- SUZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Suzano (SUZ) 6-KCurrent report (foreign)

Filed: 13 May 21, 8:36am

Exhibit 99.1

.••.••.••.••.••.••.•••• ...• .• ..• .• ,• I •1Q21.. .....••• •••• ••••I ••••IIConference Call

This presentation contains what are considered “forward-looking statements,” as defined in Section 27A of the 1933 Securities Act and Section 21E of the 1934 Securities Exchange Act, as amended. Some of these forward-looking statements are identified with words such as “believe,” “may,” “could,” “would,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” as well as the negative forms of these words, other terms of similar meaning or the use of future dates. The forward-looking statements include, without limitation, statements related to the declaration or payment of dividends, implementation of the key operational and financial strategies and investment plans, guidance about future operations and factors or trends that influence the financial situation, liquidity or operational results. Such statements reflect the current view of the management and are subject to diverse risks and uncertainties. These are qualified in accordance with the inherent risks and uncertainties involving future expectations in general, and actual results could differ materially from those currently anticipated due to various risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on diverse assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. Suzano does not undertake any obligation to update any such forward-looking statements as a result of new information, future events or otherwise, except as expressly required by law. All forward-looking statements in this presentation are covered in their entirety by this disclaimer.In addition, this presentation contains some financial indicators that are not recognized by the BR GAAP or IFRS. These indicators do not have a standard meaning and may not be comparable to indicators with a similar description used by other companies. We provide these indicators because we use them as measurements of Suzano's performance; they should not be considered separately or as a replacement for other financial metrics that have been disclosed in accordance with BR GAAP or IFRS.

This presentation contains what are considered “forward-looking statements,” as defined in Section 27A of the 1933 Securities Act and Section 21E of the 1934 Securities Exchange Act, as amended. Some of these forward-looking statements are identified with words such as “believe,” “may,” “could,” “would,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” as well as the negative forms of these words, other terms of similar meaning or the use of future dates. The forward-looking statements include, without limitation, statements related to the declaration or payment of dividends, implementation of the key operational and financial strategies and investment plans, guidance about future operations and factors or trends that influence the financial situation, liquidity or operational results. Such statements reflect the current view of the management and are subject to diverse risks and uncertainties. These are qualified in accordance with the inherent risks and uncertainties involving future expectations in general, and actual results could differ materially from those currently anticipated due to various risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on diverse assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. Suzano does not undertake any obligation to update any such forward-looking statements as a result of new information, future events or otherwise, except as expressly required by law. All forward-looking statements in this presentation are covered in their entirety by this disclaimer.In addition, this presentation contains some financial indicators that are not recognized by the BR GAAP or IFRS. These indicators do not have a standard meaning and may not be comparable to indicators with a similar description used by other companies. We provide these indicators because we use them as measurements of Suzano's performance; they should not be considered separately or as a replacement for other financial metrics that have been disclosed in accordance with BR GAAP or IFRS.

Pulp: 2.7 million tons (vs. 2.8 million tons 1Q20) Paper1: 264 thousand tons (vs. 239 thousand tons 1Q20) Pulp Inventory: stable vs. 4Q20Adjusted EBITDA: R$4.9 billion (vs. R$3.0 billion 1Q20) Operating Cash Generation2: R$3.9 billion (vs. R$2.3 billion 1Q20) Cash Cost ex-downtime: R$623/ton (vs. R$596/ton 1Q20)Liquidity: US$2.4 billion (vs. US$2.5 billion 4Q20) Net Debt: US$11.6 billion (vs. US$12.3 billion 4Q20) 3 Leverage : 3.8x in US$ (vs. 4.3x in US$ 4Q20)1Excluding Consumer Goods. | 2 Operating Cash Generation = Adjusted EBITDA less Sustaining capex. | 3 Net Debt / Adjusted EBITDA in the last 12 months.

