- DDD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

3D Systems (DDD) 8-K3D Systems to Present at the Needham Growth Conference

Filed: 7 Jan 04, 12:00am

Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

[GRAPHIC]

Customer Driven Solid Imaging Solutions

Investor Presentation

January 2004

NASDAQ: TDSC www.3dsystems.com

[GRAPHIC]

Forward-Looking Information Statement

Certain statements made by the company in this presentation are forward looking statements. These statements include comments as to the company’s beliefs and expectations as to future events and trends affecting the company’s business. These forward-looking statements are based upon management’s current expectations concerning future events and trends and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors stated under the heading “Forward-Looking Statements” in management’s discussion and analysis of results of operations and financial condition, which appear in the company’s most recent annual report on Form 10-K or quarterly report on Form 10-Q, as well as other factors, could cause actual results to differ materially from such statements.

© Copyright 2003 by 3D Systems, Inc. All rights reserved. Specifications subject to change without notice. The 3D logo, 3D Systems, SLA, SLS, ThermoJet and Accura are registered trademarks and SLS, InVision, Amethyst, Bluestone, DuraForm, LaserForm and CastForm are trademarks of 3D Systems. “the solid imaging company” and ADM are service marks of 3D Systems, Inc. All other product names or services mentioned are trademarks or registered trademarks of their respective companies.

Customer Driven Solid Imaging Solutions | NASDAQ: TDSC |

[LOGO]

2

[GRAPHIC]

Who Are We?

A Global Leader

Solid Imaging Solutions for:

• Design & Model Communication

• Rapid Prototyping & Tooling

• Instant Manufacturing…ADMSM

• Related Customer Services

Overview

• $116 MM sales in ’02

• HQ in Valencia, CA

• 407 employees

• 359 patents worldwide

• Pioneered emergence of industry in 1987

• 3 technology platforms

• Global presence

• Largest direct field sales & service force

3

[GRAPHIC]

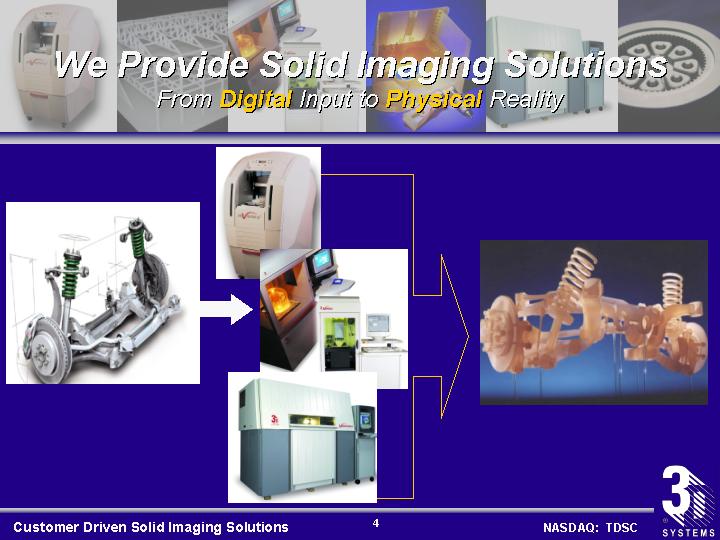

We Provide Solid Imaging Solutions

From Digital Input to Physical Reality

[GRAPHIC]

4

[GRAPHIC]

Comprehensive Family of Solid Imaging Solutions

Multi-Jet Modeling

[GRAPHIC] |

| [GRAPHIC] |

|

|

|

ThermoJet® printer |

| InVisionTM 3-D printer |

|

|

|

[GRAPHIC] |

| [GRAPHIC] |

|

|

|

TJ 88 |

| VisiJetTM |

Stereolithography

SLA® systems

[GRAPHIC] | ||

| ||

Viper SLA system | ||

SLA 5000 system | ||

SLA 7000 system | ||

| ||

[GRAPHIC] | ||

| ||

BluestoneTM | ||

|

|

|

[GRAPHIC] |

| [GRAPHIC] |

|

|

|

Broad Range SL products |

| AmethystTM |

Selective Laser Sintering

SLS ® systems

[GRAPHIC] | ||

| ||

Vanguard SLS system | ||

Vanguard HS SLS system | ||

|

|

|

[GRAPHIC] |

| [GRAPHIC] |

|

|

|

LaserFormTM A6 |

| DuraFormTM |

| ||

[GRAPHIC] | ||

| ||

CastFormTM A6 | ||

5

[GRAPHIC]

