- SUZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Suzano (SUZ) 6-KCurrent report (foreign)

Filed: 24 Mar 21, 8:40am

Exhibit 99.1

| [LOGO] |

| What we have learnt from the Covid-19 pandemic... At the society level: To be even more connected and supportive Socio-economically diverse Investments of R$185 million to protect people and society Less exposed to social risk Joint efforts to accelerate vaccination program for the Brazilian population Liquidity program for small suppliers and service providers Participation in a project to produce 6,500 ventilators Related SDGs Hospital construction and assistance in regions Where we operate Income generation initiatives for nearby communities Long Term Goals for Suzano Mitigate income inequality | Education Technical assistance for indigenous and other traditional communities to access public policies during emergencies 2 |

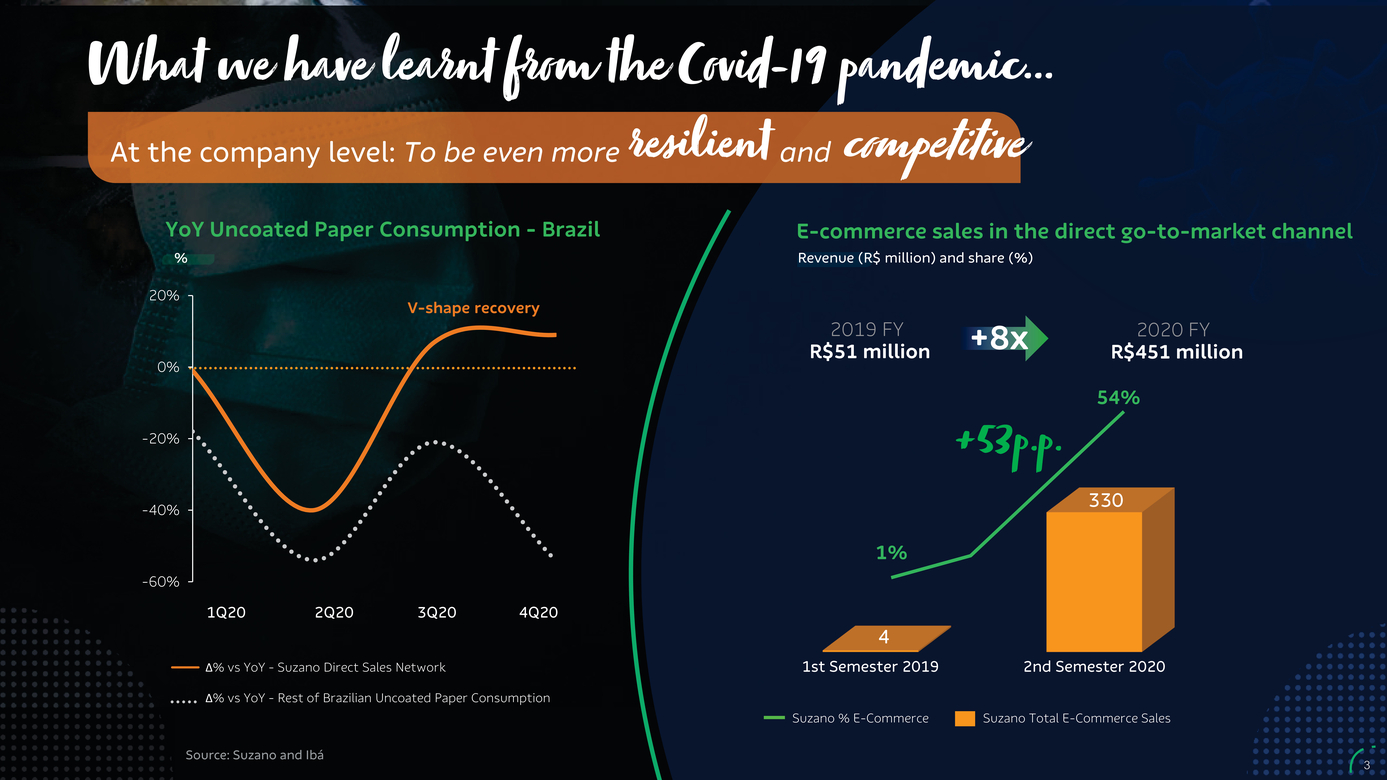

| What we have learnt from the Covid-19 pandemic... At the company level: To be even more resilient and competitive YoY Uncoated Paper Consumption - Brazil % E-commerce sales in the direct go-to-market channel Revenue (R$ million) and share (%) 20% 0% -20% -40% shape recovery 2019 FY R$51 million +8x +53p.p. 2020 FY R$451 million 54% 330 -60% 1Q202Q20 3Q20 1% 4Q20 4 ∆% vs YoY - Suzano Direct Sales Network 1st Semester 20192nd Semester 2020 ∆% vs YoY - Rest of Brazilian Uncoated Paper Consumption Suzano % E-CommerceSuzano Total E-Commerce Sales Source: Suzano and Ibá 3 |

| What we have learnt from the Covid-19 pandemic... At the planet level: To be even more guided by Purpose Our PurposeIn action... Using only raw materials from renewable sources, beginning with planted and harvested eucalyptus Production that preserves the native vegetation and biodiversity Storing more tons of carbon, for an even more positive climate impact Developing packaging that is recyclable and biodegradable Replacing other materials 4 |

| 1.Strategy 2. Financial Management 3. Outlook with Purpose 5 |

| Avenues Maintain relevance in Pulp, through good projects Expand boldly into New Markets Be “Best-in-Class” in the Total Pulp Cost vision Play a leading role in sustainability 6 |

| Avenues Be “Best-in-Class” in the Total Pulp Cost vision 7 |

| Digital Forestry sector. Pioneering Groundbreaking digital tool for the forestry Tetrys Numerous scenarios to define the best clone / environment match. 10B0e%nefits Risk Management Analytics / big data to anticipate and mitigate climate change risks. Reduced volatility in forest productivity. 2021 planting program: 2% gain on productivity (vs. 2020). Reduction in the average forest-to-mill distance. Producing more with less natural resources. 8 |

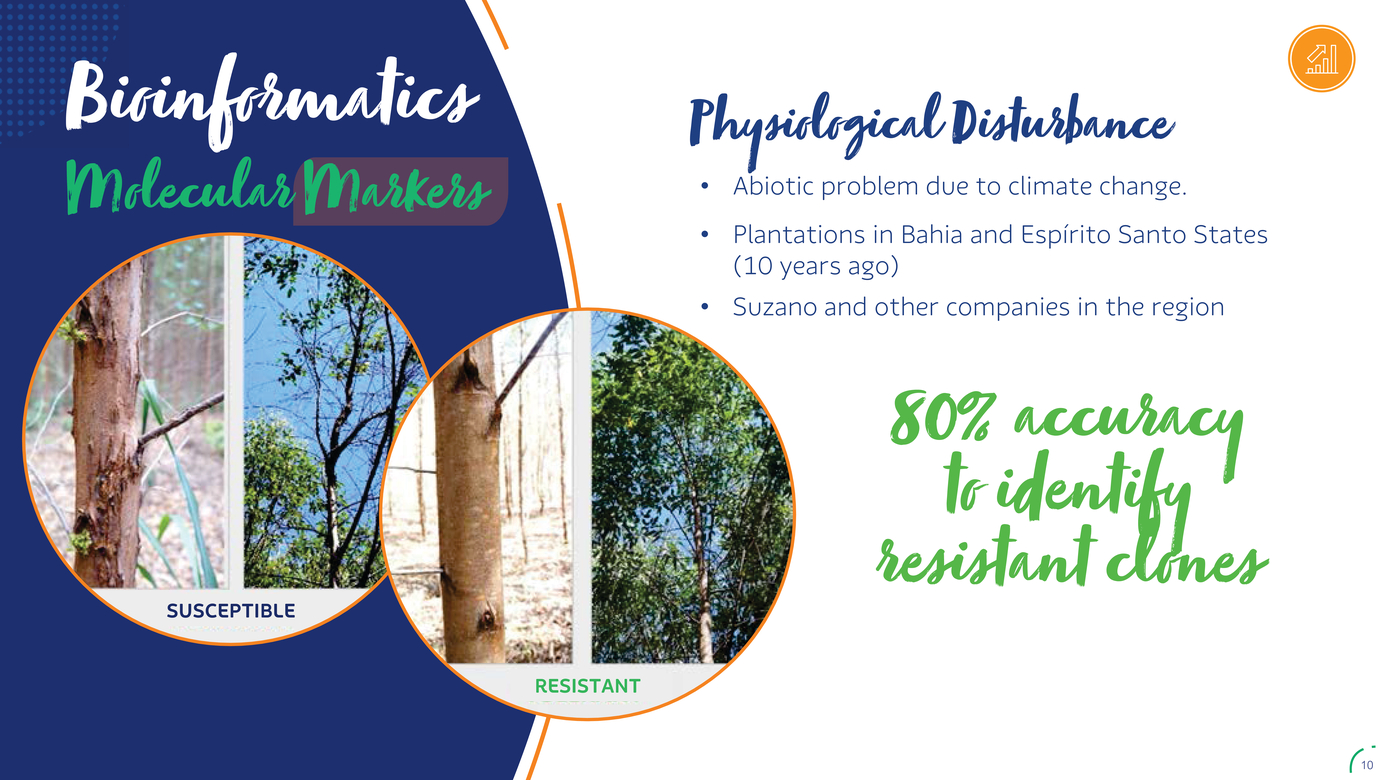

| BioinformaticsClone Selection based on DNA Molecular Markers Milestone in Forestry Breeding! 300,000 trees are candidates for cloning Fast elimination of inadequate candidates Better selection of genetic materials for our long-term tree breeding program More precise selection of commercial clones 9 |

| Bioinformatics Molecular Markers Physiological Disturbance Abiotic problem due to climate change. Plantations in Bahia and Espírito Santo States (10 years ago) Suzano and other companies in the region 80% accuracy to identify resistant clones SUSCEPTIBLE 10 |

| Competitiveness and resilience that comes from the forest base Base repositioning Closer areas that reduce average distance from forest to mill and emissions - towards the goal of 156 km in 2024 Optimized Genetic Base Total Operational Disbursement (TOD) Reduction Forestry Productivity 11 |

| Higher Logistics Efficiency SHiexxa-ttrermailer Trucks Case: BA and MS Other Initiatives Use of Natural Gas Electric Trucks More Optimized Light Trucks Autonomous Vehicles Lower Logistics Cost Reduced emission 12 |

| Digital Forestry Base Geo Mapping (Wood Specification) “With the Best Operating Sequence” (Harvest Planning) ecognition 24h Monitoring of Operations Productivit lerts 13 |

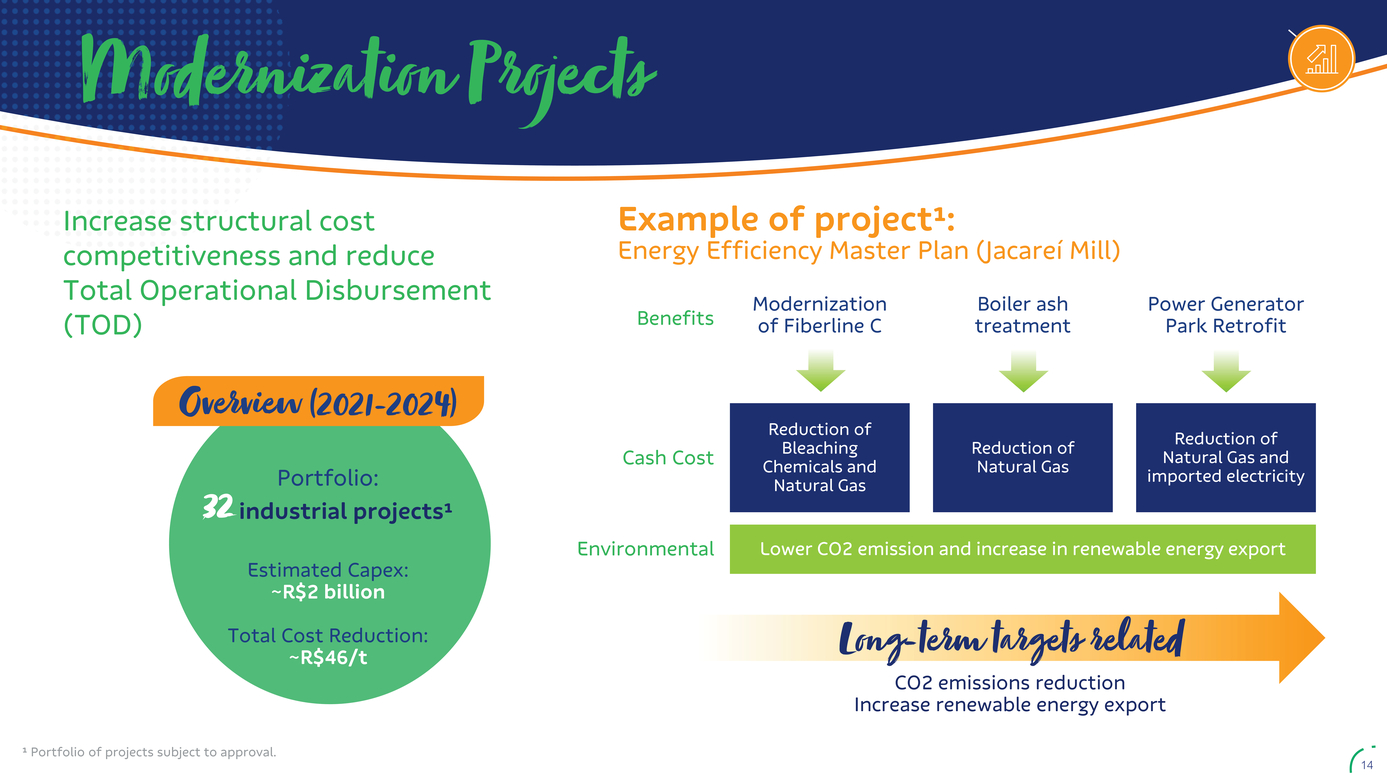

| Modernization Projects Increase structural cost competitiveness and reduce Example of project¹: Energy Efficiency Master Plan (Jacareí Mill) Total Operational Disbursement (TOD) Benefits Modernization of Fiberline C Boiler ash treatment Power Generator Park Retrofit Overview (2021-2024) Portfolio: 32 industrial projects¹ Estimated Capex: ~R$2 billion Total Cost Reduction: ~R$46/t Reduction of Bleaching Chemicals and Natural Gas Reduction of Natural Gas Reduction of Natural Gas and imported electricity Environmental Long-term targets related CO2 emissions reduction Increase renewable energy export ¹ Portfolio of projects subject to approval. 14 |

