- SUZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Suzano (SUZ) 6-KCurrent report (foreign)

Filed: 26 Mar 21, 7:34am

Exhibit 99.2

MANAGEMENT PROPOSAL

ANNUAL ORDINARY AND EXTRAORDINARY SHAREHOLDERS’ MEETINGS

OF

SUZANO S.A.

TO BE HELD CUMULATIVELY

EXCLUSIVELY IN ELECTRONIC FORM

ON APRIL 27, 2021

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

INDEX

| I. Information on the matters subject to resolution | 3 |

| II. Comments from Officers (Section 10 - CVM Instruction No. 480/09) | 7 |

| III. Management compensation (Section 13 - CVM Instruction 480/09) | 71 |

| IV. Details of the origin and justifications for the relevant amendments to the Bylaws, with an analysis of their legal and economic effects (Article 11 - CVM Instruction 481) | 121 |

| V. Highlight of the amendments made to the Bylaws and Consolidated Bylaws (Article 11 - CVM Instruction 481/09) | 159 |

The above items are an integral part of this Management Proposal (“Management Proposal” or “Proposal”) and meets the requirements of Law No. 6,404 of December 15, 1976 (“Brazilian Corporate Law”) and CVM Instruction No. 481/09, of December 17, 2009, as amended (“ICVM 481”).

2

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

| I. | Information on the matters subject to resolution |

Dear Shareholders,

The Management of Suzano S.A. (“Company” or “Suzano”) hereby presents to the Shareholders the following proposals to be the subject to resolution in the Annual Ordinary (“AGM”) and Extraordinary (“EGM”) General Meetings to be cumulatively held (“AOEM”) on April 27, 2021, at 16:00, only in digital form, pursuant to ICVM 481, as amended by CVM Instruction No. 622, as of April 17, 2020.

The Company emphasizes that the presentation of the information contained in this Proposal does not replace, for any purpose, the attentive and complete reading of all its Attachments.

(1) Verify management’s accounts for the fiscal year ended on December 31, 2020 and examine, discuss and vote on the financial statements of the Company, related to the fiscal year ended on 12/31/2020, as well as appreciate the report of the management relating to such fiscal year.

The Management Report and the individual and consolidated Financial Statements of Company and their respective Explanatory Notes, all related to the fiscal year ended on December 31, 2020, accompanied by the report of the independent auditor and the opinion of the Fiscal Council are available on the company’s website www.suzano.com.br/ri, the Brazilian Securities Exchange Commission’s (“CVM”) website www.cvm.gov.br and of B3 S.A. – Brasil, Bolsa, Balcão (“B3”) www.b3.com.br.

The individual and consolidated Financial Statements and the Company’s Management Report were prepared by the Board of Officers, audited by PricewaterhouseCoopers Auditores Independentes and approved by the Board of Directors of the Company, in accordance with favorable manifestations by the Audit Committee and Fiscal Council, at the meetings held on February 10, 2021. The referred statements are available in same electronic addresses referred to herein.

As stated in the Financial Statements, losses were verified in the fiscal year of 2020 and, for this reason, as decided by the CVM Board on September 27, 2011 (CVM Process RJ2010/ 14687), Attachment 9-1-II of ICVM 481 is not being presented in this Proposal.

The other information and the management’s comments on the Company’s financial situation in accordance with Section 10 of the Reference Form and with ICVM 481 are set out in this Proposal pursuant to item II below.

3

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

(2) Resolve on the absorption of accumulated losses by the balance of capital reserves.

It was verified in the fiscal year ended on December 31, 2020, as evidenced in the Company's Financial Statements, audited by PricewaterhouseCoopers Auditores Independentes, a loss in the amount of BRL 10,724,828,000.00 (ten billion, seven hundred and twenty-four million, eight hundred and twenty-eight thousand reais), having been used to absorb the losses the balances of (i) realization of the assigned cost, net of tax effects in the amount of BRL 70,654,000.00 (seventy million, six hundred and fifty-four thousand reais), (ii) the legal reserve in the amount of BRL 317,144,000.00 (three hundred and seventeen million, one hundred and forty-four thousand reais), and (iii) the prescribed dividends in the amount of BRL 130,000.00 (one hundred and thirty thousand reais). Additionally, the management proposes the use BRL 6,410,885,000.00 (six billion, four hundred and ten million, eight hundred and eighty-five thousand reais), recorded in the capital reserve account, for compensation of the balance of losses verified in the fiscal year ended on December 31, 2020

Following the aforementioned compensations and considering the absorption of the capital reserve balance proposed herein, the balance of the remaining accumulated fiscal year losses will be in the amount of BRL 3,926,015,000.00 (three billion, nine hundred and twenty-six million and fifteen thousand reais).

The Company's Financial Statements, submitted to the shareholders' appreciation at the AOEM, consider the use of capital reserves to offset losses, as indicated above.

(3) Determine the overall annual compensation of the Company’s Management.

It is proposed that the Company's Shareholders attending the Annual Ordinary Shareholders’ General Meeting approve the annual global amount of up to BRL 140,953,475.40 (one hundred and forty million, nine hundred and fifty-three thousand, four hundred and seventy-five reais and forty cents) as compensation for the Management (Board of Directors – and participation in Committees by the members of the Board of Directors - and Board of Officers) and members of the Company’s Fiscal Council, if installed, in compliance with the provisions of current legislation and the Company’s Bylaws.

The proposed amount comprises: (a) up to BRL 17,504,696.57 (seventeen million, five hundred and four thousand, six hundred and ninety-six reais and fifty-seven cents) corresponding to the fees of the members of the Board of Directors and participation in Committees by the members of the Board of Directors; (b) up to BRL 122,490,445.50 (one hundred and twenty-two million, four hundred and ninety thousand, four hundred and forty-five reais and fifty cents) corresponding to the fixed and variable compensation of the members of the Statutory Board of Officers; (c) BRL 958,333.33 (nine hundred and fifty-eight thousand, three hundred and thirty-three reais and thirty-three cents) corresponding to the fees of the Fiscal Council, and (d) corresponding amounts are included, benefits of any nature, and, (e) the corresponding amounts do not include taxes and charges levied on compensation and which are borne by the Company, pursuant to CVM Circular Letter 01/21.

Considering taxes and charges levied on compensation, the proposed total will be of BRL 150,000,000 (one hundred and fifty million reais) comprised by: (a) up to BRL 21,000,000 (twenty-one million reais) corresponding to the members of the Board of Directors’ fees and participation in Committees of members of the Board of Directors; (b) up to BRL 127,850,000 (one hundred and twenty-seven million, eight hundred and fifty thousand reais) corresponding to the fixed and variable compensation of members of the Statutory Board of Directors; (c) BRL 1,150,000 (one million one hundred and fifty thousand reais) corresponding to Fiscal Council fees.

4

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

The variable compensation that the members of the Statutory Board of Officers of the Company may receive corresponds to short-term incentive plans as compensation for the fulfillment of goals that support the Company's short-term strategy and long-term incentives, which, by means of phantom share mechanisms and the Stock Option Program, which rewards executives for achieving results that support the Company's medium and long-term strategic objectives, through appreciation of their shares. Both sections of the variable compensation act to align the executives with the objectives of the shareholders and with the sustainability of the Company.

The fixed and variable compensation of the members of the Statutory Board of Officers are determined, in accordance with market standards, via surveys conducted by renowned consultants specialized in the subject and are further detailed in item III of this Proposal, pursuant to Section 13 of the Reference Form and ICVM 481. Therefore, the payment of the variable compensation is conditioned and proportional to the partial or total fulfillment of the pre-established goals, and may even not be due, in the event that the goals in question are not reached.

The compensation of the Company’s Management seeks to match the alignment of managers with the objectives of the shareholders and with the strategy and sustainability of the Company, while it tries to properly compensate such executives and maintain and recognize high performance professionals, with appropriate skills and market experiences, and stimulating a meritocratic culture. Therefore, it aims at equating the managers’ responsibilities, the time dedicated to the functions, competence, professional reputation and the value of their services in the market with fees proposed and assessed by the Compensation Committee.

It should be noted that the global annual amount proposed above, refers to an estimate of the maximum total amount that may be spent by the Company on compensation of its management (including the compensation and eventual benefits) in the period comprised between the months of January and December of 2021 in line with the period covered by the Reference Form (fiscal year) referred to in ICVM 481.

In being an estimate, although based on criteria, forecasts concerning share value and values known at the time of determination (e.g. fixed compensation value), this proposed Annual overall amount is subject to circumstances which are unpredictable or not definitive at the time of approval, particularly due to the following events: (i) the appreciation (or devaluation) of the price of the shares issued by the Company, impacting the portion of the basic compensation paid in shares; and (ii) the eventual dismissal of members of the statutory Board of Officers with corresponding payment of the funds arising out the dismissals.

