UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Joint Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

Schroder Series Trust Schroder Global Series Trust |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Joint Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

SCHRODER SERIES TRUST

Schroder Emerging Markets Small Cap Fund

Schroder Long Duration Investment-Grade Bond Fund

Schroder Short Duration Bond Fund

Schroder Total Return Fixed Income Fund

SCHRODER GLOBAL SERIES TRUST

Schroder North American Equity Fund

875 Third Avenue, 22nd Floor

New York, New York 10022

[Date]

Dear Shareholder:

You are cordially invited to attend the Joint Special Meeting of Shareholders of the series of Schroder Series Trust and Schroder Global Series Trust (the “Trusts”) listed above (each, a “Fund,” and collectively, the “Funds”) to be held on [February 2], 2017, at [10:00 a.m.] Eastern Time, at the offices of the Trusts at 875 Third Avenue, 22nd Floor, New York, New York 10022 (the “Meeting”). A formal Notice of Joint Special Meeting of Shareholders is enclosed.

As discussed in more detail in the enclosed Joint Proxy Statement, in connection with our previously- announced plans to transition the above-listed Funds to the SEI Advisors’ Inner Circle mutual fund platform, you will be asked to elect four new Trustees of the Trusts to succeed the current Trustees. In addition, if you are a shareholder of Schroder Emerging Markets Small Cap Fund, Schroder Long Duration Investment-Grade Bond Fund and/or Schroder Short Duration Bond Fund, you will be asked to vote on proposed amendments to the Funds’ management contracts. I encourage you to read the enclosed Joint Proxy Statement carefully.

Whether or not you plan to be present at the Meeting, your vote is needed. Please complete, sign, and return the enclosed proxy card promptly. A postage-paid envelope is enclosed for this purpose. You may also vote by telephone or the internet, should you prefer. Please refer to instructions that appear on the enclosed proxy card.

We look forward to seeing you at the Meeting or receiving your proxy card so your shares may be voted at the Meeting.

| Sincerely yours, |

| |

| /s/ Catherine Mazza |

| Catherine Mazza |

| Chairman |

| Schroder Series Trust |

| Schroder Global Series Trust |

SHAREHOLDERS ARE URGED TO SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE OR VIA THE INTERNET SO AS TO BE REPRESENTED AT THE MEETING.

1

SCHRODER SERIES TRUST

Schroder Emerging Markets Small Cap Fund

Schroder Long Duration Investment-Grade Bond Fund

Schroder Short Duration Bond Fund

Schroder Total Return Fixed Income Fund

SCHRODER GLOBAL SERIES TRUST

Schroder North American Equity Fund

875 Third Avenue, 22nd Floor

New York, New York 10022

Notice of Joint Special Meeting of Shareholders

A Joint Special Meeting of Shareholders (the “Meeting”) of the series of Schroder Series Trust and Schroder Global Series Trust (the “Trusts”) listed above (each, a “Fund,” and, collectively, the “Funds”) will be held at the offices of the Trusts at 875 Third Avenue, 22nd Floor, New York, New York 10022, on [February 2], 2017, at [10:00 a.m.] Eastern Time, for the following purposes, as further described in the attached Joint Proxy Statement:

1. To elect Trustees of Schroder Series Trust (to be voted on by shareholders of each Fund that is a series of Schroder Series Trust, voting together as a single class).

2. To elect Trustees of Schroder Global Series Trust (to be voted on by shareholders of Schroder North American Equity Fund, a series of Schroder Global Series Trust).

3. To approve amended and restated management contracts between Schroder Investment Management North America Inc. (“SIMNA”) and Schroder Series Trust, on behalf of each of Schroder Emerging Markets Small Cap Fund, Schroder Short Duration Bond Fund and Schroder Long Duration Investment-Grade Bond Fund (to be voted on by shareholders of each of those Funds individually).

In addition, shareholders may be asked to consider and act upon other matters as may properly come before the Meeting and any adjournments thereof.

Shareholders of record as of the close of business on December [27], 2016 are entitled to notice of, and to vote at, the Meeting and any adjournments thereof.

| By order of the Trustees of each Trust, |

| |

| /s/ ABBY L. INGBER |

| ABBY L. INGBER |

| Clerk |

| Schroder Series Trust |

| Schroder Global Series Trust |

[Date]

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE, AND MAIL THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE OR VIA THE INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

2

SCHRODER SERIES TRUST

Schroder Emerging Markets Small Cap Fund

Schroder Long Duration Investment-Grade Bond Fund

Schroder Short Duration Bond Fund

Schroder Total Return Fixed Income Fund

SCHRODER GLOBAL SERIES TRUST

Schroder North American Equity Fund

875 Third Avenue, 22nd Floor

New York, New York 10022

Joint Proxy Statement

[Date]

This proxy is being solicited on behalf of the Trustees of Schroder Series Trust and Schroder Global Series Trust (the “Trusts”) for use at the Joint Special Meeting of Shareholders of the series of the Trusts listed above (each, a “Fund,” and, collectively, the “Funds”), to be held on [February 2], 2017, at [10:00 am] Eastern Time at the offices of the Trusts at 875 Third Avenue, 22nd Floor, New York, New York 10022, and at any adjournment thereof (the “Meeting”). The Meeting will be held for the purposes set forth in the accompanying Notice of Meeting of Shareholders (the “Notice”). Shareholders of record of the Funds as of the close of business on December [27], 2016 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and at any adjourned session. The Notice, this Joint Proxy Statement, and the enclosed form of proxy are first being mailed or otherwise made available to shareholders on or about [Date].

Shares represented by duly executed proxies will be voted in accordance with the specifications made. If no specification is made on a duly executed proxy, shares will be voted in accordance with the recommendations of the Trustees of the Trusts. You may revoke a proxy at any time before it is exercised, by sending or delivering a written revocation to the Clerk of the Trusts (which will be effective when it is received by the Clerk), by properly executing a later-dated proxy, or by attending the Meeting, requesting return of your proxy, and voting in person.

The number of outstanding shares of each class of shares of each Fund held on the Record Date is listed in Exhibit B. Each share is entitled to one vote, with fractional shares entitled to a proportionate fractional vote.

Copies of the Trusts’ most recent annual and semi-annual reports may be obtained without charge by writing the Fund at P.O. Box 55260, Boston, Massachusetts 02205-5260, or by calling (800) 464-3108. Copies of the annual report, the semi-annual report and this Joint Proxy Statement may also be obtained through the Schroder Mutual Funds’ website at www.schroderfunds.com.

3

Table of Contents

QUESTIONS AND ANSWERS | 6 |

| |

PROPOSALS 1 AND 2 — ELECTION OF TRUSTEES | 10 |

| |

Introduction | 10 |

| |

Comparison of Board Leadership Structures | 10 |

| |

Nominees for Trustee | 12 |

| |

Considerations of the Board and Experience, Qualifications, Attributes, and Skills of Nominees | 15 |

| |

Committees of the Board of Trustees | 17 |

| |

Securities Ownership | 18 |

| |

Nominees’ Compensation | 19 |

| |

Shareholder Communications with the Board of Trustees | 20 |

| |

Officers of the Trusts | 20 |

| |

Miscellaneous | 22 |

| |

Required Vote | 23 |

| |

Recommendation | 23 |

| |

PROPOSAL 3— MANAGEMENT CONTRACT APPROVALS | 24 |

| |

Introduction | 24 |

| |

Description of the Existing Management Contracts | 25 |

| |

Description of the Amended and Restated Management Contracts and Certain Differences from the Existing Management Contracts | 26 |

| |

Fees Payable Under the Existing Management Contracts and the Amended and Restated Management Contracts | 26 |

