Washington, D.C. 20549

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

Limited Term Tax-Exempt Bond Fund of America seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The Tax-Exempt Bond Fund of America seeks to provide a high level of current income exempt from federal income tax, consistent with preservation of capital.

American High-Income Municipal Bond Fund seeks to provide a high level of current income exempt from regular federal income tax.

American Funds Tax-Exempt Fund of New York seeks to provide a high level of current income exempt from regular federal, New York state and New York City income taxes, with a secondary objective of preservation of capital.

The Tax-Exempt Fund of California seeks to provide a high level of current income exempt from regular federal and California state income taxes, with a secondary objective of preservation of capital.

Each fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2013 (the most recent calendar quarter-end) and the total annual fund operating expense ratios as of the prospectus dated October 1, 2013 (unaudited):

For other share class results, visit americanfunds.com and americanfundsretirement.com.

The five- and 10-year investment results for American Funds Short-Term Tax-Exempt Bond Fund include the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore are not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of those periods. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers (and expense reimbursements for American Funds Short-Term Tax-Exempt Bond Fund and American Funds Tax-Exempt Fund of New York), without which results would have been lower. The adviser has committed to retain any reimbursements for American Funds Tax-Exempt Fund of New York only through September 30, 2013. Visit americanfunds.com for more information.

A summary of each fund’s 30-day yield can be found on page 3.

We are pleased to present you with this annual report for six American Funds municipal bond funds. This report covers the period from August 1, 2012, through July 31, 2013, for American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York. The report also covers the period from September 1, 2012, through July 31, 2013, for The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California, whose fiscal years have changed.

The municipal bond market enjoyed relative strength during much of the fiscal year, but the period closed with a broad selloff that ensued in May, triggered by signs of a stronger economy, rising U.S. Treasury yields and indications from the Federal Reserve that it might begin to reduce its bond purchase program. For the 12 months ended July 31, 2013, the Barclays Municipal Bond Index, a broad measure of the investment-grade tax-exempt bond market, recorded a 2.19% loss. By way of comparison, the Barclays U.S. Aggregate Index, a broad measure of the investment-grade taxable fixed-income market, declined 1.91%. In general, shorter duration municipal bonds fared better than longer duration issues. Although below investment-grade securities (those rated Ba/BB and below) sustained some of the sharpest declines in the final two months of the period, overall returns for these higher yielding bonds were generally better. Barclays High Yield Municipal Bond Index gained 0.80% during the fiscal year. All market indexes referenced in this report are unmanaged and, therefore, have no expenses.

Against this backdrop, results for these six American Funds tax-exempt bond funds were generally negative. Total returns ranged from 0.16% for American Funds Short-Term Tax-Exempt Bond Fund to –3.16% for American Funds Tax-Exempt Fund of New York. While we are disappointed with the overall results, we are gratified that all six funds outpaced their respective peer groups, as measured by Lipper. (Turn to pages 4 through 16 for detailed results for each fund.)

Fixed-income markets experienced two distinct phases during the fiscal year. For much of the period, yields for U.S. Treasuries and many other categories of bonds remained near historic lows as investors focused on the slow pace of the economic recovery and the possible effects of automatic tax increases and across-the-board federal government budget cuts. As has been the case over the past few years, enthusiasm for municipal bonds was relatively high during these first months of the fiscal year. With the Fed holding short-term interest rates near zero, investors were drawn to the municipal market in part by the relatively attractive yields of some tax-exempt bonds compared with taxable securities.

However, many of these conditions reversed during the closing months of the year, creating a highly challenging and volatile climate for bond investors. Housing market data indicated that home prices increased in March and April at their fastest pace since 2006, triggering greater optimism about the healing economy. During May and June, rising interest rates and indications from the Fed that it might reduce its monthly asset purchases fueled a sharp selloff in Treasuries. The yield on the benchmark 10-year note rose 82 basis points to 2.52% in two months.

In a volatile three months for fixed-income securities broadly, municipal bonds suffered particularly acute declines from May through July, reflecting, in part, the relative illiquidity in the market. As investors became increasingly concerned about rising interest rates and possible Fed action, redemptions from municipal bond mutual funds spiked. Outflows exceeded $1 billion each week of June, including a record $4.5 billion the week of June 26, according to data from Lipper.

The municipal market came under further pressure in July, when Detroit filed for bankruptcy protection — the largest U.S. city ever to do so. It is important to point out that the circumstances leading to Detroit’s bankruptcy are particular to that city’s financial struggles and are in no way directly related to most of the thousands of issuers in the vast municipal bond market. However, given the size and scope of the city’s bankruptcy — its debt is estimated to be between $18 billion and $20 billion — the proceedings could contribute to heightened volatility in the short term. As such, we are paying close attention to developments. We also note that the funds had very limited exposure to Detroit’s debt during the period.

We expect continued volatility in the coming months. The direction of U.S. fiscal policy is uncertain, and political gridlock could resurface as the debt ceiling deadline approaches. That said, there are reasons for optimism. The fiscal outlook for many state and local governments is improving. What’s more, the recent market selloff was indiscriminate, and we are finding a number of long-term investment opportunities at what we believe are attractive prices. We continue to focus on the long term and base each of our investment decisions on in-depth research of individual bond issuers as well as economic and market conditions.

We thank you for the confidence you have placed in us, and we look forward to reporting back to you in six months.

Brenda S. Ellerin

President, American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America

Neil L. Langberg

President, The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California

Karl J. Zeile

President, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class A shares as of August 31, 2013. Both measures reflect the 2.50%/3.75% maximum sales charge. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ. The equivalent taxable yield assumes a 43.4% tax rate.1

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

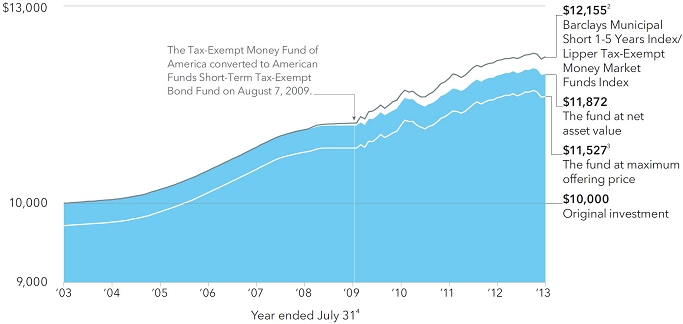

The fund produced a positive total return of 0.16%, exceeding the 0.08% result of the Lipper Short Municipal Debt Funds Average, a peer group measure. The unmanaged Barclays Municipal Short 1–5 Years Index, which has no expenses, returned 0.50%. See page 16 for additional results.

For the fiscal year, the fund paid monthly dividends totaling 12.5 cents a share, amounting to a federally tax-exempt income return of 1.22% for investors who reinvested dividends. This is equivalent to a taxable income return of 2.16% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return may also be exempt from some state and local taxes.

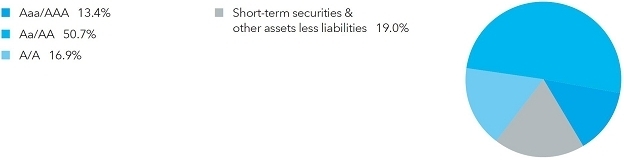

In a turbulent market environment, the fund’s focus on high-quality issues with shorter durations helped it generate a positive return. Many of the fund’s largest investments were among sectors where revenue bonds support critical local enterprises, including airports (9.9%), hospital facilities (9.0%) and electric utilities (5.1%).

