Table of Contents

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

Table of Contents

333 Three D Systems Circle

Rock Hill, South Carolina 29730

August 13, 2024

Dear Fellow Stockholder:

We are pleased to invite you to 3D Systems Corporation’s 2024 Annual Meeting of Stockholders.

At 3D Systems, our corporate purpose is to deliver leading additive manufacturing solutions for Industrial and Healthcare applications. Over the course of the last four years, we executed an aggressive four-phase plan to reorganize, restructure, divest non-core assets, and invest organically and through acquisition for accelerated growth. This plan included reorganizing into two business units, Healthcare Solutions and Industrial Solutions, restructuring to gain efficiencies, and divesting non-core assets and businesses focused outside additive manufacturing. Our two key verticals span a range of industries. Healthcare Solutions includes dental, medical devices, personalized health services, and regenerative medicine. Industrial Solutions includes aerospace, defense, transportation, and general manufacturing.

After completion of our initial transformation activities, we prioritized our focus on driving innovation, performance, and reliability and empowering our customers to create products and models never before possible. We provide full-service solutions, powered by the experience of our application engineers who collaborate with customers to transform how they deliver their products and services.

During 2023, we announced three phases of restructuring activities to rationalize our cost structure and to better position us for long-term profitable growth. Execution on these activities continues in 2024.

Our 2024 stockholders meeting will be held virtually on August 30, 2024, at 2:30 PM Eastern Time, to accommodate our stockholders around the world who will be able to listen, vote and submit questions from their homes or any remote location with internet connectivity.

We encourage you to participate in the Annual Meeting so that we can review the past year with you, listen to your suggestions, and answer any questions that you may have. Whether or not you plan to participate in the Annual Meeting, please vote your shares as soon as possible so that your vote will be counted.

Thank you for your continued support of 3D Systems.

Sincerely,

Dr. Jeffrey A. Graves

President and Chief Executive Officer

Table of Contents

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS OF

3D SYSTEMS CORPORATION

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of 3D Systems Corporation, a Delaware corporation (the “Company,” “3D Systems,” “we,” and “us”), will be held:

| When: | Where: | Why: | ||

Friday, August 30, 2024, at 2:30 p.m., Eastern Time. | The Annual Meeting will be held via live webcast at www.proxydocs.com/DDD. To participate, you will need the control number provided on your proxy card or voting instruction form. | Stockholders are being asked to vote on the four agenda items described below and to consider any other business properly brought before the Annual Meeting and any adjournment or postponement of the Annual Meeting. | ||

Items of Business

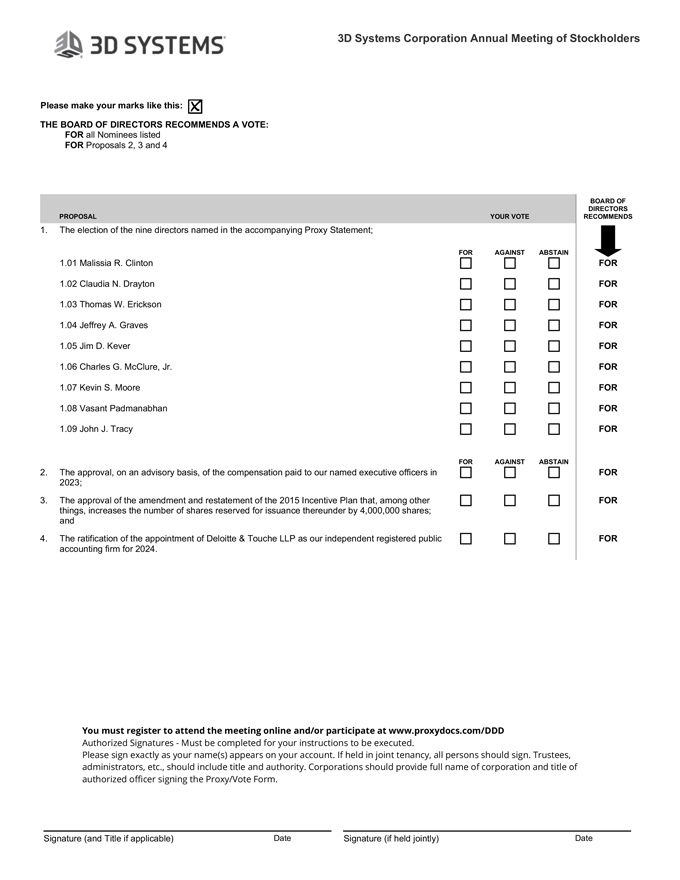

| 1. | The election of the nine directors named in the accompanying Proxy Statement; |

| 2. | The approval, on an advisory basis, of the compensation paid to our named executive officers in 2023; |

| 3. | The approval of the amendment and restatement of the 2015 Incentive Plan that, among other things, increases the number of shares reserved for issuance thereunder by 4,000,000 shares; and |

| 4. | The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024. |

Stockholders of record at the close of business on July 2, 2024, are entitled to notice of, to attend, and to vote at the Annual Meeting. On or about August 13, 2024, this Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”), and proxy card are being mailed to stockholders.

We encourage you to vote on the proposals to be considered at the Annual Meeting electronically at www.proxydocs.com/DDD. You may also vote by telephone or by mailing your completed and signed proxy card or voting instruction form as set forth on your proxy card or any voting instruction form provided to you.

Regardless of whether you plan to participate in the Annual Meeting, we encourage you to vote your shares electronically on the internet, by telephone, or by proxy card. Please vote today to ensure that your votes are counted.

If you participate in the Annual Meeting, you will be able to vote your shares electronically during the Annual Meeting if you so desire, even if you previously voted. See page 71 of this Proxy Statement for additional details on how to participate in the Annual Meeting.

By Order of the Board of Directors

Andrew W.B. Wright

Secretary

Rock Hill, South Carolina

August 13, 2024

|

Attend Online

The Annual Meeting will be held via live webcast at www.proxydocs.com/DDD. To participate, you will need the control number provided on your proxy card or voting instruction form.

|

Important Information Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

This Proxy Statement and the 2023 Annual Report are available at www.proxydocs.com/DDD

|

Table of Contents

TABLE OF CONTENTS

| 2024 PROXY STATEMENT |

Table of Contents

BOARD OF DIRECTORS

Proposal 1: Election of Directors

NOMINATION AND ELECTION OF DIRECTORS

Each of our nine director nominees is a current 3D Systems director, and, if elected, each of the director nominees will serve for a one-year term expiring at the Annual Meeting to be held in 2025. Current director Mr. William E. Curran is not standing for re-election at the Annual Meeting based on the mandatory retirement age under our Corporate Governance Guidelines. As a result, the Board will be reduced to nine members immediately prior to the Annual Meeting. Proxies cannot be voted for a greater number of individuals than the number of nominees.

Our Amended and Restated By-Laws (“By-Laws”) provide that a director nominee is elected only if he or she receives a majority of the votes cast with respect to his or her election in an uncontested election (that is, the number of votes cast “for” that nominee exceeds the number of votes cast “against” that nominee). Stockholders can vote to “abstain,” but that vote will not have an effect in determining the election results. For more information, see “Frequently Asked Questions” on page 71. If a nominee who currently serves as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director” until the director’s successor is elected and qualified or until the director’s earlier resignation or removal. However, under our Corporate Governance Guidelines, each director must submit an advance, contingent, and irrevocable resignation that the Board may accept if stockholders do not re-elect that director. In that situation, our Corporate Governance and Sustainability Committee would make a recommendation to the Board about whether to accept or reject the resignation or whether to take other action instead. Within 90 days from the date of the certified election results, the Board would act on the Corporate Governance and Sustainability Committee’s recommendation and publicly disclose its decision and the rationale behind it.

