Japan (consumer discretionary, underweight to materials and utilities) have been the most significant contributors to outperformance, while Pacific ex-Japan (Atlas Iron) has detracted the most.

Outlook

Looking ahead, given the challenges of the rocky path to normalisation, we believe equity markets will continue their cautious recovery, but that confidence will be fragile and markets will be prone to sentiment swings. We hope to use these sentiments to our advantage by building positions in strong companies with good long-term growth prospects. While economic data remain patchy, we believe that markets are still discounting a high level of bad news and that valuations are very attractive, especially in stocks where beta is high or the growth story is longer term. In addition, given abnormally low interest rates, the disconnect between bond and equities is extreme in our view.

Despite signs that stock-specific newsflow is starting to exert some bearing on share price performance, the determinant of market, sector and stock returns remains focussed on macro risks. This is likely to remain the case for some time to come, at least until we start to see a clearer path for peripheral Europe. In light of this, the macro environment is central.

Liquidity support from central banks globally, and especially in Europe and the US, will help the slow and painful adjustments taking place in the developed world. The question is whether the latest round of liquidity injections will prove to be a temporary fix or lead to something more permanent. The open-ended nature of the latest round of central bank action is positive for equities as investors will have to accept the current low level of real bond yields as the new norm. However, structural reforms in many countries still need to be designed and implemented for a lasting improvement in the global economy.

12

The slowdown in Chinese growth has been a significant source of market concern for much of this year. Its third quarter growth came in at 7.4%, its slowest rate of growth since early 2009. However, there has been a significant improvement recent data and this is likely to be the bottoming of growth which should support investor sentiment over the coming months, especially in more growth-focussed areas of the market. The completion of the once-in-a-decade leadership transition is likely to be positive for equities in the region as it removes an element of uncertainty. It will also pave the way for more decisive policy action to support growth which will be positive for global equities.

The US remains one of the bright spots in the developed market world, but the impending “fiscal cliff” is reason for caution. Politicians now have a tight window to negotiate before the January 1 deadline. Markets are currently relatively benign about the impact any cuts could have on global growth and so, as the deadline approaches, this could be a source of market volatility.

Europe will continue to be a swing factor in markets for some time so we remain cautious on the region especially the periphery. Slow progress is nevertheless being made to address both the immediate issues in the bond markets and the more fundamental issues of fiscal union and debt mutualisation. Peripheral bond yields have fallen in response to the ECB pledge of support, Greece appears set to receive the next bailout tranche, and Spain may be close to officially asking the ECB for help. Europe’s economy is not yet showing signs of a recovery but in general, politicians (in some but not all countries) are showing signs of a slight shift in stance towards measures that promote growth but do not undermine deleveraging efforts.

We continue to pursue companies which, irrespective of the short-term market uncertainties, we believe are benefiting from longer-term global trends. We believe the Fund remains well-balanced with exposure to both defensive growth and more cyclical stocks. The Fund’s trading activity will, as ever, focus on stock-specific situations where we feel there is sustainable growth, valuation upside and catalysts ahead.

We remain of the view that the disparity in valuation within the market which has seen expensive defensives bid higher at the expense of longer duration stocks will normalise as market sentiment and risk appetite starts to improve. We have witnessed some of this over recent months as deep defensive stocks have de-rated while stocks with greater market sensitivity have outperformed. We expect this to be an on-going feature of relative returns, albeit punctured by periods of occasional retrenchment.

13

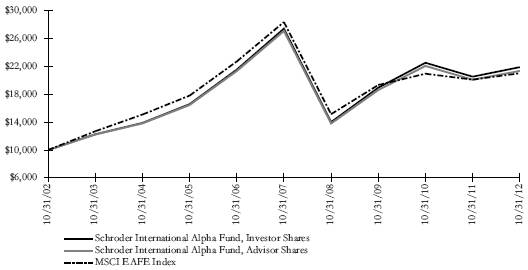

Comparison of Change in the Value of a $10,000 Investment in the Schroder International Alpha Fund

Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI) EAFE Index.

