UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the fiscal year ended December 31, 2016

BADGER METER, INC.

4545 W. Brown Deer Road

Milwaukee, Wisconsin 53223

(414) 355-0400

A Wisconsin Corporation

IRS Employer Identification No. 39-0143280

Commission File No. 001-06706

The Company has the following classes of securities registered pursuant to Section 12(b) of the Act:

| Title of class: | Name of each exchange on which registered: | |

| Common Stock | New York Stock Exchange | |

| Common Share Purchase Rights | New York Stock Exchange | |

The Company does not have any securities registered pursuant to Section 12(g) of the Act.

Indicate by check mark if the Company is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the Company is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act: (Check one).

| Large accelerated filer | ý | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the Common Stock held by non-affiliates of the Company as of June 30, 2016 was $971,283,504. For purposes of this calculation only, (i) shares of Common Stock are deemed to have a market value of $36.52 per share, the closing price of the Common Stock as reported on the New York Stock Exchange on June 30, 2016, and (ii) each of the Company's executive officers and directors is deemed to be an affiliate of the Company.

As of February 9, 2017, there were 29,112,113 shares of Common Stock outstanding with a par value of $1 per share.

Portions of the Company's Proxy Statement for the 2017 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of the registrant's fiscal year, are incorporated by reference from the definitive Proxy Statement into Part III of this Annual Report on Form 10-K.

Special Note Regarding Forward Looking Statements

Certain statements contained in this Annual Report on Form 10-K, as well as other information provided from time to time by Badger Meter, Inc. (the “Company”) or its employees, may contain forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “think,” “should,” “could” and “objective” or similar expressions are intended to identify forward looking statements. All such forward looking statements are based on the Company’s then current views and assumptions and involve risks and uncertainties. Some risks and uncertainties that could cause actual results to differ materially from those expressed or implied in forward looking statements include those described in Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 that include, among other things:

| • | the continued shift in the Company’s business from lower cost, manually read meters toward more expensive, value-added automatic meter reading (AMR) systems, advanced metering infrastructure (AMI) systems and advanced metering analytics (AMA) systems that offer more comprehensive solutions to customers’ metering needs; |

| • | the success or failure of newer Company products; |

| • | changes in competitive pricing and bids in both the domestic and foreign marketplaces, and particularly in continued intense price competition on government bid contracts for lower cost, manually read meters; |

| • | the actions (or lack thereof) of the Company’s competitors; |

| • | changes in the Company’s relationships with its alliance partners, primarily its alliance partners that provide radio solutions, and particularly those that sell products that do or may compete with the Company’s products; |

| • | changes in the general health of the United States and foreign economies, including to some extent such things as the length and severity of global economic downturns, international or civil conflicts that affect international trade, the ability of municipal water utility customers to authorize and finance purchases of the Company’s products, the Company’s ability to obtain financing, housing starts in the United States, and overall industrial activity; |

| • | unusual weather, weather patterns or other natural phenomena, including related economic and other ancillary effects of any such events; |

| • | economic policy changes, including but not limited to, trade policy and corporate taxation; |

| • | the timing and impact of government funding programs that stimulate national and global economies, as well as the impact of government budget cuts or partial shutdowns of governmental operations; |

| • | changes in the cost and/or availability of needed raw materials and parts, such as volatility in the cost of brass castings as a result of fluctuations in commodity prices, particularly for copper and scrap metal at the supplier level, foreign-sourced electronic components as a result of currency exchange fluctuations and/or lead times, and plastic resin as a result of changes in petroleum and natural gas prices; |

| • | the Company’s expanded role as a prime contractor for providing complete technology systems to governmental entities, which brings with it added risks, including but not limited to, the Company’s responsibility for subcontractor performance, additional costs and expenses if the Company and its subcontractors fail to meet the timetable agreed to with the governmental entity, and the Company’s expanded warranty and performance obligations; |

| • | the Company’s ability to successfully integrate acquired businesses or products; |

| • | changes in foreign economic conditions, particularly currency fluctuations in the United States dollar, the Euro and the Mexican peso; |

| • | the inability to develop technologically advanced products; |

| • | the failure of the Company’s products to operate as intended; |

| • | the inability to protect the Company’s proprietary rights to its products; |

| • | disruptions and other damages to information technology and other networks and operations due to breaches in data security or any other cybersecurity attack; |

| • | transportation delays or interruptions; |

| • | violations or alleged violations of the U.S. Foreign Corrupt Practices Act (FCPA) or other anti-corruption laws and the Foreign Account Tax Compliance provisions of the Hiring Incentives to Restore Employment Act (referred to as FATCA); |

| • | the loss of certain single-source suppliers; and |

| • | changes in laws and regulations, particularly laws dealing with the content or handling of materials used in the Company's products. |

All of these factors are beyond the Company's control to varying degrees. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward looking statements contained in this Annual Report on Form 10-K and are cautioned not to place undue reliance on such forward looking statements. The forward looking statements made in this document are made only as of the date of this document and the Company assumes no obligation, and disclaims any obligation, to update any such forward looking statements to reflect subsequent events or circumstances.

PART I

ITEM 1. BUSINESS

Badger Meter, Inc. (the “Company”) is a leading innovator, manufacturer and marketer of products incorporating flow measurement, control and communication solutions serving markets worldwide. The Company was incorporated in 1905.

Throughout this 2016 Annual Report on Form 10-K, the words “we,” “us” and “our” refer to the Company.

Available Information

The Company's Internet address is http://www.badgermeter.com. The Company makes available free of charge (other than an investor's own Internet access charges) through its Internet website its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, on the same day they are electronically filed with, or furnished to, the Securities and Exchange Commission. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Market Overview, Products, Systems and Solutions

Badger Meter is an innovator in flow measurement, control and communication solutions, serving water utilities, municipalities, and commercial and industrial customers worldwide. The Company’s products measure water, oil, chemicals and other fluids, and are known for accuracy, long-lasting durability and for providing and communicating valuable and timely measurement data. The Company’s product lines fall into two categories: sales of water meters and related technologies to municipal water utilities (municipal water) and sales of meters to various industries for water and other fluids (flow instrumentation). The Company estimates that over 85% of its products are used in water applications when both categories are grouped together.

Municipal water, the largest category by sales volume, includes mechanical and ultrasonic (electronic) water meters and related technologies and services used by municipal water utilities as the basis for generating water and wastewater revenues. The key market for the Company’s municipal water meter products is North America, primarily the United States, because most of the Company's meters are designed and manufactured to conform to standards promulgated by the American Water Works Association. The majority of water meters sold by the Company continue to be mechanical in nature. In recent years, the Company has made inroads in selling ultrasonic water meters. The development of smaller diameter ultrasonic water meters combined with advanced radio technology now provides the Company with the opportunity to sell into other geographical markets, for example Europe, the Middle East and South America. In the municipal water category, sales of water meters and related technologies and services are also commonly referred to as residential or commercial water meter sales, the latter referring to larger sizes of water meters.

Flow instrumentation includes meters and valves sold worldwide to measure and control materials flowing through a pipe or pipeline including water, air, steam, oil, and other liquids and gases. These products are used in a variety of applications, primarily into the following industries: water/wastewater; heating, ventilating and air conditioning (HVAC); oil and gas; chemical

2

and petrochemical; test and measurement; automotive aftermarket; and the concrete construction process. Furthermore, the Company’s flow instrumentation technologies are sold to original equipment manufacturers as the primary flow measurement device within a product or system.

