Long Island’s Premier Community Bank

www.astoriafederal.com

Investor Presentation

First Quarter Ended

March 31, 2007

This presentation may contain forward-looking statements that are based on various assumptions

and analyses made by us in light of our management’s experience and its perception of historical

trends, current conditions and expected future developments, as well as other factors it believes

are appropriate under the circumstances. These statements are not guarantees of future

performance and are subject to risks, uncertainties and other factors (many of which are beyond

our control) that could cause actual results to differ materially from future results expressed or

implied by such forward-looking statements. These factors include, without limitation, the

following: the timing and occurrence or non-occurrence of events may be subject to

circumstances beyond our control; there may be increases in competitive pressure among

financial institutions or from non-financial institutions; changes in the interest rate environment

may reduce interest margins or affect the value of our investments; changes in deposit flows,

loan demand or real estate values may adversely affect our business; changes in accounting

principles, policies or guidelines may cause our financial condition to be perceived differently;

general economic conditions, either nationally or locally in some or all areas in which we do

business, or conditions in the real estate or securities markets or the banking industry may be

less favorable than we currently anticipate; legislation or regulatory changes may adversely affect

our business; technological changes may be more difficult or expensive than we anticipate;

success or consummation of new business initiatives may be more difficult or expensive than we

anticipate; or litigation or other matters before regulatory agencies, whether currently existing or

commencing in the future, may be determined adverse to us or may delay occurrence or non-

occurrence of events longer than we anticipate. We assume no obligation to update any forward-

looking statements to reflect events or circumstances after the date of this document.

2

Corporate Profile

$21.4 billion in assets

• $15.1 billion in loans

$13.4 billion in deposits

8.3% deposit market share in Long Island market

– Largest thrift depository

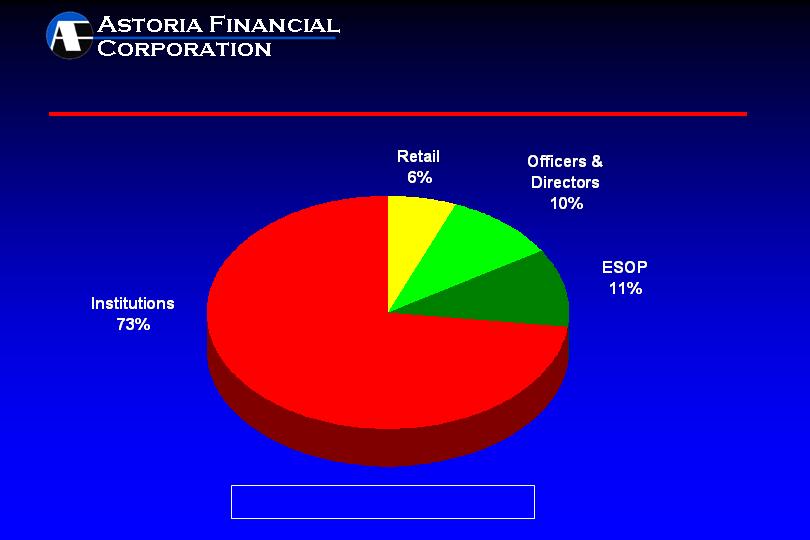

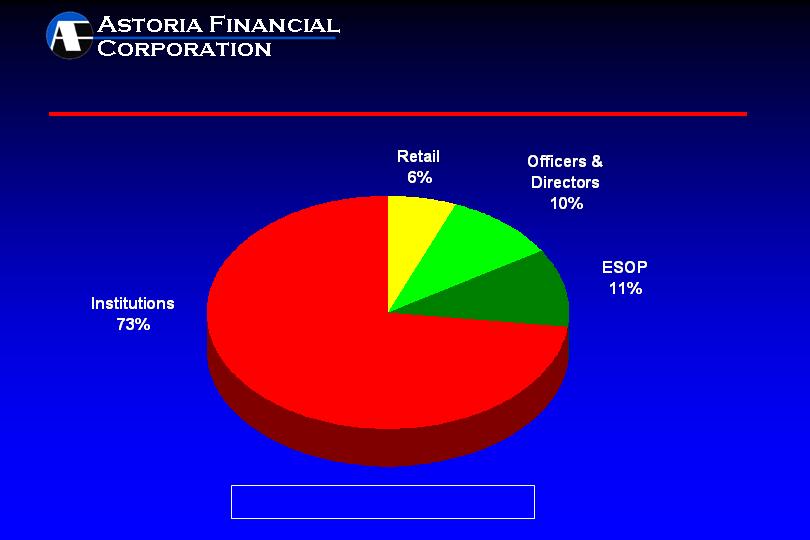

Insider & ESOP stock ownership: 21%

Corporate Governance: AF outperformed 98.8% of all

banks in the S&P Banks industry group *

$2.6 billion market cap

13+ years as a public company – enhancing shareholder

value

All figures in this presentation are as of March 31, 2007 and all stock market data is as of May 1, 2007, except as noted.

