Third Quarter 2017 Investor Presentation EXHIBIT 99.1 |

Page 2 Cautionary Statements This presentation may include forward-looking statements by the Company and our authorized officers pertaining to such matters as our goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals. Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward-looking statements are subject to the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in competitive pressures among financial institutions or from non-financial institutions; our ability to obtain the necessary shareholder and regulatory approvals of any acquisitions we may propose, our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we may acquire into our operations, and our ability to realize related revenue synergies and cost savings within expected time frames; changes in legislation, regulations, and policies; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. More information regarding some of these factors is provided in the Risk Factors section of our Form 10-K for the year ended December 31, 2016 and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this presentation, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov. This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our performance and financial condition with those of other banks. Such non-GAAP financial measures are supplemental to, and are not to be considered in isolation or as a substitute for, measures calculated in accordance with GAAP. Forward-Looking Information Our Supplemental Use of Non-GAAP Financial Measures |

Page 3 ASSETS DEPOSITS MULTI-FAMILY LOANS MARKET CAP TOTAL RETURN ON INVESTMENT $48.5 billion $28.9 billion $27.2 billion $6.3 billion 4,007% With assets of $48.5 billion at 9/30/17, we are the 24th largest U.S. bank holding company. With deposits of $28.9 billion and 255 branches in Metro New York, New Jersey, Ohio, Florida, and Arizona at 9/30/17, we rank 29th among the nation’s largest depositories. With a portfolio of $27.2 billion at the end of September, we are a leading producer of multi-family loans in New York City. With a market cap of $6.3 billion at 9/30/17, we rank 26th among the nation’s publicly traded banks and thrifts. From 11/23/93 through 9/30/17, we provided our charter investors with a total return on investment of 4,007%. (a) We rank among the largest U.S. bank holding companies. (a) Bloomberg Note: Except as otherwise indicated, all industry data was provided by S&P Global Market Intelligence as of 11/15/17. |

3Q 2017 PERFORMANCE HIGHLIGHTS |

Page 5 (dollars in thousands, except per share data) 3Q 2017 Strong Profitability Measures: Net income available to common shareholders $102,261 Diluted earnings per common share $0.21 Return on average assets 0.91% Return on average common stockholders’ equity 6.53 Return on average tangible assets (a) 0.96 Return on average tangible stockholders’ equity (a) 10.69 Net interest margin 2.53 Efficiency ratio 42.10 Income Statement Highlights (a) ROTA and ROTCE are non-GAAP financial measures. Please see page 31 for a discussion and reconciliation of these measures to our ROA and ROCE. |

Page 6 COMPANY CAPITAL 9/30/17 Common stockholders’ equity / total assets 12.91% Common equity tier 1 capital ratio 11.54 Tier 1 risk-based capital ratio 13.06 Total risk-based capital ratio 14.59 Leverage capital ratio 9.40 BANK CAPITAL 9/30/17 Community Bank: Common equity tier 1 capital ratio 13.60% Leverage capital ratio 9.80 Commercial Bank: Common equity tier 1 capital ratio 15.30% Leverage capital ratio 11.07 BALANCE SHEET 9/30/17 Loans, net / total assets 77.3% Securities / total assets 6.3 Deposits / total assets 59.6 Wholesale borrowings / total assets 24.8 ASSET QUALITY At or for the Three Months Ended 9/30/17 Non-performing loans / total loans 0.18% Non-performing assets / total assets 0.17 Net charge-offs / average loans (non- annualized) (a) 0.00 Balance Sheet Highlights (a) The calculation of net charge-offs to average loans for the three months ended 9/30/17 excludes charge-offs of $40.6 million on taxi medallion-related loans. |

