LONG ISLAND’S PREMIER COMMUNITY BANK

www.astoriafederal.com

SECOND QUARTER ENDED

JUNE 30, 2003

This presentation may contain forward-looking statements that are based on various assumptions and analyses made by us in light of our management’s experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond our control) that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These factors include, without limitation, the following: the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control; there may be increases in competitive pressure among financial institutions or from non-financial institutions; changes in the interest rate environment may reduce interest margins; changes in deposit flows, loan demand or real estate values may adversely affect our business; changes in accounting principles, policies or guidelines may cause our financial condition to be perceived differently; general economic conditions, either nationally or locally in some or all areas in which we do business, or conditions in the securities markets or the banking industry may be less favorable than we currently anticipate; legislation or regulatory changes may adversely affect our business; technological changes may be more difficult or expensive than we anticipate; success or consummation of new business initiatives may be more difficult or expensive than we anticipate; or litigation or other matters before regulatory agencies, whether currently existing or commencing in the future, may delay occurrence or non-occurrence of events longer than we anticipate. We assume no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document.

Corporate Profile

$22.3 billion in assets

$11.3 billion in deposits, 51% low-cost core deposits(1)

9% deposit market share in Long Island market

3rd largest, just behind Chase and Citibank

Serves 700,000 customers/consumers

Book value per common share(2): $19.49

Tangible book value per common share(3): $17.05

Insider & ESOP stock ownership: 16%

$2.3 billion market cap

All figures in this presentation are as of June 30, 2003 and all market data and IBES consensus are as of July 30, 2003, except as noted.

NYSE: AF

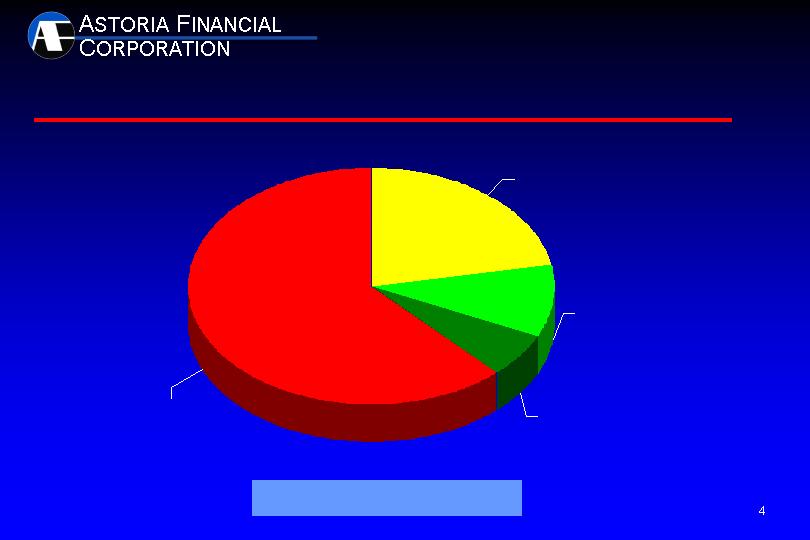

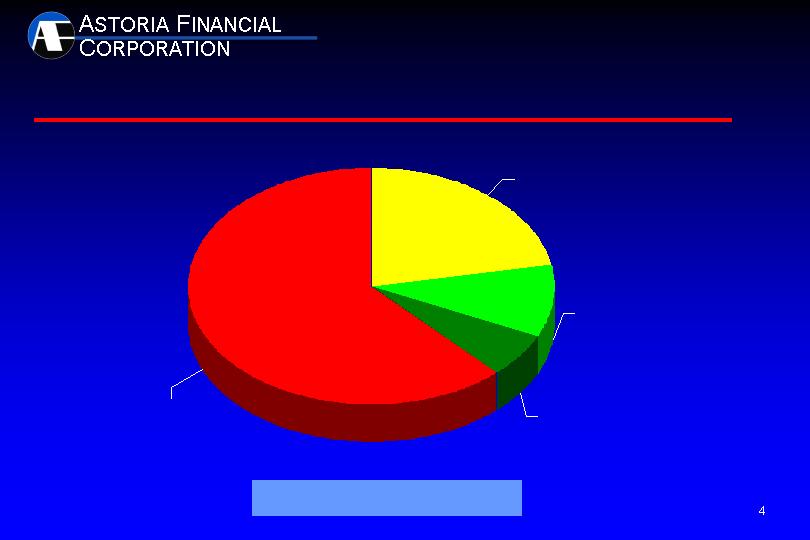

Officers &

Directors

6%

ESOP

10%

Retail

14%

Institutions

70%

Ownership Profile

June 30, 2003

Shares Outstanding: 80,672,623

Our formula for enhancing shareholder value is

simple and has been proven successful!

Retail Banking – Premier community bank on Long Island

Full service provider of financial services and products

Keen focus on customer service – Anytime/Anywhere banking, 24/7!

Extended hours, Saturday & Sunday banking

Multi-channel distribution network- branches, ATMs, telephone and

Internet

Mortgage Lending – Portfolio lender, not a mortgage banker

Single Family, Multifamily and Commercial Real Estate Expertise

Top Quality - Low Credit Risk Lending

Operating Efficiency

Focus on core businesses:

Execution excellence is key!

Retail Banking/Market Penetration

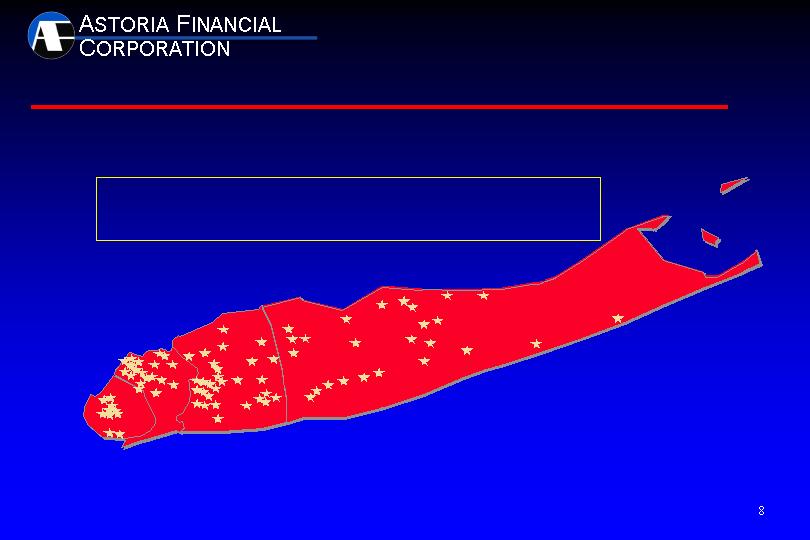

Leading Retail Banking Franchise

$11.3 billion in deposits, 86 banking office network

Low cost/stable source of funds – average rate: 2.02%

Core Deposits represent 51% of Deposits, or $5.8 billion

Checking accounts of $1.5 billion, or 26% of core deposits

Pro-active sales culture

Banking offices with high average deposits

Long Island Offices (83) - Nassau (29), Queens (17), Suffolk (25),

Brooklyn (12) – Average Deposits of $132 Million

Westchester Offices (3) - Average Deposits of $126 Million

Alternative delivery channels

ATMs, telephone and Internet banking

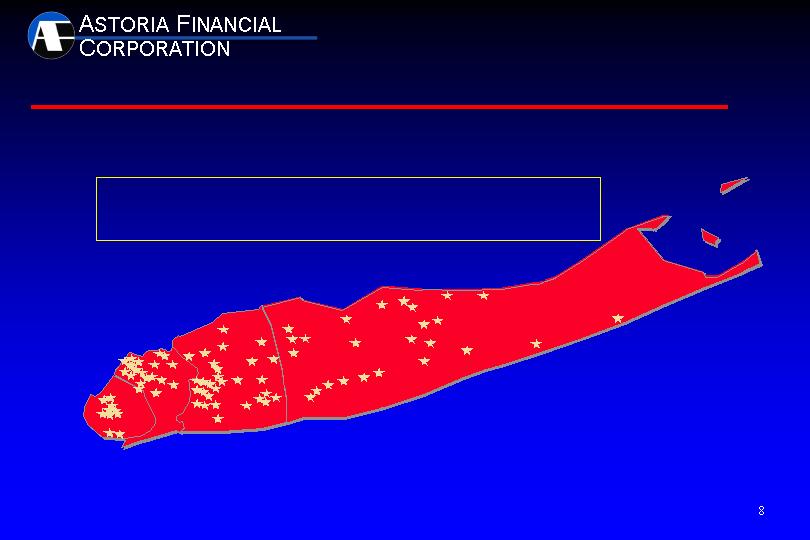

Long Island Powerhouse

Nassau

Queens

Brooklyn

Suffolk

Banking Offices and Deposit Share Ranking on Long Island

Overall Deposit Share Ranking:

#1- all thrifts, #3- all financial institutions

Average

Deposits

Strong Position in Core Market

Brooklyn, Queens, Nassau and Suffolk

Source: FDIC Deposit Market Share Report. Data as of 6/30/02, most recent available, adjusted for pending acquisitions.

