- SUZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Suzano (SUZ) 6-KCurrent report (foreign)

Filed: 29 Aug 22, 9:36am

Exhibit 99.1

SUZANO S.A.

Publicly Held Company with Authorized Capital

CNPJ/ME No 16.404.287/0001-55

NIRE No. 29.300.016.331

MATERIAL FACT

São Paulo, 29 August 2022 – Suzano S.A. (“Company” or “Suzano”) (B3: SUZB3 / NYSE: SUZ), pursuant to Paragraph 4 of Section 157 of Law No. 6,404, of December 15, 1976, as amended (“Brazilian Corporate Law”), CVM Resolution No. 44 of August 23, 2021, as amended, and Section 3 of CVM Resolution No. 78 of March 29, 2022, informs its shareholders and the market in general that its management will submit to the approval of the shareholders, in an Extraordinary General Shareholders’ Meeting to be held on September 29, 2022, at 11 a.m. (“EGSM”), the mergers, by the Company, of the following companies: (a) Suzano Trading Ltd.; (b) Rio Verde Participações e Propriedades Rurais S.A.; (c) Caravelas Florestal S.A.; (d) Vitex SP Participações S.A.; (e) Parkia SP Participações S.A.; (f) Sobrasil Comercial S.A.; (g) Vitex ES Participações S.A.; (h) Parkia ES Participações S.A.; (i) Claraíba Comercial S.A.; (j) Vitex BA Participações S.A.; (k) Parkia BA Participações S.A.; (l) Garacuí Comercial S.A.; (m) Vitex MS Participações S.A.; (n) Parkia MS Participações S.A.; and (o) Duas Marias Comercial S.A. (“Target Companies”), of which Suzano holds, directly or indirectly, shares representing the entire share capital, with the transfer of the net equity of each of them to the Company and their consequent termination (“Mergers”), in terms presented in the form of Exhibit I to the present material fact.

As informed in the Call Notice for the EGSM made available to the Shareholders on this date, the Company’s management decided to hold the EGSM exclusively in digital form, pursuant to CVM Resolution No. 81 of March 29, 2022.

São Paulo, August 29, 2022.

Marcelo Feriozzi Bacci

SUZANO S.A.

Publicly Held Company with Authorized Capital

CNPJ/ME No 16.404.287/0001-55

NIRE No. 29.300.016.331

EXHIBIT I

Information on the Mergers

(in the form of Exhibit A to CVM Resolution No.78/22)

The transaction consists of the merger of each of the Target Companies into Suzano, under the terms and conditions set forth in the Protocol and Justification Instrument of the Mergers, entered into by and between Suzano’s and the Target Companies’ managements on August 26, 2022 (“Merger Agreement”).

The acts of mergers are considered independent, and shall occur in stages within a single act, at the EGSM, according to the following order:

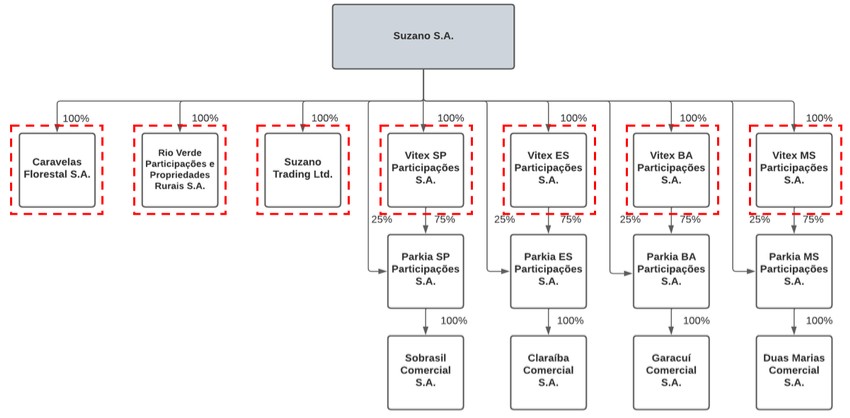

| (i) | Mergers of Caravelas, Rio Verde, Suzano Trading, Vitex SP, Vitex ES, Vitex BA and Vitex MS, as illustrated bellow: |

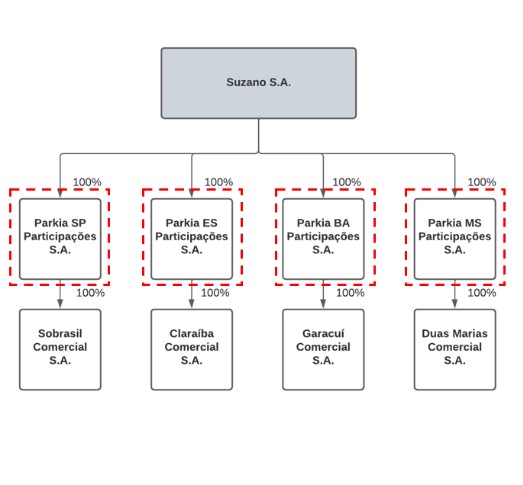

| (ii) | Then, the mergers of Parkia SP, Parkia ES, Parkia BA and Parkia MS, as illustrated bellow: |

