QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on June 22, 2004

Registration No. 333-113982

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

Form S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AFFINITY GROUP, INC.*

(Exact name of registrant as

specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 7900

(Primary Standard

Industrial Code

Number) | | 13-3377709

(I.R.S. Employer

Identification No.) |

2575 Vista Del Mar Drive

Ventura, CA 93001

805-667-4100

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

Thomas F. Wolfe, Chief Financial Officer

Affinity Group, Inc.

2575 Vista Del Mar Drive

Ventura, CA 93001

805-667-4100 | | Catherine A. Bartlett

Kaplan, Strangis and Kaplan, P.A.

90 South Seventh Street, Suite 5500

Minneapolis, MN 55402

612-375-1138 |

(Names and addresses, including zip codes, and telephone numbers, including area codes, of agents for service)

*The Co-Registrants listed on the next page are also included in this Form S-4 Registration Statement as additional Registrants. The Co-Registrants are the direct and indirect subsidiaries of the Registrant and the guarantors of the notes to be registered hereby.

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount To

Be Registered

| | Proposed Maximum

Offering Price

Per Unit

| | Proposed Maximum

Aggregate

Offering Price

| | Amount of

Registration Fee(1)

|

|---|

|

| 9% Senior Subordinated Notes due 2012 | | $200,000,000 | | 100% | | $200,000,000 | | $25,340 |

|

| Guarantees of 9% Senior Subordinates Notes due 2012(2) | | — | | — | | — | | None(3) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933.

- (2)

- Each subsidiary of Affinity Group, Inc. that is listed on the table of Additional Registrants on the following page will guarantee the notes being registered hereby.

- (3)

- Pursuant to Rule 457(n) of the Securities Act, no separate consideration will be received for the Guarantees and, therefore, no additional registration fee is required.

Each Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name

| | State or other

Jurisdiction of

Incorporation or

Organization

| | I.R.S. Employer

Identification

Number

|

|---|

| Affinity Advertising, LP | | Minnesota | | 36-4479428 |

| Affinity Brokerage, Inc. | | Delaware | | 77-0450002 |

| Affinity Road and Travel Club, Inc. | | Texas | | 23-2066824 |

| Camp Coast to Coast, Inc. | | Delaware | | 13-3377711 |

| Camping Realty, Inc. | | Kentucky | | 62-1357841 |

| Camping World, Inc. | | Kentucky | | 61-1217779 |

| Camping World Insurance Services of Nevada, Inc. | | Nevada | | 88-0447614 |

| Camping World Insurance Services of Texas, Inc. | | Texas | | 74-2999476 |

| Coast Marketing Group, Inc. | | Delaware | | 36-4283353 |

| CWI, Inc. | | Kentucky | | 61-0994306 |

| CW Michigan, Inc. | | Delaware | | 31-1552845 |

| Ehlert Publishing Group, Inc. | | Minnesota | | 41-1593263 |

| Golf Card International Corp. | | Delaware | | 87-0511642 |

| Golf Card Resort Services, Inc. | | Delaware | | 84-1238913 |

| GSS Enterprises, Inc. | | Delaware | | 84-1238910 |

| Power Sports Media, Inc. | | Delaware | | 36-4483237 |

| TL Enterprises, Inc. | | Delaware | | 84-1236595 |

| VBI, Inc. | | Delaware | | 95-4284593 |

The address of each of the Co-Registrants is c/o Affinity Group, Inc., 2575 Vista Del Mar Drive, Ventura, CA 93001, telephone 805-667-4100.

The name and address, including zip code, of the agent for service for each of the Co-Registrants is Thomas F. Wolfe, Chief Financial Officer of Affinity Group, Inc., 2575 Vista Del Mar Drive, Ventura, CA 93001, telephone 805-667-4100.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated June 22, 2004.

PROSPECTUS

AFFINITY GROUP, INC.

$200,000,000 aggregate principal amount of registered

9% Senior Subordinated Notes due 2012

for any and all of a like principal amount of outstanding unregistered

9% Senior Subordinated Notes due 2012

We are offering to exchange 9% senior subordinated notes due 2012 (the "exchange notes") that have been registered under the Securities Act of 1933, as amended (the "Securities Act"), for any and all of the $200,000,000 aggregate principal amount outstanding of our 9% senior subordinated notes due 2012 (the "old notes") that were issued and sold by us on February 18, 2004 in a private offering exempt from registration under the Securities Act. This offer to exchange is subject to the conditions set forth in this prospectus and the accompanying letter of transmittal.

Material Terms of this Exchange Offer

- •

- The exchange offer expires at 5:00 p.m., New York City time, on , 2004, unless extended.

- •

- We will exchange all old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer.

- •

- You may withdraw tendered old notes at any time prior to the expiration of this exchange offer.

- •

- You may tender old notes only in denominations of $1,000 and multiples of $1,000.

- •

- The exchange of old notes for exchange notes pursuant to this exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- The terms of the exchange notes are substantially identical to the old notes, except for certain transfer restrictions and registration rights relating to the old notes, and will be guaranteed by our present and future subsidiaries on terms substantially identical in all material respects to the guarantees of the old notes.

- •

- We will not receive any proceeds from this exchange offer.

- •

- Affiliates of our company may not participate in this exchange offer.

- •

- We do not intend to apply for listing of the exchange notes on any securities exchange or to seek approval for quotation of the exchange notes through an automated quotation system.

See "Risk Factors" beginning on page 17 of this prospectus to read about factors you should consider before making an investment in the exchange notes.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2004.

FORWARD-LOOKING STATEMENTS

We make "forward-looking statements" throughout this prospectus. Whenever you read a statement that is not simply a statement of historical fact (such as when we describe what we "believe," "expect" or "anticipate" will occur, and other similar statements), you must remember that our expectations may not be correct, even though we believe they are reasonable. We do not guarantee that the transactions and events described in this prospectus will happen as described (or that they will happen at all). You should read this prospectus completely and with the understanding that actual future results may be materially different from what we expect. We will not update these forward-looking statements, even though our situation will change in the future.

Whether actual results will conform with our expectations and predictions is subject to a number of risks and uncertainties, many of which are outside our control, any one of which, or a combination of which, could materially affect the results of our operations and whether the forward-looking statements made by us ultimately prove to be accurate, including:

- •

- our substantial indebtedness;

- •

- our future profitability;

- •

- consumer spending;

- •

- fuel prices;

- •

- general economic conditions;

- •

- economic conditions in the RV industry;

- •

- regulatory changes;

- •

- our relationships with marketing partners;

- •

- our ability to attract and retain members;

- •

- competition; and

- •

- increase in paper, postage and shipping costs.

1

PROSPECTUS SUMMARY

The following summary highlights selected information about this offering. It likely does not contain all the information that is important to you. For a more complete understanding of this offering, we encourage you to read this entire document. As used in this prospectus, unless the context indicates otherwise: "we," "our" and "us" refer to Affinity Group, Inc. and its consolidated subsidiaries. Unless stated otherwise, all membership and circulation data is given as of December 31, 2003.

The Company

We are a member-based direct marketing organization targeting North American recreational vehicle or RV owners and outdoor enthusiasts. Our club members form a receptive audience to which we sell products, services, merchandise and publications targeted to their specific recreational interests. In addition, we are a specialty retailer of RV-related products. We operate through three principal lines of business, including (i) club memberships and related products and services, (ii) subscription magazines and other publications including directories, and (iii) specialty merchandise sold primarily through our 36 Camping World retail supercenters, mail order catalogs and the Internet.

