Exhibit 99.2 + •Cover style Building a Global Leader in Additive Manufacturing JULY 13, 2023

Forward-Looking Statements Certain statements made in this document that are not statements of integration will be successful or synergies will be realized if such historical or current facts are forward-looking statements within the transaction were to be consummated. Business combination proposals, meaning of the Private Securities Litigation Reform Act of 1995. Forward- transactions and integrations are subject to numerous risks and looking statements involve known and unknown risks, uncertainties and uncertainties. Although management believes that the expectations other factors that may cause the actual results, performance or reflected in the forward-looking statements are reasonable, forward-looking achievements of the company to be materially different from historical statements are not, and should not be relied upon as a guarantee of future results or from any future results or projections expressed or implied by performance or results, nor will they necessarily prove to be accurate such forward-looking statements. In many cases, forward-looking indications of the times at which such performance or results will be statements can be identified by terms such as “believes,” “belief,” “expects,” achieved. The forward-looking statements included are made only as of the “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative date of the statement. 3D Systems undertakes no obligation to update or of these terms or other comparable terminology. Forward-looking revise any forward-looking statements made by management or on its statements are based upon management’s beliefs, assumptions and behalf, whether as a result of future developments, subsequent events or current expectations and may include comments as to the company’s circumstances, or otherwise, except as required by law. beliefs and expectations as to future events and trends affecting its All references to the binding nature of the offer and merger agreement business and are necessarily subject to uncertainties, many of which are being proposed by 3D Systems, whether in a press release, presentation, outside the control of the company. The factors described under the other document or public statement, are subject to the contents of the headings “Forward-Looking Statements” and “Risk Factors” in the escrow letter that has been delivered to Stratasys and will be on file publicly company’s with the SEC. periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. In particular, we note that there is no assurance that a definitive agreement for the transaction referenced in this document will be entered into or consummated or that 2

Additional Information This communication does not constitute an offer to buy or sell or the This document shall not constitute an offer to buy or sell or the solicitation solicitation of an offer to sell or buy any securities. This communication of an offer to sell or buy any securities, nor shall there be any sale of relates to a proposal which 3D Systems has made for a business securities in any jurisdiction in which such offer, solicitation or sale would combination with Stratasys. In furtherance of this proposal and subject to be unlawful prior to registration or qualification under the securities laws of future developments, 3D Systems (and, if a negotiated transaction is any such jurisdiction. No offering of securities shall be made except by agreed, Stratasys) may file one or more registration statements, proxy means of a prospectus meeting the requirements of Section 10 of the U.S. statements or other documents with the SEC. This communication is not a Securities Act of 1933, as amended. substitute for any proxy statement, registration statement, prospectus or This communication is neither a solicitation of a proxy nor a substitute for other document that 3D Systems and/or Stratasys may file with the SEC in any proxy statement or other filings that may be made with the SEC. connection with the proposed transaction. Nonetheless, 3D Systems and its directors and executive officers and other Investors and security holders of 3D Systems and Stratasys are urged to members of management and employees may be deemed to be read the proxy statement(s), registration statement, prospectus and/or participants in the solicitation of proxies in respect of the proposed other documents filed with the SEC carefully in their entirety if and when transaction. You can find information about 3D Systems’ executive officers they become available as they will contain important information about the and directors in 3D Systems’ definitive proxy statement filed with the SEC proposed transaction. Any definitive proxy statement(s) or prospectus(es) on April 5, 2023. Additional information regarding the interests of such (if and when available) will be mailed to stockholders of 3D Systems and/or potential participants will be included in one or more registration Stratasys, as applicable. Investors and security holders will be able to obtain statements, proxy statements or other documents filed with the SEC if and free copies of these documents (if and when available) and other when they become available. These documents (if and when available) may documents filed with the SEC by 3D Systems through the web site be obtained free of charge from the SEC’s website at http://www.sec.gov. maintained by the SEC at http://www.sec.gov. 3

