QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

LodgeNet Entertainment Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

3900 West Innovation Street

Sioux Falls, South Dakota 57107

April 8, 2002

Dear Fellow Stockholder:

You are cordially invited to attend the 2002 Annual Meeting of Stockholders of LodgeNet Entertainment Corporation. The meeting will be held on Wednesday, May 8, 2002, at 9:00 a.m., Central Daylight Time, at LodgeNet's Headquarters and Distribution Center, 3900 West Innovation Street, Sioux Falls, South Dakota 57107. I encourage you to read carefully the enclosed Notice of Annual Meeting and Proxy Statement.

I hope you will be able to attend the Annual Meeting. Whether or not you plan to attend, I urge you to complete, sign, date and promptly return the enclosed proxy card in the enclosed envelope in order to make certain that your shares will be represented at the Annual Meeting. Your vote is important, whether you own a few shares or many.

Sincerely,

Scott C. Petersen

Chairman of the Board,

President and Chief Executive Officer

LODGENET ENTERTAINMENT CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that, pursuant to its Bylaws and the call of its Board of Directors, the Annual Meeting of Stockholders (the "Meeting") of LodgeNet Entertainment Corporation (the "Company") will be held at LodgeNet's Headquarters and Distribution Center, 3900 West Innovation Street, Sioux Falls, South Dakota 57107 on Wednesday, May 8, 2002, at 9:00 a.m., Central Daylight Time, for the purpose of considering and voting upon the following matters:

To Receive and Consider:

The report of Management on the business of the Company and the Company's audited financial statements for the fiscal year ended December 31, 2001, together with the report thereon of Arthur Andersen LLP, the Company's independent public accountants.

To Act On:

- 1.

- Election of Director. To elect one person to the Board of Directors of the Company to serve for a three-year term expiring in 2005 and until such person's successor is elected and qualified. The Board of Directors' nominee is:

R. F. Leyendecker

- 2.

- Other Business. To transact such other business as may properly come before the Meeting and at any and all adjournments thereof.

Historically the Company has submitted the appointment of Arthur Andersen LLP as the Company's independent public accountants for stockholder ratification, but given the uncertainty and the pace of developments related to Arthur Andersen's recent challenges, the Board of Directors does not believe it is appropriate to seek stockholder ratification of the appointment of the independent public accountants at this time. The Audit Committee has been authorized by the Board of Directors to engage the Company's independent public accountants for the fiscal year ending December 31, 2002. The Audit Committee will report such engagement at the Meeting, or publicly through the filing of a Report on Form 8-K with the Securities and Exchange Commission, when it occurs.

Only those stockholders of record on March 11, 2002 shall be entitled to notice of and to vote in person or by proxy at the Meeting.

The Proxy Statement which accompanies this notice contains additional information regarding the proposals to be considered at the Meeting and stockholders are encouraged to read it in its entirety.

As set forth in the enclosed Proxy Statement, the proxy is solicited by and on behalf of the Board of Directors of the Company. It is expected that these materials will be first mailed to stockholders on or about April 8, 2002.

1

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE TO BE SURE THAT YOUR STOCK IS VOTED. YOUR VOTE IS IMPORTANT, WHETHER YOU OWN A FEW SHARES OR MANY.

| | | By Order of the Board of Directors, |

|

|

|

| | | Daniel P. Johnson

Secretary |

Dated: April 8, 2002 |

|

|

2

LODGENET ENTERTAINMENT CORPORATION

3900 West Innovation Street

Sioux Falls, South Dakota 57107

(605) 988-1000

PROXY STATEMENT

Annual Meeting of Stockholders

May 8, 2002

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of LodgeNet Entertainment Corporation (the "Company") for use at the Annual Meeting of Stockholders (the "Meeting") of the Company to be held on Wednesday, May 8, 2002, at LodgeNet's Headquarters and Distribution Center, 3900 West Innovation Street, Sioux Falls, South Dakota 57107 at 9:00 a.m., Central Daylight Time, and at any and all adjournments thereof. Scott C. Petersen and Gary H. Ritondaro, the designated proxyholders (the "Proxyholders"), are members of the Company's management. This Proxy Statement and the enclosed proxy card (the "Proxy") and other enclosures will be first mailed to stockholders on or about April 8, 2002. Only stockholders of record on March 11, 2002 (the "Record Date") are entitled to vote in person or by proxy at the Meeting.

