New York Community Bancorp, Inc.

Measure the difference.

Invest in the strength.

First Quarter 2003

Investor Presentation

May 2003

Forward-looking Statements and Risk Factors

This presentation contains certain forward-looking statements with regard to the Company's prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions, and describe future plans, strategies, and expectations of the Company, are generally identified by use of the words "plan," "believe," "expect," "intend," "anticipate," "estimate," "project," or other similar expressions. The Company's ability to predict results or the actual effects of its plans and strategies is inherently uncertain. Accordingly, actual results may differ materially from anticipated results. Factors that could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to, changes in market interest rates, general economic conditions, legislation, and regulation; changes in the monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; changes in the quality or composition of the loan or investment portfolios; changes in deposit flows, competition, and demand for financial services and loan, deposit, or investment products in the Company's local markets; changes in local real estate values; changes in accounting principles and guidelines; war or terrorist activities; and other economic, competitive, governmental, regulatory, geopolitical, and technological factors affecting the Company's operations, pricing, and services.

Specific factors that could cause future results to vary from current management expectations are detailed from time to time in the Company's SEC filings, which are available at the Company's web site, www.myNYCB.com.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

2

Measure the difference.

Industry data - SNL DataSource as of 5/14/03

NYCB data - Company reports

NYCB 2000 and 2001 data based on core earnings. Please see footnote 1 in the Appendix on page 30.

The graphs and tables on pages 4, 5, 6, 8, 16, and 26 of this presentation reflect the Company's cash or core earnings for certain periods. Please see the footnotes on pages 30 and 32 for a reconciliation of the Company's GAAP and core earnings and GAAP and cash earnings for the periods indicated.

For a reconciliation of stockholders' equity and tangible stockholders' equity, please see the footnote on page 31.

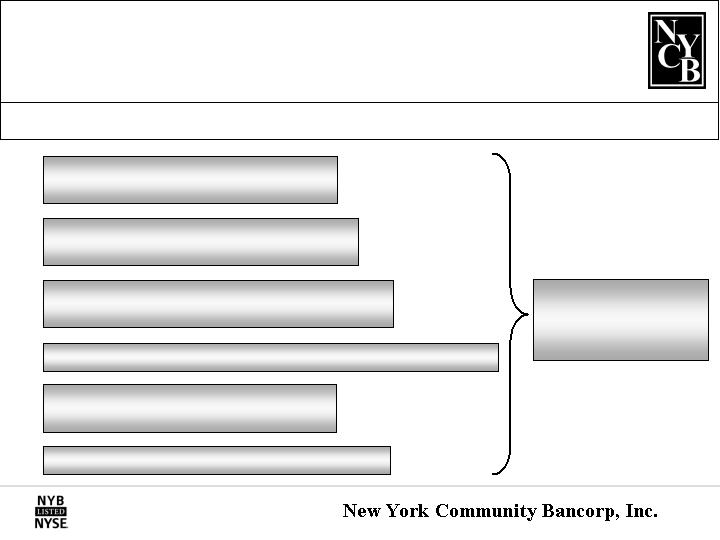

ROA

ROE

Efficiency ratio

NPAs/Total assets

NCOs/Average loans

May 2003 ThriftINVESTOR

SNL DataSource

Ranking Criteria

%

2.59

22.60

25.50

0.15

0.00

NYCB

Cash(2)

2002

%

2.29

19.95

25.32

0.15

0.00

NYCB GAAP

*

**

Measure the Difference: Performance

NYCB has been ranked the nation's top-performing large thrift for the past 5 years.*

Industry

Average**

0.87

9.07

62.67

0.70

0.19

%

3 Mos. 2003

NYCB

Cash(2)

