Exhibit 99.1

LEXINGTON REALTY TRUST

QUARTERLY SUPPLEMENTAL INFORMATION

September 30, 2017

Table of Contents

| Section | | Page |

| | | |

| Third Quarter 2017 Earnings Press Release | | 3 |

| | | |

| Portfolio Data | | |

| Investment / Capital Recycling Summary | | 15 |

| Forward Purchase Commitments | | 16 |

| Financing Summary | | 17 |

| Leasing Summary | | 18 |

| Other Revenue Data | | 20 |

| Portfolio Detail by Asset Class | | 22 |

| Portfolio Composition | | 23 |

| Components of Net Asset Value | | 24 |

| Top Markets | | 25 |

| Single-Tenant Office Markets | | 26 |

| Tenant Industry Diversification | | 27 |

| Top 10 Tenants or Guarantors | | 28 |

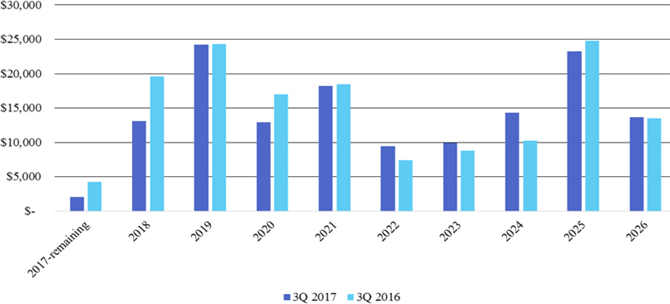

| Lease Rollover Schedules – GAAP Basis | | 29 |

| Property Leases and Vacancies – Consolidated Portfolio | | 31 |

| Property Leases and Vacancies – Non-consolidated Portfolio | | 38 |

| Select Credit Metrics Summary | | 39 |

| Financial Covenants | | 40 |

| Mortgages and Notes Payable | | 41 |

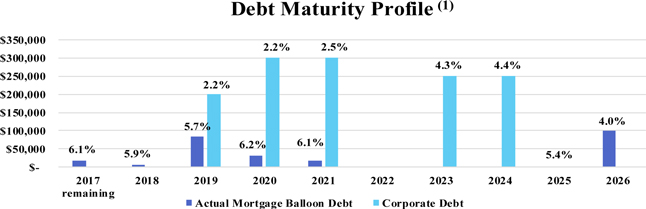

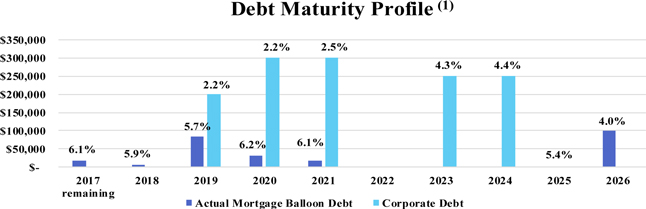

| Debt Maturity Schedule | | 43 |

| Selected Balance Sheet Account Data | | 44 |

| Non-GAAP Measures – Definitions | | 45 |

| Reconciliation of Non-GAAP Measures | | 47 |

| Investor Information | | 51 |

This Quarterly Earnings Press Release and Quarterly Supplemental Information contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under the control of Lexington Realty Trust (“Lexington”), which may cause actual results, performance or achievements of Lexington and its subsidiaries to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Lexington’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, risks related to: (1) the authorization of Lexington’s Board of Trustees of future dividend declarations, (2) Lexington’s ability to achieve its estimates of net income attributable to common shareholders and Adjusted Company FFO available to all equityholders and unitholders – diluted for the year ending December 31, 2017, (3) the successful consummation of any lease, acquisition, build-to-suit, disposition, financing or other transaction on the terms described herein or at all, (4) the failure to continue to qualify as a real estate investment trust, (5) changes in general business and economic conditions, including the impact of any new legislation, (6) competition, (7) increases in real estate construction costs, (8) changes in interest rates, (9) changes in accessibility of debt and equity capital markets, and (10) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington’s web site atwww.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington’s future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects,” may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to revise those forward-looking statements to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington’s expectations will be realized.

LEXINGTONREALTYTRUST

TRADED: NYSE: LXP

ONEPENNPLAZA, SUITE4015

NEWYORK, NY 10119-4015

FOR IMMEDIATE RELEASE

LEXINGTON REALTY TRUST REPORTS THIRD QUARTER 2017 RESULTS

AND ANNOUNCES DIVIDEND INCREASE

New York, NY - November 7, 2017 - Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate investment trust focused on single-tenant real estate investments, today announced results for the third quarter ended September 30, 2017.

Third Quarter 2017 Highlights

| • | Generated Net Income attributable to common shareholders of $3.9 million, or $0.02 per diluted common share. |

| • | Generated Adjusted Company Funds From Operations available to all equityholders and unitholders - diluted (“Adjusted Company FFO”) of $60.7 million, or $0.25 per diluted common share. |

| • | Acquired four industrial properties for an aggregated cost of $266.1 million and completed the Opelika, AL industrial build-to-suit project for $37.3 million. |

| • | Disposed of 12 properties for $42.0 million. |

| • | Amended the revolving credit facility, together with the related term loans, increasing the capacity by $200.0 million. |

| • | Retired $25.2 million of secured debt. |

| • | Completed 1.2 million square feet of new leases and lease extensions with portfolio 97.9% leased at quarter end. |

Subsequent Events

| • | Increased the quarterly common share/unit dividend/distribution to $0.1775 per common share/unit. |

| • | Acquired an industrial property in Lafayette, IN for $17.5 million. |

| • | Disposed of four properties for $28.2 million. |

| • | Completed 700,000 square feet of new and extended leases. |

Adjusted Company FFO is a non-GAAP financial measure. It and certain other non-GAAP financial measures are defined and reconciled later in this press release.

T. Wilson Eglin, Chief Executive Officer and President of Lexington Realty Trust, commented, “We are very pleased with our third quarter results, the continued success of our business plan execution, and today’s announcement on the dividend increase. During the quarter and subsequently, we acquired or completed over $320 million of industrial properties, sold approximately $70 million of non-core assets, and leased over 1.9 million square feet. The quality of our portfolio has significantly improved through our sustained efforts. Our portfolio has an increasing percentage of rents from industrial properties, is younger, has a longer weighted-average lease term, and has less near-term lease rollover.”

FINANCIAL RESULTS

Revenues

For the quarter ended September 30, 2017, total gross revenues were $97.7 million, compared with total gross revenues of $106.0 million for the quarter ended September 30, 2016. The decrease was primarily attributable to 2017 and 2016 property sales, particularly the sale of the New York City land investments in 2016, and lease expirations, partially offset by revenue generated from property acquisitions and new leases.

Net Income Attributable to Common Shareholders

For the quarter ended September 30, 2017, net income attributable to common shareholders was $3.9 million, or $0.02 per diluted share, compared with net loss attributable to common shareholders for the quarter ended September 30, 2016 of $27.0 million, or $0.12 per diluted share.

Adjusted Company FFO

For the quarter ended September 30, 2017, Lexington generated Adjusted Company FFO of $60.7 million, or $0.25 per diluted share, compared to Adjusted Company FFO for the quarter ended September 30, 2016 of $67.2 million, or $0.28 per diluted share. The decrease was primarily attributable to the items discussed above under “Revenues”.

Dividends/Distributions

As previously announced, during the third quarter of 2017, Lexington declared a regular quarterly common share/unit dividend/distribution for the quarter ended September 30, 2017 of $ 0.175 per common share/unit, which was paid on October 16, 2017 to common shareholders/unitholders of record as of September 29, 2017. Lexington also declared a dividend of $0.8125 per share on its Series C Cumulative Convertible Preferred Stock (“Series C Preferred”), which is expected to be paid on November 15, 2017 to Series C Preferred Shareholders of record as of October 31, 2017.

Subsequent to quarter end, Lexington increased its quarterly common share/unit dividend/distribution to $0.1775 per common share/unit, which equates to an annualized dividend of $0.71 per common share/unit. The declared quarterly dividend/distribution will be payable on January 16, 2018 to common shareholders/unitholders of record as of December 29, 2017. In addition, Lexington declared a dividend of $0.8125 per share on its Series C Preferred, which is expected to be paid February 15, 2018 to Series C Preferred Shareholders of record as of January 31, 2018.

TRANSACTION ACTIVITY

ACQUISITIONS AND COMPLETED BUILD-TO-SUIT TRANSACTIONS

| Tenant (Guarantor) | | Location | | Sq. Ft. | | | Property Type | | Initial Basis ($000) | | | Approximate Lease Term (Yrs) | |

| Golden State Foods Corp. (Golden State Enterprises, Inc.) | | Opelika, AL | | | 165,000 | | | Industrial | | $ | 37,269 | | | | 25 | |

| Georgia Pacific Consumer Products LP (Georgia-Pacific LLC)(1) | | McDonough, GA | | | 1,121,000 | | | Industrial | | | 66,700 | | | | 10 | |

| McCormick & Company, Inc.(2) | | Byhalia, MS | | | 616,000 | | | Industrial | | | 36,590 | | | | 10 | |

| Kellogg Sales Company (Kellogg Company) | | Jackson, TN | | | 1,062,000 | | | Industrial | | | 57,920 | | | | 10 | |

| Nissan North America, Inc. | | Smyrna, TN | | | 1,505,000 | | | Industrial | | | 104,890 | | | | 10 | |

| | | | | | 4,469,000 | | | | | $ | 303,369 | | | | | |

| (1) | Square footage includes a 220,000 square foot expansion that is expected to be completed in 2018. |

| (2) | Initial Basis excludes a $133 thousand future tenant improvement allowance and $767 thousand of rent abatements, which were credited at closing. |

The above properties were acquired/completed at aggregate weighted-average estimated GAAP and cash capitalization rates of 6.6% and 5.7%, respectively.