In this sense, the company had in the year 2020 overall expenditure with the compensation of the Managements (Board of Directors and Executive Board of Officers) in the amount of BRL 133,720,168.02 (one hundred and thirty-three million, seven hundred and twenty thousand, one hundred and sixty-eight reais and two cents) versus the total amount of BRL 150,000,000.00 (one hundred and fifty million reais) approved at the Annual General Meeting of 2020 for such fiscal year, representing therefore BRL 16,279,831.98 (sixteen million, two hundred and seventy-nine thousand, eight hundred and thirty-one reais and ninety-eight cents) less than originally approved.

5

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

Considering the issues above, in particular the aforementioned unpredictable or non-definitive circumstances mentioned herein, as well as the change in the compensation strategy adopted for the Board of Directors and reflected for the 12 months in 2021, which, following the best market compensation practices evaluated of Board of Directors members with full dedication and also considering the responsibilities attributed for their participation in Advisory Committees, extinguished the payment of variable compensation for members of the Board of Directors, the Company proposes to maintain the global annual amount of compensation that may come to be attributed to the Company’s Management at the same level as that approved for the fiscal year 2020 - without any increase, resulting, therefore, in a clear commitment of the Company to continuously provide to its shareholders and to the general market scenarios as close as possible to the reality of the Company and the expected performance of it and its managers.

For more information on this matter, see the document contained in the attachment III of this Proposal, pursuant to Section 13 of the Reference Form and ICVM 481.

(4) Reform the Company's Bylaws, with specific amendments to reflect the modifications to the Novo Mercado Rules of B3 S.A. - Brasil, Bolsa, Balcão (“B3”).

With the intention of aligning the wording of the current Bylaws of the Company with the rules of B3's Novo Mercado regulations, pursuant to Official Letter 86/2018-DRE, of March 9, 2018, management proposes the occasional adaptations, improving the rules of corporate governance with its shareholders, the market in general, as well as the rationalization and simplifications in the Company's Bylaws. The above amendments are attached to this proposal in Items IV and V, containing the proposed amendments, detailing the origin and justifications of the relevant amendments, with analysis of their legal and economic effects, pursuant to article 11 of CVM Instruction 481.

Additional Information and Where to Find It

The documents provided for in the Brazilian Corporate Law and in ICVM 481 were submitted to CVM on the present date, through the Periodic Information System (IPE) and are available to the shareholders at the Company’s headquarters, at the Company’s Investor Relations website (www.suzano.com.br/ri), as well as on the CVM website (www.cvm.gov.br) and B3 S.A. - Brasil, Bolsa, Balcão website (http://www.b3.com.br).

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

6

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

II. Comments from Officers (Section 10 - CVM Instruction No. 480/09)

10.1. Comments on:

The consolidated annual information of the Company, which is presented throughout item 10 of the Reference Form, was prepared in accordance with the rules of the Securities Exchange Comission (CVM) and the Accounting Pronouncements Committee (Comissão de Pronunciamentos Contábeis - CPC) and are in compliance with the International Accounting Standards (IFRS) issued by the International Accounting Standards Board (IASB). The unaudited, intermediate and consolidated financial information of the Company, presented also throughout item 10 of the Reference Form, was drafted in accordance with IAS 34 - Intermediate Statement (IAS 34 – Demonstração Intermediária) issued by IASB and with accounting practices adopted in Brazil for intermediate statements - Technical Pronouncement - CPC 21 - "Interim Financial Information" (Pronunciamento Técnico - CPC 21 – "Informações Financeiras Intermediárias"). The information contained in this document was obtained from the financial information made available to CVM. The Company also informs that the information contained in the Section 10 of the Reference Form was prepared in millions of reais and the balances may differ due to rounding used to maintain consistency of the document.

a) General financial and equity conditions.

Executive Board understands that the Company’s financial condition is sufficient to perform its short- and medium-term obligations. The Company has been concentrating its efforts in obtaining credit lines with longer terms and competitive costs.

In the fiscal years ended in December 31, 2020, 2019 and 2018, the Company registered losses in the amount of BRL 10,714.9 million, BRL 2,814.8 million and net income of BRL 318.4 million, respectively. The variations in the Company’s results in 2020 are mainly due to the negative variation of BRL 26,244.2 million of the net financial income. This effect was partially offset by the increase in deferred Income Taxes of BRL 8,371.4 million due to losses for the year

The adjusted EBITDA in the twelve-month period ended December 31, 2020 was BRL 14,949.5 million, and in 2019 it was BRL 10,723.6 million. Cash flow generation, as measured by EBITDA, in the twelve-month period ended December 31, 2020 mainly reflects: (a) sales volume 12% higher than the same period in 2019; and (b) the appreciation of the Dollar against the Real, effects that were partially offset by the devaluation of the listed cellulose price, in dollars.

In the fiscal years ended on December 31, 2019 and 2018, the Company recorded, respectively, Net income (losses) of BRL 2,814.7 million and BRL 318.3 million. The variations in the Company's results for the year ended December 31, 2019 when compared to the same period for the year ended December 31, 2018, are mainly due to: (i) a decrease in the financial result of BRL 1,883, 3 million, and (ii) the increase in selling, general and administrative expenses, of BRL 1,654.7 million. These effects were partially offset by the increase in the volume of pulp sales in the year, due to the consolidation of Fibria.

7

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

Adjusted EBITDA in 2019 was BRL 10,723,6 million, and in 2018 it was BRL 6.814.3 million. Cash generation, as measured by EBITDA, in 2019 mainly reflects:

(i) consolidation of Fibria; and (ii) the appreciation of the dollar against the Brazilian real, partially offset these effects by the depreciation of pulp list price in dollars.

The Company’s net equity for the fiscal year ended in December 31, 2020 was BRL 7,337.3 million, on December 31, 2019 was BRL 18.088,0 million, and on December 31,2018 it was BRL12.025,9 million. The variation was mainly due to losses during the fiscal year in the amount of BRL 10,714.9, which absorbed BRL 6,410.9 million from the capital reserves and BRL 317.1 million from the revenue reserves.

On December 31, 2020, the Company recognized cash, cash equivalents and financial investments in the amount of 9,231.9 million, on 2019 it was BRL 9.579,5 million, and on 2018 it was BRL 25.486,0 million. As of December 31, 2020, consolidated net debt totaled BRL 63.668,0 million, on December 31, 2019, consolidated net debt totaled BRL 54,104.9 million, as of December 31, 2018, BRL 10,251.5 million.

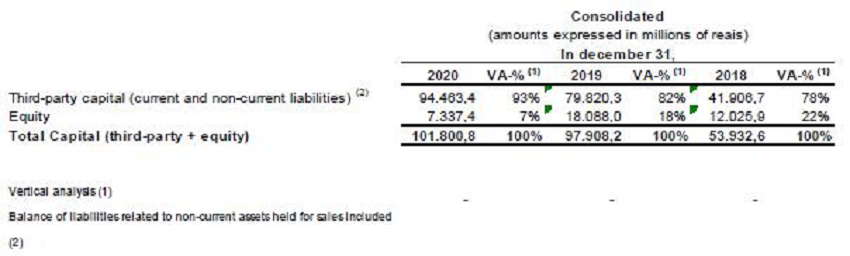

b) Capital structure.

The percentage of capital comprised of own capital (Equity divided by total liabilities) was 7,2 in 2020, 18,5% in 2019, 22,3% in 2018.

The percentage of capital comprised of third-party capital (Demandable Liabilities divided by total liabilities) was 92,8% in 2020, 81,5% in 2019, 77,7% to 2018.

There is no provision in the Company’s Bylaws to redeem shares.

Historically, the Company finances its operations with a combination of resources arising from: (i) its operating activities; (ii) shareholders’ investments; and (iii) loans and financing with the financial market.

8

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

c) Payment capacity in relation to the financial commitments assumed.

The Company’s funding and cash management policy is based on the concept of “liquidity horizon”, which provides the measure of time during which the cash available, added to the generation of operational cash and the funds from financing contracted and not disbursed, estimated based on unfavorable market conditions, is capable of supporting the payment of all obligations contracted for the period, including all short-term financing principal and interest amortizations. The available Cash balance on December 31, 2020 is capable of supporting the next two years of long-term debt, as shown in the amortization chart in item 10.1 (f) below. For maturities greater than these periods, we must consider an estimate of operating cash flow generation.

In view of the foregoing, the Executive Board adopts the commitment of maintaining the Company’s financial and economic balance and, to this end, it relies on the existing funds, the generation of operational cash, the access to capital and financing markets at competitive costs, in addition to numerous alternatives analyzed by the Company whenever necessary. Company’s officers believe that the operating cash flow, added to cash and cash equivalents, are sufficient to meet the financial commitments assumed.