%

2.40

21.69

23.92

0.12

0.00

2.24

20.22

25.19

0.12

0.00

%

NYCB GAAP

0.95

10.08

61.81

0.62

0.19

%

Industry

Average**

4

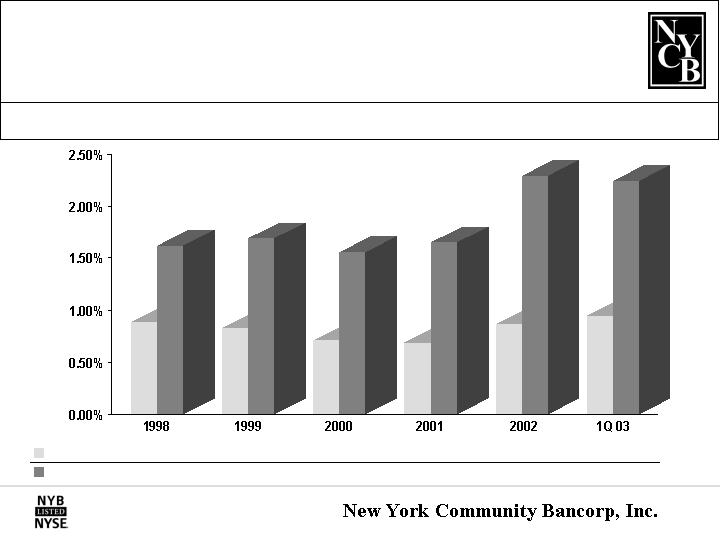

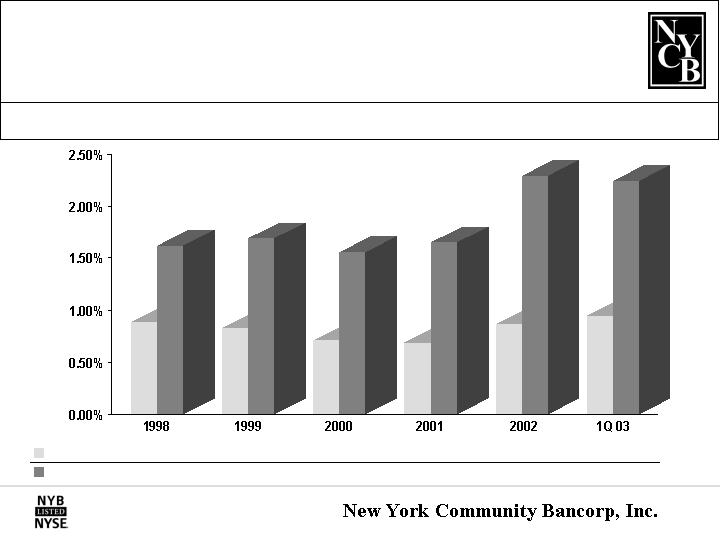

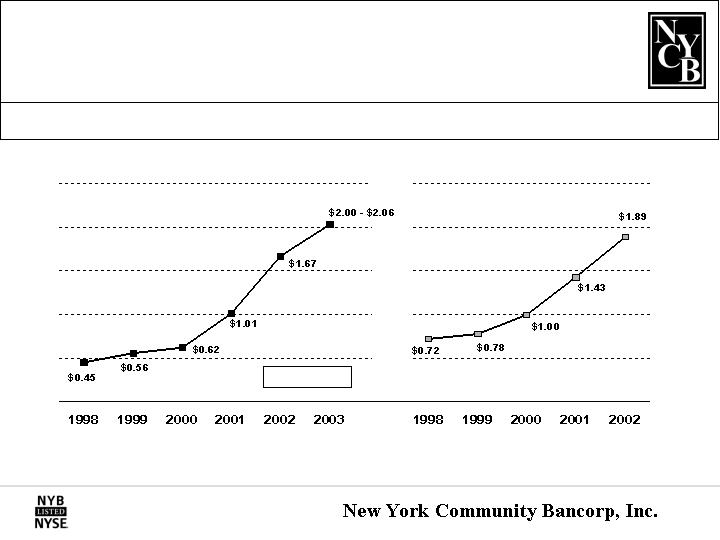

Measure the Performance: ROA

NYCB's 1Q 2003 ROA exceeded the industry average by 129 basis points.

U.S. Thrifts

0.89%

0.83%

0.71%

0.69%

0.87%

NYCB

1.62%

1.69%

1.56%

1.65%

2.29%

2.24%

(3)

(3)

0.95%

5

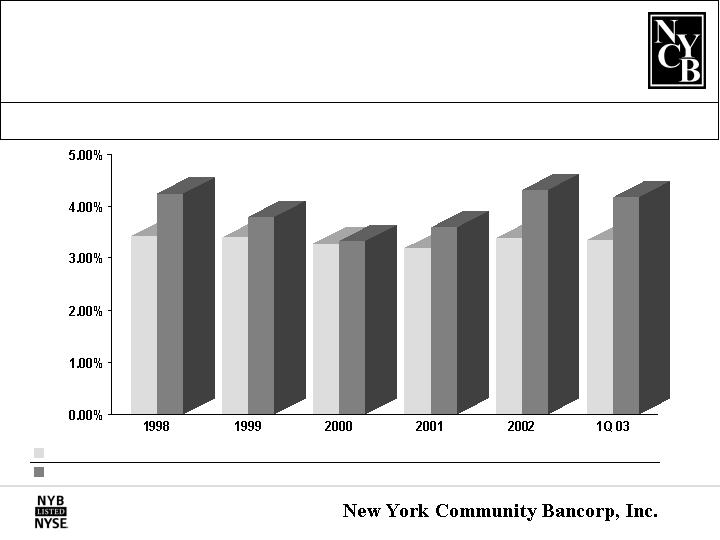

Measure the Performance: ROE

U.S. Thrifts

NYCB

7.92%

17.32%

7.72%

22.99%

7.40%

19.40%

7.89%

18.30%

9.07%

19.95%

10.08%

20.22%

(4)

(4)

NYCB's 1Q 2003 ROE exceeded the industry average by 1,014 basis points.

6

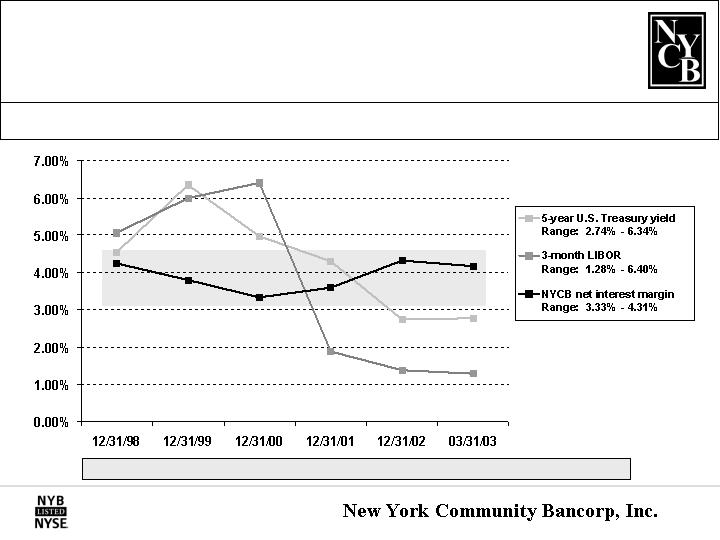

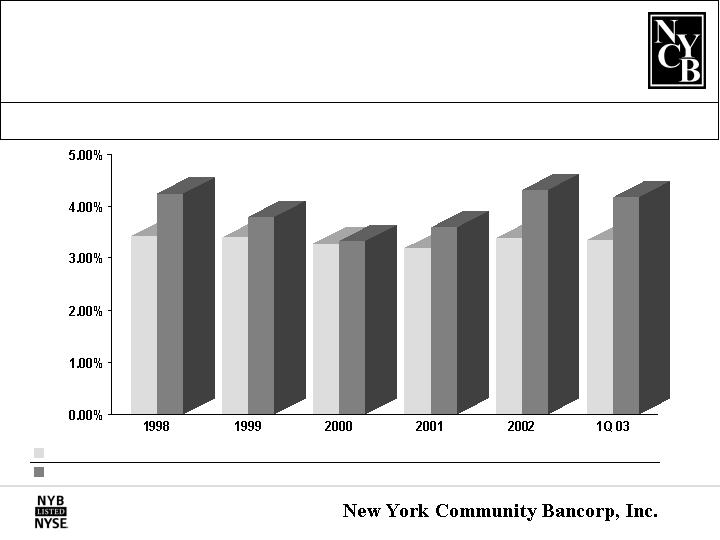

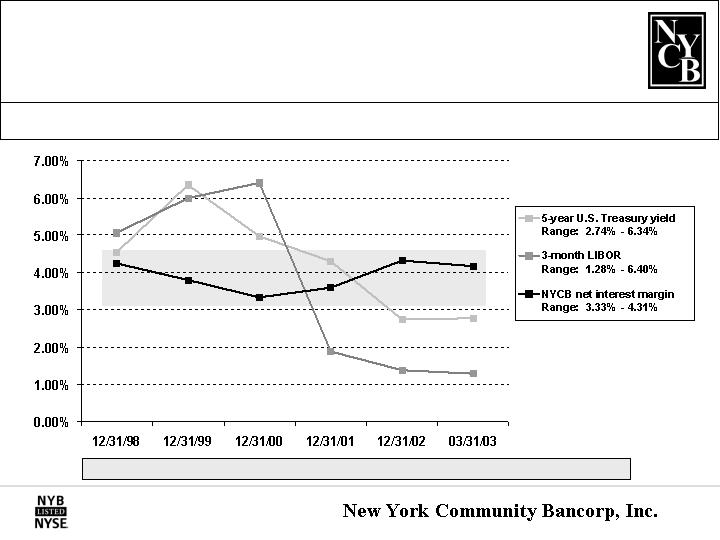

Measure the Performance: Net Interest Margin

NYCB's margin has consistently exceeded the industry average.

