- FLG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Flagstar Financial (FLG) PRE 14APreliminary proxy

Filed: 12 Apr 22, 5:27pm

| ☒ | Preliminary proxy statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14-a6(e)(2)) |

| ☐ | Definitive proxy statement |

| ☐ | Definitive additional materials |

| ☐ | Soliciting material under Rule 14a-12 |

| ☒ | No fee required. |

☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 22, 2022 |

Sincerely, | |

| |

| Thomas R. Cangemi | |

| Chairman of the Board | |

| President and Chief Executive Officer |

April 22, 2021 |

Sincerely, | |

| |

| Hanif “Wally” Dahya | |

| Presiding Director |

MEETING NOTICE |

| DATE AND TIME: | Wednesday, June 1, 2022 at 10:00 a.m., Eastern Daylight Time. | |

| PLACE: | The 2022 Annual Meeting of Shareholders of New York Community Bancorp, Inc. (the “Company”) will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/NYCB2022. | |

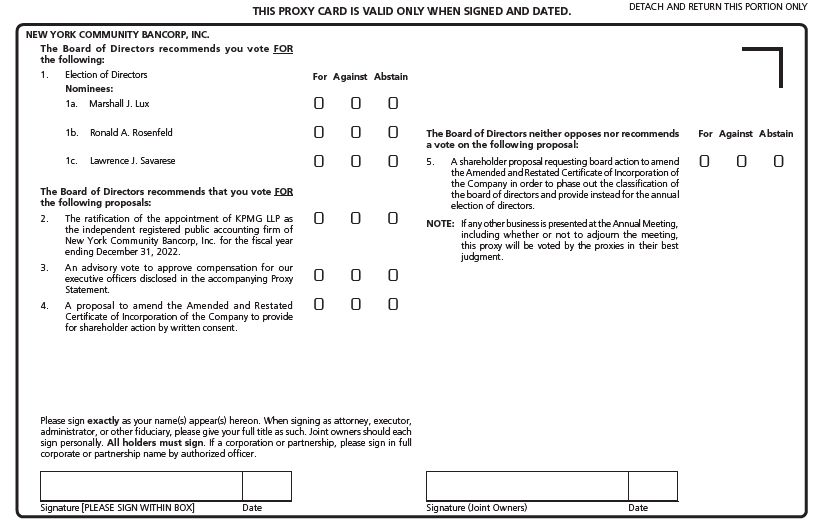

| ITEMS OF BUSINESS: | 1) The election of three directors to three-year terms; 2) The ratification of the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022; 3) Approval, on a non-binding advisory basis, of New York Community Bancorp, Inc.’s Named Executive Officer compensation; 4) A proposal to amend the Amended and Restated Certificate of Incorporation of the Company in order to provide for shareholder action by written consent; 5) To consider a shareholder proposal requesting Board action to eliminate the classified Board by approving amendments to the Amended and Restated Certificate of Incorporation of the Company; and 6) Such other matters as may properly come before the meeting or any adjournments thereof, including whether or not to adjourn the meeting. | |

| WHO CAN VOTE: | You are entitled to vote if you were a shareholder of record at the close of business on Tuesday, April 5, 2022. | |

| VOTING: | We urge you to participate in the meeting, either by attending and voting in person or by voting as promptly as possible by telephone, through the Internet, or by mailing your completed proxy card (or voting instruction form, if you hold your shares through a broker, bank, or other nominee). Each share is entitled to one vote on each matter to be voted upon at the annual meeting. Your vote is important and we urge you to exercise your right to cast it. | |

| MEETING ADMISSION: | To be admitted to the meeting at www.virtualshareholdermeeting.com/NYCB2022, you must enter the control number found on the proxy card, voting instruction form, or notice you received. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting. | |

| 2021 ANNUAL REPORT: | A copy of our 2021 Annual Report to Shareholders, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2021, accompanies this Notice and Proxy Statement. | |

| DATE OF DISTRIBUTION: | This Notice, the Proxy Statement, and the proxy card are first being made available or mailed to shareholders on or about April 22, 2022. |

| By Order of the Board of Directors, | |

| |

| R. Patrick Quinn | |

Senior Executive Vice President, | |

General Counsel and Corporate Secretary | |

Westbury, New York |

TABLE OF CONTENTS |

| 1 | |

| 6 | |

| 8 | |

| 12 | |

| 12 | |

| 13 | |

| 14 | |

| 15 | |

| 18 | |

| 22 | |

| 22 | |

| 23 | |

| 24 | |

| | |

| 25 | |

| 25 | |

| 25 | |

| 28 | |

| 28 | |

| 30 | |

| 37 | |

| 39 | |

| 40 | |

| | |

| 47 | |

| 49 | |

| 54 | |

| 55 | |

| 55 | |

| 57 | |

| 58 | |

| 59 | |

| 59 | |

| 60 | |

| 61 | |

| 62 | |

| 65 | |

| 66 | |

| 70 | |

| 71 | |

| 72 | |

| A-1 | |

| B-1 |

PROXY SUMMARY |

| Voting Matters: | Recommendation of the Board: | |||

| Proposal 1 | The election of three directors to three-year terms. | FOR ALL | ||

| Proposal 2 | Ratification of the appointment of KPMG, LLP as our independent registered public accounting firm for 2022. | FOR | ||

| Proposal 3 | Approval, on a non-binding advisory basis, of New York Community Bancorp, Inc.’s Named Executive Officer compensation. | FOR | ||

| Proposal 4 | A proposal to amend the Amended and Restated Certificate of Incorporation of the Company in order to provide for shareholder action by written consent. | FOR | ||

| Proposal 5 | A shareholder proposal requesting Board action to amend the Amended and Restated Certificate of Incorporation of the Company in order to phase out the classification of the Board of Director and provide instead for the annual election of directors. | NEUTRAL | ||

| Company Profile: | |

New York Community Bancorp, Inc. is the largest savings bank holding company in the nation and New York Community Bank is one of the leading depositories in most of the markets we serve. Our roots go back to 1859, when we were chartered by the State of New York in Queens, a borough of New York City. Since then, we have grown from a single branch in Flushing to 237 branch offices in five states. Based in Hicksville, NY, New York Community Bancorp, Inc. is a leading producer of multi-family loans on non-luxury, rent-regulated apartment buildings in New York City, and the parent of New York Community Bank. At December 31, 2021, the Company reported assets of $59.5 billion, loans of $46 billion, deposits of $35.1 billion, and shareholders’ equity of $7.0 billion. |  |

• We compete for depositors in these diverse markets by emphasizing service and convenience, with a comprehensive menu of traditional and non-traditional products and services, and access to multiple service. • We underwrite our loans in accordance with conservative credit standards in order to maintain a high level of asset quality. • We originate asset-based loans, dealer floor-plan loans, and equipment loans and leases to large corporate obligators in stable industries nationwide through the Community Bank’s specialty finance subsidiary, NYCB Specialty Finance LLC. | |

PROXY SUMMARY |

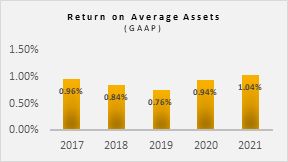

Performance Highlights1: |

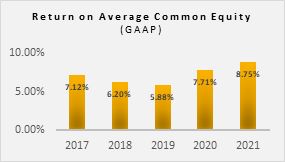

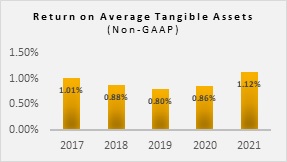

In 2021, our Company reported net income available to common shareholders of $563 million, or diluted earnings per common share of $1.20. This represents a return on average tangible assets of 1.12% and a return on average tangible common equity of 14.61%. |

PROXY SUMMARY |

| Performance Highlights (cont’d) |

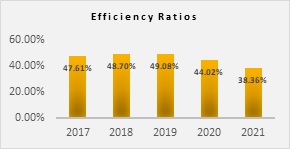

• We paid our shareholders an annual dividend of $0.68 per common share, which translates into total cash dividends of $315.9 million for our common shareholders. As of the record date for the Annual Meeting, this reflected a 6.5% dividend yield on our stock. • Reflecting our profitability – and our capital position – we have distributed $6.7 billion of quarterly cash dividends over the past 108 quarters and repurchased $1.2 billion of our shares. • Over the course of our public life, we have produced multi-family loans totaling $107.2 billion, including $8.3 billion in 2021. • Likewise, we have produced commercial real estate loans totaling $23.4 billion, including $892.9 million in 2021 alone. • From 1993 through the end of 2021, we recorded a mere 107 basis points of losses (cumulative charge-offs as a percent of average loans), in contrast to an industry average of 2,454 basis points during the same time. • From 1993 through 2021, our average efficiency ratio was 39.9%, in contrast to the 60.74% industry average (as reported by S&P Global Market Intelligence). • Over the course of our public life, we have expanded our balance sheet by $35.3 billion through 10 mergers and acquisitions, involving seven in-market competitors and two out-of-market banks. |

| Executive Compensation Highlights: |

The following provides an overview of 2021 executive compensation: • The Compensation Committee revised our annual cash incentive plan for senior management to incorporate budget-based, weighted targets for operating earnings and ROAA. The Committee also added a strategic/qualitative scorecard to provide a more holistic assessment of the Company’s performance. The Company recorded results under the new plan design at the stretch level. • The Committee made grants under the 2021 long-term equity incentive plan which had two components: (i) an award of time-based vested restricted stock with three-year vesting and (ii) a three-year (2021-2023) performance-based equity award with payouts based on the Company’s performance with respect to two metrics (earnings per share growth and return on average tangible common equity) relative to an industry index group. Awards were made at the target level. • The Committee authorized base salary adjustments for our CEO and CFO when they assumed their present positions. The adjustments reflected consideration of market data and their positioning relative to other senior executives. In addition, the Committee made one-time promotional grants of restricted stock to each executive with five-year vesting. • For a detailed discussion of our 2021 executive compensation program, see Compensation Discussion and Analysis in this Proxy Statement. |