The MSCI EAFE Index is a market weighted index composed of companies representative of the market structure of certain developed market countries in Europe, Australia, Asia and the Far East, and reflects dividends reinvested net of non-recoverable withholding tax.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Ten Years Ended

October 31, 2012 (a) | |

Schroder International Alpha Fund(b) — | | | | | | | |

Investor Shares | | 6.67 | % | (4.41 | )% | 8.16 | % |

Advisor Shares | | 6.32 | % | (4.64 | )% | 7.90 | %(c) |

MSCI EAFE Index | | 4.61 | % | (5.81 | )% | 7.73 | % |

(a) | Average annual total return. |

(b) | Effective March 21, 2012, the advisory fee of the Fund decreased to 0.80% per annum. If the Fund had paid such lower fees during prior periods, the returns of the Fund would have been higher. |

(c) | The Advisor Shares commenced operations on May 15, 2006. The performance information provided in the above table for periods prior to May 15, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares. |

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security | | % of Net Assets | |

Nestle | | 3.0 | % |

BHP Billiton | | 2.7 | |

Roche Holding | | 2.5 | |

Credit Suisse Group | | 2.3 | |

AIA Group | | 2.3 | |

Geographic Allocation

| | % of Net Assets | |

Continental Europe | | 40.7 | % |

United Kingdom | | 24.0 | |

Japan | | 13.4 | |

Pacific ex-Japan | | 8.7 | |

Emerging Markets | | 8.2 | |

North America | | 3.3 | |

Short-Term Investment | | 1.7 | |

Other Assets and Liabilities | | 0.0 | |

14

Schroder International Multi-Cap Value Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder International Multi-Cap Value Fund (the “Fund”) gained 6.84% (Investor Shares) and 6.63% (Advisor Shares) compared to the Morgan Stanley Capital International EAFE Index (the “Index”), a broad-based basket of international stocks, which rose 4.61% during this same period.

Market Background

As 2011 drew to a close, stress in the interbank markets was markedly reduced following the European Central Bank’s (ECB’s) Long-Term Refinancing Operations (LTRO) in December, and again in February 2012.

After this strong start to 2012, investor confidence declined in the second quarter as the effects of the ECB’s LTRO faded and macroeconomic data disappointed. Spain was in the spotlight and, to a lesser extent, Italy while discussion of a possible Greek exit from the Euro raised concerns.

Later in the year markets rose strongly and yields on Spanish and Italian government bonds fell on the back of substantial supportive measures announced by both the ECB and the US Federal Reserve. The rally helped markets to secure positive returns over the period as a whole.

Strong returns across a broad range of sectors, both defensive and more cyclical, drove markets higher. Particularly strong performers included biotechnology and pharmaceutical stocks, real estate and consumer-related names. Defense & Aero and Air freight & Logistics companies also outperformed the market. Laggards included materials and technology stocks.

Portfolio Review

The Fund generated positive absolute returns over the year, and outperformed the Index. Positive stock selection across a broad range of sectors contributed to the relative gains. Performance was strongest among the Fund’s holdings in telecom services, financials, information technology and utilities stocks. Healthcare and consumer-related names were among the top detractors.

At a regional level, contributors included the Fund’s holdings in Japan, Pacific ex-Japan and the UK; the Fund’s allocation to emerging Asia also added value over the period.

Over the third quarter, the Fund rotated into more cyclical and defensively positioned value stocks funded by a reduction in resources and defensive quality where valuations became stretched in our view.

Regionally, the Fund’s allocation to Europe increased by almost 5% over the third quarter with increased exposure to the UK, Germany, France, Italy and Spain. However, the Fund remains over 9% underweight to continental Europe and the UK.

Outlook

Improving market sentiment should ultimately lead to a broadening of the market towards more neglected mid and small cap stocks where we believe more opportunities may be found. Investors should also then start to focus upon other less-expensive areas such as emerging markets and mid-cap stocks more generally. That said, we are certainly not being complacent as many of the structural issues that plague the global economy are far from resolved, although there does appear to be a greater willingness on the part of policymakers to assist recovery.

