JPMorgan Funds are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds.

This report is submitted for the general information of the shareholders of the Portfolio. It is not authorized for distribution to prospective investors in the Portfolio unless preceded or accompanied by a prospectus.

The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. Shareholders may request the Form N-Q without charge by calling 1-800-480-4111 or by visiting the variable insurance portfolio section of the JPMorgan Funds’ website at www.jpmorganfunds.com.

A description of the Portfolio’s policies and procedures with respect to the disclosure of the Portfolio’s holdings is available in the Statement of Additional Information.

A copy of proxy policies and procedures are available without charge upon request by calling 1-800-480-4111 and on the SEC’s website at www.sec.gov. The Trustees have delegated the authority to vote proxies for securities owned by the Portfolio to the Advisor. A copy of the Portfolio’s voting record for the most recent 12-month period ended June 30 is available on the SEC’s website at www.sec.gov or at the Portfolio’s website at www.jpmorganfunds.com no later than August 31 of each year. The Portfolio’s proxy voting record will include, among other things, a brief description of the matter voted on for each portfolio security, and will state how each vote was cast, for example, for or against the proposal.

CONTENTS | President’s Letter | | | | | 1 | | Portfolio Commentary:

| | | | | | | | JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio | | | | | 2 | | | Schedule of Portfolio Investments | | | | | 4 | | | Statement of Assets and Liabilities | | | | | 7 | | | Statement of Operations | | | | | 8 | | | Statement of Changes in Net Assets | | | | | 9 | | | Financial Highlights | | | | | 10 | | | Notes to Financial Statements | | | | | 12 | | | Trustees | | | | | 16 | | | Officers | | | | | 18 | | | Schedule of Shareholder Expenses | | | | | 20 | |

HIGHLIGHTS | • | | U.S. stocks generally positive in first half of 2006 |

| • | | Investors tried to predict interest rate hikes |

| • | | Gross domestic product (GDP) moved sharply higher |

| • | | Market volatility expected until interest rate picture is clearer |

Effective May 1, 2006, the existing shares of the Portfolio were designated as Class 1 shares. The performance, expenses and other information shown in this report for the Portfolio is information applicable to the Class 1 shares. Investments in the Portfolio are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested. Past performance is no guarantee for future performance. The general market views expressed in this report are opinions based on current market conditions and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Portfolio. This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by separate accounts of participating insurance companies. Portfolio shares are also offered to qualified pension and retirement plans (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio. Prospective investors should refer to the Portfolio’s prospectus for a discussion of the Portfolio’s investment objective, strategies and risks. Call JPMorgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Portfolio including management fees and other expenses. Please read it carefully before investing.

PRESIDENT’S LETTER

JULY 14, 2006 (Unaudited)

Dear Shareholder: We are pleased to present this semi-annual report for the JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio for the six months ended June 30, 2006. Inside, you’ll find information detailing the performance of the Portfolio, along with a report from the portfolio manager. | | | |

“Despite repeated interest rate hikes and surging energy prices, the U.S. economy was surprisingly resilient.”

|

All Eyes on the Federal Reserve Board While the U.S. stock market weakened late in the reporting period, overall it produced positive returns for the first half of the calendar year. The equity market kicked off 2006 with investors encouraged by overall strong economic growth and positive corporate earnings. However, the last two months were marked by increased volatility. A great deal of the driving forces behind the market’s ups and downs resulted from the actions of the Federal Open Market Committee (FOMC). In February 2006, Ben Bernanke assumed the role of Federal Reserve (Fed) Board Chairman, replacing long-time fixture Alan Greenspan. The transition was less than smooth for investors, as they attempted to predict the FOMC’s future actions regarding interest rates. The FOMC’s statements first hinted that there may be a break from rate increases and then telegraphed additional rate hikes due to fears of rising inflation. In late June, the FOMC raised short-term rates for the 17th consecutive time, bringing the fed funds target rate to 5.25% — its highest level in more than five years. Despite repeated interest rate hikes and surging energy prices, the U.S. economy was surprisingly resilient. After gross domestic product (GDP) fell in the fourth quarter, the economy moved sharply higher in the first quarter of 2006. During this time, GDP rose 5.6%, its highest reading since the third quarter of 2003. Stocks Produce Positive Results The broad stock market, as measured by the S&P 500 Index, returned 2.71% for the six months ended June 30, 2006. After a fast start to the year, the market took a step backwards in mid-May on fears that additional rate hikes may adversely affect the economic expansion and temper corporate profits. Looking more closely at the market over the six months, small- and mid-cap stocks outperformed their large-cap counterparts, with the Russell Midcap, Russell 2000 and Russell 1000 Indexes returning 4.84%, 8.21% and 2.76%, respectively. However, as many market pundits have anticipated, large-cap stocks generated relatively better results late in the period. After a prolonged period of lagging smaller-cap stocks, many large caps appeared attractively valued and may be better equipped to handle more moderate economic growth. Outlook Looking ahead, the markets could continue to experience periods of volatility until the FOMC’s interest rate stance is better understood. Coinciding with its latest rate hike in June, the Fed said: “The extent and timing of any additional firming...will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.” Investors will likely be closely monitoring the economic “tea leaves” in an attempt to ascertain the FOMC’s next move. On behalf of us all at JPMorgan Asset Management, thank you for your confidence and the continued trust you have placed in us. We look forward to serving your investment needs for many years to come. Should you have any questions, please feel free to contact the JPMorgan Funds Service Center at 1-800-480-4111. George C.W. Gatch

President

JPMorgan Funds JUNE 30, 2006 JPMORGAN INSURANCE TRUST 1

JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio

(formerly JPMorgan Investment Trust Mid Cap Growth Portfolio)

PORTFOLIO COMMENTARY

AS OF JUNE 30, 2006 (Unaudited)

PORTFOLIO FACTS

| Portfolio Inception | | | | August 1, 1994 | | Fiscal Year End | | | | December 31 | | Net Assets as of 6/30/2006 | | | | $176,336,738 | | Primary Benchmark | | | | Russell Midcap

Growth Index |

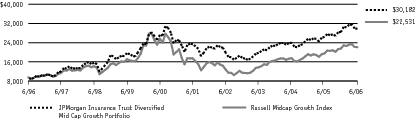

Q. HOW DID THE PORTFOLIO PERFORM? A. | | The JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio, which seeks to provide growth of capital and, secondarily, current income by investing primarily in equity securities, returned 4.53% over the six months ended June 30, 2006, compared to the 2.56% return for the Russell Midcap Growth Index over the same period.* |

Q. WHY DID THE PORTFOLIO PERFORM THIS WAY? A. | | The Portfolio outperformed its benchmark for the period due primarily to stock selection in the information technology, consumer discretionary and financial sectors. Stock selection in the healthcare and industrial sectors as well as an underweight in materials detracted from performance. |

| | Alliance Data Systems Corp., a credit and marketing services provider, was among the top contributors for the period. The company notched several wins, including agreements to provide co-branded credit cards with specialty retailers New York & Company and Goody’s. In addition, the company reported first-quarter profits significantly ahead of expectations due to strong performance from its transaction services business. All elements of the company were strong, including organic growth of over 20% in its Canadian Air Miles Reward Program. Also contributing to performance was Amphenol Corp., a maker of electrical connectors used in aerospace applications, computers and networking equipment, to name a few. The company experienced strong results in all of its business segments, especially wireless handsets and broadband communication networks. In addition, recently acquired Amphenol TCS, a supplier of high-speed, high-density, printed circuit board interconnect products, showed strong progress and a much higher level of earnings accretion than originally anticipated. |

| | On the negative side, Jabil Circuit Inc., a global leader in the electronic manufacturing services (EMS) industry, was among the top detractors for the period. The company announced that its fiscal third-quarter earnings would fall shy of expectations. Investors feared that the earnings shortfall, driven by operational issues, would continue into the next quarter and likely beyond. PDL BioPharma Inc., a biotechnology company, was another significant detractor. The company reported first-quarter earnings for 2006 that were significantly lower than anticipated. The company lowered 2006 revenue expectations and raised research and development (R&D) expense guidance. |

Q. | | HOW WAS THE PORTFOLIO MANAGED? |

A. | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for dominant franchises with predictable business models deemed capable of achieving sustained growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. We seek to maintain sector diversification in the Portfolio by avoiding large allocations that are contingent on macroeconomic or sector trends. |

