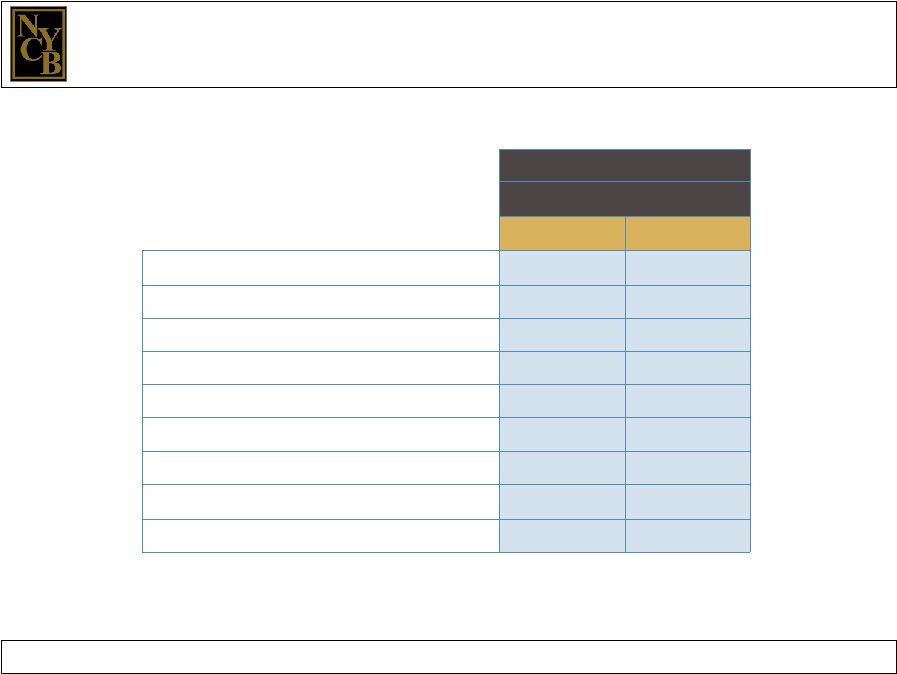

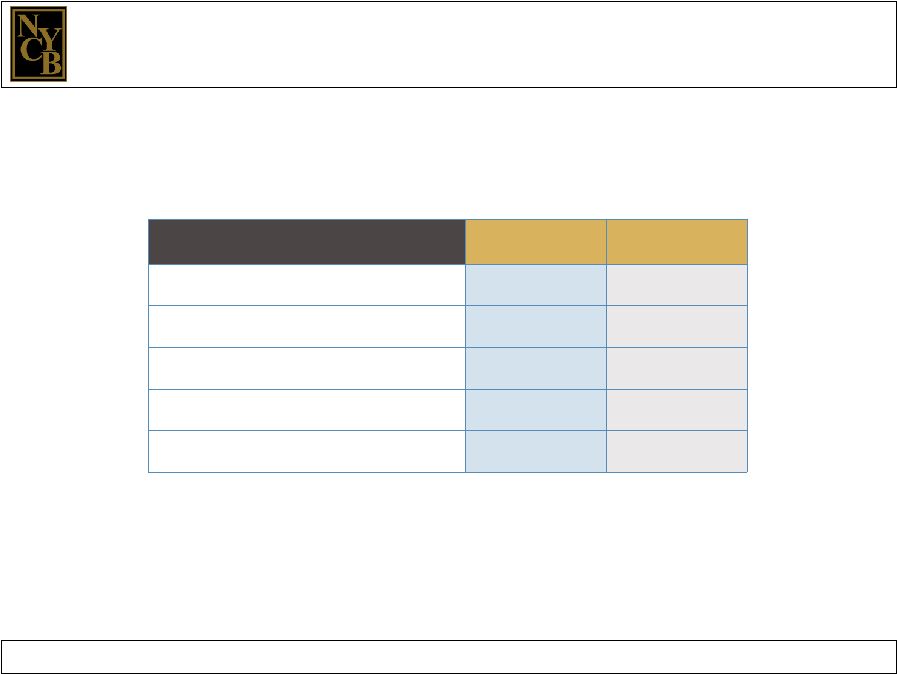

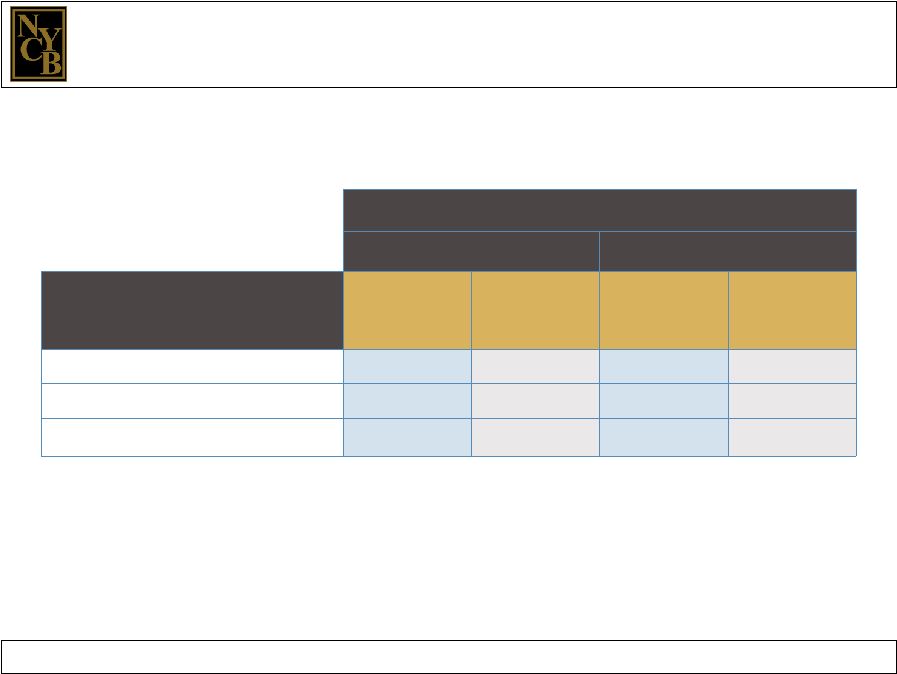

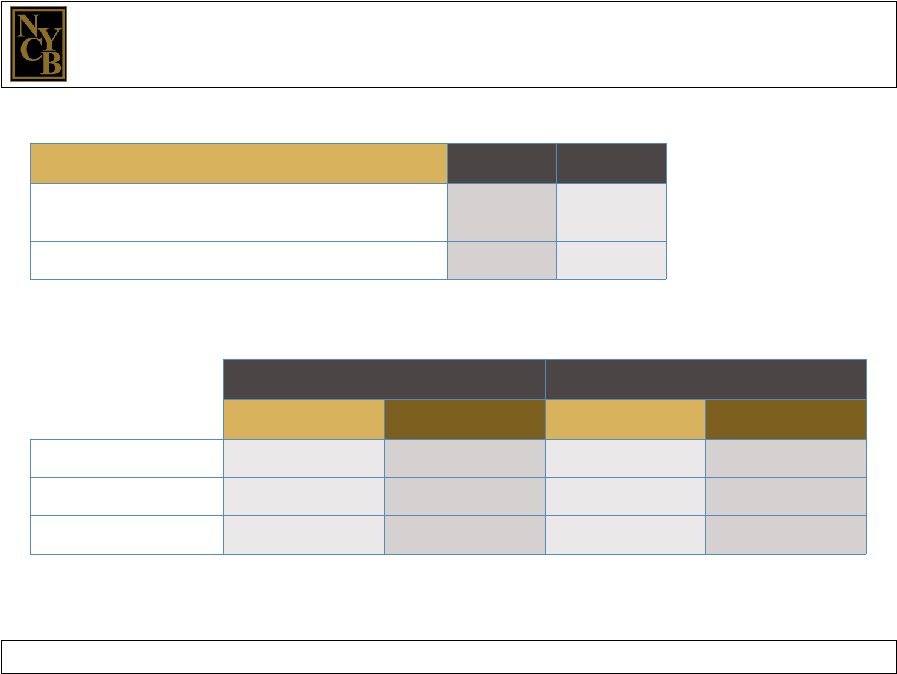

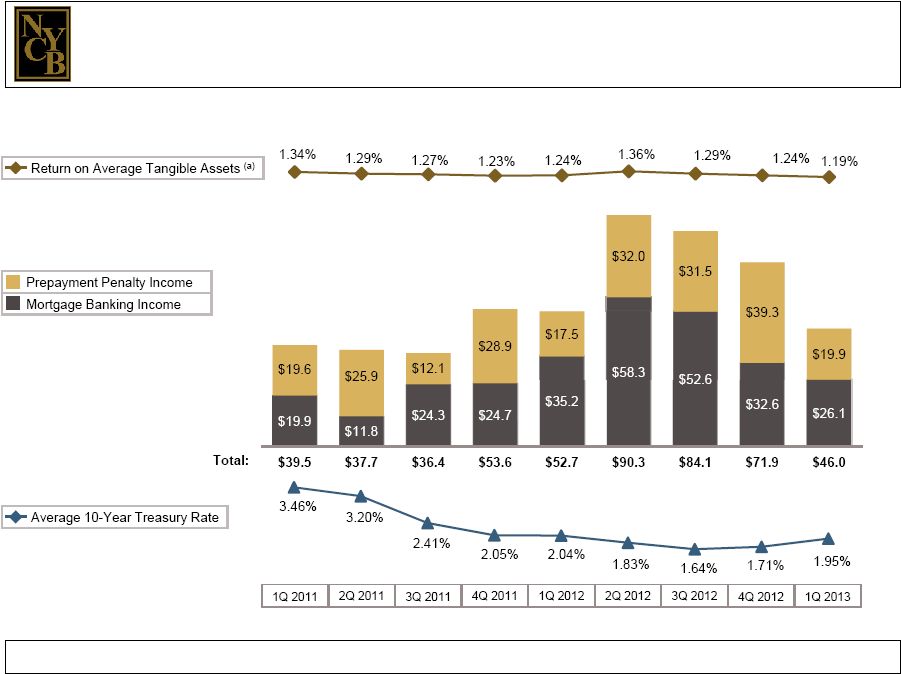

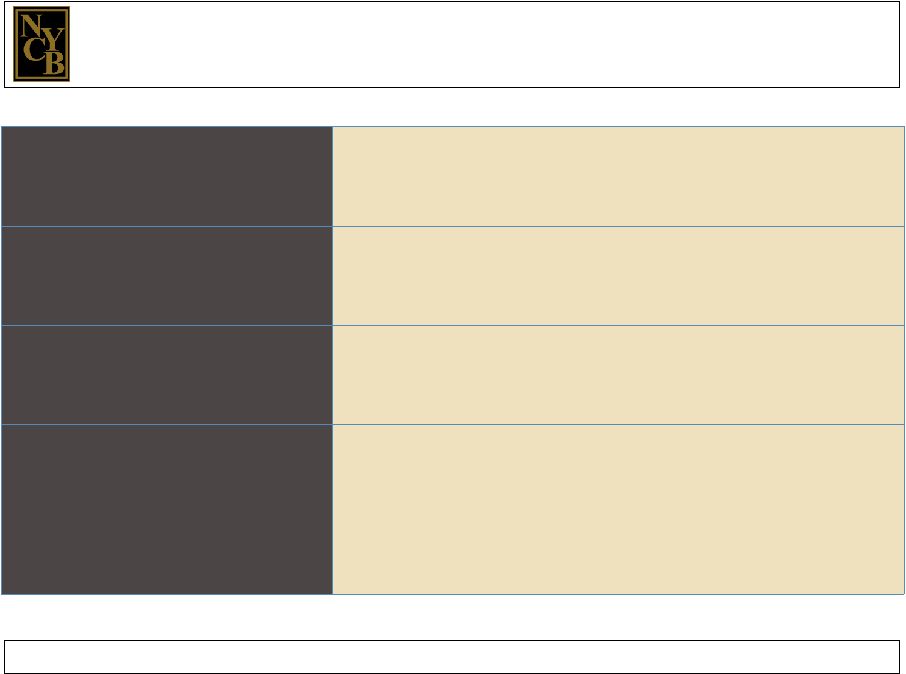

New York Community Bancorp, Inc. Page 40 For the Three Months Ended (dollars in thousands) March 31, 2013 March 31, 2012 June 30, 2012 September 30, 2012 December 31, 2012 March 31, 2011 June 30, 2011 September 30, 2011 December 31, 2011 Average Assets $43,243,259 $41,775,013 $41,916,854 $43,205,076 $43,087,846 $40,713,044 $40,853,788 $41,261,984 $41,683,129 Less: Average goodwill and core deposit intangibles (2,466,622) (2,486,018) (2,480,921) (2,476,056) (2,471,204) (2,511,349) (2,503,966) (2,497,076) (2,491,327) Average tangible assets $40,776,637 $39,288,995 $39,435,933 $40,729,020 $40,616,642 $38,201,695 $38,349,822 $38,764,908 $39,191,802 Average Stockholders’ Equity $ 5,630,877 $ 5,528,296 $ 5,565,581 $ 5,557,693 $ 5,498,040 $ 5,511,970 $ 5,458,017 $ 5,501,226 $ 5,535,114 Less: Average goodwill and core deposit intangibles (2,466,622) (2,486,018) (2,480,921) (2,476,056) (2,471,204) (2,511,349) (2,503,966) (2,497,076) (2,491,327) Average tangible stockholders’ equity $ 3,164,255 $ 3,042,278 $ 3,084,660 $ 3,081,637 $ 3,026,836 $ 3,000,621 $ 2,954,051 $ 3,004,150 $ 3,043,787 Net Income $118,675 $118,253 $131,212 $128,798 $122,843 $123,176 $119,459 $119,750 $117,652 Add back: Amortization of core deposit intangibles, net of tax 2,653 3,095 2,952 2,913 2,826 4,431 4,286 3,653 3,269 Adjusted net income $121,328 $121,348 $134,164 $131,711 $125,669 $127,607 $123,745 $123,403 $120,921 Return on average assets 1.10% 1.13% 1.25% 1.19% 1.14% 1.21% 1.17% 1.16% 1.13% Return on average tangible assets 1.19 1.24 1.36 1.29 1.24 1.34 1.29 1.27 1.23 Return on average stockholders’ equity 8.43 8.56 9.43 9.27 8.94 8.94 8.75 8.71 8.50 Return on average tangible stockholders’ equity 15.34 15.95 17.40 17.10 16.61 17.01 16.76 16.43 15.89 Average tangible assets and average tangible stockholders’ equity are non-GAAP financial measures. The following table presents reconciliations of these non-GAAP measures with the related GAAP measures for the three months ended March 31, 2013; March 31, June 30, September 30, and December 31, 2012; and March 31, June 30, September 30, and December 31, 2011. Reconciliations of GAAP and Non-GAAP Financial Measures |