Searchable text section of graphics shown above

3D Systems Corporation

2007 Needham Conference

January 10, 2006

[LOGO] | NASDAQ: TDSC

www.3dsystems.com | Transform Your Products |

Forward-Looking Statements

Certain statements made in this presentation that are not statements of historical or current facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements which explicitly describe such risks and uncertainties, readers are urged to consider statements in the future tenses or that include the terms “believes,” “belief,” “estimates,” “expects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to the company’s beliefs and expectations as to future events and trends affecting its business. Forward-looking statements are based upon management’s current expectations concerning future events and trends and are necessarily subject to uncertainties, many of which are outside the control of the company. The factors stated under the headings “Forward-Looking Statements,” “Cautionary Statements and Risk Factors,” which appear in the company’s periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements.

Experience the difference…

2

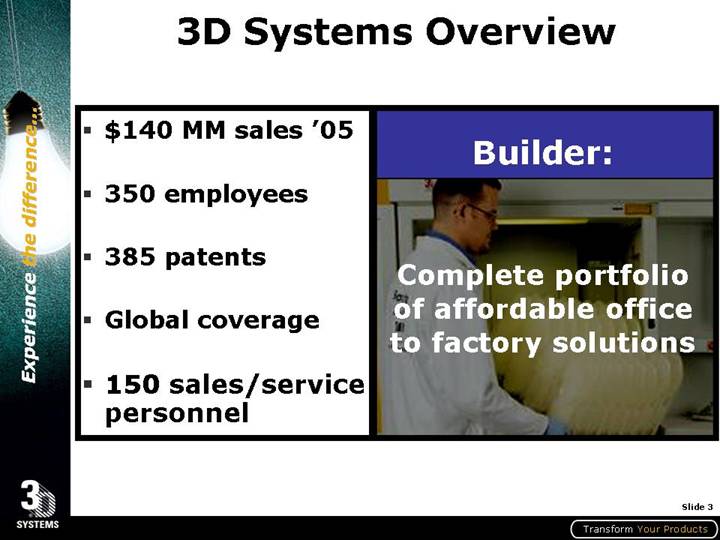

3D Systems Overview

• $140 MM sales ‘05

• 350 employees

• 385 patents

• Global coverage

• 150 sales/service personnel

Builder:

Complete portfolio of affordable office to factory solutions

[GRAPHIC]

3

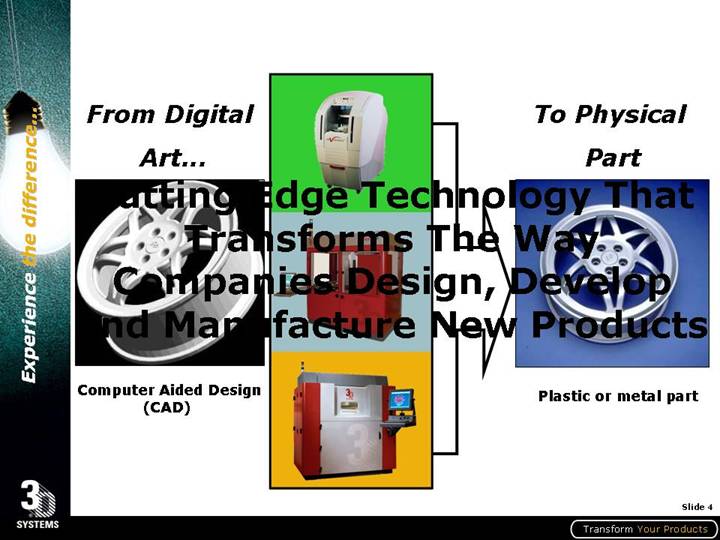

Cutting Edge Technology That Transforms The Way Companies Design, Develop and Manufacture New Products

From Digital Art...

[GRAPHIC]

Computer Aided Design (CAD)

[GRAPHIC]

To Physical Part

[GRAPHIC]

Plastic or metal part

4

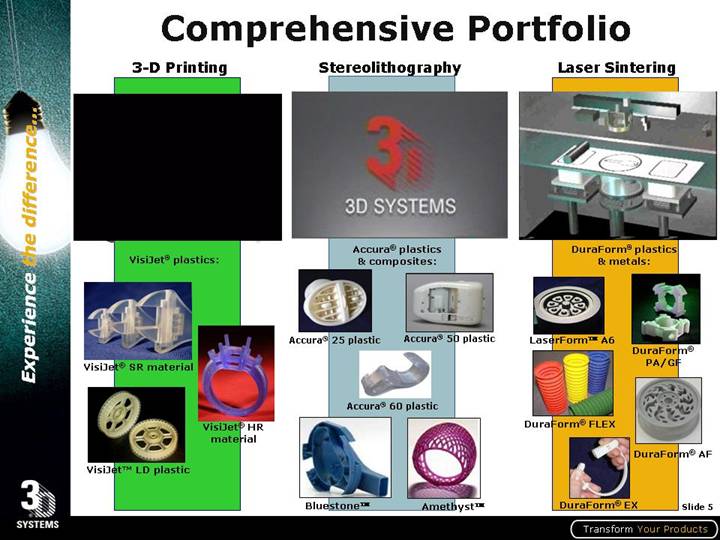

Comprehensive Portfolio

3-D Printing

[GRAPHIC]

VisiJet® plastics:

[GRAPHIC]

VisiJet® SR material

[GRAPHIC]

VisiJet® HR material

[GRAPHIC]

VisiJet™ LD plastic

Stereolithography

[GRAPHIC]

Accura® plastics & composites:

[GRAPHIC]

Accura® 25 plastic

[GRAPHIC]

Accura® 50 plastic

[GRAPHIC]

Accura® 60 plastic

[GRAPHIC]

BluestoneÔ

[GRAPHIC]

AmethystÔ

Laser Sintering

[GRAPHIC]

DuraForm® plastics & metals:

[GRAPHIC]

LaserFormÔ A6

[GRAPHIC]

DuraForm® PA/GF

[GRAPHIC]