Residential and commercial water meters are generally classified as either manually read meters or remotely read meters via radio technology. A manually read meter consists of a water meter and a register that provides a visual totalized meter reading. Meters equipped with radio technology (endpoints) receive flow measurement data from encoder registers attached to the water meter, which is encrypted and transmitted via radio frequency to a receiver that collects and formats the data appropriately for water utility billing systems. These remotely read, or mobile, systems are either automatic meter reading (AMR) systems, where a vehicle equipped for meter reading purposes, including a radio receiver, computer and reading software, collects the data from utilities’ meters; or fixed network advanced metering infrastructure (AMI) systems, where data is gathered utilizing a network of permanent data collectors or gateway receivers that are always active or listening for the radio transmission from the utilities’ meters. AMI systems eliminate the need for utility personnel to drive through service territories to collect data from the meters. These systems provide the utilities with more frequent and diverse data from their meters at specified intervals.

The ORION® family of radio endpoints provides water utilities with a range of industry-leading options for meter reading. These include ORION Migratable (ME) (for mobile meter reading), ORION Fixed Network (SE) (for traditional fixed network applications), and ORION Cellular (for infrastructure-free meter reading). ORION Migratable makes the migration to fixed network easier for utilities that prefer to start with mobile reading and later adopt fixed network communications, allowing utilities to choose a solution for their current needs and be positioned for their future operational changes. ORION Cellular eliminates the need for utility-owned fixed network infrastructure, allows for rapid deployment and decreases ongoing maintenance.

Critical to the water metering ecosystem is information and analytics. The Company’s BEACON® AMA Managed Solution is the latest in metering technology. BEACON AMA combines the BEACON analytical software suite with proven ORION technologies using two-way fixed and cellular networks in a managed solution, improving utilities’ visibility of their water consumption and eliminating the need for costly utility-managed infrastructure.

The BEACON AMA secure, cloud-hosted software suite includes a customizable dashboard, the ability to establish alerts for specific conditions, and consumer engagement tools that allow end water customers to view and manage their water usage activity. Benefits to the utility include improved customer service, increased visibility through faster leak detection, the ability to promote and quantify the effects of its water conservation efforts, and easier compliance reporting.

The Company’s net sales and corresponding net earnings depend on unit volume and product mix, with the Company generally earning higher margins on meters equipped with radio technology. The Company’s proprietary radio products generally result in higher margins than the remarketed, non-proprietary technology products. The Company also sells registers and endpoints separately to customers who wish to upgrade their existing meters in the field.

Water meter replacement and the adoption and deployment of new technology comprise the majority of water meter product sales, including radio products. To a much lesser extent, housing starts also contribute to the new product sales base. Over the last decade, there has been a growing trend in the conversion from manually read water meters to radio technology. This conversion rate is accelerating and contributes to an increased water meter and radio solutions base of the business. The Company estimates that approximately 55% of water meters installed in the United States have been converted to a radio solutions technology. The Company’s strategy is to fulfill customers’ metering expectations and requirements with its proprietary meter reading systems or other systems available through its alliance partners in the marketplace.

Flow instrumentation products serve flow measurement and control applications across a broad industrial spectrum, occasionally leveraging the same technologies used in the municipal water category. Specialized communication protocols that control the entire flow measurement process and mandatory certifications drive these markets. The Company’s specific flow measurement and control applications and technologies serve the flow measurement market through both customized and standard flow instrumentation solutions.

Industries today face accelerating demands to contain costs, reduce product variability, and meet ever-changing safety, regulatory and sustainability requirements. To address these challenges, customers must reap more value from every component in their systems. This system-wide scrutiny has heightened the focus on flow instrumentation in industrial process, manufacturing, commercial fluid, building automation, and precision engineering applications where flow measurement and control are critical.

3

An industry leader in both mechanical and ultrasonic (electronic) flow metering technologies, the Company offers one of the broadest flow measurement, control and communication portfolios in the market. This portfolio carries respected brand names including Recordall®, E-Series®, ORION, Hedland®, Dynasonics®, Blancett®, and Research Control®, and includes eight of the ten major flow meter technologies. Customers rely on the Company for application-specific solutions that deliver accurate, timely and dependable flow data and control essential for product quality, cost control, safer operations, regulatory compliance, and more sustainable operations.

The Company's products are sold throughout the world through employees, resellers and representatives. Depending on the customer mix, there can be a moderate seasonal impact on sales, primarily relating to higher sales of certain municipal water products during the spring and summer months. No single customer accounts for more than 10% of the Company's sales.

Competition

There are competitors in each category in which the Company sells its products, and the competition varies from moderate to intense. Major competitors for utility water meters include Sensus, Neptune Technology Group Inc., Master Meter, Inc. and Mueller Water Products, Inc. Together with Badger Meter, it is estimated that these companies sell in excess of 90% of the water meters in the North American market, which has been somewhat insulated from other competitors due to the nature of the mechanical technology used and the standards promulgated by the American Water Works Association. In recent years, the Company, as well as some of its competitors, have introduced various forms of electronic meters, which have no moving parts, and have seen sales of those products begin to grow. As the global water metering market, including the North American market, begins to adopt these technologies, Kamstrup A/S, Diehl Metering GmbH and Itron, Inc. are also potential competitors.

The Company's primary competitors for water utility radio products in North America are Itron, Inc., Neptune Technology Group Inc. and Sensus. Outside of North America, the primary competitors include Itron, Inc., Sensus, Diehl Metering GmbH and Elster Group GmbH. While the Company sells its own proprietary radio systems (ORION and GALAXY®), it is also a reseller of the Itron® products. A number of the Company's competitors in certain markets have greater financial resources than the Company. The Company, however, believes it currently provides the leading technologies in water meters and radio water systems. As a result of significant research and development activities, the Company enjoys favorable patent positions and trade secret protections for several of its technologies, products and processes.

There are many competitors in the flow instrumentation markets due to the various markets and applications being served. For example, major competitors in the flow instrumentation markets include Emerson Electric Company, Krohne Messtechnik GmbH, Endress+Hauser AG and Yokogawa Electric Corporation. In the HVAC market, the key competitor is Onicon Incorporated. In upstream oil and gas, Cameron International Corporation is the primary competitor. The Company competes with AW-Lake Company in the measurement of on-machine hydraulic fluids. With a portfolio consisting of products utilizing eight of the ten major flow meter technologies, the Company is well positioned to compete in these markets.

Backlog

The Company's total backlog of unshipped orders at December 31, 2016 and 2015 was $40.5 million and $35.7 million, respectively. The backlog is comprised of firm orders and signed contractual commitments, or portions of such commitments that call for shipment within 12 months. Backlog can be significantly affected by the timing of orders for large projects and the amounts can vary due to the timing of work performed.

Raw Materials and Components

Raw materials used in the manufacture of the Company's products include purchased castings made of metal or alloys (such as brass, which uses copper as its main component, aluminum, stainless steel and cast iron), plastic resins, glass, microprocessors and other electronic subassemblies, and components. There are multiple sources for these raw materials and components, but the Company relies on single suppliers for certain brass castings, certain resins and certain electronic subassemblies. The Company believes these items would be available from other sources, but that the loss of certain suppliers would result in a higher cost of materials, delivery delays, short-term increases in inventory and higher quality control costs in the short term. The Company carries business interruption insurance on key suppliers. The Company's purchases of raw materials are based on production schedules, and as a result, inventory on hand is generally not exposed to price fluctuations. World commodity markets and currency exchange rates may also affect the prices of material purchased in the future. The Company does not hold significant amounts of precious metals.

