Investor Presentation

Fourth Quarter Ended

December 31, 2007

www.astoriafederal.com

Forward Looking Statement

This presentation may contain a number of forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are based on various assumptions and analyses made by us in light

of our management’s experience and its perception of historical trends, current conditions and expected

future developments, as well as other factors we believe are appropriate under the circumstances. These

statements are not guarantees of future performance and are subject to risks, uncertainties and other factors

(many of which are beyond our control) that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. These factors include, without limitation, the

following: the timing and occurrence or non-occurrence of events may be subject to circumstances beyond

our control; there may be increases in competitive pressure among financial institutions or from non-financial

institutions; changes in the interest rate environment may reduce interest margins or affect the value of our

investments; changes in deposit flows, loan demand or real estate values may adversely affect our business;

changes in accounting principles, policies or guidelines may cause our financial condition to be perceived

differently; general economic conditions, either nationally or locally in some or all areas in which we do

business, or conditions in the real estate or securities markets or the banking industry may be less favorable

than we currently anticipate; legislative or regulatory changes may adversely affect our business; applicable

technological changes may be more difficult or expensive than we anticipate; success or consummation of

new business initiatives may be more difficult or expensive than we anticipate; or litigation or matters before

regulatory agencies, whether currently existing or commencing in the future, may be determined adverse to us

or may delay occurrence or non-occurrence of events longer than we anticipate. We assume no obligation to

update any forward-looking statements to reflect events or circumstances after the date of this document.

2

NYSE: AF

Corporate Profile

$21.7 billion in assets

• $16.2 billion in loans

$13.0 billion in deposits

8.4% deposit market share in Long Island market

– Largest thrift depository

Insider & ESOP stock ownership: 21%

Corporate Governance: AF outperformed 97% of all banks in

the S&P Banks industry group *

Solid and seasoned management team

14 years as a public company – enhancing shareholder value

All figures in this presentation are as of December 31, 2007, except as noted.