If any nominee becomes unavailable for any reason or if a vacancy should occur before the election, the holders of proxies may vote the shares represented by such duly executed proxies in favor of such other person as they may determine. Alternatively, in lieu of designating a substitute, the Board may reduce the number of directors.

| The Board of Directors unanimously recommends that you vote FOR each of the nominees listed below. |

| 2024 PROXY STATEMENT | 1 |

Table of Contents

BOARD OF DIRECTORS

Malissia R. Clinton

Age: 55

Director Since: 2019

Board Committees:

• Compensation • Compliance • Corporate Governance and Sustainability | Position, Principal Occupation and Professional Experience: Ms. Clinton has served as Executive Vice President and General Counsel of Meritage Homes Corporation, the fifth-largest public homebuilder in the United States, since April 2022 and previously served as Senior Vice President, General Counsel and Secretary at The Aerospace Corporation, a nonprofit corporation that provides technical guidance and advice on all aspects of space missions, from 2009 through March 2022. She worked at Northrop Grumman from 2002 to 2009, including as Senior Counsel for Special Projects beginning in 2007. Prior to joining Northrop Grumman, Ms. Clinton worked at TRW Space Technology, a division of TRW, Inc., as Counsel in its Telecommunication Programs and Avionic Systems division. She began her career as an Associate at Tuttle & Taylor.

Director Qualifications: The Corporate Governance and Sustainability Committee believes that Ms. Clinton’s strong experience in compliance matters and aerospace, a key vertical for the Company, provide clear support for her nomination for election to the Board.

| |||

Other Current Public Directorships: None.

| Prior Public Company Directorships (within the last five years): Progyny, Inc. | |||

Other Directorships: Arizona State University Foundation and Pacaso.

| ||||

Claudia N. Drayton

Age: 56

Director Since: 2021

Board Committees:

• Audit • Corporate Governance and Sustainability | Position, Principal Occupation and Professional Experience: Ms. Drayton served as the Chief Financial Officer of Quantum-Si, a life sciences tools company commercializing a unique protein sequencing platform, from April 2021 to June 2023. Previously, she served as Chief Financial Officer at CHF Solutions (now Nuwellis, Inc.), an early-stage medical device company, from January 2015 to April 2021. Prior to joining CHF Solutions, Ms. Drayton spent 15 years with Medtronic plc. Before joining Medtronic, Ms. Drayton was an audit and business advisory manager at Arthur Andersen LLP.

Director Qualifications: The Corporate Governance and Sustainability Committee believes that Ms. Drayton’s extensive experience in key areas of healthcare and biotechnology as well as financial leadership in both public accounting and biotech companies provide clear support for her nomination for election to the Board.

| |||

Other Current Public Directorships: Brookdale Senior Living Inc.

| Prior Public Company Directorships (within the last five years): None. | |||

| 2 |  | 2024 PROXY STATEMENT |

Table of Contents

BOARD OF DIRECTORS

Thomas W. Erickson

Age: 73

Director Since: 2015

Board Committees:

• Compensation • Corporate Governance and Sustainability | Position, Principal Occupation and Professional Experience: Mr. Erickson has been President and Chief Executive Officer of ECG Ventures, Inc., an investment firm, since 1988 and Chair of the Board of Dermatologists of Central States, LLC (DOCS) since 2022. Mr. Erickson has previously served as Chair and Interim President and Chief Executive Officer of National Medical Health Card Systems, Inc.; Chair of the Board of PathWays, Inc.; Chair of the Board of TransHealthcare, Inc.; Chair and Interim Chief Executive Officer of LifeCare Holdings, Inc.; Interim President and Chief Executive Officer of Luminex Corporation; Chair of the Board of Inmar, Inc.; Chair of the Board and Interim President and Chief Executive Officer of Western Dental Services, Inc.; and Interim President and Chief Executive Officer of Omega Healthcare Investors, Inc. Mr. Erickson was also co-founder, President and Chief Executive Officer of CareSelect Group, Inc.

Director Qualifications: The Corporate Governance and Sustainability Committee believes that Mr. Erickson’s extensive executive management and operational experience, particularly in the healthcare industry, provide clear support for his nomination for election to the Board.

| |||

Other Current Public Directorships: None.

Prior Public Company Directorships (within the last five years): American Renal Associates Holdings, Inc. and Luminex Corporation. | Other Directorships, Trusteeships and Memberships: Dermatologists of Central States, LLC, MGA Home Care, LLC, MW Industries, LP and Pearl Street Dental Management, LLC. | |||

Jeffrey A. Graves

Age: 63

Director Since: 2020 | Position, Principal Occupation and Professional Experience: Dr. Graves has served as the Company’s President and Chief Executive Officer since May 2020. From 2012 to May 2020, he was CEO, President and Director of MTS Systems Corporation, a global supplier of test, simulation, and measurement systems. From 2005 until 2012, he served as President and CEO of C&D Technologies, Inc. Dr. Graves also held leadership roles with Kemet Corporation as Chief Operating Officer from 2001 to 2003 and CEO from 2003 to 2005. Previously he held several leadership and technical roles with GE, Rockwell, and Howmet Corporation.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Dr. Graves’s extensive executive management, corporate strategy and international operational experience provides clear support for his nomination for election to the Board. Additionally, Dr. Graves has significant knowledge of the Company and the competitive environment in which it operates.

| |||

Other Current Public Directorships: Integra Lifesciences Holdings Corporation.

| Prior Public Company Directorships (within the last five years): Hexcel Corporation, FARO Technologies and MTS Systems Corporation. | |||

| 2024 PROXY STATEMENT | 3 |

Table of Contents

BOARD OF DIRECTORS

Jim D. Kever

Age: 71

Director Since: 1996

Board Committees:

• Compensation • Corporate Governance and Sustainability | Position, Principal Occupation and Professional Experience: Mr. Kever has been a Principal in Voyent Partners, LLC, a venture capital firm, since 2001. He previously served as President and Co-Chief Executive Officer of the Transaction Services Division of WebMD Corporation (formerly Envoy Corporation) from 1995 to 2001. Prior to 1995 he served as Envoy Corporation’s Executive Vice President, Secretary and General Counsel.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Mr. Kever’s wide experience in operations, finance and executive management provides clear support for his nomination for election to the Board.

| |||

Other Current Public Directorships: None.

| Prior Public Company Directorships (within the last five years): Luminex Corporation. | |||

Charles G. McClure, Jr.

Age: 70

Director Since: 2017

Chair Since: 2018

Board Committees:

• Compliance | Position, Principal Occupation and Professional Experience: Mr. McClure has served as a Managing Partner of Michigan Capital Advisors, a private investment firm, since 2014 and has more than 35 years of experience in the transportation industry. Prior to founding Michigan Capital Advisors, Mr. McClure served as Chair of the Board, Chief Executive Officer and President of Meritor, Inc. from 2004 through 2013. From 2002 through 2004, Mr. McClure served as Chief Executive Officer, President and a member of the Board of Federal Mogul Corp. Mr. McClure joined Federal Mogul in 2001 as president, Chief Operating Officer and a member of the Board. Before joining Federal Mogul, Mr. McClure served as President, Chief Executive Officer and a member of the Board of Detroit Diesel. He joined Detroit Diesel in 1997 after 14 years in a variety of management positions with Johnson Controls.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Mr. McClure’s broad experience in operations and executive management and significant expertise in the automotive industry, a key vertical for the Company, provide clear support for his nomination for election to the Board.

| |||

Other Current Public Directorships: DTE Energy Company and Crane Corporation.

Prior Public Company Directorships | Other Directorships, Trusteeships and Memberships: Henry Ford Health Systems, Invest Detroit, Penske Corp and Detroit Regional Partnership. | |||

Kevin S. Moore

Age: 69

Director Since: 1999

Board Committees:

• Audit • Compensation | Position, Principal Occupation and Professional Experience: Mr. Moore has been with The Clark Estates, Inc., a private investment firm and a major company stockholder, for more than 30 years, where he is currently Vice Chairman.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Mr. Moore’s wide experience in operations, finance and executive management, and as the president of a major stockholder, brings perspective on strategy and growth for the benefit of our stockholders and provides clear support for his nomination for election to our Board. | |||

Other Current Public Directorships: None.

