As filed with the Securities and Exchange Commission on September 16, 2004

Registration No. 333-117777

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

REGISTRATION STATEMENT

UNDER SCHEDULE B OF

THE SECURITIES ACT OF 1933

CHINA DEVELOPMENT BANK*

(Name of Registrant)

THE PEOPLE’S REPUBLIC OF CHINA

(Co-Signatory)

Name and address of authorized agent in the United States:

Zheng Bailin

General Manager

Bank of China New York Branch

410 Madison Avenue

New York, New York 10017

It is requested that copies of all notices and communications

from the Securities and Exchange Commission be sent to:

| | |

Huanting Timothy Li, Esq. Sidley Austin Brown & WoodLLP 39/F, Two International Finance Centre 8 Finance Street Hong Kong SAR, China | | Henry Haihua Ding, Esq. Sidley Austin Brown & WoodLLP One China World Tower, Suite 3527 1 Jian Guo Men Wai Avenue Beijing 100004, China |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

The Securities covered by this registration statement are to be offered on a delayed or continuous basis pursuant to Releases Nos. 33-6240 and 33-6424 under the Securities Act of 1933.

*Effective March 16, 1999, the English name of the registrant has been changed from The State Development Bank of China to China Development Bank.

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus included in this registration statement, as amended, and supplements to such prospectus will also be used in connection with $500,000,000 of debt securities registered under registration statement no. 333-10282, which together with the debt securities registered under this registration statement no. 333-117777, as amended, total $1,000,000,000. This amendment no. 2 to the registration statement no. 333-117777 also constitutes post-effective amendment no. 3 to registration statement no. 333-10282, such post-effective amendment to become effective concurrently with the effectiveness of this registration statement, as amended, in accordance with Section 8(c) of the Securities Act of 1933.

The registrant hereby amends this registration statement (including in its form as post-effective amendment) on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement (no. 333-117777) relates to $1,000,000,000 aggregate principal amount of debt securities of China Development Bank to be offered from time to time as separate issues on terms and in the manner to be specified in prospectus supplements to be delivered in connection with each such offering. The prospectus constituting a part of this registration statement relates to (i) $500,000,000 aggregate principal amount of debt securities registered under this registration statement and (ii) $500,000,000 aggregate principal amount of debt securities being carried forward which have been registered under registration statement no. 333-10282.

CROSS REFERENCE SHEET

Between Schedule B of the Securities Act of 1933

and the prospectus

| | |

Schedule B Item

| | Heading in prospectus*

|

| |

1. | | Cover Page |

| |

2. | | China Development Bank – Use of Proceeds |

| |

3. | | Cover Page; China Development Bank – Business – Sources of Funds; – Report of Independent Accountants – Notes to Financial Statements; – Description of Debt Securities; People’s Republic of China – Internal and External Debt; Part II of the Registration Statement and Exhibits thereto |

| |

4. | | China Development Bank – Business – Debt Repayment Record; People’s Republic of China – Internal and External Debt – Debt Record |

| |

5. | | China Development Bank – Report of Independent Accountants – China Development Bank Income Statements; People’s Republic of China – Public Finance |

| |

6. | | Plan of Distribution; Part II of the Registration Statement and Exhibits thereto |

| |

7. | | Authorized Agent in the United States |

| |

8. | | Cover Page; China Development Bank – Use of Proceeds |

| |

9. | | Cover page; Plan of Distribution |

| |

10. | | Cover Page; Plan of Distribution; Part II of the Registration Statement and Exhibits thereto |

| |

11. | | Part II of the Registration Statement and Exhibits thereto |

| |

12. | | Validity of the Debt Securities; Part II of the Registration Statement and Exhibits thereto |

| |

13. | | Part II of the Registration Statement and Exhibits thereto |

| |

14. | | Part II of the Registration Statement and Exhibits thereto |

| * | Information may be provided, amended or supplemented from time to time by amendments to this registration statement or in the relevant prospectus supplement. |

Information in this preliminary prospectus supplement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS SUPPLEMENT DATED SEPTEMBER 16, 2004

PROSPECTUS SUPPLEMENT

(To prospectus dated , 2004)

(formerly known as The State Development Bank of China)

US$ % Notes due

We, China Development Bank, are offering US$ principal amount of our % notes due , with the following terms:

| | • | annual interest rate of %; |

| | • | interest payable on and of each year, beginning , 2005; |

| | • | not redeemable before the maturity date; and |

| | • | without the benefit of any sinking fund. |

The notes will constitute our direct, unconditional, general and unsecured obligations and rank equally with our other general, unsecured and unsubordinated public external indebtedness.

Pursuant to the Special Decree of the State Council of China dated March 17, 1994, the People’s Bank of China, the PRC central bank, is authorized and obligated to provide short-term loans to us if we experience any liquidity shortages. However, the obligation of the People’s Bank of China to make such loans to us does not constitute a guarantee of the notes, and is not enforceable against the PRC central bank or the PRC government by, and does not confer any right under or in respect of the Special Decree upon, any noteholder.

We have applied for listing of and permission to deal in the notes on The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange. We expect the listing of the notes in global form on The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange to commence on or about , 2004.

Neither the United States Securities and Exchange Commission nor any state securities commission in the United States has approved or disapproved of these securities or determined whether this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| | | | | |

| | | Per note

| | Total

|

Public offering price(1) | | US$ | | | % |

Underwriting discount | | US$ | | | % |

Proceeds, before expenses, to us(1) | | US$ | | | % |

| (1) | Plus accrued interest from , 2004 if settlement occurs after that date. |

The notes will be ready for delivery in book-entry form only, through The Depository Trust Company, on or about , 2004. The notes offered by this prospectus supplement may be cancelled at any time up to the closing date when we will have received the subscription monies and issued the notes.

Joint Lead Managers and Joint Bookrunners

| | | | |

| Merrill Lynch & Co. Sole Global Coordinator | | BNP Paribas | | Goldman Sachs (Asia) L.L.C. |

| HSBC | | Morgan Stanley | | UBS Investment Bank |

The date of this prospectus supplement is , 2004

This prospectus supplement and the accompanying prospectus include particulars given in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited for the purpose of giving information with regard to us. We have made all reasonable inquiries and confirm that this prospectus supplement and the accompanying prospectus contain all information with respect to our bank, China and the notes that is material in the context of the issue and offering of the notes, and that this information is true and accurate in all material respects and is not misleading, that the opinions and intentions expressed in this prospectus supplement and the accompanying prospectus are honestly held and that, to the best of our knowledge and belief, there are no other facts the omission of which would make any of this information or the expression of these opinions and intentions misleading. We accept responsibility accordingly.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus in making your investment decision. We have not authorized anyone to provide you with any other information. If you receive any unauthorized information, you must not rely on it. You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate at any date other than its date of issue.

Until (40 days after the commencement of this offering), all dealers that effect transactions in the notes, whether or not participating in this offering, may be required to deliver a prospectus supplement and the accompanying prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus supplement and the accompanying prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange take no responsibility for the contents of this prospectus supplement and the accompanying prospectus, make no representation as to the accuracy or completeness of this prospectus supplement and the accompanying prospectus and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus supplement and the accompanying prospectus.

We have made forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended in this prospectus supplement and the accompanying prospectus. The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “forecast,” “seek,” “will,” “would” and similar expressions, as they relate to us, are intended to identify a number of these forward-looking statements. Forward-looking statements are statements that are not historical facts. These statements are based on our current plans, estimates, assumptions and projections and involve known and unknown developments and factors that may cause our financial condition and results of operations or business environment to be materially different from that expressed or implied by these forward-looking statements. Therefore, you should not place undue reliance on them. Actual results, performance or achievements may differ materially from the information contained in the forward looking statements as a result of a number of factors, including changes in interest rates, exchange rates, PRC economic, political and social conditions, government fiscal, monetary and other policies as well as the prospects of China’s continued economic reform. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any of them in light of new information or future events.

