Disclaimer This presentation contains what are considered “forward-looking statements,” as defined in Section 27A of the 1933 Securities Act and Section 21E of the 1934 Securities Exchange Act, as amended. Some of these forward-looking statements are identified with words such as “believe,” “may,” “could,” “would,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” as well as the negative forms of these words, other terms of similar meaning or the use of future dates. The forward-looking statements include, without limitation, statements related to the declaration or payment of dividends, implementation of the key operational and financial strategies and investment plans, guidance about future operations and factors or trends that influence the financial situation, liquidity or operational results. Such statements reflect the current view of the management and are subject to diverse risks and uncertainties. These are qualified in accordance with the inherent risks and uncertainties involving future expectations in general, and actual results could differ materially from those currently anticipated due to various risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on diverse assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. Suzano does not undertake any obligation to update any such forward-looking statements as a result of new information, future events or otherwise, except as expressly required by law. All forward- looking statements in this presentation are covered in their entirety by this disclaimer. In addition, this presentation contains some financial indicators that are not recognized by the BR GAAP or IFRS. These indicators do not have a standard meaning and may not be comparable to indicators with a similar description used by other companies. We provide these indicators because we use them as measurements of Suzano's performance; they should not be considered separately or as a replacement for other financial metrics that have been disclosed in accordance with BR GAAP or IFRS.

Business Strategy Financial Management Q&A

Business Strategy Advance in the links of the chain, always with competitive advantage Be “Best-in-Class” in the Total Pulp Cost vision Maintain relevance in Pulp Play a leading role in sustainability Expand boldly into New Markets avenues

Business Strategy avenues Play a leading role in sustainability Expand boldly into New Markets Advance in the links of the chain, always with competitive advantage Be “Best-in-Class” in the Total Pulp Cost vision Maintain relevance in Pulp

Currently... Capital allocation strategy Forward looking dynamics of the P&P sector Levers for greater structural competitiveness What are the main themes for Suzano's investment case?

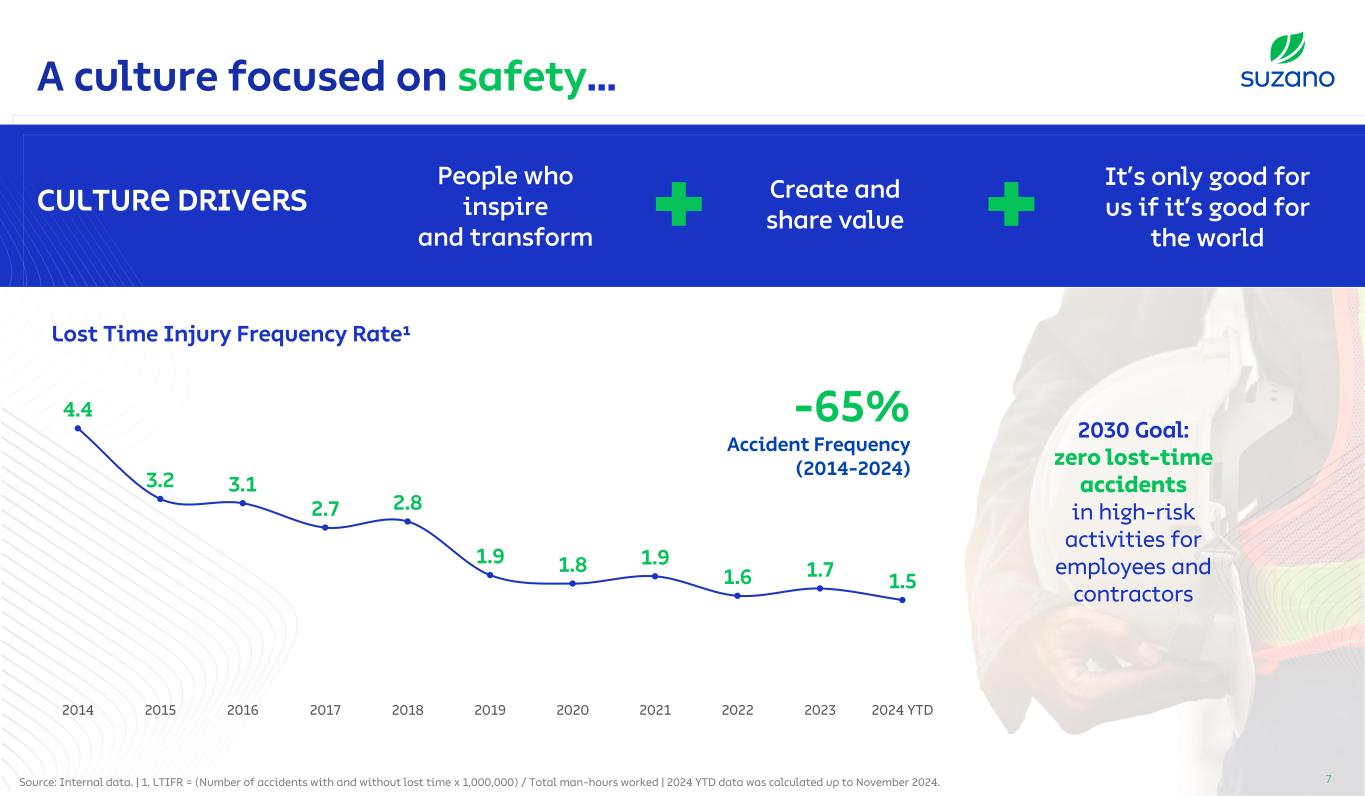

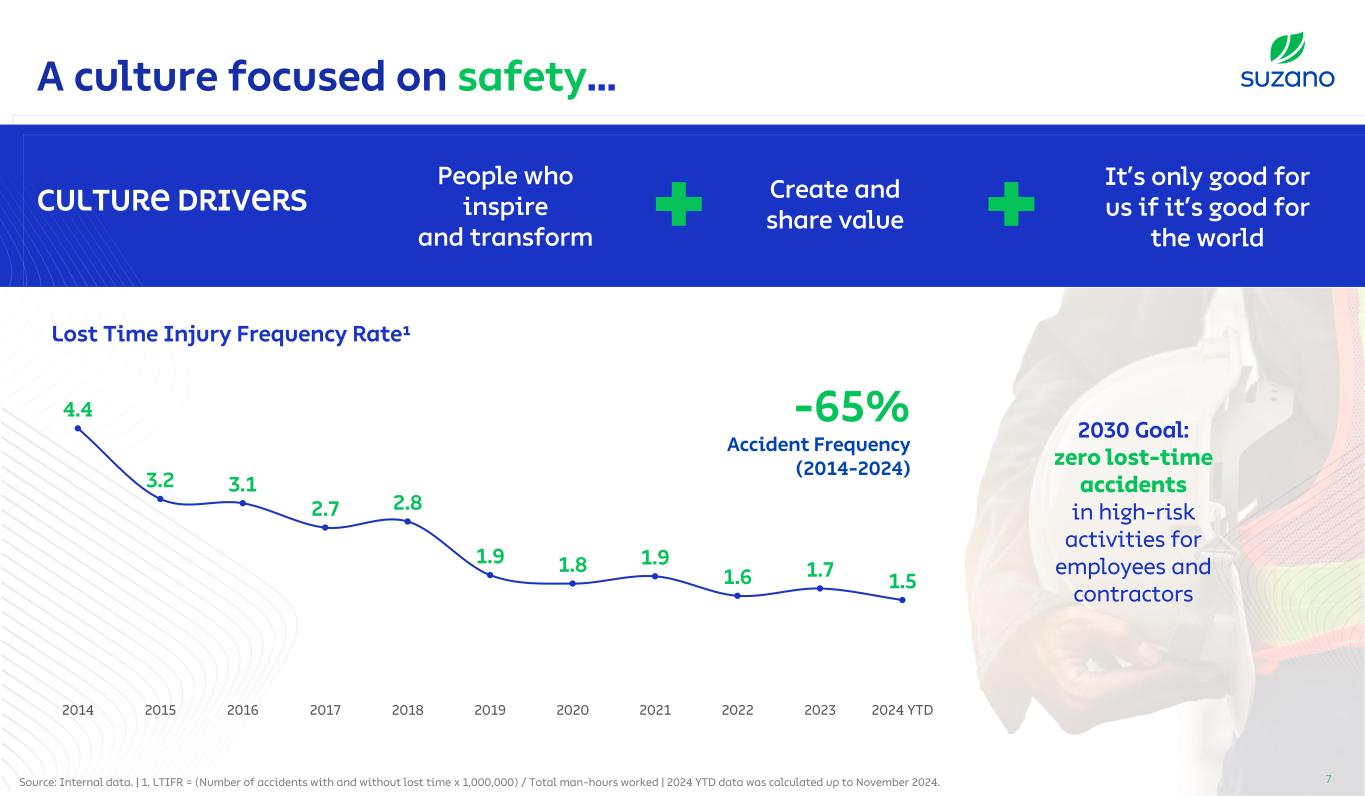

A culture focused on safety… Culture drivers It’s only good for us if it’s good for the world People who inspire and transform Create and share value -65% Accident Frequency (2014-2024) Lost Time Injury Frequency Rate¹ 4.4 3.2 3.1 2.7 2.8 1.9 1.8 1.9 1.6 1.7 1.5 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD 2030 Goal: zero lost-time accidents in high-risk activities for employees and contractors Source: Internal data. | 1. LTIFR = (Number of accidents with and without lost time x 1,000,000) / Total man-hours worked | 2024 YTD data was calculated up to November 2024. 7

95% Feel proud to work at Suzano 95% Recommend Suzano as a good place to work 94% Understand how their role contributes to the company's strategy Source: Suzano 2023 Engagement Survey – Korn Ferry Market Ref. with a strong commitment with leadership development… 90% 81% 86% 75% 90% 85% Team development 2023 2024 Brazilian Market1 Global Market1 74 78 73 69 82 85 67 65 “I feel that my immediate leadership invests time in team development” “I have development opportunities at Suzano” Source: Results of 2023 Engagement Survey and 2024 Pulse Survey | 1. Reference values from 2023 Korn Ferry Survey Engagement Survey results 8

⚫ Linked with variable compensation for 100% leadership positions ⚫ Dedicated programs for female talent attraction and development 2025 goal: 30% women at leadership positions1 1Manager and above and gender diversity 74 98 114 135 149 2020 2021 2022 2023 2024 YTD 19% 23% 24% 25% 27% Source: Suzano's People Analytics | 2024 YTD data was calculated up to November 2024. 9 Gender diversity evolution % and positions

Avenues Maintain relevance in Pulp Advance in the links of the chain, always with competitive advantage Expand boldly into New Markets Be “Best-in-Class” in the Total Pulp Cost vision

What we have been facing Climate change & impacts Labor shortage Higher logistics costs Limited Eucawood availability Overcoming a challenging environment A journey towards higher competitiveness 11 How we are addressing Third party Eucawood reduction More Eucawood per hectare Mechanized Eucatree plantation Eucafarms closer to our mills

% Total area impacted¹ (SP & MS) 0.61 0.38 2019-2023 (avg) 2024 Monitoring tower center A total of 133 towers among all sites real time monitoring Satellite coverage on 100% of the area Prediction models Forecast of fire direction to better allocate fire brigade fleet Average response time: 30 minutes (from detection to fighting) Challenge: Climate uncertainties & impacts Effective fire protection system 12 1. Include eucalyptus and native areas. SP and MS states account for 58% of Suzano's operational forestry base

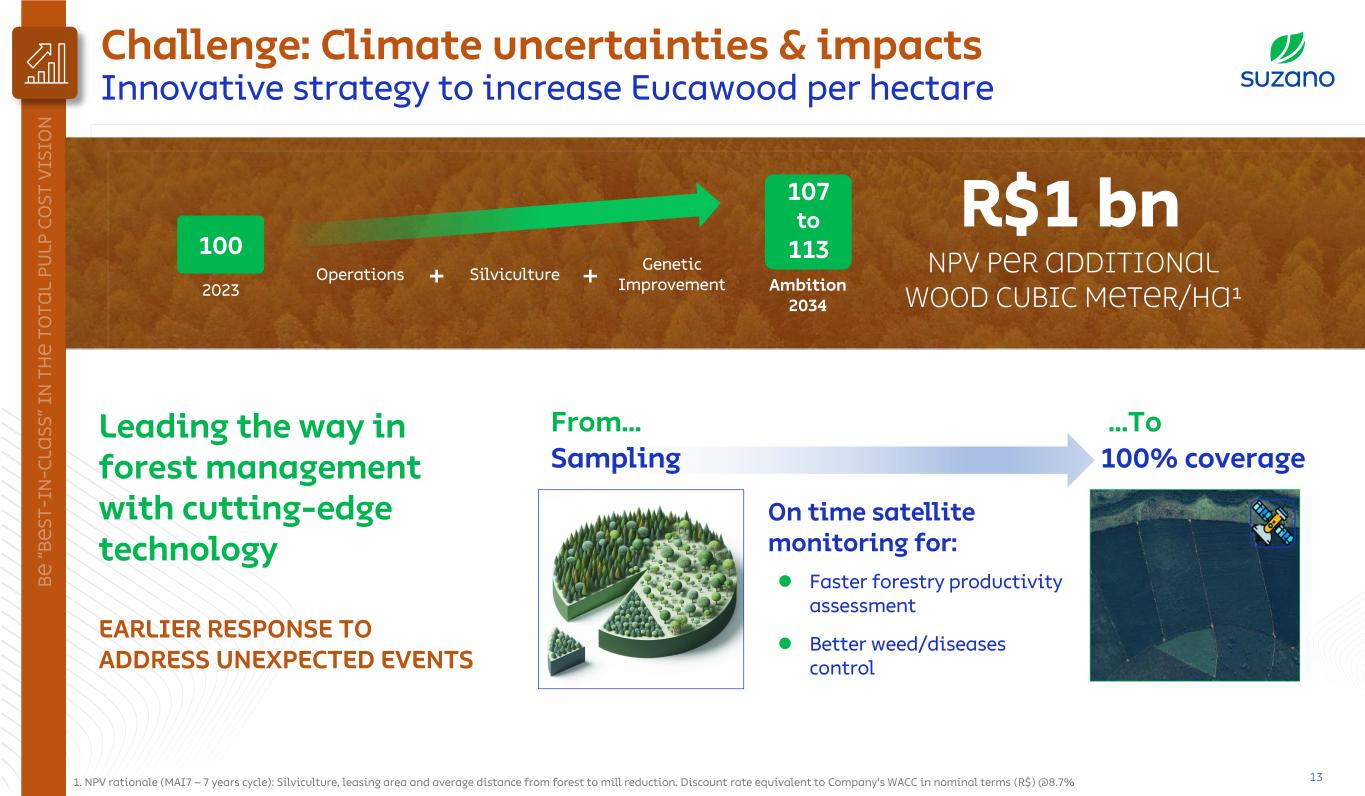

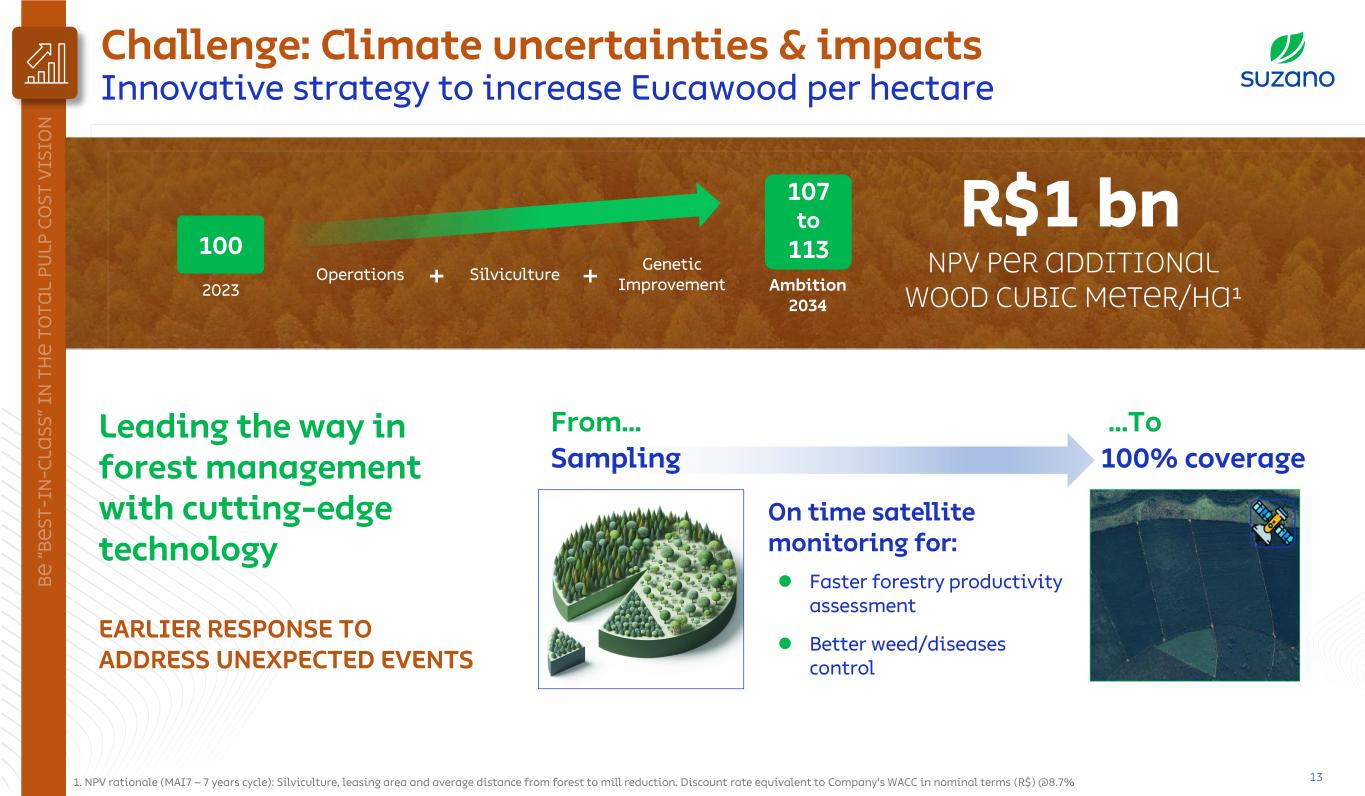

…To 100% coverage NPV per ADDITIONAL wood cubic meter/ha¹ R$1 bn Leading the way in forest management with cutting-edge technology From… Sampling EARLIER RESPONSE TO ADDRESS UNEXPECTED EVENTS On time satellite monitoring for: ⚫ Better weed/diseases control ⚫ Faster forestry productivity assessment Challenge: Climate uncertainties & impacts Innovative strategy to increase Eucawood per hectare 131. NPV rationale (MAI7 – 7 years cycle): Silviculture, leasing area and average distance from forest to mill reduction. Discount rate equivalent to Company's WACC in nominal terms (R$) @8.7% 100 2023 Operations Silviculture Genetic Improvement Ambition 2034 107 to 113

Reducing labor intensity in 40% 2030 58% 85% 2024 2030 Mechanized Silviculture Level (%) Mechanized irrigationPlanting machineAutomated nursery 2024 - 2030 Challenge: Labor shortage Mechanization to address rural population decline 14 Suzano Ventures Accelerating development through strategic investments in agtech startups.

