- SUZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Suzano (SUZ) 6-KCurrent report (foreign)

Filed: 9 Apr 20, 7:51am

Exhibit 99.1

Conference Call – Update on Covid-19April 09, 2020

o Management Focuso Financial Highlightso Pulp & Paper Market

o Management Focuso Financial Highlightso Pulp & Paper Market

on Covid-19 contextPeopleSocietyBusinesscontinuity4

to care for our PeopleHome office (except for activities that requires on-site presence)Cancellation of events, trips, visits to the mills and face- to-face meetingsRemoval of pregnants, patients with chronic diseases and people over 60 yearsIncreased of cleaning and sanitizing common areasMaintenance of operations with minimal employees and service providersGuidance for employees and service providers to keep their distanceMeasurement of body temperature on arrival at the mill gatesChartered buses circulating with fewer passengersDistribution of lunch boxes and greater spacing between tables and chairsApplication of the screening questionnaire for suppliersAdoption of quarantine in case of risk of contaminationMaintenance downtimes postponementsFrequent information sharing5

to care for our PeopleHome office (except for activities that requires on-site presence)Cancellation of events, trips, visits to the mills and face- to-face meetingsRemoval of pregnants, patients with chronic diseases and people over 60 yearsIncreased of cleaning and sanitizing common areasMaintenance of operations with minimal employees and service providersGuidance for employees and service providers to keep their distanceMeasurement of body temperature on arrival at the mill gatesChartered buses circulating with fewer passengersDistribution of lunch boxes and greater spacing between tables and chairsApplication of the screening questionnaire for suppliersAdoption of quarantine in case of risk of contaminationMaintenance downtimes postponementsFrequent information sharing5

to care for our PeopleHome office (except for activities that requires on-site presence)Cancellation of events, trips, visits to the mills and face- to-face meetingsRemoval of pregnants, patients with chronic diseases and people over 60 yearsIncreased of cleaning and sanitizing common areasMaintenance of operations with minimal employees and service providersGuidance for employees and service providers to keep their distanceMeasurement of body temperature on arrival at the mill gatesChartered buses circulating with fewer passengersDistribution of lunch boxes and greater spacing between tables and chairsApplication of the screening questionnaire for suppliersAdoption of quarantine in case of risk of contaminationMaintenance downtimes postponementsFrequent information sharing5

o Management Focuso Financial Highlightso Pulp & Paper Market

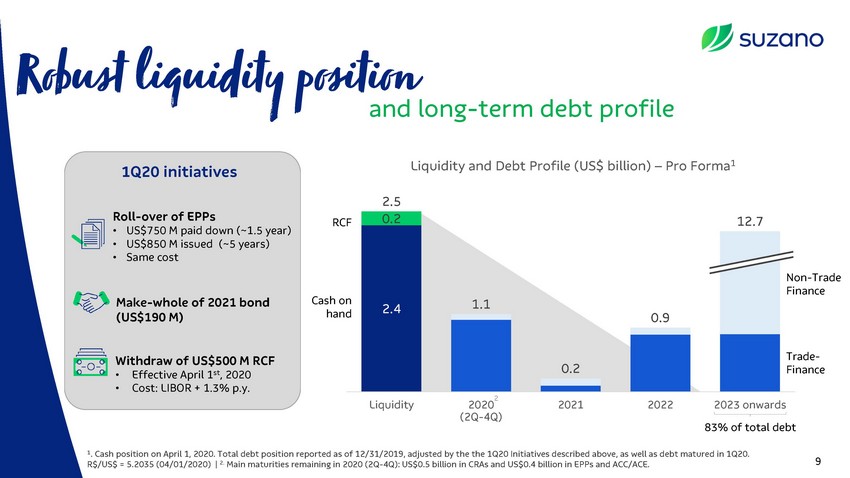

and long-term debt profile1Q20 initiativesLiquidity and Debt Profile (US$ billion) – Pro Forma1Roll-over of EPPs • US$750 M paid down (~1.5 year) • US$850 M issued (~5 years) • Same costMake-whole of 2021 bond (US$190 M)Withdraw of US$500 M RCF • Effective April 1st, 2020 • Cost: LIBOR + 1.3% p.y.RCFCash on hand2.5 0.22.41.120.20.912.7Non-Trade FinanceTrade- FinanceLiquidity 2020 (2Q-4Q)2021 2022 2023 onwards83% of total debt1. Cash position on April 1, 2020. Total debt position reported as of 12/31/2019, adjusted by the the 1Q20 Initiatives described above, as well as debt matured in 1Q20. R$/US$ = 5.2035 (04/01/2020) | 2. Main maturities remaining in 2020 (2Q-4Q): US$0.5 billion in CRAs and US$0.4 billion in EPPs and ACC/ACE. 9