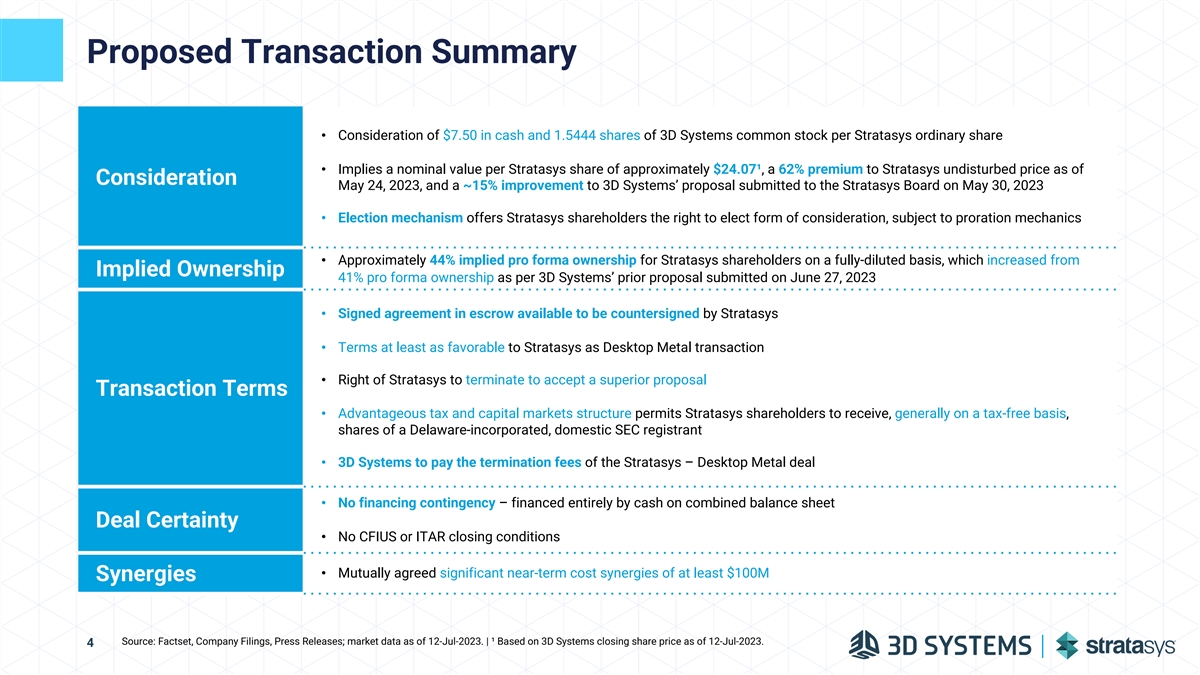

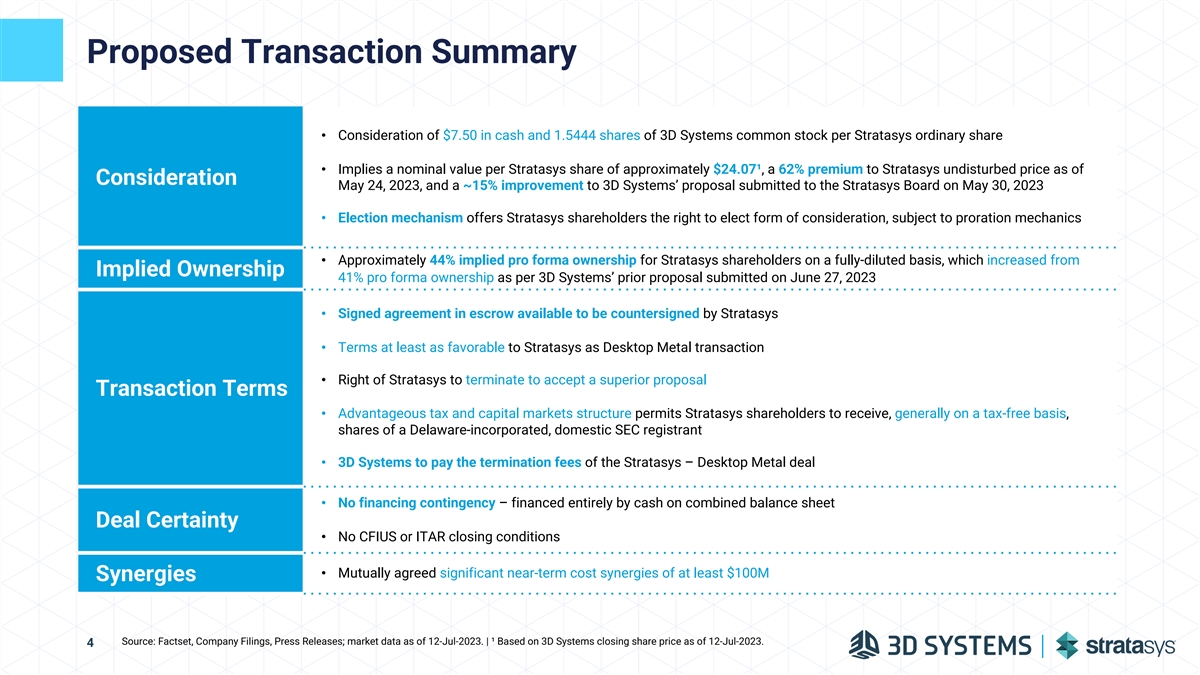

Proposed Transaction Summary • Consideration of $7.50 in cash and 1.5444 shares of 3D Systems common stock per Stratasys ordinary share • Implies a nominal value per Stratasys share of approximately $24.07¹, a 62% premium to Stratasys undisturbed price as of Consideration May 24, 2023, and a ~15% improvement to 3D Systems’ proposal submitted to the Stratasys Board on May 30, 2023 • Election mechanism offers Stratasys shareholders the right to elect form of consideration, subject to proration mechanics • Approximately 44% implied pro forma ownership for Stratasys shareholders on a fully-diluted basis, which increased from Implied Ownership 41% pro forma ownership as per 3D Systems’ prior proposal submitted on June 27, 2023 • Signed agreement in escrow available to be countersigned by Stratasys • Terms at least as favorable to Stratasys as Desktop Metal transaction • Right of Stratasys to terminate to accept a superior proposal Transaction Terms • Advantageous tax and capital markets structure permits Stratasys shareholders to receive, generally on a tax-free basis, shares of a Delaware-incorporated, domestic SEC registrant • 3D Systems to pay the termination fees of the Stratasys – Desktop Metal deal • No financing contingency – financed entirely by cash on combined balance sheet Deal Certainty • No CFIUS or ITAR closing conditions • Mutually agreed significant near-term cost synergies of at least $100M Synergies Source: Factset, Company Filings, Press Releases; market data as of 12-Jul-2023. | ¹ Based on 3D Systems closing share price as of 12-Jul-2023. 4

An Unparalleled Transaction for Stratasys Shareholders 1 2 3 Creates Player with Delivers Exceptional Secures Higher Value Differentiated Scale Cost Synergies that Through Stronger and Broadest Drive Significant Value Financial Profile Capabilities in Rapidly Creation Growing Industry Higher Value. Equal Certainty. The Best Path Forward. 5

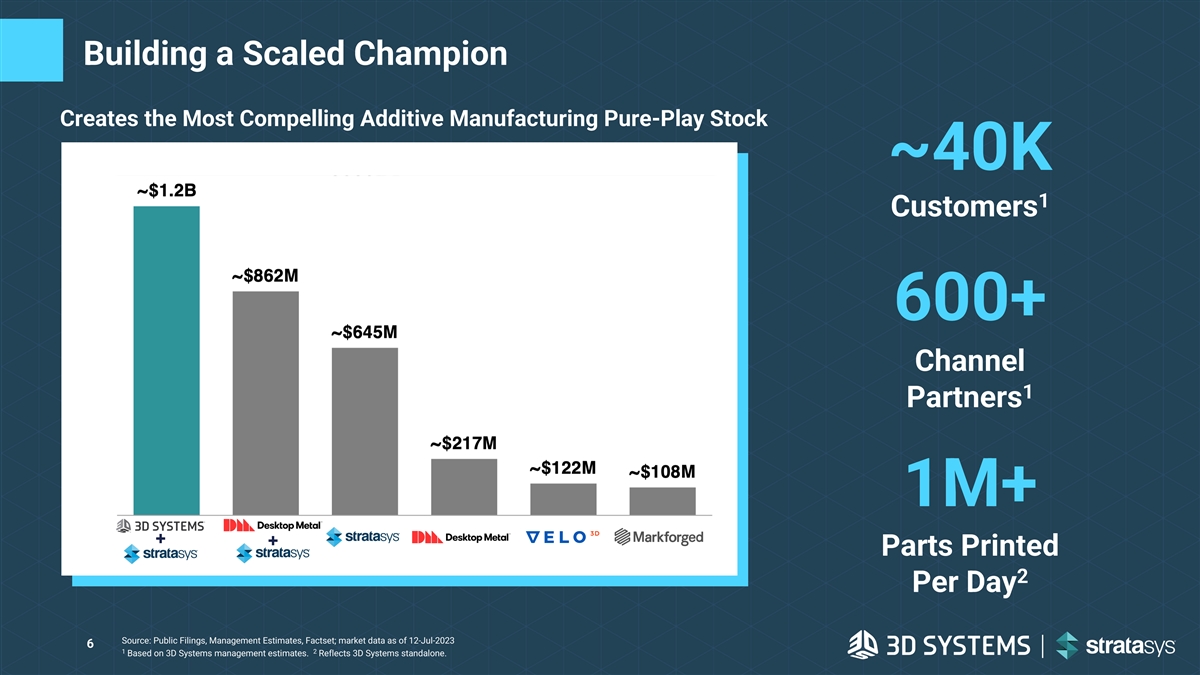

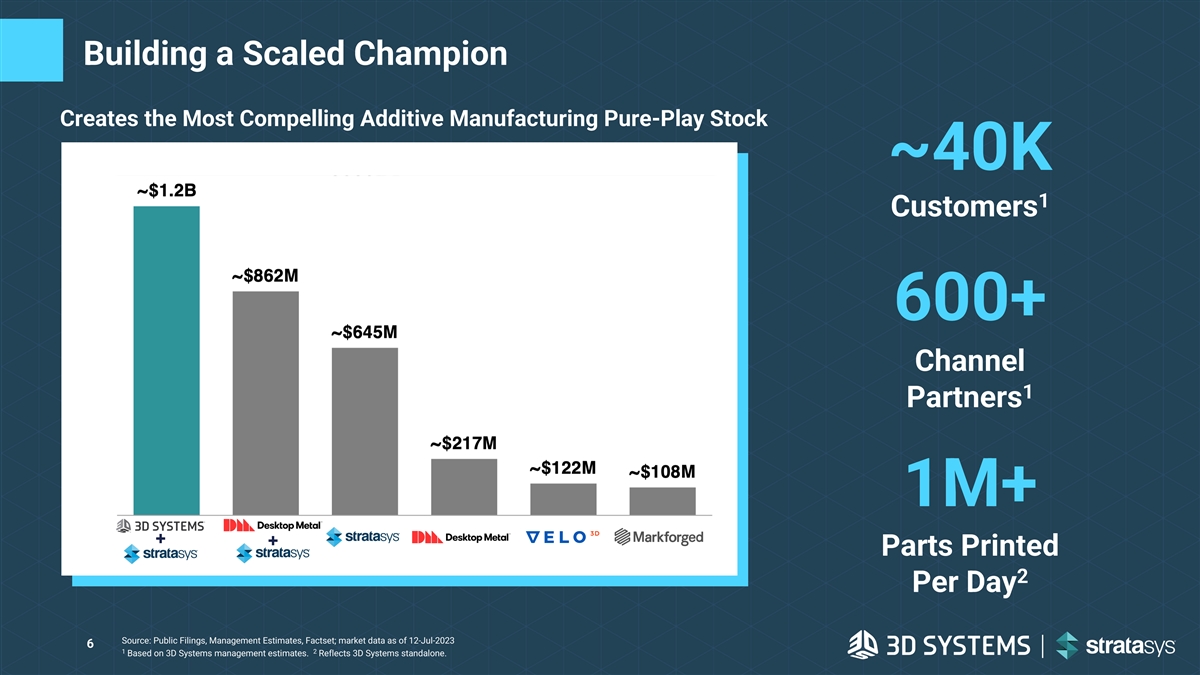

Building a Scaled Champion Creates the Most Compelling Additive Manufacturing Pure-Play Stock ~40K 2023E Revenue 1 Customers 600+ Channel 1 Partners 1M+ Parts Printed 2 Per Day Source: Public Filings, Management Estimates, Factset; market data as of 12-Jul-2023 6 1 2 Based on 3D Systems management estimates. Reflects 3D Systems standalone.