The results shown are before taxes on fund distributions and sale of fund shares.

The five-and 10-year investment results include the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore are not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of those periods. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. Visit americanfunds.com for more information.

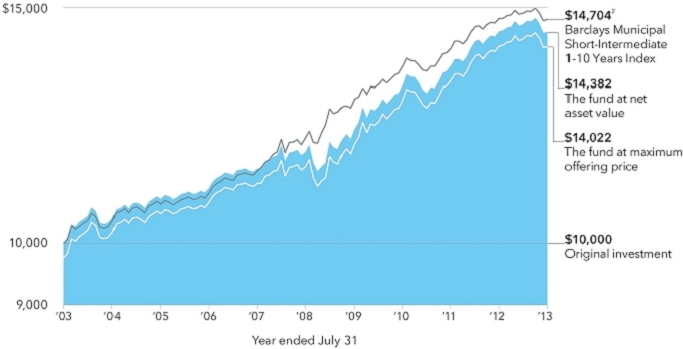

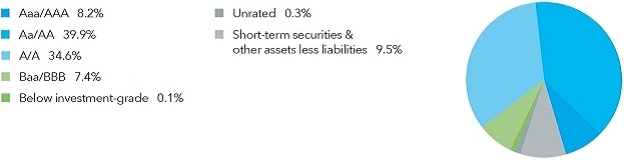

The fund’s total return was –0.13%. That result outpaced the –1.84% return of the fund’s peer group, as measured by the Lipper Intermediate Municipal Debt Funds Average. By way of comparison, the return for the unmanaged Barclays Municipal Short-Intermediate 1–10 Years Index, which has no expenses, was –0.18%. See page 16 for fund results over longer periods of time.

For the fiscal year, the fund paid monthly dividends totaling about 40 cents a share, amounting to a federally tax-exempt income return of 2.47% for investors who reinvested dividends. This is equivalent to a taxable income return of 4.36% for investors in the 43.4%1 maximum federal tax bracket.

The fund invests in investment-grade bonds (those rated Baa/BBB and above) with short- to medium-length maturities. This relatively conservative approach helped it provide a measure of relative stability during the year. At the end of the year, debt rated A and higher accounted for 82.7% of the portfolio’s holdings. The portfolio included significant holdings of revenue bonds in a variety of sectors, including hospital facilities (12.2%), airports (12.2%) and electric utilities (7.3%).

The results shown are before taxes on fund distributions and sale of fund shares.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

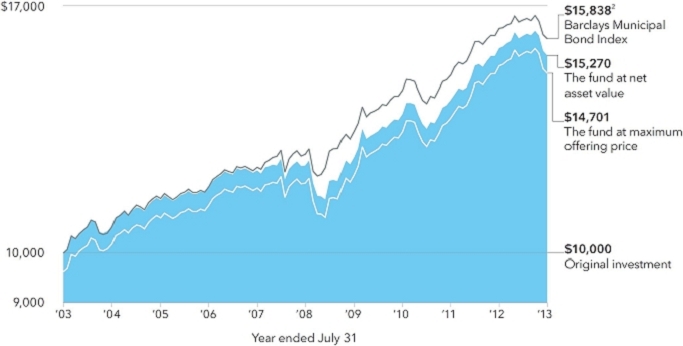

For the 11 months ended July 31, 2013, the fund recorded a –1.93% decline. The result was better than both the –3.26% total return of the Lipper General & Insured Municipal Debt Funds Average, a peer group measure, and the –2.30% return of the Barclays Municipal Bond Index, which is unmanaged and has no expenses. Results for longer time periods can be found on page 16.

For the 11-month period, the fund paid monthly dividends totaling about 40.1 cents a share, amounting to a federally tax-exempt income return of 3.11% for investors who reinvested dividends. This is equivalent to a taxable income return of 5.49% for investors in the 43.4%1 maximum federal tax bracket. The fund does not invest in bonds subject to the Alternative Minimum Tax (AMT).

In advance of the turbulent period that closed out the fiscal year, the fund’s managers adopted a relatively conservative approach, focusing on shorter duration securities. At fiscal year-end the fund’s average duration was seven years. Although the fund’s overall return was negative, this approach helped results on a relative basis. The fund’s managers continued to concentrate on revenue bonds, an area of the market where they believe credit research is most useful. With investments in more than 2,000 individual securities representing 50 U.S. states and territories, the fund also maintained broad geographic diversification.

The results shown are before taxes on fund distributions and sale of fund shares.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

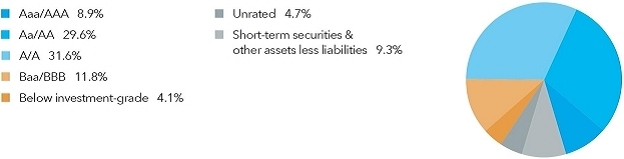

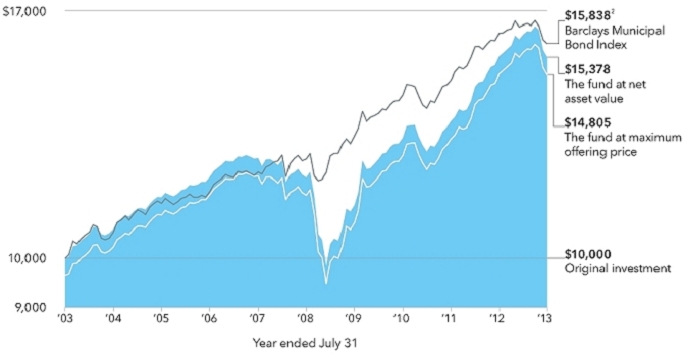

The fund recorded a total return of –0.25%, outpacing the –2.62% return of the Lipper High-Yield Municipal Debt Funds Average, a measure of the fund’s peer group. The unmanaged Barclays High Yield Municipal Bond Index, which has no expenses, advanced 0.80%. For fund results over extended time frames, see page 16.

For the period, the fund paid monthly dividends totaling 63.4 cents a share, amounting to a federally tax-exempt income return of 4.27% for investors who reinvested dividends. This is equivalent to a taxable income return of 7.54% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return may also be exempt from some state and local taxes.

Although higher yielding bonds sustained particularly steep declines in the final three months of the fiscal year, generally speaking lower rated bonds outpaced the broader market in part because of strong demand for yield in the earlier part of the period.

The fund’s managers rely on intensive credit research in their efforts to identify bonds that they believe offer the best potential return given their risk. This research-driven approach has resulted in a broadly diversified portfolio. We believe strong credit selection bolstered the fund’s result on a relative basis as it avoided some of the more troubled issuers in the market. While the fund’s overall total return was negative for the year, we believe the portfolio is well positioned for the long term.