4

Research and Development

Expenditures for research and development activities relating to the development of new products, the improvement of existing products and manufacturing process improvements were $10.6 million in both 2016 and 2015 compared to $9.5 million in 2014. Research and development activities are primarily sponsored by the Company. The Company also engages in some joint research and development with other companies.

Intangible Assets

The Company owns or controls several trade secrets and many patents, trademarks and trade names in the United States and other countries that relate to its products and technologies. No single patent, trademark, trade name or trade secret is material to the Company's business as a whole.

Environmental Protection

The Company is subject to contingencies related to environmental laws and regulations. The Company is named as one of many potentially responsible parties in two landfill lawsuits. The landfill sites are impacted by the Federal Comprehensive Environmental Response, Compensation and Liability Act and other environmental laws and regulations. At this time, the Company does not believe the ultimate resolution of these matters will have a material adverse effect on the Company’s financial position or results of operations, either from a cash flow perspective or on the financial statements as a whole. This belief is based on the Company’s assessment of its limited past involvement with these landfill sites as well as the substantial involvement of and government focus on other named third parties with these landfill sites. However, due to the inherent uncertainties of such proceedings, the Company cannot predict the ultimate outcome of any of these matters. A future change in circumstances with respect to these specific matters or with respect to sites formerly or currently owned or operated by the Company, off-site disposal locations used by the Company, and property owned by third parties that is near such sites, could result in future costs to the Company and such amounts could be material. Expenditures for compliance control provisions and regulations during 2016, 2015 and 2014 were not material.

Employees

The Company and its subsidiaries employed 1,562 persons at December 31, 2016, 114 of whom are covered by a collective bargaining agreement with District 10 of the International Association of Machinists. The Company is currently operating under a three-year contract with the union, which expires on October 31, 2019. The Company believes it has good relations with the union and all of its employees.

The following table sets forth certain information regarding the Executive Officers of the Registrant.

| Name | Position | Age at 2/28/2017 |

| Richard A. Meeusen | Chairman, President and Chief Executive Officer | 62 |

| Richard E. Johnson | Senior Vice President — Finance, Chief Financial Officer and Treasurer | 62 |

| Fred J. Begale | Vice President — Engineering | 52 |

| William R. A. Bergum | Vice President — General Counsel and Secretary | 52 |

| Gregory M. Gomez | Vice President — Flow Instrumentation | 52 |

| Horst E. Gras | Vice President — International Operations | 61 |

| Trina L. Jashinsky | Vice President — Human Resources | 54 |

| Raymond G. Serdynski | Vice President — Manufacturing | 60 |

| Beverly L. P. Smiley | Vice President — Controller | 67 |

| Kimberly K. Stoll | Vice President — Sales and Marketing | 50 |

There are no family relationships between any of the executive officers. Officers are elected annually at the first meeting of the Board of Directors held after each annual meeting of the shareholders. Each officer holds office until his or her successor has been elected or until his or her death, resignation or removal. There is no arrangement or understanding between any executive officer and any other person pursuant to which he or she was elected as an officer.

Mr. Meeusen has served as Chairman, President and Chief Executive Officer for more than five years.

5

Mr. Johnson has served as Senior Vice President - Finance, Chief Financial Officer and Treasurer for more than five years.

Mr. Begale has served as Vice President - Engineering for more than five years.

Mr. Bergum has served as Vice President - General Counsel and Secretary for more than five years.

Ms. Jashinsky was elected Vice President - Human Resources in October 2016. Prior to joining the Company, Ms. Jashinsky was Vice President of Human Resources at Gannett Company, Inc. from February 2015 to July 2016, Senior Vice President Human Resources at Fiserv, Inc. from March 2014 to February 2015, and Vice President Global Corporate Human Resources at Johnson Controls, Inc. from May 2010 to February 2014.

Mr. Gomez was elected Vice President - Flow Instrumentation in September 2014. Mr. Gomez served as Vice President - Business Development from December 2010 to September 2014.

Mr. Gras has served as Vice President - International Operations for more than five years.

Mr. Serdynski has served as Vice President - Manufacturing for more than five years.

Ms. Smiley has served as Vice President - Controller for more than five years.

Ms. Stoll was elected Vice President - Sales and Marketing in February 2012. Ms. Stoll served as Vice President - Marketing from April 2009 to February 2012.

Foreign Operations and Export Sales

The Company distributes its products through employees, resellers and representatives throughout the world. Additionally, the Company has a sales, distribution and manufacturing facility in Neuffen, Germany; sales and customer service offices in Mexico, Singapore, China, United Arab Emirates and Slovakia; manufacturing facilities in Nogales, Mexico; and manufacturing and sales facilities in Brno, Czech Republic and Bern, Switzerland. The Company exports products from the United States that are manufactured in Milwaukee, Wisconsin; Racine, Wisconsin; Tulsa, Oklahoma; and Scottsdale, Arizona.

Information about the Company's foreign operations and export sales is included in Note 10 “Industry Segment and Geographic Areas” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this 2016 Annual Report on Form 10-K.

Financial Information about Industry Segments

The Company operates in one industry segment as an innovator, manufacturer and marketer of products incorporating flow measurement, control and communication solutions as described in Note 10 “Industry Segment and Geographic Areas” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this 2016 Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

Shareholders, potential investors and other readers are urged to consider the significant business risks described below in addition to the other information set forth or incorporated by reference in this 2016 Annual Report on Form 10-K, including the “Special Note Regarding Forward Looking Statements” at the front of this 2016 Annual Report on Form 10-K. If any of the events contemplated by the following risks actually occur, our financial condition or results of operations could be materially adversely affected. The following list of risk factors may not be exhaustive. We operate in a continually changing business, economic and geopolitical environment, and new risk factors may emerge from time to time. We can neither predict these new risk factors with certainty nor assess the precise impact, if any, on our business, or the extent to which any factor, or combination of factors, may adversely impact our results of operations. While there is much uncertainty, we do analyze the risks we face, perform a probability assessment of their impacts and attempt to soften their potential impact when and if possible.

6

Competitive pressures in the marketplace could decrease our revenues and profits.

Competitive pressures in the marketplace for our products could adversely affect our competitive position, leading to a possible loss of market share or a decrease in prices, either of which could result in decreased revenues and profits. We operate in an environment where competition varies from moderate to intense and a number of our competitors have greater financial resources. Our competitors also include alliance partners that sell products that do or may compete with our products, particularly those that provide radio solutions. The principal elements of competition for our most significant product applications, residential and commercial water meters for the municipal water utility market (with various radio technology systems), are price, product technology, quality and service. The competitive environment is also affected by the movement toward radio technologies and away from manually read meters, the demand for replacement units and, to some extent, such things as global economic conditions, the timing and size of governmental programs such as stimulus fund programs, the ability of municipal water utility customers to authorize and finance purchases of our products, our ability to obtain financing, housing starts in the United States, and overall economic activity. For our flow instrumentation products, the competitive environment is affected by the general economic health of various industrial sectors particularly in the United States and Europe.

The inability to develop technologically advanced products could harm our future success.