In connection with this issue and for a limited period after the issue date, Merrill Lynch, Pierce, Fenner & Smith Incorporated (or any person acting on its behalf) may, to the extent permitted by applicable laws and regulations, over-allot or effect transactions which may have the effect of supporting the market price of the notes at a level higher than that which might otherwise prevail. However, there is no obligation on Merrill Lynch, Pierce, Fenner & Smith Incorporated to do this. Such stabilization, if commenced, may be discontinued at any time, and must be brought to an end after a limited period.

i

TABLE OF CONTENTS

ii

SUMMARY

This summary does not contain all the information that may be important to you. You should read the entire prospectus supplement and accompanying prospectus before making any investment decision.

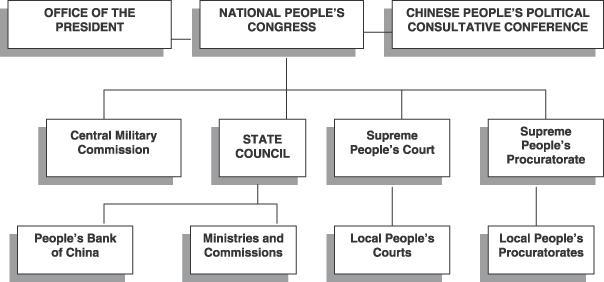

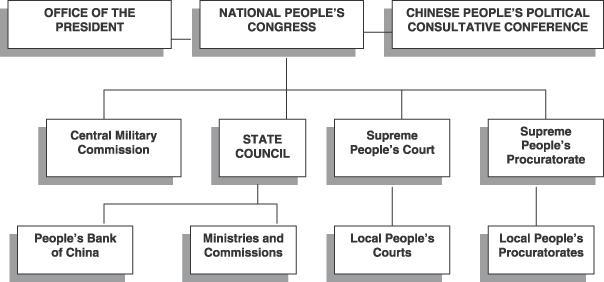

China Development Bank

We (formerly known as The State Development Bank of China) are a government policy-oriented statutory financial institution established pursuant to the Special Decree of the State Council of China dated March 17, 1994. We are the only policy bank in China that has been designated as a ministry-level institution. Wholly owned by the PRC central government, we conduct our business under the direct supervision of the State Council, the highest institution of government administration in China. We are regulated by the China Banking Regulatory Commission with respect to our banking operations and by the People’s Bank of China with respect to the scale of our annual funding and lending activities. We also report regularly to the Ministry of Finance on our financial condition and results of operations.

Our primary purpose is to foster the economic development of China by providing long-term financing for policy-oriented and related projects in line with the government’s development strategy and its industrial policies. Consistent with our purpose as an instrument of China's national economic development strategy, our current principal activities focus on raising funds and mobilizing resources to support the development of industries encouraged by the central government. These industries include infrastructure facilities, basic industries and pillar industries in China, such as railway and road transportation, power generation, telecommunication, petrochemical and chemical industries, urban public facilities and environmental facilities. Our lending activities endeavor to support the PRC government’s development strategy of seeking a balanced development between the coastal regions of China and the central and western regions and also endeavor to guide both the volume and structure of fixed asset investments in China. Although profit maximization is not our goal under the Special Decree, we have made, and will continue to make, efforts to achieve profitability in a cost-effective manner.

Pursuant to the Special Decree, the People’s Bank of China is authorized and obligated to provide short-term loans to us when we experience any liquidity shortages. The support obligation of the People’s Bank of China does not constitute a guarantee of our notes or other debt securities, and is not enforceable against the PRC central bank or the PRC government by any holder of our debt securities. It does not confer any right under or in respect of the Special Decree upon a holder of our debt securities.

S-1

The following summary of our historical financial information as of or for the years ended December 31, 2001, 2002 and 2003 is derived from our audited financial statements included in the accompanying prospectus. Our audited financial statements are prepared and presented in accordance with the International Financial Reporting Standards. Since this information is only a summary, you should read our complete financial statements included in the accompanying prospectus beginning on page F-1.

| | | | | | | | | | | | |

| | | As of, or for year ended, December 31,

| |

| | | 2001

| | | 2002

| | | 2003

| |

| | | (in Rmb) | | | (in Rmb) | | | (in Rmb) | | | (in US$) | |

| | | (in millions) | |

Income Statement Data | | | | | | | | | | | | |

Interest income | | 45,386 | | | 51,668 | | | 59,167 | | | 7,149 | |

Interest expense | | (29,946 | ) | | (32,206 | ) | | (34,747 | ) | | (4,198 | ) |

Profit before tax | | 14,917 | | | 16,693 | | | 18,467 | | | 2,231 | |

Net profit | | 11,147 | | | 11,919 | | | 13,212 | | | 1,596 | |

| | | | |

Balance Sheet Data | | | | | | | | | | | | |

Cash and balance with the central bank | | 4,498 | | | 7,354 | | | 16,143 | | | 1,950 | |

Due from other banks | | 2,022 | | | 913 | | | 2,085 | | | 252 | |

Loans, net | | 731,318 | | | 876,132 | | | 1,120,885 | | | 135,427 | |

Total assets | | 889,922 | | | 1,040,128 | | | 1,279,167 | | | 154,550 | |

Total liabilities | | 828,041 | | | 964,727 | | | 1,189,738 | | | 143,745 | |

Owner’s equity | | 61,881 | | | 75,401 | | | 89,429 | | | 10,805 | |

People’s Republic of China

China is the third largest country in the world in terms of land area, occupying a territory of approximately 3.7 million square miles. China is also the world’s largest nation by population, with approximately 1,292.3 million people at the end of 2003. The capital of China is Beijing.

Over the past two and a half decades, China has implemented a series of economic reforms to revitalize its economy and improve living standards through the creation of a socialist market economy. In connection with these reforms, the Chinese government has lifted output controls on numerous agricultural and industrial enterprises, liberalized price controls on most products, and implemented policies designed to attract foreign investment and technology. The Chinese government has also introduced tax and fiscal reforms designed to improve the uniformity and fairness of China’s tax system and to formalize the distribution of tax revenues between the central and local governments. The Chinese government is continuing its efforts to reform its state-owned enterprises in order to increase their productivity, efficiency and profitability. In addition, the Chinese government has been reforming its financial system to improve its ability to manage monetary policy through macroeconomic policy tools, to strengthen financial institution supervision and to enhance risk control and transparency in China’s financial markets.

China’s entry into the World Trade Organization in 2001 has introduced, and will continue to introduce, greater competition into China’s banking sector. The increasingly competitive banking environment in China will put pressure on banks to improve their quality of service, operational profitability, risk control capability, management efficiency, human resources, customer base and other areas. We believe that China’s WTO accession will bring both challenges and opportunities to the banking sector in China. For more information on China’s WTO commitments on the banking services, see “People’s Republic of China—PRC Financial System—Financial Sector Restructuring.”