| |

Board Considerations | 27 |

| |

Miscellaneous | 28 |

| |

Required Vote | 29 |

| |

Recommendation | 29 |

| |

ADDITIONAL INFORMATION ABOUT PROPOSAL 3 | 30 |

| |

Information Regarding the Amended Administration Agreement | 30 |

4

Additional Information Regarding SIMNA’s and SIMNA Ltd.’s Directors | 30 |

| |

ADDITIONAL INFORMATION | 31 |

| |

Shareholder Liability | 31 |

| |

Independent Registered Public Accounting Firm | 31 |

| |

Share Ownership Information | 32 |

| |

Quorum | 32 |

| |

Other Business | 32 |

| |

Solicitation of Proxies | 32 |

| |

Adjournment | 33 |

| |

Tabulation of Votes | 33 |

| |

Date for Receipt of Shareholders’ Proposals for Meetings of Shareholders | 33 |

| |

Householding | 33 |

| |

EXHIBIT A — NOMINATING COMMITTEE CHARTER | 34 |

| |

EXHIBIT B — SHARES OUTSTANDING | 37 |

| |

EXHIBIT C — PRINCIPAL HOLDERS AND CONTROL PERSONS | 38 |

| |

EXHIBIT D — EXISTING MANAGEMENT CONTRACTS | 40 |

| |

EXHIBIT E — EXISTING MANAGEMENT CONTRACT DATES | 57 |

| |

EXHIBIT F — FORM OF AMENDED AND RESTATED MANAGEMENT CONTRACTS | 58 |

| |

EXHIBIT G — ESTIMATED COMPARISON OF FEES AND EXPENSES BEFORE AND AFTER TRANSITION | 70 |

| |

EXHIBIT H — COMPARISON OF ADMINISTRATION EXPENSES PAYABLE TO SEI BEFORE AND AFTER THE TRANSITION | 75 |

5

QUESTIONS AND ANSWERS

YOUR VOTE IS IMPORTANT

To help reach the level of shareholder participation required, and to ensure that the Trusts do not incur additional expenses associated with follow-up communications, please vote today, even if you plan to attend the Meeting. Simply follow the instructions on the enclosed proxy card and choose the voting method that works best for you — the internet, telephone or mail. Your prompt action will ensure your voice is heard, so vote your shares now.

1. What proposals am I being asked to consider?

Shareholders of the Funds as described below are being asked to consider the following proposals (the “Proposals”):

Proposal Summary | | Fund(s) Voting on the Proposal |

1. Election of Trustees of Schroder Series Trust | | Schroder Emerging Markets Small Cap Fund

Schroder Long Duration Investment-Grade Bond Fund

Schroder Short Duration Bond Fund

Schroder Total Return Fixed Income Fund |

2. Election of Trustees of Schroder Global Series Trust | | Schroder North American Equity Fund |

3. Approval of amended and restated management contracts to remove sections relating to Schroder Investment Management North America Inc.’s (“SIMNA’s”) provision and oversight of administrative services* | | Schroder Emerging Markets Small Cap Fund

Schroder Long Duration Investment-Grade Bond Fund

Schroder Short Duration Bond Fund |

* To be voted on by shareholders of each applicable Fund individually.

2. Why is Schroder Investment Management North America Inc. (SIMNA) recommending these changes?

As part of SIMNA’s overall strategic plan regarding US mutual funds, effective October 24, 2016, ten of the funds in the Schroder mutual fund complex were reorganized as series of The Hartford Mutual Funds II, Inc., and it was subsequently determined that another fund would be liquidated (collectively, the “Other Fund Restructurings”). In anticipation of the Other Fund Restructurings, SIMNA was concerned that, with only five remaining Funds, the Trusts would have a significantly smaller asset base and therefore would incur expenses at potentially significantly higher rates than they have historically. As a result, after considering various options for the Funds, SIMNA obtained board approval for, and is now recommending to shareholders, the changes described in this Proxy Statement to transition the Funds to the SEI Advisors’ Inner Circle mutual fund platform (the “SEI Platform”). The SEI Platform provides to its participating mutual funds, with assets in excess of $45.9 billion as of November 30, 2016, an infrastructure offering fund administration, accounting, investor servicing and distribution services. SIMNA believes that the scale of the SEI Platform and favorable contractual arrangements that SEI Investments Global Funds Services and its affiliates (“SEI”) have been able to negotiate with service providers offer the Funds the opportunity to benefit from efficient administration and the potential over time for lower expenses and greater economies of scale.

In developing this proposal, SIMNA considered that SEI has been providing the Funds high quality administrative services at reasonable prices for many years. In addition, SEI has substantial experience in administering and servicing mutual funds in the institutional space, and SIMNA believes that this will benefit current institutional investors and present an attractive platform for additional institutional subscriptions in the Funds.

The transition will not result in any changes to the Funds’ investment objectives, principal investment strategies, investment adviser or portfolio management teams. SIMNA will continue to serve as investment adviser to the Funds and Schroder Investment Management North America Limited (“SIMNA Ltd.”) will continue to serve as sub-adviser to Schroder

6

Emerging Markets Small Cap Fund and Schroder North American Equity Fund. In addition, the transition will not result in a change in the Funds’ auditor, transfer agent, or custodian.

3. What are shareholders being asked to approve to facilitate the transition to the SEI Platform?

In order to gain the full benefits and cost savings associated with the transition to the SEI Platform, each Trust will be “adopted” onto the SEI Platform. To accomplish this, we are proposing that certain individuals currently serving as Trustees for The Advisors’ Inner Circle Fund III, a trust that is part of the SEI Platform, succeed the current Trustees of the Trusts. Election of those new Trustees requires a vote of the Trusts’ shareholders. Thereafter, SEI, which already provides administrative services to each of the Funds, will enter into a new administrative services agreement with each Fund, pursuant to which SEI will provide a fuller range of services. Additional services provided by SEI will include, among other items, general vendor management and oversight, annual due diligence review of service providers, service contract negotiation, coordinating and filing regulatory materials, managing and coordinating audit-related activities, and maintaining Fund compliance policies and procedures. SEI personnel are also expected to serve as the Funds’ officers following the transition. Although implementation of the new administrative services agreements does not require shareholder approval, the management contracts for certain Funds will need to be revised to accommodate the new administrative services agreements with SEI, which does require shareholder approval. If all of the Proposals pass, the transition is expected to occur on or about February [ ], 2017.

4. What are the potential benefits of the Proposals to shareholders?

The transition to the SEI Platform is expected to offer the Funds, as part of the larger platform, efficient administration and the potential over time for lower expenses and greater economies of scale. The transition has been designed to allow the Funds to seamlessly continue their operations and investment programs without interruption and without a change to any Fund’s portfolio management team. If shareholders do not approve the Proposals and therefore the Funds do not transition to the SEI Platform (or undertake a comparable transition), the Funds, as the only remaining series of the Trusts, are expected to incur expenses at potentially significantly higher rates than they have historically. The Board of Trustees would consider, in that case, what other alternatives might be available to the Funds, including the potential liquidation of the Funds.

5. What are the proposed changes to the management contracts?

To transition to the SEI Platform, we are proposing amendments to the management contracts of Schroder Emerging Markets Small Cap Fund, Schroder Long Duration Investment-Grade Bond Fund, and Schroder Short Duration Bond Fund (the “Proposal 3 Funds”) to remove sections relating to the provision and oversight of administrative services by SIMNA in anticipation of the increased administrative services to be provided by SEI, which will be provided to the Proposal 3 Funds pursuant to an amended separate contract. It is proposed that the management fees to be paid to SIMNA under the Proposal 3 Funds’ management contracts would remain the same and not be reduced, in light of management’s view that the component of the management fee charged for providing and overseeing fund administrative services was not a driving factor in determining the current management fees and that those services were ancillary to SIMNA’s services as investment adviser to the Proposal 3 Funds. Management continues to believe that the current fees under the management contracts, even without the administrative services component, remain reasonable in light of the nature and quality of the services provided, the profitability to SIMNA from managing the Funds, and the levels of these fees compared to those paid by comparable peer funds and Schroder client accounts. To assure that there is no adverse impact on the total expenses paid by the Proposal 3 Funds and their shareholders in the period following the transition to the SEI Platform, the contractual expense limitations that limit the total expense ratios of each of the Proposal 3 Funds will remain in effect at current levels for at least two years following the transition. For more information regarding the effect of the transition on each of the Fund’s expense ratios, please see below.