There are approximately 1.8 million dues paying members enrolled in our clubs. We currently have 5.9 million in aggregate circulation and approximately 1.2 million paid subscriptions across our 43 publications. For the year ended December 31, 2003, our actual revenue, operating income and net income were $425.4 million, $46.2 million and $24.4 million, respectively. Pro forma EBITDA (as defined in "Summary Historical Consolidated Financial and Other Data") and pro forma net income were $55.9 million and $13.2 million, respectively.

Membership Clubs, Products and Services

We operate four membership clubs including the Good Sam Club, President's Club, and Coast to Coast Club which are directed toward RV owners, campers and outdoor vacationers, as well as the Golf Card Club which targets golfers. These clubs offer a wide variety of discounts and benefits, the average estimated value of which significantly exceeds the cost of membership. Membership in each club is sold individually and although the Good Sam Club, President's Club and Coast to Coast Club all service the RV community, there is little direct competition between our clubs in terms of the benefits offered. Consequently, approximately 27% of our club members belong to more than one club at any given time.

We promote products and services that either address the specific needs of RV owners or are designed for people who fit the demographic characteristics of our club members, publication subscribers or Camping World customers. We leverage the large membership base of our four membership clubs, our publications' subscribers and our Camping World customers to market our products and services. These products and services include emergency road service, or ERS, various forms of insurance, extended warranty and credit cards. All of our products and services are provided by third parties that pay us a marketing fee based on referrals, with the exception of ERS, where we outsource the service to Cross Country Motor Club, Inc., a third party nationwide motor club.

Publications

We publish and distribute a variety of specialty publications for select markets in the recreation and leisure industry, including general circulation periodicals, club magazines, directories, and RV industry trade magazines. As of December 31, 2003, we had 5.9 million in aggregate circulation and approximately 1.2 million paid subscriptions across our 43 publications.

We believe that the focused audience of each of our publications is an important factor in attracting advertisers, which include manufacturers of RVs and RV-related products, campground

2

operators and large national RV dealerships as well as manufacturers of power sports vehicles and accessories. Our publications often represent a primary advertising channel for their particular market segments affording us significant leverage with our advertisers. As a result, we have experienced significant stability in advertising spending from year to year.

Camping World

Our Camping World subsidiary is a national specialty retailer of merchandise, accessories and services for RV owners and camping enthusiasts. We believe that Camping World's position in the RV accessory industry results from a high level of positive brand recognition, an effective triple channel distribution strategy (stores, catalogs and online) and a commitment to offer a broad selection of specialized RV products and services at competitive prices combined with technical assistance and on-site installation. We opened three Camping World supercenters in 2004, including our 36th Camping World supercenter in the second quarter of 2004. Our Camping World supercenters offer approximately 8,000 items, of which we estimate approximately 70% are not regularly available in general merchandise stores. In addition, Camping World's supercenters provide installation and repair services for RV products which are not available at other retail outlets. During the year ended December 31, 2003, we distributed 4.2 million Camping World catalogs to targeted customers within our database, selected campground sites and our Camping World supercenters.

Camping World supercenters are strategically located in areas where high concentrations of RV owners live or in proximity to destinations frequented by RV users. We seek to locate our supercenters next to RV dealerships, which provides us with increased retail traffic. Where possible, we seek to enhance the benefits of locating next to RV dealerships through a dealer alliance program by entering into cooperative operating agreements with those dealerships. At present, 15 Camping World supercenters are located next to RV dealerships; of those, seven Camping World supercenters are part of our dealer alliance program. We have opened three Camping World supercenters so far in 2004, and our current strategy is to open three additional Camping World supercenters next to RV dealerships as part of the dealer alliance program during the remainder of 2004. Additionally, we have installed in-store kiosks in our Camping World supercenters to market our subscription-based products and services, including vehicle insurance, extended warranty and ERS. Camping World's supercenters are designed to provide one-stop shopping by combining broad product selection, technical assistance and on-site installation services.

Competitive Strengths

We believe that our key competitive strengths are as follows:

Stable, Recurring Cash Flow Stream. Our membership clubs, subscription-based products and services and publications businesses historically have provided a recurring cash flow stream through a core base of customers. Our four membership clubs have a historical average renewal rate of 67%, which we believe compares favorably to other subscription-based businesses. Similarly, our subscription-based products and services also historically have experienced high renewal rates, averaging over 85% over the past four years for our largest product and service offerings (ERS, RV vehicle insurance and extended warranty).

Established Market Positions. We are an established direct marketing organization targeting North American RV owners and outdoor enthusiasts with comprehensive targeted product offerings. Our Good Sam Club, which was founded in 1966, and President's Club, which was founded in 1986, are both long-established RV membership clubs in North America. Camping World is a long-established national specialty retailer of merchandise accessories and services for RV owners and camping enthusiasts.

3

We believe our significant size relative to our competition is a meaningful advantage that provides us greater leverage to negotiate benefits and discounts with third-party service providers for our members and consequently enhances the value of our product and service offerings. Additionally, these negotiating and pricing advantages allow us to increase membership dues without risking the loss of members, who are compensated by additional savings. These advantages compound as new customers are drawn to the higher savings earned by our club members. Our 1.8 million club members and the 7.3 million consumers in our proprietary database serve as a unique, captive audience for direct marketing, which significantly lowers customer acquisition costs relative to our competitors and facilitates cost-effective cross-selling.

Largely Recession Resistant. We believe the characteristics of our business mitigate the effects of economic downturns on our operating performance. While the sale of new RVs is generally influenced by economic conditions, our financial performance historically has shown little correlation to changes in the Gross Domestic Product, gas prices or even new RV shipments. We believe this is due in part to the small cost of our products and services relative to the cost of purchasing an RV and to the fact that our clubs provide average annual savings significantly in excess of the annual dues. We market our clubs, products and services to a sizable existing installed base of 6.9 million RV owners, which affords us the ability to continue to attract new customers irrespective of new RV sales. During an economic downturn, we believe the sales of our products may increase because RV owners may be more likely to take vacations utilizing RVs, as such vacations generally are less expensive than vacations necessitating plane or train travel and hotel accommodations.

Favorable Demographic Trends. Favorable demographic trends, in particular the aging of the "baby boomers," indicate that RV ownership should increase during the next 10 years. Overall RV ownership rates have historically been highest, with 14% penetration, in the 55-64 age bracket, an age group that is expected to grow 45% by 2010, according to the 2001 University of Michigan Survey Research Center study of RV owners sponsored by the Recreational Vehicle Industry Association, or the RV Survey. Furthermore, the 45-54 age bracket, which maintains the second highest ownership rate of RVs, is expected to grow 15% by 2010. The growth in these age groups is expected to generate dramatic growth in the pool of potential RV consumers. Also, according to the RV Survey, this age group shift will drive the number of households that own at least one RV from 6.9 million in 2001 to 7.9 million in 2010. In addition, RV owners have household incomes that significantly exceed the national average. These demographics are attractive for advertisers and third-party providers of products and services.

Experienced and Incentivized Management Team. Our executive management team has extensive publishing, direct marketing and retail experience with significant expertise in the RV industry. With an average of over 13 years with us, the team has developed substantial experience in increasing our target customer base, using strategic alliances to bolster product offerings that create value for our customers and increasing cross-selling opportunities for our high margin product offerings. Our consistent operating performance, to a great extent, is attributable to our senior managers who are responsible for developing and implementing our business strategy and focusing on increasing profitability. Our executive management team is compensated both through an annual salary and through a management incentive program that is directly tied to our financial performance.