S-2

The following table presents summary historical information of China as of or for the years ended December 31, 1999, 2000, 2001, 2002 and 2003 and contain data derived from official sources. Since this information is only a summary, you should read the complete disclosure included under “People’s Republic of China” in this prospectus supplement and the accompanying prospectus.

| | | | | | | | | | | | | | | |

| | | As of, or for year ended, December 31,

| |

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| | | 2003

| |

The Economy | | | | | | | | | | | | | | | |

GDP (in billions of Rmb) | | 8,206.8 | | | 8,946.8 | | | 9,713.5 | | | 10,517.2 | | | 11,689.8 | |

Real GDP Growth Rate | | 7.1 | % | | 8.0 | % | | 7.5 | % | | 8.3 | % | | 9.1 | % |

Population (in millions) | | 1,257.9 | | | 1,267.4 | | | 1,276.3 | | | 1,284.5 | | | 1,292.3 | |

Per Capita GDP (in Rmb) | | 6,551.0 | | | 7086.0 | | | 7,651.0 | | | 8,214.0 | | | 9,073.0 | |

Annual Rate of Inflation | | (1.4 | )% | | 0.4 | % | | 0.7 | % | | (0.8 | )% | | 1.2 | % |

Urban Work Force Unemployment Rate (year end) | | 3.1 | % | | 3.1 | % | | 3.6 | % | | 4.0 | % | | 4.3 | % |

Foreign Trade Surplus (in billions of US$) | | 29.2 | | | 24.1 | | | 22.6 | | | 30.4 | | | 25.4 | |

Current Account Balance (in billions of US$) | | 21.1 | | | 20.5 | | | 17.4 | | | 35.4 | | | 45.9 | |

Capital Account Balance (in billions of US$) | | 5.2 | | | 1.9 | | | 34.8 | | | 32.3 | | | 52.7 | |

Foreign Exchange Reserves (in billions of US$) (year end) | | 154.7 | | | 165.6 | | | 212.2 | | | 286.4 | | | 403.3 | |

Public Finance | | | | | | | | | | | | | | | |

Government Revenues (in billions of Rmb) | | 1,144.4 | | | 1,339.5 | | | 1,638.6 | | | 1,890.4 | | | 2,169.1 | |

% of GDP | | 13.9 | % | | 15.0 | % | | 16.8 | % | | 18.0 | % | | 18.6 | % |

Government Expenditures (in billions of Rmb) | | 1,318.8 | | | 1,588.7 | | | 1,890.3 | | | 2,205.3 | | | 2,460.7 | |

% of GDP | | 16.1 | % | | 17.8 | % | | 19.4 | % | | 21.0 | % | | 21.0 | % |

Deficit (in billions of Rmb) | | (174.4 | ) | | (249.1 | ) | | (251.7 | ) | | (315.0 | ) | | (291.6 | ) |

% of GDP | | 2.1 | % | | 2.8 | % | | 2.6 | % | | 3.0 | % | | 2.5 | % |

Internal and External Debt (year end) | | | | | | | | | | | | | | | |

Direct Internal Debt (in billions of Rmb)(1) | | 1,054.2 | | | 1,302.0 | | | 1,561.8 | | | 1,907.9 | | | 2,126.1 | |

% of GDP | | 12.8 | % | | 14.6 | % | | 16.0 | % | | 18.2 | % | | 18.2 | % |

Direct External Debt (in billions of US$)(1) | | 47.3 | | | 49.0 | | | 49.8 | | | 50.5 | | | 52.8 | |

% of GDP | | 4.8 | % | | 4.5 | % | | 4.2 | % | | 4.0 | % | | 3.7 | % |

Total Internal Debt (in billions of Rmb)(2) | | 1,775.8 | | | 2,130.1 | | | 2,496.0 | | | 2,989.3 | | | 3,395.7 | |

% of GDP | | 21.6 | % | | 23.8 | % | | 25.6 | % | | 28.4 | % | | 29.0 | % |

Total External Debt (in billions of US$)(2) | | 151.8 | | | 145.7 | | | 170.1 | | | 168.5 | | | 193.6 | |

% of GDP | | 15.3 | % | | 13.5 | % | | 14.5 | % | | 13.3 | % | | 13.7 | % |

Total Direct Debt (in billions of Rmb) | | 1,445.8 | | | 1,707.6 | | | 1,974.0 | | | 2,325.9 | | | 2,563.1 | |

% of GDP | | 17.6 | % | | 19.1 | % | | 20.3 | % | | 22.1 | % | | 21.9 | % |

| (1) | Direct debt, whether internal or external, means debt incurred directly by the central government in the name of China. |

| (2) | Total internal debt and total external debt include direct debt as well as debt incurred by other PRC financial institutions and corporate enterprises. |

S-3

Recent Credit Ratings

The credit ratings accorded to our foreign currency debt securities or foreign currency debt securities of China by rating agencies are not recommendations to purchase, hold or sell the notes or any securities since such ratings do not comment as to market price or suitability for you. Any rating may not remain in effect for any given period of time or may be revised or withdrawn entirely by a rating agency in the future if in its judgment circumstances so warrant, and if any such rating is so revised or withdrawn, we and China are under no obligation to update this prospectus supplement and the accompanying prospectus.

China Development Bank. On October 16, 2003, Moody’s Investors Service, Inc. affirmed our A2 long-term foreign currency debt rating with stable outlook. On November 27, 2003, Fitch IBCA, Inc. affirmed our senior, unsecured, long-term foreign currency debt rating at A–, with positive rating outlook. On February 18, 2004, Standard & Poor’s Ratings Group affirmed our BBB+ long-term foreign currency debt rating with stable outlook.

China. On October 15, 2003, Moody’s Investors Service, Inc. affirmed China’s sovereign rating at A2 for long-term foreign currency denominated debt, with stable outlook. On October 13, 2003, Fitch IBCA, Inc. affirmed the senior, unsecured, long-term foreign currency debt rating of China at A–, with positive rating outlook. On February 18, 2004, Standard & Poor’s Ratings Group affirmed its BBB+ long-term foreign currency sovereign and senior unsecured credit rating for China, with positive outlook.

Concurrent Offering

Concurrently with this offering, we are also conducting a separate offering outside the United States of an aggregate principal amount of € of our % bonds due . This concurrent offering has not been, and will not be, registered under the United States Securities Act and may not be offered or sold within the United States or to, or for the account or benefit of, any U.S. person.

S-4

The Offering

This offering summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus. It is not complete and does not contain all the information that you should consider before investing in the notes. You should read this entire prospectus supplement and the accompanying prospectus carefully.

Interest Rate | % per year. |

Interest Payment Dates | and of each year, beginning , 2005. |

Redemption or Sinking Fund | None. |

Form and Denomination | Global note, registered in the name of Cede & Co., a nominee of The Depository Trust Company. The notes will be issued in minimum denominations of US$10,000 or integral multiples of US$1,000 in excess of US$10,000. |

Proposed Listing | The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange. |

Ranking | Equal with our other general, unsecured and unsubordinated public external indebtedness. The term “public external indebtedness” includes our foreign currency borrowings and guarantees having an original maturity of more than one year which may be quoted, listed or traded on any securities market outside mainland China. Such public external indebtedness does not include amounts owed to state-owned financial institutions in China. As of June 30, 2004, the amount of our public external indebtedness outstanding was US$1,118.0 million. As of June 30, 2004, we had aggregate borrowings overseas with maturities of or over 365 days, including our public external indebtedness, of approximately US$6,303.2 million. |

Limitation on Other Indebtedness | None. |

Credit Support | The notes are not guaranteed by China. The PRC central bank, the People’s Bank of China, is authorized and obligated under the Special Decree of the State Council to provide short-term loans to us in the event we experience any liquidity shortages. However, the noteholders do not have any rights against the PRC central bank or the PRC government in respect of this support obligation. |

Negative Pledge | We will not secure any other public external indebtedness unless we also secure the notes on the same terms. |

S-5

Events of Default | Any noteholder can declare its note to be payable immediately if: |

| | • | we fail to pay interest or principal on the note for 30 days after the payment date; |

| | • | we fail to perform covenants with respect to the notes for 60 days after notice from the holders of 10% or more of the notes; |

| | • | we fail to pay more than US$25,000,000, or its equivalent in any other currency or currencies, of other public external indebtedness for 30 days after it becomes due; |

| | • | we are dissolved, merged or consolidated by the PRC authorities or all or a material part of our assets are transferred (unless we are the continuing entity or the notes are assumed by another agency designated by the State Council of China); |

| | • | China ceases to own at least 51% of our bank; or |

| | • | unless the PRC central government will guarantee or otherwise assume the indebtedness evidenced by the notes, the People’s Bank of China (or any successor central bank of China) fails to provide the liquidity support stipulated in the Special Decree as in effect as of the date of issuance of the notes or the Special Decree is amended in a manner which prejudices the rights of the noteholders or ceases to be valid or effective. |