* Source: Institutional Shareholder Services (ISS)

NYSE: AF

3

Dividend Growth

CAGR = 26%

* 2Q07 annualized; yielding 3.91%, as of May 1, 2007

4

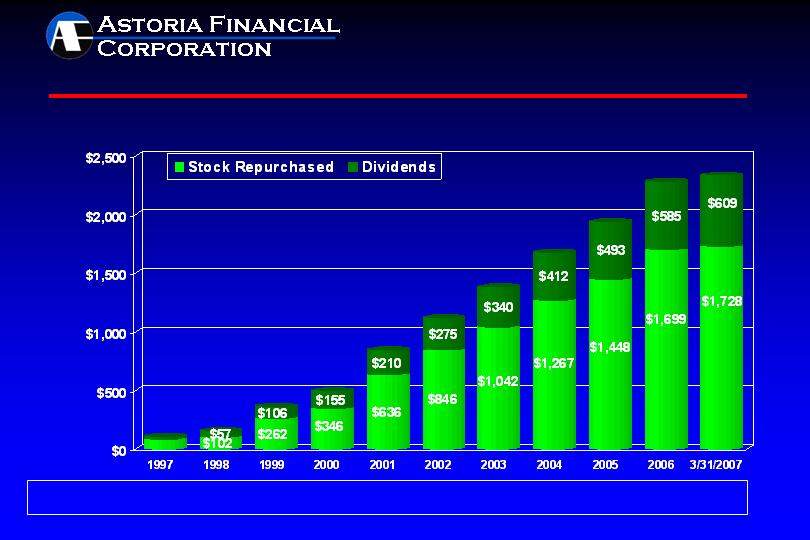

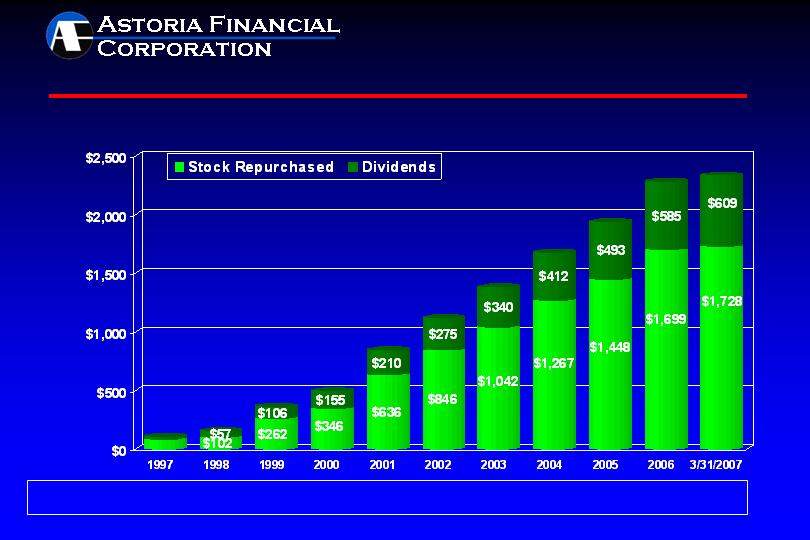

Cumulative Cash Returned to Shareholders

(In Millions)

$110

$159

$368

$846

$1,121

$501

Over $2.3 billion returned to shareholders in the past 10+ years

$1,382

$1,679

Shares Repurchased: 6.7M 1.0M 12.8M 7.8M 15.5M 10.9M 10.6M 9.1M 6.6M 8.4M 1.0M

Average Price: $12.85 $16.31 $12.48 $10.81 $18.70 $19.32 $18.42 $24.82 $27.49 $29.92 $28.35