* Source: Institutional Shareholder Services (ISS) as of January 1, 2008

3

Dividend Growth

CAGR = 23%

* 1Q08 annualized; 4.19% yield, as of January 30, 2008

4

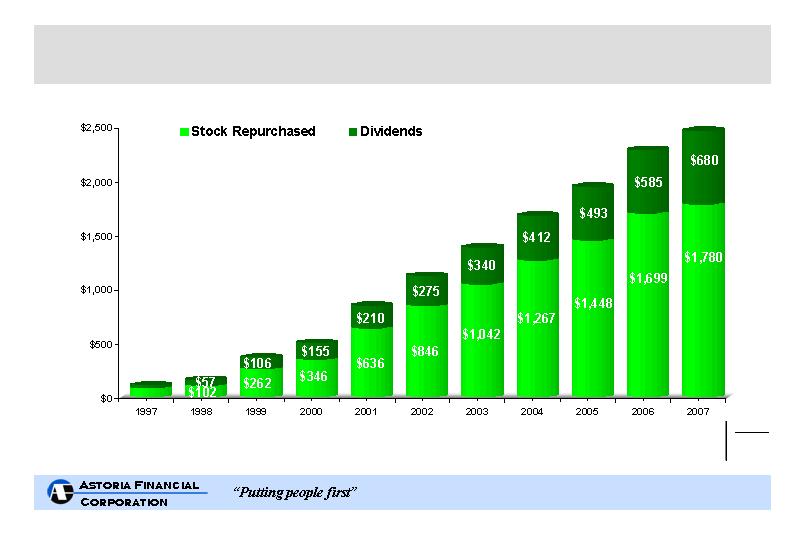

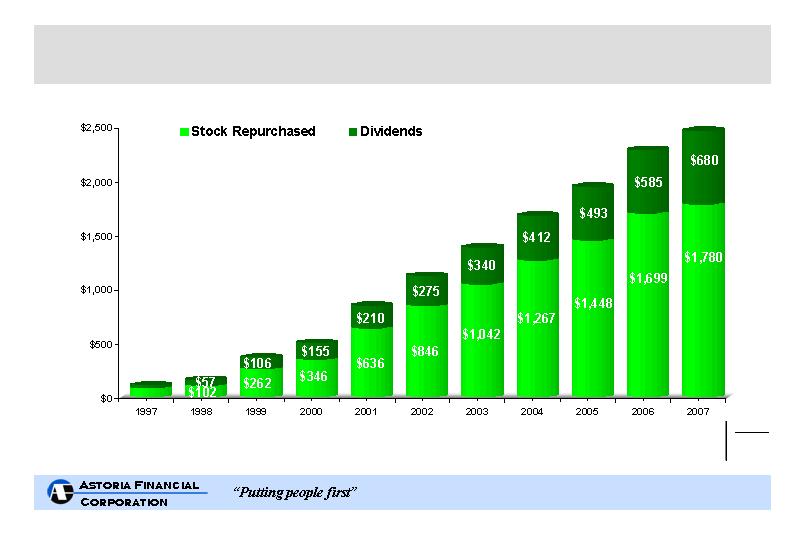

Cumulative Cash Returned to Shareholders

(In Millions)

$110

$159

$368

$846

$1,121

$501

$2.5 billion returned to shareholders in the past 11 years

$1,382

$1,679

$1,941

$2,284

$2,460

* Amount does not cross foot due to rounding

5

Shares

TOTAL

Repurchased:

6.7M

1.0M

12.8M

7.8M

15.5M

10.9M

10.6M

9.1M

6.6M

8.4M

3.0M

92.3M*

Average Price:

$12.85

$16.31

$12.48

$10.81

$18.70

$19.32

$18.42

$24.82

$27.49

$29.92

$26.64

$19.27

Stock Performance - Comparative Total Return

Comparative returns from November 30, 1993 – December 31, 2007 (IPO 11/18/93)

AF CAGR = 15%

6

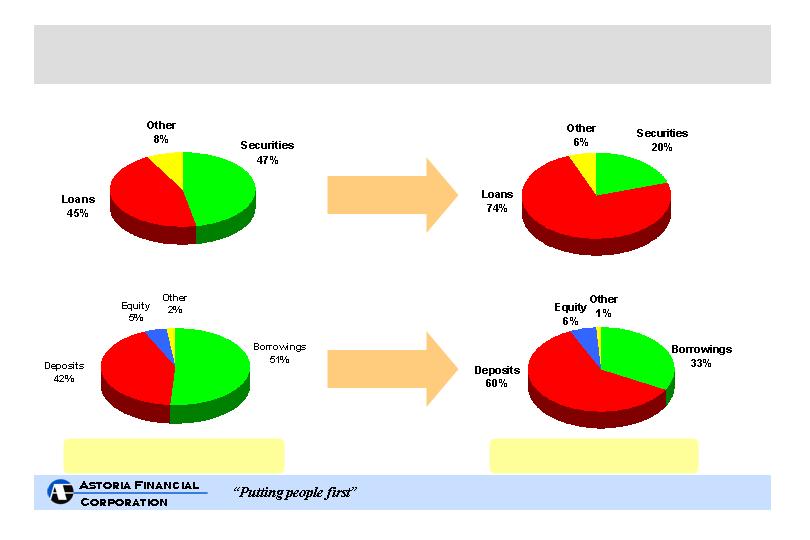

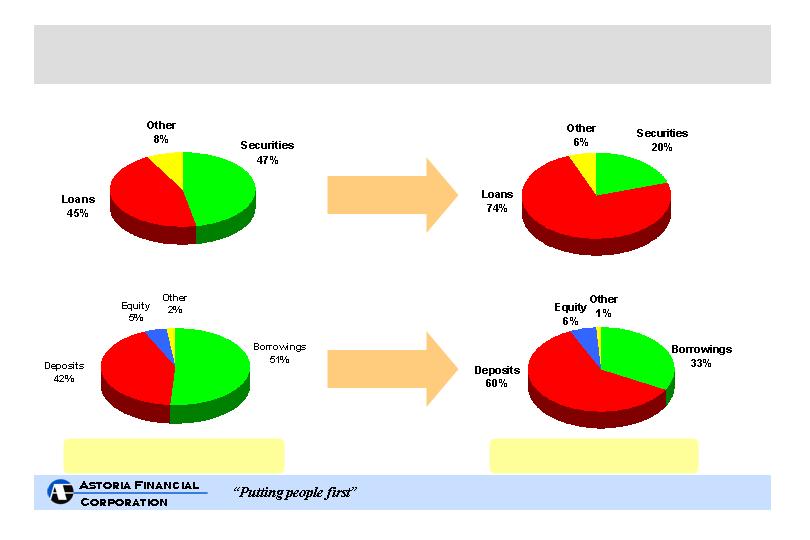

(In Billions)

12/31/99 12/31/07

Loans

Securities

12/31/99 12/31/07

Deposits

Borrowings

vs.