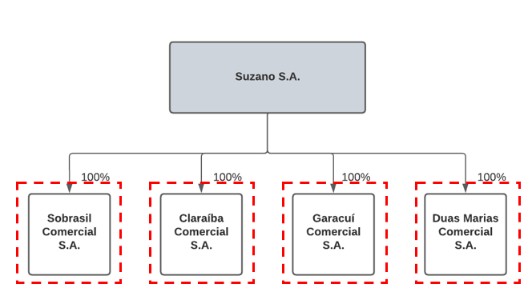

| (iii) | And, finally, the mergers of Sobrasil, Claraíba, Garacuí and Duas Marias, as illustrated bellow: |

As a result of the Mergers, the Target Companies will cease to exist and be succeeded by the Company in all its rights and obligations, in accordance with Section 227 of Law No. 6,404, of December 15, 1976, as amended (“Brazilian Corporate Law”). The Mergers will not result in a capital increase of Suzano.

The Mergers intend to allow for efficiency and synergy improvements stemming from the reduction of overall operational, logistical and administrative costs, as well as result in management optimization and simplification of the corporate structure.

As indicated in item 2 above, the Mergers will enable efficiency and synergy improvements stemming from the reduction of overall operational, logistical and administrative costs, as well as result in management optimization and simplification of the corporate structure.

The Company estimates that the costs of carrying out the Mergers are in the order of approximately R$ 501,187.00 (five hundred and one thousand, one hundred and eighty-seven Brazilian reais), including expenses with publications, records, auditors, appraisers, lawyers and others professionals engaged to advise on the transaction.

Considering that Suzano currently holds, directly or indirectly, one hundred percent (100%) of the share capital of each of the Target Companies, and that upon the merger of each of the Target Companies, Suzano shall directly hold one hundred percent (100%) of the share capital of each of the Target Companies, observing the order of mergers defined in Section 1.1.1 of the Merger Agreement (Exhibit B to the Management Proposal) e and described in item 2 above; and (ii) the activities carried out by the Target Companies are restricted to activities currently carried out by the Company, Suzano does not identify risk factors related to the Company, as already described in “Section 4, Item 4.1(d)”of the Company Reference Form 2022 (version 4). Thus, the Mergers do not represent an additional risk factor for the

Company, and the information described in “Section 4 - Risk Factors” of the Company Reference Form 2022 (version 4) remains valid and current.

The Mergers shall not result in a capital increase of Suzano and, consequently, there will be no exchange ratio of shares, in view of the fact that the Company, currently holds, directly or indirectly, one hundred percent (100%) of the share capital of each of the Target Companies, and that upon the merger of each of the Target Companies, Suzano shall directly hold one hundred percent (100%) of the share capital of each of the Target Companies, observing the order of mergers defined in Section 1.1.1 of the Merger Agreement (Exhibit B to the Management Proposal) and described in item 2 above.

Not applicable. Please refer to item 4 above.

Not applicable.

The consummation of the Mergers is not subject to any approval by Brazilian or foreign authorities

Considering the answer to item 4 above, and in view of the decision of the Board of Commissioners of the Brazilian Securities and Exchange Commission, issued on 15 February 2018 in connection with Proceeding SEI No. 19957.011351/2017-21, Section 264 of the Brazilian Corporate Law is not applicable to the Mergers, thus, it will not be necessary to prepare the reports referred to in said provision.

The Mergers shall not grant the right of withdrawal to dissenting shareholders of Suzano, in connection with the Mergers, provided that the applicable law limits such right to shareholders of the Target Companies, and the Company, currently holds, directly or indirectly, one hundred percent (100%) of the share capital of each of the Target Companies, and that upon the merger of each of the Target Companies, Suzano shall directly hold one hundred percent (100%) of the share capital of each of the Target Companies, observing the order of mergers defined in Section 1.1.1 of the Merger Agreement (Exhibit B to the Management Proposal) and described in item 2 above.

The appraisal reports, prepared in accordance with the financial statements, have as reference dates the following: (i) regarding the Mergers of Suzano Trading and Rio Verde, May 31, 2022; (ii) regarding the Mergers of the Parkia Companies, June 30, 2022; and (iii) regarding the Merger of Caravelas, August 9, 2022 (“Base Dates”).