PROXY SUMMARY |

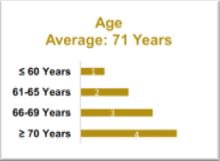

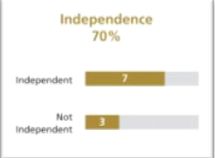

| Governance Highlights: |

We are committed to maintaining the highest standards of corporate governance. Strong corporate governance practices help us achieve our performance goals and maintain the trust and confidence of our shareholders and other constituents. Highlights of our governance standards and policies include: • Our Board of Directors is comprised of individuals possessing a well-rounded variety of skills, knowledge, experience and perspectives and who have unique experience and perspectives on our business. • 70% of our Board members satisfy New York Stock Exchange independence standards, and each of the Compensation, Audit, and Nominating and Corporate Governance Committees are comprised wholly of independent directors. • Our Presiding Director is the lead independent director with significant governance responsibilities. • Our Board recently welcomed a new member, Marshall J. Lux, who has significant qualifications and experience and appointed him to the Audit and Risk Assessment Committees of the Board. • Recognizing that diversity and inclusion benefits companies by providing a broad range of perspectives and insights, and continuing the Board’s focus on diversity and refreshment, the Board’s Board Development Subcommittee of the Nominating and Corporate Governance Committee has assisted with identifying candidates with a diversity of ethnicities and gender for potential Board service. • Our Bylaws provide for “proxy access,” allowing eligible shareholders to include their own nominees for director in the Company’s proxy materials. • Our Board recently approved amendments to the Company’s Bylaws lowering the retirement age requirement from 80 to 75 which will become effective upon regulatory approval. • Our Board and Board Committees perform annual self-evaluations and adopt action plans to implement changes when deemed necessary or appropriate. • Our Board Risk Assessment Committee, which meets the requirements for U.S. Bank Holding Companies under the Dodd-Frank Act’s Enhanced Prudential Standards, meets at least on a quarterly basis and oversees a robust and exacting enterprise risk management program. • Our Board has submitted a proposal to shareholders to provide for shareholder action by written consent by amending the Company’s Amended and Restated Certificate of Incorporation. |

| Community Support: |

Service to our customers and the community is an important part of the New York Community Bank culture. We support the communities we serve through lending, investments, services, and charitable giving, including through New York Community Bank Foundation and Richmond County Savings Foundation, with the following notable highlights: • Annually, the Bank and the Foundations contribute over $3.7 million through grants, employee giving, sponsorships, pro bono, and in-kind donations. • New York Community Bank employees in 2021, despite the continuing impact of the coronavirus pandemic, volunteered approximately 1,700 hours for community organizations. • Almost 200 Bank employees have leadership roles within community organizations. • Employees participated in more than 135 community events and many were conducted virtually because of the continuing coronavirus pandemic. • The Foundations have awarded more than $97 million in grants to more than 6,200 community organizations since 2000, including $17 million for health and human services, $13.2 million for education, $16.8 million for civic and community organizations, and $16 million for arts and culture. • The Community Bank’s corporate philanthropy program contributes nearly $1.0 million annually to community organizations. The Community Bank is a leading multifamily mortgage portfolio lender. While a significant share of multifamily mortgage loans are originated in New York and New Jersey, where rent-regulated apartment buildings are a predominant housing type, the Bank is also a leading multifamily mortgage portfolio lender in Ohio, Florida, and Arizona. The Community Bank originated multifamily loans that were primarily secured by non-luxury residential apartment buildings that feature rent-regulated units and below-market rents. Many of the neighborhoods in which the Community Bank originated multifamily loans can be considered areas of naturally occurring affordable housing. In the last 10 years, the Community Bank’s multi-family lending in neighborhoods of naturally occurring affordable housing, primarily in low- and moderate-income areas, represented 65% of total originated loans and 53% of total originated loan amount. In New York City where the Community Bank originates a significant share of multi-family loans, 71% of the number of loans and 65% of total loan amount were originated in neighborhoods containing naturally occurring affordable housing more often found in low- and moderate-income areas. |

PROXY SUMMARY |

Additionally, we continue to support communities impacted by disasters through corporate donations to relief organizations. We also provide our employees with paid time off to volunteer with community organizations and encourage our employees to lead philanthropic initiatives that matter to them. In response to the COVID-19 pandemic, the health, safety, and financial well-being of our customers and employees remained a top priority. Some of the actions we have taken to address these evolving needs include: • establishing a senior management working group, led by the Chief Operating Officer, that has met regularly throughout the pandemic to address and continually monitor developing health, safety, operational issues; • slowly transitioning employees back to the office in phases – 25%, 50%, 75% staffing levels – based upon essential need while continuing to maintain an effective work-from-home program for all of our employees; • ensuring customer access to our services, including through enhanced online and mobile banking platforms, while modifying physical access to our branch and other locations; • establishing a 24-hour help line for employees and their family members to speak with qualified clinicians and distribution of daily communications to ensure that employees were able to have ongoing access critical information about the pandemic and our responsive operations; • offering extensive loan modifications to our borrowers who required temporary assistance under a carefully structured and phased loan relief program; • providing customers with access to certain Small Business Administration Pandemic related lending programs, including U.S. Small Business Administration’s the Paycheck Protection Program; • providing grants and donations to community organizations to address coronavirus concerns, including for PPE, surgical equipment, and to address food insecurity; and • targeting investments to select New York City not-for-profit companies that address small business lending needs. |

SHAREHOLDER OUTREACH AND RECENT INITIATIVES |

| What we heard | Our Response | ||||

| Shareholders emphasized concerns regarding the ways the Company can help protect the environment and also further social goals, including diversity in our board and our workforce | √ | The Company is examining additional ways to improve its energy use and carbon emissions in our operations and also ways we can help our borrowers do the same. Among other things, management has established an ESG working group to evaluate and assess the many ways that we are impacted by these concerns. | |||

| Some shareholders favor declassification of the Board of Directors, while others favor a Board whose members are elected in multiple classes over three years | √ | In 2021, the Board proffered a proposal to phase out the classification of the board of directors by amending the Amended and Restated Certificate of Incorporation of the Company. The proposal did not receive the affirmative support of the percentage of the Company’s outstanding shares required for the proposal to pass. Our Board, consistent with its fiduciary duties, continues to regularly reexamine its position with respect to our classified board structure. | |||

| The Board of Directors should seek to refresh its members from time to time so that its composition reflects an appropriate mix of individuals by tenure, skills, expertise, experience, age, and gender in connection with current and future Company business needs | √ | The Board maintains a policy to consider a mix of individuals by tenure, skills, expertise, experience, age, gender, race, and ethnicity in connection with current and future Company business needs. In 2021, the Board formed a Board Development Subcommittee of the Nominating and Corporate Governance Committee to identify, assess, and make recommendations regarding new prospective candidates for membership on the Company and New York Community Bank Boards with a focus on finding qualified candidates who can fulfill the Board’s commitment to pursuing diversity as represented by age, gender, ethnicity, professional background and other considerations at every level of the Company and Community Bank. |