PORTFOLIO COMPOSITION**

| Information Technology | | | | | 24.4 | % | | Industrials | | | | | 19.5 | | | Health Care | | | | | 15.8 | | | Consumer Discretionary | | | | | 15.7 | | | Financials | | | | | 10.8 | | | Energy | | | | | 8.8 | | | Telecommunication Services | | | | | 2.5 | | | Materials | | | | | 1.3 | | | Short-Term Investments | | | | | 1.5 | | | Investments of Cash Collateral for Securities on Loan | | | | | 11.4 | |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**

| 1. | | | | West Corp. | | | 3.0 | % | | 2. | | | | Amphenol Corp., Class A | | | 2.8 | | | 3. | | | | Alliance Data Systems Corp. | | | 2.6 | | | 4. | | | | DaVita, Inc. | | | 2.0 | | | 5. | | | | NII Holdings, Inc. | | | 1.7 | | | 6. | | | | Lazard Ltd., Class A (Bermuda) | | | 1.6 | | | 7. | | | | Omnicare, Inc. | | | 1.5 | | | 8. | | | | Scientific Games Corp., Class A | | | 1.4 | | | 9. | | | | BEA Systems, Inc. | | | 1.4 | | | 10. | | | | Celgene Corp. | | | 1.4 | |

| * | | The advisor seeks to achieve the Portfolio’s objective. There can be no guarantee it will be achieved. |

| ** | | Percentages indicated are based upon net assets as of June 30, 2006. The portfolio’s composition is subject to change. |

2 JPMORGAN INSURANCE TRUST JUNE 30, 2006

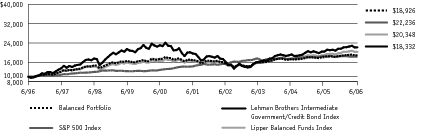

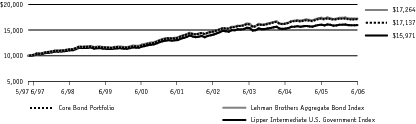

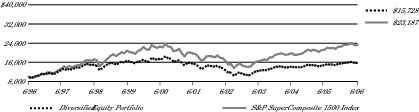

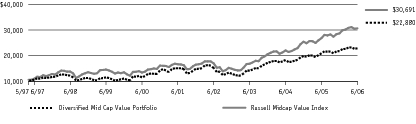

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2006

| | | | INCEPTION DATE

| | 1 YEAR

| | 5 YEAR

| | 10 YEAR

|

|---|

DIVERSIFIED MID CAP GROWTH PORTFOLIO | | | | | 8/1/94 | | | | 12.55 | % | | | 4.92 | % | | | 11.68 | % |

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111. The graph illustrates comparative performance for $10,000 invested in the JPMorgan Insurance Trust Mid Cap Growth Portfolio and the Russell Midcap Growth Index. The performance of the Portfolio assumes reinvestment of all dividends. The performance of the index does not include fees and expenses attributable to the Portfolio and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell Midcap Growth Index measures the performance of mid cap companies with higher price-to-book ratios and higher forecasted growth values. Investors cannot invest directly in an index. The performance does not reflect any charges imposed by the Policies or Eligible Plans. If these charges were included, the returns would be lower than shown. Performance may also reflect the waiver and reimbursement of the Portfolio’s fees/expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. JUNE 30, 2006 JPMORGAN INSURANCE TRUST 3

JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio

(formerly JPMorgan Investment Trust Mid Cap Growth Portfolio)

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2006 (Unaudited)

SHARES

|

|

|

| SECURITY DESCRIPTION

|

| VALUE ($)

|

|---|

Long-Term Investments — 98.8% | | | | | | Common Stocks — 98.8% | | | | | | Aerospace & Defense — 1.9% | | 21,350 | | | | Precision Castparts Corp. | | | 1,275,876 | | | 37,650 | | | | Rockwell Collins, Inc. | | | 2,103,506 | | | | | | | | | | 3,379,382 | | | | | | | Air Freight & Logistics — 1.0% | | 34,600 | | | | C.H. Robinson Worldwide, Inc. | | | 1,844,180 | | | | | | | Airlines — 0.9% | | 60,550 | | | | Skywest, Inc. | | | 1,501,640 | | | | | | | Biotechnology — 1.9% | | 51,250 | | | | Celgene Corp. (a) | | | 2,430,788 | | | 27,400 | | | | Vertex Pharmaceuticals, Inc. (a) | | | 1,005,854 | | | | | | | | | | 3,436,642 | | | | | | | Capital Markets — 6.0% | | 15,450 | | | | Affiliated Managers Group, Inc. (a) (c) | | | 1,342,450 | | | 98,300 | | | | E*Trade Financial Corp. (a) | | | 2,243,206 | | | 27,550 | | | | Investment Technology Group, Inc. (a) | | | 1,401,193 | | | 70,337 | | | | Lazard Ltd., Class A (Bermuda) | | | 2,841,615 | | | 15,250 | | | | Legg Mason, Inc. | | | 1,517,680 | | | 34,600 | | | | T. Rowe Price Group, Inc. | | | 1,308,226 | | | | | | | | | | 10,654,370 | | | | | | | Chemicals — 1.3% | | 96,750 | | | | Rockwood Holdings, Inc. (a) | | | 2,226,218 | | | | | | | Commercial Banks — 0.8% | | 18,000 | | | | Zions Bancorp | | | 1,402,920 | | | | | | | Commercial Services & Supplies — 7.0% | | 35,100 | | | | Brady Corp., Class A | | | 1,293,084 | | | 12,800 | | | | Corporate Executive Board Co. | | | 1,282,560 | | | 17,500 | | | | Corrections Corp. of America (a) | | | 926,450 | | | 107,800 | | | | Steelcase, Inc. | | | 1,773,310 | | | 27,400 | | | | Stericycle, Inc. (a) (c) | | | 1,783,740 | | | 110,726 | | | | West Corp. (a) | | | 5,304,883 | | | | | | | | | | 12,364,027 | | | | | | | Communications Equipment — 1.2% | | 35,700 | | | | Adtran, Inc. (c) | | | 800,751 | | | 32,000 | | | | Harris Corp. | | | 1,328,320 | | | | | | | | | | 2,129,071 | | | | | | | Computers & Peripherals — 4.0% | | 55,600 | | | | NCR Corp. (a) | | | 2,037,184 | | | 52,000 | | | | Network Appliance, Inc. (a) | | | 1,835,600 | | | 80,200 | | | | Seagate Technology (Cayman Islands) (a) | | | 1,815,728 | | | 318,500 | | | | Sun Microsystems, Inc. (a) | | | 1,321,775 | | | | | | | | | | 7,010,287 | | | | | | | Consumer Finance — 1.2% | | 73,850 | | | | AmeriCredit Corp. (a) (c) | | | 2,061,892 | | | | | | | Diversified Consumer Services — 1.5% | | 20,300 | | | | ITT Educational Services, Inc. (a) | | | 1,335,943 | | | 30,200 | | | | Weight Watchers International, Inc. | | | 1,234,878 | | | | | | | | | | 2,570,821 | | | | | | | Diversified Financial Services — 0.7% | | 18,900 | | | | NYSE Group, Inc.(a) (c) | | | 1,294,272 | | | | | | | Electrical Equipment — 2.1% | | 54,700 | | | | General Cable Corp. (a) | | | 1,914,500 | | | 38,350 | | | | Roper Industries, Inc. | | | 1,792,862 | | | | | | | | | | 3,707,362 | | | | | | | Electronic Equipment & Instruments — 3.7% | | 89,350 | | | | Amphenol Corp., Class A | | | 5,000,026 | | | 63,050 | | | | Jabil Circuit, Inc. | | | 1,614,080 | | | | | | | | | | 6,614,106 | | | | | | | Energy Equipment & Services — 5.5% | | 33,950 | | | | BJ Services Co. | | | 1,264,977 | | | 40,500 | | | | ENSCO International, Inc. | | | 1,863,810 | | | 25,100 | | | | FMC Technologies, Inc. (a) | | | 1,693,246 | | | 27,200 | | | | Grant Prideco, Inc. (a) | | | 1,217,200 | | | 25,100 | | | | National Oilwell Varco, Inc. (a) | | | 1,589,332 | | | 13,300 | | | | Noble Corp. | | | 989,786 | | | 22,000 | | | | Tidewater, Inc. | | | 1,082,400 | | | | | | | | | | 9,700,751 | | | | | | | Health Care Equipment & Supplies — 1.9% | | 29,400 | | | | Advanced Medical Optics, Inc. (a) (c) | | | 1,490,580 | | | 6,500 | | | | Hologic, Inc. (a) (c) | | | 320,840 | | | 35,300 | | | | Mentor Corp. (c) | | | 1,535,550 | | | | | | | | | | 3,346,970 | | | | | | | Health Care Providers & Services — 6.8% | | 35,050 | | | | Aetna, Inc. | | | 1,399,547 | | | 29,961 | | | | Caremark Rx, Inc. | | | 1,494,155 | | | 31,782 | | | | Coventry Health Care, Inc. (a) | | | 1,746,103 | | | 70,400 | | | | DaVita, Inc. (a) | | | 3,498,880 | | | 22,000 | | | | Medco Health Solutions, Inc. (a) | | | 1,260,160 | | | 54,500 | | | | Omnicare, Inc. | | | 2,584,390 | | | | | | | | | | 11,983,235 | | | | | | | Health Care Technology — 1.2% | | 22,700 | | | | Cerner Corp. (a) | | | 842,397 | | | 49,300 | | | | Per-Se Technologies, Inc. (a) (c) | | | 1,241,374 | | | | | | | | | | 2,083,771 | |

SEE NOTES TO FINANCIAL STATEMENTS.