1. Chase

2. Citigroup

3. ASTORIA

4. GreenPoint

5. North Fork

6. HSBC

7. NY Community/RSLN

8. Washington Mutual

The combined population of these four counties (7.0 million) exceeds the population

of 38 individual U.S. states

$ 19,487

15,676

10,878

9,371

8,932

8,642

8,244

7,914

Total - Core Market

$122,391

$2,544

(506)

603

84

1,061

194

828

(1,212)

16%

13

9

8

7

7

7

7

149

142

83

61

132

93

103

73

$131

110

131

154

68

92

80

108

1,372

(Dollars in millions)

Institution

Deposits

Growth

06/01-06/02

Market

Share

Branches

($ in millions) Suffolk .

Institution Total

Well Positioned in Key Markets

Source: FDIC Deposit Market Share Report.

Deposits

Data as of 6/30/02, most recent available, adjusted for pending acquisitions.

1. Citigroup

2. Chase

3. GreenPoint

4. Astoria

5. NYB/RSLN

$6,318

5,094

3,858

3,825

3,536

16%

13

10

10

9

58

32

21

29

36

Share

Branches

Share

Branches

Total

$38,574

411

1. Chase

2. Citigroup

3. Astoria

4. NYB/RSLN

5. North Fork

$5,147

3,774

3,172

3,016

2,506

$31,849

Total

16%

12

10

9

8

40

27

19

25

15

12

247

Share

Branches

1. Chase

2. North Fork

3. Citigroup

4. Astoria

5. Fleet

Total

$4,177

3,823

2,428

2,358

1,755

$24,735

17%

16

10

10

7

35

54

29

25

33

383

($ in millions) Brooklyn .

Institution Total

Share

Branches

1. Chase

2. HSBC

3. Wamu

4. Citigroup

5. GreenPoint

Astoria (#7)

Total

$5,069

3,421

3,374

3,156

2,492

1,522

$27,233

19%

13

12

12

9

6

42

30

17

34

35

331

($ in millions) Nassau .

Institution Total

($ in millions) Queens .

Institution Total

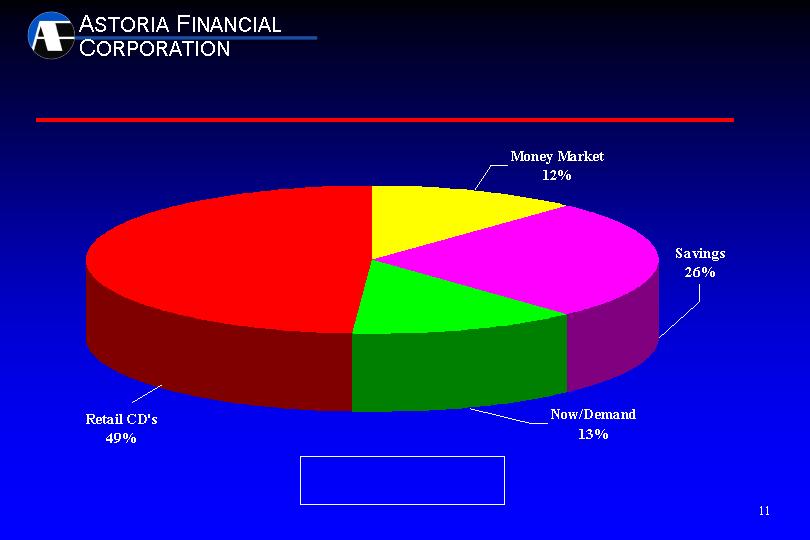

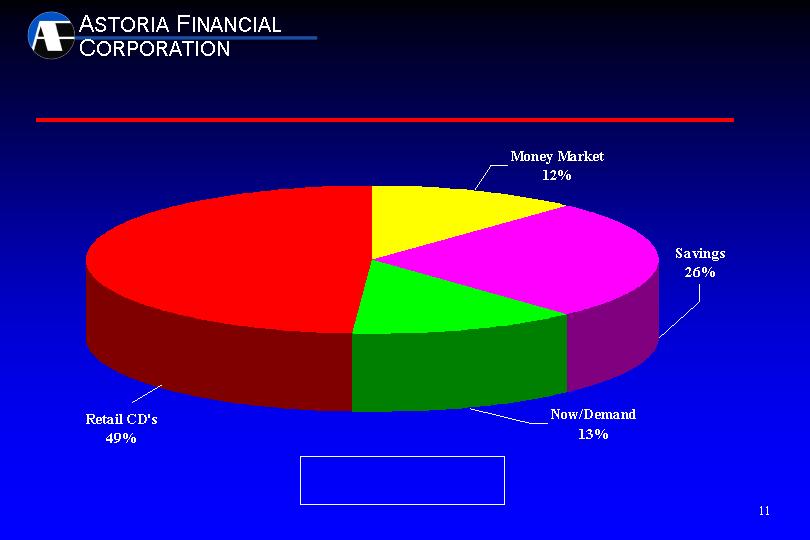

Deposit Composition

Total - $11.3 Billion

51% Core or $5.8 Billion

At June 30, 2003

$5.5B @ 3.67%

$1.4B @ 0.72%

$2.9B @ 0.50%

$1.5 B @ 0.14%

Average Rate: 2.02%

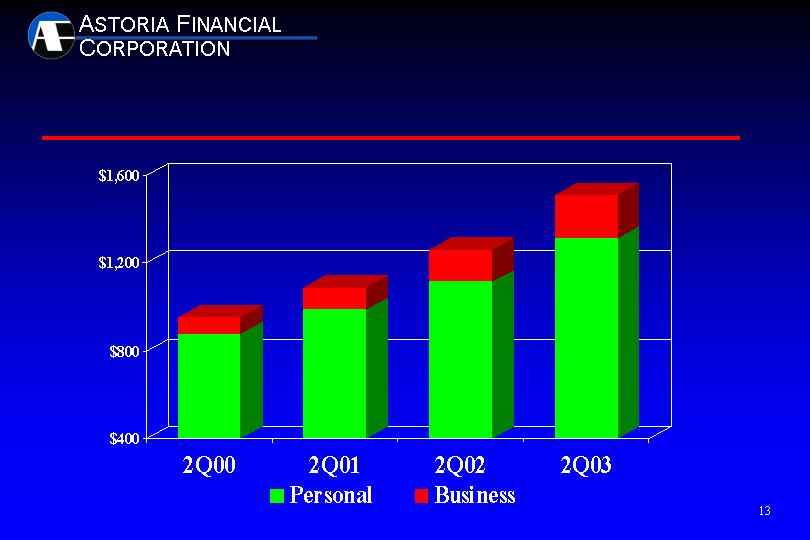

Sales Initiatives – PEAK Process

Performance based on Enthusiasm, Actions and Knowledge

A “needs” based approach to sales rather than “product” based

approach using a “Financial Needs Analysis Profile”

Highly interactive program – daily and weekly meetings create a

focus that is shared throughout the branch network

Incentives for strong performance, both individual and

team

2002 results exceeded expectations

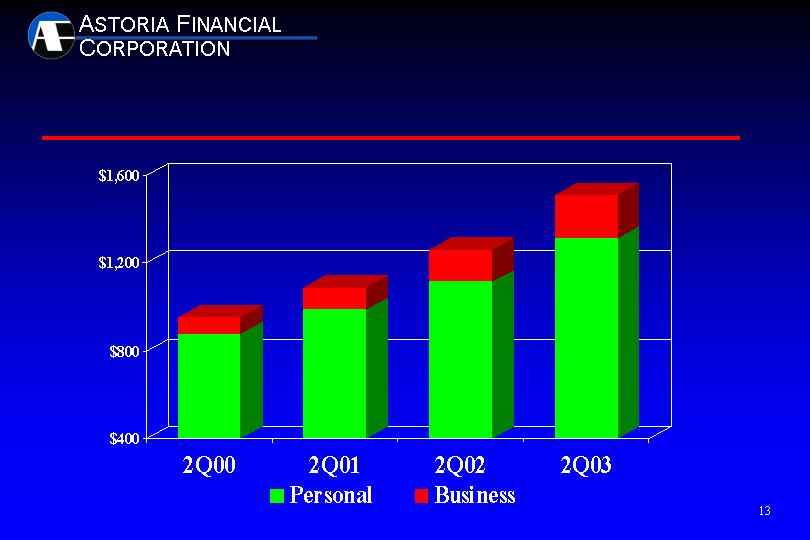

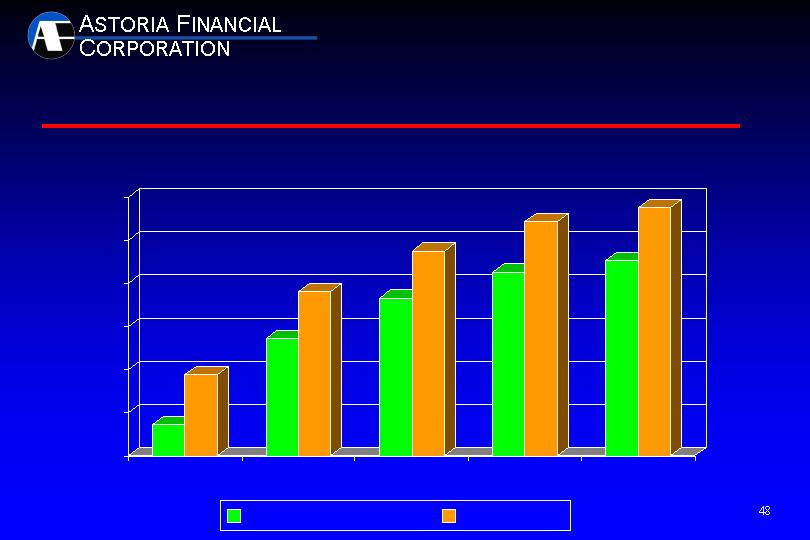

Checking Account Growth

($ in millions)