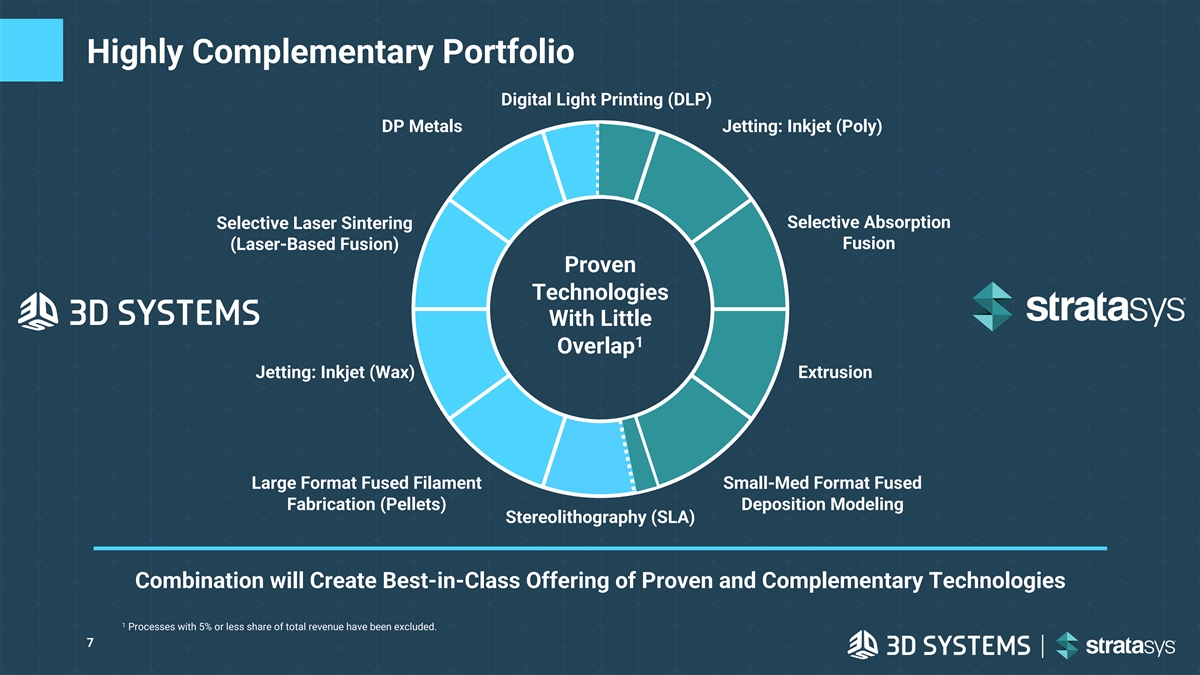

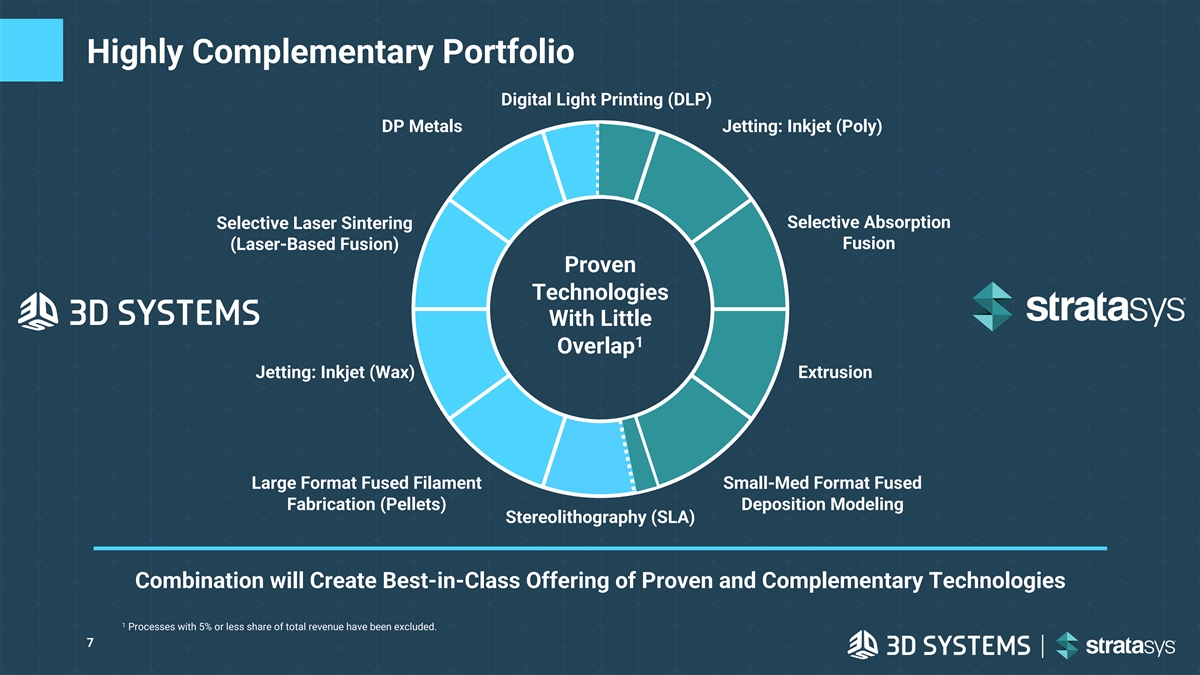

Highly Complementary Portfolio Digital Light Printing (DLP) DP Metals Jetting: Inkjet (Poly) Selective Laser Sintering Selective Absorption Fusion (Laser-Based Fusion) Proven Technologies With Little 1 Overlap Jetting: Inkjet (Wax) Extrusion SSYS Large Format Fused Filament Small-Med Format Fused Fabrication (Pellets) Deposition Modeling Stereolithography (SLA) Combination will Create Best-in-Class Offering of Proven and Complementary Technologies 1 Processes with 5% or less share of total revenue have been excluded. 7