We believe that our future success depends, in part, on our ability to develop technologically advanced products that meet or exceed appropriate industry standards. Although we believe that we currently have a competitive advantage in this area, maintaining such advantage will require continued investment in research and development, sales, marketing and manufacturing capabilities. There can be no assurance that we will have sufficient resources to make such investments or that we will be able to make the technological advances necessary to maintain such competitive advantage. If we are unable to maintain our competitive advantage, our future financial performance may be adversely affected. We are not currently aware of any emerging standards or new products that could render our existing products obsolete in the near term. The water utility industry is beginning to see the adoption of ultrasonic (electronic) water meters. Electronic water metering has lower barriers to entry that could affect the competitive landscape in North America. We believe we have a competitive product if the adoption rate for electronic meters were to accelerate.

The inability to obtain adequate supplies of raw materials and component parts at favorable prices could decrease our profit margins and negatively impact timely delivery to customers.

We are affected by the availability and prices for raw materials and component parts, including purchased castings made of metal or alloys (such as brass, which uses copper as its main component, aluminum, stainless steel and cast iron), plastic resins, glass, microprocessors and other electronic subassemblies, and components that are used in the manufacturing process. The inability to obtain adequate supplies of raw materials and component parts for our products at favorable prices could have a material adverse affect on our business, financial condition or results of operations by decreasing profit margins and by negatively impacting timely deliveries to customers. In the past, we have been able to offset increases in raw materials and component parts by increased sales prices, active materials management, product engineering programs and the diversity of materials used in the production processes. However, we cannot be certain that we will be able to accomplish this in the future. Since we do not control the actual production of these raw materials and component parts, there may be delays caused by an interruption in the production or transportation of these materials for reasons that are beyond our control. World commodity markets and inflation may also affect raw material and component part prices.

Regulations related to conflict minerals may force us to incur additional expenses.

The Securities and Exchange Commission has adopted disclosure requirements related to certain minerals sourced from the Democratic Republic of Congo and surrounding countries, or “conflict minerals,” that are necessary to the functionality of a product manufactured, or contracted to be manufactured, by a Securities and Exchange Commission reporting company. The minerals that the rules cover are commonly referred to as “3TG��� and include tin, tantalum, tungsten and gold. Implementation of the disclosure requirements could affect the sourcing and availability of some of the materials that we use in the manufacture of our products. There is also uncertainty relating to the requirements of the regulations as a result of ongoing litigation challenging the constitutionality of portions of the regulations. Our supply chain is complex, and if we are not able to determine the origins for all conflict minerals used in our products or that our products are “conflict free,” then we may face reputational challenges with customers or investors. We could also incur significant costs related to the compliance process, including potential difficulty or added costs in satisfying disclosure and audit requirements.

7

Economic conditions could cause a material adverse impact on our sales and operating results.

As a supplier of products, the majority of which are to water utilities, we may be adversely affected by global economic conditions, delays in governmental programs created to stimulate the economy, and the impact of government budget cuts or partial shutdowns of governmental operations that affect our customers, including independent distributors, large city utilities, private water companies and numerous smaller municipal water utilities. These customers may delay capital projects, including non-critical maintenance and upgrades, or may not have the ability to authorize and finance purchases during economic downturns or instability in world markets. We also sell products for other applications to reduce our dependency on the municipal water market. A significant downturn in this market could cause a material adverse impact on sales and operating results. Therefore, a downturn in general economic conditions, as well as in the municipal water market, and delays in the timing or amounts of possible economic stimulus fund programs, government budget cuts or partial shutdowns of governmental operations, or the availability of funds to municipalities could result in a reduction in demand for our products and services and could harm the business.

Economic impacts due to leadership or policy changes in the countries where we do business could negatively affect our profitability.

We may be affected by adjustments to economic and trade polices, such as taxation and the like, when countries where we produce or sell our products change leadership or economic policies. These types of changes, as well as any related regulatory changes, could significantly increase our costs and adversely affect our profitability and financial condition.

Unusual weather and other natural phenomena could adversely affect our business.

Our sales may be adversely affected by unusual weather, weather patterns, or other natural phenomena that could have an impact on the timing of orders in given periods, depending on the particular mix of customers being served by us at the time.

Failure to manufacture quality products could have a material adverse affect on our business.

If we fail to maintain and enforce quality control and testing procedures, our products will not meet required performance standards. Product quality and performance are a priority for us since our products are used in various applications where precise control of fluids is essential. Although we believe we have a very good reputation for product quality, any future production and/or sale of substandard products would seriously harm our reputation, resulting in both a loss of current customers to competitors and damage to our ability to attract new customers. In addition, if any of our products prove to be defective, we may be required to participate in a recall involving such products. A successful claim brought against us with respect to a defective product in excess of available insurance coverage, if any, or a requirement to participate in a major product recall, could have a material adverse affect on our business, results of operations or financial condition.

Litigation against us could be costly, time consuming to defend and could adversely affect our profitability.

From time to time, we are subject to legal proceedings and claims that arise in the ordinary course of business. For example, we may be subject to workers' compensation claims, employment/labor disputes, customer and supplier disputes, product liability claims, intellectual property disputes and contractual disputes related to warranties arising out of the conduct of our business. Litigation may result in substantial costs and may divert management's attention and resources, which could adversely affect our profitability or financial condition.

If our technology products do not operate as intended, our business could be materially and adversely affected.

We sell and install software products, including some that are provided in "the cloud," that may contain unexpected design defects or may encounter unexpected complications during installation or when used with other technologies utilized by the customer. A failure of our technology products to operate as intended and in a seamless fashion with other products or a failure of a cloud network could materially and adversely affect our results of operations, financial position and cash flows.

8

Our expanded role as a prime contractor brings certain risks that could have a material adverse affect to our business.

The Company periodically assumes the role as a prime contractor for providing complete technology systems to governmental entities, which brings with it added risks, including but not limited to, our responsibility for managing subcontractor performance and the potential for expanded warranty and performance obligations. While we have managed a limited number of these types of arrangements, it is possible to encounter a situation where we may not be able to perform up to the expectations of the governmental entity, and thus incur additional costs that could affect our profitability or harm our reputation.

Disruptions and other damages to our information technology and other networks and operations, and breaches in data security or cybersecurity attacks could have a negative financial impact and damage our reputation.

Our ability to serve customers, as well as increase revenues and control costs, depends in part on the reliability of our sophisticated technologies, system networks and cloud-based software. We use information technology and other systems to manage our business in order to maximize our revenue, effectiveness and efficiency. Unauthorized parties gaining access to digital systems and networks for purposes of misappropriating assets or sensitive financial, personal or business information, corrupting data, causing operational disruptions and other cyber-related risks could adversely impact our customer relationships, business plans and our reputation. In some cases, we are dependent on third-party technologies and service providers for which there is no certainty of uninterrupted availability or through which hackers could gain access to sensitive and/or personal information. These potential disruptions and cyber-attacks could negatively affect revenues, costs, customer demand, system availability and our reputation.

If we are not able to protect our proprietary rights to our software and related products, our ability to market our software products could be hindered and our results of operations, financial position and cash flows could be materially and adversely affected.

We rely on our agreements with customers, confidentiality agreements with employees, and our trademarks, trade secrets, copyrights and patents to protect our proprietary rights. These legal protections and precautions may not prevent misappropriation of our proprietary information. In addition, substantial litigation regarding intellectual property rights exists in the software industry, and software products may increasingly be subject to third-party infringement claims. Such litigation and misappropriation of our proprietary information could hinder our ability to market and sell products and services and our results of operations, financial position and cash flows could be materially and adversely affected.