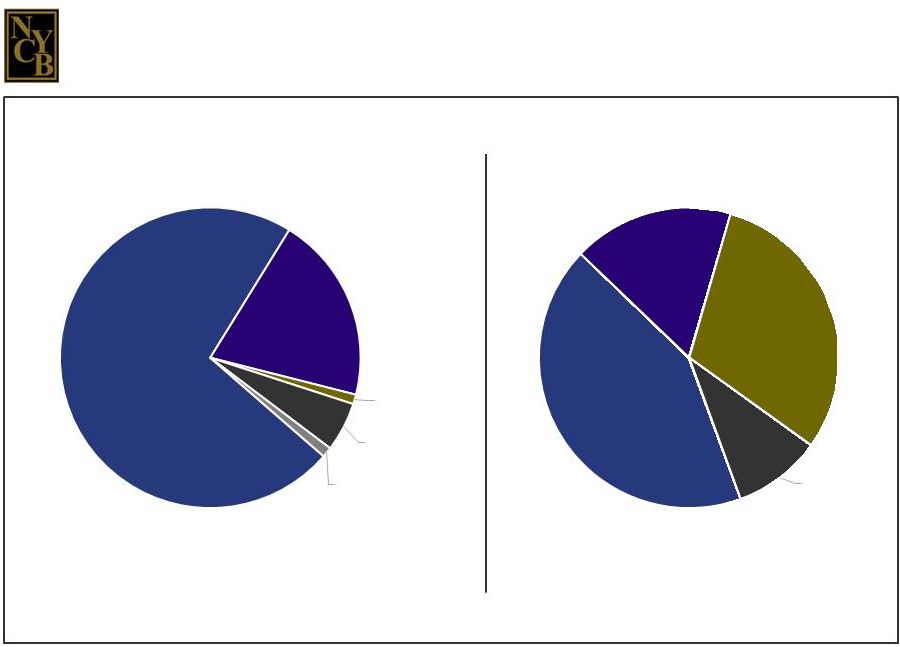

Page 7 Interest- Bearing Checking and MMA 43% Savings 17% CDs 30% Non- Interest- Bearing 10% TOTAL HFI LOANS: $37.5 BN AVERAGE YIELD ON LOANS: 3.71% TOTAL DEPOSITS: $28.9 BN AVERAGE COST OF INTEREST-BEARING DEPOSITS: 0.94% LOANS AT 9/30/17 DEPOSITS AT 9/30/17 Loans and Deposits Multi- Family 73% CRE 20% 1-4 Family 1% C&I 5% ADC 1% |

Page 8 Our regulatory capital ratios exceed those of our peers. RATIO NYCB AT 9/30/17 PEERS (MEDIAN AT 9/30/17) Tier 1 Risk-Based Capital 13.06% 11.51% Total Risk-Based Capital 14.59 13.17 Tier 1 Leverage 9.40 9.34 Common Equity Tier 1 11.54 10.98 |

LOOKING FORWARD |

Page 10 Total non-covered loans grew nearly 3% on an annualized basis, and we expect loan growth to accelerate in the fourth quarter. Held-for-investment loan originations rose 24% from the previous quarter, including 50% growth in multi-family originations and 30% growth in CRE originations. Pipeline, excluding 1-4 family loans, rose 17% to $2.1 billion – its highest level in two years. Currently, we have ample opportunity to grow the balance sheet by approximately $5.9 billion in Q4 2017 without breaching the SIFI threshold on a trailing four-quarter basis. As a result of the sale of our mortgage banking operations, we have $3.1 billion of excess cash earning 1.34% Current loan yield is 3.71% and current yield on securities is 3.81%. Annual cost savings from the sale of our mortgage banking operations are estimated at $60 million. We anticipate additional cost save opportunities from lower SIFI-readiness expenses. Q4 2017 operating expenses are expected to be in the $151-$152 million range – down about $10 million from Q3 2017. Levers for Future Earnings Growth |

Page 11 We continue to be encouraged by recent signs of regulatory easing. Qualitative stress testing for financial institutions with assets greater than $50 billion and less than $250 billion has been eliminated. The regulatory approval process for mergers resulting in the creation of a bank holding company with assets below $100 billion has been eased; the threshold was previously $25 billion. There is general consensus among regulators, congressional leadership, and the current administration that the current $50 billion SIFI threshold should be raised. Raising the SIFI threshold would: — facilitate our ability to engage in mergers with institutions, regardless of size; — enable us to grow our loan portfolio organically, as well as through acquisitions; and — enable us to grow our deposits and our market share through acquisitions. |

Page 12 We also are encouraged by proposed changes to the federal tax laws for corporations. Changes to the federal corporate tax laws would be expected to benefit our earnings in two important ways: Our current federal corporate tax rate is 35%. All other things being equal, a reduction in the federal tax rate to 20% would be approximately 23% accretive to our earnings. The reduced federal tax rate as applied to our existing net deferred tax liability position would provide a one-time earnings benefit. |