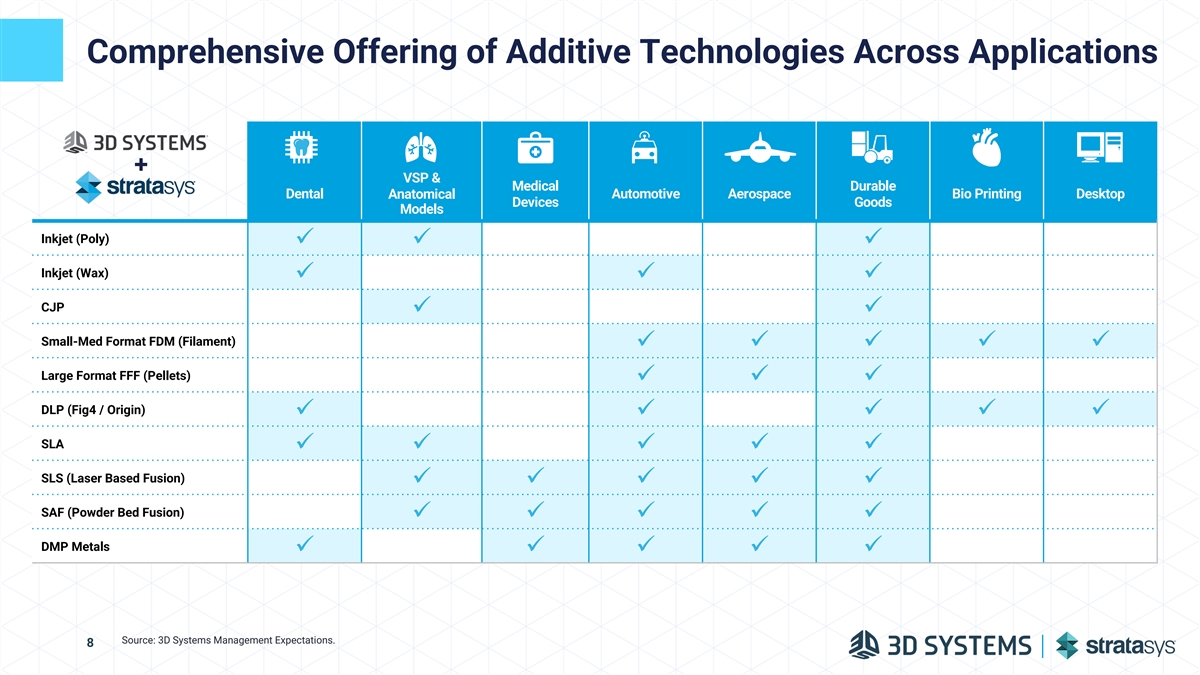

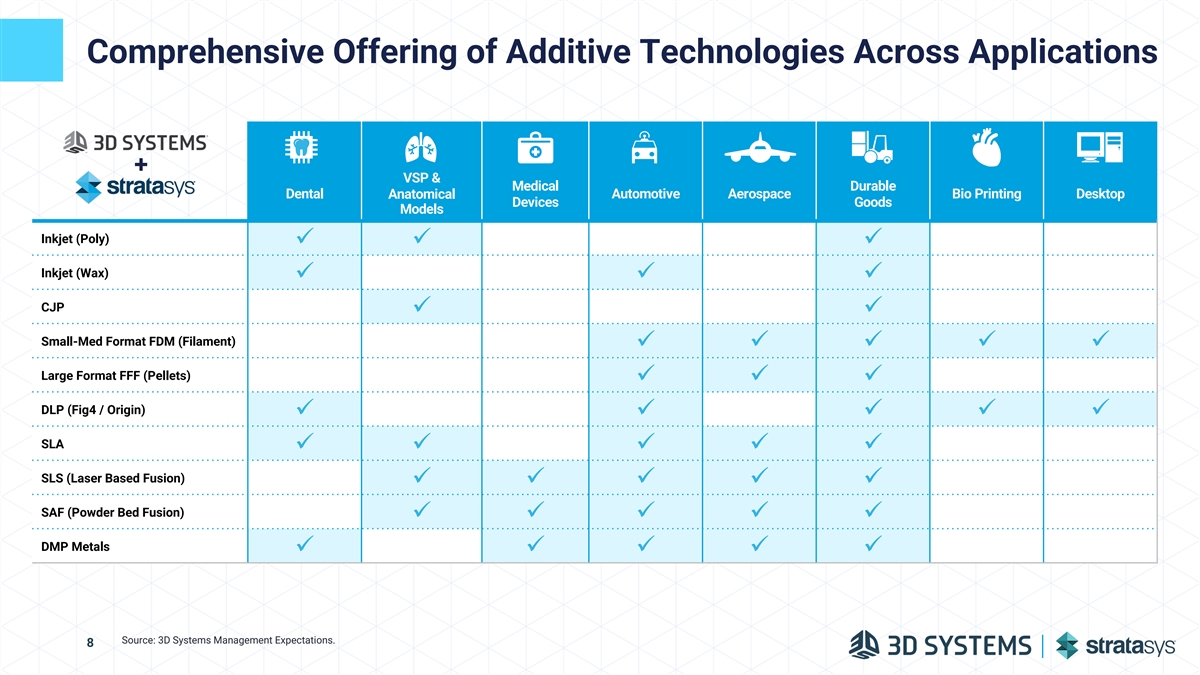

Comprehensive Offering of Additive Technologies Across Applications VSP & Medical Durable Dental Anatomical Automotive Aerospace Bio Printing Desktop Devices Goods Models Inkjet (Poly) ü ü ü Inkjet (Wax) ü ü ü CJP ü ü Small-Med Format FDM (Filament) ü ü ü ü ü Large Format FFF (Pellets) ü ü ü DLP (Fig4 / Origin) ü ü ü ü ü SLA ü ü ü ü ü SLS (Laser Based Fusion) ü ü ü ü ü SAF (Powder Bed Fusion) ü ü ü ü ü DMP Metals ü ü ü ü ü Source: 3D Systems Management Expectations. 8

Significant Near-Term Cost Synergies Jointly Identified and Agreed Upon by 3D and Stratasys Teams Breakdown of Expected Synergies SG&A Savings • Supply chain efficiencies COGS • Eliminate overlapping functions Synergies • Effective global services support identified during SG&A $100mm+ R&D Integration of cost synergies 1-day in-person • Optimizing development opportunities without loss of technological expertise meeting between • Design-for-cost initiatives and 3D Systems and R&D complementary development opportunities Stratasys • Ability to leverage combined portfolio of management R&D investments Synergies Expected • Harmonizing parallel investments in teams in to be Fully Realized in software platforms Sep-2022 18 Months Post Close, with COGS Optimization ~60% Realized in Year One • Optimized supply chain • Footprint rationalization + Potentially Meaningful Revenue Upside 9

Best-in-Class Combined Financial Profile ~$1.2bn ~$885mm 1 1 Combined 2023E Revenue Combined 2023E Revenue (More than $1bn in Revenue TODAY, NOT by 2026) ~$145mm ~$55mm 2 3 Combined 2023E EBITDA Combined 2023E EBITDA Assuming run rate cost synergies Assuming run rate cost synergies ~12% ~6% 2 3 Combined 2023E EBITDA Margin Combined 2023E EBITDA Margin Assuming run rate cost synergies Assuming run rate cost synergies 1 2 3 Sources: Company Filings. Note: Based on midpoint of CY2023E guidance. Based on midpoint of CY2023E EBITDA guidance and $100mm run-rate cost synergies. Based on midpoint of CY2023E EBITDA guidance and $50mm of run-rate cost synergies as stated in investor presentation published 20-Jun-2023. 10