DuraForm® FLEX

[GRAPHIC]

DuraForm® AF

[GRAPHIC]

DuraForm® EX

5

Industrial

[LOGO]

[GRAPHIC]

6

Consumer

[LOGO]

[GRAPHIC]

7

Automotive

[LOGO]

[GRAPHIC]

8

Aerospace

[LOGO]

[GRAPHIC]

9

Motorsports

[LOGO]

[GRAPHIC]

10

Service Providers

[LOGO]

[GRAPHIC]

11

Healthcare

[LOGO]

[GRAPHIC]

12

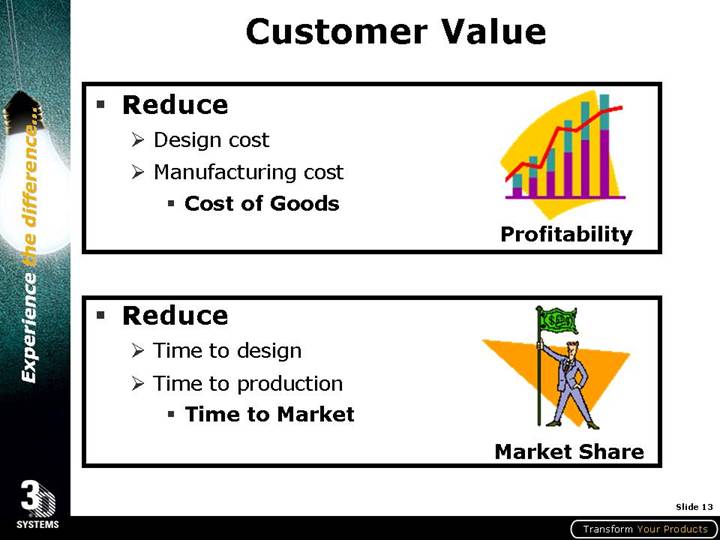

Customer Value

• Reduce

• Design cost

• Manufacturing cost

• Cost of Goods

[GRAPHIC]

Profitability

• Reduce

• Time to design

• Time to production

• Time to Market

[GRAPHIC]

Market Share

13

Global Coverage

[GRAPHIC]

U.S.

[GRAPHIC]

U.K.

[GRAPHIC]

France

Switzerland

[GRAPHIC]

Germany

[GRAPHIC]

Italy

[GRAPHIC]

Japan

[GRAPHIC]

Hong Kong

We Cover 80% of the World

14

Financial Restatement Update

• We previously announced that we had determined that the Company’s financial statements included in our Form 10-Q Reports for the first and second quarters of 2006 contained errors and would be restated.

• We postponed our 3Q06 earnings release and Form 10-Q filing until these restatements have been completed.

15

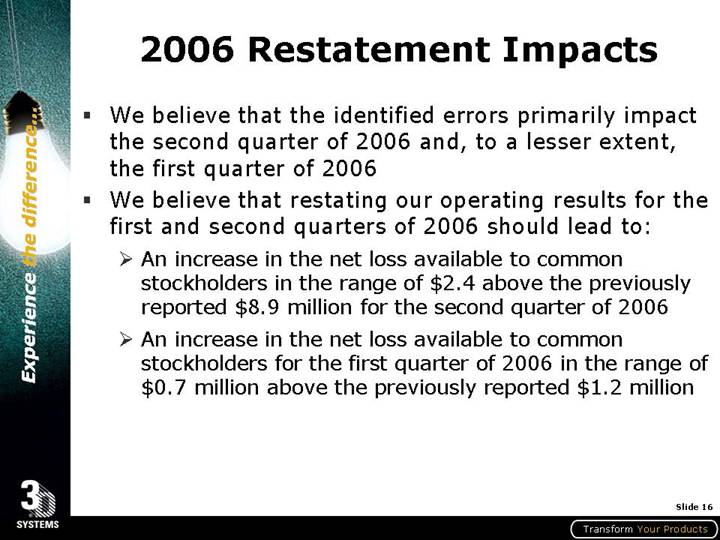

2006 Restatement Impacts

• We believe that the identified errors primarily impact the second quarter of 2006 and, to a lesser extent, the first quarter of 2006

• We believe that restating our operating results for the first and second quarters of 2006 should lead to:

• An increase in the net loss available to common stockholders in the range of $2.4 above the previously reported $8.9 million for the second quarter of 2006

• An increase in the net loss available to common stockholders for the first quarter of 2006 in the range of $0.7 million above the previously reported $1.2 million

16

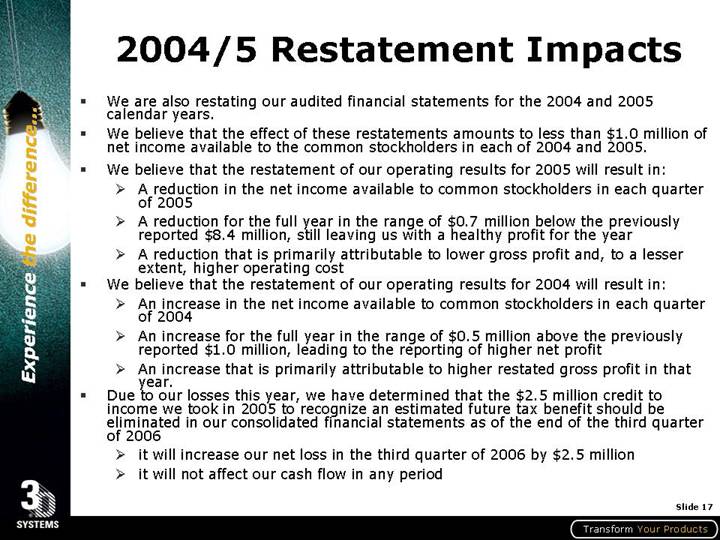

2004/5 Restatement Impacts

• We are also restating our audited financial statements for the 2004 and 2005 calendar years.

• We believe that the effect of these restatements amounts to less than $1.0 million of net income available to the common stockholders in each of 2004 and 2005.