$1,941

$2,284

$2,337

5

1Q07 Financial Highlights

Deposits increased $198 million, or 6% annualized

Loan portfolio increased $124 million, or 3% annualized

- - One-to-four family loan portfolio increased $156 million,

or 6% annualized, to $10.4 billion

Securities portfolio decreased $252 million, or 19%

annualized

Borrowings decreased $440 million, or 26% annualized

Repurchased 1.0 million shares

6

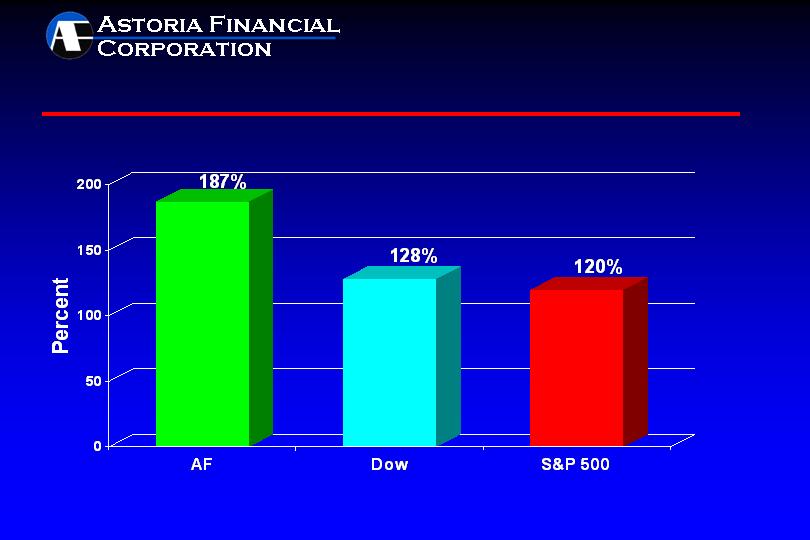

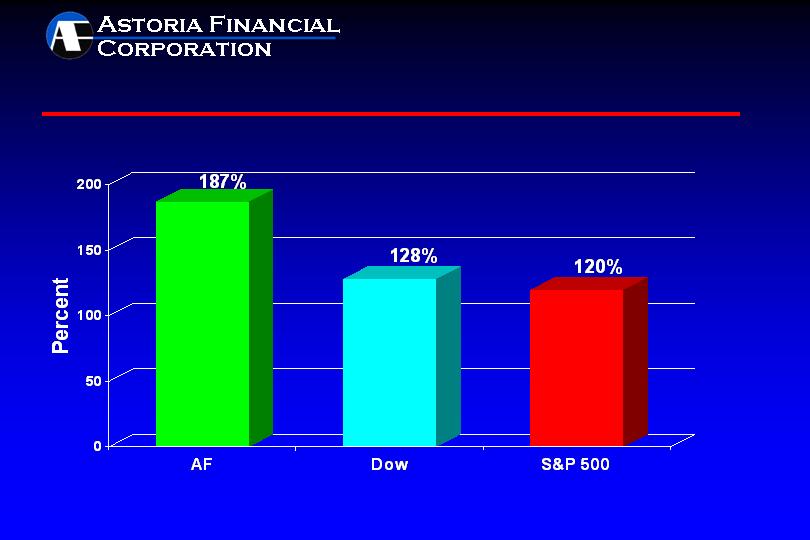

Stock Performance - Comparative Ten Year Total Return

AF CAGR = 11%

Comparative returns from March 31, 1997 – March 31, 2007

7

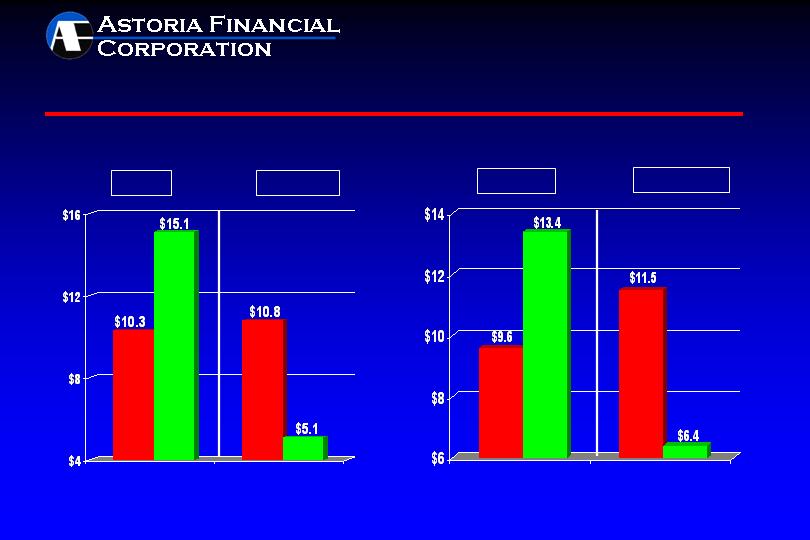

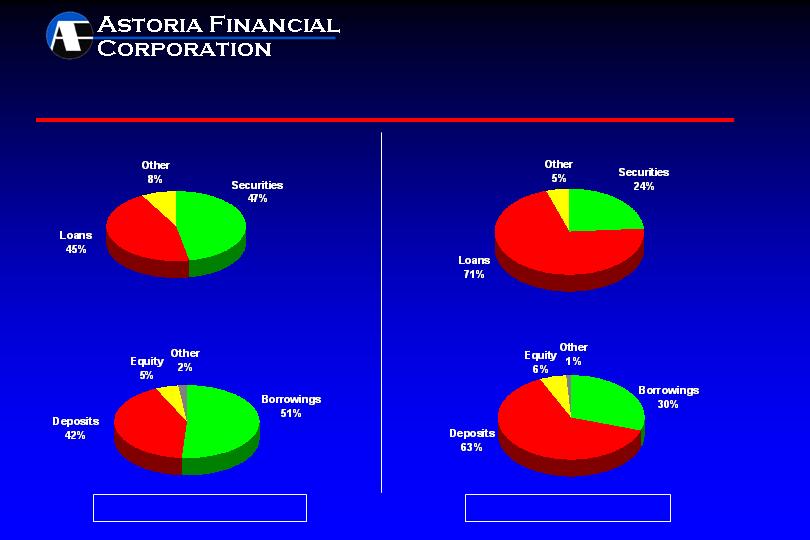

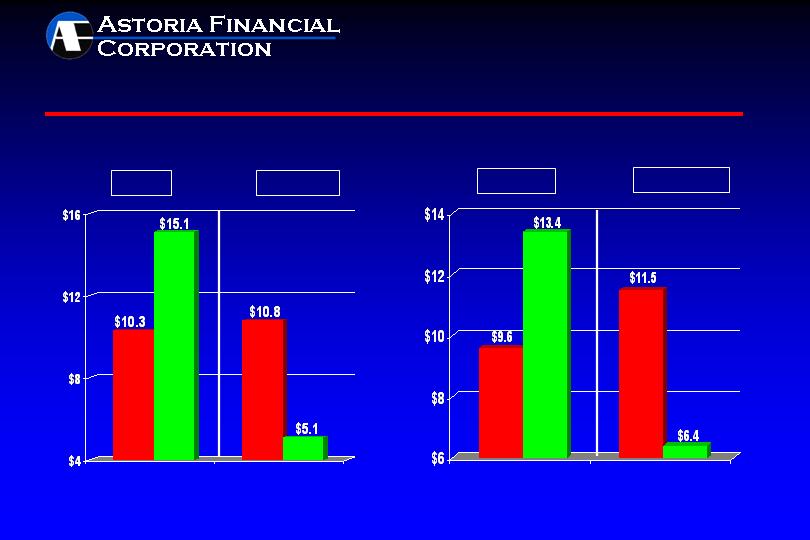

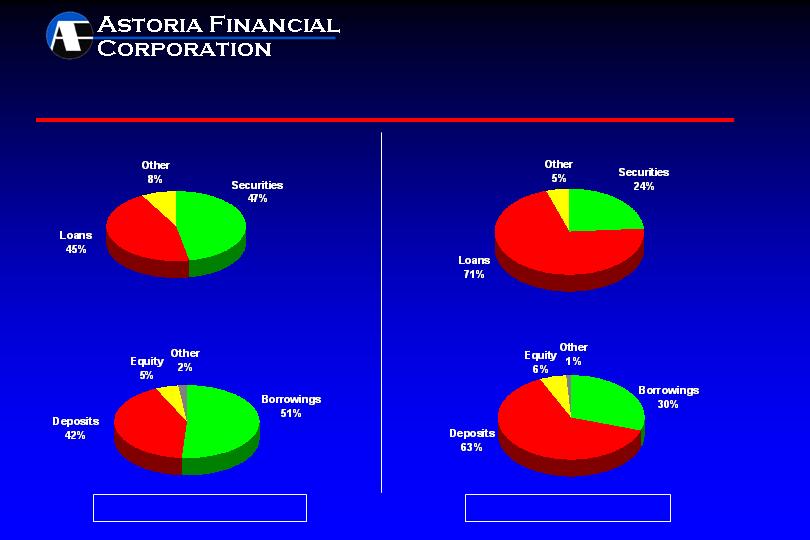

Focus on Core Business

(In Billions)

12/31/99 03/31/07

Loans

Securities

12/31/99 03/31/07

Deposits

Borrowings

vs.

Assets

Liabilities

12/31/99 03/31/07

12/31/99 03/31/07

vs.

8

Improving Balance Sheet Quality

Total Assets: 21,393,867

Total Assets: $22,696,536

At December 31, 1999

At March 31, 2007

Assets

Assets

Liabilities & Shareholders’ Equity

Liabilities & Shareholders’ Equity

9

A Simple Formula for Enhancing Shareholder Value

EFFICIENCY

MORTGAGE LENDING

• Portfolio lender, not a mtge. banker

• 1-4 Family, Multi-Family and

Commercial R.E. expertise

• Superior asset quality

RETAIL BANKING

• Premier community bank on

Long Island

• Dominant deposit market share

• #1 thrift depository in core market

10

Primarily short-term, 5/1 hybrid ARMs for portfolio

Minimizes interest rate risk

Multiple delivery channels provide flexibility & efficiency

Retail*

Commissioned brokers covering 26 states*

Third party originators – correspondents covering 43 states*

Secondary marketing capability

Sale of 15 year and 30 year fixed rate loans reduces interest rate risk

Geographically diversified portfolio

Reduces lending concentrations

1-4 Family Mortgage Lending

* All loans underwritten to Astoria’s stringent standards. Broker and correspondent networks also include D.C.

