First Quarter 2023 Investor Presentation Parent company of

21st Quarter 2023 Forward-Looking Information This presentation may include forward-looking statements by the Company and our authorized officers pertaining to such matters as our goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, and our ongoing strategic relationship with Figure Technologies, Inc. Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward-looking statements are subject to the following principal risks and uncertainties: the effect of the COVID-19 pandemic, including the length of time that the pandemic continues, the potential imposition of future shelter in place orders or additional restrictions on travel in the future, the effect of the pandemic on the general economy and on the businesses of our borrowers and their ability to make payments on their obligations, the remedial actions and stimulus measures adopted by federal, state, and local governments; the inability of employees to work due to illness, quarantine, or government mandates; general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in competitive pressures among financial institutions or from non-financial institutions; changes in legislation, regulations, and policies; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, our ongoing restructuring of our mortgage business, and our ongoing strategic relationship with Figure Technologies, Inc.; the outcome of any legal proceedings that may be instituted against the Company or any other party to the Flagstar or Figure Technologies, Inc. transactions; the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; revenues following the transactions may be lower than expected, and the occurrence of any event, change or other circumstances that could give rise to the right of any of the parties to the Figure Technologies, Inc. strategic relationship to terminate the agreements governing such relationship; and there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations). More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2022 and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov. Our Supplemental Use of Non-GAAP Financial Measures This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our performance and financial condition with those of other banks. Such non-GAAP financial measures are supplemental to, and are not to be considered in isolation or as a substitute for, measures calculated in accordance with GAAP. Cautionary Statements

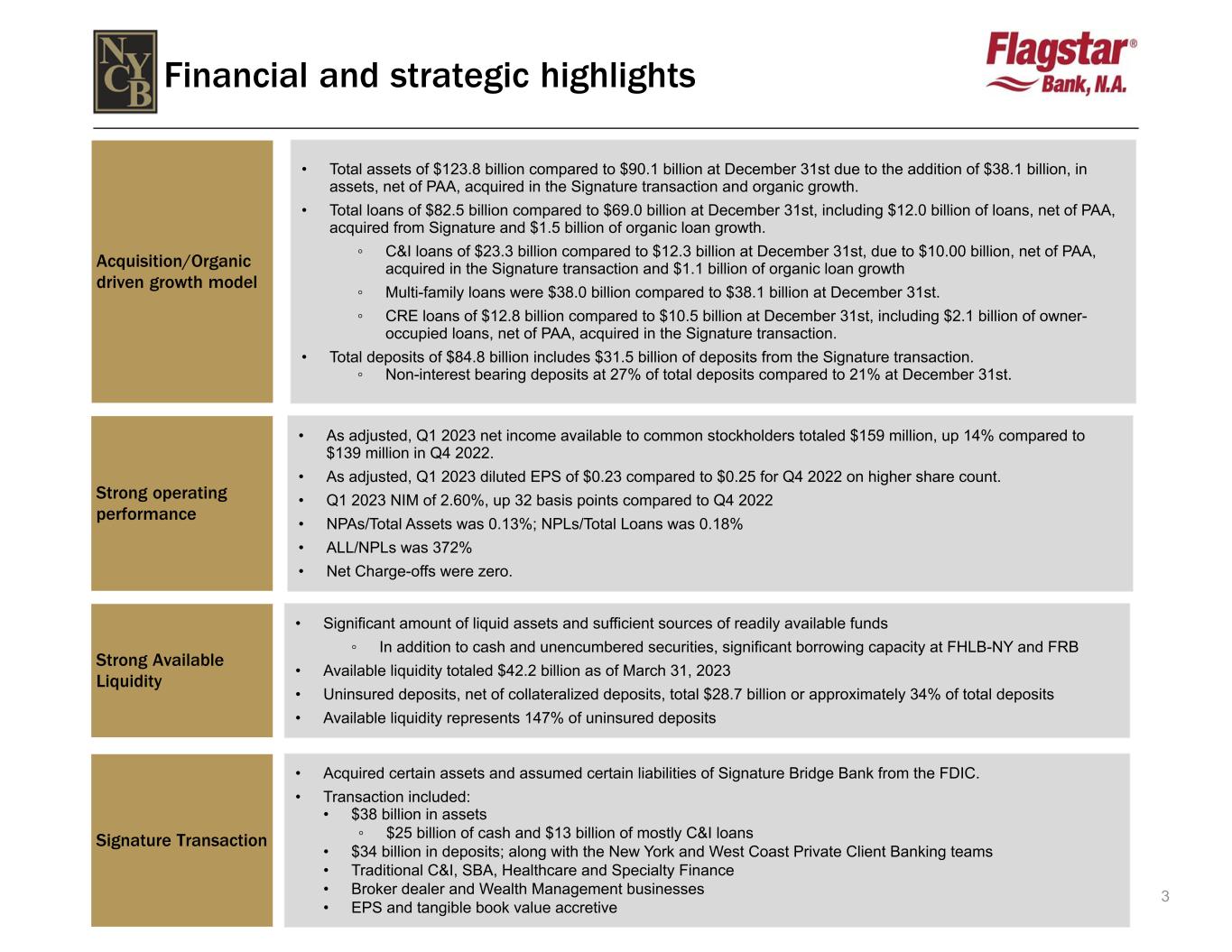

3 Acquisition/Organic driven growth model • Significant amount of liquid assets and sufficient sources of readily available funds ◦ In addition to cash and unencumbered securities, significant borrowing capacity at FHLB-NY and FRB • Available liquidity totaled $42.2 billion as of March 31, 2023 • Uninsured deposits, net of collateralized deposits, total $28.7 billion or approximately 34% of total deposits • Available liquidity represents 147% of uninsured deposits Strong operating performance Signature Transaction • Acquired certain assets and assumed certain liabilities of Signature Bridge Bank from the FDIC. • Transaction included: • $38 billion in assets ◦ $25 billion of cash and $13 billion of mostly C&I loans • $34 billion in deposits; along with the New York and West Coast Private Client Banking teams • Traditional C&I, SBA, Healthcare and Specialty Finance • Broker dealer and Wealth Management businesses • EPS and tangible book value accretive • Total assets of $123.8 billion compared to $90.1 billion at December 31st due to the addition of $38.1 billion, in assets, net of PAA, acquired in the Signature transaction and organic growth. • Total loans of $82.5 billion compared to $69.0 billion at December 31st, including $12.0 billion of loans, net of PAA, acquired from Signature and $1.5 billion of organic loan growth. ◦ C&I loans of $23.3 billion compared to $12.3 billion at December 31st, due to $10.00 billion, net of PAA, acquired in the Signature transaction and $1.1 billion of organic loan growth ◦ Multi-family loans were $38.0 billion compared to $38.1 billion at December 31st. ◦ CRE loans of $12.8 billion compared to $10.5 billion at December 31st, including $2.1 billion of owner- occupied loans, net of PAA, acquired in the Signature transaction. • Total deposits of $84.8 billion includes $31.5 billion of deposits from the Signature transaction. ◦ Non-interest bearing deposits at 27% of total deposits compared to 21% at December 31st. Financial and strategic highlights • As adjusted, Q1 2023 net income available to common stockholders totaled $159 million, up 14% compared to $139 million in Q4 2022. • As adjusted, Q1 2023 diluted EPS of $0.23 compared to $0.25 for Q4 2022 on higher share count. • Q1 2023 NIM of 2.60%, up 32 basis points compared to Q4 2022 • NPAs/Total Assets was 0.13%; NPLs/Total Loans was 0.18% • ALL/NPLs was 372% • Net Charge-offs were zero. Strong Available Liquidity

41st Quarter 2023 Observations • Adjusted non-interest income(1) increased $58 million due to: • Net return on MSR, up $16 million • Net gain on loan sales up $15 million • Net loan administration income up $4 million Non-interest income • Net interest income increased $176 million, up 46% • Net interest margin was 2.60%, a 32 bps increase compared to 4Q22. Net interest income • Non-interest expense increased $207 million primarily driven by a full quarter of Flagstar and 12 days of Signature expenses. Non-interest expense Quarterly income comparison 1. Non-GAAP number, please see reconciliations on page 27. 2. Rounded to the nearest hundred million. Q4 22 includes a full quarter of legacy Flagstar fallout adjusted rate lock commitments. $mm Q1 2023 Q4 2022 $ Variance % Variance Net interest income $555 $379 $176 46 % Provision for credit losses 170 124 46 NM Net interest income after PLL 385 255 130 51 % Fee income 27 10 17 170 % Bank-owned life insurance 10 8 2 25 % Net loss on securities 0 — 0 NM Net return on mortgage servicing rights 22 6 16 NM Net gain (loss) on loan sales and securitizations 20 5 15 NM Net loan administration income 7 3 4 NM Bargain purchase gain 2,001 159 1,842 Other noninterest income 11 7 4 NM Total noninterest income 2,098 198 1,900 NM Compensation and benefits 219 116 103 89 % Occupancy and equipment 37 25 12 48 % General and administrative 138 63 75 NM Total operating expenses 394 204 190 93 % Intangible asset amortization 15 5 10 NM Merger-related expenses 67 60 7 NM Total non-interest expenses 476 269 207 NM Income before income taxes 2,007 184 1,823 991 % Provision for income taxes 1 12 (11) (92) % Net income $2,006 $172 $1,834 1066 % Preferred stock dividends 8 8 0 — % Net income available to common stockholders $1,998 $164 $1,834 1118 % Basic earnings per common share $2.88 $0.30 $2.58 NM Diluted earnings per common share $2.87 $0.30 $2.57 NM Adjusted net income to available to common stockholders(1) $159 $139 $20 14 % Adjusted diluted earnings per common share(1) $0.23 $0.25 $(0.02) 863 % Dividends per common share $0.17 $0.17 $0.00 NM Profitability Net interest margin 2.60 % 2.28 % 32 bps Fallout adjusted rate lock commitments(2) $2,617 $3,099 N/A Net gain on loan sale margin 0.76 % 0.56 % N/A