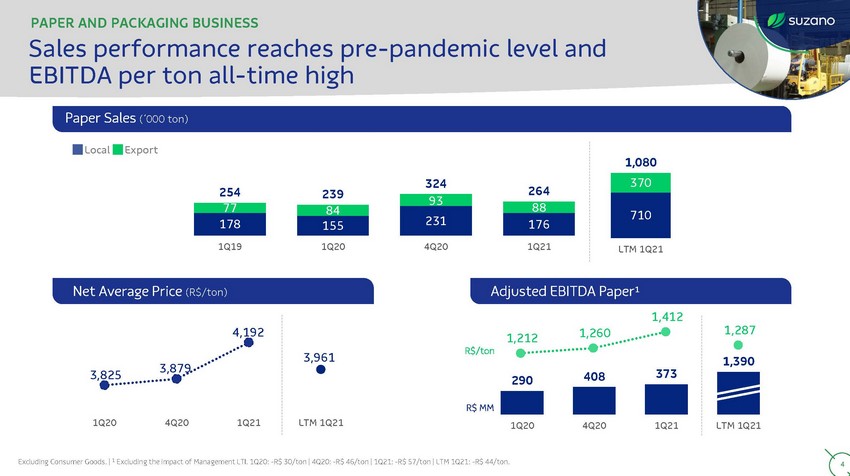

PAPER AND PACKAGING BUSINESS Sales performance reaches pre-pandemic level and EBITDA per ton all-time highLocalExport254 239 324 2641Q19 1Q20 4Q20 1Q211,080LTM 1Q214,1923,961R$/ton1,412290 408 3731,2871,3901Q20 4Q20 1Q21LTM 1Q21R$ MM1Q204Q201Q21LTM 1Q21Excluding Consumer Goods. | 1 Excluding the impact of Management LTI. 1Q20: -R$ 30/ton | 4Q20: -R$ 46/ton | 1Q21: -R$ 57/ton | LTM 1Q21: -R$ 44/ton.

PAPER AND PACKAGING BUSINESS Sales performance reaches pre-pandemic level and EBITDA per ton all-time highLocalExport254 239 324 2641Q19 1Q20 4Q20 1Q211,080LTM 1Q214,1923,961R$/ton1,412290 408 3731,2871,3901Q20 4Q20 1Q21LTM 1Q21R$ MM1Q204Q201Q21LTM 1Q21Excluding Consumer Goods. | 1 Excluding the impact of Management LTI. 1Q20: -R$ 30/ton | 4Q20: -R$ 46/ton | 1Q21: -R$ 57/ton | LTM 1Q21: -R$ 44/ton.

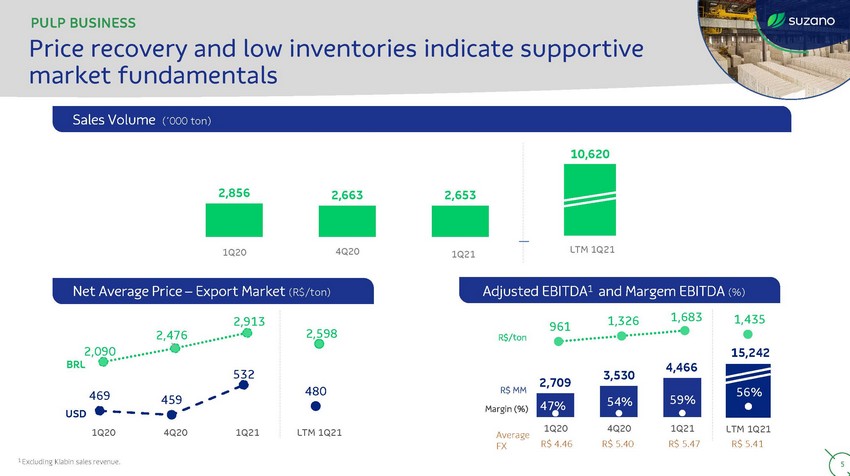

PULP BUSINESS Price recovery and low inventories indicate supportive market fundamentals2,856 2,6632,090 BRLUSD2,913 2,4765322,598480R$/tonR$ MMMargin (%)961 1,326 1,6833,530 4,466 2,7091,43515,2421Q20 4Q20 1Q21LTM 1Q21Average1Q20 4Q20 1Q21LTM 1Q211 Excluding Klabin sales revenue.

PULP BUSINESS Price recovery and low inventories indicate supportive market fundamentals2,856 2,6632,090 BRLUSD2,913 2,4765322,598480R$/tonR$ MMMargin (%)961 1,326 1,6833,530 4,466 2,7091,43515,2421Q20 4Q20 1Q21LTM 1Q21Average1Q20 4Q20 1Q21LTM 1Q211 Excluding Klabin sales revenue.