Prior Public Company Directorships (within the last five years): None.

|

Other Directorships, Trusteeships and Memberships: Aspect Holdings, LLC, The Clark Foundation, The National Baseball Hall of Fame & Museum, Inc., and Bassett Healthcare Network and Bassett Medical Center. | |||

| 4 |  | 2024 PROXY STATEMENT |

Table of Contents

BOARD OF DIRECTORS

Vasant Padmanabhan

Age: 58

Director Since: 2020

Board Committees:

• Compliance • Technology Applications | Position, Principal Occupation and Professional Experience: Dr. Padmanabhan has served as President, Global Ear, Nose & Throat Business Unit, President Global Research & Development and as a member of the Executive Committee for Smith+Nephew, a global medical devices business operating in the markets for advanced surgical devices, since August 2016. Prior to joining Smith+Nephew, Dr. Padmanabhan served as Senior Vice President for Thoratec Corporation from June 2014 until its acquisition by St. Jude Medical, Inc. in October 2015. Prior to joining Thoratec, Dr. Padmanabhan served in several roles of increasing responsibility for 18 years with Medtronic plc in their Cardiac Rhythm Management business, including as Vice President of Product Development for the Implantable Defibrillator Business and as Vice President of Connected Care R&D and Operations.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Dr. Padmanabhan’s specialized expertise in the healthcare industry, new product development and business development provides clear support for his nomination for election to the Board. | |||

Other Current Public Directorships: None.

Prior Public Company Directorships (within the last five years): None. |

Other Directorships, Trusteeships and Memberships: Trice Medical | |||

John J. Tracy

Age: 69

Director Since: 2017

Board Committees:

• Compliance • Technology Applications | Position, Principal Occupation and Professional Experience: Dr. Tracy retired from The Boeing Company in 2016 as its Chief Technology Officer and Senior Vice President, Engineering, Operations, and Technology with more than 37 years of aerospace-industry experience. Prior to that he served as Vice President, Engineering and Mission Assurance for Boeing Integrated Defense Systems and Vice President Structural Technologies, Prototyping and Quality of Phantom Works at The Boeing Company, after serving in roles of increasing responsibility at Hercules, McDonnell Douglas and The Boeing Company. Dr. Tracy is a member of the National Academy of Engineering.

Director Qualifications: The Corporate Governance and Sustainability Committee believes Dr. Tracy’s strong leadership experience and specialized expertise in aerospace engineering and manufacturing, structure and materials provide clear support for his nomination for election to the Board. | |||

Other Current Public Directorships: None.

|

Prior Public Company Directorships (within the last five years): None. | |||

| 2024 PROXY STATEMENT | 5 |

Table of Contents

CORPORATE GOVERNANCE AT 3D SYSTEMS

ROLE OF THE BOARD OF DIRECTORS

Our Board oversees the management of the Company’s business and affairs. Stockholders elect the members of the Board to act on their behalf and to oversee their interests. Unless reserved to the stockholders under applicable law or our By-Laws, all corporate authority resides in the Board as the representative of the stockholders. The Board selects and appoints executive officers to manage the day-to-day operations of the Company while retaining ultimate oversight responsibilities. Together, the Board and management share an ongoing commitment to the highest standards of corporate governance and ethics. The Board reviews all aspects of our governance policies and practices, including our Corporate Governance Guidelines and the Company’s Code Conduct and Code of Ethics, at least annually and makes changes as necessary. The Company’s Governance documents are available at “Availability of Information” on page 18.

CODE OF CONDUCT AND CODE OF ETHICS

Our Code of Conduct applies to all of our employees worldwide, including all of our officers. We separately maintain a Code of Ethics that applies to our CEO, CFO, principal accounting officer, and all other senior financial executives and to directors of the Company when acting in their capacity as directors.

These documents are designed to set high standards of business conduct and ethics for our activities and to help directors, officers, and employees resolve ethical issues. The purpose of our Code of Conduct and our Code of Ethics is to provide assurance to the greatest possible extent that our business is conducted in a consistently legal and ethical manner. Employees may submit concerns or complaints regarding ethical issues on a confidential basis by means of our 3D Systems Open Line, which includes a toll-free telephone number and website. Communications through the 3D Systems Open Line are monitored on a daily basis, and all messages are reported to the Chief Compliance Officer and the Chair of the Compliance Committee.

We intend to disclose amendments to, or waivers from, any provision of the Code of Ethics that applies to our CEO, CFO, or principal accounting officer, and persons performing similar functions and that relates to any element of the Code of Ethics described in Item 406(b) of Regulation S-K by posting such information on our website. There have been no such waivers since the date of the proxy statement for our 2023 Annual Meeting.

CORPORATE GOVERNANCE GUIDELINES

Our Board of Directors is committed to sound and effective corporate governance practices, to exercising its oversight responsibilities diligently with respect to our business and affairs consistent with the highest principles of business ethics, and to meeting the corporate governance requirements that apply to us. We believe that good corporate governance helps to ensure that the Company is managed for the long-term benefit of our stockholders. We regularly review and consider our corporate governance policies and practices, taking into account the Securities and Exchange Commission’s (the “SEC”) corporate governance rules and regulations, the corporate governance standards of the New York Stock Exchange (the “NYSE”), and stockholder feedback.

The Board has adopted Corporate Governance Guidelines that provide a framework for the governance of the Company as a whole and describe the principles and practices that the Board follows in carrying out its responsibilities. Our Corporate Governance Guidelines address, among other things:

| • | The structure, composition, functions, and policies of the Board and its committees; |

| • | Director qualification standards and nomination process; |

| • | Expectations and responsibilities of the directors; |

| • | Management succession planning; |

| • | Communications with stockholders and independent directors; and |

| • | Annual self-evaluations by the Board and its Committees. |

The Corporate Governance and Sustainability Committee is responsible for overseeing our Corporate Governance Guidelines, periodically assessing their adequacy, and modifying them to meet new circumstances. See “Availability of Information” on page 18 for instructions on how to view the Company’s Corporate Governance Guidelines.

| 6 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

BOARD LEADERSHIP

The Board has separated the position of its Chair from the position of CEO. Mr. McClure, an independent director, serves as Chair of the Board of Directors. Mr. McClure was appointed Chair in October 2018.

While we do not currently have a policy regarding whether the Chair and CEO roles must be combined or separated, the Board believes that the roles of the Chair and CEO should be separate as an aid in the Board’s oversight of management and to allow the CEO to focus primarily on management responsibilities.

The Board periodically reviews the appropriateness and effectiveness of its leadership structure. The Board believes that the current Board leadership structure allows Dr. Graves to focus on managing the daily operations of the Company in his role as CEO while permitting Mr. McClure to oversee the Board’s significant functions. The Board also believes that the current structure aids in the efficient conduct of Board meetings as the directors discuss key business and strategic matters and other critical issues. If any future change in the Board’s leadership structure occurs (which the Board does not currently expect to happen), the Board will take such actions with respect to its leadership structure as it then considers to be appropriate.

