Exhibit 99.1

3D Systems 2nd Quarter and First Half 2004 Results

Operator

Good Morning and welcome to 3D Systems conference call and audio-web cast to discuss 2nd quarter and 1st half 2004 results.

My name is Lowana and I will be facilitating the audio portion of today’s interactive broadcast. All lines have been placed on mute to prevent any background noise. For those of you on the web, please notice the toolbar on the right of your screen. The features on this toolbar allow you to interact with the other show participants and to show different options.

If you experience any issues during the call, please press * then 0 on a touch-tone phone. Each request will be answered as quickly as possible. At this time, I would like to turn the call over to Elizabeth Goode, Director of Corporate Development of 3D Systems.

Elizabeth Goode, Director of Corporate Development

Thanks, and welcome to 3D Systems conference call to discuss 2nd quarter and 1st half 2004 results. I am Elizabeth Goode, Director of Corporate Development, and with me on the call are Abe Reichental, our CEO, Fred Jones, our CFO, and Bob Grace our General Counsel.

This call can also be accessed via the 3D Systems website at www.3Dsystems.com. The audio web cast portion of this call contains a slide presentation. For those following along on the phone, wishing to access the slide portion of this presentation may do so. Should you choose to do so, we recommend that you sign in for the interactive teleconference. This will give you the ability to ask questions related to the conference call at the end to the session.

For those that choose to access the streaming portion of the web cast, please be aware that there is a three-second delay and you will not be able to pose questions via the web. Before we begin the discussion, I would like to preface the comments made today with a statement regarding forward-looking statements.

Certain statements made by the company in this Conference call and web cast are forward-looking statements. These statements include comments as to the company’s beliefs and expectations as to future events and trends affecting the company’s business. These forward-looking statements are based upon management’s current expectations concerning future events and trends and are necessarily subject to uncertainties, many of which are outside of the control of the company.

1

The factors stated under the headings forward-looking statements and cautionary statements and risk factors and managements discussion and analysis of results of operations and financial condition which appear on the company’s periodic filings with the Securities and Exchange Commission as well as other factors, could cause actual results to differ materially from such statements. This call is being recorded and will be available for review until one week from today. This call and presentation can also be accessed via the 3D Systems website under the Investor Relations section.

At this time, I’d like to introduce Abe Reichental, CEO.

Abe Reichental, CEO

Good morning everyone and thanks for taking the time to listen to our call this morning. This morning I will give you an overview of the quarter’s financial and operating results and Fred Jones our CFO will discuss some of the financial aspects in more detail.

We are pleased to announce this morning continued improvement in the companies operating results during the 2nd quarter. Earlier this morning we reported high revenue and improve growth profit margin and lower operating expenses for the 2nd quarter and in the first six-months of 2004. We also report that a modest operating profit for the 2nd quarter of 2004 and a sharply reduced operating lull for the six-month period compared to the 2003 period.

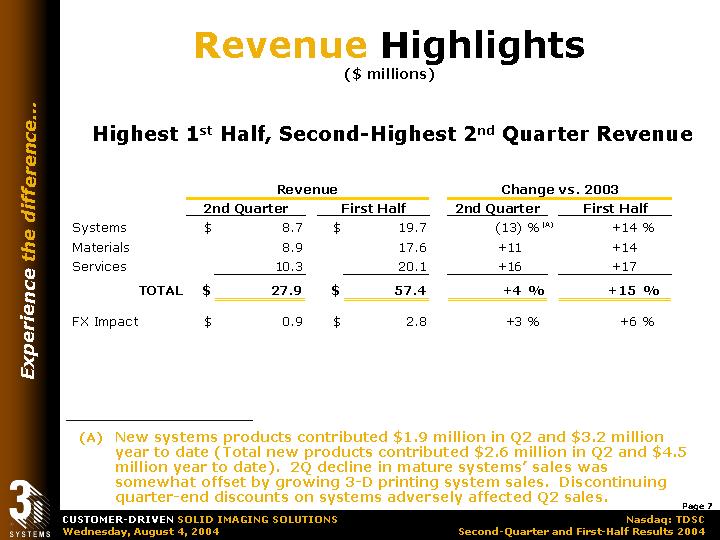

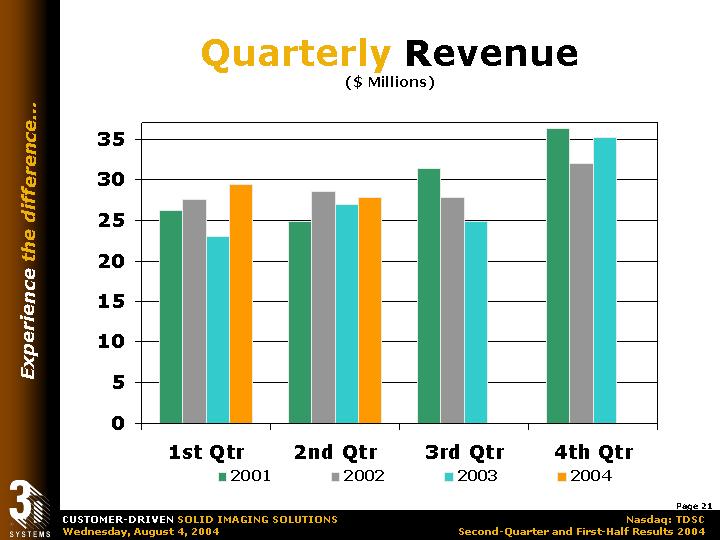

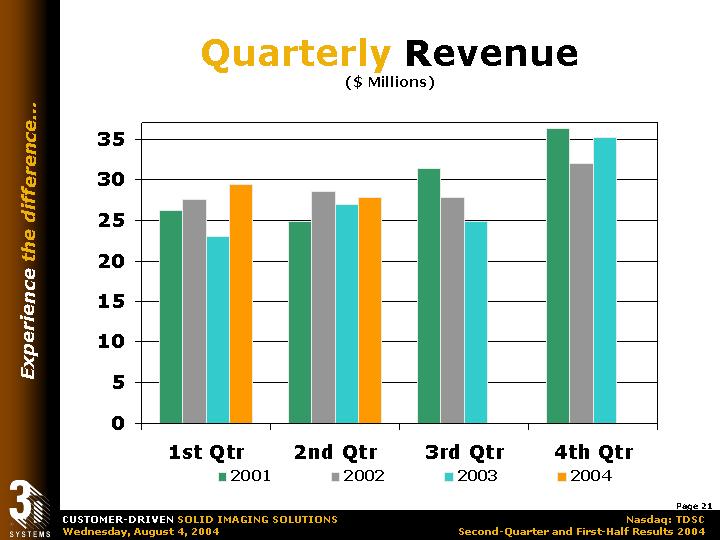

Aided by sales of new products, revenues for the 2nd quarter were $27.9 million representing a 4% increase over last year’s 2nd quarter. To those of you viewing the graph on the web cast, you can see that the 2nd quarter represented the 3rd quarter of successive year over year increases in quarterly revenue, and revenue for the 1st and 2nd quarters combined set the record for the 1st half revenue. Typically, revenues in the 2nd quarter is higher than in the 1st quarter, that was not the case this year, and I want to explain why this was not the case in the 2nd quarter of this year.

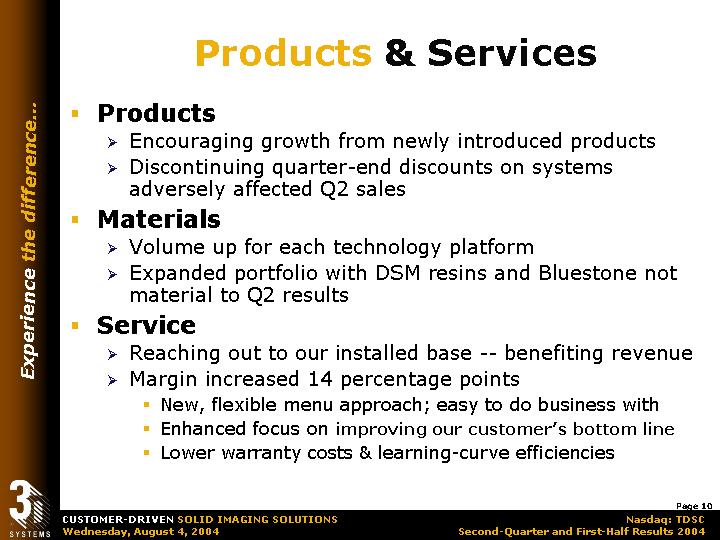

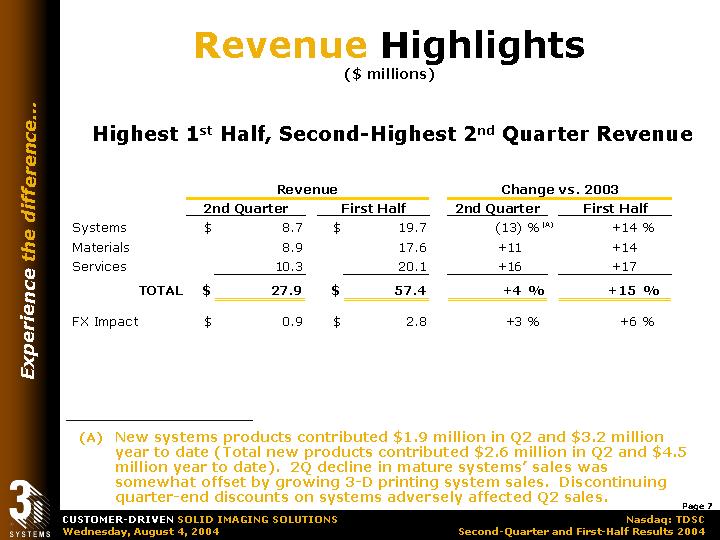

As you can see in this table, revenues for the 2nd quarter for materials and services were up 11% and 16% respectively, and recorded an even higher percentage gained for the first half compared to last years comparable period. Even though systems revenue increased by 14% during the 3rd half in line with increases in materials and services, revenues from systems declined by 13% during the 2nd quarter compared to last year’s 2nd quarter. That decline was in the face of 1.9 million of systems revenue during the 2nd quarter from new products introduced within the last nine months. Sales of the InVision™ 3D printer, introduced late in the 4th quarter of last year, were responsible for a large portion of this growth. So, the 2nd quarter’s decrease in systems revenue was driven by our more mature products.