6. How will the transition to the SEI Platform affect the total expenses of the Funds?

Although the administrative services fees to be charged by SEI after the transition are expected initially to be higher than the current administrative fees, efficiencies provided by the scope and breadth of the SEI Platform are expected to reduce the Funds’ expense ratios over time as the Funds achieve greater scale. More specifically, the total expense ratios, when adjusted to take into account the effect of the Other Fund Restructurings, for most of the Funds (Schroder Long Duration Investment-Grade Bond Fund, Schroder North American Equity Fund, and Schroder Total Return Fixed Income) are expected to be lower immediately after the transition; for the remaining Funds (Schroder Emerging Markets Small Cap

7

Fund and Schroder Short Duration Bond Fund) they are expected to be higher. However, due to efficiencies provided by the scope and breadth of the SEI Platform, the total expense ratios of all of the Funds are expected to be lower over time than current total expense ratios to the extent the Funds achieve larger scale. In addition, to assure that there is no adverse impact on the total expenses paid by the Funds and their shareholders in the period following the transition to the SEI Platform, contractual expense limitations that limit the total expense ratios of the Funds will remain in effect at current levels for at least two years following the transition (currently, contractual expense limitations are in place for each Fund except for Schroder North American Equity Fund). For more information regarding the estimated effect of the transition on each Fund’s expense ratio, see Exhibit G. Please note that this exhibit is based on estimates; the actual expenses of the Funds may be different.

7. How do the Trustees recommend that I vote?

The Trustees unanimously recommend that shareholders of the Funds vote “FOR” the Proposals.

8. Will my Fund pay for this proxy solicitation?

No. SIMNA or its affiliates will bear all of the costs associated with this proxy solicitation.

9. What level of shareholder support is needed to approve the Proposals?

· For Proposals 1 and 2, a Nominee to serve as trustee of a Trust who receives the affirmative vote of a plurality of the votes cast by shareholders of that Trust in person or by proxy at the Meeting, if a quorum is present, shall be elected. All shareholders of all Funds of a Trust vote together as a single class.

· Proposal 3 will be considered approved with respect to a Fund if it is approved by the lesser of (i) 67% of the shares of that Fund that are present at the Meeting, if the holders of more than 50% of the shares of the Fund outstanding as of the Record Date are present or represented by proxy at the Meeting, or (ii) more than 50% of the shares of the Fund outstanding on the Record Date. All share classes of a Fund vote together as a single class on the Proposal as it relates to the Fund.

10. Who is entitled to vote at the Meeting?

Shareholders of record as of December [27], 2016 are entitled to vote at the Meeting. Shareholders of each Fund listed below are entitled to vote on each Proposal.

Proposal 1: Schroder Emerging Markets Small Cap Fund, Schroder Long Duration Investment-Grade Bond Fund, Schroder Short Duration Bond Fund, and Schroder Total Return Fixed Income Fund (to be voted on by shareholders of all Funds together as a single class).

Proposal 2: Schroder North American Equity Fund

Proposal 3: Schroder Emerging Markets Small Cap Fund, Schroder Short Duration Bond Fund, and Schroder Long Duration Investment-Grade Bond Fund (to be voted on by shareholders of each of those Funds individually).

All eligible shareholders are urged to vote.

11. When and where will the Meeting be held?

The Meeting is scheduled for [February 2], 2017 at [10:00 a.m.] Eastern Time, at the offices of the Trusts at 875 Third Avenue, 22nd Floor, New York, New York 10022.

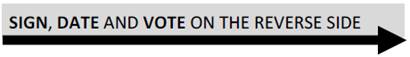

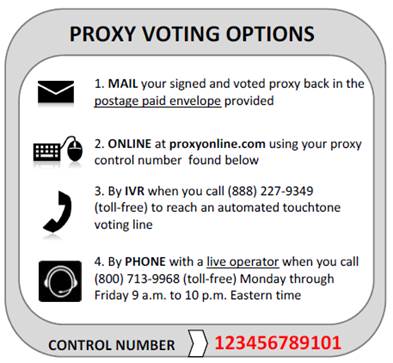

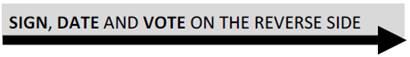

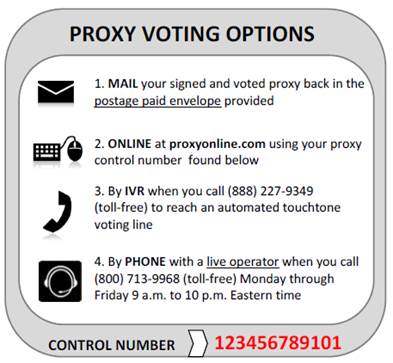

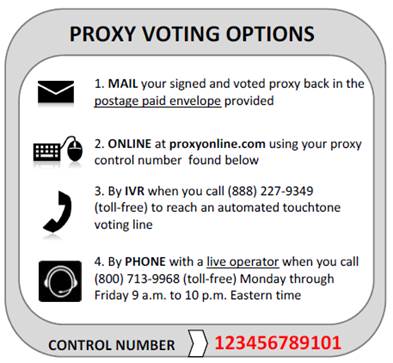

12. What method of voting may I use?

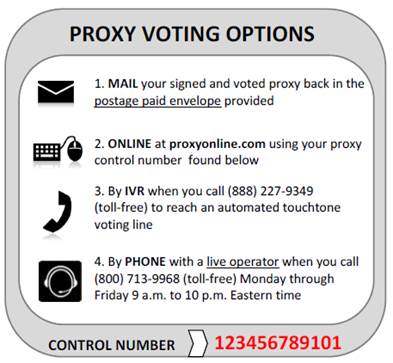

Simply select the voting format that you find most convenient:

8

· Telephone (to speak to a representative of AST Fund Solutions, LLC, the Trusts’ proxy solicitor): Call (800) 713-9968 (toll free).

· Internet: Access the web site shown on your proxy card(s) and follow the online instructions.

· Mail: Complete and return the enclosed proxy card(s).

· In person: Attend the Meeting on [February 2], 2017.

Whichever method you choose, please be sure to cast your vote as soon as possible. To help reach the level of shareholder participation required, and to ensure that the Funds do not incur additional expenses associated with follow-up communications, please vote today, even if you plan to attend the Meeting.

11. Whom should I call if I have additional questions?

If you have questions related to the proxy material or attending the Meeting or need assistance in voting your shares, please contact AST Fund Solutions, LLC, the Trusts’ proxy solicitor, toll free at (800) 713-9968.

9

PROPOSALS 1 AND 2 — ELECTION OF TRUSTEES

Introduction

As part of the transition to the SEI Platform, it is proposed that the existing members of the Boards of Trustees of the Trusts (the “Current Board”) be succeeded by a new slate of successor trustees described in this Joint Proxy Statement (the “Nominees” or the “Nominee Trustees”), each of whom currently serves as a trustee of The Advisors’ Inner Circle Fund III, one of the investment companies on the SEI Platform (the “SEI Trust”). Election of the Nominee Trustees is recommended so that the Funds can become part of the SEI Platform. The Nominee Trustees are familiar with SEI Investments Global Funds Services and its affiliates (“SEI”) and the SEI Platform, will be able to coordinate their oversight of the Funds with the other mutual funds they oversee, and will be paid fees at rates reflecting the combined responsibilities for the Trusts, the SEI Trust and certain other registered investment companies on the SEI Platform. SEI personnel are also expected to serve as the Funds’ officers following the transition.

The Current Board is proposing that Jon C. Hunt, Thomas P. Lemke, Randall S. Yanker, and William M. Doran be elected to serve as Nominee Trustees of each Trust. Messrs. Hunt, Lemke, and Yanker are not currently “interested persons” of the SEI Trust, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”) and are referred to herein as the “Independent Nominee Trustees.” Mr. Doran is an “interested person” of the SEI Trust, and is referred to herein as the “Interested Nominee Trustee.” Shareholders of each Trust will vote separately to elect Nominee Trustees of their Trust.

The Current Board is composed of three Trustees, two of whom are independent Trustees and one of whom is an interested Trustee. The current independent Trustees of the Trusts are Jay S. Calhoun and Mark D. Gersten. The current interested Trustee is Catherine A. Mazza. No current Trustee has been proposed for re-election as a Trustee. The current Trustees will be succeeded in office by the Nominee Trustees upon the election and qualification of Nominee Trustees as their successors. If every Nominee Trustee is approved by shareholders, the Board of each Trust will be composed of three Independent Nominee Trustees and one Interested Nominee Trustee.