4 JPMORGAN INSURANCE TRUST JUNE 30, 2006

SHARES

|

|

|

| SECURITY DESCRIPTION

|

| VALUE ($)

|

|---|

Long-Term Investments — Continued | | | | | | Hotels, Restaurants & Leisure — 5.3% | | 34,000 | | | | Four Seasons Hotels, Inc. (Canada) (c) | | | 2,088,960 | | | 26,450 | | | | Panera Bread Co., Class A (a) | | | 1,778,498 | | | 36,050 | | | | Royal Caribbean Cruises Ltd. (c) | | | 1,378,912 | | | 71,600 | | | | Scientific Games Corp., Class A (a) | | | 2,550,392 | | | 20,750 | | | | Wynn Resorts Ltd. (a) (c) | | | 1,520,975 | | | | | | | | | | 9,317,737 | | | | | | | Insurance — 2.1% | | 18,800 | | | | Everest Re Group Ltd. (Bermuda) | | | 1,627,516 | | | 45,100 | | | | Hanover Insurance Group, Inc. (The) | | | 2,140,446 | | | | | | | | | | 3,767,962 | | | | | | | IT Services — 4.2% | | 77,550 | | | | Alliance Data Systems Corp. (a) | | | 4,561,491 | | | 28,300 | | | | CheckFree Corp. (a) | | | 1,402,548 | | | 29,300 | | | | MasterCard, Inc., Class A (a) (c) | | | 1,406,400 | | | | | | | | | | 7,370,439 | | | | | | | Leisure Equipment & Products — 0.8% | | 32,500 | | | | Pool Corp. (c) | | | 1,417,975 | | | | | | | Life Sciences Tools & Services — 1.1% | | 31,600 | | | | Covance, Inc. (a) | | | 1,934,552 | | | | | | | Machinery — 2.8% | | 34,400 | | | | ITT Industries, Inc. | | | 1,702,800 | | | 30,850 | | | | Oshkosh Truck Corp. | | | 1,465,992 | | | 21,700 | | | | Parker-Hannifin Corp. | | | 1,683,920 | | | | | | | | | | 4,852,712 | | | | | | | Marine — 0.8% | | 22,800 | | | | American Commercial Lines, Inc. (a) | | | 1,373,700 | | | | | | | Oil, Gas & Consumable Fuels — 3.3% | | 46,300 | | | | Consol Energy, Inc. | | | 2,163,136 | | | 28,850 | | | | Newfield Exploration Co. (a) | | | 1,411,919 | | | 33,950 | | | | Southwestern Energy Co. (a) | | | 1,057,882 | | | 68,300 | | | | Talisman Energy, Inc. (Canada) | | | 1,193,884 | | | | | | | | | | 5,826,821 | | | | | | | Pharmaceuticals — 2.9% | | 45,850 | | | | Adams Respiratory Therapeutics, Inc. (a) (c) | | | 2,045,827 | | | 12,200 | | | | Allergan, Inc. | | | 1,308,572 | | | 40,150 | | | | Shire Pharmaceuticals Group plc ADR (United Kingdom) | | | 1,775,834 | | | | | | | | | | 5,130,233 | | | | | | | Road & Rail — 2.5% | | 23,700 | | | | Con-way, Inc. | | | 1,372,941 | | | 62,750 | | | | J.B.Hunt Transport Services, Inc. | | | 1,563,102 | | | 29,100 | | | | Norfolk Southern Corp. | | | 1,548,702 | | | | | | | | | | 4,484,745 | | | | | | | Semiconductors & Semiconductor Equipment — 5.7% | | 25,300 | | | | Advanced Micro Devices, Inc. (a) | | | 617,826 | | | 35,200 | | | | Broadcom Corp., Class A (a) | | | 1,057,760 | | | 114,150 | | | | Integrated Device Technology, Inc. (a) | | | 1,618,647 | | | 34,050 | | | | KLA-Tencor Corp. | | | 1,415,459 | | | 37,000 | | | | Linear Technology Corp. | | | 1,239,130 | | | 21,900 | | | | Marvell Technology Group Ltd. (Bermuda) (a) | | | 970,827 | | | 54,015 | | | | Microchip Technology, Inc. | | | 1,812,203 | | | 58,100 | | | | Nvidia Corp. (a) | | | 1,236,949 | | | | | | | | | | 9,968,801 | | | | | | | Software — 5.6% | | 42,750 | | | | Adobe Systems, Inc. (a) | | | 1,297,890 | | | 48,250 | | | | Amdocs Ltd. (United Kingdom) (a) | | | 1,765,950 | | | 193,600 | | | | BEA Systems, Inc. (a) | | | 2,534,224 | | | 44,800 | | | | Citrix Systems, Inc. (a) | | | 1,798,272 | | | 73,000 | | | | McAfee, Inc. (a) (c) | | | 1,771,710 | | | 33,200 | | | | Red Hat, Inc. (a) | | | 776,880 | | | | | | | | | | 9,944,926 | | | | | | | Specialty Retail — 6.6% | | 40,450 | | | | AnnTaylor Stores Corp. (a) | | | 1,754,721 | | | 68,000 | | | | Circuit City Stores, Inc. | | | 1,850,960 | | | 37,200 | | | | Dick’s Sporting Goods, Inc. (a) | | | 1,473,120 | | | 46,400 | | | | GameStop Corp., Class A (a) (c) | | | 1,948,800 | | | 65,100 | | | | Petsmart, Inc. | | | 1,666,560 | | | 71,400 | | | | TJX Cos., Inc. | | | 1,632,204 | | | 23,900 | | | | Tractor Supply Co. (a) | | | 1,320,953 | | | | | | | | | | 11,647,318 | | | | | | | Textiles, Apparel & Luxury Goods — 1.5% | | 43,100 | | | | Coach, Inc. (a) | | | 1,288,690 | | | 23,750 | | | | Polo Ralph Lauren Corp. | | | 1,303,875 | | | | | | | | | | 2,592,565 | | | | | | | Trading Companies & Distributors — 0.5% | | 22,700 | | | | GATX Corp. | | | 964,750 | | | | | | | Wireless Telecommunication Services — 2.5% | | 52,350 | | | | NII Holdings, Inc. (a) | | | 2,951,493 | | | 35,300 | | | | Rogers Communications, Inc. (Canada), Class B | | | 1,426,120 | | | | | | | | | | 4,377,613 | | | | | | | Total Common Stocks

(Cost $155,093,910) | | | 174,284,766 | |

SEE NOTES TO FINANCIAL STATEMENTS.

JUNE 30, 2006 JPMORGAN INSURANCE TRUST 5

JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio

(formerly JPMorgan Investment Trust Mid Cap Growth Portfolio)

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2006 (Unaudited) (continued)

SHARES

|

|

|

| SECURITY DESCRIPTION

|

| VALUE ($)

|

|---|

Short-Term Investment — 1.5% | | | | | | Investment Company — 1.5% | | 2,651,843 | | | | JPMorgan Liquid Assets Money Market

Fund (b) (m)

