SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

MATERIAL FACT

São Paulo, August 30th, 2024 – Suzano S.A. (“Company”) (B3: SUZB3 / NYSE: SUZ), in compliance with the provisions included in paragraph 4 of article 157 of Law No. 6,404, dated December 15, 1976, as amended in Securities and Exchange Commission of Brazil (“CVM”) Resolution No. 44, dated August 23, 2021, as amended, and in article 3 of CVM Resolution No. 78, dated March 29, 2022, informs to its shareholders and the market in general that its management shall submit to appraisal by its shareholders, at an Extraordinary General Meeting of the Company to be held on September 30, 2024, at 10:00 a.m. (“EGM”), the merger by the Company of the wholly-owned companies acquired by the Company on July 31, 2024, in accordance with Material Fact disclosed on this same date: (i) Timber VII SPE S.A. and (ii) Timber XX SPE S.A.; and its respective investees companies (i) Pradaria Agroflorestal Ltda.; and (ii) Cabeceira Agroindustrial Ltda.; and (iii) Frigg Florestal S.A. (“Target Companies”), with transfer of the entire owners’ equity to the Company, and subsequent dissolution of the Target Companies, presented in Exhibit I to this material fact.

As mentioned in the EGM’s Call Notice made available to the Shareholders on this date, the Company’s management decided to hold the EGM through exclusively digital means, under CVM Resolution No. 81, dated March 29, 2022, as amended.

Further information on the EGM is available to shareholders in the Management Proposal, on the websites of the CVM (https://www.gov.br/cvm), B3 (http://www.b3.com.br) and Suzano (http://www.ri.suzano.com.br).

São Paulo, August 30th, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

EXHIBIT I

Information on the merger transaction

(under Annex A to CVM Resolution No. 78, dated March 23, 2022)

1. Companies involved in the Mergers and their Activities

1.1. Suzano S.A.

(a) Identification. Suzano S.A., a publicly held corporation, enrolled with the Brazilian Corporate Taxpayers’ Registry of the Ministry of Economy (“CNPJ/ME”) under No. 16.404.287/0001-55, registered with the Board of Trade of the State of Bahia under the Company Identification Number (“NIRE”) 29.300.016.331, with head office in the Capital of the State of Bahia (Salvador), at Avenida Professor Magalhães Neto, No. 1752, 10th floor, Rooms 1009 to 1011, Pituba, ZIP code 41810-012 (“Suzano”).

(b) Activities. Suzano dedicates and shall continue to dedicate, after the Mergers, to (a) manufacture, trade, import and export of pulp, paper and other products originated from the transformation of forest materials, including their recycling, as well as wood, products related to the printing industry, and accessory products or those sold alongside them, including but not limited to stationery products, cleaning products, and other sanitary and personal hygiene products, and their respective accessories; (b) formation and commercial operation of homogeneous forests, company-owned or owned by third parties, directly or through contracts with companies specializing in forest cultivation and management, as well as the conservation of native forest; (c) provision of services, and import, export and commercial operation of assets related to the Company’s purposes, including but not limited to the resale and/or promotion, even through electronic means, of goods and products that are part of the Company’s corporate purpose, as well as establishing a technological channel developed for e-commerce to trade goods and products that are part of the corporate purpose of the Company or its subsidiaries and/or brands licensed by or to the Company and/or its subsidiaries; (d) transportation, by itself or by third parties; (e) holding interest as a partner or shareholder in any other company or project; (f) operation of port terminals; (g) generation and sale of electricity; (h) rendering of waterborne transport services by means of cabotage and inland navigation, as well as auxiliary activities, such as maritime operations and signaling; (i) rendering of port operator services for the movement and storage of goods, for or deriving of waterborne transport, within the organized port area; and (j) operation of airports and landing fields.

1.2. Timber VII SPE S.A.

(a) Identification. Timber VII SPE S.A., a corporation, enrolled with CNPJ/MF under No. 23.741.553/0001-09, registered in the Board of Trade of the State of São Paulo under NIRE 35.300.485.271, with head office in the city of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima, 1355, 8th floor, Pinheiros, ZIP Code 01.452-919 (“Timber VII”);

(b) Activities. The corporate purpose of Timber VII is the holding of interests in other companies, as member or shareholder, in the country or abroad.

1.3. Pradaria Agroflorestal Ltda.

(a) Identification. Pradaria Agroflorestal Ltda., a limited liability company, enrolled with CNPJ/MF under No. 08.859.609/0001-22, registered in the Board of Trade of the State of Mato Grosso do Sul under NIRE 43.207.969.995, with registered office in the city of Ribas do Rio Pardo, at Rodovia BR 262 Km 220 - Suzano, s/n, Sala Bataguassu, Zona Rural district, ZIP Code 79180-000 (“Pradaria”).

(b) Activities. Pradaria’s corporate purpose is: commercial exploration of wooden products in all its forms, forest and agricultural products, including seeds, machinery and raw materials; forestation and reforestation; and the holding of interests in other companies, as member or shareholder.