In the fiscal years ended on December 31, 2020, 2019 and 2017, the Company fully complied with its commitments.

d) Sources of financing for working capital and investments in noncurrent assets to used.

The Company raises funds, when necessary, through financial agreements, which are used to finance the Company’s working capital requirements and short- and mid-term investments, as well as to maintain available cash at a level that the Company believes to be appropriate for the performance of its activities. The Company’s financing and borrowings are detailed in item “10.1.f.” below.

The working capital financing, as shown in the Financing and Loans table below, it was, obtained through export financing transactions, which allow matching the flows of receipts of exports and the flows of payment of such financing, with the additional advantage of hedging the export receivables against the risk of exchange rate differences and through forfaiting and letter of credit discounts, when appropriate.

For project financing, the Company took out loans from Development Banks and other financing project-oriented institutions, which offer competitive terms, including payment terms for principal and interest compatible with the project return flows, so as to avoid that its implementation causes negative effects on the Company’s payment capacity.

The Company also used, as financing alternatives, issues of senior notes (bonds), as placement of debt securities in the international market, and debentures and Agribusiness Receivables Certificates (CRA), as placement of debt securities in the domestic market.

e) Sources of financing for working capital and investments in noncurrent assets to be used to cover liquidity deficiencies.

The Company has high liquidity level and a consistent cash generation, which, jointly with capital market access, as observed in items “10.1.a.” and “10.1.b.”, are enough to equate satisfactorily its short- and medium-term obligations. If there are any mismatches in cash with amounts falling due in the short term, the Company may contract new credit lines for working capital and for investments, these credit lines being treated on a case-by-case basis. The sources of financing used by the Company for working capital and short- and long-term investments are indicated in items “10.1.d” and “10.1. f”.

9

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

f) Indebtedness levels and debt characteristics

(i) relevant loan and financing agreements;

The Company’s consolidated loans and financings on December 31, 2020, 2019 and 2019 had the following sources (in thousands of reais):

a) If the Long-Term Interest Rate (“TJLP”) exceeds 6% per annum, the excess portion is incorporated into the principal and subject to interest. Transactions subject to TLP are composed of the IPCA rate and a fixed interest rate from BNDES.

b) Borrowings and financing are collateralized, as applicable, by (i) plant mortgages; (ii) rural properties; (iii) conditional sale of the financed assets; (iv) shareholders’ surety; and (v) bank (personal) guarantee.

c) On June 29, 2018, the Company carried out the 6th issue of non-convertible debentures in shares of unsecured type, in the amount of BRL 4,681,100,000.00, with remuneration interest corresponding to 112.50% of the DI rate, with the payment of the nominal unit value occurring in two installments, the first due on June 30, 2025 and the second on June 29, 2026. On September 15, 2019 the Company carried out the 8th issue of non-convertible debentures into unsecured shares, in the amount of BRL 750,000,000.00, with remuneration interest corresponding to 100% of the DI rate plus 1.20%, with semiannual payments, and payment of the nominal unit value in a single installment due on September 15, 2028.

10

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

In March 2017, Suzano Austria issued Senior Notes amounting to US$ 300 million maturing on March 16, 2047, with semiannual payment of interest of 7.00% p.a. and final return to investors of 7,38% p.a. Additionally, in the last quarter of 2017, Suzano, through its subsidiary Suzano Trading, repurchased Senior Notes in the amount of (i) US$ 456 million and, through Suzano Austria, reopened the issue of Senior Notes in the amounts of (i) US$ 200 million, maturing on July 14, 2026, and corresponding interest at 4.62% per annum, to be paid semiannually, in January and July, and (ii) US$ 200 million maturing on March 16, 2047, with interest corresponding to 6.30% per year, to be paid semiannually in March and September. In September 2018, there was a new issue of Senior Notes in the amount of US$ 1.0 billion, with interest of 6.00% per annum and maturity in 2029. In November 2018, Suzano Austria reopened the issue of Senior Notes due on March 16, 2047 in the amount of US$ 500 million, with interest corresponding to 6.85% per year, to be paid semiannually in the months of March and September. In February 2019, Suzano Austria reopened the September 2018 issue, with a fixed interest rate of 6.00% p.a., in the amount of US$ 750 million, maturing in 2029. In May 2019, Suzano Austria reopened the issue of March 2017 with amount of of $ 250 million maturing in 2047 and semiannually payment of interest of 7,00% per annum and issued Senior Notes in the amount of US$ 1 billion with maturity in January 2030, and semiannually payment of interest of 5,00% per annum. In September 2020, Suzano Austria issued Global Notes in the amount of U$ 750 million, maturing in 2031 with semiannual interest of 3.75% per year until January 15, 2021 and 4.00% per year as of 16 July 2026. In November 2020, Suzano Austria reopened Global Notes due 2031, issued two months earlier, in the amount of U$ 500 million with the same conditions described above.

d) In December 2018, the Company, through its subsidiary Suzano Europa, signed a syndicated loan of US$ 2,300 million, agreed in March 2018, with payment of quarterly interest and repayment of principal between December 2022 and December 2023. in June 2019, the Company, through its subsidiaries Fibria Overseas Finance and Suzano International Trade, contracted a syndicated loan in the amount of US$ 750 million with payment of quarterly interest and repayment of the principal between March 2024 and June 2025. On February 14, 2020, the Company, through its wholly-owned subsidiaries Suzano Pulp and Paper Europe S.A., Suzano Austria GmbH and Fibria Overseas Finance Ltd., entered into a syndicated export prepayment agreement in the amount of US$ 850 million, with quarterly interest payments and maturity in February 2026. On April 2, 2020, the Company, through its subsidiary Suzano Pulp and Paper Europe S.A., withdrew US$ 500 million with quarterly interest payments and amortization of the principal amount in February 2024, having paid the applicable amount in connection with such agreement in August of the same year.

e) In the third quarter of 2018 two Export credit notes were contracted, with Banco Safra S.A., totaling BRL 1.3 billion, indexed to the CDI, with interest of 0.08% per month, amortization of the principal amount and interest on June 25, 2025 and June 25, 2026 and maturing in 2026. Regarding the Agribusiness Receivables Certificates, the outstanding positions of Fibria at the end of 2019 were included due to the merger of the companies into the Company.

f) In the third quarter of 2018, a Financial Rural Producer Certificate was contracted, with Banco Safra S.A., with a volume of BRL 275 million, indexed to the CDI, with interest of 0.08% per month, amortization of the principal and interest amounts on August 28, 2025 and August 28, 2026, maturing in 2026.

g) Mostly related to the “Surplus Value”, in relation to the business combination of the Company with Fibria, in 2020.

11

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

Other Financial Agreements

Between 2018 and 2019, the Company engaged swap trading notes with Banco Bradesco S.A., with a total volume of BRL 5.3 billion, with a 96% interest rate and 112.5% of the CDI, maturing on January 14, 2022, September 22, 2022, June 22, 2023, December 14, 2023 and June 29, 2026.

On June 6, 2018, the Company entered into an agreement for derivative transactions with Banco BNP Paribas Brasil S.A., in the amount of BRL 980 million, with a 4.05% yearly interest rate and maturity on February 13, 2023.

On August 10, 13, 16, 20 and 2018 and February 20, 2019, the Company entered into agreements concerning derivatives operations with Banco Credit Agricole Brasil S.A., with a total volume of BRL 3.3 billion, 4.075%, 4.069%, 4.062% and 4.057%, and 2.488% yearly interest rates, and maturities on January 2, 2024 and February 13, 2026.

On February 25, 2019, the Company entered into an agreement for derivative operations with Banco J.P. Morgan S.A, in the total volume of BRL 1 billion, with an 8.35% yearly interest rate and maturity on February 26, 2024.

On May 03, 06 and 07, 2019, the Company entered into agreements for derivatives operations with Banco MUFG Brasil S.A., in the total volume of BRL 270 million, with 95.95%, 95.5% and 96.3% CDI interest rates and maturities on June 22 and August 14, 2023.

On August 10, 13, 16, 20, 2018, the Company entered into agreements for derivatives operations with Banco Morgan Stanley S.A., in the total volume of BRL 2.5 billion, with 4.069%, 4.057%, 4.066% and 4.054% yearly interest rates and maturity on January 2, 2024.

On July 31 and August 31, 2018, the Company entered into agreements for derivatives operations with Banco Safra S.A., in the total volume of BRL 1.5 billion, with 5.705% and 5.60% yearly interest rates and maturity on July 31 and August 28, 2026.

Between 2018, 2019 and 2020, the Company entered into agreements for derivatives operations with Banco Santander (Brasil) S.A., in the total volume of BRL 2 billion, with a 96% CDI interest rate, and an additional yearly interest rate between 3.20% and 4.074%, and maturities between January 2022 and June 2025.