The results shown are before taxes on fund distributions and sale of fund shares.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

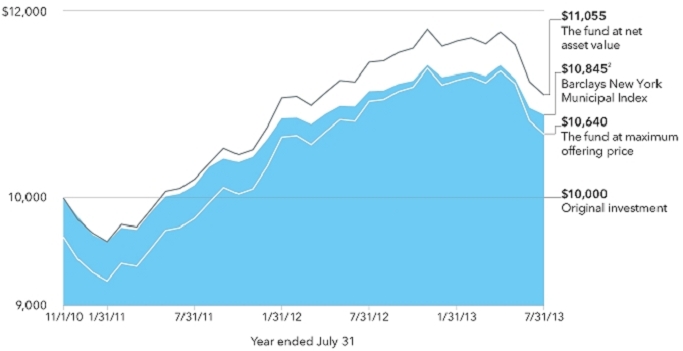

The fund registered a decline of –3.16%. That result bested the –3.85% total return of the Lipper New York Municipal Debt Funds Average, a measure of its peer group. The unmanaged Barclays New York Municipal Index, which has no expenses, declined –2.25%. The fund’s lifetime (since 11/1/10) average annual total return can be found on page 16.

For the fiscal year, the fund paid monthly dividends totaling about 31 cents a share, representing an income return of 2.90% for those who reinvested dividends. For investors in the 50.59% combined effective federal, New York state and New York City tax bracket, this is equivalent to a taxable income return of 5.87%.

Generally speaking, New York municipal bonds lagged the broader market during the period, in part due to a healthy level of issuance within the state.

The fund’s managers sought to maintain a broadly diversified portfolio throughout the period, including holdings spanning the credit spectrum and representing a wide variety of sectors and issuers. A modest exposure to securities issued by Puerto Rico contributed to the fund’s negative return, as Puerto Rico’s credit rating was downgraded by Moody’s during the year.

The results shown are before taxes on fund distributions and sale of fund shares.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. These reimbursements may be adjusted or discontinued by the investment adviser at any time, subject to any restrictions in the fund’s prospectus. Visit americanfunds.com for more information.

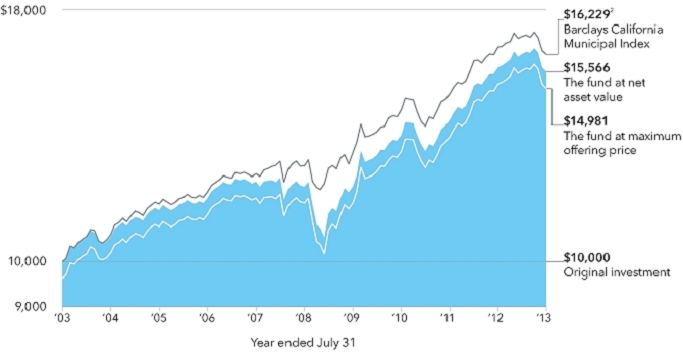

For the 11 months ended July 31, 2013, the fund declined –1.45%. That result was better than the –2.95% total return of the fund’s peer group, as measured by the Lipper California Municipal Debt Funds Average. By way of comparison, the unmanaged Barclays California Municipal Index, which has no expenses, registered a –1.79% return. See page 16 for fund results over extended time periods.

For the period, the fund paid monthly dividends totaling about 58.5 cents a share, amounting to an income return of 3.39% for investors who reinvested dividends. This is equivalent to a taxable income return of 6.91% for investors in the 50.93% effective combined federal and California tax bracket.

The health of the California economy improved markedly over the fiscal period, and the state reported that income and sales tax receipts had increased. With higher income and sales taxes in effect this year, this trend is likely to continue if the economy continues to gain strength.

During the period, the fund’s managers began to position the fund more defensively, opting for shorter duration bonds. The portfolio remains heavily invested in revenue bonds, such as those issued by airports, water and sewer facilities, and electric utilities.

The results shown are before taxes on fund distributions and sale of fund shares.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Agcy. = Agency

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California, which is presently the only series of The American Funds Tax-Exempt Series II (each a “fund” or collectively, the “funds”), are registered under the Investment Company Act of 1940 as open-end, diversified management investment companies.

On December 5, 2012, the boards of trustees for The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California approved to change the funds’ fiscal year-ends from August 31 to July 31.

The funds’ investment objectives and the principal strategies the funds use to achieve these objectives are as follows:

American Funds Short-Term Tax-Exempt Bond Fund has three share classes (Class A, as well as two F share classes, F-1 and F-2). American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California each have five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2). Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America and American High-Income Municipal Bond Fund each have six share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2) and one share class that is only available to the American Funds Portfolio Series (Class R-6). Some share classes are only available to limited categories of investors. The funds’ share classes are further described below:

Holders of all share classes of each fund have equal pro rata rights to the assets, dividends and liquidation proceeds of each fund held. Each share class of each fund has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class of each fund.

Each fund’s financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The funds follow the significant accounting policies described below, as well as the valuation policies described in the next section on valuation.

Capital Research and Management Company (“CRMC”), the funds’ investment adviser, values each fund’s investments at fair value as defined by accounting principles generally accepted in the United States of America. The net asset value of each share class of each fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Fixed-income securities, including short-term securities purchased with more than 60 days left to maturity, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the following inputs: benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data. For certain distressed securities, valuations may include cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts.

When the funds’ investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type. Some securities may be valued based on their effective maturity or average life, which may be shorter than the stated maturity.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates fair value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par when they reach 60 days.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the funds’ investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of each fund’s board of trustees as further described below. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

The funds’ investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Investing in each fund may involve certain risks including, but not limited to, those described below.

Bonds and other debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Credit risk is broadly gauged by the credit ratings of the securities in which a fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The funds’ investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate the risks of an issuer defaulting on its obligations.

As of and during the period ended July 31, 2013, none of the funds had a liability for any unrecognized tax benefits. The funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in their respective statement of operations. During the period, none of the funds incurred any significant interest or penalties.

The funds are not subject to examination by U.S. federal tax authorities or state tax authorities for tax years before the dates shown in the following table:

As indicated in the following tables, some of the funds had capital loss carryforwards available at July 31, 2013. These will be used to offset any capital gains realized by these funds in future years through the expiration dates. Funds with a capital loss carryforward will not make distributions from capital gains while a capital loss carryforward remains.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after July 31, 2011, (August 31, 2011, for The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California) may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

Additional tax basis disclosures for each fund are as follows (dollars in thousands):

The tax character of distributions paid or accrued to shareholders of each fund was as follows (dollars in thousands):

See end of distributions tables for footnotes.

CRMC, the funds’ investment adviser, is the parent company of American Funds Distributors,® Inc. (“AFD”), the principal underwriter of the funds’ shares, and American Funds Service Company® (“AFS”), the funds’ transfer agent. CRMC, AFD and AFS are considered related parties to each fund.

The range of rates, asset and gross income levels and the current annualized rates of average net assets for each fund are as follows:

CRMC has agreed to reimburse a portion of the fees and expenses of American Funds Tax-Exempt Fund of New York during its startup period. This reimbursement may be adjusted or discontinued by CRMC, subject to any restrictions in the fund’s prospectus. For the year ended July 31, 2013, total fees and expenses reimbursed by CRMC were $100,000. Fees and expenses in the statement of operations are presented gross of any reimbursements from CRMC.

Capital share transactions in the funds were as follows (dollars and shares in thousands):

See end of capital share transactions tables for footnotes.

Each fund made purchases and sales of investment securities, excluding short-term securities and U.S. government obligations, if any, during the year ended July 31, 2013 (11 months ended July 31, 2013, for the Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California), as follows (dollars in thousands):

At July 31, 2013, CRMC held aggregate ownership of 31% of the outstanding shares of American Funds Tax-Exempt Fund of New York. The ownership represents the seed money invested in the fund when it began operations on November 1, 2010.