The term of office of each elected Nominee for each Trust will be until he or she retires, resigns, is removed or dies or until his or her successor is elected and qualified. Each Nominee Trustee has consented to be named in this Joint Proxy Statement and to serve as a Nominee Trustee of each Trust if elected. The Current Board has no reason to believe that any Nominee Trustee will become unavailable to serve as a Nominee Trustee.

In 2016, after the Current Board had reviewed the qualifications and considered the appointment of the Nominee Trustees, Jay C. Nadel was appointed to the Board of the SEI Trust. Because the Current Board did not consider Mr. Nadel’s possible appointment due to timing, shareholders are not being asked to elect Mr. Nadel as part of these Proposals. In order to provide the Trusts with the oversight and expertise of the full Board of the SEI Trust, it is currently anticipated that, if Proposal 1 and 2 are approved, the Nominee Trustees will appoint Mr. Nadel as a member of the Board promptly after the election of the Nominee Trustees to the Board. As a result, information regarding Mr. Nadel has been included throughout this Joint Proxy Statement in each section that discloses information regarding the Independent Nominee Trustees. Mr. Nadel is not an “interested person” of the SEI Trust, as defined in Section 2(a)(19) of the 1940 Act, and currently serves as the Chairman of the Audit Committee of the SEI Trust.

Comparison of Board Leadership Structures

The business of each Trust is managed under the direction of its Board of Trustees. Subject to the provisions of each Trust’s Declaration of Trust, its Bylaws and the laws of the Commonwealth of Massachusetts, the Trustees of each Trust have all powers necessary and convenient to carry out this responsibility, including the election and removal of the Trust’s officers.

The Current Board consists of three Trustees, two of whom are independent Trustees. If every Nominee Trustee is approved by shareholders, the Board will consist of four trustees, three of whom are expected to be Independent Nominee Trustees. In addition, as discussed above, it is anticipated that promptly after the election of the Nominee Trustees to the Board, the Nominee Trustees will appoint Jay C. Nadel to the Board. If Mr. Nadel is appointed to the Board as anticipated, the Board will consist of five trustees, four of whom are expected to be disinterested.

10

Ms. Catherine A. Mazza, who is an interested Trustee, has served as Chairman of the Board of each Trust since May 2003 and following the election of the Nominees, it is anticipated that Mr. William M. Doran will serve as Chairman of the Boards. The Chairman of the Board presides at meetings of the Board and acts as a liaison with service providers, officers, attorneys and other Trustees generally between meetings, and performs such other functions as may be requested by the Board from time to time. For the fiscal year ended October 31, 2016, the Board of Schroder Series Trust and the Board of Schroder Global Series Trust each held seven meetings.

The Current Board has not designated a lead independent Trustee, but it is expected that, following the election of the Nominee Trustees to the Board (the “Nominee Board”), the Nominee Trustees will designate Mr. Hunt as lead independent Trustee. In his role as lead independent Trustee, it is expected that Mr. Hunt will, among other things: (i) preside over Board meetings in the absence of the Chairman of the Board; (ii) preside over executive sessions of the independent Trustees; (iii) along with the Chairman of the Board, oversee the development of agendas for Board meetings; (iv) facilitate communication between the independent Trustees and management, and among the independent Trustees; (v) serve as a key point person for dealings between the independent Trustees and management; and (vi) have such other responsibilities as the Board or independent Trustees determine from time to time.

The number of Trustees of each Trust is fixed from time to time by the Trustees but may not be less than three. Each Trustee shall serve until he or she retires, resigns, is removed or dies or until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his or her successor. At any meeting called for the purpose, a Trustee may be removed by vote of the holders of two-thirds of the outstanding shares of the Trust.

The Current Board has adopted a committee structure, which allows it to perform more effectively its oversight function for the Funds. The Current Board has two standing committees to facilitate the Trustees’ oversight of the management of the Trust: the Audit Committee and the Nominating Committee. Following the election of the Nominee Board, it is expected that the Nominee Board will continue to maintain in place an Audit Committee and that the Nominating Committee will be replaced by a Governance Committee whose responsibilities will include, in addition to similar responsibilities described below for the Trusts’ Nominating Committee, considering and reviewing Board governance and compensation issues and conducting self-assessments of the Board’s operations. The functions and role of each committee are described below under “Committees of the Board of Trustees.” The membership of each of those committees currently consists of all of the disinterested Trustees. The committees report regularly to the Board of Trustees.

The Current Board reviews its leadership structure periodically and has determined that its leadership structure, including a majority of independent Trustees and Committees comprised entirely of independent Trustees, is appropriate in light of the characteristics and circumstances of the Trusts. In reaching this conclusion, the Current Board considered, among other things, the extent to which the work of the Board is conducted through the Committees, the number of Funds overseen, the variety of asset classes in which those Funds invest, and the management and other service arrangements of each Fund. The Current Board also believes that its structure facilitates an efficient flow of information concerning the management of the Funds to the independent Trustees.

In connection with its oversight of each Trust, the Current Board also oversees each Trust’s management and risk management processes. With respect to management, executive officers of the Trusts, including the President and Principal Executive Officer, Treasurer and Chief Financial Officer, Chief Legal Officer, and Chief Compliance Officer, are appointed by the Board of Trustees in accordance with the applicable Trust’s Bylaws, provided that the Chief Compliance Officer must be approved by a majority of the disinterested Trustees. Each of the President, the Treasurer, and the Clerk shall hold office until he or she dies, resigns, is removed or becomes disqualified, and each other officer of each Trust shall hold office at the pleasure of the Trustees of the applicable Trust. A Trust’s Board of Trustees may remove any officer of that Trust at any time, with or without cause, provided that a majority of the disinterested Trustees must approve the removal of the Chief Compliance Officer. In connection with performing its oversight function with respect to risk management, the Board of Trustees has received regular reports from SIMNA and from executive officers of the Trusts, including but not limited to the President and Principal Executive Officer, Chief Compliance Officer, Treasurer and Chief Financial Officer, and Chief Legal Officer, on a variety of matters. These reports include specific information on risk oversight by SIMNA, activities of SIMNA’s risk committee, activities of the valuation committee, results of operational and compliance testing on the Funds, the performance of the Funds and their use of certain instruments, including restricted and illiquid securities, derivatives, and borrowings. Each Trust has determined that its leadership and committee structure is appropriate for the Funds and the applicable Trust in light of the size of the Trust and the Schroders fund complex, and reviews the effectiveness of its committee structure at least annually.

11

It is expected that, following the election of the Nominee Trustees to the Board, the Board will maintain a similar leadership and committee structure, except as noted, with responsibilities and practices similar to those described above.

Nominees for Trustee

On June 16, 2016, the Nominating Committee of the Current Board met and together nominated the Nominee Trustees to stand for election by shareholders at the Meeting, and the Current Board met and together determined to nominate the Nominee Trustees to stand for election by shareholders at the Meeting.

The following table sets forth certain information concerning the Nominees. The information is listed separately for (i) the Nominee who is or would be an Interested Nominee Trustee; and (ii) the Nominees who are or would be Independent Nominee Trustees. Unless otherwise indicated, the business address of the persons listed below is SEI Investments Company, One Freedom Valley Drive, Oaks, Pennsylvania 19456.

Interested Nominee Trustee:

Name

and Year of

Birth | | Position(s)

Held with

Trusts | | Length of

Time

Served(1) | | Principal

Occupation(s)

During Past 5

Years | | Number of Funds

in Fund Complex

Overseen or to be

Overseen by

Nominee Trustee(2) | | Other Directorships

Held by Nominee

Trustee |

William M. Doran(3)

(Born: 1940) | | Nominee | | Nominee | | Self-Employed Consultant since 2003. Partner at Morgan, Lewis & Bockius LLP (law firm) from 1976 to 2003. Counsel to each trust on the SEI Platform, SEI Investments, SEI Investments Management Corporation, SEI Investments Global Funds Services and SEI Investments Distribution Co. | | 5 | | Current Directorships: Chairman of the Board of Trustees of the SEI Trust. Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, The KP Funds, Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company), Gallery Trust, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. Director of |

12

| | | | | | | | | | SEI Investments (Europe), Limited, SEI Investments—Global Funds Services, Limited, SEI Investments Global, Limited, SEI Investments (Asia), Limited, SEI Global Nominee Ltd. and SEI Investments — Unit Trust Management (UK) Limited and SEI Investments Co. Director of SEI Investments Distribution Co. since 2003.