CAGR = 17%

$954

$1,090

$1,262

$1,511

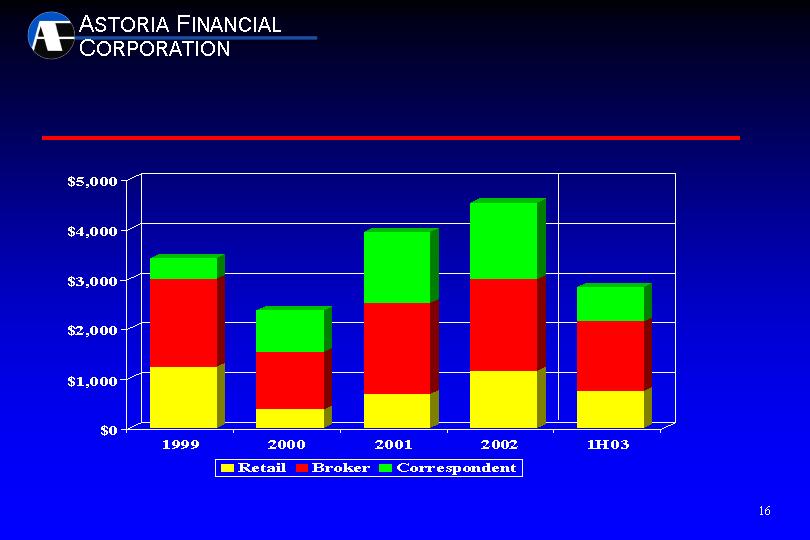

Mortgage Lending Growth

Asset Quality Trends

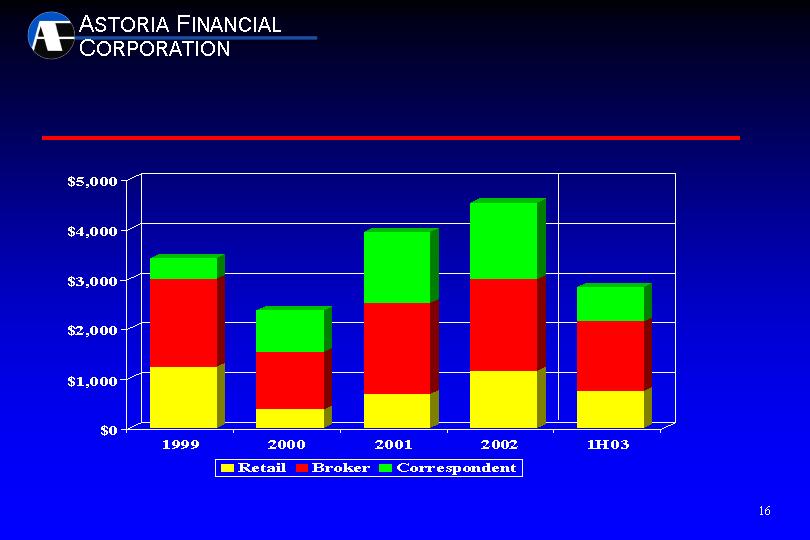

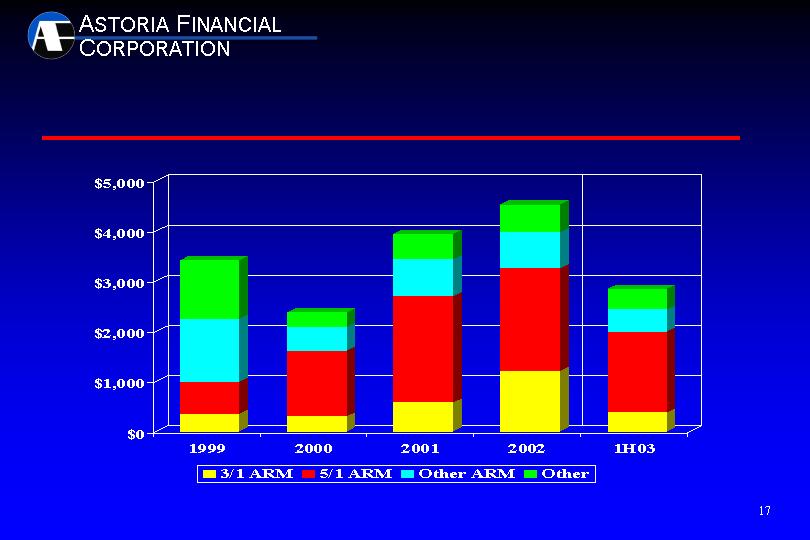

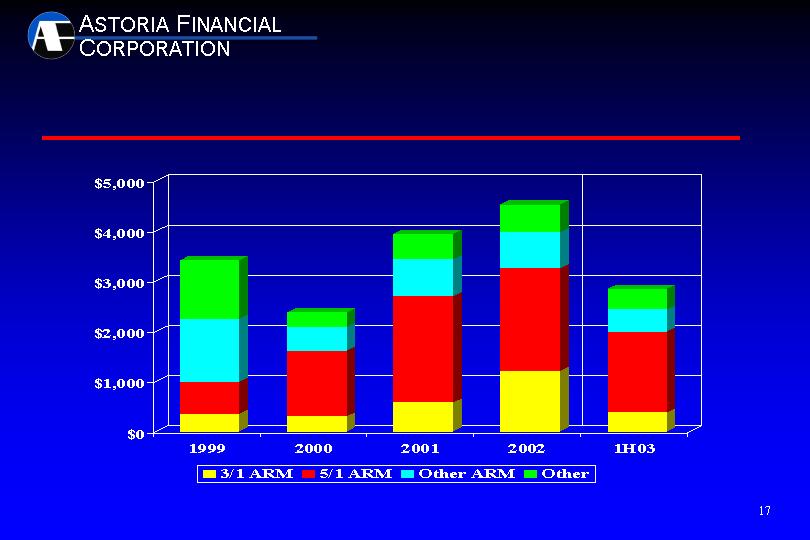

Primarily short-term, 3/1 & 5/1 hybrid ARMs for portfolio

Minimizes interest rate risk

Multiple delivery channels provide flexibility & efficiency

Retail*

Commissioned representatives/brokers-originations in 19 states*

Third party originators – correspondent relationships in 44 states*

Secondary marketing capability

Sale of 15 year and 30 year fixed rate loans reduces interest rate risk

Geographically diversified portfolio

Reduces lending concentrations

1-4 Family Mortgage Lending

* All loans underwritten to Astoria’s stringent standards.

1-4 Family Mortgage Loan Originations

By Delivery Channel

$2.4B

$4.5B

(In Millions)

$3.9B

$3.4B

$2.8B

1-4 Family Mortgage Loan Originations

By Product Type

$2.4B

$3.9B

$4.5B

(In Millions)

$3.4B

$2.8B

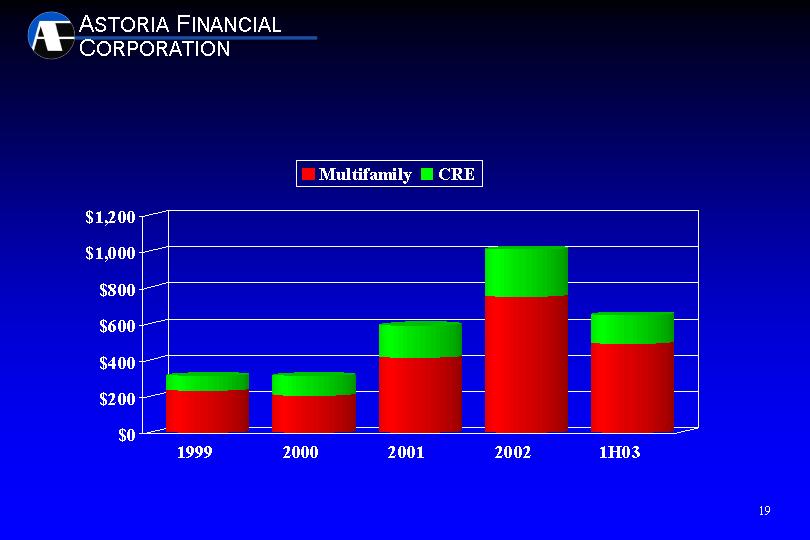

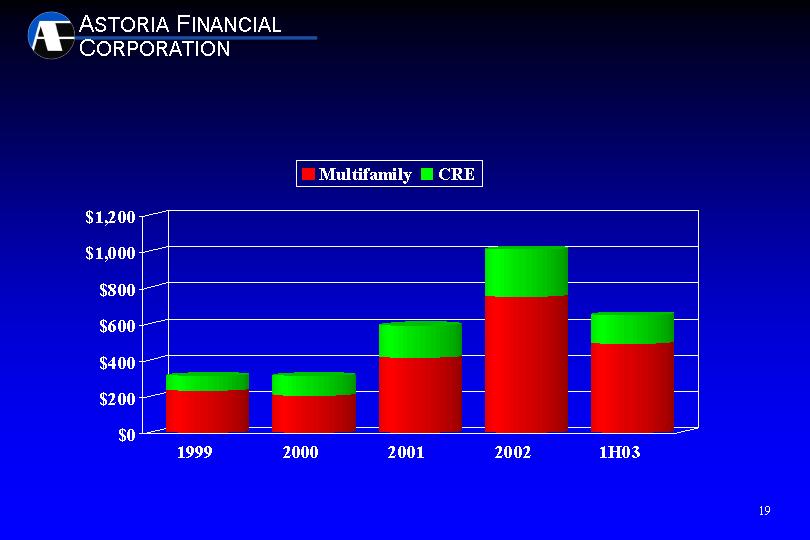

Solid and growing Multifamily/CRE portfolio

Multifamily/Commercial Real Estate Lending

Note: LTV is based on current principal balances and original appraised values.