Matters to be Considered

The matters to be considered and voted upon at the Meeting will be:

- 1.

- Election of Director. To elect one person to the Board of Directors of the Company to serve for a three-year term expiring in 2005 and until such person's successor is elected and qualified. The Board of Directors' nominee is:

R. F. Leyendecker

- 2.

- Other Business. To transact such other business as may properly come before the Meeting and at any and all adjournments thereof.

Historically the Company has submitted the appointment of Arthur Andersen LLP as the Company's independent public accountants for stockholder ratification, but given the uncertainty and the pace of developments related to Arthur Andersen's recent challenges, the Board of Directors does not believe it is appropriate to seek stockholder ratification of the appointment of the independent public accountants at this time. The Audit Committee has been authorized by the Board of Directors to engage the Company's independent public accountants for the fiscal year ending December 31, 2002. The Audit Committee will report such engagement at the Meeting, or publicly through the filing of a Report on Form 8-K with the Securities and Exchange Commission, when it occurs.

Voting and Revocability of Proxies

A Proxy for use at the Meeting is enclosed. The Proxy must be signed and dated by you or your authorized representative or agent. You may revoke a Proxy at any time before it is exercised at the Meeting by submitting to the Secretary of the Company a written revocation of such proxy or a duly executed proxy bearing a later date or by voting in person at the Meeting.

3

Unless revoked, the shares of common stock represented by Proxies will be voted in accordance with the instructions given thereon. In the absence of any instruction in the Proxy, your shares of common stock will be voted: "FOR" the election of the nominee for director set forth herein.

The enclosed Proxy confers discretionary authority with respect to any amendments or modifications of the proposals or other business which properly may be brought before the Meeting. As of the date hereof, management is not aware of any such amendments or modifications or other matters to be presented for action at the Meeting. However, if any other matters properly come before the Meeting, the Proxies solicited hereby will be voted by the Proxyholders in accordance with the recommendation and in the discretion of the Board of Directors.

Costs of Solicitation of Proxies

This Proxy is made on behalf of the Board of Directors of the Company and the Company will bear the costs of solicitation. The expense of preparing, assembling, printing and mailing this Proxy Statement and the materials used in this solicitation of Proxies also will be borne by the Company. It is contemplated that Proxies will be solicited principally through the mail, but directors, officers and regular employees of the Company may solicit Proxies personally or by telephone. Although there is no formal agreement to do so, the Company may reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding these proxy materials to their principals. The Company does not intend to utilize the services of other individuals or entities not employed by or affiliated with the Company in connection with the solicitation of Proxies.

Outstanding Securities and Voting Rights

The authorized capital of the Company consists of 50,000,000 shares of common stock, par value $.01 per share, of which 12,311,878 shares were issued and outstanding on the Record Date, and 5,000,000 shares of preferred stock, $.01 par value, of which there are no shares outstanding.

A majority of the outstanding shares of common stock constitutes a quorum for the conduct of business at the Meeting. Each stockholder is entitled to one vote, in person or by proxy, for each share of common stock standing in his or her name on the books of the Company as of the Record Date on any matter submitted to the stockholders. The Company's Certificate of Incorporation does not authorize cumulative voting. In the election of directors, the person receiving the highest number of votes will be elected. Shares represented by a proxy card marked as abstaining on any proposal will be counted as a vote against that matter. If a broker which is the record holder of certain shares indicates on a proxy that it does not have discretionary authority to vote on a particular matter as to such shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular matter, these non-voted shares will be counted for quorum purposes but are not deemed to be present or represented for purposes of determining whether stockholder approval of that matter has been obtained.

Brokers and nominees holding common stock in "street name" which are members of a stock exchange are required by the rules of the exchange to transmit this Proxy Statement to the beneficial owner of the common stock and to solicit voting instructions with respect to the matters submitted to the stockholders. In the event any such broker or nominee has not received instructions from the beneficial owner by the date specified in the statement accompanying such material, the broker or nominee may give or authorize the giving of a Proxy to vote such common stock on the matters to be considered at the Meeting;provided, however, that the broker or nominee may not give or authorize the giving of a Proxy for any matter if it has notice of any contest with respect to any matter, and,provided, further, that the broker or nominee may not vote the common stock "FOR" any matter which substantially affects the rights or privileges of the common stock without specific instructions from the beneficial owner. If you hold your common stock in "street name" and you fail to instruct your broker

4

or nominee as to how to vote your common stock, your broker or nominee may, in its discretion, vote your common stock "FOR" the election of the Board of Directors' nominee.

