Safe Harbor

This presentation, together with other statements and information publicly disseminated by Lexington, contains certain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act,

as amended. Lexington intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with

these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe Lexington’s future plans,

strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” intends,” “anticipates,” “estimates,”

“projects” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks,

uncertainties, uncertainties and other factors which are, in some cases, beyond Lexington’s control and which could materially affect

actual results, performances or achievements. These factors include, but are not limited to those set forth in Lexington’s periodic filings

with the Securities and Exchange Commission, including, without limitation, our Annual Report on Form 10-K for the year ended

December 31, 2005 under “Item 1a. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” Lexington undertakes no obligation to publicly release the results of any revisions to these forward-looking

statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated

events. Accordingly, there is no assurance that Lexington’s expectations will be realized.

Lexington believes that funds from operations ("FFO") enhances an investor's understanding of Lexington’s financial condition, results

of operations and cash flows. Lexington believes that FFO is an appropriate, but limited, measure of the performance of an equity

REIT. FFO is defined in the April 2002 “White Paper” issued by the National Association of Real Estate Investment Trusts, Inc. as “net

income (or loss) computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains (or losses) from sales

of property, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint

ventures.” FFO should not be considered an alternative to net income as an indicator of operating performance or to cash flows from

operating activities as determined in accordance with GAAP, or as a measure of liquidity to other consolidated income or cash flow

statement data as determined in accordance with GAAP. A reconciliation of FFO to net income is provided in Lexington’s Supplemental

Reporting Package for the year ended December 31, 2005, which can be accessed in the Investor Relations section at www.lxp.com.

2

Agenda

I.

Company History

E. Robert Roskind, Chairman

II.

Lexington Corporate Properties Trust

T. Wilson Eglin, Chief Executive Officer

III.

Acquisitions

Richard J. Rouse, Vice Chairman & CIO

Natasha Roberts, Director of Acquisitions

IV.

Lexington Strategic Asset Corp.

Brendan P. Mullinix, Chief Operating Officer

BREAK

V. Portfolio Management

John B. Vander Zwaag, Executive Vice President

VI.

Finance

Patrick Carroll, Chief Financial Officer

VII.

Questions

3

Company History

E. ROBERT ROSKIND,

CHAIRMAN

4

Evolution

- Acquisition volume of $1.0

billion

- Sale/leaseback and

Build-to-Suit

Multiple property types:

