Fourth Quarter 2024 Results January 30, 2025

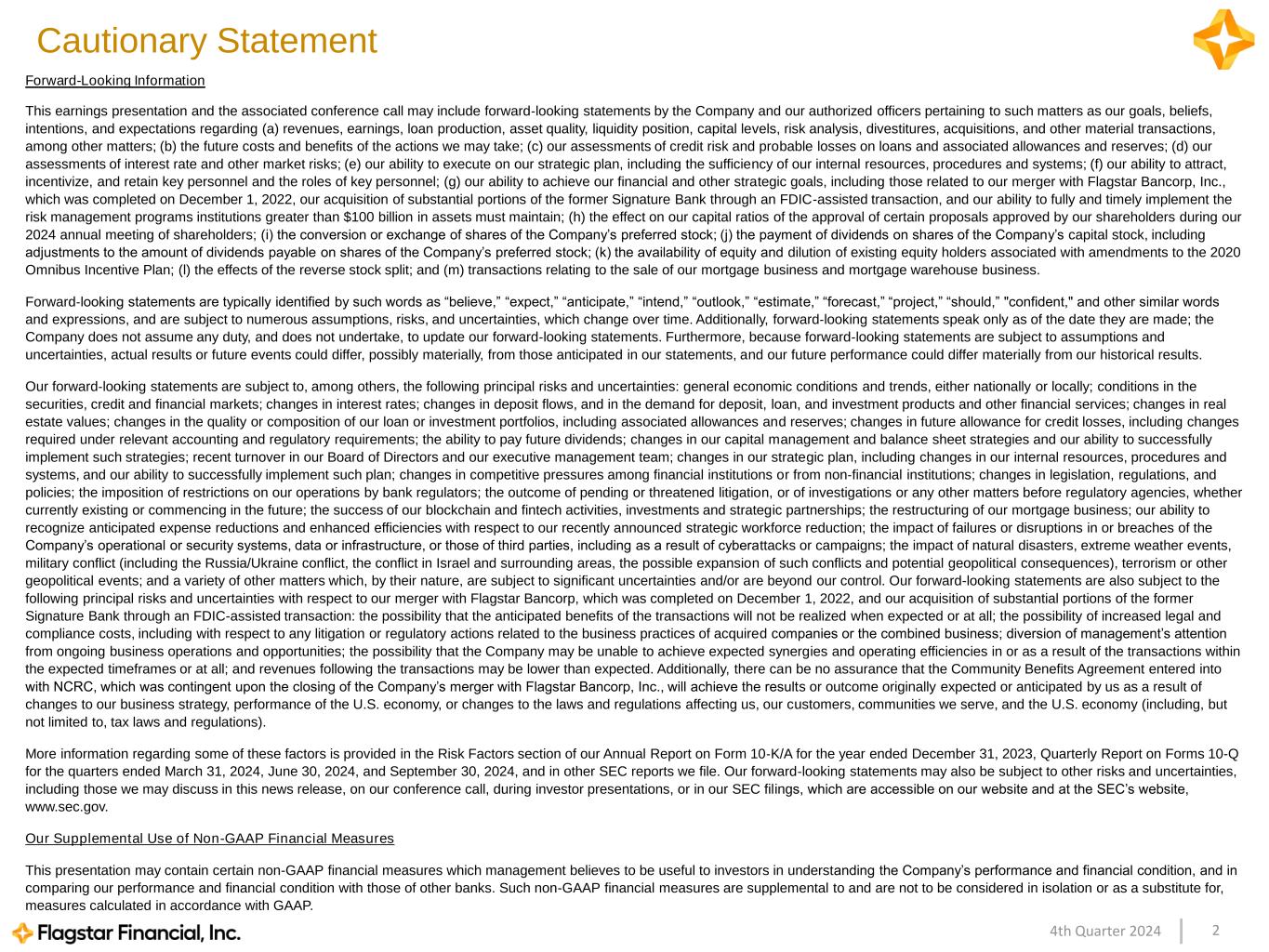

24th Quarter 2024 Cautionary Statement Forward-Looking Information This earnings presentation and the associated conference call may include forward‐looking statements by the Company and our authorized officers pertaining to such matters as our goals, beliefs, intentions, and expectations regarding (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the future costs and benefits of the actions we may take; (c) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (d) our assessments of interest rate and other market risks; (e) our ability to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (f) our ability to attract, incentivize, and retain key personnel and the roles of key personnel; (g) our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, and our ability to fully and timely implement the risk management programs institutions greater than $100 billion in assets must maintain; (h) the effect on our capital ratios of the approval of certain proposals approved by our shareholders during our 2024 annual meeting of shareholders; (i) the conversion or exchange of shares of the Company’s preferred stock; (j) the payment of dividends on shares of the Company’s capital stock, including adjustments to the amount of dividends payable on shares of the Company’s preferred stock; (k) the availability of equity and dilution of existing equity holders associated with amendments to the 2020 Omnibus Incentive Plan; (l) the effects of the reverse stock split; and (m) transactions relating to the sale of our mortgage business and mortgage warehouse business. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” "confident," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward‐looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses, including changes required under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; recent turnover in our Board of Directors and our executive management team; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the imposition of restrictions on our operations by bank regulators; the outcome of pending or threatened litigation, or of investigations or any other matters before regulatory agencies, whether currently existing or commencing in the future; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; our ability to recognize anticipated expense reductions and enhanced efficiencies with respect to our recently announced strategic workforce reduction; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations). More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K/A for the year ended December 31, 2023, Quarterly Report on Forms 10-Q for the quarters ended March 31, 2024, June 30, 2024, and September 30, 2024, and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov. Our Supplemental Use of Non-GAAP Financial Measures This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our performance and financial condition with those of other banks. Such non-GAAP financial measures are supplemental to and are not to be considered in isolation or as a substitute for, measures calculated in accordance with GAAP.

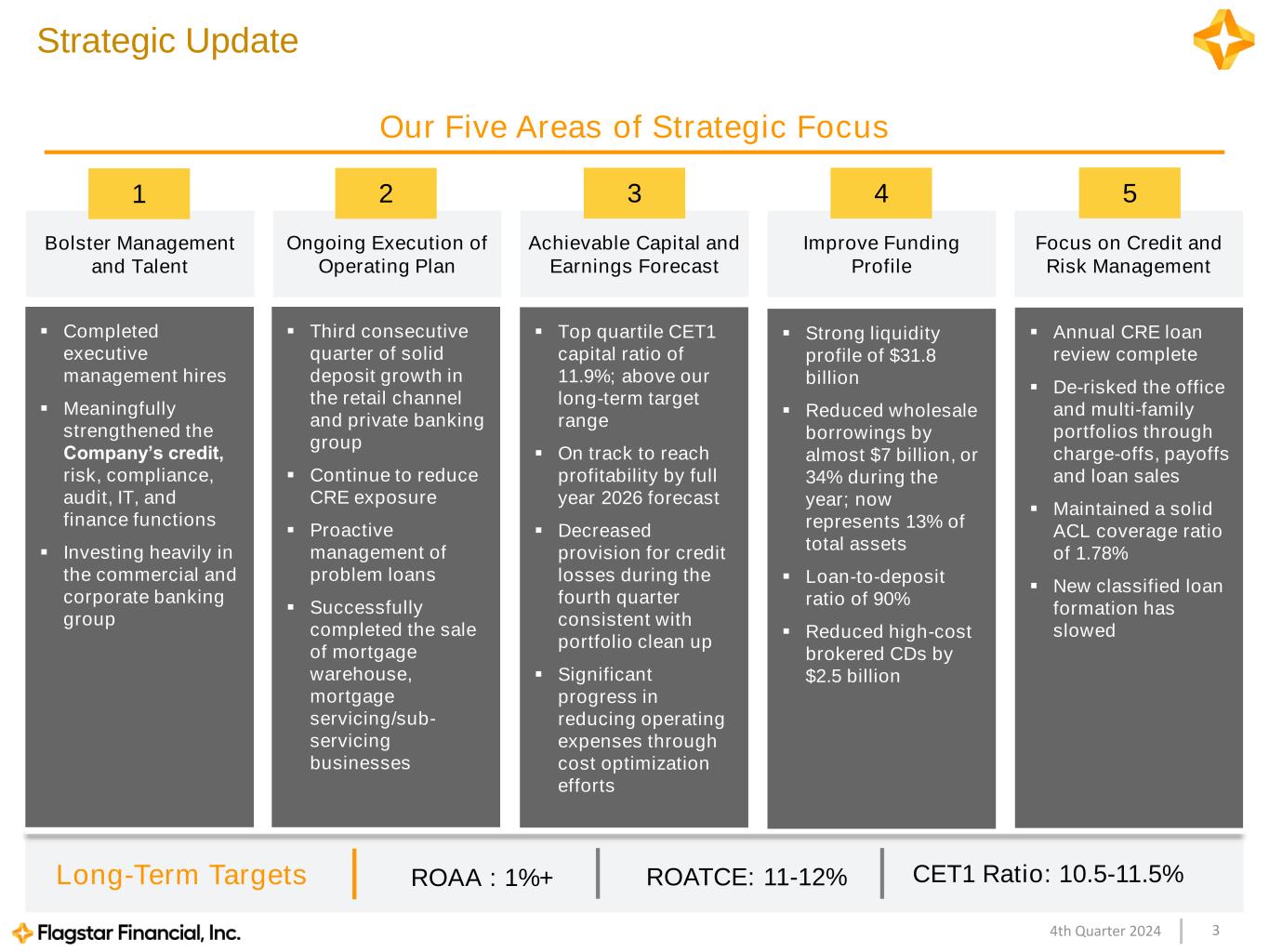

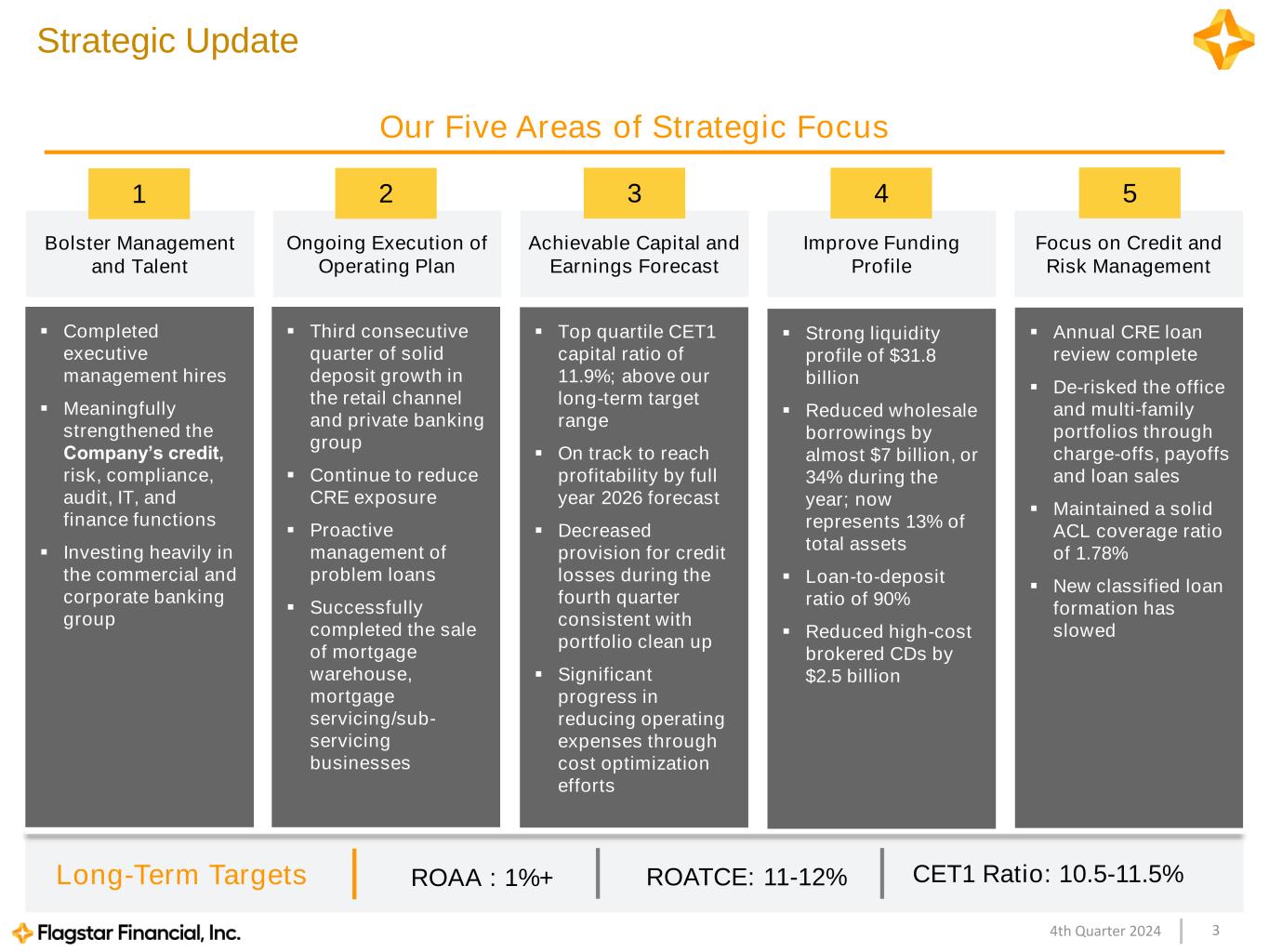

34th Quarter 2024 Our Five Areas of Strategic Focus Long-Term Targets Strategic Update ▪ Top quartile CET1 capital ratio of 11.9%; above our long-term target range ▪ On track to reach profitability by full year 2026 forecast ▪ Decreased provision for credit losses during the fourth quarter consistent with portfolio clean up ▪ Significant progress in reducing operating expenses through cost optimization efforts Achievable Capital and Earnings Forecast ▪ Annual CRE loan review complete ▪ De-risked the office and multi-family portfolios through charge-offs, payoffs and loan sales ▪ Maintained a solid ACL coverage ratio of 1.78% ▪ New classified loan formation has slowed Improve Funding Profile ▪ Strong liquidity profile of $31.8 billion ▪ Reduced wholesale borrowings by almost $7 billion, or 34% during the year; now represents 13% of total assets ▪ Loan-to-deposit ratio of 90% ▪ Reduced high-cost brokered CDs by $2.5 billion Focus on Credit and Risk Management ▪ Third consecutive quarter of solid deposit growth in the retail channel and private banking group ▪ Continue to reduce CRE exposure ▪ Proactive management of problem loans ▪ Successfully completed the sale of mortgage warehouse, mortgage servicing/sub- servicing businesses Ongoing Execution of Operating Plan ▪ Completed executive management hires ▪ Meaningfully strengthened the Company’s credit, risk, compliance, audit, IT, and finance functions ▪ Investing heavily in the commercial and corporate banking group Bolster Management and Talent ROAA : 1%+ ROATCE: 11-12% CET1 Ratio: 10.5-11.5% 1 2 3 4 5

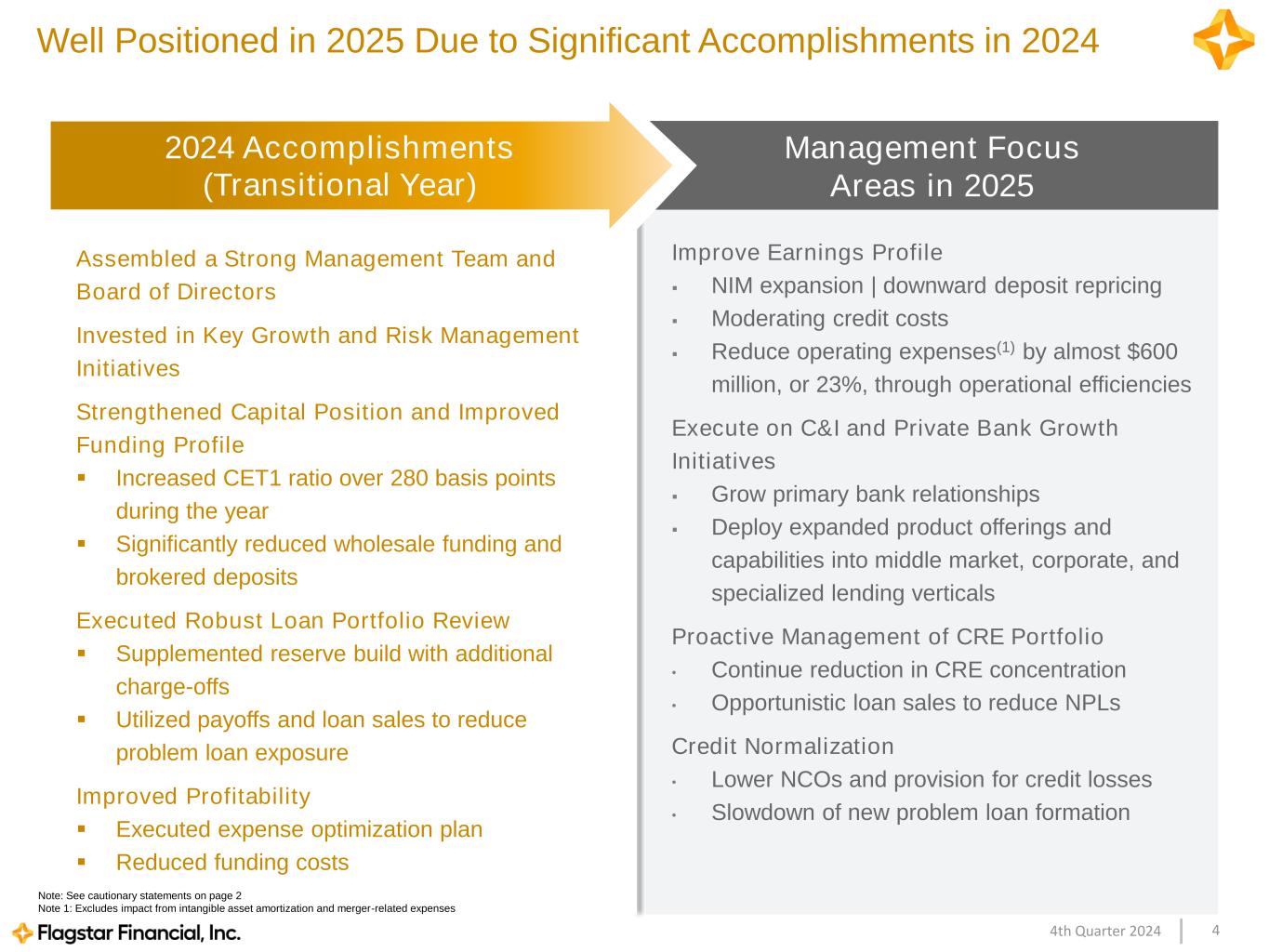

44th Quarter 2024 Improve Earnings Profile ▪ NIM expansion | downward deposit repricing ▪ Moderating credit costs ▪ Reduce operating expenses(1) by almost $600 million, or 23%, through operational efficiencies Execute on C&I and Private Bank Growth Initiatives ▪ Grow primary bank relationships ▪ Deploy expanded product offerings and capabilities into middle market, corporate, and specialized lending verticals Proactive Management of CRE Portfolio • Continue reduction in CRE concentration • Opportunistic loan sales to reduce NPLs Credit Normalization • Lower NCOs and provision for credit losses • Slowdown of new problem loan formation Management Focus Areas in 2025 2024 Accomplishments (Transitional Year) Assembled a Strong Management Team and Board of Directors Invested in Key Growth and Risk Management Initiatives Strengthened Capital Position and Improved Funding Profile ▪ Increased CET1 ratio over 280 basis points during the year ▪ Significantly reduced wholesale funding and brokered deposits Executed Robust Loan Portfolio Review ▪ Supplemented reserve build with additional charge-offs ▪ Utilized payoffs and loan sales to reduce problem loan exposure Improved Profitability ▪ Executed expense optimization plan ▪ Reduced funding costs Well Positioned in 2025 Due to Significant Accomplishments in 2024 Note: See cautionary statements on page 2 Note 1: Excludes impact from intangible asset amortization and merger-related expenses