Assets

Liabilities

12/31/99 12/31/07

12/31/99 12/31/07

vs.

Focus on Core Business

(In Billions)

(In Billions)

7

Total Assets: $22,696,536

At December 31, 1999

Assets

Assets

Liabilities & Shareholders’ Equity

Liabilities & Shareholders’ Equity

Total Assets: $21,719,368

At December 31, 2007

Improving Balance Sheet Quality

($ in thousands)

($ in thousands)

8

EFFICIENCY

MORTGAGE LENDING

• Portfolio lender, not a mtge. banker

• 1-4 Family, Multi-Family and

Commercial R.E. expertise

• Superior asset quality

RETAIL BANKING

• Premier community bank on

Long Island

• Dominant deposit market share

• #1 thrift depository in core market

Formula for Enhancing Shareholder Value

9

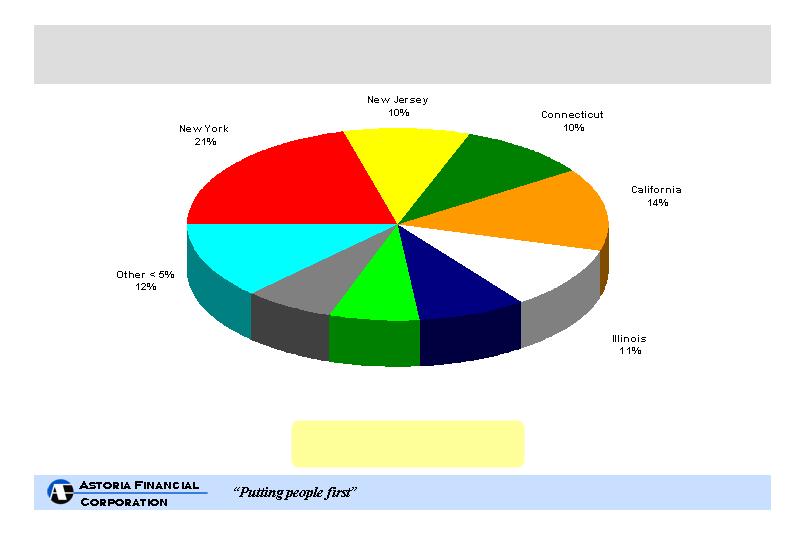

Primarily short-term, 5/1 jumbo prime hybrid ARMs for portfolio

Minimizes interest rate risk

Average loan amount for 2007 production = $550,000

Average LTV on 2007 production = 65%

Multiple delivery channels provide flexibility & efficiency

Retail*

Commissioned brokers covering 22 states*

Third party originators – correspondents covering 29 states*

Secondary marketing capability

Sale of 15 year and 30 year fixed rate loans reduces interest rate risk

Geographically diversified portfolio

Reduces lending concentrations

1-4 Family Mortgage Lending

* All loans underwritten to Astoria’s stringent standards. Broker and correspondent networks also include D.C.