As part of our disciplined prodigy to improve operating results over time, we ceased offering customers large quarter end discounts to promote the sale of mature systems. While the implementation of this strategy adversely impacted revenues in the quarter, it contributed to our higher growth profit margin in the 2nd margin and the 1st half of this year. By changing our sales

2

strategy, we believe that it will ultimately prove to be beneficial by reducing the portion of system sales made in the last weeks of the quarter and by improving gross profit margins.

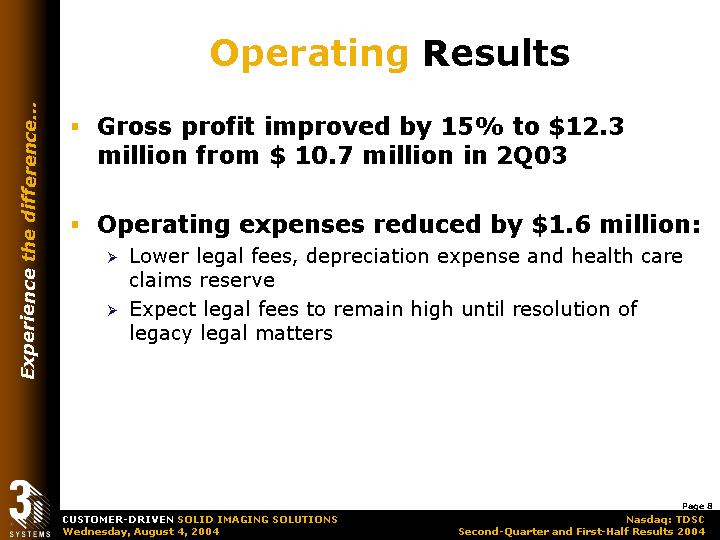

Our gross profit increased by 15% year over year in the 2nd quarter as a result of both increases in our top line and a decline in our cost of sales. Operating expenses were $1.6 million lower year over year because of lower legal fees, lower depreciation expense, and lower employee health care costs. It is very difficult if not impossible for us to predict whether these legal costs for legacy matters will trail off or go up over the near term, and it is impossible for us to predict when they will get results. The company is working to resolve its remaining litigation.

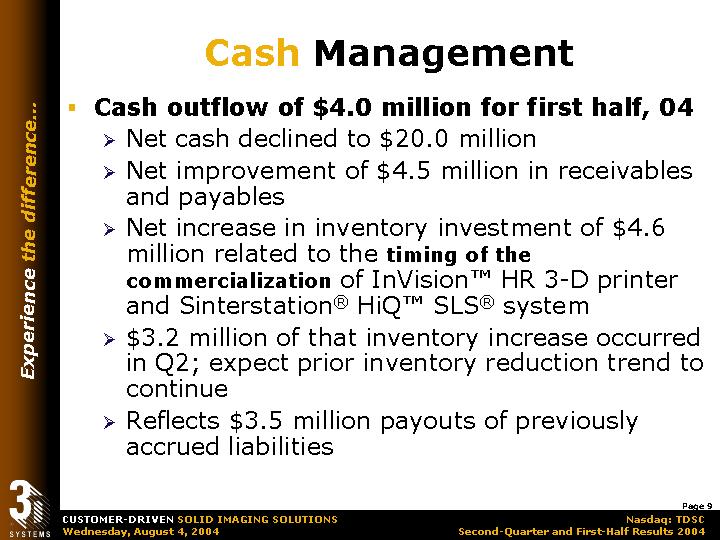

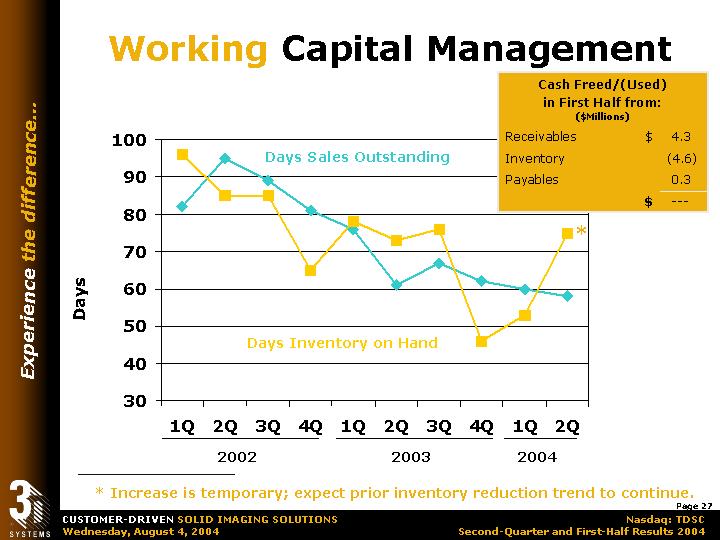

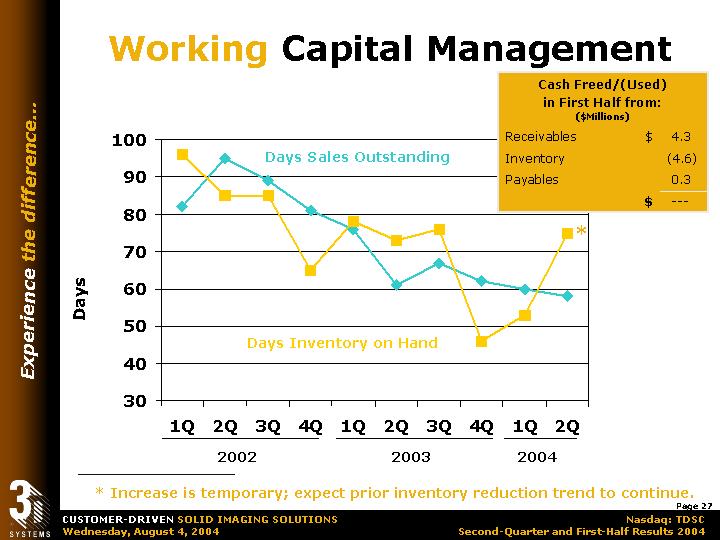

We used $4 million of cash during the 1st half of this year primarily related to a temporary increase in our inventory investment in connection with the timing of several new product launches. We improved upon our accounts receivable and our accounts payable balances generating $4.5 million between the two in the 1st half.

Inventory investment consumed $4.6 million of cash during the 1st half, 3/4ths of that in the 2nd quarter related to building new InVision™ HR printers and the new Sinterstation® HiQ SLS® systems for those two product launches, which were scheduled for early July. As we sell these new models, we expect inventory to resume its prior downward trend. Outsourcing our assembly operations should enhance this downward trend as well. At quarter end, we had $20 million of unrestricted cash and a $15 million revolving credit agreement, which we do not currently intend to use for borrowing. During the 2nd quarter, we had encouraging growth from newly introduced products. Sales of our InVision™ 3D printer are growing substantially and we shipped several of our new InVision™ HR 3D printers at the end of the quarter. This shipment occurred ahead of our planned July launch. We are very pleased that interest in this high-resolution unit has been high, particularly from the jewelry sector.

As I previously mentioned in the 2nd quarter of 2004 we ceased offering customers large quarter end discounts to promote the sale of mature systems. In the absence of this change, systems revenues likely would have been higher in this year’s 2nd quarter compared to the 2nd quarter of 2003. While this change in marketing approach might continue to adversely impact systems revenues in future quarters, we believe that it will ultimately prove to be beneficial by reducing the proportion of our systems sales that are made in the last month of each quarter and by improving gross profit margins.

Material sales were strong during the 2nd quarter, particularly with resin and powder sales volumes. We are excited about the opportunities to grow related to the recently announced distribution agreement with Dreve for hearing aid products and with DSM for the entire Somos® product line for stereolithography, and for our own recently announced Bluestone™ material, an engineered nano-composite product.

Service revenues and margins are benefiting from the successful implementation of certain service related strategic initiatives. Our new menu of service options, our new customer productivity and improvement options, our own efficiency improvements and lower warranty costs this year helped increase growth margins as a percentage of sales by 14 percentage points on top of sales growth of 16% year over year. We anticipate further service improvement

3

opportunities. Our overall business performance strategies to continue frequent new product introductions, as a result, R&D expenditures should be higher in the latter half of this year. We estimate this being in the range of 10% of revenue. Many of our new product offerings are so new that they did not have time to contribute materially to 2nd quarter revenues, but we see sales from them growing as they get traction in the market place. We recently extended our 3D printing portfolio with the high-resolution InVision™ printer and we foresee additional portfolio extension and greater participation in that sector. We are endeavoring to grow in the adaptation of digital manufacturing and to that end a few weeks ago we launched the Sinterstation® HiQ SLS® System which reflects years of laser sintering customer experience captured by working very closely with leading manufacturing end users in industries such as aerospace, automotive, dental devices and hearing aid instruments.