FORWARD PURCHASE COMMITMENTS

| Location | | Sq. Ft. | | | Property Type | | Maximum Acquisition Cost ($000) | | | Estimated Acquisition Date | | Estimated Initial GAAP Yield | | | Estimated Initial Cash Yield | | | Approximate Lease Term (Yrs) | |

| Warren, MI(1) | | | 260,000 | | | Industrial | | $ | 47,000 | | | 4Q 17 | | | 8.3 | % | | | 7.3 | % | | | 15 | |

| Romulus, MI | | | 500,000 | | | Industrial | | | 39,330 | | | 4Q 17 | | | 6.5 | % | | | 6.1 | % | | | 15 | |

| Lafayette, IN | | | 309,000 | | | Industrial | | | 17,450 | | | 4Q 17 | | | 7.0 | % | | | 6.9 | % | | | 7 | |

| | | | 1,069,000 | | | | | $ | 103,780 | | | | | | 7.4 | % | | | 6.8 | % | | | | |

| (1) | A $4.6 million letter of credit secures the obligation to purchase this property. |

PROPERTY DISPOSITIONS(1)

| Primary Tenant (Guarantor) | | Location | | Property Type | | Gross Disposition Price ($000) | | | Annualized Net Income(2) ($000) | | | Annualized NOI(2) ($000) | | | Month of Disposition | | % Leased | |

| Food Lion, LLC/Delhaize America, Inc. | | Lexington, NC | | Other | | $ | 1,412 | | | $ | 102 | | | $ | 138 | | | July | | | 100 | % |

| Vacant | | Rock Hill, SC | | Multi-Tenant - Office | | | 6,250 | | | | (407 | ) | | | (388 | ) | | July | | | 0 | % |

| Bank of America, N.A. (Bank of America Corporation)(3) | | Various, GA | | Other | | | 7,050 | | | | 593 | | | | 841 | | | August | | | 100 | % |

| Vacant(4) | | Memphis, TN | | Multi-Tenant - Office | | | 3,496 | | | | (533 | ) | | | (60 | ) | | August | | | 0 | % |

| 3D Systems Corporation | | Rock Hill, SC | | Office | | | 8,600 | | | | 286 | | | | 703 | | | September | | | 100 | % |

| Wipro Data Center and Cloud Services, Inc. (Infocrossing, Inc.) | | Tempe, AZ | | Office | | | 15,200 | | | | 553 | | | | 981 | | | September | | | 100 | % |

| | | | | | | $ | 42,008 | | | $ | 594 | | | $ | 2,215 | | | | | | | |

| (1) | In addition to the dispositions in the table, Lexington disposed of its Port Chester, NY property by its property owner subsidiary abandoning its leasehold interest in September 2017. |

| (2) | Quarterly period prior to sale, excluding impairment charges, annualized. |

| (4) | Conveyed to lender in a foreclosure sale. |

These dispositions resulted in aggregate gains on sales of $10.6 million and aggregate impairment charges of $5.2 million.

LEASING

During the third quarter of 2017, Lexington executed the following new and extended leases:

| | LEASE EXTENSIONS | | | | | |

| | | | | | | | | | | | |

| | | Location | | Primary Tenant(1) | | Prior Term | | Lease Expiration Date | | Sq. Ft. | |

| | | Office/Multi-Tenant | | | | | | | | | | | | |

| 1 | | Rockaway | | NJ | | Atlantic Health System, Inc. | | 12/2027 | | 12/2029 | | | 92,326 | |

| 2 | | Baton Rouge | | LA | | New Cingular Wireless PCS, LLC | | 10/2017 | | 10/2022 | | | 70,100 | |

| 3-7 | | Honolulu | | HI | | N/A | | 2017 | | 2018-2021 | | | 6,196 | |

| 7 | | Total office lease extensions | | | | | | | | | | | 168,622 | |

| | | | | | | | | | | | | | | |

| | | Industrial | | | | | | | | | | | | |

| 1 | | Columbus | | OH | | ODW Logistics, Inc. | | 06/2018 | | 06/2020 | | | 772,450 | |

| 2 | | Marshall | | MI | | Tenneco Automotive Operating Company, Inc. | | 09/2018 | | 09/2028 | | | 246,508 | |

| 2 | | Total industrial lease extensions | | | | | | | | | | | 1,018,958 | |

| | | | | | | | | | | | | | | |

| 9 | | Total lease extensions | | | | | | | | | | | 1,187,580 | |

| | | NEW LEASES | | | | | | | | | |

| | | | | | | | | | | | |

| | Location | | | | | | Lease Expiration Date | | Sq. Ft. | |

| | | Office/Multi-Tenant | | | | | | | | | | | | |

| 1-3 | | Honolulu | | HI | | N/A | | | | 2018-2020 | | | 952 | |

| 3 | | Total new office leases | | | | | | | | | | | 952 | |

| | | | | | | | | | | | | | | |

| 3 | | Total new leases | | | | | | | | | | | 952 | |

| | | | | | | | | | | | | | | |

| 12 | | TOTAL NEW AND EXTENDED LEASES | | | | | | | | | | | 1,188,532 | |

| (1) | Leases greater than 10,000 square feet. |

As of September 30, 2017, Lexington's portfolio was 97.9% leased, excluding any property subject to a mortgage loan in default.

BALANCE SHEET/CAPITAL MARKETS

In the third quarter of 2017, Lexington satisfied an aggregate $25.2 million of nonrecourse mortgage debt.

Additionally, in September 2017, Lexington amended its credit facility. The amendment, among other things, (a) increased the amount of the revolving credit line capacity by an aggregate of $105 million for an aggregate capacity of $505 million; (b) obligated the term loan lenders to make additional term loans in the aggregate amount of $95 million, consisting of a $50 million increase in the term loan due in 2020, for an aggregate outstanding amount of $300 million, and a $45 million increase in the term loan due in 2021, for an aggregate outstanding amount of $300 million; and (c) with lender approval, increases the maximum overall capacity of the facility to an aggregate of $2.01 billion.

2017 EARNINGS GUIDANCE

Lexington now estimates that its net income attributable to common shareholders per diluted common share for the year ended December 31, 2017 will be within an expected range of $0.35 to $0.37. Lexington is narrowing its Adjusted Company FFO for the year ended December 31, 2017 to be within an expected range of $0.95 to $0.97 per diluted common share. This guidance is forward looking, excludes the impact of certain items and is based on current expectations.

THIRD QUARTER 2017 CONFERENCE CALL

Lexington will host a conference call today, November 7, 2017, at 8:30 a.m. Eastern Time, to discuss its results for the quarter ended September 30, 2017. Interested parties may participate in this conference call by dialing 1-844-825-9783 (U.S.), 1-412-317-5163 (International) or 1-855-669-9657 (Canada). A replay of the call will be available through February 7, 2018, at 1-877-344-7529 (U.S.), 1-412-317-0088 (International) or 1-855-669-9658 (Canada), pin code for all replay numbers is 10113450. A live webcast of the conference call will be available atwww.lxp.com within the Investors section.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) that owns a diversified portfolio of real estate assets consisting primarily of equity investments in single-tenant net-leased commercial properties across the United States. Lexington seeks to expand its portfolio through build-to-suit transactions, sale-leaseback transactions and other transactions, including acquisitions. For more information, including Lexington's Quarterly Supplemental Information package, or to follow Lexington on social media, visitwww.lxp.com.

Contact:

Investor or Media Inquiries for Lexington Realty Trust:

Heather Gentry, Senior Vice President of Investor Relations

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: hgentry@lxp.com

This release contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under Lexington's control which may cause actual results, performance or achievements of Lexington to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Lexington's periodic reports filed with the Securities and Exchange Commission, including risks related to: (1) the authorization by Lexington's Board of Trustees of future dividend declarations, (2) Lexington's ability to achieve its estimates of net income attributable to common shareholders and Adjusted Company FFO for the year ending December 31, 2017, (3) the successful consummation of any lease, acquisition, build-to-suit, disposition, financing or other transaction, (4) the failure to continue to qualify as a real estate investment trust, (5) changes in general business and economic conditions, including the impact of any legislation, (6) competition, (7) increases in real estate construction costs, (8) changes in interest rates, (9) changes in accessibility of debt and equity capital markets, and (10) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington's web site atwww.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington's future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington's expectations will be realized.

References to Lexington refer to Lexington Realty Trust and its consolidated subsidiaries. All interests in properties and loans are held, and all property operating activities are conducted, through special purpose entities, which are separate and distinct legal entities that maintain separate books and records, but in some instances are consolidated for financial statement purposes and/or disregarded for income tax purposes. The assets and credit of each special purpose entity with a property subject to a mortgage loan are not available to creditors to satisfy the debt and other obligations of any other person, including any other special purpose entity or affiliate. Consolidated entities that are not property owner subsidiaries do not directly own any of the assets of a property owner subsidiary (or the general partner, member of managing member of such property owner subsidiary), but merely hold partnership, membership or beneficial interests therein which interests are subordinate to the claims of the property owner subsidiary's (or its general partner's, member's or managing member's) creditors.

Non-GAAP Financial Measures - Definitions

Lexington has used non-GAAP financial measures as defined by the Securities and Exchange Commission Regulation G in this Quarterly Earnings Release and in other public disclosures.

Lexington believes that the measures defined below are helpful to investors in measuring our performance or that of an individual investment. Since these measures exclude certain items which are included in their respective most comparable measures under generally accepted accounting principles (“GAAP”), reliance on the measures has limitations; management compensates for these limitations by using the measures simply as supplemental measures that are weighed in balance with other GAAP measures. These measures are not necessarily indications of our cash flow available to fund cash needs. Additionally, they should not be used as an alternative to the respective most comparable GAAP measures when evaluating Lexington's financial performance or cash flow from operating, investing or financing activities or liquidity.

Cash Rent: Cash Rent is calculated by making adjustments to GAAP rent to remove the impact of GAAP required adjustments to rental income such as adjustments for straight-line rents relating to free rent periods and contractual rent increases. Cash Rent excludes lease termination income. Lexington believes Cash Rent provides a meaningful indication of an investment's ability to fund cash needs.

Company Funds Available for Distribution (“FAD”): FAD is calculated by making adjustments to Adjusted Company FFO (see below) for (1) straight-line adjustments, (2) lease incentive amortization, (3) amortization of above/below market leases, (4) lease termination payments, net, (5) non-cash interest, net, (6) non-cash charges, net, (7) cash paid for tenant improvements, and (8) cash paid for lease costs. Although FAD may not be comparable to that of other real estate investment trusts (“REITs”), Lexington believes it provides a meaningful indication of its ability to fund cash needs. FAD is a non-GAAP financial measure and should not be viewed as an alternative measurement of operating performance to net income, as an alternative to net cash flows from operating activities or as a measure of liquidity.

Funds from Operations (“FFO”) and Adjusted Company FFO: Lexington believes that Funds from Operations, or FFO, which is a non-GAAP measure, is a widely recognized and appropriate measure of the performance of an equity REIT. Lexington believes FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. As a result, FFO provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities, interest costs and other matters without the inclusion of depreciation and amortization, providing perspective that may not necessarily be apparent from net income.

The National Association of Real Estate Investment Trusts, or NAREIT, defines FFO as “net income (or loss) computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus real estate depreciation and amortization and after adjustments for non-consolidated partnerships and joint ventures.” NAREIT clarified its computation of FFO to exclude impairment charges on depreciable real estate owned directly or indirectly. FFO does not represent cash generated from operating activities in accordance with GAAP and is not indicative of cash available to fund cash needs.

Lexington presents FFO available to common shareholders and unitholders - basic and also presents FFO available to all equityholders and unitholders - diluted on a company-wide basis as if all securities that are convertible, at the holder's option, into Lexington’s common shares, are converted at the beginning of the period. Lexington also presents Adjusted Company FFO available to all equityholders and unitholders - diluted which adjusts FFO available to all equityholders and unitholders - diluted for certain items which we believe are not indicative of the operating results of Lexington's real estate portfolio. Lexington believes this is an appropriate presentation as it is frequently requested by security analysts, investors and other interested parties. Since others do not calculate these measures in a similar fashion, these measures may not be comparable to similarly titled measures as reported by others. These measures should not be considered as an alternative to net income as an indicator of Lexington’s operating performance or as an alternative to cash flow as a measure of liquidity.

GAAP and Cash Yield or Capitalization Rate: GAAP and cash yields or capitalization rates are measures of operating performance used to evaluate the individual performance of an investment. These measures are estimates and are not presented or intended to be viewed as a liquidity or performance measure that present a numerical measure of Lexington's historical or future financial performance, financial position or cash flows. The yield or capitalization rate is calculated by dividing the annualized NOI (as defined below, except GAAP rent adjustments are added back to rental income to calculate GAAP yield or capitalization rate) the investment is expected to generate (or has generated) divided by the acquisition/completion cost (or sale) price.