(Cost $2,651,843) | | | 2,651,843 | |

PRINCIPAL

AMOUNT($)

|

|

|

|

|

|

|

|---|

Investments of Cash Collateral for Securities on Loan — 11.4% | | | | | | Certificates of Deposit — 1.5% | | 1,400,000 | | | | Deutsche Bank New York, | | | | | | | | | | FRN, 5.41%, 01/22/08 | | | 1,400,000 | | | 1,299,317 | | | | Societe Generale, New York, | | | | | | | | | | FRN, 5.26%, 06/20/07 | | | 1,299,317 | | | | | | | | | | 2,699,317 | | | | | | | Corporate Notes — 5.6% | | 1,500,000 | | | | American Express Credit Corp., | | | | | | | | | | FRN, 5.21%, 01/15/08 | | | 1,500,000 | | | 750,000 | | | | Banque Federative Du Credit, | | | | | | | | | | FRN, 5.30%, 07/13/07 | | | 750,000 | | | 1,500,339 | | | | Beta Finance, Inc., | | | | | | | | | | FRN, 5.38%, 03/15/07 | | | 1,500,339 | | | 1,600,000 | | | | CDC Financial Products Inc., | | | | | | | | | | FRN, 5.41%, 07/31/06 | | | 1,600,000 | | | 1,200,000 | | | | Citigroup Global Markets, Inc. | | | | | | | | | | FRN, 5.38%, 07/07/06 | | | 1,200,000 | | | 262,487 | | | | Citigroup Global Markets Holding Inc., | | | | | | | | | | FRN, 5.41%, 12/12/06 | | | 262,487 | | | 1,000,090 | | | | Links Finance LLC, | | | | | | | | | | FRN, 5.36%, 10/06/06 | | | 1,000,090 | | | 486,577 | | | | MBIA Global Funding LLC, | | | | | | | | | | FRN, 5.42%, 01/26/07 | | | 486,577 | | | 1,500,000 | | | | Unicredito Italiano Bank plc, | | | | | | | | | | FRN, 5.16%, 07/31/07 | | | 1,500,000 | | | | | | | | | | 9,799,493 | | | | | | | Repurchase Agreements — 4.3% | | 3,747,238 | | | | Bank of America Securities LLC, 5.32%, dated 6/30/06, due 07/03/06, repurchase price $3,748,899,

collateralized by U.S. Government Agency Mortgages. | | | 3,747,238 | | | 1,250,000 | | | | Lehman Brothers, Inc., 5.32%, dated 6/30/06, due 07/03/06, repurchase price $1,250,554,

collateralized by U.S. Government Agency Mortgages. | | | 1,250,000 | | | 1,250,000 | | | | Morgan Stanley, 5.33%, dated 6/30/06, due 07/03/06, repurchase price $1,250,555, collateralized by

U.S. Government Agency Mortgages. | | | 1,250,000 | | | 1,250,000 | | | | UBS Securities LLC, 5.32%, dated 6/30/06, due 07/03/06, repurchase price $1,250,554, collateralized

by U.S. Government Agency Mortgages. | | | 1,250,000 | | | | | | | | | | 7,497,238 | | | | | | | Total Investments of Cash Collateral for Securities on Loan

(Cost $19,996,048) | | | 19,996,048 | | | | | | | Total Investments — 111.7%

(Cost $177,741,801) | | | 196,932,657 | | | | | | | Liabilities in Excess of Other Assets — (11.7)% | | | (20,595,919 | ) | | | | | | NET ASSETS — 100.0% | | $ | 176,336,738 | |

____________

Percentages indicated are based on net assets. | (a) | — | Non-income producing security. |

| (b) | — | Investment in affiliate. Money market fund registered under the Investment Company Act of 1940, as amended, and advised by JPMorgan Investment Advisors Inc. |

| (c) | — | Security, or a portion of the security, has been delivered to a counterparty as part of a security lending transaction. |

| (m) | — | All or a portion of this security is segregated for current or potential holdings of futures, swaps, options, TBA, when-issued securities, delayed delivery securities, and reverse repurchase agreements. |

| ADR | — | American Depositary Receipt |

| FRN | — | Floating Rate Note. The rate shown is the rate in effect as of June 30, 2006. |

SEE NOTES TO FINANCIAL STATEMENTS.

6 JPMORGAN INSURANCE TRUST JUNE 30, 2006

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2006 (Unaudited)

|

|

|

| Diversified Mid Cap

Growth Portfolio

|

|---|

ASSETS: | | | | | | | | Investments in non-affiliates, at value | | | | $ | 194,280,814 | | | Investments in affiliates, at value | | | | | 2,651,843 | | | Total investment securities, at value | | | | | 196,932,657 | | | Cash | | | | | 9,559 | | | Receivables: | | | | | | | | Investment securities sold | | | | | 1,079,783 | | | Portfolio shares sold | | | | | 15,193 | | | Interest and dividends | | | | | 49,571 | | | Prepaid expenses and other assets | | | | | 53,195 | | | Total Assets | | | | | 198,139,958 | | | | LIABILITIES: | | | | | | | | Payables: | | | | | | | | Investment securities purchased | | | | | 1,570,569 | | | Collateral for securities lending program | | | | | 19,996,048 | | | Portfolio shares redeemed | | | | | 97,511 | | | Accrued liabilities: | | | | | | | | Investment advisory fees | | | | | 92,895 | | | Administration fees | | | | | 14,590 | | | Custodian and accounting fees | | | | | 6,121 | | | Trustees’ and Officers’ fees | | | | | 78 | | | Other | | | | | 25,408 | | | Total Liabilities | | | | | 21,803,220 | | | Net Assets | | | | $ | 176,336,738 | | | | NET ASSETS: | | | | | | | | Paid in capital | | | | $ | 143,509,301 | | | Accumulated undistributed (distributions in excess of) net investment income | | | | | 169,404 | | | Accumulated net realized gains (losses) | | | | | 13,467,177 | | | Net unrealized appreciation (depreciation) | | | | | 19,190,856 | | | Total Net Assets | | | | $ | 176,336,738 | | | | | Outstanding units of beneficial interest (shares) (unlimited amount authorized, no par value) | | | | | 8,837,160 | | | Net asset value, offering and redemption price per share | | | | $ | 19.95 | | | | | Cost of investments | | | | $ | 177,741,801 | | | Market value of securities on loan | | | | $ | 19,764,002 | |

SEE NOTES TO FINANCIAL STATEMENTS.

JUNE 30, 2006 JPMORGAN INSURANCE TRUST 7

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2006 (Unaudited)

|

|

|

|

Diversified Mid Cap

Growth Portfolio

|

|---|

INVESTMENT INCOME: | | | | | | | | Dividend income | | | | $ | 875,740 | | | Dividend income from affiliates (a) | | | | | 70,248 | | | Income from securities lending (net) | | | | | 82,427 | | | Foreign taxes withheld | | | | | (1,000 | ) | | Total investment income | | | | | 1,027,415 | | | | EXPENSES: | | | | | | | | Investment advisory fees | | | | | 607,153 | | | Administration fees | | | | | 122,871 | | | Custodian and accounting fees | | | | | 12,475 | | | Professional fees | | | | | 27,070 | | | Trustees’ and Officers’ fees | | | | | 1,479 | | | Transfer agent fees | | | | | 31,291 | | | Printing and mailing costs | | | | | 38,781 | | | Other | | | | | 10,110 | | | Total expenses | | | | | 851,230 | | | Less earnings credits | | | | | (316 | ) | | Net expenses | | | | | 850,914 | | | Net investment income (loss) | | | | | 176,501 | | | | REALIZED/UNREALIZED GAINS (LOSSES): | | | | | | | | Net realized gain (loss) on transactions from investments | | | | | 13,845,734 | | | Change in net unrealized appreciation (depreciation) of investments | | | | | (5,269,323 | ) | | Net realized/unrealized gains (losses) | | | | | 8,576,411 | | | Change in net assets resulting from operations | | | | $ | 8,752,912 | |

| (a) | | Includes reimbursements of investment advisory and administration fees. See Fees and Other Transactions with Affiliates in the Notes to Financial Statements. |

SEE NOTES TO FINANCIAL STATEMENTS.

8 JPMORGAN INSURANCE TRUST JUNE 30, 2006

STATEMENT OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | Diversified

Mid Cap Growth Portfolio

| |

|---|

|

|

|

| Six Months

Ended

6/30/2006

(Unaudited)

|

| Year Ended

12/31/2005

|

|---|

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | | | | | | | | | Net investment income (loss) | | | | $ | 176,501 | | | $ | (677,416 | ) | | Net realized gain (loss) | | | | | 13,845,734 | | | | 34,053,459 | | | Change in net unrealized appreciation (depreciation) | | | | | (5,269,323 | ) | | | (13,975,622 | ) | | Change in net assets resulting from operations | | | | | 8,752,912 | | | | 19,400,421 | | | | DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | From net realized gains | | | | | (5,397,317 | ) | | | — | | | | CHANGE IN NET ASSETS FROM CAPITAL TRANSACTIONS: | | | | | | | | | | | | Proceeds from shares issued | | | | | 7,411,865 | | | | 13,158,822 | | | Dividends reinvested | | | | | 5,397,317 | | | | — | | | Cost of shares redeemed | | | | | (24,301,968 | ) | | | (44,927,766 | ) | | Change in net assets from capital transactions | | | | | (11,492,786 | ) | | | (31,768,944 | ) | | | NET ASSETS: | | | | | | | | | | | | Change in net assets | | | | | (8,137,191 | ) | | | (12,368,523 | ) | | Beginning of period | | | | | 184,473,929 | | | | 196,842,452 | | | End of period | | | | $ | 176,336,738 | | | $ | 184,473,929 | | | Accumulated undistributed (distributions in excess of) net investment income | | | | $ | 169,404 | | | $ | (7,097 | ) | SHARE TRANSACTIONS: | | | | | | | | | | | | Issued | | | | | 360,600 | | | | 727,008 | | | Reinvested | | | | | 256,161 | | | | — | | | Redeemed | | | | | (1,179,043 | ) | | | (2,464,580 | ) | | Change in shares | | | | | (562,282 | ) | | | (1,737,572 | ) |

SEE NOTES TO FINANCIAL STATEMENTS.