Beneficial Ownership of Principal Stockholders and Management

The following table sets forth the beneficial ownership of common stock as of the Record Date by each person known to the Company to be the record or beneficial owner of more than five percent of the outstanding shares of common stock (other than depositories holding shares of common stock in "street name"), by each director and nominee for director, each executive officer named in the Summary Compensation Table, and by all directors and executive officers, as a group:

Name and Address of Beneficial Owner(1)(2)

| | Amount and Nature of

Beneficial Ownership(3)

| | Percent

of Class(3)

| |

|---|

Scott C. Petersen,

Chairman of the Board, President and Chief Executive Officer(4) | | 554,725 | | 4.5 | % |

John M. O'Haugherty,

Senior Vice President, Chief Operating Officer(4) | | 194,117 | | 1.6 | % |

David M. Bankers,

Senior Vice President, Chief Technology Officer(4) | | 119,105 | | * | |

Gary H. Ritondaro,

Senior Vice President, Chief Financial Officer(15) | | 8,346 | | * | |

R. Douglas Bradbury, Director(5) |

|

30,977 |

|

* |

|

| Lawrence Flinn, Jr., Director(6) | | 157,536 | | 1.3 | % |

| Richard R. Hylland, Director(7) | | 62,536 | | * | |

| R. F. Leyendecker, Director(8) | | 64,536 | | * | |

| Alex Brown Investment Management(9) | | 953,600 | | 7.8 | % |

| Barclays Global Fund Advisors(10) | | 661,504 | | 5.4 | % |

| Hilton Hotels Corporation(11) | | 1,548,156 | | 11.1 | % |

| PAR Investment Partners, L.P.(12) | | 1,777,800 | | 14.5 | % |

| Vanguard Explorer Fund(13) | | 889,100 | | 7.2 | % |

| Wellington Management Company LLP(14) | | 1,495,189 | | 12.2 | % |

Directors and Executive Officers(4)(5)(6)(7)(8)(15)

(A group of 8 persons) |

|

1,191,878 |

|

9.7 |

% |

- *

- Less than 1%.

- (1)

- Unless otherwise indicated, the address of such person is 3900 West Innovation Street, Sioux Falls, South Dakota 57107.

- (2)

- Each named person has sole voting and investment power with respect to the shares listed, except as noted below.

- (3)

- Shares which the person (or group) has the right to acquire within 60 days after the Record Date are deemed to be outstanding in calculating the percentage ownership of the person (or group) but are not deemed to be outstanding as to any other person (or group).

- (4)

- Includes shares issuable upon the exercise of options to purchase Common Stock which the person (or group) has the right to acquire within 60 days after the Record Date as follows: Mr. Petersen, 380,343 shares; Mr. O'Haugherty, 154,617 shares; Mr. Bankers, 119,006 shares; and Mr. Ritondaro, 7,500 shares; and all directors and executive officers as a group, 865,446 shares. For Mr. Petersen, includes 38,500 shares owned by Mr. Petersen's spouse and 6,150 shares owned by Mr. Petersen's children. For Mr. Bankers, includes 99 shares owned by Mr. Bankers' minor children.

5

- (5)

- Includes 30,000 shares of Common Stock which Mr. Bradbury has the right to acquire by the exercise of vested stock options.

- (6)

- Includes 53,000 shares of Common Stock which Mr. Flinn has the right to acquire by the exercise of vested stock options.

- (7)

- Includes 58,000 shares of Common Stock which Mr. Hylland has the right to acquire by the exercise of vested stock options.

- (8)

- Includes 63,000 shares of Common Stock which Mr. Leyendecker has the right to acquire by the exercise of vested stock options.

- (9)

- The address for Alex Brown Investment Management is 217 E. Redwood Street, Suite 1400, Baltimore, Maryland, 21202; address and share ownership information based on Schedule 13G filed for the year ended December 31, 2001.

- (10)

- The address for Barclays Global Fund Advisors is 45 Fremont Street, San Francisco, CA 94105; address and share ownership information based on Schedule 13G filed for the year ended December 31,2001.

- (11)

- Includes a warrant for 1,548,156 shares, dated October 9, 2000 with an exercise price of $20.437 per share and an expiration date of October 9, 2007.