office, industrial, retail,

health clubs, hotels,

convenience stores, gas

stations, bus terminals

and restaurants

- Major sponsor of income-

oriented partnerships

1985 - 1992

- Private partnership

- Corporate finance

transactions

- Tax-oriented investment

programs

- Sale/leaseback focus

- Hotels, retail, office and

industrial

1973 – 1985

- 17.7% annual compound

return to shareholders

- 13 consecutive years of

dividend increases

- Joint venture strategy

- Capital source for

corporations and merchant

builders

- Primary focus on office and

industrial

- Nationwide platform

- Assets under management

grew from $200 million to

$4.5 billion

- 1993 IPO

1993 - Present

5

Keys to Long-Term Success

People & Corporate Culture

Investment Strategy

Business Philosophy

6

1993 IPO

Believed that REITs would emerge as best way for

public to invest in real estate

Assets under management have grown from $200

million to $4.5 billion

Track record of smart growth

17.7% annual compound return to shareholders

13 consecutive years of per share dividend increases

7

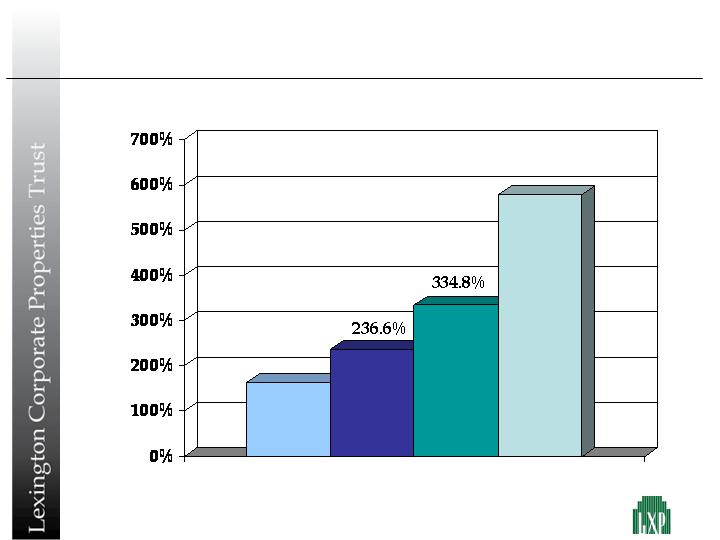

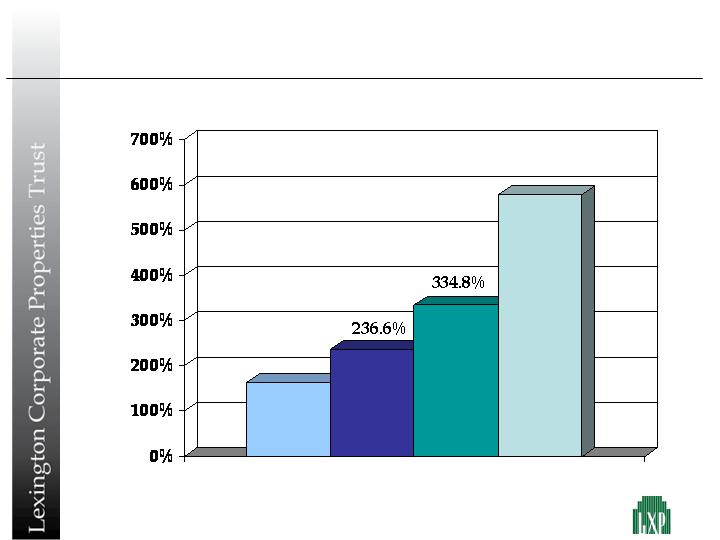

Stellar Market Performance

577.7%

S & P 500

NAREIT

LXP

Total returns 10/22/93 – 12/31/05

Russell

2000

163.2%

Source: Bloomberg

8

Lexington Corporate Properties Trust

T. WILSON EGLIN,

CHIEF EXECUTIVE OFFICER

9

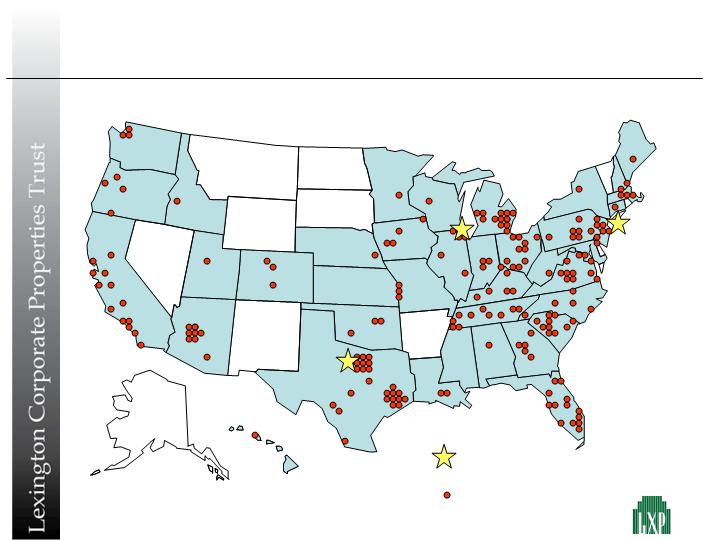

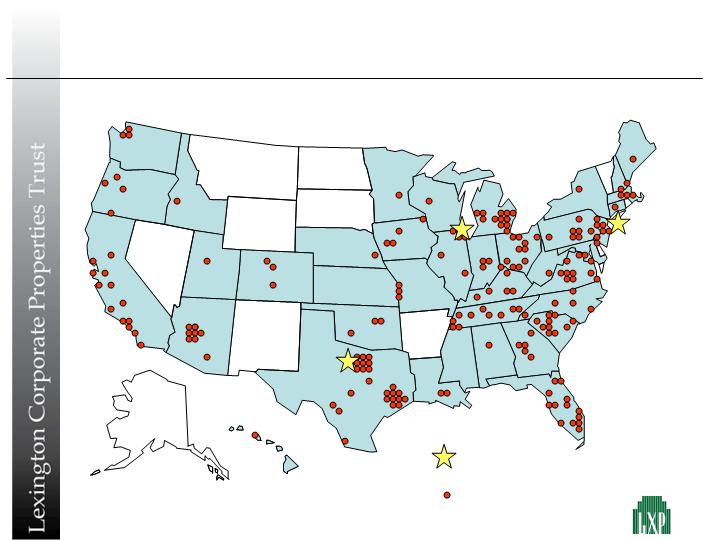

Who We Are – NYSE: LXP

Largest REIT focused on single-tenant office and

industrial properties

Nationwide investment platform

- 40.2 million square feet in 39 states

- Diversification and competitive advantage

Growth segments

- Corporate sale/leaseback transactions

- Build-to-suit

- Properties subject to existing leases

- UPREIT structure

Joint ventures

Disciplined capital allocator: acquisitions, dispositions,

stock repurchases and capital recycling

Proven management team: average experience 20 years

10

Why Net Lease?

Tenant is responsible for operating expenses

Insulates property owner from rising costs

Long-term leases reduce short-term market risk

Provides predictable, growing cash flow with lower

risk and retenanting costs than multi-tenanted assets

Vacancy risk mitigated due to:

(i) Strategic significance of asset

(ii) Length of lease commitment

(iii) Credit tenant

(iv) Properties suitable for alternate users

11

WV

Nationwide Investment Platform

Corporate Offices

Property Locations

12

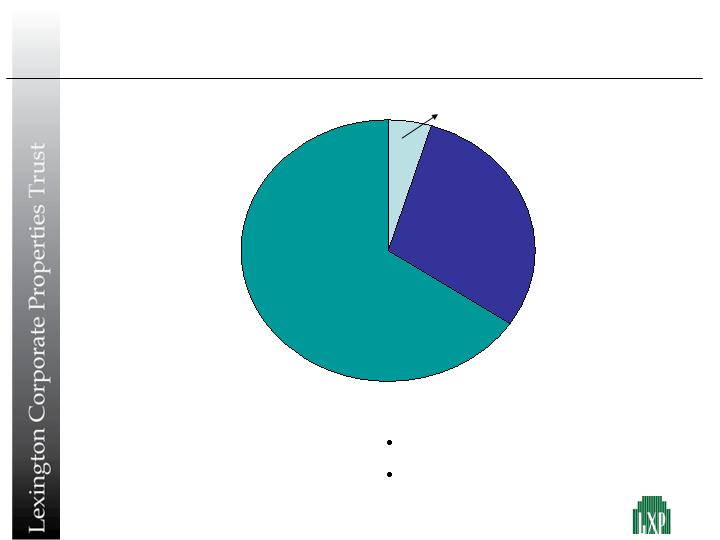

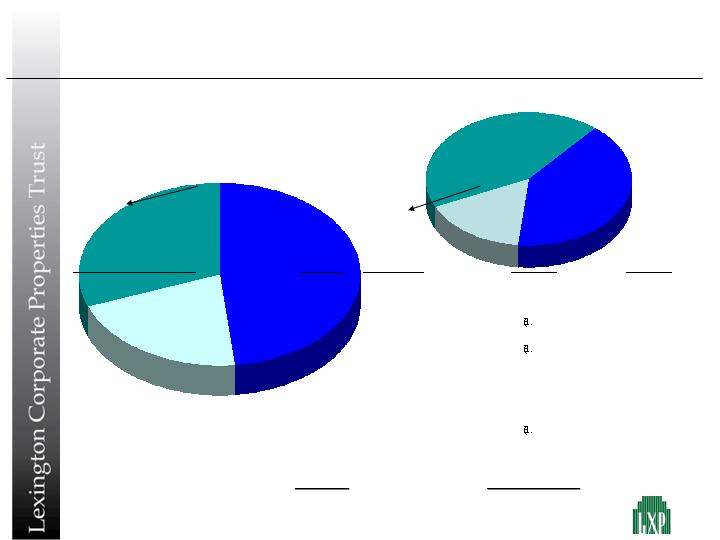

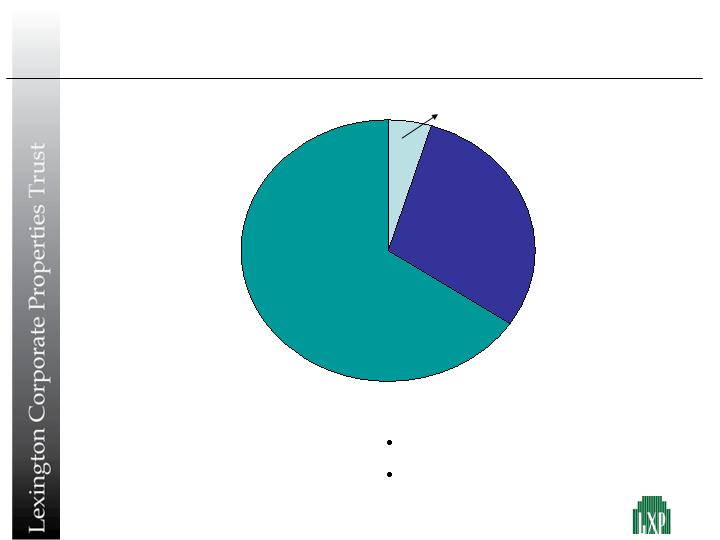

Portfolio Composition

Current Allocation Strategy

Reduced emphasis on retail

Allocation weighted toward office

* Revenue for the twelve months ended

December 31, 2005.

Industrial

29.7%

Office

65.6%

Retail 4.7%

13

Lease Rollover Schedule

% of Revenue at 12/31/05

14

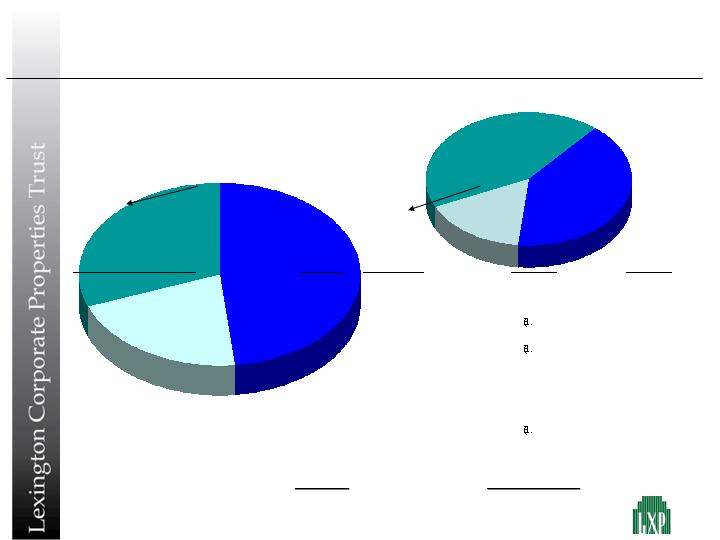

LXP Tenant Credit Profile

15

Investment

Grade

40.6%

Unrated

30.8%

2005

Non-

investment

Grade 20.9%

Investment

Grade

48.3%

2004

Non-

Investment

Grade 16.4%

Unrated

43.0%

\

Number of

Percentage of Rent

Top 15 Tenants (Guarantors)

Properties

Property Type

12/31/2005

12/31/2004

Baker Hughes, Inc.

4

Office (3)/ Industrial (1)

5.8%

6.0%

Kmart Corporation

7

Industrial(1)/Retail(6)

4.3%

5.3%

Dana Corporation

10

Office (1)/Industrial (9)

3.6%

-

Northwest Pipeline Corp.

1

Office

3.6%

5.2%

Wells Fargo Home Mortgage, Inc.