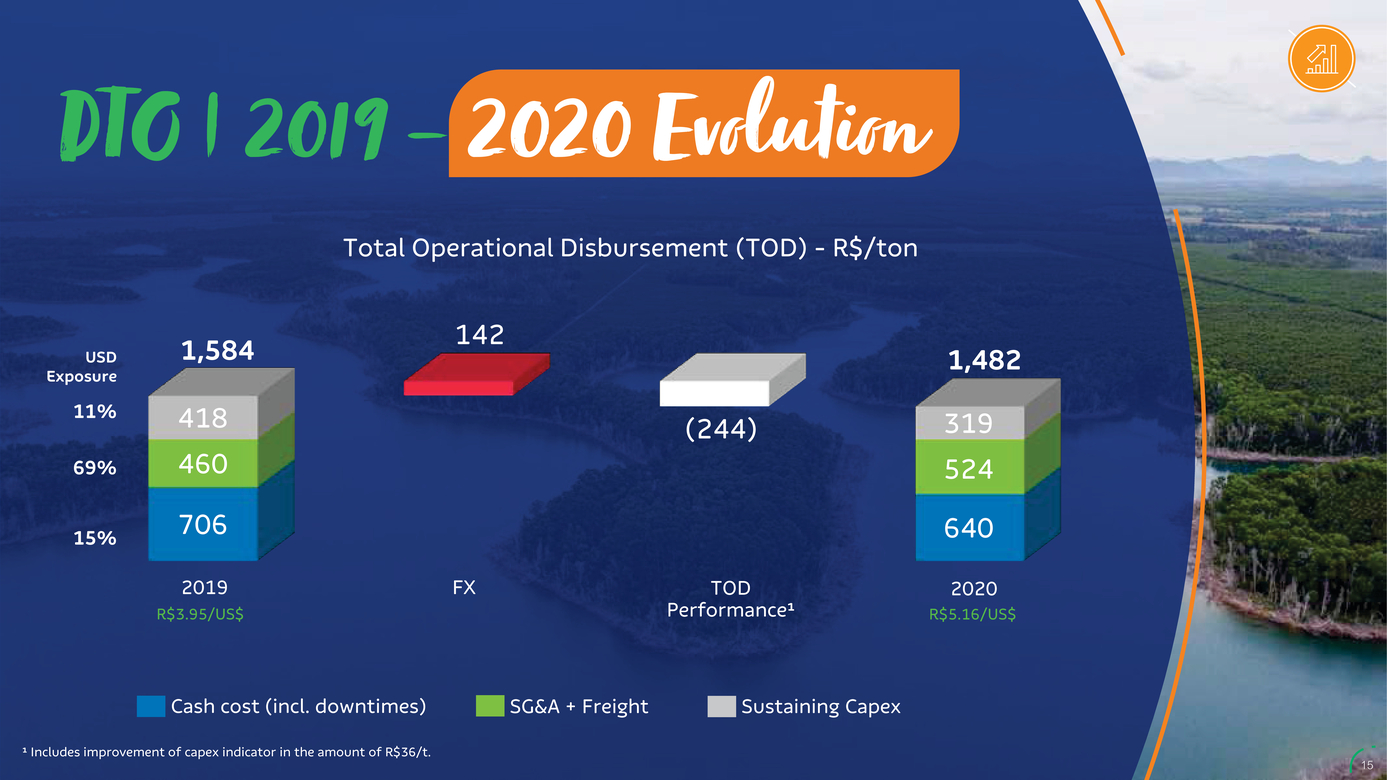

| DTO | 2019 – 2020 Evolution Total Operational Disbursement (TOD) - R$/ton USD Exposure 11% 69% 15% 1,584 418 460 706 142 (244) 1,482 319 524 640 FX TOD Performance¹ 2020 R$5.16/US$ R$3.95/US$ Cash cost (incl. downtimes) SG&A + Freight Sustaining Capex ¹ Includes improvement of capex indicator in the amount of R$36/t. 15 |

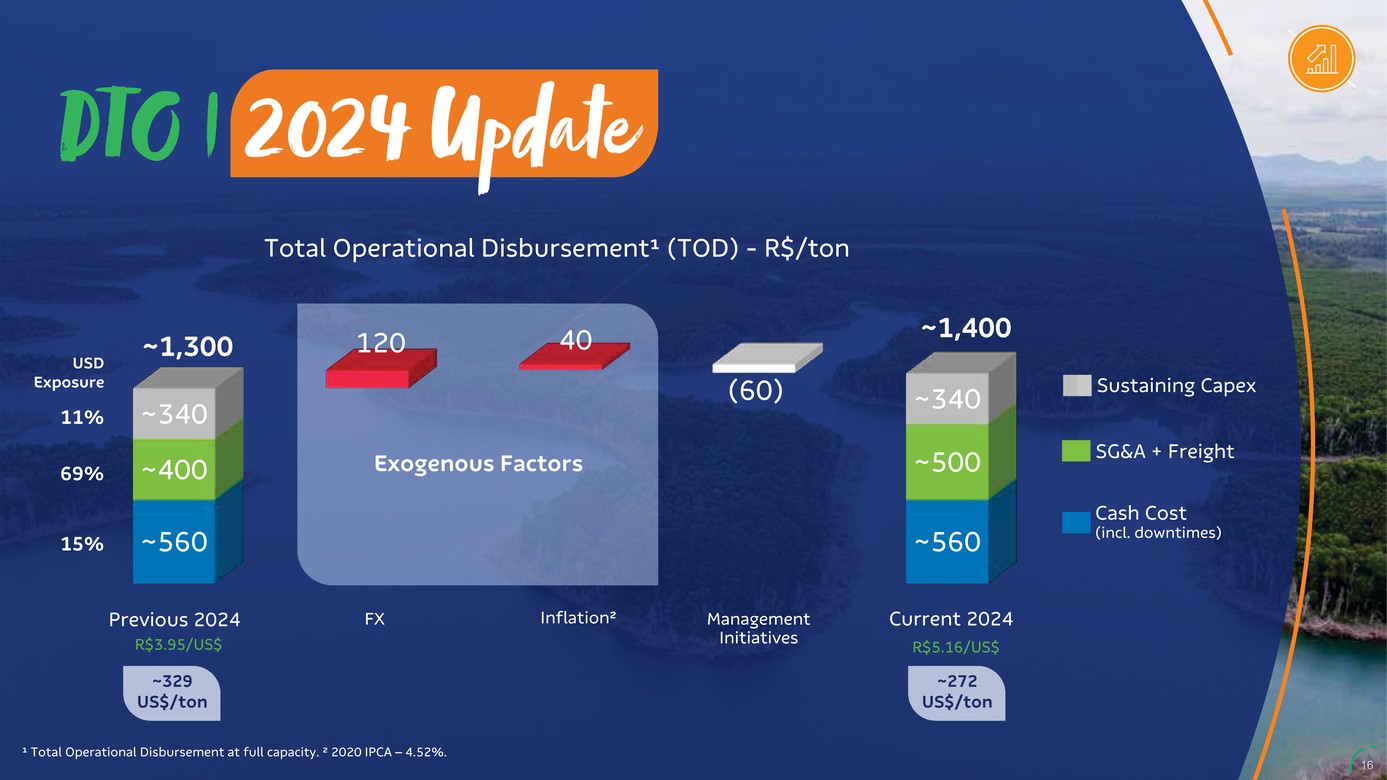

| DTO | 2024 Update Total Operational Disbursement¹ (TOD) - R$/ton USD Exposure ~1,300 12040 (60) ~1,400 Sustaining Capex 11% ~340~340 SG&A + Freight 69% ~400 ~500 Cash Cost 15% ~560~560 (incl. downtimes) Previous 2024FX R$3.95/US$ Inflation² Management Initiatives Current 2024 R$5.16/US$ ~329 US$/ton ~272 US$/ton ¹ Total Operational Disbursement at full capacity. ² 2020 IPCA – 4.52%. 16 |

| Avenues Maintain relevance in Pulp, through good projects 17 |

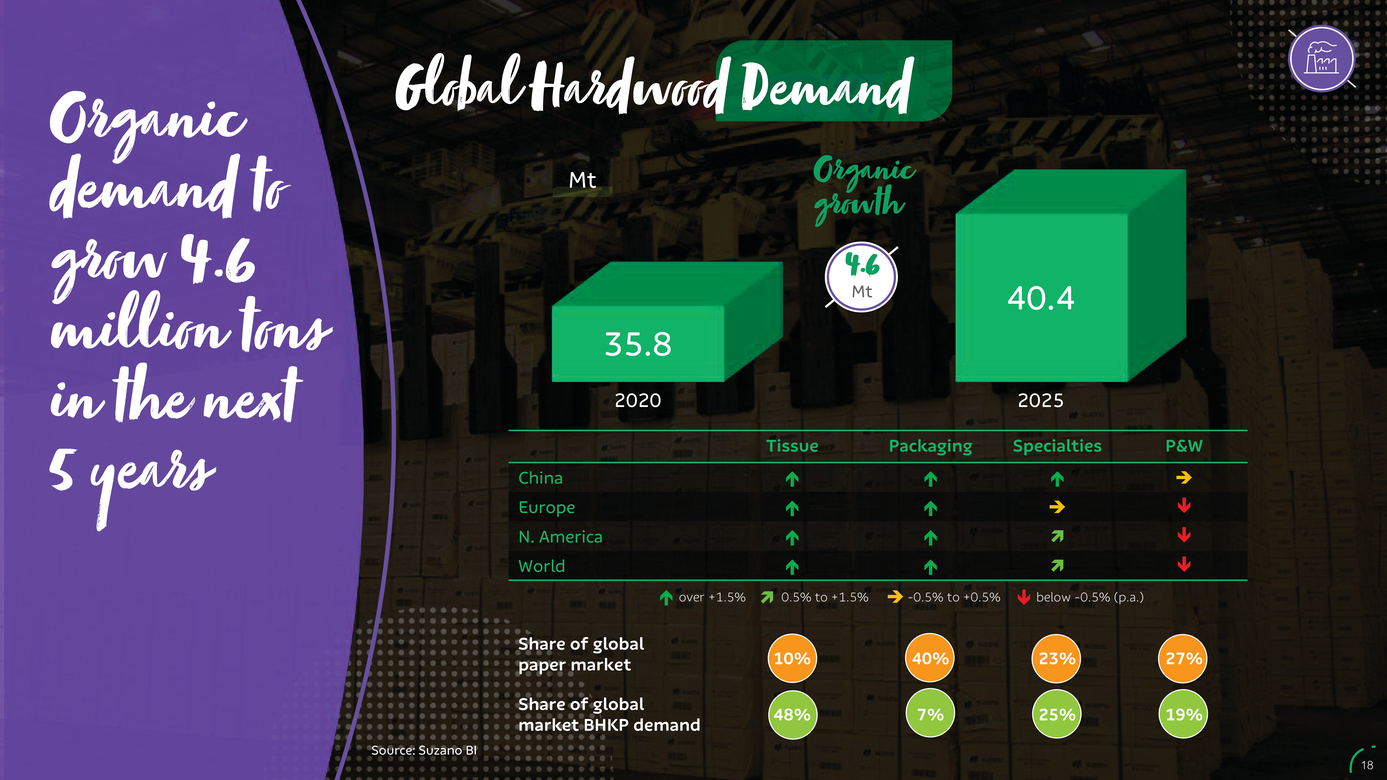

| Organic Global Hardwood Demand demand to grow 4.6 million tons Mt 35.8 Organic growth 4.6 Mt 40.4 Tissue Packaging Specialties P&W China Europe N. America World 20202025 Source: Suzano BI 18 |