Net Operating Income (“NOI”): NOI is a measure of operating performance used to evaluate the individual performance of an investment. This measure is not presented or intended to be viewed as a liquidity or performance measure that presents a numerical measure of Lexington's historical or future financial performance, financial position or cash flows. Lexington defines NOI as operating revenues (rental income (less GAAP rent adjustments and lease termination income), tenant reimbursements and other property income) less property operating expenses. Other REITs may use different methodologies for calculating NOI, and accordingly, Lexington's NOI may not be comparable to other companies. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, acquisition-related expenses, other nonproperty income and losses, and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. Lexington believes that net income is the most directly comparable GAAP measure to NOI.

# # #

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited and in thousands, except share and per share data)

| | | Three months ended September 30, | | | Nine months ended September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| Gross revenues: | | | | | | | | | | | | | | | | |

| Rental | | $ | 89,704 | | | $ | 98,602 | | | $ | 265,923 | | | $ | 310,804 | |

| Tenant reimbursements | | | 7,985 | | | | 7,379 | | | | 23,549 | | | | 23,366 | |

| Total gross revenues | | | 97,689 | | | | 105,981 | | | | 289,472 | | | | 334,170 | |

| Expense applicable to revenues: | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | (43,495 | ) | | | (40,288 | ) | | | (128,706 | ) | | | (124,687 | ) |

| Property operating | | | (11,694 | ) | | | (11,472 | ) | | | (36,784 | ) | | | (34,843 | ) |

| General and administrative | | | (7,963 | ) | | | (7,510 | ) | | | (25,561 | ) | | | (23,032 | ) |

| Litigation reserve | | | (2,050 | ) | | | — | | | | (2,050 | ) | | | — | |

| Non-operating income | | | 1,005 | | | | 3,080 | | | | 4,997 | | | | 9,500 | |

| Interest and amortization expense | | | (18,887 | ) | | | (23,001 | ) | | | (57,828 | ) | | | (68,573 | ) |

| Debt satisfaction gains (charges), net | | | 2,424 | | | | 2,538 | | | | 2,378 | | | | (818 | ) |

| Impairment charges and loan loss | | | (21,986 | ) | | | (72,890 | ) | | | (43,577 | ) | | | (75,904 | ) |

| Gains on sales of properties | | | 10,645 | | | | 16,072 | | | | 55,078 | | | | 58,413 | |

| Income (loss) before provision for income taxes and equity in earnings (losses) of non-consolidated entities | | | 5,688 | | | | (27,490 | ) | | | 57,419 | | | | 74,226 | |

| Provision for income taxes | | | (375 | ) | | | (462 | ) | | | (1,174 | ) | | | (1,099 | ) |

| Equity in earnings (losses) of non-consolidated entities | | | 283 | | | | 340 | | | | (1,064 | ) | | | 6,394 | |

| Net income (loss) | | | 5,596 | | | | (27,612 | ) | | | 55,181 | | | | 79,521 | |

| Less net (income) loss attributable to noncontrolling interests | | | (55 | ) | | | 2,260 | | | | (448 | ) | | | 102 | |

| Net income (loss) attributable to Lexington Realty Trust shareholders | | | 5,541 | | | | (25,352 | ) | | | 54,733 | | | | 79,623 | |

| Dividends attributable to preferred shares – Series C | | | (1,573 | ) | | | (1,573 | ) | | | (4,718 | ) | | | (4,718 | ) |

| Allocation to participating securities | | | (52 | ) | | | (50 | ) | | | (183 | ) | | | (187 | ) |

| Net income (loss) attributable to common shareholders | | $ | 3,916 | | | $ | (26,975 | ) | | $ | 49,832 | | | $ | 74,718 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders - per common share basic | | $ | 0.02 | | | $ | (0.12 | ) | | $ | 0.21 | | | $ | 0.32 | |

| Weighted-average common shares outstanding – basic | | | 237,989,098 | | | | 234,207,396 | | | | 237,632,572 | | | | 233,151,600 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders - per common share diluted | | $ | 0.02 | | | $ | (0.12 | ) | | $ | 0.21 | | | $ | 0.31 | |

| Weighted-average common shares outstanding – diluted | | | 241,702,715 | | | | 234,207,396 | | | | 241,442,227 | | | | 237,215,883 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited and in thousands, except share and per share data)

| | | September 30, 2017 | | | December 31, 2016 | |

| Assets: | | | | | | | | |

| Real estate, at cost | | $ | 3,837,705 | | | $ | 3,533,172 | |

| Real estate - intangible assets | | | 595,904 | | | | 597,294 | |

| Investments in real estate under construction | | | — | | | | 106,652 | |

| | | | 4,433,609 | | | | 4,237,118 | |

| Less: accumulated depreciation and amortization | | | 1,200,814 | | | | 1,208,792 | |

| Real estate, net | | | 3,232,795 | | | | 3,028,326 | |

| Assets held for sale | | | 8,638 | | | | 23,808 | |

| Cash and cash equivalents | | | 140,545 | | | | 86,637 | |

| Restricted cash | | | 34,946 | | | | 31,142 | |

| Investment in and advances to non-consolidated entities | | | 60,683 | | | | 67,125 | |

| Deferred expenses, net | | | 32,426 | | | | 33,360 | |

| Loans receivable, net | | | — | | | | 94,210 | |

| Rent receivable – current | | | 6,388 | | | | 7,516 | |

| Rent receivable – deferred | | | 46,611 | | | | 31,455 | |

| Other assets | | | 32,124 | | | | 37,888 | |

| Total assets | | $ | 3,595,156 | | | $ | 3,441,467 | |

| | | | | | | | | |

| Liabilities and Equity: | | | | | | | | |

| Liabilities: | | | | | | | | |

| Mortgages and notes payable, net | | $ | 670,345 | | | $ | 738,047 | |

| Revolving credit facility borrowings | | | 200,000 | | | | — | |

| Term loans payable, net | | | 596,369 | | | | 501,093 | |

| Senior notes payable, net | | | 494,989 | | | | 494,362 | |

| Trust preferred securities, net | | | 127,171 | | | | 127,096 | |

| Dividends payable | | | 48,494 | | | | 47,264 | |

| Liabilities held for sale | | | 442 | | | | 191 | |

| Accounts payable and other liabilities | | | 36,728 | | | | 59,601 | |

| Accrued interest payable | | | 11,683 | | | | 6,704 | |

| Deferred revenue - including below market leases, net | | | 34,069 | | | | 39,895 | |

| Prepaid rent | | | 15,371 | | | | 14,723 | |

| Total liabilities | | | 2,235,661 | | | | 2,028,976 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| Equity: | | | | | | | | |

| Preferred shares, par value $0.0001 per share; authorized 100,000,000 shares: | | | | | | | | |

| Series C Cumulative Convertible Preferred, liquidation preference $96,770; 1,935,400 shares issued and outstanding | | | 94,016 | | | | 94,016 | |

| Common shares, par value $0.0001 per share; authorized 400,000,000 shares, 240,643,775 and 238,037,177 shares issued and outstanding in 2017 and 2016, respectively | | | 24 | | | | 24 | |

| Additional paid-in-capital | | | 2,824,379 | | | | 2,800,736 | |

| Accumulated distributions in excess of net income | | | (1,576,459 | ) | | | (1,500,966 | ) |

| Accumulated other comprehensive income (loss) | | | 510 | | | | (1,033 | ) |

| Total shareholders’ equity | | | 1,342,470 | | | | 1,392,777 | |

| Noncontrolling interests | | | 17,025 | | | | 19,714 | |

| Total equity | | | 1,359,495 | | | | 1,412,491 | |

| Total liabilities and equity | | $ | 3,595,156 | | | $ | 3,441,467 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

EARNINGS PER SHARE

(Unaudited and in thousands, except share and per share data)

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| EARNINGS PER SHARE: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders | | $ | 3,916 | | | $ | (26,975 | ) | | $ | 49,832 | | | $ | 74,718 | |

| | | | | | | | | | | | | | | | | |

| Weighted-average number of common shares outstanding - basic | | | 237,989,098 | | | | 234,207,396 | | | | 237,632,572 | | | | 233,151,600 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders - per common share basic | | $ | 0.02 | | | $ | (0.12 | ) | | $ | 0.21 | | | $ | 0.32 | |

| | | | | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders - basic | | $ | 3,916 | | | $ | (26,975 | ) | | $ | 49,832 | | | $ | 74,718 | |

| Impact of assumed conversions | | | (173 | ) | | | — | | | | (192 | ) | | | (845 | ) |

| Net income (loss) attributable to common shareholders | | $ | 3,743 | | | $ | (26,975 | ) | | $ | 49,640 | | | $ | 73,873 | |

| | | | | | | | | | | | | | | | | |

| Weighted-average common shares outstanding - basic | | | 237,989,098 | | | | 234,207,396 | | | | 237,632,572 | | | | 233,151,600 | |

| Effect of dilutive securities: | | | | | | | | | | | | | | | | |

| Share options | | | 66,748 | | | | — | | | | 95,788 | | | | 246,166 | |

| Operating Partnership Units | | | 3,646,869 | | | | — | | | | 3,713,867 | | | | 3,818,117 | |

| Weighted-average common shares outstanding - diluted | | | 241,702,715 | | | | 234,207,396 | | | | 241,442,227 | | | | 237,215,883 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders - per common share diluted | | $ | 0.02 | | | $ | (0.12 | ) | | | 0.21 | | | $ | 0.31 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

ADJUSTED COMPANY FUNDS FROM OPERATIONS & COMPANY FUNDS AVAILABLE FOR DISTRIBUTION

(Unaudited and in thousands, except share and per share data)