We believe that with further system enhancements coupled with additional laser sensoring material development, we can accelerate the adaptation and expansion of digital manufacturing as a viable flexible and cost effective alternative to today’s traditional manufacturing methods. In all of our businesses, we are striving to improve customer service quality and responsiveness. In our service business, we are working to further enhance our service productivity and margins and to create new service offerings.

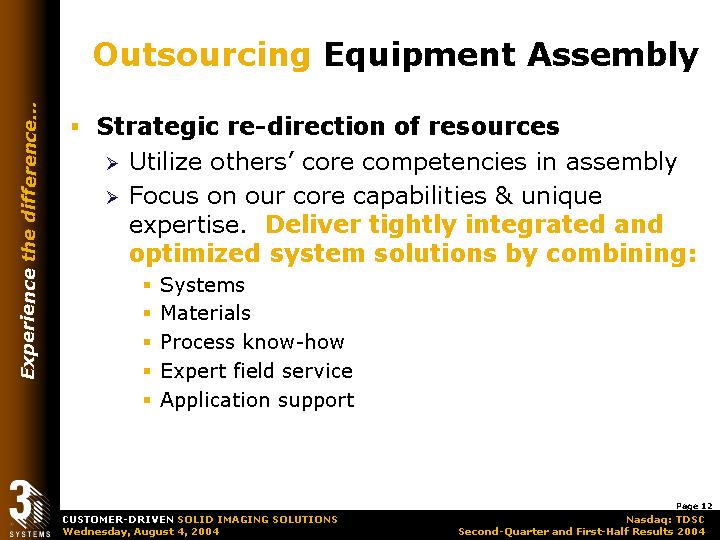

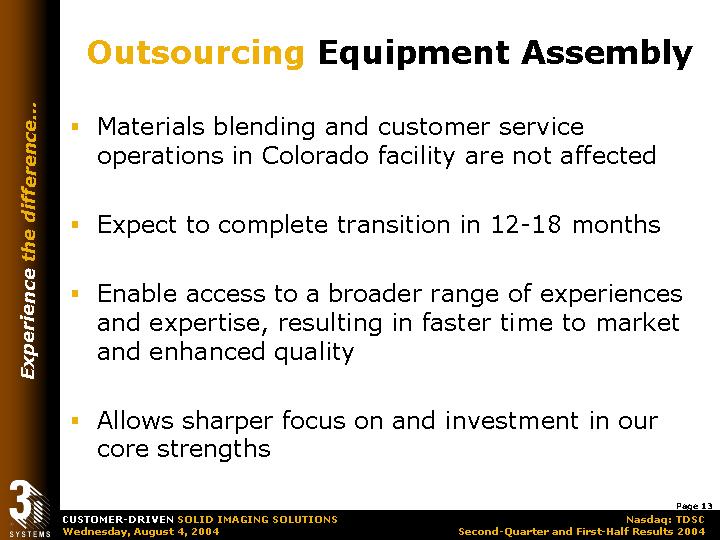

One of our bolder strategic initiatives is our recently announced outsourcing of our assembly operation. This strategic redirection of resources is intended to utilize other core competencies in assembly while focusing our own core competencies and unique expertise on developing and delivering tightly integrated system solutions. We will focus on combining our know how in systems, materials and processes to create new integrated offerings to enhance our customer’s productivity and profitability. These development activities are then combined with expert field service and application support to provide a comprehensive solution for our customer needs.

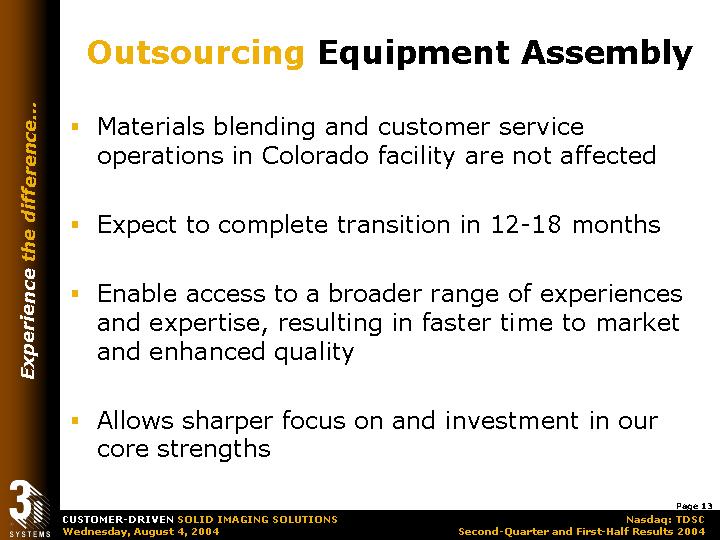

This strategic move of fast equipment assembly but not our materials blending and customer service operation in our Grand Junction, Colorado facility. This transition is expected to be completed within 12 to 18 months. Because we anticipate using multiple third-party design engineering and assembly providers in order to tap varied expertise capabilities. The dispersion of production should permit us to bring new products to market faster and with enhanced product quality while we enhance our own focus on our core strengths.

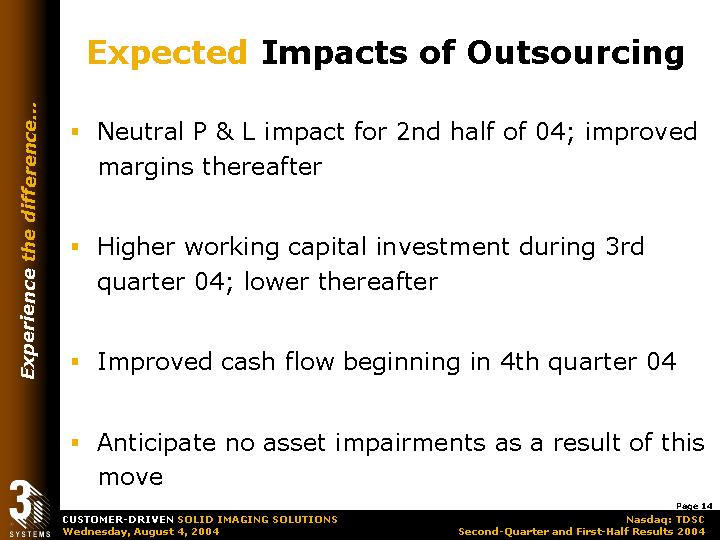

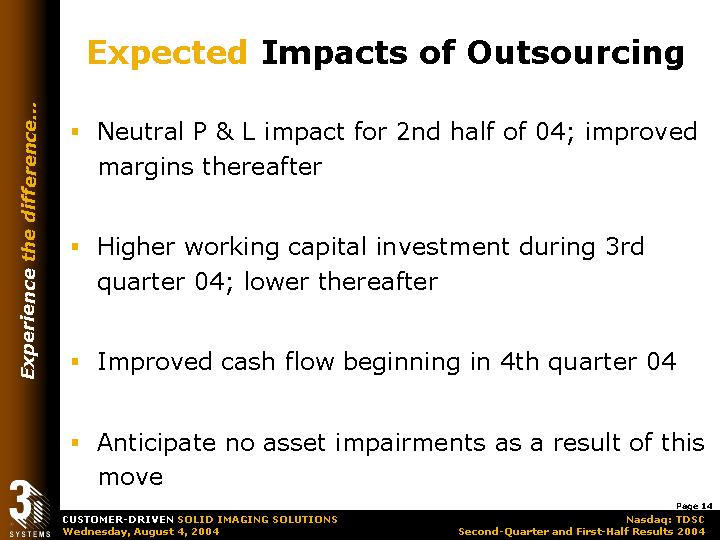

The transition costs are not expected to be material. We expect the impact on the 2nd half profitability to be roughly neutral. We anticipate noticeable origin improvement from this initiative beginning in the 1st quarter of 2005.

Working capital investments to this initiative is expected to be higher during the latter half of this year, but to decline in 2005. Cash flow improvement should improve beginning in the 4th quarter of this year as a result of the curtailment of purchases on our own parts or production parts. We do not anticipate any asset impairment charges arising from this transition.

Because of the importance of new products to our future growth, I want to quickly review our recent new product introductions. The InVision™ HR stands for High Resolution printer, and was scheduled for roll out in July, but the project team was able to launch it one month ahead of

4

schedule in June, just eight months after the launch of our first InVision™ 3D printer. This new printer can create finer detail parts, which are ideal for certain applications such as jewelry, dental, medical implant, and precious alloy part casting. Priced at an affordable level of $59,900, it has been very well received in the market place and represents a significant addition to our 3D printer portfolio.