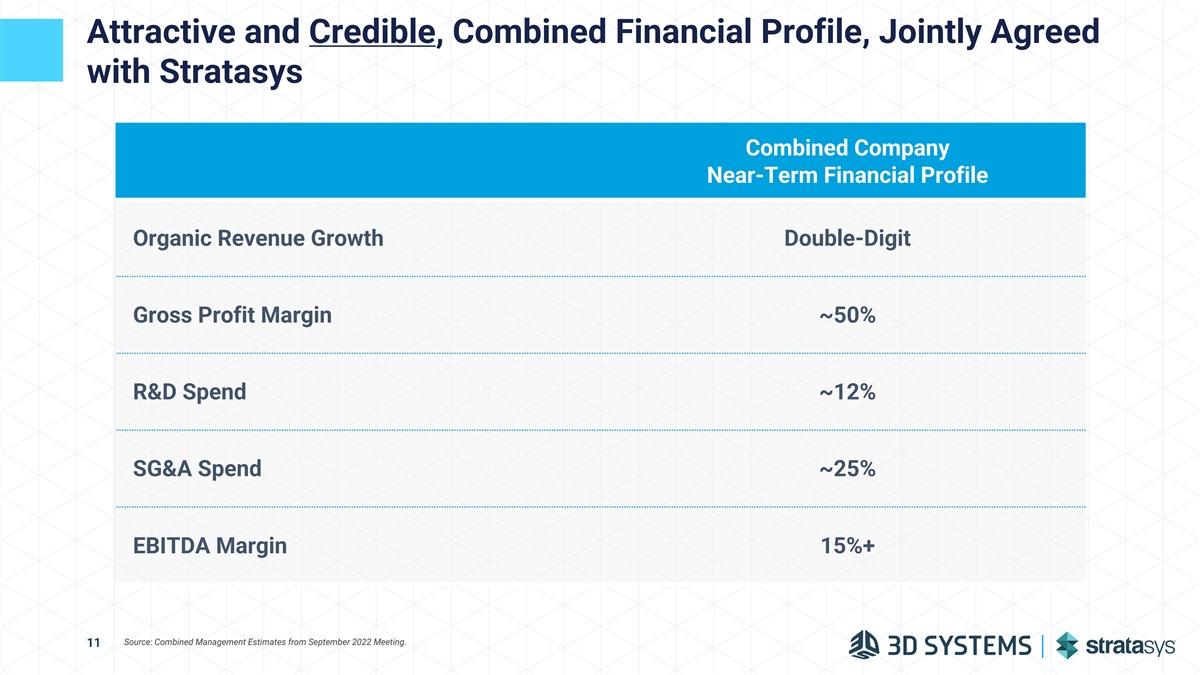

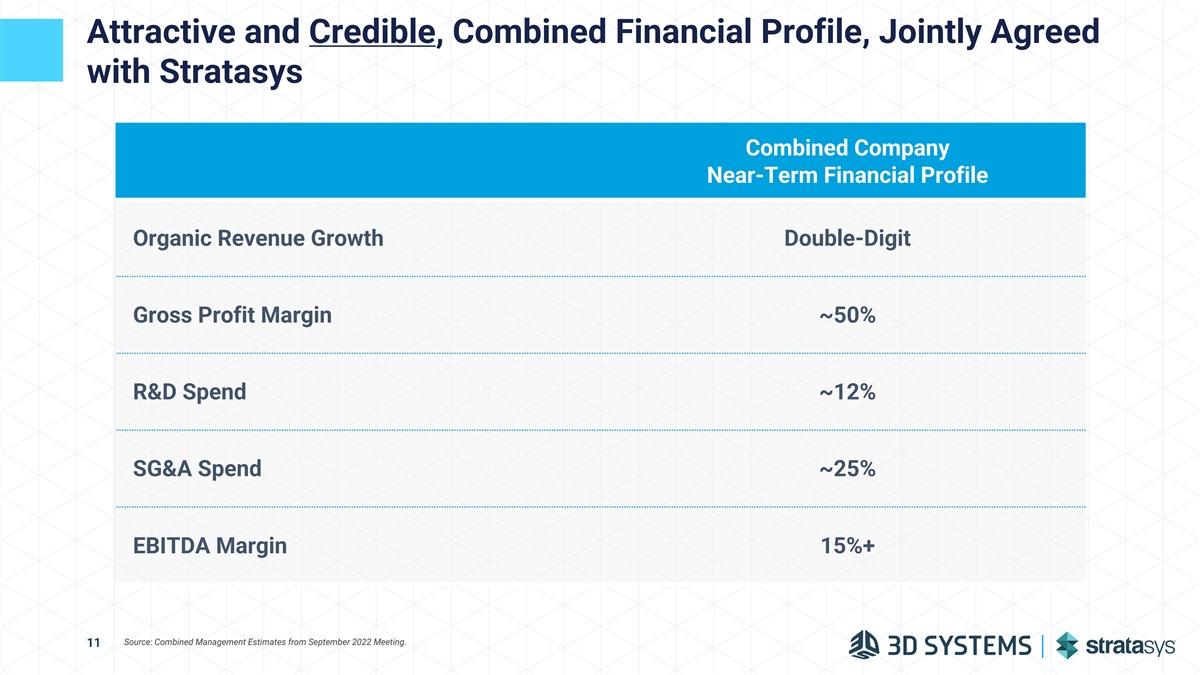

Attractive and Credible, Combined Financial Profile, Jointly Agreed with Stratasys Combined Company Near-Term Financial Profile Organic Revenue Growth Double-Digit Gross Profit Margin ~50% R&D Spend ~12% SG&A Spend ~25% EBITDA Margin 15%+ Source: Combined Management Estimates from September 2022 Meeting. 11

Clearly Superior Proposal 12

Setting the Record Straight + $ 1.5B $ 3.2B $(0.6) $2.3 $ 1.3B $ 2.0B $0.7 $1.0 Illustrative 15x $ 0.5 Capitalization 8 (Cash 41% Multiple on Consideration) $0.6 $100mm Illustrative 15x $ 1.1B Synergies Capitalization ~44% Multiple on Stratasys Ownership $50mm $ 1.4 $1.4 $1.4 in Synergies $1.1 (Stock Combined (Stock Consideration) Entity Consideration) 8 59% Stratas ys 3D Systems Illus tra tive Value Reduction in Combined Va lue Crea tion Stratasys Des ktop Meta l Net Cos t Combined Va lue Cre a tion to 1, 2 1,3 4 2, 5 5, 6 7 Equity Value Equity Value of Cost Combined Cas h Equity Value to Stratas ys Equity Equity Synergies Equity Va lue Stratasys Synergies Shareholders Shareholders (Capitalized) 1 1 Value Per Stratasys Share : Value Per Stratasys Share : ~$28 ~$19 1 Source: Stratasys proxy and investor presentation as of 20-Jun-2023, equity research, 3D Systems Management; market data as of 12-Jul-2023. Note: Excludes potential value of NOLs of the combined company. | 2 3 Equity values calculated based on 60-day VWAPs for Stratasys and 3D Systems as of 24-May-2023. | Assumes Stratasys fully diluted shares outstanding of 71.1mm, per the Stratasys proxy as of 20-Jun-2023. | 4 5 Assumes 3D Systems fully diluted shares outstanding of 139.8mm. | Including cash consideration paid to Stratasys shareholders, Desktop Metal termination fee, and illustrative transaction costs. | Equity values 6 for Desktop Metal and Stratasys are calculated based on closing price as of 24-May-2023 as per Stratasys investor presentation as of 20-Jun-2023. | Assumes Desktop Metal fully diluted shares outstanding of 13 7 8 348.0mm, per the Stratasys proxy as of 20-Jun-2023. | Based on $50mm cost synergies capitalized at 15.0x, net of integration costs and transaction fees of $20mm and $50mm, respectively. | Based on pro forma ownership in Stratasys proxy as of 20-Jun-2023.