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| FUNDS FROM OPERATIONS: | | | | | | | | | | | | | | | | |

| Basic and Diluted: | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders | | $ | 3,916 | | | $ | (26,975 | ) | | $ | 49,832 | | | $ | 74,718 | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 42,015 | | | | 38,642 | | | | 124,633 | | | | 119,523 | |

| Impairment charges - real estate, including non-consolidated entities | | | 21,986 | | | | 72,890 | | | | 41,795 | | | | 75,904 | |

| Noncontrolling interests - OP units | | | (173 | ) | | | (2,507 | ) | | | (192 | ) | | | (845 | ) |

| Amortization of leasing commissions | | | 1,480 | | | | 1,646 | | | | 4,073 | | | | 5,164 | |

| Joint venture and noncontrolling interest adjustment | | | 259 | | | | 284 | | | | 864 | | | | 742 | |

| Gains on sales of properties, including non-consolidated entities | | | (10,645 | ) | | | (16,072 | ) | | | (56,530 | ) | | | (63,791 | ) |

| Tax on sales of properties | | | — | | | | — | | | | — | | | | 50 | |

| FFO available to common shareholders and unitholders - basic | | | 58,838 | | | | 67,908 | | | | 164,475 | | | | 211,465 | |

| Preferred dividends | | | 1,573 | | | | 1,573 | | | | 4,718 | | | | 4,718 | |

| Interest and amortization on 6.00% Convertible Guaranteed Notes | | | — | | | | 47 | | | | — | | | | 532 | |

| Amount allocated to participating securities | | | 52 | | | | 50 | | | | 183 | | | | 187 | |

| FFO available to all equityholders and unitholders - diluted | | | 60,463 | | | | 69,578 | | | | 169,376 | | | | 216,902 | |

| Litigation reserve | | | 2,050 | | | | — | | | | 2,050 | | | | — | |

| Debt satisfaction (gains) charges, net | | | (2,424 | ) | | | (2,538 | ) | | | (2,378 | ) | | | 818 | |

| Loan loss | | | — | | | | — | | | | 5,294 | | | | — | |

| Transaction costs | | | 612 | | | | 115 | | | | 1,100 | | | | 329 | |

| Adjusted Company FFO available to all equityholders and unitholders - diluted | | | 60,701 | | | | 67,155 | | | | 175,442 | | | | 218,049 | |

| | | | | | | | | | | | | | | | | |

| FUNDS AVAILABLE FOR DISTRIBUTION: | | | | | | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Straight-line adjustments | | | (4,002 | ) | | | (11,317 | ) | | | (12,552 | ) | | | (35,697 | ) |

| Lease incentives | | | 515 | | | | 414 | | | | 1,456 | | | | 1,256 | |

| Amortization of above/below market leases | | | 320 | | | | 572 | | | | 1,180 | | | | 1,527 | |

| Lease termination payments, net | | | (142 | ) | | | (1,839 | ) | | | (437 | ) | | | (6,402 | ) |

| Non-cash interest, net | | | 795 | | | | (512 | ) | | | 1,447 | | | | (1,526 | ) |

| Non-cash charges, net | | | 2,066 | | | | 2,296 | | | | 6,199 | | | | 6,906 | |

| Tenant improvements | | | (4,072 | ) | | | (1,173 | ) | | | (10,067 | ) | | | (1,292 | ) |

| Lease costs | | | (2,228 | ) | | | (1,458 | ) | | | (5,284 | ) | | | (6,165 | ) |

| Company Funds Available for Distribution | | $ | 53,953 | | | $ | 54,138 | | | $ | 157,384 | | | $ | 176,656 | |

| | | | | | | | | | | | | | | | | |

| Per Common Share and Unit Amounts | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | |

| FFO | | $ | 0.24 | | | $ | 0.29 | | | $ | 0.68 | | | $ | 0.89 | |

| | | | | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | |

| FFO | | $ | 0.24 | | | $ | 0.29 | | | $ | 0.69 | | | $ | 0.89 | |

| Adjusted Company FFO | | $ | 0.25 | | | $ | 0.28 | | | $ | 0.71 | | | $ | 0.89 | |

| | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | |

| Weighted-average common shares outstanding - basic EPS | | | 237,989,098 | | | | 234,207,396 | | | | 237,632,572 | | | | 233,151,600 | |

| Operating partnership units(1) | | | 3,646,869 | | | | 3,815,386 | | | | 3,713,867 | | | | 3,818,117 | |

| Weighted-average common shares outstanding - basic FFO | | | 241,635,967 | | | | 238,022,782 | | | | 241,346,439 | | | | 236,969,717 | |

| | | | | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | |

| Weighted-average common shares outstanding - diluted EPS | | | 241,702,715 | | | | 234,207,396 | | | | 241,442,227 | | | | 237,215,883 | |

| Operating partnership units(1) | | | — | | | | 3,815,386 | | | | — | | | | — | |

| 6% Convertible Guaranteed Notes | | | — | | | | 508,912 | | | | — | | | | 1,439,456 | |

| Unvested share-based payment awards | | | 655,228 | | | | 570,260 | | | | 650,348 | | | | 478,329 | |

| Share Options | | | — | | | | 238,395 | | | | — | | | | — | |

| Preferred shares - Series C | | | 4,710,570 | | | | 4,710,570 | | | | 4,710,570 | | | | 4,710,570 | |

| Weighted-average common shares outstanding - diluted FFO | | | 247,068,513 | | | | 244,050,919 | | | | 246,803,145 | | | | 243,844,238 | |

| (1) | Includes OP units other than OP units held by Lexington. |

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

2017 EARNINGS GUIDANCE

| | | Twelve Months Ended

December 31, 2017 | |

| | | Range | |

| Estimated: | | | | | | | | |

| Net income attributable to common shareholders per diluted common share(1) | | $ | 0.35 | | | $ | 0.37 | |

| Depreciation and amortization | | | 0.70 | | | | 0.70 | |

| Impact of capital transactions | | | (0.10 | ) | | | (0.10 | ) |

| Estimated Adjusted Company FFO per diluted common share | | $ | 0.95 | | | $ | 0.97 | |

| (1) | Assumes all convertible securities are dilutive. |

LEXINGTON REALTY TRUST

2017 Third Quarter Investment / Capital Recycling Summary

PROPERTY INVESTMENTS

| | | Primary Tenant (Guarantor) | | Location | | Square Feet | | | Property Type | | Initial Basis

($000) | | | Month Closed | | | Primary Lease

Expiration | |

| 1 | | Golden State Foods Corp. (Golden State Enterprises, Inc.) | | Opelika | | AL | | | 165,000 | | | Industrial | | $ | 37,269 | | | July | | | 05/2042 | |

| 2 | | Georgia-Pacific Consumer Products LP (Georgia-Pacific LLC)(6) | | McDonough | | GA | | | 1,121,000 | | | Industrial | | | 66,700 | | | August | | | 01/2028 | |

| 3 | | McCormick & Company, Inc.(1) | | Byhalia | | MS | | | 616,000 | | | Industrial | | | 36,590 | | | September | | | 09/2027 | |

| 4 | | Kellogg Sales Company (Kellogg Company) | | Jackson | | TN | | | 1,062,000 | | | Industrial | | | 57,920 | | | September | | | 10/2027 | |

| 5 | | Nissan North America, Inc. | | Smyrna | | TN | | | 1,505,000 | | | Industrial | | | 104,890 | | | September | | | 04/2027 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 5 | | TOTAL PROPERTY INVESTMENTS(2) | | | | | | | 4,469,000 | | | | | $ | 303,369 | | | | | | | |

CAPITAL RECYCLING

| | | PROPERTY DISPOSITIONS(3) | | | | | | | | | | | | | | | | | | | | | | | |

| | | Primary Tenant | | Location | | Property Type | | Gross

Sale Price

($000) | | | Annualized

Net Income

($000)(5) | | | Annualized

NOI ($000)(4)(5) | | | Month of

Disposition | | % Leased | | | Gross Sale

Price PSF | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | Food Lion, LLC / Delhaize America, Inc. | | Lexington | | NC | | Other | | $ | 1,412 | | | $ | 102 | | | $ | 138 | | | July | | | 100 | % | | $ | 61.39 | |

| 2 | | Vacant | | Rock Hill | | SC | | Multi-tenant - Office | | | 6,250 | | | | (407 | ) | | | (388 | ) | | July | | | 0 | % | | | 59.81 | |

| 3-9 | | Bank of America, N.A.(7) | | Various | | GA | | Other | | | 7,050 | | | | 593 | | | | 841 | | | August | | | 100 | % | | | 129.62 | |

| 10 | | Vacant(8) | | Memphis | | TN | | Multi-tenant - Office | | | 3,496 | | | | (533 | ) | | | (60 | ) | | August | | | 0 | % | | | 93.90 | |

| 11 | | 3D Systems Corporation | | Rock Hill | | SC | | Office | | | 8,600 | | | | 286 | | | | 703 | | | September | | | 100 | % | | | 107.46 | |

| 12 | | Wipro Data Center and Cloud Services, Inc. | | Tempe | | AZ | | Office | | | 15,200 | | | | 553 | | | | 981 | | | September | | | 100 | % | | | 253.33 | |

| 12 | | TOTAL PROPERTY DISPOSITIONS | | | | | | | | $ | 42,008 | | | $ | 594 | | | $ | 2,215 | | | | | | | | | | | |

Footnotes

| (1) | Initial Basis excludes a $133 thousand future tenant improvement allowance and $767 thousand of rent abatements, which were credited at closing. |

| (2) | The above were acquired / completed at aggregate weighted-average GAAP and cash capitalization rates of 6.6% and 5.7%, respectively. |

| (3) | Lexington's property owner subsidiary also abandoned its leasehold interest in the property in Port Chester, NY. |

| (4) | See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (5) | Quarterly period prior to sale; excluding impairment charges, annualized. |

| (6) | Square feet includes a 220,000 square foot expansion that is expected to be completed in 2018. |

| (8) | Conveyed to lender in a foreclosure sale. |

LEXINGTON REALTY TRUST

2017 Third Quarter Forward Purchase Commitments

FORWARD PURCHASE COMMITMENTS(1)

| | | Location | | Property Type | | Sq. Ft. | | | Approximate

Lease Term

(Years) | | Maximum

Acquisition

Cost ($000) | | | Estimated

Completion

Date | | Estimated

GAAP Yield(2) | | | Estimated

Initial Cash

Yield(2) | |

| 1 | | Warren, MI(3) | | Industrial | | | 260,000 | | | 15 | | $ | 47,000 | | | 4Q 17 | | | 8.3 | % | | | 7.3 | % |

| 2 | | Romulus, MI | | Industrial | | | 500,000 | | | 15 | | | 39,330 | | | 4Q 17 | | | 6.5 | % | | | 6.1 | % |

| 3 | | Lafayette, IN | | Industrial | | | 309,000 | | | 7 | | | 17,450 | | | 4Q 17 | | | 7.0 | % | | | 6.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 | | TOTAL FORWARD PURCHASE COMMITMENTS | | | | | 1,069,000 | | | | | $ | 103,780 | | | | | | 7.4 | % | | | 6.8 | % |

Footnotes

| (1) | Lexington can give no assurance that any of the potential investments that are under commitment or contract will be completed or, if completed, will perform to Lexington's expectations. |

| (2) | See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (3) | A $4.6 million letter of credit secures the obligation to purchase this property. |

LEXINGTON REALTY TRUST

2017 Third Quarter Financing Summary

DEBT RETIRED

| | | Location | | Primary Tenant | | Property Type | | Face /

Satisfaction

($000) | | | Fixed Rate | | | Maturity

Date |

| | | | | | | | | | | | | | | |

| | | Consolidated Mortgage Debt: | | | | | | | | | | | | |

| 1 | | McDonough, GA | | United States Cold Storage, Inc. | | Industrial | | $ | 21,731 | | | | 6.110 | % | | 11/2017 |

| 2 | | Memphis, TN(1) | | Vacant | | Office | | | 3,496 | | | | 5.710 | % | | N/A |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | $ | 25,227 | | | | | | | |

CORPORATE LEVEL FINANCING(2)

| Type | | Amount ($000) | | | Current Interest

Rate | | Maturity

Date |

| Revolving Credit Facility | | $ | 200,000 | | | LIBOR plus 100 bps | | 08/2019 |

| Term Loan | | | 50,000 | | | LIBOR plus 110 bps | | 08/2020 |

| Term Loan | | | 45,000 | | | LIBOR plus 110 bps | | 01/2021 |

| | | $ | 295,000 | | | | | |

Footnotes:

| (1) | Property conveyed to lender in a foreclosure sale. |

| (2) | Lexington amended its unsecured credit agreement, increasing the capacity by $200.0 million, consisting of a $105.0 million increase to the revolving credit facility, a $50.0 million increase to the term loan maturing in 2020 and a $45.0 million increase to the term loan maturing in 2021. |