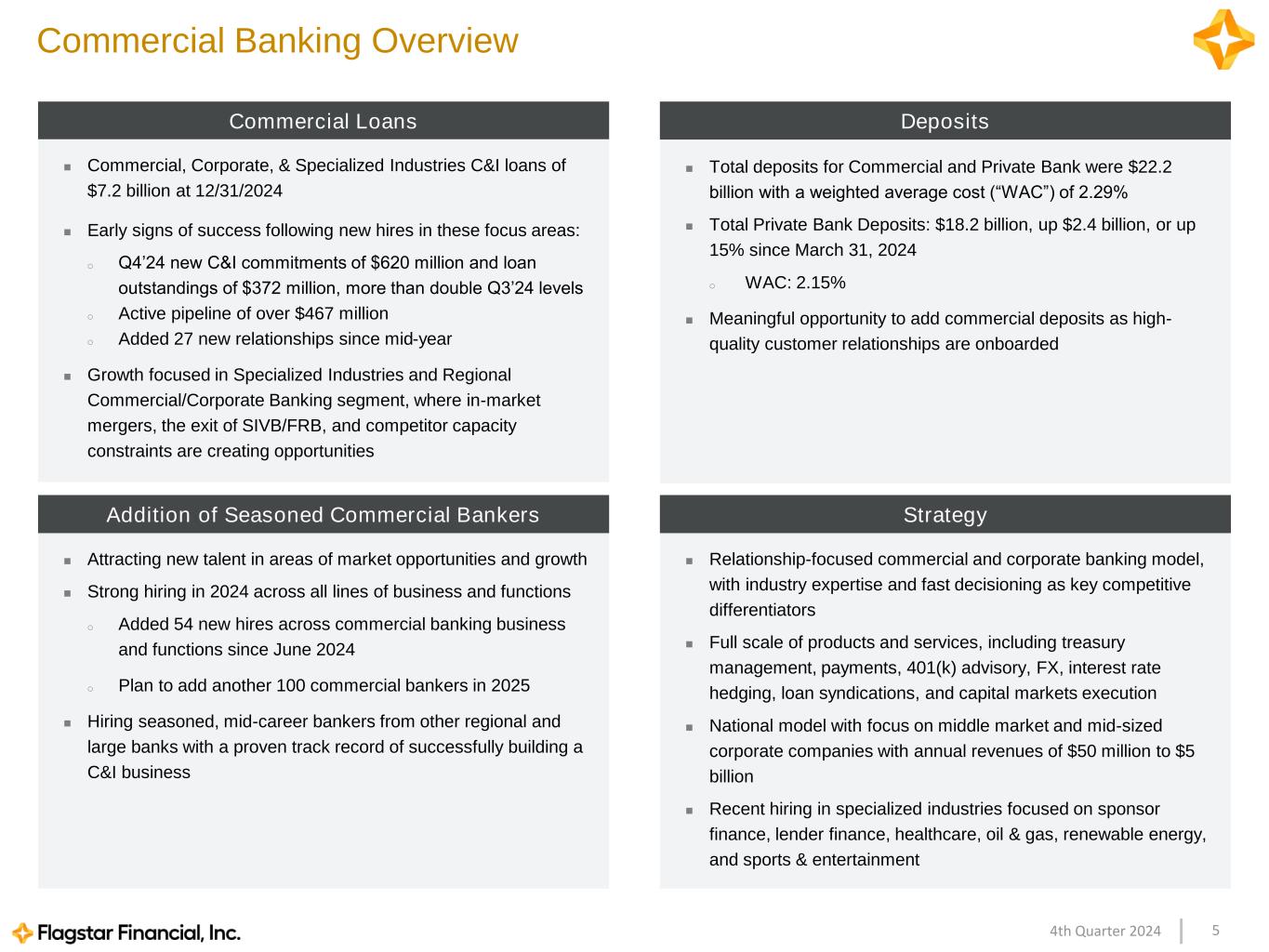

54th Quarter 2024 Commercial Banking Overview DepositsCommercial Loans ◼ Relationship-focused commercial and corporate banking model, with industry expertise and fast decisioning as key competitive differentiators ◼ Full scale of products and services, including treasury management, payments, 401(k) advisory, FX, interest rate hedging, loan syndications, and capital markets execution ◼ National model with focus on middle market and mid-sized corporate companies with annual revenues of $50 million to $5 billion ◼ Recent hiring in specialized industries focused on sponsor finance, lender finance, healthcare, oil & gas, renewable energy, and sports & entertainment StrategyAddition of Seasoned Commercial Bankers ◼ Attracting new talent in areas of market opportunities and growth ◼ Strong hiring in 2024 across all lines of business and functions o Added 54 new hires across commercial banking business and functions since June 2024 o Plan to add another 100 commercial bankers in 2025 ◼ Hiring seasoned, mid-career bankers from other regional and large banks with a proven track record of successfully building a C&I business ◼ Commercial, Corporate, & Specialized Industries C&I loans of $7.2 billion at 12/31/2024 ◼ Early signs of success following new hires in these focus areas: o Q4’24 new C&I commitments of $620 million and loan outstandings of $372 million, more than double Q3’24 levels o Active pipeline of over $467 million o Added 27 new relationships since mid-year ◼ Growth focused in Specialized Industries and Regional Commercial/Corporate Banking segment, where in-market mergers, the exit of SIVB/FRB, and competitor capacity constraints are creating opportunities ◼ Total deposits for Commercial and Private Bank were $22.2 billion with a weighted average cost (“WAC”) of 2.29% ◼ Total Private Bank Deposits: $18.2 billion, up $2.4 billion, or up 15% since March 31, 2024 o WAC: 2.15% ◼ Meaningful opportunity to add commercial deposits as high- quality customer relationships are onboarded

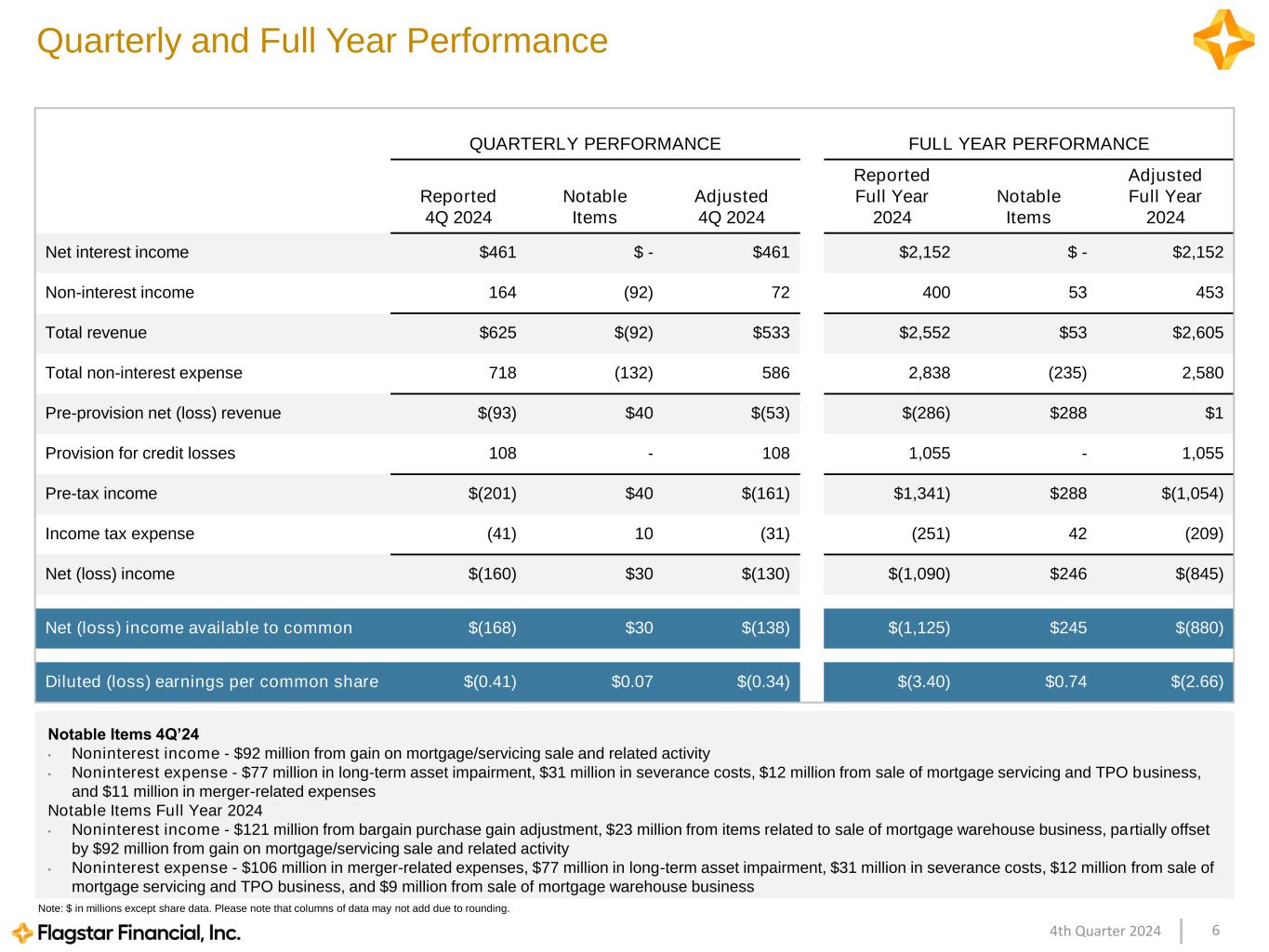

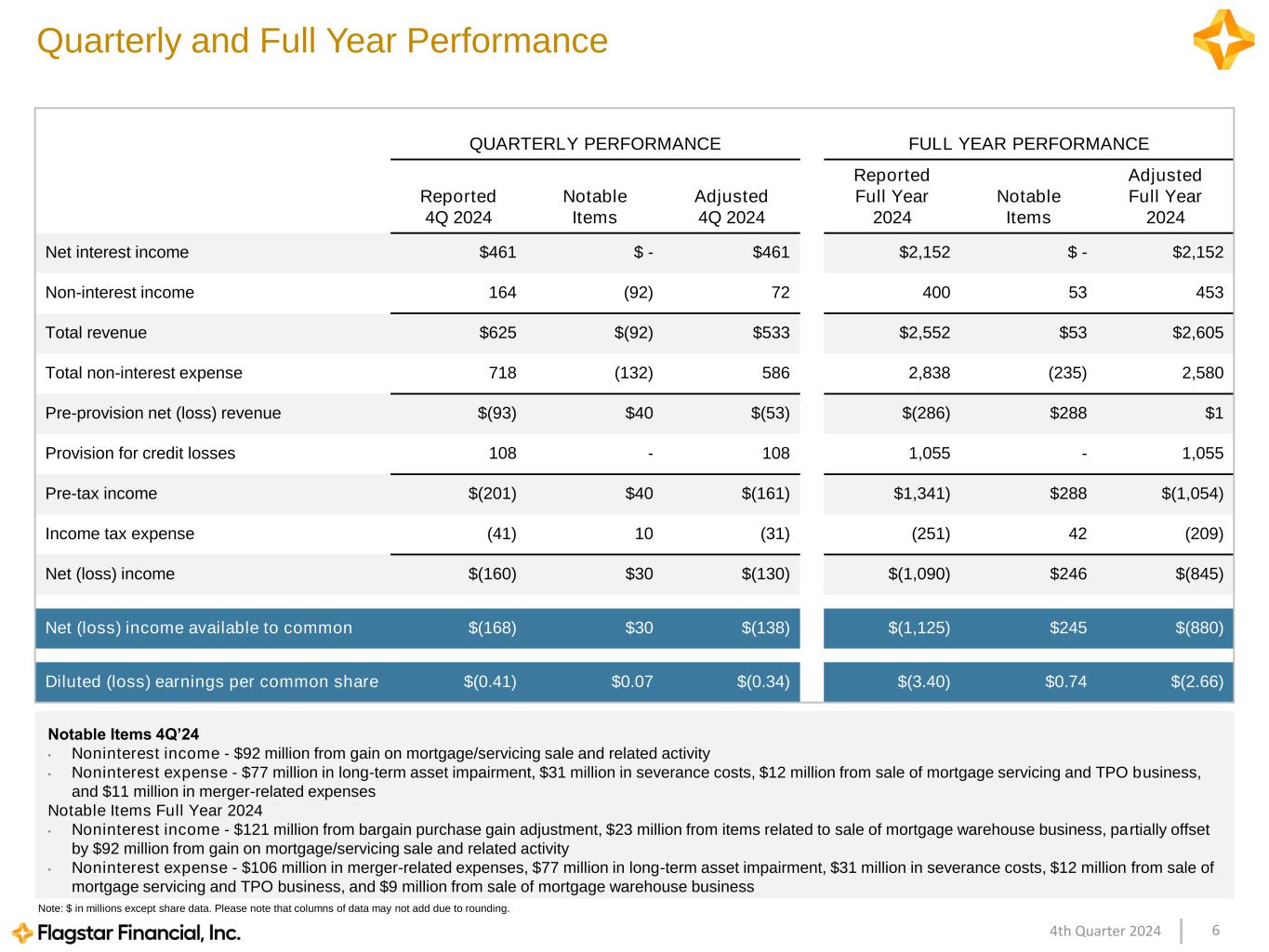

64th Quarter 2024 Note: $ in millions except share data. Please note that columns of data may not add due to rounding. Quarterly and Full Year Performance QUARTERLY PERFORMANCE FULL YEAR PERFORMANCE Reported 4Q 2024 Notable Items Adjusted 4Q 2024 Reported Full Year 2024 Notable Items Adjusted Full Year 2024 Net interest income $461 $ - $461 $2,152 $ - $2,152 Non-interest income 164 (92) 72 400 53 453 Total revenue $625 $(92) $533 $2,552 $53 $2,605 Total non-interest expense 718 (132) 586 2,838 (235) 2,580 Pre-provision net (loss) revenue $(93) $40 $(53) $(286) $288 $1 Provision for credit losses 108 - 108 1,055 - 1,055 Pre-tax income $(201) $40 $(161) $1,341) $288 $(1,054) Income tax expense (41) 10 (31) (251) 42 (209) Net (loss) income $(160) $30 $(130) $(1,090) $246 $(845) Net (loss) income available to common $(168) $30 $(138) $(1,125) $245 $(880) Diluted (loss) earnings per common share $(0.41) $0.07 $(0.34) $(3.40) $0.74 $(2.66) Notable Items 4Q’24 • Noninterest income - $92 million from gain on mortgage/servicing sale and related activity • Noninterest expense - $77 million in long-term asset impairment, $31 million in severance costs, $12 million from sale of mortgage servicing and TPO business, and $11 million in merger-related expenses Notable Items Full Year 2024 • Noninterest income - $121 million from bargain purchase gain adjustment, $23 million from items related to sale of mortgage warehouse business, partially offset by $92 million from gain on mortgage/servicing sale and related activity • Noninterest expense - $106 million in merger-related expenses, $77 million in long-term asset impairment, $31 million in severance costs, $12 million from sale of mortgage servicing and TPO business, and $9 million from sale of mortgage warehouse business

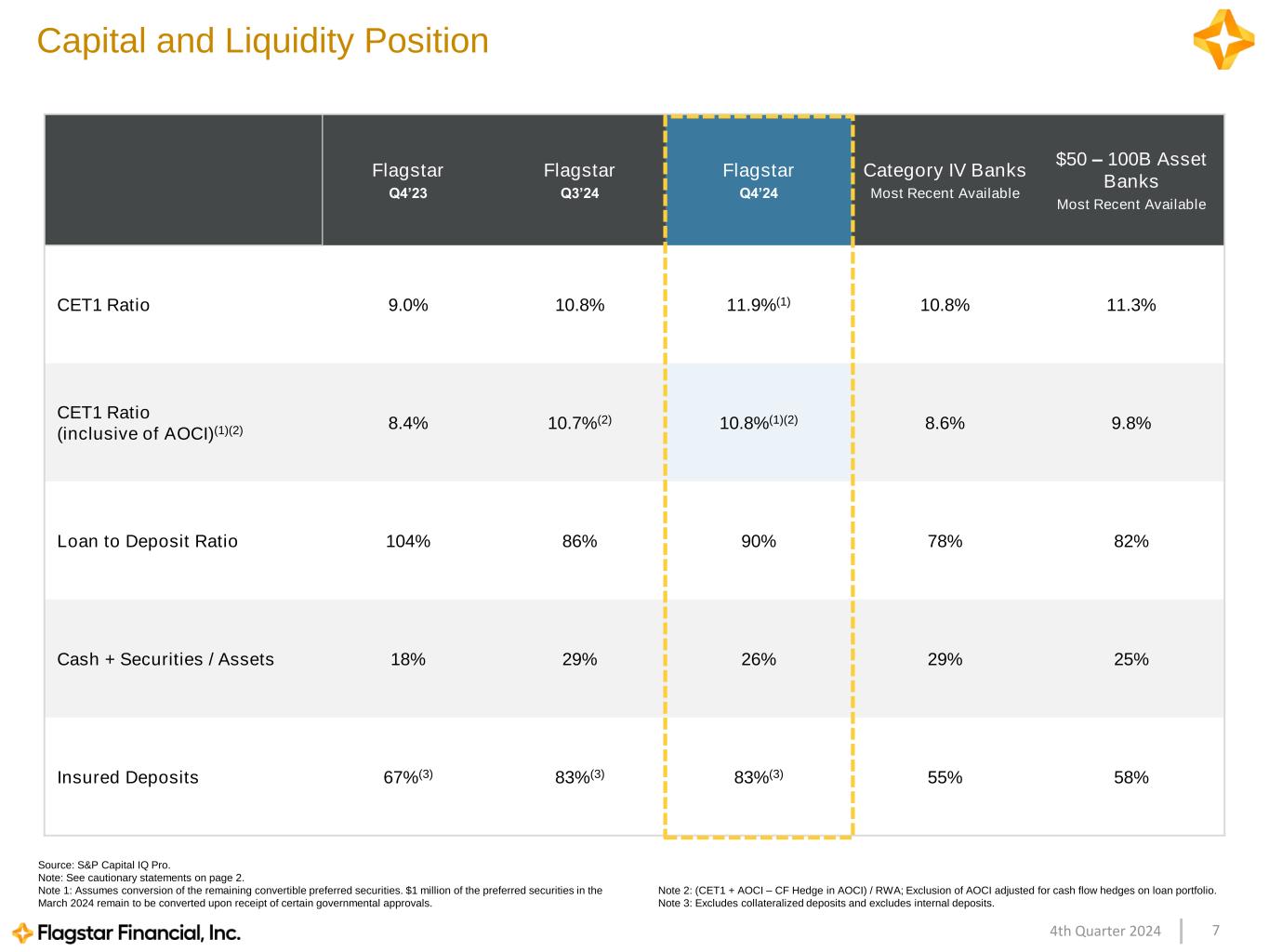

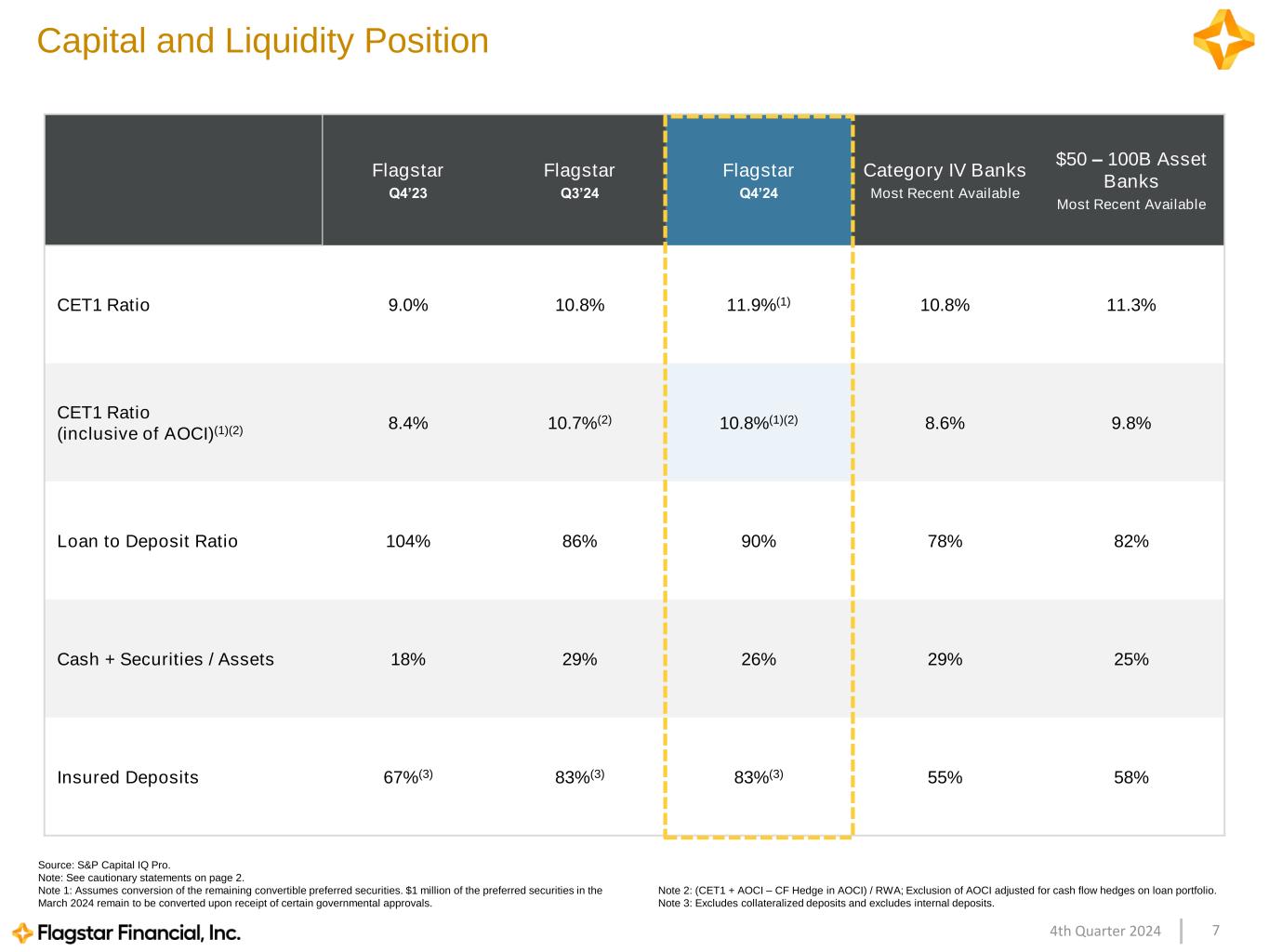

74th Quarter 2024 Flagstar Q4’23 Flagstar Q3’24 Flagstar Q4’24 Category IV Banks Most Recent Available $50 – 100B Asset Banks Most Recent Available CET1 Ratio 9.0% 10.8% 11.9%(1) 10.8% 11.3% CET1 Ratio (inclusive of AOCI)(1)(2) 8.4% 10.7%(2) 10.8%(1)(2) 8.6% 9.8% Loan to Deposit Ratio 104% 86% 90% 78% 82% Cash + Securities / Assets 18% 29% 26% 29% 25% Insured Deposits 67%(3) 83%(3) 83%(3) 55% 58% Source: S&P Capital IQ Pro. Note: See cautionary statements on page 2. Note 1: Assumes conversion of the remaining convertible preferred securities. $1 million of the preferred securities in the March 2024 remain to be converted upon receipt of certain governmental approvals. Note 2: (CET1 + AOCI – CF Hedge in AOCI) / RWA; Exclusion of AOCI adjusted for cash flow hedges on loan portfolio. Note 3: Excludes collateralized deposits and excludes internal deposits. Capital and Liquidity Position