$2.6 billion in portfolio – Average yield 7.60%

Conservative underwriting - Average LTV < 65%

Average loan in portfolio < $1 million

All loans in local market

Portfolio target: 25% of total loan portfolio by year-end 2003

Multifamily/Commercial Real Estate Originations

(In Millions)

Originations include mixed use property loans. Average loan balance outstanding is < $1 million.

All loans originated in local market.

Asset Quality

Minimal credit risk

Strong reserves

Low delinquency trends

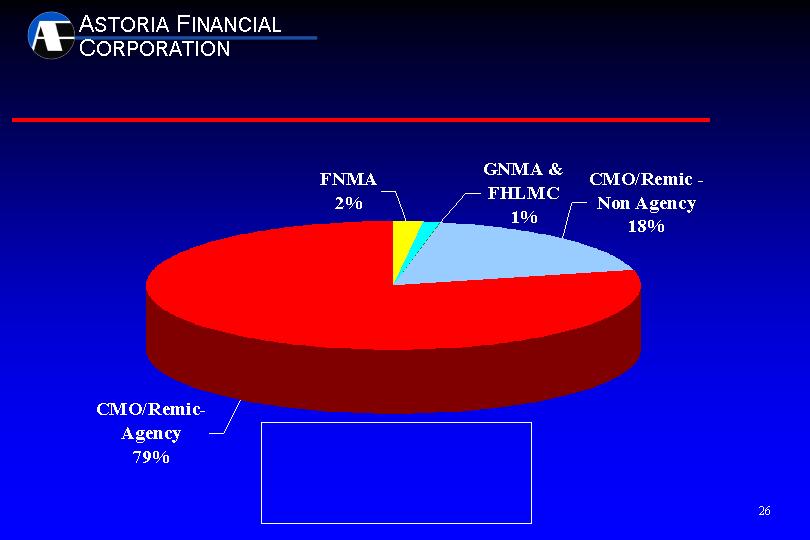

Top quality MBS portfolio

Asset Quality Focus

Conservative underwriting, top quality loans, low LTVs

No sub-prime lending

99+% of all loans secured by real estate

Allowance for loan losses/non-performing loans: 232%

Primarily agency, agency-backed or ‘AAA’ rated

Average LTV: 63.1%

Total Portfolio: $12.0 billion

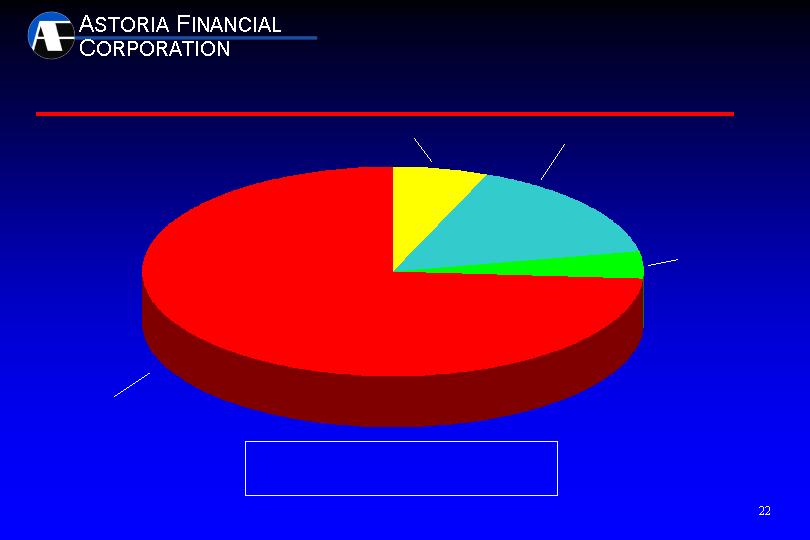

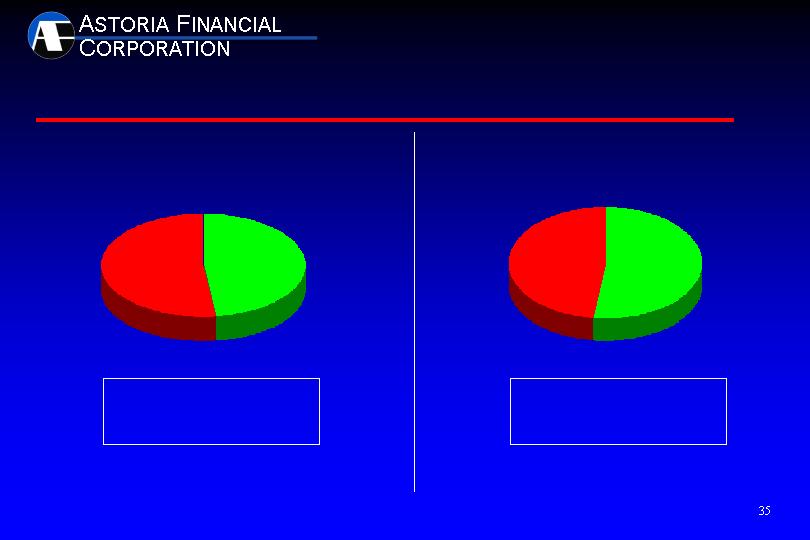

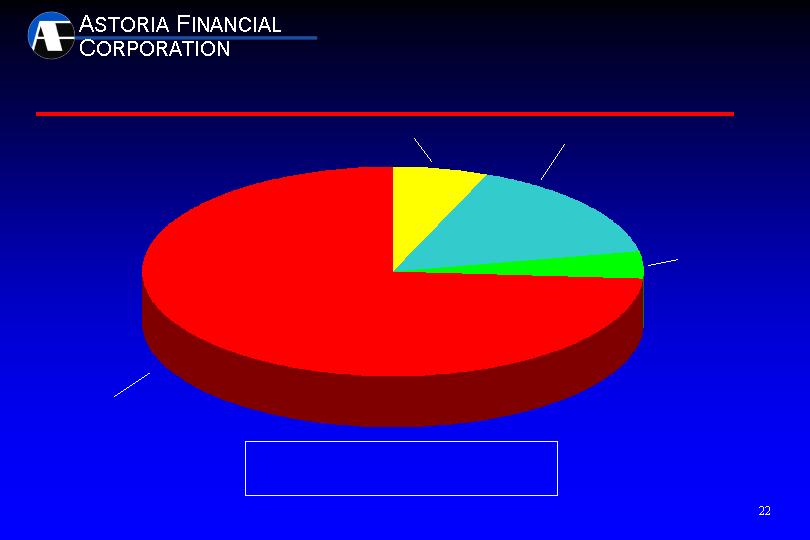

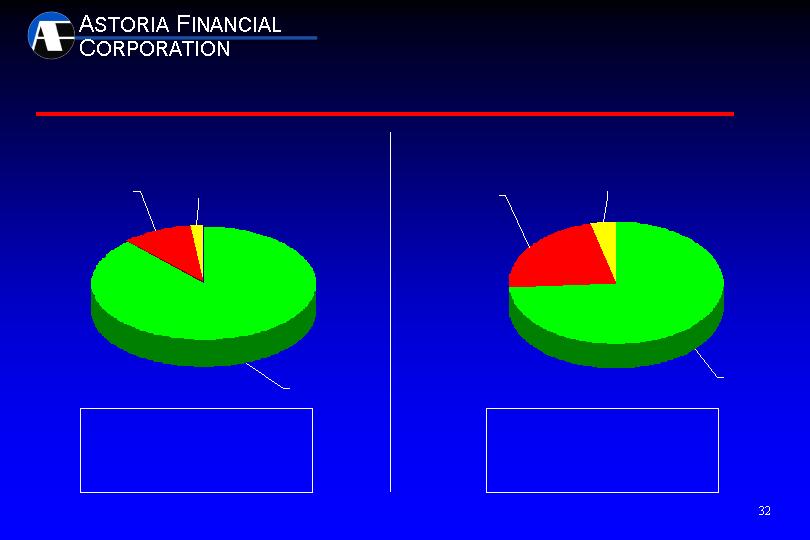

Low Credit Risk Loan Portfolio Composition

At June 30, 2003

Excludes loans held for sale; LTV based on current principal balance and original appraised value.

