UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2005

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 033-67532

SHEFFIELD STEEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | | | 74-2191557 |

(State or other jurisdiction of

incorporation or organization) | | | | (I.R.S. Employer

Identification No.) |

| | |

| 220 North Jefferson Street, Sand Springs, OK | | | | 74063 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code (918) 245-1335

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes¨. Noþ.

The aggregate market value of voting stock held by nonaffiliates is unknown as the Registrant’s stock is not traded on an established public trading market.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. YESþ NO¨

As of July 14, 2005, there were 4,956,819 shares of the Registrants $.01 par value Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Company’s Annual Meeting of Shareholders to be held on September 14, 2005 are incorporated by reference into Part III of this Report on Form 10-K.

EXPLANATORY NOTE

We are filing this amendment (the “Amendment”) to our Annual Report on Form 10-K for the fiscal year ended April 30, 2005 (the “Original Filing”) to provide information relating to our inability to include an audit report (the “Audit Report”) from the our predecessor auditor, KPMG, on the statements of income and cash flows for the period from August 14, 2002 to April 30, 2003 (the “2003 Period”) appearing in the Original Filing. As reported in the Form 12b-25 which we filed on July 15, 2005, KPMG has refused to reissue the Audit Report as a result of receiving a letter from us outlining a malpractice claim against them related to company-sponsored pension plans. KPMG claims that the allegations in the letter compromise its independence and prevent it from reissuing the Audit Report.

Because we have not previously been required to file audited financial statements for the 2003 Period under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Audit Report has not been included in any Exchange Act filings by us. KPMG consented, however, to the inclusion of the Audit Report in our Registration Statement on Form S-4 (File No. 333-121176) filed on December 10, 2004 and amended December 17, 2004, February 8, 2005, February 23, 2005 and March 7, 2005. We cannot give any assurance that KPMG would reissue the Audit Report in its original form and without qualification if the independence issue were resolved. However, we are not aware of any subsequent events, transactions or other matters that may have affected the Audit Report as previously issued.

This Amendment reproduces the Original Filing with the addition of this Explanatory Note and certain revisions to more clearly indicate that the statements of income and cash flows for the 2003 Period are unaudited. This Amendment also corrects certain references to our 2005 Proxy Statement appearing in Part III of this report. Except for these changes, this Amendment does not reflect any events that have occurred after July 15, 2005, the filing date of the Original Filing, or modify or update the disclosures presented in the Original Filing.

Part I

FORWARD LOOKING STATEMENTS

This report contains statements that are forward-looking. You should read the following discussion in connection with our consolidated financial statements, including the notes to those statements, included in this document. The following discussion contains forward-looking statements which include numerous risks which you should carefully consider. These statements are based on current expectations and assumptions that are subject to uncertainties not currently known to us or that we currently deem to be immaterial which could cause actual results to differ materially. Additional risks and uncertainties may also materially and adversely affect our business. Any risks could materially adversely affect our business, financial condition or results of operations.

(a) General Development of Business

We are engaged in the manufacturing, fabricating and sale of steel products including hot rolled steel bar, concrete reinforcing bar, or “rebar,” and fabricated products which focus on niche products and target customers with special needs. We believe that our product quality and responsive service are two competitive advantages that distinguish us in the market place. Additionally, since our predecessor’s inception almost 75 years ago, we have maintained a competitive cost structure as a result of our efficient melt and cast operations, high productivity levels, low energy costs and competitive steel scrap costs. We focus on building and maintaining long-term relationships with our customers by providing competitive pricing, assured product availability and reliable, prompt delivery and service. This strategy increases the competitiveness of our customers and has significantly contributed to our strong customer relationships. Our fiscal years end on April 30.

(b) Financial Information and Classes of Products or Services

We are a regional mini-mill with one line of business which is producing a range of steel products including hot rolled steel bar, rebar, and fabricated products.

The following table provides information regarding the historical shipment levels and average selling prices per ton of our products:

| | | | | | | | | | | | |

| | | Year ended

April 30,

| |

| | | 2005

| | | 2004

| | | 2003

| |

Tons shipped: | | | | | | | | | | | | |

Rebar | | | 52 | % | | | 59 | % | | | 46 | % |

Hot Rolled Bars | | | 32 | % | | | 28 | % | | | 36 | % |

Fabricated Products | | | 14 | % | | | 12 | % | | | 14 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total finished products | | | 98 | % | | | 99 | % | | | 96 | % |

Billets | | | 2 | % | | | 1 | % | | | 4 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total tons shipped | | | 100 | % | | | 100 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Average price per ton shipped | | $ | 578.89 | | | $ | 396.91 | | | $ | 366.16 | |

Average production cost per ton | | $ | 479.12 | | | $ | 347.80 | | | $ | 334.11 | |

Average gross margin per ton | | $ | 99.77 | | | $ | 49.11 | | | $ | 32.05 | |

1

(c) Narrative Description of Business

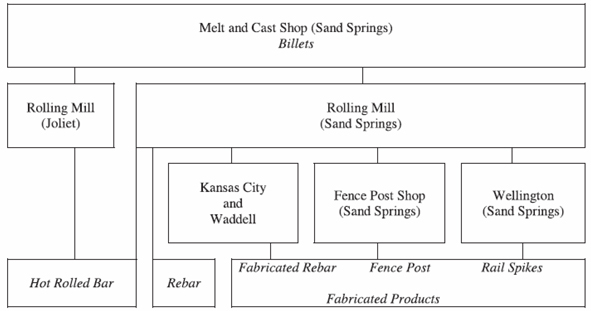

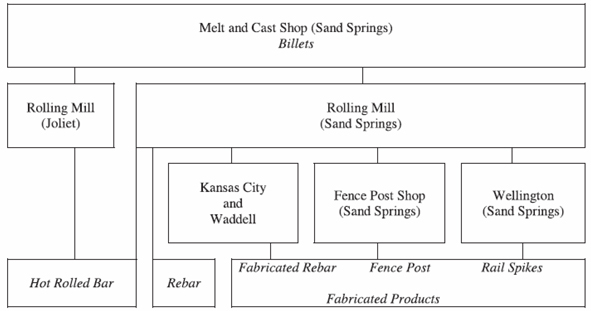

The following diagram illustrates the production capabilities and inter-relationship between our facilities.

In Sand Springs, steel scrap is conveyed by rail car from our scrap yard to the melt shop, where the steel scrap is melted in two 85-ton electric arc furnaces. During the scrap melting process, impurities are removed from the molten steel. The molten steel is refined and then poured into a ladle, where metal alloys are added to obtain desired chemical compositions. This manufacturing process consumes large amounts of electricity which we purchase from the Public Service Company of Oklahoma (“PSO”) under a real-time pricing tariff at a contracted price, adjusted for fuel costs. During the summer months, we may elect to shutdown our melt shop during peak periods of power costs.

The molten steel is then conveyed to a six-strand continuous caster that casts various sizes of billets. The continuous caster is capable of casting billets up to 6 inches square and 50 feet long. These billets are then reheated in the natural gas reheat furnaces and rolled into various finished steel products at the rolling mills in Sand Springs or Joliet. The new reheat furnace in Sand Springs significantly reduces natural gas usage due to its greater efficiency.

The rolling mill in Sand Springs produces rebar, “T”-section (which is further processed into fence posts) and a range of hot rolled bar products, including squares (which are forged into track spikes at Wellington). The rolling mill in Joliet produces an extensive range of hot rolled bar products. A portion of the rebar produced in Sand Springs is epoxy coated at our Kansas City facility and fabricated at either Kansas City or Waddell as epoxy coated or uncoated bar.