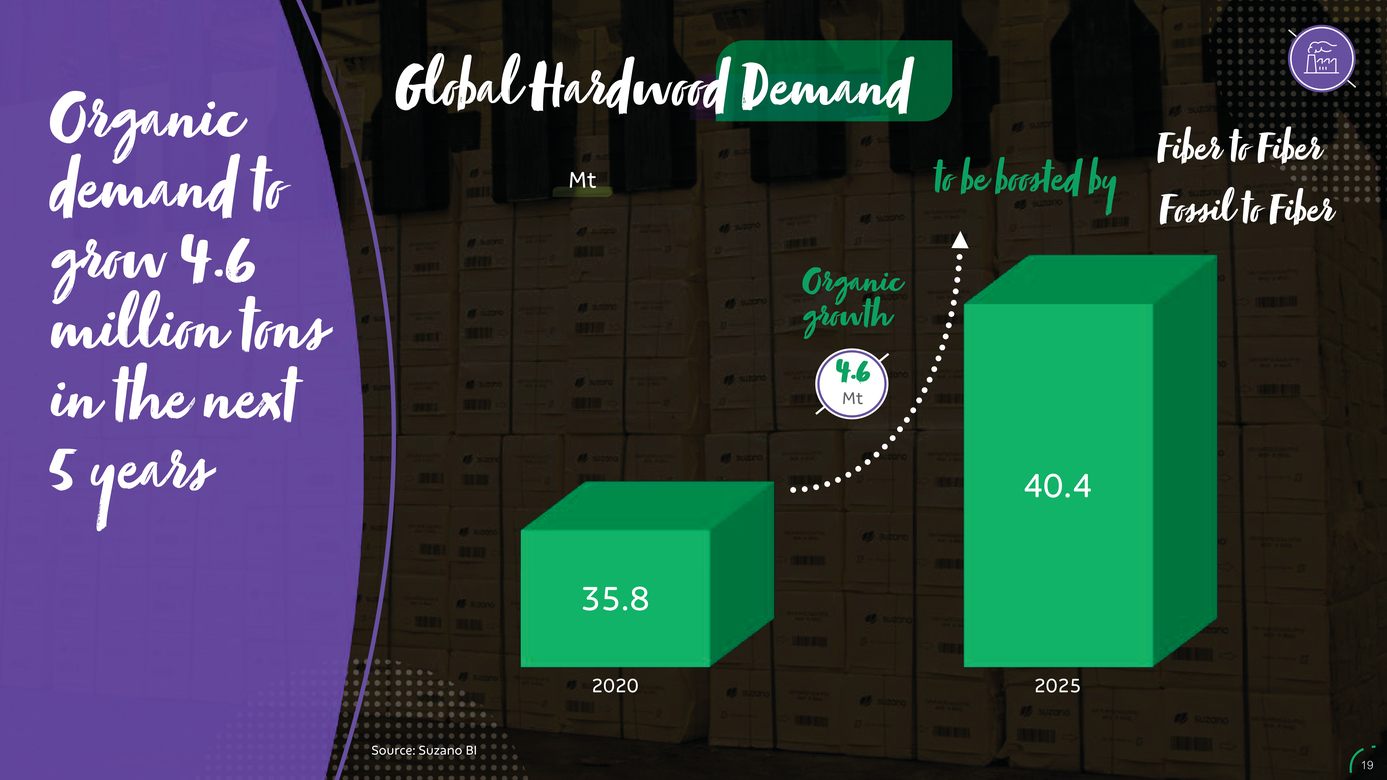

| Organic demand to Global Hardwood Demand Mt to be boosted by Fiber to Fiber Fossil to Fiber grow 4.6 million tons in the next 5 years Organic growth 4.6 Mt 40.4 35.8 20202025 Source: Suzano BI 19 |

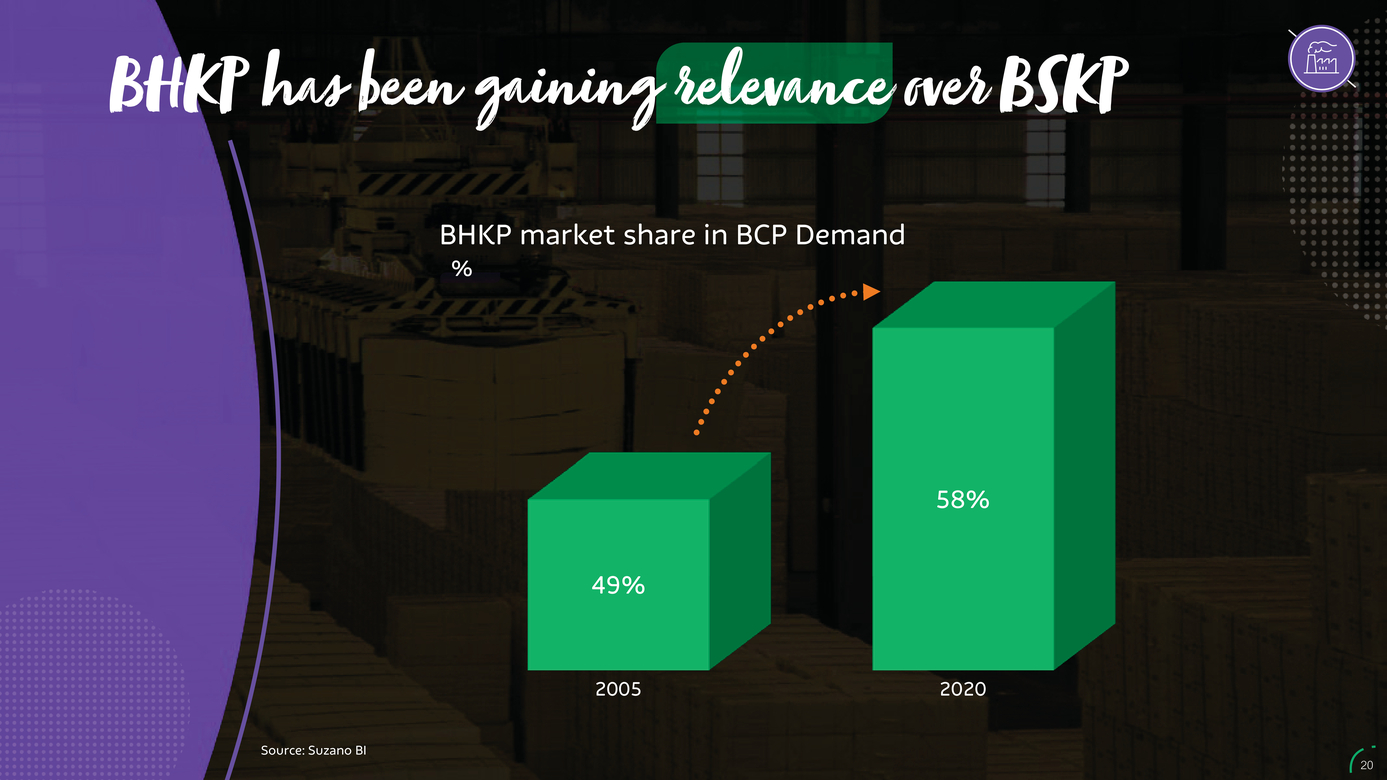

| BHKP has been gaining relevance over BSKP BHKP market share in BCP Demand % 58% 49% 20052020 Source: Suzano BI 20 |

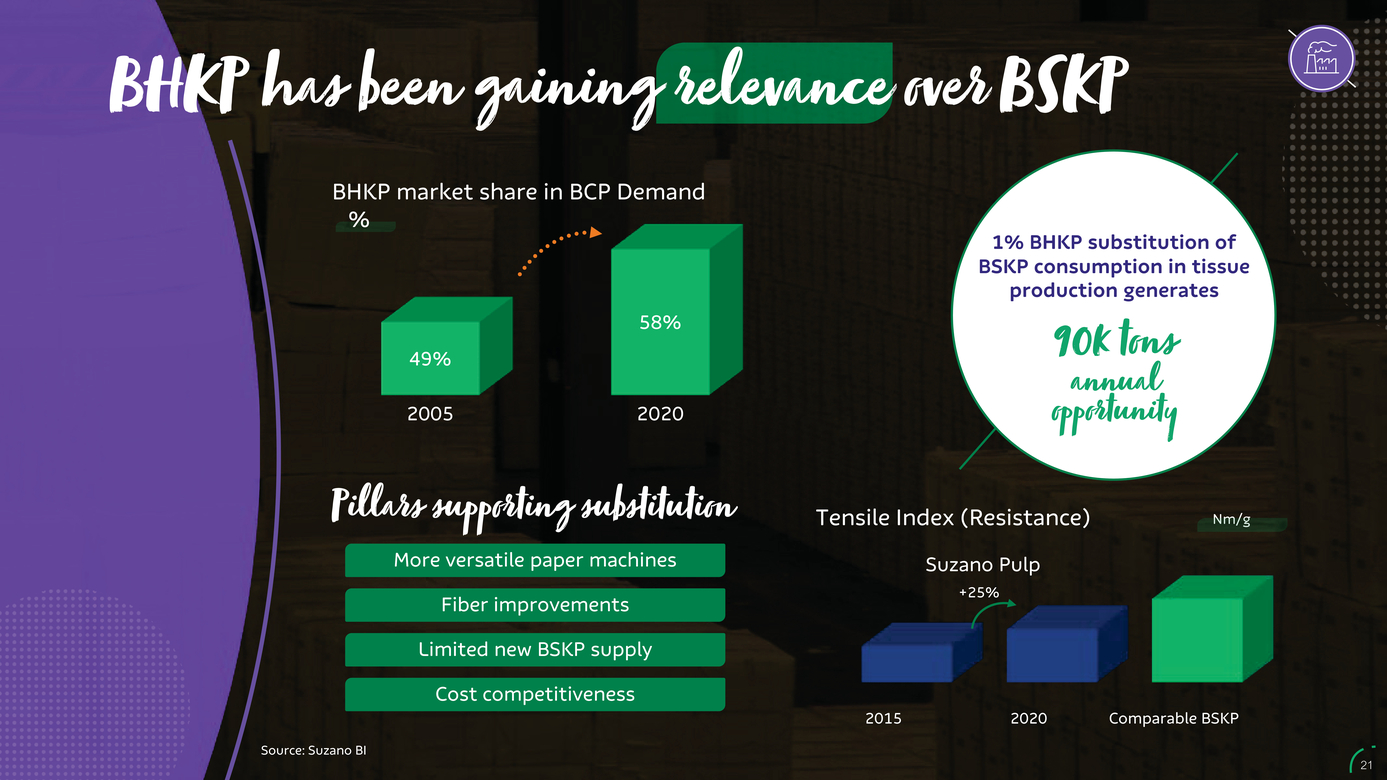

| BHKP has been gaining relevance over BSKP BHKP market share in BCP Demand % 58% 49% 2005 2020 90k tons annual opportunity More versatile paper machines Fiber improvements Tensile Index (Resistance)Nm/g Suzano Pulp +25% Limited new BSKP supply Cost competitiveness Source: Suzano BI 21 |

| New opportunities will bring potential for demand growth Mt in 5 years Fiber to Fiber: other factors increasing the addressable market Reducing RCP/SOP availability Reduction in nonwood pulp production in China De-integration due to lack of wood availability Source: Suzano BI 22 |

| result in exponential Fossil to Fiber Unleashed potential 190 million tons First estimates account for paper addressing 32 million tons single use plastic market plastic substitution in the next 20 years(1) Source: Suzano BI | (1) “Breaking the plastic wave” study from Pew Trusts (2020) supported by University of Oxford and Ellen Mcarthur Foundation 23 |

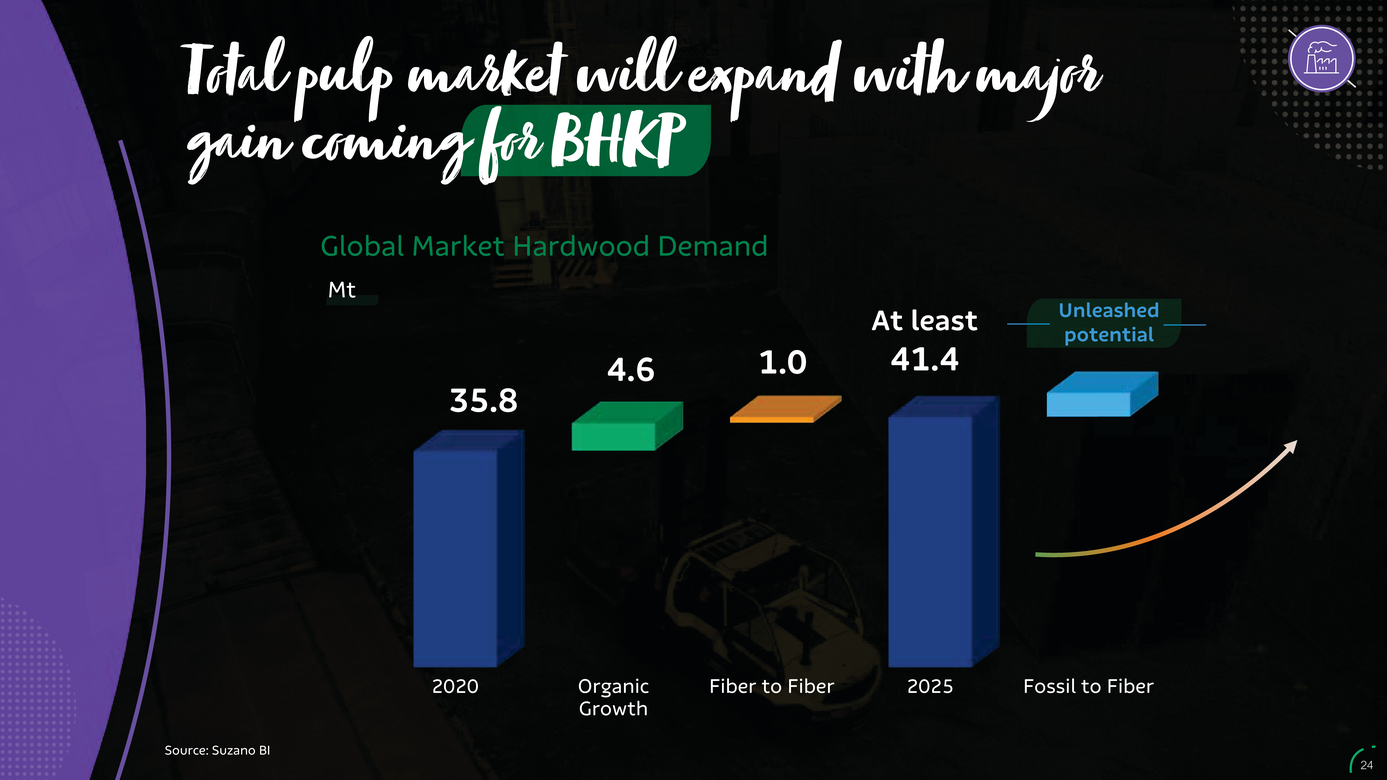

| Total pulp market will expand with major gain coming for BHKP Global Market Hardwood Demand Mt 4.61.0 At least 41.4 Unleashed potential 35.8 2020Organic Growth Fiber to Fiber2025Fossil to Fiber Source: Suzano BI 24 |