• We believe that the restatement of our operating results for 2005 will result in:

• A reduction in the net income available to common stockholders in each quarter of 2005

• A reduction for the full year in the range of $0.7 million below the previously reported $8.4 million, still leaving us with a healthy profit for the year

• A reduction that is primarily attributable to lower gross profit and, to a lesser extent, higher operating cost

• We believe that the restatement of our operating results for 2004 will result in:

• An increase in the net income available to common stockholders in each quarter of 2004

• An increase for the full year in the range of $0.5 million above the previously reported $1.0 million, leading to the reporting of higher net profit

• An increase that is primarily attributable to higher restated gross profit in that year.

• Due to our losses this year, we have determined that the $2.5 million credit to income we took in 2005 to recognize an estimated future tax benefit should be eliminated in our consolidated financial statements as of the end of the third quarter of 2006

• it will increase our net loss in the third quarter of 2006 by $2.5 million

• it will not affect our cash flow in any period

17

Q3, 2006 Expectations

• Based upon the information that is currently available, we believe that we will report a loss for the third quarter of 2006

• Consolidated revenue for the third quarter should be in the range of $30.0 to $31.0 million

• Backlog in the neighborhood of $13.0 million

• Net loss available to the common stockholders should be in the range of $12.5 to $13.5 million

• Anticipated loss will reflect continuing effects of the costs of the strategic initiatives, resulting business disruptions and other related factors

• Loss will include approximately $2.5 million of severance and restructuring cost as a result of our relocation to Rock Hill, SC

• Costs incurred to remediate the business and ERP disruptions

• Other factors that adversely affected our performance in the third quarter of 2006 included:

• Higher R&D expenses from:

• Stepped up product development activities

• Materials’ development agreement with Symyx

• Special customer accommodations

18

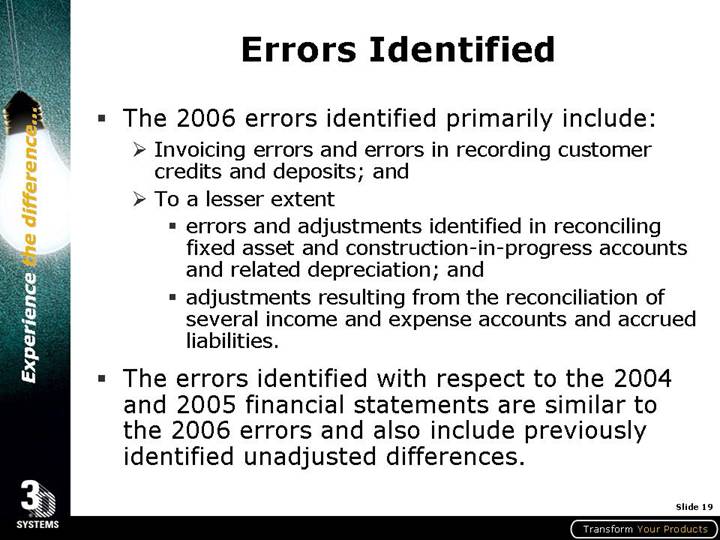

Errors Identified

• The 2006 errors identified primarily include:

• Invoicing errors and errors in recording customer credits and deposits; and

• To a lesser extent

• errors and adjustments identified in reconciling fixed asset and construction-in-progress accounts and related depreciation; and

• adjustments resulting from the reconciliation of several income and expense accounts and accrued liabilities.

• The errors identified with respect to the 2004 and 2005 financial statements are similar to the 2006 errors and also include previously identified unadjusted differences.

19

How Did We Identify the Errors?

We identified the errors primarily as a result of our efforts to remediate the material weakness that we previously identified and disclosed with respect to our second quarter 2006 financial statements through:

• Our ongoing progress toward completing the implementation of our new ERP system

• Further reconciliation of the records in our new ERP system and those in our legacy systems

• More rigorous testing of our internal controls in the context of the new ERP system environment

20

Other Significant Events

• Grand Junction, CO Facility Sale:

• Entered agreement to sell Grand Junction facility for a price of $7 million

• We expect sale to conclude sale in the first quarter of 2007.

• Preferred Stock Conversion:

• Converted $15.2 million of preferred stock into common stock in June 2006.

• Expect to save $1.6 million annually of dividend cost.

• Early Convertible Subordinated Debentures Conversion:

• $7 million of our 6% convertible subordinated debentures were voluntarily converted into common stock in Q3, reducing outstanding amount to $15.4 million.

• Expect to save $400,000 annually in interest costs as a result of this conversion.

• Purchase of Rock Hill, SC Facility:

• Entered into agreement to purchase facility for $10.1 million, subject to certain customary conditions

• Are working to secure financing

• Expect to close on or before January 31, 2007

21

Next Steps and Timing

• As of today, the estimates or ranges of anticipated adjustments for the 2004, 2005 and 2006 periods discussed above remain subject to change, and additional adjustments may be required for those periods

• We are continuing to work as diligently as we can with our outside auditors to complete our restatements and to complete the filing of our third-quarter 2006 Form 10-Q as soon as possible

• We have appealed the delisting notice that we received from NASDAQ

22

Internal Controls Remediation

• As a result of the errors that have led to these restatements, we believe that material weaknesses in our internal control over financial reporting may exist in addition to the previously reported control deficiencies identified and disclosed in connection with closing our books for the second quarter of 2006.

• We are continuing to identify, quantify and remediate any control deficiencies that may have resulted in errors in our financial statements.

• We are taking the required steps necessary to provide assurance that all weaknesses are remedied and that they will not reoccur.