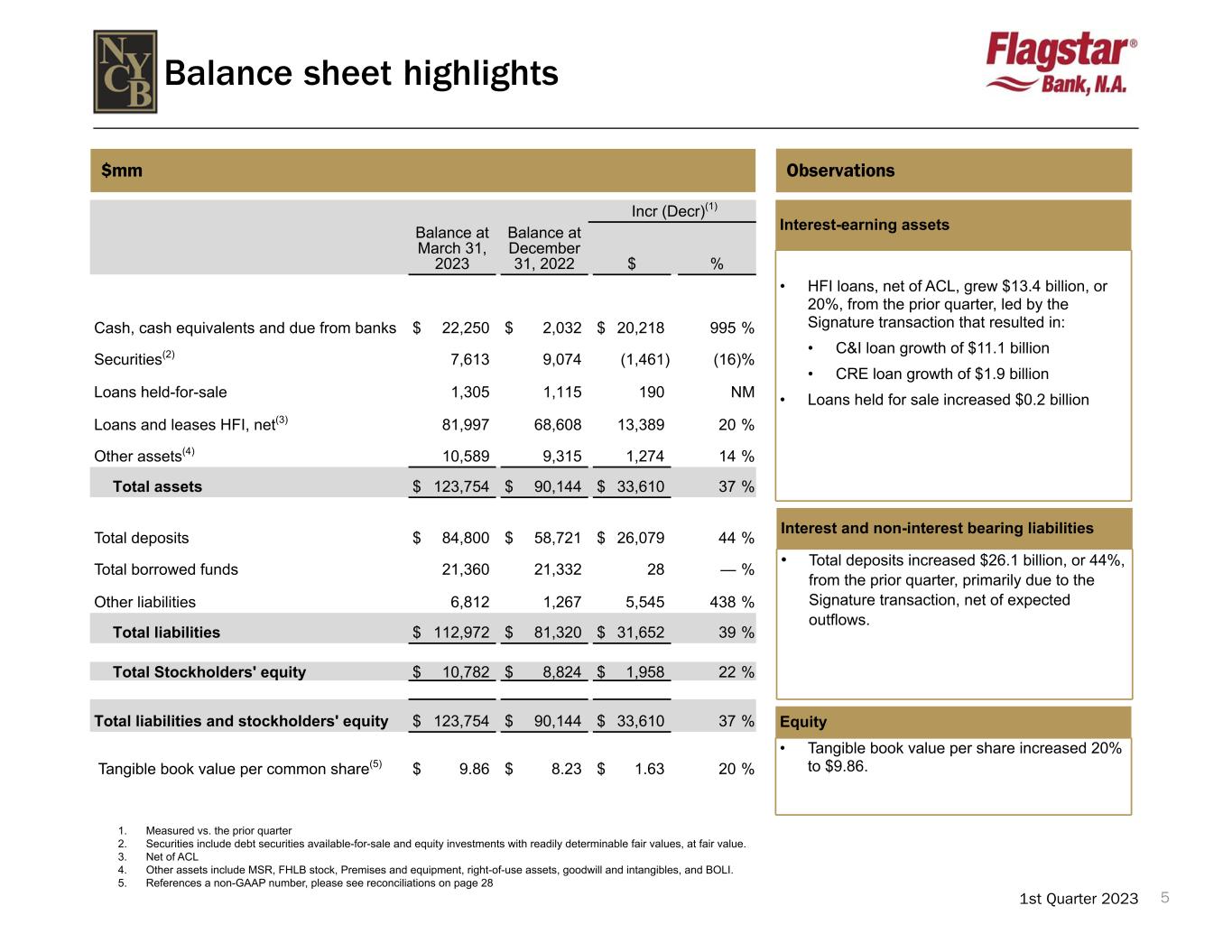

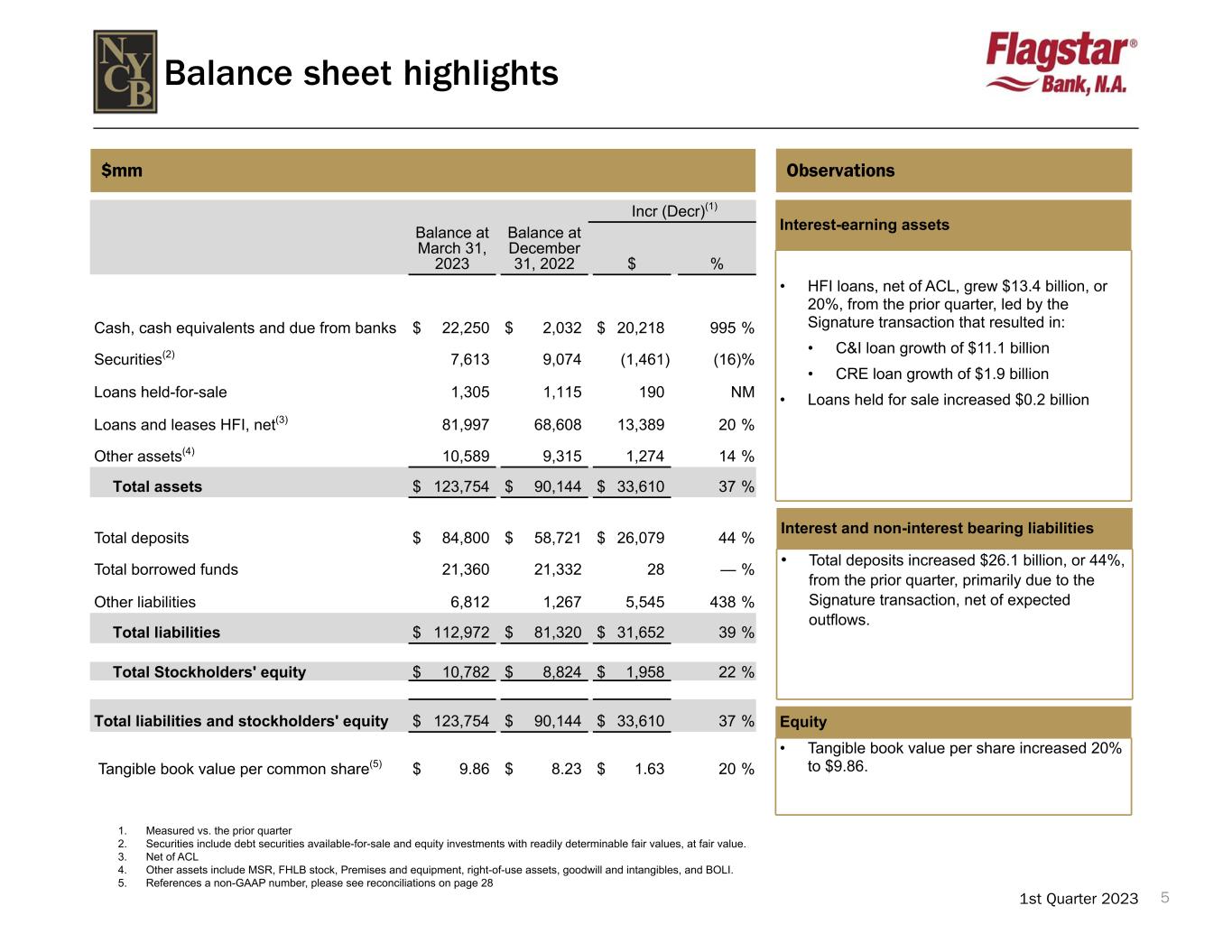

51st Quarter 2023 $mm Observations Balance sheet highlights Incr (Decr)(1) Balance at March 31, 2023 Balance at December 31, 2022 $ % Cash, cash equivalents and due from banks $ 22,250 $ 2,032 $ 20,218 995 % Securities(2) 7,613 9,074 (1,461) (16) % Loans held-for-sale 1,305 1,115 190 NM Loans and leases HFI, net(3) 81,997 68,608 13,389 20 % Other assets(4) 10,589 9,315 1,274 14 % Total assets $ 123,754 $ 90,144 $ 33,610 37 % Total deposits $ 84,800 $ 58,721 $ 26,079 44 % Total borrowed funds 21,360 21,332 28 — % Other liabilities 6,812 1,267 5,545 438 % Total liabilities $ 112,972 $ 81,320 $ 31,652 39 % Total Stockholders' equity $ 10,782 $ 8,824 $ 1,958 22 % Total liabilities and stockholders' equity $ 123,754 $ 90,144 $ 33,610 37 % Tangible book value per common share(5) $ 9.86 $ 8.23 $ 1.63 20 % 1. Measured vs. the prior quarter 2. Securities include debt securities available-for-sale and equity investments with readily determinable fair values, at fair value. 3. Net of ACL 4. Other assets include MSR, FHLB stock, Premises and equipment, right-of-use assets, goodwill and intangibles, and BOLI. 5. References a non-GAAP number, please see reconciliations on page 28 Interest and non-interest bearing liabilities • Total deposits increased $26.1 billion, or 44%, from the prior quarter, primarily due to the Signature transaction, net of expected outflows. Equity • Tangible book value per share increased 20% to $9.86. Interest-earning assets • HFI loans, net of ACL, grew $13.4 billion, or 20%, from the prior quarter, led by the Signature transaction that resulted in: • C&I loan growth of $11.1 billion • CRE loan growth of $1.9 billion • Loans held for sale increased $0.2 billion

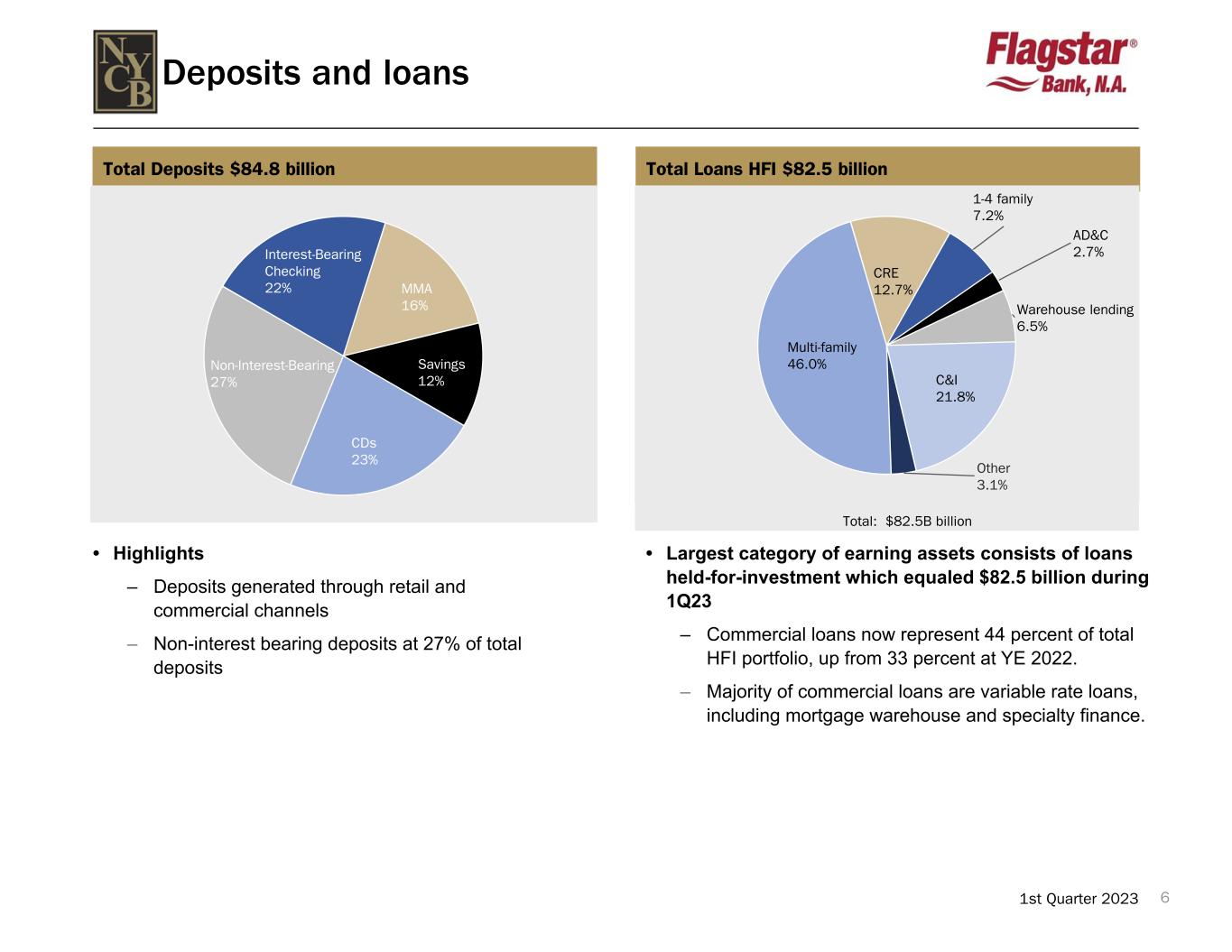

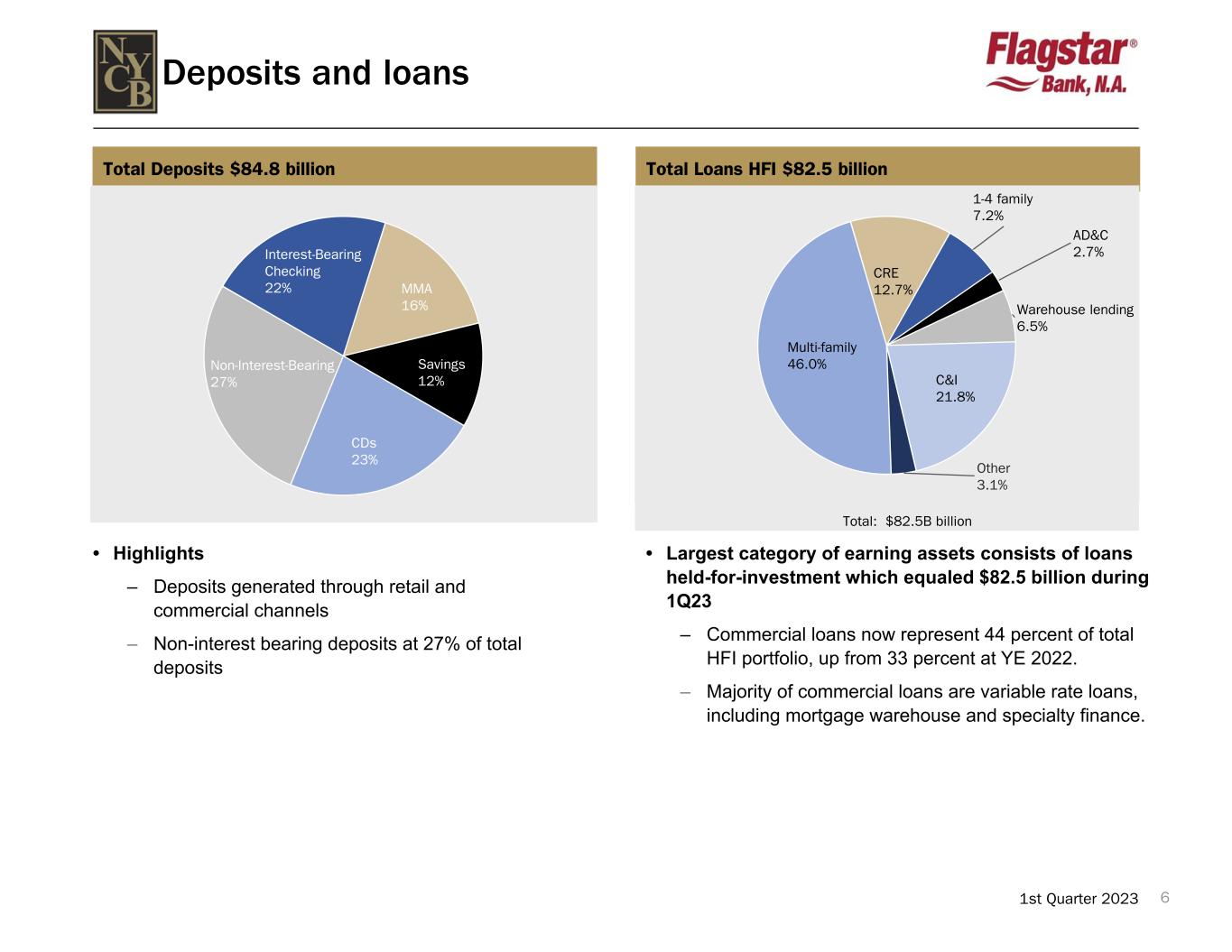

61st Quarter 2023 Deposits and loans • Highlights – Deposits generated through retail and commercial channels – Non-interest bearing deposits at 27% of total deposits Total Deposits $84.8 billion Total Loans HFI $82.5 billion • Largest category of earning assets consists of loans held-for-investment which equaled $82.5 billion during 1Q23 – Commercial loans now represent 44 percent of total HFI portfolio, up from 33 percent at YE 2022. – Majority of commercial loans are variable rate loans, including mortgage warehouse and specialty finance. Interest-Bearing Checking 22% MMA 16% Savings 12% CDs 23% Non-Interest-Bearing 27% Total: $82.5B billion Multi-family 46.0% CRE 12.7% 1-4 family 7.2% AD&C 2.7% Warehouse lending 6.5% C&I 21.8% Other 3.1%

