UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended DECEMBER 31, 2020 |

Commission file number 001-38755

| Suzano S.A. |

| (Exact name of Registrant as specified in its charter) |

| |

| Suzano Inc. |

| (Translation of Registrant’s name into English) |

| |

| Federative Republic of Brazil |

| (Jurisdiction of incorporation or organization) |

| |

Av. Professor Magalhães Neto, 1,752 10th Floor, Rooms 1010 and 1011 Salvador, Brazil 41810-012 |

| (Address of principal executive offices) |

| |

Marcelo Feriozzi Bacci Chief Financial and Investor Relations Officer Telephone: +55 11 3503-9000 Email: ri@suzano.com.br Av. Faria Lima, 1,355 – 7th Floor São Paulo, Brazil, 01452-919 |

| (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class: | Trading Symbol | Name of each exchange on which registered: |

| Common Shares, without par value | | New York Stock Exchange* |

| American Depositary Shares (as evidenced by American Depositary Receipts), each representing two Common Shares | — | New York Stock Exchange |

| 4.000% Notes due 2025, issued by Fibria Overseas Finance Ltd. | FBR/25 | New York Stock Exchange |

| 5.500% Notes due 2027, issued by Fibria Overseas Finance Ltd. | FBR/27 | New York Stock Exchange |

| 5.250% Notes due 2024, issued by Fibria Overseas Finance Ltd. | FBR/24 | New York Stock Exchange |

| 6.000% Notes due 2029, issued by Suzano Austria GmbH | SUZ/29 | New York Stock Exchange |

| 5.000% Notes due 2030, issued by Suzano Austria GmbH | SUZ/30 | New York Stock Exchange |

| 3.750% Notes due 2031, issued by Suzano Austria GmbH | SUZ/31 | New York Stock Exchange |

* Not for trading purposes but only in connection with the registration on the New York Stock Exchange of American Depositary Shares representing those common shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

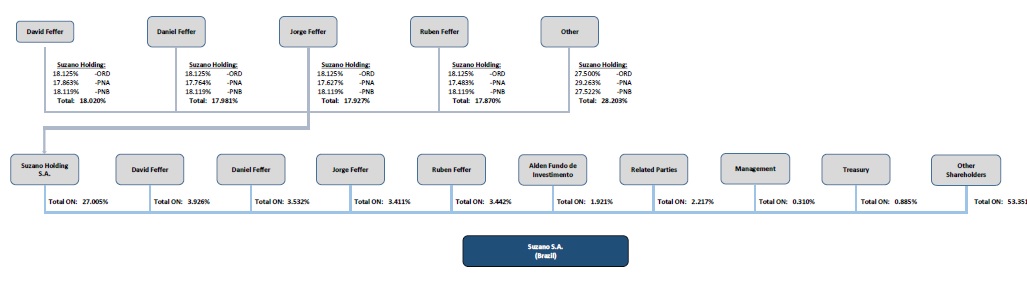

The number of outstanding shares of stock of Suzano S.A. as of December 31, 2020 was:

1,361,263,584 common shares, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

☒ Yes ☐ No

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | | International Financial Reporting Standards as issued

by the International Accounting Standards Board ☒ | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

TABLE OF CONTENTS

Page

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements, mainly in “Item 3. Key Information — Risk Factors,” “Item 4. Information on Suzano — Business Overview” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current expectations about future events and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions, including among other things:

| • | the outbreak of the COVID-19 pandemic and its impacts on the sanitary and health conditions in Brazil and in our principal export markets, as well as any impact on our business, financial condition, results of operations and prospects, including impacts in the demand for printing and writing papers, and any further actions that alter our business operations, as may be required by local authorities, or that we determine are in the best interests of our employees, communities and clients; |

| • | our management and future operation; |

| • | the implementation of our main operational strategies, including our potential participation in acquisitions, joint venture transactions or other investment opportunities; |

| • | general economic, political and business conditions, both in Brazil and in our principal export markets; |

| • | industry trends and the general level of demand for, and change in the market prices of, our products; |

| • | existing and future governmental regulation, including tax, labor, pension and environmental laws and regulations and import tariffs in Brazil and in other markets in which we operate or to which we export our products; |

| • | the competitive nature of the industries in which we operate; |

| • | our level of capitalization, including the levels of our indebtedness and overall leverage; |

| • | the cost and availability of financing; |

| • | our compliance with the covenants contained in the instruments governing our indebtedness; |

| • | the implementation of our financing strategy and capital expenditure plans; |

| • | inflation and fluctuations in currency exchange rates, including the Brazilian real and the U.S. dollar; |

| • | legal and administrative proceedings to which we are or may become a party; |

| • | the volatility of the prices of the raw materials we sell or purchase to use in our business; |

| • | other statements included in this annual report that are not historical; and |

| • | other factors or trends affecting our financial condition or results of operations, including those factors identified or discussed in “Item 3. Key Information — Risk Factors.” |

The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “hope,” “intend,” “may,” “might,” “should,” “would,” “will,” “understand” and similar words are intended to identify forward-looking statements. We undertake no obligation to update publicly or revise any forward- looking statements because of new information, future events or otherwise. In light of these risks and uncertainties, forward-looking information, events and circumstances discussed in this annual report might not occur and are not guarantees of future performance. Our actual results and performance may differ substantially from the forward-looking statements included in this annual report.

GLOSSARY OF CERTAIN TERMS USED IN THIS ANNUAL REPORT

Herein, “Suzano”, the “Company”, “we”, “us” and “our” refer to Suzano and its consolidated subsidiaries, unless the context otherwise requires. References to “Fibria” refer to former “Fibria Celulose S.A.”. All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “US$” are to United States dollars, the official currency of the United States.

| ADENE | Agency for the Development of the Northeastern Brazil, or Agência de Desenvolvimento do Nordeste. |

| ADR | American Depositary Receipts. |

| ADS | American Depositary Shares. |

| ANTAQ | Brazilian regulatory agency regulating aquatic transportation, or Agência Nacional de Transportes Aquaviários. |

| B3 | B3 S.A. – Brasil, Bolsa, Balcão, the São Paulo Stock Exchange. |

| BNDES | The Brazilian Development Bank, or Banco Nacional de Desenvolvimento Econômico e Social. |

| BNDESPAR | BNDES Participações S.A. |

| Brazilian Corporation Law | Brazilian Law No. 6.404/76, as amended. |

| CADE | Brazilian antitrust authority, or Conselho Administrativo de Defesa Econômica. |

| COFINS | Contribution for the Financing of Social Security, or Contribuição para o Financiamento da Seguridade Social. |

| CONFAZ | National Board of Financial Policy, or Conselho Nacional de Política Fazendária. |

| CSLL | Social Contribution on Net Income, or Contribuição Social Sobre o Lucro Líquido. |

| CVM | Brazilian Securities Commission, or Comissão de Valores Mobiliários. |

| Exchange Act | U.S. Securities Exchange Act of 1934, as amended. |

| FGTS | Government Severance Indemnity Fund for Employees, or Fundo de Garantia do Tempo de Serviço. |

| GHG | Greenhouse gas. |

| IBÁ | Brazilian Tree Industry, or Indústria Brasileira de Árvores. |

| IBAMA | Brazilian Federal Environmental Agency, or Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais Renováveis. |

| ICMS | Tax on Sale of Goods and Services, or Imposto sobre Circulação de Mercadorias e Serviços. |

