Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

3D Systems Corporation

[GRAPHIC]

September 2004

Nasdaq: TDSC

www.3dsystems.com

EXPERIENCE THE DIFFERENCE | |

Customer-driven solid imaging solutions | [LOGO] |

[LOGO] | | EXPERIENCE THE DIFFERENCE |

Forward-Looking Statements

Certain statements made by the company in this presentation are forward-looking statements. These statements include comments as to the company’s beliefs and expectations as to future events and trends affecting the company’s business. These forward-looking statements are based upon management’s current expectations concerning future events and trends and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors stated under the headings “Forward-Looking Statements” and “Cautionary Statements and Risk Factors” in management’s discussion and analysis of results of operations and financial condition, which appear in the company’s periodic filings with the Securities and Exchange Commission as well as other factors, could cause actual results to differ materially from such statements.

© Copyright 2004 by 3D Systems, Inc. All rights reserved. The 3D logo, 3D Systems, SLA, SLS, DuraForm, ThermoJet and Accura are registered trademarks and SLS, InVision, Amethyst, Bluestone, La serForm and CastForm are trademarks of 3D Systems. “the solid imaging company” and ADM are service marks of 3D Systems, Inc. All other product names or services mentioned are trademarks or registered trademarks of their respective companies.

CUSTOMER-DRIVEN SOLID IMAGING SOLUTIONS | Nasdaq: TDSC |

2

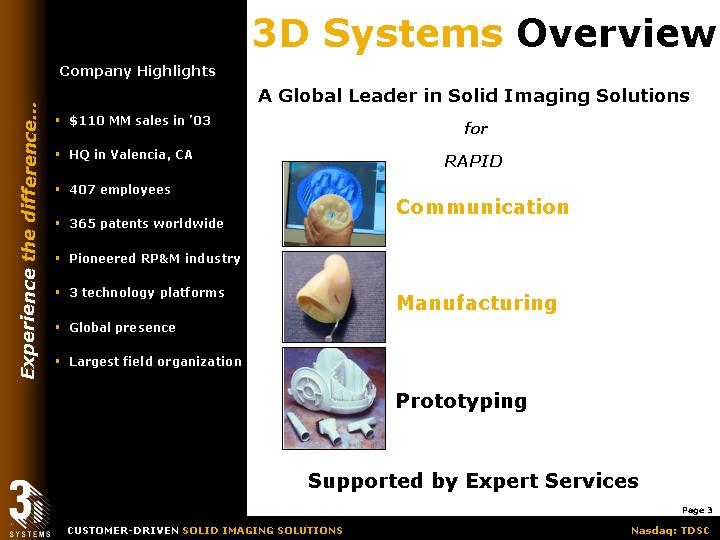

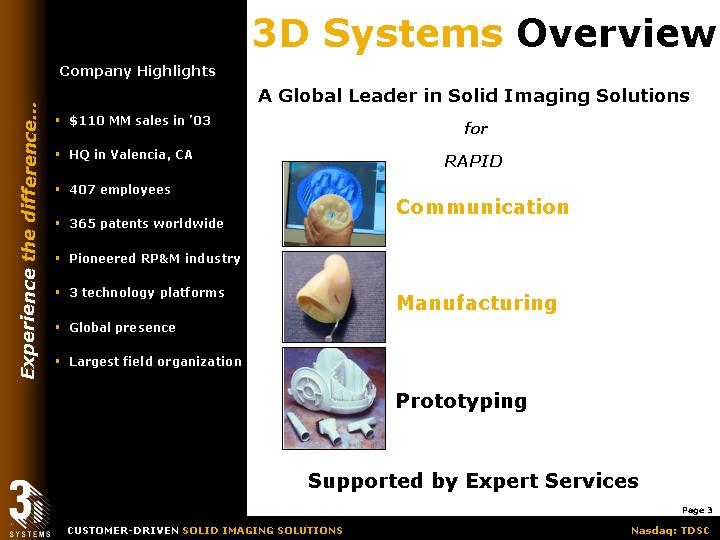

Company Highlights

• $110 MM sales in ‘03

• HQ in Valencia, CA

• 407 employees

• 365 patents worldwide

• Pioneered RP&M industry

• 3 technology platforms

• Global presence

• Largest field organization

3D Systems Overview

A Global Leader in Solid Imaging Solutions

for

RAPID

[GRAPHIC]

Communication

[GRAPHIC]

Manufacturing

[GRAPHIC]

Prototyping

Supported by Expert Services

3

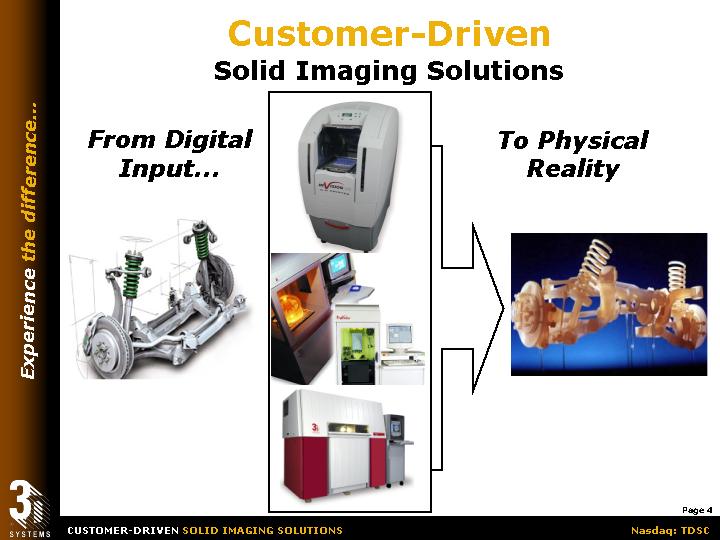

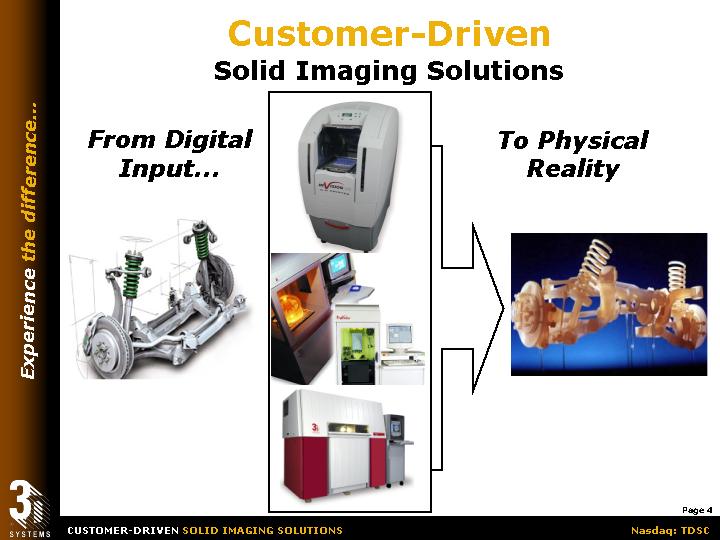

Customer-Driven

Solid Imaging Solutions

From Digital Input... | | | | To Physical Reality |

| | | | |

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

4

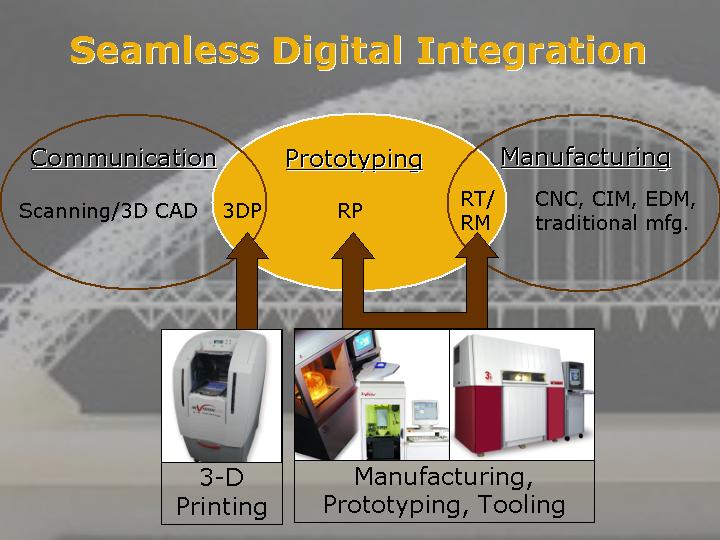

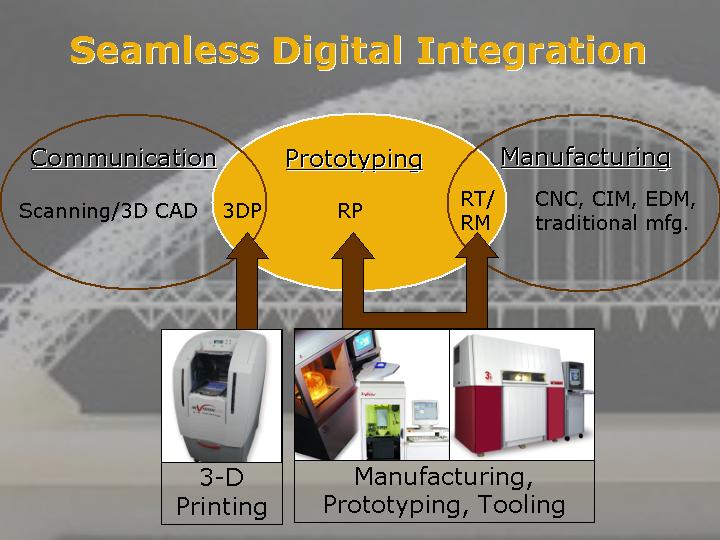

Seamless Digital Integration

Communication | | | Prototyping | | Manufacturing |

| | | | |

Scanning/3D CAD | | 3DP | | RP | | RT/ | CNC, CIM, EDM, |

| | | | RM | traditional mfg. |

| | | | | |

| [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | | |

| 3-D Printing | | Manufacturing, Prototyping, Tooling |

5

Comprehensive Solid Imaging Solutions

3-D printing | | Stereolithography

SLA® Systems | | Selective Laser Sintering

SLS® Systems |

| | | | |

InVisionTM 3-D printer

InVision HR 3-D printer | | Viper SLA system

SLA 5000 system

SLA 7000 system | | Sinterstation® HiQ SLS system |

| | | | |

[GRAPHIC] | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

| | | | |

[GRAPHIC] | | Broad range of SL materials: | | Broad range of LS materials: |

VisiJet® material | | | | |

| | [GRAPHIC] | | [GRAPHIC] |

| | BluestoneTM | | LaserFormTM A6 |

[GRAPHIC] | | [GRAPHIC] | [GRAPHIC] | | [GRAPHIC] |

VisiJet® HR material | | | AmethystTM | | CastFormTM PS |

| | | | [GRAPHIC] |

| | | | DuraForm® PA/GF |

| | | | | | |

Expert Solutions From $39,900 To $499,000

6

Customer Presence

[GRAPHIC]