SHAREHOLDER OUTREACH AND RECENT INITIATIVES |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) |

| ➢ | ESG Progress and Opportunities |

| Recent Progress | Opportunities in Progress and on the Horizon |

| Environmental | |

Roadmap. Began the process to establish a roadmap and framework to achieve sustainability goals. Resources. Working with climate experts to advise on environmental matters. Accomplishments. • Implemented several measures to reduce the Company’s environmental impact (see Environmental section below). | Carbon footprint. Calculate our own greenhouse gas emissions and set baseline so that we are positioned to set reduction targets. Environmental initiatives. Work with environmental task force, facilities personnel and procurement to identify measures to improve the resource efficiency of our footprint and activities. Portfolio Analysis. Initialize portfolio analysis on climate risk exposure. |

| Social | |

Diversity, Equity and Inclusion (DEI). • Provide learning opportunities that allow employees to deepen their understanding of diverse skills, opinions and knowledge. • Identify, participate in and sponsor recruitment events focused on diversity, including those for individuals with disabilities, LGBTQ+, veterans and more. • The Community Bank’s “My Community SimplyOne Checking” account was certified by the Cities for Financial Empowerment Fund as meeting the Bank On National Account Standards for 2021 – 2022. Bank On-certified accounts promote financial inclusion for the underbanked and unbanked consumers through standard account features that are low-cost, with robust transaction capabilities. • Available Spanish language version of the Community Bank website (www.myNYCB.com) and its direct banking website (www.MyBankingDirect.com) meeting the rising needs of our Spanish-speaking customer base. • The Community Bank’s sponsored Foundations since their founding have awarded more than $97 million in grants to more than 6,200 community organizations since 2000, including $17 million for health and human services (e.g., Person Centered Care Services, On Your Mark), $13.2 million for education (e.g., SUNY Empire State College-Black Male Initiative, Girls Inc. of Long Island, CSJ Learning Connection, The Grace Foundation), $16.8 million for civic and community organizations (e.g., Urban League of Long Island, Urban League of Greater Phoenix, Habitat for Humanity, Legal Service for NYC), and $16 million for arts and culture (e.g., Hofstra University National Center for Suburban Studies, Women’s Diversity Network). | Culture. Continue to work toward infusing DEI into our programs and activities, internally and externally. Talent. Focus on increasing talent from underrepresented communities in key business units and leadership roles. CRA. Continue to expand access to housing for low-and-moderate income (LMI) individuals, support economic development and community revitalization in LMI communities, and improve financial capability and stability in LMI communities. Community Benefits Agreement (CBA). Entered into a CBA with the National Community Reinvestment Coalition pursuant to which the Company will commit $28 billion in loans, investments, and other financial support to communities and people of color, LMI families and communities and small businesses. The CBA was developed with NCRC and its members in conjunction with the Company’s pending merger with Flagstar Bancorp, Inc. and is subject to the closing of the merger. |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) |

• In 2021, the corporate philanthropy program contributed nearly $1.0 million to community organizations. Community Reinvestment Act (CRA). • Community Bank originated multifamily loans in the five footprint states – New York, New Jersey, Ohio, Florida, Arizona – that were primarily secured by non-luxury residential apartment buildings that feature rent-regulated units and below-market rents. • Community Bank’s multi-family lending in neighborhoods of naturally occurring affordable housing, primarily in low- and moderate-income areas, represented 65% of total originated loans and 53% of total originated loan amount in 2021. • In New York City where the Community Bank originates a significant share of multi-family loans 71% of the number of loans and 65% of total loan amounts were originated in neighborhoods containing naturally occurring affordable housing more often found in low- and moderate-income areas in 2021. Wellness & Benefits. Continue to provide tools, resources and support to promote employees’ financial, emotional and physical well-being. | |

| Governance and Disclosure | |

Strategy. Adopted initial ESG strategy and pillars. Responsibility. • Board assigned the Nominating & Corporate Governance Committee with ESG oversight; regular updates at Committee meetings scheduled. • At the direction of the Board, the Chief Risk Officer established a management level ESG Working Group, whose members include senior leadership from key areas within the Company, which is charged with responsibility to address ESG issues including, among other things, climate risks, diversity, equity and inclusion, and disclosure. • Scheduled regular updates on climate-related risks and opportunities for management. • Incorporated climate risk into risk appetite policy. | Measurement. Establish qualitative and quantitative measurements to monitor ESG progress. Implementation. Move forward with engagement of ESG advisors. Engage with advisors, working group, and task forces to operationalize solutions. Risk management. Incorporate climate risk where possible within our existing risk management processes and policies. Disclosure Standards. Begin the process of aligning ESG reporting with applicable SEC, accounting, regulatory, and industry standards. Shareholder Outreach. Conduct first proactive ESG outreach effort in 2022; continue that outreach in 2023. |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) |

• Established subject matter ESG sub-working groups to address environmental, social, and governance initiatives and report to the management level ESG Working Group. |

| ➢ | Environmental |

| ✔ | Partnered with New York City’s energy company, Consolidated Edison, in its LED light replacement and exchange program and replaced old fixtures with LED light fixtures at several Community Bank branches; |

| ✔ | Upgraded Heating, Ventilation, and Air Conditioner (HVAC) systems to more energy efficient systems at several Community Bank branches and at the Company’s corporate headquarters; |

| ✔ | Replaced bottled water with water filtration systems at all corporate and branch locations; |

| ✔ | Ensured paper is recycled through vendor shredding program (resulting in approximately 2,858 trees, 804 cubic yards of landfill, 101,804 gallons of oil, 1,875,353 gallons of water, and 1,071,630 kilowatts of energy saved in 2021); |

| ✔ | Originated 40.7% of the Company’s toner cartridge usage from re-manufactured toner cartridges; |

| ✔ | Switched to paperless services in all branches; arranged new waste recycling / streaming program with waste management vendor; and implemented digital business strategies to reduce paper usage, postage and other support functions that impact the environment; |

| ✔ | Implemented utility use with energy saving smart technology at the Company’s corporate headquarters and throughout the Community Bank’s branch network; |

| ✔ | Replaced and upgraded insulation at corporate headquarters; |

| ✔ | Ensured that all offsite records storage vendors are recycling all Company records to be destroyed; and |

| ✔ | Developed and deployed virtual collaboration tools to reduce employee travel and commutes. |

| ➢ | Human Capital |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) |

Gender, race and ethnic identity of our Executives and Managers, as otherwise known or provided voluntarily1 | |||||||||

| Year | Female | Male | Hispanic/Latino | White | Black or African American | Native Hawaiian or Pacific Islander | Asian | American Indian or Alaskan Native | Two or More Races |

| 2021 | 496 | 292 | 112 | 490 | 102 | 2 | 71 | 2 | 9 |

| 2020 | 519 | 297 | 109 | 514 | 107 | 2 | 74 | 2 | 8 |

| 2019 | 527 | 287 | 109 | 517 | 107 | 3 | 69 | 2 | 7 |

| 2018 | 530 | 301 | 102 | 549 | 107 | 3 | 61 | 2 | 7 |

Gender, race and ethnic identity of our Employees, as otherwise known or provided voluntarily1 | |||||||||

| Year | Female | Male | Hispanic/Latino | White | Black or African American | Native Hawaiian or Pacific Islander | Asian | American Indian or Alaskan Native | Two or More Races |

| 2021 | 1886 | 929 | 477 | 1433 | 448 | 9 | 393 | 12 | 43 |

| 2020 | 1980 | 968 | 497 | 1572 | 444 | 8 | 413 | 10 | 49 |

| 2019 | 2025 | 952 | 499 | 1560 | 465 | 8 | 389 | 10 | 46 |

| 2018 | 2057 | 1032 | 493 | 1683 | 462 | 10 | 375 | 10 | 33 |

CORPORATE GOVERNANCE |

| ✔ | Majority of independent directors; |

| ✔ | Majority Voting for Directors; |

| ✔ | Proxy Access for Shareholders; |

| ✔ | Independent Presiding Director; |

| ✔ | Code of Business Conduct and Ethics; |

| ✔ | Annual Board & Committee Evaluations; |

| ✔ | Risk Assessment Committee; |

| ✔ | Executive Compensation; |

| ✔ | Claw Back Provision; |

| ✔ | Board Member and Executive Ownership of Shares; |

| ✔ | Anti-Pledging and Hedging; |

| ✔ | No Poison Pill; |

| ✔ | Chief Diversity Officer; |

| ✔ | Diversity Policy; |

| ✔ | Codes of Professional Conduct for Directors, Officers, and Employees; |

| ✔ | Anti-Harassment and Anti-Retaliation Policies; and |

| ✔ | Statement of Vendor Principles. |

CORPORATE GOVERNANCE |

| Chairman of the Board: | ✔ Calls Board and shareholder meetings |

| ✔ Presides at Board and shareholder meetings | |

| ✔ Approves Board meeting schedules, agendas, materials, subject to the approval of the Presiding Director | |

| Presiding Director: | ✔ Presides at Board meetings in the Chairman’s absence or when otherwise appropriate |

| ✔ Acts as a liaison between independent directors and the Chairman/CEO | |

| ✔ Presides over executive sessions of independent directors | |

| ✔ Engages and consults with major shareholders and other constituencies, where appropriate | |

| ✔ Provides advice and guidance to the CEO on executing long-term strategy | |

| ✔ Guides the annual performance review of the Chairman/CEO | |

| ✔ Advises the CEO of the Board’s information needs | |

| ✔ Guides the annual independent director consideration of Chairman/CEO compensation | |

| ✔ Meets one-on-one with the Chairman/CEO following executive sessions of the independent directors | |

| ✔ Has the authority to call for a Board meeting or a meeting of independent directors | |

| ✔ Guides the self-assessment of the Board | |

| ✔ Approves agendas and adds agenda items for Board meetings and meetings of independent directors |

CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE |

| ➢ | Whether the individual meets the requirements for independence; |

| ➢ | The individual’s general understanding of the various disciplines relevant to the success of a large publicly-traded company in today’s global business environment; |

| ➢ | The individual’s understanding of the Company’s business and markets; |

| ➢ | The individual’s professional expertise and experience; |

| ➢ | The individual’s educational and professional background; and |

| ➢ | Other characteristics of the individual that promote diversity of views and experiences, including diversity with respect to gender, age, race and ethnicity. |

CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE |

| Director | Audit | Compensation | Nominating & Corporate Governance | Risk Assessment | Credit Committee1 |

| Dominick Ciampa | |||||

Hanif “Wally” Dahya@ # | |||||

| Leslie D. Dunn | |||||

| Marshall J. Lux | |||||

| James J. O’Donovan | |||||

| Lawrence Rosano, Jr. | |||||

| Ronald A. Rosenfeld | |||||

Lawrence J. Savarese*# | |||||

| Thomas R. Cangemi† | |||||

| Robert Wann | |||||

| Meetings Held in 2021 | 11 | 7 | 4 | 12 | 5(2) |

| (1) | All Company Board Committees are replicated at the Community Bank level. Additionally, the Community Bank Board maintains a Credit Committee which is a new committee formed from the merger of the former Mortgage and Real Estate Committee and Commercial Credit Committee of the Community Bank’s Board on July 27, 2021. The membership of the new Credit Committee consists of the members of the two former committees. |

| (2) | Prior to the establishment of the Credit Committee on July 27, 2021, the Mortgage and Real Estate Committee held 29 meetings and the Commercial Credit Committee held 30 meetings during 2021. |

15 Board Meetings Communication between meetings as appropriate | 4 Executive sessions of independent directors Led by Presiding Director | 34 Meetings of Principal Standing Committees | 64 Meetings of Specific Purpose Committees | |||||||||

CORPORATE GOVERNANCE |

| Audit Committee | |

Members: Lawrence J. Savarese (Chair) Dominick Ciampa Hanif “Wally” Dahya Leslie D. Dunn Marshall J. Lux Ronald A. Rosenfeld The Board of Directors has determined that Mr. Savarese is an “audit committee financial expert” under the rules of the SEC. Meetings held in 2021: 11 | The purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities, including with respect to review and, as applicable, approval of (1) the integrity of the Company’s financial statements; (2) the Company’s compliance with applicable legal and regulatory requirements; (3) the independent registered public accounting firm’s qualifications and independence; (4) the performance of the Company’s internal audit function and independent auditors; (5) the system of internal controls relating to financial reporting, accounting, legal compliance, and ethics established by management and the Board; and (6) the Company’s internal and external auditing processes. This Committee meets with the Company’s and the Community Bank’s internal auditors to review the performance of the internal audit function. A detailed list of the Committee’s functions is included in its written charter adopted by the Board of Directors, a copy of which is available free of charge on the corporate governance pages within the Investor Relations portion of our website at www.myNYCB.com, and is available in print to any shareholder who requests a copy. |

| Compensation Committee | |

Members: Hanif “Wally” Dahya (Chair) Leslie D. Dunn Lawrence Rosano, Jr. Lawrence J. Savarese Meetings held in 2021: 7 | This committee meets to establish compensation for the executive officers and to review the Company’s incentive compensation programs when necessary. (See Compensation Discussion and Analysis beginning on page 25 for further information on the Company’s processes and procedures for the consideration and determination of executive and director compensation.) Consistent with SEC disclosure requirements, the Compensation Committee has assessed the Company’s compensation programs and has concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. At the Committee’s direction, management of the Company maintains an Incentive Compensation and Performance Management Committee responsible for overseeing and monitoring non-executive incentive compensation objectives, performance management, and incentive compensation plans. The Committee, which consists of various senior officers, including the Chief Operating Officer and the Chief Risk Officer, has assessed the Company’s non-executive incentive compensation plans to determine if the programs’ provisions and operations create undesired or unintentional risk of a material nature. This risk assessment process includes a review of plan policies and practices; an analysis to identify risks and risk controls related to the plans; and determinations as to the sufficiency of risk identification, the balance of potential risk to potential reward, risk controls, and the consistency of the programs and their risks with regard to the Company’s strategies. Compensation agreements are subject to risk reviews by first and second lines of defense: an attorney designed by the Chief Operating Officer performs a first line review, which is followed by the Chief Risk Officer’s second line review. Reporting by the Incentive Compensation and Performance Management Committee to the Compensation Committee occurs at least annually. Although the Compensation Committee reviews all compensation programs, it focuses on the programs with variability of payout, the ability of a participant to directly affect payout, and the controls on participant action and payout. Based on the foregoing, we believe that our executive compensation policies and practices do not create inappropriate or unintended significant risk to the Company as a whole. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and our risk management practices; and are supported by the oversight and administration of the Compensation Committee. |

CORPORATE GOVERNANCE |

| Nominating and Corporate Governance Committee | |

Members: Leslie D. Dunn (Chair) Dominick Ciampa Hanif “Wally” Dahya Lawrence Rosano, Jr. Ronald A. Rosenfeld Lawrence J. Savarese Meetings held in 2021: 4 | The Committee considers and recommends the nominees for director to stand for election at the Company’s Annual Meeting of Shareholders. The Nominating and Governance Committee is responsible for recommending to the Board the qualifications for Board membership, identifying, assessing, and recommending qualified director candidates for the Board’s consideration, assisting the Board in organizing itself to discharge its duties and responsibilities, and providing oversight of the Company’s corporate governance practices and policies, including an effective process for shareholders to communicate with the Board. The Committee is composed entirely of independent directors as defined by the NYSE Corporate Governance Standards and operates under a written charter. The Nominating and Corporate Governance Committee’s charter is available on the corporate governance pages within the Investor Relations portion of the Company’s website at www.myNYCB.com and is available in print upon request. The Committee’s role in, and process for, identifying and evaluating prospective director nominees is described herein and above in Board Diversity and Tenure. See also Procedures for Shareholders to Recommend Directors. In addition, the Committee makes recommendations to the Board concerning director independence, Board committee assignments, committee chairman positions, Audit Committee “financial experts,” the financial literacy of Audit Committee members, and Risk Assessment Committee “risk management experts.” |

| Risk Assessment Committee | |

Members: Lawrence Rosano, Jr. (Chair) Dominick Ciampa Hanif “Wally” Dahya Leslie D. Dunn Marshall J. Lux Ronald A. Rosenfeld Lawrence J. Savarese The Board of Directors has determined that Messrs. Dahya and Savarese are “risk management experts” under the enhanced prudential standards of the Dodd-Frank Act. Meetings held in 2021: 12 | The Risk Assessment Committee has been appointed by the Company’s Board of Directors to assist the Board in fulfilling its responsibilities with respect to oversight of the Company’s risk management program, including as it relates to the risk appetite of the Company and the policies and procedures used to manage various risks, including credit, market, interest rate, liquidity, legal/compliance, regulatory, strategic, operational, reputational, and certain other risks. The Risk Assessment Committee enhances the Board’s oversight of risk management activities at the Company through active and frequent engagement. The Risk Assessment Committee’s role is one of oversight, recognizing that management is responsible for designing, implementing, and maintaining an effective risk management program. The Company’s departmental managers are the first line of defense for managing risk in the areas for which they are responsible. As a second line of defense, the Company’s Chief Risk Officer provides overall leadership for several important independent risk management functions, including: information security and cyber security, bank secrecy act and anti-money laundering, as well as Company-wide enterprise risk, operational risk, compliance risk and model risk management frameworks, that are focused on risk identification, risk measurement, risk monitoring, risk mitigation, risk reporting and escalation. At each regularly scheduled meeting of the Risk Assessment Committee, the Committee receives a monthly report from the Chief Risk Officer with respect to the Company’s approach to the management of risks, including the implementation of various risk management frameworks and highlights of the Company’s risk mitigation efforts. The Chief Risk Officer is responsible for supervising an integrated effort to identify, assess, and monitor risks (including through risk measurement, risk monitoring, risk mitigation, and risk reporting) that may affect the Company’s ability to execute on its corporate strategy, onboard risk within approved risks limits and warning levels, and fulfill its business objectives. On a quarterly basis, the Risk Assessment Committee receives detailed risk reports from the Chief Information Security Officer, the Compliance, Privacy, and Fair Lending Officer, as well as the BSA and OFAC Officer, each of whom report directly into the Chief Risk Officer and also maintain separate reporting lines to the Risk Assessment Committee. The Risk Assessment Committee responsibilities also include oversight of the Company’s capital and stress testing program as required under the applicable rules and regulations of the Dodd-Frank Act and, more recently, to oversee the Company’s climate risks and other ESG initiatives. |