Project Announcement

Project Announcement

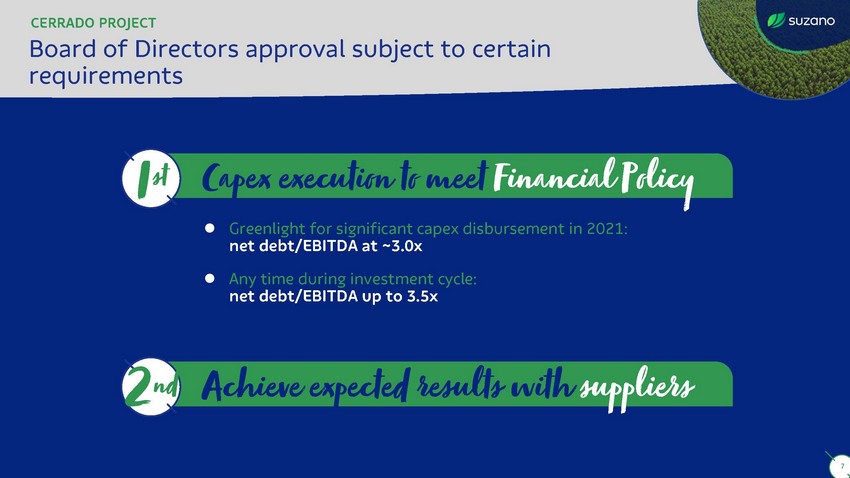

CERRADO PROJECT Board of Directors approval subject to certain requirementsnet debt/EBITDA at ~3.0x Any time during investment cycle: net debt/EBITDA up to 3.5x

CERRADO PROJECT Board of Directors approval subject to certain requirementsnet debt/EBITDA at ~3.0x Any time during investment cycle: net debt/EBITDA up to 3.5x

CERRADO PROJECT Moving ahead with our long-term strategyMaintain relevance in Pulp, through good projects Improve competitiveness with the lowest cash production cost Attractive returns even in more adverse scenarios Economies of scale Increase leadership position in the pulp market Long-term demand for market pulp outpaces new supply Contributing to company’s sustainability goals8

CERRADO PROJECT Moving ahead with our long-term strategyMaintain relevance in Pulp, through good projects Improve competitiveness with the lowest cash production cost Attractive returns even in more adverse scenarios Economies of scale Increase leadership position in the pulp market Long-term demand for market pulp outpaces new supply Contributing to company’s sustainability goals8

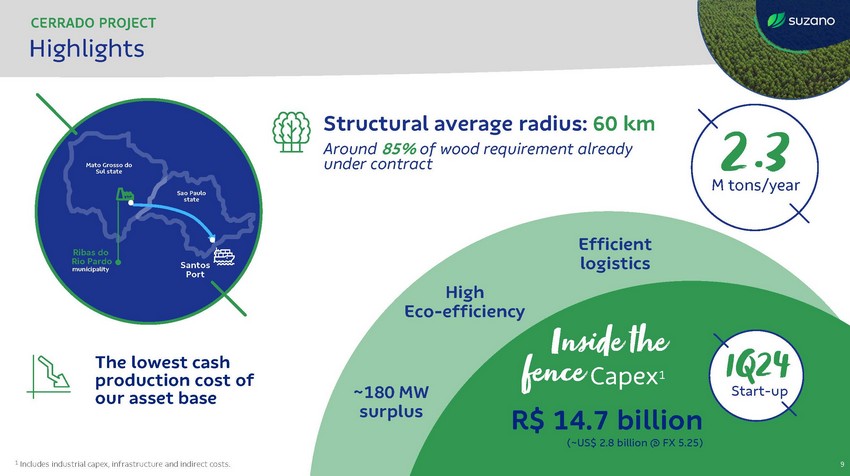

CERRADO PROJECT HighlightsMato Grosso do Sul stateSao Paulo stateStructural average radius: 60 km Around 85% of wood requirement already under contractM tons/yearRibas do Rio Pardo municipalitySantos PortHigh Eco-efficiencyEfficient logisticsThe lowest cash production cost of our asset base~180 MW surplusCapex1 R$ 14.7 billion (~US$ 2.8 billion @ FX 5.25)Start-up1 Includes industrial capex, infrastructure and indirect costs. 9

CERRADO PROJECT HighlightsMato Grosso do Sul stateSao Paulo stateStructural average radius: 60 km Around 85% of wood requirement already under contractM tons/yearRibas do Rio Pardo municipalitySantos PortHigh Eco-efficiencyEfficient logisticsThe lowest cash production cost of our asset base~180 MW surplusCapex1 R$ 14.7 billion (~US$ 2.8 billion @ FX 5.25)Start-up1 Includes industrial capex, infrastructure and indirect costs. 9