Our Strategy

Our primary business strategy is to maximize the sale of club memberships, products, services, publications and merchandise to our target customer base of RV owners and outdoor enthusiasts. To this end, we focus on cross-selling our various offerings to each of our customers while managing customer acquisition costs and maintaining high renewal rates by providing high value product offerings.

4

Maximize Customer Retention with Value-Added Product Offerings. A key aspect of our strategy is to maximize the value proposition of each of our product offerings, which contributes to strong customer renewal rates. Each of our four membership clubs provides our customers with tangible savings over and above the membership fee. On average, club members realize savings five times greater than the cost of their annual membership dues as the result of being able to purchase products and services at discounts made available through our clubs. We believe that the participation levels and renewal rates of club members reflect the benefits derived from their membership. As such, in order to maximize customer renewal rates, we constantly evaluate member satisfaction and actively respond to changing member preferences through the enhancement or introduction of new membership benefits including products and services.

Efficiently Acquire New Customers. We believe efficient customer acquisition and database population are critical to driving our growth and profitability. Camping World and its discount buyer's club, President's Club, together, account for approximately 70% of our new customer database entries. In addition to being a highly valuable customer loyalty program, President's Club allows us to capture specific information about each customer including RV type and usage, as well as information on the customer's age, income, net worth and interests, while adding virtually no incremental customer acquisition costs. We then are able to customize our direct marketing offers based upon our customers' profiles. Other methods of customer acquisition include purchasing lists from data providers and placing our publications at campgrounds and dealerships. We then manage our database and target our offers to the customers most likely to purchase more than one of our product offerings.

Cross-Sell Products and Services to Existing Customers. We proactively cross-sell our products and services across our customer base. For example, we use our existing customer database to cost-efficiently market Camping World products through catalogs. Conversely, Camping World supercenters provide direct customer referrals to our membership clubs, products and services through their in-store kiosks. In addition, we use our publications to communicate with our core customer base and to promote our other business segments to existing club members. Our magazines contain relevant content as well as various forms of advertisements for our membership clubs, products and services.

Develop and Market Additional Product and Service Offerings and Additional Affinity Groups. We continually evaluate additional products and services that can be developed and offered to our customer base of RV owners and outdoor enthusiasts and we continually expand the variety of products and services that are attractive to our customer base. When introducing new products and services, we concentrate on products and services provided by third parties, which we can market without significant capital investment or underwriting risk and for which we typically receive a marketing fee from the service provider based on sales volume. We seek to utilize the purchasing power of our club members to obtain products and services at attractive prices. Also, we believe that the experience we have accumulated in managing our existing recreational affinity groups is applicable to the management of other recreational interest organizations. As a result, we conduct ongoing evaluations for developing or acquiring affinity groups for which we can build membership enrollment and to which we can market products and services.

Expand Niche Recreational Publications. We believe aggregate circulation of our magazines is an important factor in determining the amount of revenue we can obtain from advertisers. Consequently, we seek to expand our presence as a publisher in select recreational niches through the introduction of new magazine titles and the acquisition of other publications in our markets or in complementary recreational market niches. Publications in complementary niches may also provide the opportunity to launch new membership clubs, to market our products and services to new customers and to develop other products and services which meet the special needs of these customers. For example, our acquisition of the publishing assets of Poole Publications, Inc. in October 2003 allowed us to expand our presence in the recreational boat market niche.

5

Increase Camping World Penetration. We intend to continue the controlled expansion of our Camping World supercenter network by developing Camping World stores alongside or within independent RV dealerships, including RV dealerships owned and operated by our affiliates, which provides a competitive advantage by creating a means of increasing retail customer traffic. In 2003 we opened four new Camping World stores. In 2004 we opened three new Camping World stores, and we intend to open three additional Camping World stores in 2004 as a part of our dealer alliance program. In addition to generating increased cash flows from the sale of merchandise, a larger network of geographically diverse Camping World stores will enhance our ability to market our portfolio of membership clubs, publications and product and service offerings to a significantly larger customer base.

Recent Developments

Tender Offer, Issuance of Senior Subordinated Notes and Related Transactions. On January 20, 2004, our parent company at the time, Affinity Group Holding, Inc., or AGHI, commenced a tender offer to purchase up to $100.0 million aggregate principal amount of its 11% Senior Notes due 2007, or the AGHI notes. On February 18, 2004, we issued $200,000,000 9% Senior Subordinated Notes due 2012, or the old notes. We used the proceeds to fund the $107.9 million tender offer for the AGHI notes, repay $25.0 million of our senior credit facility, pay a $60.0 million stockholder distribution and pay $7.1 million in transaction fees and expenses in connection with the offering of the AGHI notes and the amendment to the terms of our senior credit facility. On April 1, 2004, AGHI redeemed $14.3 million principal amount of the AGHI notes not purchased in the tender offer. On April 27, 2004, AGHI merged with us; we are the surviving entity in that merger. For accounting purposes, the merger has been accounted for as a combination of entities under common control using historical cost. At the time of the merger, AGHI was a wholly-owned subsidiary of AGHI Holding Corp., or AGHC, a privately held company with no business activities other than the ownership of all of the shares of our stock. As a result of the merger, AGHC owns all of the shares of our stock. Stephen Adams, our chairman, owns approximately 97.4% of the outstanding shares of AGHC, and his ownership of AGHC was not affected by the merger. In connection with the retirement of the notes and the merger, we amended the terms of our senior credit facility. See "Description of Other Indebtedness."

Management Changes. Joe McAdams retired as our President and Chief Executive Officer effective as of December 31, 2003. Mr. McAdams will remain on our Board of Directors. Effective as of January 1, 2004: Michael Schneider has been promoted to the position of our Chief Executive Officer from his position as our Chief Operating Officer, Mark Boggess has been promoted to the position of Chief Executive Officer of our Camping World subsidiary from his position as our Chief Financial Officer, and Thomas Wolfe has been promoted to the position of our Chief Financial Officer from the position of our Vice President of Finance and Controller. Additionally Mr. Schneider and Mr. Boggess joined our Board of Directors.

Until December 31, 2003, we and Stephen Adams were parties to an amended employment agreement providing for his employment as the Chairman of our Board of Directors. That agreement terminated effective as of December 31, 2003 upon payment of the stockholder distribution from the proceeds of the old notes.

6

Guarantors

The old notes and the senior credit facility are, and the new notes will be, guaranteed by the following restricted subsidiaries, described in this prospectus as "guarantors," which term also includes any future restricted subsidiaries as described in this prospectus:

Name

| | State or other

Jurisdiction of

Incorporation or

Organization

|

|---|

| Affinity Advertising, LP | | Minnesota |

| Affinity Brokerage, Inc. | | Delaware |

| Affinity Road and Travel Club, Inc. | | Texas |

| Camp Coast to Coast, Inc. | | Delaware |

| Camping Realty, Inc. | | Kentucky |

| Camping World, Inc. | | Kentucky |

| Camping World Insurance Services of Nevada, Inc. | | Nevada |

| Camping World Insurance Services of Texas, Inc. | | Texas |

| Coast Marketing Group, Inc. | | Delaware |

| CWI, Inc. | | Kentucky |

| CW Michigan, Inc. | | Delaware |

| Ehlert Publishing Group, Inc. | | Minnesota |

| Golf Card International Corp. | | Delaware |

| Golf Card Resort Services, Inc. | | Delaware |

| GSS Enterprises, Inc. | | Delaware |

| Power Sports Media, Inc. | | Delaware |

| TL Enterprises, Inc. | | Delaware |

| VBI, Inc. | | Delaware |

We are a Delaware corporation. Our principal executive office is located at 2575 Vista Del Mar Drive, Ventura, California 93001, and our telephone number is (805) 667-4100. Our corporate website ishttp://www.affinitygroup.com and a portal to our membership clubs, products and services can be found athttp://www.rv.net. The information found on our website does not form part of this prospectus.