CORPORATE GOVERNANCE |

| General Counsel & Corporate Secretary | New York Community Bancorp, Inc. 102 Duffy Avenue, Hicksville, NY 11801 Attention: General Counsel & Corporate Secretary |

| Investor Relations | New York Community Bancorp, Inc. 102 Duffy Avenue, Hicksville, NY 11801 Attention: Investor Relations IR@myNYCB.com |

| Board of Directors | New York Community Bancorp, Inc. c/o Office of the Corporate Secretary 102 Duffy Avenue, Hicksville, NY 11801 |

| Presiding Director | New York Community Bancorp, Inc. c/o Office of the Corporate Secretary 102 Duffy Avenue, Hicksville, NY 11801 Attention: Hanif “Wally” Dahya, Presiding Director |

| Audit Committee of the Board of Directors | New York Community Bancorp, Inc. c/o Office of the Corporate Secretary 102 Duffy Avenue, Hicksville, NY 11801 Attention: Lawrence J. Savarese, Audit Committee Chairman |

CORPORATE GOVERNANCE |

| a. | the name of the person recommended as a director candidate; |

| b. | all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| c. | the written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| d. | the name and address of the shareholder making the recommendation, as they appear on the Company’s books; provided, however, that if the shareholder is not a registered holder of Common Stock, the shareholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Common Stock; |

| e. | a statement disclosing whether such shareholder is acting with, or on behalf of, any other person and, if applicable, the identity of such person; and |

| f. | such other information as the Company may require in accordance with its established nomination procedures then in effect. |

BENEFICIAL OWNERSHIP |

| Name | Age | Director Since | Shares of Common Stock Beneficially Owned (1) (2) | Percent of Class | |

| Nominees (Whose Terms Would Expire in 2025): | |||||

| Marshall J. Lux | 62 | 2022 | 8,297 | (3) | 0.002% |

| Ronald A. Rosenfeld | 83 | 2012 | 168,916 | (3,4) | 0.036% |

| Lawrence J. Savarese | 65 | 2013 | 146,030 | (3,4) | 0.031% |

| Directors Whose Terms Expire in 2023 | |||||

| Dominick Ciampa | 88 | 1995 | 511,467 | (3,4) | 0.110% |

| Leslie D. Dunn | 77 | 2015 | 43,250 | (3,4) | 0.009% |

| Lawrence Rosano, Jr. | 69 | 2014 | 48,750 | (3,4) | 0.010% |

| Robert Wann | 67 | 2008 | 2,452,390 | (3,5) | 0.525% |

| Directors Whose Terms Expire in 2024 | |||||

| Thomas R. Cangemi | 53 | 2020 | 1,510,104 | (3,4,5,6) | 0.323% |

| Hanif “Wally” Dahya | 66 | 2007 | 209,848 | (3,4) | 0.045% |

| James J. O’Donovan | 79 | 2003 | 1,408,216 | (3,4,5) | 0.302% |

| Named Executive Officers Who Are Not Directors: | |||||

| John T. Adams | 59 | -- | 140,077 | (3,4) | 0.030% |

| John J. Pinto | 51 | -- | 616,751 | (3,5) | 0.132% |

| R. Patrick Quinn | 60 | -- | 111,464 | (3,5) | 0.024% |

| All directors and executive officers as a group (13 persons) | 7,375,560 | 1.579% | |||

| (1) | Includes the following shares of common stock held directly: Mr. Cangemi: 1,038,125; Mr. Ciampa: 52,305; Mr. O’Donovan: 753,661; Mr. Rosano: 32,853; Mr. Savarese: 103,190; Mr. Wann: 1,530,802; Mr. Pinto: 436,859; Mr. Adams: 69,641; and Mr. Quinn: 43,943. |

| (2) | Each person effectively exercises sole (or shares with spouse or other immediate family member) voting or dispositive power as to shares reported herein (except as noted). Figures include all of the shares held directly and indirectly by directors and the Company’s executive officers, as well as the shares underlying stock awards that have been granted to, and are currently exercisable or exercisable within 60 days by, such directors and executive officers under the Company’s various stock-based benefit plans. |

| (3) | Includes the following shares of unvested restricted stock awards: Mr. Cangemi – 278,501; Mr. Ciampa – 25,583; Mr. Dahya – 19,340; Ms. Dunn – 13,397; Mr. O’Donovan – 19,340; Mr. Rosano – 13,397; Mr. Rosenfeld – 13,397; Mr. Savarese – 19,340; Mr. Wann – 52,031; Mr. Pinto – 99,534; Mr. Adams: 30,307; and Mr. Quinn: 30,681. |

| (4) | Includes the following shares that are owned by spouses of the named nominees, continuing directors, and executive officers or are held in individual retirement accounts, trust accounts, custodian accounts, or foundation accounts for which the directors and the executive officers are deemed beneficial owners: Mr. Cangemi – 60,335; Mr. Ciampa – 433,579; Mr. Dahya – 190,508; Ms. Dunn – 29,853; Mr. Rosano – 2,500; Mr. Rosenfeld – 155,519; and Mr. Savarese – 23,500. |

| (5) | Includes the following shares held by the trustee of the New York Community Bancorp, Inc. Employee Savings Plan (“401(k)”): Mr. Cangemi – 133,143; Mr. O’Donovan – 241,140; Mr. Wann – 537,441; Mr. Pinto – 80,358; Mr. Adams – 40,129; and Mr. Quinn – 36,840 which include shares acquired in Messrs. Cangemi’s and Pinto’s accounts pursuant to dividend reinvestment. Also includes 332,116 and 394,075 shares allocated under the Community Bank’s Supplemental Benefits Plan (and acquired for their Supplemental Employee Retirement Plan (the “SERP”) accounts pursuant to dividend reinvestment) to the accounts of Messrs. O’Donovan and Wann, respectively. The Community Bank Supplemental Benefit Plan, SERP, and Employee Savings Plan are more particularly described in the Compensation Discussion and Analysis section of this proxy statement beginning on page 25. |

| (6) | Mr. Cangemi has pledged 515,729 shares of Common Stock pursuant to margin account arrangements, and Mr. Quinn has pledged 43,943 shares. The margin balances outstanding, if any, pursuant to such arrangements may vary from time to time. All pledge obligations entered into before the adoption of the new policy on pledging stock are grandfathered for the duration of the pledge commitment. See page 38 for a summary of our policy on hedging and pledging of Common Stock. |

EXECUTIVE COMPENSATION |

| ✔ | Thomas R. Cangemi, President and Chief Executive Officer |

| ✔ | Robert Wann, Senior Executive Vice President and Chief Operating Officer |

| ✔ | John J. Pinto, Senior Executive Vice President and Chief Financial Officer |

| ✔ | John T. Adams, Senior Executive Vice President and Chief Lending Officer |

| ✔ | R. Patrick Quinn, Senior Executive Vice President, General Counsel and Corporate Secretary |

| ➢ | Scope of the Compensation Discussion and Analysis |

| ✔ | an overview of our compensation philosophy; |

| ✔ | a discussion of our 2020 say-on-pay advisory vote and our shareholder engagement process during 2021 and early 2022; |

| ✔ | an overview of the Company’s business environment in 2021; |

| ✔ | a discussion of the governance environment in which executive compensation decisions are made; |

| ✔ | a description of each element of our executive compensation program and the purpose it serves; |

| ✔ | a review of the process by which the Compensation Committee makes compensation decisions, including an overview of the timeline, the parties involved, risk considerations and tax considerations; and |

| ✔ | a discussion of the Compensation Committee’s 2021 incentive compensation decisions and the key factors that influenced those decisions. |

| ➢ | 2021 Executive Compensation Highlights |

| ➢ | Impact of the Ongoing COVID-19 Pandemic |

| ➢ | 2021 Executive Pay Highlights |

| ➢ | Salary Review |

| ➢ | Annual Incentive Compensation |

EXECUTIVE COMPENSATION |

| ➢ | Equity Compensation |

| ➢ | Our Compensation Philosophy |

| ✔ | Support our strategic objectives and drive the creation of shareholder value through the attainment of positive business results. |

| ✔ | Place a significant portion of each executive’s total compensation at risk based on the Company’s short- and long-term performance on an absolute basis and relative to our peers. |

| ✔ | Be competitive in the market for executive talent and provide a means for the Company to attract and retain key executives. |

| ✔ | Align the interests of our executives with our shareholders by providing our executives with a meaningful equity stake in the Company. |

| ✔ | Maintain our executive pay program within a strong governance framework to ensure that our program does not provide incentives for our executives to take unnecessary or excessive risks that could compromise the value of our business. |

| ➢ | Our 2021 Say-on-Pay Advisory Vote |

EXECUTIVE COMPENSATION |

| ➢ | Engaging With Our Shareholders |

| ➢ | 2021 Business Performance |

| ➢ | Selected Financial Highlights |

| $59.5 Billion | $35.1 Billion | $563 Million | 18% | |||

| Assets | Deposits | Net Income Available to Common Shareholders | Balance Sheet Growth Since SIFI Limit Increase | |||

| $1.20 | 18% | 1.04% | 8.75% | |||

| EPS (Fully Diluted) | EPS Growth | ROAA | ROACE | |||

| $45.7 Billion | 38.6% | 10.83% | 0.07% | |||

Loans Held for Investment | Efficiency Ratio | Tier 1 Risk-Based Capital | Avg. Non-Performing Loans/Total Loans |