Use of Proceeds | We intend to use the net proceeds of approximately US$ from the sale of the notes to fund foreign currency-denominated loans we extend to finance infrastructure and other industrial projects in China, to repay our outstanding indebtedness and for working capital and general corporate purposes. |

Fiscal Agent | JPMorgan Chase Bank. |

Paying agent in Luxembourg | JPMorgan Chase Bank Luxembourg S.A. |

Governing Law | The notes and the fiscal agency agreement will be governed by New York law except that all matters relating to their authorization and execution by us are governed by the laws of China. |

S-6

DESCRIPTION OF THE NOTES

The following description of the notes and the general description of our debt securities in the accompanying prospectus contain a summary of material provisions of the notes and the fiscal agency agreement. These descriptions are subject to the actual and detailed provisions of the notes and the fiscal agency agreement. We have filed a form of the fiscal agency agreement and a form of our debt securities as exhibits to our registration statement (no. 333-10282) on April 26, 1999. The following description of the notes supplements, and should be read in conjunction with, the description of the general terms and provisions of our debt securities contained in the accompanying prospectus under the caption “Description of the Debt Securities.” If anything described in the following description is inconsistent with the description in the accompanying prospectus, you should rely on the following description.

The % notes due are to be issued pursuant to the fiscal agency agreement dated as of May 18, 1999 between us and JPMorgan Chase Bank, as fiscal agent. As used in this prospectus supplement, the term “notes” means these % notes due . These notes are a series of our debt securities described in “Description of the Debt Securities” in the accompanying prospectus.

The notes will be denominated in principal amounts of US$10,000 and integral multiples of US$1,000 in excess of US$10,000.

The notes will initially be issued in an aggregate principal amount of US$ and will mature on . The notes will bear interest at the rate of % per year from , 2004 payable semiannually on and of each year, commencing on , 2005, to the persons in whose names the notes are registered on the preceding and , respectively. Interest on the notes will be computed on the basis of a 360-day year of twelve 30-day months. Upon maturity, the notes will be redeemed at par.

We may from time to time, without your consent, create and issue further notes having the same terms and conditions as the notes in all respects, except for issue date, issue price, the first payment of interest thereon and the interest scheduled to be paid prior to the issue date, provided, however, that such additional notes do not have a greater amount of original issue discount for U.S. federal tax purposes (regardless of whether any holders of such additional notes are subject to U.S. federal tax laws) than the outstanding notes have as of the date of the issue of such additional notes. Additional notes issued in this manner will be consolidated with and will form a single series with the notes. References to the notes in this prospectus supplement include such further notes.

The notes will be issued in the form of fully registered global debt securities. Such global debt securities will be deposited with, or on behalf of, The Depository Trust Company, or DTC, New York, New York and registered in the name of Cede & Co. as DTC’s nominee. Beneficial interests in such global debt securities will be represented by, and transfers of such beneficial interests will be effected only through, book-entry accounts maintained by DTC and its participants (including Euroclear and Clearstream). See “Description of the Debt Securities — Book-Entry System” and “Global Clearance and Settlement” in the accompanying prospectus. We will issue notes in definitive form in exchange for the global debt securities only in the limited circumstances described in the accompanying prospectus under “Description of the Debt Securities — Definitive Certificates.”

The notes are not subject to redemption by us or any noteholder prior to maturity. We will not provide any sinking fund for the amortization and retirement of the notes.

So long as the notes are listed on The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange and their respective rules so require, all notices to noteholders will be published in a daily newspaper of general circulation in Hong Kong and Luxembourg, as the case may be. If the notes are represented by global debt securities, notices will be sent to the relevant depositary, such as DTC, or its nominee as the holder of the global debt securities, and the depositary will communicate these notices to its participants and further to the beneficial owners of these global debt securities in accordance with their standard procedures.

S-7

UNDERWRITING

Subject to the terms and conditions described in the underwriting agreement (comprising of the underwriting agreement basic terms and the related terms agreement dated , 2004), we have agreed to sell to each of the underwriters named below severally, and each of the underwriters has severally agreed to purchase, the respective principal amount of notes set forth opposite its name below:

| | | |

Underwriter

| | Principal amount of notes

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated | | US$ | |

BNP Paribas Securities Corp. | | | |

Goldman Sachs (Asia) L.L.C. | | | |

The Hongkong and Shanghai Banking Corporation Limited | | | |

Morgan Stanley & Co. International Limited | | | |

UBS Limited | | | |

| | |

|

|

Total | | US$ | |

| | |

|

|

The several underwriters have agreed, subject to the terms and conditions set forth in the underwriting agreement, to purchase all the notes offered in this prospectus supplement if any of the notes is purchased. In the event of default by one or more of the underwriters, the underwriting agreement provides that, in certain circumstances, purchase commitments of the nondefaulting underwriters may be increased, or additional underwriters may be added, or the underwriting agreement may be terminated.

We estimate that our expenses associated with the offer and sale of the notes will be US$ .

We have agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act of 1933, or to contribute to payments the underwriters may be required to make in that respect.

The notes are a new issue of securities with no established trading market. We intend to apply for listing of the notes on The Stock Exchange of Hong Kong Limited and the Luxembourg Stock Exchange in accordance with their respective rules.

Commissions and Discounts

The underwriters have advised us that they propose initially to offer the notes directly to the public at the offering price described on the cover page of this prospectus supplement and to certain dealers at such prices less a concession not in excess of % of the principal amount of the notes. The underwriters may allow, and such dealers may reallow, a discount not in excess of % of the principal amount of the notes to certain other dealers. After the initial public offering, the public offering price, concession and discount may be changed.

Selling Restrictions

Each underwriter has agreed that it will not offer, sell or deliver any of the notes, directly or indirectly, or distribute this prospectus supplement or the accompanying prospectus, or any other offering material relating to the notes, in or from any jurisdiction except under circumstances that will, to the best knowledge and belief of such underwriter, result in compliance with the applicable laws and regulations of such jurisdiction (including, without limitation, any prospectus delivery requirements) and which will not impose any obligations on us except as set forth in the underwriting agreement.

United Kingdom

Each underwriter has agreed that (i) it has not offered or sold and, prior to the expiry of the period of six months from the date of issue of the notes, it will not offer or sell, any notes to persons in the United Kingdom except to persons whose ordinary activities involve them in acquiring, holding, managing or disposing of investments (as principal or agent) for the purposes of their businesses or otherwise in circumstances which have not resulted and will not result in an offer to the public in the United Kingdom within the meaning of the Public Offers of Securities Regulations 1995 (as amended); (ii) it has complied and will comply with all applicable

S-8

provisions of the Financial Services and Markets Act 2000 (the “FSMA”) with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom; and (iii) it has only communicated or caused to be communicated and will only communicate or cause to be communicated any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to us.

Germany

No action has been or will be taken in the Federal Republic of Germany that would permit a public offering of the notes, or distribution of this prospectus supplement and the accompanying prospectus or any other offering material relating to the notes. In particular, no sales prospectus (Verkaufsprospekt) within the meaning of the German Securities Sales Prospectus Act (Wertpapier-Verkaufsprospektgesetz) of December 13, 1990, as amended (the “German Sales Prospectus Act”), has been or will be published within the Federal Republic of Germany, nor have this prospectus supplement and the accompanying prospectus been filed with or approved by the Germany Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht) for publication within the Federal Republic of Germany. Accordingly, any offer or sale of notes or any distribution of offering material relating to the notes within the Federal Republic of Germany may violate the provisions of the German Sales Prospectus Act.