To the Board of Trustees and Shareholders of American Funds Short-Term Tax-Exempt Bond Fund,

Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America,

American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York

In our opinion, the accompanying statements of assets and liabilities, including the summary investment portfolios (investment portfolio for American Funds Tax-Exempt Fund of New York), and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York (the “Funds”) at July 31, 2013, the results of each of their operations, the changes in each of their net assets and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2013 by correspondence with the custodians and brokers, provide a reasonable basis for our opinion.

To the Shareholders and Board of Trustees of The American Funds Tax-Exempt Series II — The Tax-Exempt Fund of California:

We have audited the accompanying statement of assets and liabilities of The American Funds Tax-Exempt Series II — The Tax-Exempt Fund of California (the “Fund”), including the summary investment portfolio, as of July 31, 2013, the related statements of operations for the period from September 1, 2012 through July 31, 2013 and the year ended August 31, 2012, the statements of changes in net assets for the period from September 1, 2012 through July 31, 2013 and the two years ended August 31, 2012, and its financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2013, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The American Funds Tax-Exempt Series II — The Tax-Exempt Fund of California as of July 31, 2013, the results of its operations for the period from September 1, 2012 through July 31, 2013 and the year ended August 31, 2012, the changes in its net assets for the period from September 1, 2012 through July 31, 2013 and the two years ended August 31, 2012, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

As a fund shareholder, you incur two types of costs: (1) transaction costs, such as initial sales charges on purchase payments and contingent deferred sales charges on redemptions (loads), and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other expenses. The examples shown on the following pages are intended to help shareholders understand the ongoing costs (in dollars) of investing in the funds so they can compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (February 1, 2013, through July 31, 2013).

The first line of each share class of each fund in the tables on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

The second line of each share class of each fund in the tables on the following pages provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio for the share class and an assumed rate of return of 5.00% per year before expenses, which is not the actual return of the share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5.00% hypothetical example with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

There are some account fees that are charged to certain types of accounts, such as individual retirement accounts (generally, a $10 fee is charged to set up the account and an additional $10 fee is charged to the account annually), that would increase the amount of expenses paid on your account. In addition, Class F-1 and F-2 shareholders may be subject to fees charged by financial intermediaries, typically ranging from 0.75% to 1.50% of assets annually depending on services offered. You can estimate the impact of these fees by adding the amount of the fees to the total estimated expenses you paid on your account during the period as calculated above. In addition, your ending account value would be lower by the amount of these fees.

Note that the expenses shown in the tables on the following pages are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), if any. Therefore, the second line of each share class of each fund in the tables is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

See end of expense examples tables for footnote.

We are required to advise you of the federal tax status of certain distributions received by shareholders during the fiscal year. We hereby designate the following amounts for the period ended July 31, 2013:

The funds’ boards (the “board”) have approved each fund’s Investment Advisory and Service Agreement (the “agreement”) with Capital Research and Management Company (“CRMC”) for an additional one-year term through March 31, 2014. The board approved the agreement following the recommendation of each fund’s Contracts Committee (the “committee”), which is composed of all of the fund’s independent board members. The board and the committee determined that each fund’s advisory fee structure was fair and reasonable in relation to the services provided and that approving the agreement was in the best interests of each fund and its shareholders.

In reaching this decision, the board and the committee took into account information furnished to them throughout the year, as well as information prepared specifically in connection with their review of the agreements, and were advised by their independent counsel. They considered the factors discussed in the following pages, among others, but did not identify any single issue or particular piece of information that, in isolation, was the controlling factor, and each board and committee member did not necessarily attribute the same weight to each factor.

The board and the committee considered the depth and quality of CRMC’s investment management process, including its global research capabilities; the experience, capability and integrity of its senior management and other personnel; the low turnover rates of its key personnel; the overall financial strength and stability of its organization; and the ongoing evolution of CRMC’s organizational structure designed to maintain and strengthen these qualities. The board and the committee also considered the nature, extent and quality of administrative, compliance and shareholder services provided by CRMC to the funds under each fund’s agreement and other agreements, as well as the benefits to each fund’s shareholders from investing in a fund that is part of a large family of funds. The board and the committee concluded that the nature, extent and quality of the services provided by CRMC have benefited and should continue to benefit each fund and its shareholders.

The board and the committee considered the investment results of each fund in light of its objective. They compared each fund’s investment results with those of other relevant funds (including funds that form the basis of the Lipper index for the category in which the fund is included), and market data such as relevant market indexes, over various periods through October 31, 2012. This report, including the letter to shareholders and related disclosures, contains certain information about each fund’s investment results.

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide current income that is exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital. The board and the committee reviewed the fund’s investment results measured against the Lipper Short Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays Municipal Short 1-5 Years Index. They noted that the investment results for the fund were stronger than the results of the Lipper average over the 10-month, one-year, three-year and lifetime periods, while lower than those of the Barclays index for those periods.

Limited Term Tax-Exempt Bond Fund of America seeks to provide current income that is exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital. The board and the committee reviewed the fund’s investment results measured against the Lipper Intermediate Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays Municipal Short-Intermediate 1-10 Years Index. They noted that the investment results for the fund were stronger than the results of the Barclays index for the 10-month, one-year and three-year periods, while lower than those of the Lipper average for all periods shown and those of the Barclays index for the five-year,10-year and lifetime periods. They also noted that the standard deviation of the fund’s returns, a measure of risk, was below the Lipper average for all periods.

The Tax-Exempt Bond Fund of America seeks to provide a high level of current income exempt from federal income tax, consistent with the preservation of capital. The board and the committee reviewed the fund’s investment results measured against the Lipper General & Insured Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays Municipal Bond Index. They noted that the investment results for the fund were stronger than the results of the Lipper average for all periods, and were stronger than the results of the Barclays index for the 10-month, one-year and three-year periods (although below the results of the index for the five-year and 10-year periods).

American High-Income Municipal Bond Fund seeks to provide a high level of current income exempt from regular federal income tax. The board and the committee reviewed the fund’s investment results measured against the Lipper High-Yield Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays High Yield Municipal Bond Index. They noted that the investment results for the fund were equal to or stronger than the results of the Lipper average for all periods shown other than the 10-month period, while lower than those of the Barclays index for all periods.

American Funds Tax-Exempt Fund of New York seeks to provide a high level of current income exempt from regular federal, New York state and New York City income taxes, with a secondary objective of preservation of capital. The board and the committee reviewed the fund’s investment results measured against the Lipper New York Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays New York Municipal Index. They noted that the investment results for the fund were stronger than the results of both the Lipper average and the Barclays index for the 10-month, one-year and lifetime periods.

The Tax-Exempt Fund of California seeks to provide a high level of current income exempt from regular federal and California state income taxes, with a secondary objective of preservation of capital. The board and the committee reviewed the fund’s investment results measured against the Lipper California Municipal Debt Funds Average (the Lipper category that includes the fund) and the Barclays California Municipal Index. They noted that the investment results for the fund were stronger than the results of the Lipper average for the three-year, five-year, 10-year and lifetime periods (although below the results of the average for the 10-month and one-year periods), and were stronger than the results of the Barclays index for the 10-month, one- and three-year periods (although below the results of the index for the five-year and 10-year periods).

The board and the committee concluded that each fund’s investment results have been satisfactory and that CRMC’s record in managing the funds indicated that its continued management should benefit the funds and their shareholders.