23

State of Business

• We made good progress in resolving the causes of the business disruptions

• Our continuing high level of backlog ~$13 million at 9/30/06 suggests that the demand for our products remains strong

• Materials’ revenue continued its double-digit pace of growth in the third quarter of 2006

• We have already incurred most of the costs of our strategic initiatives and disruptions

• We have funded approximately $17 million from our cash balances to support our strategic initiatives, including:

• Our relocation to Rock Hill

• Inventory levels

• We had more than $5 million of unrestricted cash at September 30, 2006

• We have a comparable amount of cash currently

• We expect to return to our historical levels of performance in accounts receivable days outstanding and inventory

• We have completed our move and consolidation into our new headquarters in Rock Hill, South Carolina

24

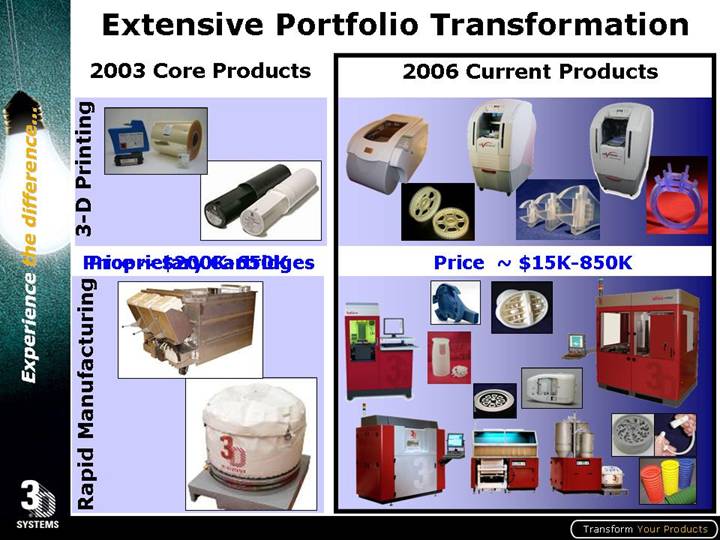

Extensive Portfolio Transformation

2003 Core Products

3-D Printing

[GRAPHIC]

Proprietary Cartridges

Rapid Manufacturing

[GRAPHIC]

Price ~ $200K-650K

2006 Current Products

[GRAPHIC]

Price ~ $15K-850K

25

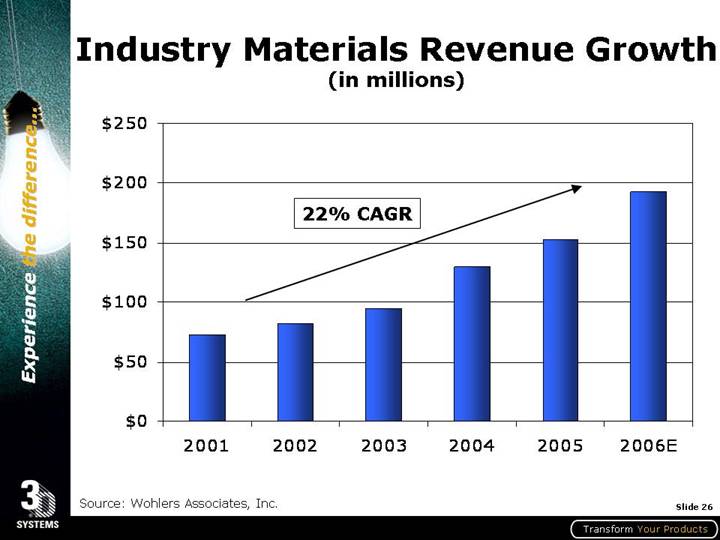

Industry Materials Revenue Growth

(in millions)

[CHART]

Source: Wohlers Associates, Inc.

26

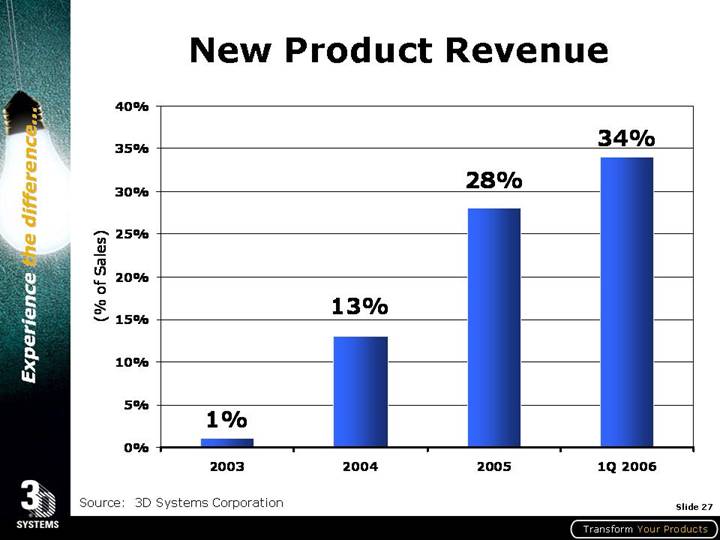

New Product Revenue

[CHART]