The Fund’s defensive exposure remains biased towards telecoms where many stocks are offering dividend yields of more than 5% while the Fund is underweight consumer staples where valuations often trade on P/E multiples significantly higher than that of the broader market. Although the Fund is also underweight healthcare, many of the Fund’s holdings have dividend yields of over 3.5% with high-quality balance sheets, reasonable dividend certainty and potential for growth.

We are close to historic highs in terms of the Fund’s allocation to healthcare stocks. On the other hand, utilities remain unexciting, and the Fund’s exposure remains low relative to its historic weight.

The Fund remains broadly neutral on resources but has a slightly higher allocation to energy and a lower allocation to materials.

We are trimming the Fund’s positions in some strongly performing financials and remain significantly underweight overall. We retain a preference for insurance. Regionally, the Fund’s largest underweight is to Asian financials, where we are concerned with asset quality.

Within emerging markets, we favor defensives (telecoms) and resources for the Fund’s portfolio while we remain more wary of financials. The Fund continues to have a risk-adjusted position in Japanese value stocks. These stocks are typically either small/mid cap or relatively low quality leading to a small risk-adjusted position size.

15

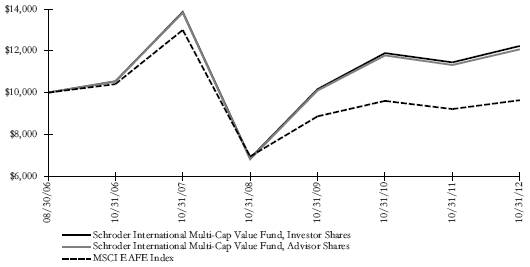

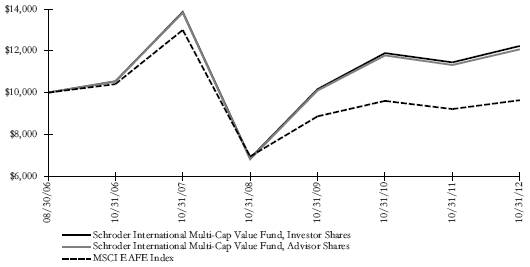

Comparison of Change in the Value of a $10,000 Investment in the Schroder International Multi-Cap Value Fund

Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI )EAFE Index.

The MSCI EAFE Index is a market weighted index composed of companies representative of the market structure of certain developed market countries in Europe, Australia, Asia and the Far East, and reflects dividends reinvested net of non-recoverable withholding tax.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Five Years Ended

October 31, 2012 (a) | | Annualized

Since

Inception (b) | |

Schroder International Multi-Cap Value Fund (c) — | | | | | | | |

Investor Shares | | 6.84 | % | (2.48 | )% | 3.32 | % |

Advisor Shares | | 6.63 | % | (2.68 | )% | 3.10 | % |

MSCI EAFE Index | | 4.61 | % | (5.81 | )% | (0.60 | )% |

(a) | Average annual total return. |

(b) | From commencement of fund operations on August 30, 2006. |

(c) | Effective March 21, 2012, the advisory fee of the Fund decreased to 0.80% per annum. If the Fund had paid such lower fees during prior periods, the returns would have been higher. |

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

Sanofi | | 0.7 | % |

Statoil | | 0.7 | |

GlaxoSmithKline | | 0.7 | |

Total | | 0.7 | |

Royal Dutch Shell | | 0.7 | |

* Excludes Short-Term Investments.

Geographic Allocation

| | % of Net Assets | |

Continental Europe | | 32.2 | % |

Japan | | 19.5 | |

United Kingdom | | 19.5 | |

Pacific ex-Japan | | 13.4 | |

Emerging Markets | | 8.5 | |

North America | | 4.7 | |

Short-Term Investment | | 1.0 | |

Other Assets and Liabilities | | 1.2 | |

16

Schroder Global Quality Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

For the twelve-month period ended October 31, 2012, the Schroder Global Quality Fund (the “Fund”) returned 10.00% for its Institutional Shares compared to the Morgan Stanley Capital International All Country World Index (the “Index”), a broad-based basket of global stocks, which returned 9.45% during this same period. On September 28, 2012, the Fund started offering a new share class, Institutional Service Shares. For the period of their commencement on September 28, 2012 through October 31, 2012, Institutional Service Shares returned -0.37%.