Broad, Diverse Installed Base

7

The 3D Advantage

[GRAPHIC]

• Time to market

• Time to volume

• Time to replacement

• Instant manufacturing

• Mass customization

• Broad flexibility

• Global reach

• Expert support

Economic Drivers… Customer Value

8

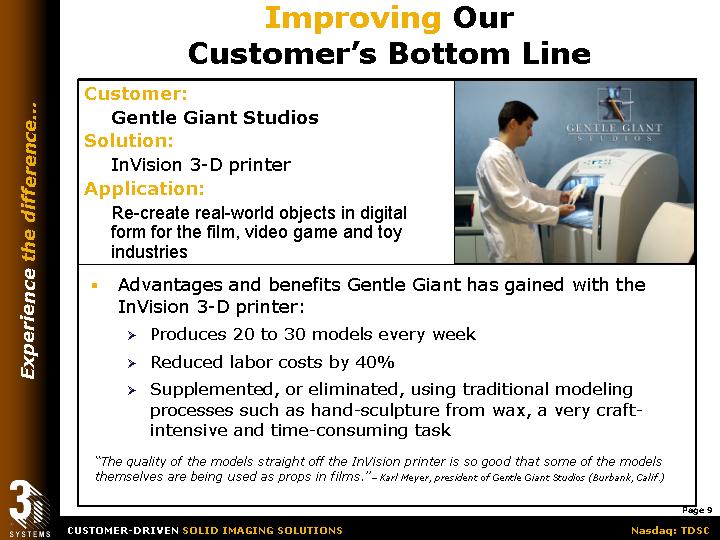

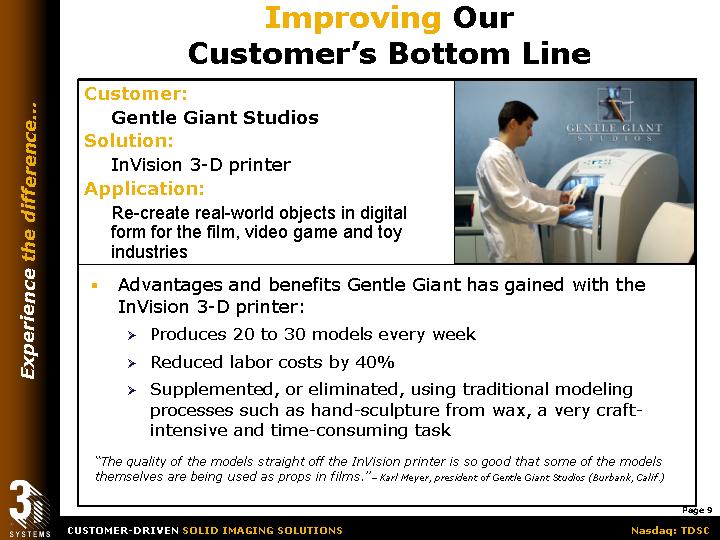

Improving Our Customer’s Bottom Line

Customer:

Gentle Giant Studios

Solution:

InVision 3-D printer

Application:

Re-create real-world objects in digital form for the film, video game and toy industries

[GRAPHIC]

• Advantages and benefits Gentle Giant has gained with the InVision 3-D printer:

• Produces 20 to 30 models every week

• Reduced labor costs by 40%

• Supplemented, or eliminated, using traditional modeling processes such as hand-sculpture from wax, a very craft-intensive and time-consuming task

“The quality of the models straight off the InVision printer is so good that some of the models themselves are being used as props in films.”– Karl Meyer, president of Gentle Giant Studios (Burbank, Calif.)

9

Improving Our Customer’s Bottom Line

Customer:

Medical Modeling LLC

Solution:

Stereolithography

Application:

Successful separation of conjoined twins using stereolithography modeling

[GRAPHIC]

• Stereolithography models are used for pre-operative planning by a team of ten surgeons to successfully separate twin boys in October 2003

• The ability to transform cat scans into physical models allows a surgical team to:

• Improve pre-op preparations

• Develop faster surgical plan and practice

• Enhance surgery success

10

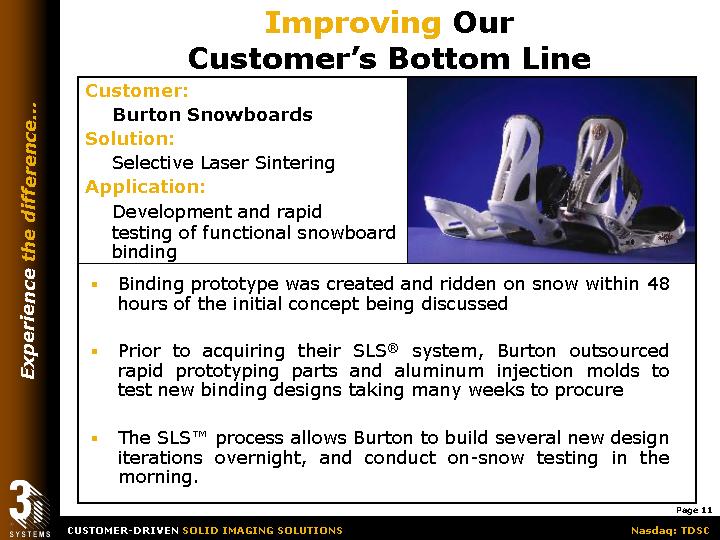

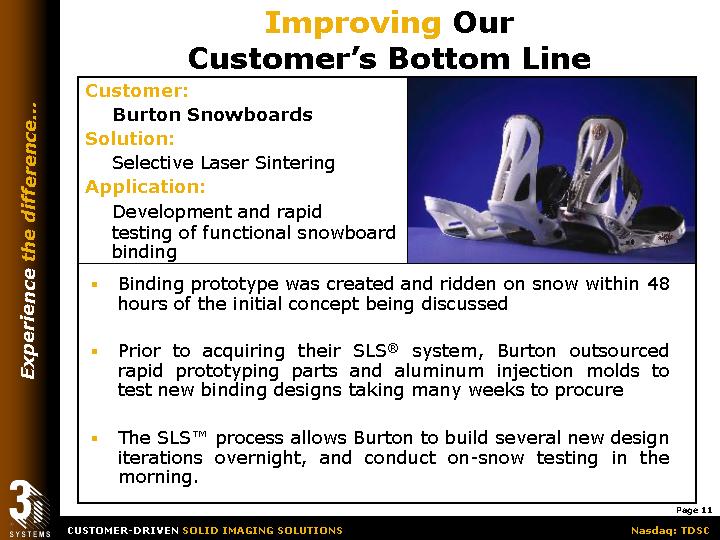

Improving Our Customer’s Bottom Line

Customer:

Burton Snowboards

Solution:

Selective Laser Sintering

Application:

Development and rapid testing of functional snowboard binding

[GRAPHIC]

• Binding prototype was created and ridden on snow within 48 hours of the initial concept being discussed

• Prior to acquiring their SLS® system, Burton outsourced rapid prototyping parts and aluminum injection molds to test new binding designs taking many weeks to procure

• The SLS™ process allows Burton to build several new design iterations overnight, and conduct on-snow testing in the morning.

11

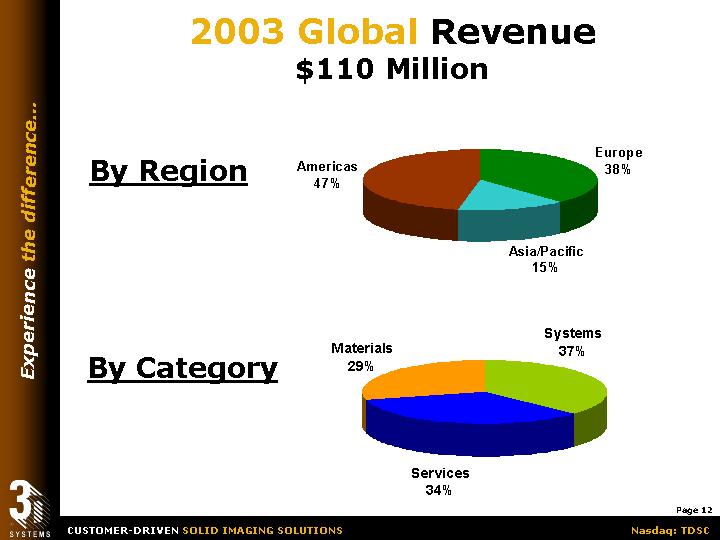

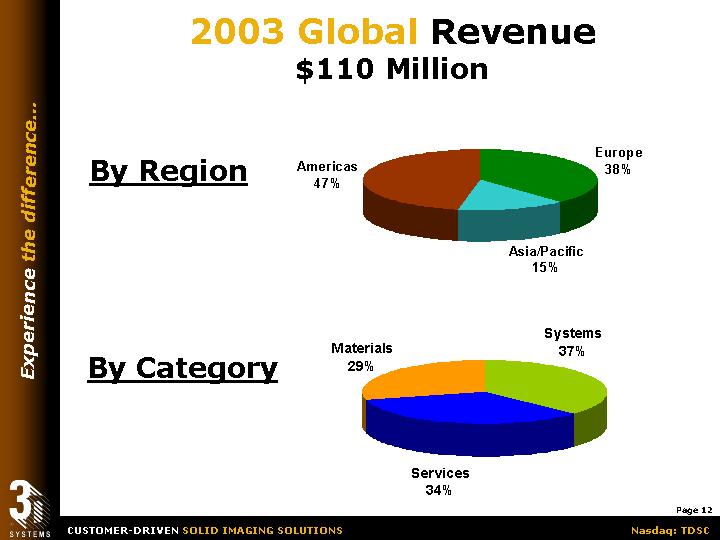

2003 Global Revenue

$110 Million

By Region

[CHART]

By Category

[CHART]