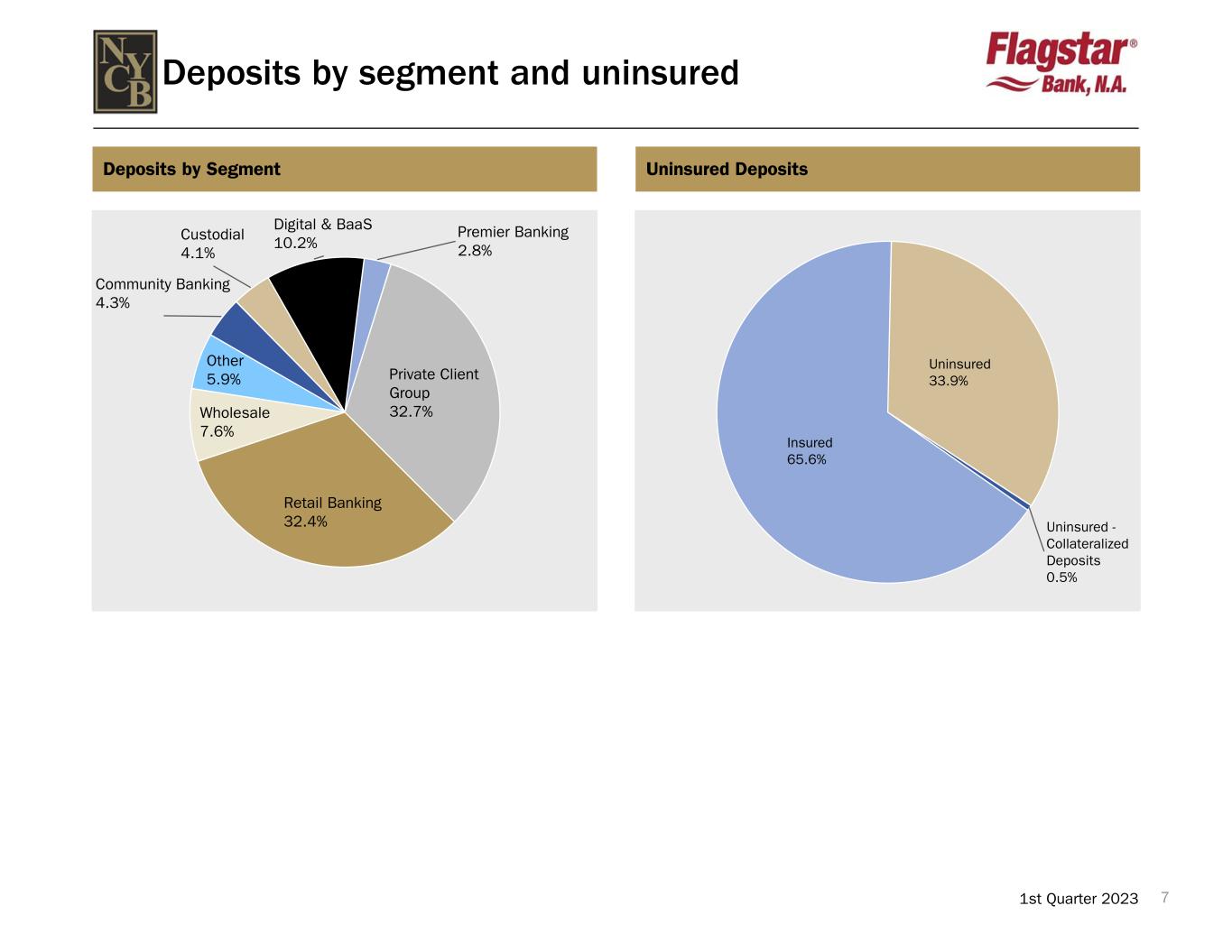

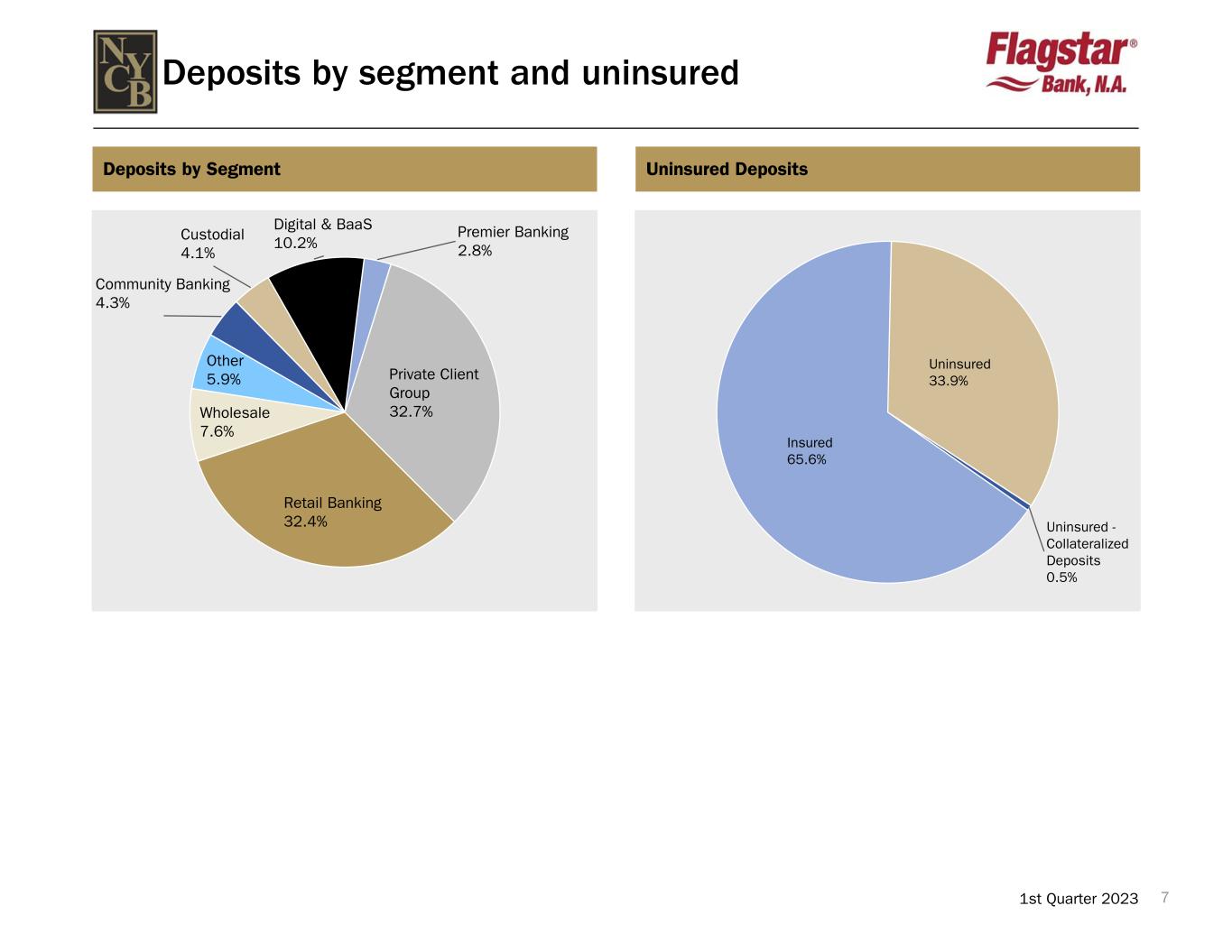

71st Quarter 2023 Deposits by segment and uninsured Deposits by Segment Uninsured Deposits Community Banking 4.3% Custodial 4.1% Digital & BaaS 10.2% Premier Banking 2.8% Private Client Group 32.7% Retail Banking 32.4% Wholesale 7.6% Other 5.9% Insured 65.6% Uninsured 33.9% Uninsured - Collateralized Deposits 0.5%