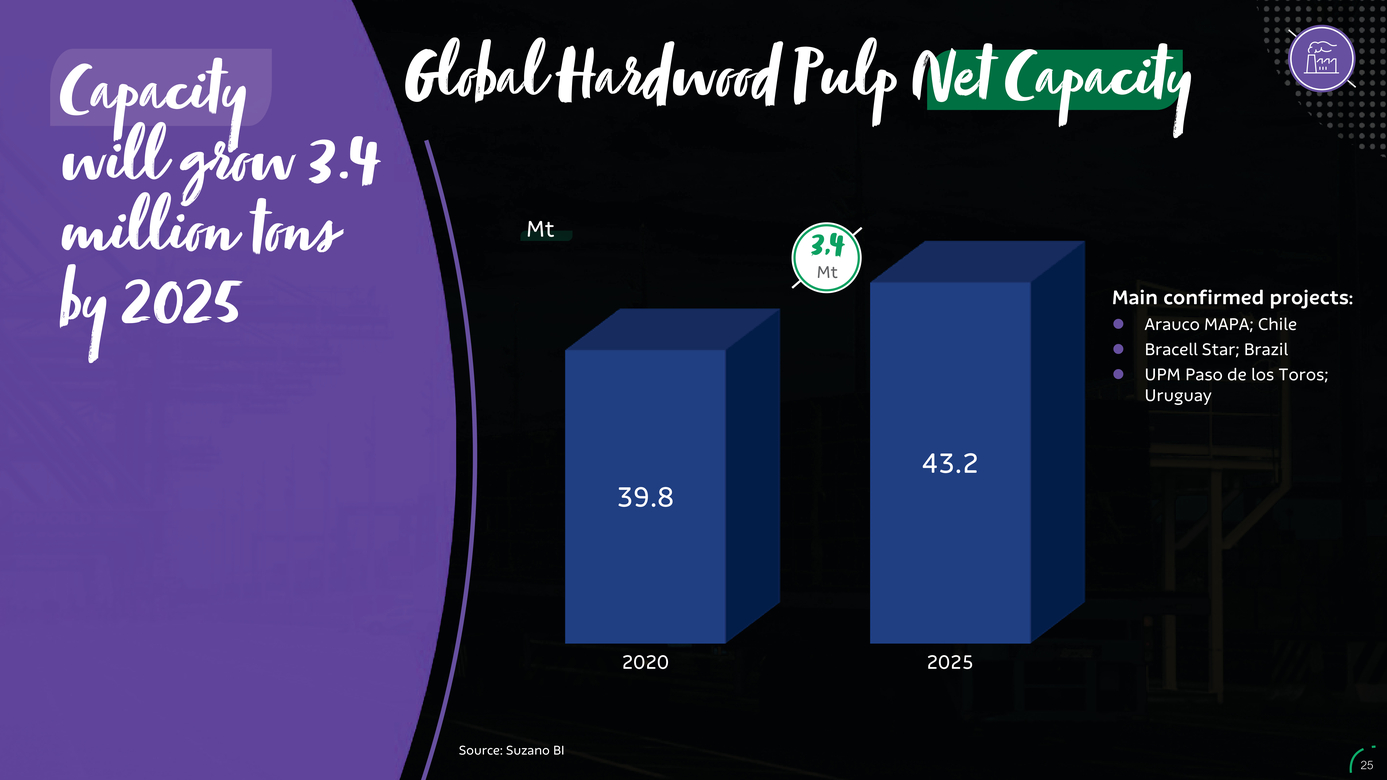

| Capacity will grow 3.4 million tons by 2025 Global Hardwood Pulp Net Capacity Mt 3,4 Mt Main confirmed projects: Arauco MAPA; Chile Bracell Star; Brazil UPM Paso de los Toros; Uruguay 39.8 43.2 20202025 Source: Suzano BI 25 |

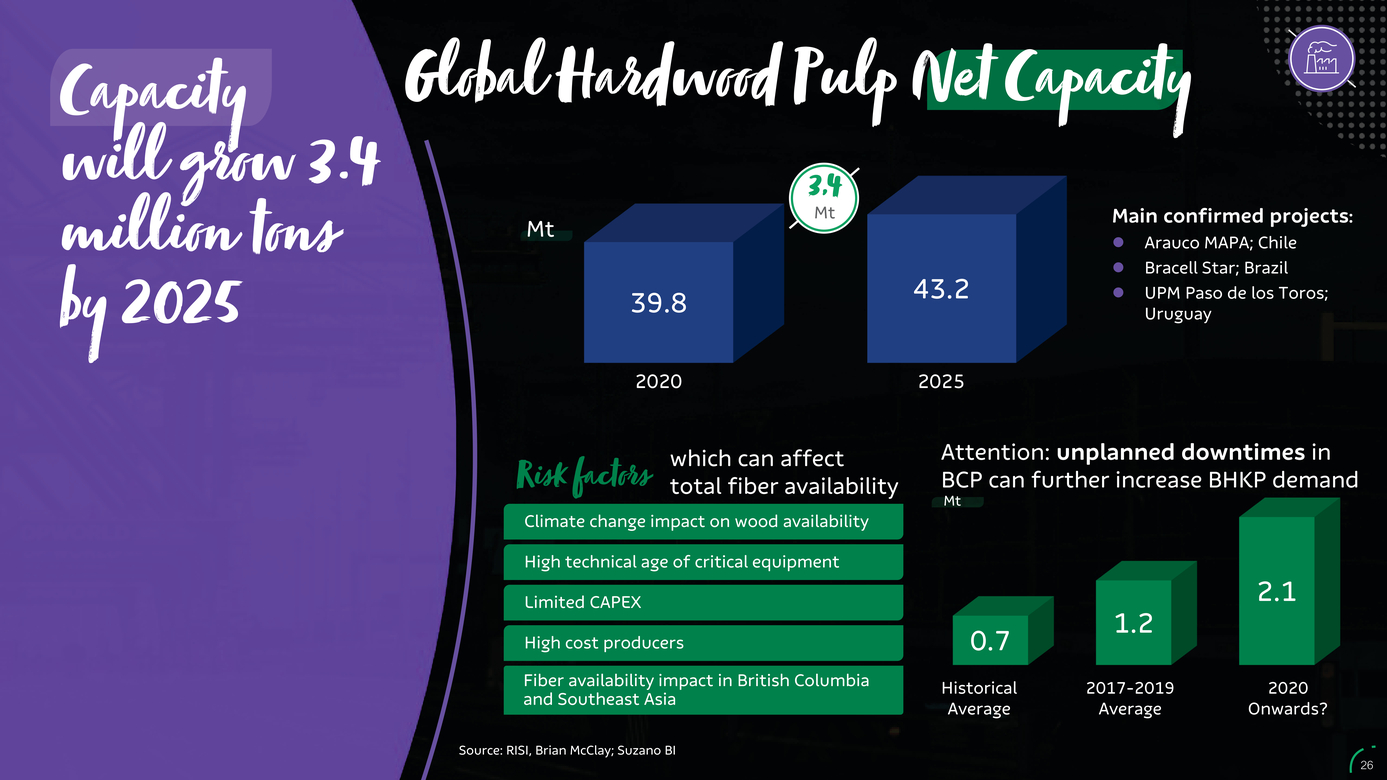

| Capacity will grow 3.4 Global Hardwood Pulp Net Capacity 3,4 MtMain confirmed projects: million tons by 2025 Mt 39.843.2 20202025 Arauco MAPA; Chile Bracell Star; Brazil UPM Paso de los Toros; Uruguay Risk factors which can affect total fiber availability Climate change impact on wood availability High technical age of critical equipment Limited CAPEX High cost producers Fiber availability impact in British Columbia and Southeast Asia Attention: unplanned downtimes in BCP can further increase BHKP demand Mt 2.1 0.7 1.2 2017-2019 Average 2020 Onwards? Source: RISI, Brian McClay; Suzano BI 26 |

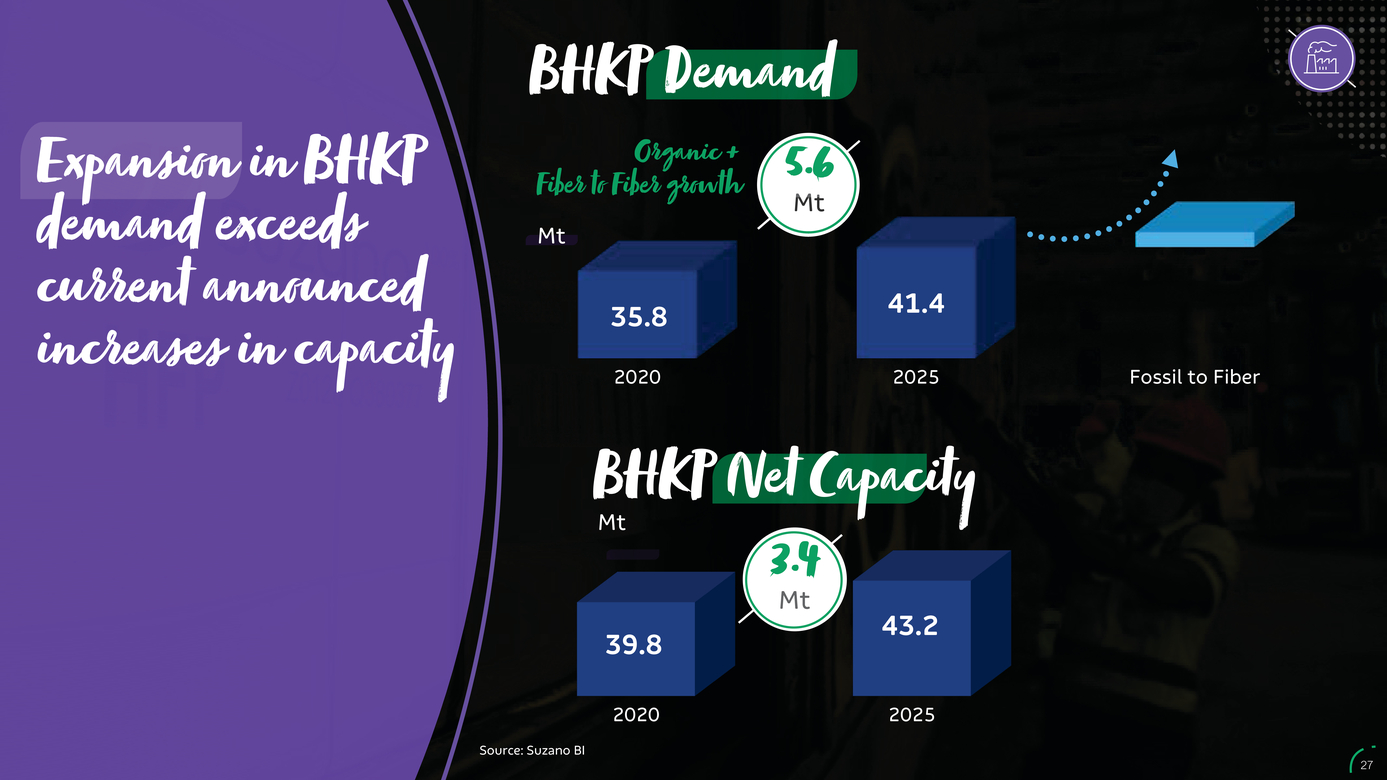

| BHKP Demand Expansion in BHKP Organic + Fiber to Fiber growth 5.6 Mt demand exceeds current announced increases in capacity Mt 35.841.4 20202025Fossil to Fiber BHKP Net Capacity Mt 3.4 Mt 39.843.2 20202025 Source: Suzano BI 27 |

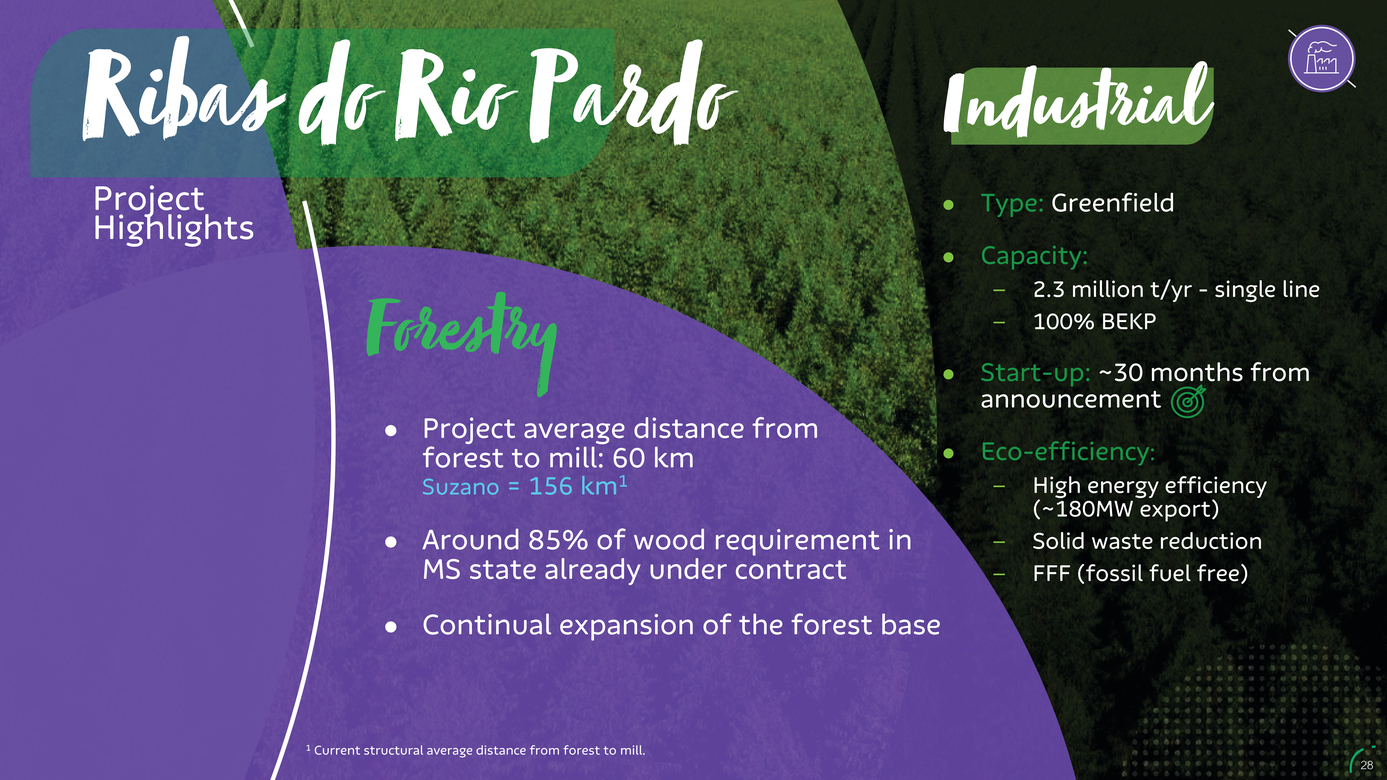

| Ribas do Rio Pardo Project Highlights Forestry Project average distance from forest to mill: 60 km Suzano = 156 km1 Around 85% of wood requirement in MS state already under contract Continual expansion of the forest base Industrial Type: Greenfield Capacity: 2.3 million t/yr - single line 100% BEKP Start-up: ~30 months from announcement Eco-efficiency: High energy efficiency (~180MW export) Solid waste reduction FFF (fossil fuel free) 1 Current structural average distance from forest to mill. 28 |