12

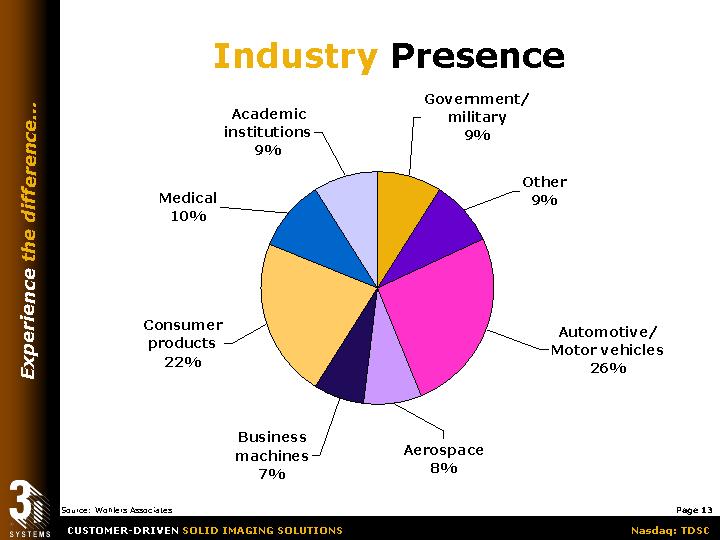

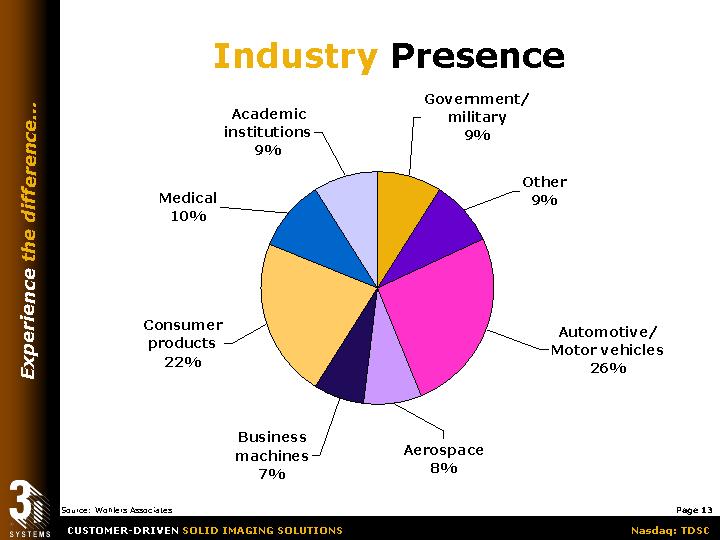

Industry Presence

[CHART]

Source: Wohlers Associates

13

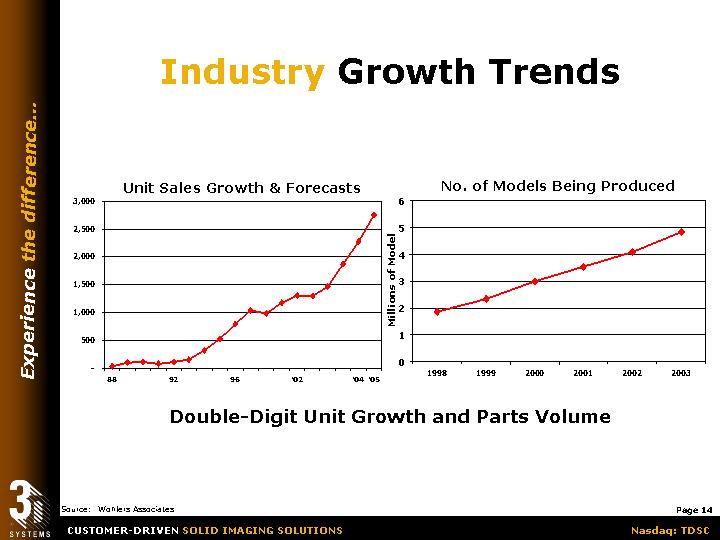

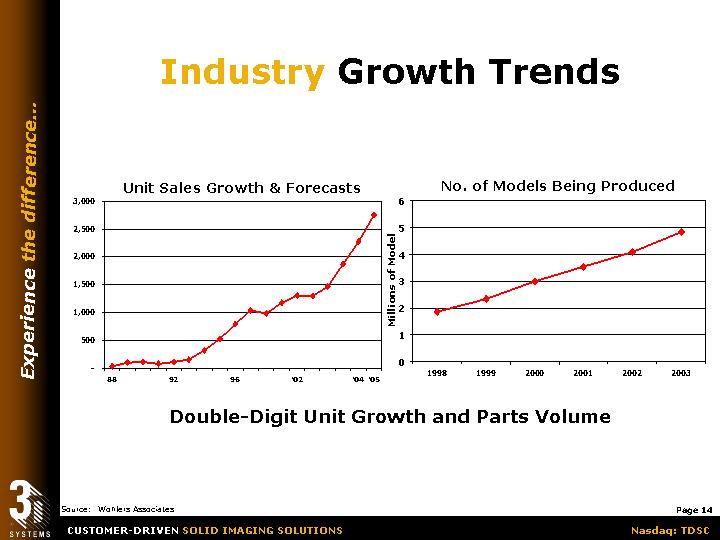

Industry Growth Trends

Unit Sales Growth & Forecasts

[CHART]

No. of Models Being Produced

[CHART]

Double-Digit Unit Growth and Parts Volume

Source: Wohlers Associates

14

Significant Addressable Markets

• 2003 Total Industry Revenue:

$528 Million

• 2003 Reported Total User Base:

11,376

• 2003 Total number of CAD Users:

4.8 Million

500,000 Qualified Prospects

3-D Printing & Manufacturing

Source: Wohlers Associates and 3D Systems

15

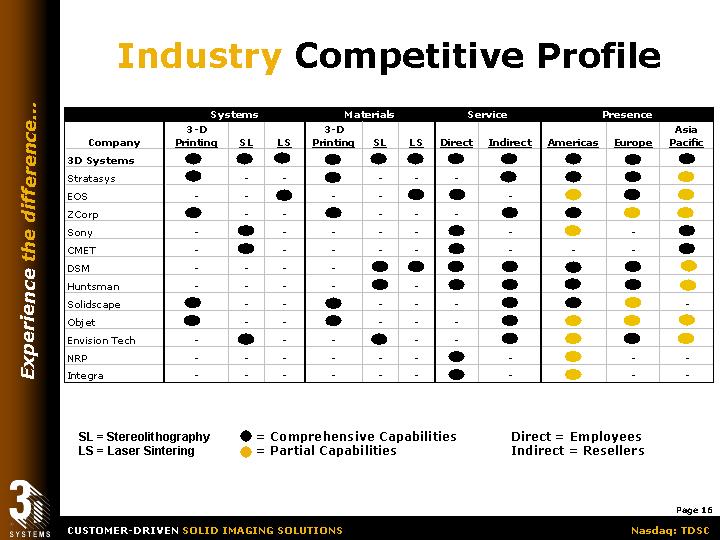

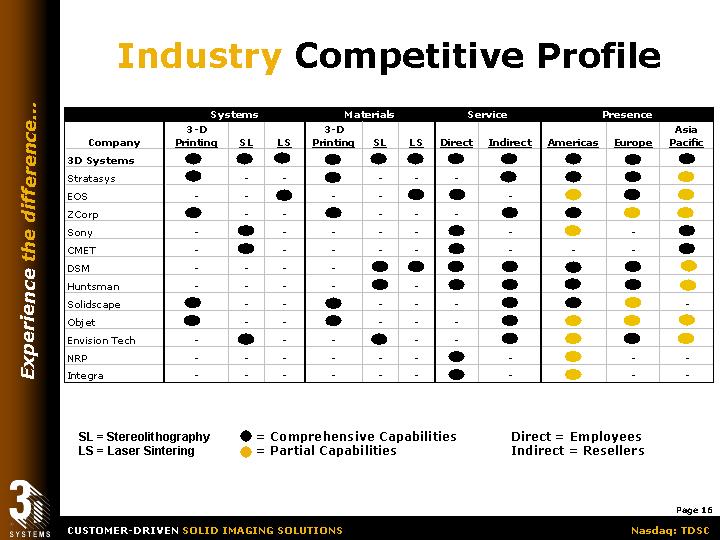

Industry Competitive Profile

| | Systems | | Materials | | Service | | Presence | |

| | 3-D | | | | | | 3-D | | | | | | | | | | | | | | Asia | |

Company | | Printing | | SL | | LS | | Printing | | SL | | LS | | Direct | | Indirect | | Americas | | Europe | | Pacific | |

3D Systems | | ý | | ý | | ý | | ý | | ý | | ý | | ý | | ý | | ý | | ý | | ý | |

Stratasys | | ý | | — | | — | | ý | | — | | — | | — | | ý | | ý | | ý | | o | |

EOS | | — | | — | | ý | | — | | — | | ý | | ý | | — | | o | | ý | | o | |

ZCorp | | ý | | — | | — | | ý | | — | | — | | — | | ý | | ý | | o | | o | |

Sony | | — | | ý | | — | | — | | — | | — | | ý | | — | | o | | — | | ý | |

CMET | | — | | ý | | — | | — | | — | | — | | ý | | — | | — | | — | | ý | |

DSM | | — | | — | | — | | — | | ý | | ý | | ý | | ý | | ý | | ý | | o | |

Huntsman | | — | | — | | — | | — | | ý | | — | | ý | | ý | | ý | | ý | | o | |

Solidscape | | ý | | — | | — | | ý | | — | | — | | — | | ý | | ý | | o | | — | |

Objet | | ý | | — | | — | | ý | | — | | — | | — | | ý | | o | | o | | o | |

Envision Tech | | — | | ý | | — | | — | | ý | | — | | — | | ý | | o | | ý | | o | |

