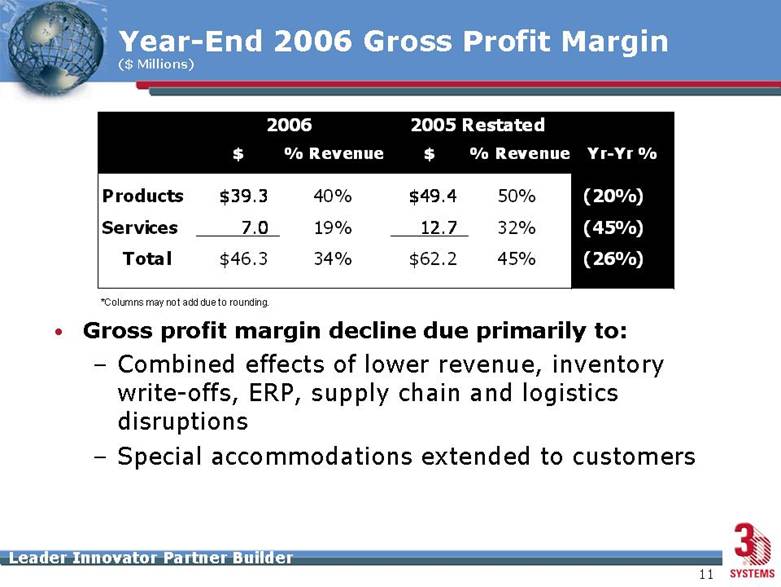

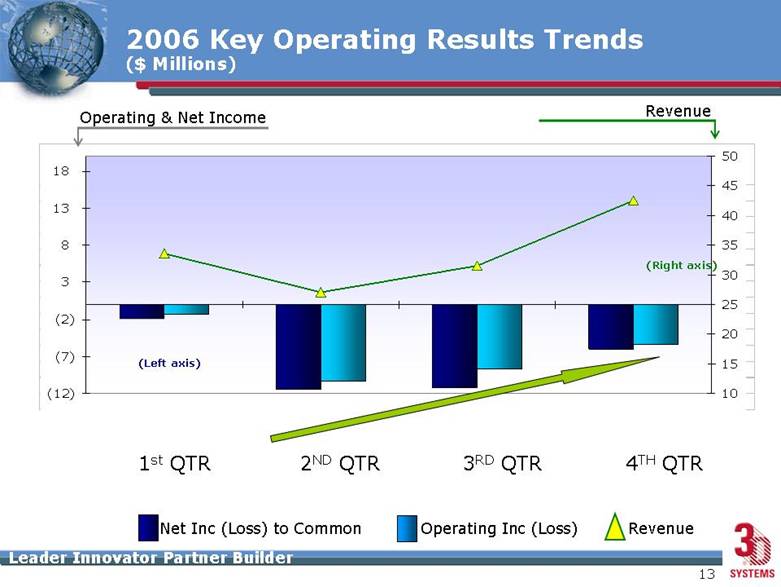

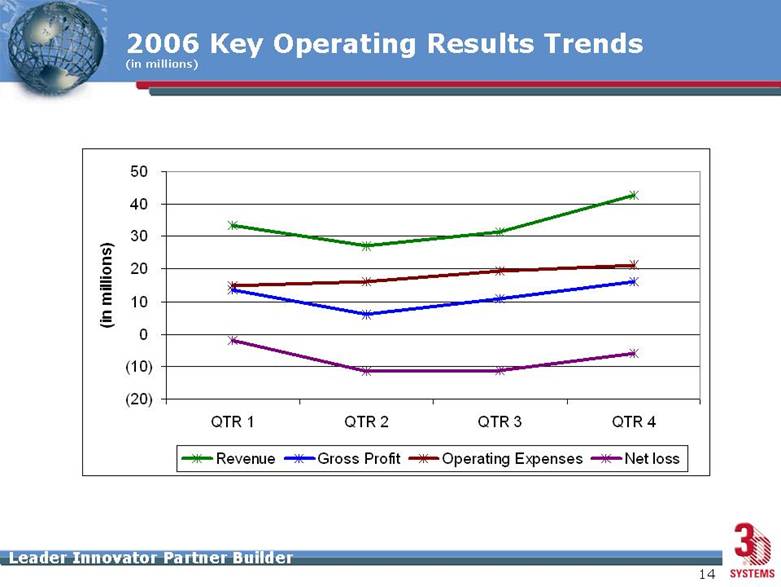

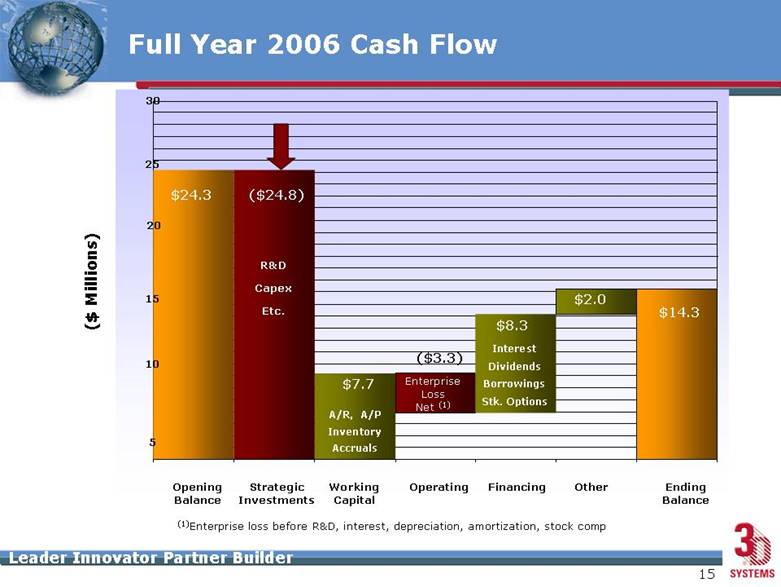

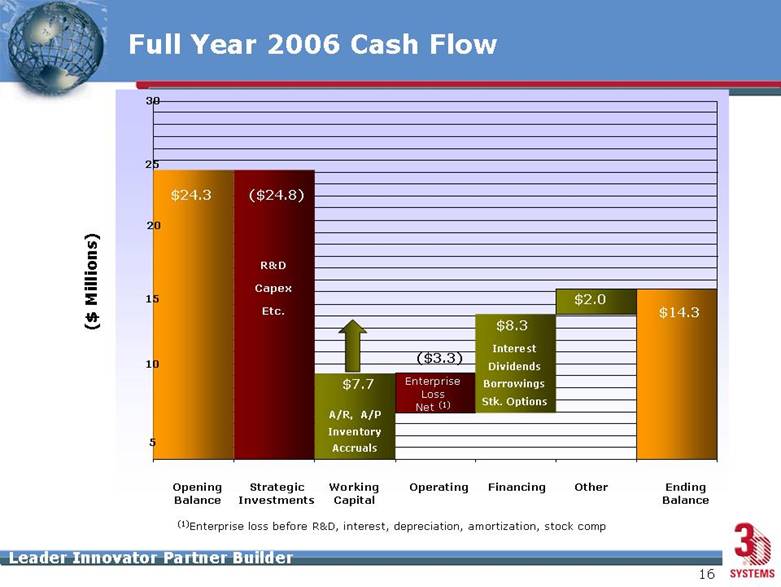

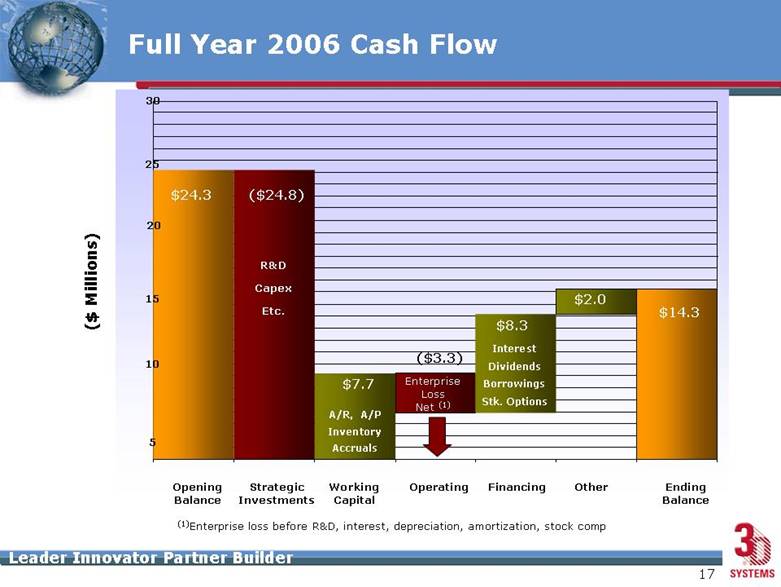

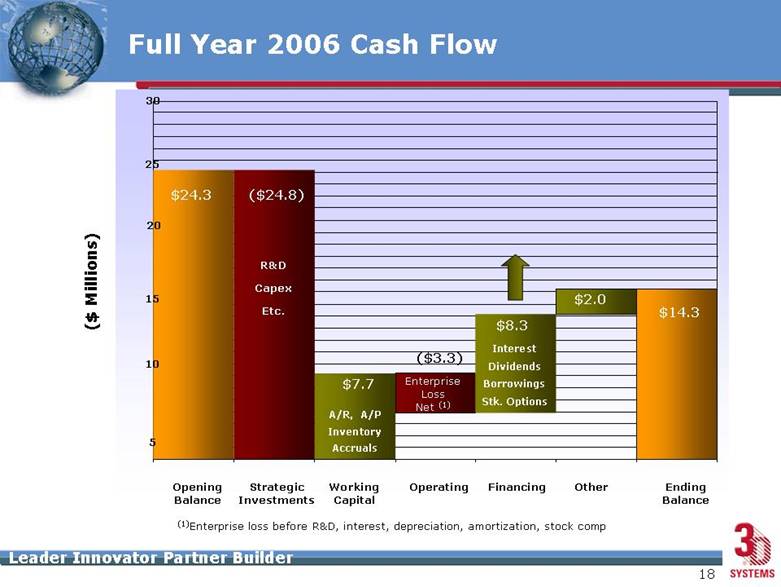

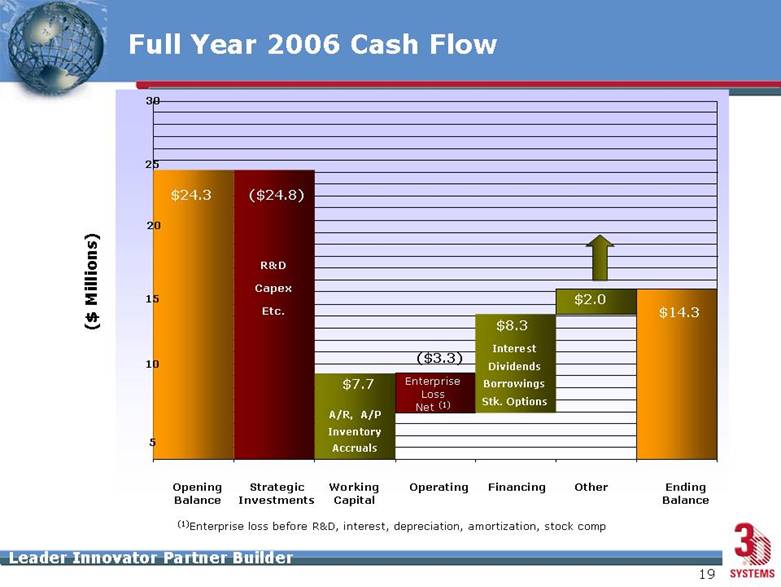

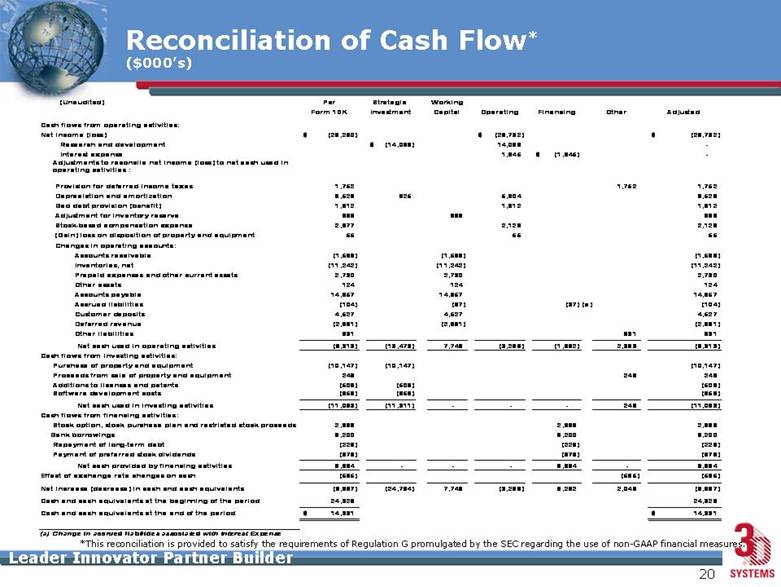

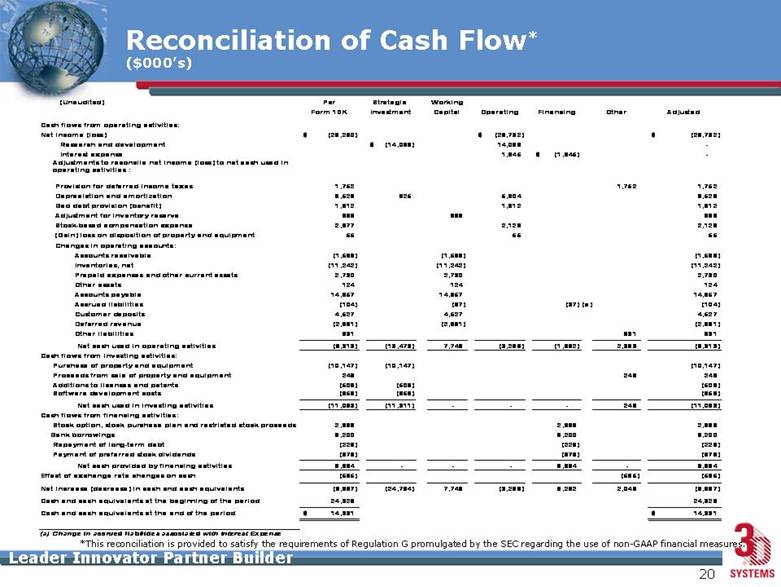

| Reconciliation of Cash Flow* ($000’s) *This reconciliation is provided to satisfy the requirements of Regulation G promulgated by the SEC regarding the use of non-GAAP financial measures. (Unaudited) Per Strategic Working Form 10K Investment Capital Operating Financing Other