Our production capabilities are highly flexible and enable us to shift our product mix to take advantage of changing market conditions. Factors that affect the allocation of our production capacity include product demand, margins and throughput potential. As an example, if the construction markets are active and a profit potential exists, we have the capability to increase our production of rebar while decreasing our production of hot rolled bar products. Conversely, when construction activity and demand for rebar slows, we can shift the production of these two products, decreasing rebar production while increasing hot rolled bar production. This flexibility enables us to achieve an optimal product mix within our primary markets. We also generally maintain a base level of production in most of our product lines in order to ensure an adequate supply to meet projected customer needs.

Our management team is comprised of a number of seasoned, industry veterans that average 30 years of experience in the steel industry. Over the past five years, management has implemented numerous initiatives to achieve significant operating efficiencies and cost savings which have increased our rolling mill capacity at our Sand Springs plant significantly. These initiatives include the successful installation of a reheat furnace, implementation of improved mill set-up techniques and implementation of preventive maintenance practices.

2

We have been aggressively instituting more effective maintenance and operating practices and process efficiencies. We perform routine and preventive maintenance on a weekly basis, which has increased the efficiency of our Sand Springs rolling mill and has enabled us to reduce the overall amount of equipment-related down time. We have been able to make productivity and cost improvements in the Sand Springs melt shop as well.

(i) Products

Rebar

Our facility located in Sand Springs, Oklahoma provides us with a competitive geographical advantage as a primary rebar supplier in the south-central United States comprising Oklahoma, western Arkansas, western Missouri, Kansas, eastern Colorado, northeastern New Mexico and northern Texas and we have developed significant customer relationships in Arizona, California and Nevada. Our targeted customer focus often enables us to act as the sole supplier of particular products to our customers who are leading fabricators who then shear and bend the rebar to meet engineering or architectural specifications for construction projects. Rebar demand is driven by infrastructure investment trends and trends in commercial and industrial construction. During periods of overall reduced steel industry demand, we have maintained relatively stable rebar sales volume due to the level of public sector investment in roads, bridges, water projects, airports and public facilities.

We believe that we supply in excess of 50% of the rebar purchased by rebar fabricators in these markets.

Rebar is rolled in standard diameters from #3 bar (3/8 inch or 10mm) to #18 bar (2¼ inches or 57mm) and sheared to standard lengths from 20 feet to 60 feet. To provide rapid response to customer needs, we maintain a finished goods inventory of 25,000 to 35,000 tons of rebar. Our primary methods of rebar distribution are by tractor trailer and rail.

Hot Rolled Bar

We sell a variety of specialty hot rolled bar products, including flats, squares, rounds and special shapes for end use applications that include auto parts, conveyor assemblies, pole line hardware, wrenches, farm equipment and construction machinery. Hot rolled bar products produced in Sand Springs are sold primarily to end product manufacturers. The majority of hot rolled bar products produced in Joliet are sold direct to original

3

equipment manufacturers and cold drawn bar finishers. We focus on specialty products and target customers with special requirements as to bar shape, size and chemical composition and, in many cases, small volume needs. Our primary method of hot rolled bar distribution is by tractor trailer.

Fabricated Steel Products

We manufacture three fabricated steel products: (1) fabricated rebar, including epoxy-coated rebar, (2) railroad track spikes and (3) fence posts, which are sold to distributors and farm cooperatives. Fabricated rebar is shipped from Waddell and Kansas City to highway and commercial construction contractors in Missouri, Kansas, Nebraska, Iowa and contiguous markets, with Waddell handling smaller, higher value added jobs and Kansas City handling large volume jobs.

We forge rail spikes at Wellington, our railroad track spike manufacturing operations located in Sand Springs. Wellington provides a downstream market for our rolling mill products (square hot rolled bar). Wellington sells primarily to the two large western railroads.

Fence posts are produced in a post fabrication shop located within the Sand Springs facility and adjacent to the Sand Springs rolling mill in two weights (1.25 pounds per foot and 1.33 pounds per foot), in orange and green colors and various lengths from 4 feet to 8 feet. Our primary method of fabricated steel product distribution is by tractor trailer to locations in Oklahoma, Kansas, Missouri, Texas and Arkansas.

Billets

Billets are semi-finished steel products that are usually rolled or forged into a finished steel product. As we have improved productivity in the Sand Springs mill, we have been able to convert virtually all of our billet production internally, and routine billet sales to third parties have ceased. We did make a single, opportunistic billet sale during fiscal year 2005. Sales volume potential and pricing for billets, particularly in the spot market, is highly variable. The dominant competitive factors are price and availability. Billet sales to other steel mills are generally at extremely low margins, and sales are dependent on market conditions that vary widely.

(ii) New products

During fiscal year 2005 we did not introduce any product or segment that would require the investment of a material amount of assets or that is otherwise material.

(iii) Raw Materials - Scrap

Our primary raw material is steel scrap, which is generated principally from industrial, automotive, demolition, railroad, obsolete and other sources. Scrap comprises approximately 100% (we have used a very limited amount of scrap substitutes in the past) of the metallic melt mix in our electric arc furnace steelmaking, in contrast to integrated mill steelmaking, where the proportion of scrap has traditionally been approximately 20%. We purchase scrap in the open market directly from dealers. The cost of steel scrap is subject to market forces, including demand by other steel producers, export/import volumes and utilization of scrap substitutes such as pig iron and hot-briquette iron. Our cost of scrap can vary significantly, and we may not be able to adjust product prices in the short-term to recover large increases in scrap costs. Over longer periods of time, however, product prices and steel scrap prices have tended to move in the same direction.

Many variables can impact scrap prices, the most critical of which, until recently, was the level of U.S. steel production. The United States has generally been a net scrap exporter. Generally, as domestic steel demand increased, so did scrap demand and resulting scrap prices. The reverse was also normally true, with scrap prices following steel prices downward where supply exceeded demand. However, during late 2000, the flood of imported steel, much of it unfairly traded, resulted in sharply reduced new steel production with corresponding decreases in the demand and the price of scrap. Starting during the latter part of 2002 and continuing through 2003 and into 2004, the price of scrap has risen sharply upward and remains extremely volatile. Scrap prices increased by $91.43 (85.5%) per ton from March 2003 to March 2004. This increase resulted largely from foreign scrap demand, particularly from China, a relatively weak U.S. dollar that makes U.S. scrap exports more attractive and relatively static if not limited scrap availability in the United States due to a weak economy and the shrinking domestic manufacturing base.

We currently purchase approximately 90% of our scrap from dealers in Oklahoma, southern Kansas, western Arkansas and southwestern Missouri. We believe this is a relatively close area to source such a high percentage of our scrap needs relative to other western mills. This is due to being in a well supplied area and our

4

strategy to produce both rebar and hot rolled bars, which allows us to use both secondary and premium scrap grades in reasonable balance to local scrap supply. In response to recent increases in scrap prices, we implemented a raw material surcharge effective January 1, 2004. This surcharge is intended to help us maintain margins for our products and insulate us from volatile scrap market price movements. Our ability to continue this surcharge, however, is uncertain and dependent on our customers’ ability and willingness to absorb these costs.

(iv) Patents, trademarks, licenses, franchises and concessions

We hold no patents, trademarks, licenses, franchises or concessions that are material to our business operations.

(v) Seasonality

The steel industry, in general, and our business in particular, is subject to seasonality. Our customers are primarily located in the south-central United States and their demand for steel declines in the winter due to reduced activity in the construction industry. As a result, our sales generally decline during the third fiscal quarter (November, December and January). We have attempted to reduce our exposure to seasonality by expanding our customer base to include “all-season” customers located in the western United States.