Former Directorships: Director of SEI Alpha Strategy Portfolios, LP to 2013. Trustee of O’Connor EQUUS (closed-end investment company) to 2016. Trustee of SEI Liquid Asset Trust to 2016. |

(1) Each Trustee shall serve until he or she retires, resigns, is removed or dies or until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his or her successor.

(2) If the Proposals pass, the “Fund Complex” will consist of the four series of Schroder Series Trust and the one series of Schroder Global Series Trust.

(3) If the Proposals pass, Mr. Doran may be deemed to be an “interested person” of the Trusts, as defined in Section 2(a)(19) of the 1940 Act, by virtue of his affiliation with SEI Investments Distribution Co. and its affiliates. In addition, if the Proposals pass, it is expected that the Nominee Board will approve each Fund entering into a new distribution agreement with SEI Investments Distribution Co., which would replace the Funds’current distribution arrangements with Schroder Fund Advisors LLC (“SFA”).

13

Independent Nominee Trustees:

Name

and Date of

Birth | | Position(s) Held

with Trust | | Length of

Time

Served(1) | | Principal

Occupation(s)

During Past 5

Years | | Number of

Funds in Fund

Complex

Overseen or to

be Overseen

by Nominee

Trustee(2) | | Other Directorships

Held by Nominee

Trustee |

Jon C. Hunt

(Born: 1951) | | Nominee | | Nominee | | Retired since 2013. Consultant to Management, Convergent Capital Management, LLC (“CCM”) from 2012 to 2013. Managing Director and Chief Operating Officer, CCM from 1998 to 2012. | | 5 | | Current Directorships: Trustee of the SEI Trust, City National Rochdale Funds, Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company) and Gallery Trust. Member of Independent Committee of Nuveen Commodities Asset Management.

Former Directorship: O’Connor EQUUS (closed-end investment company), |

Thomas P. Lemke

(Born: 1954) | | Nominee | | Nominee | | Retired since 2013. Executive Vice President and General Counsel, Legg Mason, Inc. from 2005 to 2013. | | 5 | | Current Directorships:

Trustee of the SEI Trust, AXA Premier VIP Trust, Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company), Gallery Trust and JP Morgan Active ETFs.

Former Directorships: Trustee of Munder Funds to 2014. Director of Victory Funds to 2015. Trustee of O’Connor EQUUS (closed-end investment company) to 2016. |

14

Randall S. Yanker

(Born: 1960) | | Nominee | | Nominee | | Co-Founder and Senior Partner, Alternative Asset Managers, L.P. since 2004. | | 5 | | Current Directorships: Trustee of the SEI Trust, Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company) and Gallery Trust. Independent Non-Executive Director of HFA Holdings Limited.

Former Directorship: Trustee of O’Connor EQUUS (closed-end investment company) to 2016. |

Jay C. Nadel(3) | | None | | N/A | | Self-Employed Consultant since 2004. | | 5 | | Current Directorships: Trustee of the SEI Trust, City National Rochdale Funds, Winton Series Trust, Winton Diversified Opportunities Trust (closed-end investment company) and Gallery Trust. Director of Lapolla Industries, Inc.

Former Directorship: Trustee of Rochdale Investment Trust to 2013. |

(1) Each Trustee shall serve until he or she retires, resigns, is removed or dies or until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his or her successor.

(2) If the Proposals pass, the “Fund Complex” will consist of the four series of Schroder Series Trust and the one series of Schroder Global Series Trust.

(3) In order to provide the Trusts with the oversight and expertise of the full Board of the SEI Trust, it is currently anticipated that the Nominee Trustees will appoint Mr. Nadel as a member of the Board promptly after the election of the Nominee Trustees to the Board. Shareholders are not being asked to elect Mr. Nadel as part of these Proposals.

Considerations of the Board and Experience, Qualifications, Attributes, and Skills of Nominees

The Current Board has determined to nominate each of the Nominees to serve as a Nominee Trustee of the Trusts based on several factors (none of which alone is decisive).

The Current Board considered the potential benefits to the Trusts of their transition to the SEI Platform. In this regard, the Current Board considered that the election of the Nominee Trustees was required in order to transition the Funds to the SEI Platform. The Current Board also considered that the Nominee Trustees are familiar with SEI and the SEI Platform, and the information provided to them by SIMNA about the SEI Platform. SIMNA reported to the Current Board that the SEI

15

Platform, with its well-established oversight and governance structure, will bring potential benefits of scale from the SEI Platform to the Funds, thereby offering the possibility of decreased operating costs and improved processing efficiencies. Similarly, SIMNA reported its belief that the Funds will be in a position to benefit from any favorable contractual arrangements that SEI has been able to negotiate with service providers to the SEI Platform based on the SEI Platform’s significantly greater asset size. SIMNA further reported that SEI has been providing the Funds high quality administrative services at reasonable prices for many years. In addition, SIMNA noted that SEI has substantial experience in administering and servicing mutual funds in the institutional space, and that SIMNA believes SEI’s experience will benefit current institutional investors and present an attractive platform for additional institutional subscriptions in the Funds. SIMNA noted that this, in turn, creates the potential over time for lower expenses and the achievement of greater economies of scale.

In respect of each Nominee, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Funds, were a significant factor in the determination that the individual should serve as a Nominee Trustee of the Trusts. The following is a summary of various qualifications, experiences and skills of each Nominee (in addition to business experience during the past five years set forth in the table above) that contributed to the Current Board’s conclusion that an individual should serve on the Board.

Independent Nominee Trustees:

Jon C. Hunt. The Current Board has concluded that Mr. Hunt should serve as Trustee because of the experience he gained in a variety of leadership roles with different investment management institutions, his experience in and knowledge of the financial services industry, and the experience he has gained as a board member of open-end, closed-end and private funds investing in a broad range of asset classes, including alternative asset classes.

Thomas P. Lemke. The Current Board has concluded that Mr. Lemke should serve as Trustee because of the extensive experience he has in the financial services industry, including experience in various senior management positions with financial services firms and multiple years of service with a regulatory agency, his background in controls, including legal, compliance and risk management, and his service as general counsel for several financial services firms.

Randall S. Yanker. The Current Board has concluded that Mr. Yanker should serve as Trustee because of the experience he gained in a variety of leadership roles with the alternative asset management divisions of various financial services firms, his experience in and knowledge of the financial services industry, and the experience he has gained advising institutions on alternative asset management.

Jay C. Nadel. It is currently anticipated that the Nominee Trustees will appoint Mr. Nadel as a member of the Board promptly after the election of the Nominee Trustees to the Board. The board of trustees of the SEI Trust has concluded that Mr. Nadel should serve as a trustee of the SEI Trust because of the experience he gained in a variety of leadership roles with an audit firm and various financial services firms, his experience in and knowledge of the financial services industry, and the experience he has gained serving on other mutual fund and operating company boards. Shareholders are not being asked to elect Mr. Nadel as part of these Proposals.

Interested Nominee Trustee:

William M. Doran. The Current Board has concluded that Mr. Doran should serve as Trustee because of the experience he gained serving as a partner in the investment management and securities industry practice of a large law firm, his experience in and knowledge of the financial services industry, and the experience he has gained serving on other mutual fund boards.

In considering the nomination of the Nominee Board, the Current Board considered the complementary individual skills and experience of the individual Nominees primarily in the broader context of the Nominee Board’s overall composition so that the Nominee Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Funds.

References to the experience, qualifications, attributes, and skills of the Nominees are pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out of the Nominee Board or any Nominee as having any

16

special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

Committees of the Board of Trustees

Audit Committee

The Current Board has a separately-designated standing Audit Committee composed entirely of the disinterested Trustees. The Audit Committee provides oversight with respect to the internal and external accounting and auditing procedures of the Funds and, among other things, considers the selection of the independent registered public accounting firms for the Funds and the scope of the audit, approves all audit and permitted non-audit services proposed to be performed by those accountants on behalf of the Funds, and considers other services provided by those accountants to the Funds and SIMNA and its affiliates and the possible effect of those services on the independence of those accountants. For the fiscal year ended October 31, 2016, the Audit Committee of the Board of Schroder Series Trust and the Board of Schroder Global Series Trust each held four meetings.