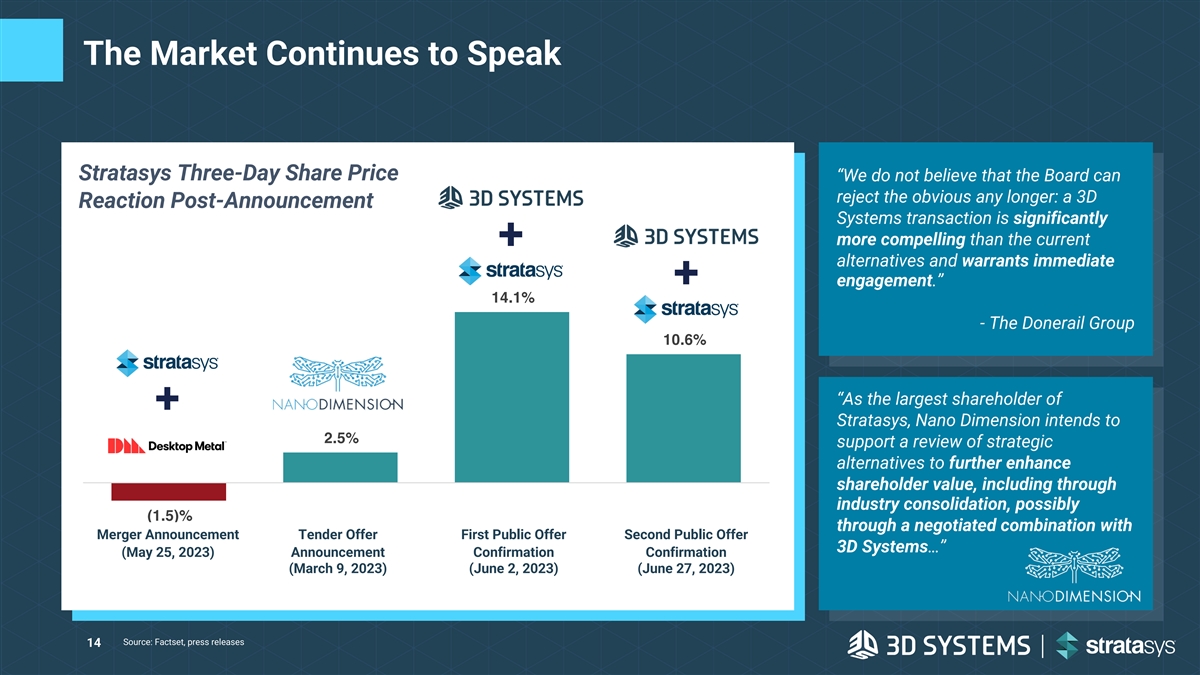

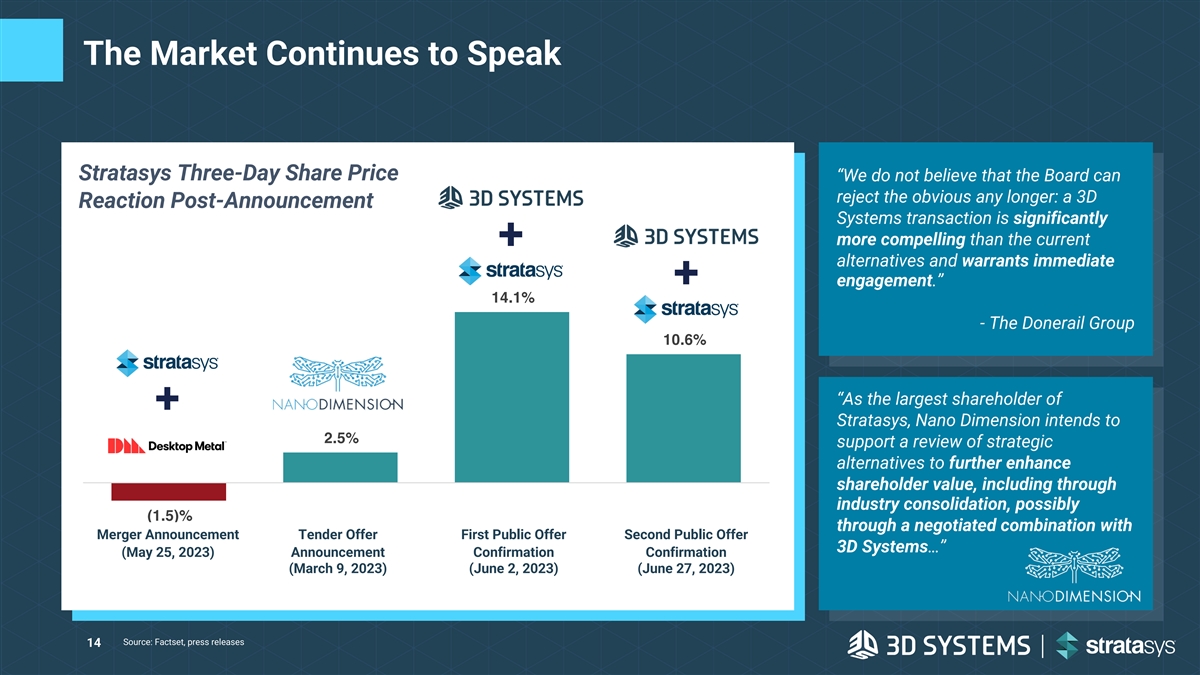

The Market Continues to Speak Stratasys Three-Day Share Price “We do not believe that the Board can reject the obvious any longer: a 3D Reaction Post-Announcement Systems transaction is significantly more compelling than the current alternatives and warrants immediate engagement.” 14.1% - The Donerail Group 10.6% “As the largest shareholder of Stratasys, Nano Dimension intends to 2.5% support a review of strategic alternatives to further enhance shareholder value, including through industry consolidation, possibly (1.5)% through a negotiated combination with Merger Announcement Tender Offer First Public Offer Second Public Offer SSYS + DM Merger Announcement (25-May-23) Nano Tender Offer Announcement (09-Mar-23) 3D Systems Offer Announcement (02-Jun-23) 3D Systems Second Offer Announcement (27- 3D Systems…” Jun-23) (May 25, 2023) Announcement Confirmation Confirmation (March 9, 2023) (June 2, 2023) (June 27, 2023) Source: Factset, press releases 14