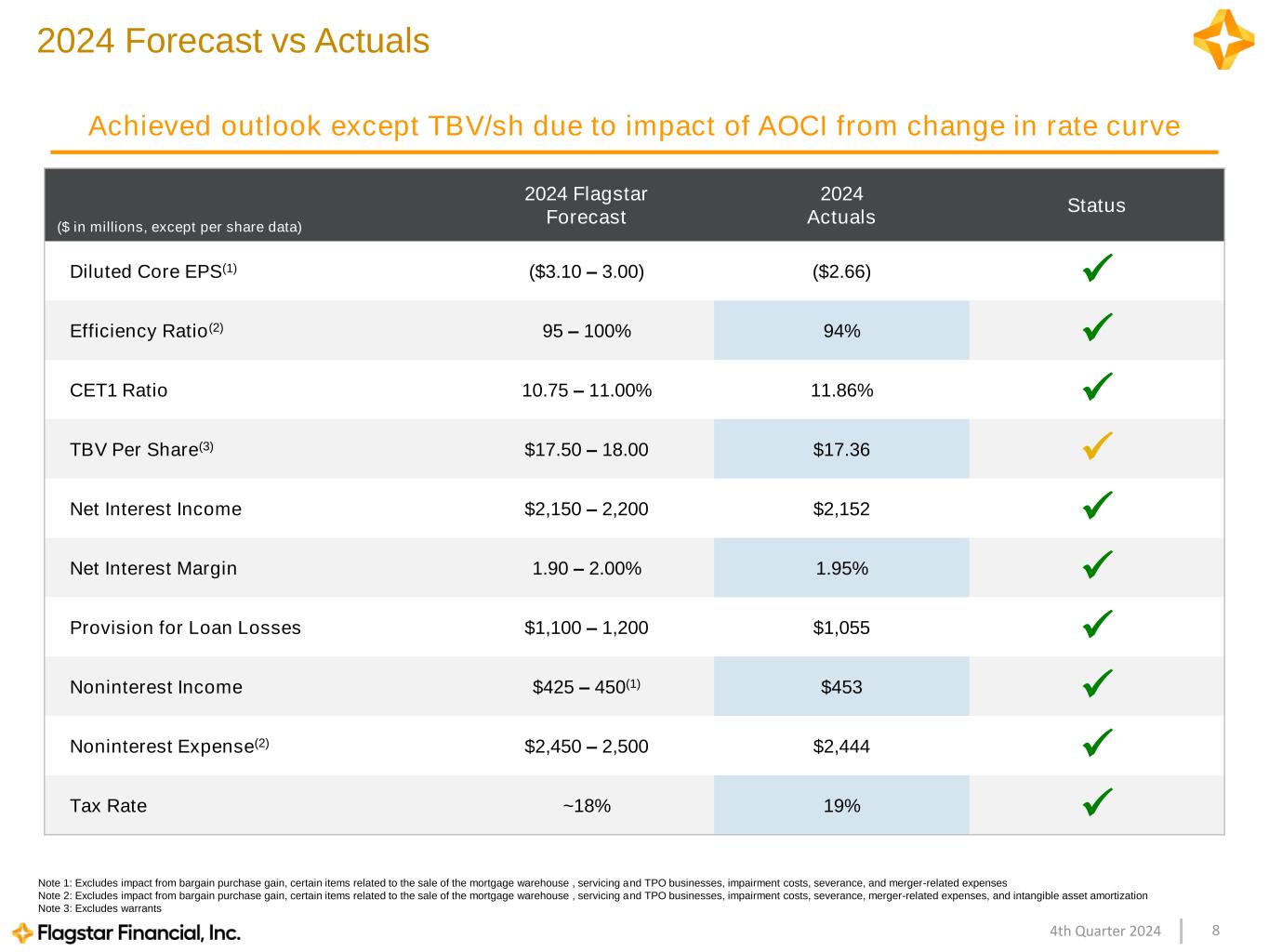

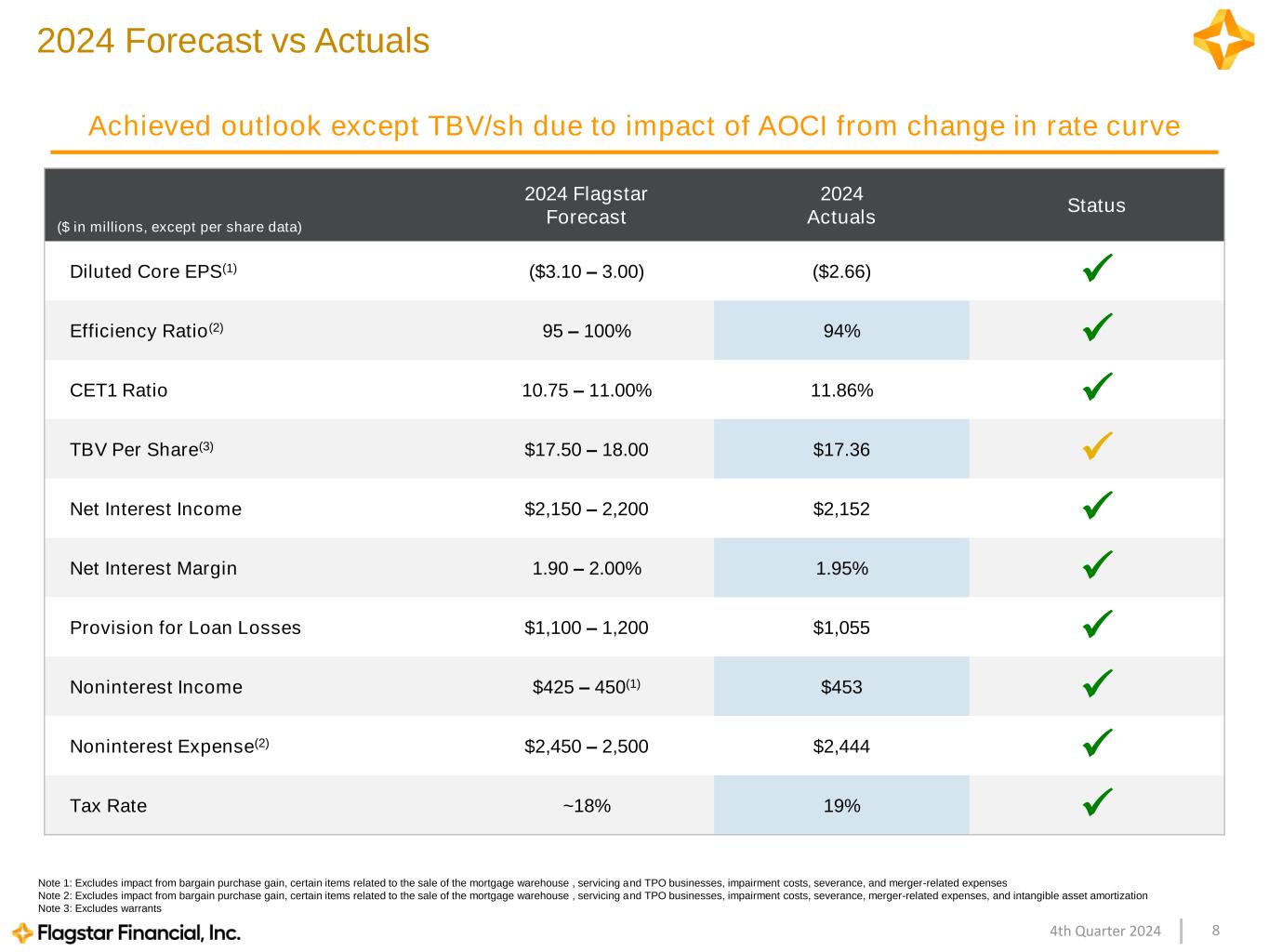

84th Quarter 2024 ($ in millions, except per share data) 2024 Flagstar Forecast 2024 Actuals Status Diluted Core EPS(1) ($3.10 – 3.00) ($2.66) ✓ Efficiency Ratio(2) 95 – 100% 94% ✓ CET1 Ratio 10.75 – 11.00% 11.86% ✓ TBV Per Share(3) $17.50 – 18.00 $17.36 ✓ Net Interest Income $2,150 – 2,200 $2,152 ✓ Net Interest Margin 1.90 – 2.00% 1.95% ✓ Provision for Loan Losses $1,100 – 1,200 $1,055 ✓ Noninterest Income $425 – 450(1) $453 ✓ Noninterest Expense(2) $2,450 – 2,500 $2,444 ✓ Tax Rate ~18% 19% ✓ 2024 Forecast vs Actuals Note 1: Excludes impact from bargain purchase gain, certain items related to the sale of the mortgage warehouse , servicing and TPO businesses, impairment costs, severance, and merger-related expenses Note 2: Excludes impact from bargain purchase gain, certain items related to the sale of the mortgage warehouse , servicing and TPO businesses, impairment costs, severance, merger-related expenses, and intangible asset amortization Note 3: Excludes warrants Achieved outlook except TBV/sh due to impact of AOCI from change in rate curve

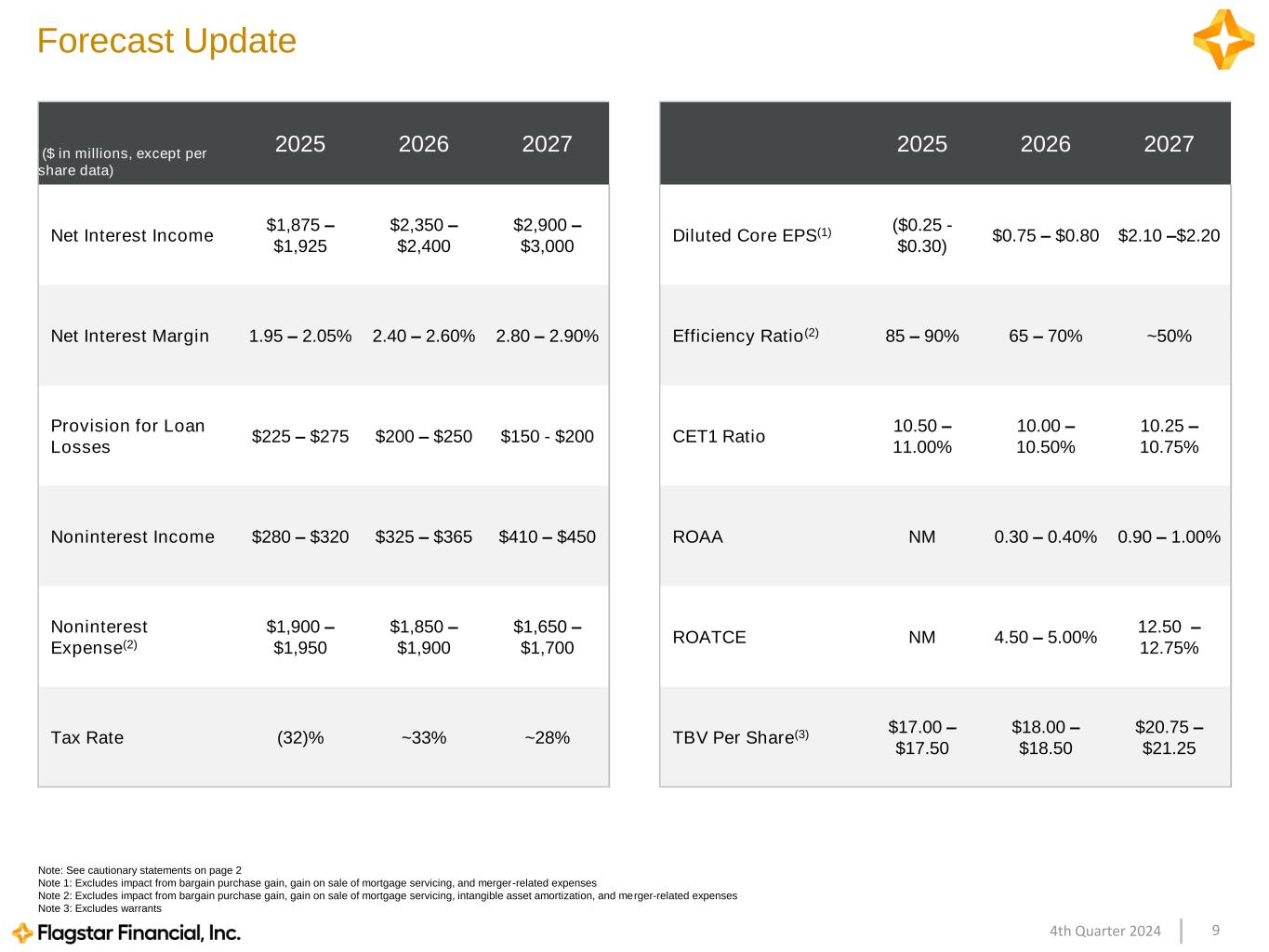

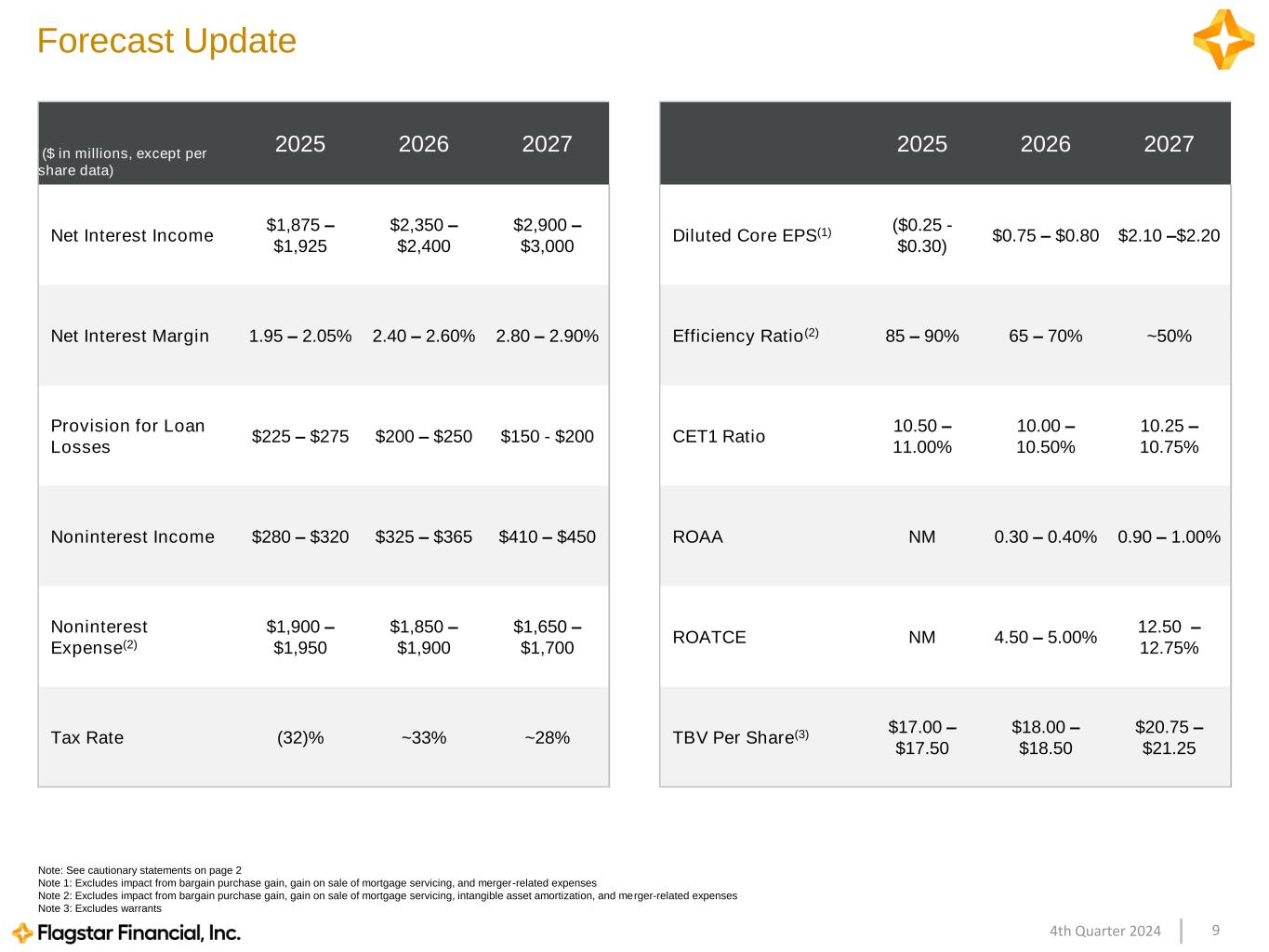

94th Quarter 2024 2025 2026 2027 Diluted Core EPS(1) ($0.25 - $0.30) $0.75 – $0.80 $2.10 –$2.20 Efficiency Ratio(2) 85 – 90% 65 – 70% ~50% CET1 Ratio 10.50 – 11.00% 10.00 – 10.50% 10.25 – 10.75% ROAA NM 0.30 – 0.40% 0.90 – 1.00% ROATCE NM 4.50 – 5.00% 12.50 – 12.75% TBV Per Share(3) $17.00 – $17.50 $18.00 – $18.50 $20.75 – $21.25 Forecast Update Note: See cautionary statements on page 2 Note 1: Excludes impact from bargain purchase gain, gain on sale of mortgage servicing, and merger-related expenses Note 2: Excludes impact from bargain purchase gain, gain on sale of mortgage servicing, intangible asset amortization, and merger-related expenses Note 3: Excludes warrants ($ in millions, except per share data) 2025 2026 2027 Net Interest Income $1,875 – $1,925 $2,350 – $2,400 $2,900 – $3,000 Net Interest Margin 1.95 – 2.05% 2.40 – 2.60% 2.80 – 2.90% Provision for Loan Losses $225 – $275 $200 – $250 $150 - $200 Noninterest Income $280 – $320 $325 – $365 $410 – $450 Noninterest Expense(2) $1,900 – $1,950 $1,850 – $1,900 $1,650 – $1,700 Tax Rate (32)% ~33% ~28%