In fiscal year 2002, we began a sales and marketing effort targeting Arizona, California and Nevada due to their booming construction markets. As a result, we were able to develop supply relationships with several growing customers in these areas. These customers have purchased the majority of our increased production during fiscal year 2004 and have largely been responsible for an increase in our volume of sales from 452,951 tons in fiscal year 2003, with a peak of 616,531 tons in fiscal year 2004, to 512,460 tons in fiscal year 2005. In addition, many of our newer customers in the western United States are “all season” customers. Increased sales to these customer groups serve to reduce the seasonality of our business by increasing rebar sales during the winter months. We believe that increasing our market penetration in these areas and adding new geographically appropriate markets will enable us to reduce our exposure to the historical cycles and seasonality of the steel industry by expanding the demand base for our products.

(vi) Working Capital practices

We do not offer extended payment terms to our customers, nor are we required to carry certain inventory levels to meet rapid delivery requirements of customers; although, the market requires stocking rebar by size, grade, and length.

(vii) Customers

Approximately 39% of our sales are made to ten customers. No single customer accounts for more than 10% of sales, with our largest customer accounting for 7.7% of sales.

In Sand Springs, we have a competitive geographical advantage in the south-central United States hot rolled bar market. This enables our customers to benefit from lower freight costs, shorter lead times and more timely deliveries. As a result of these advantages and our reputation for quality and service, we have developed a number of close relationships with hot rolled bar product customers in our region.

We have been able to forge relationships with customers based upon differentiated customer service rather than solely on price. Our strategy is to work with only one major fabricator in each of our primary markets. As a result of providing consistent product quality, reliable and prompt delivery and customized service, we have become the majority or sole source supplier of particular shapes, sizes or steel chemistries to many of our customers.

Our ability to provide superior service and create strategic value for our customers has enabled us to maintain long-term relationships with our customers.

(viii) Backlogs

We do not have a material amount of backlogged products. Virtually all our backlog is shipped within the fiscal year.

(ix) Government contracts

We do not have material contracts subject to renegotiation of profits or termination at the election of the Government.

5

(x) Competition

We compete with a number of domestic mini-mills in each of our markets. There are common competitive factors in the steel bar business — price, proximity to market, quality and service — although their relative importance varies in the different market segments.

Rebar

Since pricing, availability, freight costs and delivery times are the most important competitive factors in the sale of rebar, sales tend to be concentrated within about 350 miles of a mini-mill. In the south-central United States, we have a competitive advantage as the closest mill serving an area comprising Oklahoma, western Arkansas, western Missouri, Kansas, eastern Colorado, northeastern New Mexico and northern Texas. The majority of our rebar tonnage is shipped to this area, although we have had recent success in opening new markets in Arizona, California and Nevada. We compete in the rebar market with a number of other mini-mills, principally Structural Metals, Incorporated, Gerdau-Ameristeel, Nucor Steel and others. Foreign competition does impact certain customers or geographic locations.

Our strategy is to focus on end-users and to provide our customers with tailored services and a broad product offering. Imported rebar lacks a complete size and length range to offer to the market generally focusing on only the small diameter bars in 20 foot lengths. Therefore, the twenty-foot length rebar and no-grade rebar markets have been impacted by foreign imports, which has had the effect of significantly reducing selling prices in the past.

Hot Rolled Bar

In the market for hot rolled bar products, our Joliet facility occupies a niche position at the specialty end of the product range. We believe we are the sole supplier to certain customers because of their requirements for particular shapes, sizes, small order quantities or steel chemistries. In other cases, we compete with a limited number of other producers of specialty hot rolled bar products, including Kentucky Electric Steel Incorporated, Gerdau Ameristeel and others. From Sand Springs and to a much lesser degree from Joliet, we compete with mini-mill producers of standard hot rolled bar products, including Chaparral Steel Company, Gerdau Ameristeel, Nucor Steel and Structural Metals, Incorporated. Competitors vary from customer to customer depending on location, product specifications and requirements for order sizes and inventory support.

Fabricated Steel Products

For fabricated rebar, our primary competitors are fabrication shops that are furnished with rebar from other mini-mills in the Midwest. In recent years, we believe that increased demand for product which is epoxy-coated prior to fabrication (to protect against corrosion in the field), from contractors bidding on infrastructure projects has provided Kansas City with a competitive advantage. Other competitive factors include delivery performance, engineering support, accurate fabrication and competitive pricing. Waddell’s focus is on small rebar projects, which complements Kansas City’s larger projects. The different market focus of the two locations allows for the most efficient production at each location.

In the railroad track spike market competitive factors include quality, service and price. Our primary competitors are Gerdau-Ameristeel and Birmingham Rail.

Competitive factors in fence post sales include product quality measured by durability, appearance, workmanship, delivery response time, price and freight costs. Competitors include Structural Metals, Incorporated, Chicago Heights Steel Company and foreign suppliers.

Competition from foreign producers is typically strong. In general, approximately 25% of U.S. domestic steel demand is satisfied by imported steel. However, the level of imports is substantially affected by the relative strength of foreign economies and fluctuation in the value of the U.S. dollar against foreign currencies, with steel imports tending to increase when the value of the dollar is strong in relation to foreign currencies. During the late 1990s, the situation was exacerbated by the weakening of certain economies, particularly in Eastern Europe, Asia and Latin America. Because of the ownership, control or subsidization of some foreign steel producers by

6

their governments, decisions by such producers with respect to their production, sales and pricing decisions are often influenced to a greater degree by political and economic policy considerations than by prevailing market conditions, realities of the marketplace or considerations of profit or loss.

Most foreign markets are less open than the U.S. market, allowing foreign producers to maintain higher prices in their own markets, while dumping excess production at lower and often subsidized prices into the U.S. market. Dumping involves selling a product below cost or for less than in the exporter’s home country and is a violation of U.S. trade laws. A number of steel industry anti-dumping initiatives, or trade cases, have been brought in recent years in an attempt to stem the flow of these unlawful imports. Some have been successful while others have not.

(xi) Research and Development

During the past three fiscal years, we did not have any material research and development activities.

(xii) Regulatory Matters

We are subject to a broad range of environmental laws, including those governing air emissions, storm water discharges and the handling and disposal of wastes. We have spent substantial amounts to comply with these requirements. In addition, in the event that we release hazardous materials into the environment, we could be responsible for the remediation of contamination associated with such a release. Primarily because the melting process in Sand Springs generates emission dust that contains lead, cadmium and other heavy metals, we are classified, in the same manner as other electric arc furnace operators in this industry, as a generator of hazardous waste.

The RCRA regulates emissions of sludge/dust from electric arc furnaces (“KO61”), a waste stream generated in significant quantities in Sand Springs. All of the KO61 generated in Sand Springs is shipped to Mexico, where a High Temperature Metals Recovery processor, Zinc Nacional, S.A., recovers the zinc, lead and cadmium and manufactures commercial and high purity zinc products. Zinc Nacional, S.A. is in compliance with the Mexican agency, Office of Environmental Protection, which is similar to the EPA in the United States.

In accordance with the Clean Air Act Amendments of 1990 and Oklahoma’s State Implementation Plan, we received a Title V operating permit in March 1998. We have been routinely audited and have had no resulting violations or outstanding issues. Late in 2000, we participated in a plant-wide EPA self-audit at our Sand Springs plant. No financially significant issues were found to exist in our opinion. In October 2003 we received our Title V Permit Renewal, which is formally described as our Part 70 Operating Permit Renewal 2002-019-TVR. Additional or new air emission control regulations or requirements applicable to our operations may be promulgated under the Clean Air Act in the future. We cannot at this time accurately estimate the costs, if any, of compliance with such future Clean Air Act regulations or requirements.