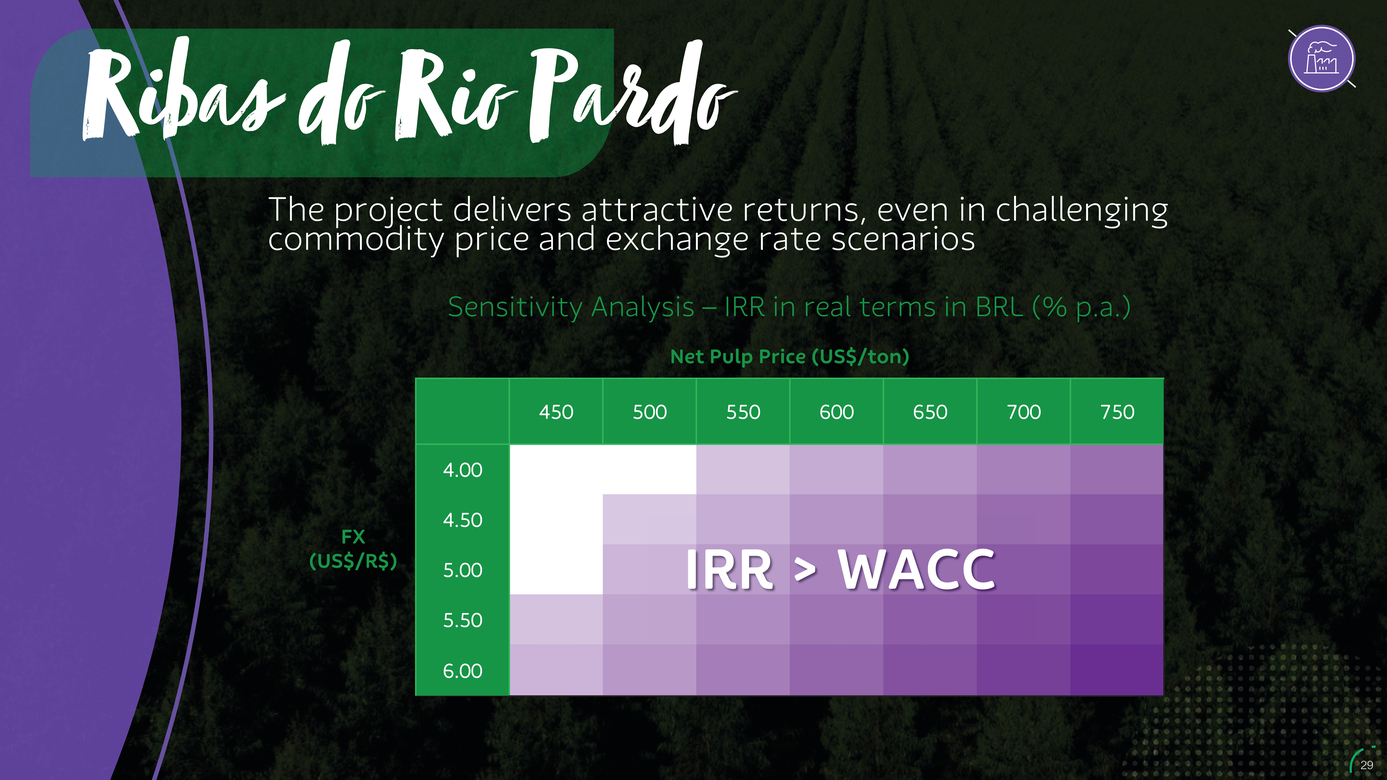

| Ribas do Rio Pardo The project delivers attractive returns, even in challenging commodity price and exchange rate scenarios Sensitivity Analysis – IRR in real terms in BRL (% p.a.) Net Pulp Price (US$/ton) 450500550600650700750 4.00 (US$/R$) 4.50 5.00 5.50 6.00 IRR > WACC 29 |

| Avenues Advance in the links of the chain, always with competitive advantage 30 |

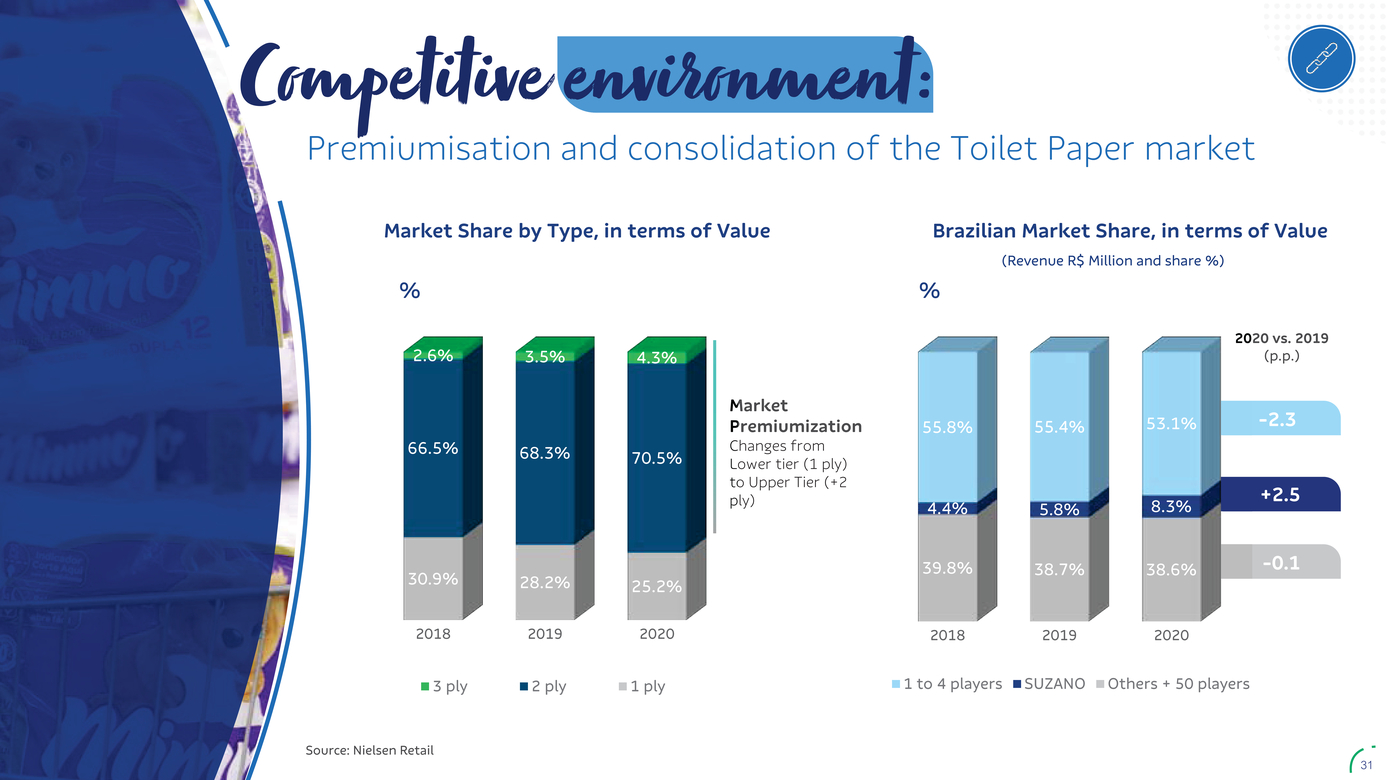

| environment: Premiumisation and consolidation of the Toilet Paper market Market Share by Type, in terms of Value Brazilian Market Share, in terms of Value (Revenue R$ Million and share %) %% 2020 vs. 2019 (p.p.) 55.8% 55.4% 53.1% -2.3 4.4% 5.8% 8.3% +2.5 39.8% 38.7% 38.6% -0.1 66.5%68.3%70.5% Market Premiumization Changes from Lower tier (1 ply) to Upper Tier (+2 ply) 30.9%28.2%25.2% 201820192020 201820192020 3 ply2 ply1 ply 1 to 4 playersSUZANOOthers + 50 players Source: Nielsen Retail 31 |