1.4. Timber XX SPE S.A.

(a) Identification. Timber XX SPE S.A., a corporation, enrolled with CNPJ/MF under No. 40.157.006/0001-91, registered in the Board of Trade of the State of São Paulo under NIRE 35.300.561.724, with head office in the city of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima, 1355, 8th floor, Pinheiros, ZIP Code 01452-919 (“Timber XX”).

(b) Activities. The corporate purpose of Timber XX is the holding of interests in other companies, as member or shareholder, in the country or abroad.

1.5. Cabeceira Agroindustrial S.A.

(a) Identification. Cabeceira Agroflorestal Ltda., a limited liability company, enrolled with CNPJ/MF under No. 15.735.568/0001-28, registered in the Board of Trade of the State of São Paulo under NIRE 35.233.099.165, with head office in the city of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima, 1355, 8th floor, Pinheiros, ZIP Code 01452-919 (“Cabeceira”).

(b) Activities. Cabeceira’s corporate purpose is: performance of a trading company’s export activities; forestation and reforestation; agricultural activities; industrialization, sale, import and export of wood and its by-products; the holding of interests in other companies, as member or shareholder, as well as in business and industrial undertakings; the support to forestry production; extraction of wood in planted forests; the holding of interests, in Brazil or abroad, in other companies or investment funds as member, shareholder or quotaholder, and the administration of own assets; the provision of technical and ancillary accounting services and administrative support.

1.6. Frigg Florestal S.A.

(a) Identification. Frigg Florestal S.A., a corporation, enrolled with CNPJ/MF under No. 07.903.740/0001-87, registered in the Board of Trade of the State of São Paulo under NIRE 35.300.572.998, with head office in the city of São Paulo, State of São Paulo, at Avenida Brigadeiro Faria Lima, 1355, 8th floor, Pinheiros, ZIP Code 01452-919 (“Frigg Florestal”);

(b) Activities. Frigg Florestal’s corporate purpose is: forestry production in planted forests; forest production support activities, including forestry repopulation and replanting of forest species; the holding of interests as quotaholder or shareholder in other companies, whether they are partnerships or business companies, national or foreign; the sale of wood and its by-products; and the provision of technical and ancillary accounting services and administrative support.

2. Description and Purpose of the transaction

The transaction consists in merger of the Target Companies into Suzano (“Mergers”), under the terms and conditions provided for in the Protocol and Justification of the Mergers, entered into between their management bodies on August 29, 2024 (“Protocol and Justification”). The Protocol and Justification is part of the Management Proposal for the Extraordinary General Meeting to be held on September 30, 2024, at 10:00 a.m. (“EGM”), which will decide on the Mergers.

The Mergers are considered as independent acts, and will occur in two (2) subsequent stages in a single act, at the EGM, respecting the following order:

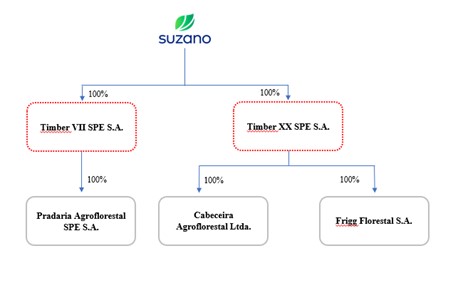

(i) First Stage: Mergers of Timber VII and Timber XX, as illustrated below:

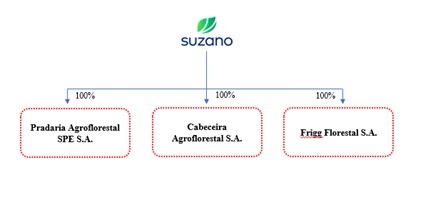

(ii) Second stage: the Mergers of Pradaria, Cabeceira and Frigg Florestal, as illustrated below:

As a result of the Mergers, the Target Companies will be dissolved and succeeded by the Company in all their rights and obligations, pursuant to article 227 of Law No. 6,404, dated December, 1976, as amended (“Brazilian Corporation Law”).

The Mergers will not imply an increase in Suzano’s capital, given that Suzano directly or indirectly holds the entire share capital of the Target Companies and, therefore, the value of the net equity of each of the Target Companies is already fully reflected in Suzano’s net equity.

The Mergers are intended to enable the acquisition of efficiency gains coming from the reduction of administrative costs, as well as optimization of management and simplification of the group’s corporate structure.

3. Main benefits, costs and risks of the transaction

3.1. Main Benefits

As indicated in item 2 above, the Mergers will enable the acquisition of efficiency gains on administrative costs, as well as optimization of management and simplification of the corporate structure.

3.2. Costs

The Company estimates that the costs for carrying out the Mergers are around two hundred and fifty thousand reais (BRL 250,000.00), including expenses with publications, registrations, auditors, appraisers, attorneys and other professionals engaged to advise the transaction.