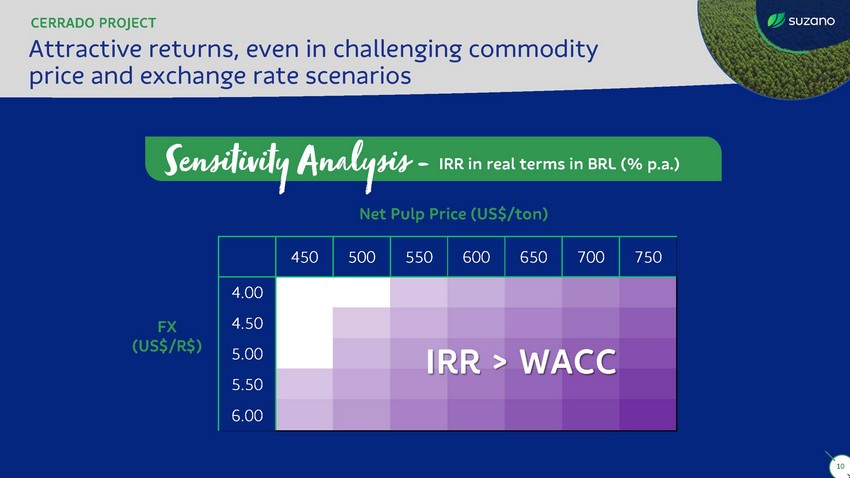

CERRADO PROJECT Attractive returns, even in challenging commodity price and exchange rate scenariosFX (US$/R$)Net Pulp Price (US$/ton)450 500 550 600 650 700 750 4.00 4.50 5.00 IR R > WACC 5.50

CERRADO PROJECT Attractive returns, even in challenging commodity price and exchange rate scenariosFX (US$/R$)Net Pulp Price (US$/ton)450 500 550 600 650 700 750 4.00 4.50 5.00 IR R > WACC 5.50

CERRADO PROJECT No major debt maturities in the coming years and no need to raise new debtLocal currency 69%31% Foreign currency44% 44%Stand-by facilities2.4Expansion Capex (FX @ 5.25)2.7 0.48.7MTM Hedge29%2021202220233%2024Cash on hand1Q21 Liquidity9M2021 2022 2023202420252026 onwards1 Expected. | 2 CETIP calculation methodology considers FX D-1 R$ 5,70.

CERRADO PROJECT No major debt maturities in the coming years and no need to raise new debtLocal currency 69%31% Foreign currency44% 44%Stand-by facilities2.4Expansion Capex (FX @ 5.25)2.7 0.48.7MTM Hedge29%2021202220233%2024Cash on hand1Q21 Liquidity9M2021 2022 2023202420252026 onwards1 Expected. | 2 CETIP calculation methodology considers FX D-1 R$ 5,70.

CAPEX GUIDANCE 2021 UpdateCapex (R$ billion) 1Q21 2021e (previous) 2021e (current) Sustaining 1.0 4.0 4.0 Modernization and Expansion 0.0 0.2 0.2 Port Terminals 0.1 0.2 0.2 Forest and Land 0.2 0.4 0.7 Others 0.0 0.1 0.1 CERRADO PROJECT 0.0 - 1.0 TOTAL 1.3 4.9 + R$ 1.3 Bn 6.2

CAPEX GUIDANCE 2021 UpdateCapex (R$ billion) 1Q21 2021e (previous) 2021e (current) Sustaining 1.0 4.0 4.0 Modernization and Expansion 0.0 0.2 0.2 Port Terminals 0.1 0.2 0.2 Forest and Land 0.2 0.4 0.7 Others 0.0 0.1 0.1 CERRADO PROJECT 0.0 - 1.0 TOTAL 1.3 4.9 + R$ 1.3 Bn 6.2

CERRADO PROJECT TakeawaysSuzano will become even more competitive and relevant on the pulp market to serve robust demand growthDedicated team with proven experience in successful pulp projects managementFunding for the project mostly based on cash generationSignificant contribution to sustainability long-term goals achievement on:Financial discipline throughout the investment cycle is key to Board of Directors approvalClimate ChangeRenewable Energy ExportMitigate income inequality

CERRADO PROJECT TakeawaysSuzano will become even more competitive and relevant on the pulp market to serve robust demand growthDedicated team with proven experience in successful pulp projects managementFunding for the project mostly based on cash generationSignificant contribution to sustainability long-term goals achievement on:Financial discipline throughout the investment cycle is key to Board of Directors approvalClimate ChangeRenewable Energy ExportMitigate income inequality

Investor Relations www.suzano.com.br/ir ir@suzano.com.br

Investor Relations www.suzano.com.br/ir ir@suzano.com.br