7

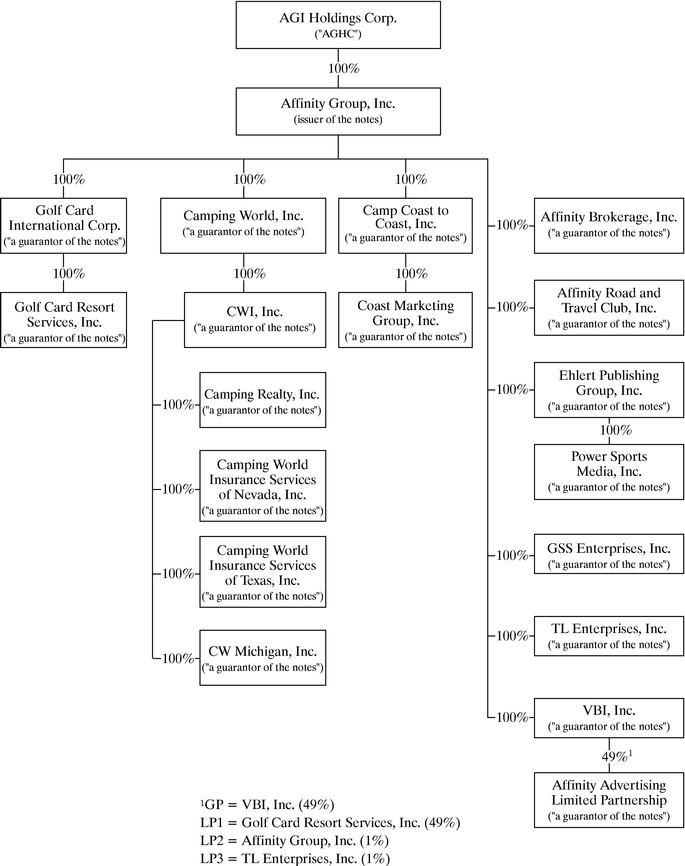

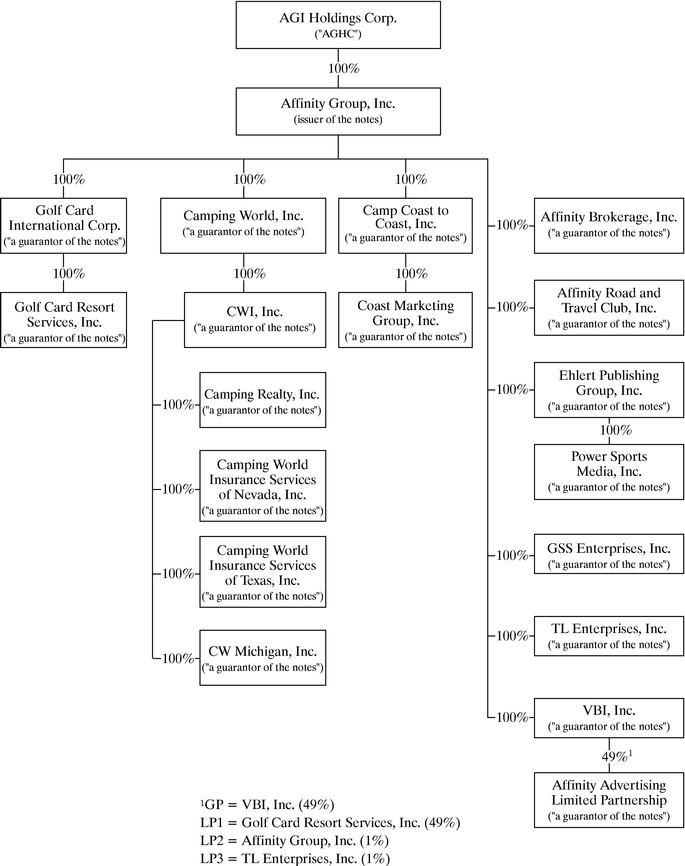

Summary of Corporate Structure

The following chart is a summary of our corporate structure after giving effect to the merger of AGHI with us on April 27, 2004.

8

SUMMARY OF THE EXCHANGE OFFER

| Background | | On February 18, 2004, we issued $200,000,000 aggregate principal amount of 9% Senior Subordinated Notes due 2012 in a private offering. These old notes were not registered under the Securities Act. In connection with the offering of the old notes, we entered into a registration rights agreement with the initial purchasers of the old notes, dated February 18, 2004, which we refer to as the registration rights agreement, in which we agreed to offer to exchange old notes for new notes which have been registered under the Securities Act. This exchange offer is intended to satisfy that obligation. |

Securities Offered |

|

$200,000,000 aggregate principal amount of 9% Senior Subordinated Notes due 2012, which we have registered under the Securities Act. |

Issuer |

|

Affinity Group, Inc. |

The Exchange Offer |

|

We are offering to exchange $1,000 principal amount of exchange notes for each $1,000 principal amount of old notes. The terms of the old notes and the exchange notes are identical in all material respects, except that the exchange notes do not restrict transfer and do not include exchange or registration rights. The exchange notes will be guaranteed by our present and future restricted subsidiaries on terms substantially identical in all material respects to the guarantees of the old notes. After this exchange offer is completed, you will no longer be entitled to any exchange or registration rights with respect to your old notes. Under limited circumstances, certain holders of outstanding old notes may require us to file a shelf registration statement under the Securities Act. As of this date, there is $200,000,000 aggregate principal amount of old notes outstanding. |

Required Representations |

|

In order to participate in this exchange offer, you will be required to make certain representations to us in a letter of transmittal, including that: |

|

|

• |

|

any exchange notes will be acquired by you in the ordinary course of your business; |

|

|

• |

|

you have no arrangement or understanding with any person to participate in the distribution (within the meaning of the Securities Act) of the exchange notes; and |

|

|

• |

|

you are not our "affiliate" or the "affiliate" of any of our Guarantors, as defined under Rule 405 of the Securities Act. |

| | | | | |

9

Resale |

|

Based upon the existing interpretations of the staff of the Securities and Exchange Commission (the "Commission") as described in several no-action letters to other issuers regarding similar exchange offers, we believe that the exchange notes issued in this exchange offer can be traded freely by you without compliance with the registration and prospectus delivery provisions of the Securities Act provided that: |

|

|

• |

|

the exchange notes issued in this exchange offer are being acquired in the ordinary course of your business; |

|

|

• |

|

you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate in the distribution of the exchange notes issued to you in this exchange offer; and |

|

|

• |

|

you are not our "affiliate" or the "affiliate" of any of our Guarantors, as defined under Rule 405 of the Securities Act. |

|

|

If our belief is inaccurate and you transfer any exchange note issued to you in this exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from such requirements, you may incur liability under the Securities Act. We do not assume or indemnify you against such liability. |

|

|

Each participating broker-dealer that is issued exchange notes in this exchange offer for its own account in exchange for old notes which were acquired by such participating broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes issued in this exchange offer. We have agreed in the registration rights agreement that a participating broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in this exchange offer. |

|

|

We do not intend to apply for listing of the exchange notes on any securities exchange or to seek approval for quotation of the exchange notes through an automated quotation system. Accordingly, there can be no assurance that an active market will develop upon completion of this exchange offer or, if developed, that such market will be sustained or as to the liquidity of any market. |