JUNE 30, 2006 JPMORGAN INSURANCE TRUST 9

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | Per share operating performance

|

|

|---|

| | | |

| | Investment operations

| | Distributions

| |

|---|

|

|

|

| Net asset

value,

beginning

of period

|

| Net

investment

income

(loss)

|

| Net realized

and unrealized

gains

(losses) on

investments

|

| Total from

investment

operations

|

| Net

realized

gains

|

| Total

distributions

|

|---|

Diversified Mid Cap Growth Portfolio | | | | | | | | | | | | | | | | | | | | | | | | | | | | Six Months Ended June 30, 2006 (Unaudited) | | | | $ | 19.63 | | | $ | 0.02 | | | $ | 0.90 | | | $ | 0.92 | | | $ | (0.60 | ) | | $ | (0.60 | ) | | Year Ended December 31, 2005 | | | | | 17.67 | | | | (0.07 | ) | | | 2.03 | | | | 1.96 | | | | — | | | | — | | | Year Ended December 31, 2004 | | | | | 15.69 | | | | (0.06 | ) | | | 2.04 | | | | 1.98 | | | | — | | | | — | | | Year Ended December 31, 2003 | | | | | 12.34 | | | | (0.04 | ) | | | 3.39 | | | | 3.35 | | | | — | | | | — | | | Year Ended December 31, 2002 | | | | | 15.45 | | | | (0.05 | ) | | | (3.06 | ) | | | (3.11 | ) | | | — | | | | — | | | Year Ended December 31, 2001 | | | | | 21.23 | | | | (0.06 | ) | | | (2.53 | ) | | | (2.59 | ) | | | (3.19 | ) | | | (3.19 | ) |

(a) Annualized for periods less than one year. (b) Not annualized for periods less than one year. | (c) | | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. |

SEE NOTES TO FINANCIAL STATEMENTS.

10 JPMORGAN INSURANCE TRUST JUNE 30, 2006

| | Ratios/Supplemental data

|

|

|---|

| | | |

| |

| | Ratios to average net assets (a)

| |

|---|

Net asset

value, end

of period

|

|

|

| Total

return (b)(c)

|

| Net assets

end of

period

(000’s)

|

| Net

expenses

|

| Net

investment

income

(loss)

|

| Expenses

without waivers,

reimbursements

and earnings credits

|

| Portfolio

turnover

rate (b)

|

|---|

| $19.95 | | | | | 4.53 | % | | $ | 176,337 | | | | 0.91 | % | | | 0.19 | % | | | 0.91 | % | | | 56 | % | | 19.63 | | | | | 11.09 | | | | 184,474 | | | | 0.88 | | | | (0.36 | ) | | | 0.88 | | | | 113 | | | 17.67 | | | | | 12.62 | | | | 196,842 | | | | 0.85 | | | | (0.35 | ) | | | 0.86 | | | | 74 | | | 15.69 | | | | | 27.15 | | | | 195,606 | | | | 0.84 | | | | (0.27 | ) | | | 0.86 | | | | 69 | | | 12.34 | | | | | (20.13 | ) | | | 144,108 | | | | 0.83 | | | | (0.37 | ) | | | 0.85 | | | | 76 | | | 15.45 | | | | | (10.65 | ) | | | 192,708 | | | | 0.82 | | | | (0.37 | ) | | | 0.83 | | | | 92 | |

SEE NOTES TO FINANCIAL STATEMENTS.

JUNE 30, 2006 JPMORGAN INSURANCE TRUST 11

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2006 (Unaudited)

1. Organization JPMorgan Insurance Trust (formerly JPMorgan Investment Trust) (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment company established as a Massachusetts business trust. The JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio is a separate Portfolio of the Trust (the “Portfolio”). Effective May 1, 2006, the Board of Trustees approved the name change from JPMorgan Investment Trust Mid Cap Growth Portfolio to JPMorgan Insurance Trust Diversified Mid Cap Growth Portfolio and designated the existing shares as Class 1 Shares. Portfolio shares are offered only to separate accounts of participating insurance companies and eligible plans. Individuals may not purchase shares directly from the Portfolio. 2. Significant Accounting Policies The following is a summary of significant accounting policies followed by the Trust in preparation of its financial statements. The policies are in accordance with accounting principles generally accepted in the United States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. A. Valuation of Investments — Listed securities are valued at the last sale price on the exchange on which they are primarily traded. The value of National Market Systems equity securities quoted by the NASDAQ Stock Market shall generally be the NASDAQ Official Closing Price. Unlisted securities are valued at the last sale price provided by an independent pricing agent or principal market maker. Listed securities for which the latest sales prices are not available are valued at the mean of the latest bid and ask price as of the closing of the primary exchange where such securities are normally traded. Corporate debt securities, debt securities issued by the U.S. Treasury or a U.S. government agency (other than short-term investments maturing in 61 days or less), and municipal securities are valued each day based on readily available market quotations received from third party broker-dealers of comparable securities or independent or affiliated pricing services approved by the Board of Trustees. Such pricing services and broker-dealers will generally provide bid-side quotations. Generally, short-term investments (other than certain high yield securities) maturing in 61 days or less are valued at amortized cost, which approximates market value. Futures, options and other derivatives are valued on the basis of available market quotations. Investments in other open-end investment companies are valued at such investment company’s current day closing net asset value per share. Securities or other assets for which market quotations are not readily available or for which market quotations do not represent the value at the time of pricing (including certain illiquid securities) are fair valued in accordance with procedures established by and under the supervision and responsibility of the Trustees. Trading in securities on most foreign exchanges and over-the-counter markets is normally completed before the close of the domestic market and may also take place on days when the domestic market is closed. In accordance with procedures adopted by the Trustees, the Portfolio applies fair value pricing on a daily basis except for North American, Central American, South American and Caribbean equity securities held in their portfolios by utilizing the quotations of an independent pricing service, unless the Portfolio’s adviser determines that use of another valuation methodology is appropriate. The pricing service uses statistical analyses and quantitative models to adjust local market prices using factors such as subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, in determining fair value as of the time the Portfolio calculates its net asset value. B. Repurchase Agreements — The Portfolio may enter into repurchase agreement transactions with institutions that meet the advisor’s credit guidelines. Each repurchase agreement is valued at amortized cost. The Portfolio requires that the collateral received in a repurchase agreement transaction be transferred to a custodian in a manner sufficient to enable the Portfolio to obtain collateral in the event of a counterparty default. If the counterparty defaults and the fair value of the collateral declines, realization of the collateral by the Portfolio may be delayed or limited. C. Securities Lending — To generate additional income, the Portfolio may lend up to 33-1/3% of its assets pursuant to agreements (“borrower agreements”) requiring that the loan be continuously secured by cash or securities issued by the U.S. government or its agencies or its instrumentalities (“U.S. government securities”). JPMorgan Chase Bank, N.A. (“JPMCB”), an affiliate of the Portfolio, serves as lending agent pursuant to a Securities Lending Agreement approved by the Board of Trustees (the “Securities Lending Agreement”). Under the Securities Lending Agreement, JPMCB acting as agent for the Portfolio loans securities to approved borrowers pursuant to approved borrower agreements in exchange for collateral equal to at least 100% of the market value of the loaned securities plus accrued interest. During the term of the loan, the Portfolio receives payments from borrowers equivalent to the dividends and interest that would have been earned on securities lent while simultaneously seeking to earn income on the investment of cash collateral in accordance with investment guidelines contained in the Securities Lending Agreement. For loans secured by cash, the Portfolio retains the interest on cash collateral investments but is required to pay the borrower a portion of such interest for the use of the cash collateral. For loans secured by U.S. government securities, the borrower pays a borrower fee to the lending agent on behalf of the Portfolio. The net income earned on the securities lending (after payment of rebates and the lending agent’s fee) is included in the Statement of Operations as income from securities lending (net). Information on the investment of cash collateral is shown in the Schedule of Portfolio Investments. Under the Securities Lending Agreement, JPMCB is entitled to a fee equal to (i) 0.06% calculated on an annualized basis and accrued daily, based upon the value of collateral received from borrowers for each loan of U.S. Securities outstanding during a given month; and (ii) 12 JPMORGAN INSURANCE TRUST JUNE 30, 2006

0.1142% calculated on an annualized basis and accrued daily, based upon the value of collateral received from borrowers for each loan of non-U.S. Securities outstanding during a given month. For the period ended June 30, 2006, JPMCB voluntarily reduced its fees to: (i) 0.05% for each loan of U.S. Securities and (ii) 0.10% for each loan of non-U.S. Securities, respectively.