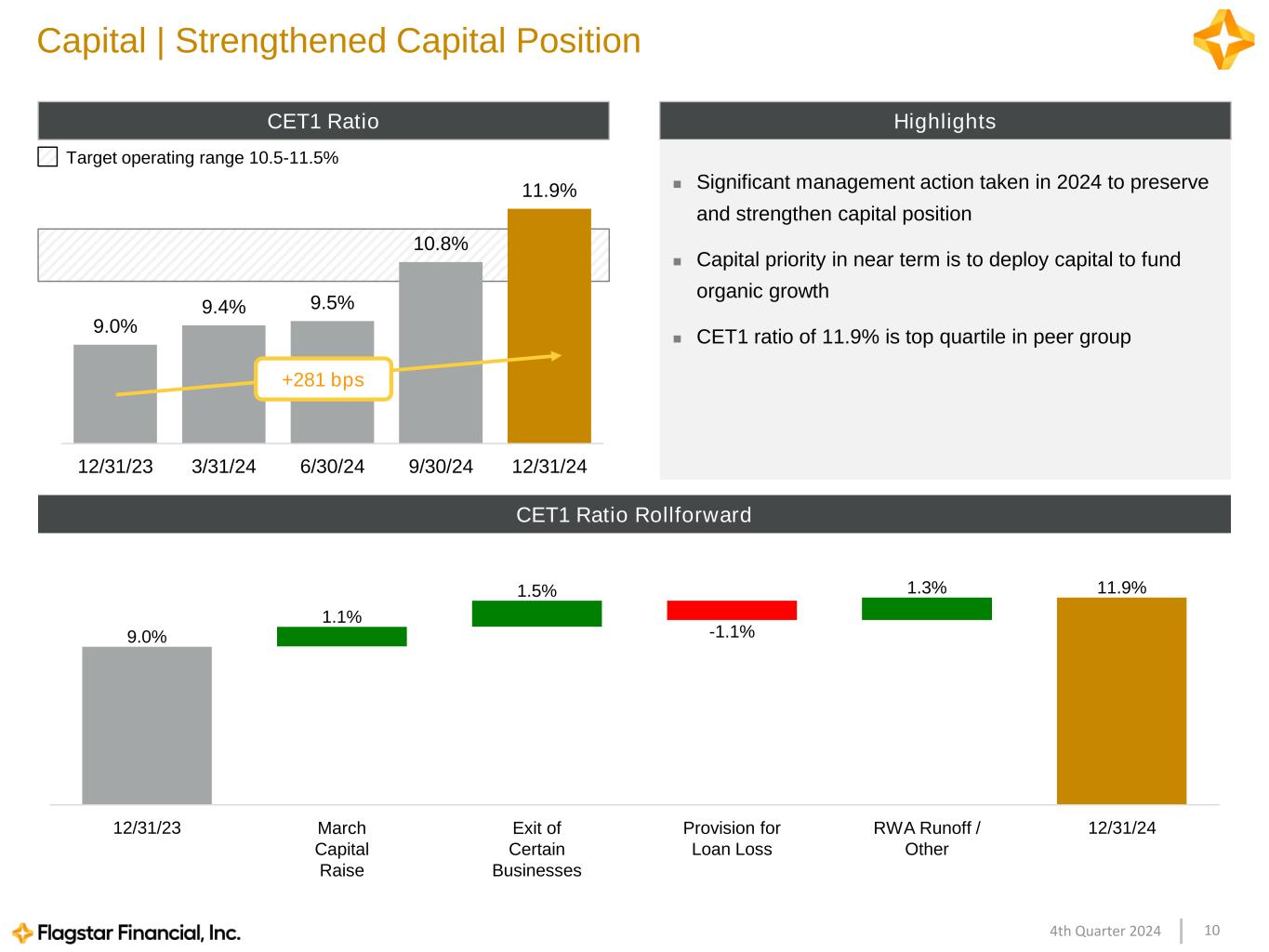

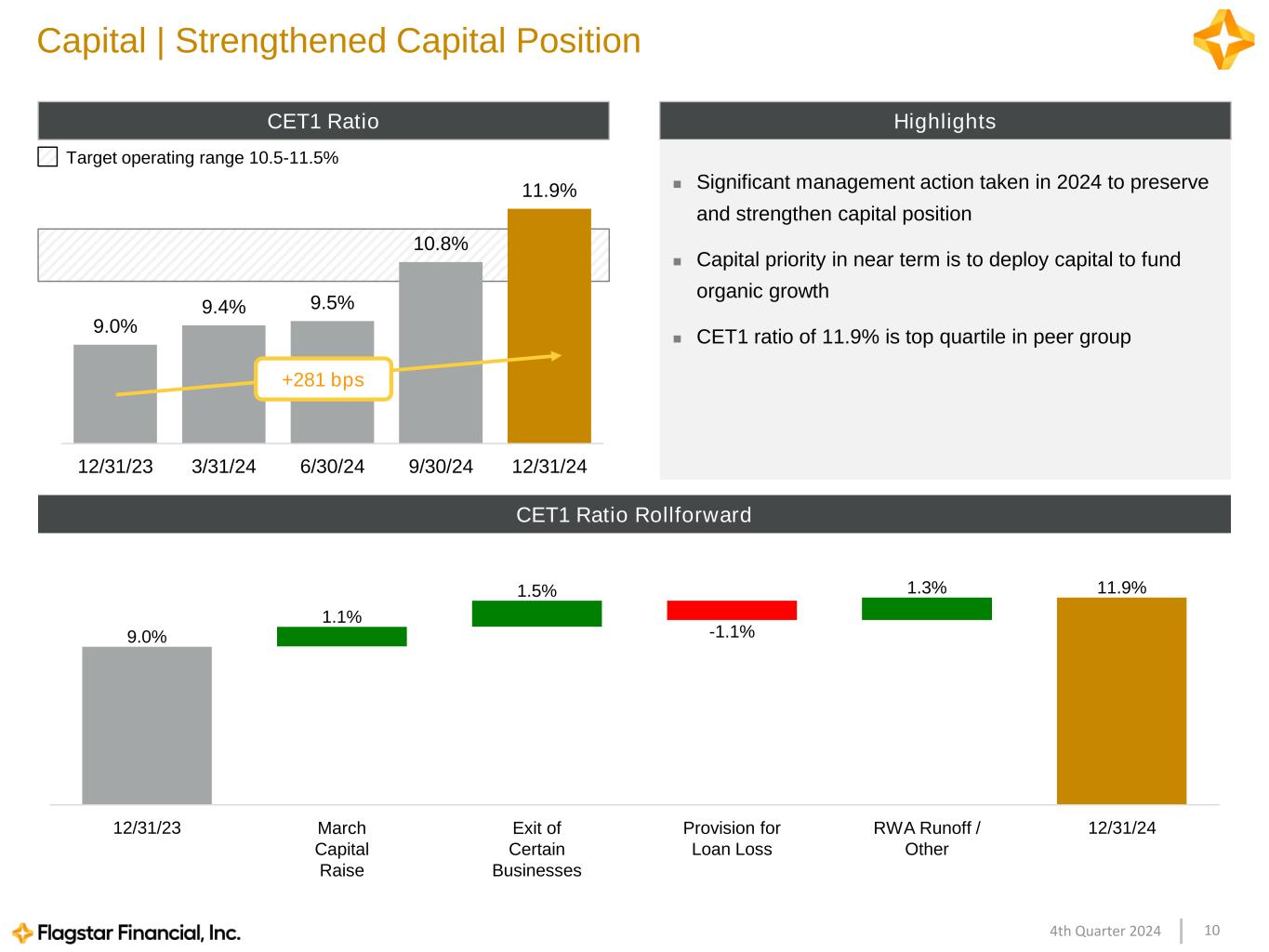

104th Quarter 2024 9.0% 9.4% 9.5% 10.8% 11.9% 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Capital | Strengthened Capital Position Highlights ◼ Significant management action taken in 2024 to preserve and strengthen capital position ◼ Capital priority in near term is to deploy capital to fund organic growth ◼ CET1 ratio of 11.9% is top quartile in peer group CET1 Ratio +281 bps Target operating range 10.5-11.5% 9.0% 1.1% 1.5% -1.1% 1.3% 11.9% 12/31/23 March Capital Raise Exit of Certain Businesses Provision for Loan Loss RWA Runoff / Other 12/31/24 CET1 Ratio Rollforward

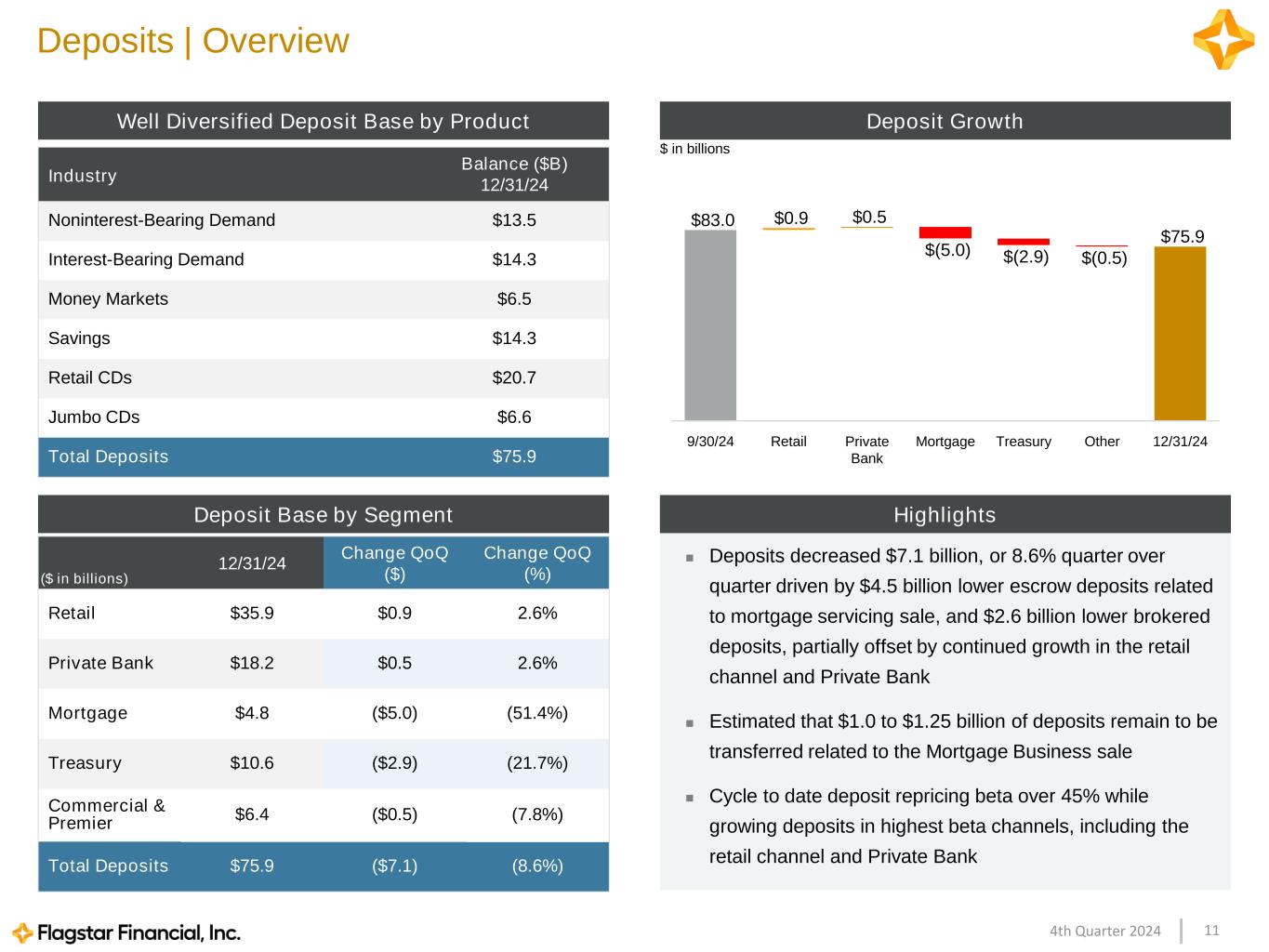

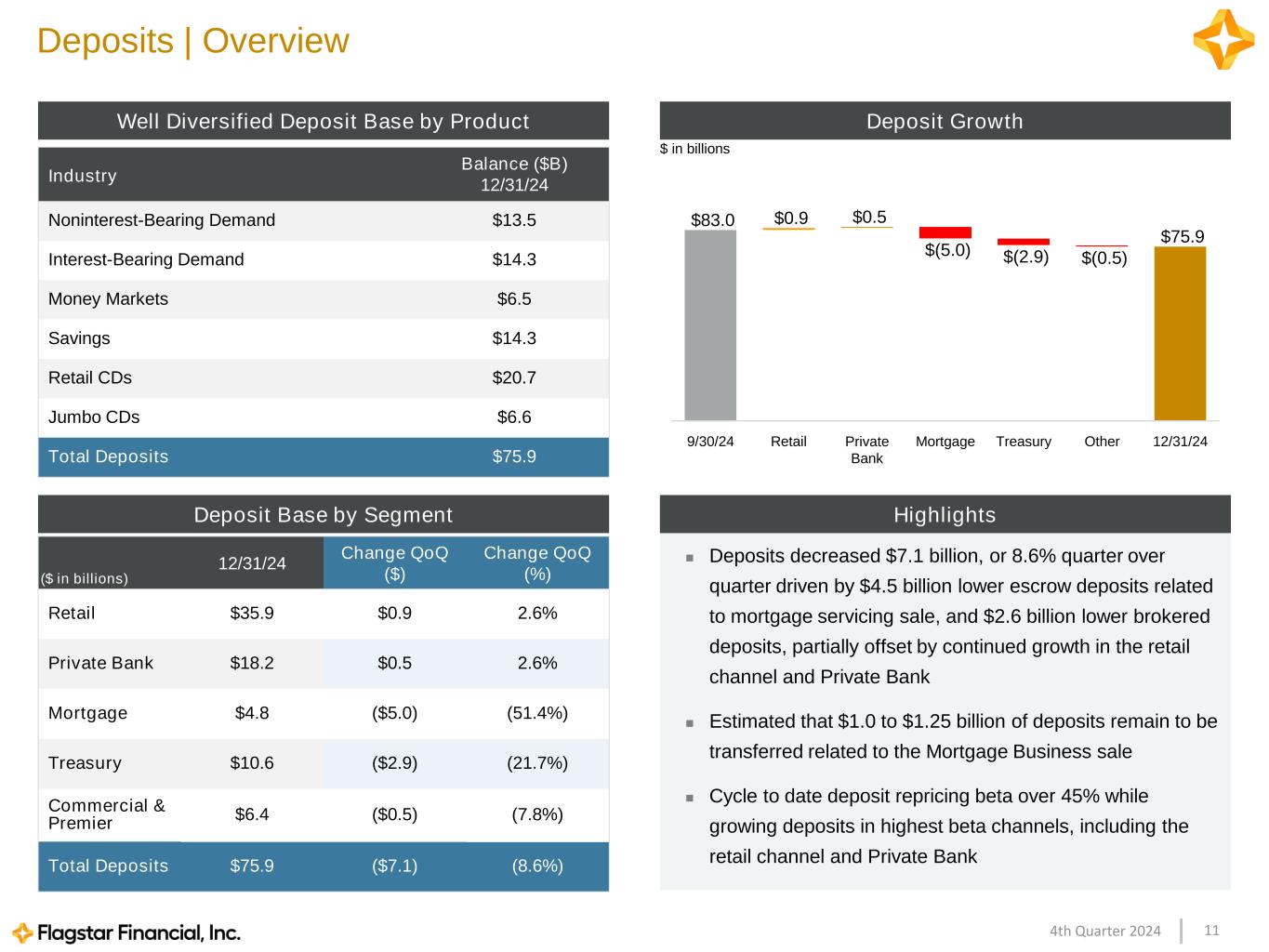

114th Quarter 2024 Industry Balance ($B) 12/31/24 Noninterest-Bearing Demand $13.5 Interest-Bearing Demand $14.3 Money Markets $6.5 Savings $14.3 Retail CDs $20.7 Jumbo CDs $6.6 Total Deposits $75.9 Deposits | Overview Deposit GrowthWell Diversified Deposit Base by Product ◼ Deposits decreased $7.1 billion, or 8.6% quarter over quarter driven by $4.5 billion lower escrow deposits related to mortgage servicing sale, and $2.6 billion lower brokered deposits, partially offset by continued growth in the retail channel and Private Bank ◼ Estimated that $1.0 to $1.25 billion of deposits remain to be transferred related to the Mortgage Business sale ◼ Cycle to date deposit repricing beta over 45% while growing deposits in highest beta channels, including the retail channel and Private Bank HighlightsDeposit Base by Segment ($ in billions) 12/31/24 Change QoQ ($) Change QoQ (%) Retail $35.9 $0.9 2.6% Private Bank $18.2 $0.5 2.6% Mortgage $4.8 ($5.0) (51.4%) Treasury $10.6 ($2.9) (21.7%) Commercial & Premier $6.4 ($0.5) (7.8%) Total Deposits $75.9 ($7.1) (8.6%) $ in billions $83.0 $0.9 $0.5 $(5.0) $(2.9) $(0.5) $75.9 9/30/24 Retail Private Bank Mortgage Treasury Other 12/31/24

124th Quarter 2024 Commercial Real Estate | 2024 Payoffs and CRE Concentration Trends Q4 2024 Total Substandard (%) 2024 Payoffs Total Substandard (%) Multi-Family $623 million 55% $2.4 billion 42% Office $2 million 21% $150 million 93% Non-Office CRE $293 million 33% $939 million 19% Total CRE $916 million 48% $3.5 billion 38% Significant CRE payoffs at par with 48% of the payoffs from substandard loans in the fourth quarter CRE Portfolio Payoffs at Par 501% 443% 12/31/23 12/31/24 Total CRE Balances CRE payoffs and paydowns driving significant reduction in CRE concentration ratio -58% $50.6 $45.9 12/31/23 12/31/24 CRE Concentration Ratio(1) $ in billions -9% Note 1: Calculated as: Total CRE balances (excluding owner occupied) / (Tier 1 Capital + Allowance for Loans & Lease Losses)