Between 2018 and 2019, the Company entered into agreements for derivatives operations with Banco Itaú Unibanco S.A., in the total volume of BRL 4.6 billion, with a 97.38% CDI interest rate, and an additional yearly interest rate between 3.34% and 5.79% and maturities between January 2022 and July 2025.

12

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

Amortizations

The repayment schedule of the financial obligations in effect on December 31, 2020, as well as the exposure of the Company’s debt by indexes, is shown below:

Type and Index Exposure on December 31, 2020

13

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

(ii) other long-term relationships with financial institutions

Although there are no other debt-related contracts than the one described above, the Company maintains commercial relationships with the main financial agents in the market, aiming at the ready access to credit lines for eventual demands for working capital and investment financing.

(iii) Degree of subordination between debts

As of December 31, 2020 and December 31, 2019 and 2018, the Company's indebtedness was comprised of debts with collateral and unsecured debts, with no subordination contractual clause. Accordingly, in the event of universal creditors' disagreement, the subordination between the obligations recorded in the financial statements will occur in the following order, in accordance with Law No. 11,101, of February 9, 2005, as amended: (i) labor claims; (ii) credits with real guarantee up to the limit of the value of the recorded asset; (iii) tax credits; (iv) credits with special privilege as provided for in Law No. 11,101/2005; (v) credits with general privilege as provided for in Law No. 11,101/2005; (vi) unsecured credits; (vii) fines and financial penalties; and (viii) subordinated credits.

(iv) any restrictions imposed on the Company, in particular, in relation to debt limits and contracting of new debts, the distribution of dividends, the sale of assets, the issuance of new securities and the sale of corporate control, as well as if the issuer has been complying with these restrictions.

The Company does not currently have financial covenants in its financing agreements. In certain financing agreements, there are clauses of non-financial covenants, including, but not limited to, restrictions on the sale of control. These clauses provide essentially for the maximum level of assignment of receivables, guarantees to third parties and sale of operating assets, which are also in compliance.

Additionally, the Company has financial contracts with BNDES, in which there are certain restrictions and specific obligations, such as (i) prior consent of BNDES for merger, spin-off, dissolution, incorporation, reduction or delisting or change in effective control, direct or indirect, of the Company, or any other corporate restructuring process involving the Company; (ii) inclusion of BNDES in corporate agreements, articles of association, or corporate agreement of a device that results in restrictions or losses on the ability to pay the financial obligations assumed by the Company.

The Company, in the normal course of its operations, has complied with all applicable contractual provisions and claims to be in compliance with all obligations assumed in its financial contracts.

14

|

| SUZANO S.A. |

| Publicly-Held Company with Authorized Capital |

| CNPJ No. 16.404.287/0001-55 |

| NIRE No. 29.300.016.331 |

| Management Proposal – AOEM of April 27, 2020 |

g) Limits of financing contracted and percentage already used

On December 31, 2020, there were two agreements in effect with balances pending disbursement and with limits utilization. The agreements are as follows:

| Financial Agent | Agreement | Financing | Indexer | Interest Rate: (%p.a.) | Maturity Date | Disbursements made | Available Balance | ||

| Amount | % | Amount | % | ||||||

| BNDES | Credit Limit | BRL 706 milion | TLP | IPCA + 3.6 % p.a. | 11/16/2034 | BRL 400 million | 56.66% | BRL 306 million | 43.34% |

| BNDES | Credit Limit | BRL 480 million | SELIC | SELIC + 1.96 % p.a. | 02/15/2040 | BRL 480 million | 100% | - | - |

h) Significant changes in each item of the financial statements

Basis of preparation and presentation

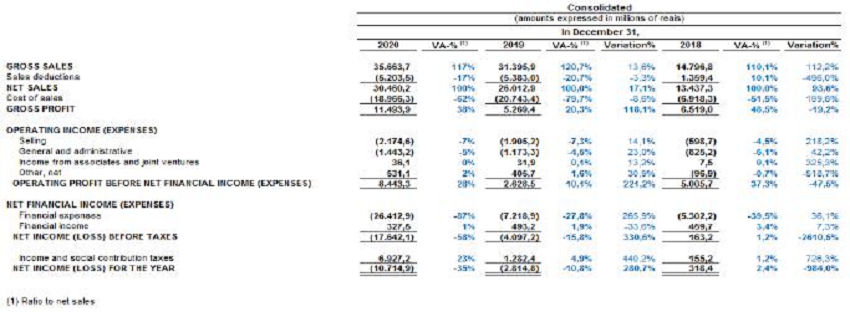

Comparative Analysis of the Consolidated Results

Comparative Analysis of Consolidated Results – Twelve-month periods ended on December 31, 2020 and 2019

Net Revenue

Suzano’s net revenue in the period of twelve months ended on December 31, 2020 was BRL 30,460.3 million, 17.1 % higher than net revenue recorded for the twelve-month period ended December 31, 2019, of BRL 26,013.0 million, as a result of (i) an increase in sales volume by 12%, and (ii) depreciation of exchange rate between Real and Dollar in the period in question.

The net revenue obtained from the sales of pulp in the period of twelve months ended on December 31, 2020 totaled BRL 25,578.3 million, 21.6 % higher than the revenue recorded in the period of twelve months ended on December 31, 2019, due to (i) an increase in sales volume by 15%, and (ii) depreciation of the exchange rate of Real x Dollar in the period in question. Revenue from pulp represented 80.8% of total revenue for the twelve-month period ended December 31, 2019, compared to 84.0% for the twelve-month period ended December 31, 2020.

15

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

The export revenue from pulp was BRL 23,968.8 million in the twelve-month period ended on December 31, 2020, 24.9% higher than the export of pulp in the twelve-month period ended on December 31, 2019, due to (i) a 17.0% increase in sales volume; and (ii) depreciation of the exchange rate of Real x Dollar in the period in question.

International average net price of pulp in the twelve-month period ended December 31, 2020 decreased 18%, from US$ 567/ton in the twelve-month period ended December 31, 2019 to US$ 463/ton in 2020. In the domestic market, the average net price of pulp decreased by 7%, from BRL 2,207/ton in the twelve-month period ended December 31, 2019 to BRL 2,046,0/ton in the same period in 2020.

Net revenue from paper sales in the twelve-month period ended December 31, 2020 totaled R$ 4,882.0 million, 2.1% less than the same period last year. Of this revenue, 68.8% derived from sales in the domestic market and 31.2% from the foreign market. Domestic market net revenue decreased by 3.5% in relation to the twelve-month period ended on December 31, 2019, mainly impacted by the lower sales volume by 6% due to the global scenario of COVID-19.

The average international net paper price in the twelve-month period ended December 31, 2020 was US$ 788.0/ton, 16.7% lower than the price in the same period in 2019. In the domestic market, the average price registered was R$ 4,188.2/ton in the twelve-month period ended on December 31, 2020, 2.7% above the price of the same period in 2019.

Cost of Sales (“SoS”)

The cost of products sold by Suzano in the twelve-month period ended December 31, 2020 totaled BRL 18,966.3 million, 8.6% lower than that recorded in the same period in 2019, of BRL 20,743.5 million, due, mainly, to an 85% drop in the amortization of inventory gains, resulting from the business combination with Fibria, in the amount of BRL 2,409.1 million in the twelve-month period ended on December 31, 2019. This gain was partially offset operating expenses to combat COVID-19 of BRL 95.0 million.

Gross profit

Due to the reasons explained above, the gross profit for the twelve-month period ended December 31, 2020 was BRL 11,493.9 million, 118.1% higher than the gross profit for the same period in 2019, of BRL 5,269.5 million. Suzano's gross margin increased from 20.3% in the twelve-month period ended December 31, 2019, to 37.7% for the same period in 2020, due to the reasons previously explained.

Selling and Administrative Expenses

Suzano's selling expenses totaled BRL 2,174.7 million in the twelve-month period ended December 31, 2020, 14.1% higher than the amount recorded in the same period in 2019, of BRL 1,905.3 million. The variation can be explained by the BRL 234.5 million increase in logistics expenses, which was impacted by the higher sales volume in the period, in addition to the depreciation of the Real x Dollar exchange rate in the period in question.

16

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Suzano's general and administrative expenses totaled BRL 1,443.2 million in the twelve-month period ended December 31, 2020, 23.0% higher than the amount recorded in the same period of 2019 of BRL 1,173.4 million. The variation can be explained by the increase in personnel expenses in the amount of BRL 219.8 million, in addition to expenses with donations of BRL 48.6 million and additional operating expenses of BRL 41.1 million, both related to COVID- 19.