We are subject to a broad range of federal, state and local environmental regulations and requirements, including those governing air emissions and discharges into water, and the handling and disposal of solid and/or hazardous wastes. As part of the normal course of business, we incur an average of $1.0 to $2.0 million in expenses annually, primarily for the disposal of baghouse dust generated in the melt shop, to comply with these regulations and requirements. In addition, in the event that we release a hazardous substance, we could be responsible for the remediation of contamination associated with such a release. We believe that we are currently in substantial compliance with all material and applicable environmental regulations.

(xiii) Employees

As of April 30, 2005, we had 661 employees. Approximately 68% of our employees are represented by one of three collective bargaining units affiliated with the United Steelworkers of America (Sand Springs, Joliet and Kansas City). Sand Springs is party to a collective bargaining agreement covering 292 hourly-paid production and maintenance employees. This agreement, which was negotiated and ratified during April 2004, is for a two-year period expiring on March 2, 2006. Joliet is also party to a collective bargaining agreement, which was ratified in May 2004, covering 122 hourly-paid production and maintenance employees that expires on January 31, 2006. Kansas City had a collective bargaining agreement, covering 26 employees that expired on October 31, 2003. Kansas City is operating under the terms of the expired agreement. The Railway has 15 employees of which 10 are represented by various labor unions.

7

We own properties related to our operation of the Sand Springs facility, the Joliet facility and the Waddell facility. We lease nine acres of land adjacent to the Joliet facility from the Metropolitan Water Reclamation District of Greater Chicago under a long-term lease expiring in 2053. We also lease the plant in Kansas City and the Wellington facility in Sand Springs.

The Railway provides freight service between Sand Springs and Tulsa, Oklahoma. The Railway owns 32 miles of railroad track located on approximately 10 acres of land, three locomotives, 28 gondola railcars and four flat railcars. The Railway owns and operates a maintenance shop for normal repairs and upkeep of locomotives and railcars located on approximately six acres of land. The Railway also owns and operates an eight acre transload facility and a warehouse facility.

The following table provides information about our owned and leased properties, as of April 30, 2005:

| | | | | | | | |

| | | Buildings

| | | | |

Location

| | Acres

| | Square

Feet

| | Employees

| | Leased/

Owned

|

Sheffield - Sand Springs, OK | | | | | | 398 | | |

Mill | | 148 | | 616,548 | | | | Owned |

Corporate Office | | 1 | | 24,955 | | | | Owned |

| | |

| |

| | | | |

Total | | 149 | | 641,503 | | | | |

| | | | |

Sheffield - Joliet, IL | | | | | | 155 | | |

Mill | | 30 | | 345,735 | | | | Owned |

Joliet, IL adjacent to mill | | 9 | | — | | | | Leased |

| | |

| |

| | | | |

Total | | 39 | | 345,735 | | | | |

| | | | |

Team Rebar - Missouri | | | | | | 53 | | |

Sheffield - Kansas City, MO | | 3 | | 77,100 | | | | Leased |

Waddell’s Independence, MO | | 2 | | 32,213 | | | | Owned |

| | |

| |

| | | | |

Total | | 5 | | 109,313 | | | | |

| | | | |

Wellington - Sand Springs, OK | | | | | | 40 | | |

Mill | | 4 | | 26,000 | | | | Leased |

| | |

| |

| | | | |

Total | | 4 | | 26,000 | | | | |

| | | | |

Sand Springs Railway - Sand Springs, OK | | | | | | 15 | | |

Sand Springs Railway Transload | | 8 | | 68,722 | | | | Owned |

Sand Springs Railway Maintenance | | 6 | | 44,778 | | | | Owned |

Sand Springs Railway Track (32 miles of track) | | n/a | | n/a | | | | Owned/

right of way |

| | |

| |

| | | | |

Total | | 14 | | 113,500 | | | | |

| | |

| |

| | | | |

Company Total | | 211 | | 1,236,051 | | 661 | | |

We have granted a first priority lien on substantially all of our real property and equipment (excluding the real property and equipment of the Railway) to US Bank National Association, as trustee for the notes.

We have granted a second priority lien on such real property and equipment and a first priority lien on the real property and equipment of the Railway to The CIT Group/Business Credit, Inc. as lender under the credit facility. The credit facility is secured by a first lien on substantially all of our other personal property and US Bank National Association, as trustee for the notes, has a second lien on all such property.

8

We have total capacity to produce 600,000 tons of semi-finished goods and 620,000 tons of finished goods annually.

| | • | | Sand Springs, Oklahoma - 600,000 tons of annual semi-finished goods production capacity and 500,000 tons of annual finished goods capacity |

| | • | | Joliet, Illinois - 120,000 tons of annual finished goods capacity |

| | • | | Kansas City & Independence, Missouri – 35,000 tons annual capacity. |

We are involved in claims and legal actions arising in the ordinary course of business. We believe that the ultimate disposition of these matters will not have a material adverse effect on our financial position, results of operations or liquidity.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

None.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data for the five years ended April 30, 2005 and at our emergence from bankruptcy on August 14, 2002 should be read in conjunction with our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, included in Item 7 of this Report.

On August 14, 2002, we emerged from Chapter 11 bankruptcy. In accordance with AICPA Statement of Position 90-7,Financial Reporting by Entities in Reorganization Under the Bankruptcy Code, we adopted freshstart accounting as of August 14, 2002 and our emergence from Chapter 11 resulted in a new reporting entity. Under fresh-start accounting, the reorganization value of the entity is allocated to the entity’s assets based on fair values, and liabilities are stated at the present value of amounts to be paid determined at appropriate current interest rates. The effective date is considered to be August 14, 2002 for financial reporting purposes. The periods presented prior to August 14, 2002 have been designated “predecessor company” and the periods starting on August 14, 2002 have been designated “successor company.”

As a result of the implementation of fresh-start accounting as of August 14, 2002, our financial statements after that date are not comparable to our financial statements for prior periods because of the differences in the basis of accounting and the debt and equity structure for the predecessor company and the successor company. The most significant effect of the differences in the basis of accounting on the successor company’s financial statements is lower interest expense as a result of the discharge of $136.0 million of debt upon our emergence from bankruptcy.

9

The other financial data set forth below include calculations of EBITDA. This measure is not required by or presented in accordance with GAAP. Please see footnote 1 below for a discussion of EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor Company

| | | Predecessor Company

| |

| | | Fiscal Year Ended

April 30,

| | | Eight and

One-Half

Months Ended

April 30,

2003

| | | Three and One -

Half

Months Ended

August 13,

2002

| | | Fiscal Year Ended

April 30,

| |

| | | 2005

| | | 2004

| | | | | 2002

| | | 2001

| |

| | | (dollars in thousands, except per ton data) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Sales | | $ | 296,659 | | | $ | 244,708 | | | $ | 121,231 | | | $ | 44,621 | | | $ | 152,636 | | | $ | 166,110 | |

Cost of sales | | | 245,530 | | | | 214,619 | | | | 111,527 | | | | 39,810 | | | | 130,708 | | | | 140,666 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 51,129 | | | | 30,089 | | | | 9,704 | | | | 4,811 | | | | 21,928 | | | | 25,444 | |

Selling, general and administrative expense | | | 13,178 | | | | 13,068 | | | | 8,816 | | | | 3,952 | | | | 16,346 | | | | 14,763 | |

Depreciation and amortization | | | 7,037 | | | | 6,955 | | | | 5,694 | | | | 1,773 | | | | 15,776 | | | | 8,446 | |

Postretirement benefit expense other than pensions | | | 2,634 | | | | 2,715 | | | | 1,671 | | | | — | | | | 2,819 | | | | 2,686 | |

Litigation settlement | | | — | | | | — | | | | — | | | | — | | | | (1,119 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income (loss) | | | 28,280 | | | | 7,351 | | | | (6,477 | ) | | | (914 | ) | | | (11,894 | ) | | | (451 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Interest expense | | | 9,677 | | | | 6,935 | | | | 4,264 | | | | 762 | | | | 9,735 | | | | 16,919 | |