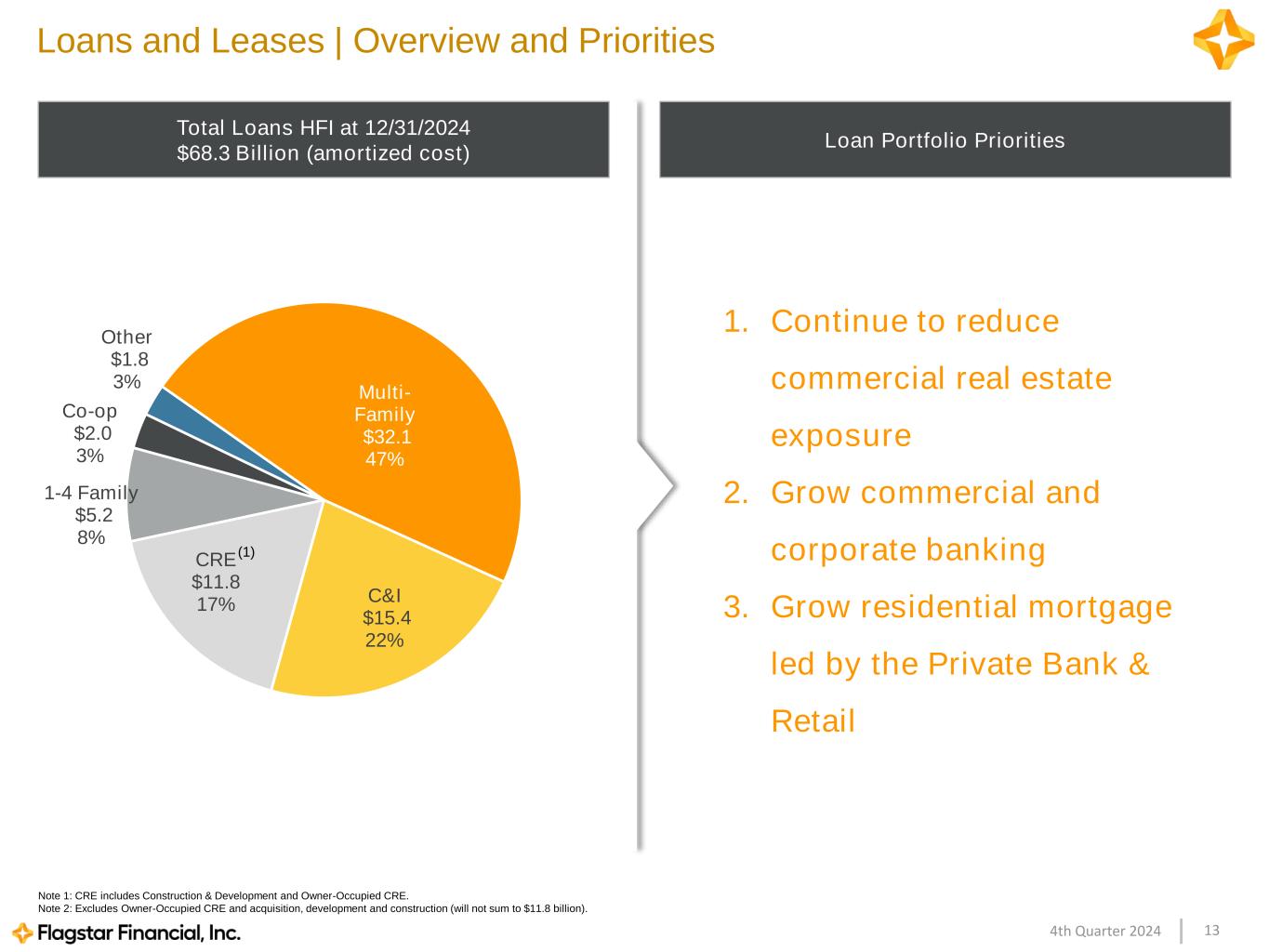

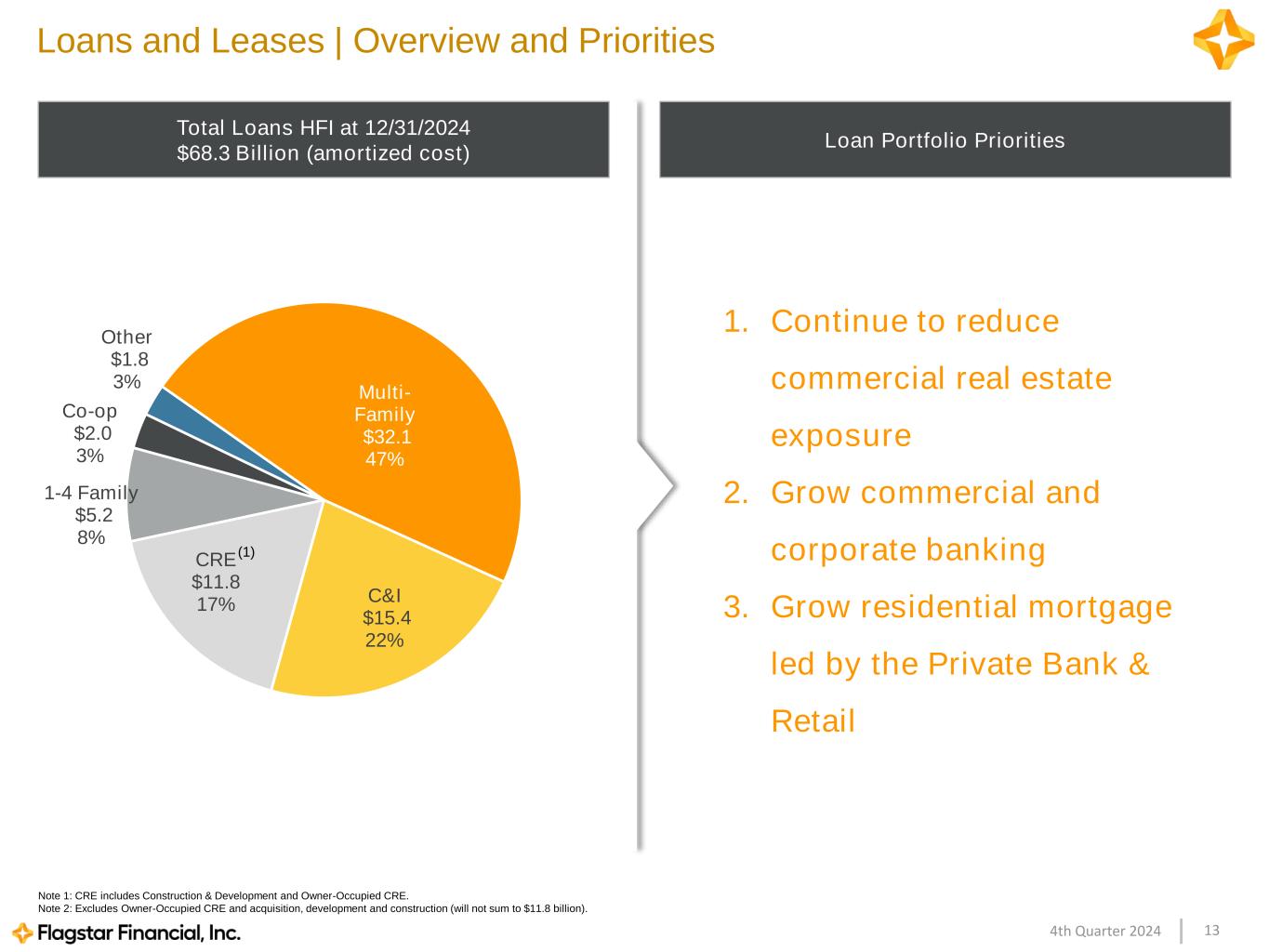

134th Quarter 2024 1. Continue to reduce commercial real estate exposure 2. Grow commercial and corporate banking 3. Grow residential mortgage led by the Private Bank & Retail Multi- Family $32.1 47% C&I $15.4 22% CRE $11.8 17% 1-4 Family $5.2 8% Co-op $2.0 3% Other $1.8 3% Loans and Leases | Overview and Priorities Total Loans HFI at 12/31/2024 $68.3 Billion (amortized cost) Note 1: CRE includes Construction & Development and Owner-Occupied CRE. Note 2: Excludes Owner-Occupied CRE and acquisition, development and construction (will not sum to $11.8 billion). (1) Loan Portfolio Priorities

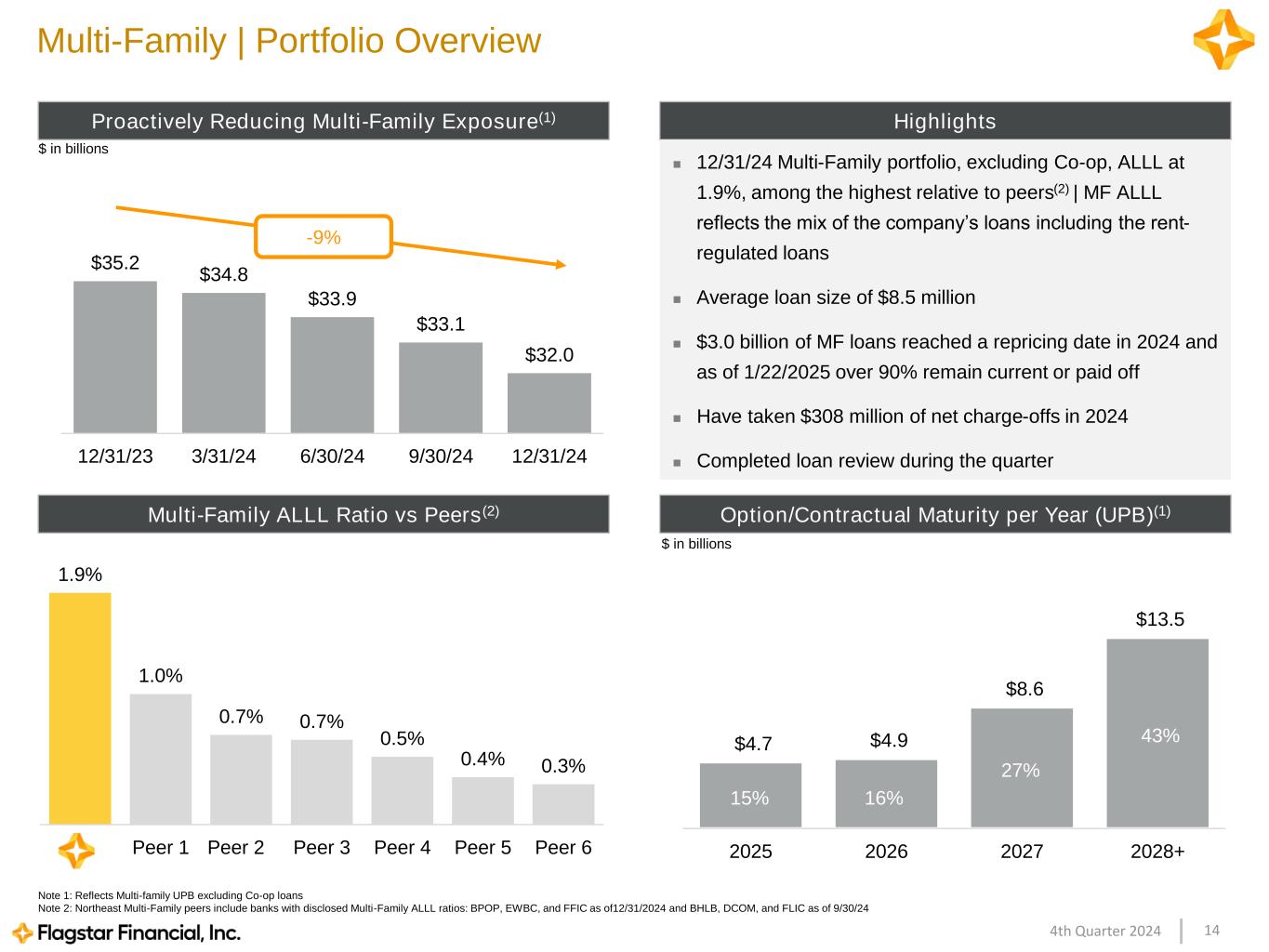

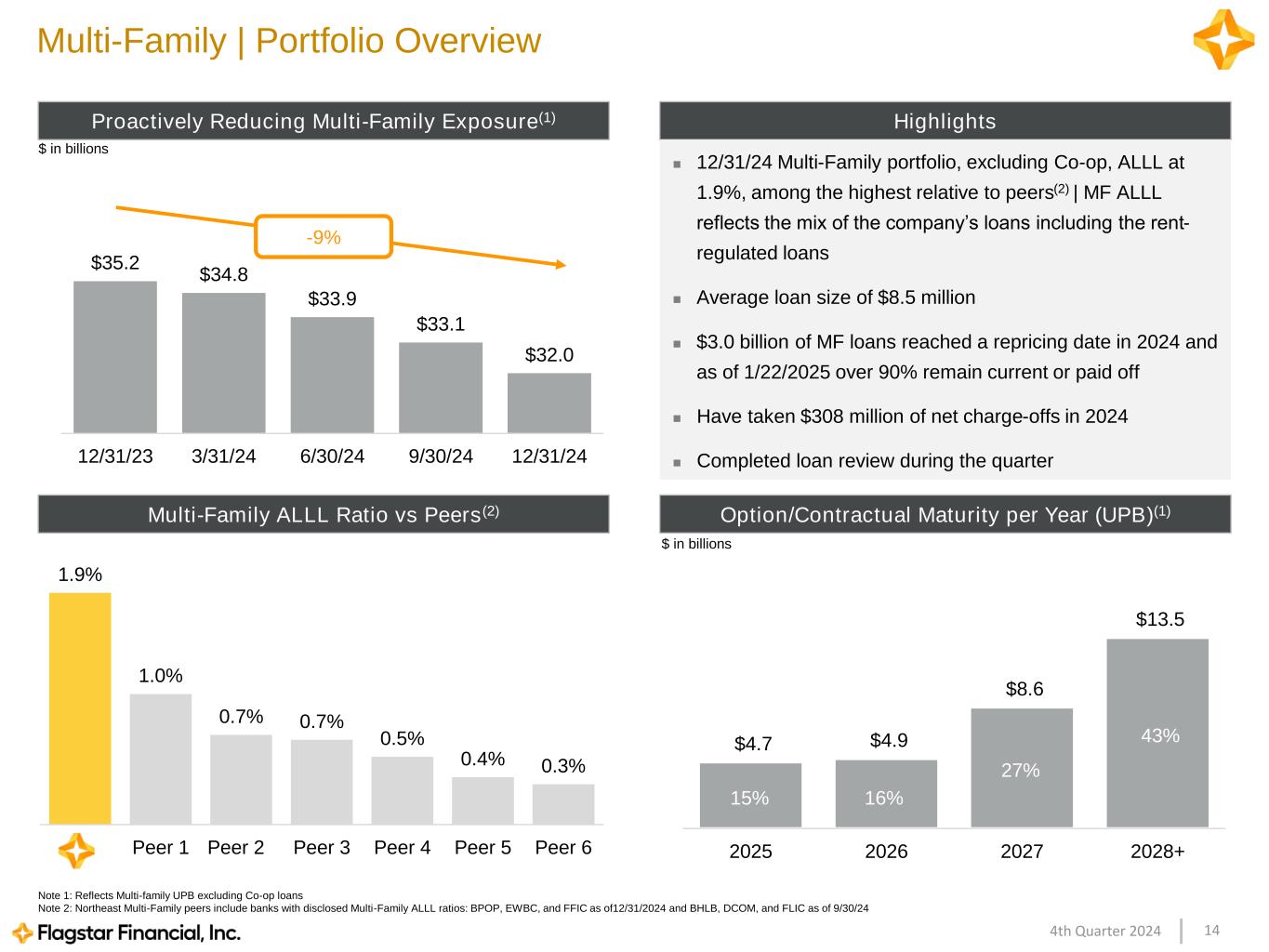

144th Quarter 2024 Multi-Family | Portfolio Overview Highlights ◼ 12/31/24 Multi-Family portfolio, excluding Co-op, ALLL at 1.9%, among the highest relative to peers(2) | MF ALLL reflects the mix of the company’s loans including the rent- regulated loans ◼ Average loan size of $8.5 million ◼ $3.0 billion of MF loans reached a repricing date in 2024 and as of 1/22/2025 over 90% remain current or paid off ◼ Have taken $308 million of net charge-offs in 2024 ◼ Completed loan review during the quarter $35.2 $34.8 $33.9 $33.1 $32.0 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Proactively Reducing Multi-Family Exposure(1) -9% Note 1: Reflects Multi-family UPB excluding Co-op loans Note 2: Northeast Multi-Family peers include banks with disclosed Multi-Family ALLL ratios: BPOP, EWBC, and FFIC as of12/31/2024 and BHLB, DCOM, and FLIC as of 9/30/24 $ in billions 1.9% 1.0% 0.7% 0.7% 0.5% 0.4% 0.3% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Multi-Family ALLL Ratio vs Peers(2) $4.7 $4.9 $8.6 $13.5 2025 2026 2027 2028+ Option/Contractual Maturity per Year (UPB)(1) $ in billions 15% 16% 27% 43%

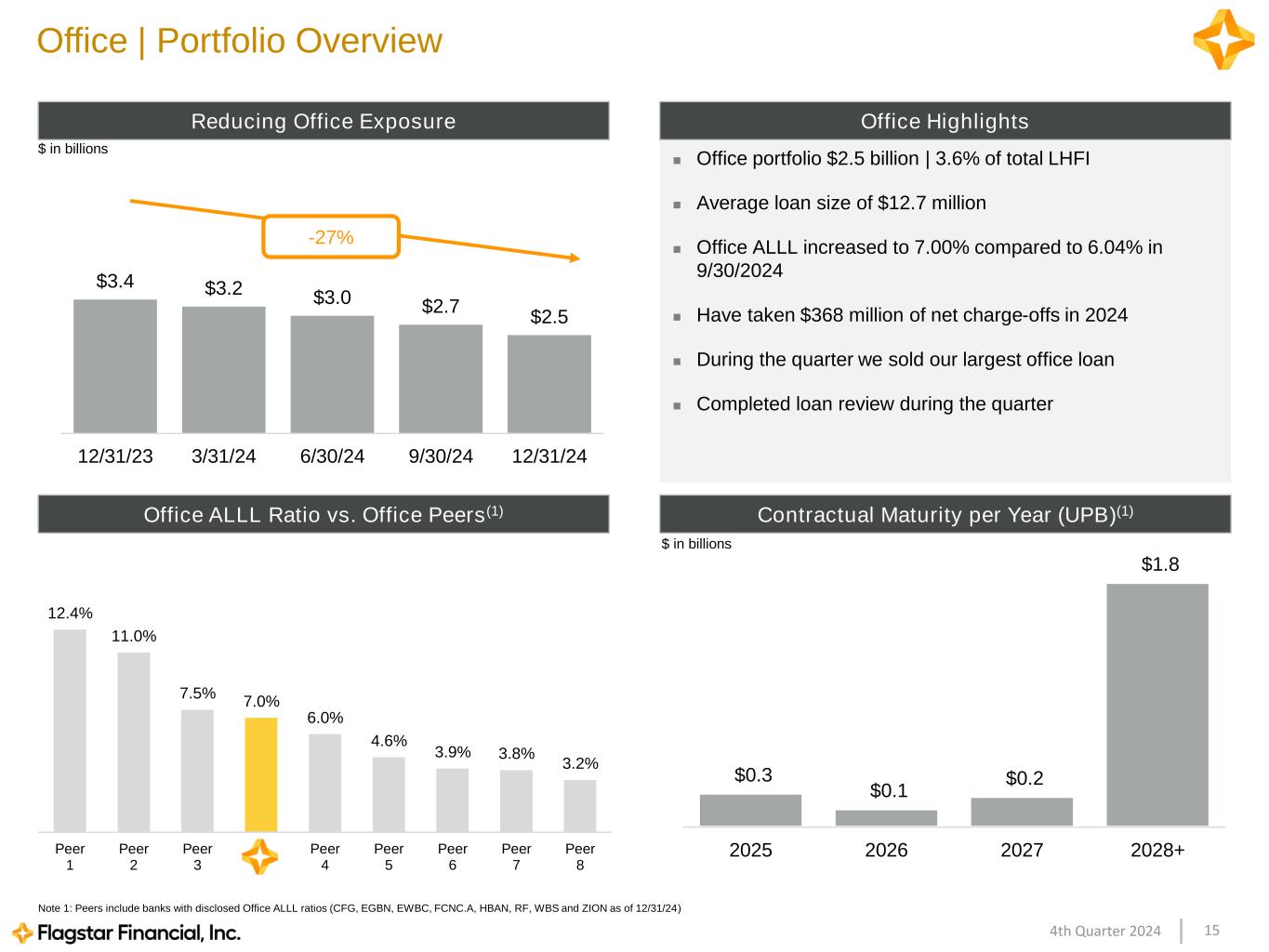

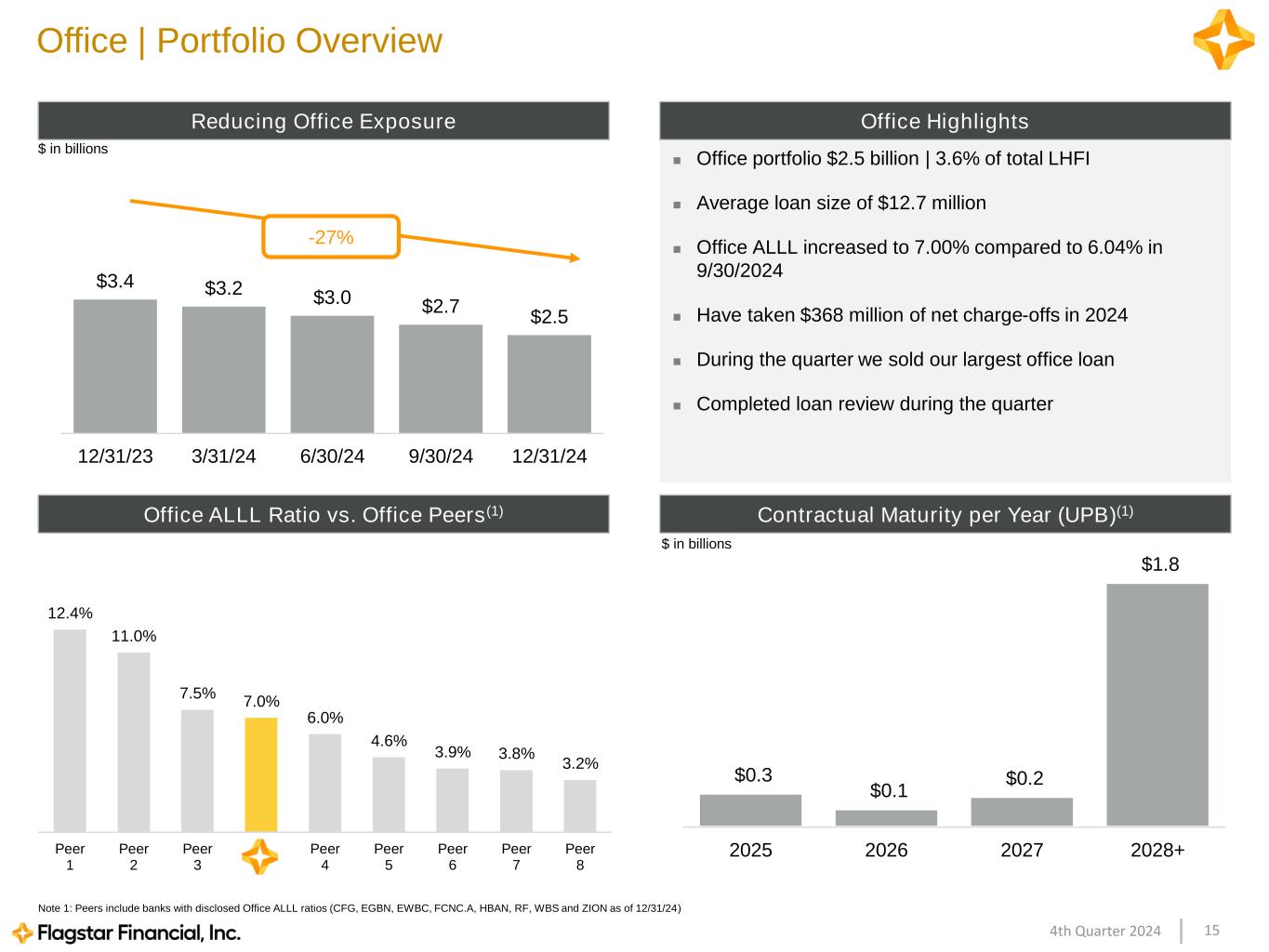

154th Quarter 2024 $3.4 $3.2 $3.0 $2.7 $2.5 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 ◼ Office portfolio $2.5 billion | 3.6% of total LHFI ◼ Average loan size of $12.7 million ◼ Office ALLL increased to 7.00% compared to 6.04% in 9/30/2024 ◼ Have taken $368 million of net charge-offs in 2024 ◼ During the quarter we sold our largest office loan ◼ Completed loan review during the quarter Office Highlights Office | Portfolio Overview Office ALLL Ratio vs. Office Peers(1) 12.4% 11.0% 7.5% 7.0% 6.0% 4.6% 3.9% 3.8% 3.2% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Note 1: Peers include banks with disclosed Office ALLL ratios (CFG, EGBN, EWBC, FCNC.A, HBAN, RF, WBS and ZION as of 12/31/24) $0.3 $0.1 $0.2 $1.8 2025 2026 2027 2028+ Contractual Maturity per Year (UPB)(1) $ in billions Reducing Office Exposure $ in billions -27%