LEXINGTON REALTY TRUST

2017 Third Quarter Leasing Summary

LEASE EXTENSIONS

| | | Tenant (Guarantor) | | Location | | Prior

Term | | Lease

Expiration

Date | | Sq. Ft. | | | New GAAP

Rent Per

Annum

($000)(1) | | | Prior GAAP

Rent Per

Annum

($000) | | | New Cash

Rent Per

Annum

($000)(1)(3) | | | Prior Cash

Rent Per

Annum

($000)(3) | |

| | | Office / Multi-Tenant Office | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1-5 | | Various | | Honolulu | | HI | | 2017 | | 2018-2021 | | | 6,196 | | | $ | 151 | | | $ | 148 | | | $ | 151 | | | $ | 148 | |

| 6 | | Atlantic Health System, Inc. | | Rockaway | | NJ | | 12/2027 | | 12/2029 | | | 92,326 | | | | 1,235 | | | | 1,194 | | | | 1,562 | | | | 1,474 | |

| 7 | | New Cingular Wireless PCS, LLC | | Baton Rouge | | LA | | 10/2017 | | 10/2022 | | | 70,100 | | | | 1,165 | | | | 1,058 | | | | 1,122 | | | | 1,101 | |

| 7 | | Total office lease extensions | | | | | | | | | | | 168,622 | | | $ | 2,551 | | | $ | 2,400 | | | $ | 2,835 | | | $ | 2,723 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Industrial | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | ODW Logistics, Inc. (Nessent Ltd. And Dist-Trans Co, LLC) | | Columbus | | OH | | 06/2018 | | 06/2020 | | | 772,450 | | | $ | 1,347 | | | $ | 1,342 | | | $ | 1,347 | | | $ | 1,347 | |

| 2 | | Tenneco Automotive Operating Company, Inc. (Tenneco, Inc.) | | Marshall | | MI | | 09/2018 | | 09/2028 | | | 246,508 | | | | 813 | | | | 698 | | | | 740 | | | | 841 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2 | | Total industrial lease extensions | | | | | | | | | | | 1,018,958 | | | $ | 2,160 | | | $ | 2,040 | | | $ | 2,087 | | | $ | 2,188 | |

| | | | | | | | | ` | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 9 | | TOTAL EXTENDED LEASES | | | | | | | | | | | 1,187,580 | | | $ | 4,711 | | | $ | 4,440 | | | $ | 4,922 | | | $ | 4,911 | |

NEW LEASES

| | | Tenant (Guarantor) | | Location | | | Lease

Expiration

Date | | Sq. Ft. | | | New GAAP

Rent Per

Annum

($000)(1) | | | New Cash

Rent Per

Annum

($000)(1)(3) | | |

| | | Office/Multi-Tenant Office | | | | | | | | | | | | | | | | | | | | |

| 1-3 | | Various | | Honolulu | | HI | | | 2018-2020 | | | 952 | | | $ | 6 | | | $ | 6 | | |

| 3 | | Total office new leases | | | | | | | | | | 952 | | | $ | 6 | | | $ | 6 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 3 | | TOTAL NEW LEASES | | | | | | | | | | 952 | | | $ | 6 | | | $ | 6 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 12 | | TOTAL NEW AND EXTENDED LEASES | | | | | | | | | | 1,188,532 | | | $ | 4,717 | | | $ | 4,928 | | |

LEXINGTON REALTY TRUST 2017

Third Quarter Leasing Summary (Continued)

LEASE NON-RENEWALS / LEASE REJECTIONS(2)

| | | Tenant | | Location | | Lease

Expiration

Date | | Sq. Ft. | | | 2016 GAAP

Rent ($000) | | | 2016 Cash

Rent ($000)(3) | |

| | | Other | | | | | | | | | | | | | | | | | | |

| 1 | | Gander Mountain Company(4) | | Albany | | GA | | 11/2028 | | | 45,554 | | | $ | 693 | | | $ | 628 | |

| 2 | | Steelcase Inc.(5) | | High Point | | NC | | 09/2017 | | | 244,851 | | | | 1,087 | | | | 1,145 | |

| | | | | | | | | | | | | | | | | | | | | |

| 2 | | TOTAL LEASE NON-RENEWALS / LEASE REJECTIONS | | | | | | | | | 290,405 | | | $ | 1,780 | | | $ | 1,773 | |

Footnotes

| (1) | Assumes twelve months rent from the later of 10/1/17 or lease commencement/extension, excluding free rent periods as applicable. |

| (2) | Excludes multi-tenant properties and non-consolidated investments. |

| (3) | See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (4) | Tenant declared bankruptcy and rejected the lease. |

| (5) | Property sold subsequent to 9/30/2017. |

LEXINGTON REALTY TRUST

Other Revenue Data

9/30/2017

($000)

Other Revenue Data

| | | GAAP Rent | |

| Asset Class | | Nine months ended | |

| | | 9/30/17(1) | | | 9/30/17

Percentage | | | 9/30/16

Percentage | |

| Office | | $ | 136,633 | | | | 53.0 | % | | | 54.1 | % |

| Industrial | | | 107,981 | | | | 41.9 | % | | | 38.6 | % |

| Multi-tenant | | | 7,363 | | | | 2.8 | % | | | 3.7 | % |

| Other | | | 5,930 | | | | 2.3 | % | | | 3.6 | % |

| | | $ | 257,907 | | | | 100.0 | % | | | 100.0 | % |

| | | GAAP Rent | |

| Credit Ratings (2) | | Nine months ended | |

| | | 9/30/17(1) | | | 9/30/17

Percentage | | | 9/30/16

Percentage | |

| Investment Grade | | $ | 101,648 | | | | 39.4 | % | | | 37.9 | % |

| Non-Investment Grade | | | 41,029 | | | | 15.9 | % | | | 16.5 | % |

| Unrated | | | 115,230 | | | | 44.7 | % | | | 45.6 | % |

| | | $ | 257,907 | | | | 100.0 | % | | | 100.0 | % |

| Weighted-Average Lease Term - Cash Basis | As of 9/30/17 | | As of 9/30/16 | |

| | 9.1 years | | 8.6 years | |

Rent Estimates for Current Assets

| Year | | GAAP (3) | | | Cash (3) | | | Difference | |

| 2017 - remaining | | $ | 92,116 | | | $ | 85,705 | | | $ | (6,411 | ) |

| 2018 | | | 362,213 | | | | 346,217 | | | | (15,996 | ) |

Footnotes

| (1) | Nine months ended 9/30/2017 GAAP rent, excluding termination income, recognized for consolidated properties owned as of 9/30/2017. |

| (2) | Credit ratings are based upon either tenant, guarantor or parent. Generally, multi-tenant assets are included in unrated. |

| (3) | Amounts assume (1) lease terms for non-cancellable periods only, (2) no new or renegotiated leases are entered into after 9/30/2017, and (3) no properties are sold or acquired after 9/30/2017. |

LEXINGTON REALTY TRUST

Other Revenue Data (Continued)

9/30/2017

($000)

Same-Store NOI(1)

| | | Nine months ended September 30, | |

| | | 2017 | | | 2016 | |

| Total Cash Rent | | $ | 218,871 | | | $ | 218,710 | |

| Tenant Reimbursements | | | 18,788 | | | | 19,807 | |

| Property Operating Expenses | | | (28,461 | ) | | | (28,388 | ) |

| Same-Store NOI | | $ | 209,198 | | | $ | 210,129 | |

| | | | | | | | | |

| Change in Same-Store NOI | | | (0.4 | %) | | | | |

| | | | | | | | | |

| Same-Store Percent Leased(2) | | As of 9/30/17 | | | As of 9/30/16 | |

| | | 97.2 | % | | | 98.9 | % |

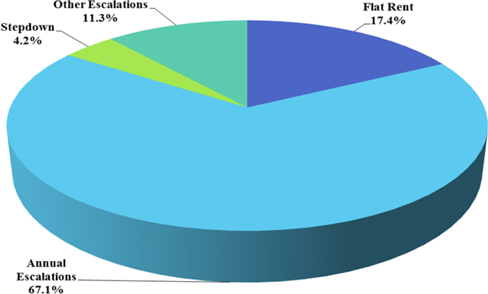

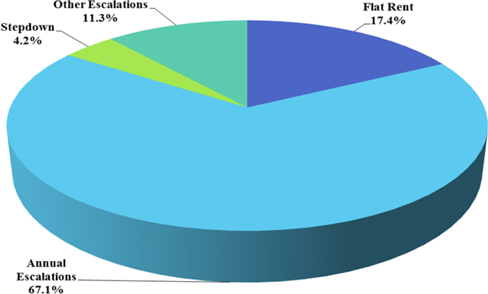

Lease Escalation Data(3)

Footnotes

| (1) | NOI is on a consolidated cash basis for all consolidated properties except properties acquired and sold in 2017 and 2016 and properties subject to mortgage loans in default at September 30, 2017. See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (2) | Excludes properties acquired or sold in 2017 and 2016 and properties subject to mortgage loans in maturity default as of 9/30/2017. |

| (3) | Based on nine months consolidated cash rents for single-tenant leases (properties greater than 70% leased) owned as of September 30, 2017. Excludes parking operations and rents from prior tenants. |

LEXINGTON REALTY TRUST

Portfolio Detail By Asset Class

9/30/2017

($000, except square footage)