11

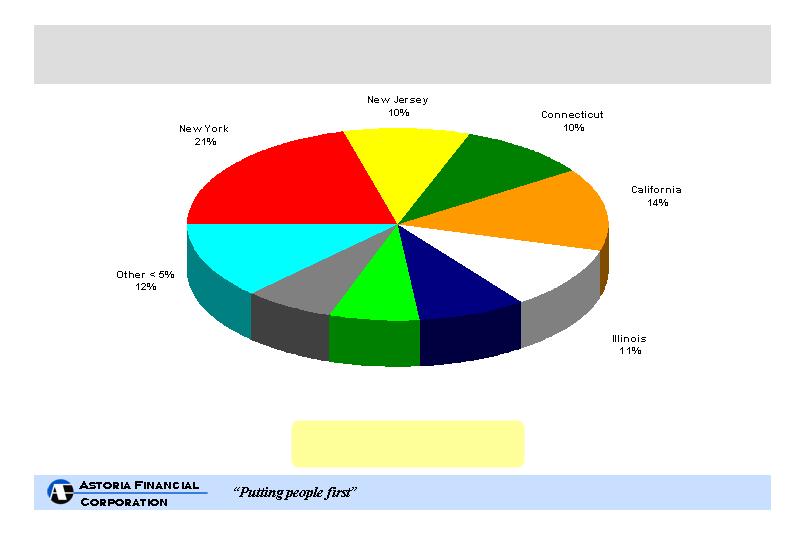

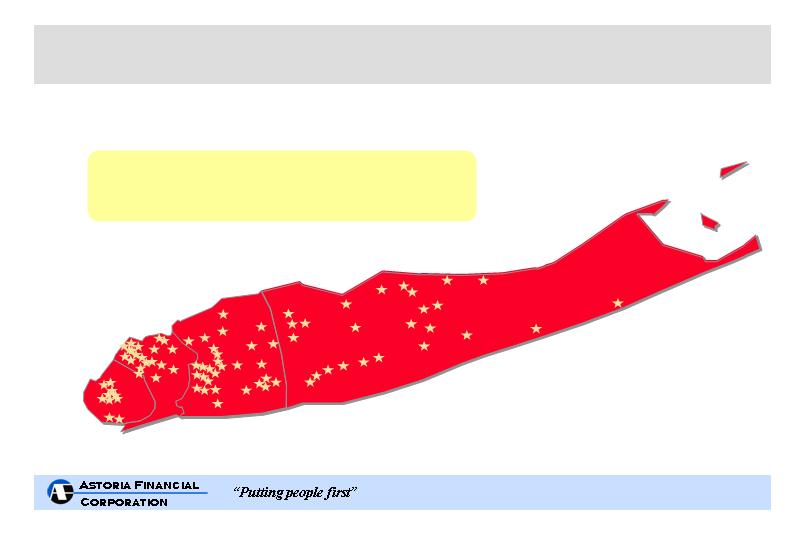

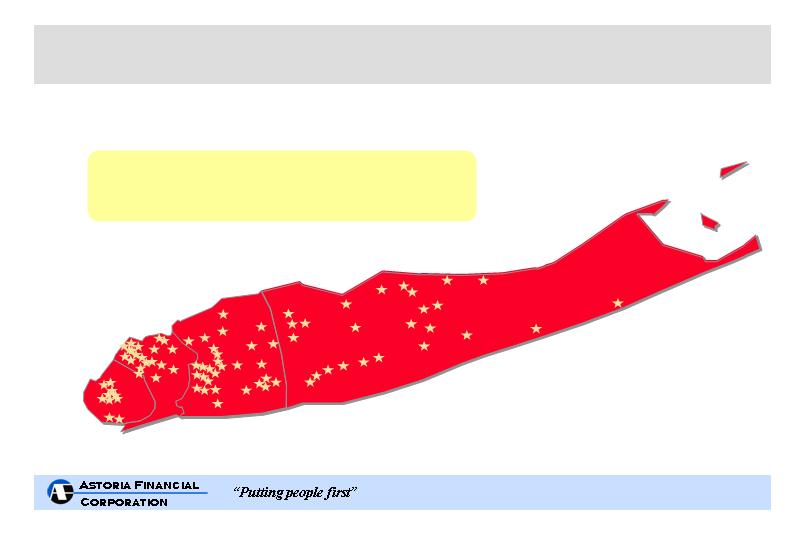

Geographic Composition of 1-4 Family Loan Portfolio

At December 31, 2007

Total 1-4 Family Loan Portfolio

$11.6 Billion

Virginia

8%

Massachusetts

7%

Maryland

7%

12

By Product Type

$4.5B

(In Billions)

$5.6B

$3.2B

$3.3B

$2.7B

$3.8B

1-4 Family Mortgage Loan Originations

13

Net portfolio growth:

($895.7) M

($238.3) M

+$83.7 M

+$703.2 M

+$456.2 M

+$1.4 B

Weighted Avg. Portfolio

Coupon at Period End

6.33%

5.26%

5.05%

5.19%

5.48%

5.70%

Fewer participants

Lending standards further tightened

Spreads widening

Volumes increasing

Mortgage Banking Dislocation:

Positive Implications for Jumbo Mtge. Portfolio Lenders

14

Solid Multifamily/CRE portfolio

$4.0 billion in portfolio

Weighted Average Coupon at December 31, 2007: 5.87%

Conservative underwriting

– 2007 production

Weighted average LTV = 65% at origination

Average loan amount = $1.3 million

– Total portfolio

Weighted average LTV < 65%*

Average loan < $1 million

Approximately 75% of multifamily portfolio is subject

to rent control or rent stabilization

Multifamily/Commercial Real Estate Lending

* Based on current principal balances and original appraised values.

15

• Limited credit risk

Conservative underwriting, top quality loans, low LTVs

No sub-prime or payment option ARM lending

Non-performing assets: $115.4 million or 0.53% of total assets*

No geographic concentration of NPLs

Charge-offs of just 2 basis points of average loans in 2007

• Top quality MBS portfolio

Primarily GSE, agency or ‘AAA’ rated

Asset Quality Focus

* Includes $38 million of loans, or 33% of NPAs, that have only missed two payments.

16

Source: MBA National Delinquency Survey. Beginning with 3Q02, MBA statistics for conventional loans excludes sub-prime loans.

1-4 Family Delinquency Ratios: AF vs. MBA

17

• One year gap: -24%

• Key balance sheet components

Short-term hybrid adjustable-rate mortgage loan portfolio

Short weighted average life MBS portfolio

Offset by:

Large, low-cost checking, savings and money market

deposit base – provides natural hedge against rising rates

Longer-term CDs

Borrowings – as needed

Interest Rate Risk Management

18

$13.0 billion in deposits, 86 banking office network

Serving the Long Island market since 1888

• Low cost/stable source of funds – average cost: 3.51%*

• $12.1 billion, or 93%, of total deposits emanate from within

5 miles of a branch

• Banking offices with high average deposits contribute to

efficiency

Long Island Offices (83) – Nassau (29), Queens (17), Suffolk (25),

Brooklyn (12) – Average Deposits of $151 Million

Westchester Offices (3) – Average Deposits of $175 Million

• Alternative delivery channels

ATM’s, telephone and Internet banking

* For the quarter ended December 31, 2007.

Leading Retail Banking Franchise

19

Nassau

Queens

Brooklyn

Suffolk

Banking Offices and Deposit Share Ranking on Long Island

Overall Deposit Share Ranking:

#1- all thrifts, #4- all financial institutions

Long Island Powerhouse

20

Source: FDIC Summary of Deposits, SNL Financial. Data as of June 30, 2007. Data includes merger and acquisition activity and pending transactions.

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

U.S. Median HHI: $53,154 / NY State Median HHI: $56,704

Well Positioned in Each of Our Key Markets

21

($ in millions)

Nassau

($ in millions)

Queens

Institution

Deposits

Branches

Institution

Deposits

1

Chase

$8,151

16

%

85

1

Chase

$7,451

19

%

67

2

Capital One/North Fork

6,578

13

60

2

Citigroup

5,046

13

29

3

Citigroup

6,552

13

54

3

Capital One/North Fork

4,766

12

51

4

Astoria

5,122

10

29

4

Astoria

3,167

8

17

5

NY Community

4,684

9

37

5

NY Community

2,971

7

45

Nassau Total

$50,739

486

Queens Total

$39,710

418

($ in millions)

Suffolk

($ in millions)

Brooklyn

Institution

Deposits

Institution

Deposits

1

Capital One/North Fork

$7,262

22

%

63

1

Chase

$6,651

21

%

46

2

Chase

6,330

19

78

2

Citigroup

4,130

13

25

3

Astoria

3,201

10

25

3

WaMu

3,572

11

33

4

WaMu

2,741

8

36

4

HSBC

3,550

11

27

5

Citigroup

2,639

8

28

5

Cap One/North Fork

2,814

9

28

Suffolk Total

$33,425

421

Astoria (#7)

1,609

5

12

Brooklyn Total

$32,438

314

Branches

Branches

Share

Share

Share

Share

Branches

Median household income: $42,491

Median household income: $95,477

Median household income: $55,921

Median household income: $83,592

Brooklyn, Queens, Nassau and Suffolk

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

Source: FDIC Summary of Deposits. Data as of June 30, 2007.