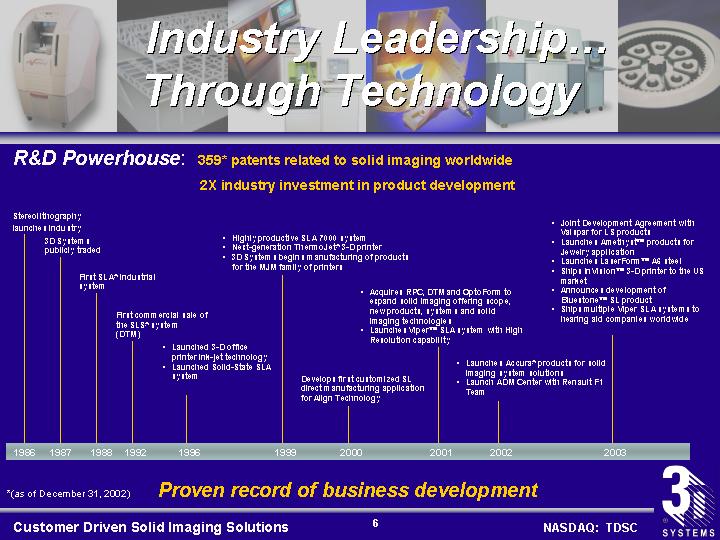

Industry Leadership… Through Technology

R&D Powerhouse: | 359* patents related to solid imaging worldwide |

|

|

| 2X industry investment in product development |

[CHART]

*(as of December 31, 2002)

Proven record of business development

6

[GRAPHIC]

Customer Value We Deliver

Time To Market

• Fast prototyping, earlier product design verification & creation of functional parts

Time To Volume

• Rapid production-quality prototypes or end-use parts

• Instant direct manufacturing of end-use parts

• Reverse engineering, part re-creation

Flexibility & Customization

• Quick tooling to manufacture end-use parts

• Diverse parts within same build

Uptime & Productivity

• Direct field service, timely support

• Expert customer application development

• 24/7 operations, low labor intensity

Improving our customers’ bottom line and competitiveness

7

[GRAPHIC]

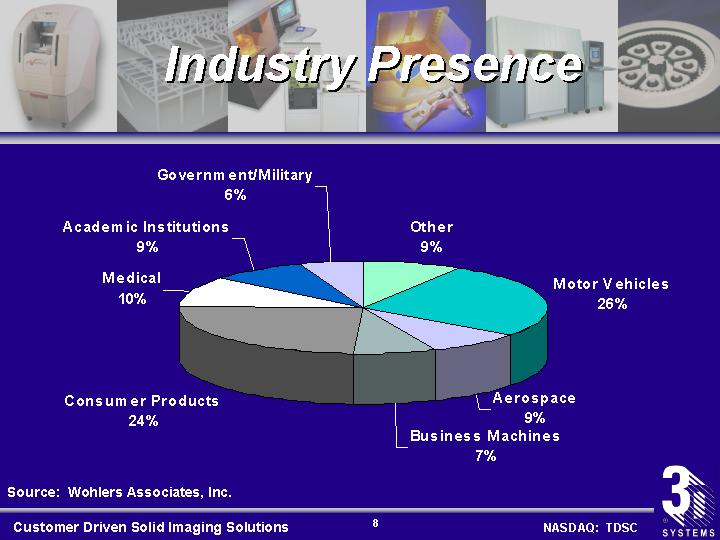

Industry Presence

[CHART]

Source: Wohlers Associates, Inc.