Source: 3D Systems Corporation

27

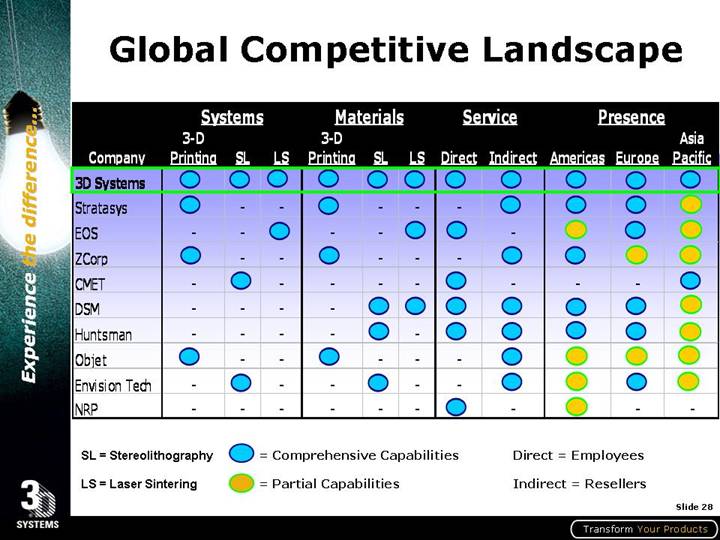

Global Competitive Landscape

| | Systems | | Materials | | Service | | Presence | |

Company | | 3-D

Printing | | SL | | LS | | 3-D

Printing | | SL | | LS | | Direct | | Indirect | | Americas | | Europe | | Asia

Pacific | |

3D Systems | | x | | x | | x | | x | | x | | x | | x | | x | | x | | x | | x | |

Stratasys | | x | | — | | — | | x | | — | | — | | — | | x | | x | | x | | o | |

EOS | | — | | — | | x | | — | | — | | x | | x | | — | | o | | x | | o | |

ZCorp | | x | | — | | — | | x | | — | | — | | — | | x | | x | | o | | o | |

CMET | | — | | x | | — | | — | | — | | — | | x | | — | | — | | — | | x | |

DSM | | — | | — | | — | | — | | x | | x | | x | | x | | x | | x | | o | |

Huntsman | | — | | — | | — | | — | | x | | — | | x | | x | | x | | x | | o | |

Objet | | x | | — | | — | | x | | — | | — | | — | | x | | o | | o | | o | |

Envision Tech | | — | | x | | — | | — | | x | | — | | — | | x | | o | | x | | o | |

NRP | | — | | — | | — | | — | | — | | — | | x | | — | | o | | — | | — | |

SL = Stereolithography | x = Comprehensive Capabilities | Direct = Employees |

| | |

LS = Laser Sintering | o = Partial Capabilities | Indirect = Resellers |

28

Fineline Competitive Web Page

[GRAPHIC]

29

Viper Pro Part Detail/Accuracy

[GRAPHIC]

30

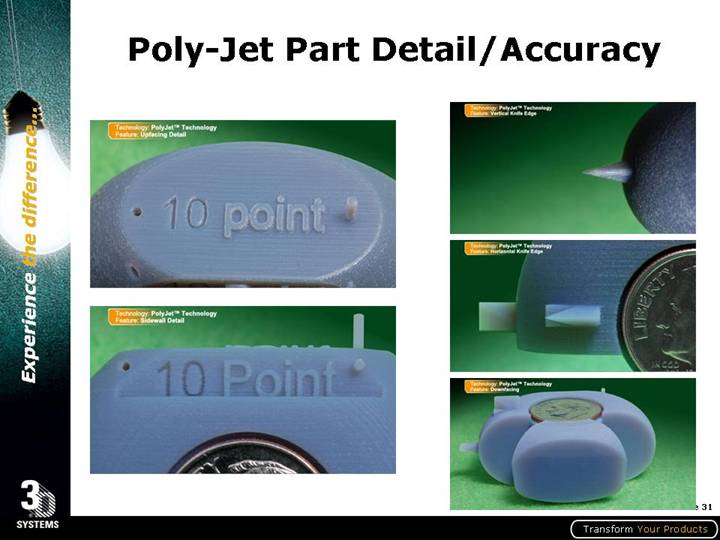

Poly-Jet Part Detail/Accuracy

[GRAPHIC]

31

FDM Detail Detail/Accuracy

[GRAPHIC]

32

Strategic Investments $17MM

• New consolidated HQ and R&D facility

• Oracle based ERP system

• Strategic materials development agreement with Symyx

• Supply chain outsourcing to UPS

• Expanded R&D facilities and personnel

• New Rapid-Manufacturing Center

• 3D Systems University

[GRAPHIC]

33

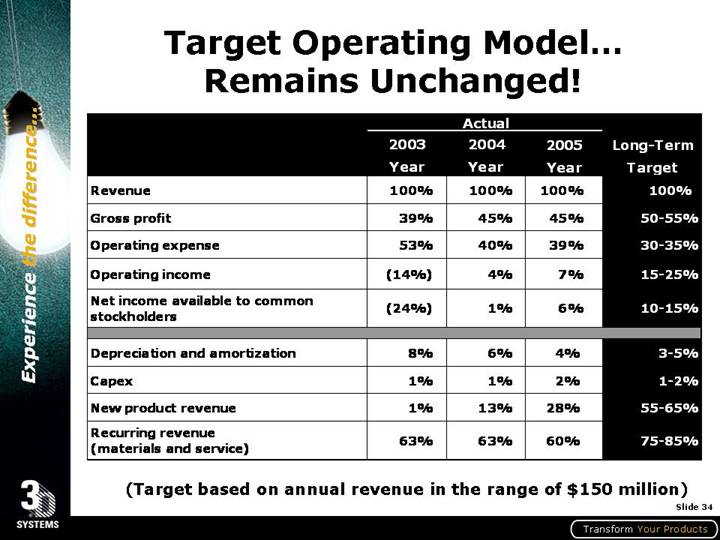

Target Operating Model…

Remains Unchanged!

| | Actual | | | |

| | 2003

Year | | 2004

Year | | 2005

Year | | Long-Term

Target | |

Revenue | | 100 | % | 100 | % | 100 | % | 100 | % |

Gross profit | | 39 | % | 45 | % | 45 | % | 50-55 | % |

Operating expense | | 53 | % | 40 | % | 39 | % | 30-35 | % |

Operating income | | (14 | )% | 4 | % | 7 | % | 15-25 | % |

Net income available to common stockholders | | (24 | )% | 1 | % | 6 | % | 10-15 | % |

| | | | | | | | | |

Depreciation and amortization | | 8 | % | 6 | % | 4 | % | 3-5 | % |

Capex | | 1 | % | 1 | % | 2 | % | 1-2 | % |

New product revenue | | 1 | % | 13 | % | 28 | % | 55-65 | % |

Recurring revenue (materials and service) | | 63 | % | 63 | % | 60 | % | 75-85 | % |

(Target based on annual revenue in the range of $150 million)