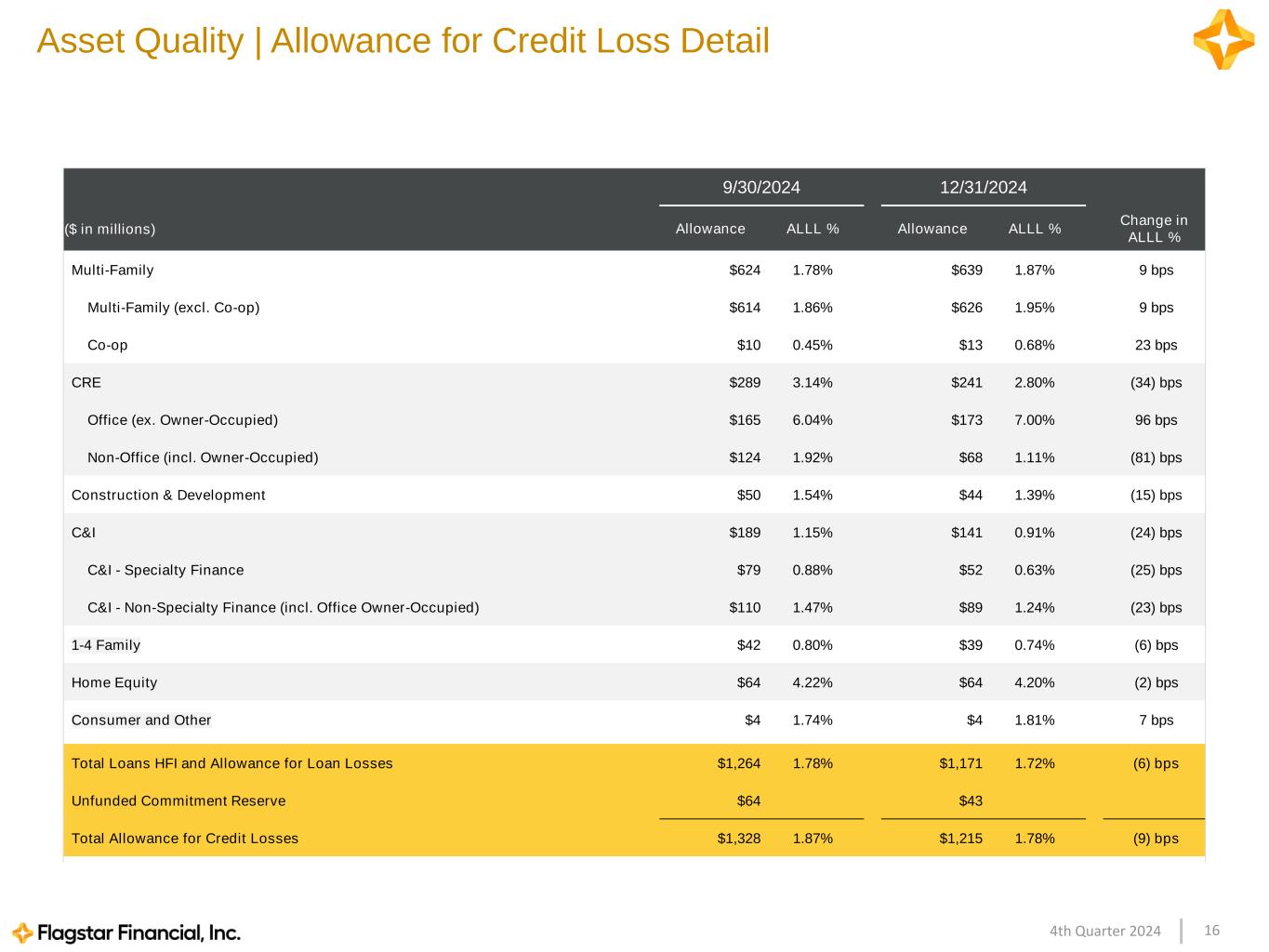

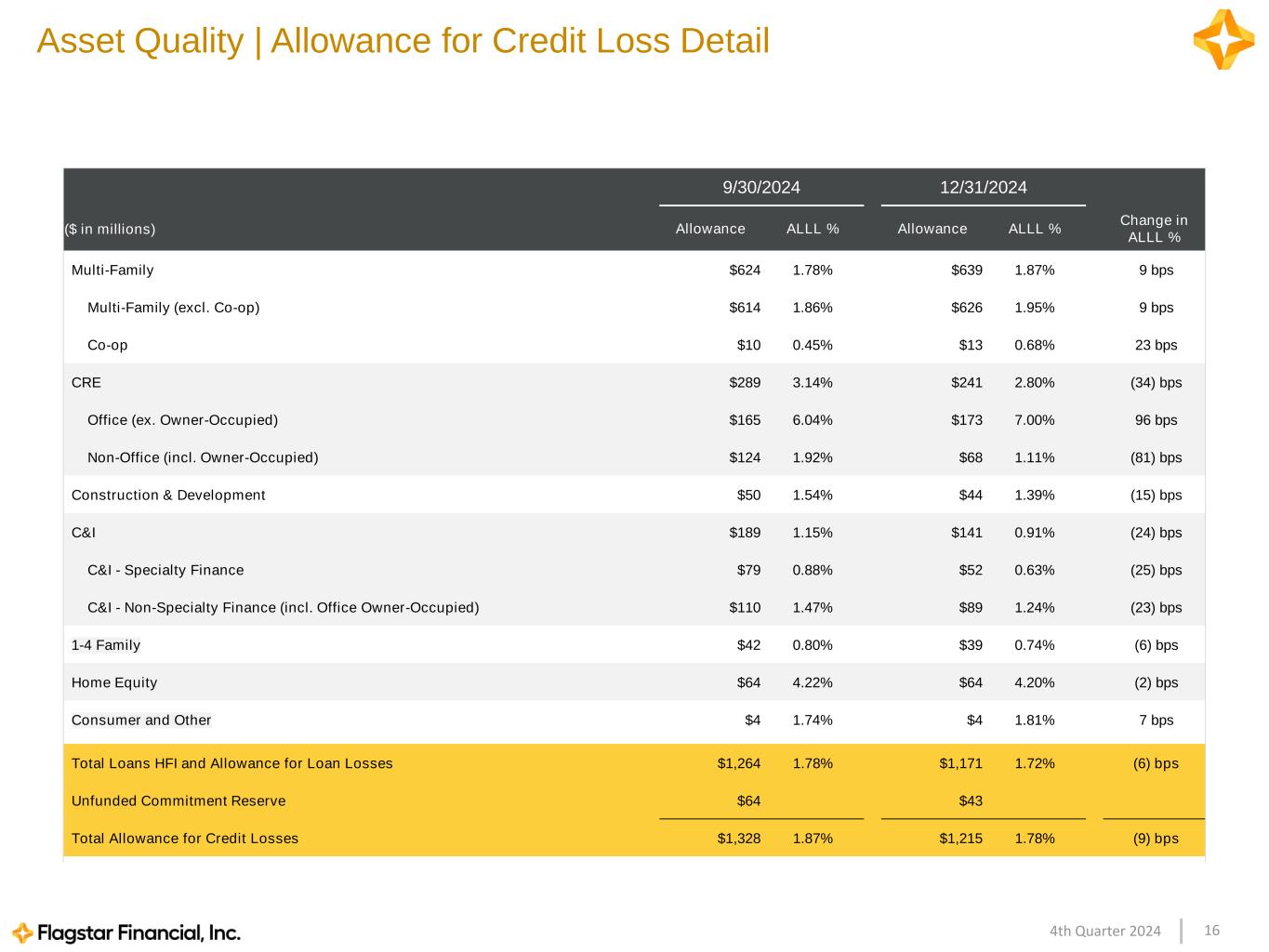

164th Quarter 2024 9/30/2024 12/31/2024 ($ in millions) Allowance ALLL % Allowance ALLL % Change in ALLL % Multi-Family $624 1.78% $639 1.87% 9 bps Multi-Family (excl. Co-op) $614 1.86% $626 1.95% 9 bps Co-op $10 0.45% $13 0.68% 23 bps CRE $289 3.14% $241 2.80% (34) bps Office (ex. Owner-Occupied) $165 6.04% $173 7.00% 96 bps Non-Office (incl. Owner-Occupied) $124 1.92% $68 1.11% (81) bps Construction & Development $50 1.54% $44 1.39% (15) bps C&I $189 1.15% $141 0.91% (24) bps C&I - Specialty Finance $79 0.88% $52 0.63% (25) bps C&I - Non-Specialty Finance (incl. Office Owner-Occupied) $110 1.47% $89 1.24% (23) bps 1-4 Family $42 0.80% $39 0.74% (6) bps Home Equity $64 4.22% $64 4.20% (2) bps Consumer and Other $4 1.74% $4 1.81% 7 bps Total Loans HFI and Allowance for Loan Losses $1,264 1.78% $1,171 1.72% (6) bps Unfunded Commitment Reserve $64 $43 Total Allowance for Credit Losses $1,328 1.87% $1,215 1.78% (9) bps Asset Quality | Allowance for Credit Loss Detail

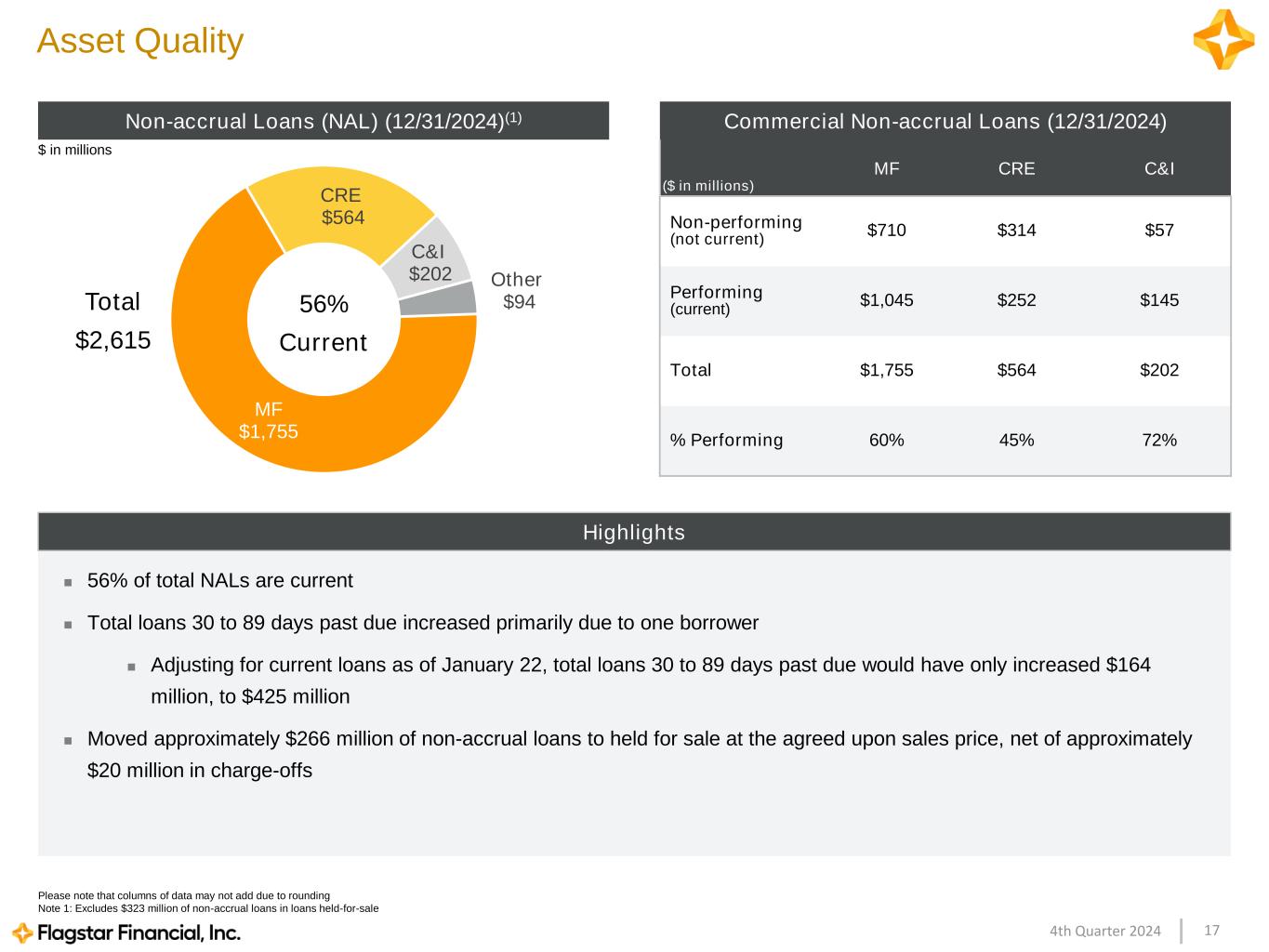

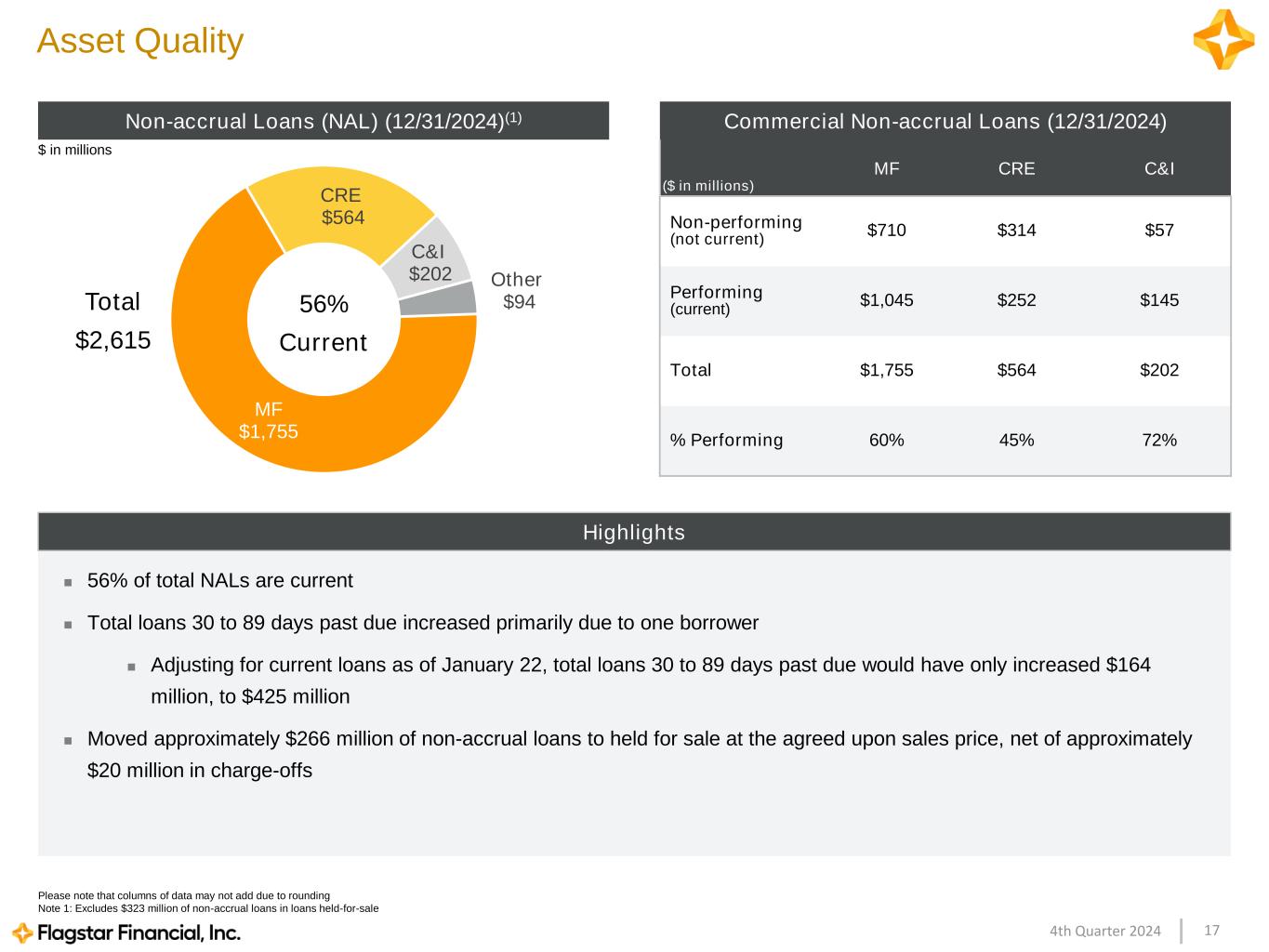

174th Quarter 2024 MF $1,755 CRE $564 C&I $202 Other $94 $ in millions Asset Quality ($ in millions) MF CRE C&I Non-performing (not current) $710 $314 $57 Performing (current) $1,045 $252 $145 Total $1,755 $564 $202 % Performing 60% 45% 72% 56% Current Non-accrual Loans (NAL) (12/31/2024)(1) Total $2,615 Commercial Non-accrual Loans (12/31/2024) Please note that columns of data may not add due to rounding Note 1: Excludes $323 million of non-accrual loans in loans held-for-sale ◼ 56% of total NALs are current ◼ Total loans 30 to 89 days past due increased primarily due to one borrower ◼ Adjusting for current loans as of January 22, total loans 30 to 89 days past due would have only increased $164 million, to $425 million ◼ Moved approximately $266 million of non-accrual loans to held for sale at the agreed upon sales price, net of approximately $20 million in charge-offs Highlights