8

[GRAPHIC]

Global Presence

[GRAPHIC]

[GRAPHIC]

Colorado

[GRAPHIC]

California

[GRAPHIC]

U.K.

France

[GRAPHIC]

Germany

Switzerland

[GRAPHIC]

Italy

[GRAPHIC]

Hong Kong

[GRAPHIC]

Japan

We Cover 80% of the World

9

[GRAPHIC]

Customer Presence

Broad, Diverse Installed Base…

[GRAPHIC]

10

[GRAPHIC]

Global Sales Mix

9 mos. YTD Sept. 26, 2003

($Millions)

By Region | By Segment |

|

|

[CHART] | [CHART] |

Total YTD Revenue $74.8

11

[GRAPHIC]

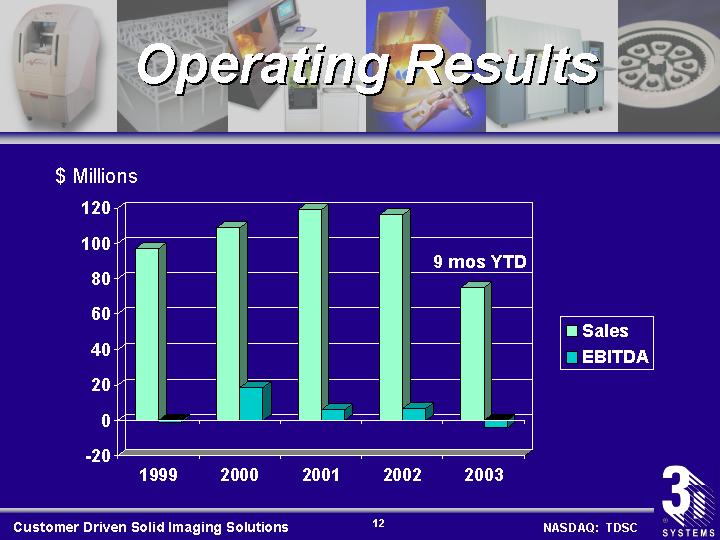

Operating Results

[CHART]

12

[GRAPHIC]

EBITDA Reconciliation

|

| ’99 |

| ’00 |

| ’01 |

| ‘02 |

| 9 Months |

| |||||

|

|

|

| (Restated) |

| (Restated) |

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net Income |

| $ | (5,301 | ) | $ | 7,870 |

| $ | (2,357 | ) | $ | (14,866 | ) | $ | (14,414 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |||||

Interest |

| 212 |

| 335 |

| 1,601 |

| 2,993 |

| 2,438 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Tax Expense/(Benefit) |

| (2,240 | ) | 4,309 |

| (992 | ) | 8,909 |

| 1,109 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Depreciation & Amortization |

| 6,608 |

| 6,245 |

| 7,704 |

| 9,902 |

| 6,782 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | (1,261 | ) | $ | 18,759 |

| $ | 5,956 |

| $ | 6,938 |

| $ | (4,085 | ) |

13

[GRAPHIC]

Industry Trends

Unit Sales Growth & Forecasts | No. of Models Being Produced |

|

|

[CHART] | [CHART] |

Source: Wohlers Associates, Inc.

14

[GRAPHIC]

Summary…

• Exciting industry…lots of growth opportunities

• Leading market position…. and technology

• Deep, diverse customer relations; broad installed base

• Global reach; geographical presence

But….

• Disappointing results, lackluster performance

• Lost focus; customer responsiveness down

• Limited new product introductions

15

[GRAPHIC]

Resulting In…

Recent significant changes within the Company’s management, its strategic direction, guiding principles and operating focus….

Renewed Commitment!