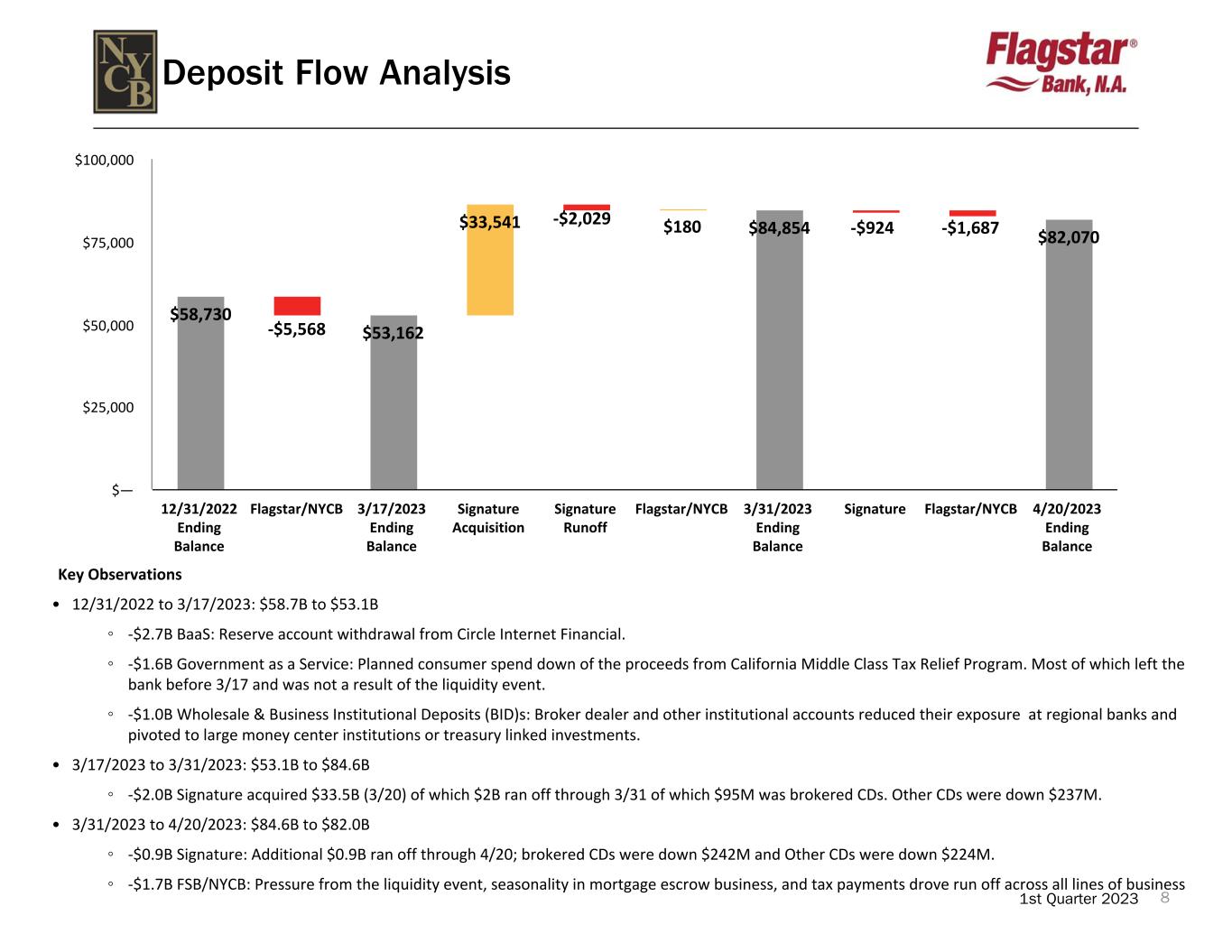

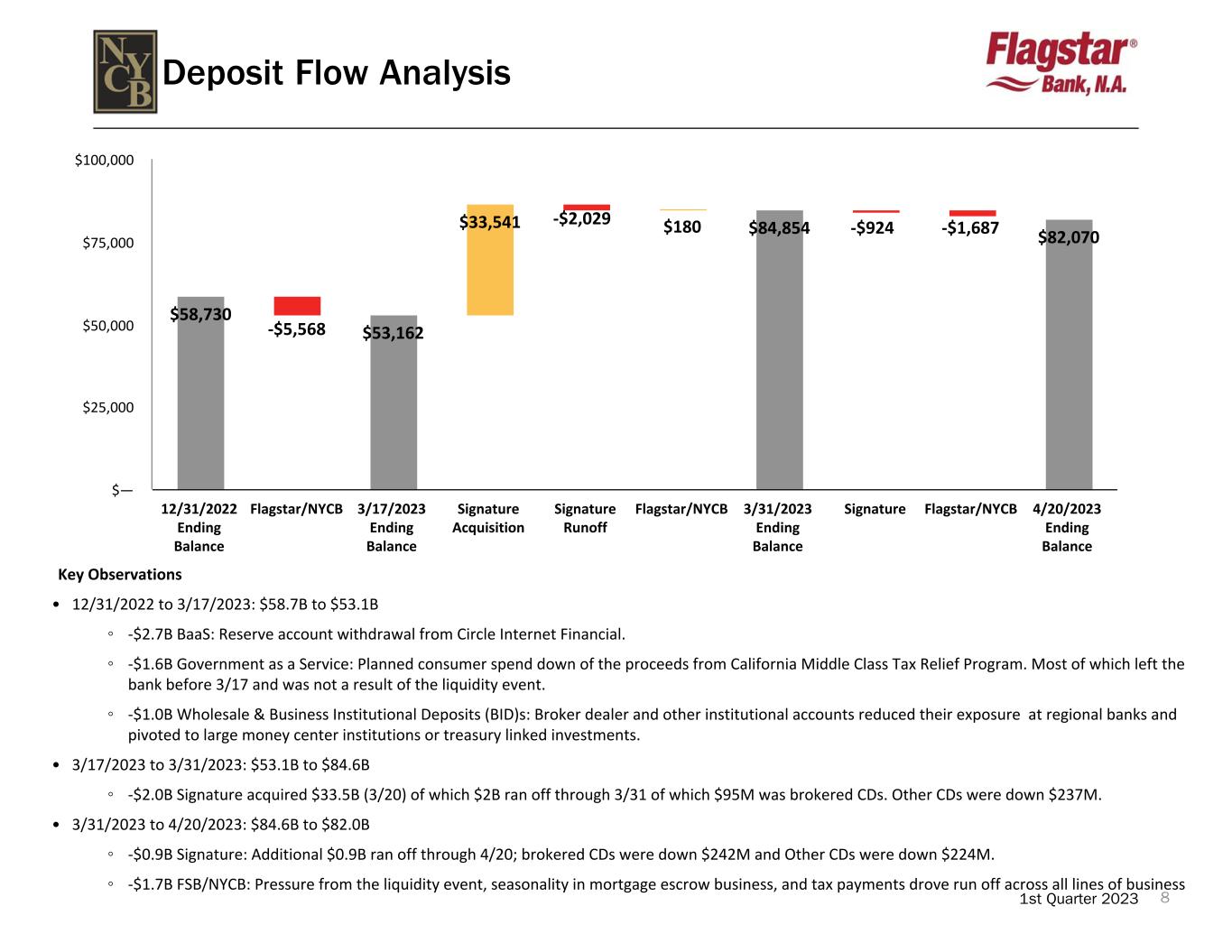

81st Quarter 2023 Deposit Flow Analysis Key Observations • 12/31/2022 to 3/17/2023: $58.7B to $53.1B ◦ -$2.7B BaaS: Reserve account withdrawal from Circle Internet Financial. ◦ -$1.6B Government as a Service: Planned consumer spend down of the proceeds from California Middle Class Tax Relief Program. Most of which left the bank before 3/17 and was not a result of the liquidity event. ◦ -$1.0B Wholesale & Business Institutional Deposits (BID)s: Broker dealer and other institutional accounts reduced their exposure at regional banks and pivoted to large money center institutions or treasury linked investments. • 3/17/2023 to 3/31/2023: $53.1B to $84.6B ◦ -$2.0B Signature acquired $33.5B (3/20) of which $2B ran off through 3/31 of which $95M was brokered CDs. Other CDs were down $237M. • 3/31/2023 to 4/20/2023: $84.6B to $82.0B ◦ -$0.9B Signature: Additional $0.9B ran off through 4/20; brokered CDs were down $242M and Other CDs were down $224M. ◦ -$1.7B FSB/NYCB: Pressure from the liquidity event, seasonality in mortgage escrow business, and tax payments drove run off across all lines of business $58,730 $53,162 $84,854 $82,070 $33,541 $180 12/31/2022 Ending Balance Flagstar/NYCB 3/17/2023 Ending Balance Signature Acquisition Signature Runoff Flagstar/NYCB 3/31/2023 Ending Balance Signature Flagstar/NYCB 4/20/2023 Ending Balance $— $25,000 $50,000 $75,000 $100,000 -$2,029 -$5,568 -$924 -$1,687

91st Quarter 2023 Liquidity Profile Cash - Federal Reserve 53.3% Unpledged Securities 16.8% Fed Funds Borrowing Capacity 5.5% FHLB Capacity 24.4% The Bank's $42.2 billion of total ready liquidity reflects a significant amount of liquid assets and sufficient sources of readily-available funds that can be accessed to meet its obligations and unanticipated needs as they arise. Ready Liquidity - $42.2 billion Cash - Federal Reserve - $22.5b Unpledged Securities - $7.1b Fed Funds Borrowing Capacity - $2.3b FHLB Capacity - $10.3b

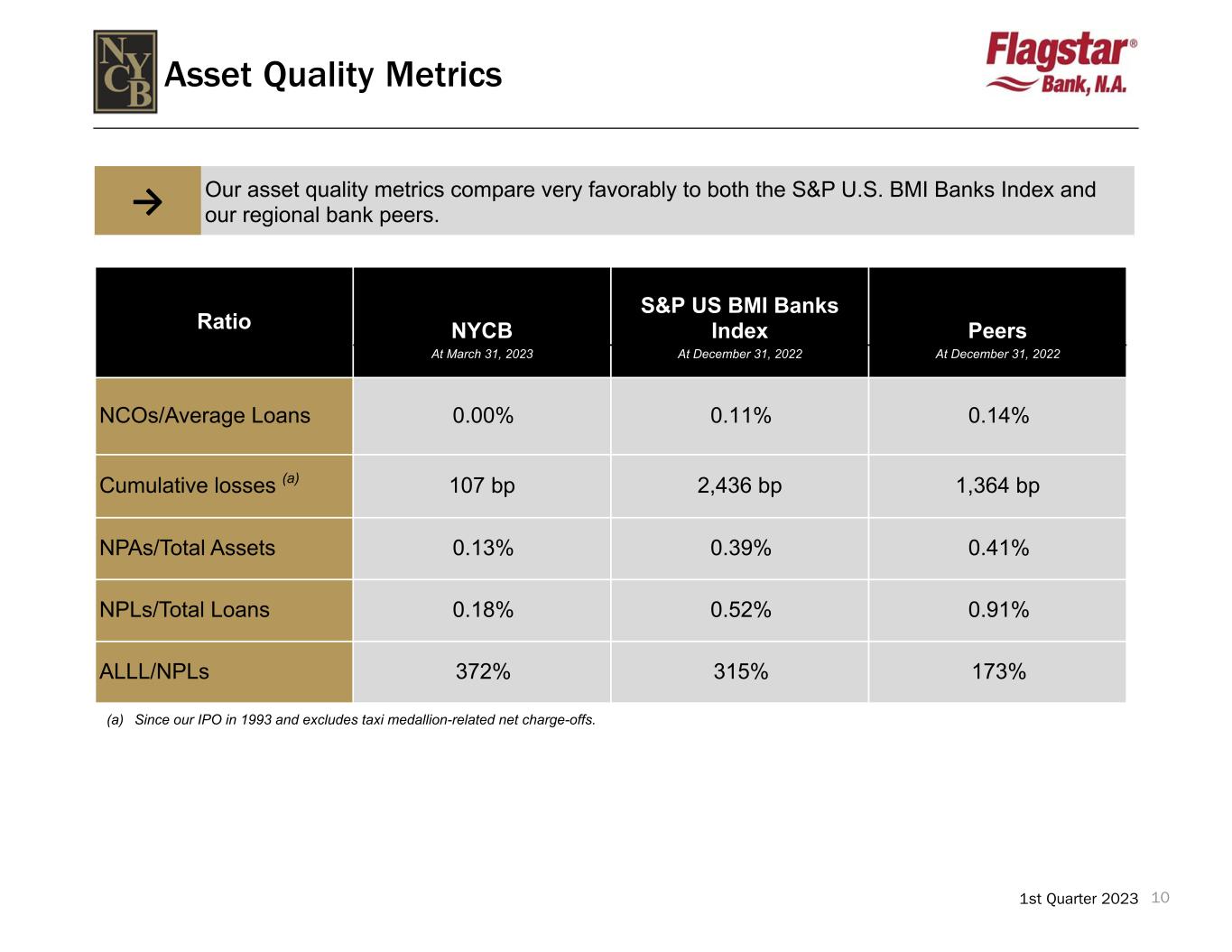

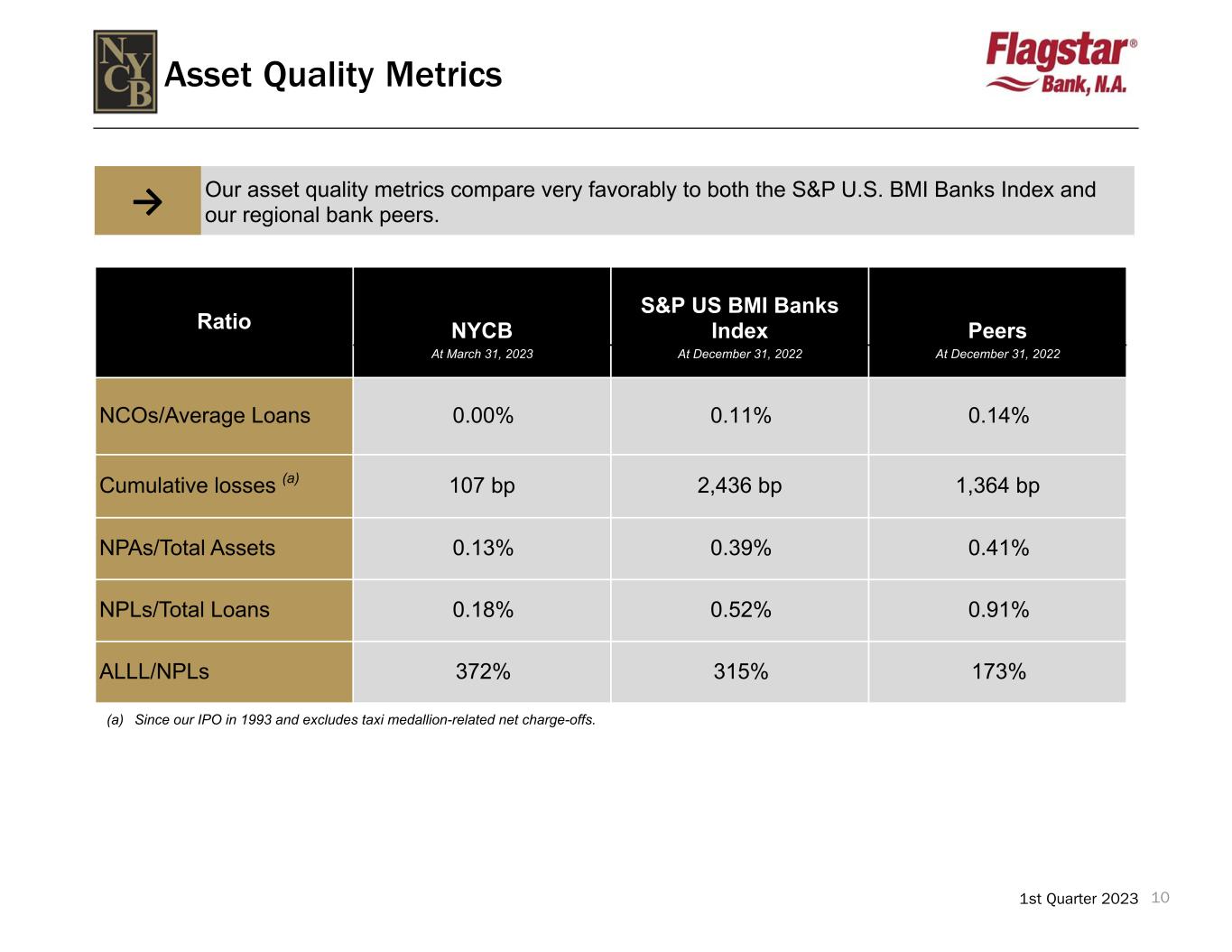

101st Quarter 2023 Asset Quality Metrics Ratio NYCB S&P US BMI Banks Index Peers At March 31, 2023 At December 31, 2022 At December 31, 2022 NCOs/Average Loans 0.00% 0.11% 0.14% Cumulative losses (a) 107 bp 2,436 bp 1,364 bp NPAs/Total Assets 0.13% 0.39% 0.41% NPLs/Total Loans 0.18% 0.52% 0.91% ALLL/NPLs 372% 315% 173% → Our asset quality metrics compare very favorably to both the S&P U.S. BMI Banks Index and our regional bank peers. (a) Since our IPO in 1993 and excludes taxi medallion-related net charge-offs.