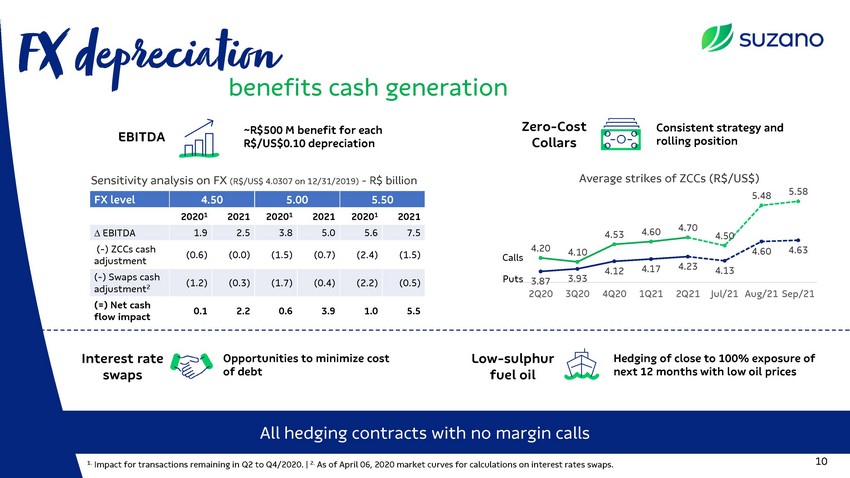

benefits cash generationEBITDA~R$500 M benefit for each R$/US$0.10 depreciationZero-Cost CollarsConsistent strategy and rolling positionSensitivity analysis on FX (R$/US$ 4.0307 on 12/31/2019) - R$ billionFX level 4.50 5.00 5.5020201 2021 20201 2021 20201 2021Average strikes of ZCCs (R$/US$) 5.48 5.58D EBITDA 1.9 2.5 3.8 5.0 5.6 7.5(-) ZCCs cash adjustment (0.6) (0.0) (1.5) (0.7) (2.4) (1.5)Calls4.20 4.104.53 4.604.70 4.504.60 4.634.12 4.17 4.234.13(-) Swaps cash adjustment2(=) Net cash(1.2) (0.3) (1.7) (0.4) (2.2) (0.5)Puts 3.87 3.932Q20 3Q20 4Q20 1Q21 2Q21 Jul/21 Aug/21 Sep/21flow impact 0.1 2.2 0.6 3.9 1.0 5.5Interest rate swapsOpportunities to minimize cost of debtLow-sulphur fuel oilHedging of close to 100% exposure of next 12 months with low oil pricesAll hedging contracts with no margin calls1. Impact for transactions remaining in Q2 to Q4/2020. | 2. As of April 06, 2020 market curves for calculations on interest rates swaps. 10

o Management Focuso Financial Highlightso Pulp & Paper Market

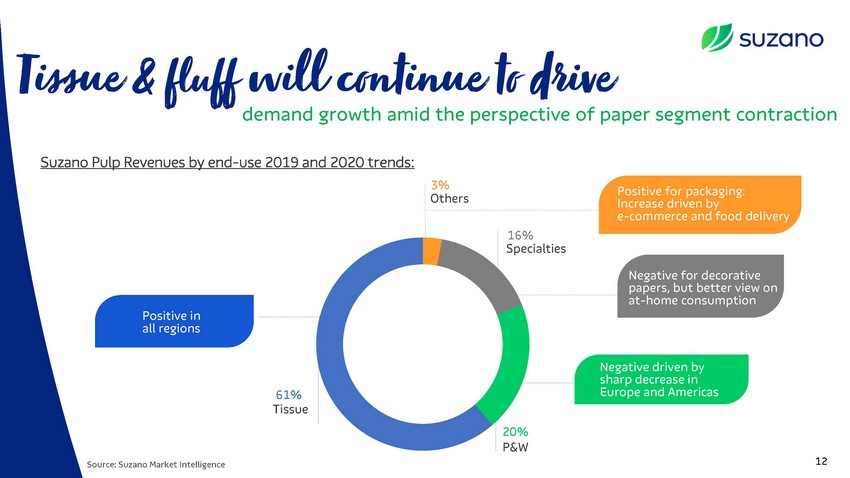

demand growth amid the perspective of paper segment contractionSuzano Pulp Revenues by end-use 2019 and 2020 trends:3% Others16% SpecialtiesPositive for packaging: Increase driven by e-commerce and food deliveryPositive in all regionsNegative for decorative papers, but better view on at-home consumptionSource: Suzano Market Intelligence61% Tissue20% P&WNegative driven by sharp decrease in Europe and Americas12

demand growth amid the perspective of paper segment contractionSuzano Pulp Revenues by end-use 2019 and 2020 trends:3% Others16% SpecialtiesPositive for packaging: Increase driven by e-commerce and food deliveryPositive in all regionsNegative for decorative papers, but better view on at-home consumptionSource: Suzano Market Intelligence61% Tissue20% P&WNegative driven by sharp decrease in Europe and Americas12

demand growth amid the perspective of paper segment contractionSuzano Pulp Revenues by end-use 2019 and 2020 trends:3% Others16% SpecialtiesPositive for packaging: Increase driven by e-commerce and food deliveryPositive in all regionsNegative for decorative papers, but better view on at-home consumptionSource: Suzano Market Intelligence61% Tissue20% P&WNegative driven by sharp decrease in Europe and Americas12

demand growth amid the perspective of paper segment contractionSuzano Pulp Revenues by end-use 2019 and 2020 trends:3% Others16% SpecialtiesPositive for packaging: Increase driven by e-commerce and food deliveryPositive in all regionsNegative for decorative papers, but better view on at-home consumptionSource: Suzano Market Intelligence61% Tissue20% P&WNegative driven by sharp decrease in Europe and Americas12

demand growth amid the perspective of paper segment contractionSuzano Pulp Revenues by end-use 2019 and 2020 trends:3% Others16% SpecialtiesPositive for packaging: Increase driven by e-commerce and food deliveryPositive in all regionsNegative for decorative papers, but better view on at-home consumptionSource: Suzano Market Intelligence61% Tissue20% P&WNegative driven by sharp decrease in Europe and Americas12