16

[GRAPHIC]

New Management Team

• Abe Reichental, President & CEO – Sept. 03 (SEE)

• Fred Jones, VP & CFO – Dec. 03 (TNB)

• Robert Grace, Jr., VP General Counsel – Nov. 03 (SEE)

• Chuck Hull, EVP & CTO – Oct. 03 (TDSC)

• Kevin McAlea, VP Global Marketing – Oct. 03 (TDSC & GE)

• Ray Saunders, VP Global Services – Oct. 03 (TDSC & ATSI)

• Stephen Goddard, VP Operations – Oct. 03 (SEE & McKinsey)

• Robert Kayser, VP Global Sales – Jan. 04 (KEM & SEE)

The Key To Successful Execution:

Right People In The Right Jobs!

17

[GRAPHIC]

New Priorities, Principles & Strategic Initiatives…

18

[GRAPHIC]

Priorities & Principles

• Customers

• Improve customer’s bottom line

• Prioritize around customer needs

• Deeper customer relationships

• Cash flow & returns

• Increase sales and margins

• Reduce inventory

• Faster collections

• Do more with less . . . and faster

19

[GRAPHIC]

Priorities & Principles

• Operational excellence

• Total employee involvement and training

• Faster, simpler business processes

• Lean six sigma quality and results

• Execution, accountability and ownership

• Innovation

• Quick, targeted development cycles

• Tactical regional & global expansion

• Specialty solutions, channels & brands

• Expanded range of customer services

• Build on company skills and privileged assets

• E. P. S.

20

[GRAPHIC]

Strategic Initiatives…

• Focus on key industries & applications

• Penetrate, expand 3-D printing segment

• Broaden range of customer services

• Speed new product development

• Optimize operations and supply chain

• Create strong performance & ethical culture

21

[GRAPHIC]

New Operating Focus

22

[GRAPHIC]

Cost Reduction Actions

• Annual operating expense reduction:

[CHART]

• Now attacking cost of goods sold

23

[GRAPHIC]

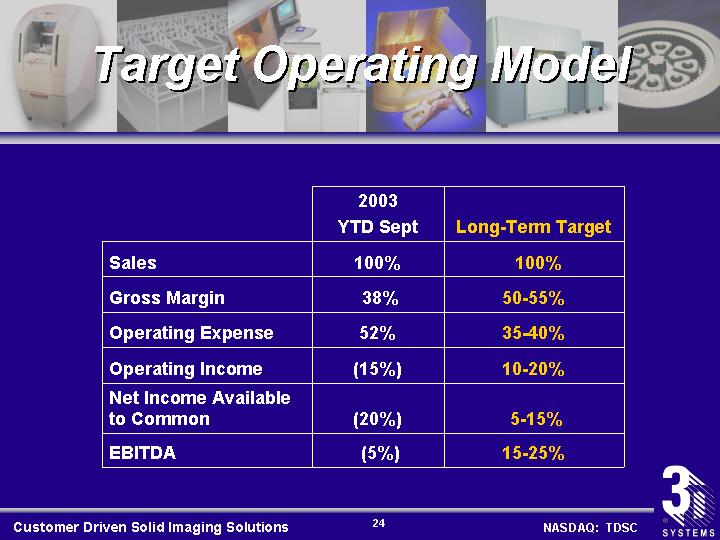

Target Operating Model

|

| 2003 |

| Long-Term Target |

|

|

|

|

|

|

|

Sales |

| 100 | % | 100 | % |

|

|

|

|

|

|

Gross Margin |

| 38 | % | 50-55 | % |

|

|

|

|

|

|

Operating Expense |

| 52 | % | 35-40 | % |

|

|

|

|

|

|

Operating Income |

| (15 | )% | 10-20 | % |

|

|

|

|

|

|

Net Income Available to Common |

| (20 | )% | 5-15 | % |

|

|

|

|

|

|

EBITDA |

| (5 | )% | 15-25 | % |

24

[GRAPHIC]

Recent Financial Improvements…

25

[GRAPHIC]