71% 72% 83% 87% 29% 28% 17% 13% 2024e 2025 2026-2028 2029-2032 Average distance from Eucafarm to mill (km) 6% spot market 7% forest partnership Wood source breakdown (%) Challenges: Higher logistics costs and limited Eucawood availability Lower average distance and Eucawood self-sufficiency Own Third Party1 1. Third party wood: forestry partnership program and spot market. 2. Considers current logistics and fuel costs. Own Planting vs. Own Harvesting (hectares – 100 basis) -36 km ~R$480MM/ year² 15 2026-20282024 2029-2032 Own planting Own harvesting 2025 144 140 110 106 100 102 106 106 186 173 153 150

WOOD CASH COST1 - RIBAS (R$/t - 100 basis) 100 78 74 66 3Q24 2025 2026-28 2029-32 Forests ≥ 3 yrs Forests between 2 & 3 yrs MATO GROSSO DO SUL: FORESTRY PRODUCTIVITY DISTRIBUTION 3Q24 inventory results +15% MAI 7 (m³/ha/yr)100 115 1. Real terms 2025 currency – Inflation 2025 -> IPCA: 4.0%, IGPM: 4.0%, INPC: 3.0%. Other assumptions: Brent $70/bbl; FX 5.35. MAI = Medium Annual Increment. Structural Eucafarm base fully established • Lower distance to the mill • Higher mechanization level • More productivity with new genetic materials RIBAS DO RIO PARDO FORESTRY BASE: 16 All competitive levers already becoming a reality on the ground Mato Grosso do Sul case: Ribas and Três Lagoas

Avenues Play a leading role in sustainability Advance in the links of the chain, always with competitive advantage Expand boldly into New Markets Be “Best-in-Class” in the Total Pulp Cost vision Maintain relevance in Pulp

18 Start-upProject approval 2022 2023 2024 Jul/2024Out/2021 Ribas confirms Suzano's excellence in project execution Global scenario instability 2020 Steel Rebar – R$/t Sources: S&P Global, CNN, BBC, Mynewsdesk, Trading Economics. 18 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000

Ribas confirms Suzano's excellence in project execution Complexity on the ground 380,000 m³ of concrete Enough to build 4.7 Maracanã Stadiums 1,983 suppliers of contracted materials and services under contract 45,000 professionals over the course of the project (peak of 11,000 people on site) 22,000 hours of training 3,000 employees hired (direct and indirect – mill and forestry) 56 million man-hours worked ~8.2 Eiffel Towers60,000 tons of construction and structural steel 115,000 pieces of equipment and instruments installed areas of health, education, social development, housing, and public security 21 social projects implemented 19

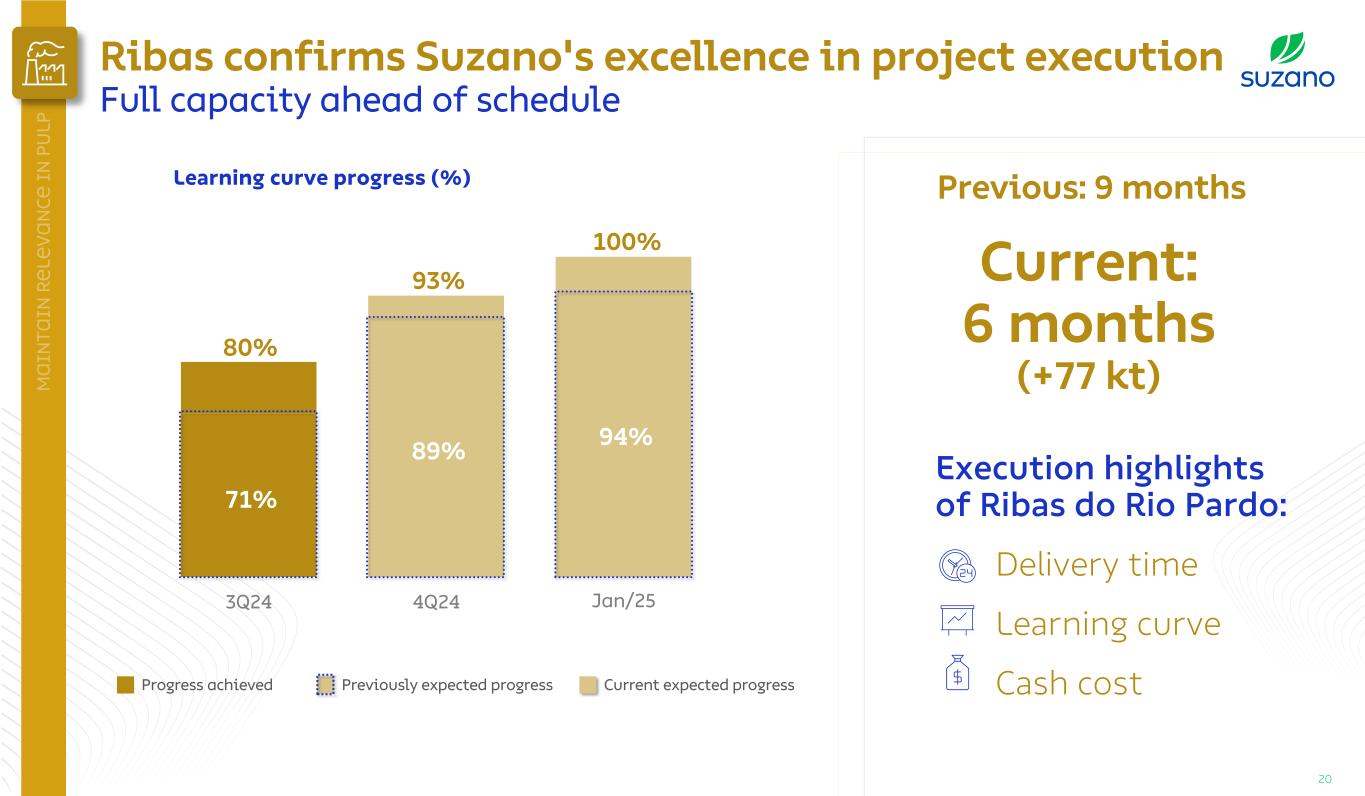

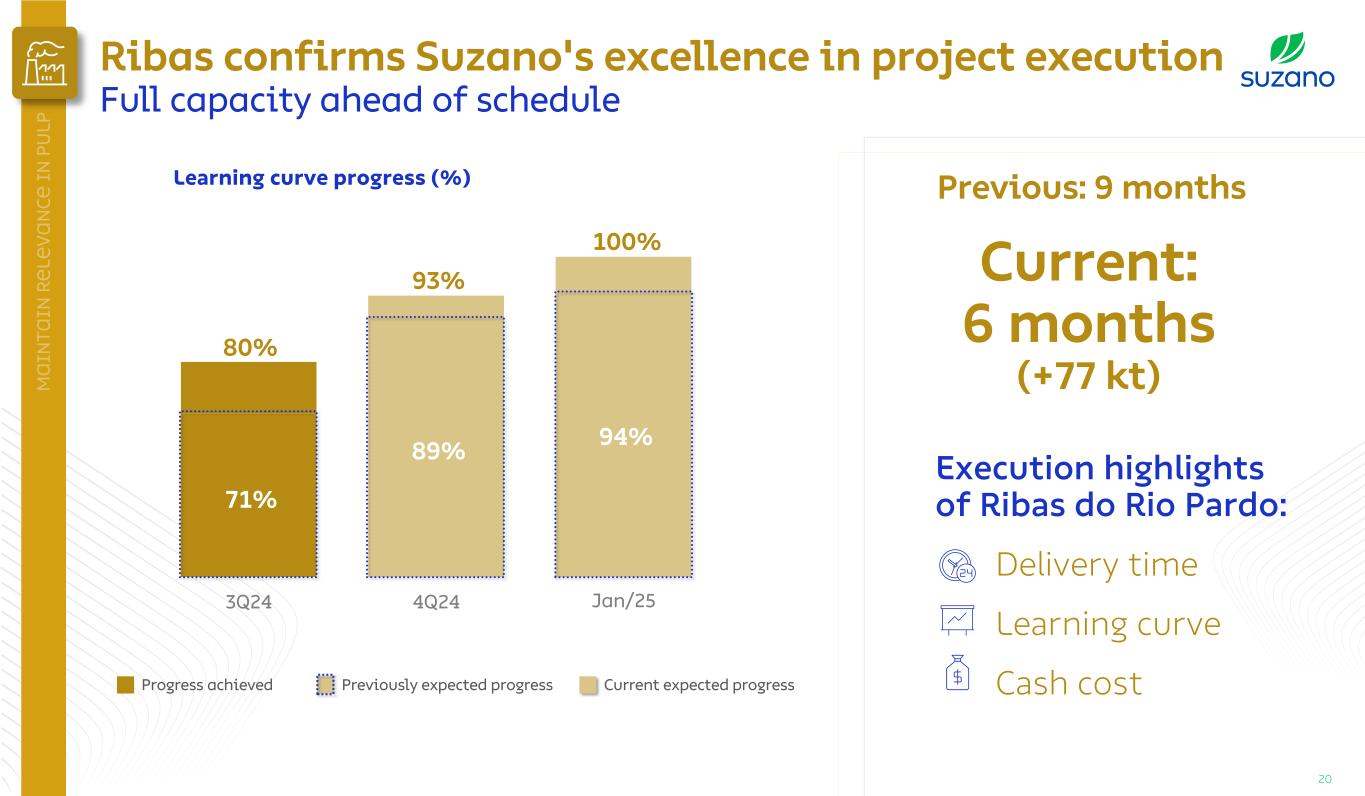

80% 2Q25 93% 100% Ribas confirms Suzano's excellence in project execution Execution highlights of Ribas do Rio Pardo: Delivery time Learning curve Cash cost Learning curve progress (%) Previously expected progressProgress achieved Current expected progress Previous: 9 months Current: 6 months (+77 kt) 71% 89% 94% 3Q24 4Q24 Jan/25 20 Full capacity ahead of schedule

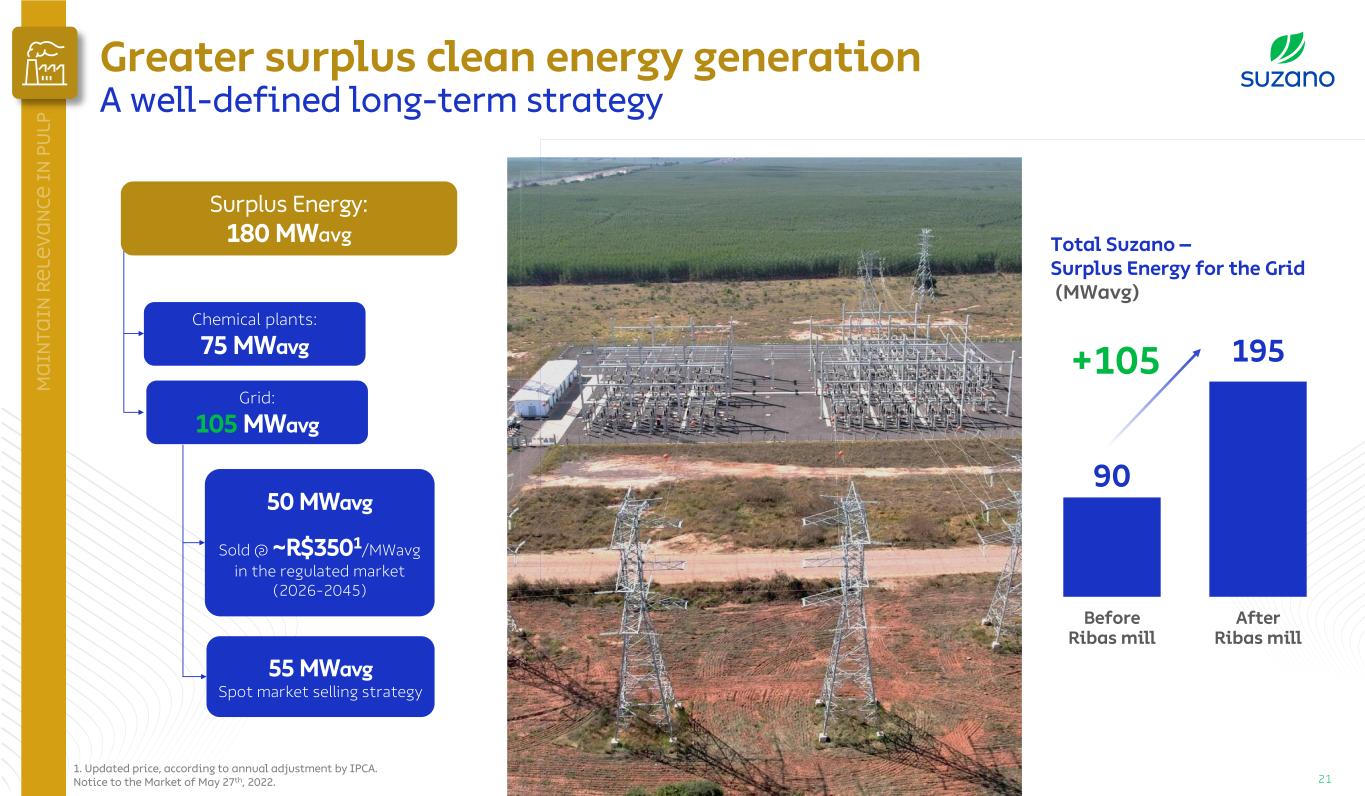

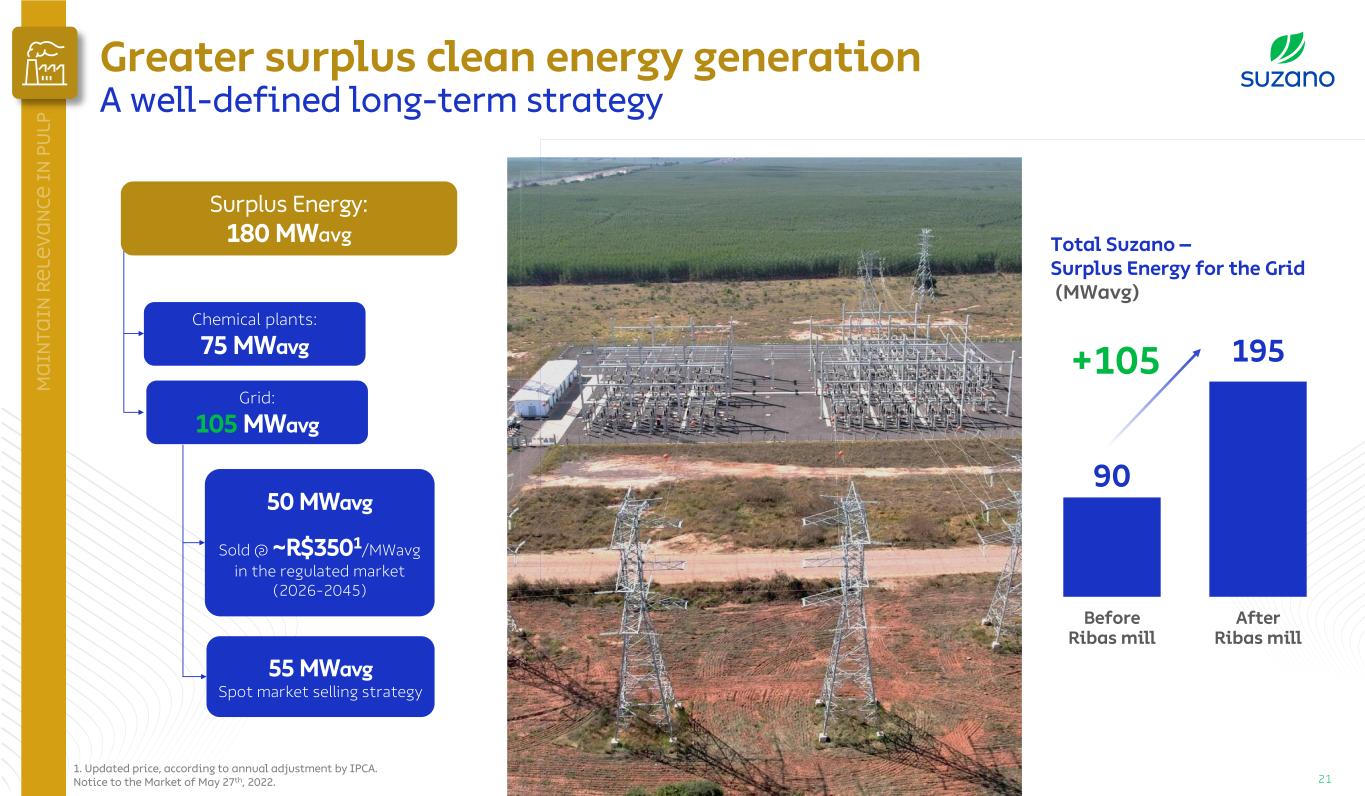

Greater surplus clean energy generation A well-defined long-term strategy 50 MWavg Sold @ ~R$3501/MWavg in the regulated market (2026-2045) 55 MWavg Spot market selling strategy Grid: 105 MWavg 90 195 Before Ribas mill After Ribas mill Chemical plants: 75 MWavg Total Suzano – Surplus Energy for the Grid (MWavg) +105 Surplus Energy: 180 MWavg 1. Updated price, according to annual adjustment by IPCA. Notice to the Market of May 27th, 2022. 21

38 100 70 64 62 3Q24 2025 2026-2028 2029-2032 Unmatched cash cost competitiveness 22 Evolution of Ribas cash cost1 ex-downtimes (R$/t – 100 basis) Currency in real terms (2025) 1. Real terms 2025 currency – Inflation 2025 -> IPCA: 4.0%, IGPM: 4.0%, INPC: 3.0%. Fixed Cost 8% Energy 14% Input 36% Wood 41% Cash cost reduction breakdown (3Q24 vs. 2032) Brent US$70/bbl FX 5.35