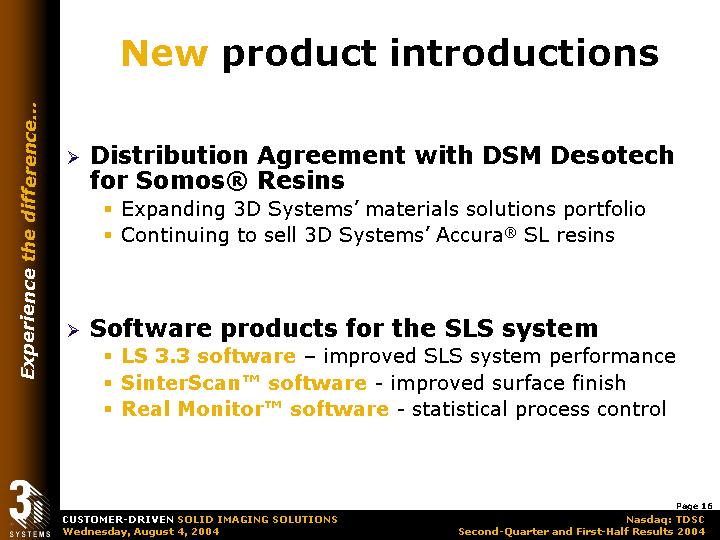

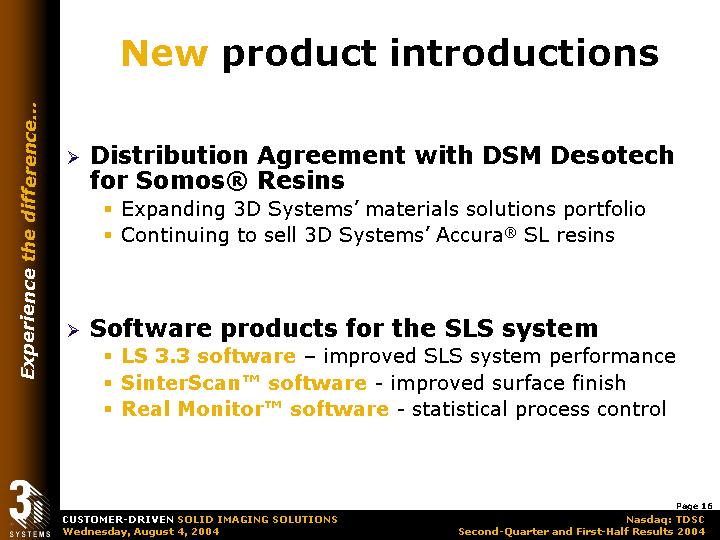

In June, we entered into a worldwide distribution agreement with DSM Desotech, a global provider of stereolithography resins, under which we will distribute their Somos® resins, thereby expanding the portfolio of potential resin solutions for our customers needs. Of course, we will continue to sell our own Accura® stereolithography resin line. In April, we introduced three new software products to improve system performance and surface finish and to monitor system performance for improved profit control.

In June, we introduced a finisher for automatic removal of supports that are built as part of the 3D printing process and a part washer to reduce processing time for parts built with our stereolithography process. Both of these products provide time saving productivity enhancement for our customers and are an immediate example of how we are implementing our most important strategic initiative improving our customers’ bottom lines.

In early July we introduced the Sinterstation HiQ SLS system, which we termed manufacturing capable because it was designed for the mass production of high quality end use parts. It embodies a number of enhancements including improved parts quality, more user friendly, reduced set up time, improved productivity, and lower material usage. This product is designed for the digital manufacturing sector, which an industry specialist, Wohlers and Associates continue to believe will represent the highest growth sector in our industry.

And last week, after several months of field-testing and improvements we begin selling our new Bluestone™ stereolithography material. This is the first commercially available engineered nano-composite resin for stereolithography systems. Its exceptional part accuracy and stiffness broadens the spectrum of applications of stereolithography built objects, thereby enhancing future growth opportunities for both of our SLA systems as well as sales of the material.

In the past nine months, we have realigned and recruited a strong and experienced management team with the announcement last week that Assad Ansari has joined us as Vice President of Global Engineering, our management team is even stronger. Assad brings with him just the right blend of experience and expertise and will play a significant role in helping us speed new product development and further improve our customers’ bottom lines. Our management team is an experienced energized team; we work well together and are making significant strides in the here and now managing the execution of our strategic road map.

At this time, I will ask Fred Jones, our CFO to share with you some additional details regarding some of our key financial results. Fred.

5

Fred Jones, CFO

Thanks Abe.

For another quick perspective on our top line growth, our web cast participants can see a graph of our quarterly revenue organized by quarter showing this years increase in perspective with other 2nd quarter revenue levels over the last four years, and as Abe indicated before, the 2nd quarter of 2004 was the 3rd straight quarter of year over year revenue increases.

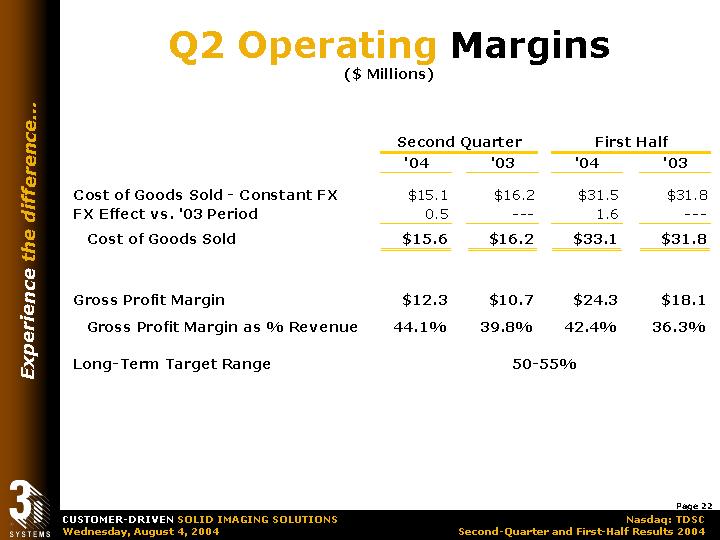

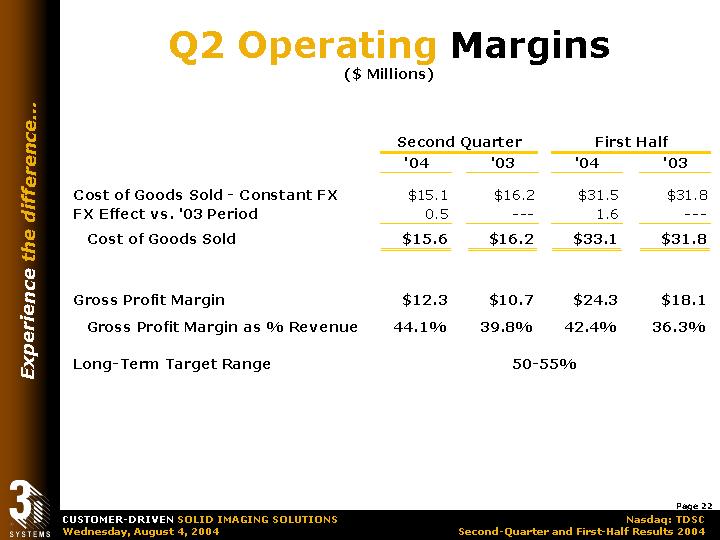

Gross profit and gross profit margins improved in both the 2nd quarter and the first six months of 2004 compared to the 2003 period. Gross profit increased to $12.3 million or 44.1% of revenue for the 2004 quarter, from $10.7 million or 39.8% of revenue for the 2nd quarter of 2003. For the six-month period, gross profit increased to $24.3 million or 42.4% of revenue from $18.1 million or 36.3% of revenue for the first six-months of 2003. The 6.1 percentage point increase in gross profit margin for the first six-months of 2004 resulted for an improved profit margin for both products and services. Service margins benefited globally from lower warranty costs and greater performance efficiencies while product margin increases were slightly offset by ramp up costs associated with new products.

