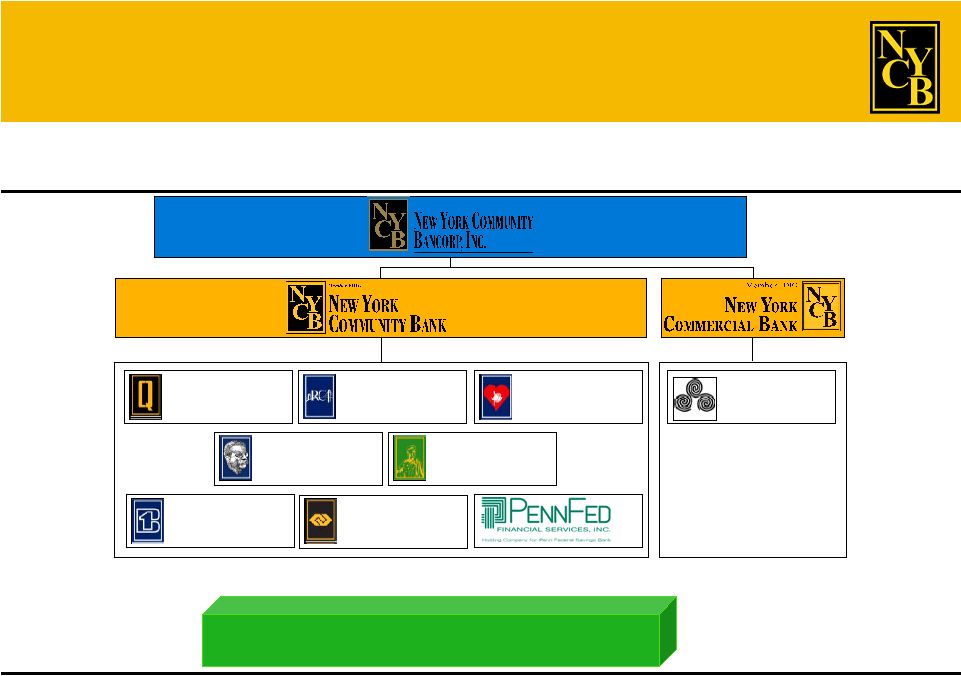

1 Forward-Looking Statements This presentation, other written materials, and statements management may make regarding the proposed transaction with PennFed Financial Services, Inc., like other written and oral communications presented by New York Community Bancorp, Inc. and its authorized officers, may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. New York Community Bancorp, Inc. intends such forward- looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of said safe harbor provisions. Forward-looking statements, which are based on certain assumptions, may be identified by their reference to future periods and include, without limitation, those statements relating to the anticipated effects of the transaction between New York Community Bancorp, Inc. and PennFed Financial Services, Inc. (the “Companies”). The following factors, among others, could cause the actual results of the transaction and the expected benefits of the transaction to the combined company and to the Companies’ shareholders, to differ materially from the expectations-stated in this presentation: the ability of the Companies to consummate the transaction; a materially adverse change in the financial condition or results of operations of either company; the ability of New York Community Bancorp, Inc. to successfully integrate the assets, liabilities, customers, systems, and any management personnel it may acquire into its operations pursuant to the transaction; and the ability to realize the related revenue synergies and cost savings within the expected time frames. In addition, factors that could cause the actual results of the transaction to differ materially from current expectations include, but are not limited to, general economic conditions and trends, either nationally or locally in some or all of the areas in which the Companies and their customers conduct their respective businesses; conditions in the securities markets or the banking industry; changes in interest rates, which may affect the Companies’ net income, the level of prepayment penalties and other future cash flows, or the market value of their assets; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services in the Companies’ local markets; changes in the financial or operating performance of the Companies’ customers’ businesses; changes in real estate values, which could impact the quality of the assets securing the Companies’ loans; changes in the quality or composition of the Companies’ loan or investment portfolios; changes in competitive pressures among financial institutions or from non-financial institutions; changes in the customer base of either company; potential exposure to unknown or contingent liabilities of companies targeted by New York Community Bancorp, Inc. for acquisition; the Companies’ timely development of new lines of business and competitive products or services within existing lines of business in a changing environment, and the acceptance of such products or services by the Companies’ customers; any interruption or breach of security resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems; the outcome of pending or threatened litigation or of other matters before regulatory agencies, or of matters resulting from regulatory exams, whether currently existing or commencing in the future; environmental conditions that exist or may exist on properties owned by, leased by, or mortgaged to the Companies; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; changes in banking, securities, tax, environmental, and insurance law, regulations, and policies, and the ability to comply with such changes in a timely manner; changes in accounting principles, policies, practices, or guidelines; changes in legislation and regulation; operational issues stemming from and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems, on which the Companies are highly dependent; changes in the monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; war or terrorist activities; and other economic, competitive, governmental, regulatory, and geopolitical factors affecting the Companies’ operations, pricing, and services. Additionally, the timing and occurrence or non-occurrence of events may be subject to circumstances beyond the Companies’ control. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by applicable law or regulation, the Companies disclaim any obligation to update any forward-looking statements. Safe Harbor Provisions of the Private Litigation Reform Act of 1995 |