It is anticipated that, following the election of the Nominee Board, the Nominee Board will continue to maintain in place an Audit Committee but will implement the practices of the existing Audit Committee of the SEI Trust (the “SEI Audit Committee”) for the Trusts. The SEI Audit Committee is composed of each of the independent Trustees of the SEI Trust, which includes Mr. Nadel. The SEI Audit Committee operates under a written charter approved by the Board of the SEI Trust. The principal responsibilities of the SEI Audit Committee include: (i) recommending which firm to engage as each fund’s independent registered public accounting firm and whether to terminate this relationship; (ii) reviewing the independent registered public accounting firm’s compensation, the proposed scope and terms of its engagement, and the firm’s independence; (iii) pre-approving audit and non-audit services provided by each fund’s independent registered public accounting firm to the Trust and certain other affiliated entities; (iv) serving as a channel of communication between the independent registered public accounting firm and the trustees; (v) reviewing the results of each external audit, including any qualifications in the independent registered public accounting firm’s opinion, any related management letter, management’s responses to recommendations made by the independent registered public accounting firm in connection with the audit, reports submitted to the SEI Audit Committee by the internal auditing department of the SEI Trust’s administrator that are material to the SEI Trust as a whole, if any, and management’s responses to any such reports; (vi) reviewing each fund’s audited financial statements and considering any significant disputes between the SEI Trust’s management and the independent registered public accounting firm that arose in connection with the preparation of those financial statements; (vii) considering, in consultation with the independent registered public accounting firm and the SEI Trust’s senior internal accounting executive, if any, the independent registered public accounting firms’ reports on the adequacy of the SEI Trust’s internal financial controls; (viii) reviewing, in consultation with each fund’s independent registered public accounting firm, major changes regarding auditing and accounting principles and practices to be followed when preparing each fund’s financial statements; and (ix) other audit related matters. Mr. Hunt, Mr. Lemke, Mr. Nadel and Mr. Yanker currently serve as members of the SEI Audit Committee. Mr. Nadel currently serves as the Chairman of the SEI Audit Committee. Following the election of the Nominee Board, the Nominee Trustees expects to designate Mr. Nadel as the Chairman of the Audit Committee of the Trusts.

Nominating Committee

The Current Board has a Nominating Committee, which is responsible for recommending individuals to the Board of the Trusts for nomination as members of the Board. All of the independent Trustees (currently, Messrs. Calhoun and Gersten) serve on the Trusts’ Nominating Committee. The Nominating Committee identifies individuals qualified to serve as Trustees, recommends individuals to be appointed to the Trust’s Board or to be proposed as nominees for election by shareholders, and sets standards or qualifications for service on the Board of Trustees. The Nominating Committee considers a wide variety of factors in evaluating Trustee candidates, including but not limited to, the individual’s availability and commitment to attend meetings and perform his or her responsibilities, relevant industry and related experience, educational background, financial experience, an assessment of his or her ability, judgment and expertise, and the overall diversity of the Board’s composition. The Nominating Committee will consider nominees properly submitted by shareholders on the same basis as it considers candidates recommended by other sources. Nominee recommendations may be submitted to the Clerk of each Trust at the Trusts’ principal business address. Shareholder recommendations must be delivered or mailed to and received by a Trust not less than 45 days nor more than 75 days prior to the Board meeting at which the nominee would be

17

elected. For the fiscal year ended October 31, 2016, the Nominating Committee of the Board of Schroder Series Trust and the Board of Schroder Global Series Trust each held one meeting.

Additional information regarding Nominating Committee procedures is available in the Nominating Committee’s Charter attached as Exhibit A.

It is anticipated that, following the election of the Nominee Board, the Nominee Board will replace the Nominating Committee with a Governance Committee and implement the practices of the Governance Committee of the SEI Trust (the “SEI Governance Committee”) for the Trusts. The SEI Governance Committee is composed of each of the independent Trustees of the SEI Trust, which includes Mr. Nadel. The SEI Governance Committee operates under a written charter approved by the Board of the SEI Trust. The principal responsibilities of the SEI Governance Committee include: (i) considering and reviewing Board governance and compensation issues; (ii) conducting a self-assessment of the Board’s operations; (iii) selecting and nominating all persons to serve as independent Trustees and evaluating the qualifications of “interested” Trustee candidates; and (iv) reviewing shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the SEI Governance Committee at the SEI Trust’s office. Mr. Hunt, Mr. Lemke, Mr. Nadel and Mr. Yanker currently serve as members of the SEI Governance Committee. Mr. Lemke currently serves as the Chairman of the SEI Governance Committee. Following the election of the Nominee Board, the Nominee Trustees will designate Mr. Lemke as the Chairman of the Governance Committee of the Trusts.

Securities Ownership

For each Nominee, the following table discloses the dollar range of equity securities beneficially owned by the Nominee in each Fund, on an aggregate basis, in any registered investment companies overseen or anticipated to be overseen by the Nominee within the Trusts’ family of investment companies, as of July 5, 2016.

The Nominees may have investments in other pools of securities managed by SIMNA. The dollar ranges used in the table are: (i) None; (ii) $1-$10,000; (iii) $10,001-$50,000; (iv) $50,001-$100,000; and (v) Over $100,000.

Nominees:

Name of

Nominee | | Dollar Range of Equity Securities Owned in the Funds To Be Overseen by

the Nominee | | Aggregate Dollar

Range of Equity

Securities in all

Registered

Investment

Companies

Overseen or to be

Overseen by

Nominee in Family

of Investment

Companies(1) |

Independent Nominee Trustees: |

Jon C. Hunt | | SCHRODER SERIES TRUST Schroder Emerging Markets Small Cap Fund Schroder Long Duration Investment-Grade Bond Fund Schroder Short Duration Bond Fund Schroder Total Return Fixed Income Fund SCHRODER GLOBAL SERIES TRUST Schroder North American Equity Fund | None None None None None | | None |

Thomas P. Lemke | | SCHRODER SERIES TRUST Schroder Emerging Markets Small Cap Fund Schroder Long Duration Investment-Grade Bond Fund | None None | | None |

18

| | Schroder Short Duration Bond Fund Schroder Total Return Fixed Income Fund SCHRODER GLOBAL SERIES TRUST Schroder North American Equity Fund | None None None | | |

Randall S. Yanker | | SCHRODER SERIES TRUST Schroder Emerging Markets Small Cap Fund Schroder Long Duration Investment-Grade Bond Fund Schroder Short Duration Bond Fund Schroder Total Return Fixed Income Fund SCHRODER GLOBAL SERIES TRUST Schroder North American Equity Fund | None None None None None | | None |

Jay C. Nadel(2) | | SCHRODER SERIES TRUST Schroder Emerging Markets Small Cap Fund Schroder Long Duration Investment-Grade Bond Fund Schroder Short Duration Bond Fund Schroder Total Return Fixed Income Fund SCHRODER GLOBAL SERIES TRUST Schroder North American Equity Fund | None None None None None | | None |

Interested Nominee Trustee: |

William M. Doran | | SCHRODER SERIES TRUST Schroder Emerging Markets Small Cap Fund Schroder Long Duration Investment-Grade Bond Fund Schroder Short Duration Bond Fund Schroder Total Return Fixed Income Fund SCHRODER GLOBAL SERIES TRUST Schroder North American Equity Fund | None None None None None | | None |

(1) The “Family of Investment Companies” consists of the four series of Schroder Series Trust and the one series of Schroder Global Series Trust.

(2) In order to provide the Trusts with the oversight and expertise of the full Board of the SEI Trust, it is currently anticipated that the Nominee Trustees will appoint Mr. Nadel as a member of the Board promptly after the election of the Nominee Trustees to the Board. Shareholders are not being asked to elect Mr. Nadel as part of these Proposals.

To the Trusts’ knowledge as of July 5, 2016, the Nominees who are expected to be Independent Nominee Trustees, if elected, and their immediate family members do not beneficially own any securities in an investment manager or principal underwriter of the Trusts, or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with an investment manager or principal underwriter of the Trusts.