NRP | | — | | — | | — | | — | | — | | — | | ý | | — | | o | | — | | — | |

Integra | | — | | — | | — | | — | | — | | — | | ý | | — | | o | | — | | — | |

SL = Stereolithography

LS = Laser Sintering

ý = Comprehensive Capabilities

o = Partial Capabilities

Direct = Employees

Indirect = Resellers

16

Building Stronger Company

• Established clear priorities

• Developed comprehensive strategy

• Recruited and realigned management team

• Recapitalized the business

• Settled significant litigation

• Introduced new products

• Created strategic alliances

• Effected corporate governance changes

• Implemented preferable accounting policies

• Enacted stronger financial controls

• Secured revolving credit line

• Launched development & manufacturing outsourcing

• Improved operating results

First Eleven Months Accomplishments

17

Strategic Priorities & Initiatives

• Improve our customer’s bottom-line

• Develop key segments

• 3-D printing

• Digital Manufacturing

• Expand range of customer services

• Accelerate new product development

• Optimize cash-flow and supply-chain

• Create performance and ethical culture

• Develop people and opportunities

Deliver Results…E.P.S

18

Experienced Management Team

• Abe Reichental, President & CEO

• Fred Jones, VP & CFO

• Robert Grace, VP & General Counsel

• Chuck Hull, EVP & CTO

• Kevin McAlea, VP Global Marketing

• Ray Saunders, VP Global Services

• Stephen Goddard, VP Operations

• Robert Kayser, VP Global Sales

• Assad Ansari, VP Global Engineering

Right People… Right Jobs

19

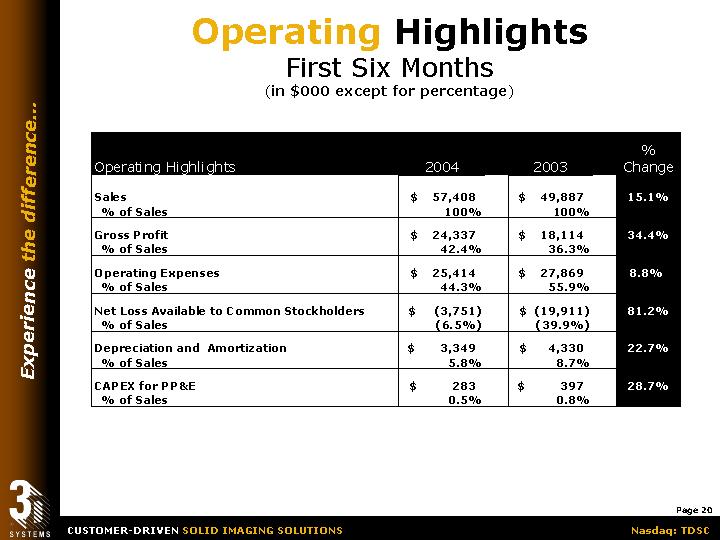

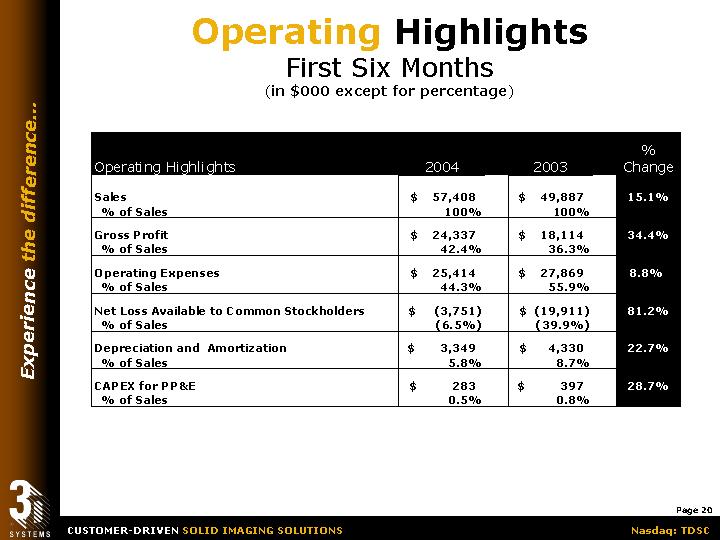

Operating Highlights

First Six Months

(in $000 except for percentage)

Operating Highlights | | 2004 | | 2003 | | %

Change | |

| | | | | | | |

Sales | | $ | 57,408 | | $ | 49,887 | | 15.1 | % |

% of Sales | | 100 | % | 100 | % | | |

| | | | | | | |

Gross Profit | | $ | 24,337 | | $ | 18,114 | | 34.4 | % |

% of Sales | | 42.4 | % | 36.3 | % | | |

| | | | | | | |

Operating Expenses | | $ | 25,414 | | $ | 27,869 | | 8.8 | % |

% of Sales | | 44.3 | % | 55.9 | % | | |

| | | | | | | |

Net Loss Available to Common Stockholders | | $ | (3,751 | ) | $ | (19,911 | ) | 81.2 | % |

% of Sales | | (6.5 | )% | (39.9 | )% | | |

| | | | | | | |

Depreciation and Amortization | | $ | 3,349 | | $ | 4,330 | | 22.7 | % |

% of Sales | | 5.8 | % | 8.7 | % | | |

| | | | | | | |

CAPEX for PP&E | | $ | 283 | | $ | 397 | | 28.7 | % |

% of Sales | | 0.5 | % | 0.8 | % | | |

20

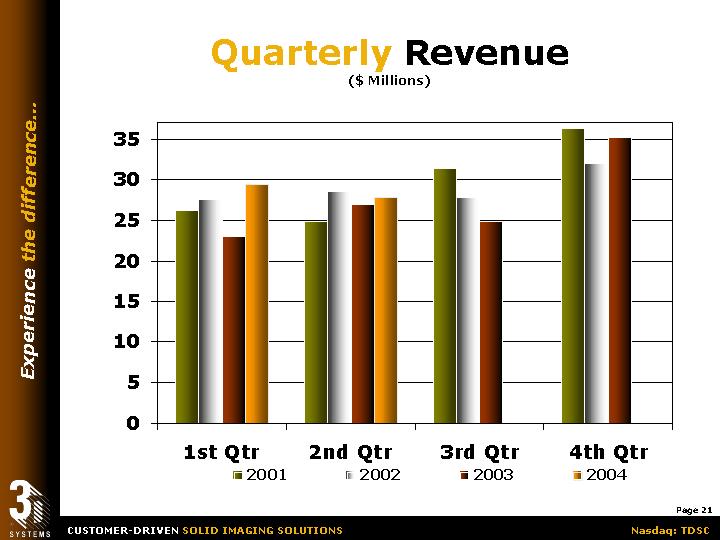

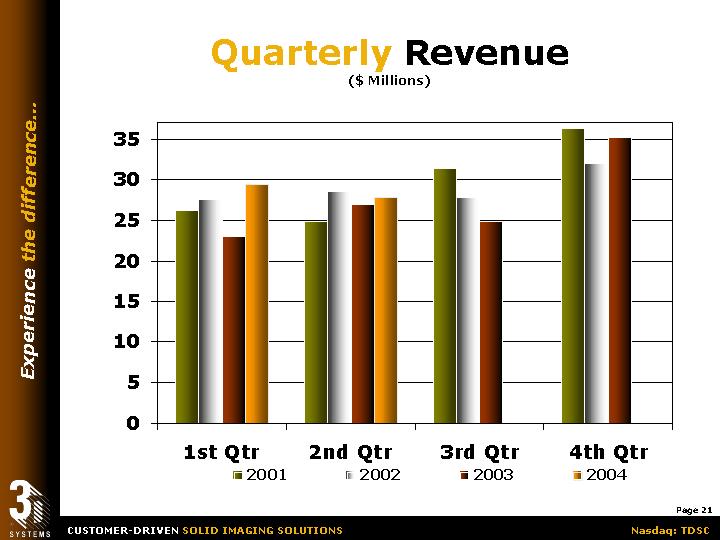

Quarterly Revenue

($ Millions)

[CHART]

21

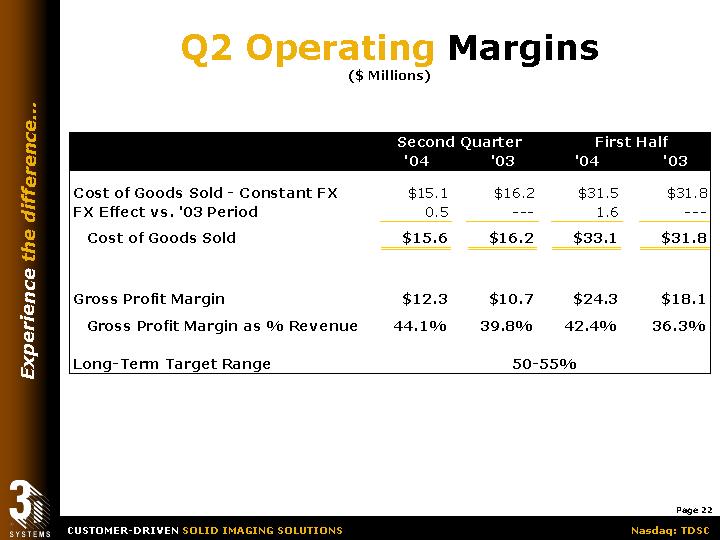

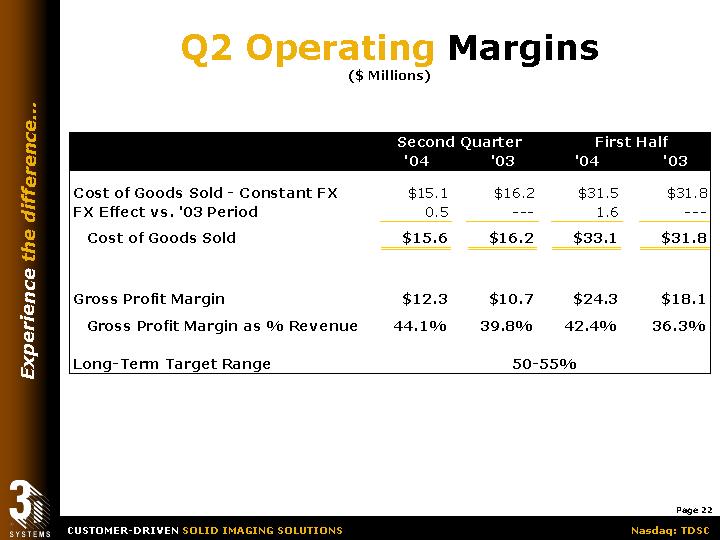

Q2 Operating Margins

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

| | | | | | | | | |

Cost of Goods Sold - Constant FX | | $ | 15.1 | | $ | 16.2 | | $ | 31.5 | | $ | 31.8 | |

FX Effect vs. ‘03 Period | | 0.5 | | — | | 1.6 | | — | |

Cost of Goods Sold | | $ | 15.6 | | $ | 16.2 | | $ | 33.1 | | $ | 31.8 | |

| | | | | | | | | |

Gross Profit Margin | | $ | 12.3 | | $ | 10.7 | | $ | 24.3 | | $ | 18.1 | |

Gross Profit Margin as% Revenue | | 44.1 | % | 39.8 | % | 42.4 | % | 36.3 | % |

| | | | | | | | | |

Long-Term Target Range | | 50-55 % | |

22

Operating Expenses

($ Millions)

[CHART]

Note: 1Q02 shows $1.8 of legal expenses offset by Vantico settlement amount. 2003 quarters are adjusted to reflect retroactive effect to 1/1/03 of accounting principle changes adopted in 4Q03. Expenses for ‘02 have not been adjusted upward to reflect any retroactive application of expensing patent litigation costs in 2002.