The board and the committee compared the advisory fees and total expense levels of each fund to those of other relevant funds. They observed that each fund’s advisory fees and expenses were less than the median fees and expenses of the other funds included in its Lipper category described above, except as follows: (i) although American Funds Short-Term Tax-Exempt Bond Fund’s advisory fees were slightly higher than the median of the other funds included in the Lipper Short Municipal Debt Funds category, its total expenses, both including and excluding distribution expenses, were below the median; and (ii) Limited Term Tax-Exempt Bond Fund of America’s advisory fees were below the median of the other funds in the Lipper Intermediate Municipal Debt Funds category, and although its total expenses were slightly higher than the median of such funds, such expenses less distribution expenses were significantly below the median.

The board and the committee also considered the breakpoint discounts in each fund’s advisory fee structure that reduce the level of fees charged by CRMC to the fund as fund assets increase. In addition, they reviewed information regarding the effective advisory fees charged to non-mutual fund clients by CRMC and its affiliates. They noted that, to the extent there were differences between the advisory fees paid by each fund and the advisory fees paid by those clients, the differences appropriately reflected the investment, operational and regulatory differences between advising the fund and the other clients. The board and the committee concluded that each fund’s cost structure was fair and reasonable in relation to the services provided, and that each fund’s shareholders receive reasonable value in return for the advisory fees and other amounts paid to CRMC by the funds.

The board and the committee considered a variety of other benefits that CRMC and its affiliates receive as a result of CRMC’s relationship with each fund and the other American Funds, including fees for administrative services provided to certain share classes; fees paid to CRMC’s affiliated transfer agent; sales charges and distribution fees received and retained by the fund’s principal underwriter, an affiliate of CRMC; and possible ancillary benefits to CRMC and its institutional management affiliates in managing other investment vehicles. The board and the committee reviewed CRMC’s portfolio trading practices, noting that while CRMC receives the benefit of research provided by broker-dealers executing portfolio transactions on behalf of each fund, it does not obtain third-party research or other services in return for allocating brokerage to such broker-dealers. The board and the committee took these ancillary benefits into account in evaluating the reasonableness of the advisory fees and other amounts paid to CRMC by each fund.

The board and the committee reviewed information regarding CRMC’s costs of providing services to the American Funds, including personnel, systems and resources of investment, compliance, trading, accounting and other administrative operations. They considered CRMC’s costs and willingness to invest in technology, infrastructure and staff to maintain and expand services and capabilities, respond to industry and regulatory developments, and attract and retain qualified personnel. They noted information regarding the compensation structure for CRMC’s investment professionals. The board and the committee also compared CRMC’s profitability and compensation data to the reported results and data of several large, publicly- held investment management companies. The board and the committee noted the competitiveness and cyclicality of both the mutual fund industry and the capital markets, and the importance in that environment of CRMC’s long-term profitability for maintaining its independence, company culture and management continuity. They further considered the breakpoint discounts in each fund’s advisory fee structure. The board and the committee concluded that each fund’s advisory fee structure reflected a reasonable sharing of benefits between CRMC and each fund’s shareholders.

See footnotes on page 88.

P.O. Box 6007

Indianapolis, IN 46206-6007

P.O. Box 2280

Norfolk, VA 23501-2280

American Funds Distributors, Inc.

333 South Hope Street

Los Angeles, CA 90071-1406

“American Funds Proxy Voting Procedures and Principles” — which describes how we vote proxies relating to portfolio securities — is available on the American Funds website or upon request by calling AFS. Each fund files its proxy voting record with the U.S. Securities and Exchange Commission (SEC) for the 12 months ended June 30 by August 31. The proxy voting record is available free of charge on the SEC website at sec.gov and on the American Funds website.

Complete July 31, 2013, portfolios of American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund and The Tax-Exempt Fund of California’s investments are available free of charge by calling AFS or visiting the SEC website (where they are part of Form N-CSR).

American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California file a complete list of their portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This filing is available free of charge on the SEC website. You may also review or, for a fee, copy this filing at the SEC’s Public Reference Room in Washington, D.C. Additional information regarding the operation of the Public Reference Room may be obtained by calling the SEC’s Office of Investor Education and Advocacy at (800) SEC-0330. Additionally, the list of portfolio holdings is available by calling AFS.

This report is for the information of shareholders of American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California, but it also may be used as sales literature when preceded or accompanied by the current prospectus or summary prospectus, which gives details about charges, expenses, investment objectives and operating policies of the funds. If used as sales material after September 30, 2013, this report must be accompanied by an American Funds statistical update for the most recently completed calendar quarter.

Since 1931, American Funds, part of Capital Group, has helped investors pursue long-term investment success. Our consistent approach — in combination with The Capital SystemSM — has resulted in a superior long-term track record.

The Registrant has adopted a Code of Ethics that applies to its Principal Executive Officer and Principal Financial Officer. The Registrant undertakes to provide to any person without charge, upon request, a copy of the Code of Ethics. Such request can be made to American Funds Service Company at 800/421-9225 or to the Secretary of the Registrant, 333 South Hope Street, Los Angeles, California 90071.

The Registrant’s board has determined that Laurel B. Mitchell, a member of the Registrant’s audit committee, is an “audit committee financial expert” and "independent," as such terms are defined in this Item. This designation will not increase the designee’s duties, obligations or liability as compared to his or her duties, obligations and liability as a member of the audit committee and of the board, nor will it reduce the responsibility of the other audit committee members. There may be other individuals who, through education or experience, would qualify as "audit committee financial experts" if the board had designated them as such. Most importantly, the board believes each member of the audit committee contributes significantly to the effective oversight of the Registrant’s financial statements and condition.

Aggregate non-audit fees paid to the Registrant’s auditors, including fees for all services billed to the Registrant, adviser and affiliates that provide ongoing services to the Registrant, were $16,000 for fiscal year 2012 and $33,000 for fiscal year 2013. The non-audit services represented by these amounts were brought to the attention of the committee and considered to be compatible with maintaining the auditors’ independence.

Not applicable to this Registrant, insofar as the Registrant is not a listed issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934.

| Bonds, notes & other debt instruments 90.49% | | |

| | Principal amount | Value |

| Alabama 1.20% | (000) | (000) |

| | | |

| 21st Century Auth., Tobacco Settlement Rev. Ref. Bonds, Series 2012-A, 5.00% 2020 | $2,500 | $ 2,826 |

| Industrial Dev. Board of the Town of Courtland, Industrial Dev. Rev. Ref. Bonds (International Paper Co. Projects), | | |

| Series 2003-A, 5.00% 2013 | 1,000 | 1,010 |

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2018 | 1,000 | 1,155 |

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2020 | 5,000 | 5,812 |

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2022 | 8,385 | 9,583 |

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2023 | 2,500 | 2,837 |

| City of Mobile Industrial Dev. Board, Pollution Control Rev. Bonds (Alabama Power Co. Barry Plant Project), | | |

| Series 2007-C, 5.00% 2034 (put 2015) | 7,000 | 7,463 |

| Special Care Facs. Fncg. Auth. of the City of Pell City, Rev. Ref. Bonds (Noland Health Services, Inc.), | | |

| Series 2012-A, 5.00% 2020 | 1,140 | 1,289 |

| Board of Trustees of the University of Alabama, Birmingham Hospital Rev. Ref. Bonds, Series 2006-A, 5.00% 2015 | 500 | 544 |