OUR BUSINESS MODEL |

STRATEGIC LOAN PRODUCTION |

Page 15 $20,714 $23,849 $25,989 $26,961 $27,162 12/31/13 12/31/14 12/31/15 12/31/16 9/30/17 PORTFOLIO STATISTICS AT OR FOR THE 3 MONTHS ENDED 9/30/17 % of non-covered loans held for investment = 72.4% Average principal balance = $5.6 million Weighted average life = 2.7 years % of our multi-family loans located in Metro New York = 77.7% % of HFI loan originations = 62.0% MULTI-FAMILY LOAN PORTFOLIO (in millions) Originations: $7,417 $7,584 $9,214 $5,685 $3,339 Net Charge-Offs (Recoveries): $11 $0 $(4) $0 $0 We are a leading producer of multi-family loans on non- luxury apartment buildings in NYC with rent-regulated units. |

Page 16 Of the loans in our portfolio that are collateralized by multi-family buildings in the five boroughs of New York City, 88% are collateralized by buildings with rent- regulated units featuring below-market rents. Rent-regulated buildings are more likely to retain their tenants – and, therefore, their revenue stream – in downward credit cycles. Together with our conservative underwriting standards, our focus on multi-family lending in this niche market has resulted in our record of superior asset quality. Over the course of our public life, losses on multi-family loans have amounted to a mere $145.8 million, representing 0.19% of the $75.5 billion of multi-family loans we have originated since 1993. Losses on commercial real estate loans totaled $18.5 million, or 0.10%, of the $19.0 billion of CRE loans we originated during the same time. Multi-family loans are less costly to produce and service than other types of loans, and therefore contribute to our superior efficiency. The way we lend in this market niche has distinguished our performance from that of other multi-family lenders. |

Page 17 $7,366 $7,637 $7,860 $7,727 $7,553 12/31/13 12/31/14 12/31/15 12/31/16 9/30/17 COMMERCIAL REAL ESTATE LOAN PORTFOLIO (in millions) Originations: $2,168 $1,661 $1,842 $1,180 $692 Net Charge-Offs (Recoveries): $0 $1 $(1) $(1) $0 Commercial real estate lending has been a logical extension of our emphasis on multi-family loans. PORTFOLIO STATISTICS AT OR FOR THE 3 MONTHS ENDED 9/30/17 % of non-covered loans held for investment = 20.1% Average principal balance = $5.7 million Weighted average life = 2.9 years % of our CRE loans located in Metro New York = 89.3% % of HFI loan originations = 10.8% |

Page 18 $172 $635 $895 $1,286 $1,480 12/31/13 12/31/14 12/31/15 12/31/16 9/30/17 SPECIALTY FINANCE LOAN AND LEASE PORTFOLIO (in millions) Originations: $258 $848 $1,068 $1,266 $1,237 Net charge-Offs: $0 $0 $0 $0 $0 The launch of our specialty finance business provided us with another high-quality lending niche. LOAN TYPES Syndicated asset-based (ABLs) and dealer floor- plan (DFPLs) loans Equipment loan and lease financing (EF) CLIENT CHARACTERISTICS Large corporate obligors Investment grade or near-investment grade ratings Mostly publicly traded Participants in stable, nationwide industries PRICING Floating rates tied to LIBOR (ABLs and DFPLs) Fixed rates at a spread over treasuries (EF) RISK-AVERSE CREDIT & UNDERWRITING STANDARDS We require a perfected first-security interest in or outright ownership of the underlying collateral Loans are structured as senior debt or as non- cancellable leases Transactions are re-underwritten in-house Underlying documentation reviewed by counsel CAGR: 77.3% |

ASSET QUALITY |

Page 20 CONSERVATIVE UNDERWRITING Conservative loan-to-value ratios Conservative debt service coverage ratios: 120% for multi-family loans and 130% for CRE loans Multi-family and CRE loans are based on the lower of economic or market value. ACTIVE BOARD INVOLVEMENT The Mortgage Committee and the Credit Committee approve all mortgage loans >$50 million and all “other C&I” loans >$5 million; the Credit Committee also approves all specialty finance loans >$15 million. A member of the Mortgage or Credit Committee participates in inspections on multi-family loans in excess of $7.5 million, and CRE and ADC loans in excess of $4.0 million. All loans of $20 million or more originated by the Community Bank and all loans of $10 million or more originated by the Commercial Bank are reported to the Board. MULTIPLE APPRAISALS All properties are appraised by independent appraisers. All independent appraisals are reviewed by in-house appraisal officers. A second independent appraisal review is performed on loans that are large and complex. RISK-AVERSE MIX OF NON-COVERED LOANS HELD FOR INVESTMENT (AT 9/30/17) Multi-family: 72.4% CRE: 20.1% One-to-Four Family: 1.1% ADC: 1.1% Commercial & Industrial: 5.3% The quality of our assets reflects the nature of our lending niche and our strong underwriting standards. |