| IFC | International Finance Corporation. |

| INCRA | Brazilian Institute for Land Reform, or Instituto Nacional de Colonização e Reforma Agrária. |

| INPI | National Industrial Property Institute, or Instituto Nacional da Propriedade Industrial |

| INSS | Social Security Contributions, or Instituto Nacional do Seguro Social. |

| IPCA | Inflation Rate Index for Consumer Goods, or Índice Nacional de Preços ao Consumidor Amplo |

| IPI | Tax on Manufactured Products, or Imposto sobre Produtos Industrializados. |

| IRPJ | Corporate Income Taxes, or Imposto de Renda Pessoa Jurídica. |

| ISS | Tax on Services, or Imposto Sobre Serviços. |

| PIS | Social Integration Program, or Programa de Integração Social. |

| PPPC | Pulp and Paper Products Council. |

| RFB | Brazilian Internal Revenue, or Receita Federal do Brasil. |

| Securities Act | U.S. Securities Act of 1933, as amended. |

| SUDENE | Superintendence for Development of the Northeast, or Superintendência do Desenvolvimento do Nordeste. |

| TJLP | Brazilian Long-Term Interest Rate, or Taxa de Juros de Longo Prazo. |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We have prepared our consolidated financial statements as of December 31, 2020 and 2019 and for each of the three years ended December 31, 2020, included herein, in compliance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The selected financial information should be read together with our consolidated financial statements, including the notes thereto.

Our functional currency and that of all our subsidiaries is the real, which is also the currency used for the preparation and presentation of our consolidated financial statements, except for investments in associates abroad related to Ensyn Corporation, F&E Technologies LLC and Spinnova OY. See note 3.2.5. to our audited consolidated financial statements.

We make statements in this annual report about our competitive position and our market share in, and the market size of, the market pulp and paper industry. We have made these statements on the basis of statistics and other information from third-party sources that we believe are reliable.

The financial information and certain other information presented in a number of tables in this annual report have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers in a column may not conform exactly to the total figure given for that column. In addition, certain percentages presented in the tables in this annual report reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based on the rounded numbers.

Given that the merger of shares (incorporação de ações) (the “Merger”), set forth in the Merger Agreement entered into by Suzano and Fibria on July 26, 2018 (the “Merger Agreement”) was consummated in January 2019, our results of operations and financial condition for some historical periods discussed in this section do not reflect or include the results of operations or any assets or liabilities of Fibria. We began consolidating Fibria and its subsidiaries as from January 1, 2019, and, accordingly, our results of operations and financial condition in future periods may not necessarily be comparable to our results of operations and financial condition for historical periods, including those discussed below. For information on Fibria’s results of operations and financial condition for these periods, see Fibria’s audited consolidated statements as of December 31, 2018 and 2017 and for the years ended December 31, 2018, 2017 and 2016 that were submitted by Fibria to the SEC on Form 6-K on February 22, 2019. In this section, we include, solely for convenience purposes, certain information on Fibria’s results of operations, cash flows and financial condition, including indebtedness and other contractual liabilities, that was extracted from Fibria’s audited consolidated financial statements. However, this information is not indicative of any future results of operations or financial condition of Fibria, or of our company and Fibria operating on a combined basis.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

For a discussion of our financial and operating data for the years ended December 31, 2020 and 2019, see “Item 5. Operating and Financial Review and Prospects.”

OTHER FINANCIAL DATA

| | | Year ended December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | (in thousands of R$, unless otherwise indicated) | |

| Gross margin (1) | | | 37.7 | % | | | 20.3 | % | | | 48.5 | % | | | 38.6 | % | | | 33.3 | % |

| Operating margin (2) | | | 27.7 | % | | | 10.1 | % | | | 37.3 | % | | | 31.0 | % | | | 13.0 | % |

| Capital expenditures (3) | | | 4,897,860 | | | | 4,868,427 | | | | 2,423,698 | | | | 1,780,302 | | | | 2,324,338 | |

| Depreciation, amortization and depletion (4) | | | 6,772,781 | | | | 5,844,855 | | | | 1,563,223 | | | | 1,402,778 | | | | 1,403,518 | |

| Cash flow provided by (used in): | | | | | | | | | | | | | | | | | | | | |

| Operating activities | | | 13,124,636 | | | | 7,576,437 | | | | 5,169,448 | | | | 3,067,332 | | | | 3,075,539 | |

| Investing activities | | | (736,417 | ) | | | (11,695,019 | ) | | | (21,961,310 | ) | | | (1,007,807 | ) | | | (3,342,484 | ) |

| Financing activities | | | (9,785,139 | ) | | | 3,141,809 | | | | 20,035,049 | | | | (2,612,089 | ) | | | 566,082 | |

| (1) | The gross margin calculation consists of dividing gross profit by net revenues. |

| (2) | The operating margin calculation consists of dividing operating profit before net financial income (expenses) by net revenues. |

| (3) | Relates to capital expenditures cash invested for the acquisition of property, plant and equipment and intangible assets and biological assets. |

| (4) | Solely for the year ended December 31, 2019, depreciation, amortization and depletion includes the amortization of fair value adjustment on the business combination with Fibria/Facepa/Ibema, except for the fair value amortization of inventories and contingencies related to the business combination with Fibria. Solely for the year ended December 31, 2020, depreciation, amortization and depletion includes subleasing of ships. |

OPERATIONAL DATA

| | | As at and for the year ended December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Number of employees | | | 15,653 | | | | 14,534 | | | | 9,385 | | | | 7,830 | | | | 7,483 | |

| Nominal production (millions of tons) | | | | | | | | | | | | | | | | | | | | |

| Pulp | | | 9.8 | | | | 9.4 | | | | 3.5 | | | | 3.5 | | | | 3.5 | |

| Paper | | | 1.2 | | | | 1.2 | | | | 1.3 | | | | 1.2 | | | | 1.2 | |

| Nominal production capacity (millions of tons) | | | | | | | | | | | | | | | | | | | | |

| Pulp | | | 10.9 | | | | 10.9 | | | | 3.6 | | | | 3.6 | | | | 3.6 | |

| Paper | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.3 | |

| Sales volumes (thousand metric tons) | | | | | | | | | | | | | | | | | | | | |

| Domestic market pulp | | | 786,621 | | | | 830,962 | | | | 298,005 | | | | 376,502 | | | | 410,564 | |

| Export market pulp | | | 10,036,495 | | | | 8,580,691 | | | | 2,927,714 | | | | 3,255,329 | | | | 3,117,814 | |

| Total market pulp | | | 10,823,116 | | | | 9,411,653 | | | | 3,225,719 | | | | 3,631,831 | | | | 3,528,378 | |

| Sales volumes (thousand metric tons) | | | | | | | | | | | | | | | | | | | | |

| Domestic market paper | | | 801,819 | | | | 853,412 | | | | 878,374 | | | | 815,917 | | | | 826,408 | |

| Export market paper | | | 375,062 | | | | 403,051 | | | | 377,263 | | | | 374,190 | | | | 361,996 | |

| Total market paper | | | 1,176,881 | | | | 1,256,463 | | | | 1,255,637 | | | | 1,190,108 | | | | 1,188,404 | |

| Total sales volumes market paper and pulp | | | 11,999,997 | | | | 10,668,116 | | | | 4,481,356 | | | | 4,821,938 | | | | 4,716,782 | |