DIRECTOR INDEPENDENCE

Eight of the nine director nominees are “independent” directors. Under the corporate governance standards of the NYSE, at least a majority of our directors and all of the members of the Audit Committee, Compensation Committee, and Corporate Governance and Sustainability Committee must be “independent” directors. The corporate governance standards of the NYSE provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the Board must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company). The Board has affirmatively determined that director nominees Malissia R. Clinton, Claudia N. Drayton, Thomas W. Erickson, Jim D. Kever, Charles G. McClure, Jr., Kevin S. Moore, Vasant Padmanabhan, and John J. Tracy satisfy the bright-line criteria of the corporate governance standards of the NYSE and that they have no material relationships with us. In making its determination, the Board and the Corporate Governance and Sustainability Committee reviewed the following relationships:

| • | Dr. Graves, our Chief Executive Officer (“CEO”), is an executive officer of the Company and, as such, is not an independent director. |

| • | Dr. Padmanabhan is an executive officer of Smith+Nephew, a customer of the Company that purchased software and on-demand services in each of 2021, 2022, and 2023. The transactions had an aggregate value of less than $1 million in each year and were negotiated in arm’s length transactions under terms similar to those offered in other third-party transactions. Based on a review of the facts and circumstances of the transactions the Board determined (based on the recommendation of the Corporate Governance and Sustainability Committee) that Dr. Padmanabhan had no direct or indirect material interest in the transactions. |

| • | Mr. Erickson is a non-executive member of the board of directors of MW Industries, the parent company of a customer of the Company that purchased healthcare services from the Company in each of 2021, 2022, and 2023 in arm’s length transactions similar to those offered in other third-party transactions. Mr. Erickson is not responsible for the 3D Systems’ account, and, based on a review of the facts and circumstances of the transactions, the Board determined (based on the recommendation of the Corporate Governance and Sustainability Committee) that Mr. Erickson had no direct or indirect material interest in the transactions. The relevant MW Industries’ subsidiary was sold in December 2023. |

DIRECTOR QUALIFICATIONS

In nominating each of the director nominees, the Corporate Governance and Sustainability Committee and the Board considered, among other things, the Corporate Governance Guidelines, which were adopted in 2004 and most recently amended in February 2022, and the Qualifications for Nomination to the Board, which were adopted in 2004 and most recently reviewed in May 2022. Our corporate governance guidelines, practices, and policies are available on our website at investor.3dsystems.com/governance. These qualifications include, among other factors, a candidate’s ethical character, experience, and diversity of background, as well as whether the candidate is

| 2024 PROXY STATEMENT | 7 |

Table of Contents

CORPORATE GOVERNANCE

independent under applicable listing standards and financially literate. The Corporate Governance and Sustainability Committee and the Board also took into consideration the following factors relating to each director since the 2023 Annual Meeting:

| • | such director’s contributions to the Board; |

| • | any material change in such director’s employment or responsibilities with any other organization; |

| • | such director’s attendance at meetings of the Board and the Board committees on which such director serves and such director’s participation in the activities of the Board and such committees; |

| • | the absence of any relationships with the Company or another organization, or any other circumstances that have arisen, that might make it inappropriate for the director to continue serving on the Board; and |

| • | such director’s age and length of service on the Board. |

The Corporate Governance and Sustainability Committee and the Board considered each nominee’s overall business experience, contributions to Board activities during 2023, and independence in their evaluation of each nominee in conjunction with the factors discussed above but did not otherwise give greater weight to any of the factors cited compared with any of the others. While the Board considers self-identified diversity characteristics and diversity of experience in its nomination decisions, we do not maintain a diversity policy relating to the composition of the Board of Directors. The Board believes that each of the nominees for director is well qualified to continue to serve as a director of the Company and that the nominees provide the mix of experience that is required to enable the Board to perform its functions.

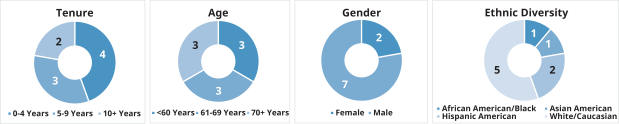

BOARD DIVERSITY AND REFRESHMENT

The Board is committed to building a Board with diverse experiences and backgrounds that has the right mix of skills, experience, and perspectives to support our future strategic direction. Our directors reflect diverse perspectives, including a complementary mix of skills, experience, and backgrounds that we believe are paramount to our ability to represent the interests of our stockholders. Our three most-recently elected independent directors each identify as gender or ethnically diverse.

SKILLS, QUALIFICATIONS AND DIVERSITY

The following matrix highlights the mix of key skills, qualities, attributes, and experiences of each director nominee and is intended to depict notable areas of focus for each director, and not having a mark does not mean that a particular director does not possess that qualification or skill. Nominees have developed competencies in these skills through education, direct experience, and oversight responsibilities. The demographic information presented is based on voluntary self-identification by each individual. Additional biographical information on each nominee begins on page 2.

| SKILLS & EXPERTISE | ||||||||||||||||||

| Capabilities | GRAVES | CLINTON | DRAYTON | ERICKSON | KEVER | MCCLURE | MOORE | PADMANABHAN | TRACY | |||||||||

Senior Leadership | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||

Global Experience | 🌑 | 🌑 | ||||||||||||||||

Industry and Applications Experience | 🌑 | 🌑 | 🌑 | |||||||||||||||

Financial Expertise | 🌑 | 🌑 | ||||||||||||||||

Product Development | 🌑 | 🌑 | 🌑 | |||||||||||||||

Operations and Manufacturing | 🌑 | 🌑 | ||||||||||||||||

Human Capital | 🌑 | 🌑 | 🌑 | |||||||||||||||

Go-To-Market | 🌑 | 🌑 | ||||||||||||||||

Public Company Board | 🌑 | 🌑 | 🌑 | |||||||||||||||

Business Development and M&A | 🌑 | 🌑 | 🌑 | |||||||||||||||

Government, Legal, and Compliance | 🌑 | 🌑 | 🌑 | |||||||||||||||

Emerging Technologies and Business Models | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||

| 8 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

| BACKGROUND | ||||||||||||||||||

| Tenure | GRAVES | CLINTON | DRAYTON | ERICKSON | KEVER | MCCLURE | MOORE | PADMANABHAN | TRACY | |||||||||

Years on the Board | 4 | 5 | 3 | 9 | 28 | 7 | 25 | 4 | 7 | |||||||||

Age | 63 | 55 | 56 | 73 | 71 | 70 | 69 | 58 | 69 | |||||||||

Gender | M | F | F | M | M | M | M | M | M | |||||||||

| Race/Ethnicity/Nationality | ||||||||||||||||||

African American/Black | 🌑 | |||||||||||||||||

Asian American | 🌑 | |||||||||||||||||

Hispanic American | 🌑 | 🌑 | ||||||||||||||||

White/Caucasian | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||

Native American | ||||||||||||||||||

MEETINGS AND MEETING ATTENDANCE

During 2023, the Board of Directors held 10 meetings. In 2023, each member of the Board of Directors attended at least 75 percent of the aggregate number of meetings of the Board of Directors held during the period for which he or she was a director and of the committees of the Board on which he or she served during the periods that he or she served, other than Mr. Padmanabhan who attended 11 of 16 meetings of the Board of Directors and committees on which he served during the year.

The Board holds executive sessions with only non-employee directors in attendance at its regular meetings and at other meetings when circumstances warrant those sessions. The CEO and other members of management are excused from these executive sessions. The Chair of the Board or the Chair of the Corporate Governance and Sustainability Committee presides over such non-management sessions of the Board. Additionally, the independent directors meet in executive session at least quarterly. The CEO, any other non-independent directors, and other members of management are excused from such meetings, and the Chair of the Board presides over such meetings.

It is expected that all incumbent directors and director nominees will attend our annual meetings of stockholders whether held virtually (as for the 2023 Annual Meeting) or in person. All the directors then in office virtually attended our 2023 Annual Meeting of Stockholders.

DIRECTOR TENURE AND RETIREMENT AGE

The Board generally believes that a mix of long- and short-tenured directors promotes an appropriate balance of views and insights and allows the Board as a whole to benefit from the historical and institutional knowledge that longer-tenured directors possess, and the fresh perspectives contributed by newer directors. In support of Board refreshment efforts, the Board has implemented both 10-year term limits (effective beginning December 2019) and a mandatory retirement age of 75 for directors. Mr. William E. Curran is not standing for reelection at the Annual Meeting due to the mandatory age requirement.