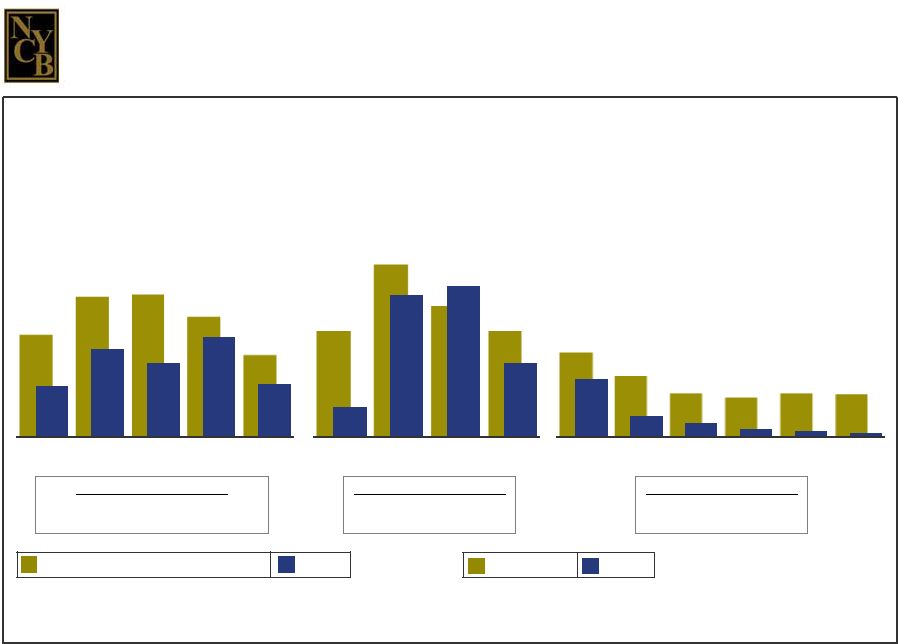

Page 21 2.91% 4.00% 4.05% 3.41% 2.35% 1.46% 2.48% 2.10% 2.83% 1.51% 12/31/89 12/31/90 12/31/91 12/31/92 12/31/93 (c) S & L CRISIS GREAT RECESSION CURRENT CREDIT CYCLE 1.86% 3.01% 2.30% 1.86% 0.51% 2.47% 2.63% 1.28% 12/31/08 12/31/09 12/31/10 12/31/11 1.39% 1.01% 0.74% 0.67% 0.74% 0.71% 0.96% 0.35% 0.23% 0.13% 0.11% 0.07% 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 9/30/17 NON-PERFORMING LOANS (a)(b) / TOTAL LOANS (a) (a) Non-performing loans and total loans exclude covered loans and non-covered purchased credit-impaired (“PCI”) loans. (b) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. Our non-performing loans at 12/31/16 and 9/30/17 exclude taxi medallion-related loans. (c) The SNL U.S. Bank and Thrift Index is used for this period only. Average NPLs/Total Loans NYCB: 1.72% Peer Group: 2.26% Average NPLs/Total Loans NYCB: 0.31% Peer Group: 0.88% Average NPLs/Total Loans NYCB: 2.08% SNL U.S. Bank and Thrift Index : 3.34% Our asset quality in down credit cycles has consistently distinguished us from our industry peers. Peer Group NYCB SNL U.S. Bank and Thrift Index NYCB |