23

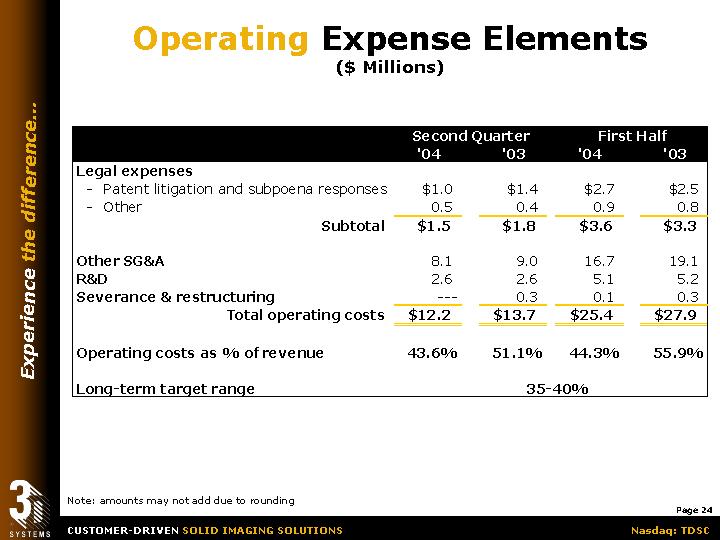

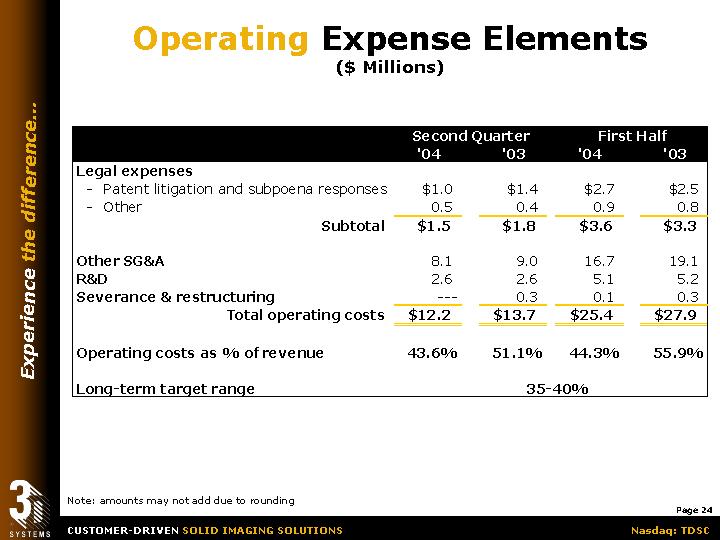

Operating Expense Elements

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

Legal expenses | | | | | | | | | |

• Patent litigation and subpoena responses | | $ | 1.0 | | $ | 1.4 | | $ | 2.7 | | $ | 2.5 | |

• Other | | 0.5 | | 0.4 | | 0.9 | | 0.8 | |

Subtotal | | $ | 1.5 | | $ | 1.8 | | $ | 3.6 | | $ | 3.3 | |

| | | | | | | | | |

Other SG&A | | 8.1 | | 9.0 | | 16.7 | | 19.1 | |

R&D | | 2.6 | | 2.6 | | 5.1 | | 5.2 | |

Severance & restructuring | | — | | 0.3 | | 0.1 | | 0.3 | |

Total operating costs | | $ | 12.2 | | $ | 13.7 | | $ | 25.4 | | $ | 27.9 | |

| | | | | | | | | |

Operating costs as % of revenue | | 43.6 | % | 51.1 | % | 44.3 | % | 55.9 | % |

| | | | | | | | | |

Long-term target range | | 35-40 % | |

Note: amounts may not add due to rounding

24

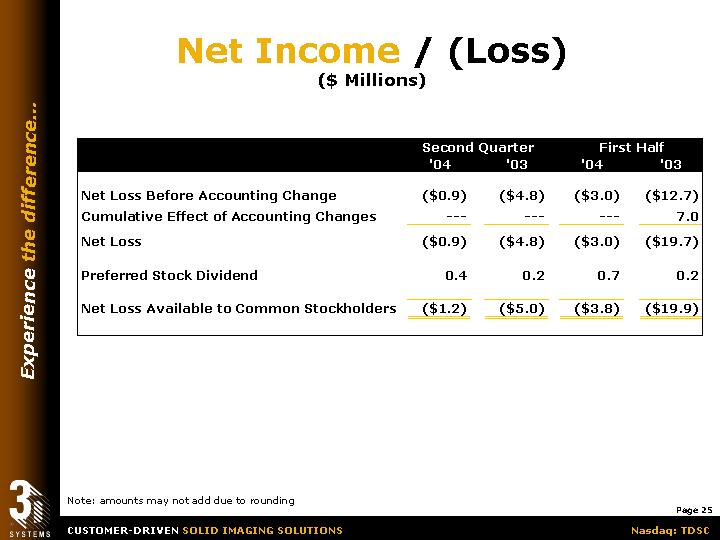

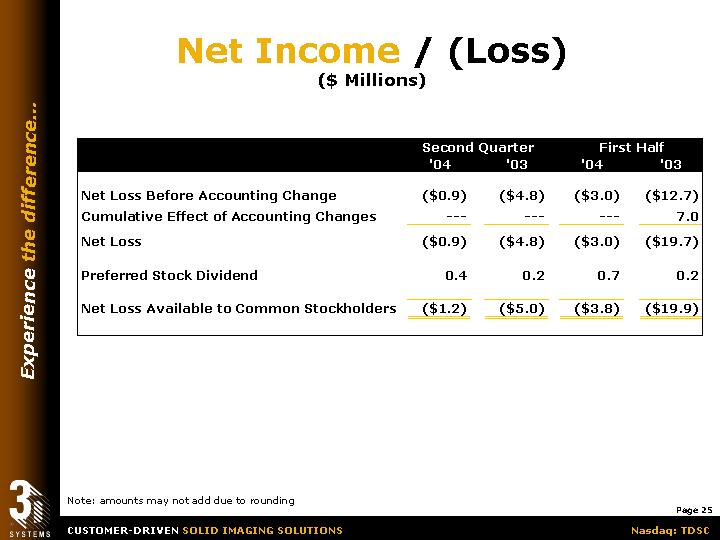

Net Income / (Loss)

($ Millions)

| | Second Quarter | | First Half | |

| | ‘04 | | ‘03 | | ‘04 | | ‘03 | |

| | | | | | | | | |

Net Loss Before Accounting Change | | $ | (0.9 | ) | $ | (4.8 | ) | $ | (3.0 | ) | $ | (12.7 | ) |

Cumulative Effect of Accounting Changes | | — | | — | | — | | 7.0 | |

Net Loss | | $ | (0.9 | ) | $ | (4.8 | ) | $ | (3.0 | ) | $ | (19.7 | ) |

| | | | | | | | | |

Preferred Stock Dividend | | 0.4 | | 0.2 | | 0.7 | | 0.2 | |

| | | | | | | | | |

Net Loss Available to Common Stockholders | | $ | (1.2 | ) | $ | (5.0 | ) | $ | (3.8 | ) | $ | (19.9 | ) |

25

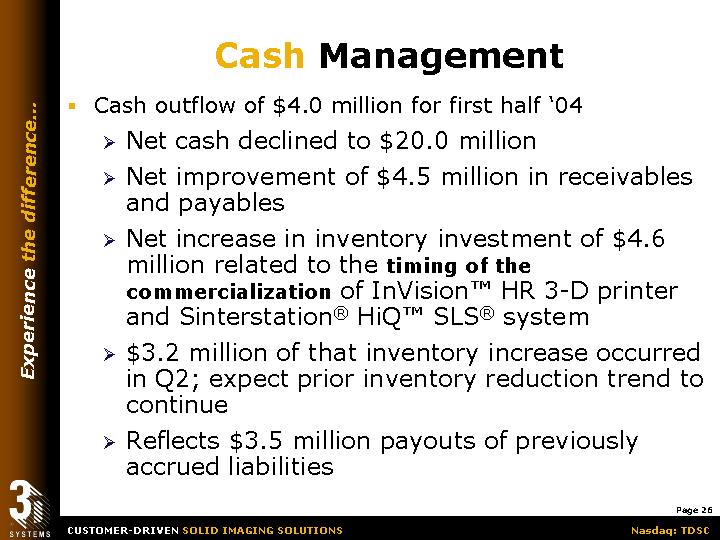

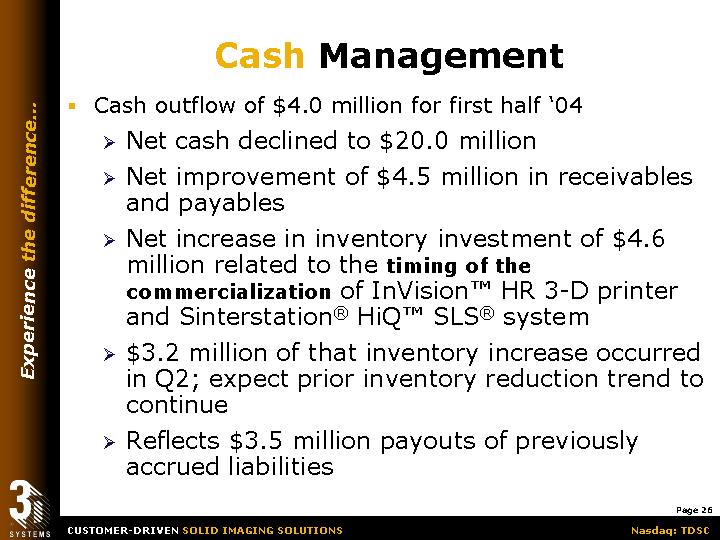

Cash Management

• Cash outflow of $4.0 million for first half ‘04

• Net cash declined to $20.0 million

• Net improvement of $4.5 million in receivables and payables

• Net increase in inventory investment of $4.6 million related to the timing of the commercialization of InVision™ HR 3-D printer and Sinterstation® HiQ™ SLS® system

• $3.2 million of that inventory increase occurred in Q2; expect prior inventory reduction trend to continue

• Reflects $3.5 million payouts of previously accrued liabilities

26

Cash Flow

($ Millions)

| | First Half | |

| | ‘04 | | ‘03 | |

Net cash used in operations | | $ | (3.2 | ) | $ | (3.0 | ) |

Cash used in investing activities | | (0.5 | ) | (1.1 | ) |

Cash provided by financing activities | | — | | 10.8 | |

FX translation impact on cash | | (0.3 | ) | — | |

Net increase/(decrease) in cash | | (4.0 | ) | 6.7 | |

Beginning Cash | | 24.0 | | 2.3 | |

Ending cash | | $ | 20.0 | | $ | 9.0 | |

27

Working Capital Management

Cash Freed/(Used) in First Half from:

($Millions)

Receivables | | $ | 4.3 | |

Inventory | | (4.6 | ) |

Payables | | 0.3 | |

| | $ | — | |

[CHART]

* Increase is temporary; expect prior inventory reduction trend to continue.