Risks of delay in recovery of securities or even loss of rights in the securities may occur should the borrower of the securities fail financially. Risks may also arise to the extent that the value of the securities loaned increases above the value of the collateral received. JPMCB will indemnify the Portfolio for losses resulting from a borrower’s failure to return a loaned security when due. Such indemnification does not extend to losses associated with declines in the value of cash collateral investments. Loans are subject to termination by the Portfolio or the borrower at any time, and are, therefore, not considered to be illiquid investments. As of June 30, 2006, the Portfolio had securities with the following market values on loan, received the following collateral and for the period then ended, paid the following amounts to related party affiliates:

|

|

|

| Lending

Agent

Fees Paid

|

| Market

Value of

Collateral

|

| Market Value

of Loaned

Securities

|

|---|

| | | | | $ | 6,654 | | | $ | 19,996,048 | | | $ | 19,764,002 | |

D. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method adjusted for amortization of premiums and accretion of discounts. Dividend income less foreign taxes withheld (if any) is recorded on the ex-dividend date or when the Portfolio first learns of the dividend. E. Allocation of Expenses — Expenses directly attributable to the Portfolio are charged directly to the Portfolio while the expenses attributable to more than one portfolio of the Trust are allocated among the respective portfolios. F. Federal Income Taxes — The Portfolio is treated as a separate taxable entity for Federal income tax purposes. The Portfolio’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized gain on investments. Accordingly, no provision for Federal income tax is necessary. The Portfolio is also a segregated portfolio of assets for insurance purposes and intends to comply with the diversification requirements at Subchapter L of the Code. G. Foreign Taxes — The Portfolio may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. The Portfolio will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests. H. Distributions to Shareholders — Dividends from net investment income and net realized capital gains, if any, are generally declared and paid at least annually. The amount of dividends and distributions from net investment income and from net capital gains are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. To the extent these “book/tax” differences are permanent in nature (i.e. that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment. I. New Accounting Pronouncement — In July 2006, the Financial Accounting Standards Board issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes — an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation establishes for all entities, including pass-through entities such as the Portfolio, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. The Interpretation is effective for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the date of effectiveness. Management has recently begun to evaluate the application of the Interpretation to the Portfolio, and is not in a position at this time to estimate the significance of its impact, if any, on the Portfolio’s financial statements. 3. Fees and Other Transactions with Affiliates A. Investment Advisory Fee — Pursuant to the Investment Advisory Agreement, JPMorgan Investment Advisors Inc. (the “Advisor”) acts as the investment advisor to the Portfolio. The Advisor is an indirect wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”). The Advisor supervises the investments of the Portfolio and for such services is paid a fee. The fee is accrued daily and paid monthly based on the Portfolio’s average daily net assets at an annual fee rate of 0.65%. The Advisor waived and/or reimbursed Investment Advisory fees as outlined in Note 3.E. The Portfolio may invest in one or more money market funds advised by the Advisor or its affiliates. Advisory and administrative fees are waived and/or reimbursed from the Portfolio in an amount sufficient to offset any doubling up of these fees related to the Portfolio’s investment in an affiliated money market fund to the extent required by law. B. Administration Fee — Pursuant to an Administration Agreement, JPMorgan Funds Management, Inc. (the “Administrator”), an indirect, wholly-owned subsidiary of JPMorgan, provides certain administration services to the Portfolio. In consideration of these services, the JUNE 30, 2006 JPMORGAN INSURANCE TRUST 13

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2006 (Unaudited) (continued)

Administrator receives a fee computed daily and paid monthly at the annual rate of 0.15% of the first $25 billion of the average daily net assets of all funds in the JPMorgan Fund Complex (excluding funds of funds and money market funds) and 0.075% of the average daily net assets in excess of $25 billion of all such funds.

The Administrator waived and/or reimbursed Administration fees as outlined in Note 3.E. Prior to May 1, 2006, the Administrator provided services for a fee computed daily and paid monthly at the annual rate of 0.18% of the first $250 million of the average daily net assets of the Trust (excluding the Equity Index Portfolio) and 0.14% of the average daily net assets of the Trust in excess of $250 million (excluding the Equity Index Portfolio). J.P. Morgan Investor Services, Co. (“JPMIS”), an indirect, wholly owned subsidiary of JPMorgan, serves as the Portfolio’s Sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMIS receives a portion of the fees payable to the Administrator. Prior to May 1, 2006, JPMIS also received a portion of the fees payable to the Administrator as compensation for fund accounting services. C. Distribution Fees — Pursuant to a Distribution Agreement, JPMorgan Distribution Services, Inc. (“the Distributor”), a wholly-owned subsidiary of JPMorgan, serves as the Trust’s exclusive underwriter and promotes and arranges for the sale of the Portfolio’s shares. The Distributor receives no compensation in its capacity as the Portfolio’s underwriter. D. Custodian and Accounting Fees — JPMCB provides portfolio custody and accounting services for the Portfolio. The amounts paid directly to JPMCB by the Portfolio for custody and accounting services are included in custodian and accounting fees in the Statement of Operations. (Effective May 1, 2006, the Portfolio began paying the fees for accounting services directly to JPMCB.) The custodian fees may be reduced by credits earned by the Portfolio, based on uninvested cash balances held by the custodian. Such earnings credits are presented separately in the Statement of Operations. Interest expense, if any, paid to the custodian related to cash overdrafts is presented as interest expense in the Statement of Operations. E. Waivers and Reimbursements — The Advisor and Administrator have contractually agreed to waive fees or reimburse the Portfolio to the extent that total annual operating expenses (excluding interest, taxes, extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.90% (0.98% prior to May 1, 2006) of the Portfolio’s average daily net assets. The contractual expense limitation agreements were in effect for the six months ended June 30, 2006. The new expense limitation percentage above is in place until at least April 30, 2007. No fees or expenses were waived or reimbursed by the Advisor or Administrator for the six months ended June 30, 2006. F. Other — Certain officers of the Trust are affiliated with the Advisor, the Administrator, the Sub-administrator and the Distributor. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Portfolio for serving in their respective roles. The Board of Trustees appointed a Chief Compliance Officer to the Portfolio in accordance with federal securities regulations. The Portfolio, along with other affiliated portfolios, make reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Trustees’ and Officers’ Fees in the Statement of Operations. The Trust adopted a Trustee Deferred Compensation Plan (the “Plan”) which allows the independent Trustees to defer the receipt of all or a portion of compensation related to performance of their duties as a Trustee. The deferred fees are invested in various JPMorgan funds until distribution in accordance with the Plan. During the period, the Portfolio may have purchased securities from an underwriting syndicate in which the principal underwriter or members of the syndicate are affiliated with the Advisor. The Portfolio may use related party brokers/dealers. For the period ended June 30, 2006, the Portfolio did not incur brokerage commissions with brokers/dealers affiliated with the Advisor. The SEC has granted an exemptive order permitting the Portfolio to engage in principal transactions with J.P. Morgan Securities, Inc., an affiliated broker, involving taxable money market instruments subject to certain conditions. 14 JPMORGAN INSURANCE TRUST JUNE 30, 2006

4. Investment Transactions During the six months ended June 30, 2006, purchases and sales of investments (excluding short-term investments) were as follows:

|

|

|

| Purchases

(excluding U.S.

Government)

|

| Sales

(excluding U.S.