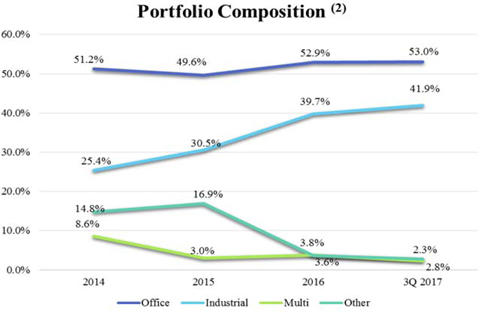

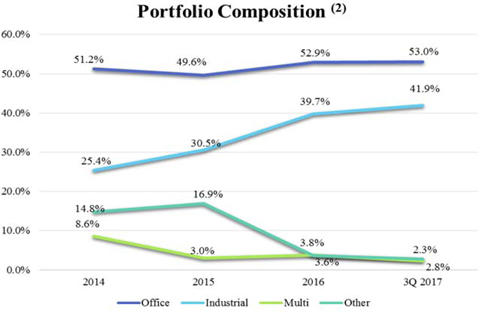

| Asset Class | | YE 2014 | | | YE 2015 | | | YE 2016 | | | Q3 2017 | |

| | | | | | | | | | | | | |

| Office | | | | | | | | | | | | | | | | |

| % of ABR(1) | | | 51.2 | % | | | 49.6 | % | | | 52.9 | % | | | 53.0 | % |

| LTL(5) | | | 31.4 | % | | | 23.2 | % | | | 26.9 | % | | | 33.1 | % |

| STL(6) | | | 68.6 | % | | | 76.8 | % | | | 73.1 | % | | | 66.9 | % |

| Leased | | | 98.6 | % | | | 99.6 | % | | | 99.6 | % | | | 99.6 | % |

| Wtd. Avg. Lease Term(2) | | | 7.4 | | | | 7.2 | | | | 7.2 | | | | 7.7 | |

| Mortgage Debt | | $ | 426,635 | | | $ | 329,696 | | | $ | 490,948 | | | $ | 474,060 | |

| % Investment Grade(1) | | | 53.3 | % | | | 48.0 | % | | | 48.1 | % | | | 51.5 | % |

| Square Feet | | | 13,264,134 | | | | 12,847,877 | | | | 11,569,940 | | | | 11,177,159 | |

| | | | | | | | | | | | | | | | | |

| Industrial | | | | | | | | | | | | | | | | |

| % of ABR(1) | | | 25.4 | % | | | 30.5 | % | | | 39.7 | % | | | 41.9 | % |

| LTL(5) | | | 47.9 | % | | | 47.4 | % | | | 50.8 | % | | | 48.2 | % |

| STL(6) | | | 52.1 | % | | | 52.6 | % | | | 49.2 | % | | | 51.8 | % |

| Leased | | | 99.7 | % | | | 99.6 | % | | | 99.9 | % | | | 99.9 | % |

| Wtd. Avg. Lease Term(2) | | | 8.8 | | | | 10.1 | | | | 10.4 | | | | 10.5 | |

| Mortgage Debt | | $ | 177,951 | | | $ | 292,293 | | | $ | 240,790 | | | $ | 195,151 | |

| % Investment Grade(1) | | | 26.6 | % | | | 27.9 | % | | | 26.2 | % | | | 26.4 | % |

| Square Feet | | | 22,745,140 | | | | 25,693,585 | | | | 27,476,653 | | | | 33,926,828 | |

| | | | | | | | | | | | | | | | | |

| Multi-Tenant | | | | | | | | | | | | | | | | |

| % of ABR(1) | | | 8.6 | % | | | 3.0 | % | | | 3.8 | % | | | 2.8 | % |

| Leased | | | 53.9 | % | | | 44.1 | % | | | 43.2 | % | | | 52.7 | % |

| Wtd. Avg. Lease Term(2) | | | 6.9 | | | | 3.4 | | | | 3.0 | | | | 2.8 | |

| Mortgage Debt | | $ | 116,763 | | | $ | 14,118 | | | $ | 10,586 | | | $ | 7,014 | |

| % Investment Grade(1) | | | 19.3 | % | | | 36.9 | % | | | 14.2 | % | | | 25.2 | % |

| Square Feet | | | 2,414,889 | | | | 2,301,864 | | | | 2,971,126 | | | | 1,973,230 | |

| | | | | | | | | | | | | | | | | |

| Other | | | | | | | | | | | | | | | | |

| % of ABR(1) | | | 14.8 | % | | | 16.9 | % | | | 3.6 | % | | | 2.3 | % |

| LTL(5) | | | 86.8 | % | | | 88.0 | % | | | 42.7 | % | | | 48.6 | % |

| STL(6) | | | 13.2 | % | | | 12.0 | % | | | 57.3 | % | | | 51.4 | % |

| Leased | | | 94.3 | % | | | 98.0 | % | | | 100.0 | % | | | 100.0 | % |

| Wtd. Avg. Lease Term(2)(3) | | | 18.2 | | | | 18.5 | | | | 14.6 | | | | 19.0 | |

| Mortgage Debt | | $ | 226,645 | | | $ | 255,218 | | | $ | 2,849 | | | $ | 710 | |

| % Investment Grade(1) | | | 4.5 | % | | | 3.3 | % | | | 17.8 | % | | | 14.9 | % |

| Square Feet | | | 1,447,724 | | | | 1,426,697 | | | | 1,306,578 | | | | 866,648 | |

| | | | | | | | | | | | | | | | | |

| Loans Receivable | | $ | 105,635 | | | $ | 95,871 | | | $ | 94,210 | | | $ | - | |

| Construction in progress(4) | | $ | 121,184 | | | $ | 103,954 | | | $ | 111,771 | | | $ | 1,077 | |

Footnotes

(1) Percentage of GAAP rent, excluding termination income, for consolidated properties owned as of each respective period.

(2) Cash basis.

(3) Cash basis adjusted to reflect NY land leases to the first purchase option date, as applicable.

(4) Includes development classified as real estate under construction on a consolidated basis.

(5) Long-term leases ("LTL") are defined as leases having a remaining term of ten years or longer.

(6) Short-term leases ("STL") are defined as leases having a remaining term of less than ten years.

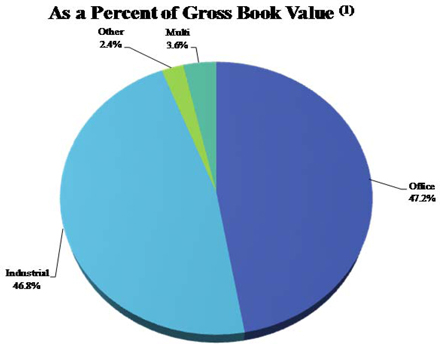

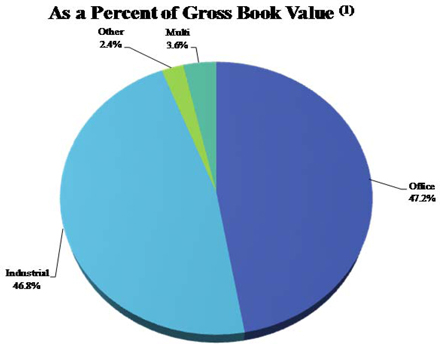

LEXINGTON REALTY TRUST

Portfolio Composition

9/30/2017

Footnotes

(1) Based on gross book value of real estate assets and real estate under construction as of 9/30/2017; excludes held for sale assets.

(2) Based on respective period GAAP rent, excluding termination income.

LEXINGTON REALTY TRUST

Components of Net Asset Value

9/30/2017

($000)

The purpose of providing the following information is to enable readers to derive their own estimates of net asset value. This information is not intended to be an asset-by-asset or enterprise valuation.

| Consolidated properties nine month net operating income (NOI)(1) | | | | |

| Office | | $ | 126,010 | |

| Industrial | | | 96,925 | |

| Multi-Tenant | | | 2,804 | |

| Other | | | 4,332 | |

| Total Net Operating Income | | $ | 230,071 | |

| | | | | |

| Lexington's share of non-consolidated nine month NOI(1) | | | | |

| Office | | $ | 314 | |

| Other | | | 623 | |

| | | $ | 937 | |

| Other income | | | | |

| Advisory fees | | $ | 776 | |

| | | | | |

| | | | | |

| In service assets not fairly valued by capitalized NOI method(1) | | | | |

| Wholly-owned assets less than 70% leased | | $ | 62,545 | |

| Wholly-owned assets acquired in 2017(2) | | $ | 512,268 | |

| Non-consolidated asset completed in 2016 | | $ | 56,823 | |

| | | | | |

| Add other assets: | | | | |

| Assets held for sale | | $ | 8,638 | |

| Development investment at cost incurred | | | 1,077 | |

| Cash and cash equivalents | | | 140,545 | |

| Restricted cash | | | 34,946 | |

| Accounts receivable, net | | | 6,388 | |

| Other assets | | | 32,124 | |

| Total other assets | | $ | 223,718 | |

| | | | | |

| Liabilities: | | | | |

| Corporate level debt (face amount) | | $ | 1,429,120 | |

| Mortgages and notes payable (face amount) | | | 676,935 | |

| Liabilities held for sale | | | 442 | |

| Dividends payable | | | 48,494 | |

| Accounts payable, accrued expenses and other liabilities | | | 63,782 | |

| Preferred stock, at liquidation value | | | 96,770 | |

| Lexington's share of non-consolidated mortgages | | | 8,395 | |

| Total deductions | | $ | 2,323,938 | |

| | | | | |

| Common shares & OP units at 9/30/2017 | | | 244,275,538 | |

Footnotes

| (1) | NOI for the existing property portfolio at September 30, 2017, excludes NOI related to assets undervalued by a capitalized NOI method and assets held for sale. Assets undervalued by a capitalized NOI method are identified generally by occupancies under 70% and assets acquired in 2017. For assets in this category an NOI capitalization approach is not appropriate, and accordingly, Lexington's net book value has been used. See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (2) | Excludes Lake Jackson, TX, which is included in NOI above. |

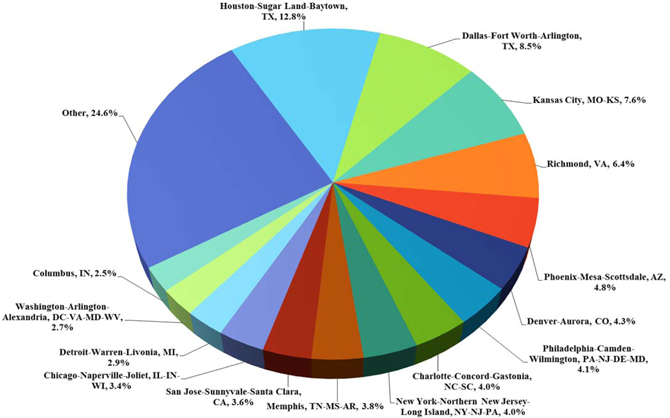

LEXINGTON REALTY TRUST

Top Markets

9/30/2017

| | | Core Based Statistical Area(2) | | Percent of

GAAP Rent as of

9/30/17 (1) | |

| 1 | | Houston-Sugar Land-Baytown, TX | | | 10.8 | % |

| 2 | | Dallas-Fort Worth-Arlington, TX | | | 5.1 | % |

| 3 | | Memphis, TN-MS-AR | | | 4.7 | % |

| 4 | | Kansas City, MO-KS | | | 4.3 | % |

| 5 | | Kennewick-Pasco-Richland, WA | | | 3.8 | % |

| 6 | | New York-Northern New Jersey-Long Island, NY-NJ-PA | | | 3.6 | % |

| 7 | | Richmond, VA | | | 3.4 | % |

| 8 | | Phoenix-Mesa-Scottsdale, AZ | | | 3.2 | % |

| 9 | | Chicago-Naperville-Joliet, IL-IN-WI | | | 2.9 | % |

| 10 | | Detroit-Warren-Livonia, MI | | | 2.6 | % |

| 11 | | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | | | 2.5 | % |

| 12 | | Denver-Aurora, CO | | | 2.3 | % |

| 13 | | Columbus, OH | | | 2.2 | % |

| 14 | | Charlotte-Concord-Gastonia, NC-SC | | | 2.1 | % |

| 15 | | Las Vegas-Paradise, NV | | | 2.0 | % |

| 16 | | San Jose-Sunnyvale-Santa Clara, CA | | | 1.9 | % |

| 17 | | Jackson, MS | | | 1.8 | % |

| 18 | | Atlanta-Sandy Springs-Marietta, GA | | | 1.5 | % |

| 19 | | Washington-Arlington-Alexandria, DC-VA-MD-WV | | | 1.4 | % |

| 20 | | Indianapolis-Carmel, IN | | | 1.4 | % |

| | | Total Top Markets(3) | | | 63.7 | % |

Footnotes

| (1) | Nine months ended 9/30/2017 GAAP rent, excluding termination income, recognized for consolidated properties owned as of 9/30/2017. |

| (2) | A Core Based Statistical Area is the official term for a functional region based around an urban center of at least 10,000 people, based on standards published by the Office of Management and Budget (OMB) in 2000. These standards are used to replace the definitions of metropolitan areas that were defined in 1990. |

| (3) | Total shown may differ from detailed amounts due to rounding. |

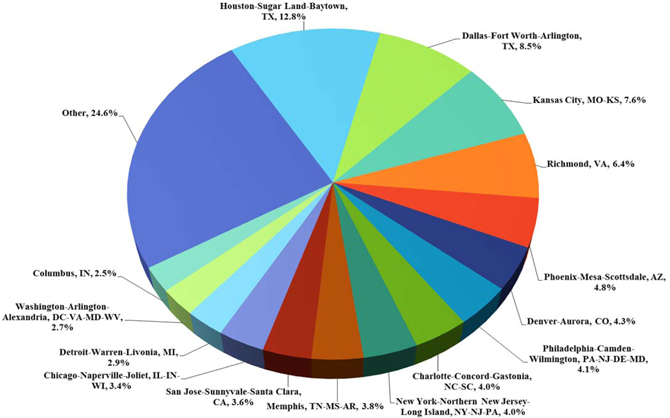

LEXINGTON REALTY TRUST

Single-Tenant Office Markets(1)(2)