- (12)

- The address of PAR Investment Partners, L.P. is One Financial Center, Suite 1600, Boston MA 02111; address and share ownership information based on Schedule 13G filed for the year ended December 31, 2001.

- (13)

- The address for Vanguard Explorer Fund is 100 Vanguard Blvd., Malvern, PA 19355; address and share ownership information based on Schedule 13G filed for the year ended December 31 2001.

- (14)

- The address of Wellington Management Company LLP is 75 State Street, Boston, Massachusetts 02109; address and share ownership information based on Schedule 13G filed for the year ended December 31, 2001.

- (15)

- On March 1, 2001, Mr. Ritondaro began his employment with the Company as Senior Vice President, Chief Financial Officer.

6

ELECTION OF DIRECTOR

Board of Directors and Nominee

The Company's Certificate of Incorporation and Bylaws provide that the number of directors shall be determined from time to time by the Board of Directors but may not be less than three nor more than nine. The Board of Directors is currently composed of five members. The Bylaws further provide for the division of the directors into three classes of approximately equal size, with directors in each class elected for a three-year term and approximately one-third of the directors elected each year.

The director nominated for reelection is R. F. Leyendecker. Mr. Leyendecker is completing the term to which he was elected by the stockholders in 1999. The nominee has indicated his willingness to serve and, unless otherwise instructed, Proxies will be voted in favor of such nominee. In the event that Mr. Leyendecker should be unable to serve as a director, it is intended that the Proxies will be voted for the election of such substitute nominee(s), if any, as shall be designated by the Board of Directors. Management has no reason to believe that the nominees will be unavailable to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"

THE ELECTION OF THE NOMINEE TO THE BOARD OF DIRECTORS.

The following table sets forth certain information, as of the Record Date, with respect to the nominee for director and the continuing directors of the Company. The number of shares of common stock beneficially owned by the nominee for director and the continuing directors is set forth above under "Beneficial Ownership of Principal Stockholders and Management."

Name

| | Age

| | Principal Occupation or Employment

for the Past Five Years

| | Year First

Became

Director(1)/

Term Expires

|

|---|

| Nominee for Director: | | | | | | |

R.F. Leyendecker |

|

56 |

|

Private investor; former Vice President of Regulatory Affairs for NorthWestern Services Group, Inc., a wholly owned subsidiary of NorthWestern Corporation* ("NOR"), 2000-2002; President and Chief Executive Officer for NorthWestern Energy Corporation and NorCom Advanced Technologies, Inc., (both wholly owned subsidiaries of NOR), 1996-2000. |

|

1986/2002 |

Other Directors: |

|

|

|

|

|

|

R. Douglas Bradbury |

|

51 |

|

Executive Vice President of Level 3 Communications, Inc.* ("LVLT"), a telecommunications and information services company, August 1997-present; and Vice Chairman of the Board, February 2000-present; Chief Financial Officer, 1997-2000; and Director since 1998. Chief Financial Officer of MFS Communications Company, Inc., 1992-1996; Senior Vice President 1992-1995 and Executive Vice President from 1995-1996. |

|

1999/2003 |

|

|

|

|

|

|

|

7

Richard R. Hylland |

|

41 |

|

President, Chief Operating Officer and Director of NorthWestern Corporation (NOR*) from 1998-present; Vice Chairman of NorthWestern Growth Corporation from 1999-present; Executive Vice President of NOR 1995-1998; Chief Executive Officer, Jan.-May 1999 and Chief Operating Officer, 1994-1999 of NorthWestern Growth Corporation (a wholly owned subsidiary of NOR); Director of MDC Communications, a provider of secure transaction products and services and communications and marketing services; Vice Chairman of Cornerstone Propane GP, Inc.; the Managing General Partner of Cornerstone Propane Partners, L.P.*; Vice Chairman of Blue Dot. Service, Inc.; Vice Chairman of Expanets, Inc.; |

|

1990/2003 |

Lawrence Flinn, Jr. |

|

66 |

|

Private Investor; Formerly Chairman, Chief Executive Officer and director of United Video Satellite Group, Inc. |

|

1994/2004 |

Scott C. Petersen |

|

46 |

|

Chairman of the Board, President and Chief Executive Officer of the Company. Mr. Petersen joined the Company in 1987 as Senior Vice President for Corporate and Legal Affairs, was appointed Executive Vice President and Chief Operating Officer in 1991, was appointed President and Chief Executive Officer in July 1998 and became Chairman of the Board in October 2000. |

|

1993/2004 |

- *

- Denotes public company.