| Board of Trustees of the University of Alabama, Birmingham Hospital Rev. Ref. Bonds, Series 2008-A, 5.25% 2017 | 1,160 | 1,334 |

| Board of Trustees of the University of Alabama, General Rev. Ref. Bonds, Series 2012-A, 5.00% 2020 | 2,500 | 2,960 |

| | | 36,813 |

| Alaska 0.04% | | |

| | | |

| Student Loan Corp., Education Loan Rev. Bonds, Series 2006-A-2, AMT, 5.00% 2016 | 1,000 | 1,099 |

| | | |

| Arizona 2.32% | | |

| | | |

| Health Facs. Auth., Rev. Ref. Bonds (Phoenix Children’s Hospital), Series 2013-A-1, 1.91% 2048 (put 2020)1 | 4,000 | 4,089 |

| City of Glendale, Water and Sewer Rev. Ref. Obligations, Series 2012, 5.00% 2020 | 1,550 | 1,810 |

| City of Glendale, Water and Sewer Rev. Ref. Obligations, Series 2012, 5.00% 2021 | 1,000 | 1,160 |

| Industrial Dev. Auth. of the City of Glendale, Rev. Ref. Bonds (Midwestern University), Series 2007, 5.25% 2018 | 1,135 | 1,272 |

| Health Facs. Auth., Rev. Bonds (Banner Health), Series 2007-A, 5.00% 2017 | 3,000 | 3,359 |

| Health Facs. Auth., Rev. Ref. Bonds (Banner Health), Series 2007-A, 5.00% 2016 | 1,900 | 2,076 |

| Health Facs. Auth., Rev. Ref. Bonds (Banner Health), Series 2007-A, 5.00% 2018 | 500 | 568 |

| Industrial Dev. Auth. of the County of Maricopa, Health Fac. Rev. Ref. Bonds (Catholic Healthcare West), | | |

| Series 2007-A, 4.125% 2015 | 1,000 | 1,063 |

| Industrial Dev. Auth. of the County of Maricopa, Health Fac. Rev. Ref. Bonds (Catholic Healthcare West), | | |

| Series 2007-A, 5.00% 2016 | 2,000 | 2,224 |

| Industrial Dev. Auth. of the County of Maricopa, Health Fac. Rev. Ref. Bonds (Catholic Healthcare West), | | |

| Series 2009-A, 5.00% 2016 | 2,400 | 2,668 |

| Industrial Dev. Auth. of the County of Maricopa, Health Fac. Rev. Ref. Bonds (Catholic Healthcare West), | | |

| Series 2009-C, 5.00% 2038 (put 2014) | 8,500 | 8,803 |

| Maricopa County Community College Dist., G.O. Bonds (Project of 2004), Series 2009-C, 5.00% 2018 | 3,500 | 4,095 |

| City of Phoenix Civic Improvement Corp., Airport Rev. Bonds, Series 2010-A, 5.00% 2019 | 1,000 | 1,171 |

| City of Phoenix Civic Improvement Corp., Airport Rev. Ref. Bonds, Series 2008-D, AMT, 5.25% 2017 | 2,000 | 2,280 |

| City of Phoenix Civic Improvement Corp., Airport Rev. Ref. Bonds, Series 2008-D, AMT, 5.25% 2018 | 1,000 | 1,155 |

| City of Phoenix Civic Improvement Corp., Wastewater System Rev. Ref. Bonds, Series 2008, 5.50% 2018 | 1,000 | 1,189 |

| City of Phoenix Civic Improvement Corp., Water System Rev. Bonds, Series 2009-A, 5.00% 2018 | 2,300 | 2,694 |

| Industrial Dev. Auth. of the City of Phoenix and the County of Pima, Single-family Mortgage Rev. Bonds, | | |

| Series 2006-3A, AMT, 5.25% 2038 | 97 | 100 |

| Bonds, notes & other debt instruments | | |

| | Principal amount | Value |

| Arizona (continued) | (000) | (000) |

| | | |

| Industrial Dev. Authorities of the City of Phoenix and the County of Maricopa, Single-family Mortgage Rev. Bonds, | | |

| Series 2007-A-2, AMT, 5.80% 2040 | $ 170 | $ 174 |

| Pima County, Sewer System Rev. Obligations, Series 2012-A, 5.00% 2021 | 400 | 461 |

| Pima County, Sewer System Rev. Obligations, Series 2012-A, 5.00% 2022 | 800 | 921 |

| Town of Queen Creek, Improvement Dist. No. 001, Improvement Bonds, 5.00% 2015 | 1,250 | 1,274 |

| School Facs. Board, Certs. of Part., Series 2008, 5.50% 2016 | 1,500 | 1,707 |

| School Facs. Board, Certs. of Part., Series 2008, 5.50% 2017 | 3,000 | 3,492 |

| School Facs. Board, Ref. Certs. of Part., Series 2005-A-1, FGIC-National insured, 5.00% 2015 | 5,000 | 5,449 |

| School Facs. Board, State School Improvement Rev. Ref. Bonds, Series 2005, 5.00% 2015 | 2,000 | 2,132 |

| School Facs. Board, State School Trust Rev. Ref. Bonds, Series 2007, AMBAC insured, 5.00% 2017 | 2,000 | 2,218 |

| State Lottery Rev. Bonds, Series 2010-A, Assured Guaranty Municipal insured, 5.00% 2019 | 3,770 | 4,388 |

| Transportation Board Highway Rev. Ref. Bonds, Series 2011-A, 5.00% 2020 | 3,270 | 3,865 |

| Board of Regents, Ref. Certs. of Part. (University of Arizona Projects), Series 2012-C, 5.00% 2020 | 3,180 | 3,671 |

| | | 71,528 |

| California 11.80% | | |

| | | |

| Alameda Corridor Transportation Auth., Rev. Ref. Bonds, Series 2013-A, 5.00% 2021 | 1,750 | 2,021 |

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Insured Rev. Ref. Bonds (Channing House), | | |

| Series 2010, 4.00% 2016 | 1,500 | 1,503 |

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Sharp HealthCare), | | |

| Series 2012-A, 4.00% 2021 | 935 | 1,005 |

| Assn. of Bay Area Governments, Fin. Auth. for Nonprofit Corps., Rev. Ref. Bonds (Sharp HealthCare), | | |

| Series 2012-A, 5.00% 2019 | 980 | 1,134 |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 0.96% 2045 (put 2023)1 | 10,000 | 9,917 |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-C-1, 0.96% 2047 (put 2023)1 | 3,500 | 3,471 |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 0.76% 2047 (put 2019)1 | 1,000 | 1,006 |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2012-F-1, 5.00% 2023 | 3,550 | 4,112 |

| City of Cathedral City, Cove Improvement Dist. No. 2004-02, Limited Obligation Improvement Bonds, 4.40% 2014 | 695 | 710 |

| Central Valley Fncg. Auth., Cogeneration Project Rev. Ref. Bonds (Carson Ice-Gen Project), | | |

| Series 2009, 5.00% 2016 | 800 | 891 |

| Central Valley Fncg. Auth., Cogeneration Project Rev. Ref. Bonds (Carson Ice-Gen Project), | | |

| Series 2009, 5.00% 2017 | 1,130 | 1,287 |

| Sacramento Cogeneration Auth., Cogeneration Project Rev. Ref. Bonds (Procter & Gamble Project), | | |