Director Emeritus Program

The Board has created a Director Emeritus program to avail itself of the counsel of directors retiring from the Board due to age or term-limit restrictions who have made and can continue to make unique contributions to the deliberations of the Board. Under the program, the

Board may, at its discretion, designate a retiring director

| 2024 PROXY STATEMENT | 9 |

Table of Contents

CORPORATE GOVERNANCE

as Director Emeritus to serve one or more annual terms subject to reappointment as Director Emeritus by the Board after each annual meeting of stockholders. A Director Emeritus may provide advisory services as requested from time to time and may be invited to attend meetings of the Board or its committees but may not vote, be counted for quorum purposes, have any of the duties or obligations imposed on our directors or officers under applicable law, or otherwise be considered a director.

In conjunction with the implementation of a retirement age for directors in 2021, Charles W. Hull, a founder of the Company and our current Executive Vice President and Chief Technology Officer for Regenerative Medicine, transitioned to Director Emeritus status following the 2021 Annual Meeting. The Board believes that Mr. Hull continues to provide valuable knowledge and leadership to the Company’s efforts in the field of regenerative medicine and other matters, and the Board recognizes the unique insight and guidance he can provide as a Director Emeritus. It is the Board’s intention to appoint Mr. Hull to a fourth term as Director Emeritus at the conclusion of the 2024 Annual Meeting.

As the founder of the entire 3D Printing industry, co-founder of our Company and in his role as Director Emeritus, Mr. Hull attends meetings of the Technology Applications Committee.

STOCKHOLDINGS OF DIRECTORS

Among the factors considered under our “Corporate Governance at 3D Systems—Director Qualifications” discussed on page 7 is an expectation that each director will hold during his or her term of office a meaningful number of shares of our Common Stock. Several of our directors beneficially own substantial numbers of shares of our Common Stock. See “Director Compensation—Stock Ownership and Holding Requirements for Non-Employee Directors” and “Security Ownership of Certain Beneficial Owners and Management” for more details.

BOARD EVALUATIONS

Our Corporate Governance Guidelines further require that the Board, acting through the Corporate Governance and Sustainability Committee, conduct a self-evaluation at least annually to determine whether it and its committees are functioning effectively. In addition, our Corporate Governance Guidelines require that each committee conduct an annual self-evaluation to assess its compliance with the requirements of its charter and the Corporate Governance Guidelines, as well as ways in which committee processes and effectiveness may be enhanced.

We are committed to providing transparency about our Board and committee evaluation process. Our Chair of the Board and Chair of the Corporate Governance and Sustainability Committee lead the Board’s self-evaluation process. Each director completes a comprehensive questionnaire evaluating the performance of the Board as a whole and the committees on which the director serves. The directors’ responses are aggregated and anonymized to encourage the directors to respond candidly and to maintain the confidentiality of their responses. The directors’ responses about the performance of the Board as a whole and the committees are summarized and shared with the Board. The annual evaluation process provides the Board with valuable insight regarding areas where the Board believes it functions effectively and, more importantly, areas where the Board believes it can improve.

RELATED PARTY TRANSACTION POLICY AND PROCEDURES

In addition to the provisions of our Code of Conduct and Code of Ethics that deal with conflicts of interest and related party transactions, we have adopted a Related Party Transaction Policy that is designed to confirm our position that related party transactions should be avoided except when they are in our interests and to require that certain types of transactions that may create conflicts of interest or other relationships with related parties are approved in advance by (a) the Board of Directors and (b) the Corporate Governance and Sustainability Committee or a committee composed of directors who are independent and disinterested with respect to the matter under consideration. This policy applies to transactions meeting the following criteria:

| • | the amount involved will or may be expected to exceed $120,000 in any calendar year; |

| • | we or any of our subsidiaries would be a participant; and |

| 10 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

| • | any person who is or was in the current or immediately preceding calendar year an executive officer, director, director nominee, greater than five percent beneficial owner of our Common Stock or immediate family member of any of the foregoing has or will have a direct or indirect material interest. |

In adopting this policy, the Board reviewed certain types of transactions and deemed them to be pre-approved even if the amount involved exceeds $120,000. These types of transactions include:

| • | employment arrangements with executive officers where such executive officer’s employment in that capacity and compensation for serving as an executive officer has been approved by the Board, the Compensation Committee, or another committee of independent directors; |

| • | director compensation arrangements where such arrangement has been approved by the Corporate Governance and Sustainability Committee (or another committee of independent directors) and the Board; |

| • | awards to executive officers and directors under compensatory plans and arrangements pursuant to our 2015 Incentive Plan, the exercise by any executive officer or director of any previously awarded stock option that is exercised in accordance with its terms, and any grants or awards made to any director or executive officer under any other equity compensation plan that has been approved by our stockholders; |

| • | certain transactions with other companies where a related party has a de minimis relationship (as described in the policy) with the other company and the amount involved in the transaction does not exceed the greater of $1,000,000 or 2 percent of the other company’s total annual revenue; |

| • | charitable contributions made by us to a charitable organization where a related party has a de minimis relationship and the amount involved does not exceed the greater of $1,000,000 or 2% of the charitable organization’s total annual receipts and charitable contributions under any matching program maintained by us that is available on a broad basis to employees generally; and |

| • | other transactions where all security holders receive proportional benefits. |

Under the terms of our Related Party Transaction Policy, when considering whether to approve a proposed related party transaction, factors to be considered include, among other things, whether such transaction is on terms no more favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related party’s interest in the transaction. A copy of our Related Party Transaction Policy is posted on our website. See “Availability of Information” on page 18.

There were no related-party transactions in 2023.

SUCCESSION PLANNING

We maintain a succession plan for the position of CEO and other executive officers. To assist the Board with this requirement, the CEO annually leads the Board of Directors in a discussion of CEO and senior management succession. The annual review includes an evaluation of the requirements for the CEO and each senior management position and an examination of potential permanent and interim candidates for CEO and other senior management positions.

RISK OVERSIGHT

Consistent with Delaware law, our business is managed by our officers under the direction and oversight of the Board. In this regard, our management, including our corporate officers, is responsible for the day-to-day management of the risks facing us, including macroeconomic, financial, strategic, operational, public reporting, legal, regulatory, political, compliance, organizational, security, and reputational risks. They carry out this responsibility through a coordinated effort among themselves in the management of our business.

In exercising its oversight responsibilities, as permitted by law, the Board receives and relies on reports and other information provided by management, reviews and approves matters that it is required or permitted to approve by law or our Certificate of Incorporation or By-Laws, and receives information relating to, and inquiries into, such other matters as it deems appropriate, including our strategic outlook, business plans, prospects and performance, succession planning, risk management, cybersecurity, and other matters for which it has oversight responsibility.

| 2024 PROXY STATEMENT | 11 |

Table of Contents

CORPORATE GOVERNANCE

The Board carries out its general oversight responsibility both by acting as a whole as well as through its committees. Among other things, the Board periodically reviews our processes for identifying, ranking, and assessing risks that affect our organization as well as the output of those processes. The Board also receives periodic reports from our management on various risks, including risks of the types mentioned facing our businesses, risks presented by transactions that are presented to the Board for approval, and risks arising out of our corporate strategy.