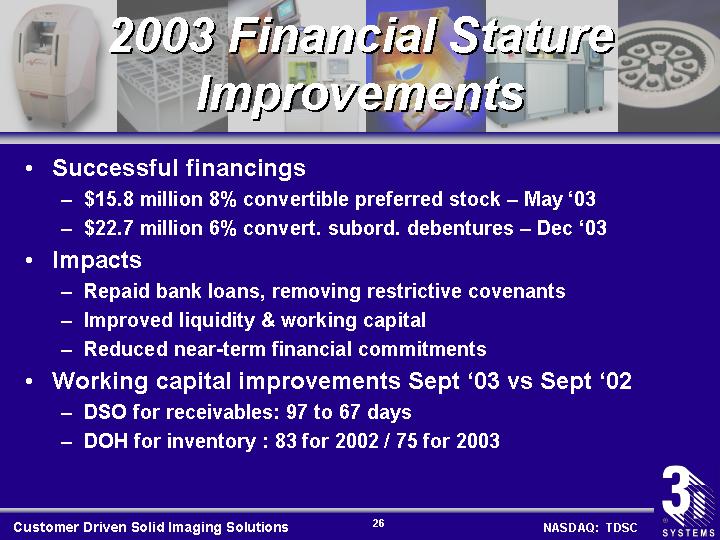

2003 Financial Stature Improvements

• Successful financings

• $15.8 million 8% convertible preferred stock – May ‘03

• $22.7 million 6% convert. subord. debentures – Dec ‘03

• Impacts

• Repaid bank loans, removing restrictive covenants

• Improved liquidity & working capital

• Reduced near-term financial commitments

• Working capital improvements Sept ‘03 vs Sept ‘02

• DSO for receivables: 97 to 67 days

• DOH for inventory: 83 for 2002 / 75 for 2003

26

[GRAPHIC]

Strong Financial Base

($ Millions)

Pro Forma Capitalization — Sept. 26, 2003*

($ Millions)

$10 callable after Dec ‘04 at 7% premium; convertible to 833,333 shares ($12/Share) |

| [CHART] |

|

| ||

|

|

| ||||

$23 callable at par after Dec. ‘06; convertible to 2,229,862 shares ($10.18/Share) |

|

| ||||

|

|

| ||||

$16 redeemable at Co’s option after May ‘06 @ $6.00; convertible 1:1 to 2,634,016 shares |

|

| ||||

|

|

|

|

| ||

Cash | [CHART] |

|

|

|

|

|

|

| $100 Total Capitalization |

|

| ||

* Pro forma giving effect to Dec ’03 subordinated debt placement & application of its proceeds.

27

[GRAPHIC]

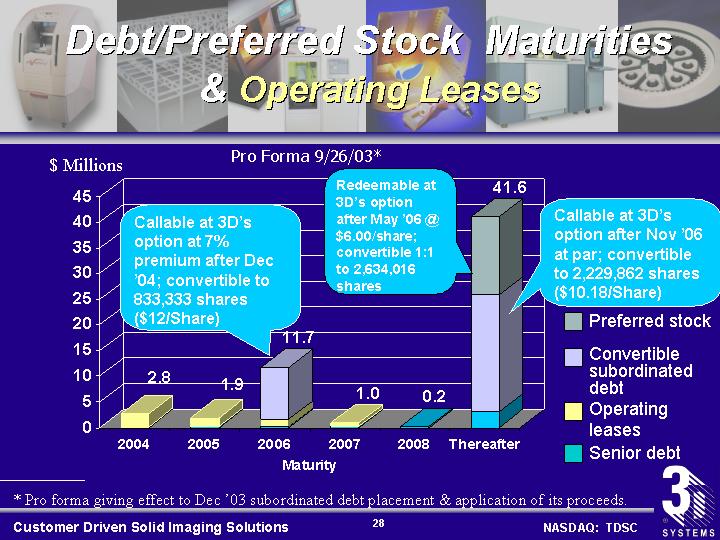

Debt/Preferred Stock Maturities & Operating Leases

[CHART]

* Pro forma giving effect to Dec ’03 subordinated debt placement & application of its proceeds.