Special Note Regarding Non-IFRS Financial Measures

A non-IFRS financial measure is any financial measure that is presented other than in accordance with all relevant accounting standards under IFRS. We disclose EBITDA and Adjusted EBITDA for Suzano in this annual report, which are considered to be non-IFRS financial measures. EBITDA is calculated as Net income (loss) plus Net financial result, Income and social contribution taxes, and Depreciation, amortization and depletion. Adjusted EBITDA for Suzano is defined as EBITDA as further adjusted to add or exclude: (i) exceptional adjustments as defined by management are those with no impact on Suzano’s ongoing business, such as Expenses with Fibria’s transaction, Amortization of fair value adjustment on business combination with Fibria, Indemnity – FACEPA, Contract renegotiation, Losango Project Adjustments, COVID-19 - Social actions, COVID-19 - Operating expenses, Fair value adjustment (others), ITBI Provision and fees, Sale of judicial credits, Shut down – 5.1 Project Mucuri facility, Non-Compete Executives, Fees of counsel, Tax credits - gains in tax lawsuit (ICMS from the PIS/COFINS calculation basis) and Agreement White Martins and (ii) non-cash adjustments are those adjustments that have impacted the income statements without a cash impact on Suzano, such as Accrual (reversal) of losses on ICMS credits, Impairment of non-financial assets, Accruals for losses on PIS and COFINS credits, Labor lawsuits provision, Fair value adjustment of biological assets, Result from sale and disposal of property, plant and equipment and biological assets, Income from associates and joint ventures, Reconciliation adjustments and Write-off of physical inventory.

The non-IFRS financial measures described in this annual report are not a substitute for the IFRS measures of net income or other performance measures.

Our management believes that disclosure of our EBITDA and Adjusted EBITDA provide useful information to investors, financial analysts and the public in their review of our operating performance and their comparison of our operating performance to the operating performance of other companies in the same industry and other industries.

For example, interest expense is dependent on the capital structure and credit rating of a company. However, debt levels, credit ratings and, therefore, the impact of interest expense on earnings vary significantly between companies. Similarly, the tax positions of individual companies can vary because of their differing abilities to take advantage of tax benefits and the differing jurisdictions in which they transact business. Finally, companies differ in the age and method of acquisition of productive assets, and thus the relative costs of those assets, as well as in the depreciation method (straight-line, accelerated or units of production), which can result in considerable variation in depreciation and amortization expenses between companies. Therefore, for comparison purposes, our management believes that our EBITIDA and Adjusted EBITDA are useful measures of operating profitability because they exclude these elements of earnings that do not provide information about the current operations of existing assets.

Moreover, other companies may calculate EBITDA and Adjusted EBITDA differently, and therefore our presentation of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures used by other companies. Each of these non-IFRS financial measures are important measures to assess our financial and operating performance. We believe that the disclosure of EBITDA and Adjusted EBITDA provides useful supplemental information to investors and financial analysts in their review of our operating performance and in the comparison of such operating performance to the operating performance of other companies in the same industry or in other industries that have different capital structures, debt levels and/or income tax rates. The presentation of non-IFRS financial information is not meant to be considered in isolation or as a substitute for the directly comparable financial measures prepared in accordance with IFRS.

See below for a reconciliation of our net income (loss) to EBITDA and Adjusted EBITDA.

| Adjusted EBITDA (R$ million) | | 2020 | | | 2019 | |

| EBITDA Reconciliation | | | | | | | | |

| Net income (loss) | | | (10,714.9 | ) | | | (2,814.7 | ) |

| (+/–) Net financial result | | | 26,085.5 | | | | 6,725.8 | |

| (+/–) Income and social contribution taxes | | | (6,927.2 | ) | | | (1,282.5 | ) |

| (+) Depreciation, amortization and depletion (1) | | | 6,772.8 | | | | 5,844.8 | |

| EBITDA | | | 15,216.2 | | | | 8,473.4 | |

| Expenses with Fibria’s Transaction(2) | | | 1.0 | | | | 79.9 | |

| Amortization of fair value adjustment on business combination with Fibria(3) | | | — | | | | 2,247.1 | |

| Indemnity – FACEPA(4) | | | — | | | | 4.1 | |

| Adjusted EBITDA (R$ million) | | 2020 | | | 2019 | |

| Accrual (reversal) of losses on ICMS credits(5) | | | (79.0 | ) | | | 181.1 | |

| Contract renegotiation(6) | | | 6.7 | | | | 45.7 | |

| Losango Project Adjustments(7) | | | — | | | | 57.8 | |

| Impairment of non-financial assets(5) | | | 45.4 | | | | — | |

| COVID-19 - Social actions(8) | | | 48.6 | | | | — | |

| COVID-19 - Operating expenses(9) | | | 136.1 | | | | — | |

| Fair value adjustment (others)(10) | | | — | | | | (32.7 | ) |

| ITBI provision and fees(11) | | | 10.5 | | | | — | |

| Accruals for losses on PIS and COFINS credits(5) | | | 11.1 | | | | 21.1 | |

| Labor lawsuits provision(5) | | | — | | | | 32.2 | |

| Fair value adjustment of biological assets(5) | | | (466.5 | ) | | | (185.4 | ) |

| Sale of judicial credits(12) | | | — | | | | (86.6 | ) |

| Result from sale and disposal of property, plant and equipment and biological assets(5) | | | 25.5 | | | | 42.7 | |

| Shut down – 5.1 Project Mucuri facility(13) | | | 29.7 | | | | — | |

| Income from associates and joint ventures(5) | | | (36.1 | ) | | | (32.0 | ) |

| Non-Compete Executives(14) | | | — | | | | 3.8 | |

| Fees of counsel(15) | | | — | | | | 2.4 | |

| Reconciliation adjustments(5) | | | — | | | | (3.0 | ) |

| Tax credits - gains in tax lawsuit (ICMS from the PIS/COFINS calculation basis)(16) | | | — | | | | (128.1 | ) |

| Agreement White Martins(17) | | | 0.4 | | | | — | |

| Write-off of physical inventory(5) | | | — | | | | 0.1 | |

| Adjusted EBITDA | | | 14,949.6 | | | | 10,723.6 | |

| (1) | Solely for the year ended December 31, 2019, depreciation, amortization and depletion includes the amortization of fair value adjustment on the business combination with Fibria/Facepa/Ibema, except for the fair value amortization of inventories and contingencies related to the business combination with Fibria. Solely for the year ended December 31, 2020, depreciation, amortization and depletion includes subleasing of ships. |

| (2) | Exceptional: Expenses incurred due to the business combination with Fibria. |

| (3) | Exceptional: Amortization of fair value adjustment on business combination with Fibria related to contingencies and inventory. |

| (4) | Exceptional: expenses related to the dismantling of machinery at Facepa. |

| (6) | Exceptional: Penalties on contractual terminations with some suppliers due to operational synergies arising from business combination with Fibria. |

| (7) | Exceptional: Provisions related to the Losango project, mainly, write-off of advances of forestry development program and write-off of wood stock in the field. |

| (8) | Exceptional: Disbursements made for carrying out the social actions implemented by Suzano. |

| (9) | Exceptional: Includes, mainly, expenses in the facilities units for the upgrading of cafeterias and workplaces, expansion of the frequency of conservation, cleaning, hygiene and maintenance of common areas, public transport with more space between passengers, distribution of masks and realization rapid tests on employees working in facilities units. |

| (10) | Exceptional: Bargain purchase Spinnova. In 2019, the Company revaluated the investment, previously classified as financial investment measured through other comprehensive income. |

| (11) | Exceptional: Provision for Property Transfer Tax ("ITBI") payments and fees referring to the regularization of land acquired prior to 2015. |

| (12) | Exceptional: The amount refers to the sale of credits related to a lawsuit against Centrais Elétricas Brasileiras S.A. (Eletrobrás). |

| (13) | Exceptional: Refers to a 2016 project of the Mucuri facility that was discontinued. |

| (14) | Exceptional: Non-compete payment made to an executive of the Company. |

| (15) | Exceptional: Fees of legal counsel arising from successful causes related to exceptional events. |

| (16) | Exceptional: For certain tax credits to be recovered, the Company has received final favorable court decisions in 2019 and recorded an asset of R$128.1 relating to PIS and COFINS tax credits within recoverable taxes and a gain in the statement of income (loss) within other operational results, regarding certain claims for the calculation period from 2006 to July 2018. |

| (17) | Exceptional: Fine for termination due to supply incidents. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