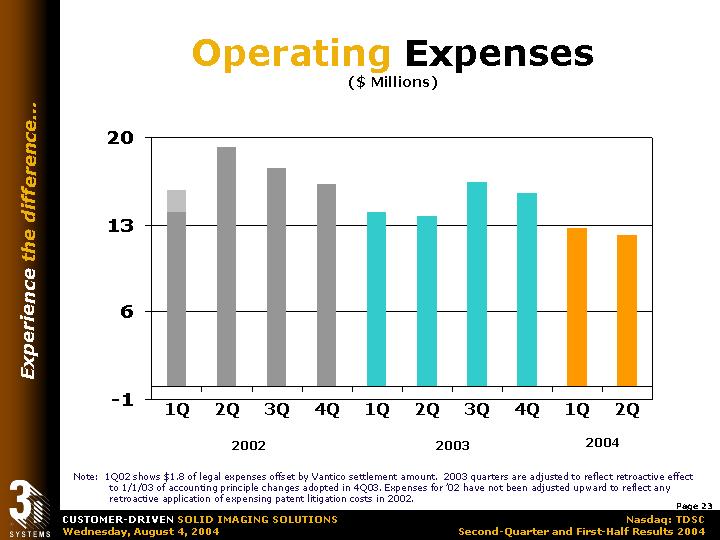

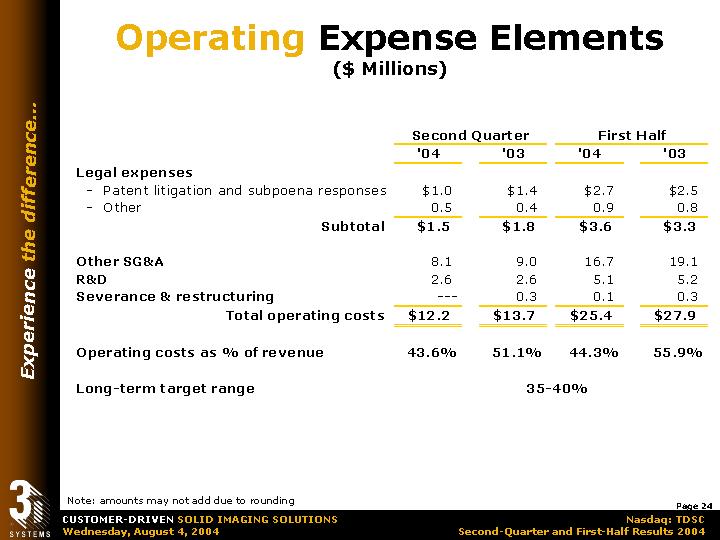

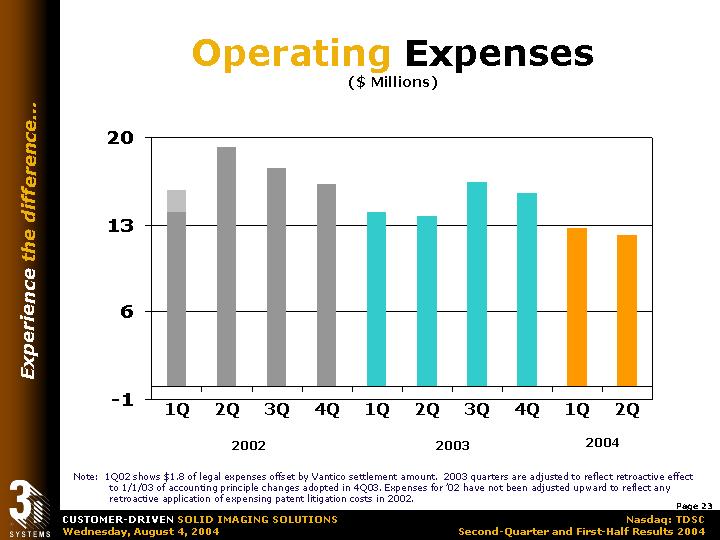

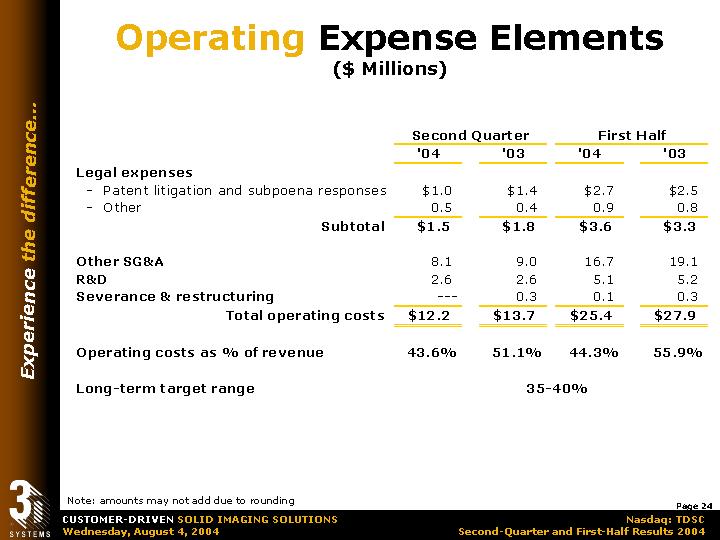

Foreign currency translation at a $.4 million favorable effect on gross profit margin in the 2nd quarter and a $.2 million favorable effect in the first six months. Our operating expenses continue to decline both on a successive quarter basis and in comparison to corresponding prior year periods. The chart visible to our web cast participants shows the downward trend in operating expenses over the last 2.5 years. The 2nd quarter operating expenses are 11.4% lower than in the 2nd quarter of last year. In fact, they are the lowest in more then twelve consecutive quarters on an absolute basis. The decline is even more significant when related to the level of revenue. In the 2nd quarter operating expenses as a percentage of revenue declined from 51.1% last year to 43.6% this year, that’s a 7.5 percentage point decline.

Similarly, operating expenses for the first half declined from 55.9% of sales to 44.3% of sales or an 11.6 percentage point improvement. The declines in operating expenses in the 2004 periods arose primarily from lowered legal fees in the 2nd quarter, lower expenses for the company’s medical benefit program including in the 2nd quarter the reversal of $.4 million in reserves for future claims under our previously self-insured medical program, lower depreciation and amortization, and lower accounting and professional fees.

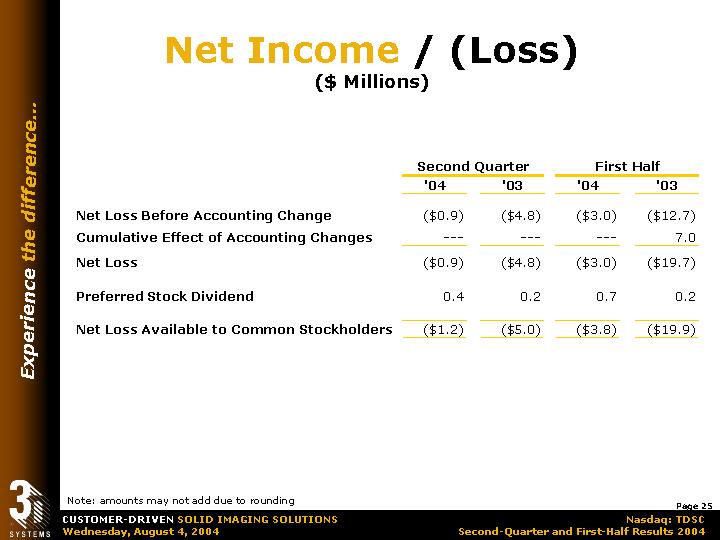

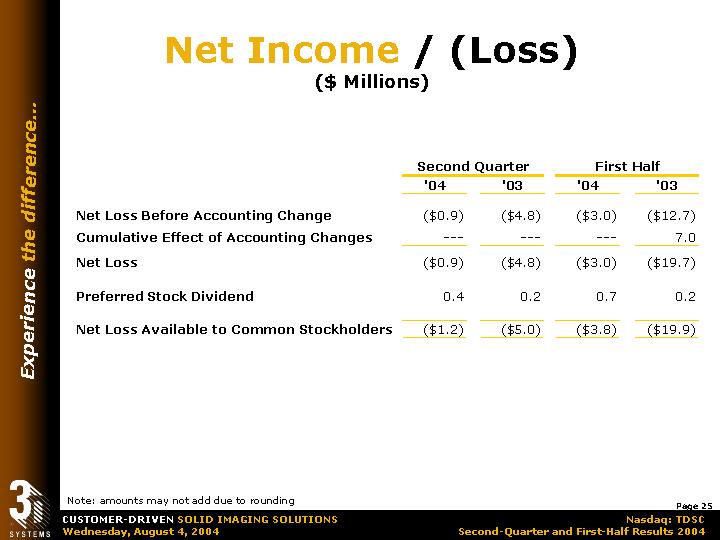

The foreign currency translation had the effect of increasing operating expenses by $.2 million in the 2nd quarter, and by $.7 million in the first six-months of 2004. Reflecting the company’s higher revenue, the approved gross profit margins, and lower operating and other expenses, net loss in the 2nd quarter narrowed significantly to $1.2 million from $5.0 million even after giving effect to preferred stock dividends. The net loss of $3.8 million in the 1st half is substantially lower then last year’s net loss even before including the $7 million cumulative effect of the two changes in accounting principals that we adopted at the end of last year.

6

Net cash used in operations in the first half of this year was primarily driven by the company’s $3 million dollar loss for the first six-months and an additional $.2 million of net cash was used for working capital. Cash decreased by $4 million during the 1st half to a balance at June 30th of $20 million. For those updating your cash flow models, you may be interested to know that depreciation and amortization was $3.3 million for the first half of this year.

Capital expenditures for PP&E during the first half of this year were only $.3 million. The relatively lower level of capital expenditures for this year reflects the deferral of certain capex decisions, primarily information technology related as a result of our changing business model and other priorities. Our working capital management efforts continue to produce beneficial results as our day sales and receivable metrics dropped to 58 days, the lowest in many years.

Some $3.2 million of cash was used during the quarter to fund higher inventory levels that was primarily in connection with the timing of the commercialization of the InVision™ HR 3D printer and the Sinterstation HiQ SLS system that we introduced late in the 2nd quarter and early in the 3rd quarter of this year. While this reversed the downward trend in days inventory on hand, we expect inventory levels to decline and resume their downward trend as those products are sold. We also expect that inventory will be further reduced as our assembly outsourcing transition progresses. We expect that all inventory used to produce those outsourced machines will be owned and held by the assemblers, representing a significant reduction in working capital investment for 3D Systems.

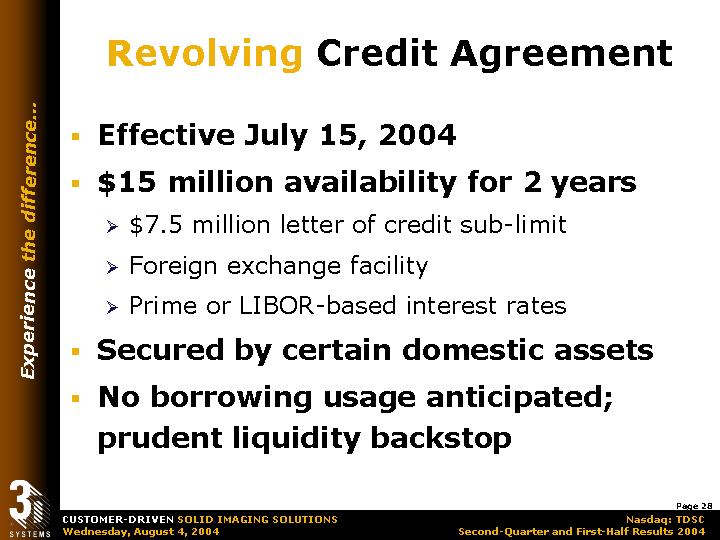

Last month we concluded a two-year revolving credit agreement, which provides to the company up to $15 million dollars of credit for a combination of borrowing, letters of credit, and foreign exchange contracts, it is secured by certain of our domestic assets but is otherwise a traditional revolving credit agreement and not an asset backed financing. While I expect we’ll utilize this facility for foreign exchange contracts, we do not currently expect to have a need to borrow under it, it just represents a prudent liquidity backstop.