28

[GRAPHIC]

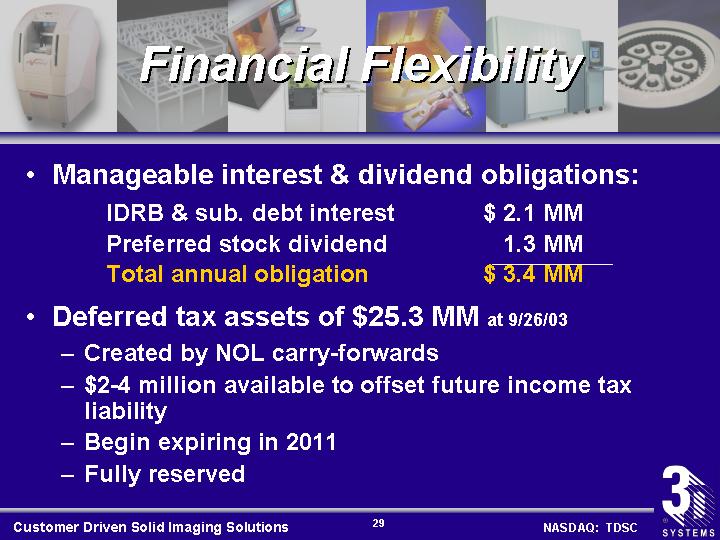

Financial Flexibility

• Manageable interest & dividend obligations:

IDRB & sub. debt interest |

| $ | 2.1 | MM |

Preferred stock dividend |

| 1.3 | MM | |

Total annual obligation |

| $ | 3.4 | MM |

• Deferred tax assets of $25.3 MM at 9/26/03

• Created by NOL carry-forwards

• $2-4 million available to offset future income tax liability

• Begin expiring in 2011

• Fully reserved

29

[GRAPHIC]

Improved Control Environment

• Supplemented financial staff with new:

• CFO

• Director Internal Audit

• Manager External Reporting

• Augmenting policies, procedures and controls

• 100% audit of sales documentation

• Functioning disclosure committee

• Conducting Section 404 evaluation of internal controls

Code Of Conduct Fully In Effect Always!

30

[GRAPHIC]

New Product Introductions...

(Sept-Dec 2003)

31

[GRAPHIC]

Amethyst™ SL Product

September 2003 | ||

| ||

|

| • Designed to meet specific needs of jewelry manufacturers |

[GRAPHIC] |

| • Pattern and master model production provide the best surface finish and create finely detailed structures |

|

| • Direct investment cast in precious metals, such as gold, produce customized jewelry, one-of-a-kind jewelry, and eliminate wax models for small series production |

32

[GRAPHIC]

InVision™ 3-D printer

October 2003 | ||

| ||

[GRAPHIC] |

| • Advanced user-friendly system |

|

| • Enhanced material toughness |

|

| • Superior finished surfaces |

|

| • Easy removal and clean-up |

|

| • Plug & play installation |

|

| • Point & print ease of use |

[GRAPHIC] |

| • Best in class part resolution |

|

| • Affordable, economical @ $39,900 |

33

[GRAPHIC]

LaserForm™ A6 steel

October 2003 | ||

| ||

[GRAPHIC] |

| • New steel tool product for tooling & end use parts |

|

| • Reduced tooling costs |

|

| • Faster Injection molding cycle times |

|

| • Mass customization |

|

| • Time to volume |

[GRAPHIC] |

| • Metallurgical innovation…Enables design, development and manufacturing of tools in a fraction of the time and cost required with more traditional methods such as CNC and EDM |

34

[GRAPHIC]

Bluestone™ SL Product

December 2003 | ||

| ||

|

| • Best in class engineered composite product |

[GRAPHIC] |

| • Provides exceptional stiffness and strength |

|

| • Deliver parts for high-performance applications, including wind tunnel models, electronic enclosures, and durable assemblies for aerospace components |

35

[GRAPHIC]

Industry & Business Outlook…

36

[GRAPHIC]