Other (income) expense | | | (1,259 | ) | | | — | | | | 49 | | | | 1,619 | | | | 2,576 | | | | 36 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before income taxes and extraordinary item | | | 19,862 | | | | 416 | | | | (10,790 | ) | | | (3,295 | ) | | | (24,205 | ) | | | (17,406 | ) |

Income tax benefit | | | (2,592 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) from continuing operations | | | 22,454 | | | | 416 | | | | (10,790 | ) | | | (3,295 | ) | | | (24,205 | ) | | | (17,406 | ) |

Extraordinary item - loss on retirement of long-term debt | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,400 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 22,454 | | | $ | 416 | | | $ | (10,790 | ) | | $ | (3,295 | ) | | $ | (24,205 | ) | | $ | (24,806 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Operational Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Tons sold | | | 512,460 | | | | 616,531 | | | | 328,968 | | | | 123,983 | | | | 423,508 | | | | 442,228 | |

Sales per ton | | $ | 578.89 | | | $ | 396.91 | | | $ | 368.52 | | | $ | 359.90 | | | $ | 360.41 | | | $ | 375.62 | |

| | | | | | |

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 161,825 | | | $ | 123,894 | | | $ | 116,089 | | | $ | 117,614 | | | $ | 119,661 | | | $ | 138,238 | |

Long-term debt (including current portion) | | | 83,051 | | | | 70,245 | | | | 65,538 | | | | 29,064 | | | | 28,224 | | | | 146,270 | |

Liabilities subject to compromise | | | — | | | | — | | | | — | | | | — | | | | 138,178 | | | | — | |

Stockholders’ equity (deficit) | | $ | 11,541 | | | $ | (9,053 | ) | | $ | (8,569 | ) | | $ | (81,474 | ) | | $ | (78,179 | ) | | $ | (49,189 | ) |

| | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA (1) | | $ | 36,576 | | | $ | 14,306 | | | $ | (832 | ) | | $ | (760 | ) | | $ | 1,306 | | | $ | 7,959 | |

Ratio of earnings to fixed charges (2) | | | 2. | 6x | | | 1.1 | x | | | — | | | | — | | | | — | | | | — | |

Depreciation expense | | | 7,037 | | | | 6,955 | | | | 5,694 | | | | 1,773 | | | | 15,776 | | | | 8,446 | |

Capital expenditures | | $ | 13,681 | | | $ | 1,381 | | | $ | 1,103 | | | $ | 559 | | | $ | 1,139 | | | $ | 5,871 | |

| (1) | EBITDA, which we define as earnings before interest, taxes, depreciation and amortization, is not a measure of financial performance calculated in accordance with accounting principles generally accepted in the United States (“GAAP”). EBITDA does not represent and should not be considered as an alternative to net income or cash flows from operations, which are determined in accordance with GAAP. |

10

We use EBITDA as a measure of operating performance, but not as a measure of liquidity. It assists us in comparing our performance on a consistent basis as it removes the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation and amortization of machinery and equipment) from our operating results.

We also use it with respect to compliance with our credit facility, which requires us to maintain a specified amount of Free Cash Flow for a rolling 12-month period that ends on the last day of each of our fiscal quarters. Free Cash Flow is defined as EBITDA (as defined in our credit facility) less certain fixed charges. EBITDA as that term is defined under our credit facility differs from the EBITDA measure used herein in that it includes a further adjustment to exclude the effect of extraordinary and/or nonrecurring gains or losses. We are in compliance with our Free Cash Flow covenant through the 12-month period ending April 30, 2005.

Material limitations exist to using EBITDA, as compared to net income, including difficulty in comparing our EBITDA results with similarly titled measures of other companies and the inability to analyze certain items, including depreciation and interest expense, that directly affect our net income or loss. We compensate for these limitations by considering the economic effect of excluded items independently and in connection with our analysis of net income. EBITDA should not be considered in isolation or as a substitute for operating income, net income or loss, cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP or as a measure of liquidity.

We believe EBITDA is useful to investors in evaluating our operating performance because:

| | • | | it is widely used in the steel industry to measure a company’s operating performance without regard to items such as depreciation and amortization, which can vary depending upon accounting methods and the book value of assets. We believe that, by eliminating such effects, EBITDA provides a meaningful measure of overall corporate performance exclusive of our capital structure and the method by which our assets were acquired; and |

| | • | | it helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation and amortization of machinery and equipment) from our operating results. Set forth below is a reconciliation of net income to EBITDA: |

The following is a reconciliation of EBITDA to net income:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor Company

| | | Predecessor Company

| |

| | | Fiscal Year Ended

April 30,

| | Eight and One-Half

Months Ended

April 30,

2003

| | | Three and

One-Half

Months Ended

August 13,

2002

| | | Fiscal Year Ended

April 30,

| |

| | | 2005

| | | 2004

| | | | 2002

| | | 2001

| |

| | | (dollars in thousands) | |

Net income (loss) | | $ | 22,454 | | | $ | 416 | | $ | (10,790 | ) | | $ | (3,295 | ) | | $ | (24,205 | ) | | $ | (24,806 | ) |

Interest expense, net | | | 9,677 | | | | 6,935 | | | 4,264 | | | | 762 | | | | 9,735 | | | | 16,919 | |

Income tax benefit | | | (2,592 | ) | | | — | | | — | | | | — | | | | — | | | | | |

Depreciation | | | 7,037 | | | | 6,955 | | | 5,694 | | | | 1,773 | | | | 15,776 | | | | 8,446 | |

Extraordinary Item | | | — | | | | — | | | — | | | | — | | | | — | | | | 7,400 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

EBITDA | | $ | 36,576 | | | $ | 14,306 | | $ | (832 | ) | | $ | (760 | ) | | $ | 1,306 | | | $ | 7,959 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (2) | For purposes of calculating this ratio, “earnings” consists of income before income taxes and fixed charges. “Fixed charges” consist of interest expense on indebtedness, amortization of debt issuance costs, amortization of debt discount and the interest portion of rental expense. Earnings were insufficient to cover fixed charges in the eight and one-half month period ended April 30, 2003 by approximately $10.8 million; in the three and one-half month period ended August 13, 2002 by approximately $3.3 million; in the fiscal year ended April 30, 2002 by approximately $24.2 million and in the fiscal year ended April 30, 2001 by approximately $17.4 million. |

11

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

MD&A contains statements that are forward-looking. You should read the following discussion in connection with our consolidated financial statements, including the notes to those statements, included in this document. The following discussion contains forward-looking statements which include numerous risks which you should carefully consider. These statements are based on current expectations and assumptions that are subject to uncertainties not currently known to us or that we currently deem to be immaterial which could cause actual results to differ materially. Additional risks and uncertainties may also materially and adversely affect our business. Any risks could materially adversely affect our business, financial condition or results of operations. Our fiscal years end on April 30.

Management Summary

Sheffield Steel is a regional mini-mill that produces a range of steel products including concrete reinforcing bar, hot rolled steel bar, and fabricated products such as fabricated rebar, railroad track spikes, and steel fence posts. Our headquarters and largest manufacturing facility is located in Sand Springs, Oklahoma, where we have an annual billet-making capacity of 600,000 tons. We also have a rolling mill in Joliet, Illinois, two rebar fabrication plants in the Kansas City area, a railroad spike manufacturing operation in Sand Springs, a post fabrication shop located adjacent to the Sand Springs mill, and a short-line railroad. The major cost components of our products are steel scrap and other raw materials, energy, labor, warehousing and handling and freight costs.

Several external factors exist which impact our results of operations, including volatility of steel prices, the cost of purchased raw materials, the magnitude and durability of world economy, the impact of production and consumption of steel in developing countries (which has a large impact on the volatility of steel raw material supplies and global steel pricing), and the fluctuating volume of imports to the United States.