Abe, that concludes my comments.

Abe Reichental, CEO

Thanks Fred.

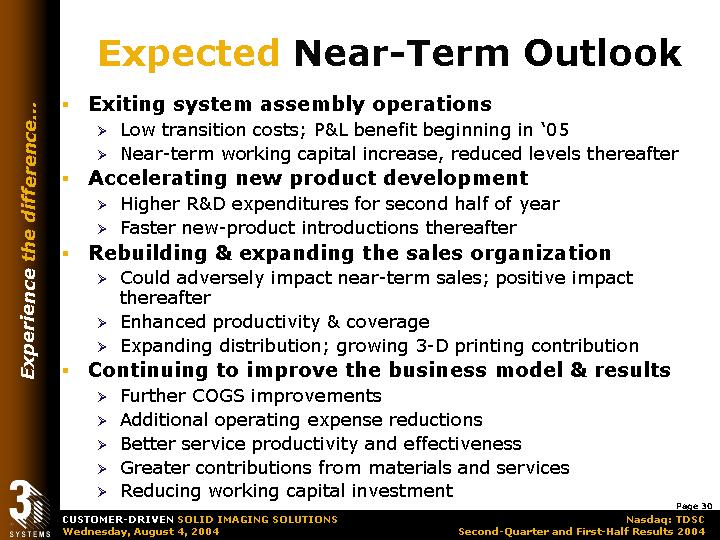

Before, we open the lines for the Q&A, I just wanted to share with you and summarize some of our expectations for the near term and longer term.

In the near term, we will be transitioning our systems assembly operations to a carefully selected third-party assemblers. This transition cost should be relatively low and the benefit should become noticeable next year after a roughly neutral impact on the P&L this year.

7

Working capital investments should increase during the transition period but decline thereafter. We are continuing to accelerate our new product development and as a result expect that R&D expenditures will be higher in the second half of this year compared to the first half, for the whole year they should equal roughly 10% of the revenue. We are currently in the process of rebuilding and extending our sales organization. This involves some realignment, reassignment, selective personnel changes, and additions to coverage. This is not a prediction, but there is an understandable possibility that we will experience some temporary inefficiencies, as new or reassigned sales personnel learn their new responsibilities. We expect the sales force productivity in both geographic and product coverage will be enhanced as a result of these changes leading to very positive future impact. Expansion of the sales organization is driven by our growing product line, the growing contribution of the 3D printing business and the need to build and expand our distribution network. And we are continuing to improve our business model and operating results in a way which we have discussed with you previously.

Further reductions and the cost goods sold and operating expenses, better service productivity, enlarged contributions through the recurring revenue portions of our business and reductions in working capital investment may sound like mother-hood and apple pie but they are the basic and important building blocks on which we focus for continuous improvement.

Longer term, we see a number of basic assets and drivers for enhanced future performance already in place or being aggressively put into place. These assets and drivers include our leading industry position, our core capabilities and unique expertise, our comprehensive strategy, our experienced management team, the operating and financial benefit that - to be garnered from the outsourcing of equipment assembly operations, our currently strong cash position, a healthy pipeline of growth opportunities and significant product and service opportunities for us to address.

Importantly, we see significant, addressable new market opportunities with our new product, particularly in the high-growth areas of 3D printing and digital manufacturing. We believe that we are very well positioned to produce measurable value for our customers, shareholders, and employees and I thank all of them for their support.

We will now open the calls for questions.

Operator

At this time I would like to remind everyone in order to ask a question, please press * and the number 1 on your telephone keypad. We’ll pause for just a moment to compile the Q&A process.

Again, to ask a question, please press * and the number 1 on your telephone keypad. We are now pausing for questions.

Your first question comes from David Cohen from Midwood Capital.

8

David Cohen – Midwood Capital

(Q) Good morning gentlemen. Uhm, question, on the plan to use the contractors for assembly, how are you going to organize around that? Can you give more color on the - the geographical organization or whether it will be a product line or a combination of the both? How many contractors are we ultimately talking about?

Abe Reichental, CEO

(A) We are talking about a handful of contractors that will be selected to conform in to our strategic plan. They will be selected based upon their capabilities and contributions, not based on their geography or location, but based on talent, capabilities and contributions and we are organizing internally to be able to manage it on an ongoing basis, via an internal dedicated program managers that will drive those activities.

David Cohen – Midwood Capital

(Q) Well, will one contractor be responsible for the InVision™ line, you know, another for your SLS systems. Or can one contract actually make multiple products for you?

Abe Reichental, CEO

(A) Well, it is possible that both of those will materialize and we will maintain certain flexibility to ensure that certain capability redundancy is built in.

David Cohen – Midwood Capital

(Q) Okay, and one – one last question. Maybe you can also give some additional color on the way in which you are organizing your sales force. Is the plan to have all of your different products sold by a direct sales force, and will there be a separate sales force for the InVision™ Systems as compared to your more mature, you know, your bigger more expensive systems. Are those going to be two separate sales forces?

9

Abe Reichental, CEO

(A) David, we are doing a few things. One is that we are rejuvenating and extending the direct sales force that sells all of our extra solutions including what you termed the, “mature systems”. In addition to that, we are in the process of dedicating a group of sales people to extend the InVision™ reseller channel to mange the InVision™ reseller channel and to pursue additional vertical markets for the 3D printing product lines that we are extending. We expect our direct sales force to sell all of the products, including the InVision™ 3D Printing Product line, working with and through the reseller while we use our dedicated 3D printing InVision™ sales force to develop and manage the channel and develop vertical markets.

David Cohen – Midwood Capital

(Q) Okay, thank you.

Abe Reichental, CEO

(A) You bet.

Operator

Your next question comes from Jay Harris from Goldsmith and Harris.

Jay Harris – Goldsmith and Harris

(Q) Good Morning Abe.

Abe Reichental, CEO

(A) Hey Jay.

10

Jay Harris – Goldsmith and Harris

(Q) There are a lot of moving parts here, let’s talk about gross margin for a moment. The outsourcing of systems manufacturing will probably have what, three benefits, lower working capital, lower product development expenses, and higher gross margins. Are those assumptions correct?

Abe Reichental, CEO

(A) You got it.

Jay Harris – Goldsmith and Harris

(Q) Alright. Eighteen months, two years from now when the restructuring has been complete and in place for a while, how much of a gross margin improvement on - do you expect to win from this?

Abe Reichental, CEO

(A) Jay, we are not prepared yet to begin to forecast and - and predict the actual growth margin improvement, but suffice it to say that we are doing it because we believe that in all of the three categories that you’ve mentioned, improved working capital, faster time to market and lower R&D investments and enhanced gross margins, those are the reasons why we are doing it, and obviously we would not be doing it just to gain a couple of percentage points in growth margins, so, one would assume that significant improvement opportunities exist, and I would point you back to our long term target operating model to remind you of the long term range that we are shooting for, and obviously outsourcing the assembly operation is one lever that we are pulling on in the here and now to help us get to the long term target range of 50% to 65%.

Jay Harris – Goldsmith and Harris

(Q) I noticed, just to continue on gross margin, if one compares the 1st quarter revenue and cost of goods sold for systems to the 2nd quarter, the revenues were down $2.1 million and the cost of goods sold was down $1.6 million, should I assume that most of that improvement was due to the elimination of deep discount business and a minor portion to new product flow? How would you address that?

11

Abe Reichental, CEO

(A) Well, it’s probably there, I mean, it’s part of the assumption. I mean at the end of the day Jay, obviously volume, mix price, all contribute into it, but certainly the elimination of discounts bolstered the gross margin.

Jay Harris – Goldsmith and Harris

(Q) You are not going to go any further are you?

Abe Reichental, CEO

(A) Jay, if you note in your opening statement, there are lots of moving parts here. We are encouraged by the triangular, encouraged that as we are executing we are beginning to see the improvements even before we are seeing any benefits from the bolder move of outsourcing the assembly, and it is premature to identify one particular trend for the very reason that you mentioned, that there are many moving parts here.

Jay Harris – Goldsmith and Harris

(Q) One other area, and then I’ll get back into the queue -

Abe Reichental, CEO

(A) I think that you have exhausted the number of questions that you can ask.

Jay Harris – Goldsmith and Harris

(Q) - now, you know me better then that. If you want, I can get back into queue now, that’s alright.

Abe Reichental, CEO

(A) Go ahead.

12

Operator

Your next question comes from Joe Halpern of Halpern Capital.

Joe Halpern, Halpern Capital

(Q) Morning guys.

Abe Reichental, CEO

(A) Morning.

Joe Halpern, Halpern Capital

(Q) I’ve got a couple of questions. First, can you give us a little color on the competitive landscape, specifically I guess, Stratus and 3D printing and who you might see the most in digital manufacturing?

Abe Reichental, CEO

(A) Sure Joe, with regards to competition, I mean it’s important to remember that we sell system solutions in three major categories: in stereolithography, laser centering and concept modeling of 3D printing, and Stratus’s primarily competes with us only in the 3D printing arena. It is also important to remember that Stratus pioneered that segment and continues to lead in it. We are the newcomers, we are a couple of quarters into it. We believe that we have the more capable system, we believe that we have a faster system, we believe that the parts that we produce cost less and look better and have a higher degree of accuracy and surface protection and we are very encouraged by the quarterly and year-to-date results and the growing importance of 3D printing to our business and I might add that we are very encouraged by the success of Stratus’ to date because it indicates that this is an opportunity that is still in its infancy.