9/30/2017

Footnotes

| (1) | Nine months ended 9/30/2017 GAAP rent, excluding termination income, recognized for consolidated single-tenant office properties owned as of 9/30/2017. |

| (2) | A Core Based Statistical Area is the official term for a functional region based around an urban center of at least 10,000 people, based on standards published by the Office of Management and Budget (OMB) in 2000. These standards are used to replace the definitions of metropolitan areas that were defined in 1990. |

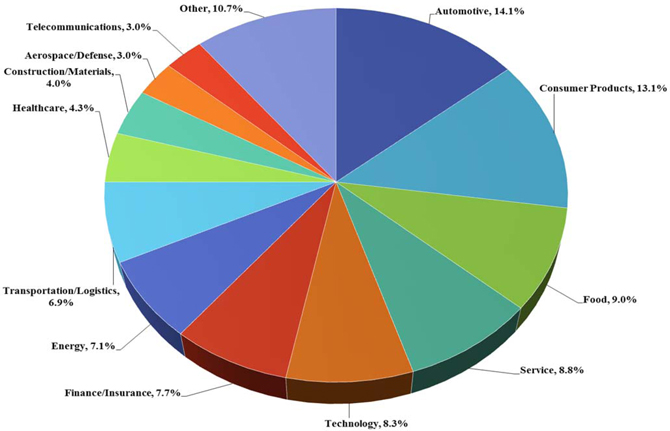

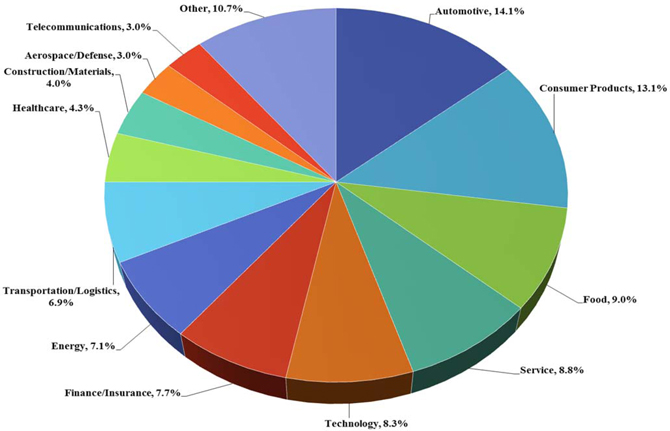

LEXINGTON REALTY TRUST

Tenant Industry Diversification(1)

9/30/2017

Footnotes

(1) Nine months ended 9/30/2017 GAAP rent, excluding termination income, recognized for consolidated properties owned as of 9/30/2017.

LEXINGTON REALTY TRUST

Top 10 Tenants or Guarantors

9/30/2017

Top 10 Tenants or Guarantors - GAAP Basis

| Tenants or Guarantors | | Number

of Leases | | Sq. Ft.

Leased | | | Sq. Ft. Leased

as a Percent of

Consolidated

Portfolio(2) | | | GAAP

Rent as of

9/30/2017

($000)(1) | | | Percent of

GAAP Rent

as of

9/30/2017

($000)(1) (2) | |

| The Dow Chemical Company | | 1 | | | 664,100 | | | | 1.4 | % | | $ | 10,906 | | | | 4.2 | % |

| Preferred Freezer Services of Richland, LLC / Preferred Freezer Services, LLC & Preferred Freezer Services Operating, LLC | | 1 | | | 456,412 | | | | 1.0 | % | | | 9,850 | | | | 3.8 | % |

| FedEx Corporation / Federal Express Corporation | | 2 | | | 661,616 | | | | 1.4 | % | | | 9,111 | | | | 3.5 | % |

| Metalsa Structural Products, Inc. / Dana Structural Products, LLC / Dana Holding Corporation and Dana Limited | | 7 | | | 2,053,359 | | | | 4.3 | % | | | 7,456 | | | | 2.9 | % |

| Nissan North America, Inc. | | 3 | | | 3,196,049 | | | | 6.7 | % | | | 7,292 | | | | 2.8 | % |

| United States of America | | 3 | | | 398,214 | | | | 0.8 | % | | | 7,244 | | | | 2.8 | % |

| Swiss Re America Holding Corporation / Westport Insurance Corporation / Swiss Re Management (US) Corporation | | 2 | | | 476,123 | | | | 1.0 | % | | | 5,913 | | | | 2.3 | % |

| McGuireWoods LLP | | 1 | | | 224,537 | | | | 0.5 | % | | | 5,388 | | | | 2.1 | % |

| Morgan, Lewis & Bockius LLP | | 1 | | | 289,432 | | | | 0.6 | % | | | 5,168 | | | | 2.0 | % |

| Industrial Terminals Management, L.L.C. / Maritime Holdings (Delaware) LLC | | 1 | | | 132,449 | | | | 0.3 | % | | | 5,080 | | | | 2.0 | % |

| | | 22 | | | 8,552,291 | | | | 17.8 | % | | $ | 73,408 | | | | 28.5 | % |

Footnotes

(1) Nine months ended 9/30/2017 GAAP rent, excluding termination income, recognized for consolidated properties owned as of 9/30/2017.

(2) Total shown may differ from detailed amounts due to rounding.

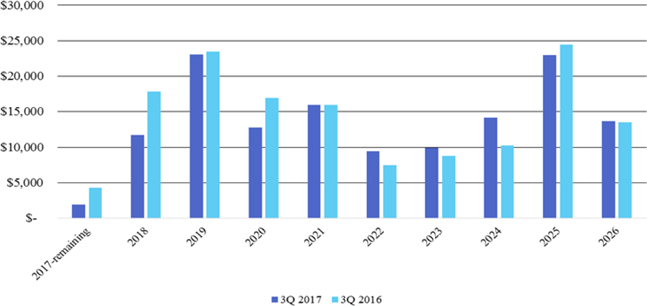

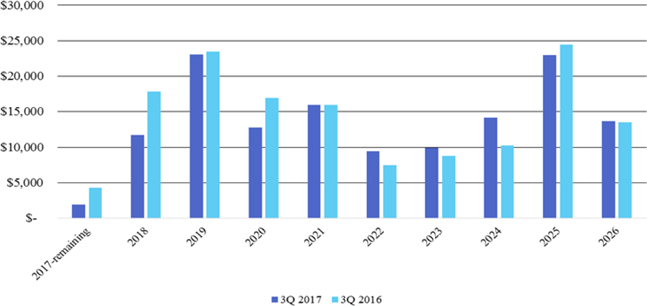

LEXINGTON REALTY TRUST

Lease Rollover Schedule - Consolidated Single-Tenant Properties GAAP Basis

9/30/2017

($000)

| Year | | Number of

Leases

Expiring | | | GAAP

Rent as of

9/30/2017 | | | Percent of

GAAP Rent

as of

9/30/2017 | | | Percent of

GAAP Rent

as of

9/30/2016 | |

| 2017 - remaining | | | 3 | | | $ | 1,924 | | | | 0.8 | % | | | 1.8 | % |

| 2018 | | | 19 | | | | 11,686 | | | | 4.7 | % | | | 7.4 | % |

| 2019 | | | 18 | | | | 23,063 | | | | 9.3 | % | | | 9.7 | % |

| 2020 | | | 13 | | | | 12,802 | | | | 5.2 | % | | | 7.0 | % |

| 2021 | | | 11 | | | | 15,954 | | | | 6.4 | % | | | 6.6 | % |

| 2022 | | | 6 | | | | 9,460 | | | | 3.8 | % | | | 3.1 | % |

| 2023 | | | 10 | | | | 9,945 | | | | 4.0 | % | | | 3.6 | % |

| 2024 | | | 12 | | | | 14,192 | | | | 5.7 | % | | | 4.2 | % |

| 2025 | | | 17 | | | | 22,979 | | | | 9.2 | % | | | 10.1 | % |

| 2026 | | | 14 | | | | 13,656 | | | | 5.5 | % | | | 5.6 | % |

| Thereafter | | | 59 | | | | 112,939 | | | | 45.4 | % | | | 37.2 | % |

| | | | | | | | | | | | | | | | | |

| Total(1) | | | 182 | | | $ | 248,600 | | | | 100.0 | % | | | | |

Footnotes

(1) Total shown may differ from detailed amounts due to rounding and does not include multi-tenant properties, parking operations and lease termination income.

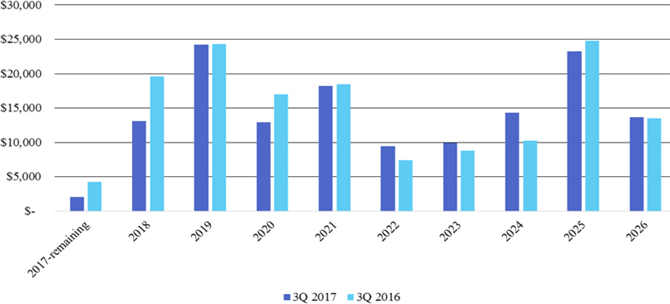

LEXINGTON REALTY TRUST

Lease Rollover Schedule - Consolidated Properties GAAP Basis

9/30/2017

($000)

| Year | | Number of

Leases

Expiring | | | GAAP

Rent as of

9/30/2017 | | | Percent of

GAAP Rent

as of

9/30/2017 | |

| 2017 - remaining | | | 21 | | | $ | 2,022 | | | | 0.8 | % |

| 2018 | | | 37 | | | | 13,132 | | | | 5.2 | % |

| 2019 | | | 26 | | | | 24,240 | | | | 9.5 | % |

| 2020 | | | 18 | | | | 12,906 | | | | 5.1 | % |

| 2021 | | | 17 | | | | 18,248 | | | | 7.2 | % |

| 2022 | | | 6 | | | | 9,460 | | | | 3.7 | % |

| 2023 | | | 10 | | | | 9,945 | | | | 3.9 | % |

| 2024 | | | 14 | | | | 14,314 | | | | 5.6 | % |

| 2025 | | | 18 | | | | 23,287 | | | | 9.2 | % |

| 2026 | | | 14 | | | | 13,656 | | | | 5.4 | % |

| Thereafter | | | 60 | | | | 113,264 | | | | 44.5 | % |

| | | | | | | | | | | | | |

| Total(1) | | | 241 | | | $ | 254,474 | | | | 100.0 | % |

Footnotes

(1) Total shown may differ from detailed amounts due to rounding and does not include parking operations and lease termination income.