We are subject to various risks and uncertainties resulting from changing competitive, economic, political, environmental and social conditions that could harm our business, results of operations or financial condition. The risks described below, although not being the only ones we face are the most important ones according to our ability to identify material risks. Other risks that we presently believe are not material could also adversely affect us.

Risks Relating to the Pulp and Paper Industry

Our products’ prices are greatly affected by international market prices, which vary depending on a number of factors that are beyond our control and could adversely affect our results of operations and financial conditions and our ability to operate our plants in an economically viable manner.

Pulp markets are typically cyclical, and our pulp prices follow international market prices, which are determined by supply and demand, global pulp production capacity and global economic conditions. Such prices can also be affected by exchange rate fluctuations between the currencies of main producing and consuming countries, movement of inventories, diverging price expectations, business strategies adopted by other producers and availability of substitutes for our products, among others. All of these factors are beyond our control and may have a significant impact on the prices for pulp and, consequently, on our operational margins, profitability and ROIC. Fluctuations in pulp price may lead us to adopt changes in our commercial strategy or production, which also may adversely affect our financial condition and results of operation.

Paper prices are also determined by supply and demand conditions in the markets in which they are sold, and are affected by various factors, including the fluctuation in pulp prices and the specific characteristics of the markets in which we operate.

We cannot assure that pulp and paper market prices and demand for our products will remain favorable to us, and any adverse price or demand fluctuations, which may occur rapidly in our markets, could adversely affect our results of operations and financial conditions and our ability to operate our plants in an economically viable manner.

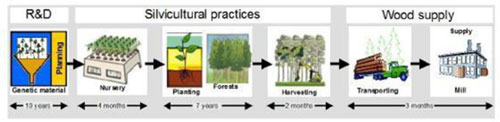

We are highly dependent on our planted forest areas for the supply of wood, which is essential to our production processes, and any damage to our forest areas or impact on prices of land we seek to purchase for our forests may adversely affect us.

Most of the wood used in our production processes is supplied by our own forestry operations, which include planted forest areas located in close proximity to our production facilities. The wood market in Brazil is very regional and limited in wood availability, as most pulp and paper producers are integrated and utilize wood grown in their own planted forests to meet their wood requirements.

Our planted forests are subject to natural threats, such as drought, fire, pests and diseases, which may reduce our supply of wood or increase the price of wood we acquire. Our planted areas are also subject to other threats, considering their wide territorial coverage and proximity to a significant number of neighbors and local communities, including loss of possession due to social unrest or squatter invasion, land title disputes, wood theft, or arson, which may result in real damage to our planting and transit areas and may adversely affect our results.

In addition, the physical effects of climate change may materially and adversely affect our operations, for example by changing air temperature and water levels, and subjecting us to unusual or different weather-related risks. Any climate changes that negatively affect the favorable climate conditions in Brazil may adversely affect the growth rate and quality of our plantations, or our production costs. Although we cannot predict the impact of changing global climate conditions, any such occurrences may increase our liabilities and capital expenditures and adversely affect our business, financial condition and results of operations.

Additionally, in acquiring land for our timber plantations, we compete with other crops, as well as with cattle breeders, which could ultimately raise land prices or make it more difficult for us to contract independent third parties to cultivate eucalyptus.

Drought in some regions of Brazil, resulting in water scarcity and related rationing, may adversely affect our business and results of operations.

In Brazil, some regions might have drought conditions during some seasons of the year, which could result in acute shortages of water and/or implementation of rationing to restrict usage. Some of our units are located in the affected areas and we cannot assure that our processes for efficient use of water and contingency plans will be able to avoid impacts from severe droughts or governmental measures to address drought conditions on our units’ operations, which could have an adverse effect on our business and results of operations.

We face significant operational risks that can result in the shutdown of our operations, which may adversely affect our financial condition and results of operations.

We face operational risks that may result in partial or temporary suspension of our operations and in loss of production. Such outages may be caused by factors associated with equipment failure, information system disruptions or failures (including due to cyber-attacks), accidents, fires, strikes, invasions, weather, exposure to natural disasters, regional water crisis, electricity power outages and chemical product spills, accidents involving water reservoirs, landfills, revocation of licenses, among other operational and environmental hazards. The occurrence of these events may, among other impacts, result in serious damage to our property, assets and reputation, liability for damages to the environment and third parties, a decrease in production or an increase in production costs, any of which may adversely affect our financial condition and results of operations.

During the normal course of our business, we depend on the continuous availability of logistics and transportation networks, including roads, railways, warehouses and ports, among others. Such operations may be disrupted by factors beyond our control, such as social movements, natural disasters, electricity shortages and labor strikes. For example, the general strike of truck drivers in May 2018 throughout Brazil resulted in a temporary suspension of our production operations over some days, which in turn caused losses in production of our pulp and paper products. In order to end the strike, the Brazilian federal government made several concessions to the truck drivers, which may have an adverse effect on our costs of inbound and outbound logistics. Any interruption in the supply of inputs for the operation of our industrial and forestry units or in the delivery of our finished products to clients could cause a material adverse impact on our results of operations.

We have entered into contracts with third parties to provide transportation and logistics services. The early termination of these contracts or our inability to renew them or negotiate new contracts with other service providers with similar conditions could adversely affect our financial and operating condition. In addition, the majority of our suppliers of transportation operate under concessions granted by the Brazilian government. The loss or non- renewal of such concessions without timely replacement for new concessions to third parties that are capable of continuing the services provided and willing to do so on similar terms as the previous service providers may also adversely affect our results of operations and financial condition.

Additionally, we are subject to quality control risks associated with our products, which may affect our consumer market and customers. In this sense, we note that our products have several properties that influence the processes of our customers, as well as the quality of the products they produce. Accordingly, we are also subject to any potential claims relating to the quality of our products, which may have a material adverse effect on our results of operations and financial condition.

We depend on third-party suppliers for a material portion of our wood requirements and also depend on few suppliers for certain raw materials. Significant reductions in supply or increases in price of these materials could adversely affect our production, products’ mix, margin or availability and, consequently, our results of operations.

Our wood resources are not sufficient to satisfy our production needs, and accordingly we seek additional wood supply from third parties through agreements to purchase standing forests or for purchases of wood delivered to our factories. Medium- and long-term supply agreements with wood suppliers may vary between one to three forest cycles, each cycle lasting approximately seven years. Lease agreements or forest partnerships have an average term of 14 to 15 years. Wood price conditions are subject to cyclical and circumstantial variations of wood demand in the different regions where we operate. A material failure to obtain wood from third party suppliers or a material interruption in our current supply arrangements may result in a significant reduction in available wood for processing at our plants, which may adversely affect our production and, accordingly, our results of operations and financial condition.