2

Office

2.8%

2.5%

Invensys Systems, Inc. (Siebe, Inc.)

2

Office

2.5%

-

Exel Logistics, Inc. (NFC plc)

4

Industrial

2.1%

3.0%

Nextel Finance Corporation

4

Office

2.0%

2.8%

Internet Security Systems, Inc.

1

Office

1.9%

-

Owens Corning

4

Industrial

1.8%

2.2%

Michaels Stores, Inc.

2

Industrial

1.7%

2.3%

Harcourt Brace

1

Industrial

1.5%

-

James Hardie Building Products, Inc.

1

Industrial

1.5%

2.0%

(James Hardie Industries N.V.)

Circuit City Stores, Inc.

2

Office (1)/Industrial (1)

1.4%

2.0%

Honeywell, Inc.

3

Office (3)

1.3%

2.5%

48

37.8%

Exposure To Dana Corporation

16

(1) These assets are owned in joint ventures. Lexington’s economic interest is shown.

($000's)

2006

Book

Non-recourse

Location

Type

Rent

Value

Debt Balance

Status

Farmington Hills, MI

Office

2,331

$

29,263

$

20,550

$

Leased but

underutilized

Elizabethtown, KY

Industrial

2,838

$

32,222

$

16,687

$

Fully utilized

Kalamazoo, MI

Industrial

1,843

$

23,607

$

17,625

$

Fully utilized

Dry Ridge, KY

Industrial

1,346

$

15,227

$

7,905

$

Fully utilized

Owensboro, KY

Industrial

796

$

8,998

$

7,069

$

Fully utilized,

expansion started

Elizabethtown, KY

Industrial

537

$

6,055

$

3,144

$

Fully utilized

Gordonsville, TN

Industrial

354

$

3,377

$

-

Fully utilized

Olive Branch, MS

Industrial

959

$

11,028

$

-

Fully utilized

Antioch, TN

1

Industrial

733

$

7,680

$

4,289

$

Motion filed to reject;

50% subleased

Hopkinsville, KY

Industrial

1,451

$

16,424

$

9,777

$

Fully utilized,

expansion started

Crossville, TN

1

Industrial

167

$

1,550

$

-

Fully utilized,

expansion started

TOTAL

13,355

$

155,431

$

87,046

$

Growth Segments

Long-term hold

Expansion

capacity

Financially

strong landlord

Sale/leasebacks

Corporate

Users

Portfolio benefit

Liquid security

Estate planning

Tax deferred

exit strategies

UPREIT

Structure

Nationwide

owner

Not a “1031”

investor

Reliable closer

Purchases

Existing

Leases

Facilitates

construction

financing

Forward

commitments

Build-To-Suit

Merchant

Builders

17

Joint Ventures Enhance Diversification & Returns

Private capital commitments mitigate dependence on capital

markets

Portfolio diversification reduces vacancy risk and credit

exposure

Fee income offsets corporate operating costs and generates

higher returns with less risk

65% leverage

Forward

commitments

BB credit tenants

URS

60% leverage

Large

transactions ($15

million+)

Forward

commitments

BB credit tenants

LION

High leverage

C-corp structure

Special use

properties

B credit tenants

LSAC

65% leverage

Large

transactions ($15

million)

Major markets

Investment

Grade Credits

NYCRF

18

Disciplined Capital Allocator

No equity issued at discount to net asset value or prior issue

price

Disciplined and patient when evaluating acquisition

opportunities

Pruning of non-core assets and bottom 10% of portfolio:

$100-$150 million of sales in 2006

Redeploy proceeds into joint ventures, especially LSAC, and

leveraged investments

Opportunistic repurchase of stock

Will return capital to shareholders if no accretive use

19

Capital Allocation: 2004 Acquisition Program

$935.1 million in assets acquired exceeded $250 million

target

44 properties

GAAP cap rate of 8.9%

$502 million in joint ventures

Acquisition Cost $935,052

Mortgage Debt $624,966

Joint Venture Equity $133,512

LXP Equity $176,574

Investments ($000’s)

Revenues $52,936

Asset Management Fees $ 726

Interest Expense $23,266

Funds From Operations $30,396

FFO Yield 17.2%

Funds From Operations ($000’s)

20

Capital Allocation: 2005 Acquisition Program

$1.14 billion in assets acquired exceeded $500 million

target

43 properties

GAAP cap rate of 8.1%

$464 million in joint ventures

Acquisition Cost $1,138,828

Mortgage Debt $ 794,482

Joint Venture Equity $ 141,337

LXP Equity $ 203,009

Investments ($000’s)

Revenues, net $62,758

Asset Management Fees $ 1,022

Interest Expense $31,493

Funds From Operations $32,287

FFO Yield 15.9%

Funds From Operations ($000’s)

21

Proven Management Team

Industry

Experience

E. Robert Roskind 32

Chairman

Richard J. Rouse 31

Vice Chairman & CIO

T. Wilson Eglin 19

CEO, President & COO

Patrick Carroll 20

CFO, Treasurer & EVP

John B. Vander Zwaag 24

Executive Vice President

Natasha Roberts 11

Director of Acquisitions

Brendan P. Mullinix 9

LSAC Chief Operating Officer

NYSE 10th Anniversary

22

Acquisitions

RICHARD J. ROUSE,

VICE CHAIRMAN & CIO

AND

NATASHA ROBERTS,

DIRECTOR OF ACQUISITIONS

23

Sourcing

Unparalleled national network of corporate users,

developers, brokers and owners

32 year track record

$10 billion of transactions sourced in 2005

SIRVA, INC.

WESTMONT, IL

MOTOROLA, INC.

FARMINGTON HILLS, MI

24

Acquisition Criteria

Single-tenant, net leased commercial properties

Minimum lease term of 7 years remaining

Purchase price: $8 million and up

Nationwide investor

Selective off-shore investor

WACKENHUT

PALM BEACH GARDENS, FL

ALSTOM POWER

RICHMOND, VA

25

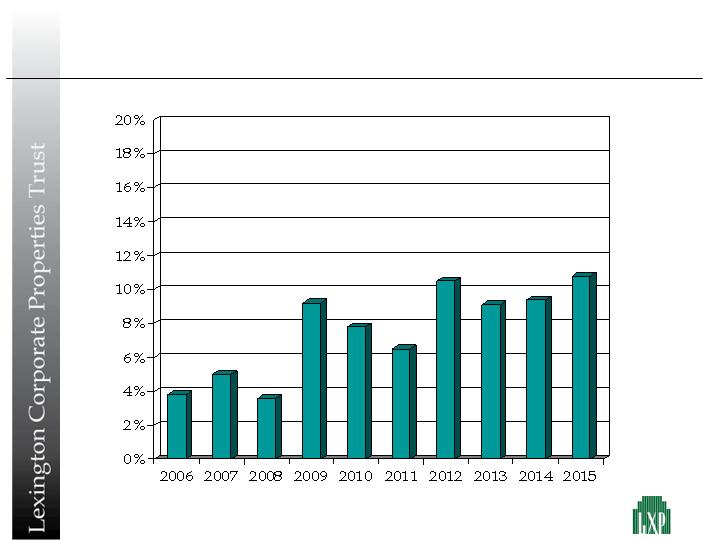

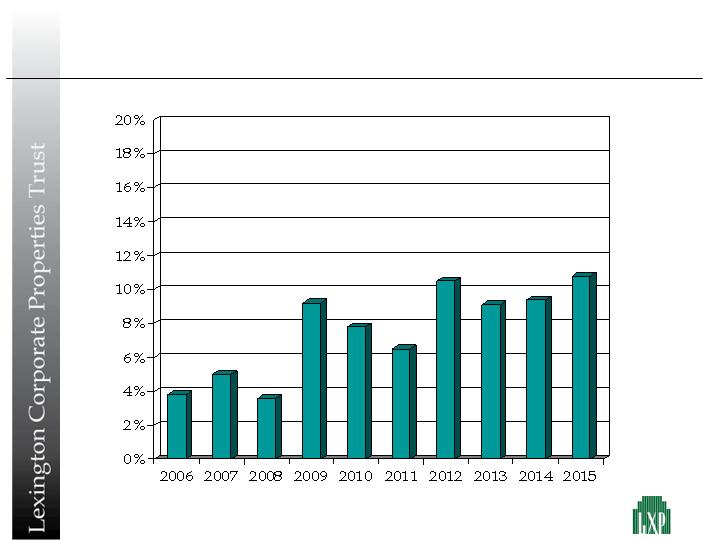

External Growth Track Record

26

Acquisition Underwriting

The Building: Design, construction quality,

efficiency, functionality, location,

replacement cost, strategic value to

tenant

The Lease: Landlord exposure, term, rental

increases, maintenance provisions

The Market: Vacancy, absorption, employment and

population trends, contract rent vs.