U.S. Thrifts

3.42%

3.40%

3.28%

3.19%

3.39%

NYCB

4.24%

3.79%

3.33%

3.59%

4.31%

4.17%

3.35%

7

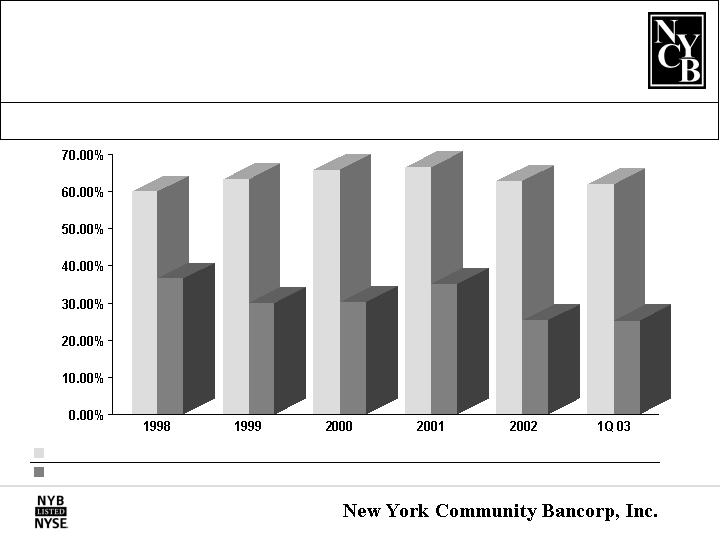

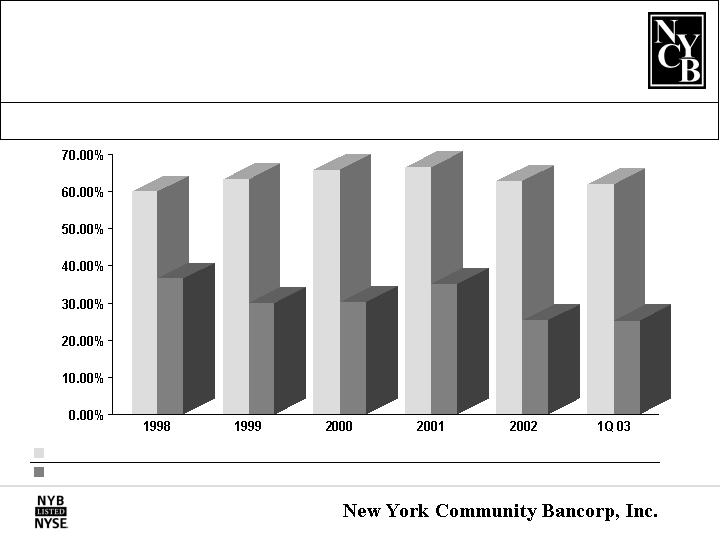

NYCB consistently ranks among the nation's most efficient thrifts.

Measure the Performance: Efficiency Ratio

NYCB

U.S. Thrifts

59.84%

63.13%

65.72%

66.42%

62.67%

36.51%

29.95%

30.20%

35.03%

25.32%

25.19%

(5)

(5)

61.81%

8

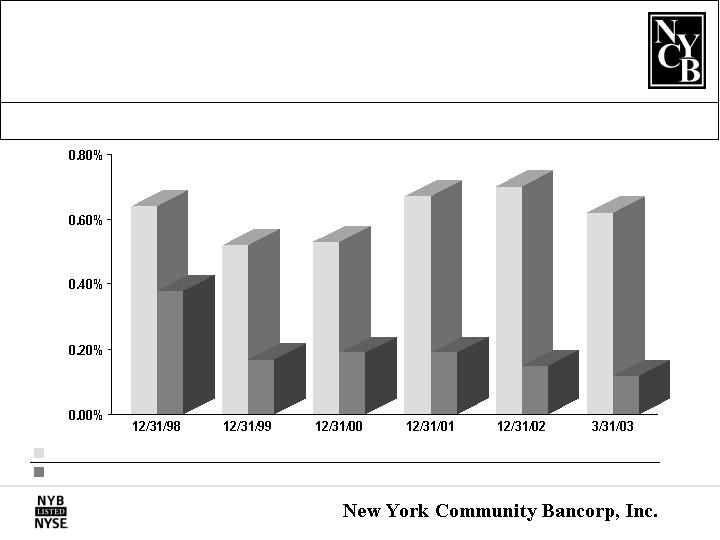

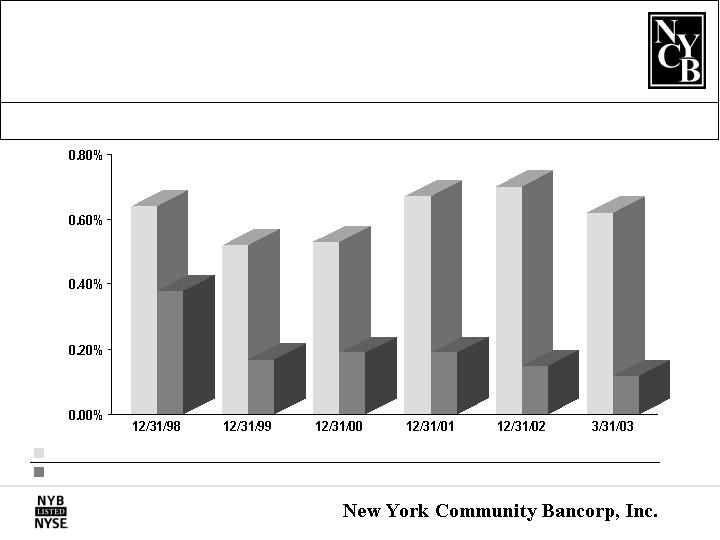

Measure the Quality: NPAs/Total Assets

Exceptional asset quality has been a hallmark of NYCB throughout its public life.