Commercial R/E - 6%

Average LTV: 63.3%

Multifamily - 16%

Average LTV: 64.4%

One-to-Four Family – 74%

Average LTV: 62.8%

Home Equity

& Other – 4%

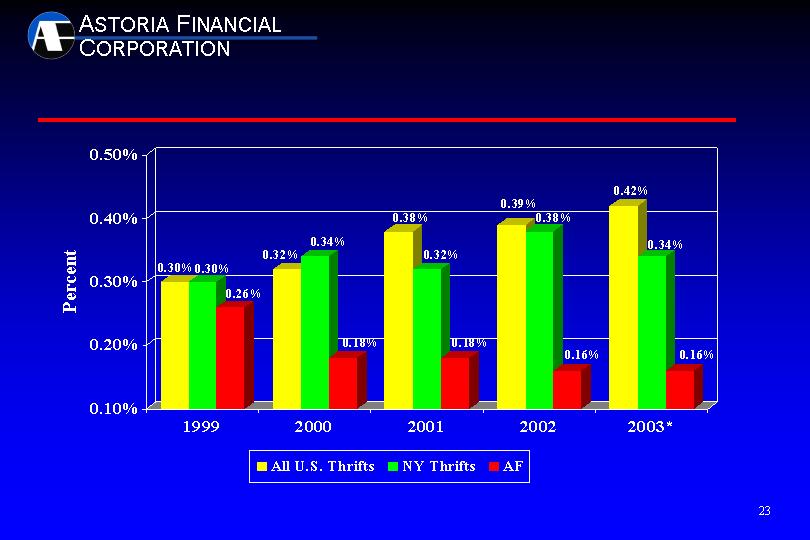

NPA to Total Assets vs Peers

* Most recent data available for All US Thrifts and NY Thrifts is as of March 31, 2003. AF data is as of June 30, 2003.

Source: SNL Financial – Median Ratios.

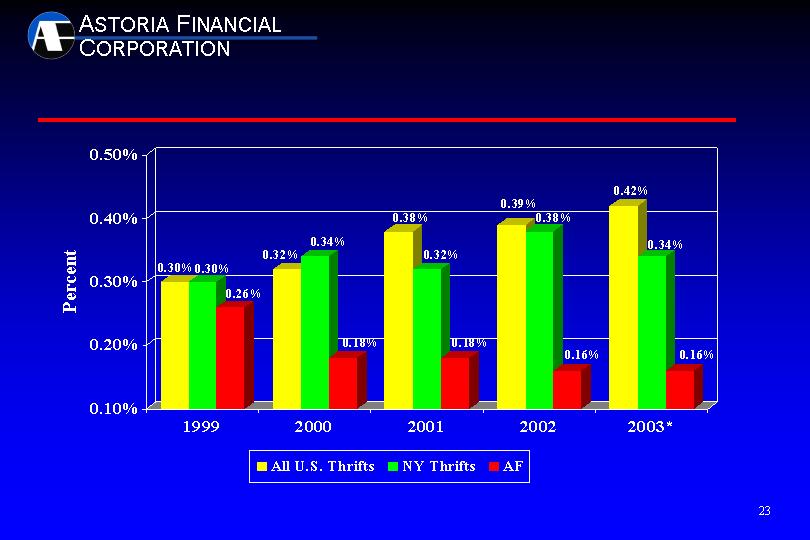

Net Charge-offs/Average Loans vs. Peers

* Most recent data available for All US Thrifts and NY Thrifts is for the quarter ended March 31, 2003. AF is for the six months ended June 30, 2003.

Source: SNL Financial – Median Ratios.

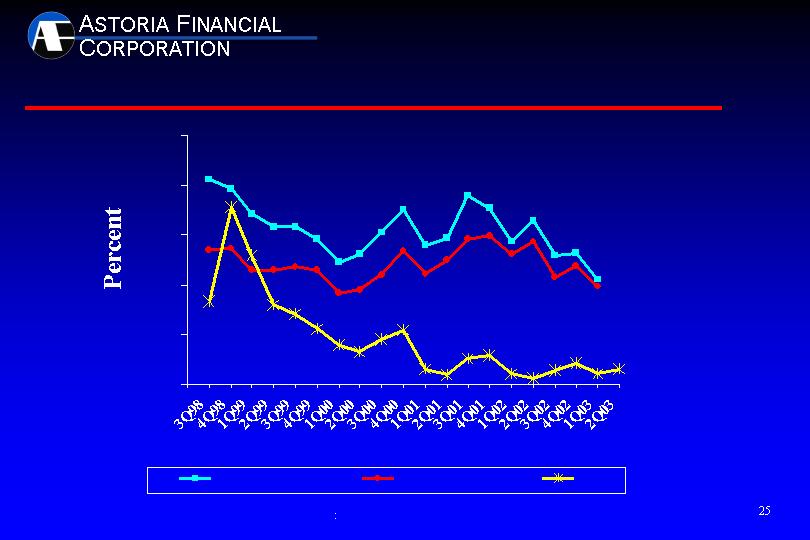

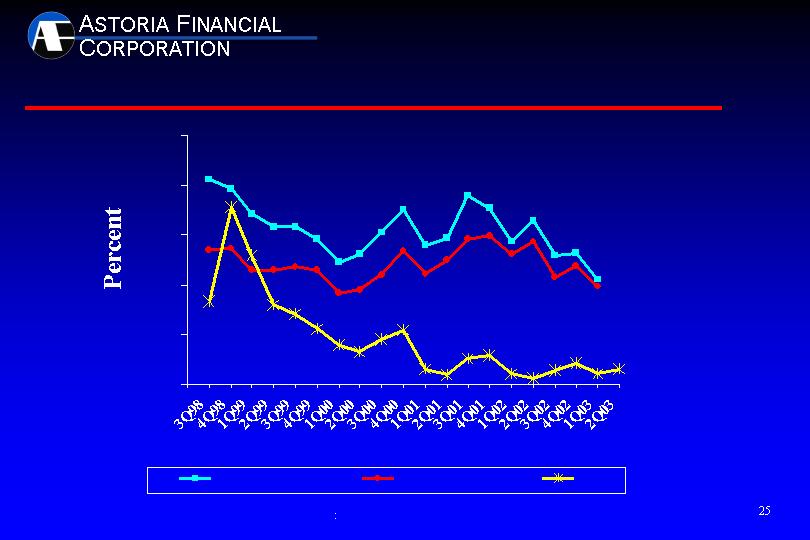

1-4 Family Delinquency Ratios: AF vs MBA

MBA NY conv

MBA US conv

AF

1.00

2.00

3.00

4.00

5.00

6.00

Source: MBA National Delinquency Survey. Beginning with 3Q02, MBA statistics for conventional loans excludes sub-prime loans.

:

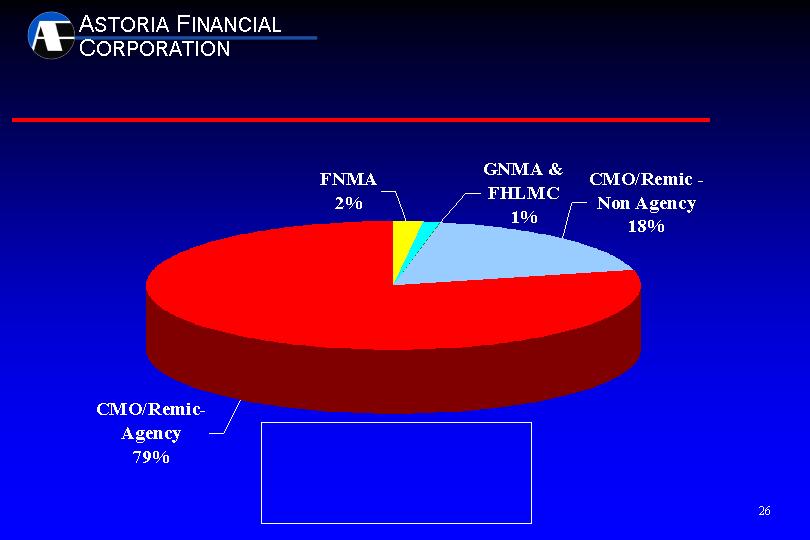

Low Credit Risk MBS Portfolio

Total MBS Portfolio Classification

Available for sale - $ 3.0B

Held to maturity - $ 5.6B

Total $ 8.6B

At June 30, 2003

Average Life: 1.8 years

One year gap: +4.65%

Key balance sheet components

Short-term hybrid adjustable-rate mortgage loan portfolio

Short weighted average life MBS portfolio

Offset by:

Large core deposit base - provides natural hedge against rising

rates

Longer-term CDs and borrowings

Interest Rate Risk Management

Rate

2.63%

5.81%

4.97%

5.80%

4.74%

Interest Rate Risk Management

Liability repricing opportunities within the next 12 months:

CD’s

Maturing

$965 Million

$800 Million

$2.8 Billion

$500 Million

$5.1 Billion

Weighted Avg.

Rate

2.08%

2.74%

2.84%

2.76%

2.59%

Maturing

$725 Million

$660 Million

$752 Million

$574 Million

$2.7 Billion

3Q03

4Q03

1Q04

2Q04

Total

Weighted Avg.