| Series 2009, 5.00% 2016 | 1,000 | 1,114 |

| Sacramento Cogeneration Auth., Cogeneration Project Rev. Ref. Bonds (Procter & Gamble Project), | | |

| Series 2009, 5.00% 2017 | 1,000 | 1,139 |

| Sacramento Municipal Utility Dist., Electric Rev. Bonds, Series 1997-K, AMBAC insured, 5.75% 2018 | 5,170 | 6,179 |

| Sacramento Municipal Utility Dist., Electric Rev. Bonds, Series 1997-K, AMBAC insured, 5.80% 2019 | 3,000 | 3,642 |

| Cerritos Public Fin. Auth., Tax Allocation Rev. Bonds (Cerritos Redev. Projects), Series 2002-A, | | |

| AMBAC insured, 5.00% 2021 | 1,000 | 1,046 |

| Cerritos Public Fncg. Auth., 2002 Tax Allocation Rev. Bonds (Cerritos Redev. Projects), | | |

| Series A, AMBAC insured, 5.00% 2019 | 1,570 | 1,687 |

| Econ. Recovery Bonds, Ref. Series 2009-A, 5.00% 2019 | 3,000 | 3,553 |

| Econ. Recovery Bonds, Ref. Series 2009-A, 5.00% 2020 | 9,000 | 10,557 |

| Econ. Recovery Bonds, Ref. Series 2009-B, 5.00% 2023 (put 2014) | 11,250 | 11,742 |

| Educational Facs. Auth., Rev. Ref. Bonds (Chapman University), Series 2011, 5.00% 2020 | 1,640 | 1,894 |

| Various Purpose G.O. Ref. Bonds, 5.00% 2020 | 5,000 | 5,868 |

| Various Purpose G.O. Ref. Bonds, 5.00% 2021 | 5,000 | 5,850 |

| Various Purpose G.O. Ref. Bonds, 5.00% 2023 | 6,500 | 7,407 |

| Golden State Tobacco Securitization Corp., Enhanced Tobacco Settlement Asset-backed Bonds, | | |

| Series 2013-A, 5.00% 2020 | 6,000 | 6,822 |

| Health Facs. Fncg. Auth., Insured Rev. Ref. Bonds (NCROC – Paradise Valley Estates Project), | | |

| Series 2013, 5.00% 2023 | 550 | 610 |

| Health Facs. Fncg. Auth., Rev. Bonds (Catholic Healthcare West), Series 2008-I, 5.125% 2022 | 705 | 757 |

| Bonds, notes & other debt instruments | | |

| | Principal amount | Value |

| California (continued) | (000) | (000) |

| | | |

| Health Facs. Fncg. Auth., Rev. Bonds (Catholic Healthcare West), Series 2008-K, 5.125% 2022 | $ 665 | $ 714 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Catholic Healthcare West), Series 2004-I, 4.95% 2026 (put 2014) | 1,000 | 1,041 |

| Health Facs. Fncg. Auth., Rev. Bonds (Sutter Health), Series 2011-D, 5.00% 2019 | 750 | 877 |

| Statewide Communities Dev. Auth., Rev. Bonds (Sutter Health), Series 2011-A, 5.00% 2019 | 1,100 | 1,287 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2008-C, 5.25% 2016 | 500 | 562 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2008-C, 5.50% 2017 | 500 | 581 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2008-C, 6.00% 2018 | 600 | 723 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-B, 5.00% 2015 | 4,260 | 4,590 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-D, 5.00% 2034 (put 2016) | 7,500 | 8,312 |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2013-D, 5.00% 2043 (put 2020) | 1,200 | 1,364 |

| Independent Cities Lease Fin. Auth., Mobile Home Park Rev. Bonds (San Juan Mobile Estates), | | |

| Series 2006-A, 5.00% 2016 | 1,255 | 1,335 |

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2011-A-1, 0.56% 2038 (put 2014)1 | 5,000 | 5,012 |

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2013-A-1, 0.34% 2047 (put 2016)1 | 3,500 | 3,489 |

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2013-A-2, 0.34% 2047 (put 2016)1 | 3,500 | 3,489 |

| Irvine Public Facs. and Infrastructure Auth., Assessment Rev. Bonds, Series 2012-A, 4.00% 2020 | 2,350 | 2,403 |

| Jurupa Public Fncg. Auth., Special Tax Rev. Bonds, Series 2013-A, 5.00% 2021 | 750 | 815 |

| Jurupa Public Fncg. Auth., Special Tax Rev. Bonds, Series 2013-A, 5.00% 2022 | 1,000 | 1,077 |

| Lee Lake Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2013-A, 5.00% 2019 | 1,805 | 1,977 |

| Lee Lake Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2013-A, 5.00% 2020 | 890 | 971 |

| Lee Lake Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2013-A, 5.00% 2022 | 1,090 | 1,165 |

| City of Long Beach, Harbor Rev. Ref. Bonds, Series 1998-A, AMT, FGIC-National insured, 6.00% 2016 | 8,430 | 9,570 |

| City of Long Beach, Harbor Rev. Ref. Bonds, Series 1998-A, AMT, FGIC-National insured, 6.00% 2019 | 3,500 | 4,199 |

| City of Long Beach, Harbor Rev. Ref. Bonds, Series 2005-A, AMT, National insured, 5.00% 2022 | 1,300 | 1,388 |

| City of Los Angeles Harbor Dept., Rev. Ref. Bonds, Series 2006-D, AMT, National insured, 5.00% 2020 | 3,100 | 3,271 |

| City of Los Angeles Harbor Dept., Rev. Ref. Bonds, Series 2011-A, AMT, 5.00% 2019 | 1,500 | 1,722 |

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Ref. Bonds, Series 2011-A, 5.00% 2018 | 770 | 907 |

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Ref. Bonds, Series 2011-A, 5.00% 2019 | 2,000 | 2,382 |

| City of Los Angeles, Wastewater System Rev. Ref. Bonds, Series 2002-A, FGIC-National insured, 6.00% 2021 | 3,000 | 3,762 |

| City of Los Angeles, Wastewater System Rev. Ref. Bonds, Series 2009-A, 5.00% 2018 | 2,500 | 2,932 |

| Los Angeles Convention and Exhibition Center Auth., Lease Rev. Ref. Bonds, Series 2008-A, 5.00% 2016 | 1,570 | 1,721 |

| Los Angeles County Metropolitan Transportation Auth., Proposition C, Sales Tax Rev. Ref. Bonds, | | |

| Series 2009-B, 5.00% 2017 | 2,500 | 2,882 |

| Los Angeles County Metropolitan Transportation Auth., Proposition C, Sales Tax Rev. Ref. Bonds, | | |

| Series 2012-B, 5.00% 2020 | 3,140 | 3,729 |

| Los Angeles County Metropolitan Transportation Auth., Proposition C, Sales Tax Rev. Ref. Bonds, | | |

| Series 2012-B, 5.00% 2021 | 6,230 | 7,369 |

| Los Angeles Unified School Dist. (County of Los Angeles), Election of 2004 G.O. Bonds, Series 2009-I, 5.00% 2020 | 3,500 | 4,126 |

| Los Angeles Unified School Dist. (County of Los Angeles), G.O. Ref. Bonds, Series 2011-A-1, 5.00% 2018 | 7,010 | 8,220 |