The combined population of these four counties (7.7 million) exceeds the population of 38 individual U.S. states

Strong Position in Core Market

(1) 2006 & 2007 deposits have been adjusted to include the effect of merger and acquisition activity and pending transactions.

22

($ in millions)

Average

June 07/06

Market

Deposits

Institution

Growth

(1)

Share

Per Branch

1

Chase

$

28,583

$

(43)

18.3

%

276

$104

2

Capital One/North Fork

21,420

(1,346)

13.7

202

106

3

Citibank

18,367

1,473

11.8

136

135

4

ASTORIA*

13,098

312

8.4

83

158

5

Washington Mutual

11,343

373

7.3

136

83

6

NY Community

10,420

(490)

6.7

128

81

7

HSBC

9,956

91

6.4

93

107

8

Commerce

6,036

1,079

3.9

57

106

9

Bank of America

5,250

213

3.4

117

45

10

Sovereign

3,510

(1,668)

2.3

36

98

Total - Top 10

$

127,983

$

(6)

81.9

%

1,264

$101

Total - Core Market

$

156,311

$

3,052

100.0

%

1,639

$95

Deposits

(1)

Branches

# of

Brooklyn, Queens, Nassau and Suffolk

* Astoria’s deposits highlighted above are comprised of retail community deposits. Astoria does not solicit broker or municipal deposits.

Source: FDIC Summary of Deposits. Data as of June 30, 2007.

Market Share Trend 1999 - 2007

(1) 1999 & 2007 deposits adjusted to include the effect of merger and acquisition activity and pending transactions.

23

($ in millions)

June 07

June 99-07

June 99-07

June 2007

June 99-07

Market

Market Share

Change in #

Institution

Deposits

(1)

$

Growth

(1)

%

Share

Gain/Loss

of Branches

1

Commerce

$

6,036

$

6,036

100.0

%

3.9

%

3.9

%

57

2

Chase

28,583

9,653

51.0

18.3

1.3

(4)

3

ASTORIA*

13,098

3,904

42.5

8.4

0.1

(1)

4

NY Community

10,420

2,377

29.6

6.7

(0.5)

28

5

Citibank

18,367

4,526

32.7

11.8

(0.6)

(21)

6

Sovereign

3,510

335

10.6

2.3

(0.6)

7

7

Washington Mutual

11,343

2,153

23.4

7.3

(1.0)

58

8

HSBC

9,956

1,425

16.7

6.4

(1.3)

(7)

9

Capital One/North Fork

21,420

4,043

23.3

13.7

(1.9)

7

10

Bank of America

5,250

(2,688)

(33.9)

3.4

(3.7)

(7)

Total - Top 10

$

127,983

$

31,764

33.0

%

81.9

%

(4.5)

%

+ 117

Total - Core Market

$

156,311

$

44,968

40.4

%

100.0

%

+ 255

Acquisition with organic growth vs. de-novo branching

Differentiation from competition

– Maintain pricing discipline

– Pro-active sales culture

– Focus on customer service

– Strong support of local community-based organizations

and activities

Retail Banking

24

Performance based on Enthusiasm, A ctions and Knowledge

“Sales Oriented and Service Obsessed”