3.3. Risks

Considering that (i) the Company currently holds, whether directly or indirectly, 100% of the capital of the Target Companies and that at the time of merger of each of the Target Companies, Suzano will be the direct holder of one hundred per cent (100%) of the capital of each of the Target Companies, following the order of merger defined in Clause 1.1.1 of the Protocol and Justification (Exhibit B to the Management Proposal) and described in item 2 above; and that (ii) the activities developed by the Target Companies to be merged into the Company are restricted to the activities already developed by the Company, the Mergers do not pose any additional risk factors to the Company, and the information described in section “4 - Risk Factors” of Suzano’s 2024 Reference Form (version 3) will remain valid and in force.

4. Shares’ Exchange Ratio

The Mergers will not result in increase of Suzano’s capital and, accordingly, there will be no share exchange ratio, since the Company is currently holder, whether directly or indirectly, of 100% of the capital of the Target Companies, and that at the time of merger of each of the Target Companies, Suzano will be the direct holder of one hundred per cent (100%) of the capital of each of the Target Companies, following the order of merger defined in Clause 1.1.1 of the Protocol and Justification (Exhibit B to the Management Proposal) and described in item 2 above.

5. Criteria to fix the exchange ratio

Not applicable, see answer to item 4 above.

6. Main assets and liabilities that will form each share of the equity in the event of spin-off

Not applicable.

7. Whether or not the Mergers have been or will be submitted to the approval of Brazilian or foreign authorities.

The completion of the Mergers will not subject to approval by the Brazilian or foreign authorities.

8. Share exchange ratio calculated in accordance with article 264 of the Brazilian Corporation Law

Considering the answer to item 4 above, and considering the decision rendered on February 15, 2018 by the Collegiate Body of the Brazilian Securities and Exchange Commission – CVM under SEI Proceeding No. 19957.011351/2017-21, article 264 of the Brazilian Corporation Law does not apply to the Mergers, so that the preparation of the reports referred to in said article will not be necessary.

9. Applicability of withdrawal right and reimbursement amount

There will be no withdrawal right within the scope of the Mergers, since the applicable law limits such right to the shareholders of the absorbed companies, and the Company is currently holder, whether directly or indirectly, of 100% of the capital of the Target Companies. Therefore, there is also no need to talk about dissenting shareholders and, consequently, the amount of reimbursement to the shareholders/quotaholders of the Target Companies as a result of the Mergers.

10. Other relevant information

10.1. Appraisal Report

The equity appraisal reports, prepared in compliance with the financial statements, have as their base date July 31, 2024 (“Base Date”).

The Company’s and the Target Companies’ managers have engaged Apsis Consultoria e Avaliações Ltda., a company enrolled with CNPJ/ME under No. 08.681.365/0001-30, with head office in the City of Rio de Janeiro, State of Rio de Janeiro, at Rua do Passeio, No. 62, 6th floor, Centro, ZIP Code 20021-290 (“Appraiser”) to prepare the appraisal report of the owners’ equity of the Target Companies at their respective book values (“Appraisal Reports”). The appointment and engagement of the Appraiser will be submitted to ratification by the EGM, under paragraph one of article 227 of the Brazilian Corporation Law.

According to the Appraisal Reports, the sum of the total owners’ equity of the Companies for purposes of the Mergers is two billion, one hundred and twenty-six million, three hundred and forty-three thousand, five hundred and seventy-three reais and ninety-eight cents (BRL 2,126,343,573.98), and this will be the amount to be transferred to Suzano, observed that the individual amount of the net assets of each of the Target Companies in the respective Base Date is:

(i) Timber VII: five hundred and forty-five million, two hundred and forty-five thousand, four hundred and thirteen reais and fifty cents (BRL 545,245,413.50);

(ii) Pradaria: five hundred and forty-five million, one hundred and fifty thousand, six hundred and fifty-six reais and thirty-two cents (BRL 545,150,656.32);

(iii) Timber XX: five hundred and eighteen million, twenty-six thousand, nine hundred and twenty-two reais and forty-four cents (BRL 518.026.922,44);

(iv) Cabeceira: two hundred and forty-one million, forty-five thousand, seven hundred and twenty-five reais and eleven cents (BRL 241,045,725.11);

(v) Frigg Florestal: two hundred and seventy-six million, eight hundred and seventy-four thousand, eight hundred and fifty-six reais and sixty-one cents (BRL 276,874,856.61);

10.2. Disclosure of documents

The Protocol and Justification, Management Proposal for the EGM and the Appraisal Reports prepared for purposes of the Mergers, will be made available to the shareholders of the Company, as of the date hereof, at the head office of the Company, at the Investor Relations website of Suzano (ri.suzano.com.br), as well as at the websites of CVM (www.cvm.gov.br ) and B3 S.A. – Brasil, Bolsa, Balcão (www.b3.com.br).

* * *