market

The Tenant: Financial strength, growth prospects,

competitive position

Superior Performance Requires Mastery in Four Critical Areas

27

Case Study: Dana Corp. Sale/Leaseback

Five mission critical manufacturing facilities

Direct relationship – transaction execution critical to tenant

FFO yield: 33.6%

$30 million of mortgage debt repurchased with $23 million

investment – 23% discount to face amount

Purchase Price: $78.9 million

Lease Term: 20 years

Cap Rate: 8.8%

Mortgage: $68.4 million

Term: 10 years

Interest Rate: 5.0%

DANA CORP.

DRY RIDGE, KY

28

Case Study: Kelsey Seybold Build-to-Suit

Forward commitment generates yield premium

15 year lease to “A” credit tenant

FFO yield: 14.8%

Purchase Price: $14.5 million

Lease Term: 15 years

Avg. Cap Rate: 8.5%

Mortgage: $10.0 million

Term: 15 years

Interest Rate: 5.6%

KELSEY SEYBOLD

SUGAR LAND, TX

29

Case Study: Wells Portfolio Acquisition

$796.4 million purchase price

$296.0 million in joint ventures

7.7% initial cap rate

27 properties – seven year

weighted average lease term

Nationwide platform created

negotiating leverage

5.2% mortgage debt

Investment ($000’s)

Acquisition Cost $796,409

Mortgage Debt $516,593

Joint Venture

Equity $ 75,303

LXP Equity $204,513

Funds From Operations ($000’s)

Revenues $45,255

Asset Management

Fees $ 362

Interest Expense $19,826

Funds From

Operations $25,791

FFO Yield 12.6%

DAIMLER-CHRYSLER

WESTLAKE, TX

30

Case Study: 6 Penn Center Acquisition

Purchase Price: $68.3 million

Lease Term: 9 Years

Avg. Cap Rate: 7.1%

Mortgage: $49.0 million

Term: 9 years

Interest Rate: 5.1%

Class “A” office property in CBD location

Philadelphia office of Morgan Lewis

FFO Yield of 12.3%

Complex tax structure eliminated competition

6 PENN CENTER

PHILADELPHIA, PA

31

Lexington Strategic Asset Corp.

BRENDAN P. MULLINIX,

CHIEF OPERATING OFFICER

32

Lexington Strategic Asset Corp.

Closed in October 2005, 6.7 million shares at $10.00 per share, net

proceeds of $61.6 million

Private Offering:

Expected 2006 Public Offering

Growth Plan

$85.0 million

Total Assets Acquired

Since Formation:

Contribution of four real estate assets in exchange for $33.2 million of

stock

LXP Investment:

100,000 shares purchased by LSAC executive officers ($1mm)

Management Investment:

Extend Lexington’s acquisition platform to take advantage of

inefficient pricing in certain credit and asset categories

Strategic Objective:

Investment in high-yielding net leased assets

Investment Focus:

Subsidiary of Lexington Corporate Properties Trust

External Advisor:

“C”-Corp. advised by Lexington Corporate Properties Trust

Corporate Structure:

August 2005

Formed:

33

Why Create LSAC?

Created to capitalize on the expanded use of net lease structures into

non-traditional sectors and property types

Focus on higher yielding net lease investments

- Private/Middle market tenants

- Special purpose real estate

- Specialized facilities

- Integral equipment

- Non-U.S. properties

“One stop” source of sale-leaseback financing for all of a company’s key

property financing needs

Expected to achieve higher unleveraged yields than those available on

traditional net lease real estate investments

“C”-Corp. structure enables non-REIT qualifying investments and

capital recycling to generate high earnings growth

Acquisition criteria does not conflict with Lexington’s

34

Why a “C”-Corp?

Reinvestment & leveraging

of retained cash flow

Dependent on accessing

capital markets

Earnings Growth Driver:

65%-75% of assets readily

accepted

Typically 50%-60% of assets

Leverage:

Very diverse

Primarily REIT-dedicated

funds

Investor Base:

15% maximum tax rate

(qualified individuals)

Ordinary income tax rate

Investor Dividend

Taxation:

40% (none to minimal

anticipated initially due to

shelter)

None

Entity Income Taxation:

No restrictions

Must be “real estate”

Eligible Investments:

Easy

Difficult

Capital Recycling:

No restrictions

4 year hold for “safe harbor”

Asset Sales:

None

90% of taxable income

Payout Requirement:

“C”-Corp

REIT

35

Case Study: Infocrossing, Inc. Sale/Leaseback

Purchase Price: $25.0 million

Lease Term: 20 years

Cap Rate: 9.2%

Mortgage: $17.5 million

Term: 10 years

Interest Rate: 5.6%

Acquisition financing for Infocrossing, Inc.’s purchase of

(i)Structure, LLC

20 year net leases on strategically important data processing

centers in Tempe, AZ and Omaha, NE

FFO yield of 17.5%

INFOCROSSING, INC.

TEMPE, AZ

36

Case Study: Dana Corp. Expansion

Purchase Price: (1) $7.4 million

Lease Term: 10 years

Cap Rate: 9.4%

Square Feet: (1) 222,200

Expansion started on strategically important facility

Significant imbedded capital gain upon lease affirmation

“C”-Corp. structure permits quick re-sale

Opportunity to sell when Dana emerges from bankruptcy

DANA CORP.

CROSSVILLE, TN

(1) Post-expansion

37

LSAC Current Portfolio

38

(1) Amounts shown are post-expansion

Net

Average

Amount

Base

Rentable

Capitalized

Annual

Average

of

Lease

Square

Costs

Rent, Net

Annual

Mortgage

Interest

Location

Tenant

Expiration

Footage

($000's)

($000's)

Yield

($000's)

Rate

Knoxville, TN

Alstom Power

Oct-2014

84,400

12,249

$

1,154

$

9.4%

7,800

$

5.3%

Jacksonville, FL

AmeriCredit Corp.

Jun-2011

85,000

14,761

$

1,112

$

7.5%

5,804

$

5.1%

Tulsa, OK

Metris

Jan-2010

101,100

13,871

$

1,307

$

9.4%

7,689

$

5.1%

Companies, Inc.

Lavonia, GA

TI Group Automotive

May-2020

133,200

14,374

$

1,200

$

8.3%

10,100

$

5.5%

Systems, LLC

Omaha, NE

InfoCrossing, Inc.