France

The notes may not be offered or sold, and will not be offered or sold, directly or indirectly, to the public in the French Republic and offers and sales of the notes in the French Republic will be made only to qualified investors (investisseurs qualifiés) acting for their own account as defined in and in accordance with Article L.411-2 of the French Code monétaire et financier and decree no.98-880 dated October 1, 1998. In addition, this prospectus supplement and the accompanying prospectus or any other offering material relating to the notes may not be distributed, and will not be distributed, in the French Republic other than to investors to whom offers and sales of the notes in the French Republic may be made as described above. This prospectus supplement and the accompanying prospectus have not been, and will not be, submitted for clearance by the French Autorité des Marchés Financiers.

Hong Kong

The notes may not be offered or sold in Hong Kong, by means of any document, any notes, other than to persons whose ordinary business is to buy or sell shares or debentures, whether as principal or agent, or in circumstances which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap. 32) of Hong Kong.

No advertisement, invitation or document relating to the notes has been issued and none of such documents will be issued, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to notes which are or are intended to be disposed of only to persons outside Hong Kong or only to “Professional Investors” within the meaning of the Securities and Futures Ordinance (CAP 571) of Hong Kong and any rules made thereunder.

Italy

The offering of the notes has not been cleared by CONSOB (the Italian Securities Exchange Commission) pursuant to Italian securities legislation and, accordingly, no notes may be offered, sold or delivered, nor may

S-9

copies of this prospectus supplement and the accompanying prospectus or any other document relating to the notes be distributed in the Republic of Italy, except:

| | (1) | to professional investors, as defined in Article 31, second paragraph, of CONSOB Regulation No. 11522 of July 1, 1998, as amended; or |

| | (2) | in circumstances which are exempted from the rules on solicitation of investments pursuant to Article 100 of Legislative Decree No. 58 of February 24, 1998, commonly referred to as the Financial Services Act, and Article 33, first paragraph, of CONSOB Regulation No. 11971 of May 14, 1999, as amended. |

Any offer, sale or delivery of the notes or distribution of copies of this prospectus supplement and the accompanying prospectus or any other document relating to the notes in the Republic of Italy under (1) or (2) above must be:

| | • | made by an investment firm, bank or financial intermediary permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act and Legislative Decree No. 385 of September 1, 1993, as amended, commonly referred to as the Banking Act; |

| | • | in compliance with Article 129 of the Banking Act and the implementing guidelines of the Bank of Italy pursuant to which the issue or the offer of securities in the Republic of Italy may need to be preceded and followed by an appropriate notice to be filed with the Bank of Italy depending, inter alia, on the aggregate value of the securities issued or offered in the Republic of Italy and their characteristics; and |

| | • | in compliance with any other applicable notification requirement or limitation which may be imposed by CONSOB or the Bank of Italy. |

Japan

The note have not been and will not be registered under the Securities and Exchange Law of Japan (the “Securities and Exchange Law”). Accordingly, the notes may not, directly or indirectly, be offered or sold in Japan or to, or for the benefit of, any resident of Japan except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the Securities and Exchange Law and other applicable laws and regulations of Japan. As used in this paragraph “resident of Japan” means any person residing in Japan, including any corporation or other entity organized under the laws of Japan.

Mainland China

The National Development and Reform Commission has approved the issuance of the notes outside the People’s Republic of China. The notes will not be offered or sold publicly in mainland China to Chinese investors. Chinese investors who wish to purchase the notes must obtain relevant governmental approvals, including necessary approvals from the State Administration of Foreign Exchange.

The Netherlands

The notes may not be offered, sold, transferred or delivered, whether directly or indirectly, to any individuals or legal entities in or from The Netherlands, as part of their initial distribution or at any time thereafter other than to individuals or legal entities who or which trade or invest in securities in the conduct of their profession or trade (which includes banks, brokers, dealers, asset management companies, investment funds, insurance companies, pension funds, other institutional investors and treasury departments of large commercial enterprises).

Singapore

This prospectus supplement and the accompanying prospectus have not been and will not be registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement, the

S-10

accompanying prospectus and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the notes may not be circulated or distributed, nor may the notes be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (1) to an institutional investor or other person specified in Section 274 of the Securities and Futures Act, Chapter 289 of Singapore, or the Singapore Securities and Futures Act, (2) to a sophisticated investor, and in accordance with the conditions, specified in Section 275 of the Singapore Securities and Futures Act or (3) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Singapore Securities and Futures Act.

Stamp Duty

Purchasers of the notes may be required to pay stamp taxes and other charges in accordance with the laws and practices of the country of purchase in addition to the price to public described on the cover page of this prospectus supplement.

Price Stabilization and Short Positions

In connection with this offering, the underwriters may engage in overallotment, stabilizing transactions and syndicate covering transactions in accordance with Regulation M under the United States Securities Exchange Act of 1934, as amended, and applicable rules and regulations of the Luxembourg Stock Exchange and Hong Kong Exchanges and Clearing Limited. In addition, Merrill Lynch, Pierce, Fenner & Smith Incorporated or any person acting for it may engage in overallotment, stabilizing transactions and syndicate covering transactions in accordance with the United Kingdom Financial Services and Markets Act 2000. Overallotment involves sales in excess of the offering size, which creates a short position for the underwriters. Stabilizing transactions involve bids to purchase the notes in the open market for the purpose of pegging, fixing or maintaining the price of the notes. Syndicate covering transactions involve purchases of the notes in the open market after the distribution has been completed in order to cover short positions. The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the representatives have repurchased notes sold by or for the account of such underwriter in stabilizing or short covering transactions. These transactions may cause the price of the notes to be higher than it would otherwise be in the absence of those transactions, but the underwriters make no prediction or representation as to the direction or magnitude of any effect that such transactions may have on the price of the notes. If the underwriters engage in stabilizing or syndicate covering transactions, they may discontinue them at any time and must bring the transactions to an end after a limited period.

Other Relationships

Some of the underwriters and their affiliates have engaged in and in the future may engage in investment banking and other commercial dealings in the ordinary course of business with us. They have received customary fees and commissions for these transactions.

S-11

LEGAL MATTERS

The validity of the notes will be passed upon on our behalf as to PRC law by the Legal Affairs Department of China Development Bank, Beijing, PRC counsel to us, and as to United States law by Sidley Austin Brown & WoodLLP, Hong Kong and Beijing, special United States counsel to us. Certain legal matters will be passed upon on behalf of the underwriters as to PRC law by Haiwen & Partners, Beijing, PRC counsel to the underwriters. The underwriters are being represented by Sullivan & Cromwell LLP with respect to U.S. Federal securities and New York State law.

GENERAL INFORMATION

We have authorized the issue and terms of the notes pursuant to the approval of the National Development and Reform Commission dated June 16, 2004. We have obtained all necessary consents, approvals and authorizations in China in connection with the issue and performance of the notes, all of which are in full force and effect. You may inspect certified copies of the approval of the National Development and Reform Commission, dated June 16, 2004, approving the issuance of the notes, copies of the fiscal agency agreement, copies of our latest annual financial statements prepared by us in accordance with the International Financial Reporting Standards and audited by PricewaterhouseCoopers in accordance with the International Standards on Auditing, copies of our articles of association, copies of this prospectus supplement and the accompanying prospectus, and copies of all amendments and supplements to this prospectus supplement and such prospectus relating to the notes, during usual business hours in Hong Kong, at the offices of Sidley Austin Brown & Wood LLP, until , 2004. In addition, our legal notices and our articles of association will be deposited at the Trade and Commerce Register (Registre de Commerce et des Registres) in Luxembourg. You may read all our documents at the office of our listing agent in Luxembourg free of charge and may also request copies of these documents upon payment of a duplicating fee to our listing agent.