A “needs” based approach to sales rather than “product”

based approach

Highly interactive program – daily and weekly meetings

create a focus that is shared throughout the branch network

Incentives for strong performance, both individual and team

Sales – PEAK Process

25

Key Findings : Favorably Positioned Against Competitors

• 71% of Astoria customers are highly satisfied

• 71% of Astoria customers are highly likely to recommend

Astoria to friend/family member

• Astoria customers are 22% more likely to net increase their

deposit relationship than are competitor customers

• Satisfaction with the branch is by far the strongest driver of

overall satisfaction – 86% of Astoria customers are highly

satisfied with quality of branch service

Customer Satisfaction

26

• Education First

Supports lifelong learning, promotes savings and provides meaningful

financial solutions to improve the way our customers live

• Neighborhood Outreach

Supports local organizations that enrich the communities within our market

area

Nearly 1,000 community-based organizations supported annually

• Results/Recognition

Six consecutive “Outstanding” Community Reinvestment Act ratings by

OTS

Astoria Federal: An integral part of the fabric of the communities we serve

Community Involvement

Key Initiatives

27

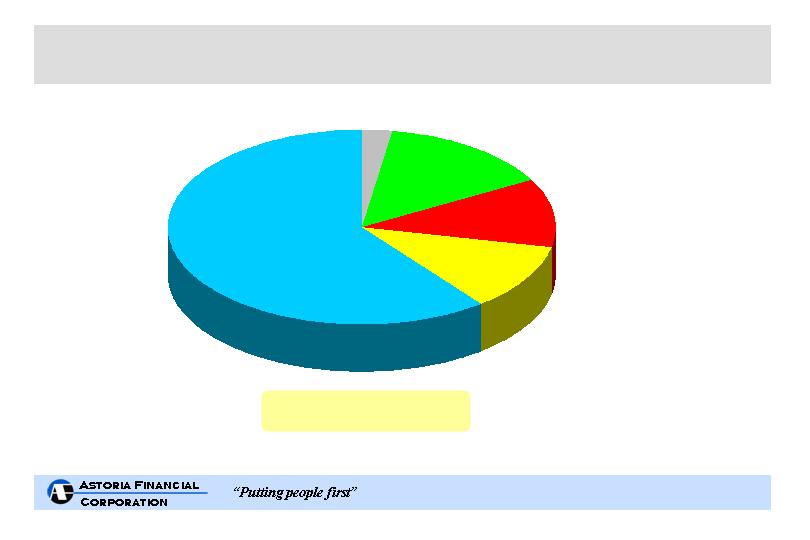

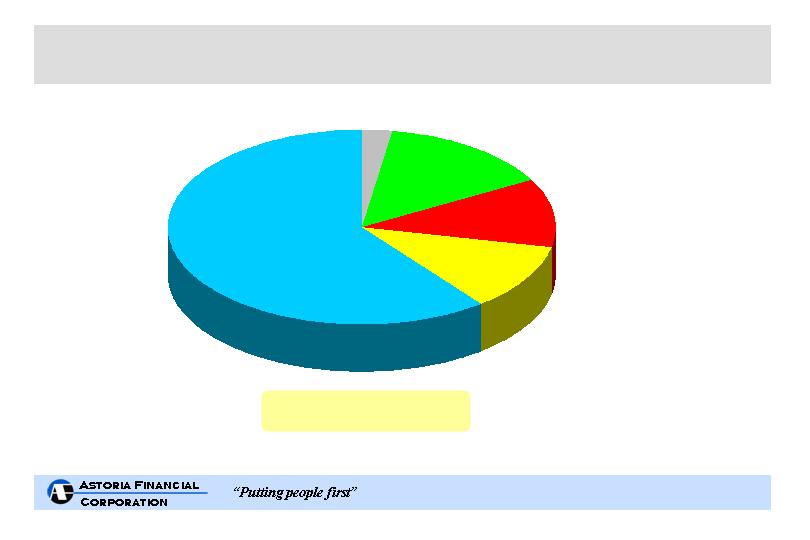

* Note: 58% of the households that have a retail CD or Liquid CD account also have a low

cost checking, savings or money market account relationship.

At December 31, 2007

Total - $13.0 Billion

*Retail CDs: $7.9B

Rate: 4.79%

Money Market: $0.3B

Rate: 0.98%

Savings: $1.9B

Rate: 0.40%

*Liquid CDs: $1.4B

Rate: 4.40%

Now/Demand: $1.5B

Rate: 0.06%

Core Community Deposits

28

* Most recent data available for All US Thrifts and NY Thrifts is for the quarter ended September 30, 2007. AF is for the twelve months

ended December 31, 2007.

Source: SNL Financial – Median Ratios

(1) G&A expense ratio represents general and administrative expense divided by average assets.