34

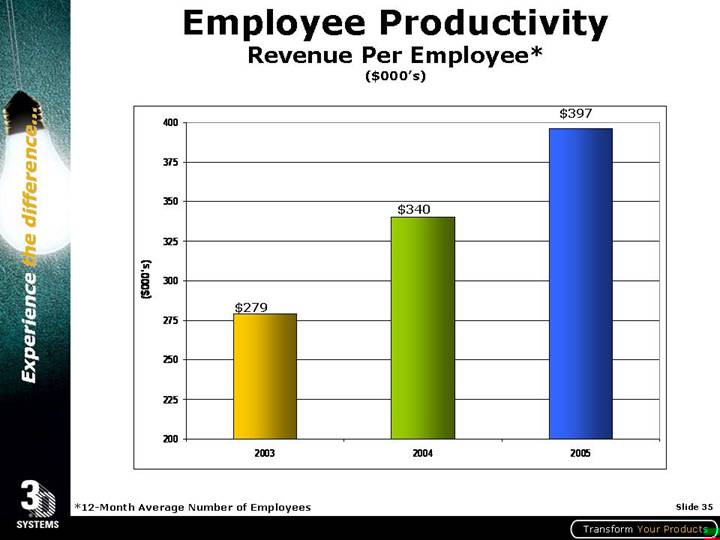

Employee Productivity

Revenue Per Employee*

($000’s)

[CHART]

*12-Month Average Number of Employees

35

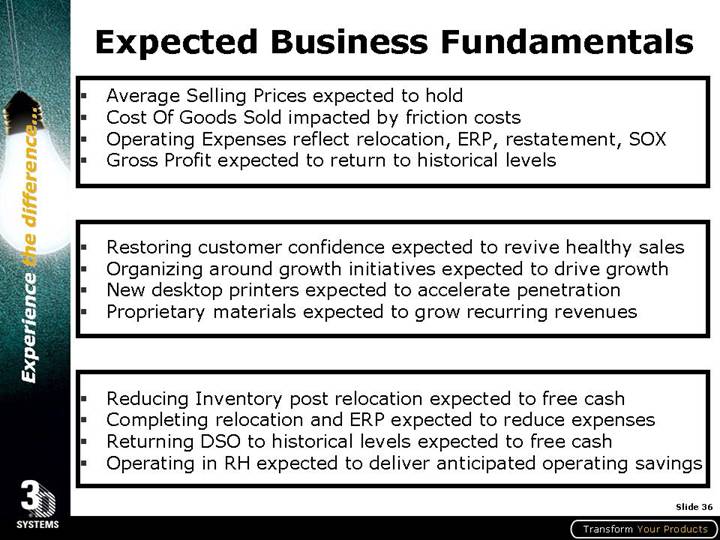

Expected Business Fundamentals

• Average Selling Prices expected to hold

• Cost Of Goods Sold impacted by friction costs

• Operating Expenses reflect relocation, ERP, restatement, SOX

• Gross Profit expected to return to historical levels

• Restoring customer confidence expected to revive healthy sales

• Organizing around growth initiatives expected to drive growth

• New desktop printers expected to accelerate penetration

• Proprietary materials expected to grow recurring revenues

• Reducing Inventory post relocation expected to free cash

• Completing relocation and ERP expected to reduce expenses

• Returning DSO to historical levels expected to free cash

• Operating in RH expected to deliver anticipated operating savings

36

Progress Report

Kevin McAlea Vice-President

Global Marketing

37

Growth Program: 3-D Printing

[GRAPHIC]

• Proof of concept

• Functional testing

• Product cost reduction

• Purchasing and quotation

[GRAPHIC]

• Product mockups

• Precision casting

• Marketing tools

• Architecture

• Education

38

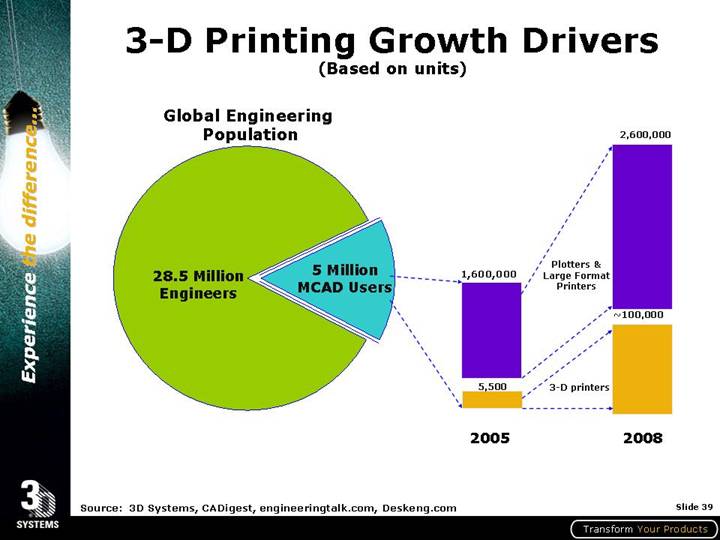

3-D Printing Growth Drivers

(Based on units)

Global Engineering Population

[CHART]

Source: 3D Systems, CADigest, engineeringtalk.com, Deskeng.com

39

3-D Printing Progress

[GRAPHIC]

• Growing resale channel

• Introduced $14,900 desk-top 3-D Printer

• Launched InVision® Dental Pro and announced sale of 10th system in early September

• Introduced new LD colors

• Nearing launch of a revolutionary new desktop 3-D Printer

[GRAPHIC]

40

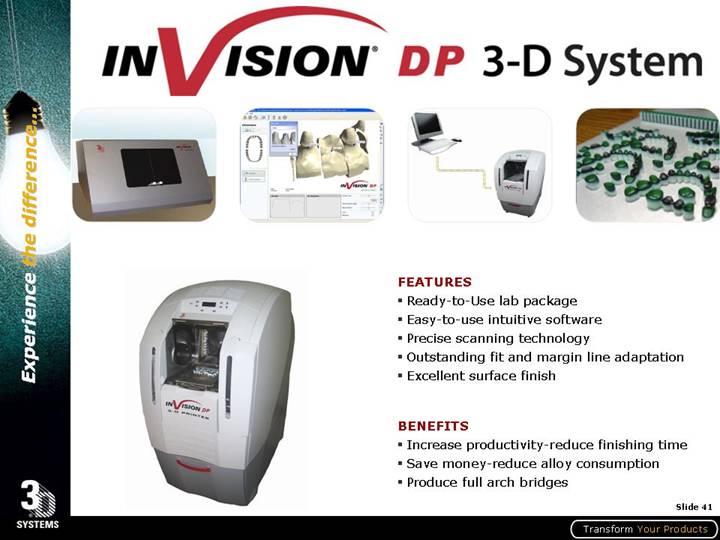

[LOGO]