In addition, we have few sources for certain raw materials that are essential for the production of pulp and paper, including fuel oil, bleached chemo thermo mechanical pulp, natural gas and third-party industry technology (maintenance). We enter into medium and long term supply agreements with such suppliers. Any significant reduction in the supply or increase in prices, on behalf of the relevant supplier, of any of these raw materials, as well as our inability to maintain the relationship or find suitable substitutes for these suppliers, could adversely affect our products’ mix, margin or availability and, consequently, our results of operations.

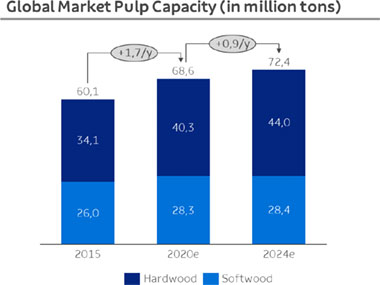

Investments by us or our competitors to enhance pulp and paper production capacity in the future may adversely affect the market price for our products.

New capacity projects developed by us or our competitors may create an imbalance between supply and demand of pulp and paper, which may cause a reduction in pulp and paper prices. Investments in new capacity may have a negative impact on pulp and paper prices and, consequently, on our financial condition or results of operations.

We face significant competition in some of our lines of business, which may adversely affect our market share in the pulp and paper industries and our profitability.

The pulp and paper markets are extremely competitive. We face substantial competition in both domestic and international markets from a large number of companies, some of which have extensive access to financial resources and low capital costs. In the domestic market, we face competition from national products, produced by companies of Brazilian and international groups, and imported products. In the international market, we compete against companies with large production and distribution capacities, significant consumer base and great variety of products.

In addition, the oversupply of coated paper in the world market, the antidumping measures adopted in other countries and the use of imported coated paper for alternative purposes, especially during periods of prolonged appreciation of the real against the U.S. dollar, may increase competition in Brazil from producers of imported paper. Moreover, if the Brazilian federal government were to decrease import taxes, or in the event of sustained appreciation of the real against the U.S. dollar, competition in Brazil from international producers may increase. The occurrence or continuation of any of the foregoing events could adversely affect us.

Additionally, the pulp and paper markets are served by numerous companies located in different countries. If we are unable to remain competitive against these producers in the future, our market share may be adversely affected. Other companies operating in the same segments may compete with us for acquisition and alliance opportunities. Strategic acquisitions or alliances by our competitors could affect our ability to enter into or consummate acquisitions and alliances that are necessary to expand our business. Further, we may face elevated costs associated with restructuring and/or financing in relation to acquisitions or strategic partnerships in comparison to our competitor companies. Companies that are better positioned to enter into acquisitions or alliances may benefit from preferable production costs, which may affect our competitiveness and market share.

Other factors affecting our ability to compete include the entry of new competitors into the markets we serve, increased competition from overseas producers, our competitors’ pricing strategies, the introduction by our competitors of new technologies and equipment, our ability to anticipate and respond to changing customer preferences and our ability to maintain the cost-efficiency of our facilities. In addition, changes within these industries, including the consolidation of our competitors and our customers, may impact competitive dynamics.

Liquidity restriction periods may increase our financial costs, limit the terms or even preclude the funding in the market, which may adversely affect our operations.

Brazilian paper and pulp companies have made significant investments during the last few years in order to compete more efficiently and on a larger scale in the international market. This trend towards consolidation has enhanced the need for resources and diversification of financing sources among national and foreign financial institutions.

In this context, we depend on third-party capital to conduct our business, by means of financing transactions to support our investments and working capital. We cannot assure that our current sources of funds will be sufficient or that they will remain available to meet our capital needs, which may require us to seek additional funds in the financial and capital markets. In liquidity restriction periods, such as the ones of 2008 and 2009 that occurred due to the international financial crisis, credit lines may become excessively short, expensive or even unavailable. Under these circumstances, there is a higher risk of not achieving success in financing and refinancing transactions, meaning that there is a higher possibility of failure in obtaining financing in the market in order to pay down existing indebtedness, as well as a higher risk of raising these funds at an elevated cost or subject to posting collateral, which may adversely affect our results of operations or financial condition.

More stringent environmental regulation could increase our expenditures and noncompliance with such regulation may result in administrative, civil and criminal liability, which may adversely affect us, our results of operations or financial condition.

Our activities are subject to extensive environmental regulation, including in relation to gas emissions, liquid effluents and solid waste management, reforestation and odor control, as well as maintenance of land reserve and permanent preservation areas. Furthermore, our activities, both industrial and forestry, require periodic renewal of environmental permits.

Environmental standards that are applicable to us are issued at the federal, state and municipal levels, and changes in the laws, rules, policies or procedures adopted in the enforcement of the current laws may adversely affect us. In Brazil, violations of environmental laws, regulations and authorizations could result in administrative, civil or criminal penalties for us, our management and our employees, including fines, imprisonment, interruption of our activities and dissolution of our corporate entity.

Governmental agencies or other competent authorities may provide new rules or additional regulations even stricter than the ones in force, or they may pursue a stricter interpretation of the existing laws and regulations, which could require us to invest additional resources in environmental compliance or to restrict our ability to operate as currently done. Additionally, noncompliance with or a violation of any such laws and regulations could result in the revocation of our licenses and suspension of our activities or in our liability for environmental remediation costs, which could be substantial. Moreover, failure to comply with environmental laws and regulations could restrict our ability to obtain financing from financial institutions.

In December 2015, several countries (including Brazil) signed the Paris Agreement, a new global environmental agreement adopting the Intended Nationally Determined Contributions, or “INDCs”, as the measures taken to reduce its emissions after 2020. The INDC that applies to Brazil provides for an increase in the share of sustainable biofuels and other sources of renewable energy in the Brazilian national energy mix, as well as zero deforestation, reforestation, forest restoration and enhancement of the native forest management. We may be materially affected by more restrictive environmental laws and regulations related to greenhouse gases and climate change, to the extent that such new laws or regulations may cause an increase in capital expenditures and investments to comply with such laws, and indirectly, by changes in prices for transportation, energy and other inputs. Both the regulations related to climate change and the changes in existing regulations, as well as the physical effects of climate change generally, could result in increased liabilities and capital expenditures, all of which could have a material adverse effect on our business and results of operations.

Failure to obtain, timely renew or maintain permits, licenses and concessions, grants and registrations necessary to develop our activities, as well as any cancellation thereof, could adversely affect our operations.

We depend on the issuance of permits, licenses, concessions, grants and registrations from various governmental agencies in order to undertake certain operational activities. Moreover, in order to obtain licenses for certain activities that are expected to have a significant environmental impact, certain investments in conservation are required to offset such impact. Furthermore, we have permits, licenses, grants and registrations that are necessary to operate our plants, which are usually valid for five years from the date of issuance and may be timely renewed. Certain of these operational licenses require, among other things, that we periodically report our compliance with emissions standards set by environmental agencies. In addition, the expansion of our operations and/or changes in the applicable legislation may require that new licenses, permits and registrations be obtained from the competent authorities, and we cannot guarantee that we will be able to obtain them or obtain them in a timely manner, which cause delays in our deployment of new activities, increased costs, monetary fines or sentences to pay compensation. In case we are fined and/or penalized for a failure to obtain, timely renew or for the cancellation of our permits, licenses, grants and registrations, as well as for noncompliance with environmental legislation, our financial and operating results and image may be adversely affected. In addition, non-compliance with applicable environmental legislation may result in partial or total shutdowns of our operating activities, which may also adversely affect our financial position and image.