We have not appointed any paying or transfer agent in Hong Kong with respect to the notes. We have agreed to appoint an agent in Hong Kong if the notes in definitive form are issued in the limited circumstances set forth under “Description of the Debt Securities — Definitive Certificates” in the accompanying prospectus. In the event that such a paying or transfer agent is appointed in Hong Kong, the name and address of such agent will be published in a daily newspaper having general circulation in Hong Kong.

Since December 31, 2003, the date of our latest consolidated financial statements contained in the accompanying prospectus, unless otherwise disclosed in this prospectus supplement, there has been no material adverse change in our condition, financial or otherwise, or in our earnings, business affairs or business prospects.

We are neither involved in any litigation, arbitration or administrative proceedings which are material in the context of the issue of the notes nor aware of any such litigation, arbitration or administrative proceedings, whether pending or threatened.

The Directive of the European Parliament and of the Council (2003/0045 (COD) (the “Transparency Directive”) regarding the harmonization of transparency requirements relating to financial information of issuers whose securities are admitted to trading on a regulated market in the European Union, such as the Luxembourg Stock Exchange, is now required to be implemented by the European Union member states. If the Transparency Directive is implemented or takes effect in Luxembourg in a manner that would require us to publish or produce financial statements according to accounting principles or standards that are different from the International Financial Reporting Standards, or that would otherwise impose requirements on us that we, in our discretion, determine are not reasonable, we may de-list the notes from the Luxembourg Stock Exchange. In these circumstances, there can be no assurance that we would obtain an alternative admission to listing, trading and/or quotation of the notes by another listing authority, exchange and/or system within or outside the European Union. For information regarding the notice requirements associated with any delisting decision, see “Description of the Debt Securities—Notices” in the accompanying prospectus.

The notes are expected to be accepted for clearance through DTC, Clearstream and Euroclear. The Common Code, CUSIP and ISIN numbers for the notes are , and , respectively.

S-12

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED SEPTEMBER 16, 2004

PROSPECTUS

(formerly known as The State Development Bank of China)

Debt Securities

We, China Development Bank, were established in 1994 as a government policy-oriented financial institution of the People’s Republic of China. We may from time to time offer our debt securities in the form of notes, bonds, debentures or other evidences of indebtedness. Each issue of our debt securities may vary as to aggregate principal amount, maturity date, public offering price, interest rate, timing of payments, provision for redemption, if any, sinking fund requirements, if any, and method of distribution, each to be determined at the time of sale. This prospectus provides you with a general description of our debt securities. We will provide a prospectus supplement describing the specific terms of the debt securities we will be offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest in our debt securities.

Our obligations under our debt securities are not guaranteed by China. The People’s Bank of China, the PRC central bank, is authorized and obligated under the Special Decree of the State Council of China dated March 17, 1994 to provide short-term loans to us if we experience any liquidity shortages. This support obligation does not, however, confer any rights under the Special Decree or otherwise upon any holder of our debt securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or determined whether this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

We may sell our debt securities to and through underwriters and may also sell our debt securities directly to other purchasers or through agents. This prospectus may not be used to make offers or sales of our debt securities unless accompanied by a prospectus supplement.

You should rely only on the information contained in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different or additional information. We are not making an offer of our debt securities in any place where the offer is not permitted by law. You should not assume that the information in this prospectus or any prospectus supplement is accurate at any date other than its date of issue.

The date of this prospectus is , 2004.

TABLE OF CONTENTS

ENFORCEMENT OF FOREIGN JUDGMENTS

We are a government policy-oriented financial institution organized under the laws of China, and substantially all of our assets are located in China. As set forth under “Description of the Debt Securities — Jurisdiction; Consent to Service,” we will consent to the jurisdiction of any federal and state court in the Borough of Manhattan, The City of New York, in respect of proceedings relating to our debt securities. In addition, we will waive, to the fullest extent permitted by law, immunity from legal proceedings on grounds of sovereignty. We have been advised by our PRC legal counsel, the Legal Affairs Department of China Development Bank, that there is uncertainty as to the enforceability in China of any actions to enforce judgments of United States courts arising out of or based on our debt securities, including judgments arising out of or based on the civil liabilities provisions of United States federal or state securities laws, primarily because there is no treaty or other arrangement or basis for reciprocal enforcement of judgments between China and the United States. We have also been advised by our Legal Affairs Department that there is uncertainty as to the enforceability in original actions brought in PRC courts of the civil liability provisions of United States federal or state securities laws. See “Description of the Debt Securities — Jurisdiction; Consent to Service.”

2

CONVENTIONS

Unless otherwise indicated, all references in this prospectus to “China” or “PRC” are to the People’s Republic of China; all references to the “central government” are to the central level of governmental administration of the PRC; all references to the “local government” are to all levels of governmental administration below the central government, such as provincial, municipal, county and township governments; all references to the “government” are to the PRC central government and local governments, collectively; and all references to “Hong Kong” are to the Hong Kong Special Administrative Region of the PRC. Unless otherwise indicated, all statistical information in this prospectus relating to China excludes information with respect to Hong Kong, the Macau Special Administrative Region and Taiwan.

All annual information is based upon January 1 to December 31 periods. Any discrepancies in any table between totals and the sums of the amounts listed in such table are due to rounding.

Unless otherwise indicated, all references in this prospectus to “Renminbi” or “Rmb” are to the lawful currency of China; all references to “Hong Kong dollar” or “HK$” are to the lawful currency of Hong Kong; all references to “U.S. dollar” or “US$” are to the lawful currency of the United States of America; all references to “Japanese yen” or “¥” are to the lawful currency of Japan; all references to “British pound” or “£” are to the lawful currency of the United Kingdom; all references to “Swiss Franc” or “CHF” are to the lawful currency of Switzerland; and all references to “Euro” or “€” are to the euro, the currency introduced at the third stage of the European Economic and Monetary Union, pursuant to the Treaty Establishing the European Community, as amended, in the European Union.

Solely for the convenience of the reader, we have translated amounts relating to year 2003 from Renminbi to U.S. dollar at US$1.00 = Rmb 8.2767, the exchange rate published by the People’s Bank of China on the last business day of 2003. On September 15, 2004, the exchange rate between U.S. dollar and Renminbi set and published by the People’s Bank of China was Rmb 8.2767 to US$1.00; and the noon buying rate in New York City for cable transfers on that day of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York was Rmb 8.2768 to US$1.00. We have translated amounts from foreign currencies other than U.S. dollar to Renminbi by first converting such currency into U.S. dollar and then into Renminbi on basis of the exchange rates between such foreign currency and U.S. dollar and between Renminbi and U.S. dollar published by the People’s Bank of China on the last business day of the relevant year or the last business day of the first half of 2004, as the case may be. For financial reporting purposes, however, we translate our foreign currency transactions into Renminbi at the exchange rates prevailing on the date of the transactions. For more information on our accounting treatment of foreign currency transactions, see note 2.B to our financial statements beginning on page F-1. For information relating to the foreign exchange system in China or historical Renminbi exchange rate information, see “People’s Republic of China — PRC Financial System — Foreign Exchange.” We are not making any representation that the Renminbi, U.S. dollar or any other currency referred to in this prospectus could have been or can be converted into U.S. dollars, Renminbi or any other currency, as the case may be, at any particular rate or at all.