Pulp overview

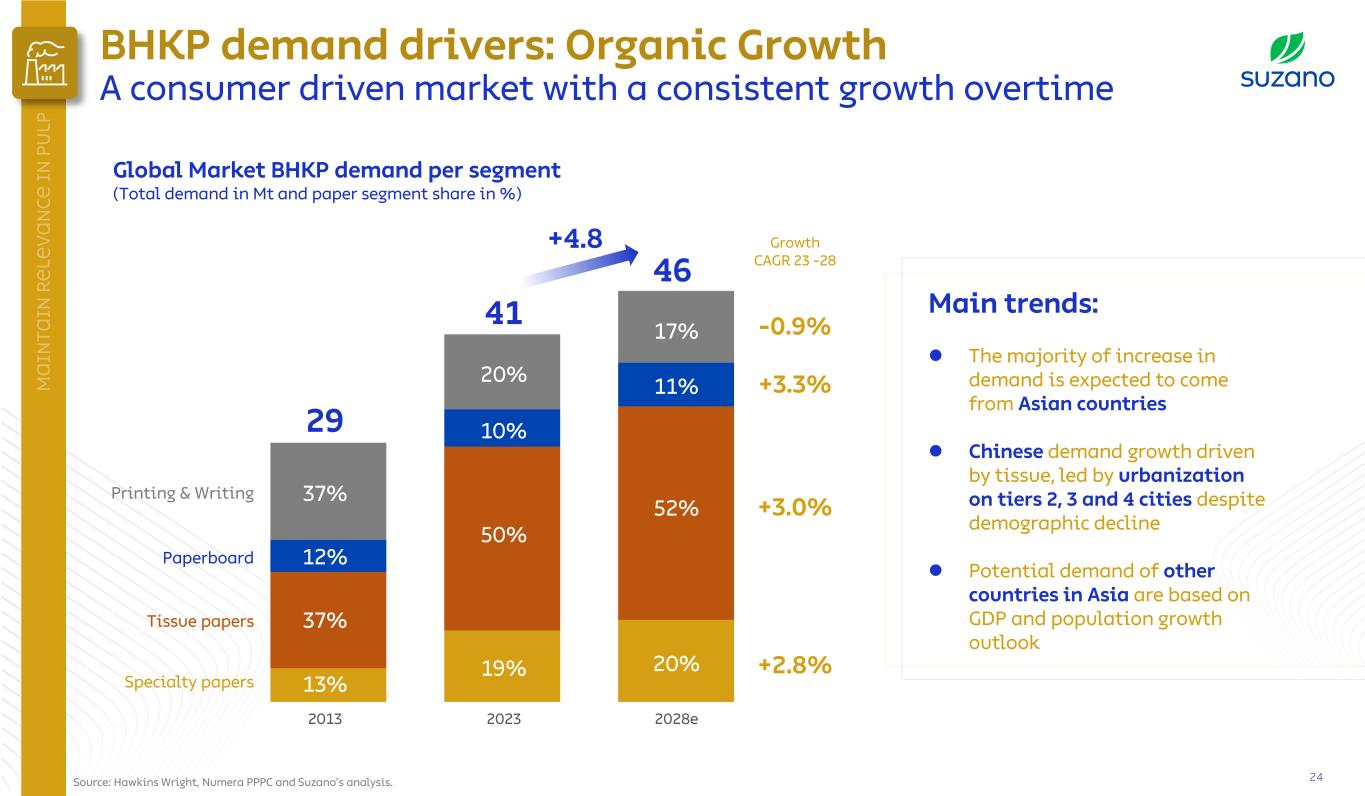

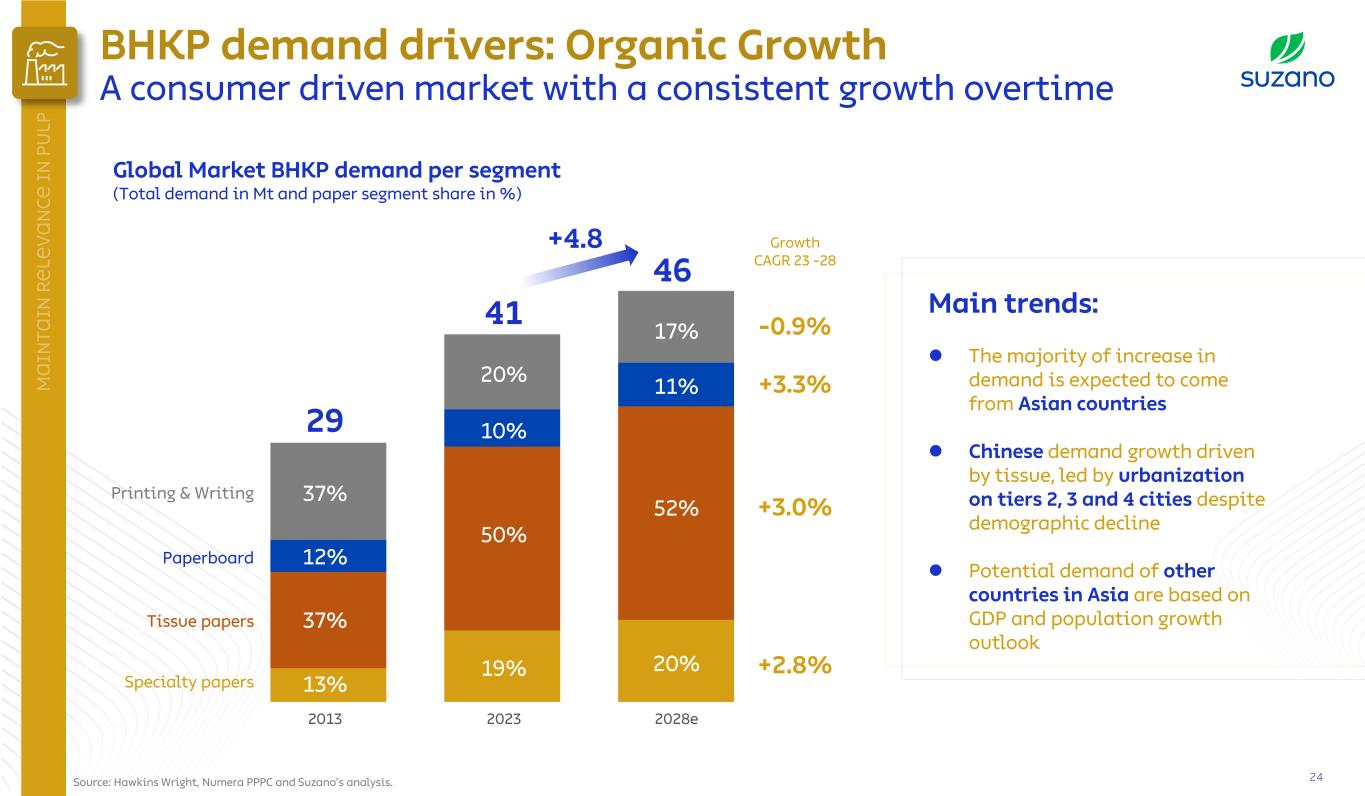

BHKP demand drivers: Organic Growth A consumer driven market with a consistent growth overtime 24 -0.9% 37% 12% 37% 13% 2013 20% 10% 50% 19% 2023 17% 11% 52% 20% 2028e Printing & Writing Paperboard Tissue papers Specialty papers 29 41 46 Global Market BHKP demand per segment (Total demand in Mt and paper segment share in %) +4.8 Growth CAGR 23 -28 +3.3% +3.0% +2.8% Main trends: ⚫ The majority of increase in demand is expected to come from Asian countries ⚫ Chinese demand growth driven by tissue, led by urbanization on tiers 2, 3 and 4 cities despite demographic decline ⚫ Potential demand of other countries in Asia are based on GDP and population growth outlook Source: Hawkins Wright, Numera PPPC and Suzano’s analysis.

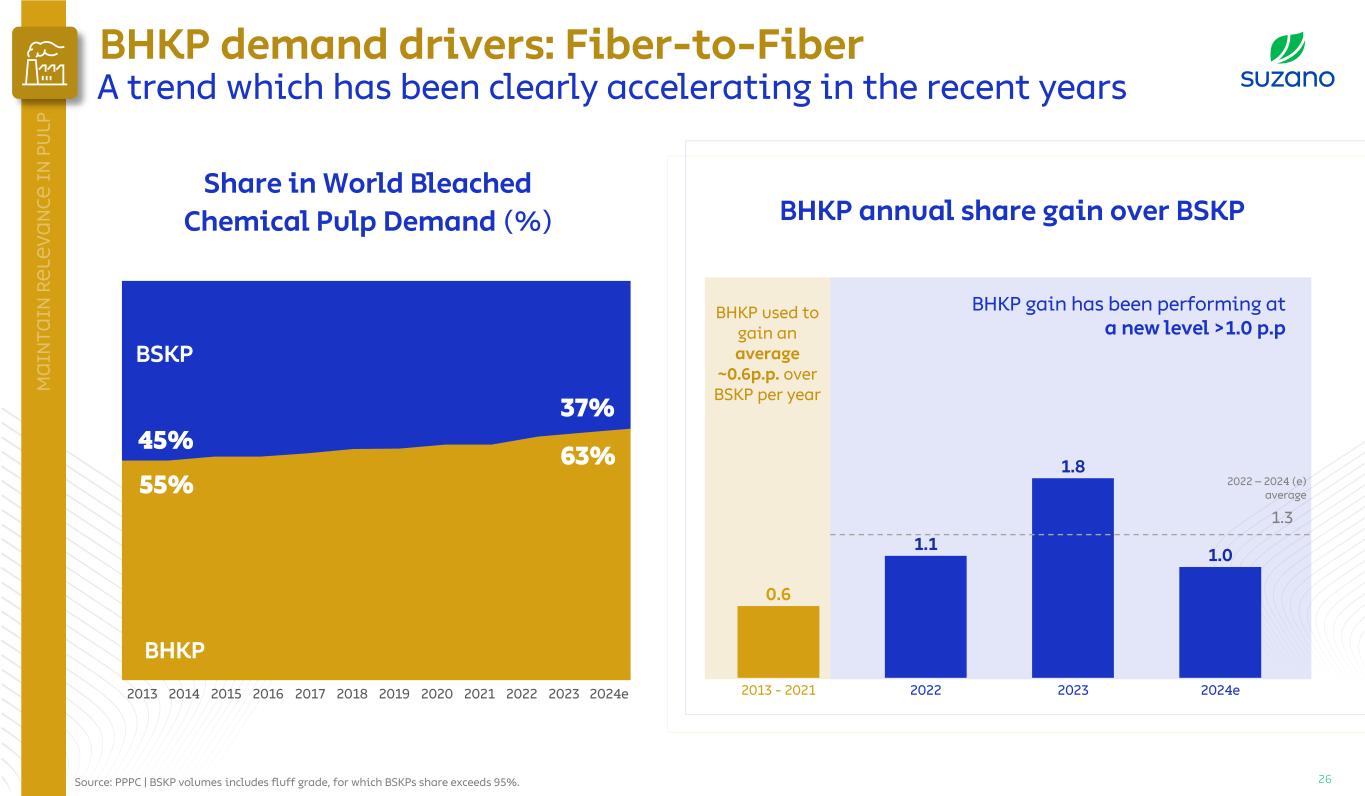

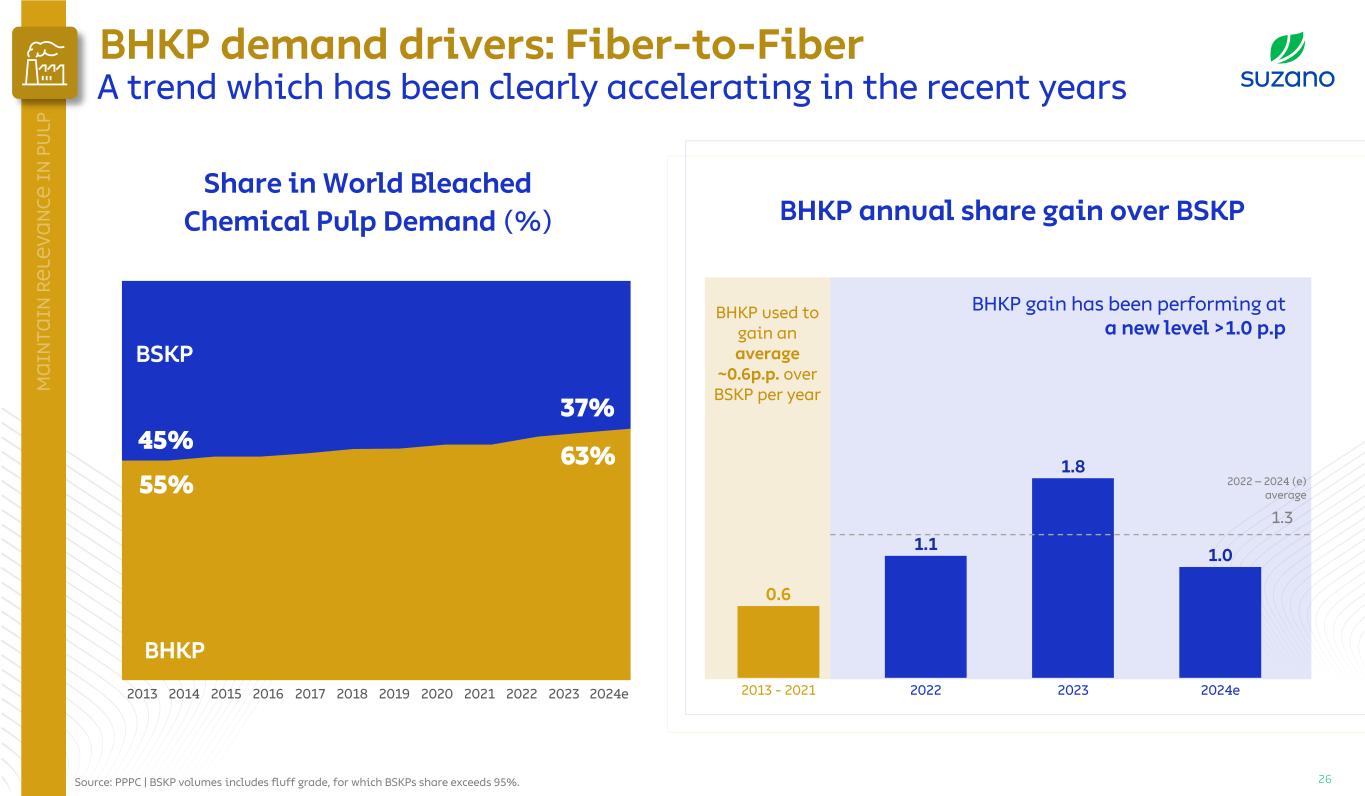

BHKP demand drivers: Fiber-to-Fiber 25 Share in World Bleached Chemical Pulp Demand (%) BSKP 55% 45% 63% 37% BHKP Source: G100 Numera PPPC 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024e Hardwood is consistently gaining market share

63% 37% BHKP used to gain an average ~0.6p.p. over BSKP per year BHKP gain has been performing at a new level >1.0 p.p BHKP annual share gain over BSKP 2013 - 2021 2022 2023 2024e 0.6 1.1 1.8 1.0 1.3 2022 – 2024 (e) average Source: PPPC | BSKP volumes includes fluff grade, for which BSKPs share exceeds 95%. 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024e BSKP 55% 45% 63% 37% BHKP 26 Share in World Bleached Chemical Pulp Demand (%) BHKP demand drivers: Fiber-to-Fiber A trend which has been clearly accelerating in the recent years

66% 79% 57% Global Region with highest furnish Region with lowest furnish B S K P B H K PMarket BCP BHKP and BSKP shares1 (%) Tissue Specialties BHKP 5-year demand increase for every +1p.p. gain in furnish2 Region with highest furnish Region with lowest furnish P&W 69% 74% 39% Global Region with highest furnish Region with lowest furnish ~ +0.6 Mt Cartonboard 63% 69% 50% Global Region with highest furnish Region with lowest furnish ~ +0.3 Mt 1. FisherSolve. 2. Suzano’s analysis | Region is defined as North America, Latin America, W. Europe, China or Other Asia (ex-China). BCP = BHKP + BSKP. 65% 82% 48% Global 27 ~ +0.6Mt~ +1.6Mt BHKP demand drivers: Fiber-to-Fiber A deeper view on fiber substitution by paper grade