Other Operating Expenses/Income

Suzano's other net operating expenses/incomes totaled BRL 531.2 million in revenue in the twelve-month period ended December 31, 2020, compared to a revenue of BRL 405.8 million in the same period in 2019. The variation The balance refers mainly to the adjustment of the fair value of the biological asset, which was BRL 281.1 million higher in the twelve-month period ended on December 31, 2020, partially offset by a gain in the twelve-month period ended on December 31, 2020. December 2019 of BRL 128.1 million related to the exclusion of ICMS from the PIS/COFINS base, a gain that was not observed in 2020.

Net Financial Result

The net financial result was negative by BRL 26,085.5 million in the twelve-month period ended on December 31, 2020, compared to the negative result of BRL 6,725.8 million in the same period in 2019. This result mainly reflects an increase expenses with derivative financial instruments of BRL 8,347.4 million and an increase in expenses with monetary and foreign exchange variations of BRL 10,566.1 million. Contributed to this result, the exchange rate variation on the balance sheet exposure between the opening of January 2020 and the closing of the month of December 2020, with accounting impact on foreign currency debt, but with cash effect only on maturities or amortizations of debt.

Income tax and social contribution on profit

Suzano's income tax and social contribution in the twelve-month period ended December 31, 2020 was creditor of BRL 6,927.2 million, compared to a credit of BRL 1,282.5 million in the same period of 2019. The increase it is due to the increase in pre-tax loss as a result of a high financial loss in the period.

Net Profit (Loss)

Due to the reasons above, Suzano recorded a net loss of BRL 10,714.9 million in the twelve-month period ended December 31, 2020, compared to a net loss of BRL 2,814.7 million recorded in the same period of the previous year. This result was impacted by the facts already mentioned above.

Comparative Analysis of Consolidated Results – Twelve-month periods ended on December 31, 2019 and 2018

Net Revenue

Suzano’s net revenue in 2019 was BRL 26,013.0 million, 93.6 % higher than net revenue recorded in 2018, of BRL 13,437.3 million, as a result of (i) increase in revenue due to the acquisition of Fibria, which presented net revenue of BRL 18,264.5 million in 2018, and (ii) the depreciation of the exchange rate of Real vs. Dollar in the period in question. These effects were partially offset by the depreciation of the list price of pulp in US dollars.

17

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

The net revenue obtained from the sales of pulp in 2019 totaled BRL 21,027.7 million, 139.4 % higher than the revenue recorded in 2018, due to (i) an increase in revenue due to the acquisition of Fibria, which recorded net revenue of BRL 18,167.3 million in 2018, and (ii) depreciation of the exchange rate of Real vs. Dollar currency in the period in question. These effects were partially offset by the devaluation of the pulp list price in dollars. The revenue from cellulose represented 65.3% of the total revenues in 2018, compared to 80.8% in 2019.

The export revenue from pulp in 2019 was BRL 19,193.8, 138.8% higher than the export of cellulose in 2018, due to (i) increase of the revenue as a result of acquisition of Fibria, which recorded export net revenue of BRL 16,530.2 million in 2018; and (ii) exchange rate depreciation of the Real x Dollar currency in the period in question. These effects were partially offset by the devaluation of pulp list price in dollar. Export revenues accounted for 73.8% in the year 2019.

International average net price of pulp in 2019 decreased 24%, from US$ 751/ton in 2018 to US$ 746/ton in 2019. In the domestic market, the average net price of pulp decreased by 12%, from BRL 2,498/ton in 2018 to BRL 2,207/ton in 2019.

The net revenue from the paper sales in 2019 totaled BRL 4,985.3 million, 7.1% higher than the previous year. Of this revenue, 69.8% derived from sales in the domestic market and 30.2% from the foreign market. The breakdown of Suzano’s total revenue from paper sales in 2019 was 84.1% in South and Central America (including Brazil), 7.7% in North America and 8.2% in other regions. The net revenue from the domestic market increased by 5.4% compared to the year 2018, impacted mainly by the Brazilian macroeconomic scenario, and export net income increased by 11.2% reflecting the higher sales volume and due to the depreciation of the exchange rate of Real vs. Dollar in the period in question.

The international average net price in 2019 was US$ 946/ton, 4% lower than the priced in 2018. In the domestic market, the average price recorded in 2019 was BRL 4,078/ton, 8% above the price of 2018.

Cost of Sales (“SoS”)

The cost of sales by Suzano in 2019 totaled BRL 20,743.5 million, 199.8% higher than that recorded in 2018, of BRL 6,918.3 million, mainly due to (i) the consolidation of Fibria, which had a cost of sales of BRL 9,904.4 million, in 2018; (ii) BRL 2,844.7 million in repayment of the fair value adjustment related to the acquisition of Fibria and Facepa; (iii) an increase in variable costs of BRL 6,869.8 million; (iv) higher volume of stops and; (v) higher freight cost per ton.

Gross profit

Due to the reasons explained above and due to the consolidation of Fibria, which in 2018 had a gross profit of BRL 8,360 million, Suzano’s gross profit was BRL 5,269.5 million in 2019, 19.2% lower than the gross profit of 2018, of BRL 6,519.0 million. Suzano’s gross margin decreased from 48.5% in 2018 to 20.3% in 2019, mainly due to the reduction in the pulp price in dollars.

18

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Selling and Administrative Expenses

Suzano’s selling expenses totaled BRL 1,905.3 million in 2019, 218.2% higher than the amount recorded in 2018 of BRL 598,7 million, and the index “selling expenses on net revenue” was 7.3%. The variation can be explained by (i) the consolidation of Fibria, which had in 2018 an expense with sales of BRL 812.8 million, and (ii) BRL 820.7 million related to the repayment of the fair value adjustment of the Fibria acquisition.

The Suzano’s administrative expenses totaled BRL 1173.4 million in 2019, 42.2% more than the amount recorded in 2018 of BRL 825.2 million. The index “administrative expenses on net revenue” remained at 4.5%. This variation is mainly due to (i) the consolidation of Fibria, which had a total of general and administrative expenses of BRL 392.1 million in 2018, (ii) increase of BRL 172.9 million in personnel expenses, (iii) an increase of BRL 88.3 million in services and (iv) an increase of BRL 95.6 million in other expenses which includes corporate expenses, insurance, materials (use and consumption), social projects and donations, travel and accomodation in 2019 compared to the same period in 2018.

Other Operating Expenses/Income

Other net operating expenses/income of Suzano totaled BRL 405.8 million of revenue in the year 2019, compared to the expense of BRL 96.9 million in 2018. The variation in the balance mainly refers to (i) an increase in the amount of BRL 314.6 thousand million in the adjustment of the fair value of biological assets due to the change in accounting practices (ii) a gain of BRL 87.0 million from the sale of legal credit (credits Eletrobras - Centrais Elétricas Brasileiras S.A.) in the year 2019 and (iii) in 2019 Suzano received final court decisions favorable related to the request of exclusion of ICMS from the PIS and COFINS tax base, so in the fourth quarter of 2019, Suzano recorded an asset of BRL 128.1 million related to credit of PIS and COFINS in the Taxes to be Recovered account and a gain in the result account of “Other operating income”.

Net Financial Result

The net financial result was negative by BRL 6,726 million in 2019, compared to the negative result of BRL 4,842.5 million in 2018. This result mainly reflects (a) an increase of interest on financing and borrowings by BRL 2,325.3 million, due to the higher volume of funding already mentioned above (b) the increase of monetary and foreign exchange variation expenses in the amount of 898.3 million due the exchange rate variation on the balance sheet exposure between the opening and closing of the year, with an accounting impact on foreign currency debt, but with cash effect only on debt maturities or repayments, (c) decrease in the result of operations with derivatives in the amount of BRL 1,659.9 million.

Income tax and social contribution on profit

The income tax and social contribution of Suzano in the year 2019 was creditor of BRL 1,282.5 million, compared to a credit of BRL 154.5 million in the year 2018. The increase is due to the increase in loss before tax.

19

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Net Profit (Loss)

Due to the reasons above, Suzano recorded a net loss of BRL 2,814.7 million in 2019, compared to the net profit of BRL 318,5 million recorded in the previous year. This result was impacted by the facts already mentioned above.

Suzano’s net income (loss) before taxes decreased BRL 4,260.4 million, from a gain of BRL 163.2 million in 2018 to a loss of -BRL 4,097.2 million in the same period of 2019.

Comparative Analysis of Consolidated Results - Years ended on December 31, 2018 and 2017

Net Revenue

Suzano

The net revenue of Suzano in 2018 was BRL 13,437.3 billion, 27.7% higher than net revenue recorded in 2017, of BRL 10,520,8 million , a result of the appreciation of the hardwood pulp list price (Average FOEX in Europe in 2016 was US$ 1,037 vs. US$ 819 in 2017), of the implementation of the increase in paper prices in the domestic and international markets and the exchange rate variation in the period.