Changes in environmental or regulatory requirements could entail additional expenses that could decrease our profitability.

We cannot predict the nature, scope or affect of future environmental or regulatory requirements to which our operations might be subject or the manner in which existing or future laws will be administered or interpreted. Compliance with such laws or regulations may entail additional expenses that could decrease profitability. We are subject to a variety of environmental laws, such as lead content in certain meters incorporating brass housings or the handling of certain electronic materials, and regulatory laws affecting the use and/or licensing of radio frequencies necessary for radio products, as well as regulations related to customs and trade practices. Currently, the cost of complying with existing laws is included as part of our on-going expenses and does not have a material affect on our business or financial position, but a change in the future could adversely affect our profitability.

Risks related to foreign markets could decrease our profitability.

Since we sell products worldwide as well as manufacture products in several countries, we are subject to risks associated with doing business internationally. These risks include such things as changes in foreign currency exchange rates, changes in political or economic conditions of specific countries or regions, potentially negative consequences from changes in tax laws or regulatory requirements, differing labor regulations, and the difficulty of managing widespread operations.

An inability to attract and retain skilled employees could negatively impact our growth and decrease our profitability.

Our success depends on our continued ability to identify, attract, develop and retain skilled personnel throughout our organization. Current and future compensation arrangements, including benefits, may not be sufficient to attract new employees or retain existing employees, which may hinder our growth.

9

Rising healthcare and retirement benefit costs could increase cost pressures and decrease our profitability.

We estimate liabilities and expenses for retirement plans and other postretirement benefits that require the use of assumptions relating to the rates used to discount the future estimated liability, rate of return on any assets and various assumptions related to the age and cost of the workforce. Actual results may differ from the estimates and have a material adverse affect on future results of operations or on the financial statements as a whole. Rising healthcare and retirement benefit costs in the United States may also add to cost pressures and decrease our profitability.

A failure to maintain good corporate governance practices could damage our reputation and adversely affect our future success.

We have a history of good corporate governance, including procedures and processes that are required by the Sarbanes-Oxley Act of 2002, the Dodd-Frank Act of 2010, and related rules and regulations, such as board committee charters, principles of corporate governance and a code of business conduct that defines how employees interact with our various stakeholders and addresses issues such as confidentiality, conflict of interest and fair dealing, and applicable exchange listing standards. Failure to maintain these corporate governance practices could harm our reputation and have a material adverse affect on our business and results of operations.

Violations or alleged violations of laws that impose requirements for the conduct of our overseas operations, including the FCPA or other anti-corruption laws, sanctioned parties restrictions, and FATCA could adversely affect our business.

In foreign countries where we operate, a risk exists that our employees, third party partners or agents could engage in business practices prohibited by applicable laws and regulations, such as the FCPA. Such anti-corruption laws generally prohibit companies from making improper payments to foreign officials and require companies to keep accurate books and records and maintain appropriate internal controls. Our policies mandate strict compliance with such laws and we devote resources to ensure compliance. However, we operate in some parts of the world that have experienced governmental corruption, and, in certain circumstances, local customs and practice might not be consistent with the requirements of anti-corruption laws. We remain subject to the risk that our employees, third party partners or agents will engage in business practices that are prohibited by our policies and violate such laws and regulations. Violations by us or a third party acting on our behalf could result in significant internal investigation costs and legal fees, civil and criminal penalties, including prohibitions on the conduct of our business, and reputational harm.

We may also be subject to legal liability and reputational damage if we violate U.S. trade sanctions administered by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), the European Union and the United Nations, and trade sanction laws such as the Iran Threat Reduction and Syria Human Rights Act of 2012.

In addition, FATCA requires certain of our subsidiaries, affiliates and other entities to obtain valid FATCA documentation from payees prior to remitting certain payments to such payees. In the event we do not obtain valid FATCA documents, we may be obliged to withhold a portion of such payments. This obligation is shared with our customers and clients who may fail to comply, in whole or in part. In such circumstances, we may incur FATCA compliance costs including withholding taxes, interest and penalties. Regulatory initiatives and changes in the regulations and guidance promulgated under FATCA may increase our costs of operations, and could adversely affect the market for our services as intermediaries, which could negatively affect our results of operations and financial condition.

Failure to successfully identify, complete and integrate acquired businesses or products could adversely affect our operations.

As part of our business strategy, we continue to evaluate and may pursue selected business or product acquisition opportunities that we believe may provide us with certain operating and financial benefits. There can be no assurance that we will identify or complete transactions with suitable acquisition candidates in the future. If we complete any such acquisitions, they may require integration into our existing business with respect to administrative, financial, sales, marketing, manufacturing and other functions to realize these anticipated benefits. If we are unable to successfully integrate a business or product acquisition, we may not realize the benefits identified in our due diligence process, and our financial results may be negatively impacted. Additionally, significant unexpected liabilities may arise during or after completion of an acquisition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

10

ITEM 2. PROPERTIES

The principal facilities utilized by the Company at December 31, 2016 are listed below. The Company owns all such facilities in fee simple except as noted. The Company believes that its facilities are generally well maintained and have sufficient capacity for its current needs.

| Approximate area | |||||||

| Location | Principal use | (square feet) | |||||

| Scottsdale, Arizona, USA | Manufacturing and offices | 32,000 | (1 | ) | |||

| Los Gatos, California, USA | Software development and offices | 3,600 | (2 | ) | |||

| Centennial, Colorado, USA | Distribution and offices | 12,000 | |||||

| Tulsa, Oklahoma, USA | Manufacturing and offices | 59,500 | |||||

| Milwaukee, Wisconsin, USA | Manufacturing and offices | 324,200 | |||||

| Racine, Wisconsin, USA | Manufacturing and offices | 134,300 | (3 | ) | |||

| Brno, Czech Republic | Manufacturing and offices | 27,800 | |||||

| Neuffen, Germany | Manufacturing and offices | 24,700 | |||||

| Nogales, Mexico | Manufacturing and offices | 181,300 | |||||

| Bern, Switzerland | Manufacturing and offices | 1,100 | (4 | ) | |||

(1) Leased facility. Lease term expires September 1, 2019.

(2) Leased facility. Lease term expires November 31, 2021.

(3) Leased facility. Lease term expires December 31, 2025.

(4) Building is owned, but land is leased from the government, as required. Lease term expires October 18, 2021.

ITEM 3. LEGAL PROCEEDINGS

In the normal course of business, the Company is named in legal proceedings from time to time. There are currently no material legal proceedings pending with respect to the Company. The more significant legal proceedings are discussed below.

Like other companies in recent years, the Company is named as a defendant in numerous pending multi-claimant/multi-defendant lawsuits alleging personal injury as a result of exposure to asbestos, manufactured by third parties, and in the past may have been integrated into or sold with a very limited number of the Company’s products. The Company is vigorously defending itself against these claims. Although it is not possible to predict the ultimate outcome of these matters, the Company does not believe the ultimate resolution of these issues will have a material adverse affect on the Company’s financial position or results of operations, either from a cash flow perspective or on the financial statements as a whole. This belief is based in part on the fact that no claimant has proven or substantially demonstrated asbestos exposure caused by products manufactured or sold by the Company and that most of the cases have been voluntarily dismissed.

The Company is subject to contingencies related to environmental laws and regulations. Information about the Company's compliance with environmental regulations is included in Part I, Item 1 of this 2016 Annual Report on Form 10-K under the heading “Environmental Protection.”