China is a participant in the General Data Dissemination System of the International Monetary Fund. However, China is not a subscriber to the Special Data Dissemination Standard of the International Monetary Fund. China has been gradually modifying the methods it uses to calculate its statistical information in order to be more consistent with international standards. As a result, this prospectus contains statistical data relating to the PRC restated for prior years on the basis of such modified methods of calculation. We use the following terms in this prospectus as defined below:

| | • | Gross domestic product or GDP means the total value of products and services produced inside China during the relevant period. |

| | • | Gross national product or GNP means GDP plus income earned by PRC nationals from products produced, services rendered and capital invested outside China, less income earned inside China by non-PRC nationals. |

| | • | Gross output value means the sum of the total (not incremental) values of products and services of each enterprise during the production process. Important characteristics of gross output value are: (1) it |

3

| | double-counts the value of products which pass through more than one enterprise during the production of such products; (2) it is stated in current rather than in constant prices; and (3) it includes inventories. |

| | • | Imports are calculated based upon (1) for purposes of foreign trade, statistics reported to the PRC customs upon entry of goods into China on a cost, insurance and freight included, or CIF, basis; and (2) for purposes of balance of payments, statistics collected on a free on board at a given departure location, or FOB, basis. |

| | • | Exports are calculated based upon (1) for purposes of foreign trade, statistics reported to the PRC customs upon departure of goods from China on an FOB basis; and (2) for purposes of balance of payments, statistics collected on an FOB basis. |

| | • | Per capita disposable income means total actual income of an urban household after individual income tax. |

| | • | Per capita net income means total residual income of a rural household, during a certain period of time, after deduction of production costs, taxes and contractual fees. |

| | • | Rate of unemployment or unemployment rate is calculated as the percentage of the members of the urban work force who register with the local employment agencies as being unemployed. “Urban work force” means permanent urban residents who are: |

| | (i) | registered under the household registration system as urban residents; |

| | (ii) | between the ages of 16 and 50 (in the case of males) and between the ages of 16 and 45 (in the case of females); and |

| | (iii) | physically capable of working. |

China does not collect statistical data regarding rural unemployment or regarding unemployment of persons residing in, but not registered as residents of, urban areas.

| | • | Rate of inflation or inflation rate is measured by the year-on-year percentage change in the consumer price index, unless otherwise specified. The consumer price index is calculated on a weighted basket of consumer goods and services for the urban and rural areas, using a monthly averaging method. Year-on-year rates are calculated by comparing the average of the twelve monthly indices for the later period against the average of the twelve monthly indices for the prior period. |

For purposes of this prospectus and unless otherwise indicated,

| | • | all annual rates of growth are average annual compounded rates; |

| | • | except in the section entitled “People’s Republic of China — PRC Public Finance,” all rates of growth or percentage changes in financial data are based upon such data expressed in constant prices (i.e., prices as adjusted for inflation); and |

| | • | all financial data are presented in current prices. |

Some statistical information about China included in this prospectus is preliminary in nature and reflects the most recent available data and are subject to subsequent adjustment by government statistical agencies. The government conducts a review of China’s official financial and economic statistics after the completion of each fiscal year. As a result, such preliminary financial and economic information in this prospectus may be subsequently adjusted or revised by the government to reflect new or more accurate data. In particular, information and data about China contained in this prospectus for 2003 and 2004 are preliminary and subject to change. Statistical information not presently available is indicated by “N/A.” In addition, statistics compiled from multiple sources or over differing periods may not always be comparable in either methodology or scope.

4

CHINA DEVELOPMENT BANK

CAPITALIZATION

As of December 31, 2003, our capitalization prepared in accordance with the International Financial Reporting Standards was as follows:

| | | | |

| | | December 31, 2003

|

| | | Rmb

| | US$

|

| | | (in millions) |

Long-term Debt(1): | | | | |

Commercial loans in foreign currency | | 41,166.5 | | 4,973.8 |

Commercial loans in Renminbi | | 19.4 | | 2.3 |

Bonds issued: | | | | |

Foreign currency bonds | | 13,299.0 | | 1,606.8 |

Renminbi bonds | | 918,820.6 | | 111,012.9 |

Borrowings from domestic banks | | 4,138.3 | | 500.0 |

Deposits | | 2,000.0 | | 241.6 |

| | |

| |

|

Total long-term debt | | 979,443.8 | | 118,337.4 |

Capital Accounts: | | | | |

Paid-in capital | | 50,000.0 | | 6,041.1 |

Reserves | | 5,160.7 | | 623.5 |

Undistributed profit | | 34,267.8 | | 4,140.3 |

| | |

| |

|

Total owner’s equity | | 89,428.5 | | 10,804.9 |

| | |

| |

|

Total capitalization | | 1,068,872.3 | | 129,142.3 |

| | |

| |

|

| (1) | Long-term debt includes all debt with a maturity of one year or longer, excluding its current portion. |

Unless otherwise disclosed in this prospectus or in applicable prospectus supplement, there has not been any material change in our capitalization since December 31, 2003.

USE OF PROCEEDS

Except as may be otherwise disclosed in the applicable prospectus supplement, we intend to use the net proceeds from the sale of our debt securities to fund foreign currency-denominated loans we extend to finance infrastructure and other industrial projects in China, to repay our outstanding indebtedness and for working capital and general corporate purposes.

5

BUSINESS

Purpose and Authority

We are a government policy-oriented statutory financial institution established pursuant to the Special Decree of the State Council of China dated March 17, 1994. We are the only policy bank in China that has been designated as a ministry-level institution. We conduct our business under the direct supervision of the State Council, the highest institution of government administration in China. We are regulated by the China Banking Regulatory Commission with respect to our banking operations and by the People’s Bank of China with respect to the scale of our annual funding and lending activities. We also report regularly to the Ministry of Finance on our financial condition and results of operations.

Our primary purpose is to foster the economic development of China by providing long-term financing for policy-oriented and related projects in line with the government’s development strategy and its industrial policies. Consistent with our purpose as an instrument of China’s national economic development strategy, our current principal activities focus on raising funds and mobilizing resources to support the development of industries encouraged by the central government. These industries include infrastructure facilities, basic industries and pillar industries in China, such as railway and road transportation, power generation, telecommunication, petrochemical and chemical industries, urban public facilities and environmental facilities. Our lending activities endeavor to support the PRC government’s development strategy of seeking a balanced development between the coastal regions of China and the central and western regions and also endeavor to guide both the volume and the structure of fixed asset investments in China. Although profit maximization is not our goal under the Special Decree, we have made, and will continue to make, efforts to achieve profitability in a cost-effective manner.

Pursuant to our articles of association, we are authorized to engage in the following activities:

| | • | manage and use “operational construction funds” and interest subsidies earmarked under the fiscal budget of the government; |

| | • | issue financial debentures to Chinese qualified institutional investors and issue construction bonds guaranteed by the Ministry of Finance; |

| | • | on-lend loans from foreign governments and international financial institutions; |

| | • | issue bonds in the international capital markets as approved by the government and borrow commercial loans from foreign banks and other financial institutions in accordance with the government’s policies on the use of foreign capital; |

| | • | extend loans to policy-oriented large-and-medium-scale infrastructure, technological renovation and related projects for key infrastructure facilities, basic industries and pillar industries; |

| | • | provide guarantees, evaluation and consultation on project loans; |

| | • | evaluate financing packages and terms for potential borrowers; |

| | • | identify domestic and foreign joint venture partners and provide market information for key infrastructure projects; and |

| | • | participate in other lines of business as approved by the central government. |

Relationship with the Government

Government Ownership. As a government instrumentality under the State Council, we are wholly owned by the central government, and no person other than the government has, or can obtain, an ownership interest or equity participation in us. Our articles of association provide that our registered capital is Rmb 50 billion and the

6

Ministry of Finance contributed fully our registered capital by the end of 2003 partially through its direct capital contribution and partially through tax rebates. All of our net income is subject to disposal by the central government for the benefit of the PRC.