Expiration Date |

|

This exchange offer will expire at 5:00 p.m., New York City time, on , 2004, unless extended. If extended, the term "expiration date" shall mean the latest date and time to which we extend this exchange offer. |

Conditions to the Exchange Offer |

|

This exchange offer is subject to certain customary conditions, which may be waived by us prior to the expiration date; these conditions are described under "The Exchange Offer—Conditions to the Exchange Offer." This exchange offer is not conditioned upon any minimum principal amount of old notes being tendered. |

| | | | | |

10

Procedures for Tendering Your

Old Notes |

|

If you wish to tender your old notes for exchange pursuant to this exchange offer, you must do one of the following on or before the expiration date: |

|

|

• |

|

make a book-entry transfer of your old notes into the exchange agent's account at The Depository Trust Company and either transmit a properly completed and duly executed letter of transmittal, which accompanies this prospectus, or a manually signed facsimile of the letter of transmittal, together with any other required documentation, to the exchange agent at the address set forth in this prospectus under "The Exchange Offer—Exchange Agent," and on the front cover of the letter of transmittal, or transmit a computer generated message transmitted by means of The Depository Trust Company's Automated Tender Offer Program system and received by the exchange agent and forming a part of a confirmation of book entry transfer in which you acknowledge and agree to be bound by the terms of the letter of transmittal; or |

|

|

• |

|

transmit the certificates for your old notes and a properly completed and duly executed letter of transmittal, or a manually signed facsimile of the letter of transmittal together with any other required documentation, to the exchange agent. |

|

|

If either of these procedures cannot be satisfied on a timely basis, then you should comply with the guaranteed delivery procedures described below. |

|

|

By executing the letter of transmittal, each holder of the old notes will make representations to us described under "The Exchange Offer—Procedures for Tendering." |

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in this exchange offer, you should contact such registered holder promptly and instruct such registered holder to tender on your behalf. If you wish to tender on your own behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name or obtain a properly completed bond power from the registered holder. |

|

|

The transfer of registered ownership may take considerable time and may not be completed prior to the expiration date. |

Guaranteed Delivery Procedures |

|

If you wish to tender your old notes and time will not permit the documents required by the letter of transmittal to reach the exchange agent prior to the expiration date, or the procedures for book-entry transfer cannot be completed on a timely basis, you must tender your old notes according to the guaranteed delivery procedures described under "The Exchange Offer—Procedures for Tendering—Guaranteed Delivery Procedures." |

| | | | | |

11

Acceptance of Old Notes and Delivery of Exchange Notes |

|

Subject to the conditions described under "The Exchange Offer—Conditions to the Exchange Offer," we will accept for exchange any and all old notes which are validly tendered in this exchange offer, and not withdrawn, prior to 5:00 p.m., New York City time, on the expiration date. We will issue the exchange notes promptly following the expiration date. |

Withdrawal Rights |

|

You may withdraw the tender of your old notes at any time prior to the expiration date, subject to compliance with the procedures for withdrawal described in this prospectus under "The Exchange Offer—Withdrawal Rights." |

Certain Income Tax Considerations |

|

For a summary of material federal income tax considerations relating to the exchange of old notes for exchange notes, see "Certain Income Tax Considerations." |

Exchange Agent |

|

The Bank of New York, the trustee under the indenture governing the notes, is serving as the exchange agent. The address, telephone number and facsimile number of the exchange agent are set forth in this prospectus under "The Exchange Offer—Exchange Agent." |

Consequences of Failure to Exchange Old Notes |

|

If you do not exchange your old notes for exchange notes pursuant to this exchange offer, you will continue to be subject to the restrictions on transfer provided in the old notes and in the indenture governing the notes. In general, the old notes may not be offered or sold unless they are registered under the Securities Act, except pursuant to an exemption from or in a transaction not subject to the Securities Act and applicable state securities laws. We currently do not intend to register the old notes under the Securities Act. |

12

SUMMARY OF TERMS OF THE NOTES

The exchange notes are identical in all material respect to the old notes, except that the exchange notes will no longer contain transfer restrictions and holders of exchange notes will no longer have registration rights. The exchange notes will evidence the same debt as the old notes, which they replace, and will be governed by the same indenture.

| Issuer | | Affinity Group, Inc. |

Notes |

|

$200,000,000 aggregate principal amount of 9% Senior Subordinated Notes due 2012 |

Maturity Date |

|

February 15, 2012 |

Interest Rate |

|

9% per year |

Interest Payment Dates |

|

February 15 and August 15, beginning August 15, 2004 |

Security and Ranking |

|

The notes will not be secured by any collateral. |

|

|

The notes will rank junior in right of payment to all of our senior debt and that of the guarantors and will rank equal in right of payment to our existing and future senior subordinated debt and that of the guarantors. If we default, therefore, your right to payment under the notes will be junior to the rights of holders of our senior debt and that of the guarantors. |

|

|

We estimate that, as of December 31, 2003, on a pro forma basis after giving effect to the application of the net proceeds of the old notes, we would have had $315.1 million of debt outstanding, of which $115.1 million would have been senior debt. |

Guarantees |

|

Our present and future restricted subsidiaries, jointly and severally, will guarantee the notes with full and unconditional guarantees of payment that will rank junior in right of payment to their senior debt, but will rank equal in right of payment to their existing and future senior subordinated debt. |

Optional Redemptions after Equity Offerings |

|

On one or more occasions before August 15, 2007, we can choose to purchase up to 35% of the outstanding principal amount of the notes with money that we raise in one or more equity offerings, as long as: |

|

|

• |

|

we pay 109% of the principal amount of the notes bought, plus accrued and unpaid interest; |

|

|

• |

|

we purchase the notes within 90 days of completing the public equity offering; and |

|

|

• |

|

at least 65% of the aggregate principal amount of the notes originally issued remains outstanding afterward. |

Change of Control Offer |

|

If we experience a change in control, we must offer to purchase the notes at 101% of their principal amount, plus accrued and unpaid interest. |

| | | | | |

13

|

|

We might not be able to pay you the required price for the notes you present to us at the time of a change in control because we might not have enough funds at that time or the terms of our senior debt payment may prevent us from paying you. |

Asset Sale Proceeds |

|

We may have to use the net cash proceeds from selling assets to offer to purchase your notes at 100% of their principal amount, plus accrued and unpaid interest. |

Certain Indenture Provision |

|

The indenture governing the notes will limit what we (and our restricted subsidiaries) may do. The provisions of the indenture will limit our ability to: |

|

|

• |

|

incur additional debt or issue preferred stock; |

|

|

• |

|

pay dividends and make distributions on, or redeem or repurchase capital stock; |

|

|

• |

|

make certain investments; |

|

|

• |

|

issue stock of subsidiaries; |

|

|

• |

|

create liens; |

|

|

• |

|

enter into transactions with affiliates; |

|

|

• |

|

enter into sale-leaseback transactions; |

|

|

• |

|

merge or consolidate; and |

|

|

• |

|

transfer and sell assets. |

|

|

These covenants are subject to a number of important exceptions. See "Description of the Notes—Certain Covenants." |

No Prior Market |

|

Although the initial purchaser of the old notes has informed us that it intends to make a market in the exchange notes, it is not obligated to do so and it may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop or be maintained. |

Use of Proceeds |

|

We will not receive any net proceeds from this exchange offer. |

RISK FACTORS

You should consider carefully all of the information in this prospectus. In particular, you should evaluate the specific risk factors under "Risk Factors," which begin on page 17, for a discussion of certain risks that should be considered by investors in connection with this exchange offer.