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

11

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Information required by this Item is set forth in Note 11 “Unaudited: Quarterly Results of Operations, Common Stock Price and Dividends” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this 2016 Annual Report on Form 10-K.

The following information in Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934, as amended, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates it by reference into such a filing.

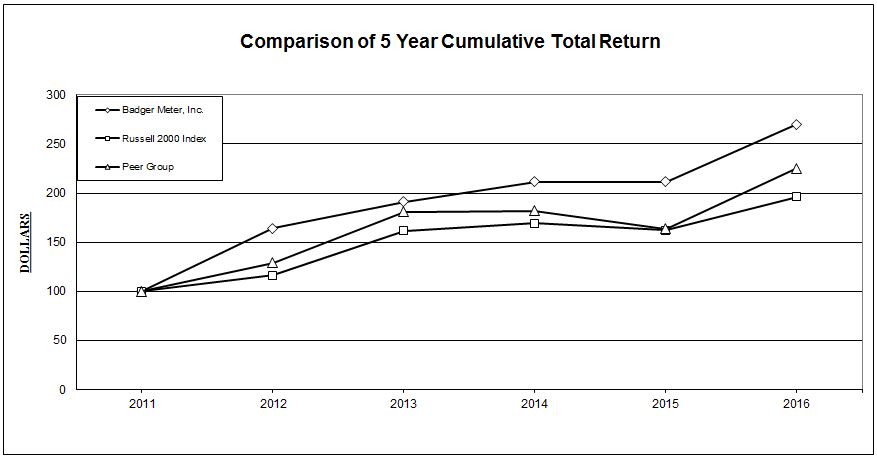

The following graph compares on a cumulative basis the yearly percentage change since January 1, 2012 in (a) the total shareholder return on the Common Stock with (b) the total return on the Russell 2000 Index, and (c) the total return of the peer group made up of 15 companies, including the Company, in similar industries and with similar market capitalization.

The graph assumes $100 invested on December 31, 2011. It further assumes the reinvestment of dividends. The returns of each component company in the peer groups have been weighted based on such company's relative market capitalization.

| December 31 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Badger Meter, Inc. | Return % | 64.04% | 16.66% | 10.49% | —% | 27.71% | |

| Cumulative $ | $100.00 | $164.04 | $191.38 | $211.46 | $211.53 | $270.15 | |

| Russell 2000 Index | Return % | 16.35% | 38.82% | 4.89% | (4.41)% | 21.31% | |

| Cumulative $ | $100.00 | $116.35 | $161.52 | $169.42 | $161.95 | $196.45 | |

| Peer Group | Return % | 29.11% | 40.14% | 0.51% | (9.99)% | 37.54% | |

| Cumulative $ | $100.00 | $129.11 | $180.94 | $181.88 | $163.71 | $225.16 | |

The Peer Group consists of A.O. Smith Corp. (AOS), Badger Meter, Inc. (BMI), CIRCOR International, Inc. (CIR), CLARCOR Inc. (CLC), ESCO Technologies Inc. (ESE), Franklin Electric Co, Inc. (FELE), Gorman-Rupp Company (GRC), Itron, Inc. (ITRI), Lindsay Corporation (LNN), MFRI, Inc. (MFRI), Mueller Water Products (MWA), Northwest Pipe Company (NWPX) , Rexnord Corporation (RXN), Sun Hydraulics Corporation (SNHY), and Watts Water Technologies, Inc. (WTS).

12

ITEM 6. SELECTED FINANCIAL DATA

BADGER METER, INC.

Ten Year Summary of Selected Consolidated Financial Data

| Years ended December 31, | ||||||||||

| (In thousands except per share data) | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Operating results | ||||||||||

| Net sales | $393,761 | 377,698 | 364,768 | 334,122 | 319,660 | 262,915 | 276,634 | 250,337 | 279,552 | 234,816 |

| Research and development | $10,597 | 10,645 | 9,496 | 10,504 | 9,567 | 8,086 | 7,164 | 6,910 | 7,136 | 5,714 |

| Earnings from continuing operations before income taxes | $49,844 | 41,152 | 44,912 | 38,009 | 43,471 | 27,349 | 44,438 | 42,333 | 39,555 | 29,325 |

| Earnings from continuing operations | $32,295 | 25,938 | 29,678 | 24,617 | 28,032 | 19,161 | 28,662 | 26,780 | 25,084 | 18,386 |

Earnings (loss) from discontinued operations (1) | $ n/a | n/a | n/a | n/a | n/a | n/a | n/a | 7,390 | n/a | (1,929) |

| Net earnings | $32,295 | 25,938 | 29,678 | 24,617 | 28,032 | 19,161 | 28,662 | 34,170 | 25,084 | 16,457 |

| Earnings from continuing operations to sales | 8.2% | 6.9% | 8.1% | 7.4% | 8.8% | 7.3% | 10.4% | 10.7% | 9.0% | 7.8% |

| Per Common share (2) | ||||||||||

| Basic earnings from continuing operations | $1.12 | 0.90 | 1.04 | 0.86 | 0.98 | 0.64 | 0.96 | 0.91 | 0.86 | 0.65 |

| Basic earnings (loss) from discontinued operations | $ n/a | n/a | n/a | n/a | n/a | n/a | n/a | 0.25 | n/a | (0.07) |

| Total basic earnings | $1.12 | 0.90 | 1.04 | 0.86 | 0.98 | 0.64 | 0.96 | 1.16 | 0.86 | 0.58 |

| Diluted earnings from continuing operations | $1.11 | 0.90 | 1.03 | 0.85 | 0.98 | 0.64 | 0.96 | 0.90 | 0.85 | 0.63 |

| Diluted earnings (loss) from discontinued operations | $ n/a | n/a | n/a | n/a | n/a | n/a | n/a | 0.25 | n/a | (0.07) |

| Total diluted earnings | $1.11 | 0.90 | 1.03 | 0.85 | 0.98 | 0.64 | 0.96 | 1.14 | 0.85 | 0.57 |

| Cash dividends declared: Common Stock | $0.43 | 0.39 | 0.37 | 0.35 | 0.33 | 0.30 | 0.26 | 0.23 | 0.20 | 0.17 |

| Price range - high | $39.36 | 32.94 | 30.46 | 28.18 | 24.30 | 22.74 | 22.75 | 22.45 | 31.37 | 23.22 |

| Price range - low | $26.40 | 25.82 | 23.24 | 20.94 | 14.65 | 13.43 | 16.29 | 11.25 | 8.79 | 11.50 |

| Closing price | $36.95 | 29.30 | 29.68 | 27.25 | 23.71 | 14.72 | 22.11 | 19.91 | 14.51 | 22.48 |

| Book value * | $8.80 | 8.00 | 7.41 | 6.82 | 5.98 | 5.93 | 5.60 | 4.82 | 3.75 | 3.17 |

| Shares outstanding at year-end (2) | ||||||||||

| Common Stock | 29,119 | 29,050 | 28,922 | 28,824 | 28,628 | 30,246 | 30,096 | 29,946 | 29,616 | 29,038 |

| Financial position | ||||||||||

| Working capital * | $75,174 | 44,784 | 34,030 | 29,122 | 27,294 | 78,782 | 64,658 | 60,419 | 35,740 | 38,725 |

| Current ratio * | 2.0 to 1 | 1.4 to 1 | 1.3 to 1 | 1.3 to 1 | 1.3 to 1 | 4.5 to 1 | 3.0 to 1 | 3.3 to 1 | 1.7 to 1 | 1.9 to 1 |