[GRAPHIC]

FEATURES

• Ready-to-Use lab package

• Easy-to-use intuitive software

• Precise scanning technology

• Outstanding fit and margin line adaptation

• Excellent surface finish

BENEFITS

• Increase productivity-reduce finishing time

• Save money-reduce alloy consumption

• Produce full arch bridges

41

3D Printing: Marketing Models

[GRAPHIC]

42

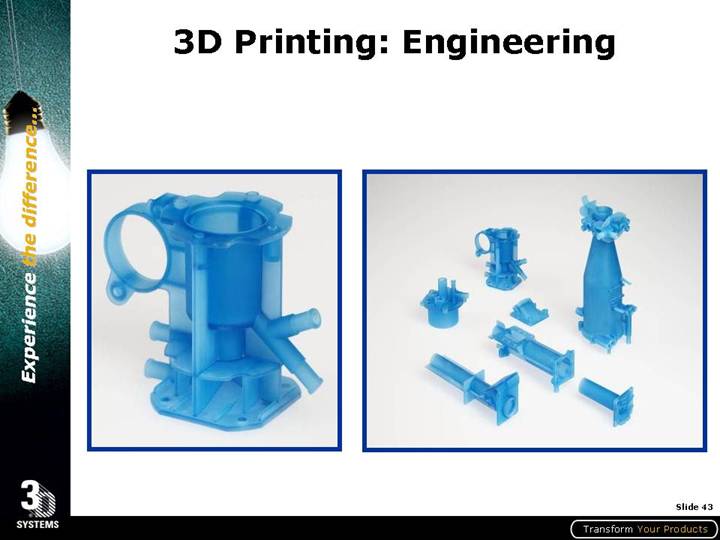

3D Printing: Engineering

[GRAPHIC]

43

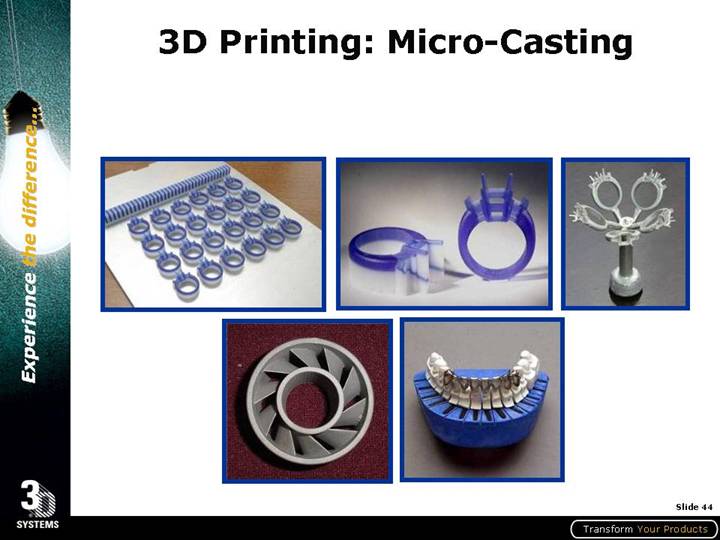

3D Printing: Micro-Casting

[GRAPHIC]

44

Growth Program: Rapid Manufacturing

[GRAPHIC]

• Hearing aids

• Aerospace

• Military

• Orthodontics

• Dental study models

• Dental drill guides

[GRAPHIC]

• Formula One/NASCAR

• Automotive

• Medical/prosthetics

• Footwear

• Tools and fixtures

• Jewelry manufacturing

45

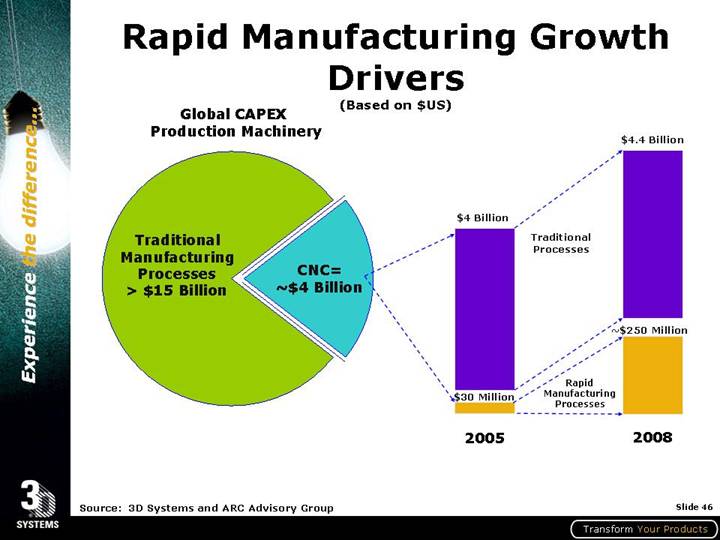

Rapid Manufacturing Growth Drivers

(Based on $US)

Global CAPEX Production Machinery

[CHART]