Government)

|

|---|

| | | | | $ | 103,884,453 | | | $ | 121,895,968 | |

During the six months ended June 30, 2006, there were no purchases or sales of U.S. Government securities. 5. Federal Income Tax Matters For Federal income tax purposes, the cost and unrealized appreciation (depreciation) in value of the investment securities at June 30, 2006, were as follows:

|

|

|

| Aggregate

Cost

|

| Gross

Unrealized

Appreciation

|

| Gross

Unrealized

Depreciation

|

| Net Unrealized

Appreciation

(Depreciation)

|

|---|

| | | | | $ | 177,741,801 | | | $ | 23,867,924 | | | $ | (4,677,068 | ) | | $ | 19,190,856 | |

6. Borrowings The Trust and JPMCB have entered into a financing arrangement. Under this arrangement, JPMCB provides an unsecured, uncommitted credit facility in the aggregate amount of $100 million to certain of the JPMorgan Funds including the Portfolio. Advances under the arrangement are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Portfolio’s borrowing restrictions. Interest on borrowings is payable at a rate determined by JPMCB at the time of borrowing. This agreement has been extended until November 21, 2006. The Portfolio had no borrowings outstanding at June 30, 2006, or at any time during the six months then ended. 7. Concentrations and Indemnifications In the normal course of business the Portfolio enters into contracts that contain a variety of representations which provide general indemnifications. The Portfolio’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet occurred. However, based on experience, the Portfolio expects the risk of loss to be remote. From time to time, the Portfolio may have a concentration of several shareholders holding a significant percentage of shares outstanding. Investment activities of these shareholders could have a material impact on the Portfolio. JUNE 30, 2006 JPMORGAN INSURANCE TRUST 15

TRUSTEES

(Unaudited)

The Portfolio’s Statement of Additional Information includes additional information about the Portfolio’s Trustees and is available, without charge, upon request by calling 1-800-480-4111 or on the Portfolio’s website at www.jpmorganfunds.com. Name (Year of Birth);

Positions With

the Portfolio

|

|

|

| Principal Occupations

During Past 5 Years

|

| Number of

Portfolios/Funds

in JPMorgan

Funds Complex (1)

Overseen by Trustee

|

| Other Directorships Held

Outside Fund Complex

|

|---|

Independent Trustees | | William J. Armstrong (1941); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 1987. | | | | Retired; CFO and Consultant, EduNeering, Inc. (internet business education supplier) (2000–2001); Vice President and Treasurer, Ingersoll–Rand Company (manufacturer of industrial equipment) (1972–2000). | | 120 | | None. | | Roland R. Eppley, Jr. (1932); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 1989. | | | | Retired; President and Chief Executive Officer, Eastern States Bankcard (1971–1988). | | 120 | | None. | | John F. Finn (1947); Trustee of Trust since 2005; Trustee of heritage One Group Mutual Funds since 1998. | | | | President and Chief Executive Officer, Gardner, Inc. (wholesale distributor to outdoor power equipment industry) (1979–present). | | 120 | | Director, Cardinal Health, Inc (CAH) (1994–present); Chairman, The Columbus Association for the Performing Arts (CAPA) (2003–present). | | Dr. Matthew Goldstein (1941); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 2003. | | | | Chancellor of the City University of New York (1999–present); President, Adelphi University (New York) (1998–1999). | | 120 | | Director, Albert Einstein School of Medicine (1998–present); Director, New Plan Excel Realty Trust, Inc. (real estate investment trust)

(2000–present); Director, Lincoln Center Institute for the Arts in Education (1999–present). | | Robert J. Higgins (1945); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 2002. | | | | Retired; Director of Administration of the State of Rhode Island (2003–2004); President — Consumer Banking and Investment Services, Fleet Boston Financial (1971–2001). | | 120 | | None. | | Peter C. Marshall (1942); Trustee of Trust since 2005; Trustee of heritage One Group Mutual Funds since 1994. | | | | Self-employed business consultant (2002–present); Senior Vice President, W.D. Hoard, Inc. (corporate parent of DCI Marketing, Inc.) (2000–2002); President, DCI Marketing, Inc. (1992–2000). | | 120 | | None. | | Marilyn McCoy (1948); Trustee of Trust since 2005; Trustee of heritage One Group Mutual Funds since 1999. | | | | Vice President of Administration and Planning, Northwestern University (1985–present). | | 120 | | Trustee, Mather LifeWays (1994–present); Trustee, Carleton College (2003–present). | | William G. Morton, Jr. (1937); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 2003. | | | | Retired; Chairman Emeritus (2001–2002), and Chairman and Chief Executive Officer, Boston Stock Exchange (1985–2001). | | 120 | | Director, Radio Shack Corporation (electronics) (1987–present); Director, The National Football Foundation and College Hall of Fame (1994–present); Trustee, Stratton Mountain School (2001–present). |

16 JPMORGAN INSURANCE TRUST JUNE 30, 2006

Name (Year of Birth);

Positions With

the Portfolio

|

|

|

| Principal Occupations

During Past 5 Years

|

| Number of

Portfolios/Funds

in JPMorgan

Funds Complex (1)

Overseen by Trustee

|

| Other Directorships Held

Outside Fund Complex

|

|---|

Independent Trustees (continued) | | Robert A. Oden, Jr. (1946); Trustee of Trust since 2005; Trustee of heritage One Group Mutual Funds since 1997. | | | | President, Carleton College (2002–present); President, Kenyon College (1995–2002). | | 120 | | Director, American University in Cairo. | | Fergus Reid, III (1932); Trustee of Trust (Chairman) since 2005; Trustee (Chairman) of heritage JPMorgan Funds since 1987. | | | | Chairman, Lumelite Corporation (plastics manufacturing) (2003–present); Chairman and Chief Executive Officer, Lumelite Corporation (1985–2002). | | 120 | | Trustee, Morgan Stanley Funds (198 portfolios) (1995–present). | | Frederick W. Ruebeck (1939); Trustee of Trust since 2005; Trustee of heritage One Group Mutual Funds since 1994. | | | | Advisor, Jerome P. Green & Associates, LLC (broker-dealer) (2000–present); Chief Investment Officer, Wabash College (2004–present); self-employed consultant (2000–present); Director of Investments, Eli Lilly and Company (1988–1999). | | 120 | | Trustee, Wabash College (1988–present); Chairman, Indianapolis Symphony Orchestra Foundation (1994–present). | | James J. Schonbachler (1943); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 2001. | | | | Retired; Managing Director of Bankers Trust Company (financial services) (1968–1998). | | 120 | | None. | Interested Trustee | | Leonard M. Spalding, Jr.* (1935); Trustee of Trust since 2005; Trustee of heritage JPMorgan Funds since 1998. | | | | Retired; Chief Executive Officer of Chase Mutual Funds (investment company) (1989–1998); President & Chief Executive Officer, Vista Capital Management (investment management) (1990–1998); Chief Investment Executive, Chase Manhattan Private Bank (investment management) (1990–1998). | | 120 | | Director, Glenview Trust Company, LLC (2001–present); Trustee, St. Catherine College (1998–present); Trustee, Bellarmine University (2000–present); Director, Springfield-Washington County Economic Development Authority (1997–present); Trustee, Marion and Washington County, Kentucky Airport Board (1998–present); Trustee, Catholic Education Foundation (2005–present). |

| (1) | | A Fund Complex means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services or have a common investment adviser or have an investment adviser that is an affiliated person of the investment adviser of any of the other registered investment companies. The JPMorgan Funds Complex which the Board of Trustees currently oversees includes eight registered investment companies (120 portfolios/funds). |

| * | | Mr. Spalding is deemed to be an “interested person” due to his ownership of JPMorgan Chase stock. |

The contact address for each of the Trustees is 245 Park Avenue, New York, NY 10167. JUNE 30, 2006 JPMORGAN INSURANCE TRUST 17

OFFICERS

(Unaudited)

Name (Year of Birth),

Positions Held with

the Trust

|

|

|

| Principal Occupations During Past 5 Years

|

|---|

George C.W. Gatch (1962),

President since 2005 | | | | Managing Director, JPMorgan Investment Management Inc.; Director and President, JPMorgan Distribution Services, Inc. and JPMorgan Funds Management, Inc. since 2005. Mr. Gatch is CEO and President of JPMorgan Funds. Mr. Gatch has been an employee since 1986 and has held positions such as President and CEO of DKB Morgan, a Japanese mutual fund company which was a joint venture between J.P. Morgan and Dai-Ichi Kangyo Bank, as well as positions in business management, marketing and sales. | Robert L. Young (1963),

Senior Vice President since 2005* | | | | Director and Vice President, JPMorgan Distribution Services, Inc. and JPMorgan Funds Management, Inc.; Chief Operating Officer, JPMorgan Funds since 2005, and One Group Mutual Funds from 2001 until 2005. Mr. Young was Vice President and Treasurer, JPMorgan Funds Management, Inc. (formerly One Group Administrative Services) and Vice President and Treasurer, JPMorgan Distribution Services, Inc. (formerly One Group Dealer Services, Inc.) from 1999 to 2005. | Patricia A. Maleski (1960),

Vice President and Chief

Administrative Officer since 2005 | | | | Managing Director, JPMorgan Funds Management, Inc.; previously, Treasurer, JPMorgan Funds and Head of Funds Administration and Board Liaison. Ms. Maleski was Vice President of Finance for the Pierpont Group, Inc. from 1996–2001, an independent company owned by the Board of Directors/Trustees of the JPMorgan Funds, prior to joining J.P. Morgan Chase & Co. in 2001. | Stephanie J. Dorsey (1969),

Treasurer since 2005* | | | | Vice President, JPMorgan Funds Management, Inc.; Director of Mutual Fund Administration, JPMorgan Funds Management, Inc. (formerly One Group Administrative Services), from 2004 to 2005; Ms. Dorsey worked for JPMorgan Chase & Co., (formerly Bank One Corporation) from 2003 to 2004; prior to joining Bank One Corporation, she was a Senior Manager specializing in Financial Services audits at PricewaterhouseCoopers LLP from 1992 through 2002. | Stephen M. Ungerman (1953),