| Net cash provided by operations | $56,185 | 35,831 | 35,735 | 34,818 | 34,802 | 31,317 | 18,396 | 36,588 | 26,143 | 27,934 |

| Capital expenditures | $10,596 | 19,766 | 12,332 | 14,311 | 8,202 | 5,336 | 9,238 | 7,750 | 13,237 | 15,971 |

| Total assets | $349,699 | 355,480 | 341,158 | 316,058 | 290,453 | 218,910 | 215,864 | 191,016 | 195,358 | 150,301 |

| Short-term and current portion of long-term debt | $37,950 | 71,360 | 75,927 | 70,045 | 66,730 | 1,790 | 12,878 | 8,003 | 19,670 | 13,582 |

| Long-term debt | $ n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a | 5,504 | 3,129 |

| Shareholders' equity (3) | $256,209 | 232,275 | 214,331 | 196,563 | 171,247 | 179,281 | 168,383 | 144,461 | 111,023 | 91,969 |

| Debt as a percent of total debt and equity * | 12.9% | 23.5% | 26.2% | 26.3% | 28.0% | 1.0% | 7.1% | 5.2% | 18.5% | 15.4% |

| Return on shareholders' equity * | 12.6% | 11.2% | 13.8% | 12.5% | 16.4% | 10.7% | 17.0% | 18.5% | 22.6% | 20.0% |

| Price/earnings ratio * | 33.3 | 32.6 | 28.8 | 32.1 | 24.3 | 23.2 | 23.2 | 22.2 | 17.2 | 35.7 |

(1) The Company's French operations have been presented as discontinued operations through 2007, the years of ownership. In 2009, discontinued operations represented the recognition of previously unrecognized tax benefits for certain deductions that were taken on prior tax returns related to the shutdown of the Company's French operations.

(2) All per share amounts and number of shares outstanding have been restated to reflect the 2016 2-for-1 stock split for the periods presented.

13

(3) The Company adopted the provisions of the Financial Accounting Standards Board Accounting Standards Codification 715, “Compensation - Retirement Benefits” on December 31, 2006, with respect to recognizing the funded status of pension and postretirement benefit plans, and at December 31, 2008, with respect to changing the measurement date.

*Description of calculations as of the applicable year end:

Book value per share equals total shareholders' equity at year-end divided by the number of common shares outstanding.

Working capital equals total current assets less total current liabilities.

Current ratio equals total current assets divided by total current liabilities.

Debt as a percent of total debt and equity equals total debt (the sum of short-term debt, current portion of long-term debt and long-term debt) divided by the sum of total debt and total shareholders' equity at year-end. The debt of the discontinued French operations is included in this calculation through 2007, the years of ownership, although there was no debt at the end of 2007 related to the French operations.

Return on shareholders' equity equals earnings from continuing operations divided by total shareholders' equity at year-end.

Price/earnings ratio equals the year-end closing stock price for common stock divided by diluted earnings per share from continuing operations.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

BUSINESS DESCRIPTION AND OVERVIEW

Badger Meter is an innovator in flow measurement, control and communication solutions, serving water utilities, municipalities, and commercial and industrial customers worldwide. The Company’s products measure water, oil, chemicals and other fluids, and are known for accuracy, long-lasting durability and for providing and communicating valuable and timely measurement data. The Company’s product lines fall into two categories: sales of water meters and related technologies to municipal water utilities (municipal water) and sales of meters to various industries for water and other fluids (flow instrumentation). The Company estimates that over 85% of its products are used in water applications when both categories are grouped together.

Municipal water, the largest category by sales volume, includes mechanical and ultrasonic (electronic) water meters and related technologies and services used by municipal water utilities as the basis for generating water and wastewater revenues. The key market for the Company’s municipal water meter products is North America, primarily the United States, because most of the Company's meters are designed and manufactured to conform to standards promulgated by the American Water Works Association. The majority of water meters sold by the Company continue to be mechanical in nature. In recent years, the Company has made inroads in selling ultrasonic water meters. The development of smaller diameter ultrasonic water meters combined with advanced radio technology now provides the Company with the opportunity to sell into other geographical markets, for example Europe, the Middle East and South America. In the municipal water category, sales of water meters and related technologies and services are also commonly referred to as residential or commercial water meter sales, the latter referring to larger sizes of water meters.

Flow instrumentation includes meters and valves sold worldwide to measure and control materials flowing through a pipe or pipeline including water, air, steam, oil, and other liquids and gases. These products are used in a variety of applications, primarily into the following industries: water/wastewater; heating, ventilating and air conditioning (HVAC); oil and gas; chemical and petrochemical; test and measurement; automotive aftermarket; and the concrete construction process. Furthermore, the Company’s flow instrumentation technologies are sold to original equipment manufacturers as the primary flow measurement device within a product or system.

Residential and commercial water meters are generally classified as either manually read meters or remotely read meters via radio technology. A manually read meter consists of a water meter and a register that provides a visual totalized meter reading. Meters equipped with radio technology (endpoints) receive flow measurement data from encoder registers attached to the water meter, which is encrypted and transmitted via radio frequency to a receiver that collects and formats the data appropriately for water utility billing systems. These remotely read, or mobile, systems are either automatic meter reading (AMR) systems, where a vehicle equipped for meter reading purposes, including a radio receiver, computer and reading software, collects the data from utilities’ meters; or fixed network advanced metering infrastructure (AMI) systems, where data is gathered utilizing a network of permanent data collectors or gateway receivers that are always active or listening for the radio transmission from the utilities’ meters. AMI systems eliminate the need for utility personnel to drive through service territories to collect data from the meters. These systems provide the utilities with more frequent and diverse data from their meters at specified intervals.

The ORION family of radio endpoints provides water utilities with a range of industry-leading options for meter reading. These include ORION Migratable (ME) (for mobile meter reading), ORION Fixed Network (SE) (for traditional fixed

14

network applications), and ORION Cellular (for infrastructure-free meter reading). ORION Migratable makes the migration to fixed network easier for utilities that prefer to start with mobile reading and later adopt fixed network communications, allowing utilities to choose a solution for their current needs and be positioned for their future operational changes. ORION Cellular eliminates the need for utility-owned fixed network infrastructure, allows for rapid deployment and decreases ongoing maintenance.

Critical to the water metering ecosystem is information and analytics. The Company’s BEACON AMA Managed Solution is the latest in metering technology. BEACON AMA combines the BEACON analytical software suite with proven ORION technologies using two-way fixed and cellular networks in a managed solution, improving utilities’ visibility of their water consumption and eliminating the need for costly utility-managed infrastructure.

The BEACON AMA secure, cloud-hosted software suite includes a customizable dashboard, the ability to establish alerts for specific conditions, and consumer engagement tools that allow end water customers to view and manage their water usage activity. Benefits to the utility include improved customer service, increased visibility through faster leak detection, the ability to promote and quantify the effects of its water conservation efforts, and easier compliance reporting.

The Company’s net sales and corresponding net earnings depend on unit volume and product mix, with the Company generally earning higher margins on meters equipped with radio technology. The Company’s proprietary radio products generally result in higher margins than the remarketed, non-proprietary technology products. The Company also sells registers and endpoints separately to customers who wish to upgrade their existing meters in the field.