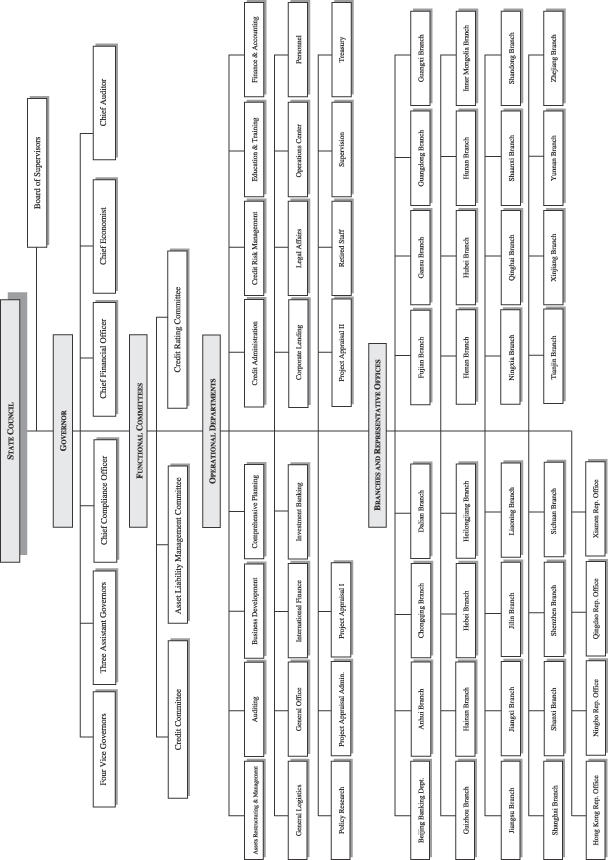

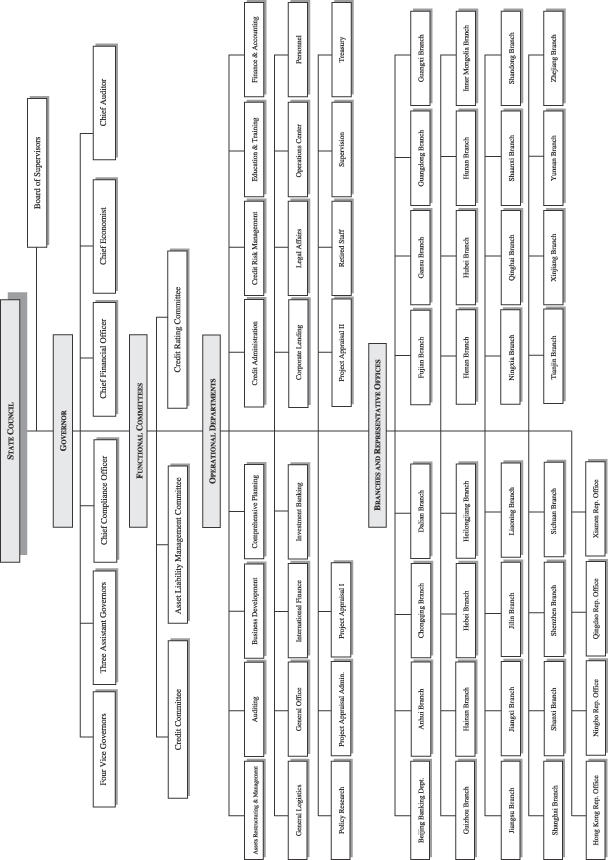

Government Supervision. Our operations are subject to the direct supervision of the State Council. Pursuant to the Special Decree, our articles of association were adopted by the State Council and may be amended only with its approval. The State Council directly appoints our governor, vice governors and the chairman of our board of supervisors.

Our board of supervisors was established with the approval of the State Council and is charged with supervising our implementation of the policies and guidelines of the government. Our board of supervisors is responsible to the State Council. Members of our board of supervisors other than its chairman are appointed with the approval of the China Banking Regulatory Commission in accordance with the Provisional Rules on Supervisory Boards at Key State-owned Financial Institutions. Our board of supervisors currently consists of six members as representatives of the Ministry of Finance, the China Banking Regulatory Commission, our bank and a designated PRC public accounting firm.

We are subject to the overall supervision of the State Council, the highest institution of government administration in China. We report our annual working plan directly to the State Council for its approval. In addition, the China Banking Regulatory Commission, as the principal regulator of China’s banking industry, regulates our banking operations, such as risk control and authorized business activities. The People’s Bank of China, as the PRC central bank, regulates our annual funding scale, our lending activities and interest rates and other monetary policy related matters. The Ministry of Finance, as the contributor of our registered capital, monitors our financial condition and results of operations and we submit our annual financial statements to the Ministry of Finance for review and approval. The National Development and Reform Commission has overall responsibility in overseeing the national economic development and structural reform. It advises the State Council and coordinates with various governmental agencies in steering the general economic development in China, such as overall investments in different economic sectors in China and overall foreign borrowings by PRC enterprises. Most of the infrastructure and industrial projects that we finance are subject to the approval of the National Development and Reform Commission. Our incurrence of foreign currency debt also requires its approval.

Government Support. In addition to contributions to our capital, the government provides direct and indirect financial support for our business activities in the following manner:

| | • | Pursuant to the Special Decree, we make annual reports of our operations, including our lending activities and sources of funds to the central government for ratification. In accordance with our request for funding, the People’s Bank of China approves the aggregate amount of financial resources to be made available to us on an annual basis in support of our domestic lending activities. |

| | • | Based on the approval of the central government, we may access the domestic bond markets, which is our most important source of funding, to issue our debentures to domestic banks, financial institutions and other PRC qualified institutional investors. |

| | • | Under the Special Decree, we are also allowed to issue construction bonds guaranteed by the Ministry of Finance although we have not issued such bonds. |

| | • | Pursuant to the Special Decree, the People’s Bank of China is authorized and obligated to provide short-term loans to us when we experience any liquidity shortages. The support obligation of the People’s Bank of China does not constitute a guarantee of our debt securities, and is not enforceable against the People’s Bank of China by any holder of our debt securities. It does not confer any right under or in respect of the Special Decree upon a holder of our debt securities. |

In addition, to the extent our actual liquidity requirements in a given fiscal year suggest a need for greater financial support on a longer term basis, we are required to report this need to the People’s Bank of China and to seek its approval for additional financing.

7

Under the Special Decree, the Ministry of Finance also provides indirect support to us in the form of interest subsidies, which are allocated each year in the annual budget of the PRC. Administration of the subsidy program, including the selection of projects, is subject to rules and regulations of the Ministry of Finance. The interest subsidies are intended to further the economic development policies of the government by enabling borrowers in selected economic sectors to borrow commercial loans from us. The Ministry of Finance approves its interest subsidies, based upon the importance of its supported projects to the national economy. The Ministry of Finance subsidizes these borrowers directly with respect to their interest payments. Although many of our projects may benefit from the interest subsidies, we are not the only financial institution that benefits from this indirect support.

Government On-lending Agent. Historically, the on-lending function for loans made or guaranteed by the International Bank for Reconstruction and Development, or the World Bank, the Asian Development Bank and other multilateral lending agencies fell within the respective jurisdiction of the Ministry of Finance and the People’s Bank of China. As a result of the government reorganization in 1998, the Ministry of Finance has become the sole coordinator for the on-lending of loans from these multilateral agencies and we have been designated as one of the on-lending agents with respect to loans from the World Bank and the Asian Development Bank. These loans are based on the central government’s credit.

Loan Operations

General

Our principal financing activity is the provision of long- and medium- term loans for large and medium size projects involving infrastructure facilities, basic industries and pillar industries including railway and road transportation, power generation, telecommunication, petrochemical and chemical industries, urban public facilities and environmental facilities. As a policy bank wholly owned by the PRC government, we have to operate in line with the PRC government’s development strategies as mandated in the Special Decree. As a result, our financing operations may be less profitable in comparison with purely commercial projects. The PRC central government has generally been supportive of our approach to these competing considerations. For example, we are not required to finance purely welfare projects, which would largely be funded with governmental fiscal appropriations. For projects that are not entirely based on market terms, we would indirectly benefit from fiscal subsidies provided by the government to the project companies. For projects that may be financed in line with market terms, we generally provide financing on such terms. Our statutory mandate of “preserving capital with small profits” set forth in the Special Decree expresses a clear intention of the PRC government that our policy-oriented lending business should be a self-sustainable one.