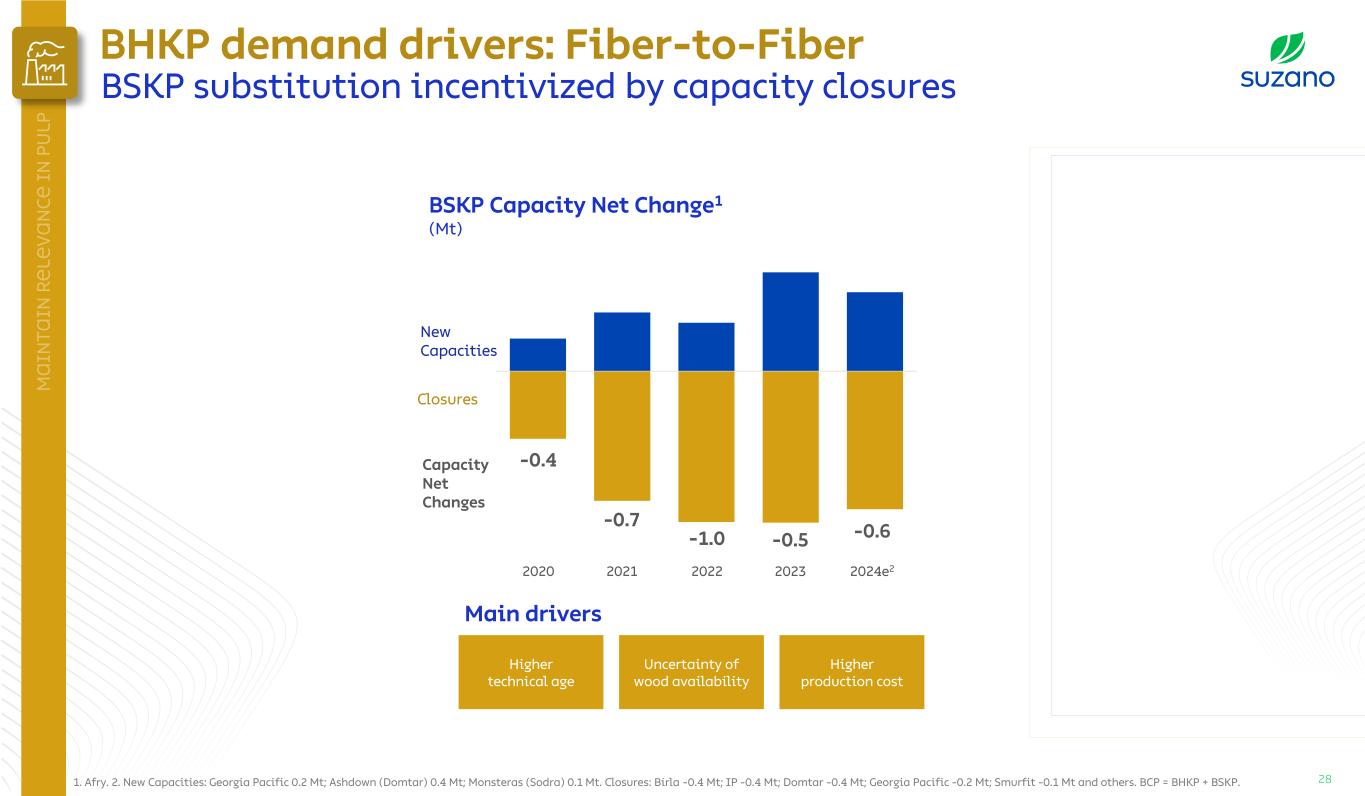

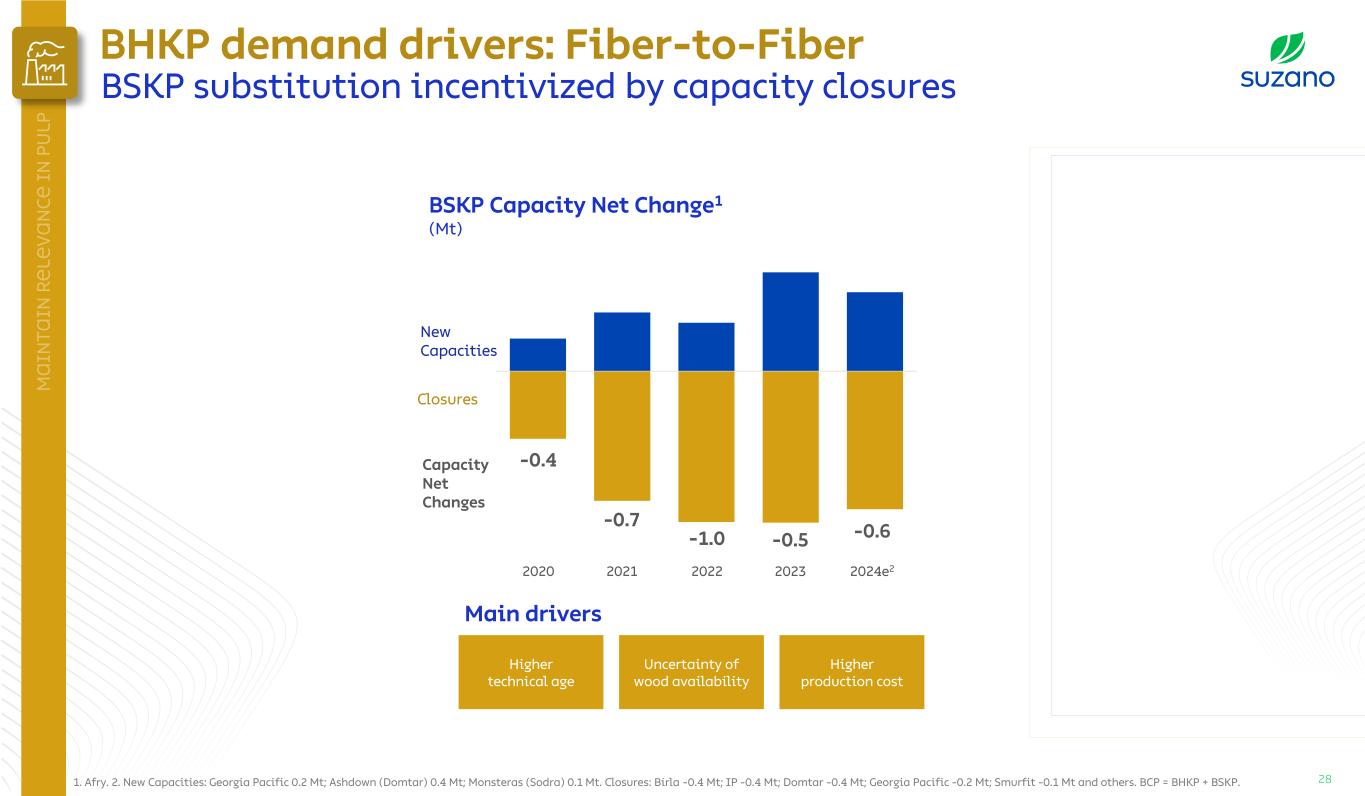

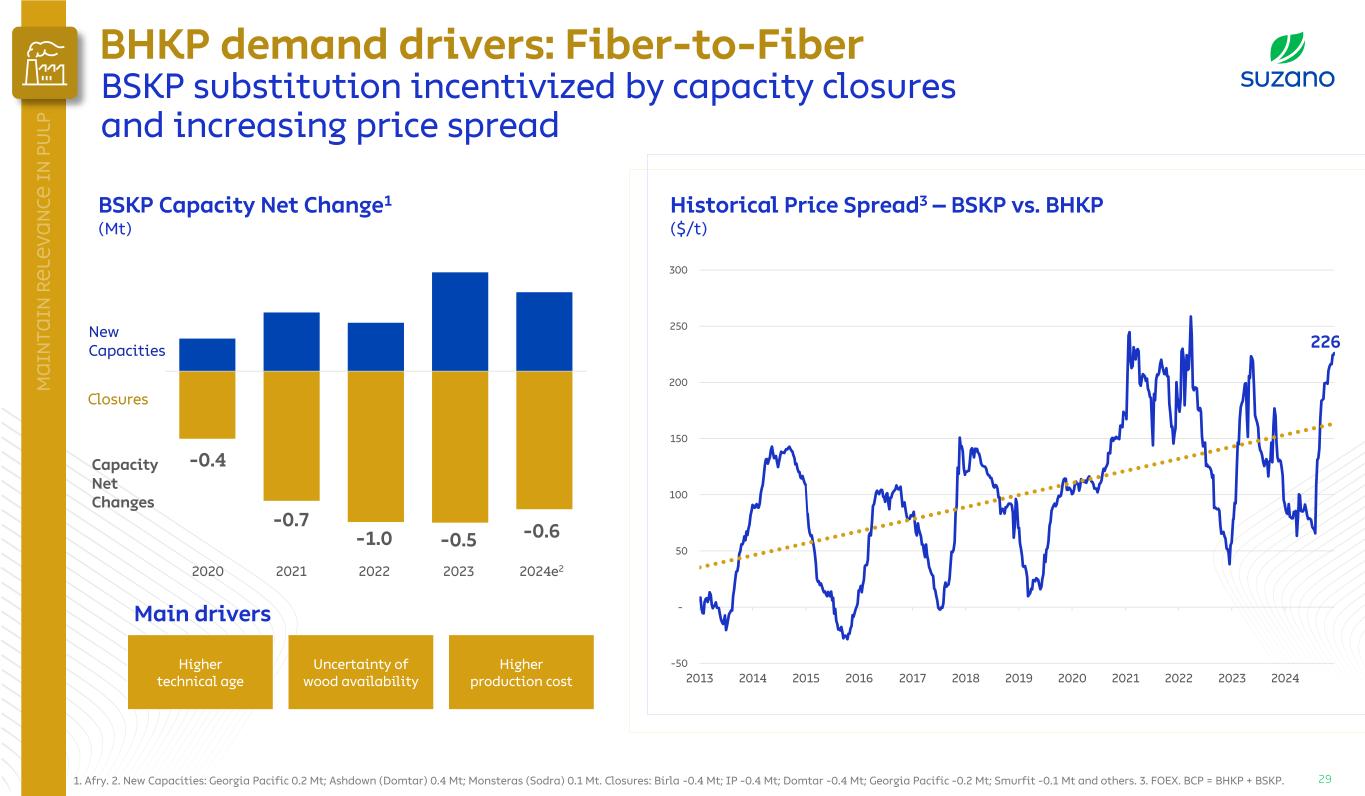

28 BSKP Capacity Net Change1 (Mt) 2020 2021 2022 2023 2024e2 -0.4 -0.7 -1.0 -0.5 -0.6 Closures Capacity Net Changes Main drivers Higher technical age Uncertainty of wood availability Higher production cost 1. Afry. 2. New Capacities: Georgia Pacific 0.2 Mt; Ashdown (Domtar) 0.4 Mt; Monsteras (Sodra) 0.1 Mt. Closures: Birla -0.4 Mt; IP -0.4 Mt; Domtar -0.4 Mt; Georgia Pacific -0.2 Mt; Smurfit -0.1 Mt and others. BCP = BHKP + BSKP. New Capacities 28 BHKP demand drivers: Fiber-to-Fiber BSKP substitution incentivized by capacity closures and increasing price spread

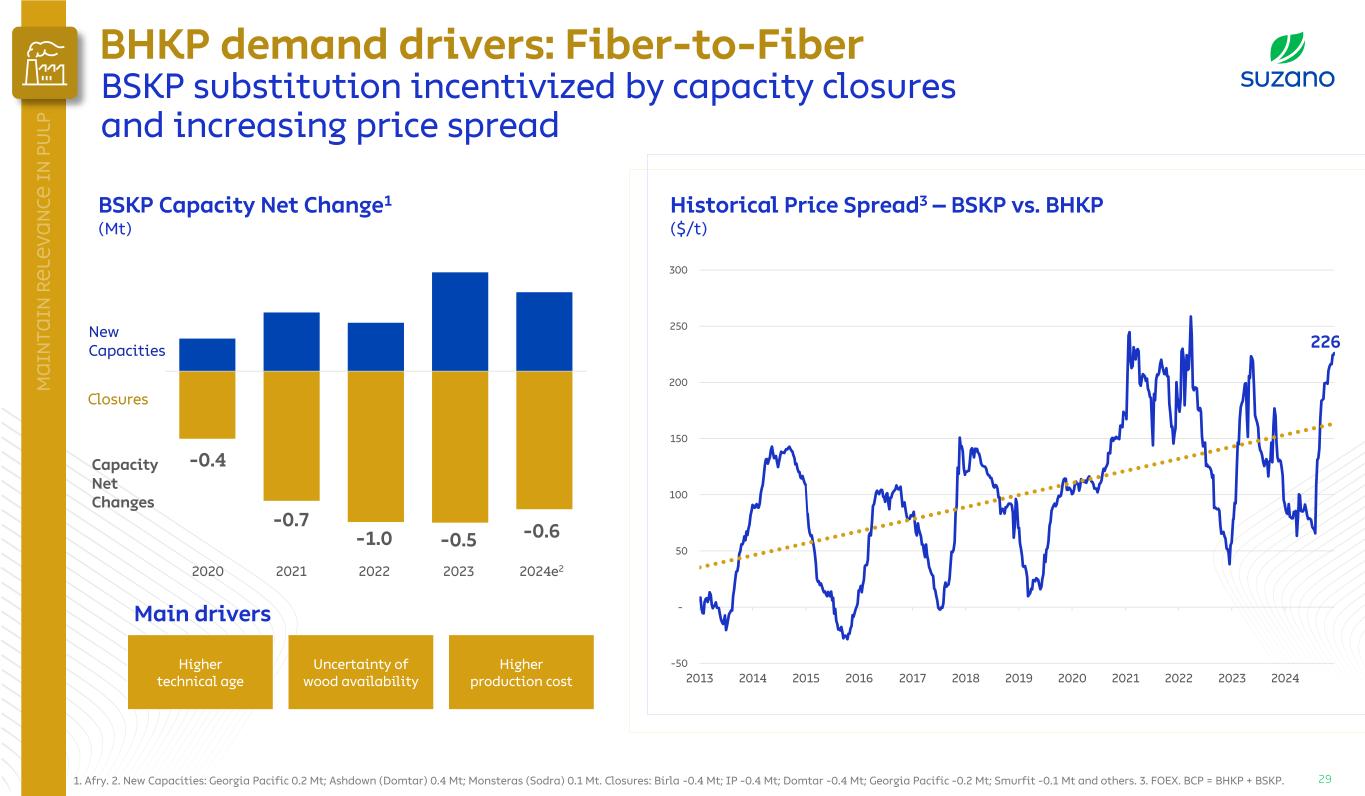

29 Main drivers Higher technical age Uncertainty of wood availability Higher production cost BSKP Capacity Net Change1 (Mt) 2020 2021 2022 2023 2024e2 -0.4 -0.7 -1.0 -0.5 -0.6 Closures Capacity Net Changes New Capacities 291. Afry. 2. New Capacities: Georgia Pacific 0.2 Mt; Ashdown (Domtar) 0.4 Mt; Monsteras (Sodra) 0.1 Mt. Closures: Birla -0.4 Mt; IP -0.4 Mt; Domtar -0.4 Mt; Georgia Pacific -0.2 Mt; Smurfit -0.1 Mt and others. 3. FOEX. BCP = BHKP + BSKP. Historical Price Spread3 – BSKP vs. BHKP ($/t) 226 -50 - 50 100 150 200 250 300 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 BHKP demand drivers: Fiber-to-Fiber BSKP substitution incentivized by capacity closures and increasing price spread

30 Engagement on fiber-to-fiber initiatives within the Top Customers North America: 80% Asia: 70% Europe: 60% % of top 10 customers in each region − Knowledge sharing − Technical training Education Services Development Services Application Services 1 2 − Local support for application engineering with the customer − China Innovability Hub as a facilitator for quicker go-to-market − Refining technology − Best fiber blending ratios − Cost optimizers − Innovation on product portfolio • Eucastrong® • Eucapack® Biopulp® solutions ecosystem 3 BHKP demand drivers: Fiber-to-Fiber Suzano is actively engaging with customers to foster fiber substitution

31 Shandong 1 Project 0.7 Mt Guanxi 3 Projects 2.6 Mt New BHKP integrated capacity - announced for next 5 years (Mt) 1.2 1.6 0.4 0.7 0.6 Player A Player B Player C Player D Player E 2024 2025 2026 Expected Start up date Start-up dates, production learning curves and operating rate levels The UNCERTAIN The NEGATIVE New integrated players competing with non-integrated players could consequently reduce market pulp demand The POSITIVE Reliance on market pulpwood reduce players effective competitiveness Cash cost curve2 (Integrated and market BHKP producers) Considerations to market pulp fundamentals Source: RISI, Afry, TTO and Suzano’s analysis | 1. Weighted average cash cost. 2. FisherSolve, Afry and Suzano’s estimative. China 88 China Capacity (Mt) Cash Cost - $/t 613 Fujian 1 Project 1.2 Mt New Chinese integrated capacities Headwinds from vertical integration in China face several uncertain factors

32 Hardwood market pulp demand (Mt) 2023 4.8 Organic Growth Fiber to Fiber 2028e Potential impact of Chinese P&P verticalization1 2028e 40.9 2.0 3.8 47.7 43.9 +6.8 +3.0 1. Estimated based on Suzano’s O.R. assumptions. Additional Fiber-to-Fiber Fossil- to-Fiber Additional demand from Integrated P&P Producers 32 Market BHKP demand Net demand growth in the coming years potentially boosted by additional upside risks

33 Estimated market BHKP supply addition¹: (Mt) 2023 2028e 6.3 Main announced projects2: − Suzano Cerrado − Fujian Liansheng − APP OKI II − Arauco Sucuriú Main conversions: − Bracell to dissolving pulp − Suzano Limeira to fluff pulp − Altri Biotek to dissolving pulp 43.3 49.6 1. New capacities in line with the latest estimates and market announcements. Include closure assumptions. 2. Other representative projects: CMPC (Guaíba), UPM (Paso de Los Toros), Arauco (MAPA). BHKP supply perspective Incoming capacities partially mitigated by expected conversions

34 89 87 88 91 89 BHKP Demand to Capacity ratio (%) 2024e 2025e 2026e 2027e 2028e Demand (Mt) Capacity1 (Mt) 41 46 41 48 41 47 43 47 44 50 Unplanned supply shortage – BCP (Mt) Supply & Demand balance 66 69 70 70 70 70 72 74 1 1 1 2 2 3 3 2 2 2 2 1 2 2 4 3 2023 2024e2017 2018 2019 2020 2021 2022 Permanent closures Unexpected Downtimes BCP Capacity (net of unexpected downtimes) Source: TTO BMA, Afry and Suzano’s analysis. | 1. Capacity figures include closure assumptions. BCP = BHKP + BSKP. 34 Despite new capacities, S&D ratio likely to improve with unplanned supply shortages

35 Supply & Demand balance for 2025 Marginal cash cost producers are expected to support price floors, even amid market volatility Market BHKP marginal production cost, CIF China $/t - CIF China Current supply underwater: ~2.9 Mt 580 560 400 450 500 550 600 650 700 750 800 850 900 Jan-15 Nov-24 Dec-25 BHKP Price, China 900 750 600 450 300 5 0 40353025201510 150 Cash Cost $/t Capacity (Mt) Cash production cost curve – Market BHKP PIX China @ 546 US$/t 35Source: Hawkins Wright, FisherSolve, FOEX and Suzano’s analysis.