11

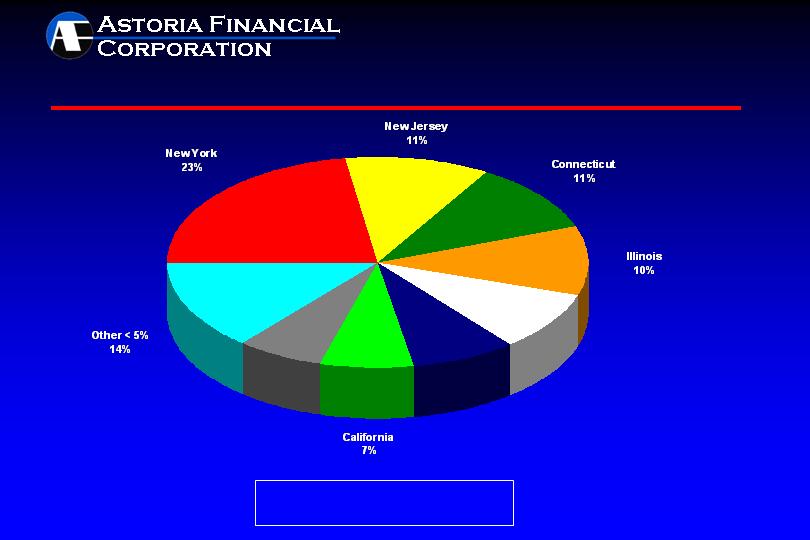

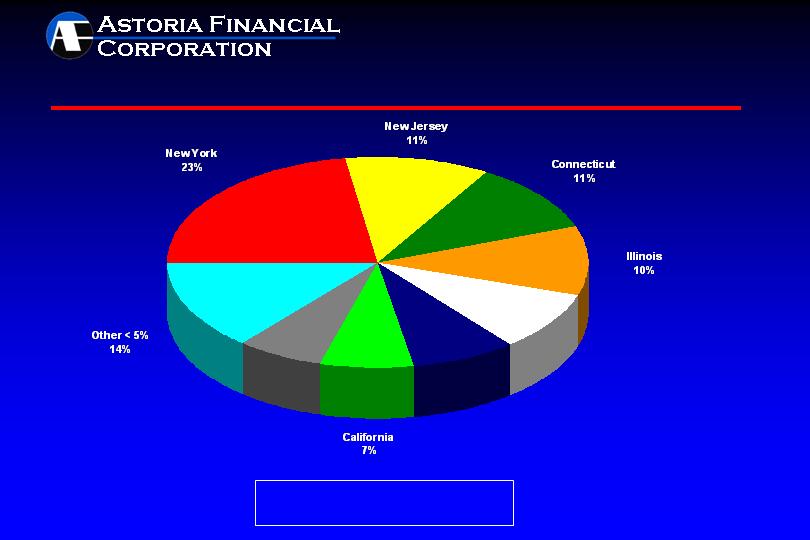

Geographic Composition of 1-4 Family Loan Portfolio

At March 31, 2007

Total 1-4 Family Loan Portfolio

$10.4 Billion

Virginia

9%

Massachusetts

7%

Maryland

8%

12

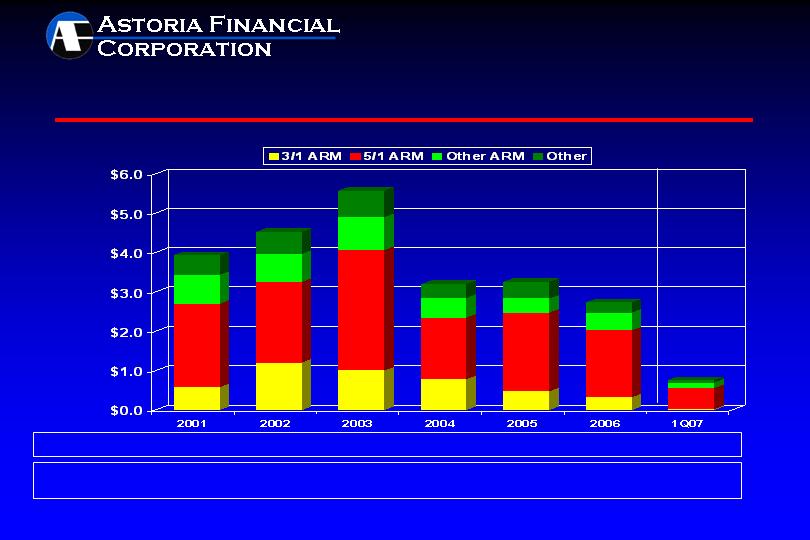

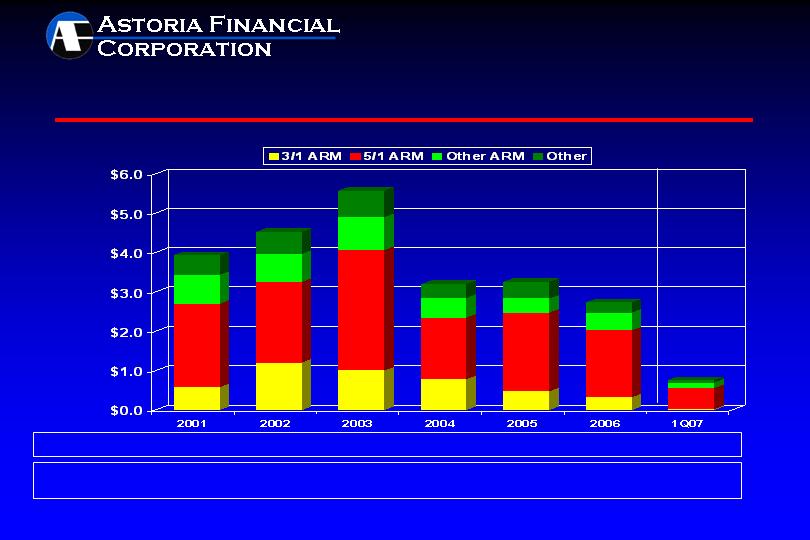

1-4 Family Mortgage Loan Originations

By Product Type

$3.9B

$4.5B

(In Billions)

$5.6B

Net portfolio growth: +$254.7 M ($895.7) M ($238.3) M +$83.7 M +$703.2 M +$456.2 M +$156.2 M

Weighted Avg. Portfolio

Coupon at Period End 7.01% 6.33% 5.26% 5.05% 5.19% 5.48% 5.51%

$3.2B

$3.3B

$2.7B

$0.76B

13

Multifamily/Commercial Real Estate Lending

• Solid and growing Multifamily/CRE portfolio

$4.1 billion in portfolio

Weighted Average Coupon at March 31, 2007: 5.84%

Conservative underwriting

– Weighted average LTV of portfolio < 65%

Average loan in portfolio < $1 million

Approximately 85% of multifamily portfolio is subject

to rent control or rent stabilization

Note: LTV is based on current principal balances and original appraised values.

14

Multifamily/CRE Portfolio Growth

(In Billions)

% of total loans 20% 25% 27% 27% 27% 27%

$2.3

$3.1

Average loan balance outstanding is < $1 million.

$3.5

$3.9

$4.1

$4.1

15

Asset Quality Focus

• Limited credit risk

Conservative underwriting, top quality loans, low LTVs

No sub-prime or payment option ARM lending

• Strong reserves

Non-performing assets: 0.32% of total assets

Allowance for loan losses/non-performing loans: 118%

• Top quality MBS portfolio

Primarily GSE, agency or ‘AAA’ rated

16

• One year gap: -16.18%

• Key balance sheet components

Short-term hybrid adjustable-rate mortgage loan portfolio

Short weighted average life MBS portfolio

Offset by:

Large, low-cost checking, savings and money market deposit

base – provides natural hedge against rising rates

Longer-term CDs

Over the past twelve months, $1.4 billion of non-callable CDs

with maturities of 18 months or greater were issued or repriced

with a weighted average rate of 5.12% and a weighted average

original maturity of 27 months

Borrowings – as needed

Interest Rate Risk Management

17

Leading Retail Banking Franchise

$13.4 billion in deposits, 86 banking office network

Serving the Long Island market since 1888

• Low cost/stable source of funds – average cost: 3.34%*

• $12.5 billion, or 93%, of total deposits emanate from within

5 miles of a branch

• Banking offices with high average deposits contribute to

efficiency

Long Island Offices (83) – Nassau (29), Queens (17), Suffolk (25),

Brooklyn (12) – Average Deposits of $155 Million

Westchester Offices (3) – Average Deposits of $178 Million

• Alternative delivery channels

ATM’s, telephone and Internet banking

* Average cost for the quarter ended March 31, 2007.