Adjusted Cash flows from operating activities: Net income (loss) (29,280) $ (28,732) $ (28,732) $ (14,098) $ 14,098 - 1,645 (1,645) $ - 1,752 1,752 1,752 Depreciation and amortization 6,529 625 5,904 6,529 Bad debt provision (benefit) 1,612 1,612 1,612 Adjustment for inventory reserve 968 968 968 Stock-based compensation expense 2,677 2,129 2,129 (Gain) loss on disposition of property and equipment 55 55 55 Changes in operating accounts: Accounts receivable (1,568) (1,568) (1,568) Inventories, net (11,242) (11,242) (11,242) Prepaid expenses and other current assets 2,730 2,730 2,730 Other assets 124 124 124 Accounts payable 14,957 14,957 14,957 Accrued liabilities (104) (67) (37) (a) (104) Customer deposits 4,527 4,527 4,527 Deferred revenue (2,681) (2,681) (2,681) Other liabilities 631 631 631 Net cash used in operating activities (8,313) (13,473) 7,748 (3,289) (1,682) 2,383 (8,313) Cash flows from investing activities: Purchase of property and equipment (10,147) (10,147) (10,147) Proceeds from sale of property and equipment 248 248 248 Additions to licenses and patents (506) (506) (506) Software development costs (658) (658) (658) Net cash used in investing activities (11,063) (11,311) - - - 248 (11,063) Cash flows from financing activities: Stock option, stock purchase plan and restricted stock proceeds 2,669 2,669 2,669 8,200 8,200 8,200 Repayment of long-term debt (226) (226) (226) Payment of preferred stock dividends (679) (679) (679) Net cash provided by financing activities 9,964 - - - 9,964 - 9,964 Effect of exchange rate changes on cash (585) (585) (585) Net increase (decrease) in cash and cash equivalents (9,997) (24,784) 7,748 (3,289) 8,282 2,046 (9,997) Cash and cash equivalents at the beginning of the period 24,328 24,328 Cash and cash equivalents at the end of the period 14,331 $ 14,331 $ (a) Change in accrued liabilities associated with Interest Expense Adjustments to reconcile net income (loss) to net cash used in operating activities : Bank borrowings Provision for deferred income taxes Interest expense Research and development |