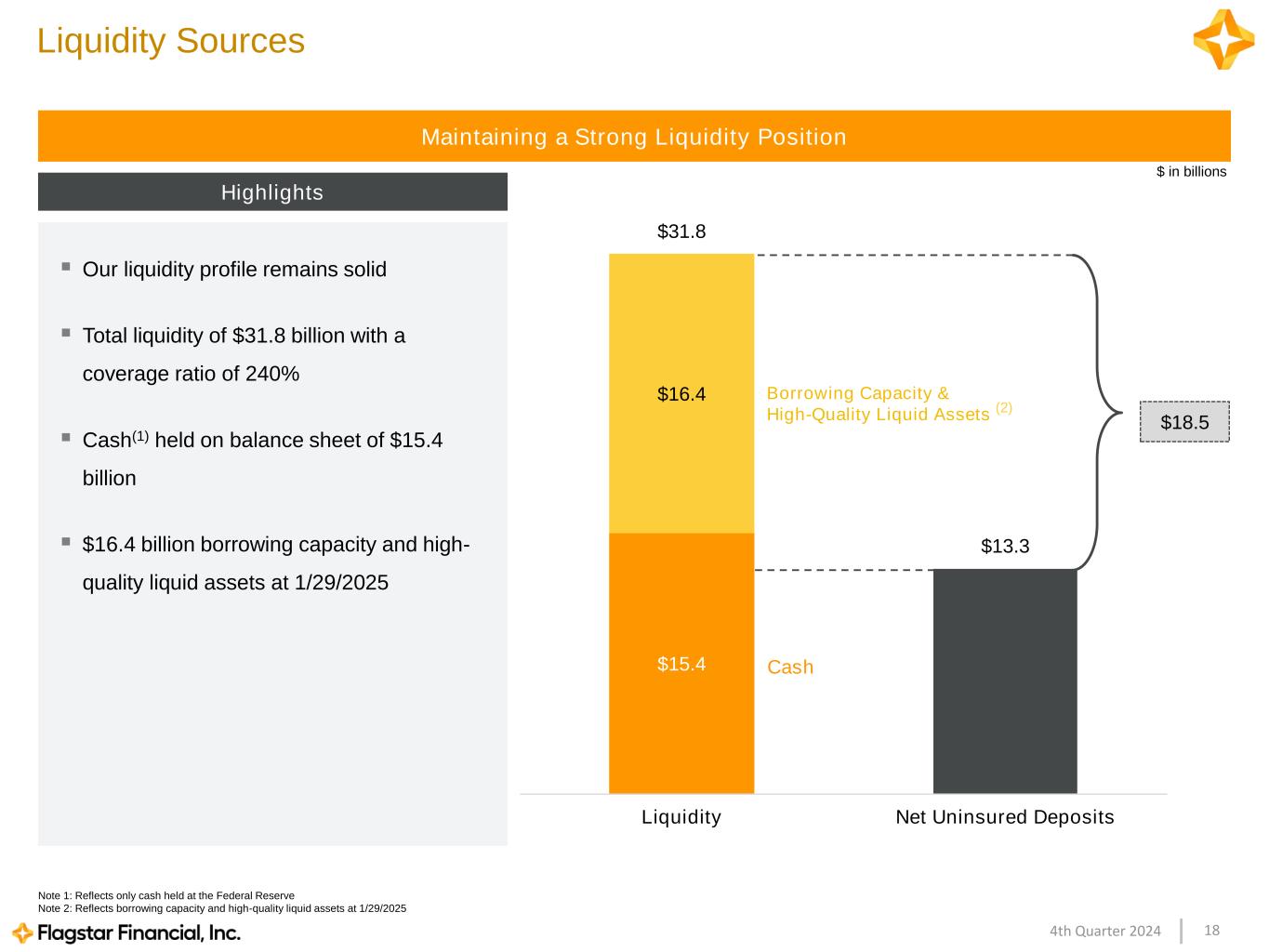

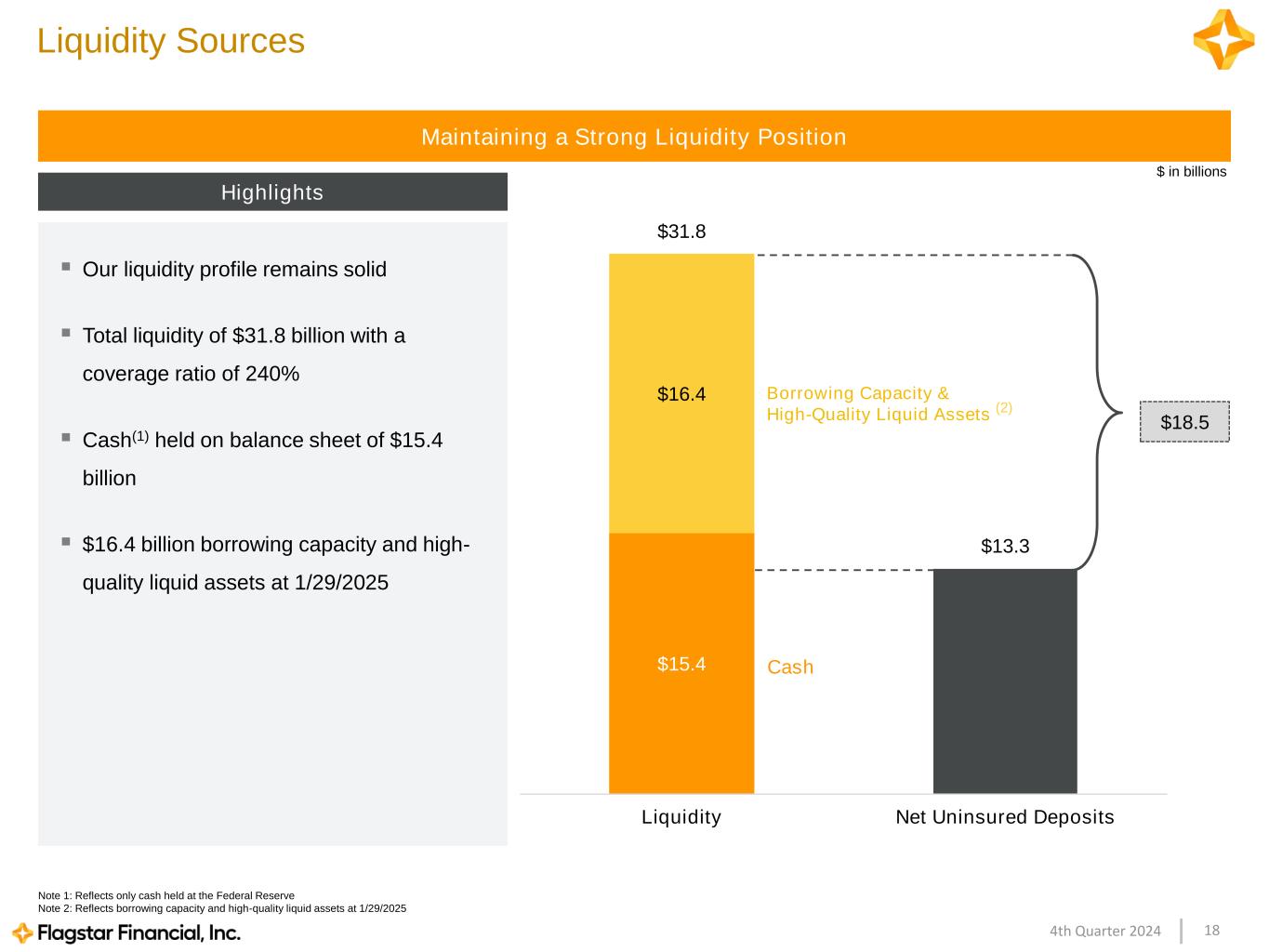

184th Quarter 2024 $15.4 $16.4 $31.8 $13.3 Liquidity Net Uninsured Deposits Liquidity Sources Maintaining a Strong Liquidity Position ▪ Our liquidity profile remains solid ▪ Total liquidity of $31.8 billion with a coverage ratio of 240% ▪ Cash(1) held on balance sheet of $15.4 billion ▪ $16.4 billion borrowing capacity and high- quality liquid assets at 1/29/2025 Highlights Cash Borrowing Capacity & High-Quality Liquid Assets $ in billions $18.5 Note 1: Reflects only cash held at the Federal Reserve Note 2: Reflects borrowing capacity and high-quality liquid assets at 1/29/2025 (2)

194th Quarter 2024 Investment Profile ◼ FLG currently trades at approximately 0.55x of tangible book value, compared to 1.84x or Category IV banks and 1.66x for banks with assets between $50 - $100 billion ◼ Q4’24 TBV Per Share: $17.36 ◼ Q4’24 TBV: $7.2 billion ◼ As we successfully execute on our strategic plan over time to transform into a diversified, high-performing regional bank, this valuation gap we believe will close ◼ FLG has multiple levers to narrow this valuation gap: — Diversify the loan portfolio — Increase core, relationship-based deposits — Increase the level of income generated from fee-based business — Rationalize our cost structure Source: S&P Capital IQ Pro. Note: Market data as of 1/29/2025

Appendix

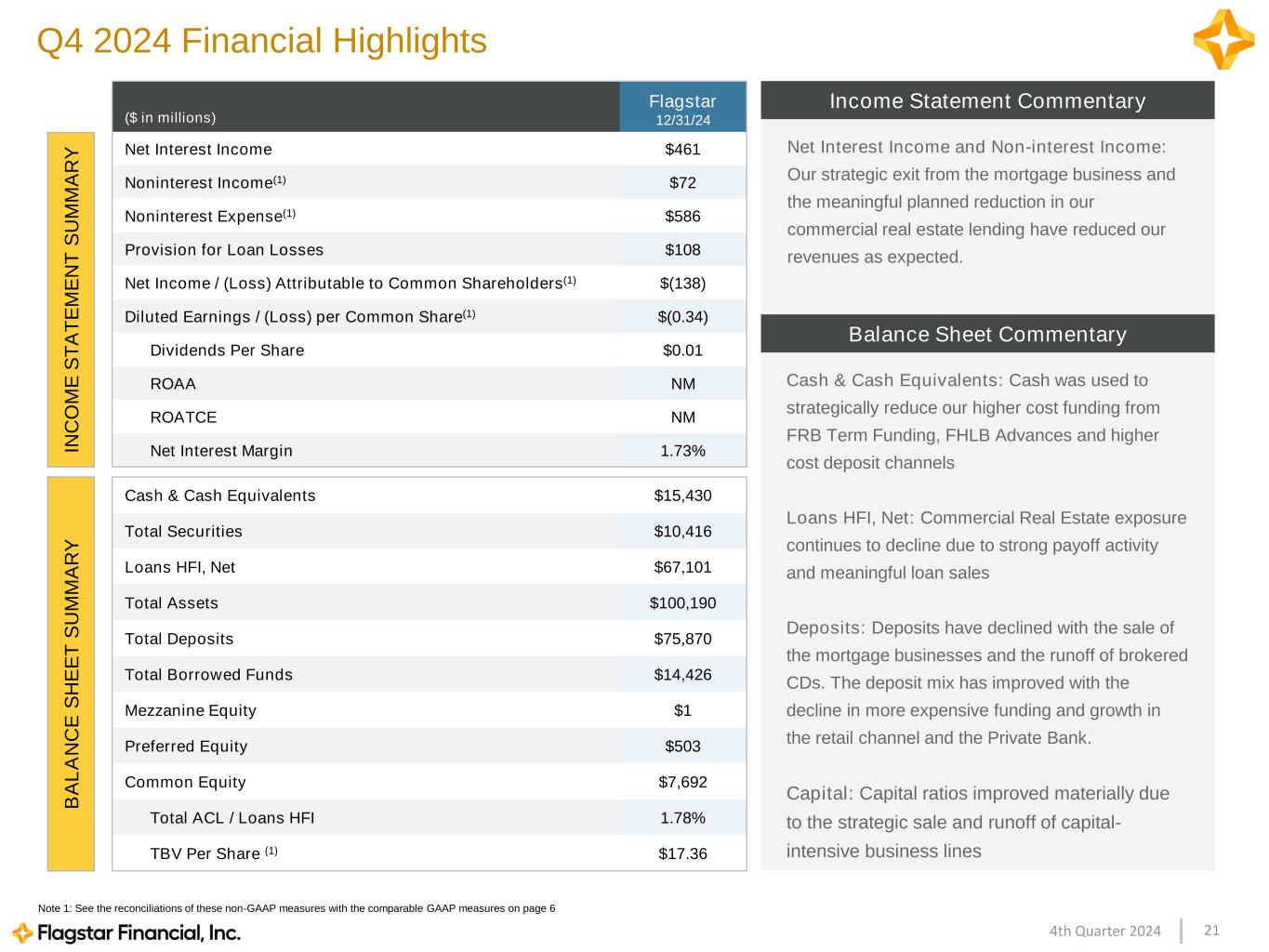

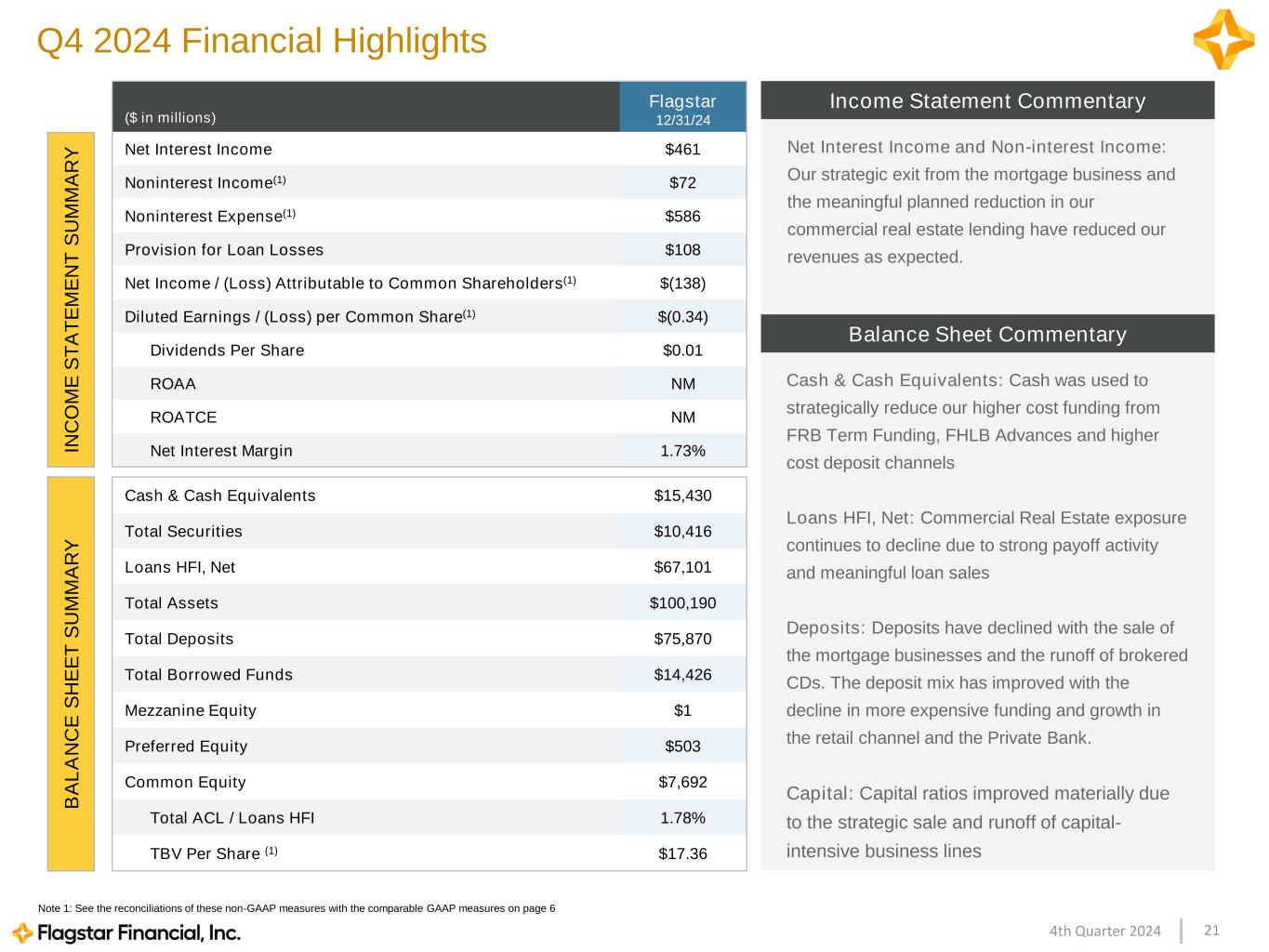

214th Quarter 2024 ($ in millions) Flagstar 12/31/24 Net Interest Income $461 Noninterest Income(1) $72 Noninterest Expense(1) $586 Provision for Loan Losses $108 Net Income / (Loss) Attributable to Common Shareholders(1) $(138) Diluted Earnings / (Loss) per Common Share(1) $(0.34) Dividends Per Share $0.01 ROAA NM ROATCE NM Net Interest Margin 1.73% Cash & Cash Equivalents $15,430 Total Securities $10,416 Loans HFI, Net $67,101 Total Assets $100,190 Total Deposits $75,870 Total Borrowed Funds $14,426 Mezzanine Equity $1 Preferred Equity $503 Common Equity $7,692 Total ACL / Loans HFI 1.78% TBV Per Share (1) $17.36 B A L A N C E S H E E T S U M M A R Y IN C O M E S T A T E M E N T S U M M A R Y Note 1: See the reconciliations of these non-GAAP measures with the comparable GAAP measures on page 6 Q4 2024 Financial Highlights Cash & Cash Equivalents: Cash was used to strategically reduce our higher cost funding from FRB Term Funding, FHLB Advances and higher cost deposit channels Loans HFI, Net: Commercial Real Estate exposure continues to decline due to strong payoff activity and meaningful loan sales Deposits: Deposits have declined with the sale of the mortgage businesses and the runoff of brokered CDs. The deposit mix has improved with the decline in more expensive funding and growth in the retail channel and the Private Bank. Capital: Capital ratios improved materially due to the strategic sale and runoff of capital- intensive business lines Balance Sheet Commentary Income Statement Commentary Net Interest Income and Non-interest Income: Our strategic exit from the mortgage business and the meaningful planned reduction in our commercial real estate lending have reduced our revenues as expected.