28

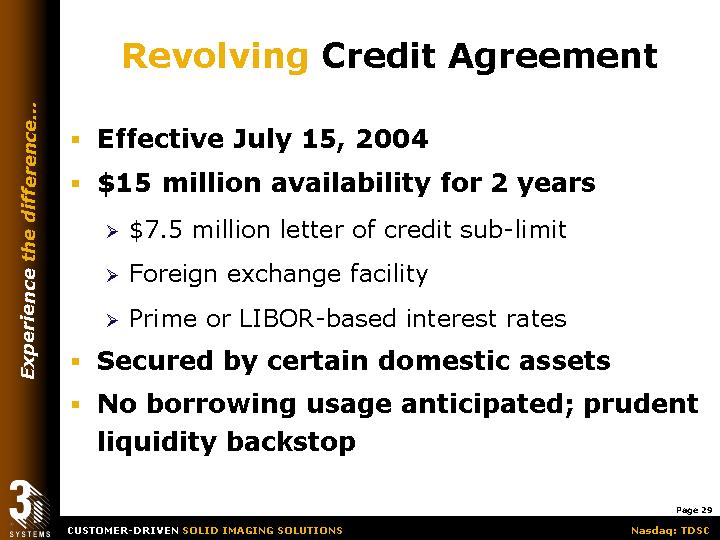

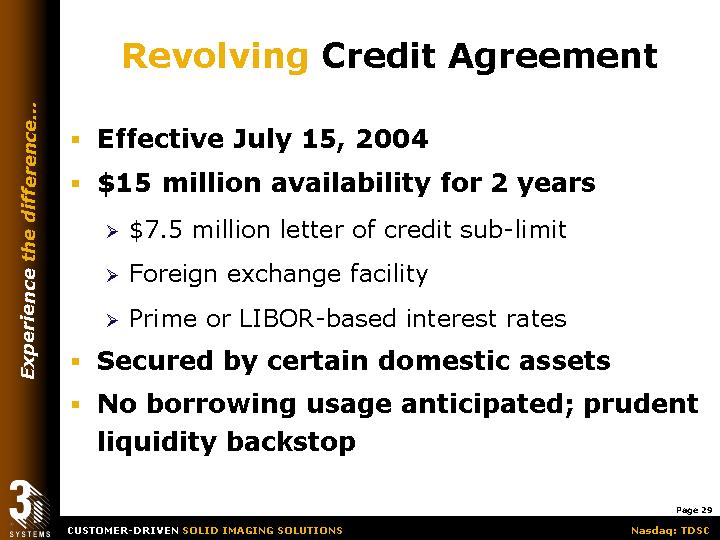

Revolving Credit Agreement

• Effective July 15, 2004

• $15 million availability for 2 years

• $7.5 million letter of credit sub-limit

• Foreign exchange facility

• Prime or LIBOR-based interest rates

• Secured by certain domestic assets

• No borrowing usage anticipated; prudent liquidity backstop

29

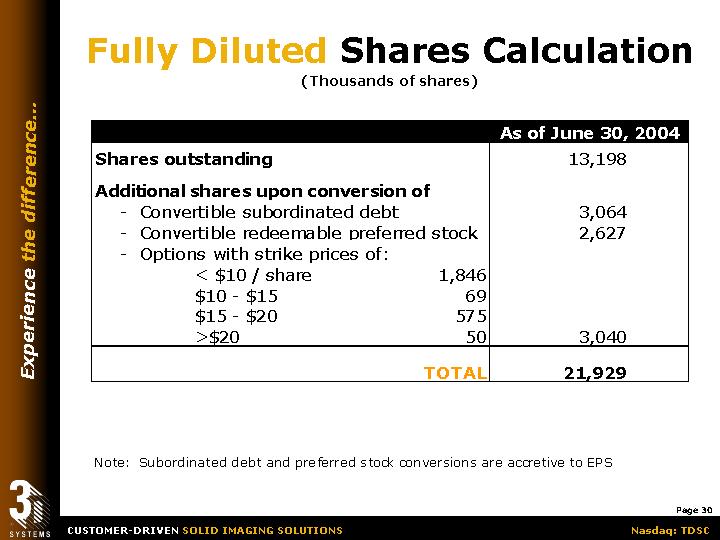

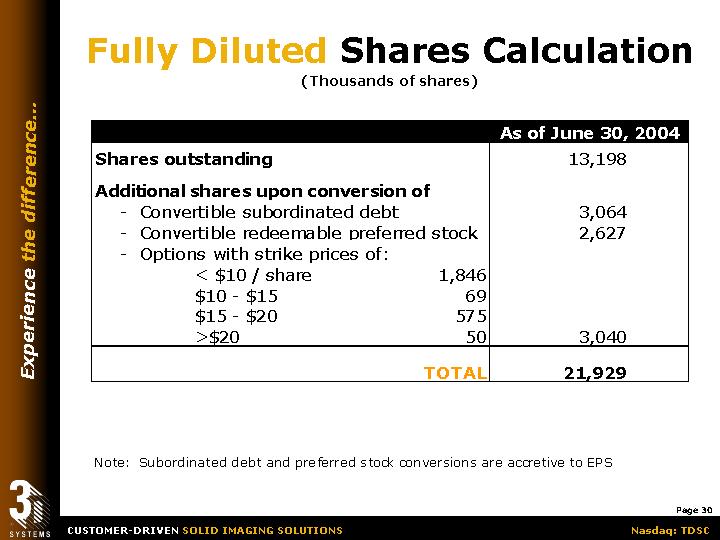

Fully Diluted Shares Calculation

(Thousands of shares)

| | As of June 30, 2004 | |

Shares outstanding | | 13,198 | |

| | | |

Additional shares upon conversion of | | | |

• Convertible subordinated debt | | 3,064 | |

• Convertible redeemable preferred stock | | 2,627 | |

• Options with strike prices of: | | | |

| < $10 / share | | 1,846 | | | |

| $10 - $15 | | 69 | | | |

| $15 - $20 | | 575 | | | |

| >$20 | | 50 | | 3,040 | |

| | | |

TOTAL | | 21,929 | |

Note: Subordinated debt and preferred stock conversions are accretive to EPS

30

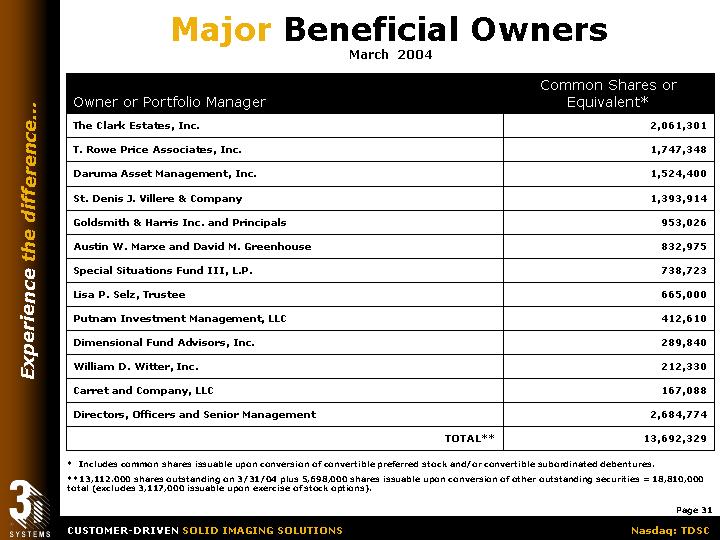

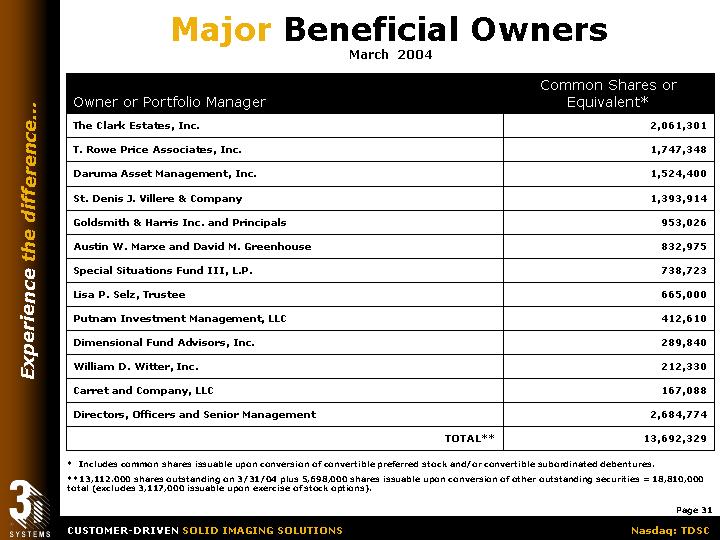

Major Beneficial Owners

March 2004

| | Common Shares or | |

Owner or Portfolio Manager | | Equivalent* | |

The Clark Estates, Inc. | | 2,061,301 | |

| | | |

T. Rowe Price Associates, Inc. | | 1,747,348 | |

| | | |

Daruma Asset Management, Inc. | | 1,524,400 | |

| | | |

St. Denis J. Villere & Company | | 1,393,914 | |

| | | |

Goldsmith & Harris Inc. and Principals | | 953,026 | |

| | | |

Austin W. Marxe and David M. Greenhouse | | 832,975 | |

| | | |

Special Situations Fund III, L.P. | | 738,723 | |

| | | |

Lisa P. Selz, Trustee | | 665,000 | |

| | | |

Putnam Investment Management, LLC | | 412,610 | |

| | | |

Dimensional Fund Advisors, Inc. | | 289,840 | |

| | | |

William D. Witter, Inc. | | 212,330 | |

| | | |

Carret and Company, LLC | | 167,088 | |

| | | |

Directors, Officers and Senior Management | | 2,684,774 | |

| | | |

TOTAL** | | 13,692,329 | |

* Includes common shares issuable upon conversion of convertible preferred stock and/or convertible subordinated debentures.