LEXINGTON REALTY TRUST

Property Leases and Vacancies - Consolidated Portfolio - 9/30/2017

Year of Lease

Expiration | | Date of Lease

Expiration | | Property Location | | City | | State | | Note | | Primary Tenant (Guarantor) | | Sq.Ft.

Leased or

Available(1) | | | GAAP

Rent

as of

9/30/2017

($000)(3) | | | Cash

Rent

as of

9/30/2017

($000)(2) | | | 9/30/2017

Debt Balance

($000) | | | Debt

Maturity |

| OFFICE PROPERTIES | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2017 | | 10/31/2017 | | 5201 West Barraque St. | | Pine Bluff | | AR | | 18 | | Entergy Services, Inc. | | | 27,189 | | | | 240 | | | | 290 | | | | - | | | - |

| | | 12/1/2017 | | 800 East Canal St. | | Richmond | | VA | | 5 | | CRG-Richmond Tenant, LLC | | | 42,947 | | | | 247 | | | | 247 | | | | - | | | - |

| 2018 | | 2/28/2018 | | 850-950 Warrenville Rd. | | Lisle | | IL | | 18 | | Flexible Steel Lacing Company, d/b/a Flexco, Inc. | | | 7,535 | | | | 109 | | | | 109 | | | | - | | | - |

| | | 5/31/2018 | | 8900 Freeport Pkwy. | | Irving | | TX | | — | | Pacific Union Financial, LLC. | | | 43,396 | | | | 588 | | | | 684 | | | | - | | | - |

| | | 6/30/2018 | | 100 Barnes Rd. | | Wallingford | | CT | | — | | 3M Company | | | 44,400 | | | | 381 | | | | 396 | | | | - | | | - |

| | | 8/31/2018 | | 3500 North Loop Rd. | | McDonough | | GA | | — | | Litton Loan Servicing LP | | | 62,218 | | | | 740 | | | | 1,025 | | | | - | | | - |

| | | 9/30/2018 | | 1701 Market St. | | Philadelphia | | PA | | — | | CBC Restaurant Corp. | | | 8,070 | | | | 158 | | | | 168 | | | | - | | | - |

| | | 10/31/2018 | | 3943 Denny Ave. | | Pascagoula | | MS | | — | | Huntington Ingalls Incorporated | | | 94,841 | | | | 445 | | | | 445 | | | | - | | | - |

| | | 12/22/2018 | | 5200 Metcalf Ave. | | Overland Park | | KS | | — | | Swiss Re America Holding Corporation / Westport Insurance Corporation / Swiss Re Management (US) Corporation | | | 320,198 | | | | 4,055 | | | | 4,031 | | | | 33,002 | | | 05/2019 |

| 2019 | | 1/31/2019 | | 2999 Southwest 6th St. | | Redmond | | OR | | — | | VoiceStream PCS I, LLC / T-Mobile West Corporation (T-Mobile USA, Inc.) | | | 77,484 | | | | 1,101 | | | | 1,337 | | | | - | | | - |

| | | | | 820 Gears Rd. | | Houston | | TX | | — | | Ricoh USA, Inc. | | | 78,895 | | | | 865 | | | | 855 | | | | - | | | - |

| | | 2/28/2019 | | 10475 Crosspoint Blvd. | | Indianapolis | | IN | | — | | DMC Insurance Inc. | | | 3,764 | | | | 52 | | | | 52 | | | | - | | | - |

| | | 4/1/2019 | | 9201 Stateline Rd. | | Kansas City | | MO | | — | | Swiss Re America Holding Corporation / Westport Insurance Corporation / Swiss Re Management (US) Corporation | | | 155,925 | | | | 1,858 | | | | 1,858 | | | | 15,728 | | | 05/2019 |

| | | 6/19/2019 | | 3965 Airways Blvd. | | Memphis | | TN | | — | | Federal Express Corporation | | | 521,286 | | | | 5,260 | | | | 5,293 | | | | - | | | - |

| | | 6/30/2019 | | 3265 East Goldstone Dr. | | Meridian | | ID | | — | | VoiceStream PCS Holding, LLC / T-Mobile PCS Holdings, LLC (T-Mobile USA, Inc.) | | | 77,484 | | | | 829 | | | | 1,096 | | | | 8,544 | | | 08/2019 |

| | | 7/15/2019 | | 19019 North 59th Ave. | | Glendale | | AZ | | — | | Honeywell International Inc. | | | 252,300 | | | | 1,426 | | | | 1,460 | | | | - | | | - |

| | | 7/31/2019 | | 500 Jackson St. | | Columbus | | IN | | — | | Cummins Inc. | | | 390,100 | | | | 3,405 | | | | 3,571 | | | | 13,333 | | | 07/2019 |

| | | 10/31/2019 | | 10475 Crosspoint Blvd. | | Indianapolis | | IN | | — | | John Wiley & Sons, Inc. | | | 123,416 | | | | 1,702 | | | | 1,736 | | | | - | | | - |

| | | | | 9601 Renner Blvd. | | Lenexa | | KS | | — | | VoiceStream PCS II Corporation (T-Mobile USA, Inc.) | | | 77,484 | | | | 857 | | | | 1,115 | | | | 8,739 | | | 12/2019 |

| | | 12/31/2019 | | 850-950 Warrenville Rd. | | Lisle | | IL | | 4, 18 | | National-Louis University | | | 91,879 | | | | 1,122 | | | | 1,225 | | | | 9,120 | | | N/A |

| 2020 | | 2/14/2020 | | 5600 Broken Sound Blvd. | | Boca Raton | | FL | | — | | Canon Solutions America, Inc. (Oce - USA Holding, Inc.) | | | 143,290 | | | | 1,683 | | | | 1,875 | | | | 19,157 | | | 02/2020 |

| | | 5/31/2020 | | 2401 Cherahala Blvd. | | Knoxville | | TN | | — | | AdvancePCS, Inc. / CaremarkPCS, L.L.C. | | | 59,748 | | | | 580 | | | | 576 | | | | - | | | - |

| | | 6/30/2020 | | 3711 San Gabriel | | Mission | | TX | | — | | VoiceStream PCS II Corporation / T-Mobile West Corporation | | | 75,016 | | | | 742 | | | | 727 | | | | - | | | - |

| | | 7/31/2020 | | 13775 McLearen Rd. | | Herndon | | VA | | 12 | | Orange Business Services U.S., Inc. (Equant N.V.) | | | 132,617 | | | | 1,256 | | | | 1,362 | | | | - | | | - |

| | | 8/31/2020 | | 133 First Park Dr. | | Oakland | | ME | | — | | Omnipoint Holdings, Inc. (T-Mobile USA, Inc.) | | | 78,610 | | | | 860 | | | | 1,107 | | | | 8,450 | | | 10/2020 |

| | | 9/30/2020 | | 9200 South Park Center Loop | | Orlando | | FL | | 4 | | Zenith Education Group, Inc. (ECMC Group, Inc.) | | | 59,927 | | | | 852 | | | | 876 | | | | 9,309 | | | N/A |

| | | 10/31/2020 | | 12209 West Markham St. | | Little Rock | | AR | | — | | Entergy Arkansas, Inc. | | | 36,311 | | | | 178 | | | | 178 | | | | - | | | - |

| 2021 | | 1/31/2021 | | 1701 Market St. | | Philadelphia | | PA | | — | | Morgan, Lewis & Bockius LLP | | | 289,432 | | | | 3,224 | | | | 3,323 | | | | - | | | - |

| | | 3/31/2021 | | 1701 Market St. | | Philadelphia | | PA | | — | | Car-Tel Communications, Inc. | | | 1,220 | | | | 45 | | | | 45 | | | | - | | | - |

| | | 6/30/2021 | | 1415 Wyckoff Rd. | | Wall | | NJ | | — | | New Jersey Natural Gas Company | | | 157,511 | | | | 2,831 | | | | 2,831 | | | | 11,924 | | | 01/2021 |

| | | | | 2050 Roanoke Rd. | | Westlake | | TX | | — | | Charles Schwab & Co., Inc. | | | 130,199 | | | | 1,129 | | | | 1,152 | | | | - | | | - |

| | | 11/30/2021 | | 29 South Jefferson Rd. | | Whippany | | NJ | | — | | CAE SimuFlite, Inc. (CAE INC.) | | | 123,734 | | | | 1,745 | | | | 1,926 | | | | 12,837 | | | 11/2021 |

| | | 12/31/2021 | | 2800 Waterford Lake Dr. | | Midlothian | | VA | | — | | Alstom Power, Inc. | | | 99,057 | | | | 1,638 | | | | 1,729 | | | | - | | | - |

| 2022 | | 5/30/2022 | | 13651 McLearen Rd. | | Herndon | | VA | | — | | United States of America | | | 159,644 | | | | 2,460 | | | | 2,632 | | | | - | | | - |

| | | 6/30/2022 | | 8555 South River Pkwy. | | Tempe | | AZ | | — | | Versum Materials US, LLC | | | 95,133 | | | | 1,313 | | | | 1,251 | | | | - | | | - |

| | | 7/31/2022 | | 1440 E 15th St. | | Tucson | | AZ | | — | | CoxCom, LLC | | | 28,591 | | | | 420 | | | | 420 | | | | - | | | - |

| | | 10/31/2022 | | 4455 American Way | | Baton Rouge | | LA | | — | | New Cingular Wireless PCS, LLC | | | 70,100 | | | | 795 | | | | 825 | | | | - | | | - |

| | | 12/31/2022 | | 231 N. Martingale Rd. | | Schaumburg | | IL | | — | | CEC Educational Services, LLC (Career Education Corporation) | | | 317,198 | | | | 3,466 | | | | 3,364 | | | | - | | | - |

LEXINGTON REALTY TRUST

Property Leases and Vacancies - Consolidated Portfolio - 9/30/2017

Year of Lease

Expiration | | Date of Lease

Expiration | | Property Location | | City | | State | | Note | | Primary Tenant (Guarantor) | | Sq.Ft.

Leased or

Available(1) | | | GAAP

Rent

as of

9/30/2017

($000)(3) | | | Cash

Rent

as of

9/30/2017

($000)(2) | | | 9/30/2017

Debt Balance

($000) | | | Debt

Maturity |

| OFFICE PROPERTIES | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2/28/2023 | | 1315 West Century Dr. | | Louisville | | CO | | — | | Rogue Wave Software, Inc. | | | 20,000 | | | | 259 | | | | 220 | | | | - | | | - |

| | | 3/31/2023 | | 8900 Freeport Pkwy. | | Irving | | TX | | — | | Nissan Motor Acceptance Corporation (Nissan North America, Inc.) | | | 225,049 | | | | 2,569 | | | | 2,781 | | | | - | | | - |