Maintain relevance in Pulp Expand boldly into New Markets Play a leading role in sustainability Be “Best-in-Class” in the Total Pulp Cost vision Avenues Advance in the links of the chain, always with competitive advantage

37 Paper & Packaging

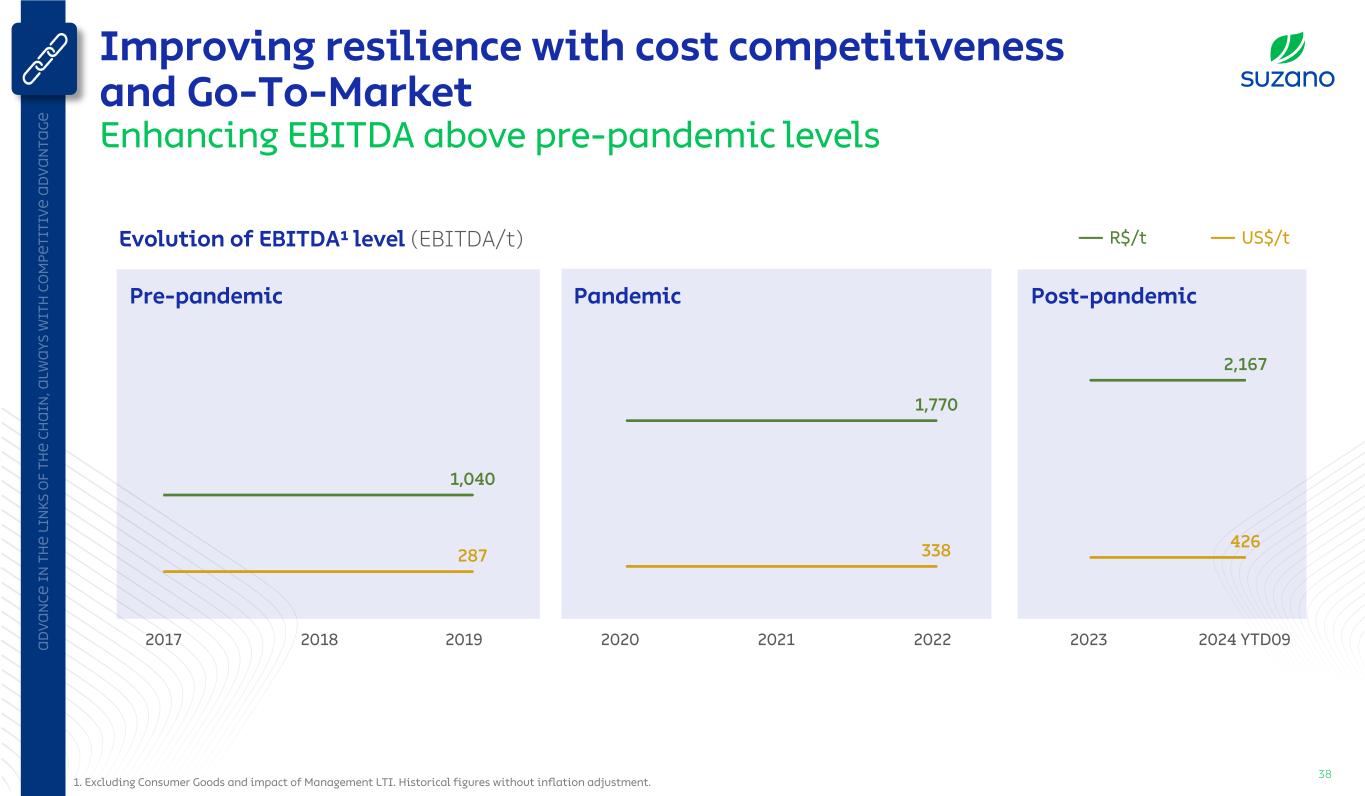

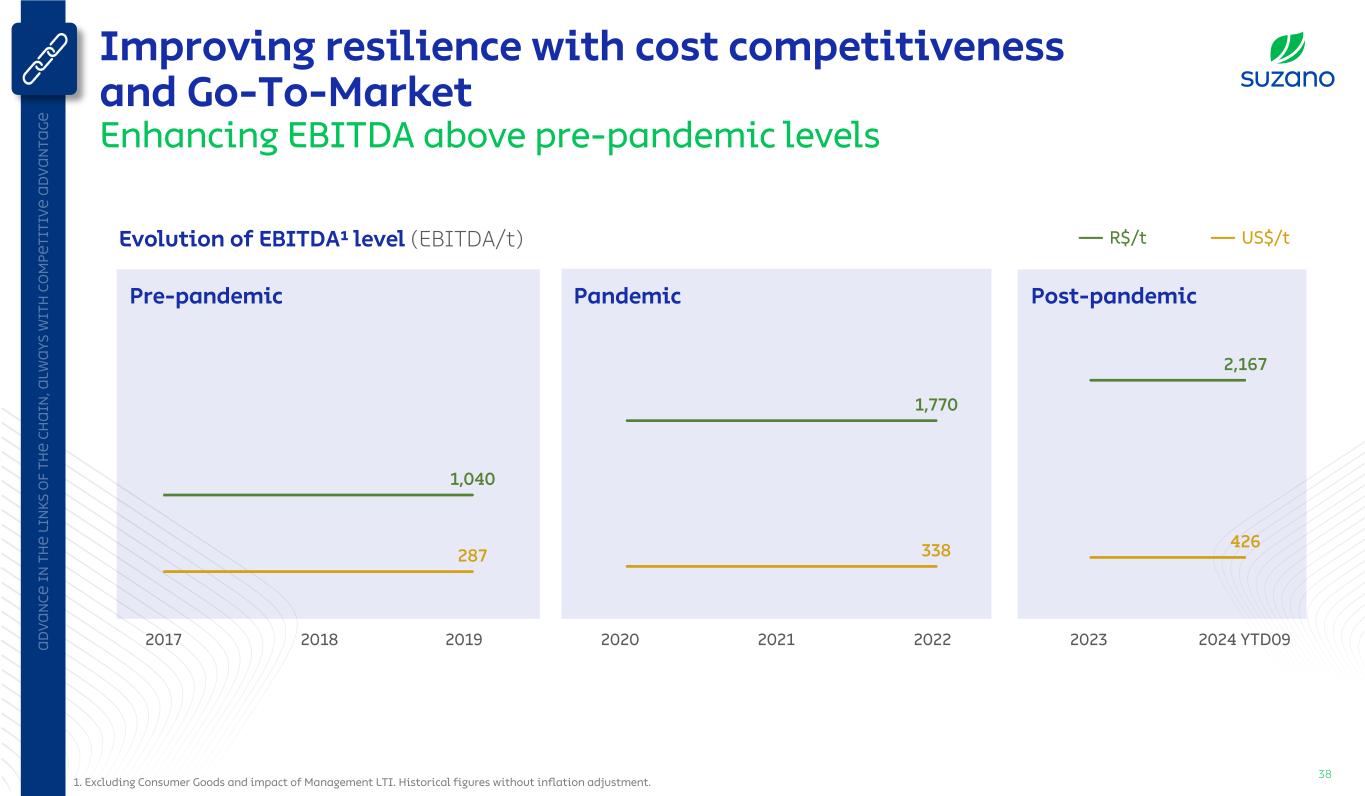

38 Improving resilience with cost competitiveness and Go-To-Market Enhancing EBITDA above pre-pandemic levels Evolution of EBITDA¹ level (EBITDA/t) Pre-pandemic Pandemic 1,040 1,770 2,167 287 338 426 2017 2018 2019 2020 2021 2022 2023 2024 YTD09 R$/t US$/t Post-pandemic 1. Excluding Consumer Goods and impact of Management LTI. Historical figures without inflation adjustment.

39 New investment in the largest P&W mill boosts cost efficiency and reduces carbon emissions Higher profitability ensured with continued advances in value chain Reduction of ~25 kt of CO2eq per year in emissions Investment of R$300 million to enhance Limeira's competitiveness Reduction of consolidated COGS by ~R$30/t at Paper unit Start-up of the 1st phase in 4Q25 NPV1: ~R$ 400 MM IRR1: >13% Natural gas consumption External biomass consumption Operating efficiency gains Opening of new DCs in Brazil and Ecuador Expansion of customer base in the USA Customers with purchase in LatAm (ex-Brazil) and North America 213 457 2023 YTD09 2024 YTD09 +115% Suzano+ 3.0 1. Discount rate equivalent to Company's WACC in nominal terms (R$) @8.7%

40 Stepping up in the packaging business: Leveraging current P&W assets and expanding capacity Global paper demand and forecast growth by segment Mt and %, 2022-2030E 2.3%1.8% -2.4% -5 .7 % Newsprint P&W Containerboard Cartonboard Use of current P&W assets to advance in the packaging market with LIN1 Case: Paper machine B8 - production mix 100% 73% 27% 2020 2024 P&W Source: Afry and Suzano’s analysis Entry into the North American paperboard market Annual Paper unit production capacity (kt/a) 82% 18% 60% 40% Pre acquisition2 Post acquisition Packaging P&W | 1. Paper especially developed to be used as fluting or linerboard in containerboard market. 2. Acquisition of Pine Bluff

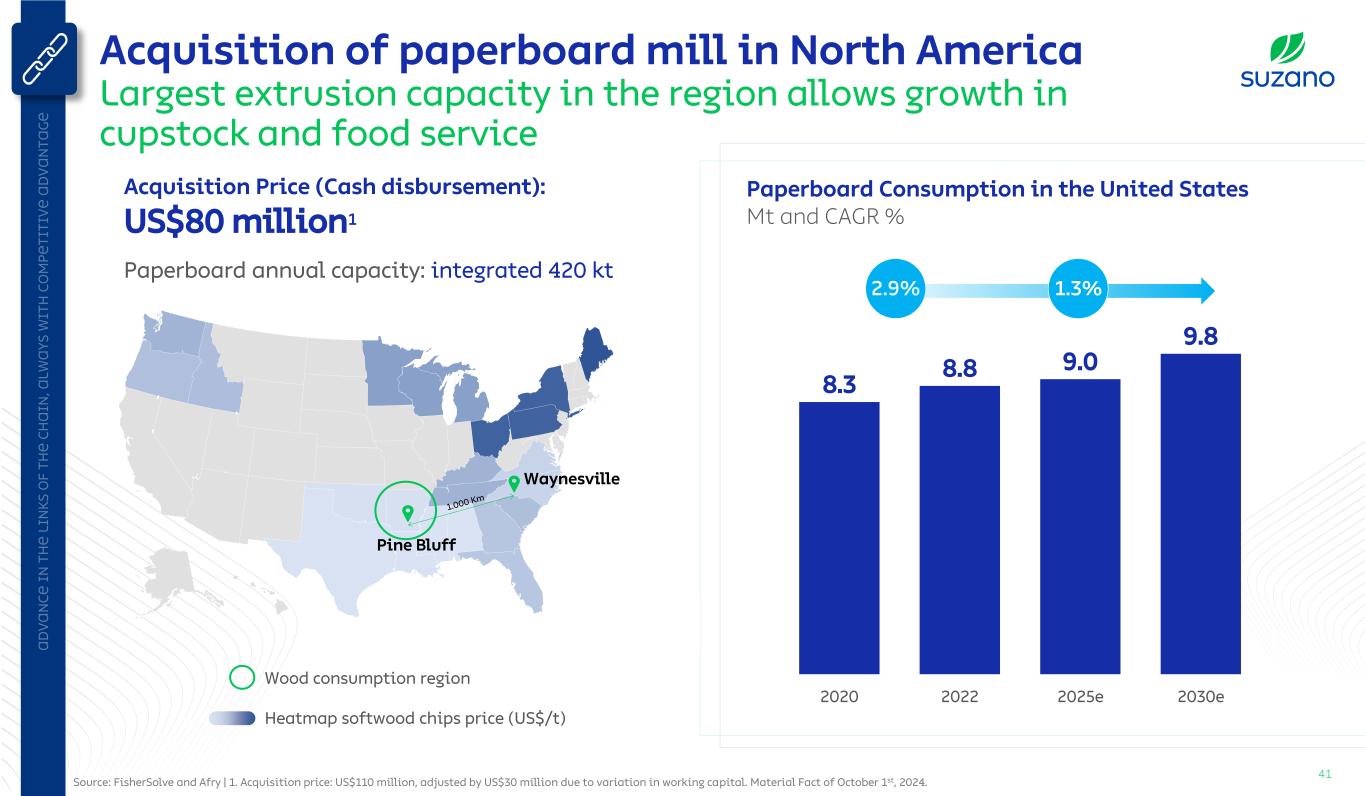

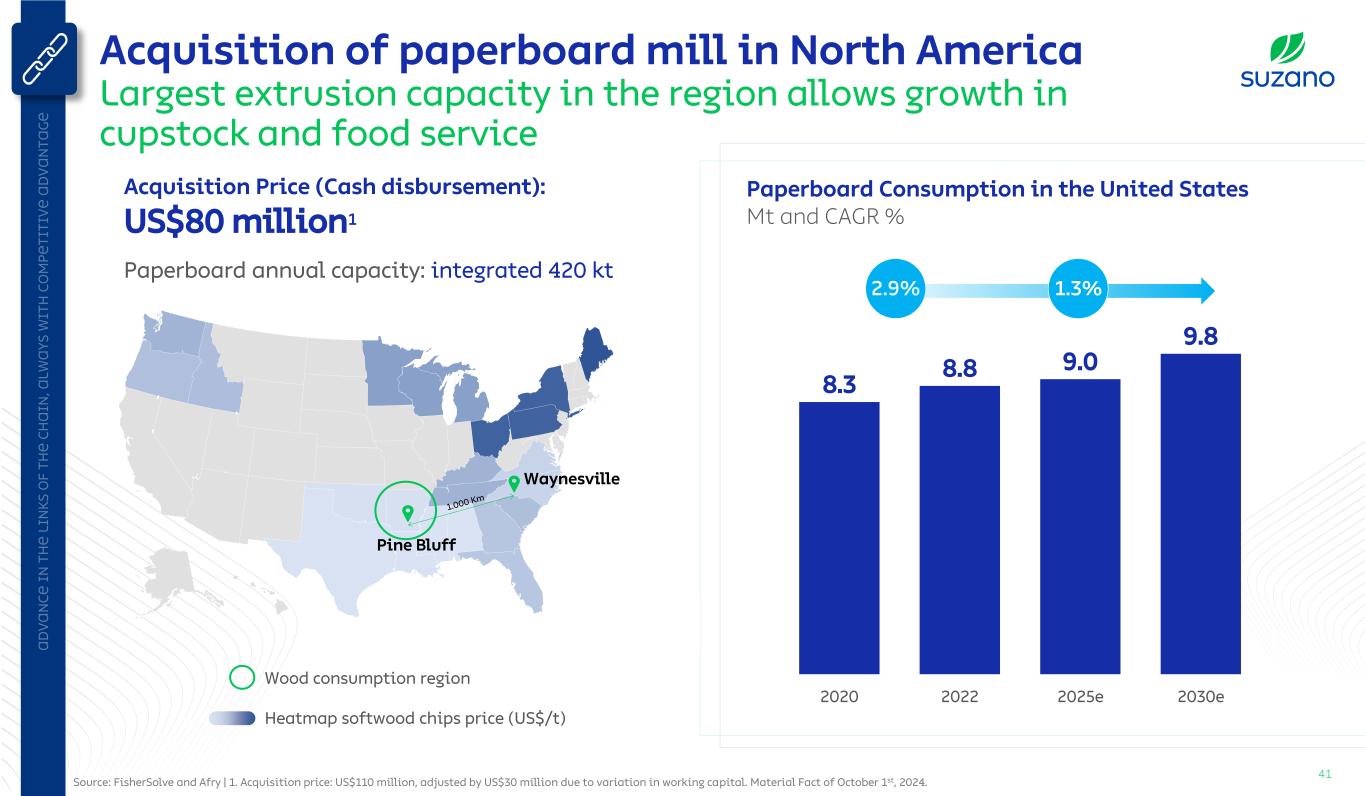

41 Acquisition of paperboard mill in North America Largest extrusion capacity in the region allows growth in cupstock and food service Paperboard Consumption in the United States Mt and CAGR % 8.3 8.8 9.0 9.8 2020 2022 2025e 2030e 2.9% 1.3% Wood consumption region Heatmap softwood chips price (US$/t) Acquisition Price (Cash disbursement): US$80 million1 Paperboard annual capacity: integrated 420 kt Waynesville Pine Bluff Source: FisherSolve and Afry | 1. Acquisition price: US$110 million, adjusted by US$30 million due to variation in working capital. Material Fact of October 1st, 2024.