3Q03

4Q03

1Q04

2Q04

Total

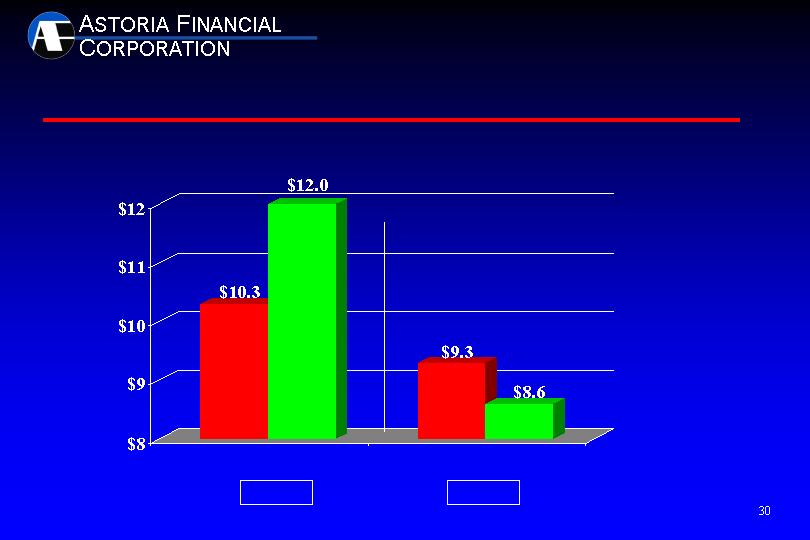

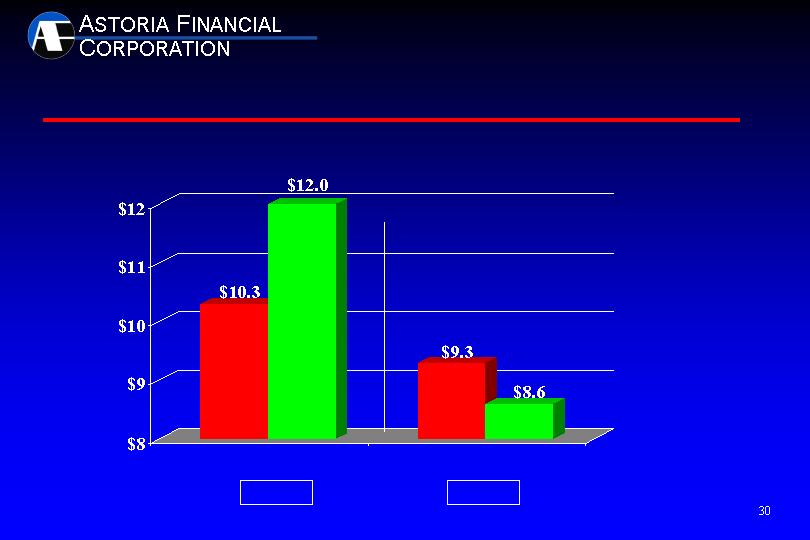

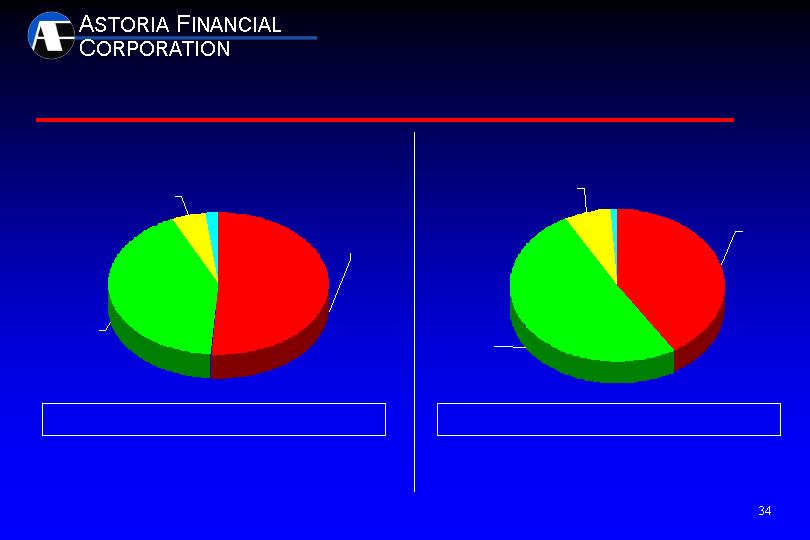

Balance Sheet Repositioning

Balance Sheet Repositioning

(In Billions)

12/31/99 6/30/03

12/31/99 6/30/03

Loans

vs.

MBS

45%

41%

14%

39%

7%

54%

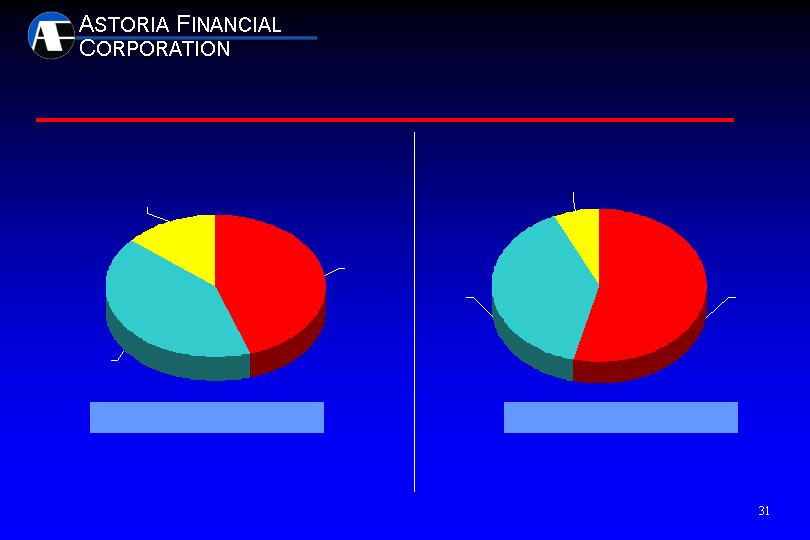

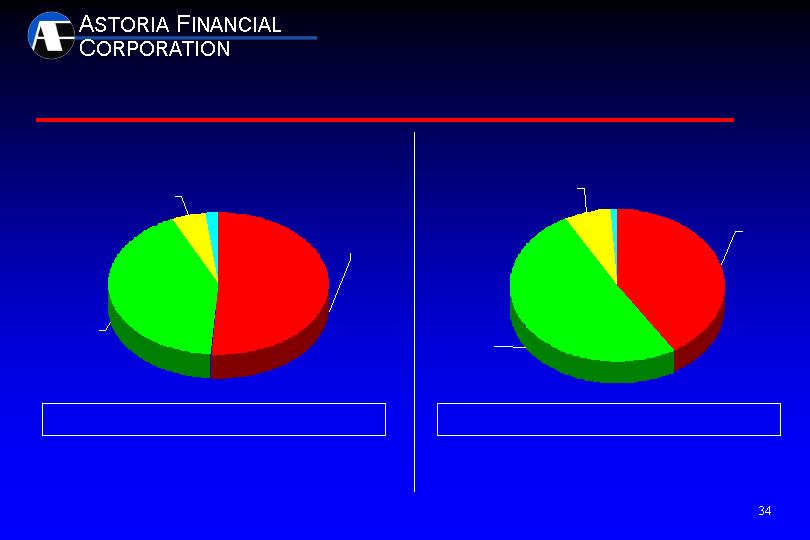

Balance Sheet Composition

December 31, 1999

June 30, 2003

Other

Loans

Other

MBS

Loans

MBS

Total Assets: $22.7 Billion

Total Assets: $22.3 Billion

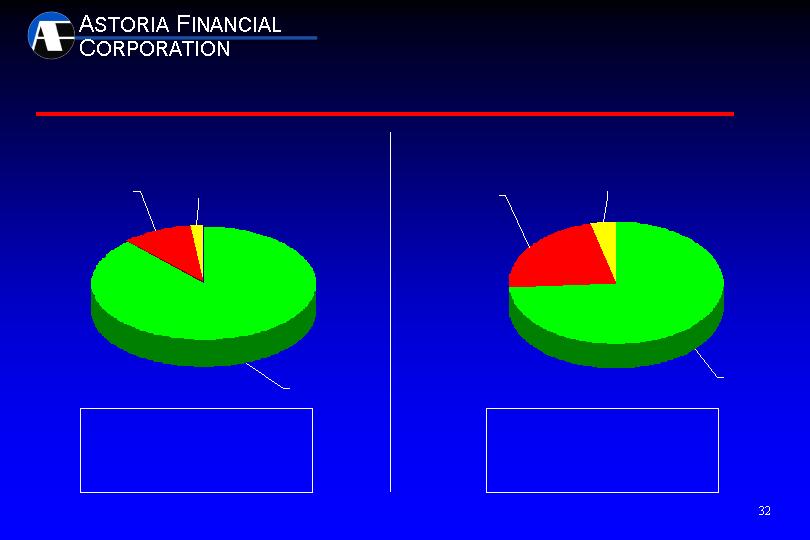

Loan Mix

Other

2%

Mulitfamily/CRE

10%

1-4 Family

88%

1-4 Family

74%

Other

4%

Multifamily/CRE

22%

1-4 Family: $9.0 Billion*

Multifamily/CRE: $1.0 Billion*

Other: $0.2 Billion*

Total Loans: $10.3 Billion

December 31, 1999

June 30, 2003

* Excludes net unamortized premium/net deferred loan costs.

Excludes loans held for sale.