Nov-2025

86,800

12,873

$

1,167

$

9.1%

9,000

$

5.6%

Tempe, AZ

InfoCrossing, Inc,

Dec-2025

60,000

12,163

$

1,128

$

9.3%

8,500

$

5.6%

Crossville, TN

(1)

Dana Corporation

Aug-2016

222,200

7,394

$

692

$

9.4%

-

-

TOTAL

772,700

87,685

$

7,760

$

8.8%

48,893

$

5.4%

Portfolio Management

JOHN B. VANDER ZWAAG,

EXECUTIVE VICE PRESIDENT

39

Portfolio Management Objectives:

High Occupancy & Income Growth

High tenant retention

- Recognize and manage occupancy risks

- Invest at the asset level

Maximize potential of existing portfolio

- Asset repositioning

- Building expansions

- Excess land development

Asset Sales

- Continuous process focused on maximizing value

and mitigating risk

40

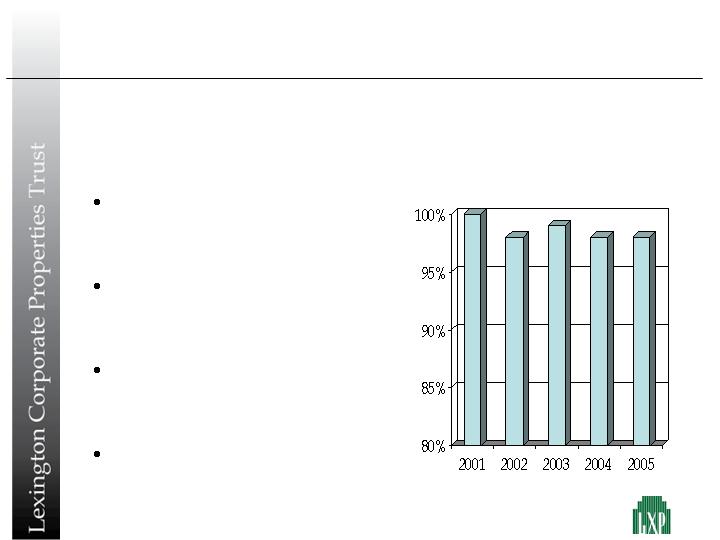

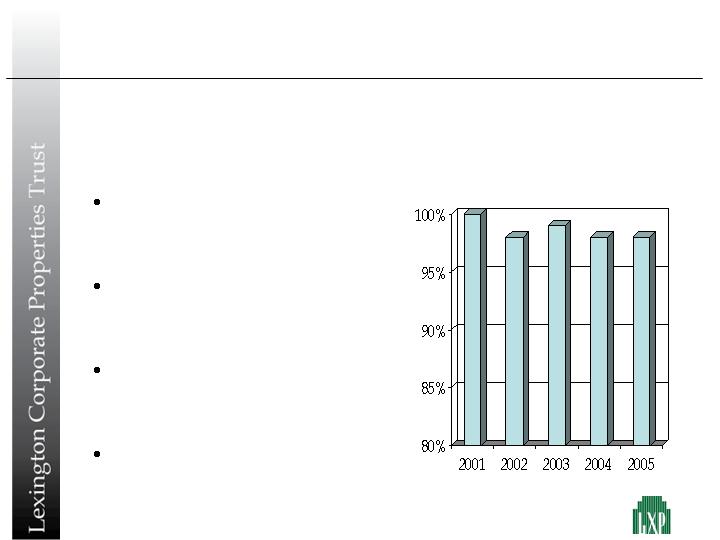

Leasing

Long-Term Leases Reduce Short-Term Market Risk, Provide Cash

Flow Stability and Mitigate Turnover Risks

LXP’s unique asset mix and

emphasis on long-term leases

mitigate vacancy risk

Approximately 73% of the

Company’s leases will expire

post-2010

LXP has a proven history of

extending leases or re-leasing

properties

98.3% leased at year end 2005

Leased*

* As of respective year-ends

41

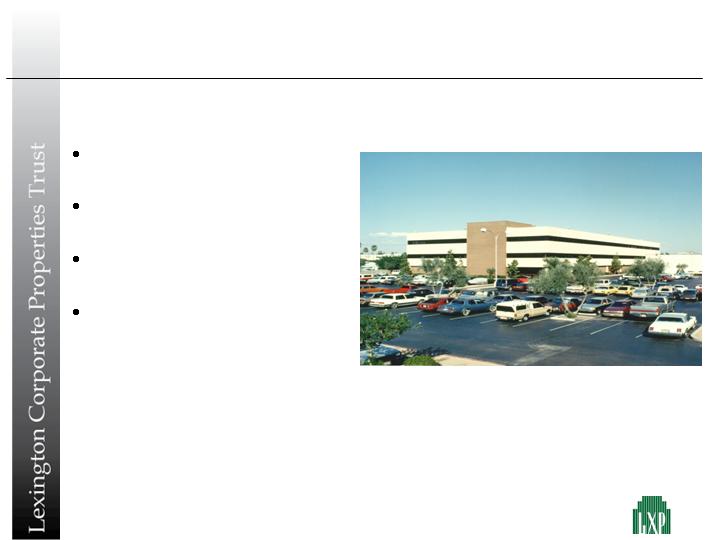

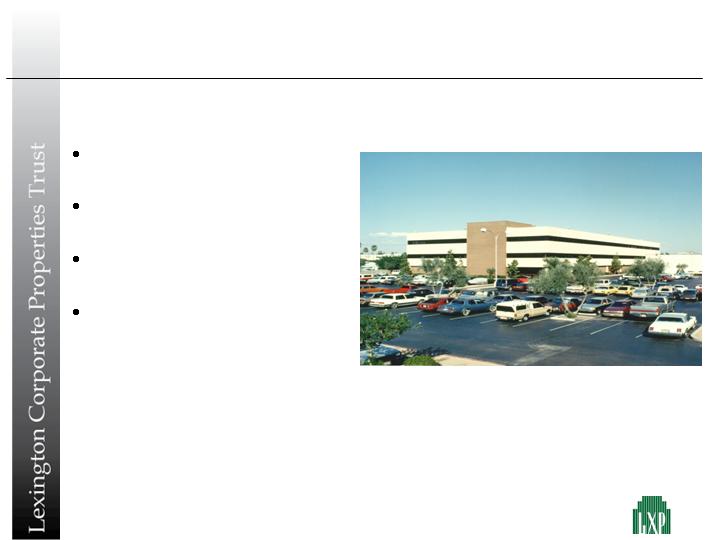

Case Study: I-17 Center, Phoenix, AZ

Formerly occupied by Bank

One

Value at 11/03 vacancy: $3.0

million

Under contract for $7.6

million

Purchase of adjacent land

for $0.7 million adds

significant value and

permits partion and sale to

two buyers

Value Doubles After Adjacent Land Purchase

I-17 CENTER

PHOENIX, AZ

42

Case Study: 1600 Viceroy Drive, Dallas, TX

Former headquarters of

Vartec Telecom

250,000 square feet

$21 million mortgage paid

off at 25% discount

48,000 square foot lease

signed

Multi-tenant strategy

1600 VICEROY DRIVE

DALLAS, TX

Repurchase of Mortgage At 25% Discount Lowers Basis

43

Case Study: Black Canyon Center, Phoenix, AZ

Refurbishment Creates Attractive Multi-Tenant Property

Formerly 100% leased to

Bull Information Systems

Conversion to multi-tenant

tenancy with Bull retained

as main tenant

Added rentable area by

decking and renting atrium

Modernized exterior with

new window lines and

entrance

Now 65% leased

BLACK CANYON CENTER

PHOENIX, AZ

44

Case Study: Owens Corning, Chester, SC

OWENS CORNING

CHESTER, SC

Expansion and Lease Affirmation for Strategically Essential Real Estate

Initial Investment: $15.5 million

Expansion: $6.4 million

Total: $21.9 million

Avg. Cap Rate: 10.0%

Mortgage: $14.0 million

Mortgage Rate: 5.4%

Initial Lease Exp.: 2020

Extended Lease Exp.: 2025