History

Our Sand Springs facility was started in 1929 and was originally named Tulsa Rolling Mills. In 1936, the facility was leased by Sheffield Steel Corporation, a subsidiary of Armco Steel Corporation. In 1946, Sheffield Steel Corporation, a subsidiary of Armco Steel Corporation, purchased the plant. During the early 1950s Sheffield Steel Corporation became a division of Armco Steel. The Sheffield name and logo continued to be used in the Midwest for steel fence posts and wire products. In 1981, Armco sold the Sand Springs facility to HMK Enterprises and the Sheffield name was retained creating the new Sheffield Steel Corporation. Sheffield started up the Kansas City Rebar fabrication facility in 1985, acquired the Joliet, Illinois mill in 1986 and acquired the Railway in 1987. Later, Sheffield acquired Waddell’s rebar Fabricators in 1997 and Wellington Industries in 1998.

During the late 1990s, the U.S. steel industry experienced high energy costs, an increased volume of imported steel due in part to the illegal dumping of steel by foreign producers and a slowdown in the general economy. As a result of these factors and our significant debt service obligations at the time, our predecessor became unable to meet its financial obligations. In December 2001, our predecessor voluntarily filed a petition for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Northern District of Oklahoma. On August 14, 2002, a plan of reorganization was confirmed by the bankruptcy court and we emerged from bankruptcy. Under the plan, we satisfied our predecessor’s indebtedness with an exchange representing 95% of the equity interest in our common stock and $30.0 million principal amount of new 10% senior secured notes due 2007. In total, $136.0 million was discharged under the plan of reorganization. The bankruptcy case was fully closed on March 30, 2005.

After we emerged from bankruptcy, our financial performance has improved due to significant changes in our business and industry. Annualized utilization at our Sands Springs rolling mill improved approximately 25%. Company-wide annual rolling capacity increased from approximately 460,000 tons to 620,000 tons as a result of the implementation of several operating initiatives, including (1) performance of scheduled preventive

12

maintenance, (2) improvement to our mill setup techniques and (3) revamping of our employee incentive plans. In addition, we expanded our sales efforts into Arizona, Nevada and California which reduced the impact of seasonality and increased our volume. The impact of rising scrap prices continues to be partially offset by scrap surcharges that were implemented in January 2004.

Due to these business improvements and industry changes, we believe that we will be able to perform significantly better in comparison to the periods prior to our emergence from bankruptcy and the implementation of these improvements and changes.

(1-2) Liquidity and Capital Resources

Our business is capital intensive and requires substantial capital expenditures for, among other things, the purchase and maintenance of equipment used in our steelmaking and finishing operations and necessary to remain in compliance with environmental laws. For fiscal year ending April 30, 2005, our capital expenditures were $13.7 million, including $8.7 million for the purchase of a previously-leased reheat furnace that we purchased with a portion of the proceeds from the sale of the new notes. In addition to capital expenditures, our short-term and long-term liquidity needs arise largely from working capital requirements, principal and interest payments related to our outstanding indebtedness. We have met, and anticipate continuing to meet, our liquidity requirements with cash provided by operations, equity, long-term borrowings, our revolving credit facility, state and local grants and capital cost reimbursements.

As of April 30, 2005, we had long-term indebtedness of $83.1 million, including a current portion of $11.9 million, and we had approximately $15.0 million of additional borrowing availability under our revolving credit facility. Our current liquidity requirements include working capital needs, cash for debt service including an excess cash flow offer to repurchase notes as required by our indenture and capital expenditures. We intend to finance current operations and investing activities with cash from operations and borrowings under our revolving credit facility.

Borrowings under our revolving credit facility bear interest at a floating rate. To the extent that interest rates increase or decrease, and to the extent that amounts outstanding under the revolving credit facility increase or decrease, there will be corresponding increases or decreases in our interest obligations. In addition, our revolving credit facility and long-term indebtedness contain certain customary covenants. Since our emergence from bankruptcy we have been in non-compliance with a covenant on three occasions, in each instance receiving a waiver of non-compliance. In July 2003, at no cost to us, we obtained a permanent waiver of the covenant to provide the lender a post-bankruptcy opening balance sheet and analysis of tax consequences of rescheduling and forgiveness of the indentures within 90 days under our previous working capital term loan. In July 2003, we received a waiver for a violation of the cash flow covenant of the revolving credit facility. We paid an accommodation fee of $100 thousand for the waiver, which was effective for the period ending on April 30, 2003. In June 2004, at no cost to us, we amended the working capital term loan, which included obtaining a waiver for non-compliance with the negative pledge, debt and capital expenditures covenants. We repaid the working capital term loan with a portion of the proceeds from the issuance of the old notes.

Bond Indenture Excess Cash Flow Offer

Under the indenture governing our 11 3/8% senior notes due 2011, we are required to offer to repurchase an amount of the 11 3/8% notes equal to half the amount of excess cash flow (as defined in the indenture) generated during fiscal year 2005. Repurchases are scheduled to occur in late August or early September 2005 and will be funded with cash on hand. The repurchase offer will be for $11.8 million of the 11 3/8% notes, as calculated below.

| | | |

| | | Fiscal Year

Ended

April 30, 2005

|

| | | (in thousands) |

Consolidated EBITDA (1) | | $ | 38,965 |

| | |

|

|

Unfunded Capital Expenditures (2) | | | 3,622 |

Principal payments on debt | | | 838 |

Cash Interest paid | | | 8,396 |

Income tax paid | | | 2,440 |

| | |

|

|

Less Total Cash Items | | | 15,296 |

| | |

|

|

Excess Cash Flow | | | 23,669 |

| | |

|

|

50% of Excess Cash Flow | | $ | 11,835 |

| | |

|

|

13

| | (1) | Consolidated EBITDA, as defined in the indenture for our 11 3/8% notes, is earnings before interest, taxes, depreciation and amortization with an add back of “consolidated non-cash charges less any non-cash items increasing consolidated net income for such period” (the “Indenture add back”). For fiscal year 2005, the add back consists of the write-off of non-cash debt issuance costs related to the retired notes as well as the write off of unamortized discount on the issuance of the retired notes. Consolidated EBITDA does not represent and should not be considered as an alternative to net income or cash flows from operations, which are determined in accordance with GAAP. We are required by our note indenture to calculate Consolidated EBITDA for the purpose of computing excess cash flow (as defined in the indenture). |

Reconciliation of Consolidated EBITDA and Net Income:

| | | | |

| | | Fiscal Year

Ended

April 30, 2005

| |

| | | (in thousands) | |

Net income (loss) | | $ | 22,454 | |

Interest expense, net | | | 9,677 | |

Income tax benefit | | | (2,592 | ) |

Depreciation | | | 7,037 | |

Indenture add back (defined in (1) above) | | | 2,389 | |

| | |

|

|

|

Consolidated EBITDA | | $ | 38,965 | |

| | |

|

|

|

| | (2) | Unfunded Capital Expenditures are capital expenditures less those expenditures made with financed funds during the year. For fiscal year 2005, financed funds were used to purchase our reheat furnace and our Railway transload facility. |

Reconciliation of Unfunded Capital Expenditures and Capital Expedentitures:

| | | |

| | | Fiscal Year

Ended

April 30, 2005

|

| | | (in thousands) |

Unfunded capital expenditures | | $ | 3,622 |

Funded capital expenditures: | | | |

Reheat furnace | | | 8,573 |

Transload facility | | | 1,486 |

| | |

|

|

Capital expenditures | | $ | 13,681 |

| | |

|

|

As required by the indenture, notice of the offer to repurchase the 11 3/8% notes must be mailed within 90 days of the fiscal year end, the offer will remain open for 20 business days and the repurchase date can be no earlier than 30 days nor later than 60 days after the notice was mailed.