18

Long Island Powerhouse

Nassau

Queens

Brooklyn

Suffolk

Banking Offices and Deposit Share Ranking on Long Island

Overall Deposit Share Ranking:

#1- all thrifts, #4- all financial institutions

19

($ in millions) Brooklyn

Institution Total Share Branches

1. Chase $6,736 21% 44

2. Citigroup 3,793 12 25

3. Sovereign 3,659 11 21

4. WaMu 3,531 11 29

5. HSBC 3,512 11 27

Astoria (#7) 1,616 5 12

Total $32,800 292

($ in millions) Suffolk

Institution Total Share Branches

1. Capital One/North Fork $8,796 26% 63

2. Chase 6,474 19 80

3. Astoria 3,070 9 25

4. WaMu 2,643 8 36

5. Citigroup 2,446 7 28

Total $33,690 418

($ in millions) Queens .

Institution Total Share Branches

1. Chase $7,200 19% 65

2. Capital One/North Fork 4,723 13 51

3. Citigroup 4,609 12 29

4. Astoria 3,158 8 17

5. NY Community 2,882 8 39

Total $37,527 396

($ in millions) Nassau ..

Institution Total Share Branches

1. Chase $8,217 17% 82

2. Capital One/North Fork 6,479 13 59

3. Citigroup 6,045 12 54

4. NY Community 5,506 11 38

5. Astoria 4,942 10 29

Total $49,243 468

Well Positioned in Each of Our Key Markets

Source: FDIC Summary of Deposits, SNL Financial. Data as of June 30, 2006. Includes completed transactions.

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

Deposits

Median household income: $90,227

Median household income: $53,531

U.S. Median HHI: $51,546 / NY State Median HHI: $54,403

Median household income: $81,248

Median household income: $40,311

20

Strong Position in Core Market

Brooklyn, Queens, Nassau and Suffolk

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

Source: FDIC Summary of Deposits. Data as of June 30, 2006.

The combined population of these four counties (7.6 million) exceeds the population of 38 individual U.S. states

(Dollars in millions) June 06/05 Market Average

Institution Deposits Growth Share Branches Deposits

1. Chase $ 28,626 $ 1,170 18.7% 271 $106

2. Capital One/North Fork 22,766 (1,723) 14.9 201 113

3. Citibank 16,894 527 11.0 136 124

4. ASTORIA * 12,786 453 8.3 83 154

5. Washington Mutual 10,970 257 7.2 127 86

6. NY Community 10,665 326 7.0 121 88

7. HSBC 9,865 476 6.4 93 106

8. Sovereign 5,178 476 3.4 38 136

9. Bank of America 5,037 (436) 3.3 112 45

10. Commerce 4,957 1,923 3.2 48 103

Total – Top 10 $127,744 $ 3,449 83.4% 1,230 104

Total - Core Market $153,259 $ 5,214 100.0% 1,574 97

21

June 2006 June 99-06 June 99-06

(Dollars in millions) June 2006 June 99-06 Market Market Share Change in #

Institution Deposits $ Growth % Share Gain/Loss of Branches

1. Chase $28,626 $ 9,696 51.2% 18.7% 1.7% - 9

2. Capital One/North Fork 22,766 5,389 31.0 14.9 (0.7) + 6

3. Commerce 4,957 4,957 3.2 3.2 + 48

4. ASTORIA * 12,786 3,592 39.1 8.3 0.0 - 1

5. Citibank 16,894 3,053 22.1 11.0 (1.4) - 21

6. NY Community 10,665 2,623 32.6 7.0 (0.2) + 21

7. Sovereign 5,178 2,003 63.1 3.4 0.5 + 9

8. Washington Mutual 10,970 1,780 19.4 7.2 (1.1) + 49

9. HSBC 9,865 1,334 15.6 6.4 (1.3) - 7

10. Bank of America 5,037 (2,901) (36.5) 3.3 (3.8) - 12

Total - Top 10 $127,744 $31,526 32.8% 83.4% (3.1) + 83

Total - Core Market $ 153,259 $41,916 37.6% 100.0% +190

Market Share Trend – 1999 - 2006

Brooklyn, Queens, Nassau and Suffolk

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

Source: FDIC Summary of Deposits. Data as of June 30, 2006.

22

Retail Banking

Acquisition with organic growth vs. de-novo branching

Differentiation from competition

– Maintain pricing discipline

– Pro-active sales culture

– Focus on customer service

– Strong support of local community-based organizations

and activities

23

Sales – PEAK Process

Performance based on Enthusiasm, A ctions and Knowledge

“Sales Oriented and Service Obsessed”

A “needs” based approach to sales rather than “product”

based approach

Highly interactive program – daily and weekly meetings

create a focus that is shared throughout the branch network

Incentives for strong performance, both individual and team

24

Key Findings : Favorably Positioned Against Competitors

71% of Astoria customers are highly satisfied

71% of Astoria customers are highly likely to recommend

Astoria to friend/family member

• Astoria customers are 22% more likely to net increase their

deposit relationship than are competitor customers.