14

Summary Historical Consolidated Financial and Other Data

The summary financial data for the three years ended December 31, 2003 presented below is derived from our audited consolidated financial statements. The summary financial data for the three month periods ended March 31, 2003 and 2004 presented below is derived from unaudited consolidated financial statements. Results for the three months ended March 31, 2004 are not necessarily indicative of results that can be expected for the year ended December 31, 2004. The pro forma summary financial data for the three months ended March 31, 2004 and year ended December 31, 2003 presented below is derived from the unaudited pro forma consolidated data. The summary financial data should be read in conjunction with "Unaudited Pro Forma Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," our consolidated financial statements and the related notes thereto, and our unaudited pro forma consolidated financial data included elsewhere herein.

| | Years Ended December 31,

| | Three Months Ended March 31,

| |

|---|

| | 2001

| | 2002

| | 2003

| | Pro Forma

2003

| | 2003

| | 2004

| | Pro Forma

2004

| |

|---|

| | (dollars in thousands)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Membership services | | $ | 119,958 | | $ | 124,546 | | $ | 128,664 | | $ | 128,664 | | $ | 29,801 | | $ | 31,519 | | $ | 31,519 | |

| | Publications | | | 65,150 | | | 66,654 | | | 71,436 | | | 71,436 | | | 15,130 | | | 17,229 | | | 17,229 | |

| | Retail | | | 220,264 | | | 239,922 | | | 225,306 | | | 225,306 | | | 47,548 | | | 52,534 | | | 52,534 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 405,372 | | | 431,122 | | | 425,406 | | | 425,406 | | | 92,479 | | | 101,282 | | | 101,282 | |

| Costs applicable to revenues: | | | | | | | | | | | | | | | | | | | | | | |

| | Membership services | | | 72,944 | | | 74,097 | | | 79,500 | | | 79,500 | | | 17,322 | | | 20,724 | | | 20,724 | |

| | Publications | | | 46,175 | | | 45,351 | | | 48,392 | | | 48,392 | | | 10,404 | | | 12,002 | | | 12,002 | |

| | Retail | | | 148,244 | | | 158,265 | | | 136,137 | | | 136,137 | | | 28,450 | | | 30,810 | | | 30,810 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 267,363 | | | 277,713 | | | 264,029 | | | 264,029 | | | 56,176 | | | 63,536 | | | 63,536 | |

Gross profit |

|

|

138,009 |

|

|

153,409 |

|

|

161,377 |

|

|

161,377 |

|

|

36,303 |

|

|

37,746 |

|

|

37,746 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Selling, general and administrative | | | 86,050 | | | 101,608 | | | 104,066 | | | 101,296 | | | 24,258 | | | 25,185 | | | 25,185 | |

| | Restructuring charge(1) | | | — | | | 2,269 | | | 1,210 | | | 1,210 | | | — | | | — | | | — | |

| | Depreciation and amortization | | | 15,929 | | | 9,417 | | | 9,883 | | | 10,753 | | | 2,482 | | | 2,983 | | | 3,097 | |

| | Loss on sale of real estate | | | 6,047 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 108,026 | | | 113,294 | | | 115,159 | | | 113,259 | | | 26,740 | | | 28,168 | | | 28,282 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income from operations | | | 29,983 | | | 40,115 | | | 46,218 | | | 48,118 | | | 9,563 | | | 9,578 | | | 9,464 | |

| Interest expense, net | | | (11,323 | ) | | (4,321 | ) | | (5,479 | ) | | (23,993 | ) | | (957 | ) | | (3,657 | ) | | (5,735 | ) |

| Debt extinguishment expense | | | (71 | ) | | — | | | (1,709 | ) | | (3,218 | ) | | — | | | (522 | ) | | (522 | ) |

| Other non-operating (expense) income, net | | | (5 | ) | | (44 | ) | | 201 | | | 201 | | | 67 | | | 47 | | | 47 | |

| Income tax expense | | | (9,197 | ) | | (13,966 | ) | | (14,811 | ) | | (7,924 | ) | | (3,322 | ) | | (2,096 | ) | | (1,237 | ) |

| Cumulative effect of accounting change(2) | | | — | | | (1,742 | ) | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 9,387 | | $ | 20,042 | | $ | 24,420 | | $ | 13,184 | | $ | 5,351 | | $ | 3,350 | | $ | 2,017 | |

| | |

| |

| |

| |

| |

| |

| |

| |

15

| | As of March 31, 2004

| |

|---|

| | Actual

| | Pro Forma

| |

|---|

| | (dollars in thousands)

| |

|---|

| Balance Sheet Data (at period end): | | | | | | | |

| Cash and cash equivalents | | $ | 15,425 | | $ | 15,425 | |

| Working capital(3) | | | (16,969 | ) | | (16,810 | ) |

| Total assets | | | 323,184 | | | 323,185 | |

| Total debt | | | 314,777 | | | 314,777 | |

| Total stockholder's deficit | | | (192,081 | ) | | (153,705 | ) |

|

|

|

|

|

|

|

|

| | Years Ended December 31,

| | Three Months Ended

March 31,

| |

|---|

| | 2001

| | 2002

| | 2003

| | Pro Forma

2003

| | 2003

| | 2004

| | Pro Forma

2004

| |

|---|

| | (dollars in thousands)

| |

|---|

Other Financial Data and Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(4) | | $ | 45,836 | | $ | 47,746 | | $ | 54,593 | | $ | 55,854 | | $ | 12,112 | | $ | 12,086 | | $ | 12,086 | |

| Capital expenditures | | | 4,454 | | | 9,867 | | | 10,810 | | | 10,810 | | | 1,872 | | | 2,577 | | | 2,577 | |

| Ratio of earnings to fixed charges(5) | | | 2.4 | x | | 6.7 | x | | 6.4 | x | | 1.8 | x | | 7.5 | x | | 2.4 | x | | 1.5 | x |

- (1)

- We incurred restructuring charges in 2002 and 2003. These charges were primarily attributable to management reorganizations in the retail segment.

- (2)

- We adopted Statement of Financial Accounting Standards (SFAS) No. 142 Goodwill and Other Intangible Assets as of January 1, 2002. Under SFAS No. 142, goodwill impairment is deemed to exist if the net book value of a reporting unit exceeds its estimated fair value. In accordance with the transition provisions of SFAS No. 142, we recorded a non-cash charge of $1,742 to reduce the carrying value of our goodwill. The SFAS No. 142 goodwill impairment is associated solely with goodwill of our Golf Card Club, which is included in our Membership Services segment.

- (3)

- Working capital is defined as current assets less current liabilities.