1-4 Family: $8.9 Billion*

Multifamily/CRE: $2.6 Billion*

Other: $0.5 Billion*

Total Loans: $12.0 Billion

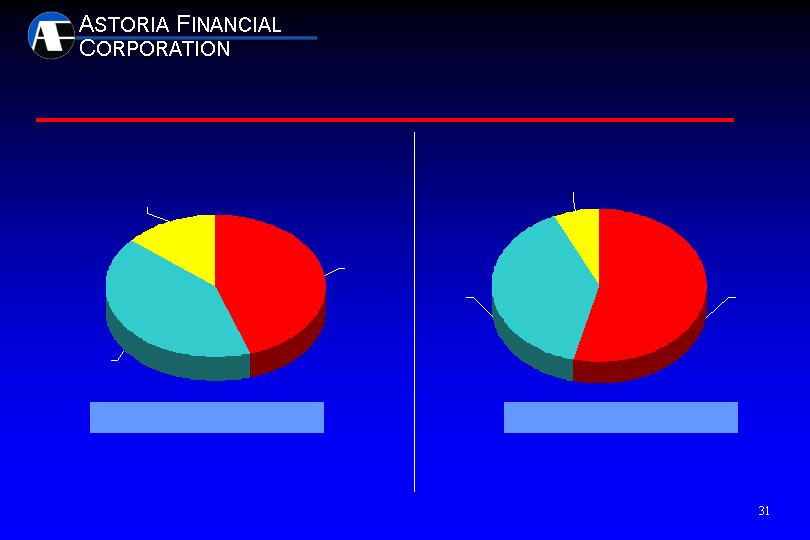

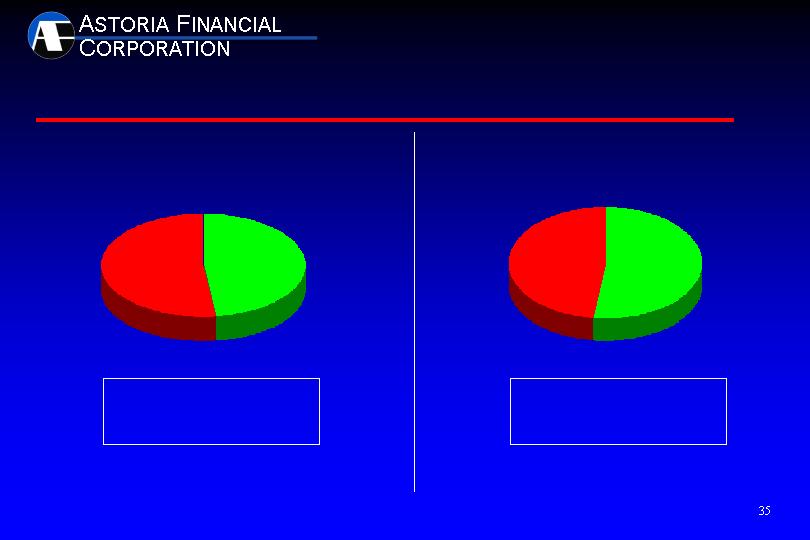

Deposits

Balance Sheet Repositioning

$9.6

$11.3

$11.5

$9.2

$8

$9

$10

$11

$12

(In Billions)

12/31/99

6/30/03

vs.

Borrowings

6/30/03

12/31/99

Total Liabilities & Equity: $22.3 Billion

Total Liabilities & Equity: $22.7 Billion

Balance Sheet Composition

42%

51%

2%

5%

1%

51%

7%

41%

December 31, 1999

June 30, 2003

Equity

Borrowings

Equity

Deposits

Borrowings

Other

Deposits

Other

CD's

52%

Core

48%

Deposit Composition

Core

51%

CD's

49%

48% Core - $4.6 Billion

Total Deposits - $9.6 billion

Average Rate: 3.94%

December 31, 1999

June 30, 2003

51% Core - $5.8 Billion

Total Deposits - $11.3 Billion

Average rate: 2.02%

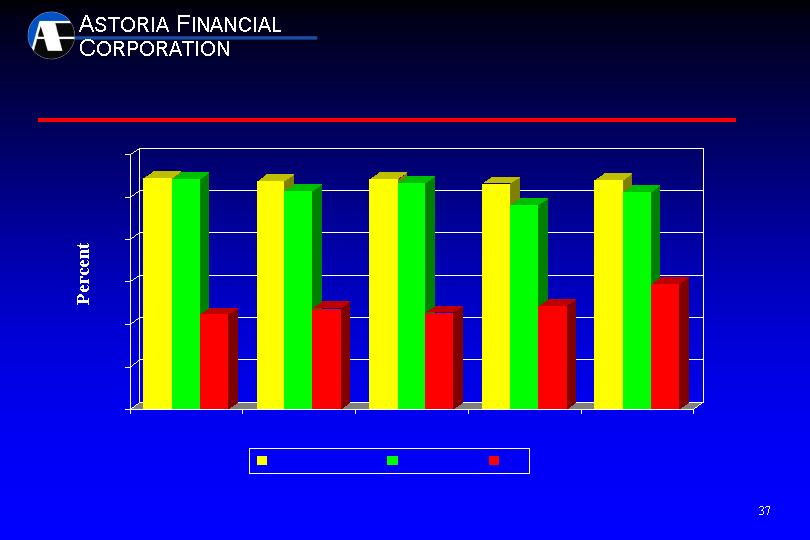

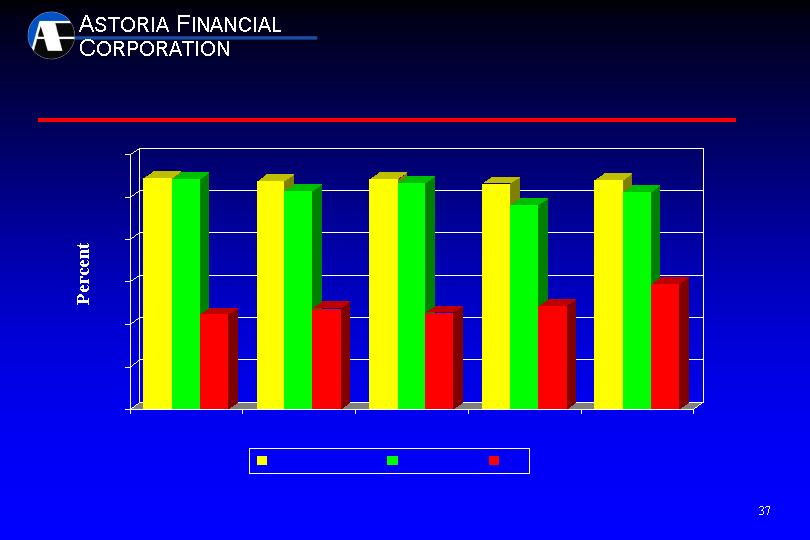

Superior Operating Efficiency

Efficiency Ratio(4)

10

20

30

40

50

60

70

1999

2000

2001

2002

2003*

All U.S. Thrifts

NY Thrifts

AF

* Most recent data available for All US Thrifts and NY Thrifts is for the quarter ended March 31, 2003. AF is for the six months ended June 30, 2003.

Source: SNL Financial – Median Ratios

Financial Results and Trends

Financial Highlights

Diluted earnings per common share

Return on average assets

Return on average equity

Return on average tangible equity(5)

Annualized dividend yield - 3.07%*

Shares repurchased – 2.5 million shares 2Q03;

4.7 million shares 1H03

$0.64

0.88%

13.27%

15.09%

2Q03

1H03

Ninth repurchase program underway – 10 million shares authorized –

4.9 million common shares remain for repurchase**

Moody’s upgraded outlook from stable to positive

* As of July 30, 2003

** As of July 15, 2003

$1.33

0.94%

13.94%

15.84%

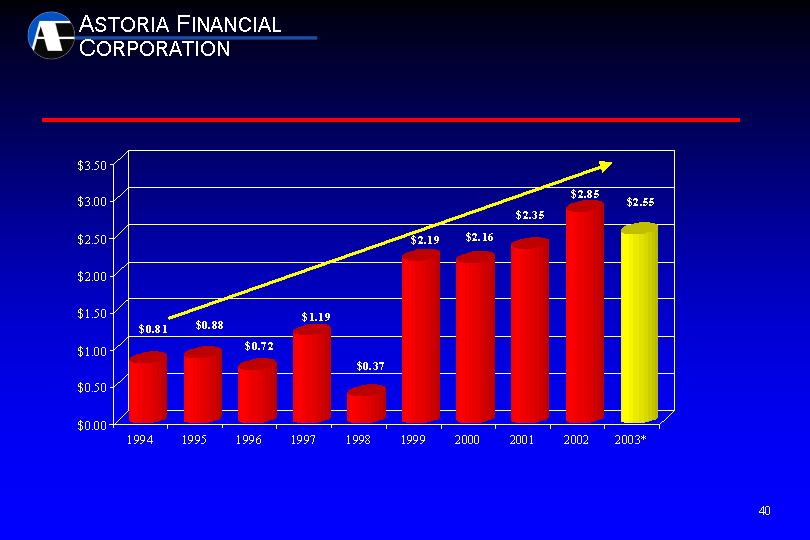

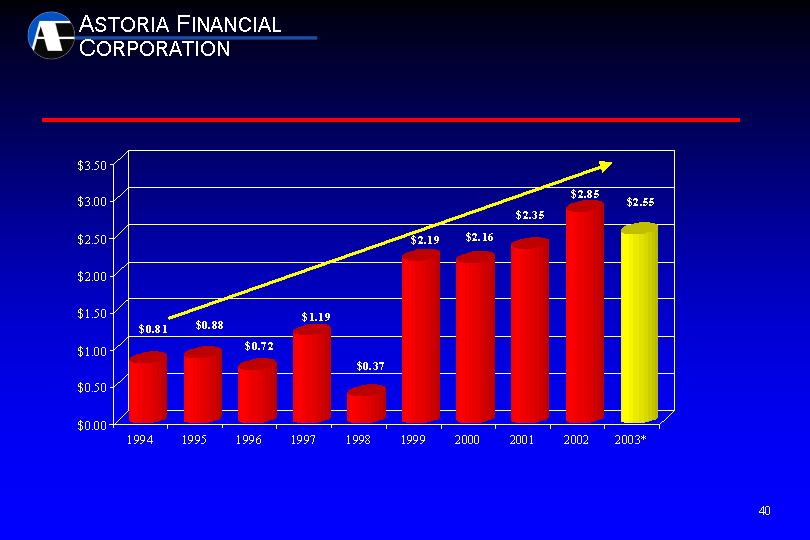

AF Historical EPS Growth

Historical GAAP EPS Growth

(1) 1996 includes the one-time special assessment of $0.28 per share, after-tax, for the re-capitalization of the Savings Association Insurance Fund.