U.S. Thrifts

0.64%

0.52%

0.53%

0.67%

0.70%

NYCB

0.38%

0.17%

0.19%

0.19%

0.15%

0.12%

0.62%

9

Measure the Quality: NPLs/Total Loans

NYCB's asset quality reflects the strong performance of its multi-family loans.

U.S. Thrifts

0.76%

0.62%

0.61%

0.81%

0.83%

NYCB

0.41%

0.19%

0.25%

0.32%

0.30%

0.26%

0.76%

10

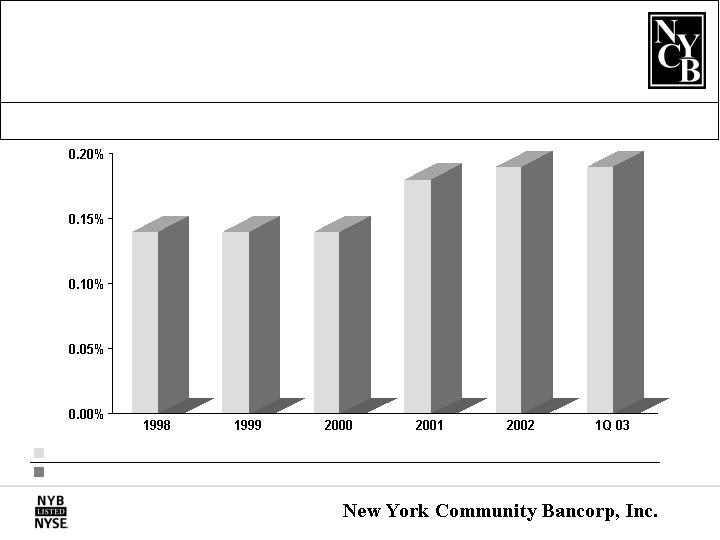

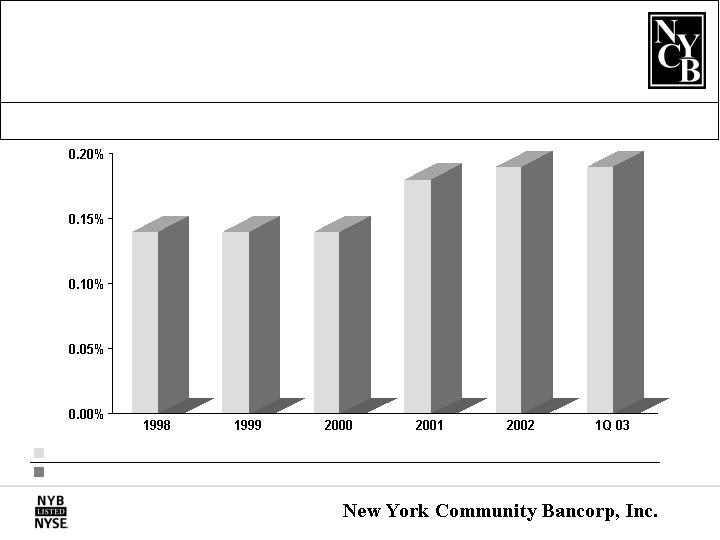

Measure the Quality: NCOs/Average Loans

The absence of any net charge-offs attests to NYCB's underwriting standards.

U.S. Thrifts

0.14%

0.14%

0.14%

0.18%

0.19%

NYCB

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.19%

11

Invest in the strength.

Strength: Industry Leader

#1 Top-performing Large Thrift in the U.S.

(for the 5th consecutive year)

#1 Best-performing Company - Total Returns

(Savings & Loans)

#4 Most Efficient Bank Holding Company

Among the Largest 500

ThriftINVESTOR

May 2003

The Wall Street Journal

March 10, 2003

American Banker

December 13, 2002

#20 Best-performing Company in the

Standard & Poor's MidCap 400 Index

BusinessWeek

Spring 2003

NYCB's performance and returns on investment have earned national recognition.

13

Strength: Market Leader

NYCB is a leading lender, depository, and producer of revenues.

SNL DataSource

Singer's Annuity and Funds Report

*

**

MARKET

LEADER

The leading producer of multi-family loans

for portfolio in New York City

The second largest thrift depository in Queens

and Staten Island*

The leading supermarket banking franchise

in the metro New York region*

Ranked within the top 3% of US thrifts generating

income from investment product sales**

The fifth largest thrift depository in New York City*

14

Total assets

Multi-family loans

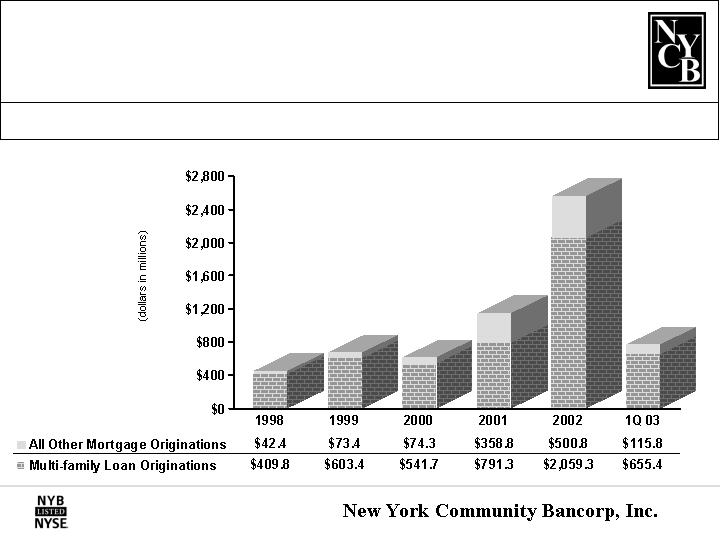

Mortgage originations

Core deposits

Stockholders' equity

Tangible stockholders' equity(6)

1-4 family loans

NPAs / Total assets

Measure the Strength: Balance Sheet

The balance sheet has benefited from M&A, restructuring, and leveraged growth.