| Municipal Improvement Corp. of Los Angeles, Lease Rev. Ref. Bonds, Series 2012-C, 5.00% 2020 | 2,000 | 2,283 |

| Municipal Improvement Corp. of Los Angeles, Lease Rev. Ref. Bonds, Series 2012-C, 5.00% 2022 | 3,250 | 3,671 |

| Morongo Band of Mission Indians, Enterprise Rev. Ref. Bonds, Series 2008-B, 5.50% 2018 | 1,220 | 1,290 |

| Murrieta Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2012, 5.00% 2020 | 1,000 | 1,104 |

| Northern California Power Agcy., Hydroelectric Project Number One Rev. Ref. Bonds, Series 2010-A, 5.00% 2019 | 1,000 | 1,168 |

| Northern California Power Agcy., Hydroelectric Project Number One Rev. Ref. Bonds, Series 2010-A, 5.00% 2020 | 2,000 | 2,283 |

| Northern California Power Agcy., Hydroelectric Project Number One Rev. Ref. Bonds, Series 2010-A, 5.00% 2021 | 1,000 | 1,121 |

| Port of Oakland, Rev. Ref. Bonds, Series 2007-A, AMT, National insured, 5.00% 2015 | 2,220 | 2,416 |

| Port of Oakland, Rev. Ref. Bonds, Series 2007-C, National insured, 5.00% 2016 | 1,000 | 1,133 |

| Port of Oakland, Rev. Ref. Bonds, Series 2007-C, National insured, 5.00% 2017 | 1,000 | 1,153 |

| Port of Oakland, Rev. Ref. Bonds, Series 2011-O, AMT, 5.00% 2020 | 2,020 | 2,278 |

| Port of Oakland, Rev. Ref. Bonds, Series 2012-P, AMT, 5.00% 2021 | 7,750 | 8,680 |

| Port of Oakland, Rev. Ref. Bonds, Series 2012-P, AMT, 5.00% 2022 | 4,000 | 4,438 |

| Port of Oakland, Rev. Ref. Bonds, Series 2012-P, AMT, 5.00% 2023 | 2,750 | 3,001 |

| Bonds, notes & other debt instruments | | |

| | Principal amount | Value |

| California (continued) | (000) | (000) |

| | | |

| City of Orange, Community Facs. Dist. No. 91-2, Special Tax Ref. Bonds (Serrano Heights Public Improvements), | | |

| Series 2013, 4.00% 2022 | $1,000 | $1,034 |

| City of Orange, Community Facs. Dist. No. 91-2, Special Tax Ref. Bonds (Serrano Heights Public Improvements), | | |

| Series 2013, 5.00% 2023 | 750 | 824 |

| Pollution Control Fncg. Auth., Solid Waste Disposal Rev. Ref. Bonds (Republic Services, Inc. Project), | | |

| Series 2002-C, AMT, 5.25% 2023 (put 2017)2 | 8,250 | 8,918 |

| Public Works Board, Lease Rev. Bonds (Judicial Council of California, Various Judicial Council Projects), | | |

| Series 2011-D, 5.00% 2019 | 2,000 | 2,332 |

| Public Works Board, Lease Rev. Bonds (Various Capital Projects), Series 2011-A, 5.00% 2019 | 2,000 | 2,328 |

| Regional Airports Improvement Corp., Facs. Lease Rev. Ref. Bonds (LAXFUEL Corp., Los Angeles | | |

| International Airport), Issue of 2005, AMT, Assured Guaranty Municipal insured, 5.00% 2014 | 1,020 | 1,038 |

| Regional Airports Improvement Corp., Facs. Lease Rev. Ref. Bonds (LAXFUEL Corp., Los Angeles | | |

| International Airport), Issue of 2012, AMT, 5.00% 2020 | 545 | 608 |

| Regional Airports Improvement Corp., Facs. Lease Rev. Ref. Bonds (LAXFUEL Corp., Los Angeles | | |

| International Airport), Issue of 2012, AMT, 5.00% 2021 | 1,700 | 1,882 |

| City of San Bernardino, Unified School Dist. G.O. Ref. Bonds, Series 2013-A, 5.00% 2017 | 400 | 453 |

| City of San Bernardino, Unified School Dist. G.O. Ref. Bonds, Series 2013-A, Assured Guaranty | | |

| Municipal insured, 5.00% 2023 | 1,100 | 1,233 |

| County of San Bernardino, Certs. of Part. (Arrowhead Ref. Project), Series 2009-A, 5.00% 2017 | 6,000 | 6,700 |

| Public Facs. Fncg. Auth. of the City of San Diego, Sewer Rev. Bonds, Series 2009-A, 5.00% 2017 | 8,500 | 9,729 |

| Public Facs. Fncg. Auth. of the City of San Diego, Sewer Rev. Ref. Bonds, Series 2009-B, 5.00% 2017 | 2,500 | 2,861 |

| Redev. Agcy. of the City and County of San Francisco, Community Facs. Dist. No. 6, Special Tax Ref. Bonds | | |

| (Mission Bay South Public Improvements), Series 2013-A, 5.00% 2022 | 1,000 | 1,060 |

| San Francisco State Building Auth., Lease Rev. Ref. Bonds (San Francisco Civic Center Complex), | | |

| Series 2005-A, FGIC-National insured, 5.00% 2016 | 2,500 | 2,722 |

| City of San Jose, Airport Rev. Bonds, Series 2007-A, AMT, AMBAC insured, 5.50% 2020 | 7,820 | 8,646 |

| City of San Jose, Airport Rev. Bonds, Series 2007-A, AMT, AMBAC insured, 5.50% 2022 | 2,500 | 2,748 |

| City of San Jose, Airport Rev. Ref. Bonds, Series 2011-A-1, AMT, 5.00% 2018 | 3,750 | 4,249 |

| City of San Jose, Airport Rev. Ref. Bonds, Series 2011-A-1, AMT, 5.00% 2019 | 3,000 | 3,408 |

| City of San Jose, Airport Rev. Ref. Bonds, Series 2011-A-1, AMT, 5.25% 2020 | 3,070 | 3,513 |

| City of San Jose, Airport Rev. Ref. Bonds, Series 2011-A-1, AMT, 5.25% 2022 | 3,650 | 4,055 |

| Sonoma-Marin Area Rail Transit Dist., Measure Q Sales Tax Rev. Bonds, Series 2011-A, 5.00% 2022 | 2,795 | 3,254 |

| South Orange County Public Fncg. Auth., Special Tax Rev. Bonds (Ladera Ranch), | | |

| Series 2005-A, AMBAC insured, 5.00% 2016 | 2,420 | 2,568 |

| Southern California Public Power Auth., Gas Project Rev. Bonds (Project No. 1), Series 2007-A, 5.00% 2016 | 1,000 | 1,083 |

| Southern California Public Power Auth., Transmission Project Rev. Ref. Bonds (Southern Transmission Project), | | |

| Series 2009-A, 5.00% 2019 | 2,500 | 2,954 |

| Statewide Communities Dev. Auth., Rev. Bonds (Kaiser Permanente), Series 2002-C, 5.00% 2029 (put 2017) | 5,700 | 6,449 |

| Statewide Communities Dev. Auth., Rev. Bonds (Kaiser Permanente), Series 2009-A, 5.00% 2019 | 2,000 | 2,320 |