The net revenue obtained from the sales of pulp in 2018 totaled BRL 8,783.3 million, 26.9% higher than the revenue recorded in 2017, due to the increase in the international pulp price, impacted by the appreciation of the Dollar. The net revenue derived from cellulose exports in 2018 was BRL 8,038.7 million, 27.7% higher than the previous year. In 2018, the share of pulp revenue from exports was 91.5% and the domestic market was 8.5%. Suzano’s revenue from sales of pulp in 2018 was 43.7% from Asia, 32.0% from Europe, 15.3% from North America and 9.0% from Latin America. As for distribution for final use, 63% of pulp sales were destined for the production of paper for sanitary purposes, 13% for printing & writing papers, 15% for special papers and 7% for packaging. The average net pulp sales price reached US$ 745.0/ton in 2018, 24.6% higher than the value recorded in 2017. In Reais, the average net price was BRL 2,772/ton, 42.7% higher to that practiced in 2017.

Net revenue from paper sales in 2018 totaled BRL 4,660.1 million, 29.9% higher than the previous year. Of this revenue, 71% derived from sales in the domestic market and 29% from the foreign market. The breakdown of Suzano’s total revenue from paper sales in 2018 was 87,6% in South and Central America (including Brazil), 4.5% in North America and 7.9% in more regions. Domestic market net revenue increased by 27.3% in 2018 compared to 2017, mainly impacted by the Brazilian macroeconomic scenario, and net export revenue increased by 27.4%, reflecting the lower price of exported paper.

The net paper average price in 2018 was BRL 3,074/ton, 1.7% lower than the price in 2017. In Reais, the average price recorded in the foreign market in 2018 was BRL 2,839/ton, 8.5% below of the 2017 price.

Fibra

Fibria’s net sales revenue increased 55.6%, or BRL 6,525.3 million, from BRL 11,739.2 million in the year ended December 31, 2017 to BRL 18,264.5 million in the corresponding period in 2018, driven by a 25% increase in average dollar prices by the appreciation of the dollar against the real and by the 11% increase in sales volume.

20

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Cost of Sales (“SoS”)

Suzano

Suzano’s cost of sales in 2018 totaled BRL 6,918.3 million, 7.3% higher than in 2017, of BRL 6,449.5 million, mainly due to the structure of Consumer Goods and the higher price of industrial inputs. The unitary SOS in 2018 was BRL 1,544/ton compared to 2017, which was BRL 1,345/ton.

Fibria

Fibria’s cost of sales (SoS) in 2018 totaled BRL 9.9 billion, an increase of 20.1% over 2017, mainly due to the higher volume sold by Fibria and the higher logistical cost, arising out the increase in volumes sales to Asia, the appreciation of the average dollar against the real of 18% and higher sales volume of pulp produced in Horizonte 2. This last factor is explained by the fact that the new production line is located more in the countryside when compared to other plants (greater average distance to the port).

Gross profit

Suzano

Due to the reasons explained above, Suzano’s gross profit was BRL 6,519.0 million in 2018, 60.1% higher than the 2017 gross profit of BRL 4,071.3 million.

Fibria

Fibria’s gross profit increased 139.5%, or BRL 4,869.3 million, from BRL 3,490.7 million in the year ended December 31, 2017 to BRL 8,360.0 million in the corresponding period in 2018, due to factors mentioned above. Fibria’s gross margin for the twelve-month period ended December 31, 2018 was 45.8%, compared to 29.7% in the corresponding period of 2017. This increase is mainly due to higher hardwood pulp price in dollar, a weaker Real and the increase in sales volume.

Selling and Administrative Expenses

Suzano

Suzano’s selling expenses totaled BRL 598.7 million in 2018, 39.0% higher than the amount recorded in 2017 of BRL 430.8 million and the “selling expenses on net revenue” ratio was 4.5%. The variation can be explained by the structuring of the Consumer Goods area from the acquisition of Facepa, expenses with Suzano Austria and expenses with labor for the commercial area.

Suzano’s administrative expenses totaled BRL 825.2 million in 2018, 56.0% higher than the amount recorded in 2017 of BRL 529.0 million. The “administrative expenses on net revenue” ratio was 6.1%. This variation is mainly due to the acquisition of Facepa, expenses with labor, expenses with consultancy for the issuance of ADRs and for the acquisition of Fibria, expenses with variable remuneration of ILP, Stock Options and additional expenses for payment of Profit Sharing bonus for employees.

21

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Fibria

Fibria’s selling expenses in 2018 totaled BRL 812.8 million, an increase of 48.5% in relation to the previous year. This increase is mainly explained by (i) increase in sales volume, due to the new production line Horizonte 2; and (ii) the sales mix, given the higher volume of pulp disposal of the Horizonte 2 line, which has higher costs than the average of the other units. Administrative expenses in 2018 totaled BRL 392.1 million, an increase of 37.2% in relation to 2017. This result is mainly due to higher expenses with consultancy services related to the transaction with Suzano and salaries and charges.

Other Operating Income/Expenses

Suzano

Suzano’s other net operating income/expenses totaled BRL 96.9 million in expenses in 2018, mainly impacted by the negative adjustment of the fair value of biological assets, which totaled BRL 129.2 million (without cash effect), compared to the income of BRL 140.5 million in 2017. The adjustment mainly reflects the increase in the gross price of the wood in the States of Maranhão and Pará, partially offset by the reduction in forest productivity, in addition to other operational and economic effects such as variation in the planted area, inflation, discount rate, future costs of forest formation, among others.

Fibria

Other operating expenses of Fibria in 2018 totaled BRL 434.4 million, an increase of 27.9% compared to 2017. The variation is mainly explained by: (i) higher expenses for variable compensation, in turn impacted by the obligation arising out the transaction with Suzano; and (ii) the increase in contingencies and the write-off of assets, partially offset by the lower expense arising out the revaluation of biological assets.

Net Financial Result

Suzano

Suzano’s net financial result was negative by BRL 4,842.5 million in 2018, compared to the negative result of BRL 1,018.9 million in 2017. This result mainly reflects, (a) the increase monetary and exchange variations, in the amount of BRL 887.2 million, due to the exchange rate variation on the balance sheet exposure between the opening and closing of the year, with accounting impact on foreign currency debt, but with cash effect only on debt maturities or repayments, (b) the increase in the result of operations with derivatives in the amount of BRL 2,808.5 million.

The financial expense in 2018 was BRL 1,481.1 million, 21.5% higher than the expense recorded in 2017. This increase is due to all the costs inherent in funding the combination of assets with Fibria.

22

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Fibria

Fibria’s net financial result in 2018 was negative by BRL 2,905.9 million, compared to the negative result of BRL 782.7 million in the year ended December 31, 2017. This variation was mainly due to the effect of the exchange variation in the portion of the Company’s indebtedness pegged to the Dollar (which in the period had a 17.1% appreciation against the real) and the negative mark-to-market result of derivative financial instruments in 2018, when compared to a positive result in 2017.

Income tax and social contribution on profit

Suzano

Suzano’s income tax and social contribution in 2018 was a creditor in BRL 155.2 million, compared to an expense of BRL 431.6 million in 2017.

In 2018, BRL 327.0 million was disbursed to pay taxes. The amount is less than reported in the financial statement due to the Company’s tax benefits.

Fibria

Fibria’s income tax increased by BRL 313.8 million in 2018, from an expense of BRL 442.1 million in the year ended December 31, 2017, compared to an expense of BRL 755.9 million during the corresponding period in 2018.

Net Profit (Loss)

Suzano

Due to the above reasons, Suzano recorded net profit of BRL 318.5 million in 2018, compared to the net profit of BRL 1,807.4 million recorded in the previous year.

Fibra

The Profit net (loss) of Fibria before taxes increased by BRL 2,280.1 billion, a gain of BRL 1,535.4 billion in the fiscal year ended December 31, 2017 to a gain of BRL 3,815.5 billion in the same period of 2018.

Fibria’s net income increased 179.8%, or BRL 1,966.3 million, from BRL 1,093.3 million in net income for the year ended December 31, 2017, to BRL 3,059.6 million in the corresponding period in 2018. Fibria’s dividends increased by BRL 2,650.8 million, from BRL 394.8 million in net income for the year ended December 31, 2017 to BRL 3,045.6 million in the corresponding period in 2018.Of the total dividend payments for the year ended December 31, 2018, BRL 262.3 million correspond to mandatory minimum dividends and BRL 2,783.3 million to extraordinary dividends. The latter reflects Fibria’s strong cash generation in the year ended December 31, 2018.