23

38

123

9

35

108

80

4

%

%

%

%

%

%

%

bp

Improvement

Since 12/31/01

bn

bn

bn

bn

bn

mn

mn

%

12/31/02

$11.3

$4.5

$2.6

$3.3

$1.3

$647.5

$265.7

0.15

bn

bn

mn

bn

bn

mn

mn

%

3/31/03

$12.0

$4.8

$771.1

$3.4

$1.3

$674.0

$232.6

0.12

15

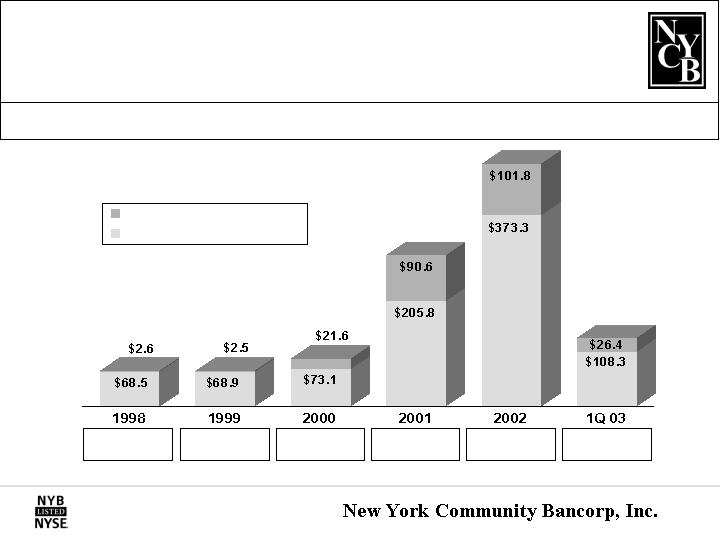

Measure the Strength: Earnings

NYCB's 1Q 2003 earnings rose 45% year-over-year.

Diluted EPS†

Net interest income

Other operating income

ROA

Spread

Margin

Efficiency ratio

$0.50

$108.3

$26.4

2.24

4.03

4.17

25.19

mn

mn

%

%

%

%

64

81

12

64

74

72

971

%*(1)

%

%

bp*(3)

bp

bp

bp*(5)

1Q 2003

$1.67

$373.3

$101.8

2.29

4.12

4.31

25.32

mn

mn

%

%

%

%

2002

Y-O-Y

Improvement

40

30

34

24

3

1

754

%

%

%

bp

bp

bp

bp

Y-O-Y

Improvement

* As compared to 2001 core measures.

† Reflects a 4-for-3 stock split on May 21, 2003.

16

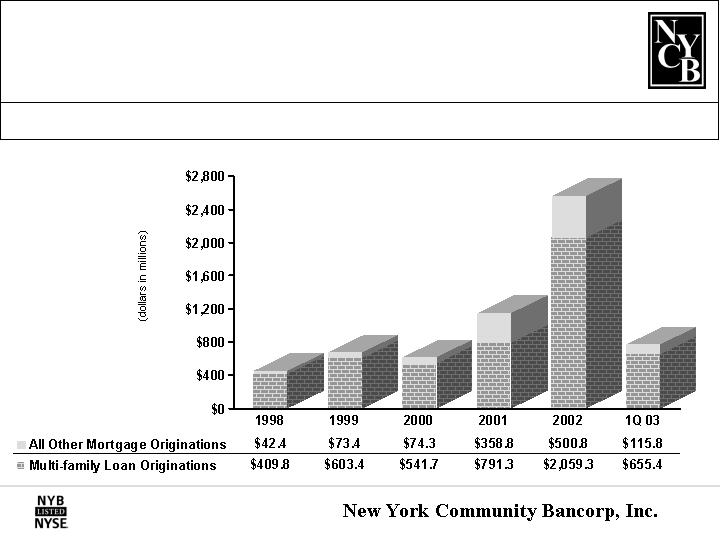

Strength: Multi-family Market Niche

NYCB is the #1 multi-family lender for portfolio in NYC.

17

Strength: Multi-family Lending Strategy

The strength of NYCB's performance reflects its emphasis on multi-family lending.

Rent-controlled / Rent-stabilized buildings

5-year fixed / 5-year adjustable term

Average term to refi: 4 years

Average loan: $2.0 million

Average LTV ratio: 58%

Stabilized cash flow

Pre-payment penalties: 5-4-3-2-1 points

A PROFITABLE, EFFICIENT, & RISK-AVERSE LOAN PORTFOLIO

No net charge-offs since 1987

18

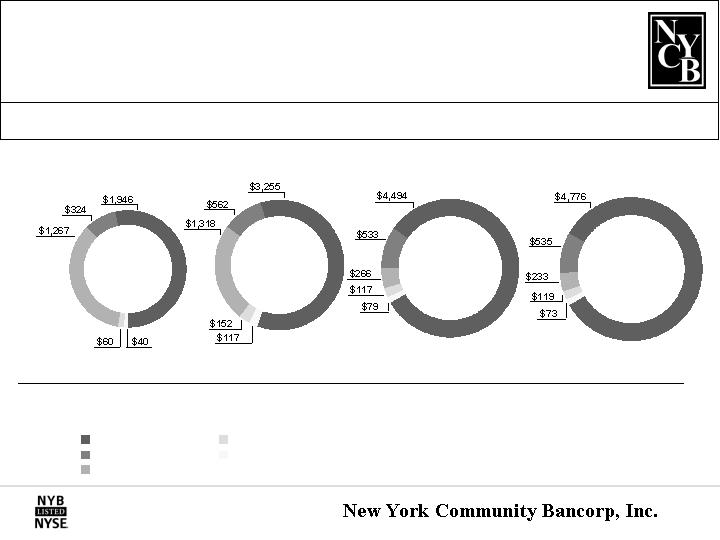

Strength: Risk-averse Loan Portfolio

The structure of NYCB's loan portfolio provides insulation against credit risk.

*

**

***

Includes loans acquired in the Haven transaction.

Includes loans acquired in the Richmond County transaction.

Reflects the securitization of 1-4 family loans totaling

$572.5 million in 2Q 2002.

(dollars in millions)

12/31/00

12/31/01

12/31/02

3/31/03

$3,636*

7.97%

$5,405**

7.71%

$5,489***

7.49%

$5,736

7.56%

Total Loans

Average Yield

Multi-family

Commercial real estate

1-4 family

Construction

Other

19

Total securities available for sale

Estimated weighted average yield

Strength: Investment Strategy

NYCB's securities portfolio is a source of cash flows for loan production.