3) Results of Operations

Fiscal Year 2005 As Compared To Fiscal Year 2004

The following presents an overview of our results of operations for the years ended April 30, 2005 and 2004.

Sales

Sales for fiscal year 2005 were $296.7 million. This was a 22% increase over fiscal year 2004. During the period, pricing increased 47% in comparison to the prior year, while shipments decreased 17%.

| | • | | Rebar sales increased 8% for fiscal year 2005 in comparison to fiscal year 2004. Shipments, however, decreased 27% as demand decreased during the second and third fiscal quarters due to customers reducing their inventories, which were at high levels, in anticipation of slower winter business. Rebar pricing was 48% higher than the prior year. |

| | • | | Sales of hot rolled bar increased 40% for fiscal year 2005. However, shipments decreased 4% as compared to fiscal year 2004 while the sales price increased 46% over the same period. |

| | • | | Fabricated product sales increased 25% for fiscal year 2005 in comparison to fiscal year 2004. This resulted from an increase in prices for fabricated products of 31% during the period, offset by a decrease in overall shipments of 4% between the periods. Within the product categories, fabricated |

14

| | rebar shipments increased by 9% and railroad spike shipments by 10%, offset by a 29% decrease in fence post shipments. Prices increased for all three categories. |

Cost of Sales and Expenses

Average cost per ton increased 38% to $479 in fiscal year 2005 from $348 in fiscal year 2004 primarily due to increased scrap and alloy prices. During the period, the average price of scrap increased $61.77 per ton, or 47%, and alloy prices increased an average of $15.50 per billet ton, or 130%. Sales volumes decreased approximately 104,000 tons during the same period.

Selling, general and administrative expense increased $0.1 million in fiscal year 2005 as compared to fiscal year 2004. Administrative costs and selling costs increased approximately $0.8 million while insurance and taxes and general expenses decreased $0.7 million.

| | • | | Administrative costs increased $0.4 million during fiscal year April 30, 2005 due to employee profit sharing accruals and selling costs increased $0.4 million resulting from filling open staffing positions. |

| | • | | Insurance costs decreased $0.3 million during the same period as a result of lower negotiated rates. A decrease of $0.4 million in general expenses resulted from lower miscellaneous expenses. |

Depreciation expense increased $0.1 million during fiscal year 2005 as compared to fiscal year 2004 due to capital expenditures offset by assets becoming fully depreciated.

Post-retirement benefit expense other than pensions decreased by $0.1 million (3%) in fiscal year ended April 30, 2005 compared to fiscal year 2004 due to a revision in actuarial estimates.

Interest expense increased 40%, or $2.7 million, during fiscal year 2005 compared to fiscal year 2004. This increase was due to $12.8 million additional debt and the higher interest rate resulting from the new 11 3/8% bonds as of fiscal year ended April 30, 2005.

The loss on debt retirement of $3.5 million which occurred as a result of the bond refinancing during the second quarter of fiscal year 2005 consisted of $2.4 million for the write-off of the unamortized discount and unamortized debt issuance costs on the bonds retired by the transaction, $0.6 million early-retirement premium of old bonds and $0.5 million in fees for early payoff of working capital revolver.

A gain of $4.8 million resulting from a litigation settlement with our former owners was recognized in fiscal year 2005. This litigation related to the payment of dividends to the former owners and redemption of stock at a time when we were insolvent or on the verge of insolvency. The gain consisted of the following:

| | | | |

| | | (in millions) | |

Cash | | $ | 4.5 | |

Note Receivable | | | 1.3 | |

Payments to prepetition unsecured creditors | | | (1.2 | ) |

Fees paid | | | (0.6 | ) |

Decrease in bankruptcy liabilities | | | 0.8 | |

| | |

|

|

|

Total | | $ | 4.8 | |

| | |

|

|

|

15

Income Taxes

The effective tax rate for fiscal year 2005 is approximately 38%. We have paid the following federal and state taxes in fiscal year 2005:

| | | |

| | | (in thousands) |

Illinois state tax | | $ | 88.0 |

Missouri state tax | | | 39.0 |

2004 federal alternate minimum tax applied to 2005 | | | 70.0 |

2005 1st quarter federal safe harbor | | | 17.5 |

2005 2nd quarter federal estimated | | | 1,475.0 |

2005 4th quarter federal estimated | | | 750.0 |

| | |

|

|

Total | | $ | 2,439.5 |

| | |

|

|

Federal tax payments were made after applying our available net operating loss carryforwards. The provision for income taxes include these payments, offset by the reduction of our valuation allowance, which allowed us to recognize the value of our deferred tax assets on the balance sheet.

Fiscal Year 2004 as Compared to the 2003 Combined Period

The following presents an overview of our results of operations for the year ended April 30, 2004, and the period from May 1, 2002 to August 13, 2002 combined with the period from August 14, 2002 to April 30, 2003 (collectively the “2003 Combined Period”). (Our results before August 14, 2002 are not generally comparable to the results of operations after that date due to the effects of fresh-start accounting and our reorganization. The 2003 Combined Period is not presented in accordance with generally accepted accounting principles.)

Sales

The increase in sales was due primarily to improved demand, which was driven in part by new customers in the western United States and a sharp reduction in steel imports resulting from strong Chinese demand for steel, a weaker dollar and high ocean shipping costs. The increase in sales was also due to the addition of a new product line at the Sand Springs facility. As explained below, shipments and pricing generally increased in fiscal year 2004 compared to the 2003 Combined Period.

| | • | | Shipments of hot rolled bar from Sand Springs increased 17% in fiscal year 2004 compared to the 2003 Combined Period. Sales volume for hot rolled bar products increased due in part to increased production and productivity rates at the Sand Springs mill. Shipments of hot rolled bar products from Joliet decreased 2%. Pricing improved at both locations. |

| | • | | Shipments of rebar increased 76% and rebar pricing increased 20% in fiscal year 2004 compared to the 2003 Combined Period. |

| | • | | Shipments of fabricated products increased 16% and fabricated product pricing increased 8% in fiscal year 2004 compared to the 2003 Combined Period. Pricing improved on fabricated rebar, railroad spikes and fence posts and shipments improved on all fabricated products except railroad spikes, which were essentially unchanged. |

Cost of Sales and Expenses

Average cost of sales increased to $348 per ton in fiscal year 2004 from $334 per ton in the 2003 Combined Period due primarily to increases in scrap costs and, to a lesser degree, to increases in energy costs. These increases were partially offset by cost reductions related to the increased throughput in Sand Springs. Costs per ton decreased due to increased production and generally consistent fixed or semi-fixed costs.

Selling, general and administrative expense increased $0.3 million in fiscal year 2004 compared to the 2003 Combined Period. This increase primarily relates to higher net periodic pension costs.

Depreciation expense decreased $0.04 million in fiscal year 2004 compared to the 2003 Combined Period due to a company-wide restricted capital expenditure program under which only essential or maintenance-related expenditures were made. Capital spending was $1.4 million for fiscal year 2004.

16

Post-retirement benefit expense increased $1.0 million in fiscal year 2004 compared to the 2003 Combined Period. No expense was recorded during the three and one-half month predecessor portion of the Combined Period due to the bankruptcy.

Interest expense increased $1.4 million in fiscal year 2004 compared to the 2003 Combined Period. This increase relates to (i) prior to emergence from bankruptcy our first mortgage debt was undersecured and subject to compromise in the Chapter 11 proceedings and, accordingly, no interest was accrued; and (ii) changes subsequent to our fresh-start date relate to changes in the level of debt outstanding and the floating interest rate.