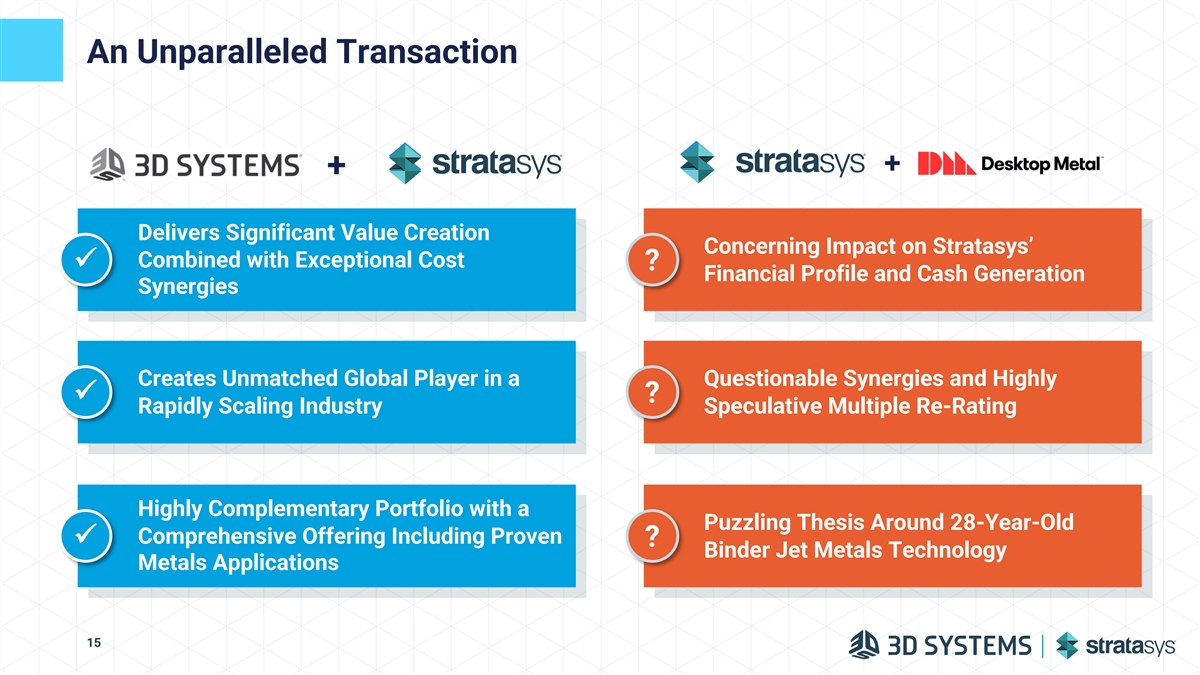

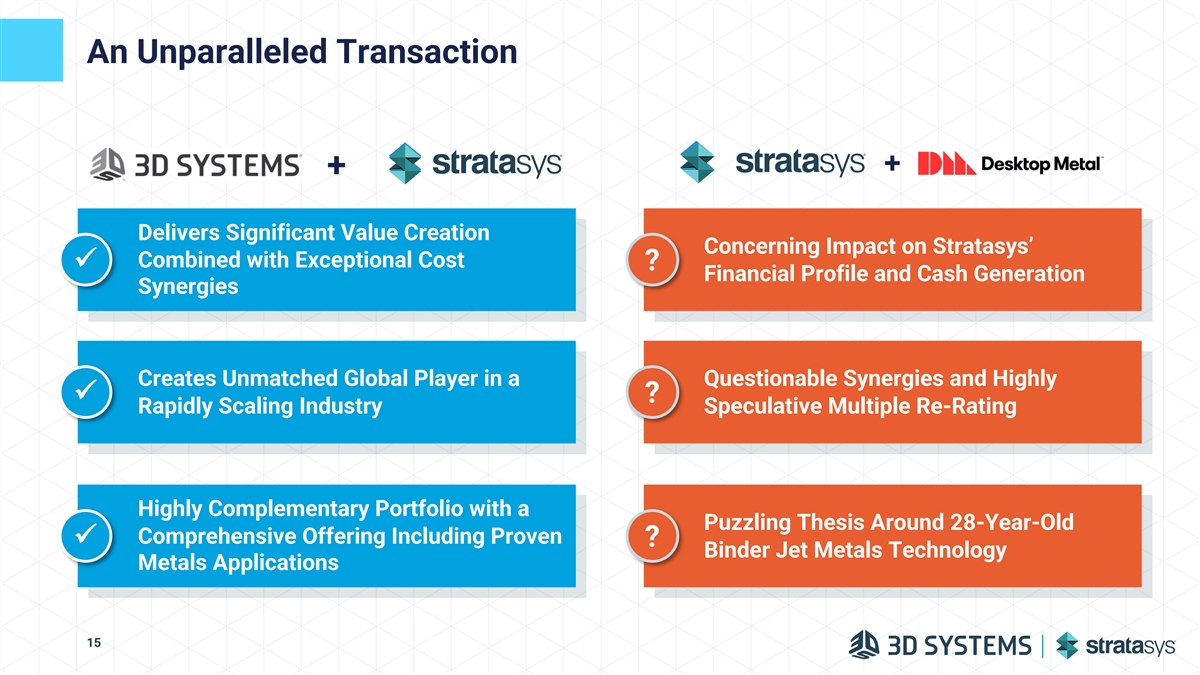

An Unparalleled Transaction + Delivers Significant Value Creation Concerning Impact on Stratasys’ Combined with Exceptional Cost ü ? Financial Profile and Cash Generation Synergies Creates Unmatched Global Player in a Questionable Synergies and Highly ü ? Rapidly Scaling Industry Speculative Multiple Re-Rating Highly Complementary Portfolio with a Puzzling Thesis Around 28-Year-Old Comprehensive Offering Including Proven ü ? Binder Jet Metals Technology Metals Applications 15

Appendix 16

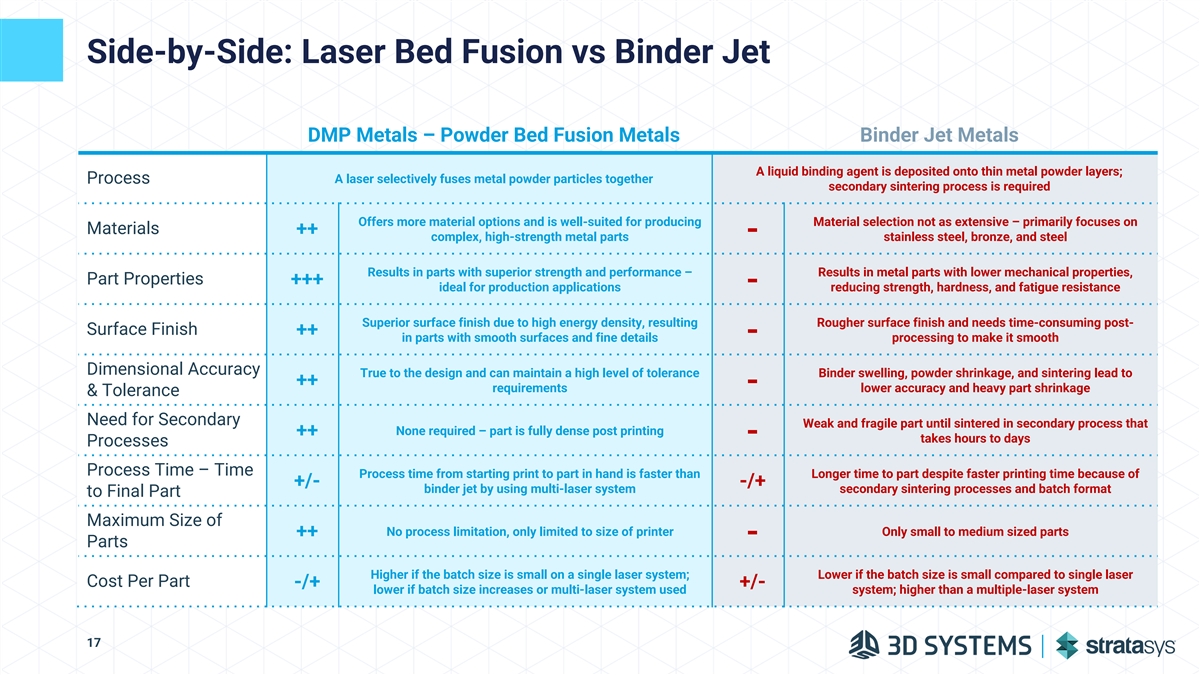

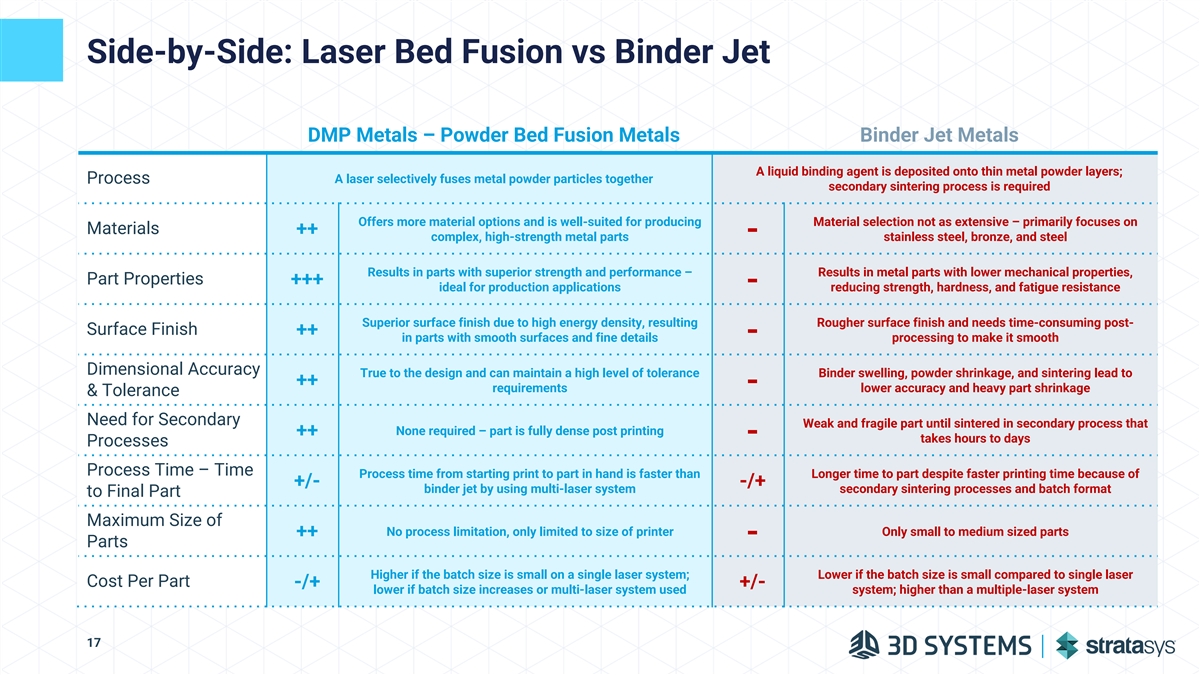

Side-by-Side: Laser Bed Fusion vs Binder Jet DMP Metals – Powder Bed Fusion Metals Binder Jet Metals A liquid binding agent is deposited onto thin metal powder layers; Process A laser selectively fuses metal powder particles together secondary sintering process is required Offers more material options and is well-suited for producing Material selection not as extensive – primarily focuses on Materials ++ - complex, high-strength metal parts stainless steel, bronze, and steel Results in parts with superior strength and performance – Results in metal parts with lower mechanical properties, Part Properties +++ ideal for production applications - reducing strength, hardness, and fatigue resistance Superior surface finish due to high energy density, resulting Rougher surface finish and needs time-consuming post- Surface Finish ++ - in parts with smooth surfaces and fine details processing to make it smooth Dimensional Accuracy True to the design and can maintain a high level of tolerance Binder swelling, powder shrinkage, and sintering lead to ++ - requirements lower accuracy and heavy part shrinkage & Tolerance Need for Secondary Weak and fragile part until sintered in secondary process that None required – part is fully dense post printing ++ - takes hours to days Processes Process Time – Time Process time from starting print to part in hand is faster than Longer time to part despite faster printing time because of +/- -/+ binder jet by using multi-laser system secondary sintering processes and batch format to Final Part Maximum Size of No process limitation, only limited to size of printer Only small to medium sized parts ++ - Parts Higher if the batch size is small on a single laser system; Lower if the batch size is small compared to single laser Cost Per Part -/+ +/- lower if batch size increases or multi-laser system used system; higher than a multiple-laser system 17