(dollars in millions)

Available-for-Sale Securities

at March 31, 2003

Mortgage-backed and -related securities

Capital trust notes

Other

Mortgage-backed and -related securities

Estimated weighted average life

$4,079

4.7%

$3,663

1.7 years

20

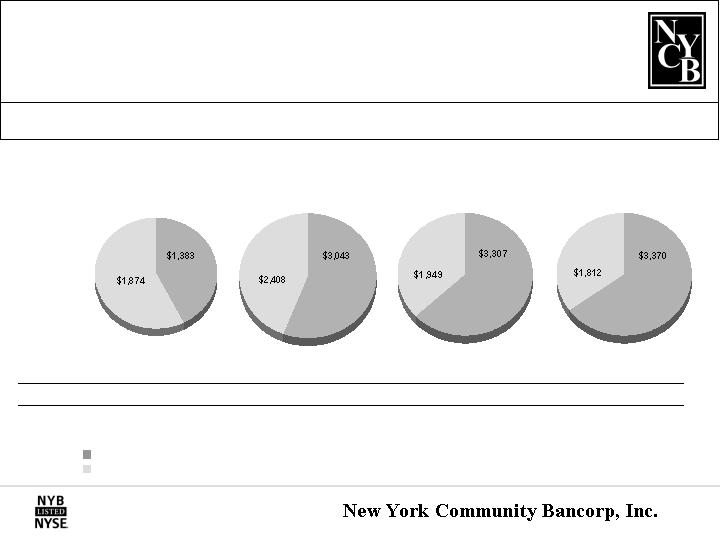

Core/Total Deposits

Total Deposits

Average Cost

42.5%

$3.3 Bn*

4.14%

55.8%

$5.5 Bn**

3.41%

62.9%

$5.3 Bn***

1.83%

Strength: Deposit Mix

12/31/01

12/31/00

12/31/02

Core deposits have grown 144% since 12/31/00.

(dollars in millions)

65.0%

$5.2 Bn

1.44%

3/31/03

Includes deposits acquired in the Haven transaction.

Includes deposits acquired in the Richmond County transaction.

Reflects the divestiture of 14 in-store branches.

*

**

***

Core deposits

CDs

21

Strength: Interest Rate Risk Management

NYCB's margin has provided a cushion against interest rate volatility.

4.24%

3.79%

3.33%

3.59%

4.31%

NYCB NIM

4.17%

22

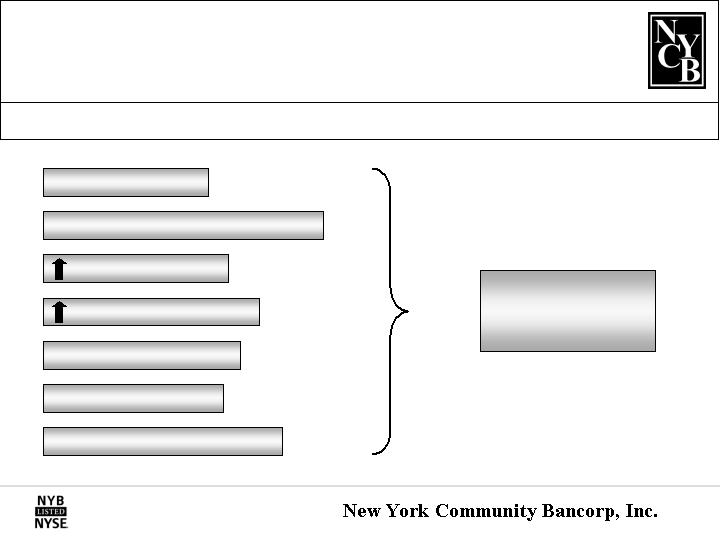

Strength: Efficiency

The consistent efficiency of NYCB's operations stems from several sources.