EXECUTIVE COMPENSATION |

| ➢ | What we do |

| ✔ | We emphasize pay-for-performance with the majority of our NEO compensation directly linked to annual and long-term performance. |

| ✔ | We make all key executive compensation decisions and all decisions affecting our NEOs through a committee of independent directors, and the committee seeks advice from an independent compensation consultant on key executive compensation matters. |

| ✔ | We engage in shareholder outreach at the Board and management levels to help us evaluate our governance structure and executive compensation program. |

| ✔ | We design our executive compensation programs to discourage excessive risk-taking and we maintain significant internal controls to evaluate and manage risk. |

| ✔ | We submit our executive compensation to an annual say-on-pay vote in order to elicit regular feedback from stockholders. |

| ✔ | We require a strong ownership commitment from our officers and directors. |

| ✔ | We maintain a robust “clawback” policy that allows us to recapture amounts paid under our incentive compensation plans on the basis of financial results in the event that such results are found to be materially misstated. |

| ➢ | What we don’t do |

| ✔ | We do not reward subpar performance and incentive pay thresholds are set accordingly. |

| ✔ | We do not guarantee salary increases or annual bonuses. |

| ✔ | We do not allow our executives to hedge or pledge Company stock. (One pledge obligation that was in effect prior to our adoption of a formal no hedging/no pledging policy in April 2016 was grandfathered from this prohibition.) |

| ✔ | We do not allow “single trigger” payouts under our employment and change-in-control agreements. |

| ✔ | We do not provide our executives with tax gross-ups triggered by equity plan vesting or other employee benefits. |

| ✔ | We do not provide our executives with excessive perquisites or benefits. |

| ✔ | We do not permit repricing of stock options without prior shareholder approval. |

| ☐ | Key Participants |

| ➢ | The Compensation Committee |

EXECUTIVE COMPENSATION |

| ➢ | Timing of Executive Compensation Decisions |

| ➢ | Our CEO’s Role in the Compensation Process |

| ➢ | The Independent Compensation Consultant |

| ➢ | Benchmarking and Peer Group Analysis |

EXECUTIVE COMPENSATION |

Bank United BOK Financial Corp. Comerica Incorporated Cullen/Frost Bankers, Inc. First Citizens Bancshares, Inc. First Horizon National Corporation F.N.B. Corporation | Huntington Bancshares Inc. KeyCorp M&T Bank Corp. Peoples United Financial, Inc. Popular, Inc. Regions Financial Corporation Signature Bank | Sterling Bancorp Synovus Financial Corp. TCF Financial Corporation Texas Capital Bancshares, Inc. Valley National Bancorp Wintrust Financial Corporation Zions Bancorporation |

| ☐ | Individual Performance Assessments |

| ☐ | Introduction |

Compensation Element | Objective | Implementation | |

Base Salary | ✔ Provides each executive with fixed compensation that reflects the executive’s position and responsibilities, market dynamics and our overall pay structure. | Base salary periodically based on the Compensation Committee’s assessment of the executive’s individual performance, a review of peer group practices and consideration of the impact of base salary levels on incentive compensation opportunities. | |

Short-Term Incentives | ✔ Provide a cash-based, market-competitive annual award opportunity linked to financial measures that are important to our business model. | The 2021 STIP was linked to two financial metrics (75% total weighting) derived from our 2021 budget projections and a strategic/qualitative assessment of the Company’s performance across a broad range of considerations (25% weighting). See, 2021 Executive Compensation Decisions below for additional information on the structure of, and results under, the 2021 STIP. | |

Long-Term Incentives | ✔ Provide an incentive for our executives to create shareholder value over the long term through equity awards. ✔ Align the interests of our executives with shareholders by awarding equity in the Company. | The 2021 LTIP included two components: (i) a grant of time-based vested restricted stock with a value equal to 25% of each NEO’s target award opportunity under the LTIP, and (ii) a grant of PBRSUs equal to 75% of the target award opportunity to be earned over the 2021-2023 performance period. For the PBRSU grant, the Committee established two metrics – 3-year EPS growth and 3-year ROATCE – to evaluate the Company’s performance relative to an industry index. See, 2021 Executive Compensation Decisions below for additional information on the structure of, and results under, the 2021 LTIP. |

EXECUTIVE COMPENSATION |

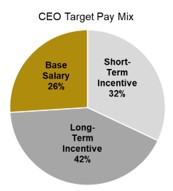

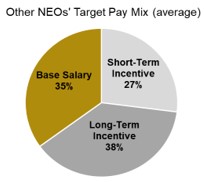

| ☐ | Target Pay Mix |

|  |

| ☐ | 2021 Executive Compensation Decisions |

| ➢ | Base Salary |

| ➢ | Executive Incentive Compensation Program |

| ☐ | 2021 STIP Overview |

| ✔ | Covered the 2021 calendar year and provided a cash incentive based on performance goals set by the Compensation Committee in February 2021. |

| ✔ | Target cash incentive opportunities were defined as a percentage of 2021 base salary and were based on peer/market practices. Additional details on cash incentive opportunities are provided in the section below. |

| ✔ | Award determinations were based, in part, on the Company’s 2021 financial performance with respect to two internal budget targets. A description of these performance metrics, the weighting of each metric and the reasons why the Committee selected each metric is set forth in the table below. Each performance metric had a separate weighting and the result for each metric contributed separately to the actual award, if any. In addition, the Committee evaluated a scorecard of strategic and other qualitative considerations relative to the Company’s 2021 financial performance and assigned a 25% weighting for this factor to results over a range from threshold to stretch achievement. |

EXECUTIVE COMPENSATION |

| ☐ | STIP Financial Performance Metrics |

| Performance Metric | How We Define and Apply It | Why We Use It |

Pre-Tax Operating Earnings | Net income before the effect of income taxes and any after-tax items, including minority interest and any extraordinary items. Pre-tax operating earnings is subject to adjustment for extraordinary items, accounting and tax law changes, discontinued operations, acquisition expenses, balance sheet restructuring charges and/or similar non-recurring or special items. This metric is an absolute metric based on the Company’s budget target and has a 50% weight in determining the actual award. | Provides direct insight into the financial health of the Company by measuring the revenue and expenses associated with the Company’s primary business activities. |

Return on Average Tangible Assets (“ROATA”) | Net income as a percentage of average tangible assets. This metric is measured by reference to the Company’s percentile ranking in the designated peer group and has a 25% weight in determining the actual award. | Shows the profitability of our assets by measuring how effectively management is deploying our assets to generate a positive return. |

| ☐ | STIP Strategic/Qualitative Scorecard |

| ☐ | 2021 STIP Award Opportunities, Performance Results and Award Determinations |

2021 Short-Term Incentive Plan Award Opportunities (as % of 2021 Base Salary) | |||

| Executive | Threshold | Target | Maximum |

| Mr. Cangemi | 62.5% | 125% | 187.5% |

| Mr. Wann | 45 | 90 | 135 |

| Mr. Pinto | 35 | 70 | 105 |

| Mr. Adams | 35 | 70 | 105 |

| Mr. Quinn | 35 | 70 | 105 |

EXECUTIVE COMPENSATION |

| Performance Measure | Weight | Performance Goals | Actual Performance | Payout as % of Target Award Opportunity | ||

| Threshold | Target | Stretch | ||||

| Pre-tax Operating Earnings | 50% | $653,592,000 | $726,214,000 | $798,835,000 | $828,973,000 | 150% |

| ROATA | 25% | 0.9% | 1.01% | 1.11% | 1.12% | 150% |

| Strategic/Qualitative Scorecard Assessment | 25% | 50% | 100% | 150% | 150% | 150% |

| Payout Range | 25% | 50% | 100% | 150% | 150% | 150% |

| Total Payout: | 100% | 50% | 100% | 150% | -- | 131.26% |

| Assessment Categories | Significant Considerations Identified by the Compensation Committee | ||