The Board also maintains several standing committees with risk oversight responsibility for various Board functions. Although the Board has ultimate responsibility for overseeing risk, its standing committees perform certain of its risk oversight responsibilities. For example, the Audit Committee engages in ongoing discussions regarding major financial and accounting risk exposures and the process and system employed to monitor and control such exposures. In addition, the Audit Committee engages in periodic discussions with management concerning the process by which risk assessment and management are undertaken, and it exercises oversight regarding the risk assessment and management processes related to, among other things, internal controls, credit, capital structure, liquidity, cybersecurity, and insurance programs. In carrying out these responsibilities, the Audit Committee, among other things, regularly reviews with the Internal Audit Director the audits or assessments of significant accounting and audit risks conducted by Internal Audit personnel based on their audit plan, and the Audit Committee regularly meets in executive sessions with the Internal Audit Director. The Audit Committee also regularly reviews with management our internal control over financial reporting, including any significant deficiencies or material weaknesses. As part of these reviews, the Audit Committee reviews steps taken by management to monitor, control, and mitigate risks. The Audit Committee also regularly reviews with the Chief Legal Officer (or other head legal officer) significant legal, regulatory, and compliance matters that could have a material impact on our financial statements or business. Finally, from time-to-time, executives who are responsible for managing particular risks, such as cybersecurity, report to the Audit Committee on how those risks are being controlled and mitigated.

Other Board committees also exercise responsibility to oversee risk within their areas of responsibility and expertise. For example, as noted in the section entitled “Risk Assessment of Compensation Policies and Practices,” the Compensation Committee oversees risk assessment and management with respect to our compensation policies and practices, and it exercises oversight with respect to our 401(k) plan; the Corporate Governance and Sustainability Committee engages in periodic discussions with our Chief Compliance Officer regarding major environment, health, and safety risks; and the Compliance Committee engages in ongoing discussion with the Chief Compliance Officer and the Chief Legal Officer (or other head legal officer) regarding regulatory and compliance matters, including compliance with applicable export controls, government contracts, FDA compliance, and similar governmental regulatory regimes.

In those cases where committees have risk oversight responsibilities, the Chairs of the committees regularly report to the full Board the significant risks facing the Company, as identified by management, and the measures undertaken by management for controlling and mitigating those risks.

RISK ASSESSMENT OF COMPENSATION POLICIES AND PRACTICES

Our Compensation Committee has reviewed our incentive compensation programs, discussed the concept of risk as it relates to our compensation program, considered various mitigating factors, and reviewed these items with its independent consultant, Meridian Compensation Partners, LLC (“Meridian”). In addition, our Compensation Committee asked Meridian to conduct an independent risk assessment of our executive compensation program. Based on these reviews and discussions, the Compensation Committee does not believe our compensation program creates risks that are reasonably likely to have a material adverse effect on our business.

For more information regarding our compensation program, see the section entitled “Compensation Discussion and Analysis” beginning on page 24.

| 12 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

SUSTAINABILITY

We deliver leading additive manufacturing solutions for industrial and healthcare applications using innovative 3D printing technologies, powered by the expertise of our global team. Innovation is core to who we are and how we work. Our solutions enable our customers to meet key product needs and advance their business models. Looking to the future, sustainability will be an integral part of our innovation to address the evolving needs of our customers.

The effects of climate change and the heightened social, economic, and health challenges around the globe are transforming our business. We are considering these important topics as we design and execute our sustainability strategy. Our sustainability strategy is organized into four pillars: Empowering our Innovation, Evolving the Future of Manufacturing, Advancing Customer Solutions, and Upholding Responsible Business Practices.

Empowering Our Innovation

We are focused on empowering innovation through our people to drive industry-leading solutions to maintain a competitive edge in additive manufacturing. We have instituted core talent strategies to prioritize the development of people, the diversity of talent to expand technology innovation, and the engagement of our global workforce.

Talent Development: We invest in talent programs to support employees with opportunities to grow, contribute, develop, and thrive. In 2023, we launched more robust talent management guidance and tools to further enable leaders to consistently develop and provide employee feedback through performance reviews, goal setting, and career development planning. We also perform strategic workforce and succession planning, as well as ongoing reviews of our organizational design, culture, and values, to address the evolving needs of our business.

Connection and Engagement: We are committed to fostering an environment where inclusion and belonging are central to how we work across our global teams and create opportunities for our diverse global workforce to connect. In 2023, we regularly engaged with employees to provide updates on our strategic priorities and company progress, as well as solicit feedback through ongoing communications, global all-hands meetings, and business town hall updates. We promoted participation in our Employee Resource Groups across the globe, coordinated various women networking sessions, and launched educational resources and dedicated space on our Company intranet to celebrate the unique perspectives of colleagues around the world. We extended our focus of inclusion within our local communities and strive to make a positive impact by serving the underserved in our communities through our 3D Gives Back volunteer program.

Innovation Rewards: One of the core values of our Company is to ‘Innovate with Purpose’ to drive long-term value. As such, we are focused on encouraging and recognizing impactful innovation through several key initiatives. In 2023, we hosted a global Technology Summit which brought engineering and operations teams around the world together to further drive collaboration, refine strategic ideas, and explore future additive manufacturing solutions as a collective team, leveraging our diverse technical expertise. We also have a Technical Fellow Program, which recognizes and establishes a career path for highly skilled engineers, designed to foster technical excellence and innovative leadership in the field of additive manufacturing.

Cross-Functional Collaboration: We are enabling cross-functional collaboration to bring together diverse expertise across engineering, operations, and customer-facing teams to harness the collective problem solving of our teams. This allows us to accelerate the transition from engineering design to manufacturing, improve operational performance and efficiency, and timely deliver comprehensive solutions to address our customers’ needs.

Evolving the Future of Manufacturing

We offer a broad portfolio of additive manufacturing products and services and are evolving the future of manufacturing for our customers. Innovation and speed to market are critical for our customers, and leveraging additive manufacturing capabilities enables our customers to shorten their innovation cycle while reducing their environmental impact.

Optimize Supply Chains and Reduce Lead Times: Our products and solutions enable on-demand production, which can help our customers to reduce on-hand inventory levels and minimize product lead times. By reducing the constraints of traditional manufacturing, our solutions empower customers to respond more quickly to business needs.

| 2024 PROXY STATEMENT | 13 |

Table of Contents

CORPORATE GOVERNANCE

Enable Localized Production: We enable customers to manufacture products closer to their end markets, which can support our customers in reducing transportation emissions, lowering logistics costs, enhancing supply chain resilience, and taking advantage of incentives for domestic manufacturing, where applicable.

Advancing Material Design: Our additive manufacturing solutions focus on advancing material design and engineering capabilities to meet customers’ unique needs and requirements, with the ability to select the most suitable materials for their specific applications.

Utilizing Digitization for Prototyping: Our digitized prototyping processes enable rapid iteration and customization of product designs, which can minimize waste and optimize material usage. This empowers our customers to iterate quickly, test concepts efficiently, and refine designs, thereby reducing the generation of physical prototypes and associated waste.

We are a member of the Additive Manufacturing Green Trade Association (AMGTA), which has a mission to educate and share knowledge amongst members about the positive environmental benefits of additive manufacturing, develop best practices, and promote the adoption of additive manufacturing as an alternative to traditional manufacturing.

Advancing Customer Solutions

We provide solutions to empower our customers to address their evolving sustainability priorities. Our unique offerings of hardware, software, materials, and services provide application-specific solutions powered by the expertise of our global team of application engineers. We are maturing our product development activities to address our customers’ key environmental and social priorities.

Circular Economy Solutions: We are contributing to a circular economy by evaluating the recyclability of materials, reducing parts and components in our products, and working on opportunities to extend product lifespans. By evolving our product design, we are adopting modular technology and interchangeable components, supporting longevity and ease of repair.

Decarbonization Solutions: We are focusing on decarbonization solutions for our products by reducing material use and weight, improving energy and resource efficiency, and driving carbon capture and storage technologies. 3D Systems is working with leading innovators in the direct air capture space to create components that remove carbon from the atmosphere through a system of filters, heat exchangers, condensers, gas separators, and compressors using our additive manufacturing solutions. The benefits of 3D printing solutions can accelerate the effectiveness of carbon capture, through attributes such as design optimization, long service life, speed of iteration, scalability, and supply chain efficiencies.