Emphasis on multi-family lending

Franchise expansion through M & A

De novo branch expansion at turn-key locations

Hub & spoke approach to in-store branching

Profitable conduit relationships

Sale of third-party products

EFFICIENCY

23

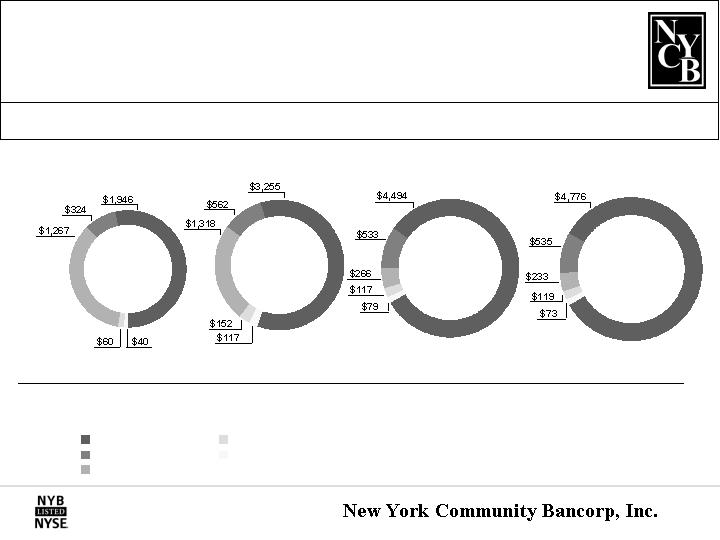

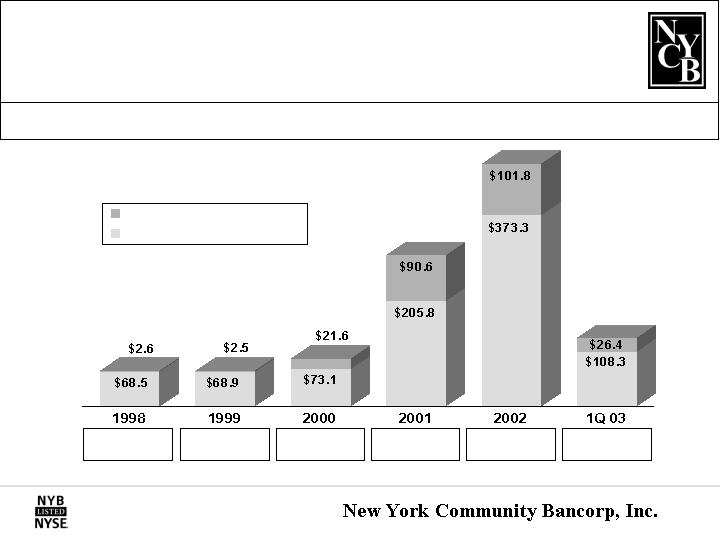

Strength: Revenue Generation

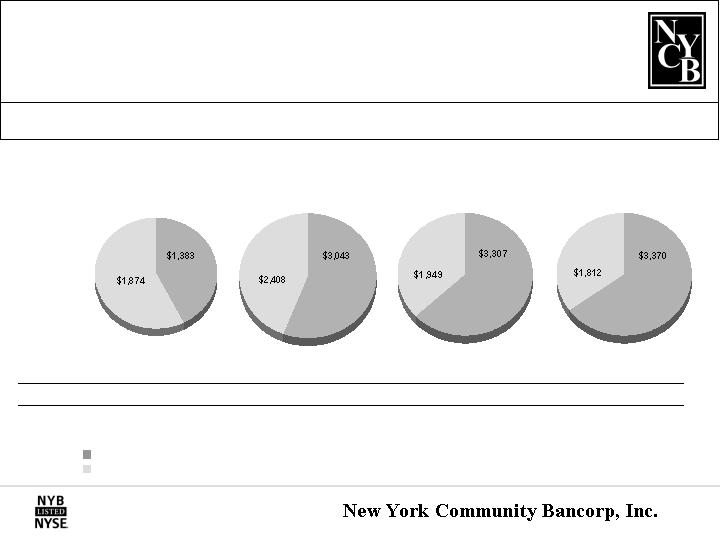

Total Revenues

$71.4

Other operating income represented 20% of 1Q 2003 revenues.

(dollars in millions)

Total Revenues

$94.7

Total Revenues

$296.4

Total Revenues

$475.1

Total Revenues

$134.7

Total Revenues

$71.1

Other operating income

Net interest income

24

Strength: Capital Management

NYCB actively manages its capital.

CAPITAL MANAGEMENT STRATEGIES

8 stock splits in 9 years, including a

4-for-3 split on 5/21/03

$147.5 million, net, generated in 2Q 02 secondary offering

4.3 million shares repurchased in 2002;

1.1 million in 1Q 03

57-fold increase in quarterly cash dividend,

including a 40% increase in 2003 to date

$267 million, net, generated in 4Q 02

offering of BONUSESSM Units

$600 million shelf registration filed in 1Q 03

25

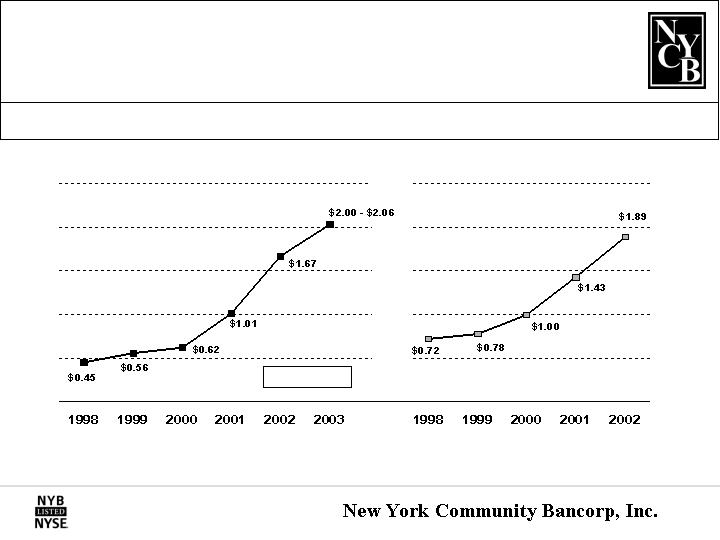

Strength: Earnings Capacity

NYCB projects 20% - 24% diluted EPS growth in 2003.

Diluted GAAP EPS*

Diluted Cash EPS*(7)

CAGR: 35.20%

Co. Estimates

(1)

(1)

Diluted GAAP and diluted cash EPS have been adjusted to reflect a 4-for-3 stock split on 5/21/03 and 3-for-2 stock splits on 3/29/01 and 9/20/01.

*

26

Strength: 2003 Projections

Several factors are currently expected to support diluted EPS growth in 2003.

REVENUE AND EXPENSE PROJECTIONS

~ 15% asset growth

~ 20% net multi-family loan growth

net interest income

other operating income

< 30% efficiency ratio

No loan loss provisions

~ 32% - 33% effective tax rate

27

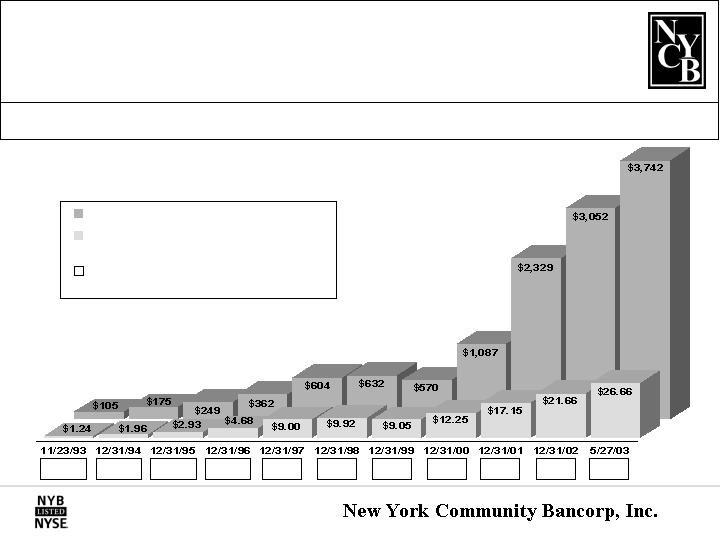

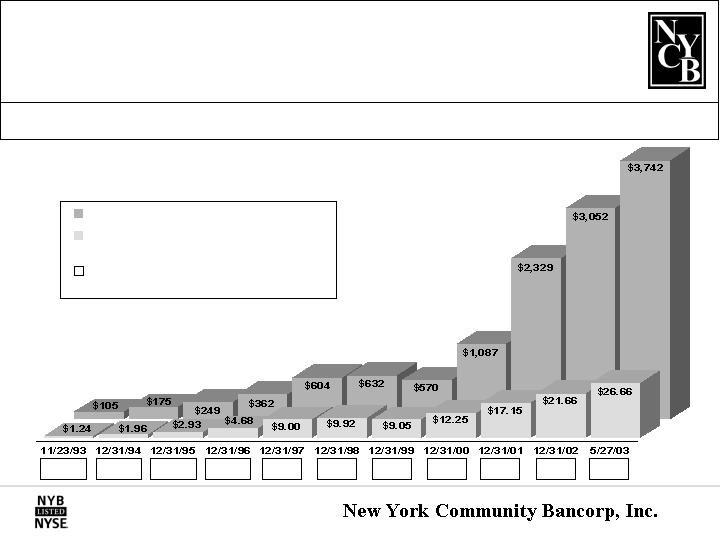

Market capitalization

Price per share (adjusted for 8 splits including a 4-for-3 stock split on 5/21/03)