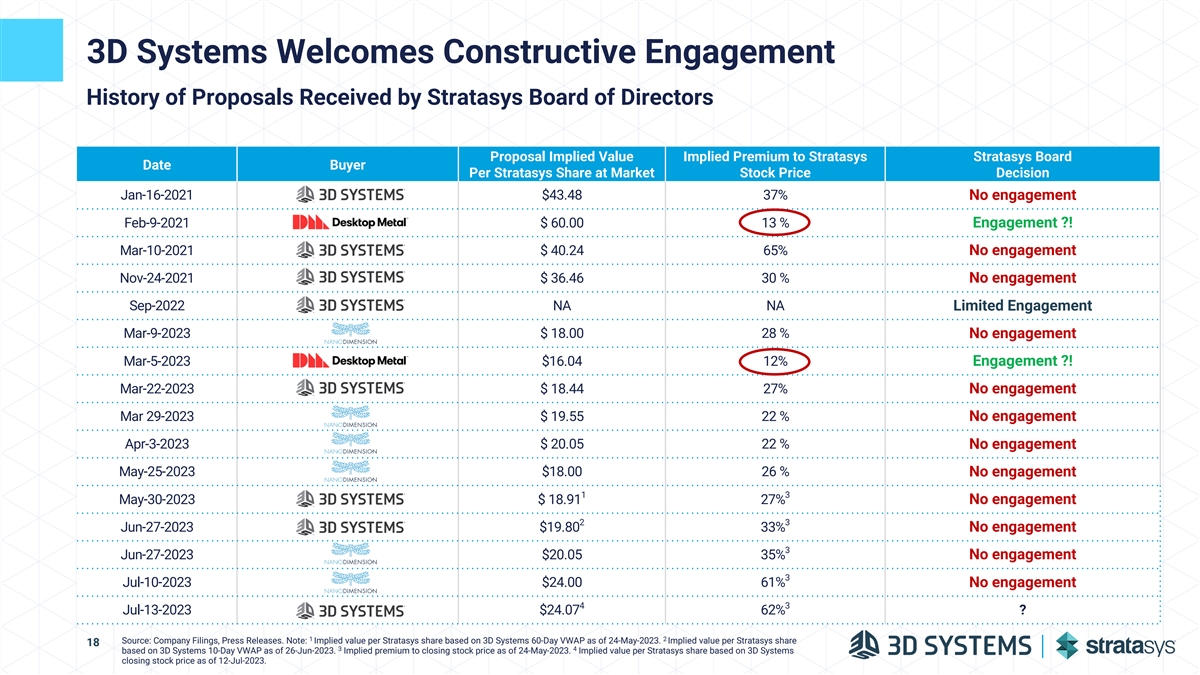

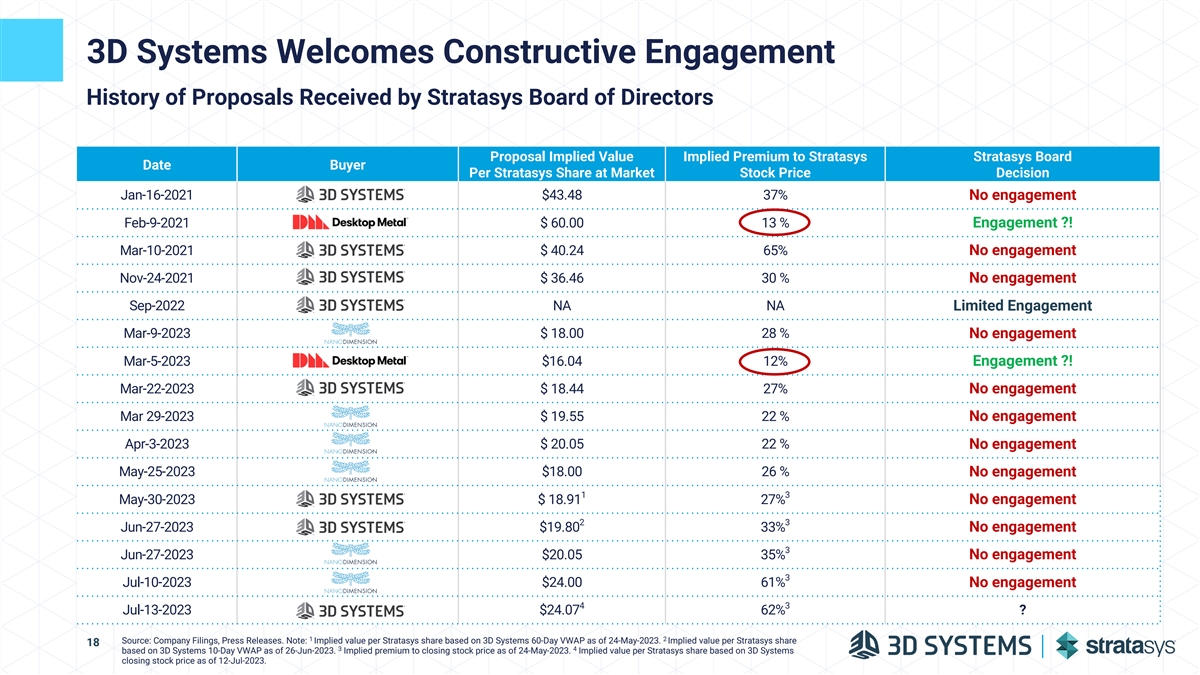

3D Systems Welcomes Constructive Engagement History of Proposals Received by Stratasys Board of Directors Proposal Implied Value Implied Premium to Stratasys Stratasys Board Date Buyer Per Stratasys Share at Market Stock Price Decision Jan-16-2021 $43.48 37% No engagement Feb-9-2021 $ 60.00 13 % Engagement ?! Mar-10-2021 $ 40.24 65% No engagement Nov-24-2021 $ 36.46 30 % No engagement Sep-2022 NA NA Limited Engagement Mar-9-2023 $ 18.00 28 % No engagement Mar-5-2023 $16.04 12% Engagement ?! Mar-22-2023 $ 18.44 27% No engagement Mar 29-2023 $ 19.55 22 % No engagement Apr-3-2023 $ 20.05 22 % No engagement May-25-2023 $18.00 26 % No engagement 1 3 May-30-2023 $ 18.91 27% No engagement 2 3 Jun-27-2023 $19.80 33% No engagement 3 Jun-27-2023 $20.05 35% No engagement 3 Jul-10-2023 $24.00 61% No engagement 4 3 Jul-13-2023 $24.07 62% ? 1 2 Source: Company Filings, Press Releases. Note: Implied value per Stratasys share based on 3D Systems 60-Day VWAP as of 24-May-2023. Implied value per Stratasys share 18 3 4 based on 3D Systems 10-Day VWAP as of 26-Jun-2023. Implied premium to closing stock price as of 24-May-2023. Implied value per Stratasys share based on 3D Systems closing stock price as of 12-Jul-2023.

Well-Positioned to Obtain Regulatory Clearances 3D Systems is confident that all applicable regulatory clearances for the proposed combination will be obtained and has requested Stratasys permit its regulatory advisors to meet with 3D’s advisors to confirm this conclusion Combined R&D Additive Industry is Capability Will Bring Manufacturing is a Experiencing Better Solutions to Dynamic Space with Accelerated 1 2 3 Consumers Intense Competition Innovation • Combines R&D teams, enhancing • Commoditization of desktop • Additive manufacturing continues innovation and bringing new segment to gain acceptance in new, solutions to customers groundbreaking use cases and • Intensification of competition manufacturers move to support • Leverages complementary skill across printing process and them sets across hardware, software, materials by both smaller players consumables, and services to and larger firms such as EOS, HP, • $2.8bn of global venture capital bring new products to market more Carbon, and GE investment into Additive quickly Manufacturing startups in 2022, up • Multitude of competitors and new 14% YoY • Creates scale to support greater entrants, including emerging number of customers, increasing Chinese players, creates a highly incentive to invest fragmented industry 19