G&A Expense Ratio(1)

29

Long Island Savings Bank Claim

– On December 28, 2007, the U.S. Court of Appeal for the Federal Circuit

denied both Astoria’s petition for a panel rehearing and a rehearing en

banc and upheld the Court’s most recent opinion which reversed

Astoria’s award of $435.8 million. Management is carefully reviewing its

options with respect to any further legal action that may be taken in this

matter.

Fidelity NY Claim

– On January 8, 2008, the U.S. Court of Federal Claims awarded Astoria

$16.0 million in damages. AF anticipates that the U.S. government,

given its practice in similar cases, may file an appeal. If so, no

assurance can be given as to the timing, content or ultimate outcome of

the appeal.

Goodwill Claims - Update

30

We anticipate the yield curve will remain positively sloped and steepen

further in 2008 which should result in improved opportunities for earnings

growth and an expansion of our net interest margin.

Strategies

• Remain focused

Grow loans, deposits and earnings assets

Capitalize on mortgage banking dislocation

Lending standards further tightened

Maintain pricing discipline

Use low-cost long-term borrowings opportunistically

• Maintain superior operating efficiency

• Continue buying back AF stock, maintaining tangible capital levels

between 4.50% and 4.75%

Objective: Produce solid returns

Outlook for 2008

31

Strong balance sheet – strong asset quality

Attractive banking franchise

Dominant deposit market share in core market

Superior operating efficiency

Well capitalized

Proactive Capital Management

Stock repurchase program in place

23% compounded annual growth in dividend*

$2.5 billion returned to shareholders in the past 11 years

* CAGR from 1995, commencement of quarterly dividend, to 1Q08 annualized

Investment Merits

32

AF: A Record of Enhancing Shareholder Value

Addendum

Addendum

35

67

Support Services

Arnold K. Greenberg

Executive Vice President

26

54

Legal

Alan P. Eggleston

EVP, Secretary & General Counsel

31

54

Mortgage Lending

Gary T. McCann

Executive Vice President

37

61

Retail Banking

Gerard C. Keegan

Vice Chairman & CAO

18

44

Chief Financial Officer

Frank E. Fusco

EVP, Treasurer & CFO

33

57

Chief Operating Officer

Monte N. Redman

President & COO

36

69

Chief Executive Officer

George L. Engelke, Jr.

Chairman & CEO

Yrs. in

Banking

Age

Responsibility

Solid and Seasoned Management Team

34

December 31, 2007

Shares Outstanding: 95,728,562

Ownership Profile

35

(1) Branches sold in 1999

(2) One satellite office closed in 1997

$11,590

86

TOTAL

6,600

35

Long Island Bancorp, Inc.

1998

2,400

14

The Greater NY Savings Bank

1997

1,800

18

Fidelity New York (2)

1995

280

4

Whitestone Savings (RTC)

1990

205

4

Oneonta Federal (1)

1987

25

1

Chenango Federal (1)

1984

100

3

Hastings-on-Hudson Federal

1982

130

5

Citizens Savings (FSLIC)

1979

$ 50

2

Metropolitan Federal

1973

Assets

# Branches

Thrift

Year

(in millions)

Acquisition History

36

By Delivery Channel

(In Billions)

$5.6B

$3.2B

$3.3B

$2.7B

$3.8B

1-4 Family Mortgage Loan Originations

37

At December 31, 2007

Total Multifamily/CRE Portfolio

$4.0 Billion

New York,

New Jersey,

Connecticut

92%

Geographic Composition of Multifamily/CRE Portfolio Loans

38

Non-Performing Asset

-

NPA

Non-Performing Loan

-

NPL

Mortgage Bankers Association

-

MBA

Office of Thrift Supervision

-

OTS

Mortgage-Backed Securities

-

MBS

Loan-To-Value Ratio

-

LTV

Institutional Shareholder Services

-

ISS

Compounded Annual Growth Rate

-

CAGR

Government Sponsored Enterprise

-

GSE

Employee Stock Ownership Plan

-

ESOP

Commercial Real Estate

-

CRE

Adjustable Rate Mortgage

-

ARM

Glossary

39

www.astoriafederal.com