Nominees’ Compensation

The Nominees, if elected, would each receive an annual retainer of $14,575 for their services as Nominee Trustees of the Funds. All of the Nominee Trustee fees would be allocated equally among the Schroder Series Trust and Schroder Global Series Trust based on their respective assets. If a meeting relates only to a single fund or group of funds, payments of such meeting fees are allocated only among those funds to which the meeting relates.

19

Shareholder Communications with the Board of Trustees

Each Board of Trustees has adopted procedures by which shareholders may send communications to the Board. Shareholders may send communications intended for the Trustees by addressing the communication directly to the Trustees (or individual Trustees) and/or otherwise clearly indicating in the salutation that the communication is for the Trustees (or individual Trustees) and by sending the communication to such Trustees at 875 Third Avenue, 22nd Floor, New York, New York 10022. The President of the applicable Trust shall either provide a copy of each properly submitted shareholder communication to the Board at its next regularly scheduled meeting or forward the communication to the Trustees promptly after receipt or may, in good faith, determine that the shareholder communication should not be provided to the Board because it does not reasonably relate to the Trust or its operations, management, activities, policies, service providers, Board, officers, shareholders or other matters relating to an investment in any constituent series of the Trust or is otherwise immaterial in nature. Other shareholder communications received by the Trusts not directly addressed and sent to the Trustees will be reviewed and generally responded to by management, and will be forwarded to the Trustees only at management’s discretion based on the matters contained therein.

Officers of the Trusts

The following table sets forth the name, age, position with the Trusts, and the principal occupations for the last five years of each of the current officers of the Trusts. Unless otherwise noted, the business address of each current officer is 875 Third Avenue, New York, New York 10022.

Name and Year of

Birth | | Position With Trusts | | Principal Occupations In Past 5 Years |

Catherine A. Mazza

(Born: 1960) | | Trustee and Chairman

(since 2006 (Schroder Capital Funds (Delaware) and Schroder Series Trust) and since 2003 (Schroder Global Series Trust)) | | Trustee and Chairman of each Trust; Institutional Director, SIMNA; Member of Board of Managers, SFA. |

Mark A. Hemenetz

(Born: 1956) | | President and Principal Executive Officer

(since 2004) | | Chief Operating Officer, SIMNA; Member of Board of Managers, SFA; President and Principal Executive Officer of each Trust and of the Swiss Helvetia Fund, Inc. |

Alan M. Mandel

(Born: 1957) | | Treasurer and Principal Financial and Accounting Officer

(since 1998) | | Head of Fund Administration, SIMNA; Member of Board of Managers, SFA; Treasurer and Principal Financial and Accounting Officer of each Trust and of the Swiss Helvetia Fund, Inc. |

Carin F. Muhlbaum

(Born: 1962) | | Vice President

(since 1998) | | General Counsel, SIMNA; Secretary and General Counsel, SFA; Vice President of each Trust and of the Swiss Helvetia Fund, Inc. Formerly, Member of Board of Managers, SFA. |

William Sauer

(Born: 1963) | | Vice President

(since 2008) | | Head of Investor Services, SIMNA; Vice President of each Trust and of the Swiss Helvetia Fund, Inc. |

Joseph Bertini

(Born: 1965) | | Chief Compliance Officer (since 2016) | | Chief Compliance Officer, SIMNA; Chief Compliance Officer of each Trust; formerly, Member of Board of Managers, SFA. |

Abby L. Ingber

(Born: 1962) | | Chief Legal Officer and Clerk

(since 2006 (Chief Legal Officer) and since 2007 (Clerk)) | | Deputy General Counsel, SIMNA; Chief Legal Officer and Clerk of each Trust; Secretary, the Swiss Helvetia Fund, Inc.; formerly, Member of Board of Managers, SFA. |

David Marshall

(Born: 1971) | | Assistant Treasurer

(since 2014) | | Manager of Fund Administration, SIMNA; Assistant Treasurer of each Trust and of the Swiss Helvetia Fund, Inc. |

Angel Lanier | | Assistant Secretary | | Legal Assistant, SIMNA; Assistant Clerk of each Trust; Assistant Secretary, the Swiss Helvetia Fund, Inc; |

20

(Born: 1961) | | (since 2005) | | Assistant Secretary, SFA. |

Reid B. Adams

(Born: 1977) | | Assistant Secretary

(since 2015) | | Associate General Counsel, SIMNA; Assistant Clerk of each Trust; Formerly, Associate, Ropes & Gray LLP. |

The following table lists the positions held by the Trusts’ current officers and interested Trustees with affiliated persons or principal underwriters of the Trusts:

Name | | Positions Held with

Affiliated Persons or

Principal Underwriters

of the Trusts |

Catherine A. Mazza | | Trustee and Chairman of each Trust; Institutional Director, SIMNA; Member of Board of Managers, SFA. |

Mark A. Hemenetz | | President and Principal Executive Officer of each Trust; Chief Operating Officer, SIMNA; Member of Board of Managers, SFA. |

Alan M. Mandel | | Head of Fund Administration, SIMNA; Member of Board of Managers, SFA; Treasurer & Principal Financial and Accounting Officer of each Trust. |

Carin F. Muhlbaum | | General Counsel, SIMNA; Secretary and General Counsel, SFA; Vice President of each Trust. |

William Sauer | | Head of Investor Services, SIMNA; Vice President of each Trust; Director, Schroder Venture Managers, Inc. |

Joseph Bertini | | Chief Compliance Officer, SIMNA; Chief Compliance Officer of each Trust; formerly, Member of Board of Managers, SFA. |

Abby L. Ingber | | Deputy General Counsel, SIMNA; Chief Legal Officer and Clerk of each Trust; formerly, Member of Board of Managers, SFA. |

Angel Lanier | | Legal Assistant, SIMNA; Assistant Secretary, SFA; Assistant Clerk of each Trust. |

Reid B. Adams | | Associate General Counsel, SIMNA; Assistant Clerk of each Trust. |

It is expected that, if the Nominee Board is elected, it will appoint a number of officers of the SEI Trust to serve as officers of the Trusts, as well. The following table sets forth the names, year of birth, anticipated position with the Trusts, and the principal occupations for the last five years of each of those persons. Unless otherwise noted, the business address of each anticipated officer is SEI Investments Company, One Freedom Valley Drive, Oaks, Pennsylvania 19456.

Certain anticipated officers of the Trusts also serve as officers of one or more mutual funds for which SEI or its affiliates act as investment manager, administrator or distributor.

Name and Year of

Birth | | Anticipated Position With

Trusts | | Principal Occupations In Past 5 Years |

Michael Beattie

(Born: 1965) | | President | | President, SEI Trust, since 2014. Director of Client Service, SEI Investments Company, since 2004. |

Robert Nesher

(Born: 1946) | | Vice Chairman | | Vice Chairman, SEI Trust, since 2014. SEI employee 1974 to present; currently performs various services on behalf of SEI Investments for which Mr. Nesher is compensated. Vice Chairman of Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company) and Gallery Trust. President, Chief Executive Officer and Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance |

21

| | | | Products Trust and SEI Catholic Values Trust. President and Director of SEI Structured Credit Fund, LP. President, Chief Executive Officer and Director of SEI Alpha Strategy Portfolios, LP, June 2007 to September 2013. |

Stephen Connors

(Born: 1984) | | Treasurer, Controller and Chief Financial Officer | | Treasurer, Controller and Chief Financial Officer, SEI Trust, since 2015. Director, SEI Investments, Fund Accounting since December 2014. Audit Manager, Deloitte & Touche LLP, from 2011 to 2014. Audit Supervisor, BBD, LLP (formerly Briggs, Bunting & Dougherty, LLP), from 2007 to 2011. |

Dianne M Descoteaux

(Born: 1977) | | Vice President and Secretary | | Vice President and Secretary, SEI Trust, since 2014. Counsel at SEI Investments since 2010. |

Russell Emery

(Born: 1962) | | Chief Compliance Officer | | Chief Compliance Officer of SEI Structured Credit Fund, LP since June 2007. Chief Compliance Officer of SEI Alpha Strategy Portfolios, LP from June 2007 to September 2013. Chief Compliance Officer of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, the SEI Trust, Bishop Street Funds, The KP Funds, Winton Series Trust, Winton Diversified Opportunities Fund (closed-end investment company), Gallery Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Daily Income Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. |