Global or regional economic conditions and events may adversely affect the demand for and the price of our products.

Demand for pulp and paper is directly related to the growth of the world economy and economic conditions. Currently, Europe, China and North America are the main consumer markets of the industry. Fluctuations in the value of local currency versus the U.S. dollar, downturns in economic activity, nationalization or any change in social, political or labor conditions in any of these countries or regions impacting matters such as sustainability, environmental regulations and trade policies and agreements, could negatively affect our financial results. Any slowing of economic growth in Europe, China and North America could adversely affect the price and volume of our exports and thus impact our operating performance.

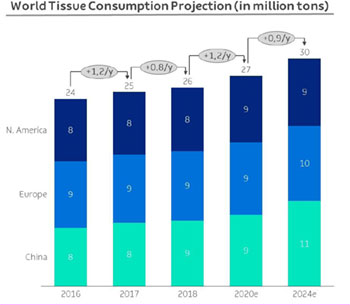

According to market statistics (PPPC), Chinese demand represented 39% of the global market pulp demand in 2020 (versus 37% in 2019 and 33% in 2018), and this demand has increased at a compound annual growth rate of 9.4% since 2005, above the global average of 2.5%. The recent investments in paper and board machines in China have been boosting pulp demand in China; however, the volatility of Chinese demand due to speculative buying movement is a key risk for any short-term demand forecast. Such behavior was experienced during the year of 2019 when, according to the PPPC’s Chinese Demand report, demand for hardwood in China fell by 3.5% in the first 6 months of 2019 vs. the same period of the previous year. However, in the year-to-date analysis (FY 2019 vs FY 2018), there was an increase of 16.7%. In 2020, the speculative buying movement was not largely noticed with similar demand growth throughout the year.

The outbreak of coronavirus or other diseases may adversely affect our operations and financial results.

In light of our activities in the foreign market, our operations and results may be negatively impacted by the novel coronavirus (COVID-19) outbreak. Global or national health concerns, including the outbreak of pandemic or contagious disease, such as the COVID-19, may adversely affect us. Since December 2019, COVID-19 has spread in China and other countries, which continues to adversely impact global commercial activity and has contributed to significant volatility in the market. Such events or potential reactions and mandates from government authorities could cause disruption of regional or global supply chains and economic activity, including significant volatility in demand, which could adversely affect our operations and financial results. Prolonged closures, stoppages and shutdowns, if continuing, may disrupt our operations and the operations of our suppliers, service providers and customers and could materially, adversely affect our revenues, financial condition, profitability, and cash flows. The extent to which the coronavirus and/or other diseases impact our results will depend on future developments, which are highly uncertain and cannot be predicted in light of the rapid development and fluidity of this situation, including new information which may emerge concerning the severity of the coronavirus and/or other diseases and the actions to contain the or treat their impact, among others.

Our exports are subject to special risks that may adversely affect our business.

We export to different regions of the world, which makes us subject to special political and regulatory risks, including currency controls in countries where we have payments receivable, possible formal or informal trade barriers and incentive policies and subsidies favoring local producers in many regions.

Thus, our future financial performance will depend on the economic, political, environmental and social conditions of our main export markets (Europe, Asia and North America). As a result, factors that are beyond our control include:

| • | imposition of barriers to trade by certain countries to limit the access of Brazilian companies to their markets or even to subsidize local producers, particularly with respect to paper products, or the granting of commercial incentives in favor of local producers; |

| • | changes in economic policies and/or conditions of the countries to which we export, which may affect our export capacity and, consequently, our business and operating results; |

| • | logistics costs, including disruptions in shipping or reduced availability of freight transportation; |

| • | significant fluctuations in global demand for pulp products, which could impact our sales, operating income and cash flows; |

| • | the deterioration of global economic conditions, which could impair the financial condition of some of our customers or foreign suppliers, thereby increasing bad debts or non-performance by our foreign suppliers, as well as increasing our costs for financing and refinancing; |

| • | changes in revenues due to variations in foreign currency exchange rates; |

| • | controls on currency exchange; and |

| • | adverse consequences deriving from the need to comply with more stringent regulatory requirements in foreign countries, including environmental rules, regulations and certification requirements. |

Risks Relating to Our Company

We pursue certain transactions from time to time and we may not be able to achieve the expected benefits of such transactions or manage potential risks related to such transactions, which may adversely affect our business and growth prospects, as well as our results of operations and financial condition and the trading price for our securities.

In the course of our business, we analyze, pursue and carry out acquisitions, strategic alliances and divestitures, and, as part of our business strategy, we may acquire other assets or businesses or enter into further strategic partnerships in Brazil or other countries.

Disagreements with our joint operation partners, unexpected events or changes in market conditions, as well as the failure to successfully integrate new businesses or manage strategic alliances, could adversely affect our results of operations and financial condition or prevent us from realizing expected gains of these acquisitions or alliances. For example, we (as successor to Fibria) hold a 50% interest in Veracel, a joint operation with Stora Enso for the production of pulp, and a 51% interest in Portocel, our subsidiary (former subsidiary of Fibria) in which Celulose Nipo-Brasileira S.A. – CENIBRA holds the remaining 49% interest stake. In May 2014, Fibria (Stora Enso’s former partner in the joint operation) commenced an arbitration against Stora Enso for alleged breach of its obligations under certain provisions of the joint operation shareholders’ agreement. For further information on the arbitral proceeding, see Item 8. “Financial Information—Consolidated Statements and Other Financial Information—Civil Proceedings.”

If we attempt to engage in future acquisitions, we would be subject to additional risks, including that we could fail to select the best partners or fail to effectively plan and manage any strategic alliance. Moreover, any significant acquisition may be subject to regulatory approval in Brazil and abroad and, as a result, may not be consummated, which may have an adverse effect on the trading price of our securities.

The expected synergies from operating as a combined company with other companies that merge into and with us may not be achieved.

We cannot provide any assurance as to the extent to which the synergies anticipated or expected from eventual future mergers, or as to the timing for their realization, or as to the expenses that will be incurred in connection with realizing synergic benefits. In particular, we may not be able to realize anticipated cost savings from combination of companies’ production facilities, or anticipated synergic benefits from joint acquisitions of raw materials, sharing of improved production techniques and integration of administrative departments.

If we are not able to achieve the synergies from eventual future mergers, our results of operations and financial condition and the trading price for our securities may be adversely affected. Even if we achieve the expected synergies eventual future mergers, we may not be able fully realize them within the anticipated timeframe.

We recorded a significant amount of goodwill and other intangible assets with determined useful life as a result of the Merger, which may be subject to impairment charges under certain circumstances in future periods in accordance with applicable accounting regulations and adversely affect our financial condition and results of operations or the trading price of our securities.

As of December 31, 2020, the value of our goodwill and other intangible assets with determined useful life relating to the Merger with Fibria were R$7,897.1 million and R$8,303.7 million, respectively. For further information, see notes 16 to our audited consolidated financial statements. Under IFRS, goodwill and intangible assets with undetermined useful life are not subject to amortization and are tested annually to identify possible need for impairment, or more often if any event or circumstance indicates that an impairment loss may have been incurred. Other intangible assets that have determined useful lives are amortized on a straight-line basis over their estimated useful lives and reviewed for impairment whenever there is an indication of impairment. In addition, under IFRS we are required to perform an impairment analysis of assets with undetermined useful life when the book value of our net assets exceeds our market capitalization. As a result, we may be required to record an impairment charge for goodwill or other intangible assets in future periods if required under IFRS, which could lead to decreased assets and reduced net income. If a significant write down were required, the charge could adversely affect our financial condition and results of operations or the trading price of our securities.