Strategic initiatives – • Acquisitions and/or organic growth • Technology/digital initiatives • Effective COVID response | • Entered into a watershed transaction with Flagstar and initiated a highly effective integration process targeted towards a smooth combination of the two institutions. • Established a separate unit for digital banking and BaaS, and initiated strategic partnerships with Figure and other parties to enhance NYCB’s capabilities in digital banking/BaaS. • Continued refinement of the Fiserv core operating system and explored opportunities to exploit Fiserv as a digital banking tool. • Notwithstanding the continuing pandemic, maintained bank operations with limited disruption and continued a highly effective program to maintain a safe environment for employees and customers. | ||

Risk/Compliance/Regulatory – • High standards of regulatory compliance • Effective enterprise risk management practices • Effective credit risk management practices | • Maintained a strong commitment to regulatory compliance throughout the institution and a cooperative dialogue with regulators. • Continued a rigorous approach to enterprise risk management designed to identify and remediate risk. • Emphasized the critical role of ethical conduct in the business environment with expectations of a commitment to accountability, transparency and escalation. • Maintained strong credit risk management practices to ensure high asset quality and to minimize risk of loss and provide borrower relief where appropriate. | ||

Reputation with key stakeholders – • Regulator relations • Shareholder relations • Employee engagement • Community relations • ESG/DE&I | • Maintained a positive and responsive approach to regulatory relations. • Continued positive engagement with shareholders in a variety of settings. • New management team adopted a proactive approach to employee engagement with regular and detailed communication with employees on corporate and personnel developments. • Continued emphasis on strong community relations and committed significant resources to the communities served by the Community Bank today and after the Flagstar merger closes. • Enhanced the bank’s commitment to ESG/DE&I objectives with (i) expanded involvement by executive management in internal, industry and community ESG/DE&I initiatives, (ii) the formation of an ESG Working Group with bank-wide representation to monitor ESG/DEI developments, (iii) continued recruitment of women and minorities throughout the bank (including senior level positions). | ||

Overall Financial Performance – • Capital position • Loan growth • Credit quality • Efficiency Ratio | • Achieved record earnings in a difficult economic environment. • Maintained a strong capital position at the holding company and bank levels. • Showed solid loan growth for the year and record loan growth in the fourth quarter. • Maintained stellar asset quality. • Maintained the current dividend. • Achieved an efficiency ratio in line with the Community Bank’s historical trends after a period where the efficiency ratio was increasing. | ||

Business Unit/Individual – • Business unit leader performance • Business unit/function leadership | • Business unit leaders exhibited solid performance across all business units, demonstrating appropriate leadership skills and a capacity to adapt to the business environment. • All business units performed well and achieved results that were consistent with the bank’s business strategy. |

EXECUTIVE COMPENSATION |

| Executive | Base Salary ($000) | Target | Maximum Potential STI Award Opportunity Based on 2020 Results (131.26% of target) | Actual STI Awards Determined by Compensation Committee | |

| % of Base | |||||

| Mr. Cangemi | $1,150 | 125% | $1,437,500 | $2,156,000 | $2,156,000 |

| Mr. Wann | 1,100 | 90 | 990,000 | 1,485,000 | 990,000 |

| Mr. Pinto | 700 | 70 | 490,000 | 735,000 | 735,000 |

| Mr. Adams | 550 | 70 | 420,000 | 630,000 | 630,000 |

| Mr. Quinn | 541 | 70 | 375,518 | 563,277 | 563,000 |

| ☐ | LTIP and Other Equity Awards |

| ✔ | 25% of the target LTIP award consisted of time-based RSAs vesting ratably over three years. The Committee limited this time-based vested component to 25% given the Committee’s intent to link the largest part of the LTIP benefit directly to future performance. Consistent with the Company’s long-standing practice for all of the approximately 450 employees who are eligible to receive RSA grants, dividends paid on the restricted shares are paid at the same time dividends are paid to other shareholders. |

| ✔ | 75% of the target LTIP award consisted of a grant of PBRSUs where the actual award earned will be based on the Company’s performance with respect to two weighted metrics over the 2021-2023 performance period relative to an objectively designated and broad index of financial institutions (see below). The award, if any, will be determined by the Committee in early 2024 after consideration of the Company’s performance relative to the index group. All awards will be settled in fully vested shares of Company common stock. The Committee awarded dividend equivalent rights in tandem with the PBRSUs but no dividend equivalent payments will be made prior to the date that the Committee determines the level at which the PBRSUs have been earned and only to the extent of the dividends that would have accrued over the performance period with respect to the shares underlying the earned PBRSUs. The Committee selected two metrics – relative ROATCE and relative EPS growth – for the 2021-2023 performance period. The Company’s performance with respect to these metrics will be evaluated at the end of the three-year performance period on a percentile ranking basis relative to an industry index consisting of 31 banks with assets between $25 billion-$250 billion selected from the KBW Regional Bank Index and the KBW Banking Index. Each performance metric has an equal weighting and the result for each metric contributes separately to the determination of the actual award at the end of the performance period, if any. The LTIP specifies that, if at the end of the performance period, a bank included in the index is not a public company or is acquired, the bank will be removed from the index for the entire performance period and the percentile results will be calculated accordingly. |

EXECUTIVE COMPENSATION |

| ✔ | For the 2021 LTIP, award opportunities were determined by reference to the 2021 base salary of each NEO. For our CEO, the 2021 target opportunity was set at 160% of 2021 base salary and allocated as described above between a grant of time-based restricted stock (25% of the target opportunity value) and the grant of PBRSUs (75% of the target opportunity value). In setting the CEO’s 2021 LTIP target opportunity, the Committee factored in Mr. Cangemi’s promotional RSA granted in January 2021 (see below) and set the target somewhat below the CEO LTIP target opportunity in recent years. |

| ✔ | The Committee set target performance for the PBRSU grants at the 55th percentile of the industry index to ensure that a target level payout requires the Company to outperform the median of the Index. The Committee set the threshold level at the 35th percentile to ensure that no payouts would be made for sustained weak performance. To receive maximum awards, performance must be at the 75th percentile or higher, a level that is intended to reward superior performance. The Committee believed that these levels establish appropriate performance targets in the context of a relative metric that is measured over a multi-year period. |

| ☐ | Award Opportunities under the 2021 LTIP |

2021 Long-Term Incentive Plan Award Opportunities (as % of 2021 Base Salary) | |

| Executive | Target |

| Mr. Cangemi | 160% |

| Mr. Wann | 125 |

| Mr. Pinto | 100 |

| Mr. Adams | 100 |

| Mr. Quinn | 100 |

| ☐ | Time-Based Vested RSAs Under the 2020 LTIP |

| Executive | 2021 Time-Based Vested Restricted Stock Awards (# shares) |

| Mr. Cangemi | 37,674 |

| Mr. Wann | 28,153 |

| Mr. Pinto | 14,333 |

| Mr. Adams | 11,261 |

| Mr. Quinn | 11,072 |

| ☐ | 2021 PBRSU Performance Metrics |

| Performance Metric | How We Define and Apply It | Why We Use It | |

3-Year Earnings Per Share Growth (relative to index group) | Measured as the compound 3-year annual growth rate of the Company’s earnings per share. The Company’s result is evaluated by reference to the Company’s percentile ranking in the designated index group of financial institutions and has a 50% weight in determining the actual award. | Provides a clear measure of profitability over time and relative to other companies in the sector. | |

3-Year Return on Average Tangible Common Equity (relative to index group) | Net income available to common shares adjusted for amortization of intangibles and goodwill impairment as a percentage of average tangible common equity. This metric is measured by reference to the Company’s percentile ranking in the designated index group of financial institutions and has a 50% weight in determining the actual award. | Provides a measure of the return on our shareholders’ investment over time and demonstrates our financial health relative to other companies in the sector. |

EXECUTIVE COMPENSATION |

| ☐ | 2021 PBRSU Performance Metric Goals |

| Performance Metrics | Weight | Performance Goals | |||

| Threshold | Target | Maximum | |||

| 3-Year Relative EPS Growth | 50% | 35th percentile | 55th percentile | 75th percentile | |

3-Year Return on Average Tangible Common Equity | 50% | 35th percentile | 55th percentile | 75th percentile | |

| Payout Range (% Target) | 100% | 50% | 100% | 150% | |

| ☐ | 2021 PBRSU Awards |

| Executive | 2021 PBRSU Awards at Target (# shares) |

| Mr. Cangemi | 203,095 |

| Mr. Wann | 99,734 |

| Mr. Pinto | 61,654 |

| Mr. Adams | 41,804 |

| Mr. Quinn | 39,894 |

| ☐ | CEO and CFO Promotion Awards |

EXECUTIVE COMPENSATION |

| ☐ | Settlement of PBRSUs for the 2019-2021 Performance Period |

| ☐ | Other Executive Benefits |

| ➢ | Employment Agreements and Change-in-Control Benefits |

| ➢ | Retirement Benefits; Employee Welfare Benefits |

| ➢ | Perquisites |

| □ | Risk Management and Our Compensation Programs |

| ✔ | Incentive compensation should balance risk and financial results in a manner that does not provide incentives for excessive risk taking. |

| ✔ | Risk management processes and internal controls should reinforce and support the development of balanced incentive compensation arrangements. |