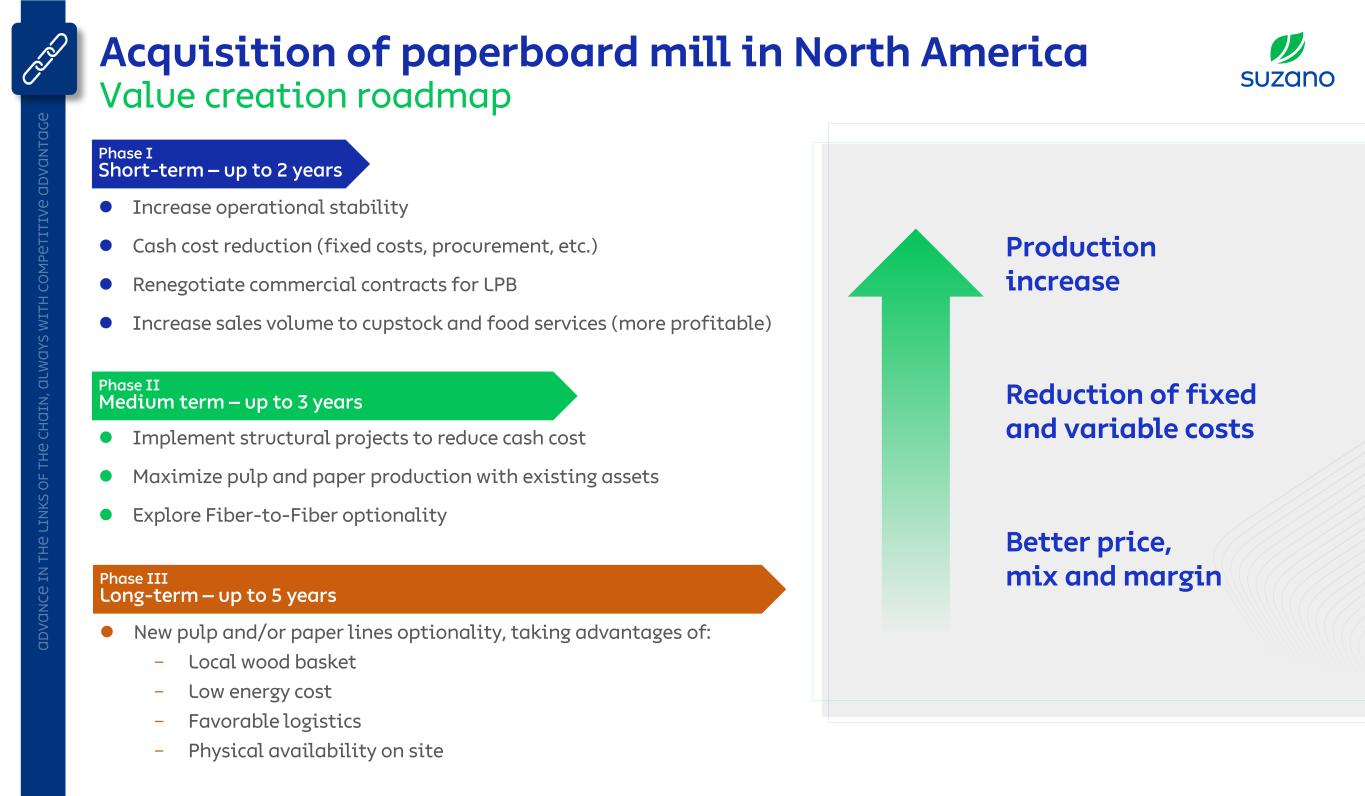

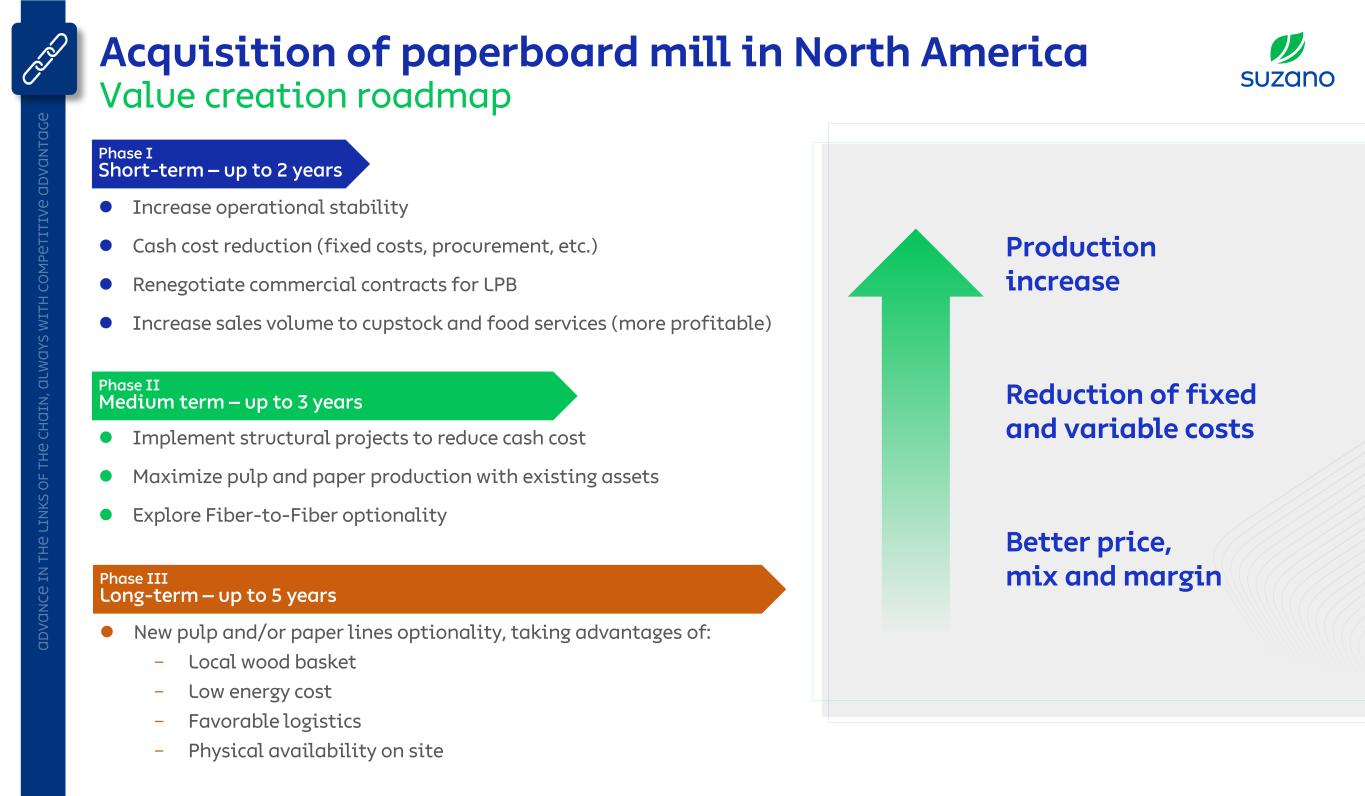

⚫ Increase operational stability ⚫ Cash cost reduction (fixed costs, procurement, etc.) ⚫ Renegotiate commercial contracts for LPB ⚫ Increase sales volume to cupstock and food services (more profitable) Acquisition of paperboard mill in North America Value creation roadmap Phase I Short-term – up to 2 years Phase II Medium term – up to 3 years Phase III Long-term – up to 5 years ⚫ Implement structural projects to reduce cash cost ⚫ Maximize pulp and paper production with existing assets ⚫ Explore Fiber-to-Fiber optionality ⚫ New pulp and/or paper lines optionality, taking advantages of: − Local wood basket − Low energy cost − Favorable logistics − Physical availability on site Better price, mix and margin Production increase Reduction of fixed and variable costs

43 Consumer goods

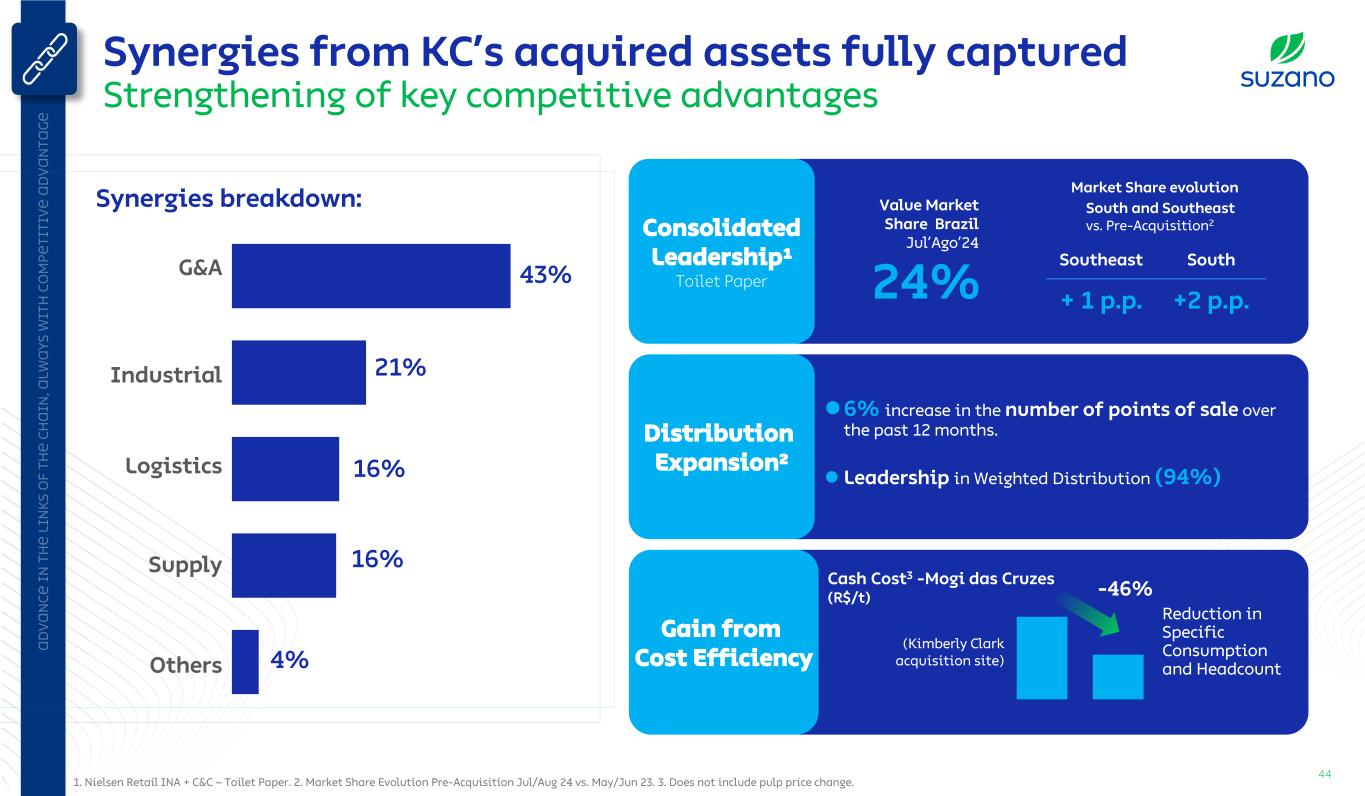

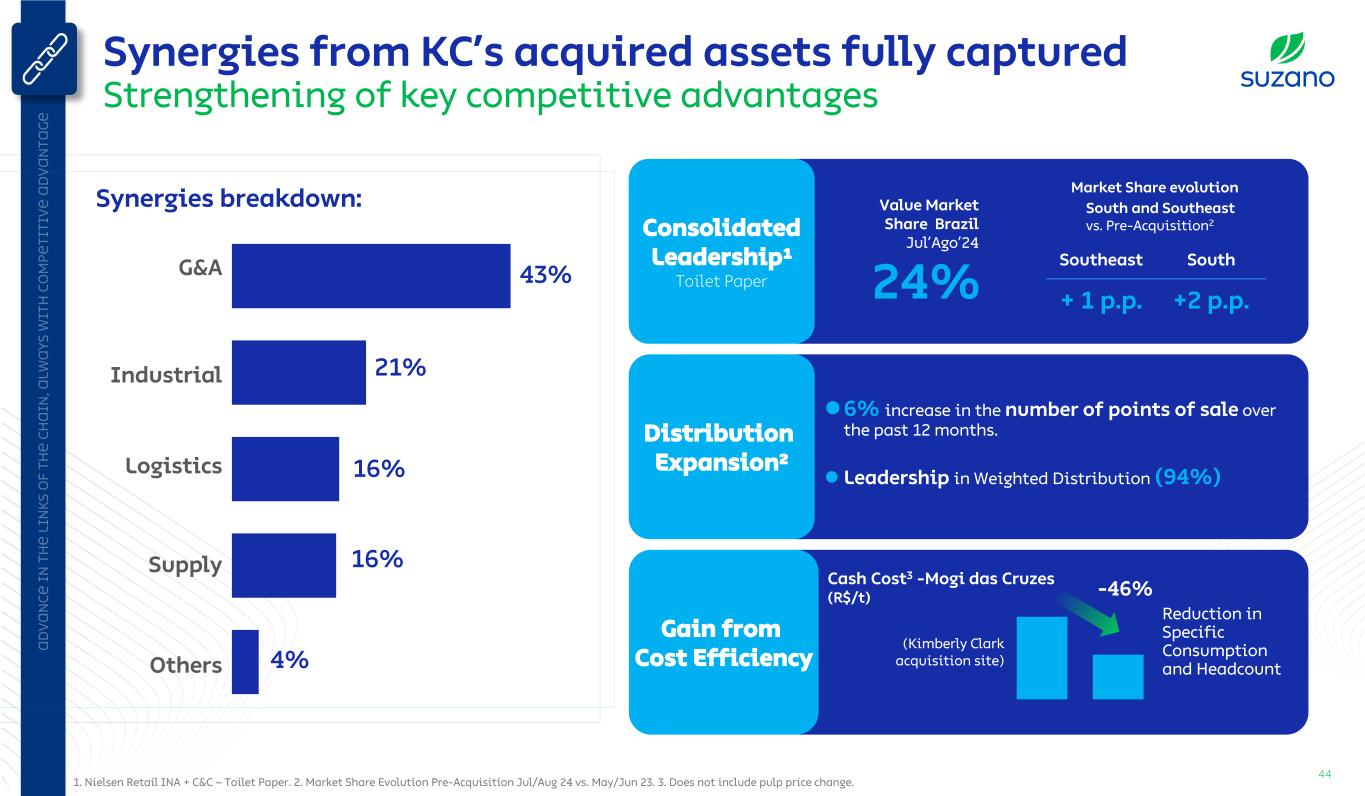

44 Consolidated Leadership¹ Toilet Paper Value Market Share Brazil Jul’Ago’24 24% Market Share evolution South and Southeast vs. Pre-Acquisition2 Distribution Expansion² ⚫6% increase in the number of points of sale over the past 12 months. ⚫ Leadership in Weighted Distribution (94%) Synergies breakdown: G&A Industrial Logistics Supply Others 43% 21% 16% 16% 4% Southeast South + 1 p.p. +2 p.p. Synergies from KC’s acquired assets fully captured Strengthening of key competitive advantages Gain from Cost Efficiency -46% (Kimberly Clark acquisition site) Reduction in Specific Consumption and Headcount Cash Cost3 -Mogi das Cruzes (R$/t) 1. Nielsen Retail INA + C&C – Toilet Paper. 2. Market Share Evolution Pre-Acquisition Jul/Aug 24 vs. May/Jun 23. 3. Does not include pulp price change.

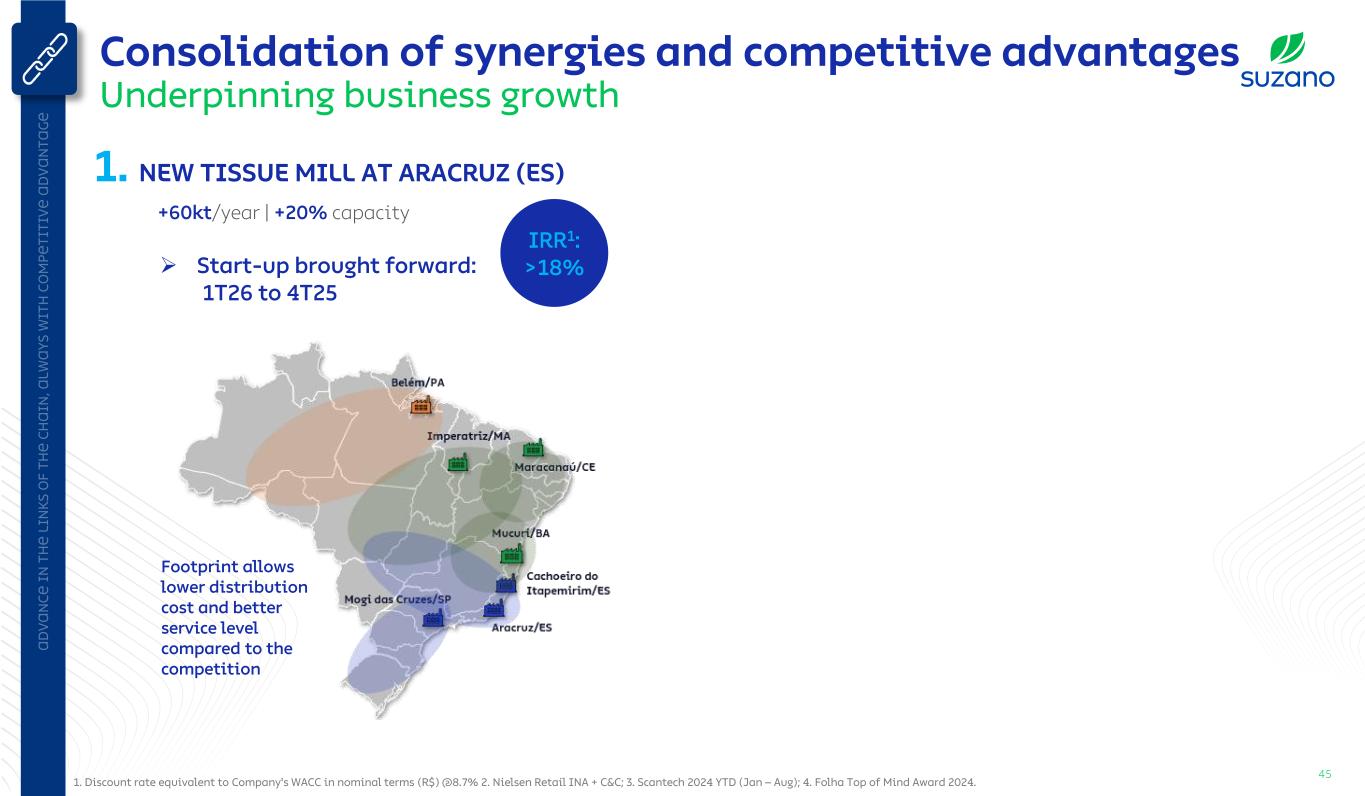

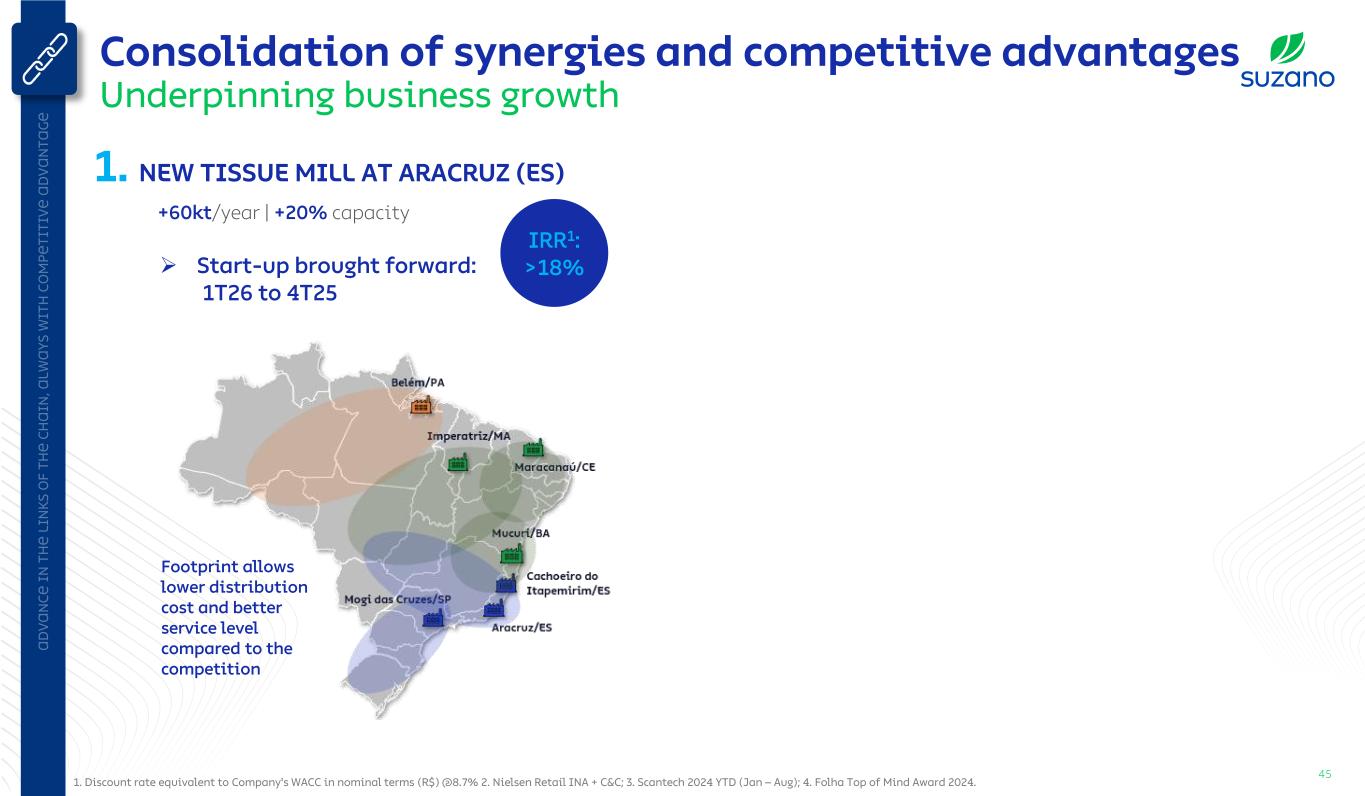

45 Consolidation of synergies and competitive advantages Underpinning business growth 1. NEW TISSUE MILL AT ARACRUZ (ES) +60kt/year | +20% capacity Footprint allows lower distribution cost and better service level compared to the competition ➢ Start-up brought forward: 1T26 to 4T25 1. Discount rate equivalent to Company's WACC in nominal terms (R$) @8.7% 2. Nielsen Retail INA + C&C; 3. Scantech 2024 YTD (Jan – Aug); 4. Folha Top of Mind Award 2024. IRR1: >18%