Page 22 S & L CRISIS 0.88% 1.63% 1.39% 0.90% 0.03% 0.13% 0.21% 0.35% 2008 2009 2010 2011 Few of our non-performing loans have resulted in actual losses. CURRENT CREDIT CYCLE NET CHARGE-OFFS / AVERAGE LOANS 0.54% 1.28% 1.50% 1.17% 0.91% 0.00% 0.00% 0.04% 0.07% 0.06% 1989 1990 1991 1992 1993 0.55% 0.32% 0.18% 0.15% 0.19% 0.24% 0.13% 0.05% 0.01% 0.00% 0.01% 2012 2013 2014 2015 2016 YTD 2017 (0.02)% * * Non-annualized 4-Year Total NYCB: 72 bp Peer Group: 480 bp 5.75-Year Total NYCB: 18 bp Peer Group: 163 bp (a) The SNL U.S. Bank and Thrift Index is used for this period only. (b) The calculation of our net charge-offs to average loans for the nine months ended 9/30/17 excludes charge-offs of $54.8 million on taxi medallion-related loans. 5-Year Total NYCB: 17 bp SNL U.S. Bank and Thrift Index: 540 bp (b) GREAT RECESSION Peer Group NYCB (a) SNL U.S. Bank and Thrift Index NYCB |

EFFICIENCY |

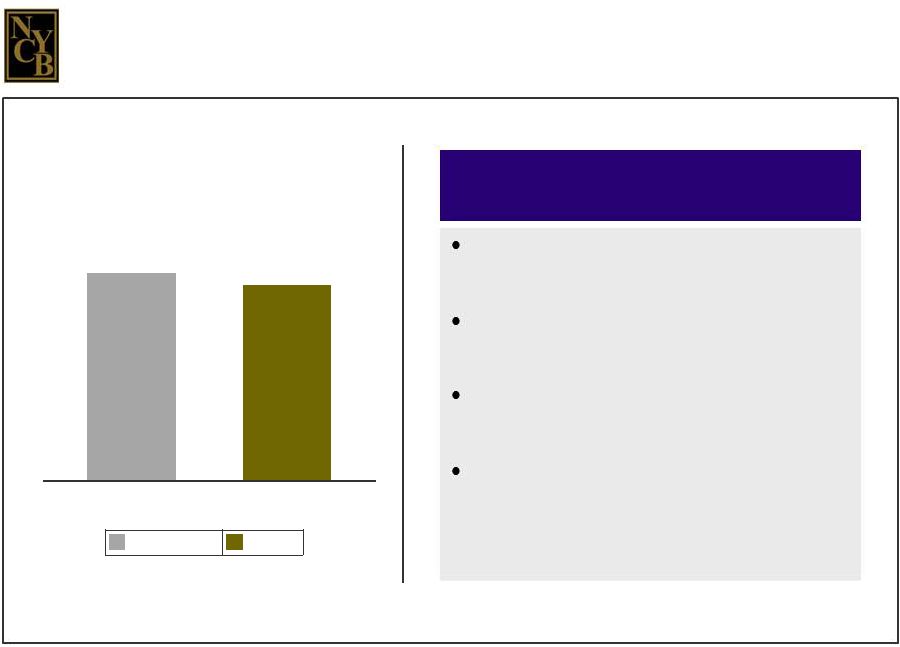

Page 24 Efficiency has been another Company hallmark. HISTORICAL DRIVERS OF OUR EFFICIENCY Multi-family and CRE lending are both broker- driven, with the borrower paying fees to the mortgage brokerage firm. Products and services are typically developed by third-party providers; their sales are a complementary source of revenues. Franchise expansion has largely stemmed from mergers and acquisitions; we rarely engage in de novo branch development. Going forward, our efficiency ratio should benefit from the approximately $60 million in annual cost savings from the sale of our mortgage banking operations and anticipated lower SIFI-readiness expenses. EFFICIENCY RATIO (a) (a) We calculate our efficiency ratio by dividing our operating expenses by the sum of our net interest income and our non-interest income; our YTD 2017 measure excludes from non-interest income an $82 million gain on sale of covered loans and mortgage banking operations. 53.91% 50.87% YTD 2017 Peer Group NYCB |