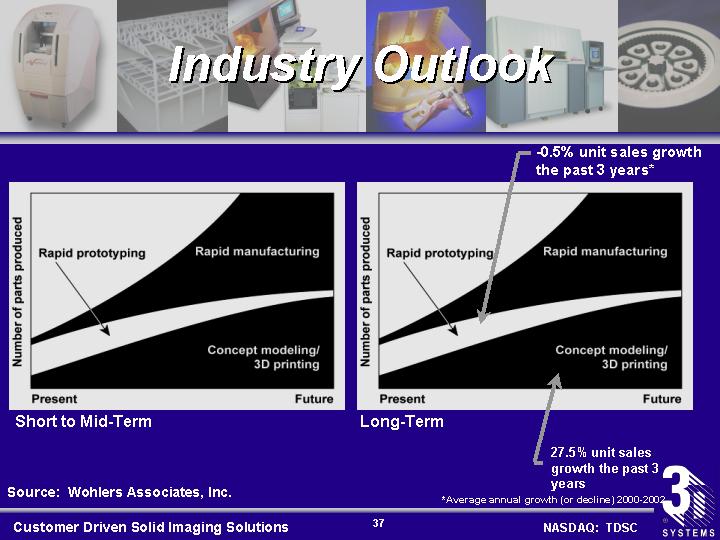

Industry Outlook

[CHART] |

| [CHART] |

|

|

|

Short to Mid-Term |

| Long-Term |

Source: Wohlers Associates, Inc.

*Average annual growth (or decline) 2000-2002

37

[GRAPHIC]

Our Positioning vs. Industry Outlook…

[CHART]

[CHART]

Source: Wohlers Associates, Inc

38

[GRAPHIC]

Leveraging Our Privileged Assets…

• Powerful brands

• Deep customer relations, diverse base

• Global presence, reach

• Differentiated product portfolio

• Broad patented & proprietary technology platforms

• Complete customer solutions: Materials, systems, expert support

• Value-based selling: Delivering measurable economic benefits

• Market leadership in solutions and end-uses

• Proven record of business development

• Direct field sales, applications & service organization

39

[GRAPHIC]

Pipeline Growth Initiatives…

40

[GRAPHIC]

New Products, Systems & Services… New Applications

• Metals and alloys

• Engineered composites

• Engineered plastics

• Ceramics

• Flexible & semi-rigid urethanes

• New universal modular SLS & SLA systems

• Enhanced 3-D printing platform and reach

• Expanded customer services portfolio

41

[GRAPHIC]

Instant Manufacturing . . . ADM

Expanded Application Base

Installations:

Hearing aid companies

Aerospace military applications

Orthodontics/dental installations

Motor sports teams

Jewelry mass customization

Tooling

Pipeline:

Aerospace-commercial Tooling |

| Automotive Metal parts |

[GRAPHIC]

[GRAPHIC]

[GRAPHIC]

Broader Range of Materials & Systems Enables Greater Acceptance

42

[GRAPHIC]

Instant Manufacturing

A View from The Industry…

[GRAPHIC]

“Factory in a box: Inside a direct-manufacturing machine, custom hearing-aid shells arise… Direct manufacturing is replacing laborious manual techniques.”

– TECHNOLOGY REVIEW November 2003

[GRAPHIC]

[GRAPHIC]

“A relatively recent technology, advanced digital manufacturing (ADM), is a reliable and cost-effective method of making end-use parts for pre-production or production applications.”

– ADVANCED MANUFACTURING MAR/APR 2003

43

[GRAPHIC]

Long-Term Growth Drivers…

• New products & systems |

| Internal |

• New customer services |

| |

• Geographic expansion |

| |

• Adjacent opportunities |

| |

|

|

|

• Increasing global trade |

| External |

• Expanding digitized media |

| |

• Demand for customization |

| |

• Affordable CAD solutions |

| |

• Time-to-market pressures |

|

44

[GRAPHIC]

In Conclusion…

• Exciting industry…lots of growth opportunities

• Leading industry position…..and technology

• Energized, experienced management team

• Clear priorities, execution, accountability & ownership

• Stronger financial base & flexibility

• Healthy pipeline of new growth initiatives

• Improving operating results and cash flow

• Measurable value for our customers, shareholders and employees

Sustained Performance & Growth

45