Market Background

As 2011 drew to a close, stress in the interbank markets was markedly reduced following the European Central Bank’s (ECB’s) Long-Term Refinancing Operations (LTRO) in December, and again in February 2012.

After this strong start to 2012, investor confidence declined in the second quarter as the effects of the ECB’s LTRO faded and macroeconomic data disappointed. Spain was in the spotlight and, to a lesser extent, Italy while discussion of a possible Greek exit from the Euro raised concerns.

Later in the period, markets rose strongly and the yields on Spanish and Italian government bonds fell on the back of substantial supportive measures announced by both the ECB and the US Federal Reserve. The rally ensured that markets secured solid positive returns over the period as a whole.

Strong returns across a broad range of sectors, both defensive and more cyclical, drove markets higher. Particularly strong performers included healthcare (biotechnology and pharmaceuticals), financials (real estate) and consumer-related names. Laggards included materials and energy stocks.

Portfolio Review

The Fund outperformed the wider market over the period. Strong stock selection across a broad range of sectors drove the relative gains. Leading contributions came from the Fund’s holdings in the financials, consumer staples, materials and utilities sectors. The Fund’s overweight allocation to healthcare also added value over the period.

Consumer discretionary holdings were among the leading detractors from Fund performance and information technology also impacted relative returns, largely due to the continued success of Apple.

Regionally, Japanese and UK holdings contributed to Fund performance, while its exposure to emerging markets stocks, in both Asia and Latin America, also boosted returns. In addition, the Fund benefited from its underweight allocation to continental European stocks. The US was the weakest performer on a relative basis.

Outlook

Within defensives, the largest sector overweight continues to be healthcare, especially equipment and service providers. Among consumer staples names, the Fund remains underweight to the more expensive food and drink “safe havens”. The Fund’s overweight exposure to telecoms is driven by positions in emerging markets stocks while it is underweight to US telecoms.

The Fund is broadly neutral with respect to resources but prefer fertilizers and the better quality, more diversified, mining companies.

In technology, the Fund is overweight semiconductors and IT services and underweight to hardware (Apple). The Fund remains underweight to autos within consumer discretionary, and is starting to increase exposure to quality industrials from an underweight position.

Within financials, the Fund retains a preference for US financials and also UK non-bank financials, remaining underweight in continental European and Asia Pacific financials.

The Fund’s regional allocations remain broadly unchanged: the strategy is underweight in continental Europe, the US and Canada in order to fund a significant overweight to the UK which looks attractive, offering high quality companies at reasonable valuations.

17

Comparison of Change in the Value of a $10,000 Investment in

the Schroder Global Quality Fund — Institutional Shares

vs. the Morgan Stanley Capital International (MSCI) World Index.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2012 | | Since

Inception | |

Schroder Global Quality Fund — | | | | | |

Institutional Shares | | 10.00 | % | 5.44 | %(a) |

Institutional Service Shares | | N/A | | (0.37 | )%(b) |

MSCI World Index | | 9.45 | % | 4.00 | % |

(a) | Institutional Shares commenced operations on November 9, 2010. Return shown is annualized since inception. |

(b) | Institutional Service Shares commenced operations on September 28, 2012. Return shown is cumulative since inception. |

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the period reflect fee waivers and/or reimbursements in effect; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Net Assets | |

Oracle | | 0.8 | % |

Microsoft | | 0.7 | |

Bristol-Myers Squibb | | 0.7 | |

AstraZeneca | | 0.7 | |

GlaxoSmithKline | | 0.7 | |

* Excludes Short-Term Investment.