47 Consolidation of synergies and competitive advantages Underpinning business growth 1. NEW TISSUE MILL AT ARACRUZ (ES) +60kt/year | +20% capacity 2. PORTFOLIO EVOLUTION Toilet Paper #1 Leader2 Paper Towels Napkins Facial Tissues #1 Leader3 Reusable Wipes #1 Leader3 Perineal Wipes #1 Leader2 Expansion of Categories with higher profitability: Innovation focused on Trade-up and Branding 0 5 Toilet Paper Category 1 Category 2 Category 3 Facial Tissues 1.0x 1.2x 2.8x 2.8x 4.7x Contribution Margin Toilet Paper - 100% Base 2024 Launch Neve 4ply BRAND AWARD TOP OF MIND 2024 PRICE 40% ABOVE MARKET AVERAGE ➢ Start-up brought forward: 1T26 to 4T25 1. Discount rate equivalent to Company's WACC in nominal terms (R$) @8.7% 2. Nielsen Retail INA + C&C; 3. Scantech 2024 YTD (Jan – Aug) IRR1: >18% Footprint allows lower distribution cost and better service level compared to the competition

Financial Management

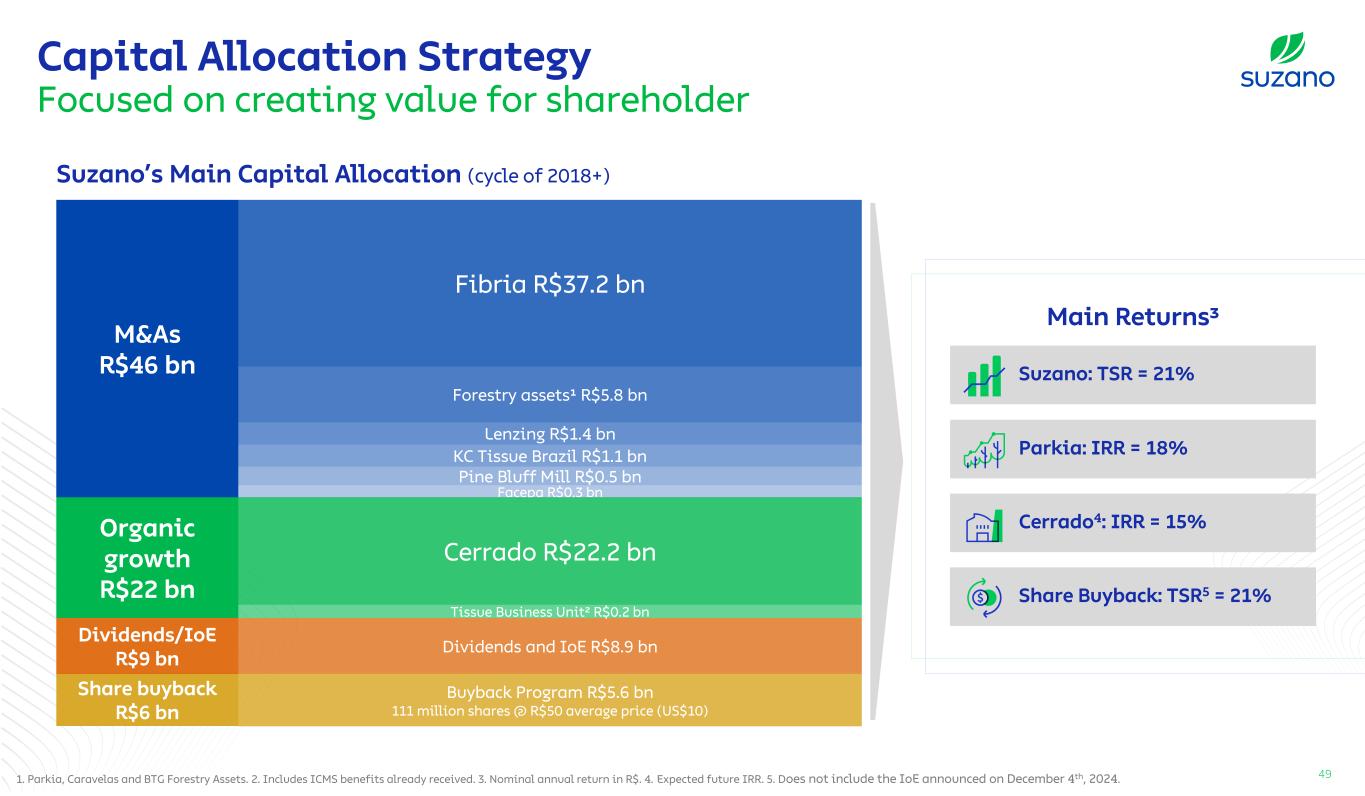

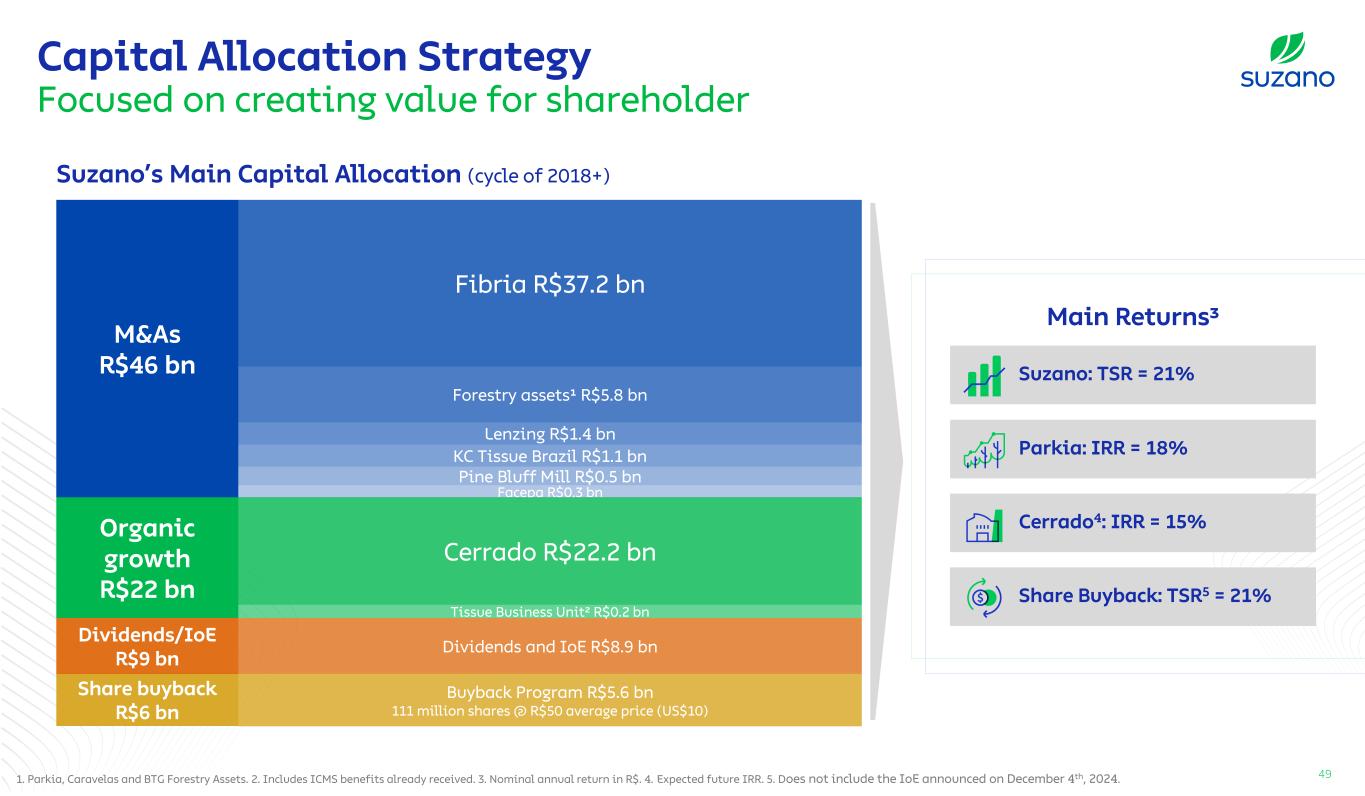

Capital Allocation Strategy Focused on creating value for shareholder Suzano’s Main Capital Allocation (cycle of 2018+) Facepa R$0,3 bn M&As R$46 bn Organic growth R$22 bn Share buyback R$6 bn Cerrado R$22.2 bn Fibria R$37.2 bn Lenzing R$1.4 bn KC Tissue Brazil R$1.1 bn Pine Bluff Mill R$0.5 bn Dividends/IoE R$9 bn Dividends and IoE R$8.9 bn Buyback Program R$5.6 bn 111 million shares @ R$50 average price (US$10) Forestry assets¹ R$5.8 bn Tissue Business Unit² R$0.2 bn Main Returns³ Suzano: TSR = 21% Parkia: IRR = 18% Cerrado4: IRR = 15% Share Buyback: TSR5 = 21% 491. Parkia, Caravelas and BTG Forestry Assets. 2. Includes ICMS benefits already received. 3. Nominal annual return in R$. 4. Expected future IRR. 5. Does not include the IoE announced on December 4th, 2024.

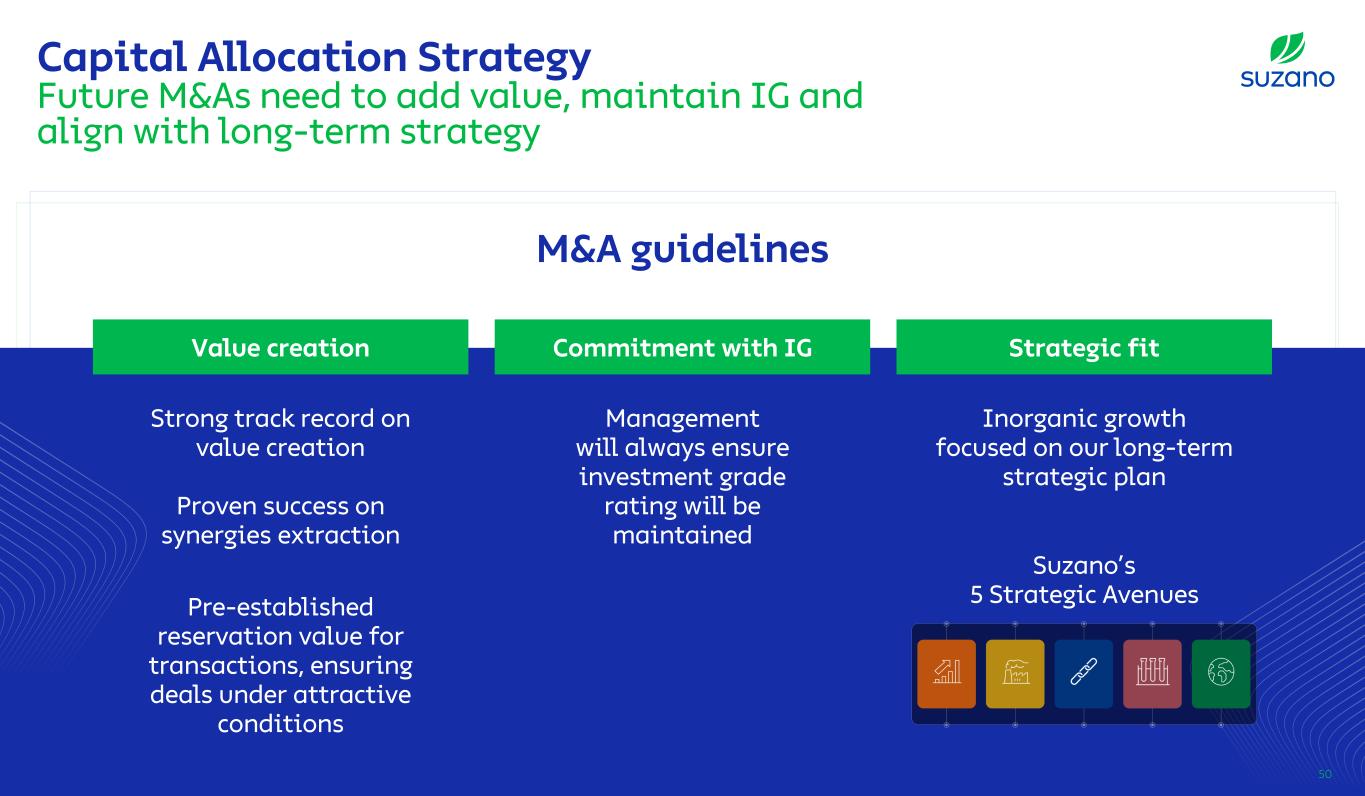

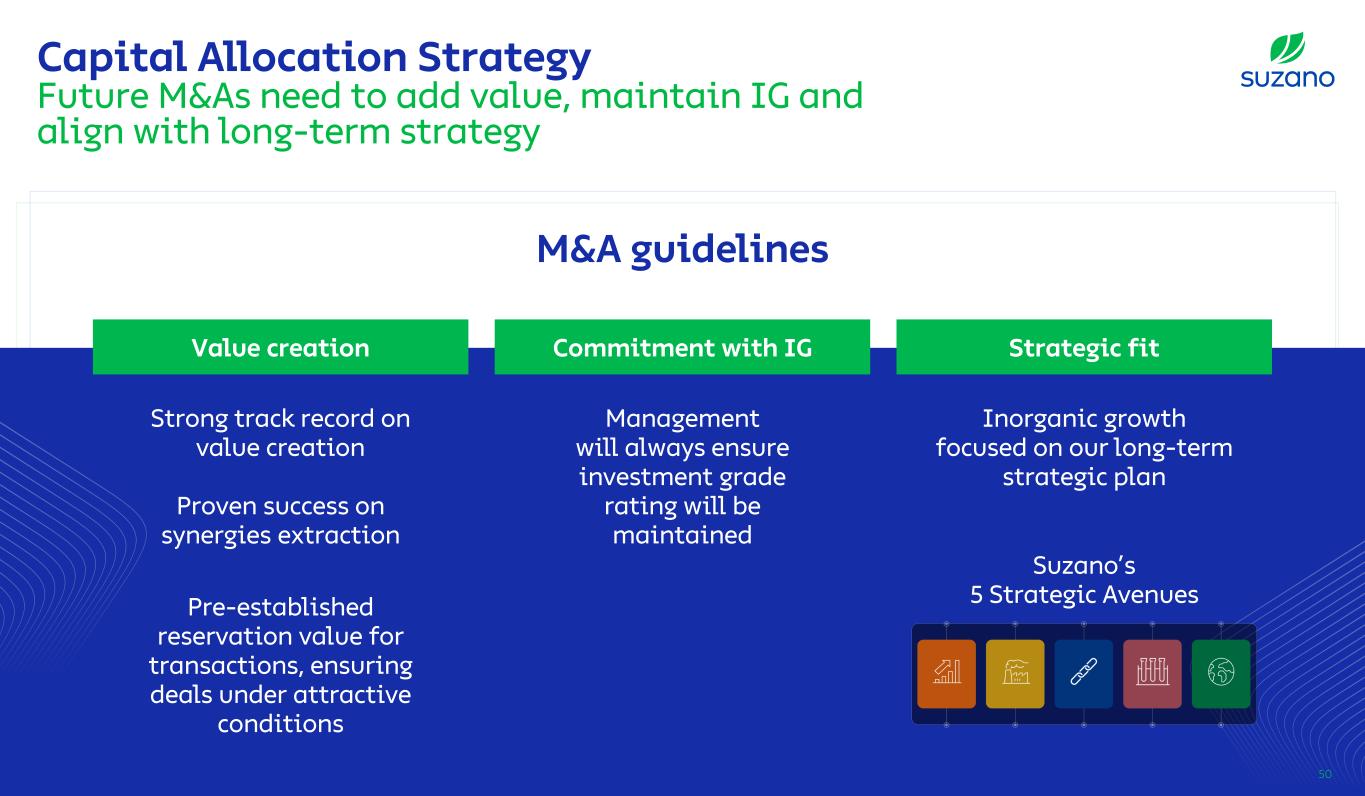

M&A guidelines Pre-established reservation value for transactions, ensuring deals under attractive conditions Strong track record on value creation Proven success on synergies extraction Value creation Commitment with IG Management will always ensure investment grade rating will be maintained 50 Capital Allocation Strategy Future M&As need to add value, maintain IG and align with long-term strategy Strategic fit Inorganic growth focused on our long-term strategic plan Suzano’s 5 Strategic Avenues

Robust and efficient debt profile Constantly focused on liquidity risk mitigation Financial management metrics Average tenor (months) >70 Debt maturing in 36 months <30% Cash coverage of financial obligations (minimum # of months) 24 RCF for tail scenarios Sizable, longer than 1 year Financial covenants None KPI Guidelines Current 28% 29 In place None 77 51 Liquidity and debt profile (US$ billion) 3.2 1.2 1.3 5.7 0.1 1.5 1.5 1.6 1.5 2.4 7.5 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Liquidity 3M24 2025 2026 2027 2028 2029 2030+ Cash “on hand” Stand-by facility (RCF) Average cost (in US$): 4.9% p.a. IFC and Finnvera As of September 30th, 2024.