Water meter replacement and the adoption and deployment of new technology comprise the majority of water meter product sales, including radio products. To a much lesser extent, housing starts also contribute to the new product sales base. Over the last decade, there has been a growing trend in the conversion from manually read water meters to radio technology. This conversion rate is accelerating and contributes to an increased water meter and radio solutions base of business. The Company estimates that approximately 55% of water meters installed in the United States have been converted to a radio solutions technology. The Company’s strategy is to fulfill customers’ metering expectations and requirements with its proprietary meter reading systems or other systems available through its alliance partners in the marketplace.

Flow instrumentation products serve flow measurement and control applications across a broad industrial spectrum, occasionally leveraging the same technologies used in the municipal water category. Specialized communication protocols that control the entire flow measurement process and mandatory certifications drive these markets. The Company’s specific flow measurement and control applications and technologies serve the flow measurement market through both customized and standard flow instrumentation solutions.

Industries today face accelerating demands to contain costs, reduce product variability, and meet ever-changing safety, regulatory and sustainability requirements. To address these challenges, customers must reap more value from every component in their systems. This system-wide scrutiny has heightened the focus on flow instrumentation in industrial process, manufacturing, commercial fluid, building automation, and precision engineering applications where flow measurement and control are critical.

An industry leader in both mechanical and electrical flow metering technologies, the Company offers one of the broadest flow measurement, control and communication portfolios in the market. The portfolio carries respected brand names including Recordall, E-Series, ORION, Hedland, Dynasonics, Blancett, and Research Control, and includes eight of the ten major flow meter technologies. Customers rely on the Company for application-specific solutions that deliver accurate, timely and dependable flow data and control essential for product quality, cost control, safer operations, regulatory compliance, and more sustainable operations.

Business Trends

Increasingly, the electric utility industry relies on AMI technology for two-way communication to monitor and control electrical devices at the customer's site. Although the Company does not sell products for electric market applications, the trend toward AMI affects the markets in which the Company does participate, particularly for those customers in the water utility market that are interested in more frequent and diverse data collection. Specifically, AMI and AMA technologies enable water utilities to capture readings from each meter at more frequent and variable intervals. Similar to the electric utility industry’s conversion to solid-state meters in recent years, the water utility industry is beginning the conversion from mechanical to ultrasonic meters. Ultrasonic water metering has lower barriers to entry, which could affect the competitive landscape for the water meter market in North America.

15

The Company sells its technology solutions to meet customer requirements. Since the technology products have comparable margins, any change in the mix between AMR, AMI or AMA is not expected to have a significant impact on the Company's net sales related to meter reading technology.

There are approximately 52,000 water utilities in the United States and the Company estimates that approximately 55% of them have converted to a radio solutions technology. With the BEACON AMA managed solution and its wide breadth of water meters, the Company believes it is well positioned to meet customers' future needs.

In the global market, companies need to comply with increasing regulations requiring companies to better manage critical resources, monitor their use of hazardous materials, and reduce exhaust gases. Some customers measure fluids to identify leaks and/or misappropriation for cost control or add measurement points to help automate manufacturing. Other customers employ measurement to comply with government mandates and laws. The Company provides technology to measure water, hydrocarbon-based fluids, chemicals, gases and steams.

Flow measurements are critical to provide a baseline and quantify reductions as customers attempt to reduce consumption. Once water usage is better understood, a strategy for water-use reduction can be developed with specific water-reduction initiatives targeted to those areas where water reduction is most viable. With the Company’s technology, customers have found costly leaks, pinpointed equipment in need of repair, and identified areas for process improvements.

Acquisitions

On October 20, 2016, the Company acquired certain assets of Precision Flow Measurement, Inc., doing business as Nice Instruments, of Manalapan Township, New Jersey. The acquisition adds a new technology for the measurement of steam to the Company's HVAC line of products.

The total purchase consideration for the Nice Instruments assets was $2.0 million, which included a $0.2 million payment after the first production run that occurred in January 2017. The Company's preliminary allocation of the purchase price at December 31, 2016 included approximately $15,000 of inventory and equipment, $0.7 million of intangibles and $1.3 million of goodwill. As of December 31, 2016, the Company had not completed its analysis for estimating the fair value of the assets acquired. This acquisition is further described in Note 3 “Acquisitions” in the Notes to Consolidated Financial Statements.

On August 17, 2015, the Company's wholly-owned subsidiary, National Meter and Automation, Inc. (“National Meter”), acquired certain assets of United Utilities, Inc. of Smyrna, Tennessee, which was one of the Company's distributors serving Tennessee and Georgia.

The total purchase consideration for the United Utilities assets was $3.3 million, which included $0.4 million in cash and settlement of $2.9 million of pre-existing Company receivables. The Company's preliminary allocation of the purchase price at December 31, 2015 included $0.8 million of receivables, $0.4 million of inventory, $0.1 million of property, plant and equipment, $1.7 million of intangibles and $0.3 million of goodwill. The preliminary allocation of the purchase price to the assets acquired was based upon the estimated fair value at the date of acquisition. In 2016, the Company completed its analysis for estimating the fair value of the assets acquired with no additional adjustments. This acquisition is further described in Note 3 “Acquisitions” in the Notes to Consolidated Financial Statements.

On October 1, 2014, the Company acquired 100% of the outstanding common stock of National Meter and Automation, Inc. of Centennial, Colorado. The purchase was estimated to add approximately $15 million of incremental annual revenues to Badger Meter, after eliminating what would be intercompany sales. National Meter was a major distributor of Badger Meter products for the municipal water utility market, serving customers in Arizona, California, Colorado, Nevada and southern Wyoming. National Meter has become a regional distribution center for Badger Meter. In addition to its primary product line of water meters and meter reading systems, National Meter provides services including meter testing, leak detection, water audits, and meter and meter reading system installation.

The total purchase consideration for National Meter was $22.9 million, which included $20.3 million in cash, a working capital adjustment and settlement of pre-existing Company receivables. The Consolidated Balance Sheets at December 31, 2014 included $2.5 million of deferred payments, of which $2.0 million was paid in late 2015 and early 2016, and $0.5 million is payable in early 2017 and is recorded in Payables at December 31, 2016. The Company finalized the valuation for estimating the fair value of the assets acquired and liabilities assumed at September 30, 2015 with a small change from the preliminary December 31, 2014 estimate. This acquisition is further described in Note 3 “Acquisitions” in the Notes to Consolidated Financial Statements.

16

Revenue and Product Mix

As the industry continues to evolve, the Company has been vigilant in anticipating and exceeding customer expectations. In 2011, the Company introduced AMA as a hardware and software solution for water and gas utilities, and then in early 2014 launched its new BEACON AMA system, as a managed solution, which it believes will help maintain the Company's position as a market leader. Since its inception, sales of BEACON AMA have continued to grow with large cities and private water utilities selecting BEACON AMA and the Company’s industry-leading water meters.

The Company continues to seek opportunities for additional revenue enhancement. For instance, the Company is periodically asked to oversee and perform field installation of its products for certain customers. The Company assumes the role of general contractor, hiring installation subcontractors and supervising their work. The Company also supports its product and technology sales with the sale of extended service programs that provide additional services beyond the standard warranty. In recent years, the Company has sold ORION radio technology to natural gas utilities for installation on their gas meters. And most recently, the introduction of the BEACON AMA system opens the door to “software as a service” revenues. With the exception of a large sale of gas radios to one particular customer several years ago, revenues from such products and services are not yet significant and the Company is uncertain of the potential growth achievable for such products and services in future periods.

RESULTS OF OPERATIONS

Net Sales