Satisfaction with the branch is by far the strongest driver of

overall satisfaction – 86% of Astoria customers are highly

satisfied with quality of branch service

Customer Satisfaction

25

Community Involvement

Key Initiatives

• Education First

Supports lifelong learning, promotes savings and provides meaningful

financial solutions to improve the way our customers live

• Neighborhood Outreach

Supports local organizations that enrich the communities within our market

area

Nearly 1000 community-based organizations supported annually

• Results/Recognition

Five consecutive “Outstanding” Community Reinvestment Act ratings by

OTS

Astoria Federal: An integral part of the fabric of the communities we serve

26

Total - $13.4 Billion

At March 31, 2007

*Retail CDs: $7.8B

Rate: 4.71%

Money Market: $0.4B

Rate: 1.00%

Savings: $2.1B

Rate: 0.40%

*Liquid CDs: $1.6B

Rate: 4.93%

Now/Demand: $1.5B

Rate: 0.06%

Core Community Deposits

* Note: 58% of the households that have a retail CD or Liquid CD account also have a low

cost checking, savings or money market account relationship.

27

G&A Expense Ratio(1)

* Most recent data available for All US Thrifts and NY Thrifts is for the year ended December 31, 2006. AF is for the three months

ended March 31, 2007.

Source: SNL Financial – Median Ratios

(1) G&A expense ratio represents general and administrative expense divided by average assets.

28

U.S. Court of Appeals for the Federal Circuit reversed AF

award of $436 million on February 1, 2007 in the LISB case

– AF filed a petition for rehearing or rehearing en banc on

April 2, 2007 with the U.S. Court of Appeals for the Federal

Circuit

Remaining goodwill litigation claim

$160 million of original supervisory goodwill created by

Fidelity NY - $135 million written off

Trial commenced on April 19, 2007 before the U.S. Court of

Federal Claims

Goodwill Claims - Update

29

Challenges

Inverted U.S. Treasury yield curve

Anticipated gradual flattening of the yield curve in the latter half of 2007

and into 2008 may result in modest net interest margin compression

continuing with a full year 2007 estimate of approximately 1.63%

Strategies

Remain focused

Grow loans and deposits

Maintain credit standards

Maintain pricing discipline

Reduce securities

• Maintain superior operating efficiency

Continue buying back AF stock, maintaining tangible capital

levels at or near 4.75%

Objective: Produce solid returns

2007 Outlook

30

Investment Merits

• Strong balance sheet – superior asset quality

Attractive banking franchise

Dominant deposit market share in core market

Superior operating efficiency

Well capitalized

Proactive Capital Management

Stock repurchase program in place

26% compounded annual growth in dividend*

Over $2.3 billion returned to shareholders in the past 10+

years

* CAGR from 1995, commencement of quarterly dividend, to 2Q07 annualized

31

AF: A Record of Enhancing Shareholder Value

Addendum

Ownership Profile

March 31, 2007

Shares Outstanding: 97,477,001

33

Acquisition History

Year Thrift # Branches Assets

(in millions)