111st Quarter 2023 Regulatory Capital Ratio NYCB S&P US BMI Banks Index Peers At March 31, 2023 At December 31, 2022 At December 31, 2022 Total Risk-Based Capital 11.59% 14.35% 12.59% Tier 1 Risk-Based Capital 9.87 12.32 10.66 Common Equity Tier 1 9.29 11.65 9.76 Tier 1 Leverage 9.18 9.58 8.72 → • We remain well capitalized and well above the minimum thresholds for all applicable ratios • Our ratios decreased as compared to the prior quarter due to the impact from the Flagstar acquisition

121st Quarter 2023 (a) Non-performing loans and total loans exclude covered loans and non-covered purchased credit-impaired (“PCI”) loans. (b) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. Our non-performing loans at 12/31/16, 12/31/17, 12/31/18, 12/31/19, 12/31/20, 12/31/21, and 12/31/22 exclude taxi medallion-related loans. Credit Quality Non-Performing Loans /Total Loans 0.78% 0.84% 0.55% 0.42% 0.19% 0.25% 0.33% 0.30% 0.33% 0.21% 0.16% 0.11% 0.11% 0.51% 2.47% 2.63% 1.28% 0.96% 0.35% 0.23% 0.13% 0.11% 0.07% 0.03% 0.07% 0.04% 0.06% 0.20% 0.18% 1.06% 0.85% 0.70% 0.63% 0.64% 0.83% 1.06% 1.11% 0.80% 0.52% 0.43% 0.60% 1.23% 2.36% 4.79% 4.69% 4.14% 3.57% 2.90% 2.26% 1.80% 1.61% 1.36% 0.85% 0.81% 0.95% 0.69% 0.52% 0.52% NYCB S&P U.S. BMI Banks Index 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Average NPLs/Total Loans NYCB: 0.45% S&P U.S. BMI Banks Index: 1.57% (a)(b) (a) Our asset quality over various credit cycles has consistently been better than our industry peers

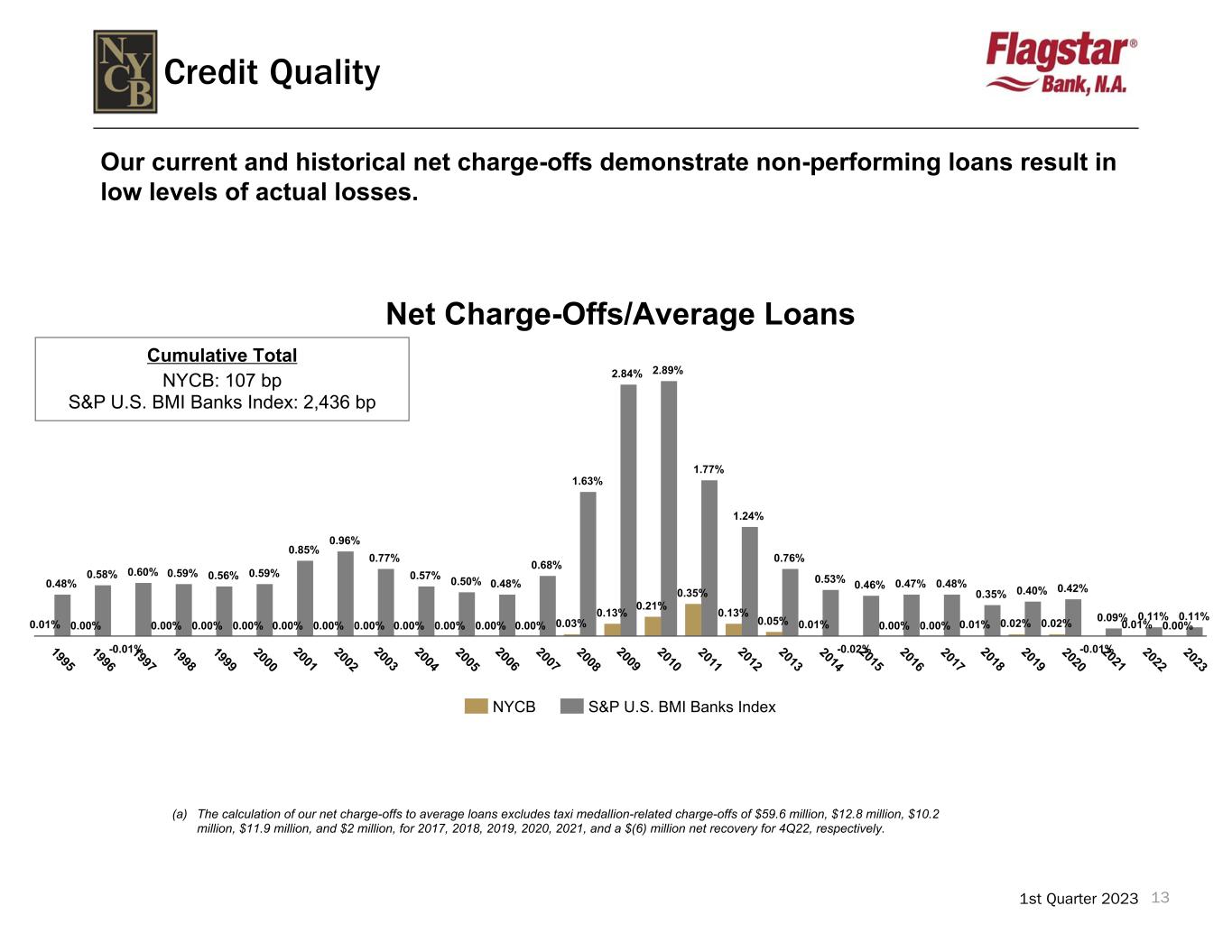

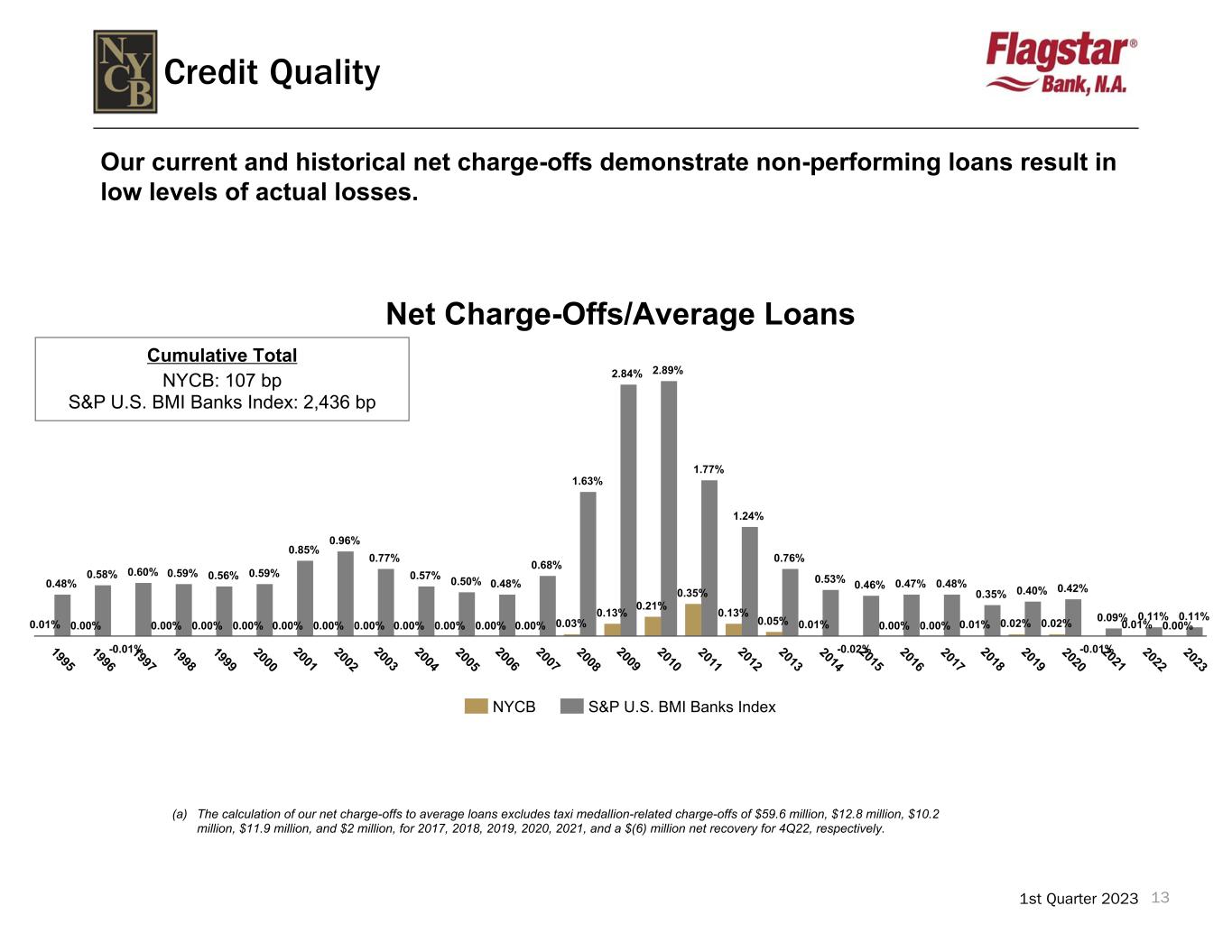

131st Quarter 2023 Credit Quality (a) The calculation of our net charge-offs to average loans excludes taxi medallion-related charge-offs of $59.6 million, $12.8 million, $10.2 million, $11.9 million, and $2 million, for 2017, 2018, 2019, 2020, 2021, and a $(6) million net recovery for 4Q22, respectively. Net Charge-Offs/Average Loans 0.01% 0.00% -0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.03% 0.13% 0.21% 0.35% 0.13% 0.05% 0.01% -0.02% 0.00% 0.00% 0.01% 0.02% 0.02% -0.01% 0.01% 0.00% 0.48% 0.58% 0.60% 0.59% 0.56% 0.59% 0.85% 0.96% 0.77% 0.57% 0.50% 0.48% 0.68% 1.63% 2.84% 2.89% 1.77% 1.24% 0.76% 0.53% 0.46% 0.47% 0.48% 0.35% 0.40% 0.42% 0.09% 0.11% 0.11% NYCB S&P U.S. BMI Banks Index 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Cumulative Total NYCB: 107 bp S&P U.S. BMI Banks Index: 2,436 bp Our current and historical net charge-offs demonstrate non-performing loans result in low levels of actual losses.

141st Quarter 2023 Community banking • Flagstar Bank, N.A. is a leading regional bank with a balanced, diversified lending platform • 435 branches nationally • Second-largest multi-family portfolio lender in the country and the leading multi-family portfolio lender in the New York City • Second largest mortgage warehouse lender nationally based on total commitments. Mortgage origination and servicing • 8th largest bank originator of residential mortgages ($24.2 billion year-to-date March 31, 2023)(1) • Scalable platform originating business in all channels and all 50 states • 6th largest sub-servicer of mortgage loans nationwide, servicing 1.5 million loans as of March 31, 2023 Corporate Overview • $124 billion in total assets • $82 billion in loans • $85 billion in total deposits • Market capitalization of $6.6 billion Company Overview l 435 Branches 1. Includes historical Flagstar originations prior to the business combination