Expansion from 194,000 square feet to 421,000 square feet

generates higher yield and extended lease term

Facilitates financing on favorable terms

FFO Yield: 10.5% pre expansion

18.1% post expansion and leveraging

45

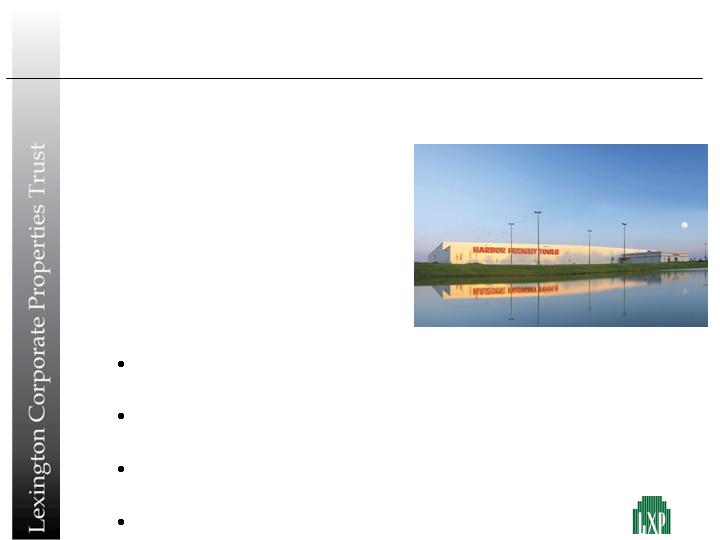

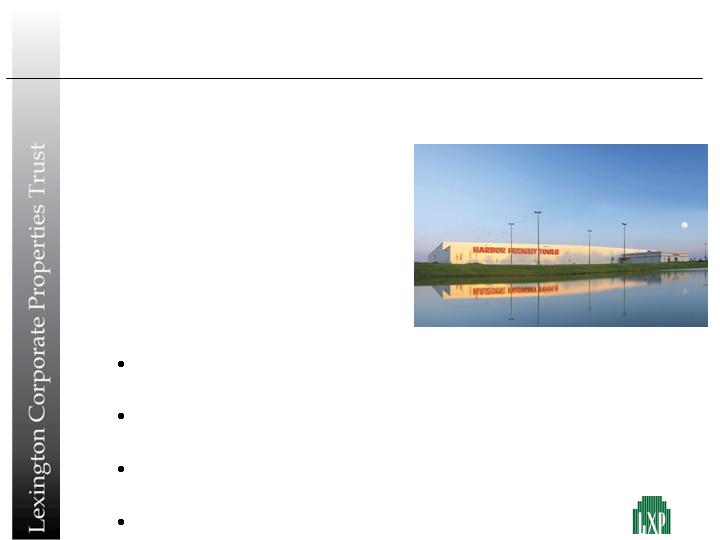

Case Study: Harbor Freight Tools, Dillon, SC

HARBOR FREIGHT TOOLS

DILLON, SC

Expansion & Refinancing Enhances ROE & Reduces Equity Investment

Initial Investment: $16.1 million

Expansion: $13.2 million

Total: $29.3 million

Avg. Cap Rate: 9.3%

Mortgage: $23.8 million

Mortgage Rate: 6.0%

Expansion and lease extension enhance market value to

approximately $40.0 million compared to $29.3 million cost

Refinancing reduces capital investment and enhances return on

equity

Market value of equity is approximately $16.2 million

compared to $5.5 million equity investment

Current FFO yield of 23.9%

46

Case Study: Collierville, TN and Olive Branch, MS

Relocated Tenant to Facility We Expanded; Leased Vacant

Building to FedEx for 15 Years

Proactive tenant relationship

creates dual investment

opportunities

Expanded Olive Branch

facility by 100,000 square

feet enhancing cash flows

and long-term occupancy

Attractive basis in both

assets

GAAP cap rate of 10.3%

FEDEX CORPORATION

COLLIERVILLE, TN

DANA CORP.

OLIVE BRANCH, MS

47

Case Study: McGraw Hill, Dubuque, IA

Cash-out Refinancing Enhances Yield

Purchase Price: $11.6 million

Initial Mortgage: $7.4 million

Initial Equity: $4.2 million

Refinanced Amount: $10.9 million

Interest Rate: 5.4%

Year Acquired: 2003

Asset appreciation enables cash-out refinancing

Enhanced returns with less capital at risk

FFO Yield: 19.1% pre refinancing

75.0% post refinancing

MC GRAW HILL

DUBUQUE, IA

48

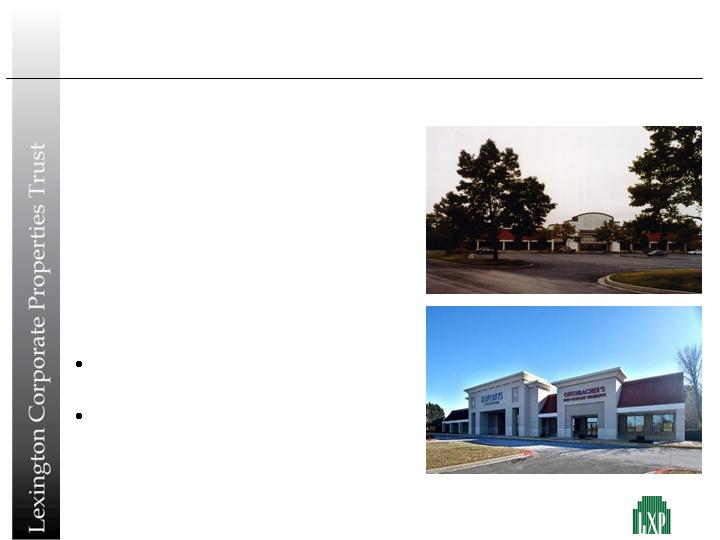

Case Study: Dobbin Road, Columbia, MD

Retail Vacancy Redeveloped and Sold for Huge Profit

Date Acquired: December 1998

Total Investment: $6.6 million

Date Sold: April, 2005

Sales Price: $12.0 million

76% capital appreciation on

6.5 year hold

Former Hechinger store

leased to Haverty Furniture

and Offenbacher Aquatics

DOBBIN ROAD

COLUMBIA, MD

49

Finance

PATRICK CARROLL,

CHIEF FINANCIAL OFFICER

50

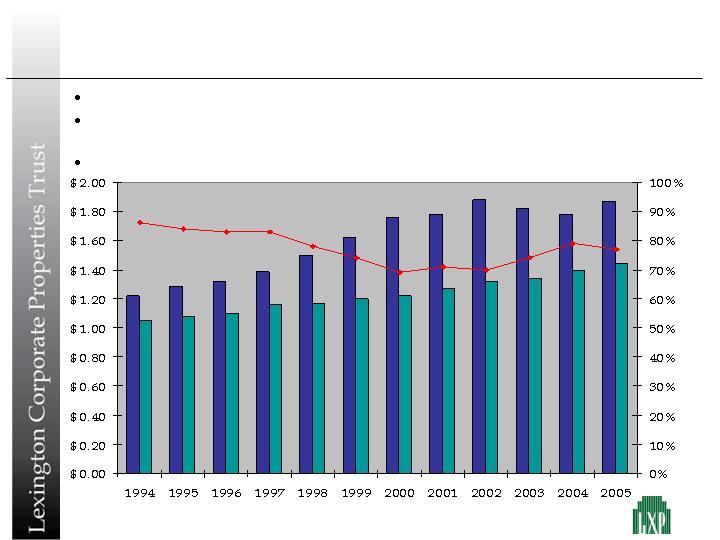

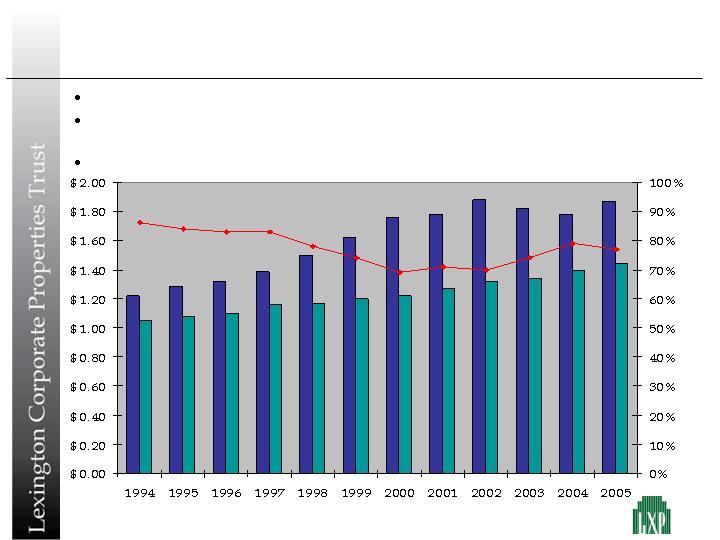

Financial Track Record

3.5% FFO per share compound growth from 1994 to 2005

Grew overall dividend by 39% over same period while reducing FFO payout from

86% to 76%

Dividend per share has increased for thirteen consecutive years

• Payout Ratio • Dividend Per Share • FFO Per Share

51

Operating Results

52

* Before non-recurring items

($ in millions, except per share data)