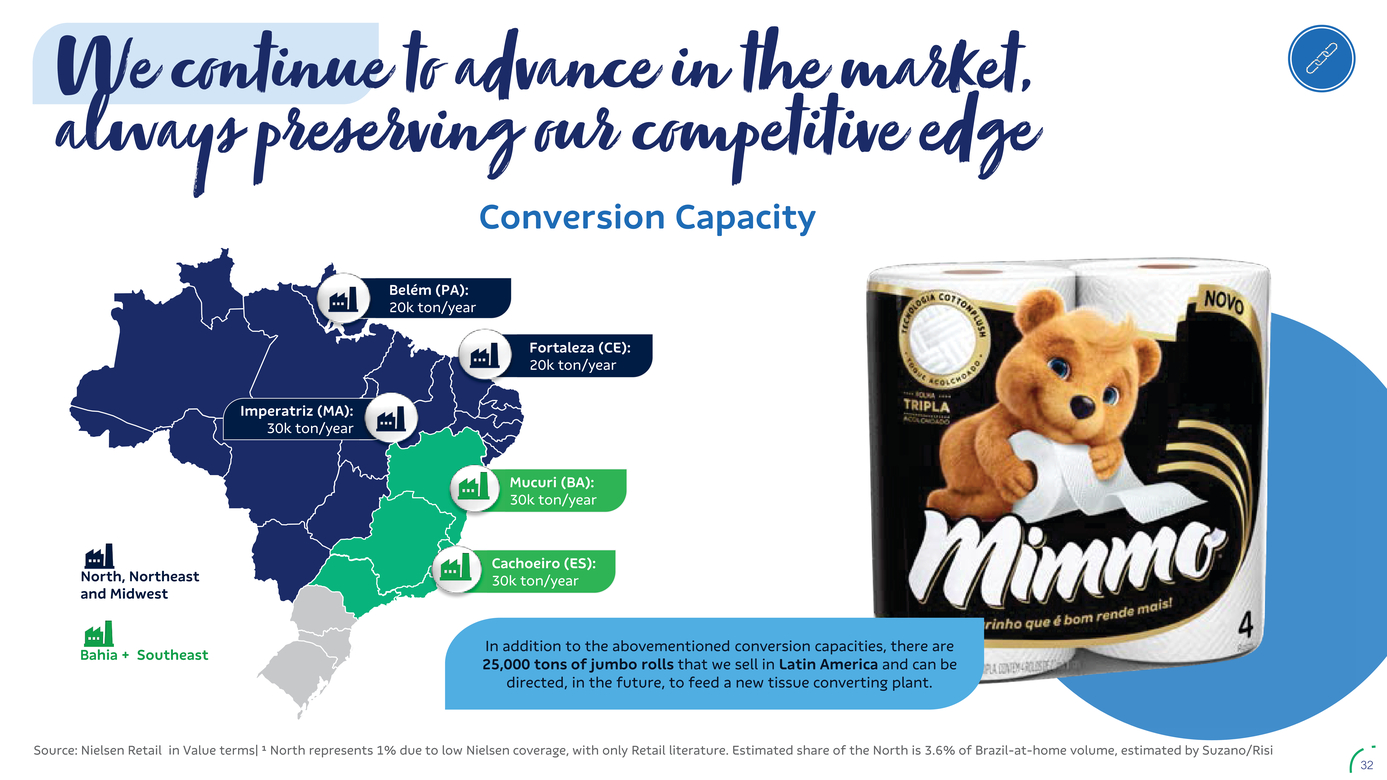

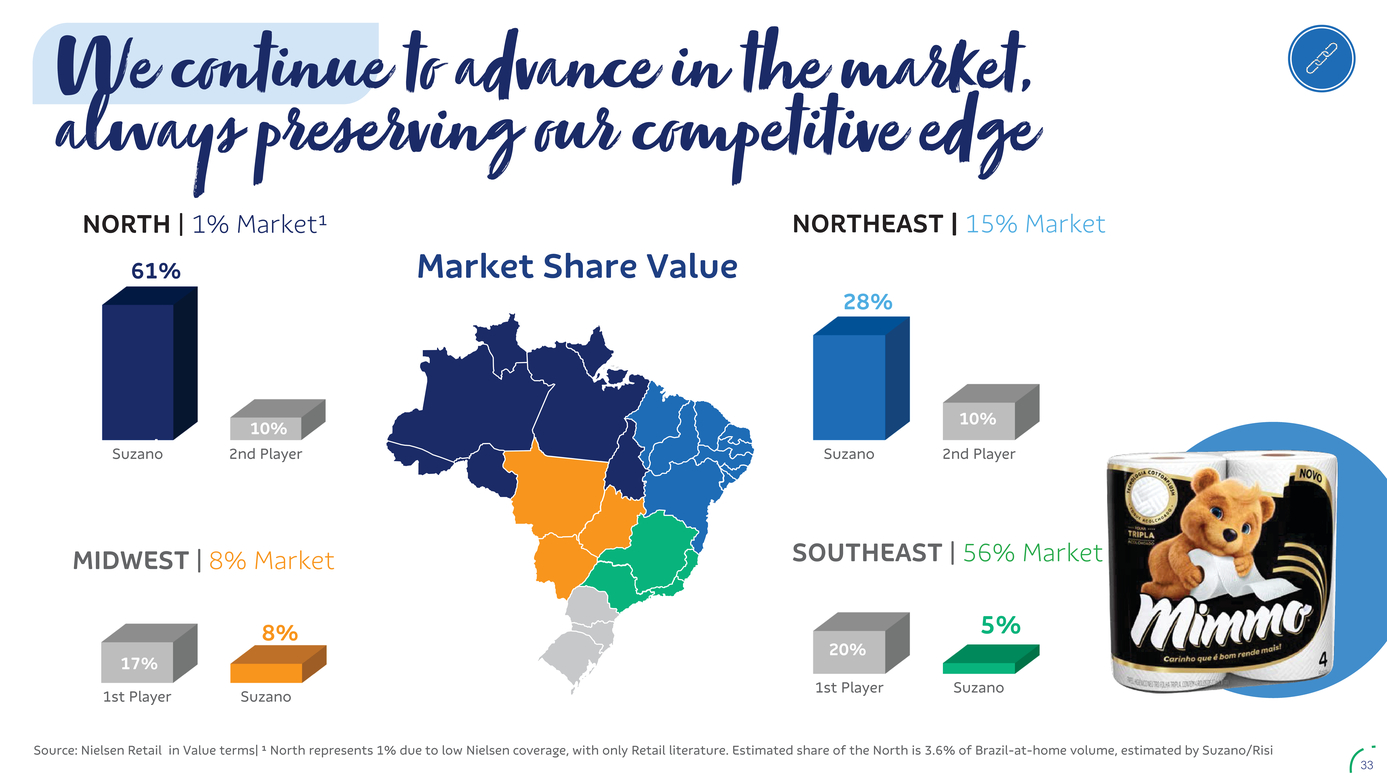

| We continue to advance in the market, always preserving our competitive edge Conversion Capacity Belém (PA): 20k ton/year Fortaleza (CE): 20k ton/year Imperatriz (MA): 30k ton/year Mucuri (BA): 30k ton/year North, Northeast and Midwest Bahia + Southeast Cachoeiro (ES): 30k ton/year In addition to the abovementioned conversion capacities, there are 25,000 tons of jumbo rolls that we sell in Latin America and can be directed, in the future, to feed a new tissue converting plant. Source: Nielsen Retail in Value terms| ¹ North represents 1% due to low Nielsen coverage, with only Retail literature. Estimated share of the North is 3.6% of Brazil-at-home volume, estimated by Suzano/Risi 32 |

| We continue to advance in the market, always preserving our competitive edge NORTH | 1% Market¹NORTHEAST | 15% Market 61% 10% 28% 10% Suzano 2nd Player SOUTHEAST | 56% Market 5% 20% 1st Player Suzano Suzano2nd Player MIDWEST | 8% Market 8% 17% 1st Player Suzano Source: Nielsen Retail in Value terms| ¹ North represents 1% due to low Nielsen coverage, with only Retail literature. Estimated share of the North is 3.6% of Brazil-at-home volume, estimated by Suzano/Risi 33 |

| Avenues Expand boldly into New Markets 34 |

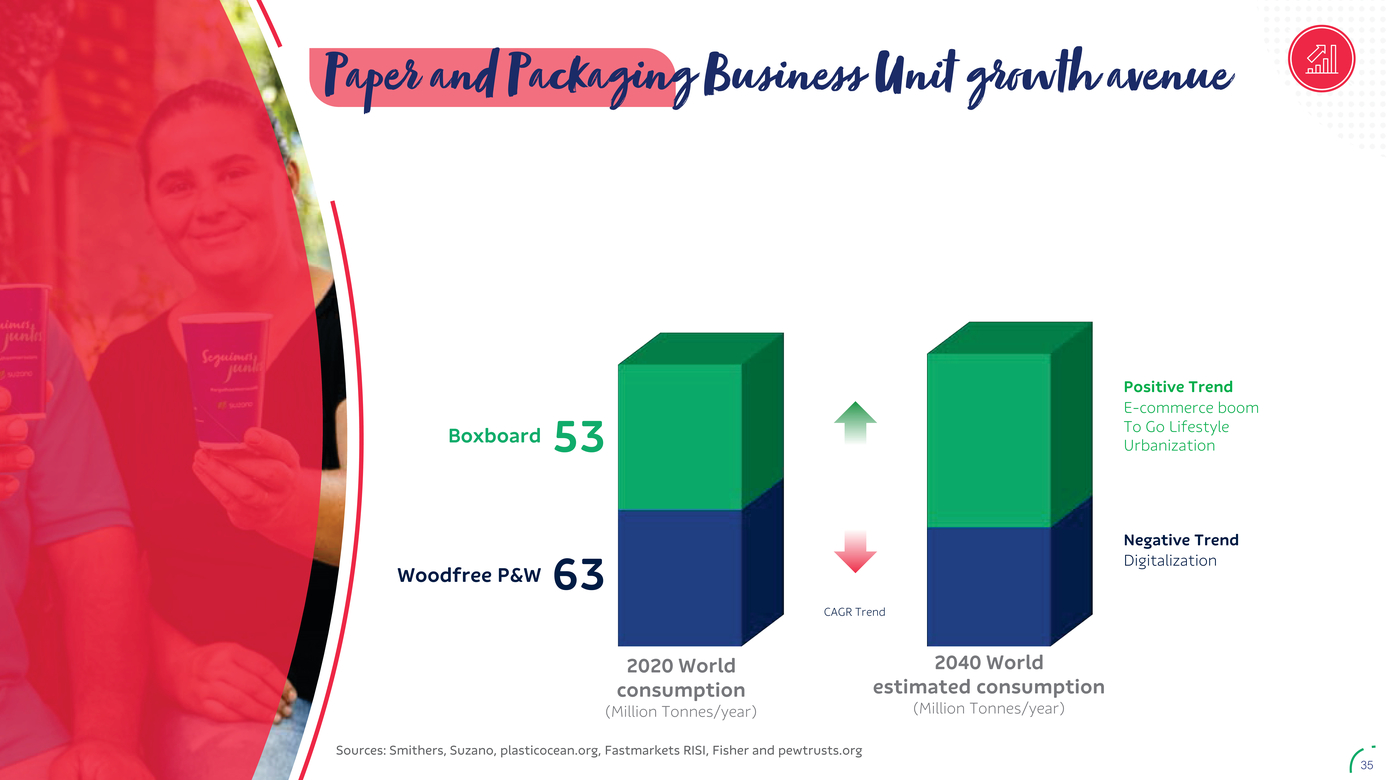

| Paper and Packaging Business Unit growth avenue Boxboard 53 Positive Trend E-commerce boom To Go Lifestyle Urbanization Woodfree P&W 63 CAGR Trend Negative Trend Digitalization 2020 World consumption (Million Tonnes/year) 2040 World estimated consumption (Million Tonnes/year) Sources: Smithers, Suzano, plasticocean.org, Fastmarkets RISI, Fisher and pewtrusts.org 35 |

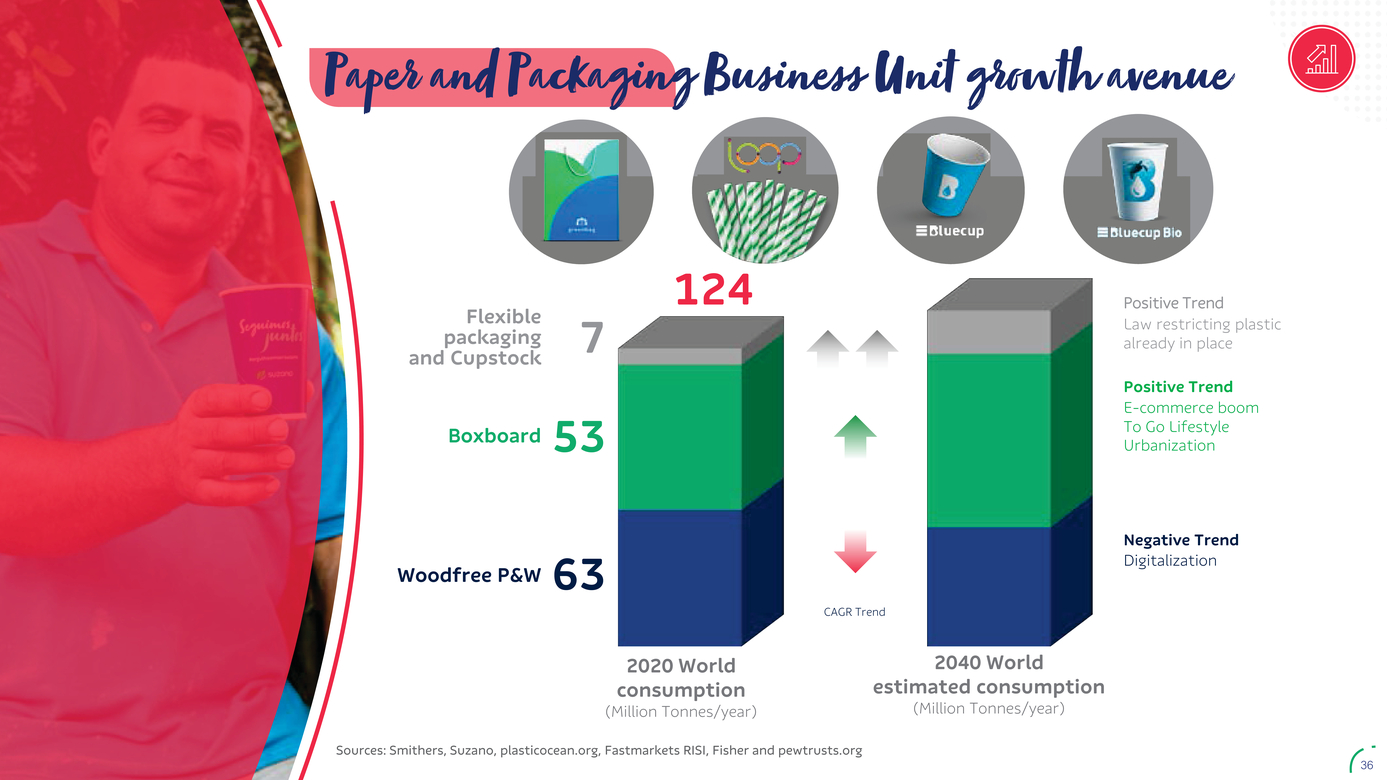

| Paper and Packaging Business Unit growth avenue 7 Boxboard 53 124 Positive Trend Law restricting plastic already in place Positive Trend E-commerce boom To Go Lifestyle Urbanization Woodfree P&W 63 CAGR Trend Negative Trend Digitalization 2020 World consumption (Million Tonnes/year) 2040 World estimated consumption (Million Tonnes/year) Sources: Smithers, Suzano, plasticocean.org, Fastmarkets RISI, Fisher and pewtrusts.org 36 |

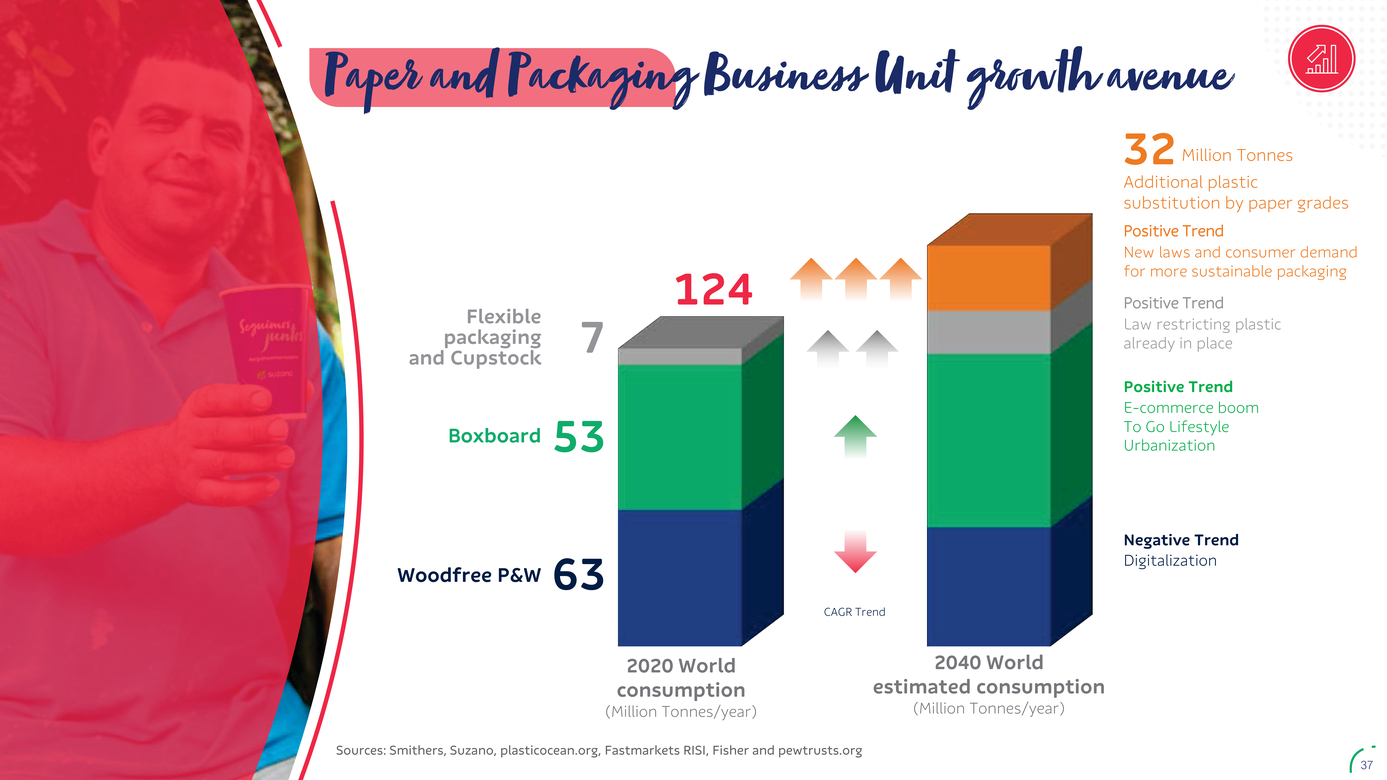

| Paper and Packaging Business Unit growth avenue 32 Million Tonnes Additional plastic substitution by paper grades Positive Trend New laws and consumer demand for more sustainable packaging 7 Boxboard 53 124 Positive Trend Law restricting plastic already in place Positive Trend E-commerce boom To Go Lifestyle Urbanization Woodfree P&W 63 CAGR Trend Negative Trend Digitalization 2020 World consumption (Million Tonnes/year) 2040 World estimated consumption (Million Tonnes/year) Sources: Smithers, Suzano, plasticocean.org, Fastmarkets RISI, Fisher and pewtrusts.org 37 |