The level of our indebtedness could adversely affect our financial condition and a material portion of our cash flow may need to be used to service our debt obligations, which could impair our ability to operate our business.

As of December 31, 2020, we had R$72.9 billion of total consolidated outstanding indebtedness (which includes current and non-current loans, financing and debentures). We are subject to the risks normally associated with significant amounts of debt, which could have important consequences to investors. Our indebtedness could, among other things: (i) require us to use a substantial portion of our cash flow from operations to pay our obligations, thereby reducing the availability of our cash flow to fund working capital, operations, capital expenditures, dividend payments, strategic acquisitions, expansion of our operations and other business activities; (ii) increase our vulnerability to a downturn in general economic and industry conditions, and may make us unable to carry out capital spending that is important to our growth; (iii) limit, along with financial and other restrictive covenants in our debt instruments, our ability to incur additional debt or equity financing or dispose of assets; and (iv) decrease our ability to deleverage and place us at a competitive disadvantage compared to our competitors that have less debt.

In addition, we are subject to agreements governing our indebtedness that require us to meet and maintain certain covenants and financial ratios. A significant or prolonged downturn in general business and economic conditions, or other significant adverse developments with respect to our results of operations or financial condition, may affect our ability to comply with these covenants or meet those financial ratios and tests and could require us to take action to reduce our debt or to act in a manner contrary to our current business objectives. Moreover, the restrictions associated with these covenants and financial ratios may prevent us from taking actions that we believe would be in the best interest of our business and may make it difficult for us to execute our business strategy successfully or effectively compete with companies that are not similarly restricted. Additionally, despite these restrictions, we may be able to incur substantial additional indebtedness in the future, which might subject us to additional restrictive covenants that could affect our financial and operational flexibility and otherwise increase the risks associated with our indebtedness as noted above. We may also need to refinance all or a portion of our debt on or before maturity, and we may not be able to do this on commercially reasonable terms or at all.

Additionally, a default under our financial agreements that is not waived by the relevant creditors may result in an acceleration of the maturity of the outstanding balance of such debt, and may also accelerate the maturity of other debt that benefits from cross-default or cross-acceleration provisions. For more information, see Item 5. “Operating and Financial Review and Prospects —Indebtedness.” If such events were to occur, our financial condition and share price could be adversely affected.

We operate under certain tax regimes in Brazil and abroad that may be suspended, cancelled or not renewed, any of which may adversely affect our financial condition and free cash flow generation.

We receive certain tax benefits by virtue of our investment projects in underdeveloped regions in Brazil, which are covered by the SUDENE and the RFB. We also benefit from tax incentives granted by states based on state laws. The program PROMARANHAO in the state of Maranhão and the program Desenvolve in the state of Bahia, published through Ordinance-GABIN nº 435/18 and Decree No. 18.270/18, respectively, are the most relevant ones for our operations. We cannot assure you that the tax incentives we currently benefit from will be maintained or renewed, particularly, but not exclusively, in light of deteriorating macroeconomic conditions that may lead to changes in current material incentives, such as the exemption of export revenues from social security contributions, the Regime Especial de Aquisição de Bens de Capital para Empresas Exportadoras, which is a special regime for the acquisition of capital goods by exporting companies, and Preponderante Exportador, among others. If such tax benefits are not effectively renewed, this could have a material adverse effect on our generation of net cash flow. In the event of constitutional challenges or if we fail to comply with specific obligations to which we are subject in connection with the tax benefits described above, such benefits may be suspended or cancelled, and we may be required to pay the taxes due in the last five years in full, plus penalties and interest, which may adversely affect us.

Our exports and international trading activities are also conducted under certain tax regimes, including rulings and incentives in some foreign countries, including Austria. These the tax rulings or benefits expire and have to be renewed from time to time. We cannot assure you that the tax regimes and incentives from which we currently benefit will be renewed or maintained in the future. In addition, we also benefit from provisions of international treaties entered into by the Brazilian federal government in order to avoid double taxation, such as the non-double taxation treaty between Brazil and Austria, pursuant to which profit earned by our wholly-owned subsidiary in Austria is not subject to double-taxation in Brazil. Although we believe in the validity of the provisions of international treaties, we brought a claim with judicial courts and are currently guaranteeing the enforceability of the Brazilian-Austria treaty by means of a preliminary injunction. If the Brazil-Austria treaty in deemed unenforceable, we may be materially adversely affected.

Fluctuations in interest rates, as well as our inability to manage risks associated with the replacement of benchmark indices, could increase the cost of servicing our debt and negatively affect our overall financial performance.

Our financial results are affected by changes in interest rates, such as the London Interbank Offered Rate (“LIBOR”), the Brazilian Interbank Deposit Certificate Rate (Certificado de Depósito Interbancário, or “CDI”) and the Brazilian Long-Term Interest Rate (Taxa de Juros de Longo Prazo, or “TJLP”). The CDI rate has fluctuated significantly in the past in response to the expansion or contraction of the Brazilian economy, as it is an instrument for Brazilian Central Bank to manage inflation and pursuit its policies targets. The CDI rate was 1.90% p.a. as of December 31, 2020, while it was 4.40% p.a. and 6.40% p.a. as of December 31, 2019 and 2018, respectively. The TJLP rate was 4.55% p.a., 5.57% p.a. and 6.98% p.a. as of December 31, 2020, 2019 and 2018, respectively.

Although the CDI rate has declined, we cannot guarantee that rates will continue to decrease. A significant increase in interest rates may impact our ability to secure financing in acceptable terms and an increase in interest rates, particularly TJLP, CDI or LIBOR, or the inflation rate index for consumer goods, or IPCA, could have a material adverse effect on our financial expenses since a significant part of our debt (BNDES loans, Agribusiness Credit Receivable Certificates - CRA and Export Prepayment Facilities) is linked to these rates. On the other hand, a significant reduction in the CDI rate could adversely impact our financial revenues derived from investment activities, since a material portion of our cash is invested in Brazilian money market instruments that are linked to the CDI rate.

On March 5, 2021 the head of the United Kingdom Financial Conduct Authority (“FCA”) announced in a public statement the date of extinction of Libor 3-months (term to which Suzano's contracts are linked) for June 30th, 2023. Considering the extinction of LIBOR over the next few years, the Company is evaluating its contracts with clauses that envisage the discontinuation of the interest rate. Most debt contracts linked to LIBOR have a clause to replace this rate with a reference index or equivalent interest rate and, for contracts that do not have a specific clause, a renegotiation will be carried out between the parties. Derivative contracts linked to LIBOR provide for a negotiation between the parties to define a new rate or an equivalent rate will be provided by the Calculation Agent.

The Company identified all of its contracts subject to LIBOR reform that have not yet been subject to the transition to an alternative reference rate and has already started contacting the respective counterparties of each contract to ensure that the best market practices will be adopted at the time of transition of the index, these terms are still under negotiation between the parties. We cannot predict how the (i) provisions relating to the discontinuation of LIBOR we have been including in our contracts, (ii) negotiations with other parties for definition of new applicable rates, or (iii) determination of an equivalent fee by a calculation agent will be implemented in practice, and can give no assurance that such implementation will not have a material effect on our financing costs.