Geographic Allocation

| | % of Net Assets | |

North America | | 47.2 | % |

Continental Europe | | 14.9 | |

United Kingdom | | 13.0 | |

Emerging Markets | | 9.3 | |

Japan | | 7.2 | |

Pacific ex-Japan | | 7.0 | |

Short-Term Investment | | 1.8 | |

Other Assets and Liabilities | | (0.4 | ) |

18

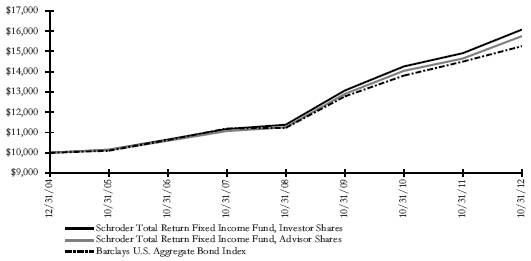

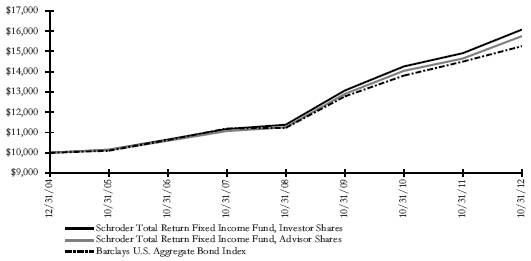

Schroder Total Return Fixed Income Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 5, 2012)

Performance

During the twelve-month period ending October 31, 2012, the Schroder Total Return Fixed Income Fund (the “Fund”) returned 7.79% (Investor Shares) and 7.52% (Advisor Shares), compared to the Barclays U.S. Aggregate Bond Index (the “Index”), a broad-based basket of U.S. debt securities, which returned 5.25%.

Market Background

The bond market registered a positive return over the twelve-month reporting period, overcoming periods of volatility and political uncertainty. Economic data improved marginally as consumer sentiment and spending were supported by better job creation, pushing the unemployment rate down to 7.8% and Gross Domestic Product (GDP) growth to 2.0%. Corporate fundamentals remained strong but are starting to show signs of peaking.

While uncertain fiscal policy clouded the optimism in the market, monetary policy in the US remained highly supportive. At its September 13, 2012, meeting, the Federal Reserve Board’s Open Market Committee followed through on stimulus tools outlined in Ben Bernanke’s August 31st Jackson Hole summit, committing to open-ended purchases of agency-issued mortgage-backed securities (MBS) at the rate of $40 billion per month and a promise to keep short term interest rates near zero until 2014. Fiscal headwinds for growth remain severe even after the election as there is still significant uncertainty surrounding the “fiscal cliff”. Many businesses are likely to keep hiring and investment plans on hold until an agreement is reached on the massive spending cuts and tax increases scheduled to come into effect at the beginning of 2013.

Moreover, the massive infusion of liquidity from the European Central Bank’s Long Term Repo Operation effectively removed the near term risk of bank funding difficulties in Europe, and provided increased demand for higher yielding European sovereign bonds.

Treasury yields decreased during the reporting period, with 10-year Treasuries declining 0.42%, to 1.69%. After initially moving higher in the beginning of period on the optimism of better prospects for the US, yields trended lower in April on the back of concerns about Greece. The persistent low level of interest rates reflected a combination of the Fed’s accommodation, higher oil prices not yet threatening inflation, and the Fed’s policy commitment anchoring the entire yield curve.

The 5.25% return for the Index during the reporting period was primarily due to the dramatic narrowing of bond spreads relative to US Treasury yields.

Returns on investment grade corporate bonds were much higher than government bonds (5.65% excess return) as investors were compensated for taking on more credit risk in the market. Within corporates, financials produced the best performance, followed by industrial bonds and then by utilities. Lower rated bonds outperformed higher quality securities. The BBB-rated sector was the top performing investment grade credit tier, returning 6.94% over comparable Treasury securities during this period. High yield corporate bonds did even better, with excess returns of 10.80% and a similar pattern of the lowest quality tiers providing the best performance.

The securitized sectors also posted positive returns, albeit smaller excess returns than corporates (1.47% over Treasuries). MBS excess returns were 1.00% and the smaller commercial MBS (CMBS — commercial mortgage-backed securities) sector returning 9.05% above Treasuries. Asset-backed securities (ABS) likewise outperformed Treasuries, with auto and credit card receivable securities providing added income versus cash alternatives.