23

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

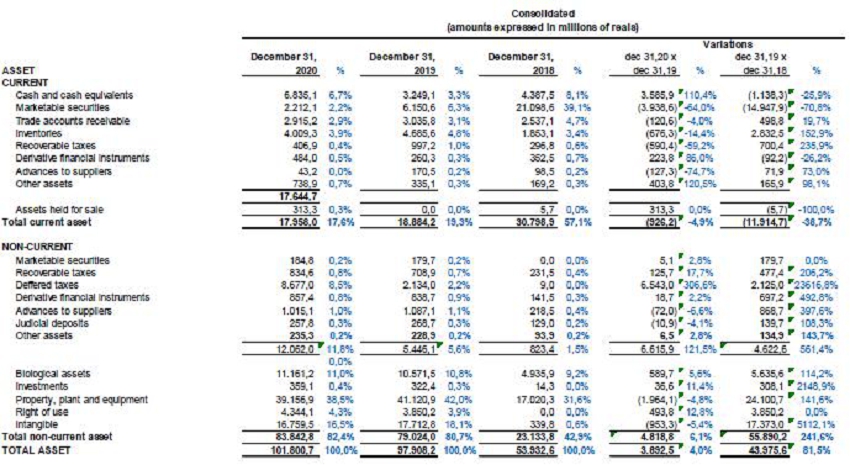

Comparative Analysis of Consolidated Balance Sheets

24

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Comparative Analysis of the Consolidated Balance Sheets - On December 31, 2020 and 2019

Current assets

Current assets were BRL 17,958.0 million on December 31, 2020, compared with a balance of BRL 18,884.2 million on December 31, 2019, representing the decrease of 4.9% or BRL 926,2 million. The participation of current assets on December 31, 2020, representing 17.6% of the total assets, compared to 19,3% on December 31, 2019.

The variation occurred mainly due to the decrease of BRL 676.3 million in inventories, mainly due to the reduction of BRL 1,148.4 million in inventories of finished pulp product related to the sale above the volume produced in exchange for the increase of BRL 403, 1 million of raw material inventories for the maintenance of the logistic chain, of BRL 590.4 million of taxes to be recovered mainly due to the reduction of BRL 363.7 million in income tax for the compensation with social security and withholding income tax from third parties, of BRL 352.6 million of cash and cash equivalents and short-term investments and an increase of BRL 403.8 million in other assets resulting from the sale of wood by BRL 200.0 million from the sale of ICMS/ES credits net of negative goodwill of 7% in the amount of BRL 129.0 million, BRL 313.3 million of assets held for sale arising from the sale of rural properties and forests (standing wood) resulting from the transaction with Bracell and Turvinho, disclosed in note 1.2.2. of the 2020 financial statement.

25

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Non-current assets

Non-current assets were BRL 83,842.8 million on December 31, 2020 and BRL 79,024.0 million on December 31, 2019, representing an increase of 6.1% or BRL 4,818.8 million.

The variation occurred mainly due to the increase of BRL 6,543.0 million in deferred income tax and social contribution, mainly related to the exchange variation of BRL 4,111.00 million and losses with derivatives of BRL 1,685.4 and a decrease of BRL 1,964 , 1 million in fixed assets, mainly due to the amortization of a capital gain of BRL 836.4.

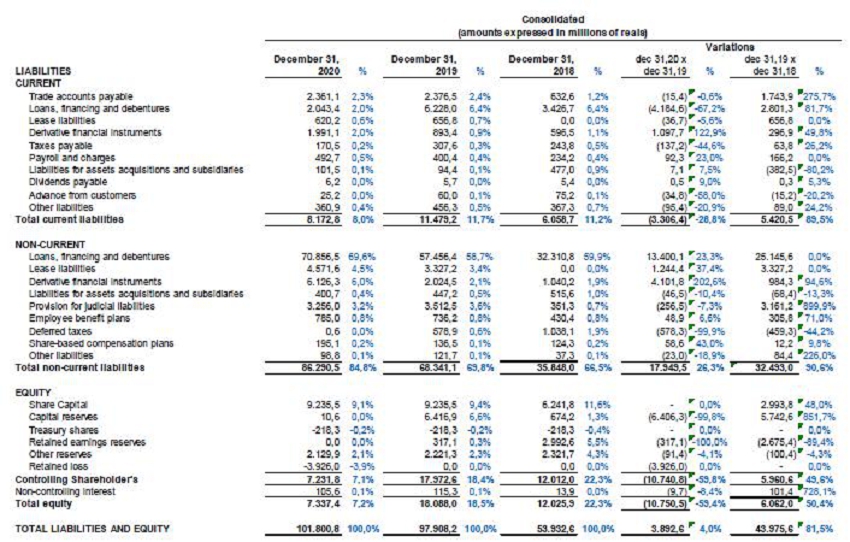

Current Liabilities

Current liabilities were BRL 8,172.8 million on December 31, 2020, compared to a balance of BRL 11,479.1 million on December 31, 2019, representing a decrease of 28.8% or BRL 3,306.4 million. The share of current liabilities in relation to total liabilities on December 31, 2020, was 8.0% compared to 11.7% on December 31, 2019.

The variance occurred mainly due to the increase of BRL 1,743.9 in suppliers, BRL 2,801.2 million in financing and borrowings and BRL 656.8 million in payable lease accounts arising out of the adoption of IFRS 16.

The variation was mainly due to the decrease of BRL 4,184.6 in loans, financing and debentures, mainly due to the settlement of the Agribusiness Receivables Certificate and Export Prepayment and BRL 137.2 million in taxes payable, mainly, federal taxes BRL 121.9 million, and an increase of BRL 1,097.7 million in derivative financial instruments, mainly due to the loss on derivatives through mark-to-market due to the increase in the dollar exchange rate on December 31, 2020.

Non-current liabilities

Non-current liabilities were BRL 86,290.5 million on December 31, 2020, compared to a balance of BRL 68,341.0 million on December 31, 2019, which represented an increase of 26.3 % or BRL17,949,5 million. The participation of current liabilities with respect to the total liabilities became 84.8% on December 31, 2020, compared to 69.8% on December 31, 2019.

The variation was due to the increase of BRL 13,400.1 million in loans, financing and debentures, mainly due to the contracting of Senior notes (Bonds) and Prepayment of exports, BRL 4,101.8 in derivative financial instruments, mainly due to the loss on derivatives by mark-to-market due to the increase in the dollar exchange rate on December 31, 2020, BRL 1,244.4 in accounts payable for lease, mainly due to the addition of BRL 858.1 of land and land, and decrease of BRL 578.3 million in deferred income tax and social contribution.

26

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Net Equity

The net equity was BRL 7,337.4 million on December 31, 2020, compared to a balance of BRL 18,088.0 million on December 31, 2019, representing a decrease of 59.4% or BRL 10,750.5 million. Equity participation increased to 7.2% of total liabilities on December 31, 2020, compared to a percentage of 18.5% on December 31, 2019.

The variation was mainly due to the loss for the year of BRL 10,714.9, absorbing BRL 6,406.3 of the capital reserve balance and BRL 317.1 million of the profit reserve balance. An accumulated loss balance of BRL 3,926.0 was also recorded.

Comparative Analysis of the Consolidated Balance Sheets - On December 31, 2019 and 2018

Current assets

Current assets were BRL 18,884.2 million on December 31, 2019, compared with a balance of BRL 30,798.9 million on December 31, 2018, representing the decrease of 38.7% or BRL 11.914,7 million. The participation of current assets on December 31, 2019, representing 19.3% of the total assets, compared to 57,1% on December 31, 2018.

The variance occurred mainly due to the decrease of BRL 14,947.9 million of financial investments, used mainly in the financial settlement of the operation with Fibria, and an increase of BRL 2,832.5 million in inventories.

Non-current assets

Non-current assets were BRL 79,023.9 million on December 31, 2019 and BRL 23.133,8 million on December 31, 2018, representing an increase of 241,6% or BRL 55,890.1 million.

The variance occurred mainly due to the increase of BRL 5,635.6 million in biological assets, BRL 24,100.6 million in fixed assets, BRL 17,372.9 million in intangible assets, BRL 3,850.2 in right of use BRL 2,134.0 in deferred income tax and social contribution, related mainly to purchase balances in operation with Fibria.

Current Liabilities

Current liabilities were BRL 11.479.1 million on December 31, 2019, compared to a balance of BRL 6.058.7 million on December 31, 2018, representing an increase of 89.4% or BRL 5.420.4 million. The participation of liabilities in relation to total liabilities on 31 December 2019 was 11.7% compared to 11.0% on December 31 2018.

The variance occurred mainly due to the increase of BRL 1,743.9 in suppliers, BRL 2.801.2 million in financing and borrowings and BRL 656.8 million in payable lease accounts arising out the adoption of IFRS 16.

27

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Non-current liabilities

Non-current liabilities were BRL 68,341.0 million on December 31, 2019, compared to a balance of BRL 35,848.0 million on December 31, 2018, which represented an increase of 90.6 % or BRL 32,493,0 million. The participation of current liabilities with respect to the total liabilities became 69.8% on December 31, 2019, compared to 66.5% on December 31, 2018.