Annual yield produced by $0.84 per share dividend on shares purchased at this date

Strength: Shareholder Value Creation

(dollars in millions, except share data)

67.74%

42.86%

28.67%

17.95%

9.33%

8.47%

9.28%

6.86%

4.90%

3.88%

3.15%

Since the IPO, the value of NYCB's shares has appreciated 2,050%.

28

NYCB has provided significant returns to its shareholders.

Strength: Returns to Shareholders

% Appreciation

Share Price

Dividend

2,050

359

104

5,700

152

110

NYCB – November 23, 1993

Haven – June 27, 2000*

Richmond County – March 27, 2001*

%

%

Reflects appreciation in the price per share and the quarterly cash dividend since the merger transaction was announced.

*

29

Reconciliation of GAAP and Non-GAAP Measures

Appendix

30

1.

As calculated in accordance with GAAP, the Company's 2000 and 2001 diluted earnings per share were $0.42 and $1.01, respectively. The 2000 amount reflected a gain of $13.5 million recorded in other operating income and a charge of $24.8 million recorded in operating expenses, resulting in a net charge of $11.4 million, or $0.20 per diluted share. The 2001 amount included a gain of $39.6 million recorded in other operating income and charges of $23.5 million and $3.0 million, respectively, recorded in operating expenses and income tax expense, resulting in an after-tax net charge of $836,000, or $0.01 per diluted share.

2.

The Company calculated its diluted cash earnings per share for 2002 by adding back to the year's net income non-cash items totaling $30.5 million. The Company calculated its diluted cash earnings per share for 1Q 2003 by adding back to the quarter's net income non-cash items totaling $4.9 million. Please see the table on page 32 for a reconciliation of the Company's diluted GAAP and cash earnings per share for the respective periods.

3.

As calculated in accordance with GAAP, the Company's 2000 and 2001 ROA were 1.06% and 1.63%, respectively. The Company's 2000 and 2001 core ROA excluded from net income the respective items identified in footnote 1, above.

4.

As calculated in accordance with GAAP, the Company's 2000 and 2001 ROE were 13.24% and 18.16%, respectively. The Company's 2000 and 2001 core ROE excluded from net income the respective items identified in footnote 1, above.

5.

As calculated in accordance with GAAP, the Company's 2000 and 2001 efficiency ratio were 52.08% and 38.04%, respectively. The Company's 2000 core efficiency ratio excluded a gain of $13.5 million on the sale of a Bank-owned property from other operating income and a merger-related charge of $24.8 million from operating expenses. Its 2001 core efficiency ratio excluded a gain of $39.6 million on the sale of certain assets from other operating income and a merger-related charge of $23.5 million from operating expenses.

6.

Please see the table on page 31 for a reconciliation of the Company's stockholders' equity and tangible stockholders' equity at March 31, 2003 and December 31, 2002 and 2001.

7.

Please see the table on page 32 for a reconciliation of the Company's diluted GAAP and diluted cash earnings per share for the years ended December 31, 1998, 1999, 2000, 2001, and 2002 .

(dollars in thousands)

Average stockholders' equity

Subtract:

Goodwill

�� Core deposit intangible

Average tangible stockholders' equity

Net income

Return on average stockholders' equity

Return on average tangible stockholders' equity

(dollars in thousands)

Average stockholders' equity

Subtract:

Goodwill

Core deposit intangible

Average tangible stockholders' equity

Net income

Return on average stockholders' equity

Return on average tangible stockholders' equity

Reconciliation of Stockholders' Equity and Tangible Stockholders' Equity

$575,290

314,109

19,583

$241,598

$104,467

18.16

43.24

$1,149,231

624,518

51,500

$ 473,213

$229,230

19.95

48.44

2002

2001

For the Years Ended December 31,

For the Three Months Ended

March 31, 2003

$1,332,946

624,518

50,000

$ 658,428

$67,368

20.22

40.93

%

%

%

Appendix

31

Appendix

(in thousands, except per share data)

Net income

Add back:

Amortization and appreciation of stock-related benefit plans

Associated tax benefits

Dividends on unallocated ESOP shares

Amortization of core deposit intangible and goodwill

Total additional contributions to tangible stockholder's equity

Cash earnings

Basic cash earnings per share

Diluted cash earnings per share

(in thousands, except per share data)

Net income

Add back:

Amortization and appreciation of stock-related benefit plans

Associated tax benefits

Dividends on unallocated ESOP shares

Amortization of core deposit intangible

Total additional contributions to tangible stockholder's equity

Cash earnings

Basic cash earnings per share

Diluted cash earnings per share

Cash Earnings Reconciliation

$26,944

6,724

8,071

2,019

--

16,814

$43,758

$0.77

$0.72

$31,664

2,559

7,269

2,857

--

12,685

$44,349

$0.80

$0.78

$24,477

24,795

5,953

2,776

494

34,018

$58,495

$1.04

$1.00

$104,467

22,775

11,000

2,302

8,428

44,505

$148,972

$1.46

$1.43

$229,230

5,902

15,860

2,718

6,000

30,480

$259,710

$1.91

$1.89

2002

2001

2000

1999

1998

For the Years Ended December 31,

$46,321

1,429

14,727

530

1,500

18,186

$64,507

$0.49

$0.49

$67,368

1,711

807

901

1,500

4,919

$72,287

$0.53

$0.53

2003

2002

For the Three Months Ended March 31,

32

For more information:

The Company trades on the NYSE under the symbol "NYB".

Log onto our web site: www.myNYCB.com

E-mail requests to: iangarola@myNYCB.com

Call Investor Relations at: (516) 683-4420

New York Community Bancorp, Inc.

615 Merrick Avenue

Westbury, NY 11590

Write to:

33

5/27/03