Page 25 36% 53% 2010 3Q 2017 NYCB EFFICIENCY RATIO PRIOR TO AND SINCE DODD-FRANK SIFI COMPLIANCE At this juncture, the majority of the SIFI-related investments have been made. Key infrastructure investments to date include: — Enhanced ERM and corporate governance frameworks — Bottom-up capital planning and stress testing capabilities — Substantial expansion of regulatory compliance staff PREPARING FOR SIFI STATUS Following the enactment of the Dodd-Frank Act, we began allocating significant resources towards SIFI preparedness. The degree to which we have already leveraged the cost of SIFI compliance is reflected in the ~ 1,700-basis point increase in our efficiency ratio since the enactment of Dodd-Frank. Our efficiency ratio has increased significantly since the enactment of Dodd-Frank. (a) We calculate our efficiency ratio by dividing our operating expenses by the sum of our net interest income and our non-interest income; our 3Q 2017 measure excludes from non-interest income an $82 million gain on sale of covered loans and mortgage banking operations. (a) |

GROWTH THROUGH ACQUISITIONS |

Page 27 Transaction Type: Savings Bank Commercial Bank Branch FDIC Deposit 1. Nov. 2000 Haven Bancorp (HAVN) Assets: $2.7 billion Deposits: $2.1 billion Branches: 25 2. July 2001 Richmond County Financial Corp. (RCBK) Assets: $3.7 billion Deposits: $2.5 billion Branches: 24 3. Oct. 2003 Roslyn Bancorp, Inc. (RSLN) Assets: $10.4 billion Deposits: $5.9 billion Branches: 38 4. Dec. 2005 Long Island Financial Corp. (LICB) Assets: $562 million Deposits: $434 million Branches: 9 5. April 2006 Atlantic Bank of New York (ABNY) Assets: $2.8 billion Deposits: $1.8 billion Branches: 14 6. April 2007 PennFed Financial Services, Inc. (PFSB) Assets: $2.3 billion Deposits: $1.6 billion Branches: 21 7. July 2007 NYC branch network of Doral Bank, FSB (Doral-NYC) Assets: $485 million Deposits: $370 million Branches: 11 8. Oct. 2007 Synergy Financial Group, Inc. (SYNF) Assets: $892 million Deposits: $564 million Branches: 16 9. Dec. 2009 AmTrust Bank Assets: $11.0 billion Deposits: $8.2 billion Branches: 64 10. March 2010 Desert Hills Bank Assets: $452 million Deposits: $375 million Branches: 3 11. June 2012 Aurora Bank FSB Assets: None Deposits: $2.2 billion Branches: 0 Payment Received: $24.0 million We have a long history of earnings-accretive transactions. The number of branches indicated for our transactions is the number of branches in our current franchise that stemmed from each. |

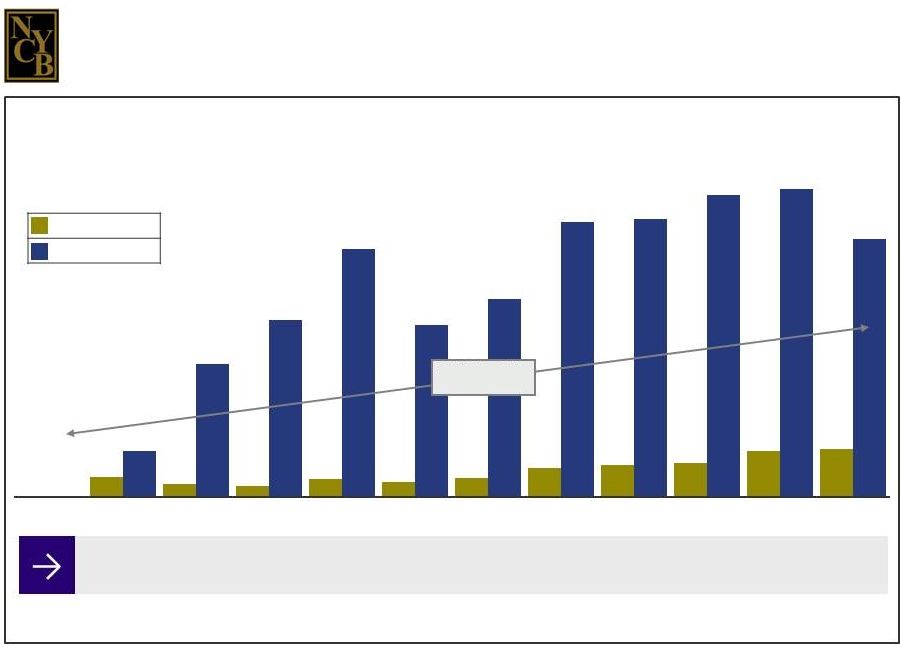

Page 28 The benefits of our business model are reflected in our total return over the course of our public life. TOTAL RETURN ON INVESTMENT (a) Bloomberg CAGR since IPO: 23.2% As a result of nine stock splits between 1994 and 2004, our charter shareholders have 2,700 shares of NYCB stock for each 100 shares originally purchased. Peer Group NYCB (a) 306% 203% 179% 286% 231% 299% 459% 492% 530% 722% 748% 717% 2,059% 2,754% 3,843% 2,670% 3,069% 4,265% 4,319% 4,682% 4,784% 4,007% 11/23/93 12/31/99 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 9/30/17 |