Lisa Whittaker

(Born: 1978) | | Vice President and Assistant Secretary | | Vice President and Assistant Secretary, SEI Trust (2014-present). Attorney, SEI Investments Company (2012-present). Associate Counsel and Compliance Officer, The Glenmede Trust Company, N.A. (2011-2012). Associate, Drinker Biddle & Reath LLP (2006-2011). |

John Y. Kim

(Born: 1981) | | Vice President and Assistant Secretary | | Vice President and Assistant Secretary, SEI Trust (2014-present). Attorney, SEI Investments Company (2014-present). Associate, Stradley Ronon Stevens & Young, LLP (2009-2014). |

Bridget E. Sudall

(Born: 1980) | | Privacy Officer and Anti-Money Laundering Officer | | Privacy Officer, SEI Trust (2015-present). Anti-Money Laundering Officer, SEI Trust (2015-present). Senior Associate and AML Officer, Morgan Stanley Alternative Investment Partners (2011-2015). Investor Services Team Lead, Morgan Stanley Alternative Investment Partners (2007-2011). |

Miscellaneous

SIMNA and its Affiliates; Fund Administrators

Schroder Investment Management North America Inc. (“SIMNA”) is the investment adviser of the Funds and Schroder Fund Advisors LLC (“SFA”), a wholly-owned subsidiary of SIMNA, is the principal underwriter of the Funds. The address of SIMNA and of SFA is 875 Third Avenue, 22nd Floor, New York, New York 10022. In consideration of SFA’s services, SIMNA reimburses SFA for its costs and expenses in distributing the Funds’ shares and pays SFA an additional amount based on a percentage of the reimbursement (currently 5%). For all Funds except Schroder North American Equity Fund, SEI Investments Global Funds Services, One Freedom Valley Drive, Oaks, Pennsylvania 19456, serves as the

22

administrator. For Schroder North American Equity Fund, SFA serves as the administrator, and SEI Investments Global Funds Services serves as the sub-administrator.

SIMNA is a wholly owned subsidiary of Schroder U.S. Holdings Inc. Affiliates of Schroder U.S. Holdings Inc. (or their predecessors) have been investment managers since 1927. Schroder U.S. Holdings Inc. is a wholly-owned subsidiary of Schroder International Holdings, which is a wholly-owned subsidiary of Schroder Administration Limited, which is a wholly-owned subsidiary of Schroders plc, a publicly-owned holding company organized under the laws of England. Schroders plc, through certain affiliates currently engaged in the asset management business, and as of September 30, 2016, had under management assets of approximately $487.1 billion.

Schroder Investment Management North America Ltd. (“SIMNA Ltd.”), an affiliate of SIMNA, has served as subadviser to Schroder Emerging Markets Small Cap Fund and Schroder North American Equity Fund since the inception of each such Fund.

Required Vote

Shareholders of the Funds that are series of Schroder Series Trust will vote as a group to elect Nominee Trustees of Schroder Series Trust. Shareholders of Schroder North American Equity Fund will vote to elect Nominee Trustees of Schroder Global Series Trust.

The election of each Nominee Trustee to a Trust requires the affirmative vote of shareholders owning of record a plurality of the shares of that Trust (the shareholders of all Funds of a Trust voting together as a single class) voted at the Meeting in person or by proxy. There is no cumulative voting in the election of Nominee Trustees.

Recommendation

The Current Board unanimously recommends that shareholders of each Trust vote FOR each Nominee.

23

PROPOSAL 3— MANAGEMENT CONTRACT APPROVALS

SEI currently serves as administrator to Schroder Emerging Markets Small Cap Fund, Schroder Long Duration Investment-Grade Bond Fund, and Schroder Short Duration Bond Fund (the “Proposal 3 Funds”). Each of the Proposal 3 Funds pays a fee directly to SEI for its services. SIMNA also provides administrative services to each Proposal 3 Fund under the existing management contracts (the “Existing Management Contracts”). SIMNA is responsible for, among other things, overseeing the performance of administrative and professional services rendered to the Proposal 3 Funds by their third-party service providers, including SEI, and the Proposal 3 Funds’ custodian, transfer agent, and auditor, overseeing the preparation and printing of regulatory filings, proxy statements and other shareholder communications, overseeing, with the cooperation of Fund counsel and other relevant parties, the preparation and dissemination of materials for meetings of the Board of Trustees, overseeing the calculation of performance data, overseeing the determination and declaration of dividends, and retaining records.

As part of the proposed transition to the SEI Platform, while SEI would continue to provide the same administrative services it currently provides to the Proposal 3 Funds, it would also provide the administrative oversight and certain other services currently provided by SIMNA pursuant to an amended and restated administration and accounting agreement (the “Amended Administration Agreement”). Additional services provided by SEI will include, among other items, general vendor management and oversight, annual due diligence review of service providers, service contract negotiation, coordinating and filing regulatory materials, managing and coordinating audit-related activities, and maintaining Fund compliance policies and procedures. SEI personnel are also expected to serve as the Funds’ officers following the transition. Shareholders of each of the Proposal 3 Funds are being asked to approve amended and restated management contracts between the Proposal 3 Funds and SIMNA (“Amended and Restated Management Contracts”) in order to remove provisions in the management contracts requiring SIMNA to provide certain administrative oversight and other services to the Proposal 3 Funds. The Amended Administration Agreement will be considered by the Nominee Board when it takes office, and is not subject to approval by the current Board or by shareholders of the Proposal 3 Funds.

The management fees the Proposal 3 Funds would pay under the Amended and Restated Management Contracts would remain the same as the fees they currently pay, even though SIMNA will no longer be providing administrative oversight and certain other services to the Proposal 3 Funds. Because the Proposal 3 Funds would pay SIMNA the same fee for fewer services, the removal of the administrative services component from the Existing Management Contracts might be seen as an increase in the fees payable by the Proposal 3 Funds to SIMNA. It is proposed that the management fees would remain the same in light of management’s view that the component of the management fee charged for providing and overseeing fund administrative services was not a driving factor in determining the current management fees and that those services were ancillary to SIMNA’s services as investment adviser to the Proposal 3 Funds under the Existing Management Contracts. Management continues to believe that the current fees under the Existing Management Contracts, even without the administrative services component, remain reasonable in light of the nature and quality of the services provided, the profitability to SIMNA from managing each Proposal 3 Fund, and the levels of those fees compared to those paid by comparable peer funds and Schroder client accounts. In addition, because expense caps will remain in place contractually for at least two years after the transition, the total expense ratios being charged to Proposal 3 Fund shareholders during the two-year period will not increase.

Although shareholders of the Proposal 3 Funds are not being asked to approve the Amended Administration Agreement, which will be considered by the Nominee Board after it takes office, it is important to understand the anticipated arrangements with SEI.

In proposing the transition to the SEI Platform, SIMNA reported to the Current Board that it believed that the fee proposed to be paid to SEI under the Amended Administration Agreement, although expected initially to be higher than the fees currently being paid to SEI by the Funds, is fair and reasonable. SIMNA told the Board that it had considered the range of services anticipated to be provided by SEI, the high quality of the administrative services provided to the Proposal 3 Funds by SEI to date, the depth of experience, expertise and resources of SEI, and the investments SEI has made in the systems and technology required to provide modern administrative services efficiently. SIMNA also said that it considered the fees to be in line with the fees SEI charges other clients for similar services and with fees paid by mutual funds for comparable administrative services generally. SIMNA also noted that the additional administrative services to be provided by SEI are a key component to its SEI Platform service offering, and that it would not be possible for the Proposal 3 Funds to transition to the SEI Platform without transitioning such administrative services from SIMNA to SEI.

SIMNA further reported that SEI has been providing the Proposal 3 Funds high quality administrative services at reasonable prices for many years. In addition, SIMNA noted that SEI has substantial experience in administering and

24

servicing mutual funds in the institutional space, and that SIMNA believes SEI’s experience will benefit current institutional investors and present an attractive platform for additional institutional subscriptions in the Proposal 3 Funds. SIMNA reported that this, in turn, creates the potential over time for lower expenses and the achievement of greater economies of scale.