EXECUTIVE COMPENSATION |

| ✔ | Banks should have strong and effective corporate governance to help ensure sound compensation practices. |

| ☐ | Stock Ownership Requirements |

| Executive | Multiple of Salary | Compliance Status | |

| CEO | 6x Base Salary | In compliance | |

| Other Named Executive Officers | 4x Base Salary | In compliance |

| ☐ | Recoupment of Incentive Compensation |

| ☐ | Hedging and Pledging of Company Stock |

| ☐ | Tax and Accounting Considerations |

EXECUTIVE COMPENSATION |

| ☐ | Equity Compensation Grant and Award Practices |

EXECUTIVE COMPENSATION TABLES |

| ☐ | Summary Compensation Table |

| Name and Principal Position | Year | Salary ($) | Stock Awards(1) ($) | Non-Equity Incentive Plan Compensation(2) ($) | All Other Compensation(3) ($) | Total Compensation ($) | ||||||

Thomas R. Cangemi(4) | 2021 | 1,150,000 | 5,058,239 | 2,156,000 | 288,066 | 8,652,305 | ||||||

| Chairman, President and | 2020 | 850,000 | 850,005 | 781,500 | 220,846 | 2,702,351 | ||||||

| CEO | 2019 | 850,000 | 850,002 | 633,000 | 416,681 | 2,749,683 | ||||||

| Robert Wann | 2021 | 1,100,000 | 1,374,992 | 990,000 | 162,413 | 3,627,405 | ||||||

| Senior EVP and COO | 2020 | 1,100,000 | 1,375,245 | 1,200,000 | 392,148 | 4,065,393 | ||||||

| 2019 | 1,100,000 | 1,375,002 | 1,054,000 | 692,158 | 4,221,160 | |||||||

John J. Pinto(4) | 2021 | 700,000 | 1,750,739 | 735,000 | 122,985 | 3,308,724 | ||||||

| Senior EVP and CFO | 2020 | 575,000 | 576,005 | 528,000 | 151,652 | 1,830,657 | ||||||

| 2019 | 575,000 | 575,008 | 428,000 | 285,959 | 1,863,967 | |||||||

| John T. Adams | 2021 | 600,000 | 550,000 | 630,000 | 52,600 | 1,832,600 | ||||||

| Senior EVP and CLO | 2020 | 550,000 | 729,754 | 505,000 | 45,282 | 1,830,036 | ||||||

| R. Patrick Quinn | 2021 | 540,750 | 707,706 | 568,000 | 27,740 | 1,844,196 | ||||||

| Senior EVP, GC and CS | ||||||||||||

| (1) | Amounts in this column for 2021 reflect the aggregate grant date value of restricted stock awards (“RSAs”) and performance-based restricted stock unit (“PBRSUs”) awarded under the Company’s 2021 long-term incentive plan (“LTIP”) covering the NEOs. The performance period for the PBRSUs is 2021-2023. In addition, for Mr. Cangemi and Mr. Pinto, the column includes the value of a promotional restricted stock award made shortly after they assumed their present positions. The awards had a grant date value of $3,218,239 (Mr. Cangemi) and $1,050,733 (Mr. Pinto). . See, the Grants of Plan-Based Awards table below and “Compensation Discussion and Analysis” for additional information regarding the promotional awards. The fair value of all equity awards has been calculated in accordance with FASB Topic ASC 718 using the valuation methodology and assumptions set forth in Note 15 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. For the PBRSUs, the amounts above were calculated based on the probable outcome of the performance conditions as of the inception date and represent the value of the target number of units granted to each NEO consistent with the estimate of the aggregate compensation cost to be recognized as of the service inception date under ASC 718. Assuming the highest level of performance, the grant date value of the PBRSUs awarded to each NEO (150% of the grant date target value) is as follows: Mr. Cangemi ($2,060,998); Mr. Wann ($1,546,873); Mr. Pinto ($787,508); Mr. Adams ($618,754) and Mr. Quinn ($604,700). For additional information regarding the 2021 equity awards, see “Compensation Discussion and Analysis and the 2021 Grants of Plan-Based Awards” table. |

| (2) | Represents a cash award for 2021 performance under the Company’s 2021 short-term incentive compensation plan (“STIP”). See, “Compensation Discussion and Analysis and the 2021 “Grants of Plan-Based Awards” table below for additional information concerning the 2021 award. |

| (3) | The following table sets forth the components of the All Other Compensation column in 2021: |

| Executive | Dividends on Unvested Restricted Stock ($) | Life Insurance Imputed Income ($) | Retirement Plan Contributions (ESOP and 401(k) match) ($) | Total ($) | ||||

| Mr. Cangemi | 259,974 | 10,279 | 17,813 | 288,066 | ||||

| Mr. Wann | 83,615 | 60,985 | 17,813 | 162,413 | ||||

| Mr. Pinto | 100,970 | 4,202 | 17,813 | 122,985 | ||||

| Mr. Adams | 29,951 | 4,836 | 17,813 | 52,600 | ||||

| Mr. Quinn | 4,080 | 5,847 | 17,813 | 27,740 |

| (4) | Messrs. Cangemi and Pinto were appointed to their present positions in January 2021. Mr. Adams was first designated as a NEO in 2020 and Mr. Quinn was first designated as a NEO in 2021. Information is provided only for the periods when Messrs. Adams and Quinn were NEOs. Mr. Adams and Mr. Quinn were promoted to Senior Executive Vice President positions in March 2022. |

EXECUTIVE COMPENSATION TABLES |

| ☐ | Grants of Plan-Based Awards |

| Executive | Award Type | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Award: Number of Shares of Stock or Units (#)(3) | Grant Date Fair Value of Stock Awards and PBRSUs ($)(4) | ||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||

| Mr. Cangemi | Cash | 2/26/21 | 718,500 | 1,437,500 | 2,156,250 | |||||

| RSA | 1/12/21 | 290,980 | 3,218,239 | |||||||

| RSA | 2/26/21 | 37,674 | 460,000 | |||||||

| PBRSU | 2/26/21 | 56,511 | 113,022 | 169,533 | 1,380,000 | |||||

| Mr. Wann | Cash | 2/26/21 | 495,000 | 990,000 | 1,336,500 | |||||

| RSAs | 2/26/21 | 28,153 | 341,995 | |||||||

| PBRSU | 2/26/21 | 42,230 | 84,459 | 126,689 | 1,031,244 | |||||

| Mr. Pinto | Cash | 2/26/21 | 245,000 | 490,000 | 735,000 | |||||

| RSA | 1/12/21 | 95,003 | 1,050,733 | |||||||

| RSA | 2/26/21 | 14,333 | 175,006 | |||||||

| PBRSU | 2/26/21 | 21,499 | 42,998 | 64,497 | 525,000 | |||||

| Mr. Adams | Cash | 2/26/21 | 210,000 | 420,000 | 630,000 | |||||

| RSA | 2/26/21 | 11,261 | 137,497 | |||||||

| PBRSU | 2/26/21 | 16,892 | 33,784 | 50,676 | 412,503 | |||||

| Mr. Quinn | Cash | 2/26/21 | 189,263 | 378,525 | 567,788 | |||||

| RSA | 1/12/21 | 15,000 | 166,950 | |||||||

| RSA | 2/26/21 | 11,072 | 135,189 | |||||||

| PBRSU | 2/26/21 | 16,608 | 33,216 | 49,825 | 405,567 | |||||

| (1) | Represents award opportunity levels under the STIP. Actual awards were determined by the Compensation Committee on March 22, 2022. See, “Compensation Discussion and Analysis” for additional information on the 2021 program and the Committee’s award determinations. |

| (2) | Amounts in this column represent award opportunities (in shares of Common Stock) at target with respect to PBRSUs granted under the 2021 LTIP on February 26, 2021 for the performance period 2021-2023. The award has a value equal to 75% of the dollar value of each officer’s target award opportunity under the 2021 LTIP. The awards will be earned based one-half on the Company’s 3-year earnings per share growth and one-half on the Company’s 3-year return on average tangible common equity over the performance period, in each case measuring the Company’s performance relative to an index consisting of banks with assets between $25 and $250 billion that are included in the KBW Banking Index and Regional Banking Index. The awards were granted at the target opportunity level and are subject to adjustment based on actual performance, which will be determined in early 2024. Dividend equivalents are accrued on these awards over the performance period and are paid only to the extent that the related PBRSUs are earned based on performance. The awards are settled in shares of Common Stock. See, “Compensation Discussion and Analysis” for additional information on the LTIP and the Committee’s award determinations. |