**13,112.000 shares outstanding on 3/31/04 plus 5,698,000 shares issuable upon conversion of other outstanding securities = 18,810,000 total (excludes 3,117,000 issuable upon exercise of stock options).

31

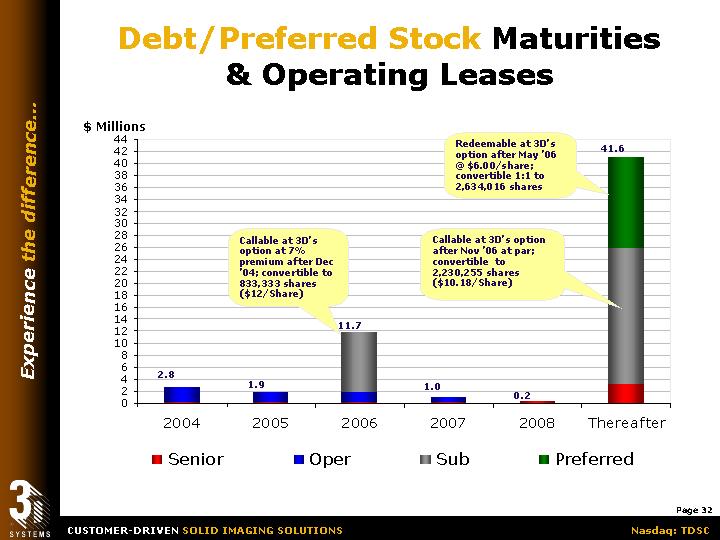

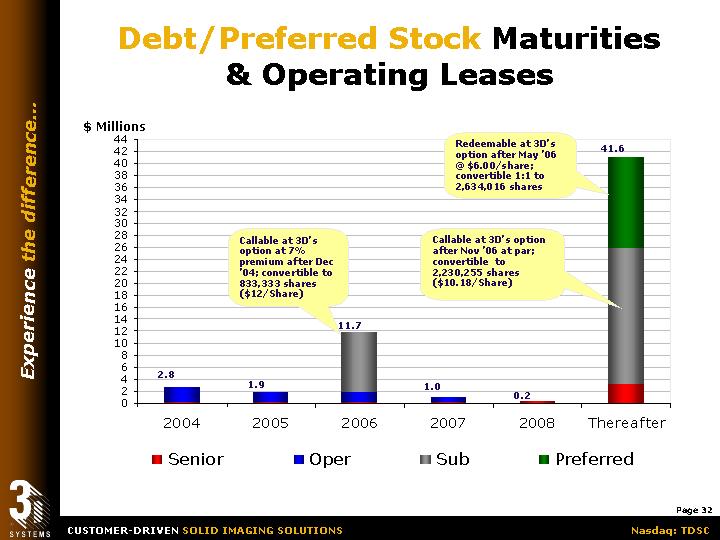

Debt/Preferred Stock Maturities & Operating Leases

[CHART]

32

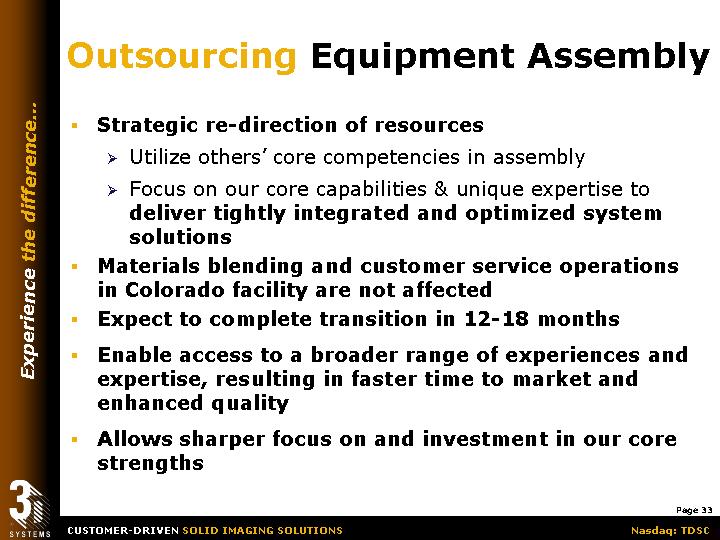

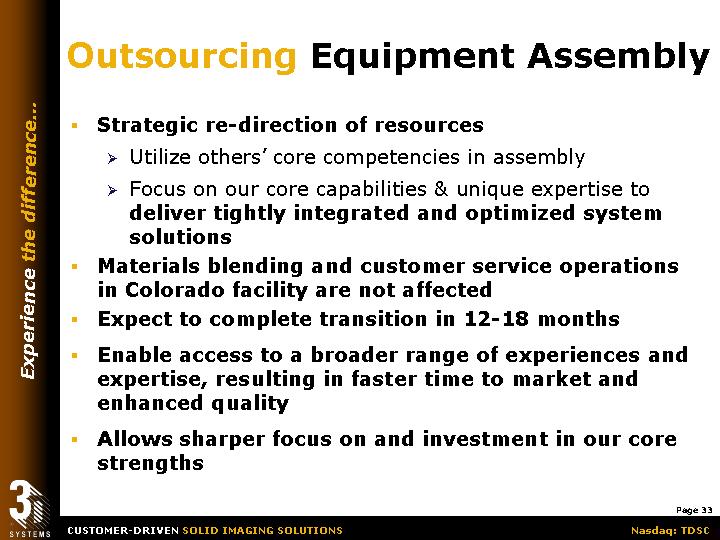

Outsourcing Equipment Assembly

• Strategic re-direction of resources

• Utilize others’ core competencies in assembly

• Focus on our core capabilities & unique expertise to deliver tightly integrated and optimized system solutions

• Materials blending and customer service operations in Colorado facility are not affected

• Expect to complete transition in 12-18 months

• Enable access to a broader range of experiences and expertise, resulting in faster time to market and enhanced quality

• Allows sharper focus on and investment in our core strengths

33

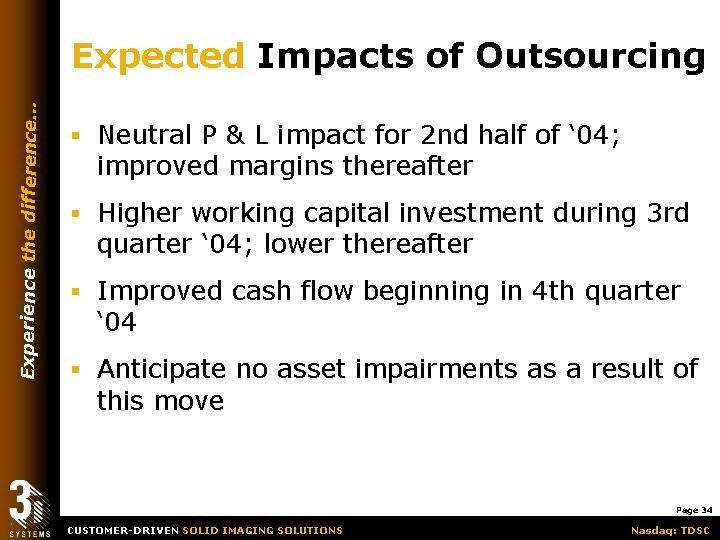

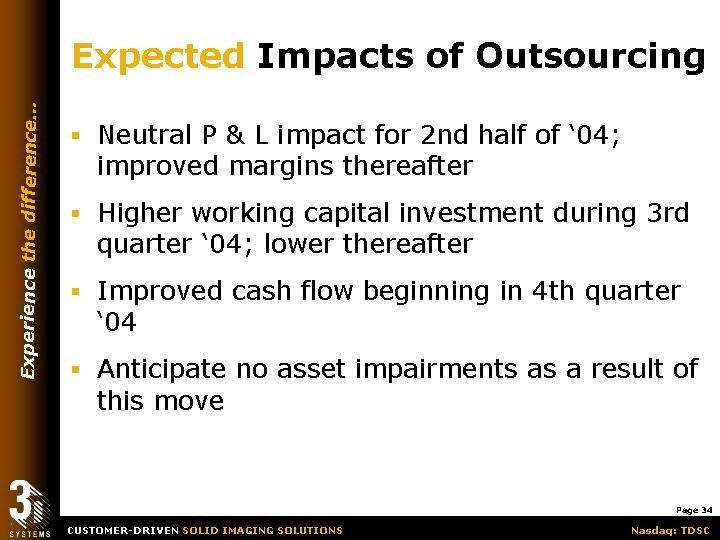

Expected Impacts of Outsourcing

• Neutral P & L impact for 2nd half of ‘04; improved margins thereafter

• Higher working capital investment during 3rd quarter ‘04; lower thereafter

• Improved cash flow beginning in 4th quarter ‘04

• Anticipate no asset impairments as a result of this move

34

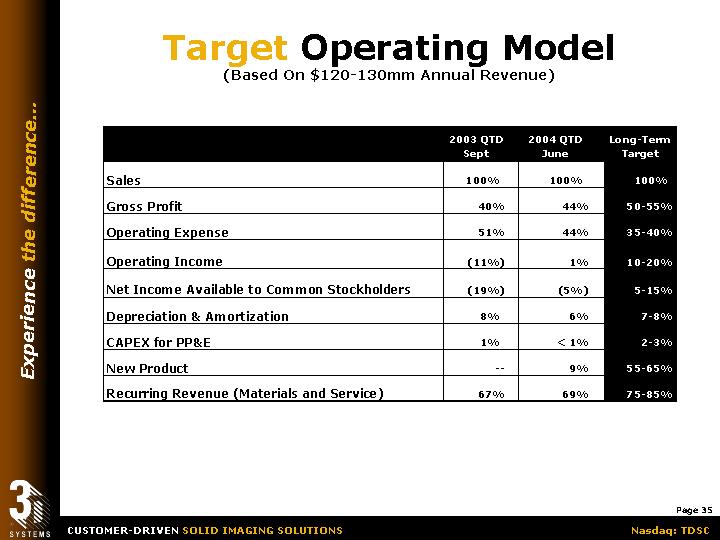

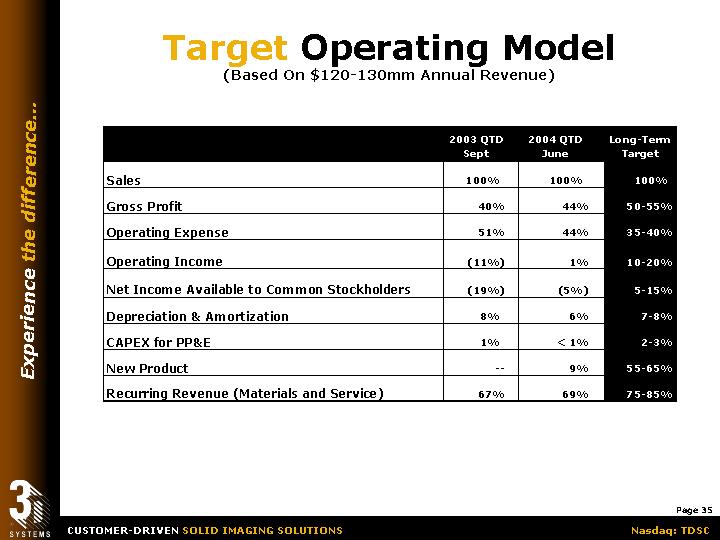

Target Operating Model

(Based On $120-130mm Annual Revenue)