Senior Vice President and Chief

Compliance Officer since 2005

| | | | Senior Vice President, JPMorgan Chase & Co.; Mr. Ungerman was head of Fund Administration — Pooled Vehicles from 2000 to 2004. Mr. Ungerman held a number of positions in Prudential Financial’s asset management business prior to 2000. | Paul L. Gulinello (1950), AML

Compliance Officer since 2005 | | | | Vice President and Anti Money Laundering Compliance Officer for JPMorgan Asset Management Americas, additionally responsible for personal trading and compliance testing since 2004; Treasury Services Operating Risk Management and Compliance Executive supporting all JPMorgan Treasury Services business units from July 2000 to 2004. | Stephen M. Benham (1959),

Secretary since 2005 | | | | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since 2004; Vice President (Legal Advisory) of Merrill Lynch Investment Managers, L.P. from 2000 to 2004; attorney associated with Kirkpatrick & Lockhart LLP from 1997 to 2000. | Elizabeth A. Davin (1964),

Assistant Secretary since 2005* | | | | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since 2005; Senior Counsel, JPMorgan Chase & Co. (formerly Bank One Corporation) from 2004 to 2005; Assistant General Counsel and Associate General Counsel and Vice President, Gartmore Global Investments, Inc. from 1999 to 2004. | Jessica K. Ditullio (1962),

Assistant Secretary since 2005* | | | | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since 2005; Ms. Ditullio has served as an attorney with various titles for JPMorgan Chase & Co. (formerly Bank One Corporation) since 1990. | Nancy E. Fields (1949),

Assistant Secretary since 2005* | | | | Vice President, JPMorgan Funds Management, Inc. and JPMorgan Distribution Services, Inc.; From 1999 to 2005, Director, Mutual Fund Administration, JPMorgan Funds Management, Inc. (formerly One Group Administrative Services, Inc.) and Senior Project Manager, Mutual Funds, JPMorgan Distribution Services, Inc. (formerly One Group Dealer Services, Inc.). | Michael C. Raczynski (1975),

Assistant Secretary (2006) | | | | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since 2006; Associate, Stroock & Stroock & Lavan LLP from 2001 to 2006. | Ellen W. O’Brien (1957),

Assistant Secretary since 2005** | | | | Assistant Vice President, JPMorgan Investor Services, Co., responsible for Blue Sky registration. Ms. O’Brien has served in this capacity since joining the firm in 1991. |

18 JPMORGAN INSURANCE TRUST JUNE 30, 2006

Name (Year of Birth),

Positions Held with

the Trust

|

|

|

| Principal Occupations During Past 5 Years

|

|---|

Suzanne E. Cioffi (1967),

Assistant Treasurer since 2005 | | | | Vice President, JPMorgan Funds Management, Inc., responsible for mutual fund financial reporting. Ms. Cioffi has overseen various fund accounting, custody and administration conversion projects during the past five years. | Arthur A. Jensen (1966),

Assistant Treasurer since 2005* | | | | Vice President, JPMorgan Funds Management, Inc. since April 2005; formerly, Vice President of Financial Services of BISYS Fund Services, Inc. from 2001 until 2005; Mr. Jensen was Section Manager at Northern Trust Company and Accounting Supervisor at Allstate Insurance Company prior to 2001. |

The contact address for each of the officers, unless otherwise noted, is 245 Park Avenue, New York, NY 10167. | * | | The contact address for the officer is 1111 Polaris Parkway, Columbus, OH 43271. |

| ** | | The contact address for the officer is 73 Tremont Street, Floor 1, Boston MA 02108. |

JUNE 30, 2006 JPMORGAN INSURANCE TRUST 19

SCHEDULE OF SHAREHOLDER EXPENSES

(Unaudited)

Hypothetical $1,000 Investment at Beginning of Period

June 30, 2006

As a shareholder of the Portfolio, you incur ongoing costs, including investment advisory fees, administration fees and other Portfolio expenses. Because the Portfolio is a funding vehicle for Policies and Eligible Plans, you may also incur sales charges and other fees relating to the Policies or Eligible Plans. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio, but not the costs of the Policies or Eligible Plans, and to compare these ongoing costs with the ongoing costs of investing in other mutual funds. The examples assume that you had a $1,000 investment in the Portfolio at the beginning of the reporting period, January 1, 2006, and continued to hold your shares at the end of the reporting period, June 30, 2006. Actual Expenses The first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees or the costs associated with the Policies and Eligible Plans through which the Portfolio is held. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transaction costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

|

|

|

| Beginning

Account Value,

January 1, 2006

|

| Ending

Account Value,

June 30, 2006

|

| Expenses

Paid During

January 1 to

June 30, 2006*

|

| Annualized

Expense Ratio

|

|---|

Diversified Mid Cap Growth Portfolio | | Actual | | | | $ | 1,000.00 | | | $ | 1,045.30 | | | $ | 4.61 | | | | 0.91 | % | | Hypothetical | | | | | 1,000.00 | | | | 1,020.28 | | | | 4.56 | | | | 0.91 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period). |

20 JPMORGAN INSURANCE TRUST JUNE 30, 2006

JPMorgan Funds are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds. This report is submitted for the general information of the shareholders of the Portfolio. It is not authorized for distribution to prospective investors in the Portfolio unless preceded or accompanied by a prospectus. Contact JPMorgan Funds Distribution Services at 1-800-480-4111 for a portfolio prospectus. You can also visit us at www.jpmorganfunds.com. Investors should carefully consider the investment objectives and risk as well as charges and expenses of the mutual fund before investing. The prospectus contains this and other information about the mutual fund. Read the prospectus carefully before investing. The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. Shareholders may request the Form N-Q without charge by calling 1-800-480-4111 or by visiting the variable insurance portfolio section of the JPMorgan Funds’ website at www.jpmorganfunds.com. A description of the Portfolio’s policies and procedures with respect to the disclosure of the Portfolio’s holdings is available in the Statement of Additional Information. A copy of proxy policies and procedures are available without charge upon request by calling 1-800-480-4111 and on the SEC’s website at www.sec.gov. The Trustees have delegated the authority to vote proxies for securities owned by the Portfolio to the Advisor. A copy of the Portfolio’s voting record for the most recent 12-month period ended June 30 is available on the SEC’s website at www.sec.gov or at the Portfolio’s website at www.jpmorganfunds.com no later than August 31 of each year. The Portfolio’s proxy voting record will include, among other things, a brief description of the matter voted on for each portfolio security, and will state how each vote was cast, for example, for or against the proposal.

© JPMorgan Chase & Co., 2006 All rights reserved. June 2006. | | SAN-JPMITDMCGP-606 |

SEMI-ANNUAL REPORT

SIX MONTHS ENDED JUNE 30, 2006 (UNAUDITED)

JPMorgan Insurance JPMorgan Insurance Trust Diversified Mid Cap Value Portfolio

(formerly JPMorgan Investment Trust Mid Cap Value Portfolio)

| NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE | |  | | This material must be preceded or accompanied by a current prospectus. | | |

CONTENTS | President’s Letter | | | | | 1 | | Portfolio Commentary:

| | | | | | | | JPMorgan Insurance Trust Diversified Mid Cap Value Portfolio | | | | | 2 | | | Schedule of Portfolio Investments | | | | | 4 | | | Statement of Assets and Liabilities | | | | | 8 | | | Statement of Operations | | | | | 9 | | | Statement of Changes in Net Assets | | | | | 10 | | | Financial Highlights | | | | | 12 | | | Notes to Financial Statements | | | | | 14 | | | Trustees | | | | | 18 | | | Officers | | | | | 20 | | | Schedule of Shareholder Expenses | | | | | 22 | |

HIGHLIGHTS | • | | U.S. stocks generally positive in first half of 2006 |

| • | | Investors tried to predict interest rate hikes |

| • | | Gross domestic product (GDP) moved sharply higher |

| • | | Market volatility expected until interest rate picture is clearer |

Effective May 1, 2006, the exciting shares of the Portfolio were designated as Class 1 Shares. The performance, expenses and other information shown in this report for the Portfolio is information applicable to the Class 1 Shares. Investments in the Portfolio are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested. Past performance is no guarantee for future performance. The general market views expressed in this report are opinions based on current market conditions and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Portfolio. This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by separate accounts of participating insurance companies. Portfolio shares are also offered to qualified pension and retirement plans (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio. Prospective investors should refer to the Portfolio’s prospectus for a discussion of the Portfolio’s investment objective, strategies and risks. Call JPMorgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Portfolio including management fees and other expenses. Please read it carefully before investing.

PRESIDENT’S LETTER