A failure or interruption of our third-party suppliers’ or our information technology systems or automated machinery may impact or paralyze our business and negatively impact our operations. Our third-party suppliers’ and our information technology system may also be vulnerable to external actions such as cyber-attacks, which can have a negative impact on our operations, reputation, improper access of confidential information and disruption of our systems integrity as well as result in fines, obligations to clients or legal litigation and have an adverse effect on the results of our business.

Our operations are heavily reliant on information technology systems to efficiently manage business processes. Therefore, disruptions to these systems may impact or even paralyze our business and negatively impact our operations. In addition, we collect and store data, including proprietary business information, and may have access to confidential or personal information in certain of our businesses that is subject to privacy and security laws, regulations and customer-imposed controls. Moreover, any failure of our third-party suppliers’ or our systems related to confidential information, caused by external cyber-attacks or internal actions, including negligence and/or misconduct of our employees, can have a negative impact on our reputation against competitors and external agents (government, regulators, suppliers and others).

Our third-party suppliers’ and our information technology systems may be vulnerable to external actions such as natural disasters, viruses, cyber- attacks, and other security breaches. Any damage or interruption may cause a negative adverse effect on the results of our business, including fines, obligations to clients or legal litigation.

We and our third-party suppliers may be subject to breaches of automation systems causing partial and/or temporary shutdowns of operations and/or improper access to strategic information, in addition to change or loss of relevant data. Costs to address the vulnerability and/or problems mentioned may be significant and may temporarily affect our operations.

While these measures are designed to deterrent, prevent, detect, and respond to unauthorized activities in our systems, we cannot assure that these, or the procedures adopted by third- party suppliers, would be to protect us from certain types of attacks, which may have a material adverse effect on our business and reputation.

Furthermore, any changes to existing safety regulations may impose additional obligations on us and result in an increase in our expenses with respect to safety equipment and procedures. For instance, changes imposing a reduced workday for safety reasons may result in reduced productivity, forcing us to hire additional staff. Similarly, provisions requiring us to install or buy additional safety equipment could increase our labor-related costs and adversely affect our operating costs and results.

Any failure to adapt to or comply with recent Brazilian regulations on data privacy may adversely affect our results and reputation.

On August 15, 2018, the Brazilian General Data Protection Law (Lei Geral de Proteção de Dados – LGPD) came into force. The LGPD regulates the use of personal data in Brazil. The LGPD significantly transformed the data protection system in Brazil and is in line with recent European legislation (the General Data Protection Regulation, or GDPR). The LGPD establishes detailed rules for the collection, use, processing and storage of personal data. It will affect all economic sectors, including the relationship between customers and suppliers of goods and services, employees and employers and other relationships in which personal data is collected, both in the digital and physical environment. Pursuant to the LGPD, security breaches that may result in significant risk or damage to personal data must be reported to the National Authority on Data Protection (Autoridade Nacional de Proteção de Dados – ANPD), the data protection regulatory body, within a reasonable time period. In light of the LGPD, our practices related to the treatment of personal data, including digital advertising, may undergo significant changes, generating additional costs to us due to the need to adapt such practices to the LGPD.

Failure to comply with the LGPD may result in formal warnings, public sanctions, the deletion of data, or the suspension of data processing activities. Furthermore, a company may be subject to a fine equal to up to 2% of its gross sales, or the gross sales of its economic group in Brazil, in the preceding fiscal year, excluding taxes, but limited to a total of R$50 million per violation. As a result, failure by us to adhere to the LGPD and any additional privacy laws or regulations enacted or approved in Brazil or in other jurisdictions in which we operate could adversely impact our business, financial condition or results of operations.

We cannot guarantee that our data protection program will be deemed sufficient by the ANPD to meet the provisions of the LGPD, nor that such program will prevent any failures in the protection of personal data processed by us, including with respect to cybersecurity incidents.

A downgrade in our credit ratings may increase our borrowing costs and/or restrict the availability of new capital or financings and have a material adverse effect on us.

The ratings address the likelihood, according to the respective evaluation methodology of each rating agency, of payment of our debt and obligations at their maturity. The ratings also address the timely payment of interest and other costs on each interest payment date. The assigned ratings to us may be raised, lowered or held constant depending, among other factors, on the rating agencies’ respective assessment of our financial strength or a change in methodology of credit assessment adopted by the credit risk agencies. We cannot assure you that our rating will remain for any given period of time or that the rating will not be lowered or withdrawn.

If our credit ratings are downgraded and the market were to perceive any such downgrade as a deterioration of our financial strength, our cost of borrowing would likely increase and our net income could decrease and our ability to obtain new financing may be adversely affected, all of which could have a material adverse effect on us.

In addition, credit rating is sensitive to any change in Brazilian sovereign credit ratings. The credit ratings of the Brazilian sovereign were downgraded in 2016 and 2018, and are no longer investment grade according to the methodologies of the major global rating agencies. Any further decrease in Brazilian sovereign credit ratings may have additional adverse consequences on our ability to obtain financing or our cost of financing and, consequently, on our results of operations and financial condition.

Unfavorable outcomes in litigation may negatively affect our results of operations, cash flows and financial condition.

In the ordinary course of our business dealings, we and our officers are, and may become, party to numerous tax, civil (including environmental) and labor disputes involving, among other remedies, significant monetary claims. An unfavorable outcome against us may result in our being required to pay substantial amounts of money, which could materially adversely affect our reputation, results of operations, cash flows and financial condition. Additionally, the amounts provisioned for legal proceedings may increase and existing provisions may become insufficient due to unfavorable outcomes in disputes against us. For more information on tax, civil (including environmental), labor and other proceedings, see Item 8. “Financial Information—Consolidated Statements and Other Financial Information—Legal and Administrative Proceedings.”

Changes in the credit risk of customers and suppliers to whom we have made advances, sales through credit lines or loans may adversely affect us.

In the markets in which we operate, it is typical, and often a condition for competitive participation, for pulp and paper producers to make advances to suppliers or to make sales to customers on credit. When we make advances, sales on credit or loans to our suppliers or customers, we assume their credit risk. Additionally, we assume additional risks when using debt instruments to make advances and sales on credit to our customers, such as credit letters. Therefore, changes in the macroeconomic environment or the market conditions under which our suppliers and our customers operate, in addition to problems related to the management of our suppliers and clients, may significantly affect their ability to make payments to us, directly impacting our assets and working capital.

These practices also expose us to the risk of a significant divergence between the rates under which we obtain financing from third parties and the rates that we grant to our customers and suppliers. We cannot assure you that we will always be able to match the terms under which we provide financing to our customers and suppliers with the terms of financing provided to us. Any increase in our customers’ and suppliers’ credit risk or divergence between their and our capital costs may materially adversely affect our shareholders’ equity and results of operations.

Social crisis in the relationship with communities and class entities, as well as, expropriation of any of our properties by the government affect the regular use, cause damage, or deprive us of the use of or fair value compensation of our properties.

Organized social movements in Brazil defend agrarian reform and the redistribution of property, with irregular occupations in rural areas being the best known form of action. Such occupations when in areas of the company may interrupt our forestry or industrial activities and, consequently, negatively affect our productive and operational results.

In addition to stoppages, land conflicts can cause a series of risks to the integrity of our employees who work in the field, possible damage to areas of high environmental value such as Permanent Preservation Areas and buffer zones of Environmental Conservation Units, in addition to reputational damage.