| We already have in place several partnerships with end users, codeveloping solutions to address plastic substitution Our Roadmap Some of the partners already in place 38 |

| Recapping our Vision of the Future Replicating our business model success... ... to address multiple new large markets PRODUCTIVE FORESTS SCALE Exploring focused technologies and partnerships SUSTAINABILITY 39 |

| JV with Spinnova announced Fiber suspension Extrusion and drying Staple Fiber/Filament Start up 1Q22 Rights of 50% participation in wood based projects First project in Finland Start up 2Q22 Textile Fibers Building partnerships in a market with more than 100 Mt and looking for sustainable solutions 40 |

| Carbon markets advancing Carbon Trading Programs - World Sources: State and Trends on Carbon Pricing, May2020 41 |

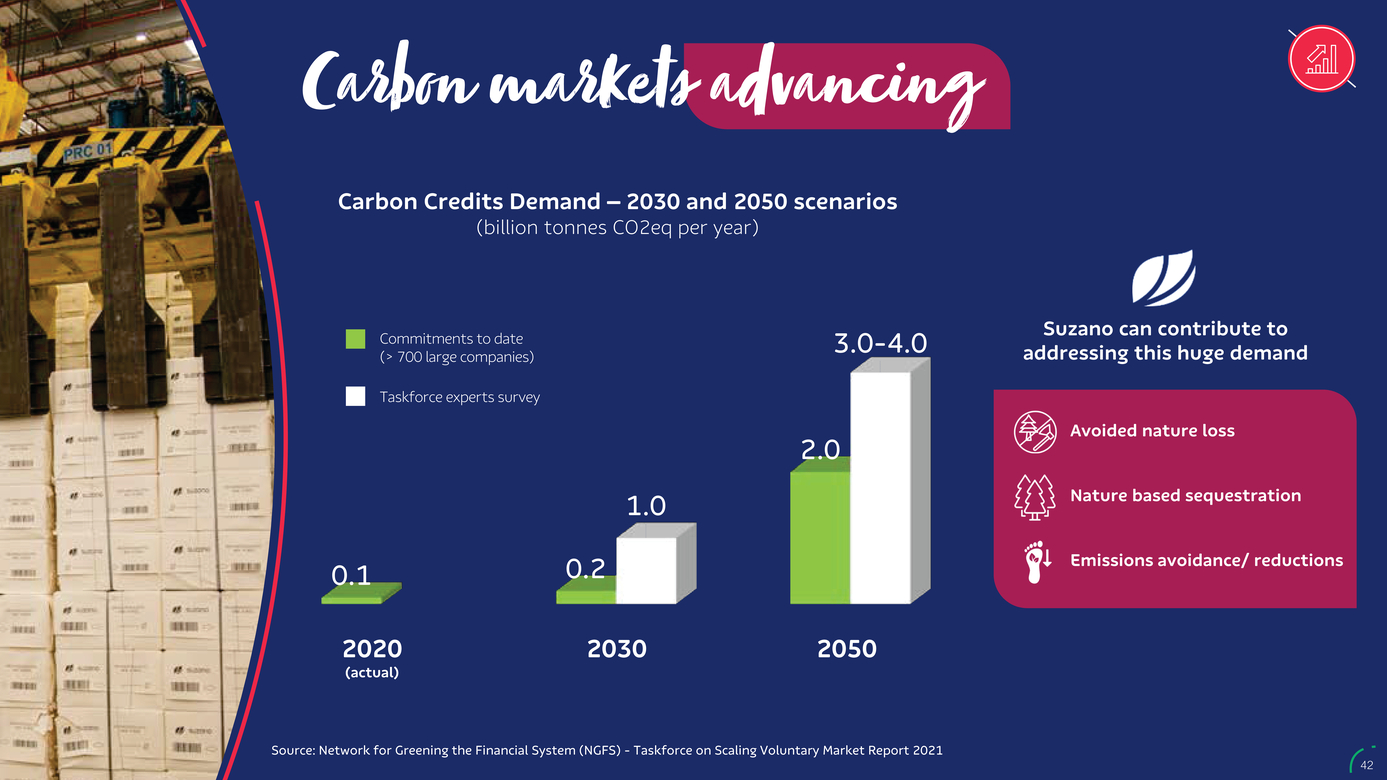

| Carbon markets advancing Carbon Credits Demand – 2030 and 2050 scenarios (billion tonnes CO2eq per year) Commitments to date (> 700 large companies) 3.0-4.0 Suzano can contribute to addressing this huge demand Taskforce experts survey 2.0 Avoided nature loss 1.0 Nature based sequestration 0.1 0.2 Emissions avoidance/ reductions 2020 (actual) 20302050 Source: Network for Greening the Financial System (NGFS) - Taskforce on Scaling Voluntary Market Report 2021 42 |

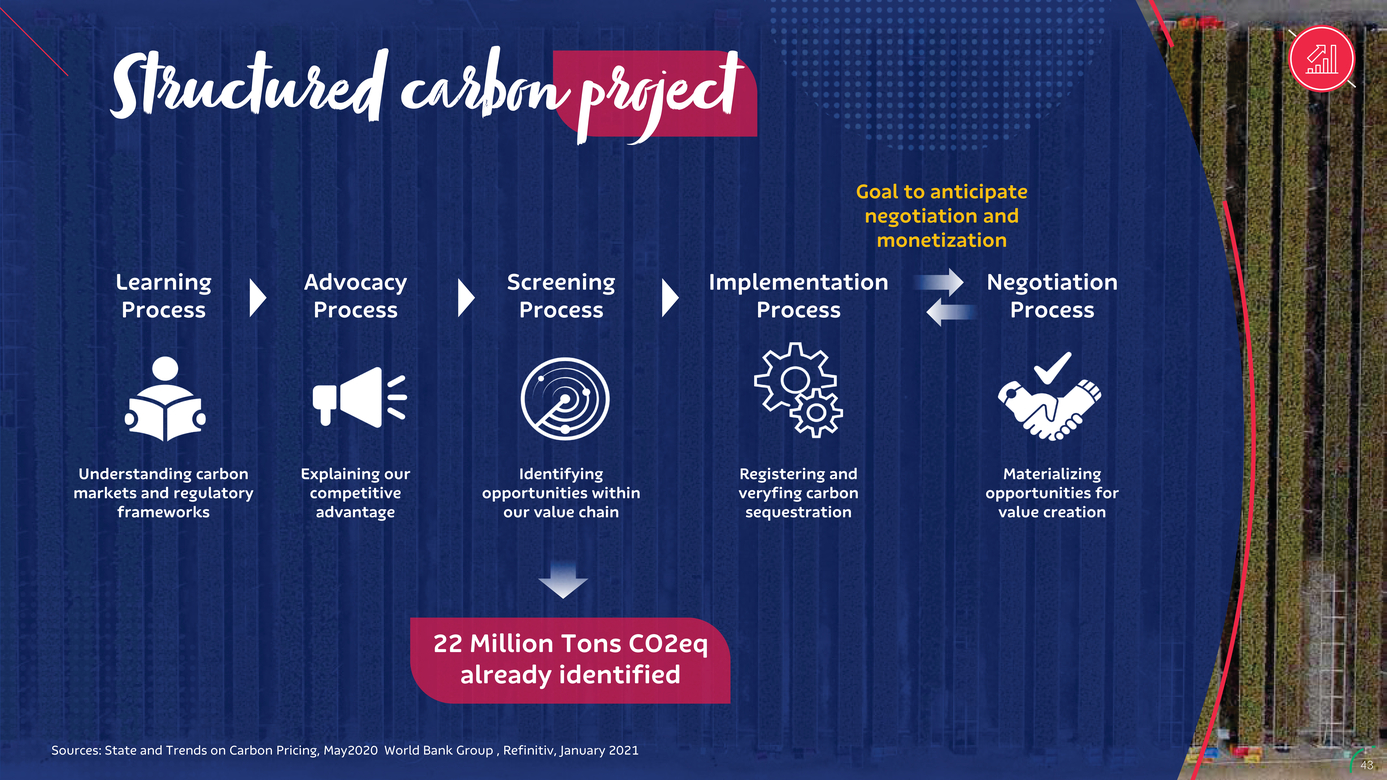

| Structured carbon project Goal to anticipate negotiation and monetization Learning Process Understanding carbon markets and regulatory frameworks Advocacy Process Explaining our competitive advantage Screening Process Identifying opportunities within our value chain Implementation Process Registering and veryfing carbon sequestration Negotiation Process Materializing opportunities for value creation Structured carbon project 22 Million Tons CO2eq already identified Sources: State and Trends on Carbon Pricing, May2020 World Bank Group , Refinitiv, January 2021 43 |

| Avenues Play a leading role in sustainability 44 |

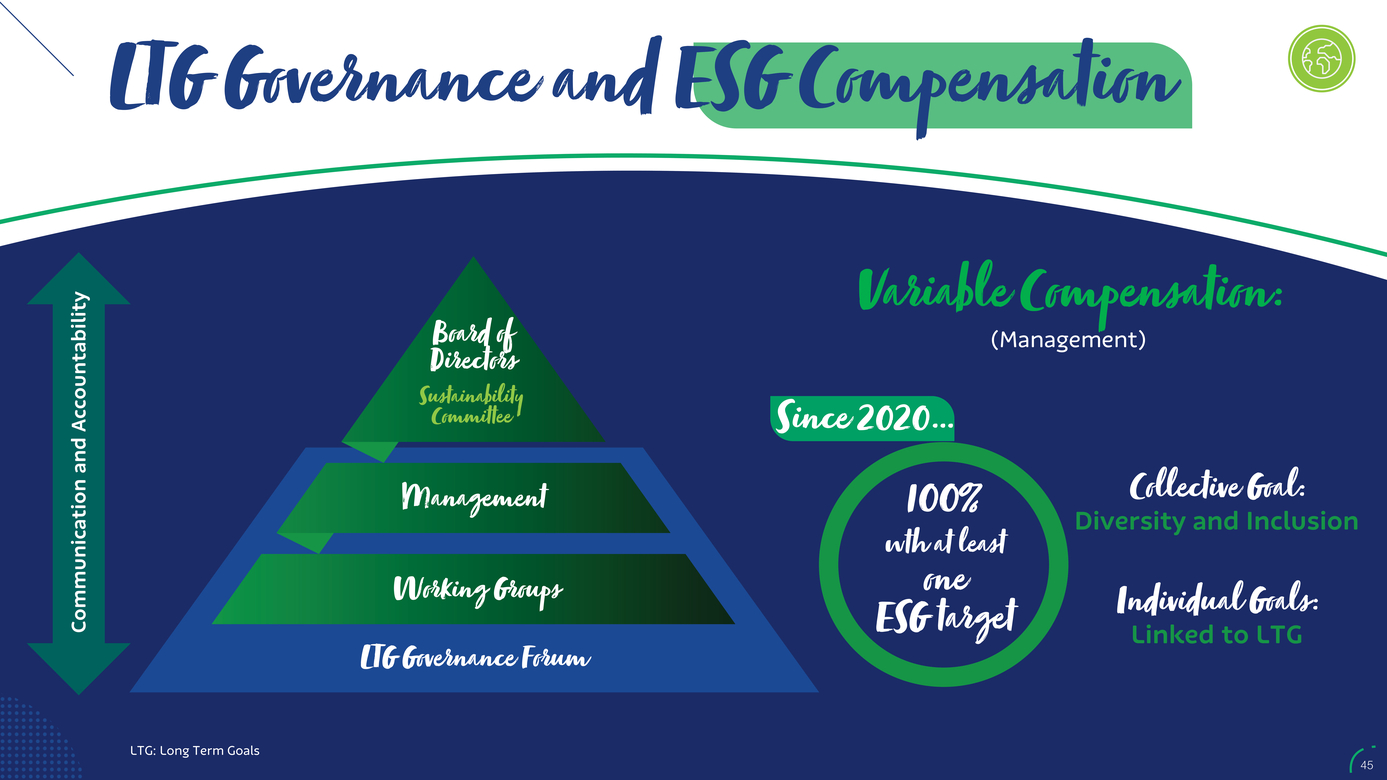

| LTG Governance and ESG Compensation Communication and Accountability Sustainability Committee Variable Compensation: (Management) Since 2020... Management Working Groups 100% wth at least ESG target Collective Goal: Diversity and Inclusion Individual Goals: Linked to LTG LTG: Long Term Goals 45 |