Patient-Centered Healthcare Solutions: Customers leverage our additive manufacturing solutions to deliver high-quality, patient-centered healthcare solutions. Our personalized solutions can optimize patient care by enhancing patient comfort, functionality, and accuracy, which may result in increased patient satisfaction, well-being, and quality of life. Personalization can promote healthcare accessibility with the capability of addressing unique individual needs.

Upholding Responsible Business Practices

We operate in a responsible and ethical manner and leverage corporate governance standards to operate with resiliency and to sustain the long-term value of our Company. We leverage this foundation to influence our sustainability strategy, including utilizing our governance structure for oversight of our sustainability program.

Program Governance: Our sustainability program is led by our Chief People Officer and Chief Administrative Officer, and the Board of Directors has delegated oversight of the Company’s sustainability program to its Corporate Governance and Sustainability Committee. In 2023, we provided periodic updates on our sustainability program strategy, annual priorities, and progress to the Committee, with materials available to the full Board.

Workplace Safety: We operate responsibly across our sites through practices to promote a safe, secure, healthy, and injury-free workplace. To fulfill this commitment, we provide annual global and site-specific safety communications and company-wide safety trainings. We also have robust, site-specific safety programs in place, which includes

| 14 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

requiring proper safety equipment at our facilities for those working in potentially high-hazard environments. We monitor injury and illness health and safety metrics across the Company to continually evolve our safety programs.

Product Quality and Safety: We prioritize product quality and safety in our design and manufacturing to meet product quality requirements and environmental compliance standards and comply with applicable product safety laws and regulations. This includes compliance with laws such as Restriction on Hazardous Substances (RoHS), Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), Toxic Substances Control Act (TSCA), Safe Drinking Water and Toxic Enforcement Act (Proposition 65) and Waste from Electrical and Electronic Equipment (WEEE).

Environmental Measures: We are committed to being responsible stewards of the environment as we operate our business, collecting data on our scope 1 and scope 2 greenhouse gas emissions, waste, and water use across our sites. In 2023, we continued our reporting on climate activities in alignment with the Task Force on Climate-Related Financial Disclosures (TCFD) and expanded disclosures on our waste and water use. Our internal metrics are used to provide insights to management as we evaluate environmental strategies, commitments, and goals around further reducing Greenhouse Gas (GHG) emissions, conserving energy, and minimizing waste.

Our ESG policies are available on our website at www.3dsystems.com/make-an-impact. See “Availability of Information” on page 18 for a list of our ESG policies.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors maintains five standing committees: Audit, Compensation, Corporate Governance and Sustainability, Compliance, and Technology Applications. Each Committee Chair meets regularly with management during the year to discuss committee business, shape agendas, and facilitate efficient meetings. The Board Chair, Mr. McClure, attends all committee meetings to serve as a resource and to identify topics requiring the full Board’s attention. In his role as Director Emeritus, Mr. Hull attends meetings of the Technology Applications Committee.

The Board has determined that each member of the Audit, Compensation, Corporate Governance and Sustainability, Compliance and Technology Applications Committees is independent according to applicable SEC and NYSE requirements and our Corporate Governance Guidelines. In addition, the Board has also determined that each member of the Audit Committee also meets the heightened standards of independence applicable to audit committee members as prescribed by the SEC and that each member of the Compensation Committee meets the heightened standards of independence applicable to compensation committee members as prescribed by the NYSE and is a “non-employee director” for purposes of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| 2024 PROXY STATEMENT | 15 |

Table of Contents

CORPORATE GOVERNANCE

Each of the committees operates under a written charter that has been approved by the Board and is posted on our website. Each committee annually reviews its charter and updates its charter as necessary. See “Availability of Information” on page 18 for the availability of each committee charter.

Audit Committee

| ||

| Members: | Primary Responsibilities: | |

William E. Curran, Chair*(1)

Claudia N. Drayton*

Kevin S. Moore*

Meetings in 2023: 7

Private sessions with independent registered public accounting firm and Internal Audit Director held at most meetings.

* Audit Committee Financial Expert

(1) Not standing for re-election at the Annual Meeting

| • Oversee internal control over financial reporting and auditing, accounting, and financial reporting processes;

• Oversee the qualifications, independence, performance, engagement retention, and compensation of our independent registered public accounting firm;

• Oversee disclosure controls and procedures, and internal audit function;

• Oversee annual independent audit of financial statements;

• Review and pre-approve audit and permissible non-audit services and fees;

• Oversee legal, regulatory, and ethical compliance matters;

• Oversee financial-related risks, enterprise risk management program, and cybersecurity; and

• Oversee the preparation of the Audit Committee Report and related disclosures for the annual proxy statement.

| |

The “Report of the Audit Committee” is set forth beginning on page 67.

Compensation Committee

| ||

| Members: | Primary Responsibilities: | |

Kevin S. Moore, Chair

Malissia R. Clinton

William E. Curran

Thomas W. Erickson

Jim D. Kever

Meetings in 2023: 3 | • Oversee the Company’s executive compensation policies, practices, and programs;

• Review and approve corporate goals and objectives for compensation, evaluate performance (along with full Board), and determine compensation for the CEO;

• Review the performance, and determine the compensation, of all other executive officers and each direct report of the CEO;

• Review and advise on management succession planning;

• Approve and oversee equity-related incentive plans and executive bonus plans;

• Review compensation policies and practices as they relate to risk management practices;

• Oversee human capital management, including the Company’s culture and diversity and inclusion programs and initiatives; and

• Oversee the preparation of the “Compensation Committee Report” and related disclosures for the annual proxy statement.

| |

The “Compensation Committee Report” is set forth on page 43.

| 16 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

Compensation Committee Interlocks and Insider Participation

None of our current executive officers served during 2023 as a director of any entity with which any of our outside directors is associated or whose executive officers served as one of our directors, and none of the members of the Compensation Committee has been an officer or employee of the Company or any of our subsidiaries.

Retainer of Independent Compensation Consultant

The Compensation Committee has sole authority to retain, compensate, and terminate a compensation consultant to assist it in the evaluation of CEO or senior executive compensation. The Compensation Committee retained Meridian as its independent compensation consultant with respect to the Company’s 2023 executive compensation program. Meridian does not provide any other services to the Company, and the Compensation Committee has determined, based on its assessment of the relevant factors set forth in the applicable SEC rules, that Meridian’s work for the Compensation Committee does not raise any conflict of interest. For additional information on the role of the compensation consultant in setting executive compensation see “Executive Compensation—Compensation Discussion and Analysis—Compensation Consultant and Compensation Peer Group” on page 29.

Corporate Governance and Sustainability Committee

| ||||||

Members:

Thomas W. Erickson, Chair

Malissia R. Clinton

Claudia N. Drayton

Jim D. Kever

Meetings in 2023: 5 | Primary Responsibilities:

• Oversee the composition, structure, and evaluation of the Board and its committees;

• Identify and recommend qualified candidates for election to the Board;

• Establish procedures for director candidate nomination and evaluation;

• Assist the Board in determining the independence of the Board nominees;

• Oversee corporate governance policies and practices, including Corporate Governance Guidelines and Code of Conduct;

• Lead annual reviews of the performance of the Board and its committees;

• Review and recommend to Board compensation programs for directors;

• Monitor strategy, policies, performance, and reporting related to the Company’s management of environmental, social, and governance (ESG) issues; and

• Review and approve related-person transactions.

| |||||

Compliance Committee

| ||||||

Members:

Malissia R. Clinton, Chair

William E. Curran

Charles G. McClure, Jr.