The variation was due to the increase of BRL 25,145.5 million in borrowings, financing and debentures, BRL 3,327.2 in lease payable accounts due to the adoption of the IFRS 16, BRL 984.3 million in unrealized losses on derivative transactions and BRL 3,161,2 in provision for court liabilities.

Net Equity

The net equity was BRL 18,087.9 million on December 31, 2019, compared to a balance of BRL 12,025.9 million on December 31, 2018, representing an increase of 50.4% or BRL 6,062.0 million. The participation of net equity increased to 18.5% of total liabilities on December 31, 2019, compared to a percentage of 22.3% in December 2018.

The variation was due to increases of BRL 2,993.7 in the capital, BRL 5,742.6 million in capital reserve both arising from issuance of common shares in connection with the business combination with Fibria and decreased BRL 2,675.4 million in revenue reserves arising out loss absorption for the year.

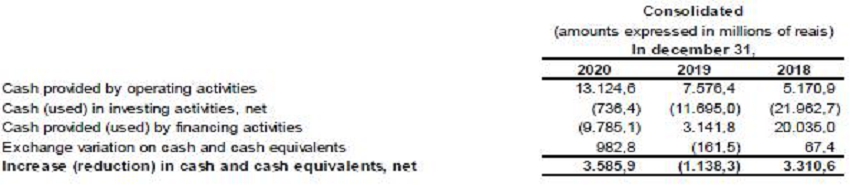

Comparative Analysis of Consolidated Cash Flows

Comparative Analysis of Cash Flow Statements - fiscal years ended December 31, 2020, 2019 and 2018

Operating Activities

Consolidated

Operating activities generated net cash in the amount of BRL 13,124.6 in fiscal year 2020. This generation is mainly associated with a gross profit of BRL 11,493.9 and an improvement in working capital in the accounts receivable, inventories and Providers.

Operating activities generated net cash in the amount of BRL 7,576.4 million in the fiscal year of 2019. This generation is mainly associated with a gross profit of BRL 5,269.5 and an improvement in working capital in the accounts index of receivable accounts and inventories.

28

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Suzano

Operating activities generated net cash in the amount of BRL 5,169.4 million in the fiscal year of 2018, and BRL 3,067.9 million in the fiscal year of 2017. The increases observed in the comparative periods are mainly associated with the increase in the net revenue from the sale of pulp and paper due to the increases in sales volumes, the increases in the sale prices of pulp and paper in the national and international markets and, depreciation of the Real against the US currency.

Fibria

The cash flow of Fibria generated by operating activities was BRL 6,873.7 million in the fiscal year of 2018, compared to US$ 4,105.8 million in the fiscal year of 2017, an increase of 67.4%. In 2018, Fibria posted a profit of BRL 3,815.5 million before income tax, compared to a revenue of BRL 1,535.4 million in 2017. The net cash flow generated by operating activities was mainly impacted by the increase of 55.6% of net revenue in the year, mainly due to the 25% increase in the net price of pulp in dollars of a 9% increase in sales volume and a 14% appreciation in the average exchange rate between 2017 and 2018.

Investing Activities

Consolidated

In 2020, investment activities consumed net cash of BRL 736.4. The amount invested is mainly composed of the acquisition of fixed assets in the amount of BRL 1,503.2 and the acquisition of biological assets in the amount of BRL 3,392.2, offset by the inverse effect of BRL 3,841.4 from financial investments, net.

In the fiscal year of 2019, investment activities consumed net cash of BRL 11,695.0 million. The amount invested comprises mainly the acquisition of Fibria of BRL 26,002.5 and acquisition of fixed, intangible and biological assets in the amount of BRL 4,868.4 million, offset by the reverse effect of BRL 19,378.9 million of financial investments, net.

Suzano

In the fiscal year of 2018, investment activities consumed net cash in the amount of BRL 21,961.3 million, and in the fiscal year of 2017, net cash in the amount of BRL 1,008.3 million was consumed. The total amount invested in 2018 is mainly composed of: (i) BRL 1,251.5 million related to the acquisition of fixed assets; (ii) BRL 1,165.0 million related to the acquisition of biological assets acquired under the contract with Duratex, and (iii) BRL 19,340.0 million related to the balance of investments recorded for financial settlement of the operation with Fibria.

29

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

Fibria

Fibria’s investment activities used net cash of BRL 5,813.5 million during the fiscal year ended December 31, 2018. During the year ended December 31, 2018, the investment activities for which Fibria used cash consisted of mainly (i) investments of BRL 3,916.0 million in fixed assets, intangible assets and forest and advances for the acquisition of wood from forests; (ii) BRL 1,674.9 million in tradable securities; and (iii) BRL 216.4 million in derivative agreements.

Financing Activities

Consolidated

In 2020, BRL 9,785.1 million of net cash was used in financing activities. The use of cash included the settlement of BRL 19,092.8 in loans, financing and debentures and BRL 4,465.6 in derivative transactions. This effect was offset by borrowing and financing and debentures in the amount of BRL 14,761.7 million, which consisted mainly of BRL 4,899.1 in export prepayments, BRL 2,638.2 in revolving credit facility, BRL 6,640 , 3 in Senior notes (Bonds) and BRL 531.7 in contracts with BNDES.

In the fiscal year of 2019, BRL 3,141.8 million net cash was generated in financing activities. Cash generation included borrowing and financing and debentures in the amount of BRL 18,993.8 million, which consisted mainly of BRL 4,340.3 million in export prepayments (EPP), BRL 4,750.0 million in debentures, BRL 8,061.4 million in senior notes (Bonds), and BRL 1,813.8 million in advances on foreign exchange contracts (ACC). On the other hand, BRL 13,994.7 million of debt was settled.

Suzano

In the fiscal year of 2018, BRL 20,035.0 million of net cash was generated in financing activities, while in the fiscal year ended December 31, 2017, the amount of BRL 2,612.1 million was applied. In 2018, cash generation included: (i) acquisition of borrowings, financing and debentures in the amount of BRL 25,645.8 million for the constitution of cash and subsequent financial settlement of the operation with Fibria; (ii) settlement of a derivative transaction of BRL 1,586.4 million; (iii) settlement of borrowings and financing of BRL 3,738.6 million; and (iv) dividend payments in the amount of BRL 210.2 million.

Fibria

Fibria’s net cash provided by financing activities, which include short and long-term secured and unsecured loans and debt repayments, resulted in a cash reduction of BRL 3,609.4 million in the fiscal year of 2018, compared to an increase of cash of BRL 2,386.8 million in the fiscal year of 2017.

In the fiscal year ended December 31, 2018, Fibria raised BRL 1,343.8 million, mainly attributable to (i) export pre-financing contract, in the total amount of BRL 540.2 million and (ii) contracts signed with BNDES, of which BRL 803.6 million was disbursed in 2018. Part of these funds was used to pay the total amount of BRL 1,921.9 million of Fibria’s principal debt.

In addition, Fibria had access to a revolving credit line committed to support any cash needs that might arise.

30

SUZANO S.A.

Publicly-Held Company with Authorized Capital

CNPJ No. 16.404.287/0001-55

NIRE No. 29.300.016.331

Management Proposal – AOEM of April 27, 2020

10.2. Board of Officers Comments on:

a) Company’s results of operations.

Please find below the comments from the Executive Board of Officers of Suzano corresponding to the analysis of (i) the important revenue components, and (ii) main factors that materially affected operating income/expenses which, in both cases, are: sales level (volume and revenue per product), sales destination (mix between domestic market and different export regions), market share and prices. Other exogenous factors over which the Company has little or no control are commented in item “10.2.b”.

In 2019, the joint operation of the companies Suzano Celulose e Papel and Fibria Celulose began after the merger of the two companies. The data reported below are representative of Suzano S.A. for 2019 and Suzano Celulose e Papel for previous years.

Pulp Sales

In the fiscal years ended in 2020, 2019 and 2018, the Company’s pulp sales accounted for, respectively, 84.0%, 80.8% and 65.4% of its total net operating income. The export volume accounted for 92.7%, 91.2% and 90.8%, of the total volume of pulp sold in these same periods. Export sales volume was 10.0 million tons, 8.6 million tons and 2.9 million tons in the years ended in 2020, 2019 and 2018, respectively.

| Fiscal year ended December 31 | ||||||||||||

| Total sales of pulp | 2020 | 2019 | 2018 | |||||||||

| Company’s sales (in thousand tons) | ||||||||||||

| Volume of sales in the domestic market | 787 | 831 | 298 | |||||||||

| Volume of sales in in the foreign market | 10,036 | 8,581 | 2,928 | |||||||||

| Total volume of sales | 10,823 | 9,412 | 3,226 | |||||||||