| ESG – Main Ratings In the first year that SUZANO, as a new company, decided to actively participate, significant improvement was already achieved... 20192020 No response DJSI Emerging Markets (Score: 71) No response Medium risk No response ISE Low risk BBB Our goal... to be a benchmark! BBChallenges Engagement Methodology 46 |

| Long Term Goals Climate Change Mitigate income inequality Replace Plastic Education Waste Diversity & Inclusion Water Energy Current Goals New Goal Biodiversity To be launched on the coming ESG call (2Q21) 47 |

| Financial Management 48 |

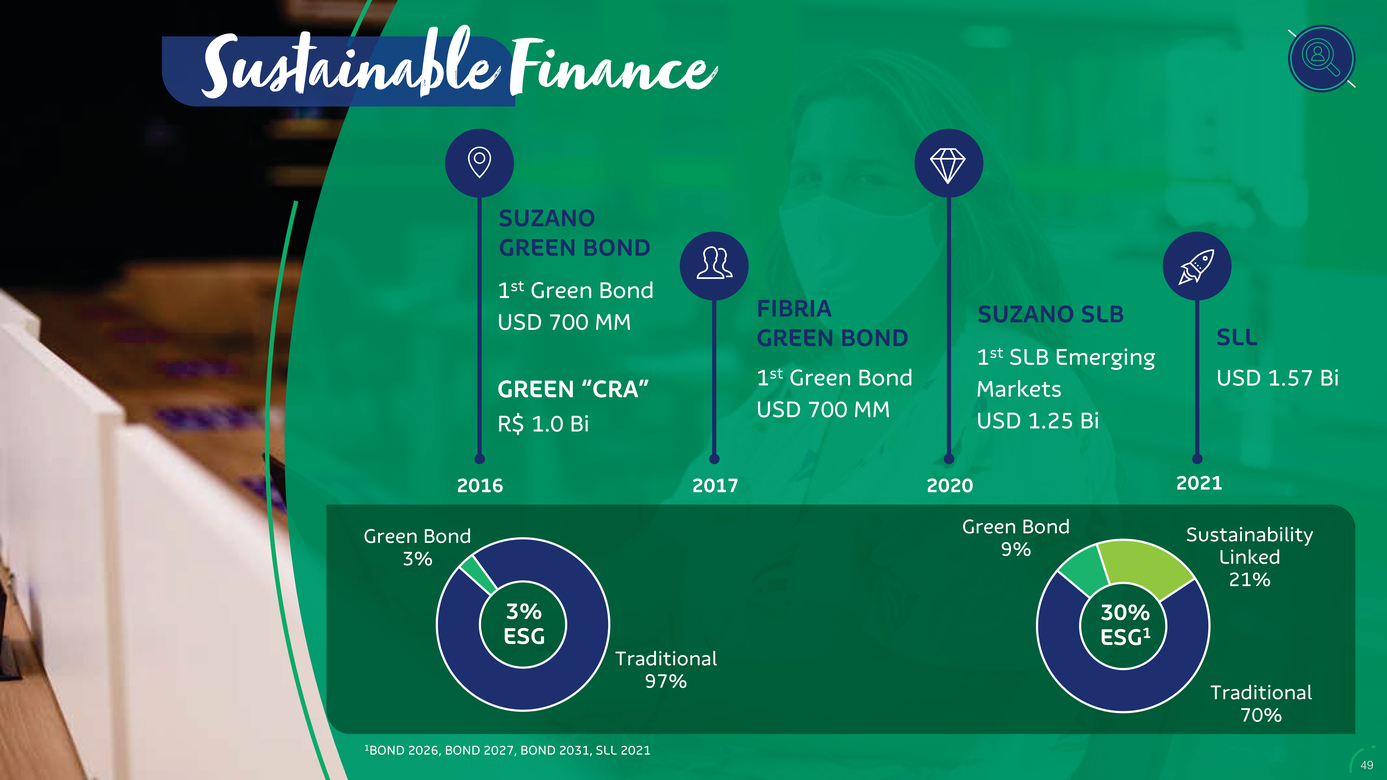

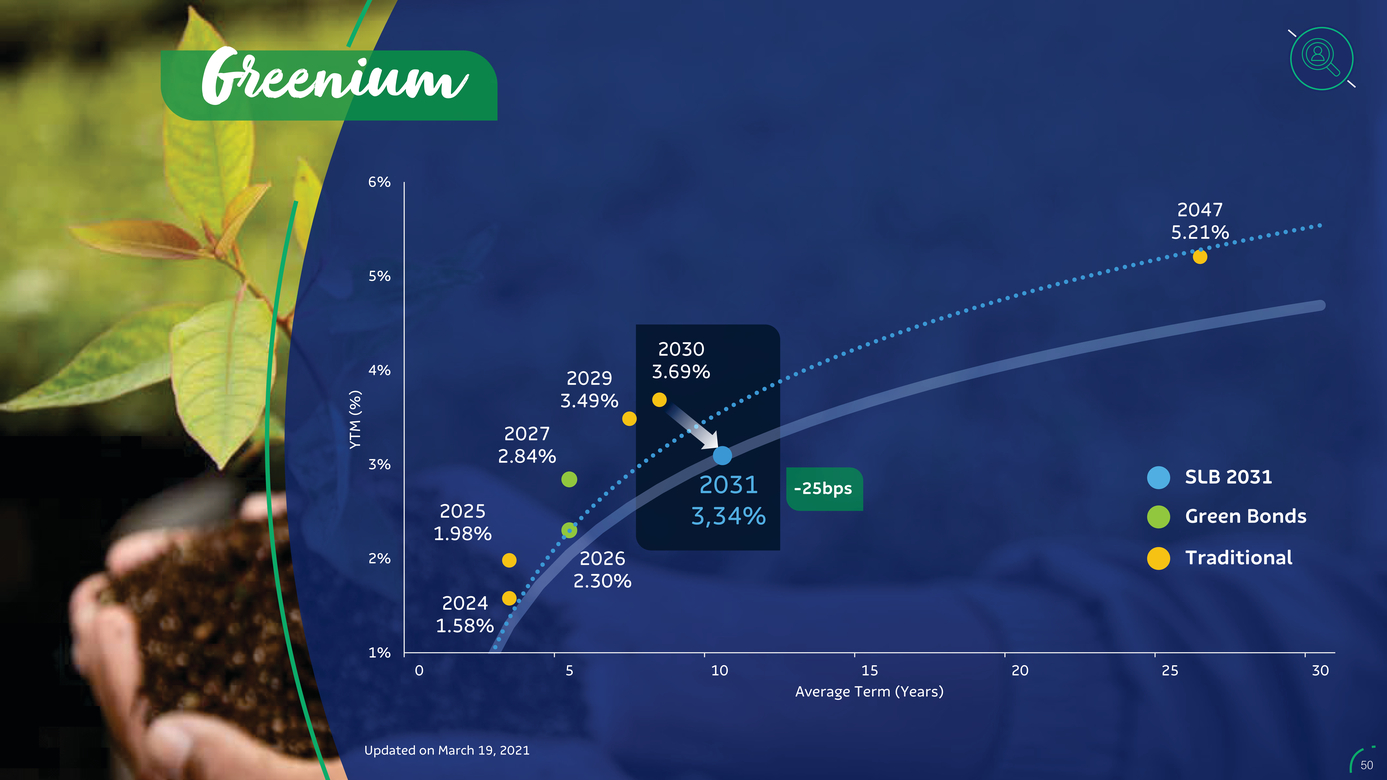

| Sustainable Finance SUZANO GREEN BOND 1st Green Bond USD 700 MM GREEN “CRA” R$ 1.0 Bi FIBRIA GREEN BOND 1st Green Bond USD 700 MM SUZANO SLB 1st SLB Emerging Markets USD 1.25 Bi SLL USD 1.57 Bi 2016 Green Bond 3% 3% 2017 2020 Green Bond 9% 30% 2021 Sustainability Linked 21% ESG Traditional 97% ESG1 Traditional 70% 1 TOP 5 do Focus. 1BOND 2026, BOND 2027, BOND 2031, SLL 2021 49 |

| Greenium 6% 2047 5.21% 5% YTM (%) 3% 2025 1.98% 2% 2024 1.58% 1% 2027 2.84% 2029 3.49% 2026 2.30% 2030 3.69% 2031 3,34% -25bps SLB 2031 Green Bonds Traditional 051015202530 Average Term (Years) Updated on March 19, 2021 50 |

| With a view to becoming even more competitive Investment Grade RatingOutlook G-Spread BBB-BBB-Stable Stable 293306 317 Baa3Stable 252 119 140 166166174 210211 IPCMPCSUZANO SLB ARAUCOVALEKLABIN SLBGERDAUBRAZILBRASKEMPETROBRASBRF Issues maturing in 2030/2031, IP 2029, were used for the purpose of comparison| G-spread updated on March 19, 2021. Source: Bloomberg 51 |

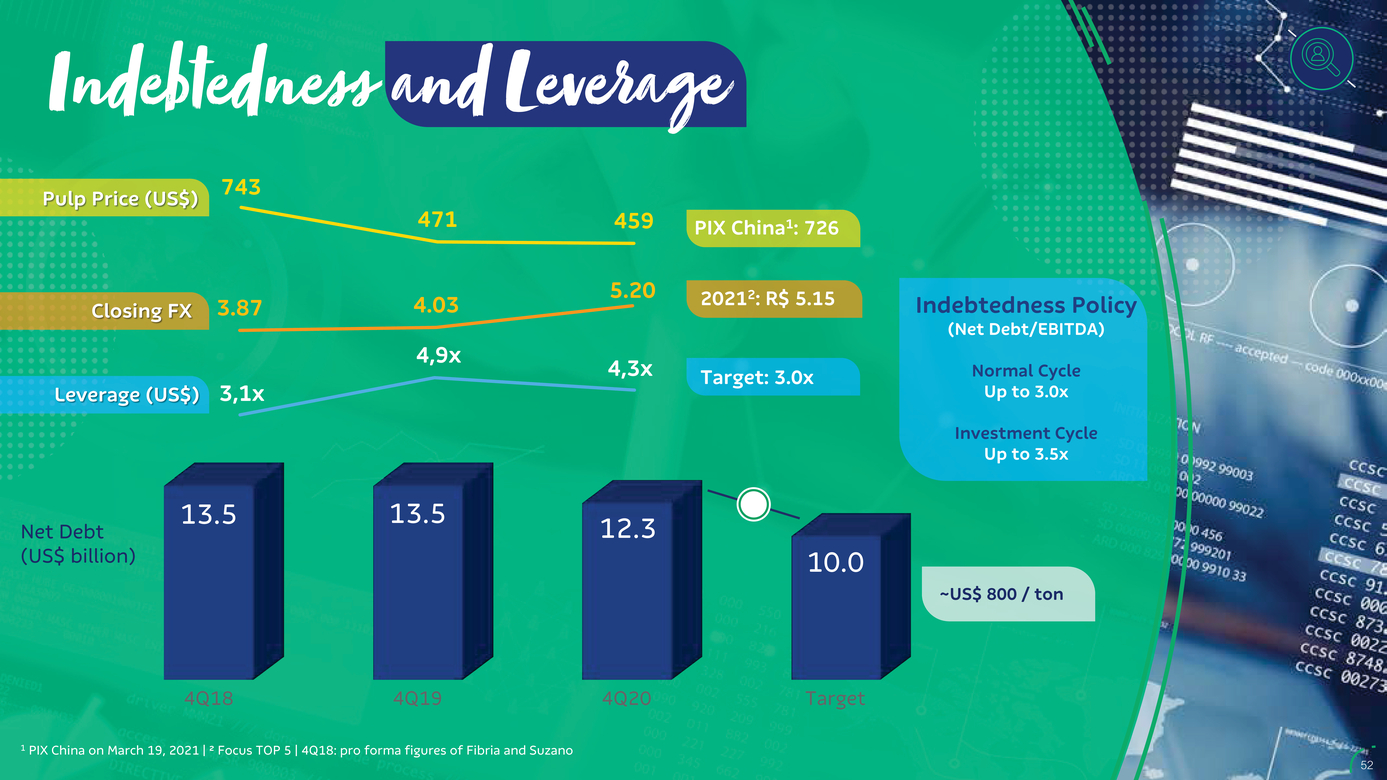

| Indebtedness and Leverage Pulp Price (US$) 743 471459 PIX China1: 726 5.202 Closing FX 3.874.03 4,9x4,3x 2021 : R$ 5.15 Indebtedness Policy (Net Debt/EBITDA) Normal Cycle Leverage (US$) 3,1x Target: 3.0x Up to 3.0x Net Debt (US$ billion) 13.513.512.3 10.0 Investment Cycle Up to 3.5x ~US$ 800 / ton 4Q184Q194Q20Target 1 PIX China on March 19, 2021 | ² Focus TOP 5 | 4Q18: pro forma figures of Fibria and Suzano 52 |

| Capital Allocation With a robust free cash flow no trade-off is needed… FREE CASH FLOW Be “Best-in-Class” & in the Total Pulp Cost vision Maintain relevance in Pulp, through good projects &Advance in the& links of the chain, always with competitive advantage Expand boldly into New Markets && Play a leading role in sustainability Main allocation Dividends WITH FINANCIAL DISCIPLINE 53 |

| Outlook Strong cash flow generation will unlock value through... Deleverage Value creation projects Enlarged addressable market Cost of capital reduction Based on Purpose 54 |

| [LOGO] |