Portfolio Review

The Fund outperformed the Index during the 12-month period ending October 31, 2012, primarily due to our investment strategy to overweight corporate credit and MBS and holding less US Treasury and agency debt. Recognizing that regulatory changes and government intervention would keep markets volatile, we were cautious in our risk budgeting and flexible with sector rotation. The Fund maintained a relatively low risk profile throughout the year while continuing to express our long term positive views for corporate and MBS based on our fundamental economic and credit research. Out-of-benchmark allocations to covered bonds, high yield corporates, and emerging market debt also added to positive returns during this time.

The Fund began the period with a moderate overweight to investment grade corporate (+0.42 years contribution to duration (CTD) above the benchmark) and high yield credit (+8% of market value). During the first half of 2012, investment strategy in the corporate sector emphasized industrial securities, especially consumer cyclicals, basic industries and transportation securities. In June, the Fund added bonds from US large-cap financial institutions and several high yield issues which both performed very well and contributed to returns. Corporate positioning was gradually reduced throughout 2012 based on our concerns over political uncertainty in Europe and the US and the potential for increased volatility. By the end of October, investment grade credit contributed about +0.25 years above the Index (in CTD terms) and exposure to high yield is just about +4% of market value. In terms of credit quality, investment strategy emphasized BBB and BB rated issuers over very high quality corporates, giving the Fund a positive sensitivity to narrowing credit spreads. This position helped returns as lower credit tiers have outperformed higher rated securities in 2012.

19

The Fund’s MBS allocation followed a similar trajectory, although the overweight was more modest than the corporate allocation to start the year. We preferred to hold lower coupon Ginnie Mae mortgages to minimize volatility from potential regulatory changes in government mortgage programs as well as possibly higher prepayment rates. Collateralized Mortgage Obligations and agency hybrid adjustable-rate mortgage (ARM) holdings also added to returns. Positioning was decreased from about 0.43 years CTD in October 2011 to a very small position in March, and then gradually increased over the last seven months to be the Fund’s largest risk position, at 0.67 year CTD a year later. This positioning added significantly to excess returns in the third quarter once the Fed announced explicit unlimited MBS purchases.

The Fund also invested in Canadian covered bonds; these holdings represented about 0.25 years CTD as of October 31, 2012. These AAA-rated securities provided relatively high income and performed well as alternatives to low yielding cash investments. ABS and CMBS exposures were in line with the Index.

The Fund’s duration was longer than the Index for most of the period. Despite low overall interest rates, Treasury yields and credit risk have had a very high and robust negative correlation with each other since mid-2011. Having a duration longer than the Index effectively acted as a partial hedge to dampen overall portfolio volatility. This longer duration was further supported by the Fed’s articulation of extended zero-percent interest rate policy and inflation having peaked on a year-over-year basis. Interest rate strategy had a positive effect on performance, particularly in the last few months as duration was increased in mid-August when 10-year yields crested 1.8%.

Outlook

Writing now after the re-election of President Obama, the outlook has clarified only slightly. Investors have been focused on the election as the key event to provide market direction and Obama’s victory does reduce uncertainty slightly; however, the considerable challenge of negotiating an agreement on US fiscal policy remains. Indeed, the status quo of an Obama presidency, Democrat-controlled Senate and Republican-controlled House of Representatives presents a difficult combination for reaching a near-term fiscal agreement and risks the continuation of the gridlock that failed to produce an agreement in 2011. While Obama’s post-election speech was reconciliatory, it may be hard to achieve an agreement that includes higher taxes for high-income earners as he promised. Increasing taxes in any form might be a virtual death sentence for Republicans seeking future re-election. As such, the approaching “fiscal cliff” which includes a combination of expiring tax cuts and mandatory spending cuts of roughly 4% GDP if not renegotiated poses a challenge for risk assets.

At this juncture, we believe an agreement on a temporary extension until later in 2013 appears likely in order to build consensus for a sustainable policy. Our base case remains that fiscal austerity of roughly 2% GDP, including some high-income tax increases, will come into effect sometime next year. Compared to private sector growth of only 2-2.5%, there is a very real risk that growth ends up close to zero, however we expect some pent-up hiring and investment once policy becomes known. A positive outcome that contains both bi-partisan support and is balanced between revenue (taxes) and spending (entitlements) remains possible.