Quarterly

Quarters Ended

Years Ended

Percentage

December 31,

December 31,

Change

2005

2004

2005

2004

2003

Gross Revenues

42.2%

$53.9

$37.9

$197.1

$143.4

$106.0

Funds From Operations*

20.8%

$30.2

$25.0

$114.6

$93.2

$72.1

FFO Per Share/Unit*

4.3%

$0.48

$0.46

$1.87

$1.79

$1.82

Dividend Per Share

2.9%

$0.36

$0.35

$1.44

$1.40

$1.34

Payout Ratio

(1.4%)

75.0%

76.1%

77.0%

78.2%

73.6%

Balance Sheet Overview

53

($ in millions, except per share data)

Years Ended December 31,

2005

2004

2003

2002

Mortgages and notes payable

1,170.6

$

765.9

$

551.4

$

491.5

$

Preferred stock

234.0

$

214.0

$

79.0

$

-

Market value of common equity

1,232.8

$

1,220.0

$

931.0

$

561.1

$

Total market capitalization

2,637.4

$

2,199.9

$

1,561.4

$

1,052.6

$

Debt to total market capitalization

44.4%

34.8%

35.3%

46.7%

Shares/units outstanding

57,876

54,030

46,112

35,287

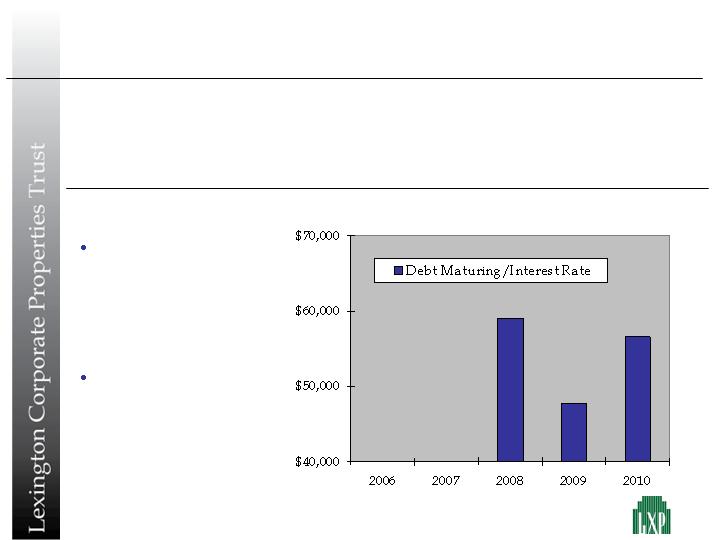

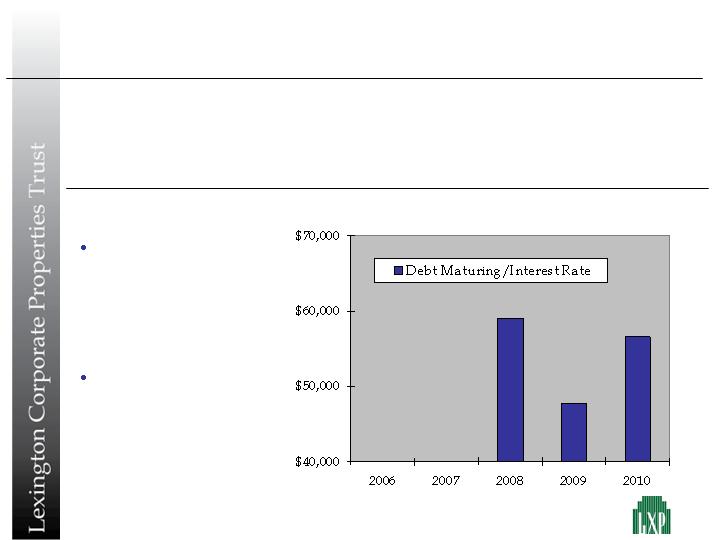

Debt Amortization

$317 million of consolidated balance sheet debt amortizes over time

Consolidated Properties

in millions

Joint Venture Properties (Pro Rata Share)

in millions

54

Debt Structure

($000’s)

$1,096,973

$255,072

$841,901

Balloon

Payment

100.0%

$1,460,804

$121,112

6.01%

Total

23.2%

$302,114

$21,682

July 2014

6.00%

Joint Venture

76.7%

$1,158,690

$99,430

January 2013

6.01%

Consolidated

% of

Total

12/31/05

Balance

Debt Service

Avg.