59% 52% 27% 24% 5% 11% 9% 13% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3Q21 3Q24 Traditional Alternatives Robust and efficient debt profile Diversification to reduce cost and expand funding options Breakdown of funding sources (% of total gross debt) Trade Finance Related Bank ⚫ LMs postponed during tougher 2022 market Non-US$ Capital Markets ⚫ Infrastructure bonds for longer tenure and lower cost ⚫ Pioneer Panda Bond transaction Non-Trade Finance Related Bank ⚫ IFC and Finnvera: counter-cyclical opportunities ⚫ Cost-competitive financial leasing US$ Capital Markets ⚫ US$: lower attractiveness since last issuance (Sep/21) 52 Source: Suzano’s analysis.

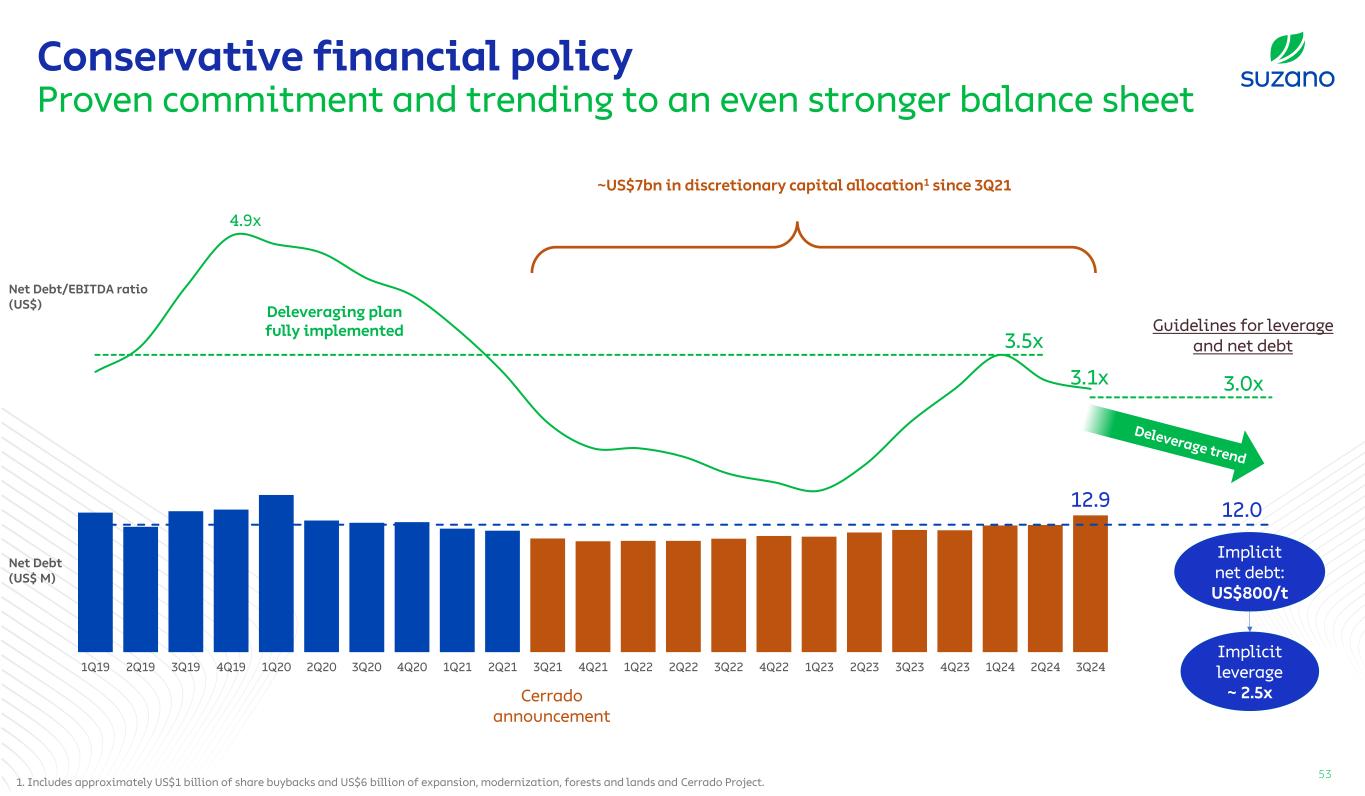

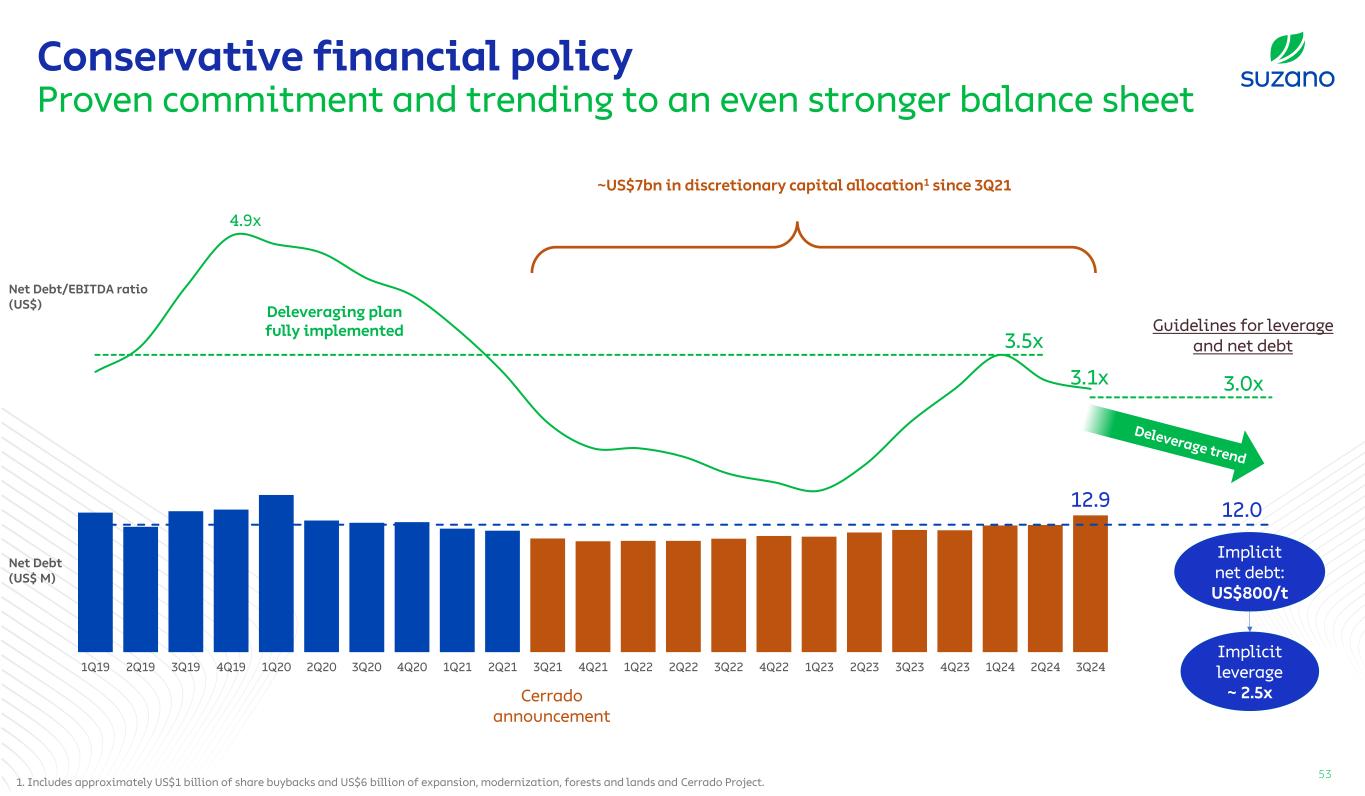

12.9 12.0 3.1x 3.5x 3.0x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 0 5 10 15 20 25 30 35 40 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 " "5 " "6 " "7 " "8 Cerrado announcement ~US$7bn in discretionary capital allocation1 since 3Q21 Guidelines for leverage and net debt Implicit net debt: US$800/t Deleveraging plan fully implemented Conservative financial policy Proven commitment and trending to an even stronger balance sheet Net Debt/EBITDA ratio (US$) Net Debt (US$ M) 4.9x Implicit leverage ~ 2.5x 53 1. Includes approximately US$1 billion of share buybacks and US$6 billion of expansion, modernization, forests and lands and Cerrado Project.

Conservative financial policy Aiming for rating improvement Strong business profile ⚫ Global leader in market pulp ⚫ Increased earnings from ex-pulp businesses ⚫ Unmatched asset base ⚫ Enhanced diversification: global footprint and end-use ⚫ Structural cost competitiveness increased by Cerrado Project Market Position Competitive Position Efficiency Robust financial position ⚫ Proven capacity to generate free cash flow throughout any market cycles Cash Flow & Leverage Financial Policy Financial Flexibility ⚫ Strong growth maintaining controlled leverage ⚫ Discipline capital allocation ⚫ Robust liquidity to navigate volatility ⚫ Global funding diversification Investment Grade status by 3 major agencies Baa3 Positive BBB- Stable BBB- Stable 54

Total Operational Disbursement TOD 9M24 vs. 2027¹ (R$/t) 872 746 651 69 12 (30) (364) 654 690 500 2,213 1,900 TOD 9M24 Inflation 2025¹ FX Commodities Effect (assumptions) Competitiveness Initiatives and Growth TOD 2027 Cash cost SG&A + Freight Sustaining Capex FX 5.24 Brent US$83/bbl Caustic soda US$364/t Forestry radius 196 km Third-party wood 29% FX 5.35 Brent US$70/bbl Caustic soda US$400/t Forestry radius 150 km Third-party wood 17% US$422/t − Production volume: (R$150/t) − Cash cost: (R$108/t) − Capex: (R$95/t) − SG&A and freight: (R$11/t) US$355/t 551. Total operational disbursement at full capacity, including integrated pulp volumes. Does not include Suzano mill. Real terms at 2025 currency; 2. Deviation from inflation forecast for 2024 + inflation rates forecast for 2025. Inflation 2024 -> IPCA: 4.3%, INPC: 4.2%, IGPM: 4.3% | 2025 -> IPCA: 4.0%, INPC: 3.0%, IGPM: 4.0%.

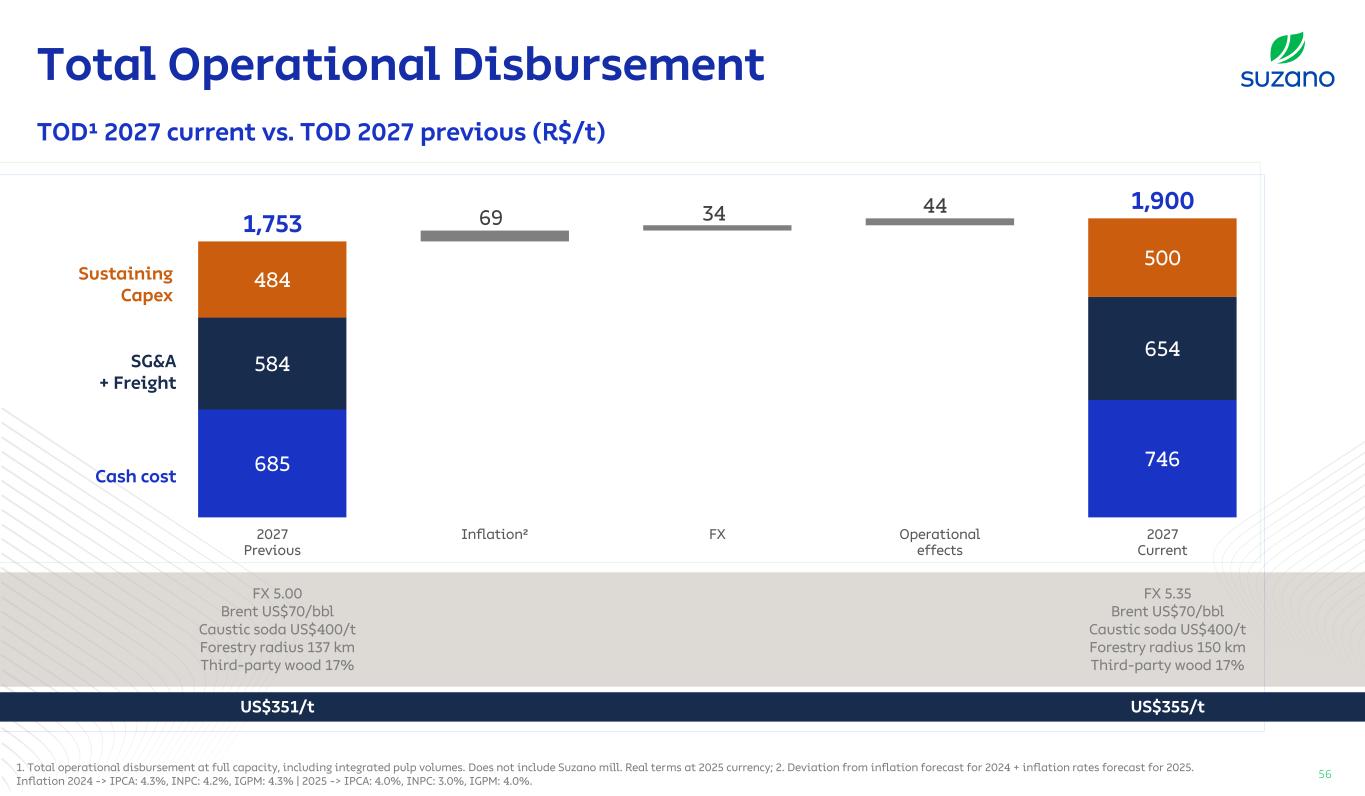

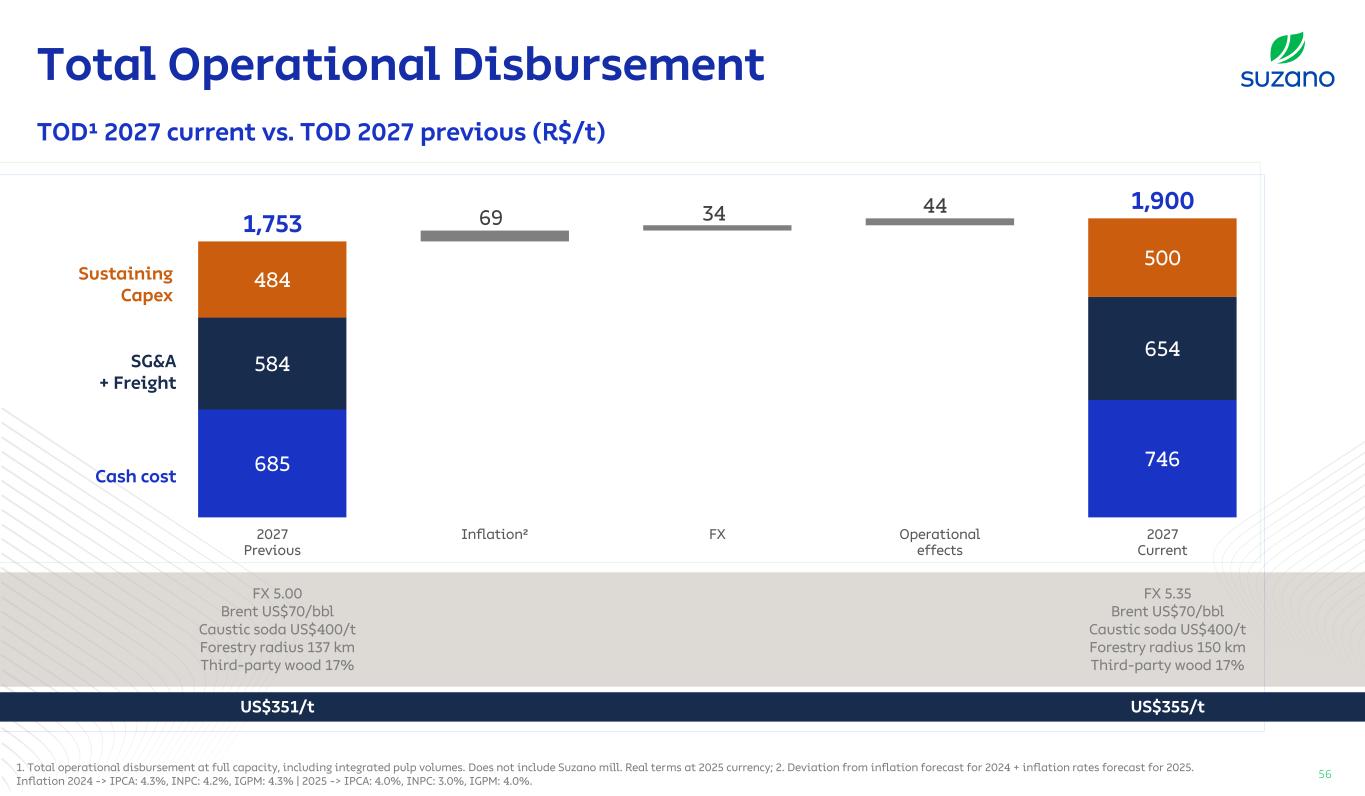

Total Operational Disbursement TOD¹ 2027 current vs. TOD 2027 previous (R$/t) FX 5.35 Brent US$70/bbl Caustic soda US$400/t Forestry radius 150 km Third-party wood 17% US$355/t FX 5.00 Brent US$70/bbl Caustic soda US$400/t Forestry radius 137 km Third-party wood 17% US$351/t 56 685 746 584 69 34 44 654 484 500 1,753 1,900 2027 Previous Inflation² FX Operational effects 2027 Current Cash cost SG&A + Freight Sustaining Capex 1. Total operational disbursement at full capacity, including integrated pulp volumes. Does not include Suzano mill. Real terms at 2025 currency; 2. Deviation from inflation forecast for 2024 + inflation rates forecast for 2025. Inflation 2024 -> IPCA: 4.3%, INPC: 4.2%, IGPM: 4.3% | 2025 -> IPCA: 4.0%, INPC: 3.0%, IGPM: 4.0%.

Takeaways

What to expect in the coming years… Structural competitiveness Disciplined capital allocation Free cash flow generation Balance sheet strength Addressable market Human capital development

Q&A

Thank you ir.suzano.com.br