| | 2003 QTD

Sept | | 2004 QTD

June | | Long-Term

Target | |

| | | | | | | |

Sales | | 100 | % | 100 | % | 100 | % |

| | | | | | | |

Gross Profit | | 40 | % | 44 | % | 50-55 | % |

| | | | | | | |

Operating Expense | | 51 | % | 44 | % | 35-40 | % |

| | | | | | | |

Operating Income | | (11 | )% | 1 | % | 10-20 | % |

| | | | | | | |

Net Income Available to Common Stockholders | | (19 | )% | (5 | )% | 5-15 | % |

| | | | | | | |

Depreciation & Amortization | | 8 | % | 6 | % | 7-8 | % |

| | | | | | | |

CAPEX for PP&E | | 1 | % | < 1 | % | 2-3 | % |

| | | | | | | |

New Product | | — | | 9 | % | 55-65 | % |

| | | | | | | |

Recurring Revenue (Materials and Service) | | 67 | % | 69 | % | 75-85 | % |

35

InVision™ 3-D Printer

[GRAPHIC]

• Advanced user-friendly system

• Enhanced material toughness

• Superior finished surfaces

• Easy removal and clean-up

• Plug and play installation

• Point and print ease of use

• Fast and productive

• Two affordable models:

• Standard @ $39,900

• High-Resolution @ $59,900

Significant Addressable Segment

36

Sinterstation® HiQ™ SLS® System

[GRAPHIC]

Complex metal parts

[GRAPHIC]

Complex investment casting patterns

[GRAPHIC]

Manufacturing-Capable

• Mass production of end-use parts

• Mass customization

• Improved part quality, user-friendly set up

• Higher productivity

• Better material usage

[GRAPHIC]

Flexible, functional parts with rubber-like performance characteristics

Significant Addressable Segment

37

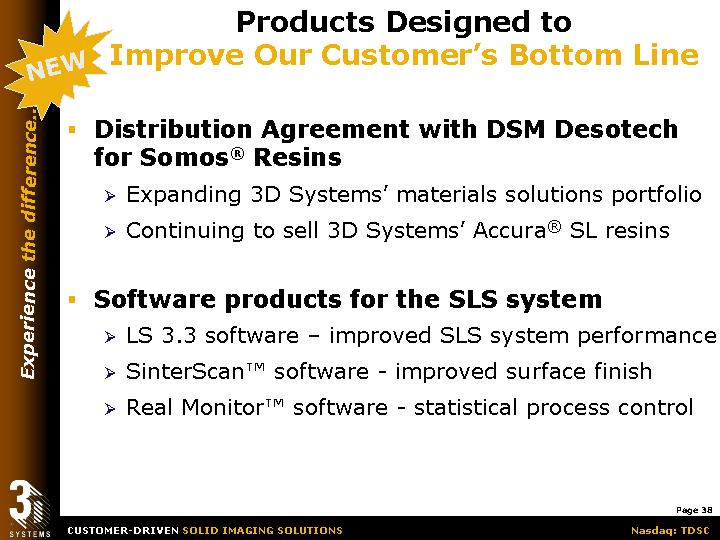

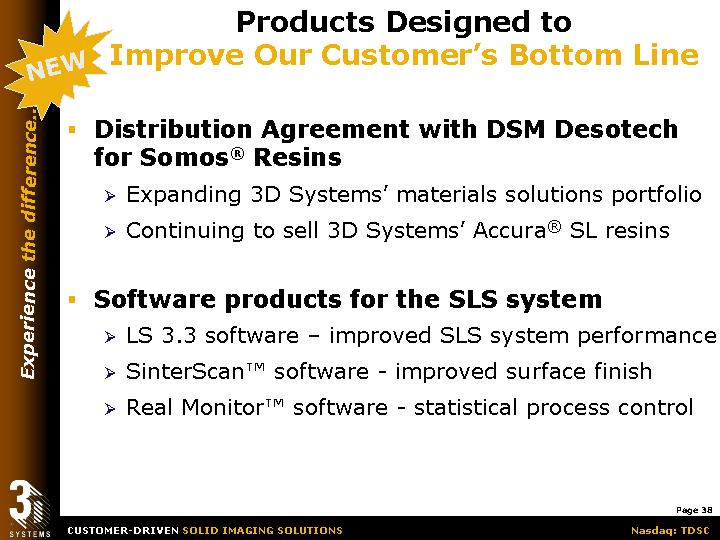

Products Designed to Improve Our Customer’s Bottom Line

• Distribution Agreement with DSM Desotech for Somos® Resins

• Expanding 3D Systems’ materials solutions portfolio

• Continuing to sell 3D Systems’ Accura® SL resins

• Software products for the SLS system

• LS 3.3 software – improved SLS system performance

• SinterScan™ software - improved surface finish

• Real Monitor™ software - statistical process control

38

Products Designed to Improve Our Customer’s Bottom Line

• InVision™ Finisher for automated support removal

[GRAPHIC]

[GRAPHIC]

• ProClean™ SL part washer to reduce post-processing time & labor

39

Products Designed to Improve Our Customer’s Bottom Line

[GRAPHIC]

Various aerodynamics and Formula 1 prototypes manufactured with Bluestone™ SL material from 3D Systems. Images courtesy of Renault F1 Team.

• Engineered Nano-Composite Bluestone™ SL material

• First commercially available engineered nano-composite resin for SLA systems Delivers

• Exceptional accuracy and stiffness

• Excellent dimensional stability

• Very low shrinkage

• Very high thermal resistance

40

Expected Near-Term Outlook

• Exiting system assembly operations

• Low transition costs; P&L benefit beginning in ‘05

• Near-term working capital increase, reduced levels thereafter

• Accelerating new product development

• Higher R&D expenditures for second half of year

• Faster new-product introductions thereafter

• Rebuilding and expanding the sales organization

• Could adversely impact near-term sales; positive impact thereafter

• Enhanced productivity and coverage

• Expanding distribution; growing 3-D printing contribution

• Continuing to improve the business model and results

• Further COGS improvements

• Additional operating expense reductions

• Better service productivity and effectiveness

• Greater contributions from materials and services

• Reducing working capital investment

41

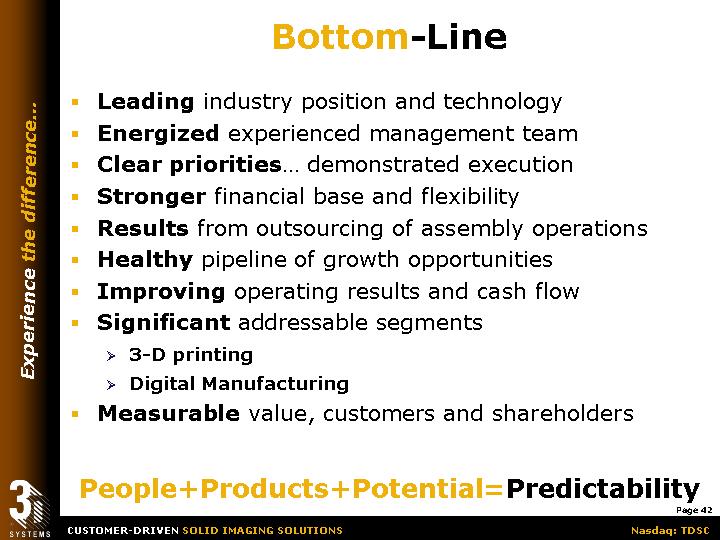

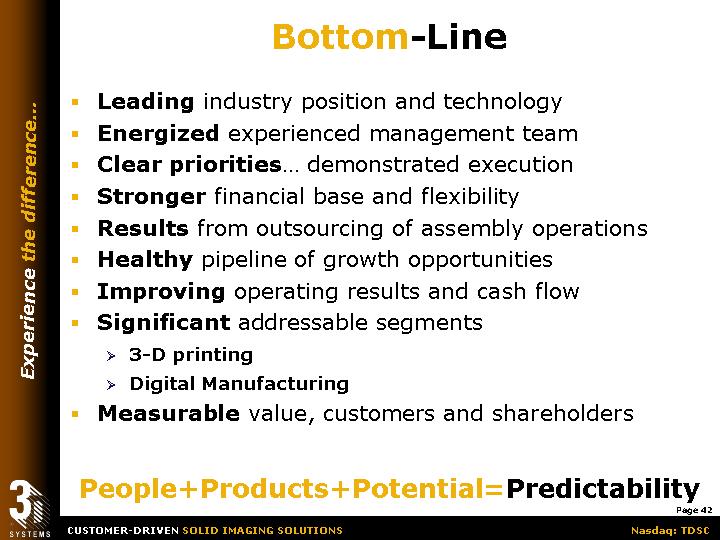

Bottom-Line

• Leading industry position and technology

• Energized experienced management team

• Clear priorities… demonstrated execution

• Stronger financial base and flexibility

• Results from outsourcing of assembly operations

• Healthy pipeline of growth opportunities

• Improving operating results and cash flow

• Significant addressable segments

• 3-D printing

• Digital Manufacturing

• Measurable value, customers and shareholders

People+Products+Potential=Predictability

42

Future… Profitable Growth

Thank You!

Experience The Difference

43