Dr. Vasant Padmanabhan

Dr. John J. Tracy

Meetings in 2023: 4

| Primary Responsibilities:

• Oversee the Company’s compliance function, including the administration of policies and procedures for compliance with laws and regulations applicable to its business;

• Oversee legal and regulatory compliance related to export compliance and government contracts; and

• Assist Board in oversight of compliance related to our healthcare business, including FDA and regulations and HIPAA requirements.

| |||||

| 2024 PROXY STATEMENT | 17 |

Table of Contents

CORPORATE GOVERNANCE

Technology Applications Committee

| ||||||

Members:

Dr. John J. Tracy, Chair

Dr. Vasant Padmanabhan

Meetings in 2023: 4 | Primary Responsibilities:

• Oversee the Company’s technology strategy and approach, including its impact on performance, growth, and competitive position;

• Review the Company’s technology capabilities and intellectual property and provide guidance on its technology and innovation strategy;

• Oversee technical workforce and its suitability for meeting needs, including engineering leadership, and the development and succession planning process for critical technology experts;

• Oversee the Company’s research and development expenditure plans; and

• Oversee the Company’s technology initiatives and investments, including through acquisitions and other business development activities.

| |

AVAILABILITY OF INFORMATION

Our corporate governance guidelines, practices, and policies are available on our website at investor.3dsystems.com/governance, including the following documents:

| • | Amended Certificate of Incorporation |

| • | Amended and Restated By-Laws |

| • | Code of Conduct |

| • | Code of Ethics |

| • | Clawback Policy |

| • | Corporate Governance Guidelines |

| • | Policy Statement Governing Insider Trading |

| • | Policy and Procedure for Stockholders Nominees to the Board |

| • | Related Party Transaction Policy and Procedures |

| • | Audit Committee Charter |

| • | Compensation Committee Charter |

| • | Compliance Committee Charter |

| • | Corporate Governance and Sustainability Committee Charter |

| • | Technology Applications Committee Charter |

Our ESG policies and practices documents are available on our website at www.3dsystems.com/make-an-impact, including the following documents:

| • | Environmental, Health, and Safety Policy |

| • | Water Policy |

| • | Waste Management Practices |

| • | Human Rights and Labor Rights Policy |

| • | Anti-Human Trafficking Policy |

| • | Conflict Minerals Policy |

Information on, or that can be accessed through, our website is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated into any other filings we make with the SEC.

| 18 |  | 2024 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

DIRECTOR COMPENSATION

We use a combination of cash and equity-based compensation to attract and retain qualified candidates to serve on our Board of Directors. In setting director compensation, we consider the significant amount of time that our directors expend in fulfilling their duties, the skill level required by us of members of our Board, and the overall level and mix of compensation compared to industry- and size-relevant peers by referencing data compiled by the Compensation Committee’s independent compensation consultant.

Director Compensation for 2023

The following table sets forth information concerning all compensation of each of our non-employee directors for their services as a director during the year ended December 31, 2023.

Fees Earned or Paid in Cash ($) | Stock Awards(1) ($)

| All Other Compensation ($) | Total ($) | |||||||||||||

Malissia R. Clinton

|

|

90,000

|

|

|

150,000 |

|

| —

|

|

|

240,000

|

| ||||

William E. Curran

|

|

105,000

|

|

|

150,000

|

|

|

—

|

|

|

255,000

|

| ||||

Claudia N. Drayton

|

|

68,113

|

|

|

150,000

|

|

|

—

|

|

|

218,113

|

| ||||

Thomas W. Erickson

|

|

78,764

|

|

|

150,000

|

|

|

—

|

|

| 228,764

|

| ||||

Jim D. Kever

|

|

70,000

|

|

|

150,000

|

|

|

—

|

|

|

220,000

|

| ||||

Charles G. McClure, Jr.

|

|

250,000

|

|

|

150,000

|

|

|

—

|

|

|

400,000

|

| ||||

Kevin S. Moore

|

|

95,000

|

|

|

150,000

|

|

|

—

|

|

|

245,000

|

| ||||

Vasant Padmanabhan

|

|

66,236

|

|

|

150,000

|

|

|

—

|

|

|

216,236

|

| ||||

John J. Tracy

|

|

90,000

|

|

|

150,000

|

|

|

—

|

|

|

240,000

|

| ||||

| (1) | Represents the aggregate grant date fair value of the stock awards granted in 2023 to each non-employee director computed in accordance with stock-based compensation accounting rules (Financial Standards Accounting Board (“FASB”) ASC Topic 718). The amounts in this column reflect the award of 18,094 shares of Common Stock made to each director in office as their annual equity award under the 2015 Incentive Plan on May 16, 2023. The value of the restricted stock awards was determined by multiplying the number of shares awarded by the closing price of our Common Stock on the date of grant ($8.29 per share). |

Director Fees

Director compensation is set by the Board, based upon the recommendation of the Corporate Governance and Sustainability Committee through the periodic review and approval of the Non-Employee Director Compensation Policy. We pay the following cash compensation to our non-employee directors:

Annual Retainers to Non-Employee Directors

| Chair

| Member

| ||||||

Board of Directors

|

$

|

250,000

|

(1)

|

$

|

50,000

|

| ||

Audit Committee

|

$

|

30,000

|

|

$

|

15,000

|

| ||

Compensation Committee

|

$

|

30,000

|

|

$

|

15,000

|

| ||

Compliance Committee

|

$

|

20,000

|

|

$

|

10,000

|

| ||

Corporate Governance and Sustainability Committee

|

$

|

10,000

|

|

$

|

5,000

|

| ||

Technology Applications Committee

|

$

|

30,000

|

|

$

|

10,000

|

| ||

| (1) | The Chair of the Board of Directors does not receive fees for service on any committee. |

| 2024 PROXY STATEMENT | 19 |

Table of Contents

CORPORATE GOVERNANCE

Non-employee directors also receive annual equity awards. We also reimburse directors for their expenses of attendance at meetings of the Board of Directors or its committees.

Dr. Graves, who is an employee of the Company, received no additional compensation for service as a director in 2023.

Director Equity Awards

Pursuant to the Non-Employee Director Compensation Policy, our directors receive annual grants of immediately vested stock equal to $150,000 in total value under the 2015 Incentive Plan upon their re-election by stockholders to serve as directors. In addition, new directors, upon their election to the Board, receive an immediately vested restricted stock award equal to such number of shares having a value equal to $75,000 and a prorated annual award for the year in which he or she is elected to the Board. All shares of Common Stock issued to directors as compensation for their services as directors are fully vested when issued.

Stock Ownership and Holding Requirements for Non-Employee Directors

Consistent with the Board-adopted Qualifications for Nomination to the Board (publicly disclosed as Addendum A to the Corporate Governance and Sustainability Committee Charter), each non-employee director is expected to hold during his or her term of office a meaningful number of shares of Common Stock. As such, our Corporate Governance Guidelines require our non-employee directors to acquire and maintain an equity stake in the Company with a minimum value equivalent to five times the annual cash retainer paid to non-employee directors (as set forth in the Non-Employee Director Compensation Policy) by the later of 2025 or within 5 years of joining the Board.

Each of our non-employee directors are required to retain all shares of Common Stock that have been awarded to them under the 2015 Incentive Plan until the minimum holding requirement is met; however, they may sell up to 50% of the shares of Common Stock covered by any award to satisfy any tax obligation arising from such grant or grants. In addition, non-employee directors are required to retain all shares of Common Stock that were awarded to them under the 2004 Restricted Stock Plan for Non-Employee Directors (which was depleted in 2019) as long as they remain a director of the Company; however, they may (a) sell up to 50% of an award to cover the tax obligation arising from such grant or grants and (b) make certain transfers of shares received under the 2004 Restricted Stock Plan for Non-Employee Directors to members of their immediate family or to a trust or other form of indirect ownership established by the director for his or her benefit or for the benefit of the members of his or her immediate family.