1973 Metropolitan Federal 2 $ 50

1979 Citizens Savings (FSLIC) 5 130

1982 Hastings-on-Hudson Federal 3 100

1984 Chenango Federal (1) 1 25

1987 Oneonta Federal (1) 4 205

1990 Whitestone Savings (RTC) 4 280

1995 Fidelity New York (2) 18 1,800

1997 The Greater NY Savings Bank 14 2,400

1998 Long Island Bancorp, Inc. 35 6,600

Total &nb sp; 86 $11,590

(1) Branches sold in 1999

(2) One satellite office closed in 1997

34

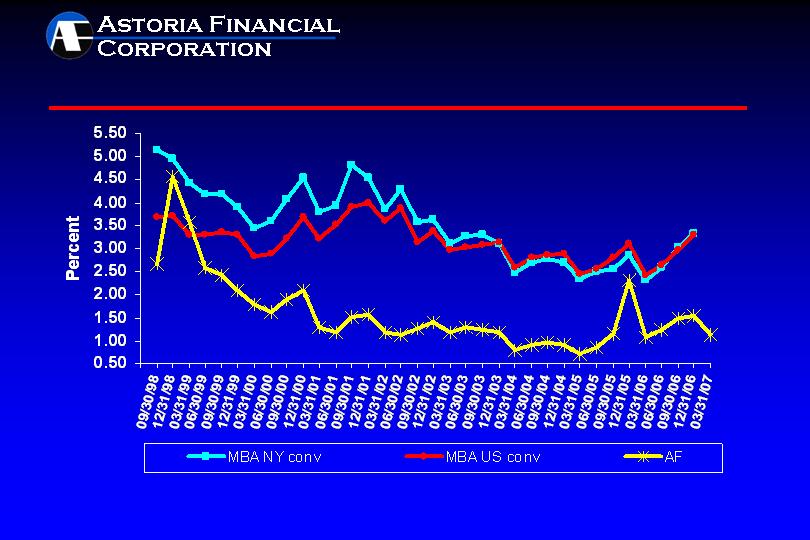

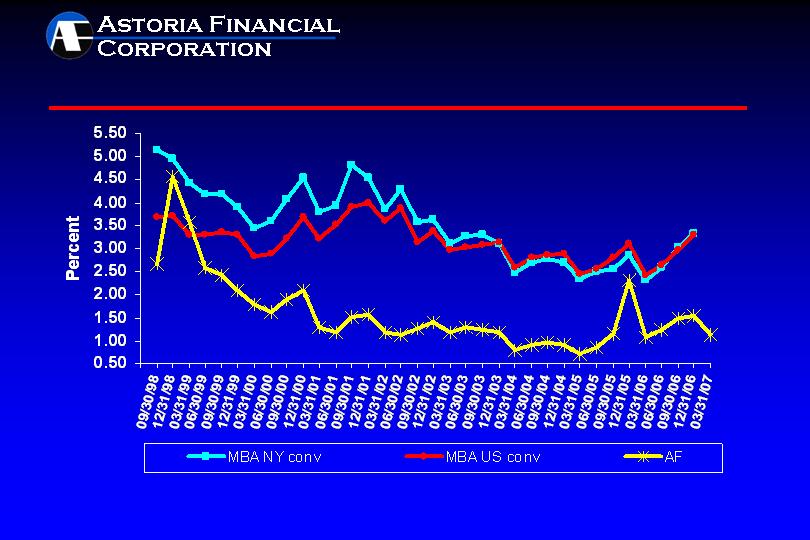

1-4 Family Delinquency Ratios: AF vs. MBA

Source: MBA National Delinquency Survey. Beginning with 3Q02, MBA statistics for conventional loans excludes sub-prime loans.

35

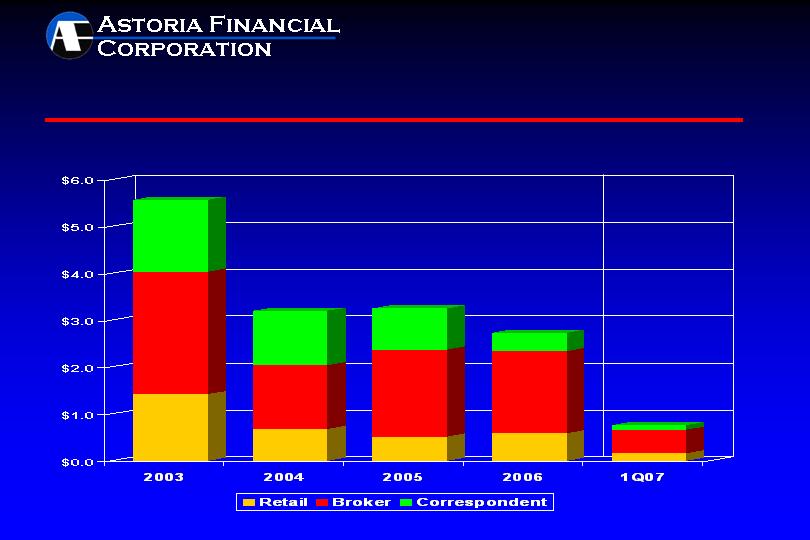

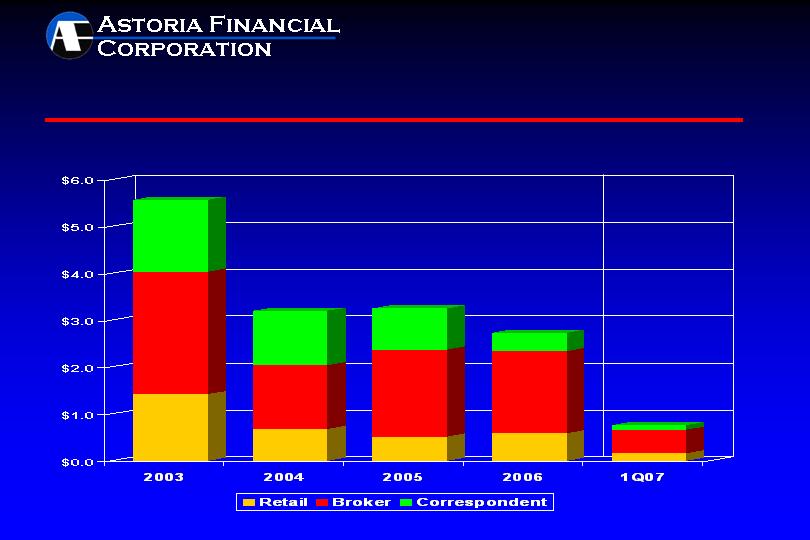

1- 4 Family Mortgage Loan Originations

By Delivery Channel

(In Billions)

$5.6B

$3.2B

$3.3B

$2.7B

$.076B

36

Geographic Composition of 1- 4 Family Loan Originations

Total 1-4 Family Originations: $760 Million

For the quarter ended March 31, 2007

Excludes home equity

Other <5%

15%

Illinois

14%

Connecticut

10%

New York

22%

37

Geographic Composition of Multifamily/CRE Loan Originations

For the quarter ended March 31, 2007

Total Multifamily/CRE

Originations

$134 Million

New York,

New Jersey,

Connecticut

83%

38

Interest Rate Risk Management

CDs Issued Weighted Average Weighted Average

or Repriced* Rate Original Term

2Q06 $384.0 Million 5.07% 31 months

3Q06 $268.9 Million 5.27% 34 months

4Q06 $211.6 Million 5.08% 20 months

1Q07 $ 492.8 Million 5.09% 22 months

TOTAL $1.4 Billion 5.12% 27 months

* Non-callable CDs issued or repriced during the period with an original maturity of 18 months or greater

39

Glossary

ARM – Adjustable Rate Mortgage

CAGR – Compounded Annual Growth Rate

CRE – Commercial Real Estate

ESOP – Employee Stock Ownership Plan

GSE – Government Sponsored Enterprise

ISS – Institutional Shareholder Services

LTV – Loan-To-Value ratio

MBS – Mortgage-Backed Securities

OTS – Office of Thrift Supervision

40

Long Island’s Premier Community Bank

www.astoriafederal.com