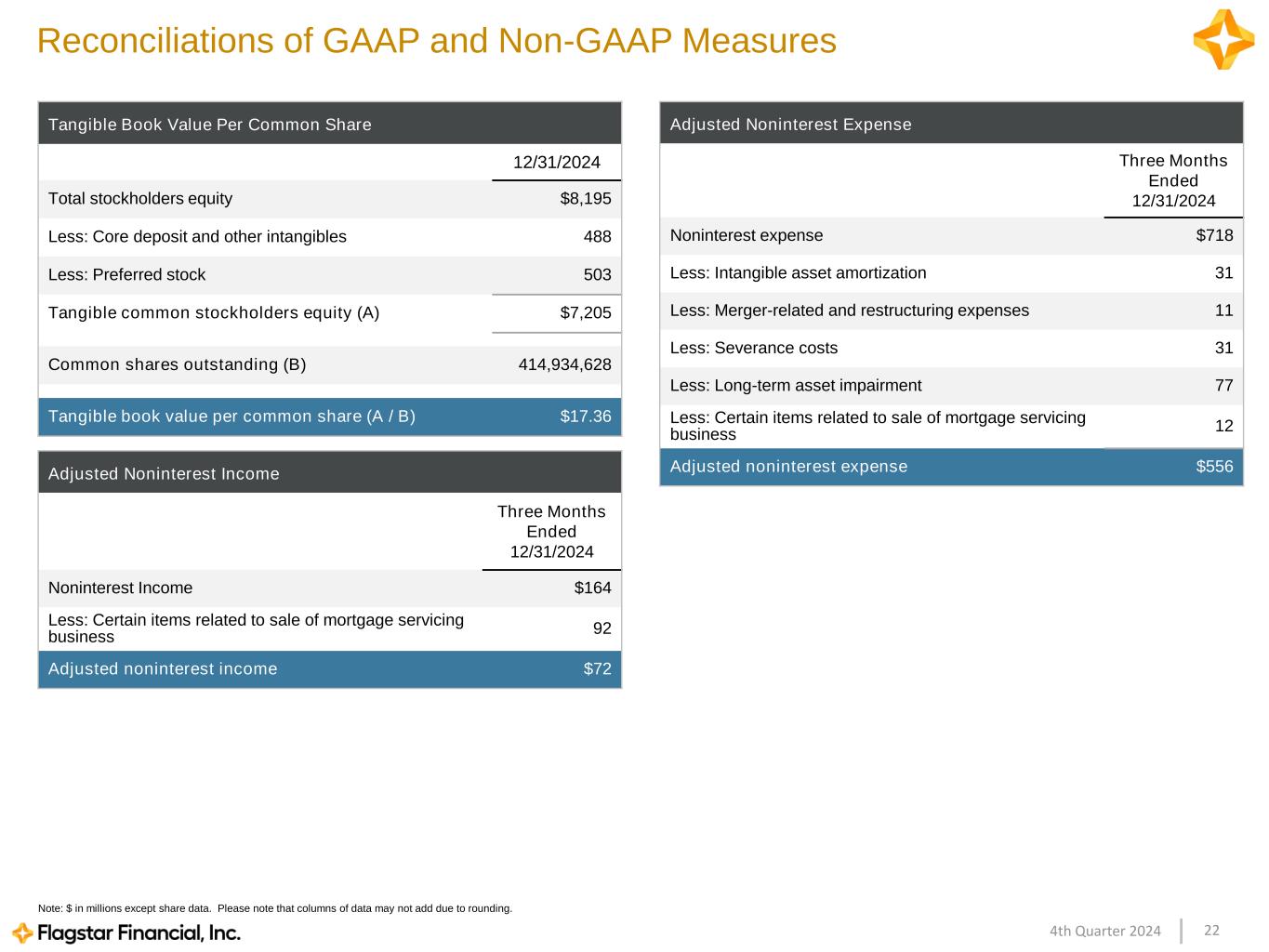

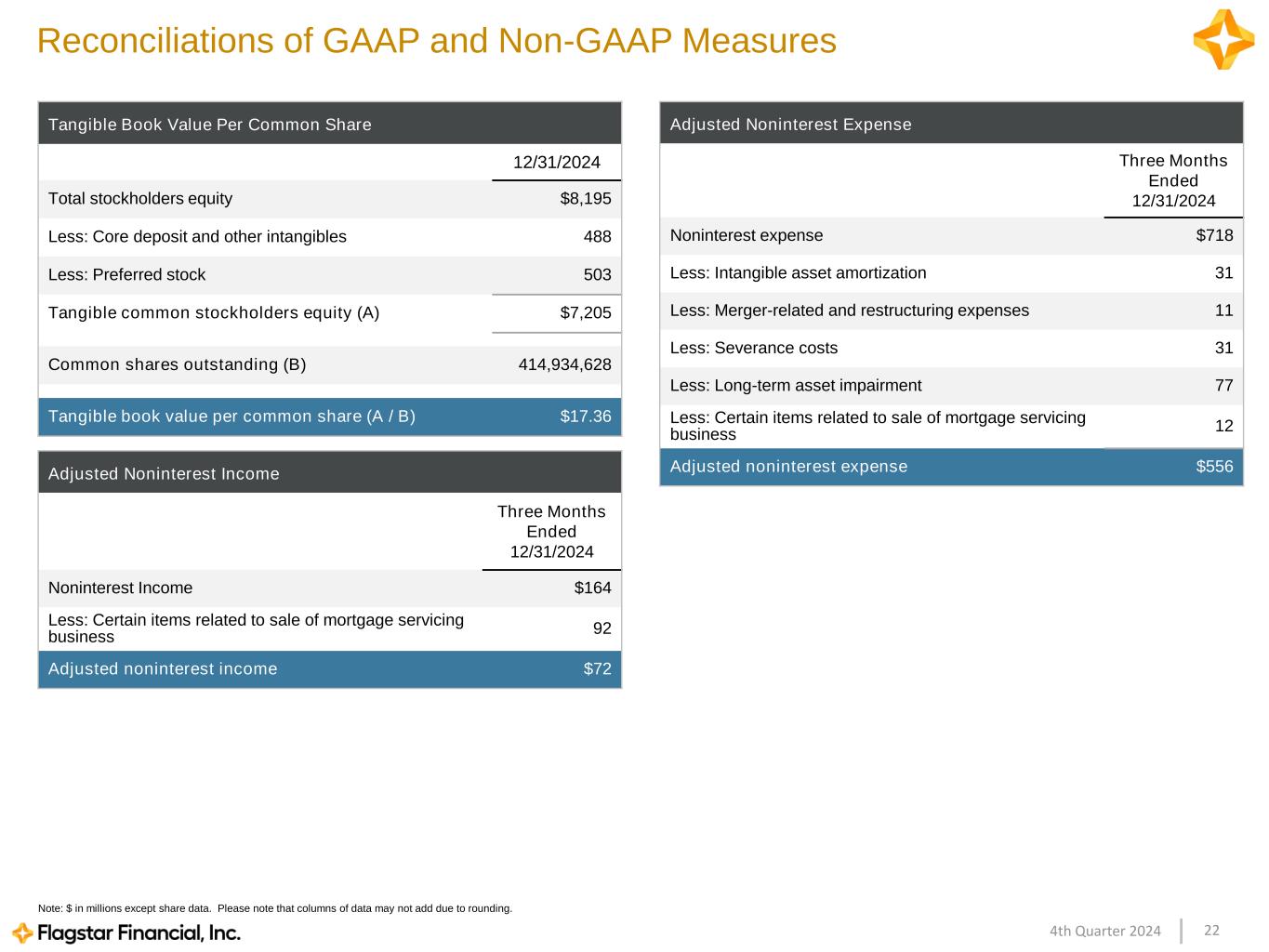

224th Quarter 2024 Note: $ in millions except share data. Please note that columns of data may not add due to rounding. Reconciliations of GAAP and Non-GAAP Measures Tangible Book Value Per Common Share 12/31/2024 Total stockholders equity $8,195 Less: Core deposit and other intangibles 488 Less: Preferred stock 503 Tangible common stockholders equity (A) $7,205 Common shares outstanding (B) 414,934,628 Tangible book value per common share (A / B) $17.36 Adjusted Noninterest Expense Three Months Ended 12/31/2024 Noninterest expense $718 Less: Intangible asset amortization 31 Less: Merger-related and restructuring expenses 11 Less: Severance costs 31 Less: Long-term asset impairment 77 Less: Certain items related to sale of mortgage servicing business 12 Adjusted noninterest expense $556Adjusted Noninterest Income Three Months Ended 12/31/2024 Noninterest Income $164 Less: Certain items related to sale of mortgage servicing business 92 Adjusted noninterest income $72

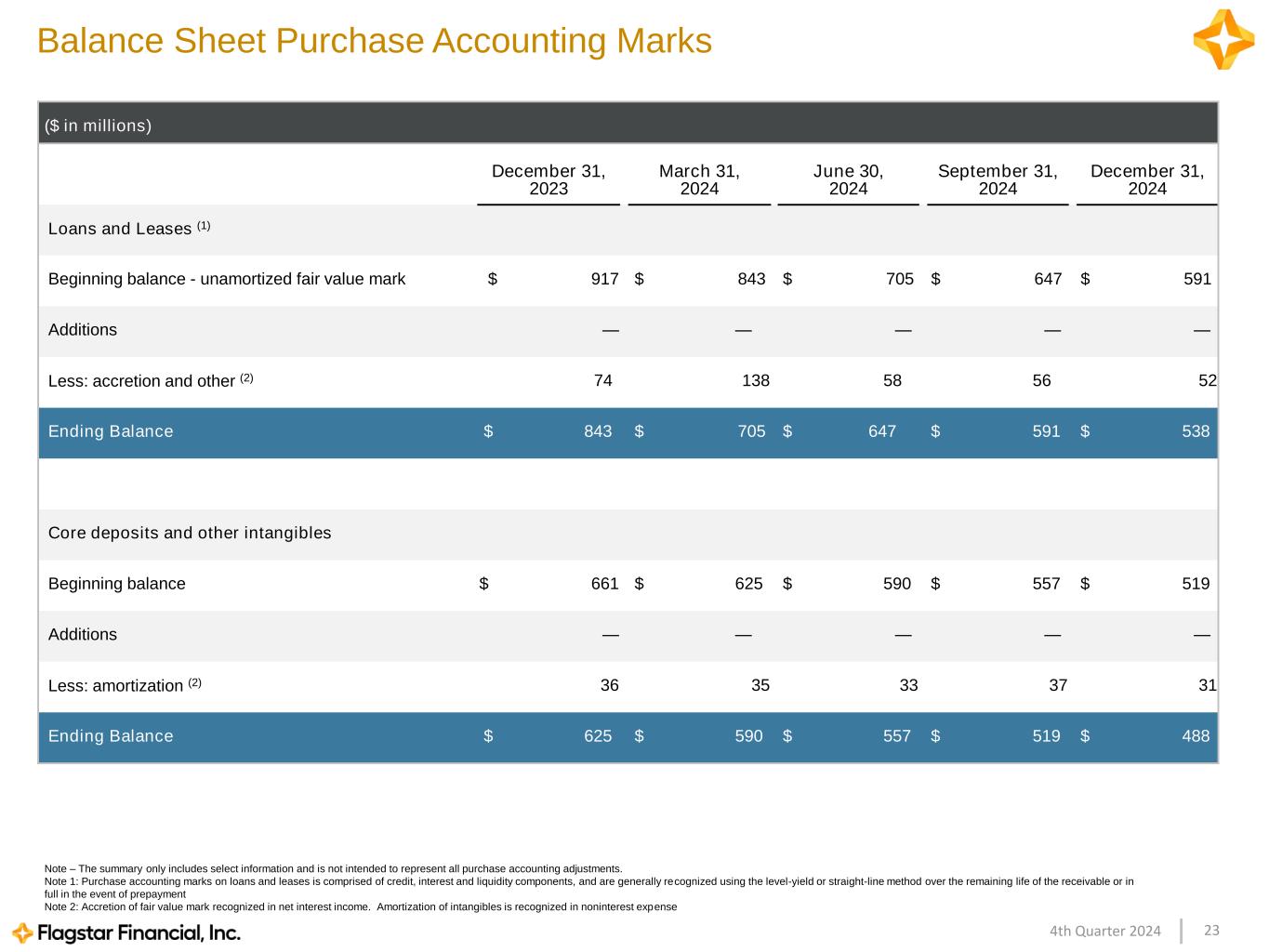

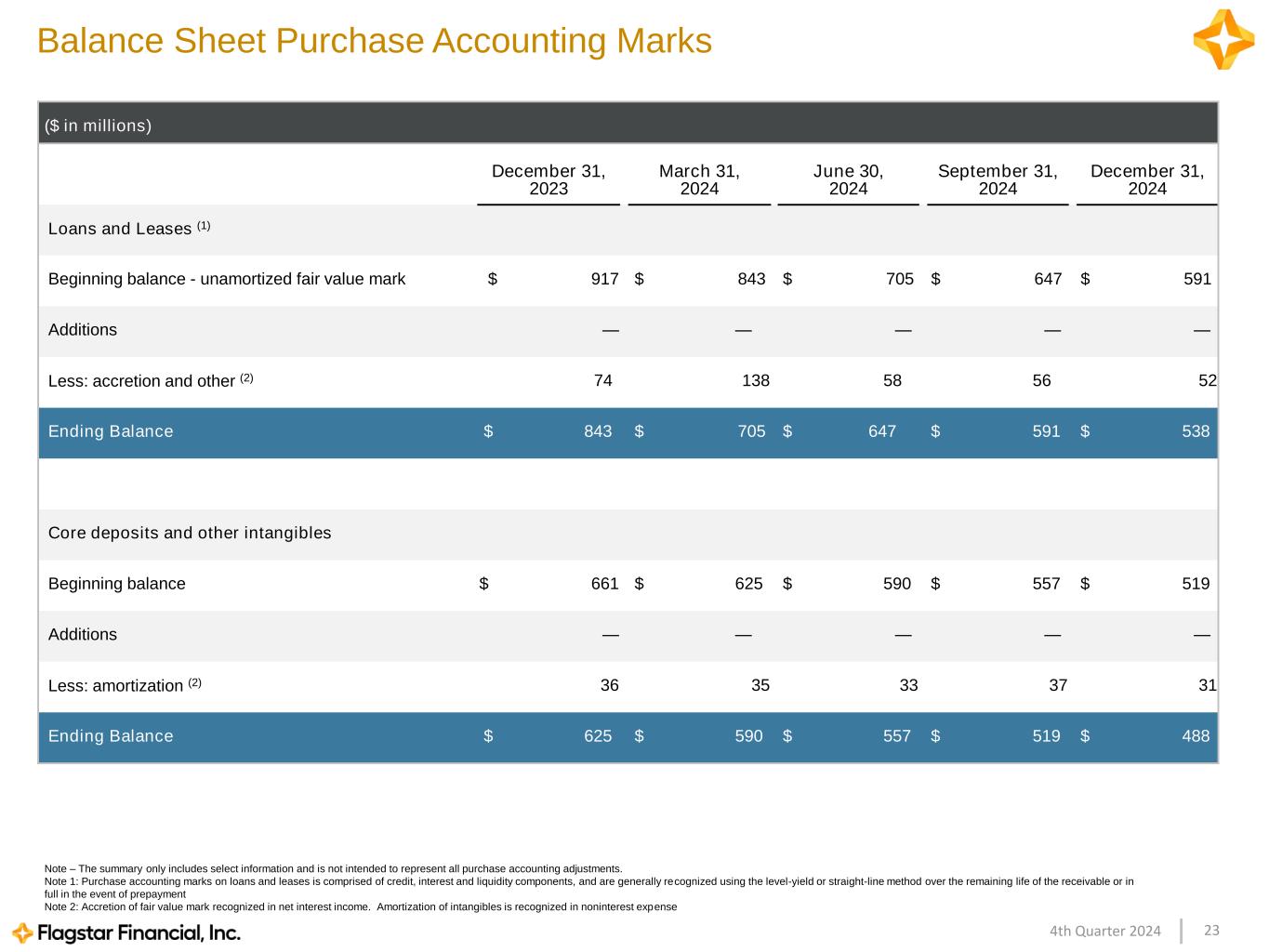

234th Quarter 2024 ($ in millions) December 31, 2023 March 31, 2024 June 30, 2024 September 31, 2024 December 31, 2024 Loans and Leases (1) Beginning balance - unamortized fair value mark $ 917 $ 843 $ 705 $ 647 $ 591 Additions — — — — — Less: accretion and other (2) 74 138 58 56 52 Ending Balance $ 843 $ 705 $ 647 $ 591 $ 538 Core deposits and other intangibles Beginning balance $ 661 $ 625 $ 590 $ 557 $ 519 Additions — — — — — Less: amortization (2) 36 35 33 37 31 Ending Balance $ 625 $ 590 $ 557 $ 519 $ 488 Note – The summary only includes select information and is not intended to represent all purchase accounting adjustments. Note 1: Purchase accounting marks on loans and leases is comprised of credit, interest and liquidity components, and are generally recognized using the level-yield or straight-line method over the remaining life of the receivable or in full in the event of prepayment Note 2: Accretion of fair value mark recognized in net interest income. Amortization of intangibles is recognized in noninterest expense Balance Sheet Purchase Accounting Marks

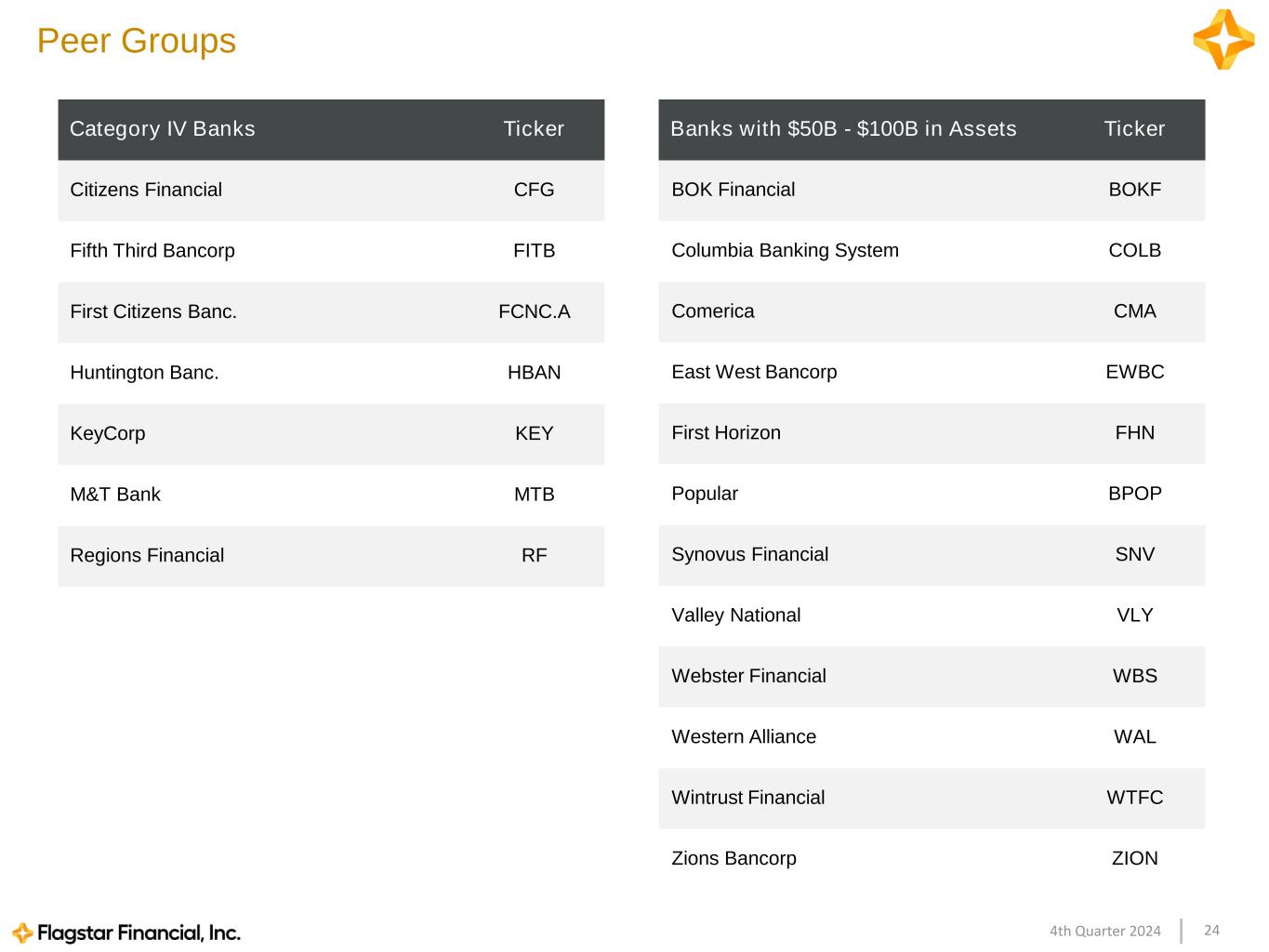

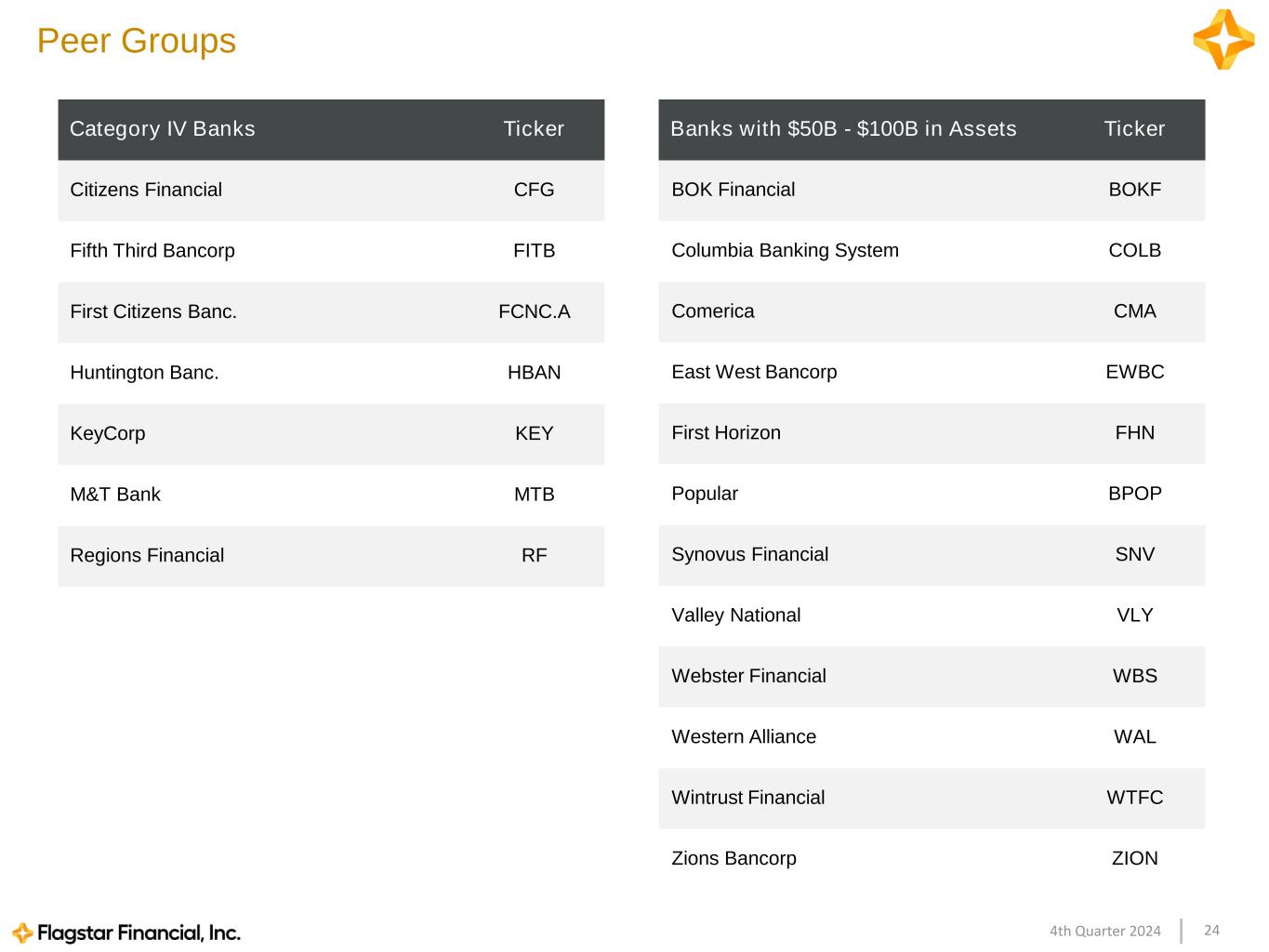

244th Quarter 2024 Category IV Banks Ticker Citizens Financial CFG Fifth Third Bancorp FITB First Citizens Banc. FCNC.A Huntington Banc. HBAN KeyCorp KEY M&T Bank MTB Regions Financial RF Banks with $50B - $100B in Assets Ticker BOK Financial BOKF Columbia Banking System COLB Comerica CMA East West Bancorp EWBC First Horizon FHN Popular BPOP Synovus Financial SNV Valley National VLY Webster Financial WBS Western Alliance WAL Wintrust Financial WTFC Zions Bancorp ZION Peer Groups