With regards to digital manufacturing and specifically the new Sinterstation HiQ SLS System that we just introduced, we believe that we, with that system, find ourselves in a leading position beginning to develop a segment of application again that is largely in its infancy, and a segment that Terry Wohlers, of Wohlers and Associates, we believe, correctly predicts will be the highest growth opportunity for our kind of technology. The only competitor in that segment is EOS - it’s

13

a German competitor - a very worthy and capable competitor, and again we believe that for a new and disruptive technology such as this that begins to challenge conventional manufacturing methods, there is plenty of room for all of us to play, benefit, and grow.

Joe Halpern, Halpern Capital

(Q) Great, thanks, and then in terms of service margins, I think they hit about 39% this quarter, is there any more room for growth or is that above the target, do you expect that number to continue or should that drop more closer to 35?

Abe Reichental, CEO

(A) Well, I – I believe that we have since the beginning of the year improved our service margins significantly; double digits, isn’t it Fred?

Joe Halpern, Halpern Capital

(Q) Yeah.

Fred Jones, CFO

Yes.

Abe Reichental, CEO

(A) And I believe that there is still in fact, I believe that we said it during the, the web cast presentation and even in the press release, we believe that there is more room to improve our service margin and we intend to continue to drive in that direction. We are very encouraged by our double-digit improvement to date, but we believe there is plenty more left in it.

Joe Halpern, Halpern Capital

(Q) Okay, thank you.

14

Abe Reichental, CEO

(A) You bet.

Operator

Your next question comes from Bernard Hamilton of Avanti Partners.

Bernard Hamilton, Avanti Partners

(Q) It was already answered, Jay asked it about the gross margins.

Abe Reichental, CEO

(A) Not a problem.

Operator

As a reminder to ask a question, please press * then the number 1 on your keypad. We now have a follow up question from Jay Harris of Goldsmith and Harris.

Jay Harris – Goldsmith and Harris

(Q) The higher R&D expenses in the last half of the year, the - they’ll be considerably higher per dollar of revenue than they were in the first half of the year as you’ve described, as what is likely to happen. Is it reasonable to assume that this higher percentage of sales could be offset by SG&A expenses coming in as a lower percentage of revenues as the year progresses?

Abe Reichental, CEO

(A) Yes, a couple of things, Jay, to address here, and let me quickly summarize. We are still catching up on several years of not developing and inventing. In the last nine months, we have introduced eight new products. We are now beginning to deal with a significant refresh to our basic technologies, the SLA and SLS, and that is what is driving a temporary increase in R&D

15

expenditures for the remainder of the year. Of course, at the same time we are continuing to manage our overall SG&A downward and we will take every opportunity to continue this downward trend of operating expenses as a percentage of sales. Bear in mind, that not all of it is in our control as we said earlier in the web cast this morning, we are still in the midst of some legacy issues which we hope will eventually be resolved but when, we don’t know, but in the meantime some of these expenses are not discretionary.

Other then that, it is safe to assume that we will continue to manage overall operating expenses down, and I should add that the R&D increase for the second half is not a permanent increase, it is an increase that we will take to make the right, prudent, timely investments and send a few developments to market. We would expect in the long term to continue to manage our R&D and any expenditure in line with our overall operating expense long term target range.

Jay Harris – Goldsmith and Harris

(Q) Okay, I’ve got a balance sheet question. Why do we have $15 million dollars of deferred revenues on the balance sheet? What are the nature of the transactions that give rise to that?

Abe Reichental, CEO

(A) Fred will answer that for you Jay.

Fred Jones, CFO

(A) Jay, when we book a service contract or maintenance contract in the system many times we get that amount upfront and we only recognize that revenue ratably over the period of the contract which is typically one year. So for the month that it is booked we’ll recognize about 1/12th of that revenue and the other 11/12ths would be a deferred revenue and come in ratably over the ensuing 11 months.

Jay Harris – Goldsmith and Harris

(Q) Okay, thank you.

16

Abe Reichental, CEO

(A) You are welcome.

Operator

Your next question comes from Adam Fisher of Barnum Asset Management.

Adam Fisher, Barnum Asset Management

(Q) Hi, how are you?

Abe Reichental, CEO

(A) Good, how are you Adam?

Adam Fisher, Barnum Asset Management

(Q) I’m good, thanks. Did we talk about the percentage of revenue for materials for the quarter?

Abe Reichental, CEO

(A) Did we break revenue?

Adam Fisher, Barnum Asset Management

(Q) Did you break that number out?

Fred Jones, CFO

(A) No, it will be in our…

17

Abe Reichental, CEO

(A) It will be in the 10Q-

Fred Jones, CFO

(A) -10Q which will be filed in the next day or two.

Adam Fisher, Barnum Asset Management

(Q) Do you have the sense of the overall trends?

Abe Reichental, CEO

(A) Well yes, we talked about the overall trend and we said that the material revenues were up double digits, but if you bear with me Adam, either Fred or I will find exactly what, I believe it was… What did we say? We’ll find it for you. It is significant.

Fred Jones, CFO

(A) I’ve got it, I just need to do my arithmetic. The materials revenue was up almost 11% in the 2nd quarter compared to the same quarter last year.

Adam Fisher, Barnum Asset Management

(Q) Okay, great. And, just remind me the gross margins on the materials are higher than the company overall?

Abe Reichental, CEO

(A) Typically, yes.

18

Adam Fisher, Barnum Asset Management

(Q) Okay. That’s it. Thank you.

Abe Reichental, CEO

(A) You are welcome.

Operator

Thank you. At this time there are no further questions.

Elizabeth Goode

Ladies and gentlemen, if there are no further questions we will now close the call. Thank you for joining us today we look forward to continuing to report progress and results. If you have missed any portion of this call, it will be made available two hours after the call, and through the 3D Systems website under the Investor Relations Section.

Operator

Thank you, this concludes today’s 3D Systems conference call. You may now disconnect.

END OF WEBCAST

19

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

3D Systems Corporation

Conference Call and Webcast

Second-Quarter and First-Half 2004 Results

Wednesday, August 4, 2004

www.3dsystems.com

EXPERIENCE THE DIFFERENCE | |

Customer-driven solid imaging solutions | [LOGO] |

Experience the difference…

Welcome Webcast Viewers

• If you wish to ask questions at the end of the conference call, you should be registered as “Interactive Teleconference”.

• If you did not register as “Interactive” and wish to participate, please follow the steps below:

• To the right of your screen check the icon marked “Phone Connection” on your tool bar. You will then need to dial in to the conference call at: 877/791-4796 (or 706/679-6014 from outside the United States).

• Questions will not be accepted through the website or “Audio Streaming”.

CUSTOMER-DRIVEN SOLID IMAGING SOLUTIONS | | Nasdaq: TDSC |

Wednesday, August 4, 2004 | | Second-Quarter and First-Half Results 2004 |

2

Participants

• Elizabeth V. Goode

Director, Corporate Development

• Abe N. Reichental

President & Chief Executive Officer

• Fred R. Jones

Vice President & Chief Financial Officer

• Robert M. Grace, Jr.

Vice President, General Counsel & Secretary

3

Forward-Looking Statements

Certain statements made by the Company in this Webcast are forward-looking statements. These statements include comments as to the Company’s beliefs and expectations as to future events and trends affecting the Company’s business. These forward-looking statecarry forwardsed upon management’s current expectations concerning future events and trends and are necessarily subject to uncertainties, many of which are outside the control of the Company. The factors stated under the headings “Forward-Looking Statements” and “Cautionary Statements and Risk Factors” in management’s discussion and analysis of results of operations and financial condition, which appear in the Company’s periodic filings with the Securities and Exchange Commission, as well as other factors could cause actual results to differ materially from such statements.

© Copyright 2004 by 3D Systems, Inc. All rights reserved. The 3D logo, 3D Systems, SLA, SLS, Sinterstation, ThermoJet, Accura and DuraForm are registered trademarks and SLS, InVision, HiQ, Amethyst, Bluestone, LaserForm and CastForm are trademarks of 3D Systems. “the solid imaging company” and ADM are service marks of 3D Systems, Inc. All other product names or services mentioned are trademarks or registered trademarks of their respective companies.

4

Business Highlights

5

Quarterly Revenue

($ Millions)

[CHART]

6

Revenue Highlights

($ millions)

Highest 1st Half, Second-Highest 2nd Quarter Revenue

| | Revenue | | Change vs. 2003 | |

| | 2nd Quarter | | First Half | | 2nd Quarter | | First Half | |

Systems | | $ | 8.7 | | $ | 19.7 | | (13 | )%(A) | +14 | % |

Materials | | 8.9 | | 17.6 | | +11 | | +14 | |

Services | | 10.3 | | 20.1 | | +16 | | +17 | |

| | | | | | | | | |

TOTAL | | $ | 27.9 | | $ | 57.4 | | +4 | % | +15 | % |

| | | | | | | | | |

FX Impact | | $ | 0.9 | | $ | 2.8 | | +3 | % | +6 | % |

(A) New systems products contributed $1.9 million in Q2 and $3.2 million year to date (Total new products contributed $2.6 million in Q2 and $4.5 million year to date). 2Q decline in mature systems’ sales was somewhat offset by growing 3-D printing system sales. Discontinuing quarter-end discounts on systems adversely affected Q2 sales.