Cash Flow Analysis

Fiscal Year 2005 As Compared To Fiscal Year 2004

Cash provided by operating activities was $6.6 million in fiscal year 2005, compared with cash flow used by operating activities of $1.1 million in fiscal year 2004. Cash provided by operations in fiscal year 2005 included:

| | • | | $22.5 million in net income, |

| | • | | $2.3 million increase in accounts payable and current liabilities due to $3.9 million increase in profit sharing accruals and $1.0 million increase in vacation accrual and other liabilities, offset by $2.4 million decrease in bankruptcy accrual and current pension benefit obligations. |

| | • | | $0.5 million increase in long-term liabilities, |

| | • | | $0.2 million increase in accrued interest, and |

| | • | | $7.0 million in depreciation. |

Cash used by operations included:

| | • | | $17.4 million increase in inventories due to an inventory build. We started fiscal year 2005 with very low levels of inventory resulting from robust shipping levels seen in early calendar year 2004. Since shipments slowed, starting in September 2004, we have been able to restore what we believe to be normal inventory levels. Additionally, inventories increased due to rising costs of our raw materials (scrap, alloys, energy, electrodes and refractories), |

| | • | | $2.4 million increase in other long term assets due to $1.1 million long-term portion of note receivable from litigation settlement, |

| | • | | $1.0 million increase in prepaid expenses and other due to prepaid income taxes and the current portion of note receivable from litigation settlement, |

| | • | | $1.6 million increase in accounts receivable due to increased sales, and |

| | • | | $1.9 increase in other comprehensive income due to adjustment in pension liability, net of tax. |

Cash used in investing activities in fiscal year 2005 was $13.7 million compared to $1.4 million in fiscal year 2004. Cash used in investing activities in fiscal year 2005 included $8.7 million for the purchase of our reheat furnace operating lease, $1.5 million by the Railway for the purchase of approximately eight acres of land that contain a 68,722 square foot office building, transloading/ warehouse facility and $0.7 million for a billet cast crane. Remaining capital expenditures are up $1.5 in fiscal year 2005 over fiscal year 2004 due to the resumption of a normal capital program.

Cash flow provided by financing activities was $7.7 million during fiscal year 2005 due to the refinancing of our debt and the resulting increase in our outstanding debt. During fiscal year 2004 cash flow provided by financing activities was $3.7 million resulting from revolving credit borrowings partially offset by debt repayments.

17

Fiscal Year 2004 as Compared to the 2003 Combined Period

Cash used in operating activities was $1.1 million in fiscal year 2004 compared to $8.1 million in the 2003 Combined Period. Cash used in operating activities in fiscal year 2004 included a $14.5 million increase in accounts receivable due to the increase in sales. This increase in accounts receivable was partially offset by $7.4 million in net income plus depreciation expense. Of the $6.4 million of interest expenses, only $3.8 million was paid in cash during fiscal year 2004, and the balance was deferred by bondholder consent. As of the end of fiscal year 2004, two quarterly bond payments remained outstanding; these payments were made on May 28, 2004 and June 30, 2004.

Cash used in investing activities in fiscal year 2004 was $1.4 million compared to $1.7 million in the 2003 Combined Period. Expenditures in both years were limited to essential maintenance related capital spending. Maintenance related spending (an expense that is included in cost of goods sold) increased in fiscal year 2004 compared to the 2003 Combined Period, contributing to an increase in our utilization rate and the resulting increase in tons produced and shipped.

Cash provided by financing activities was $3.7 million during fiscal year 2004 and consisted of increased borrowings under the revolving credit facility of $6.6 million used to finance capital spending and the increase in working capital. Other long-term debt decreased by $2.9 million in fiscal year 2004.

Borrowings - Fiscal Year 2005

As of April 30, 2005, we had long-term indebtedness of $83.1 million. We had approximately $15 million of additional borrowing availability under our revolving agreements and $4.5 million in cash for a total liquidity of $19.5 million.

Increase Cash Flow Through Capital Improvements

We have identified areas of capital improvements that will upgrade our existing equipment and processes and enable us to increase capacity, reduce costs and extend the usable life of our existing equipment. Foremost among these capital improvements is the addition of a ladle arc furnace. The addition of a ladle arc furnace will enable us to operate our electric arc furnaces at greater efficiencies by creating a very controlled refining environment that results in less alloy, energy and electric furnace consumables usage, and can accommodate more restrictive chemistries. The cost to purchase and install this equipment is approximately $8.0 to $9.0 million.

We anticipate we can have a ladle arc furnace operational in our Sand Springs facility by the second quarter of fiscal year 2007. The timing of this upgrade is, however, subject to many factors, including operational delays and our general financial condition. We believe the completion of this project would result in savings of approximately $7.50 per ton, increasing EBITDA and net income by approximately $4.0 million per year.

We used a portion of the net proceeds from the sale of the $80 million 11 3/8% notes to purchase our reheat furnace for approximately $8.7 million. Previously, we had financed the reheat furnace through an operating lease (rental expense). The purchase eliminated our exposure to a fair market value buyout of the reheat furnace in 2008.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. We review the accounting policies we use in reporting our financial results on a regular basis. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure

18

of contingent assets and liabilities. We evaluate the appropriateness of these estimates and judgments on an ongoing basis. We base our estimates on historical experience and on various other assumptions we believe are reasonable under the circumstances. Actual results may differ from these estimates due to actual outcomes being different from those upon which we based our assumptions.

The following critical accounting policies, which we have discussed with our audit committee, reflect our more significant judgments and estimates used in the preparation of our consolidated financial statements. We do not believe that changes in these assumptions and estimates that are reasonably likely to occur from period to period would have a material impact on our consolidated financial statements.

Cash Equivalents

We consider all highly liquid debt instruments with original maturities of three months or less to be cash equivalents.

Accounts Receivable

We grant credit to customers on standard industry terms of net 30 days. At April 30, 2005 and 2004, accounts receivable were outstanding an average of 40 days and 41 days, respectively. This variance from our typical credit terms is largely a result of the practice of several larger customers to pay upon receipt of monthly statements summarizing the previous month’s invoices, resulting in payment for invoices issued early in the previous month to be made outside of the 30 day credit period. The variance also is a result of our government contractor customers who pay us only after they receive payment from the government, which occurs outside of the 30 day credit period. Finally, the variance is also due in part to customers purchasing products that require further processing from third-party vendors paying only after the customer receives the finished product from those vendors, which may occur outside the 30 day credit period.

At April 30, 2005 and 2004, approximately 30% and 39% of accounts receivable were outstanding 30 days or more and, of these, approximately 80% and 86%, respectively, were outstanding 60 days or less.

We have policies and procedures in place to evaluate the collectibility of customer accounts and to estimate bad debts based on each customer’s creditworthiness and general economic conditions. We evaluate all customer accounts quarterly and our top ten customer accounts monthly. However, any adverse change in the financial condition of customers could affect our estimate of bad debts.

Inventories

Raw materials and scrap inventories are stated at the lower of average cost or market. The cost of work-in-process and finished goods inventories is based on standards which approximate the lower of cost or market. Work-in-process and finished goods include direct labor and allocated overhead. Generally, we do not have obsolete inventory. Excess finished goods inventory is written down to its scrap value and can be converted into a saleable finished good.

Other Assets

Other assets consist primarily of debt issuance costs of $4.5 million. Debt issuance costs are amortized over the term of the related indebtedness.

Reorganization Value in Excess of Identifiable Assets

Reorganization value in excess of identifiable assets is treated as goodwill in accordance with Statement of Financial Accounting Standards (SFAS) No. 142,Goodwill and Other Intangible Assets,and is evaluated by management for impairment annually. No impairment existed as of April 30, 2005 and 2004.

Property, Plant and Equipment