- (4)

- EBITDA, a measure used by management to measure operating performance, is defined as net income before income tax expense, interest expense, net depreciation and amortization. EBITDA does not represent operating income or net cash flows from operations in accordance with GAAP and should not be considered by prospective purchasers of the notes to be an alternative to operating income or cash flows from operations to fund our future cash requirements. The EBITDA measure may not be comparable to similarly titled measures used by other companies.

| | Years Ended December 31,

| | Three Months Ended

March 31,

|

|---|

| | 2001

| | 2002

| | 2003

| | Pro Forma

2003

| | 2003

| | 2004

| | Pro Forma

2004

|

|---|

| | (dollars in thousands)

|

|---|

| Net income | | $ | 9,387 | | $ | 20,042 | | $ | 24,420 | | $ | 13,184 | | $ | 5,351 | | $ | 3,350 | | $ | 2,017 |

| Income tax expense | | | 9,197 | | | 13,966 | | | 14,811 | | | 7,924 | | | 3,322 | | | 2,096 | | | 1,237 |

| Interest expense, net | | | 11,323 | | | 4,321 | | | 5,479 | | | 23,993 | | | 957 | | | 3,657 | | | 5,735 |

| Depreciation and amortization | | | 15,929 | | | 9,417 | | | 9,883 | | | 10,753 | | | 2,482 | | | 2,983 | | | 3,097 |

| | |

| |

| |

| |

| |

| |

| |

|

| | EBITDA | | $ | 45,836 | | $ | 47,746 | | $ | 54,593 | | $ | 55,854 | | $ | 12,112 | | $ | 12,086 | | $ | 12,086 |

| | |

| |

| |

| |

| |

| |

| |

|

- (5)

- In calculating the ratio of earnings to fixed charges, earnings consist of net income (loss) before income taxes plus fixed charges. Fixed charges consist of interest expenses (which include the amoritzation of deferred financing fees but excludes the write-off of deferred financing fees) and a portion of rental expense determined to represent interest based on imputed interest rates.

16

RISK FACTORS

In evaluating whether to participate in this exchange offer, you should carefully consider the risk factors set forth below as well as the other information contained in this prospectus. Any of the following risks could materially adversely affect our business, financial condition or results of operations.

Risks relating to the notes

Our substantial indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations under the notes.

We have a significant amount of indebtedness. As of March 31, 2004, our total debt and total stockholder's deficit on a pro forma basis were as follows:

| | At March 31, 2004

| |

|---|

| | (dollars in thousands)

| |

|---|

| Total senior debt | | $ | 114,777 | |

| Notes offered hereby | | | 200,000 | |

| | |

| |

| | Total debt | | $ | 314,777 | |

| | |

| |

| Total stockholder's deficit (pro forma) | | $ | (153,705 | ) |

In the future, we intend to use cash generated by operations to reduce our indebtedness. However, we may from time to time, subject to restrictions imposed by the terms of our indebtedness, pay dividends or find it more advantageous to employ cash generated by operations for capital investments and acquisitions.

Our ability to satisfy our debt service obligations will depend primarily upon our future operating performance. Future debt repayments by us, including the principal amount of the notes, may require funds in excess of our available cash flow. We cannot assure you that we will be able to raise additional funds, if necessary, through future financings. The note indenture imposes several restrictions upon us, including restrictions on our ability to incur additional indebtedness and pledge assets.

Our substantial indebtedness could have important consequences to you. For example, it could:

- •

- make it more difficult for us to satisfy our obligations with respect to the notes;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, expansion through acquisitions and other general corporate purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit our ability, among other things, to borrow additional funds.

Despite current indebtedness levels and restrictive covenants, we still may be able to incur substantially more debt in the future.

Despite our current level of debt, we may be able to incur substantial additional debt in the future. Our senior credit facility will permit total borrowings of up to $148.6 million. All such subsequent borrowings would rank senior to the notes and the guarantees. Although the terms of the indenture

17

governing the notes and the terms of our senior credit facility will restrict us and our restricted subsidiaries from incurring additional debt, these restrictions are subject to important exceptions and qualifications. If we or our subsidiaries incur additional debt, the risks that we and they now face as result of our leverage could intensify.

If our financial condition and operating results deteriorate, our relationships with our creditors, including the holders of the notes, the lenders under our senior credit facility and our suppliers, may be adversely affected.

Our operations are substantially restricted by the terms of our senior credit facility and the notes, which could adversely affect us and increase our credit risk.

The indenture governing the notes and our senior credit facility will include a number of significant restrictive covenants. These covenants will restrict, among other things, our ability to:

- •

- incur more debt;

- •

- pay dividends or make other distributions;

- •

- make investments;

- •

- issue stock of subsidiaries;

- •

- repurchase stock;

- •

- create liens;

- •

- enter into transactions with affiliates;

- •

- enter into sale-leaseback transactions;

- •

- merge or consolidate; and

- •

- transfer and sell assets.

These covenants could limit our ability to plan for or react to market conditions or to meet our capital needs. These covenants are subject to certain important exceptions.

Our senior credit facility contains other and more restrictive covenants, including financial covenants that will require us to achieve certain financial and operating results and maintain compliance with specified financial ratios, which are described in "Description of Other Indebtedness." As of March 31, 2004, our fixed charge coverage ratio was 1.48 to 1 compared to the requirement that the ratio not be less than 1.05 to 1, our total debt to EBITDA ratio was 5.0 to 1 compared to the requirement that the ratio not be greater than 5.75 to 1, our senior debt to EBITDA ratio was 1.68 to 1 compared to the requirement that the ratio not be greater than 2.35 to 1, and our total interest coverage ratio was 3.15 to 1 compared to the requirement that the ratio not be less than 2.0 to 1. Our ability to comply with these covenants and requirements may be affected by events beyond our control, and we may have to curtail some of our operations and growth plans to maintain compliance.

If we are not able to comply with the covenants and other requirements contained in the indenture, our senior credit facility or our other debt instruments, an event of default under the relevant debt instrument could occur. Our ability to comply with the provisions of our senior credit facility, the indenture governing the notes and the agreements or indentures governing other debt we may incur in the future can be affected by events beyond our control and, therefore, we may be unable to meet those ratios and conditions. If an event of default does occur, it could trigger a default under our other debt instruments, we could be prohibited from accessing additional borrowings, and the holders of the defaulted debt could declare amounts outstanding with respect to that debt to be immediately due and payable. We cannot assure you that our assets or cash flow would be sufficient to

18

fully repay borrowings under our outstanding debt instruments or that we would be able to refinance or restructure the payments of these debt securities. Even if we were able to secure additional financing, it may not be available on terms favorable to us.

To service our indebtedness, we will require a significant amount of cash, the availability of which depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including the notes, and to fund planned capital expenditures will depend on our ability to generate cash in the future. To a certain extent, this is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us under our senior credit facility in an amount sufficient to enable us to pay our indebtedness, including the notes, as it becomes due or to fund our other liquidity needs. If our future cash flow from operations and other capital resources are insufficient to pay our obligations as they mature or to fund our liquidity needs, we may be forced to reduce or delay our business activities and capital expenditures, sell assets, sell additional shares of capital stock or restructure or refinance all or a portion of our debt, including the notes, on or before its maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including our senior credit facility and the notes, on satisfactory terms or at all.

Our failure to comply with our obligations under the note indenture may result in an event of default under the indenture. A default, if not cured or waived, may permit acceleration of our other indebtedness. We cannot be certain that we will have funds available to remedy these defaults. If our indebtedness is accelerated, we cannot be certain that we will have sufficient funds available to pay the accelerated indebtedness or that we will have the ability to refinance the accelerated indebtedness on terms favorable to us or at all.