Maturity

Fixed Rate

Flat yield curve

reduces pre-payment

costs and creates

refinancing

opportunities

Near term maturities

can be refinanced at

lower rates

6.79%

7.18%

7.88%

55

Capacity For Growth

Joint ventures

- $700.0 million in acquisition capacity

- Non-public market capital source

Moderate balance sheet leverage

- 44% of market capitalization at December 31, 2005

Internal capital generation

- Amortizing debt

- Dividend reinvestment plan

56

Conclusion

T. WILSON EGLIN,

CHIEF EXECUTIVE OFFICER

57

Components of Value: Leases and Real Estate

REAL ESTATE

40.2 million square feet

3,683 acres

107 Office buildings

59 Industrial buildings

23 Retail buildings

39 States

$87.49 psf at $21.00 per

share

LEASES

202 Leases

137 Tenants

2006 rental revenues of

$242.0 million

Balanced lease rollover

Weighted average term

of 7 years

58

Key Strategies to Enhance Value

Grow our joint venture programs

- Fee income generates higher ROE with less

risk and offsets corporate overhead

- Diversify capital risk

Continually evaluate portfolio

- Prune non-core holdings

- Exit slower growth markets

- Mitigate vacancy risk

- Reinvest or distribute sale proceeds

Increase future cash flow and grow net asset value

- Strategic acquisitions and dispositions

- Disciplined, effective capital allocation

- Asset improvement initiatives

Real estate is cyclical: take profits opportunistically

59

Proven Ability To Add Value

Selective acquisitions, focus on joint ventures, asset

improvement initiatives and capital recycling

2006

Significant equity issuance at premium, purchase of

assets at “par”, three additional joint venture

programs, locked in low cost, long-term financing,

enhanced asset management capabilities

2001-2005

Capital recycling: developed joint venture business,

repurchased 1.4 million shares at a $10.62 per share

1998-2000

Acquisitions with OP Units, common shares issued at

premium to NAV, own account acquisitions

1996-1997

Active asset management: dispositions, leasing,

refinancing

1994-1995

IPO

1993

60

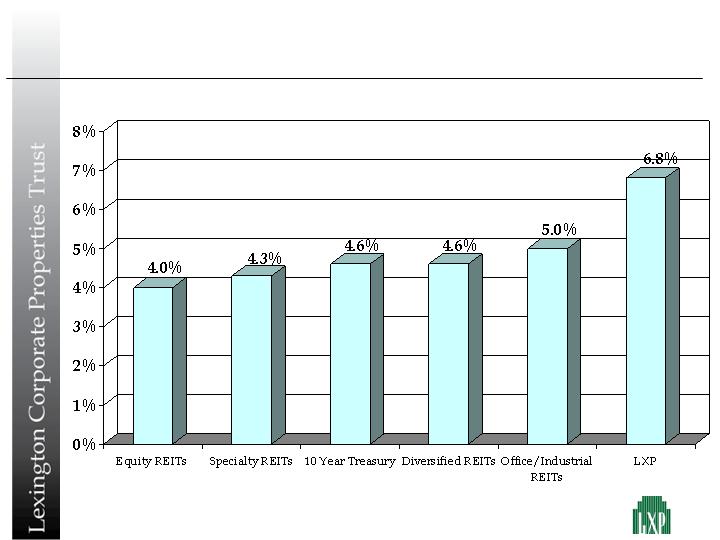

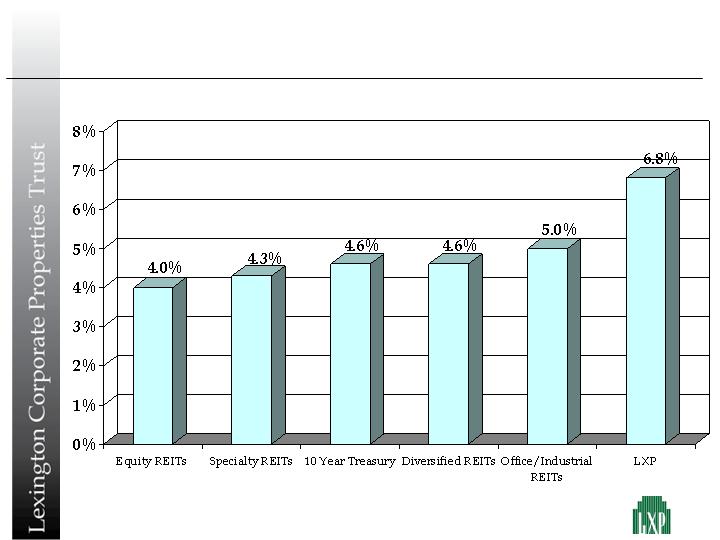

Above Average Dividend Yield

As of February, 2006.

Source: NAREIT

61

Focus on Long-Term Value Growth

High-quality diverse assets

Compelling basis relative to replacement cost

Unique focus on long-term value

Experienced management in place to execute

strategies

Financial flexibility

Disciplined capital allocation

62

Q & A

QUESTIONS & ANSWERS

63

BIOGRAPHIES

64

Biographies of Senior Management

E. ROBERT ROSKIND

Mr. Roskind has served as the Chairman of our Board of Trustees since October 1993 and was our

Co-Chief Executive Officer from October 1993 to January 2003. Mr. Roskind founded The LCP

Group, L.P. ("LCP"), a real estate advisory firm, in 1973 and has been its Chairman since 1976. Mr.

Roskind spends approximately 25% of his business time on the affairs of LCP and its affiliates;

however, Mr. Roskind prioritizes his business time to address the needs of us ahead of LCP and its

affiliates. LCP has been the general partner of various limited partnerships with which we have

had prior dealings. Mr. Roskind received his B.S. in 1966 from the University of Pennsylvania and

is a 1969 Harlan Fiske Stone Graduate of the Columbia Law School.

RICHARD J. ROUSE

Mr. Rouse has served as our Chief Investment Officer since January 2003, as Vice Chairman of our

Board of Trustees since April 1996 and as a trustee of us since October 1993. Mr. Rouse served as

our President from October 1993 to April 1996, and as one of our Co-Chief Executive Officers from

October 1993 to January 2003. Mr. Rouse graduated from Michigan State University in 1968 and

received his M.B.A. in 1970 from the Wharton School of Finance and Commerce of the University

of Pennsylvania.

T. WILSON EGLIN

Mr. Eglin has served as our Chief Executive Officer since January 2003, our Chief Operating Officer

since October 1993 and as a trustee of us since May 1994. Mr. Eglin served as Executive Vice

President from October 1993 to April 1996, and since April 1996 has served as our President. Mr.

Eglin received his B.A. from Connecticut College in 1986.

65

Biographies of Senior Management

PATRICK CARROLL

Mr. Carroll has served as our Chief Financial Officer since May 1998, our Treasurer since January

1999 and one of our Executive Vice Presidents since January 2003. Prior to joining us, Mr. Carroll

was, from 1993 to 1998, a Senior Manager in the real estate practice of Coopers & Lybrand L.L.P., a

public accounting firm that was one of the predecessors of Pricewaterhouse, Coopers LLP. Mr.

Carroll received his B.B.A. from Hofstra University in 1986, his M.S. in Taxation from C.W. Post in

1995, and is a Certified Public Accountant.

JOHN B. VANDER ZWAAG

Mr. Vander Zwaag has been employed by us since May 2003 and currently is one of our Executive

Vice Presidents. From 1982 to 1992, he was employed by LCP serving as Director of Acquisitions

from 1987 to 1992. Between his employment by LCP and us, Mr. Vander Zwaag was Managing

Director of Chesterton Binswanger Capital Advisors (1992 - 1997) and Managing Director with

Cohen Financial (1997 - 2003). He received his B.A. from Amherst College in 1979 and his M.B.A.

from Columbia University in 1982.

NATASHA ROBERTS

Ms. oberts has served as one of our Senior Vice Presidents and our Director of Acquisitions since

January 2006 and as a member of our acquisitions department since January 1997. Prior to joining

us, Ms. Roberts worked for Net Lease Partners Realty Advisors, a real estate advisory firm from

1995 to 1997. She received her B.F.A from New York University in 1989.

66

Biographies of Senior Management

BRENDAN P. MULLINIX

Mr. Mullinix is one of our Senior Vice Presidents and an Executive Vice President, the Chief

Operating Officer and the Secretary of Lexington Strategic Asset Corp. Mr. Mullinix has served as

one of our Vice Presidents since February 2000 and as a member of our acquisitions department

since October 1996. He received his B.A. from Columbia University in 1996.

67

Biographies of Board of Trustees

GEOFFREY DOHRMANN

Mr. Dohrmann has served as one of our trustees since August 2000. Mr. Dohrmann co-

founded Institutional Real Estate, Inc., a real estate-oriented publishing and consulting

company in 1987 and is currently its Chairman and Chief Executive Officer. Mr. Dohrmann

also belongs to the advisory boards for the National Real Estate Index, The Journal of Real

Estate Portfolio Management and Center for Real Estate Enterprise Management. Mr.

Dohrmann is also a fellow of the Homer Hoyt Institute and holds the Counselors of Real Estate

(CRE) designation.

CARL D. GLICKMAN

Mr. Glickman has served as one of our trustees since May 1994. Mr. Glickman has been

President of The Glickman Organization, a real estate development and management firm,

since 1953. Mr. Glickman is on the Board of Directors of Bear Stearns Companies, Inc., and

Cleveland State University.

JAMES GROSFELD

Mr. Grosfeld has served as one of our trustees since November 2003. He also serves as a

Director of Copart, Inc. and BlackRock, Inc. He has served on the Advisory Board of the

Federal National Mortgage Association and as Director of Interstate Bakeries Corporation and

Addington Resources. He was Chairman and Chief Executive Officer of Pulte Home

Corporation from 1974 to 1990. He received his B.A. from Amherst College in 1959 and L.L.B.

from Columbia Law School in 1962.

68

KEVIN W. LYNCH

Mr. Lynch has served as one of our trustees from May 2003 to the present and from May 1996 to

May 2000. Mr. Lynch co-founded and has been a Principal of The Townsend Group since 1983.

The Townsend Group is a real estate consulting firm to institutional investors in the United States.

Mr. Lynch is a frequent industry speaker and member of the Pension Real Estate Association and

the National Council of Real Estate Investment Fiduciaries. He currently sits on the Real Estate

Advisory Board for New York University and is a Director for First Industrial Realty Trust.

STANLEY R. PERLA

Mr. Perla has served as one of our trustees since August 2003. Mr. Perla, a licensed Certified

Public Accountant, was a partner for Ernst & Young LLP, a public accounting firm from

September 1978 to June 2003. He served as Ernst & Young's National Director of Real Estate

Accounting as well as Ernst & Young's National Accounting and Auditing Committee. He is an

active member of the National Association of Real Estate Investment Trusts and the National

Association of Real Estate Companies. Mr. Perla is also a director of American Mortgage

Acceptance Company and Vice President - Director of Internal Audit for Vornado Realty Trust.

SETH M. ZACHARY

Mr. Zachary has served as one of our trustees since November 1993. Since 1987, Mr. Zachary has

been a partner, and is currently the Chairman, of the law firm Paul, Hastings, Janofsky & Walker

LLP, counsel to the Company.

Biographies of Board of Trustees

69