7

Operating Results

• Gross profit improved by 15% to $12.3 million from $ 10.7 million in 2Q03

• Operating expenses reduced by $1.6 million:

• Lower legal fees, depreciation expense and health care claims reserve

• Expect legal fees to remain high until resolution of legacy legal matters

8

Cash Management

• Cash outflow of $4.0 million for first half, 04

• Net cash declined to $20.0 million

• Net improvement of $4.5 million in receivables and payables

• Net increase in inventory investment of $4.6 million related to the timing of the commercialization of InVision™ HR 3-D printer and Sinterstation® HiQ™ SLS® system

• $3.2 million of that inventory increase occurred in Q2; expect prior inventory reduction trend to continue

• Reflects $3.5 million payouts of previously accrued liabilities

9

Products & Services

• Products

• Encouraging growth from newly introduced products

• Discontinuing quarter-end discounts on systems adversely affected Q2 sales

• Materials

• Volume up for each technology platform

• Expanded portfolio with DSM resins and Bluestone not material to Q2 results

• Service

• Reaching out to our installed base — benefiting revenue

• Margin increased 14 percentage points

• New, flexible menu approach; easy to do business with

• Enhanced focus on improving our customer’s bottom line

• Lower warranty costs & learning-curve efficiencies

10

• Frequent new product introductions

• Accelerate growth from newly introduced products

• Expand 3-D printing participation and portfolio

• Broaden Digital Manufacturing adoption

• Improve customer service quality & response

• Enhance service productivity & margins

• Create new service product offerings

11

Outsourcing Equipment Assembly

• Strategic re-direction of resources

• Utilize others’ core competencies in assembly

• Focus on our core capabilities & unique expertise. Deliver tightly integrated and optimized system solutions by combining:

• Systems

• Materials

• Process know-how

• Expert field service

• Application support

12

• Materials blending and customer service operations in Colorado facility are not affected

• Expect to complete transition in 12-18 months

• Enable access to a broader range of experiences and expertise, resulting in faster time to market and enhanced quality

• Allows sharper focus on and investment in our core strengths

13

Expected Impacts of Outsourcing

• Neutral P & L impact for 2nd half of 04; improved margins thereafter

• Higher working capital investment during 3rd quarter 04; lower thereafter

• Improved cash flow beginning in 4th quarter 04

• Anticipate no asset impairments as a result of this move

14

New product introductions

[GRAPHIC]

• InVision™ HR 3-D printer, second printer introduction within eight months…

• Fine-featured, highly detailed parts

• Jewelry, dental, medical implant and precision alloy parts’ applications

• Affordable @ $59,900

15

• Distribution Agreement with DSM Desotech for Somos® Resins

• Expanding 3D Systems’ materials solutions portfolio

• Continuing to sell 3D Systems’ Accura® SL resins

• Software products for the SLS system

• LS 3.3 software – improved SLS system performance

• SinterScan™ software - improved surface finish

• Real Monitor™ software - statistical process control

16

Designed to Improve Our Customer’s Bottom Line

• InVision™ Finisher for automated support removal

[GRAPHIC]

[GRAPHIC]

• ProClean™ SL part washer to reduce post-processing time & labor

17

• Manufacturing-Capable Sinterstation® HiQ™ SLS® system

• Mass production of high-quality end-use parts

• Improved part quality, user friendliness, set up, productivity and material usage

[GRAPHIC]

[GRAPHIC]

• Engineered Nano-Composite Bluestone™ SL material

• First commercially available engineered nano-composite resin for SLA systems

• Delivers exceptional accuracy, stiffness

18

Experienced Management Team

• Abe Reichental, President & CEO (Sept. 03)

• Fred Jones, VP & CFO (Dec. 03)

• Robert Grace, VP & General Counsel (Nov. 03)

• Chuck Hull, EVP & CTO (Oct. 03)

• Kevin McAlea, VP Global Marketing (Oct. 03)

• Ray Saunders, VP Global Customers’ Success (Oct. 03)

• Stephen Goddard, VP Operations (Oct. 03)

• Robert Kayser, VP Global Sales (Jan. 04)

• Assad Ansari, VP Global Engineering (Aug. 04)

Continuous organizational development

19

Financial Highlights

20

Quarterly Revenue

($ Millions)

[CHART]

21

Q2 Operating Margins

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

Cost of Goods Sold - Constant FX | | $ | 15.1 | | $ | 16.2 | | $ | 31.5 | | $ | 31.8 | |

FX Effect vs. ‘03 Period | | 0.5 | | — | | 1.6 | | — | |

Cost of Goods Sold | | $ | 15.6 | | $ | 16.2 | | $ | 33.1 | | $ | 31.8 | |

| | | | | | | | | |

Gross Profit Margin | | $ | 12.3 | | $ | 10.7 | | $ | 24.3 | | $ | 18.1 | |

Gross Profit Margin as % Revenue | | 44.1 | % | 39.8 | % | 42.4 | % | 36.3 | % |

| | | | | | | | | |

Long-Term Target Range | | 50-55% | |

22

Operating Expenses

($ Millions)

[CHART]

Note: 1Q02 shows $1.8 of legal expenses offset by Vantico settlement amount. 2003 quarters are adjusted to reflect retroactive effect to 1/1/03 of accounting principle changes adopted in 4Q03. Expenses for ‘02 have not been adjusted upward to reflect any retroactive application of expensing patent litigation costs in 2002.

23

Operating Expense Elements

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

Legal expenses | | | | | | | | | |

• Patent litigation and subpoena responses | | $ | 1.0 | | $ | 1.4 | | $ | 2.7 | | $ | 2.5 | |

• Other | | 0.5 | | 0.4 | | 0.9 | | 0.8 | |

Subtotal | | $ | 1.5 | | $ | 1.8 | | $ | 3.6 | | $ | 3.3 | |

| | | | | | | | | |

Other SG&A | | 8.1 | | 9.0 | | 16.7 | | 19.1 | |

R&D | | 2.6 | | 2.6 | | 5.1 | | 5.2 | |

Severance & restructuring | | — | | 0.3 | | 0.1 | | 0.3 | |

Total operating costs | | $ | 12.2 | | $ | 13.7 | | $ | 25.4 | | $ | 27.9 | |

| | | | | | | | | |

Operating costs as % of revenue | | 43.6 | % | 51.1 | % | 44.3 | % | 55.9 | % |

| | | | | | | | | |

Long-term target range | | 35-40% | |

Note: amounts may not add due to rounding

24

Net Income / (Loss)

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

Net Loss Before Accounting Change | | $ | (0.9 | ) | $ | (4.8 | ) | $ | (3.0 | ) | $ | (12.7 | ) |

Cumulative Effect of Accounting Changes | | — | | — | | — | | 7.0 | |

Net Loss | | $ | (0.9 | ) | $ | (4.8 | ) | $ | (3.0 | ) | $ | (19.7 | ) |

| | | | | | | | | |

Preferred Stock Dividend | | 0.4 | | 0.2 | | 0.7 | | 0.2 | |

| | | | | | | | | |

Net Loss Available to Common Stockholders | | $ | (1.2 | ) | $ | (5.0 | ) | $ | (3.8 | ) | $ | (19.9 | ) |

25

Cash Flow

($ Millions)

| | First Half | |

| | ‘04 | | ‘03 | |

Net cash used in operations | | $ | (3.2 | ) | $ | (3.0 | ) |

Cash used in investing activities | | (0.5 | ) | (1.1 | ) |

Cash provided by financing activities | | — | | 10.8 | |

FX translation impact on cash | | (0.3 | ) | — | |

Net increase/(decrease) in cash | | (4.0 | ) | 6.7 | |

Beginning Cash | | 24.0 | | 2.3 | |

Ending cash | | $ | 20.0 | | $ | 9.0 | |

26

Working Capital Management

[CHART]

Cash Freed/(Used)

in First Half from:

($Millions)

Receivables | | $ | 4.3 | |

Inventory | | (4.6 | ) |

Payables | | 0.3 | |

| | $ | — | |

* Increase is temporary; expect prior inventory reduction trend to continue.

27

Revolving Credit Agreement

• Effective July 15, 2004

• $15 million availability for 2 years

• $7.5 million letter of credit sub-limit

• Foreign exchange facility

• Prime or LIBOR-based interest rates

• Secured by certain domestic assets

• No borrowing usage anticipated; prudent liquidity backstop

28

Outlook

29

Expected Near-Term Outlook

• Exiting system assembly operations

• Low transition costs; P&L benefit beginning in ‘05

• Near-term working capital increase, reduced levels thereafter

• Accelerating new product development

• Higher R&D expenditures for second half of year

• Faster new-product introductions thereafter

• Rebuilding & expanding the sales organization

• Could adversely impact near-term sales; positive impact thereafter

• Enhanced productivity & coverage

• Expanding distribution; growing 3-D printing contribution

• Continuing to improve the business model & results

• Further COGS improvements

• Additional operating expense reductions

• Better service productivity and effectiveness

• Greater contributions from materials and services

• Reducing working capital investment

30

Longer-Term Outlook

• Leading industry position and technology

• Privileged assets, core capabilities & unique expertise

• Clear priorities, comprehensive strategy & strong execution

• Energized, experienced management team

• Improved results from outsourcing of assembly operations

• Improved operating profit

• Improved cash flow

• Lower working capital investment

• Stronger financial base & flexibility

• Net operating loss carryforward benefits

• Healthy pipeline of growth opportunities

• Significant addressable new market opportunities

• 3-D printing & Digital Manufacturing

• Measurable value for customers, shareholders & employees

31

Question & Answer Session

All questions must be directed through the teleconference portion of this call.

Questions via the web will not be accepted.

32

Thank you

for participating

Replay of this webcast is available from the Investor Relations’ section of 3D Systems’ website: www.3DSystems.com

33