Source: 3D Systems and ARC Advisory Group

46

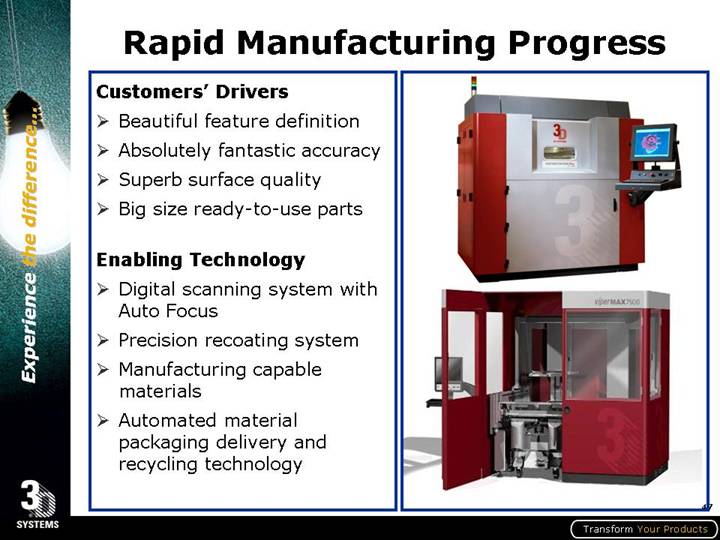

Rapid Manufacturing Progress

Customers’ Drivers

• Beautiful feature definition

• Absolutely fantastic accuracy

• Superb surface quality

• Big size ready-to-use parts

Enabling Technology

• Digital scanning system with Auto Focus

• Precision recoating system

• Manufacturing capable materials

• Automated material packaging delivery and recycling technology

[GRAPHIC]

47

Rapid Manufacturing: Larger

[GRAPHIC]

48

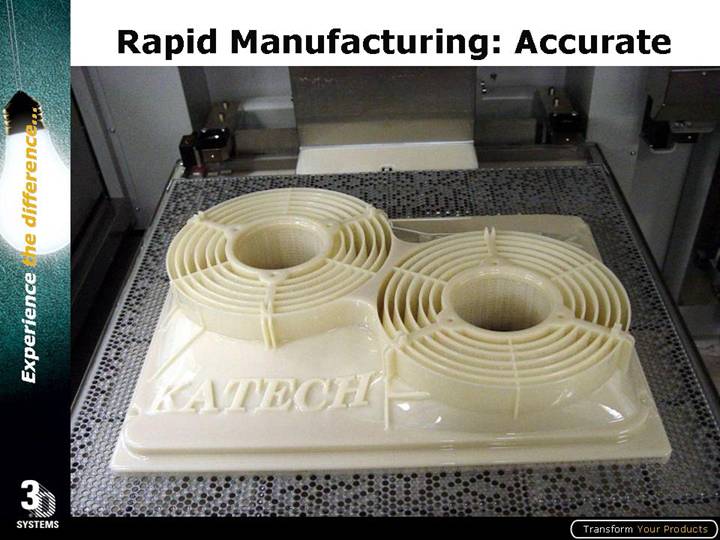

Rapid Manufacturing: Accurate

[GRAPHIC]

49

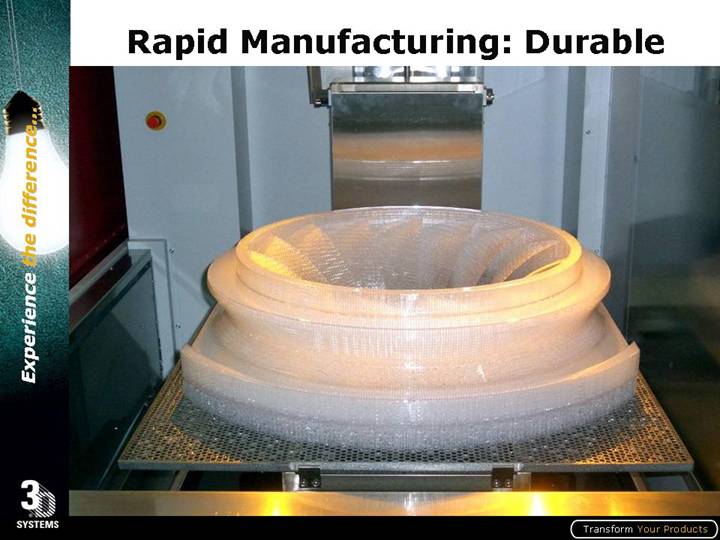

Rapid Manufacturing: Durable

[GRAPHIC]

50

Rapid Manufacturing: End Use Parts

[GRAPHIC]

51

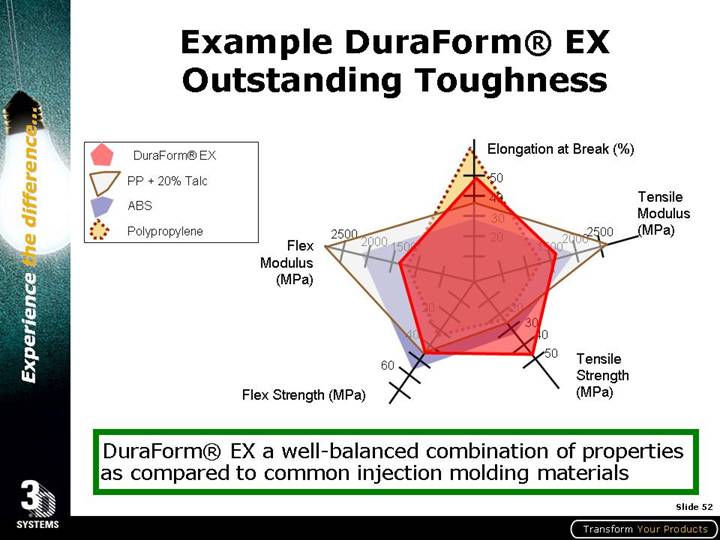

Example DuraForm® EX

Outstanding Toughness

[CHART]

DuraForm® EX a well-balanced combination of properties as compared to common injection molding materials

52

Business Model Strengths

• Leading industry position through technology

• Energized, experienced team

• Clear priorities… customer-centric culture

• Stronger financial base and flexibility

• Significant performance improvement initiatives

• Healthy pipeline of new opportunities

• Focused growth programs

• 3-D Printing

• Rapid Manufacturing

• Measurable value, customers and stockholders

Transitioning from Restructuring to Growth

53

Thank you for participating

54