(2) 1998 includes acquisition costs and restructuring charges, extinguishment of debt expense, loss on sale of securities and additional loan loss provision

totaling $0.95 per share, after-tax, related to the Long Island Bancorp, Inc. acquisition.

* IBES consensus as of July 30, 2003

CAGR = 14%

(2)

(1)

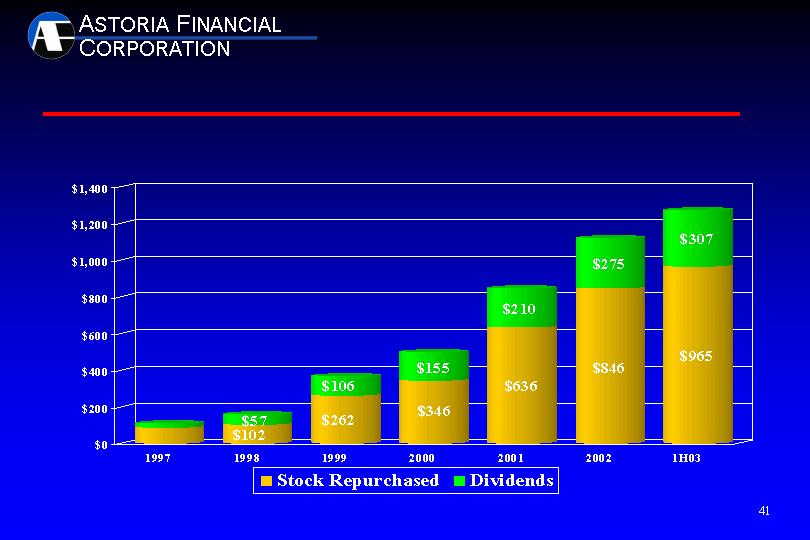

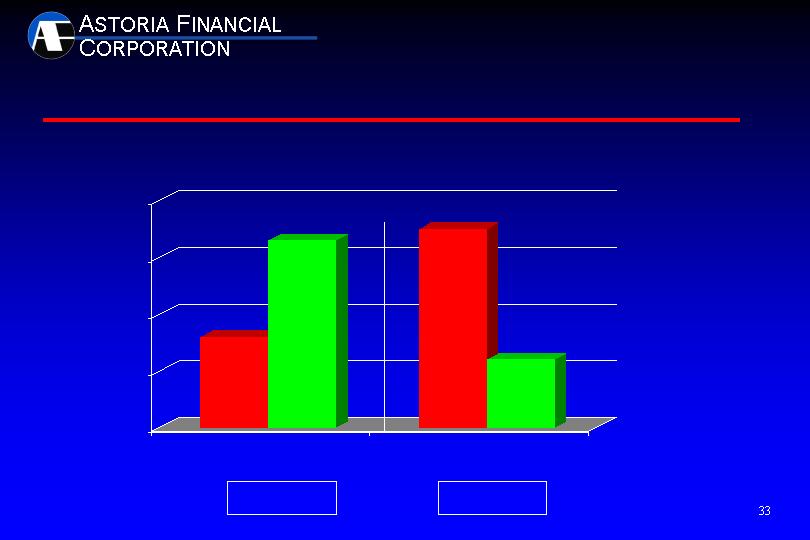

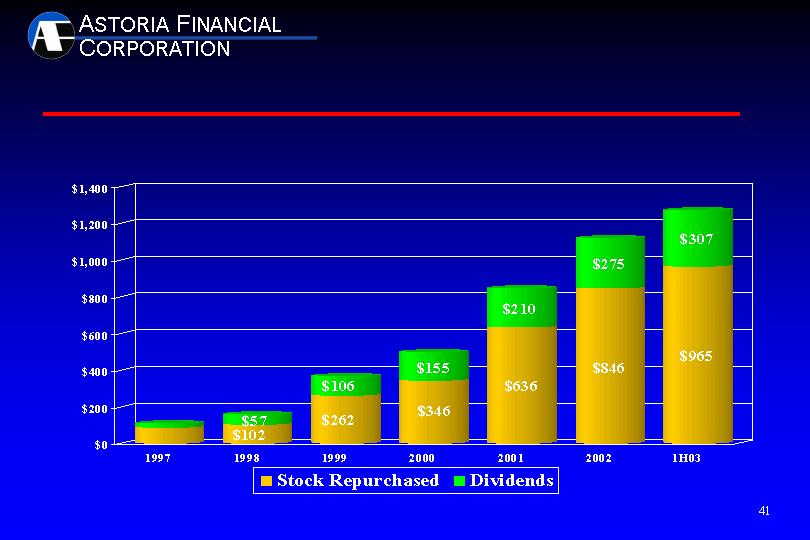

Cumulative Cash Returned to Shareholders

(In Millions)

$110

$159

$368

$846

$1,121

$501

Over $1.2 billion returned to shareholders in the past 6+ years

$1,272

One of the industry’s largest goodwill litigation claims

Goodwill Claim Update

Outcome unpredictable due to disparity in recent court

decisions

$785 million of original supervisory goodwill created

(LISB = $625 million, Fidelity NY = $160 million)

$635 million of supervisory goodwill written off

(LISB = $500 million, Fidelity NY = $135 million)

Why Invest in Astoria Financial?

Strong balance sheet – superior asset quality

Attractive banking franchise

Financial Performance

Superior operating efficiency

Well capitalized

Active stock repurchase program

Dominant deposit market share in core market

14% CAGR in EPS since 1994

19% CAGR in stock price since 1994

Over $1.2 billion returned to shareholders in the past 6+ years

Valuation Considerations

* IBES as of 07/30/03

$52.09

38.29

28.65

32.69

83.60

18.04

21.48

27.75

32.88

34.87

36.31

30.25

40.27

8.7x

10.9

11.2

12.0

12.1

12.5

12.8

12.8

12.9

13.6

13.9

14.4

16.0

12.8x

$32.64

2.8x

2.2

1.7

2.6

2.4

2.9

2.2

3.4

2.4

4.8

4.6

6.2

2.9

2.9x

$49.45

25%

2

8

16

17

13

19

18

20

30

20

69

10

18%

$42.28

GreenPoint

Webster

Astoria Financial

Charter One

Golden West

Sovereign

Staten Island

Bank North

Independence

North Fork

Hudson United

New York Community

Commerce Bancorp

Median

Astoria Stock Price at Median Levels

Price

07/30/03

2003

P/E*

Price/ TBV

Implied Deposit

Premium

Addendum

AF: A Record of Enhancing Shareholder Value

AF: A Record of Enhancing Shareholder Value

Assets of $10 billion by 2000

Improve asset quality

Enhance operating efficiency

Broaden lending capabilities

Generate returns in mid-teen

range

Enhance shareholder value

$22.3 billion in assets

0.16% NPA/total assets

39.52% efficiency ratio(4) year to date

Origination network now covers 19

states

15.84% return on average tangible

equity year to date

358% stock appreciation since IPO*

1993 IPO objectives

* Through July 30, 2003

The record as of June 30, 2003

Acquisition History

Metropolitan Federal

Citizens Savings (FSLIC)

Hastings-on-Hudson Federal

Chenango Federal

Oneonta Federal

Whitestone Savings (RTC)

Fidelity New York

The Greater New York Savings Bank

Long Island Bancorp, Inc.

Total

Year

2

5

3

1

4

4

18

14

35

86

$ 50

130

100

25

205

280

1,800

2,400

6,600

$11,590

# Branches

Assets

(in millions)

Thrift

1973

1979

1982

1984

1987

1990

1995

1997

1998

Tangible Book Value/Book Value Growth

$8

$10

$12

$14

$16

$18

$20

Dec 31 99

Dec 31 00

Dec 31 01

Dec 31 02

June 30 03

Tangible Book Value

Book Value

(Dollars per common share)

Footnotes/Glossary

Core deposits represent total deposits less time deposits.

Book value per common share represents common stockholders’ equity divided by

outstanding common shares, excluding unallocated Employee Stock Ownership Plan

(ESOP) shares.

Tangible book value per common share represents common stockholders’ equity less

goodwill divided by outstanding common shares, excluding unallocated ESOP shares.

Efficiency ratio represents general and administrative expense divided by the sum of

net interest income plus non-interest income.

Average tangible equity represents average equity less average goodwill.

(1)

(2)

(3)

(4)

(5)

NPA – Non-performing assets

MBS – Mortgage-backed securities

LTV – Loan-to-value

CAGR – Compounded annual growth rate

LONG ISLAND’S PREMIER COMMUNITY BANK

www.astoriafederal.com