- (1)

- For purposes of this table, the year in which an individual first became a director of the Company shall be the year in which such individual was appointed to the Board of Directors of the Company or its South Dakota predecessor.

Procedures for Nominating Directors

The procedures for nominating directors, other than by the Board of Directors, are set forth in the Bylaws. Nominations for the election of directors, other than by the Board of Directors, must be made by a stockholder entitled to vote for the election of directors by giving timely written notice to the Secretary of the Company at the Company's principal office. Such notice must be received at least 90 days prior to the date on which, in the immediately preceding calendar year, the Company's Annual Meeting of Stockholders for such year was held;provided, however, that in the event the date of the Annual Meeting is changed by more than 30 days from such anniversary date, such stockholder's notice must be received by the Secretary of the Company no later than 10 days after notice or prior public disclosure of the meeting is first given or made to stockholders. The stockholder's notice must be in writing and must set forth as to each proposed nominee all information relating to such person that is required to be disclosed in solicitations of proxies pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), including, but not limited to, such person's written consent to being named in the proxy statement as a nominee and to serving as a director, if

8

elected. The stockholder notice must also set forth the name and address of the nominating stockholder. If the stockholder fails to comply with the above provisions, then the Chairman of the meeting may declare that the nomination was not made in accordance with the procedures prescribed by the Bylaws and the defective nomination may be disregarded.

Committees of the Board of Directors

The Audit Committee of the Board of Directors is composed of not less than three non-employee directors who are financially literate in financial and auditing matters and are independent as defined by the National Association of Securities Dealers, listing standards. The Audit Committee of the Board of Directors is composed of Messrs. Hylland (Chair), Bradbury, Flinn and Leyendecker. The Audit Committee provides assistance to the Board in satisfying its responsibilities relating to accounting, auditing, operating and reporting practices of the Company. The Audit Committee also recommends to the Board the appointment of independent public accountants to conduct the annual audit of the Company's financial statements and confers with the independent public accountants prior to the release of quarterly earnings. The Audit Committee met four times during 2001.

The Compensation Committee of the Board of Directors is composed of Messrs. Leyendecker (Chair), Bradbury, Flinn and Hylland, each of whom is independent as defined by the National Association of Securities Dealers. The Compensation Committee is responsible for establishing compensation policies, for setting compensation levels for the Company's executive officers and serves as disinterested administrators of the Plan. The Compensation Committee met four times during 2001. For a description of the functions of the Compensation Committee, see "ELECTION OF DIRECTORS—Executive Compensation—Report of the Compensation Committee on Executive Compensation."

The Board of Directors met six times during 2001. All of the persons who were directors of the Company during 2001 attended at least 75% of the total number of meetings of the Board of Directors and the committees of the Board of Directors on which he served.

Director Compensation

The compensation to be paid to each non-employee director is set at $20,000 per year plus $500 for each committee meeting attended in person and $300 for each committee meeting attended by teleconference. The non-employee directors also receive reimbursement for travel and related expenses for attendance at Board and Committee meetings. The non-employee directors receive half of their annual retainer in the form of cash and the other half in shares of the Company's Common Stock. Non-employee directors receive upon their initial election or appointment to the Board a nonqualified stock option to purchase 12,000 shares of Common Stock under the Plan plus an additional 12,000 options to be granted on each anniversary of such election during the term of service.

Compliance with Reporting Requirements of Section 16 of the Exchange Act

Under Section 16(a) of the Exchange Act, the Company's directors, executive officers and any persons holding ten percent or more of the common stock are required to report their ownership of common stock and any changes in that ownership to the Securities and Exchange Commission (the "SEC") and to furnish the Company with copies of such reports. Specific due dates for these reports have been established and the Company is required to report in this Proxy Statement any failure to file on a timely basis by such persons. To the Company's knowledge, based solely upon a review of copies of such reports received by the Company which were filed with the SEC from January 1, 2001 through the Record Date, and upon written representations from such persons that no other reports were required, the Company has been advised that all reports required to be filed under Section 16(a) have been timely filed with the SEC.