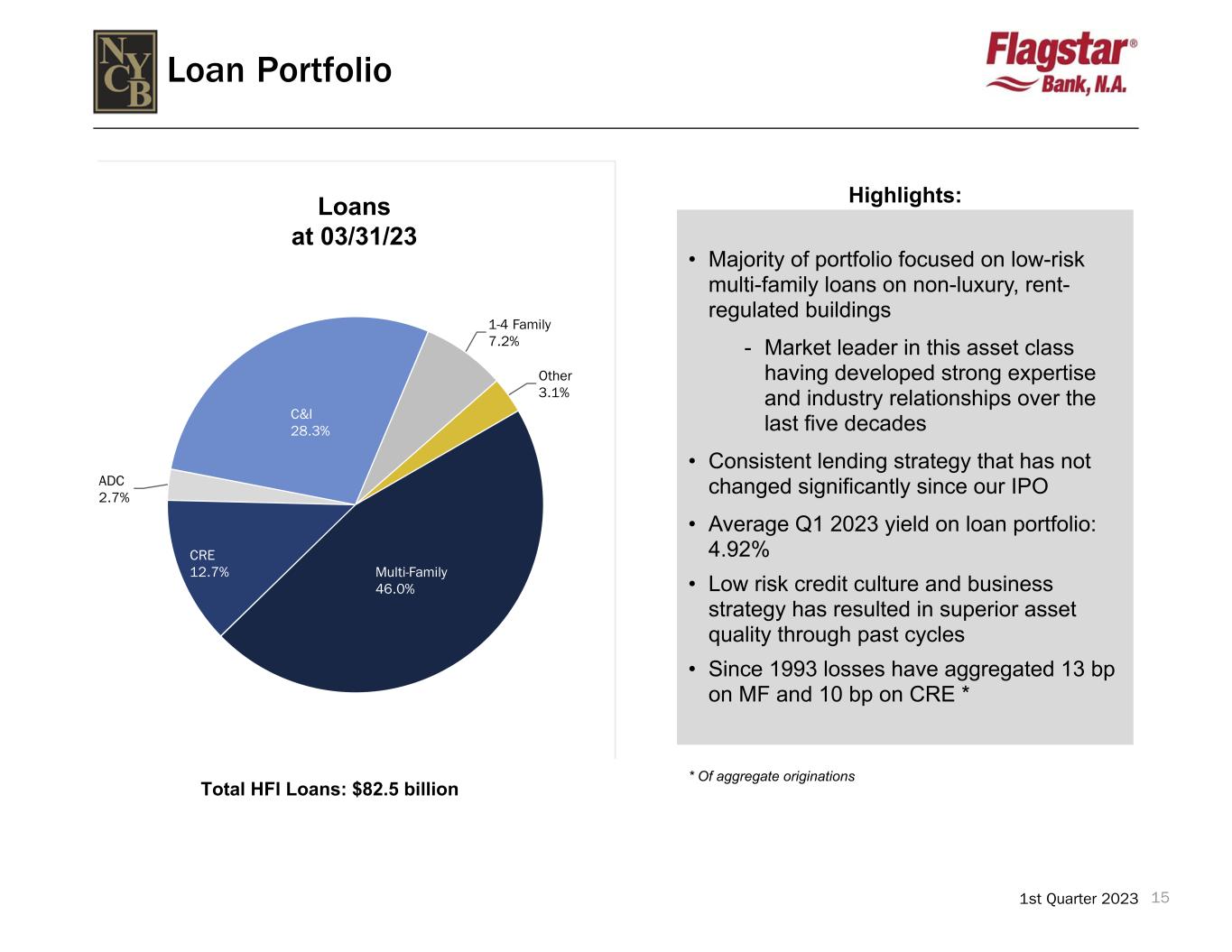

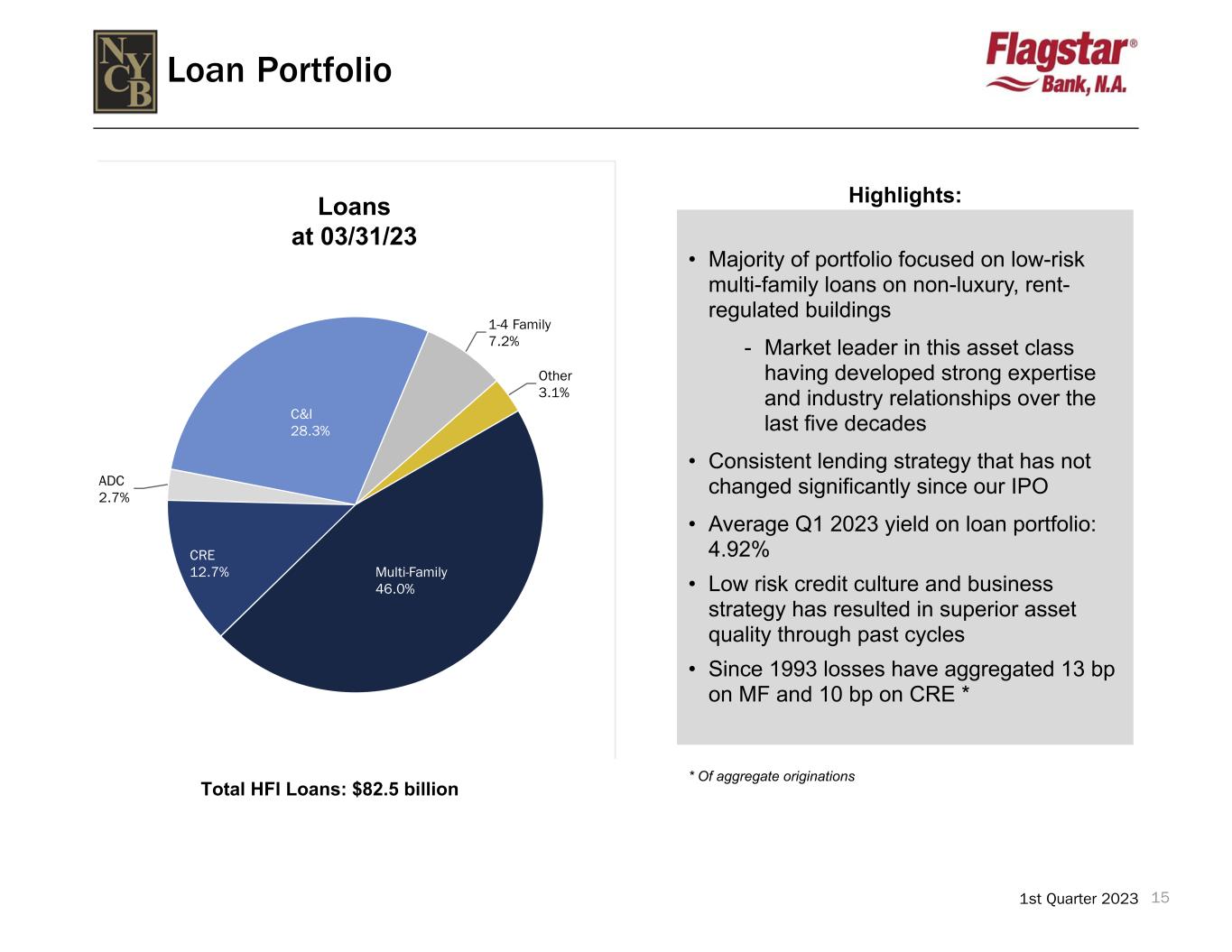

151st Quarter 2023 Total HFI Loans: $82.5 billion Loan Portfolio • Majority of portfolio focused on low-risk multi-family loans on non-luxury, rent- regulated buildings - Market leader in this asset class having developed strong expertise and industry relationships over the last five decades • Consistent lending strategy that has not changed significantly since our IPO • Average Q1 2023 yield on loan portfolio: 4.92% • Low risk credit culture and business strategy has resulted in superior asset quality through past cycles • Since 1993 losses have aggregated 13 bp on MF and 10 bp on CRE * Highlights: * Of aggregate originations Loans at 03/31/23 Multi-Family 46.0% CRE 12.7% ADC 2.7% C&I 28.3% 1-4 Family 7.2% Other 3.1%

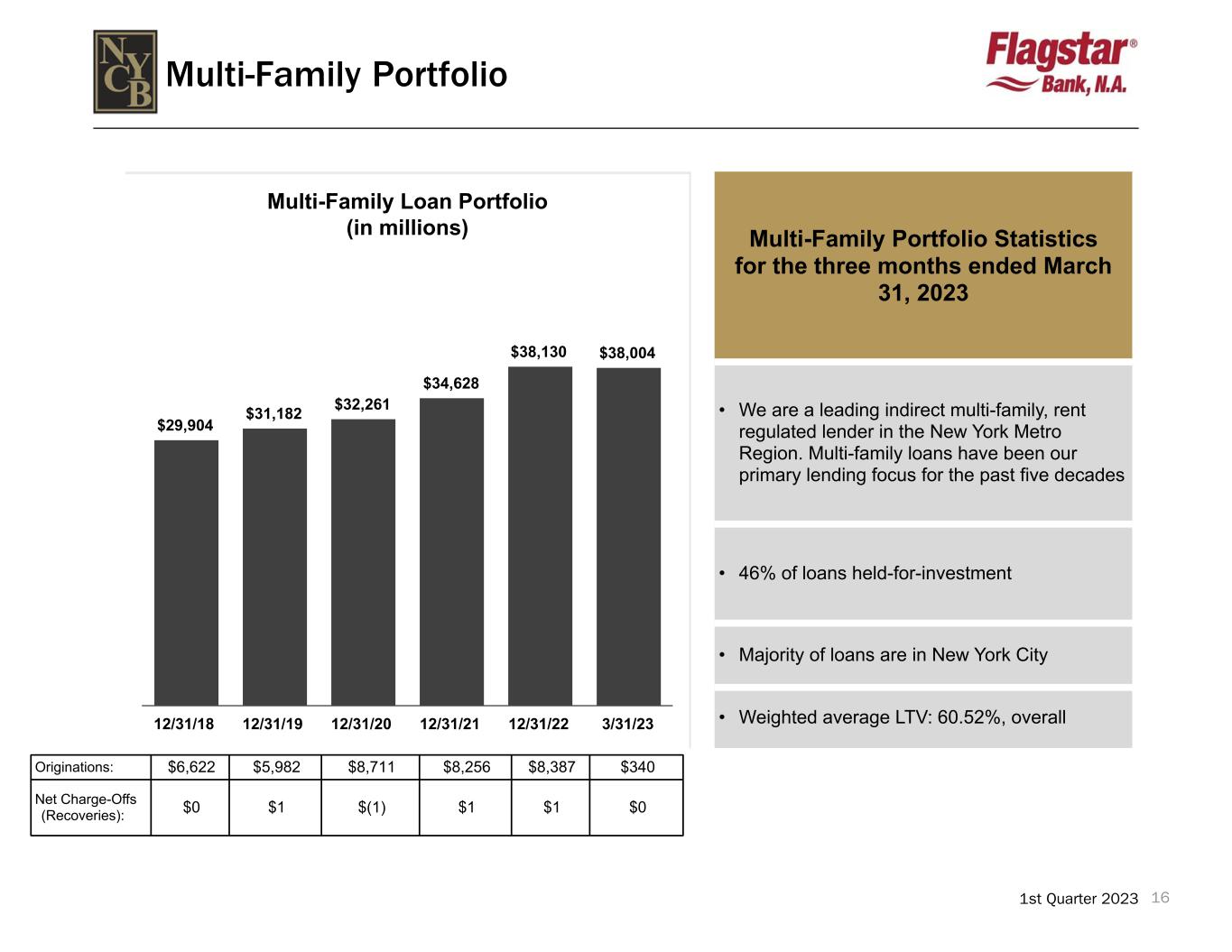

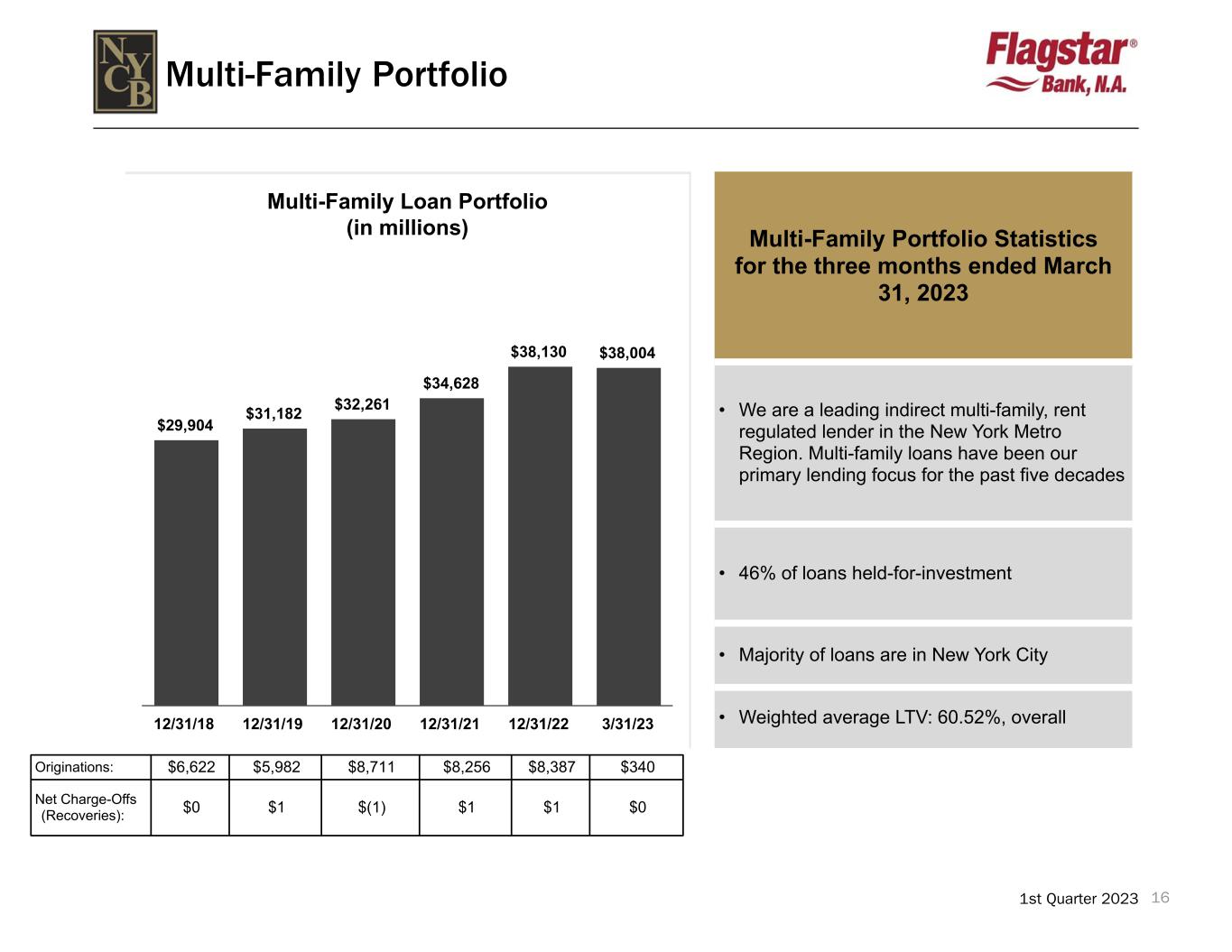

161st Quarter 2023 Multi-Family Portfolio Statistics for the three months ended March 31, 2023 • We are a leading indirect multi-family, rent regulated lender in the New York Metro Region. Multi-family loans have been our primary lending focus for the past five decades • 46% of loans held-for-investment • Majority of loans are in New York City • Weighted average LTV: 60.52%, overall Originations: $6,622 $5,982 $8,711 $8,256 $8,387 $340 Net Charge-Offs (Recoveries): $0 $1 $(1) $1 $1 $0 Multi-Family Portfolio Multi-Family Loan Portfolio (in millions) $29,904 $31,182 $32,261 $34,628 $38,130 $38,004 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23