The managers of the Company and the Target Companies engaged the specialized companies PricewaterhouseCoopers Auditores Independentes Ltda., a corporation enrolled with CNPJ/ME under No.61.562.112/0001-20, with head offices in the City of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima, No. 3732, 16th floor, Suites 1 to 6, at Edifício Adalmiro Dellape Baptista B32, Itaim Bibi (“PwC”) to prepare the net equity appraisal reports of Suzano Trading and Rio Verde at book value, and Apsis Consultoria e Avaliações Ltda., a company enrolled with CNPJ/ME under No. 08.681.365/0001-30, with head offices in the City of Rio de Janeiro, State of Rio de Janeiro, at Rua do Passeio, No. 62, 6th floor, Centro, ZIP Code 20021-290 (“Apsis” and, jointly with PwC, the “Appraisers”), to prepare the net equity appraisal reports of Parkia Companies and Caravelas, at their respective book value (“Appraisal Reports”).

The appointment and engagement of the Appraisers will be submitted for ratification by the EGSM, under the terms of the first Paragraph of Section 227 of the Brazilian Corporate Law.

Pursuant to the Appraisal Reports, the net equity of the Target Companies for purposes of the Mergers totals R$ 11,012,795,064.65 (eleven billion, twelve million, seven hundred and ninety-five thousand, sixty-four Brazilian reais and sixty-five cents), which constitutes the total net asset transferred to Suzano, observing that the individual net equity amounts of each of the Target Companies on the respective Base Date is:

| (i) | Suzano Trading: R$ 1,386,964,264.86 (one billion, three hundred and eighty-six million, nine hundred and sixty-four thousand, two hundred and sixty-four Brazilian reais and eighty-six cents); |

| (ii) | Rio Verde: R$ 361,815,846.61 (three hundred and sixty-one million, eight hundred and fifteen thousand, eight hundred and forty-six Brazilian reais and sixty-one cents); |

| (iii) | Caravelas: R$ 111,322,660.02one hundred and eleven million, three hundred and twenty-two thousand, six hundred and sixty Brazilian reais and two cents); |

| (iv) | Vitex SP: R$ 427,314,433.50 (four hundred and twenty-seven million, three hundred and fourteen thousand, four hundred and thirty-three Brazilian reais and fifty cents); |

| (v) | Parkia SP: R$ 569,775,389.95 (five hundred and sixty-nine million, seven hundred and seventy-five thousand, three hundred and eighty-nine Brazilian reais and ninety-five cents); |

| (vi) | Sobrasil: R$ 569,629,781.78 (five hundred and sixty-nine million, six hundred and twenty-nine thousand, seven hundred and eighty-one Brazilian reais and seventy-eight cents); |

| (vii) | Vitex ES: R$ 622,709,381.30 (six hundred and twenty-two million, seven hundred and nine thousand, three hundred and eighty-one Brazilian reais and thirty cents); |

| (viii) | Parkia ES: R$ 830,221,800.05 (eight hundred and thirty million, two hundred and twenty-one thousand and eight hundred Brazilian reais and five cents); |

| (ix) | Claraíba: R$ 830,149,310.61 (eight hundred thirty million, one hundred forty-nine thousand, three hundred and ten Brazilian reais and sixty-one cents); |

| (x) | Vitex BA: R$ 847,916,828.06 (eight hundred and forty-seven million, nine hundred and sixteen thousand, eight hundred and twenty-eight Brazilian reais and six cents); |

| (xi) | Parkia BA: R$ 1,130,578,024.49 (one billion, one hundred and thirty million, five hundred and seventy-eight thousand and twenty-four Brazilian reais and forty-nine cents); |

| (xii) | Garacuí: R$ 1,130,487,893.45 (one billion, one hundred and thirty million, four hundred and eighty-seven thousand, eight hundred and ninety-three Brazilian reais and forty-five cents); |

| (xiii) | Vitex MS: R$ 598,396,625.92 (five hundred and ninety-eight million, three hundred and ninety-six thousand, six hundred and twenty-five Brazilian reais and ninety-two cents); |

| (xiv) | Parkia MS: R$ 797,805,411.83 (seven hundred and ninety-seven million, eight hundred and five thousand, four hundred and eleven Brazilian reais and eighty-three cents); and |

| (xv) | Duas Marias: R$ 797,707,412.22 (seven hundred and ninety-seven million, seven hundred and seven thousand, four hundred and twelve Brazilian reais and twenty-two cents). |

The Merger Agreement, the Management Proposal for the EGSM and the Appraisal Reports prepared for the purposes of the Mergers will be available to the Company’s Shareholders as of this date, at the Company’s headquarters, in Suzano’s investor relations website,

(ri.suzano.com.br), as well as on the websites of CVM and B3 S.A.’s – Brasil, Bolsa, Balcão (www.b3.com.br ).

* * *