Page 29 11/22/17 VISIT OUR WEBSITE : ir.myNYCB.com E-MAIL REQUESTS TO : ir@myNYCB.com CALL INVESTOR RELATIONS AT : (516) 683-4420 WRITE TO : Investor Relations New York Community Bancorp, Inc. 615 Merrick Avenue Westbury, NY 11590 For More Information |

APPENDIX |

Page 31 While average stockholders’ equity, average assets, return on average assets, and return on average stockholders’ equity are financial measures that are recorded in accordance with U.S. generally accepted accounting principles ("GAAP"), average tangible stockholders’ equity, average tangible assets, return on average tangible assets, and return on average tangible stockholders’ equity are not. Nevertheless, it is management’s belief that these non-GAAP measures should be disclosed in our SEC filings, earnings releases, and other investor communications, for the following reasons: 1. Average tangible stockholders’ equity is an important indication of the Company’s ability to grow organically and through business combinations, as well as our ability to pay dividends and to engage in various capital management strategies. 2. Returns on average tangible assets and average tangible stockholders’ equity are among the profitability measures considered by current and prospective investors, both independent of, and in comparison with, our peers. We calculate average tangible stockholders’ equity by subtracting from average stockholders’ equity the sum of our average goodwill and core deposit intangibles (“CDI”), and calculate average tangible assets by subtracting the same sum from our average assets. Average tangible stockholders’ equity, average tangible assets, and the related non-GAAP profitability measures should not be considered in isolation or as a substitute for average stockholders’ equity, average assets, or any other profitability or capital measure calculated in accordance with GAAP. Moreover, the manner in which we calculate these non-GAAP measures may differ from that of other companies reporting non-GAAP measures with similar names. The following table presents reconciliations of our average common stockholders’ equity and average tangible common stockholders’ equity, our average assets and average tangible assets, and the related GAAP and non-GAAP profitability measures for the three months ended September 30, 2017: (dollars in thousands) For the Three Months Ended September 30, 2017 Average common stockholders’ equity $ 6,262,792 Less: Average goodwill and core deposit intangibles (2,436,146) Average tangible common stockholders’ equity $ 3,826,646 Average assets $48,526,259 Less: Average goodwill and core deposit intangibles (2,436,146) Average tangible assets $46,090,113 Net income available to common shareholders (1) $102,261 Add back: Amortization of core deposit intangibles, net of tax 14 Adjusted net income available to common shareholders (2) $102,275 GAAP: Return on average assets 0.91% Return on average common stockholders’ equity 6.53 Non-GAAP: Return on average tangible assets 0.96 Return on average tangible common stockholders’ equity 10.69 (1) To calculate our returns on average assets and average common stockholders’ equity for a period, we divide the net income available to common shareholders generated during that period by the average assets and the average common stockholders’ equity recorded during that time. (2) To calculate our returns on average tangible assets and average tangible common stockholders’ equity for a period, we adjust the net income available to common shareholders generated during that period by adding back the amortization of CDI, net of tax, and then divide that adjusted net income by the average tangible assets and the average tangible common stockholders’ equity recorded during that time. Reconciliations of GAAP and Non-GAAP Measures |

Page 32 Peer Group PEER TICKER BankUnited, Inc. BKU Comerica Incorporated CMA F.N.B. Corporation FITB Fifth Third Bancorp FNB Huntington Bancshares Incorporated HBAN Investors Bancorp, Inc. ISBC M&T Bank Corporation MTB Bank of the Ozarks OZRK People's United Financial, Inc. PBCT Signature Bank SBNY Sterling Bancorp STL Synovus Financial Corp. SNV Valley National Bancorp VLY Webster Financial Corporation WBS Zions Bancorporation ZION |