171st Quarter 2023 • Diversified property types which are primarily income- producing in the normal course of business • Focused on experienced top-tier developers with significant deposit and non-credit product opportunities Commercial Real Estate and ADC ($bn) Commercial real estate & ADC Portfolio Characteristics State Breakdown (by collateral location) Property Breakdown Collateral Type NBV Office $ 3.4 Retail $ 2.1 Owner-occupied Signature $ 1.9 ADC $ 1.8 Homebuilder $ 1.3 Other $ 1.3 Industrial $ 0.8 Total CRE & ADC $ 12.6 New York 38.7% Michigan 9.4% New Jersey 4.9% Florida 4.6% Pennsylvania 2.6% Texas 2.2% Ohio 1.9% All other states 35.8% Office 27% Retail 16% Homebuilder 11% Industrial 6% ADC 14% Other 11%Owner-occupied Signature 15%

181st Quarter 2023 Office Portfolio Characteristics Portfolio Profile Portfolio by location Manhattan - NY 55% Queens - NY; 7% Michigan; 6% Pennsylvania; 5% New Jersey; 5% Nassau County-NY; 4% DC; 3% Suffolk County-NY; 3% Other; 12% UPB by option/contractual maturity year ($MM) $286 $432 $496 $829 $694 $327 $281 $47 2023 2024 2025 2026 2027 2028 2029 2030+ Total Portfolio: $3.4 Billion Percent of Portfolio Multi-tenanted 90% Percent Medical Office 16% Weighted Average DSCR: 1.73x Weighted Average LTV: 56% Average Balance: $11.0 million Weighted Average Coupon: 4.62% Highlights • Primarily Class A and B • No Delinquencies or Non-performing loans as of 3/31/23 • No recent charge-offs

191st Quarter 2023 Home builder loan commitments(1) ($mm) ● National relationship-based lending platform launched in 1Q16 - Attractive asset class with good spreads (~375 bps) - Meaningful cross-sell opportunities including warehouse loans, commercial deposits and purchase originations ● Flagstar is well positioned - Focused on markets with strong housing fundamentals and higher growth potential - We do business with approximately 70 percent of the top 100 builders nationwide Home builder finance footprint Overview Tightening housing supply 1. Commitments are for loans classified as commercial real estate and commercial & industrial. $3,774 $4,107 $1,687 $1,808 $2,087 $2,299 Unpaid principal balance Unused 12/31/2022 03/31/23 Existing home sales (mm) Months supply of existing homes for sale 20 00 20 01 20 02 20 03 20 04 20 05 20 07 20 08 20 09 20 10 20 11 20 12 20 14 20 15 20 16 20 17 20 18 20 19 20 21 20 22 0 1 2 3 4 5 6 7 8 0 2 4 6 8 10 12 Source: Bloomberg (through 9/30/22) Homebuilder Finance

201st Quarter 2023 Commercial & Industrial ($bn) Commercial and Industrial Portfolio Portfolio Characteristics State Breakdown • Lines of credit and term loans for working capital needs, equipment purchases, and expansion projects • Primarily floating rate Industry Breakdown NBV Warehouse/MSR $ 6.9 Financial & Insurance 5.1 Specialty Finance 4.8 Services 2.5 Manufacturing 1.7 Rental & Leasing 1.5 Other 1.2 Total C&I $ 23.7 TX 7% NY 6% CA 6% FL 6% MI 4% NJ 4% SC 3%OH 2% OTHER 62% Specialty Finance 20% Warehouse/MSR 29% Financial & Insurance 22% Services 11% Rental & Leasing 6% Manufacturing 7% Other 5%

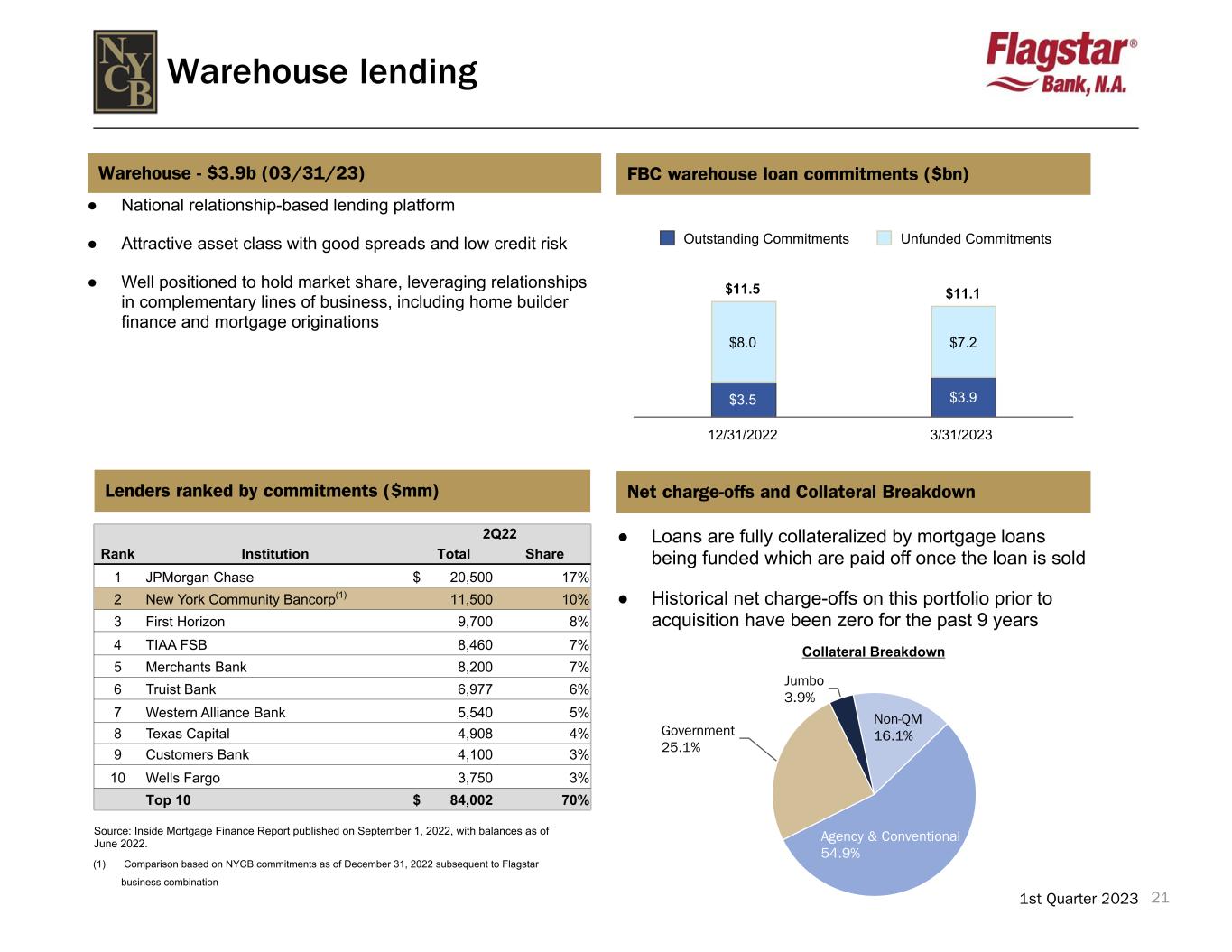

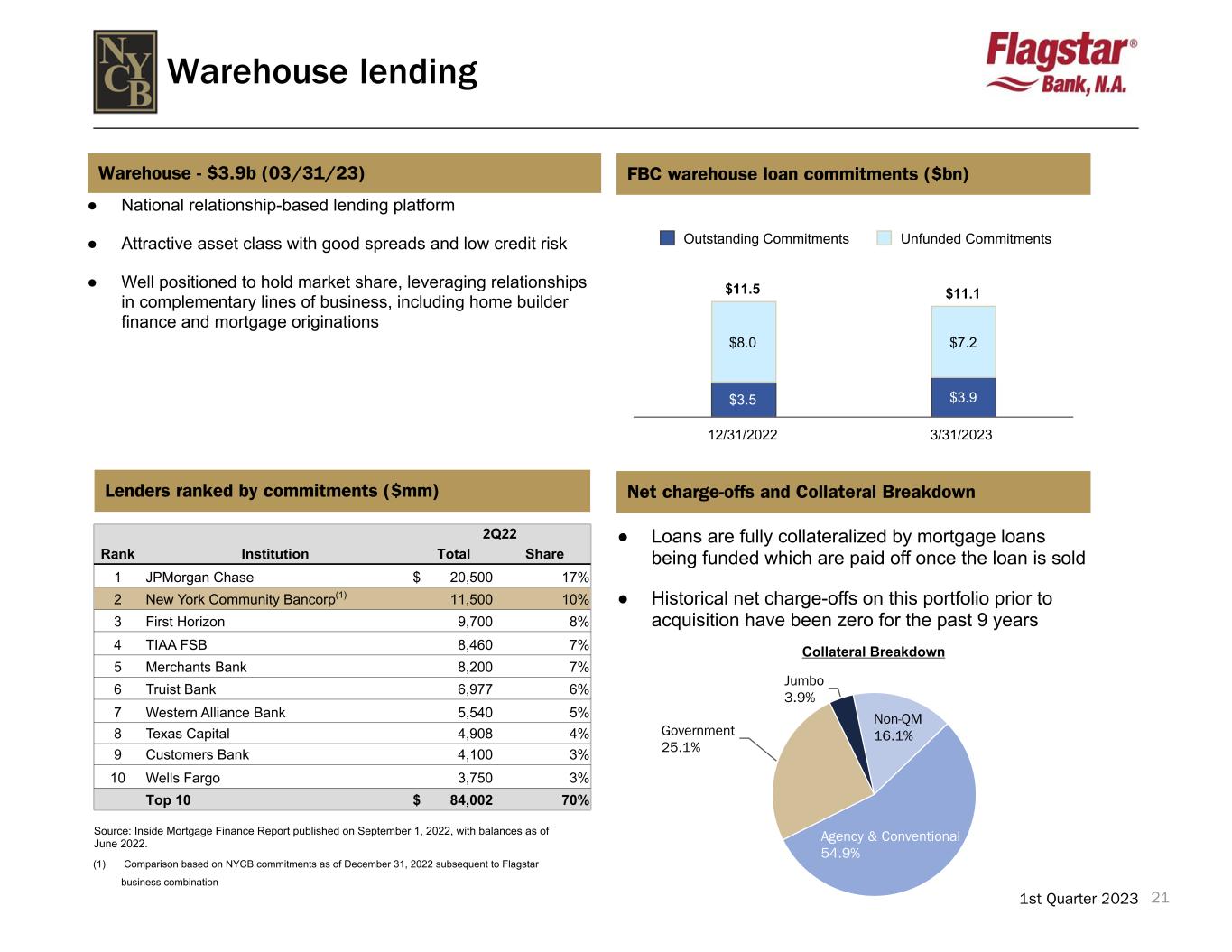

211st Quarter 2023 FBC warehouse loan commitments ($bn) Warehouse lending Lenders ranked by commitments ($mm) Source: Inside Mortgage Finance Report published on September 1, 2022, with balances as of June 2022. ● National relationship-based lending platform ● Attractive asset class with good spreads and low credit risk ● Well positioned to hold market share, leveraging relationships in complementary lines of business, including home builder finance and mortgage originations Net charge-offs and Collateral Breakdown 6 bps annual loss rate since 2006 $11.5 $11.1 $3.5 $3.9 $8.0 $7.2 Outstanding Commitments Unfunded Commitments 12/31/2022 3/31/2023 2Q22 Rank Institution Total Share 1 JPMorgan Chase $ 20,500 17 % 2 New York Community Bancorp(1) 11,500 10 % 3 First Horizon 9,700 8 % 4 TIAA FSB 8,460 7 % 5 Merchants Bank 8,200 7 % 6 Truist Bank 6,977 6 % 7 Western Alliance Bank 5,540 5 % 8 Texas Capital 4,908 4 % 9 Customers Bank 4,100 3 % 10 Wells Fargo 3,750 3 % Top 10 $ 84,002 70 % ● Loans are fully collateralized by mortgage loans being funded which are paid off once the loan is sold ● Historical net charge-offs on this portfolio prior to acquisition have been zero for the past 9 years Collateral Breakdown Agency & Conventional 54.9% Government 25.1% Jumbo 3.9% Non-QM 16.1% Warehouse - $3.9b (03/31/23) (1) Comparison based on NYCB commitments as of December 31, 2022 subsequent to Flagstar business combination

