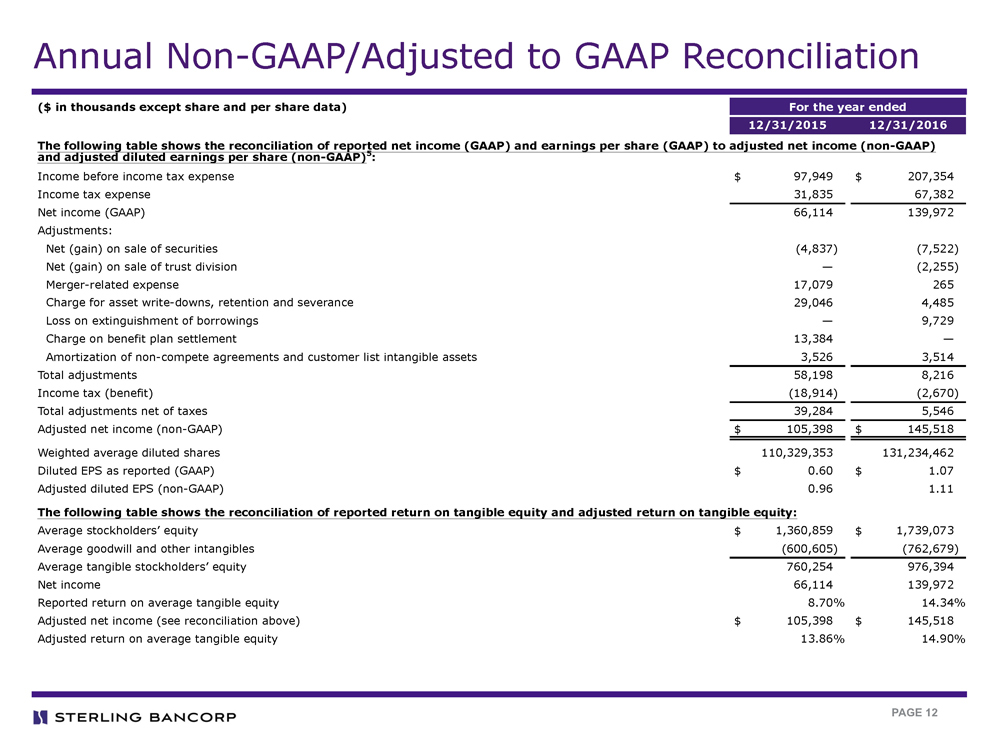

| PAGE 12 Annual Non-GAAP/Adjusted to GAAP Reconciliation ($ in thousands except share and per share data) For the year ended 12/31/2015 12/31/2016 The following table shows the reconciliation of reported net income (GAAP) and earnings per share (GAAP) to adjusted net income (non-GAAP) and adjusted diluted earnings per share (non-GAAP)5: Income before income tax expense $ 97,949 $ 207,354 Income tax expense 31,835 67,382 Net income (GAAP) 66,114 139,972 Adjustments: Net (gain) on sale of securities (4,837) (7,522) Net (gain) on sale of trust division — (2,255) Merger-related expense 17,079 265 Charge for asset write-downs, retention and severance 29,046 4,485 Loss on extinguishment of borrowings — 9,729 Charge on benefit plan settlement 13,384 — Amortization of non-compete agreements and customer list intangible assets 3,526 3,514 Total adjustments 58,198 8,216 Income tax (benefit) (18,914) (2,670) Total adjustments net of taxes 39,284 5,546 Adjusted net income (non-GAAP) $ 105,398 $ 145,518 Weighted average diluted shares 110,329,353 131,234,462 Diluted EPS as reported (GAAP) $ 0.60 $ 1.07 Adjusted diluted EPS (non-GAAP) 0.96 1.11 The following table shows the reconciliation of reported return on tangible equity and adjusted return on tangible equity: Average stockholders’ equity $ 1,360,859 $ 1,739,073 Average goodwill and other intangibles (600,605) (762,679) Average tangible stockholders’ equity 760,254 976,394 Net income 66,114 139,972 Reported return on average tangible equity 8.70% 14.34% Adjusted net income (see reconciliation above) $ 105,398 $ 145,518 Adjusted return on average tangible equity 13.86% 14.90% |