Your right to receive payments on the notes is junior to our senior indebtedness and possibly all of our future borrowings. Further, the guarantees of the notes are junior to all of the guarantors' senior indebtedness and all their future borrowings.

The notes and the guarantees rank behind all of our and the guarantors' senior indebtedness and all of our and their future borrowings, except any future indebtedness that expressly provides that it ranks equal with, or is subordinated in right of payment to, the notes and the guarantees. As a result, upon any distribution to our creditors or the creditors of the guarantors in a bankruptcy, liquidation or reorganization or similar proceeding relating to us or the guarantors or our or their property, the holders of our senior debt and the guarantors' senior debt will be entitled to be paid in full in cash before any payment may be made with respect to the notes or the guarantees.

In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to us or the guarantors, holders of the notes will participate with trade creditors and all other holders of our and the guarantors' subordinated indebtedness in the assets, if any, remaining after we and the guarantors have paid all of our senior indebtedness. However, because the indenture requires that amounts otherwise payable to holders of the notes in a bankruptcy or similar proceeding be paid to holders of senior indebtedness instead, holders of the notes may receive less, ratably, than holders of trade payables in any such proceeding. In any of these cases, we and the guarantors may not have sufficient funds to pay all of our creditors and holders of notes may receive less, ratably, than the holders of our senior indebtedness.

Assuming we had issued the notes on March 31, 2004, the notes and the guarantees would have been subordinated to $114.8 million of senior debt and approximately $28.2 million, after giving effect to the approximately $6.8 million in letters of credit outstanding on that date, would have been

19

available to us for future borrowing as additional senior debt under our senior revolving credit facility. We will be permitted to incur substantial additional indebtedness, including senior debt, in the future under the terms of the indenture.

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from guarantors.

Under federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee could be voided, or claims in respect of a guarantee could be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; and

- •

- was insolvent or rendered insolvent by reason of such incurrence;

- •

- was engaged in a business or transaction for which the guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they matured.

In addition, any payment by that guarantor pursuant to its guarantee could be voided and required to be returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets;

- •

- the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they became absolute and mature; or

- •

- it could not pay its debts as they became due.

On the basis of historical financial information, recent operating history and other factors, we believe that each guarantor, after giving effect to its guarantee of the notes, will not be insolvent, will not have unreasonably small capital for the business in which it is engaged and will not have incurred debts beyond its ability to pay such debts as they mature. We cannot assure you, however, as to what standard a court would apply in making these determinations or that a court would agree with our conclusions in this regard.

We may not have the ability to raise the funds necessary to repurchase the notes upon a change of control.

Upon the occurrence of certain specific kinds of change of control events, we will be required to offer to repurchase all outstanding notes at 101% of the principal amount thereof plus accrued and unpaid interest and liquidated damages, if any, to the date of repurchase. However, it is possible that we will not have sufficient funds at the time of the change of control to make any required repurchases or that our senior credit facility will not allow such repurchases. If we do not repay all borrowings under our senior credit facility or obtain the consent of our lenders under our senior credit facility to repurchase the notes, we will be prohibited from purchasing the notes. Our failure to purchase tendered notes would constitute a default under the indenture governing the notes, which, in turn, would constitute a default under our senior credit facility. In addition, certain important corporate

20

events relating to our capital structure would not constitute a "change of control" under the indenture. See "Description of the Notes—Change of Control Offer."

You may not be able to sell your exchange notes.

There is no existing trading market for the exchange notes. If no active trading market develops, you may not be able to sell your notes at their fair market value or at all. Future trading prices of the exchange notes will depend on many factors, including, among other things, prevailing interest rates, our operating results and the market for similar securities. We have been informed by the initial purchaser of the old notes that it currently intends to make a market in the exchange notes. However, such market-making may cease at any time. We do not intend to apply for listing the notes on any securities exchange or for quotation through any over-the-counter market.

Our former use of Arthur Andersen LLP as our independent public accountants will limit your ability to seek recovery from them related to their work.

In June 2002, Arthur Andersen LLP was convicted of federal obstruction of justice charges in connection with its destruction of documents related to Enron Corp. As a result of Arthur Andersen's conviction, Arthur Andersen is no longer in a position to reissue their audit reports, did not participate in the preparation of this prospectus and did not provide consent to include financial statements reported on by them in the offering memorandum. In addition, if a claim were to be made against Arthur Andersen LLP based upon the financial statements upon which they reported, Arthur Andersen LLP may not have the financial resources to satisfy any judgment.

Risks Relating to Our Business

We depend on our ability to attract and retain active members.

Our future success depends in large part upon continued demand for our membership club programs by consumers. Any number of factors could affect the frequency with which consumers participate in our programs or whether they enroll in a membership club at all. These factors include (1) consumer taste preferences, (2) the frequency with which members participate in club activities, (3) general economic conditions, (4) weather conditions, and (5) the availability of alternative discount programs in the region in which consumers live and work. Any significant decline in usage or increase in program cancellations, without a corresponding increase in new member enrollments, could have a material adverse effect on our business.

Our future growth depends upon continued demand for our membership clubs from consumers we serve or seek to serve. A significant downturn in leisure travel or in any of the other areas served by our membership clubs would have a material adverse effect on our business, financial condition and results of operations.

We depend on our relationships with our marketing partners and a disruption of these relationships or of our marketing partners' operations could have an adverse effect on our business and results of operations.

Our business depends in part on developing and maintaining productive relationships with providers of products and services that we offer to our customers. Many factors outside our control may harm these relationships. For example, financial difficulties that some of our marketing partners may face may adversely affect our marketing program with them. A disruption of our relationships with our marketing partners or a disruption in our marketing partners' operations could have a material adverse effect on our business and results of operations.

21

We face significant competition for disposable income spent on leisure merchandise and activities.

In general, our membership clubs, retail and catalog operations and publications compete with numerous organizations in the recreation industry for disposable income spent on leisure merchandise and activities. The products and services marketed by us, our publications and our retail operations compete with similar products, services, publications and retail businesses offered by other providers. Increased competition from these and other sources could require us to respond to competitive pressures by establishing pricing, marketing and other programs or seeking out additional strategic alliances or acquisitions that may be less favorable to us than we could otherwise establish or obtain.

Our business could be adversely affected by deteriorating general economic conditions.

Our activities relate significantly to the amount of leisure time and the amount of disposable income available to users of our products and services. Our business, therefore, may be sensitive to general economic conditions affecting the willingness of consumers to purchase club memberships and related products and services and of advertisers to place advertisements in our publications. In particular, during the gasoline shortages and resulting price increases in 1973, 1980 and 1990, there was a reduction in advertising revenues for our publications. Recently gasoline prices have increased significantly, but the impact of the increases on our business is not known at this time. In addition, the success of the membership club portion of our business depends on our members' use of certain RV sites and/or golf courses or the purchase of goods through participating merchants. If the economy slows, our members may perceive that they have less disposable income to permit them to pursue leisure activities. As a consequence, they may travel less frequently, spend less when they travel and use the benefits of their club memberships less often, if at all. Any decline in program usage would hurt our business. In addition, a decline in the national economy could cause some of the merchants who participate in our programs to go out of business. It is likely that, should the number of merchants entering bankruptcy rise, the number of uncollectible accounts would also rise. This would have an adverse effect on our business and financial results.

The interests of our principal shareholder may conflict with the interests of holders of the notes.