Appendix

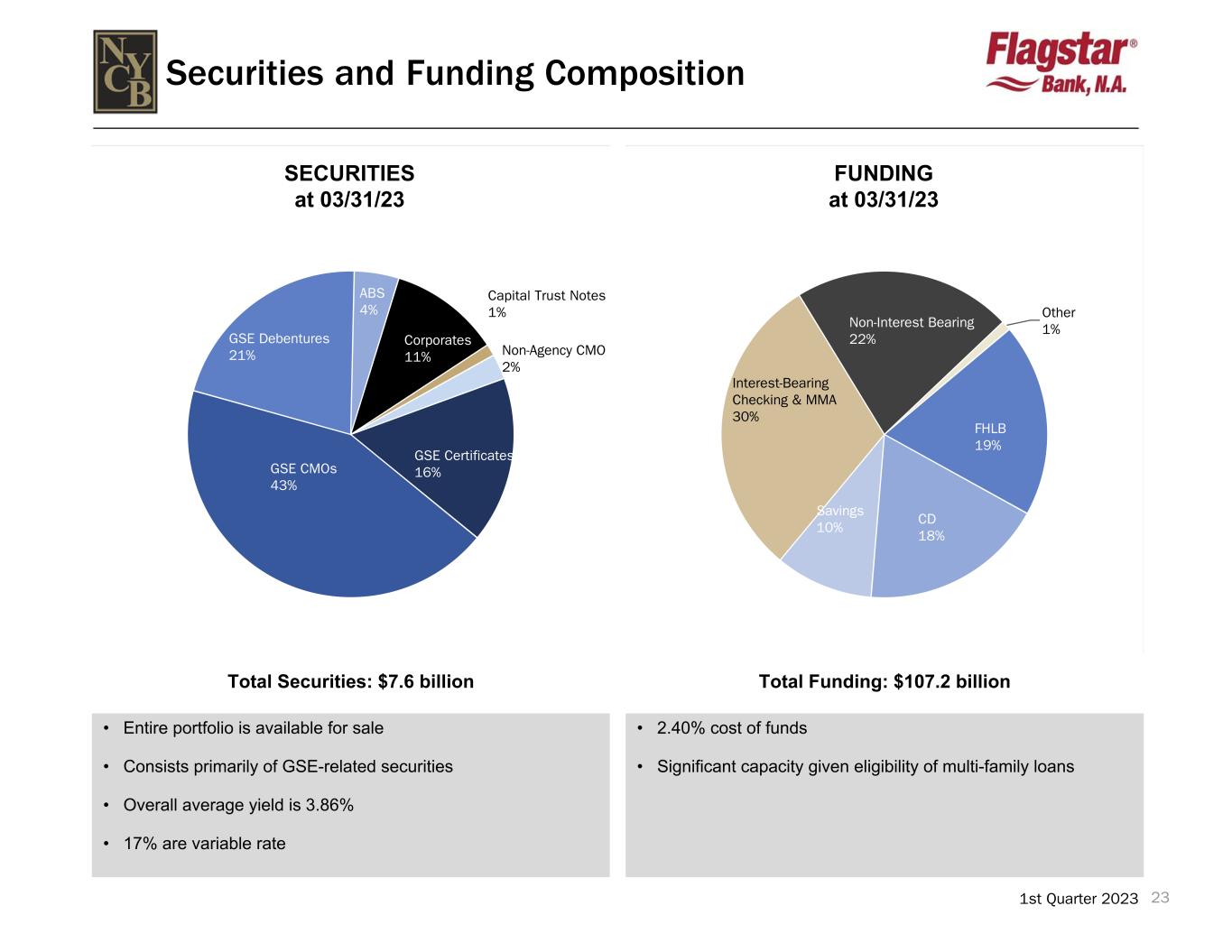

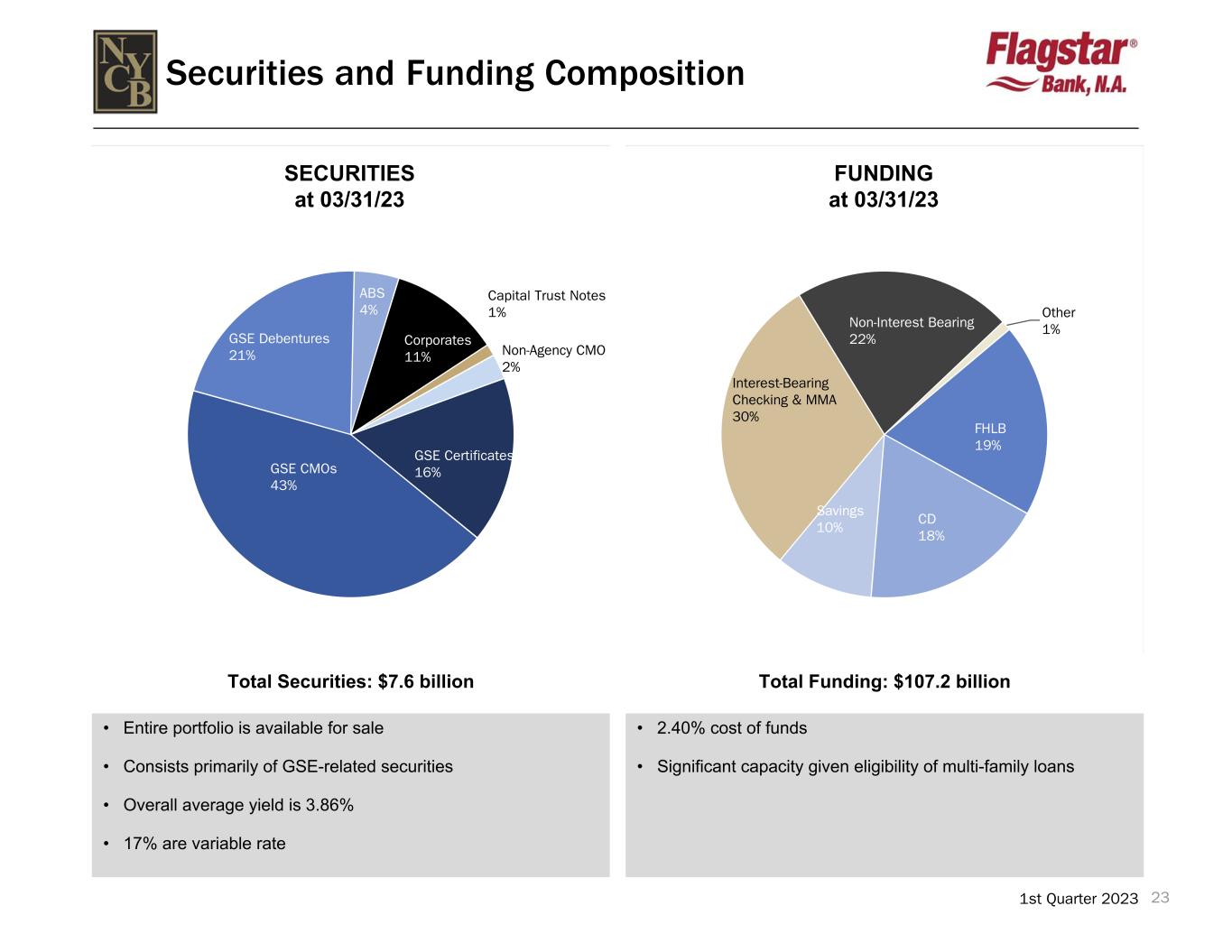

231st Quarter 2023 Securities and Funding Composition • 2.40% cost of funds • Significant capacity given eligibility of multi-family loans Total Funding: $107.2 billion • Entire portfolio is available for sale • Consists primarily of GSE-related securities • Overall average yield is 3.86% • 17% are variable rate Total Securities: $7.6 billion SECURITIES at 03/31/23 GSE Certificates 16%GSE CMOs 43% GSE Debentures 21% ABS 4% Corporates 11% Capital Trust Notes 1% Non-Agency CMO 2% FUNDING at 03/31/23 FHLB 19% CD 18% Savings 10% Interest-Bearing Checking & MMA 30% Non-Interest Bearing 22% Other 1%

241st Quarter 2023 Closings by mortgage type ($bn) Net gain on loan sales – revenue and margin Fallout-adjusted locks by channel ($bn) Closings by purpose and expense ratio ($bn) Mortgage banking $5 $20 0.56% 0.76% Gain on loan sale ($mm) Gain on sale margin (HFS) December 2022 03/31/2023 $0.7 $2.2 0.2 0.70.4 1.0 0.1 0.5 Correspondent Bulk Broker December 2022 03/31/2023 $1.4 $2.4 0.7 1.5 0.4 0.3 0.3 0.6 Conventional Jumbo Government December 2022 03/31/2023 $1,400,000,000.0 $2,400,000,000.0 $1.2 $2.0 $0.2 $0.4 Purchase originations Refinance originations December 2022 03/31/2023 Retail Mix % 82% 85% 17% 17% Purchase Mix %

251st Quarter 2023 154 7 35 Servicing portfolio MSR portfolio characteristics (% UPB) MSR portfolio statistics Net return (loss) on mortgage servicing rights ($mm) By Vintage 2023 2% 2022 25% 2021 32% 2020 25% 2020 & prior 16% By Investor Freddie 24% Fannie 59% GNMA 17% Private 1% Measure ($mm) 12/31/2022 03/31/2023 Unpaid principal balance $71,340 $72,594 Fair value of MSR $1,033 $1,034 Capitalized rate (% of UPB) 1.45 % 1.42 % Note rate 3.69 % 3.78 % Service fee 0.31 % 0.31 % Average Measure ($000) UPB per loan $253 $253 FICO 740 740 Loan to value 70.66 % 69.54 % ($mm) 03/31/2023 Servicing fees, ancilliary income, and late fees $ 56 Decrease in MSR fair value due to pay-offs, pay-downs, run-off, model changes, and other (17) Changes in estimates of fair value due to interest rate risk (19) Gain on MSR derivatives 3 Net transaction costs (1) Net return on the MSR $ 22 MSR at 12/31/2022 $ 1,033 Net return on the MSR 8.45 % Quarter-end loans serviced (000’s) 1,388 1,453 283 288 1,038 1,095 Serviced for Others Subserviced for Others Flagstar Loans HFI 4Q22 1Q23

26 Guidance(1) 1. See cautionary statements on slide 2. Provision for Credit Losses • Q2-23 NIM continues to expand from Q1 '22 levels to a range of 2.70% to 2.80% Non-interest income • Q2-23 Gain on Sale revenue of $20 million to $24 million • Net return on MSR is 8 - 10% Non-interest expense • Full-year 2023 range of $1.3 billion to $1.4 billion, excluding merger-related expenses and intangible amortization and the impact of the Signature transaction. 2023 Guidance • Approximately 23%Tax Rate Net interest income • Provision for credit losses will be impacted by loan growth, charge-offs and the impact from changing macroeconomic conditions

271st Quarter 2023 Peer Group Peer Ticker Citizens Financial CFG Comerica CMA Fifth Third Bancorp FITB First Citizens Bancshares FCNC.A Huntington Bancshares Incorporated HBAN KeyCorp KEY M&T Bank Corporation MTB Regions Financial Corporation RF Synovus Financial Corporation SNV Valley National Bancorp VLY Webster Financial Corporation WBS Western Alliance Bancorporation WAL Zions Bancorporation ZION

281st Quarter 2023 Adjusted net income and diluted earnings per share Three Months Ended March 31, 2023 Three Months Ended December 31, 2022 Three Months Ended March 31, 2022 Net income - GAAP $ 2,006 $ 172 $ 155 Merger-related and restructuring expenses, net of tax (1) 50 48 5 Bargain purchase gain (2,001) (159) — Initial provision for credit losses, net of tax 97 86 — Provision for bond related credit losses, net of tax 15 — — Net income, as adjusted - non-GAAP $ 167 $ 147 $ 160 Preferred stock dividends 8 8 8 Net income available to common stockholders, as adjusted - non-GAAP $ 159 $ 139 $ 152 Diluted earnings per common share - GAAP $ 2.87 $ 0.30 $ 0.31 Diluted earnings per common share, as adjusted - non-GAAP $ 0.23 $ 0.25 $ 0.32 Shares used for diluted common EPS computation 688,271,611 539,723,483 465,946,763 Reconciliations of GAAP and Non-GAAP Measures $mm (1) Certain merger-related items are not taxable or deductible.

291st Quarter 2023 Reconciliations of GAAP and Non-GAAP Measures $mm Non-GAAP Ratio Reconciliations Three months ended March 31, 2023 Three months ended December 31, 2022 Three months ended March 31, 2022 Total Stockholders’ Equity $ 10,782 $ 8,824 $ 6,909 Less: Goodwill and other intangible assets (3,160) (2,713) (2,426) Preferred stock (503) (503) (503) Tangible common stockholders’ equity $ 7,119 $ 5,608 $ 3,980 Total Assets $ 123,754 $ 90,144 $ 61,005 Less: Goodwill and other intangible assets (3,160) (2,713) (2,426) Tangible Assets $ 120,594 $ 87,431 $ 58,579 Average common stockholders’ equity $ 8,670 $ 6,986 $ 6,543 Less: Average goodwill and other intangible assets (2,698) (2,525) (2,426) Average tangible common stockholders’ equity $ 5,972 $ 4,461 $ 4,117 Average Assets $ 94,530 $ 72,332 $ 59,894 Less: Average goodwill and other intangible assets (2,698) (2,525) (2,426) Average tangible assets $ 91,832 $ 69,807 $ 57,468 Common shares outstanding 722,150,297 681,217,334 681,217,334 GAAP MEASURES: Return on average assets 8.49 % 0.95 % 1.04 % Return on average common stockholders' equity 92.18 % 9.34 % 8.98 % Book value per common share $ 14.23 $ 12.21 $ 13.72 Common stockholders’ equity to total assets $ 8.31 $ 9.23 $ 10.50 NON-GAAP MEASURES: Return on average tangible assets 0.73 % 0.84 % 1.11 % Return on average tangible common stockholders’ equity 10.63 % 12.38 % 14.76 % Tangible book value per common share $9.86 $8.23 $8.52 Tangible common stockholders’ equity to tangible assets $5.90 $6.41 $6.79

301st Quarter 2023 Visit our website: ir.myNYCB.com E-mail requests to: ir@myNYCB.com Call Investor Relations at: (516) 683-4420 Write to: Investor Relations New York Community Bancorp, Inc. 102 Duffy Avenue Hicksville, NY 11801 For More Information