9

Executive Compensation

Summary of Cash and Certain Other Compensation

The following table sets forth certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company's Chairman and Chief Executive Officer ("CEO") and the Company's executive officers other than the CEO (determined as of the end of the last fiscal year) (the "Named Executives") whose total annual salary and bonus exceeded $100,000 for the fiscal year ended December 31, 2001. Along with Mr. Petersen, the Company's other executive officers in 2001 were the Company's three Senior Vice Presidents (Mr. Bankers, Mr. O'Haugherty and Mr. Ritondaro).

Summary Compensation Table

| | Annual Compensation

| | Long-Term

Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation($)(1)

| | Number of

Stock Options

Granted(2)(#)

|

|---|

Scott C. Petersen

Chairman of the Board, President,

Chief Executive Officer | | 2001

2000

1999 | | 375,000

330,000

320,000 | | 160,315

127,723

193,280 | | 43,028

39,627

26,735 | | 80,000

110,000

— |

John M. O'Haugherty

Senior Vice President,

Chief Operating Officer |

|

2001

2000

1999 |

|

210,000

190,000

170,000 |

|

61,110

48,352

74,779 |

|

18,653

17,127

15,510 |

|

—

54,000

— |

David M. Bankers

Senior Vice President,

Chief Technology Officer |

|

2001

2000

1999 |

|

210,000

185,000

160,000 |

|

61,425

48,352

71,430 |

|

18,653

16,752

15,595 |

|

35,000

54,000

— |

Gary H. Ritondaro(3)

Senior Vice President,

Chief Financial Officer |

|

2001 |

|

240,539 |

|

71,905 |

|

144,890 |

|

65,000 |

- (1)

- Reflects compensation paid to the Named Executives by the Company in order for them to purchase individual supplemental insurance coverage and other benefits. Also reflects compensation paid to Mr. Ritondaro of $30,000 as a signing bonus and $94,034 for moving expenses.

- (2)

- Includes options granted in December 2001 as part of the 2002 compensation package as follows: Mr. Petersen, 80,000 options; Mr. Bankers, 35,000 options; and Mr. Ritondaro, 35,000 options.

- (3)

- On March 1, 2001, Mr. Ritondaro began his employment with the Company as Senior Vice President, Chief Financial Officer.

Employment Agreements

In connection with the Company's initial public offering in October 1993, the Company entered into an employment agreement with Mr. Petersen, dated August 16, 1993. In July 1998, Mr. Petersen became Chief Executive Officer and President of the Company and at that time the Board amended and extended the term of Mr. Petersen's agreement until June 30, 2000. Mr. Petersen's agreement contains an automatic renewal provision which, absent notice from either the Company or Mr. Petersen on or before each November 1, beginning in 1999, extends the Agreement for an additional year. Accordingly, Mr. Petersen's agreement is currently extended until June 30, 2003. The Board set

10

Mr. Petersen's base salary for 2001 at $375,000. In addition, Mr. Petersen is entitled to participate in various Company employment benefits plans.

Mr. Petersen's employment may be terminated prior to the expiration of the term of the agreement (i) automatically upon Mr. Petersen's death or disability or (ii) by the Company at any time, with or without cause, by action of its Board of Directors. In the event of any such termination of employment, the following termination benefits apply: (x) for any termination, other than for cause (including a termination due to death or disability), the Company will pay a pro rata portion of the maximum bonus for the then current year under any bonus program in which Mr. Petersen may be participating at the time, unless such payment is not permitted by the terms of the plan; and (y) for any termination by the Board of Directors without cause, including an election by the Company not to allow the agreement to automatically extend, the Company will pay Mr. Petersen a severance payment for a period of twenty four months at a monthly rate equal to Mr. Petersen's monthly base salary increased by twenty percent. In the event of a termination after a change in control involving the Company, the terms of Mr. Petersen's agreement will be governed by the terms and conditions of the Severance Agreements described below. The employment agreement contains a covenant by Mr. Petersen not to compete with the Company, or to work for a competing business, for the term of his employment. Should Mr. Petersen compete with the Company following his termination, the Company's obligation to make severance or other payments shall immediately cease.

On May 11, 1999, the Company entered into employment agreements with David M. Bankers, the Company's Senior Vice President and Chief Technology Officer and John M. O'Haugherty, the Company's Senior Vice President and Chief Operating Officer. The terms of each of those employment agreements are the same as Mr. Petersen's agreement summarized above, with the exception of salary (as set forth in the Summary Compensation Table) and the term of each of those agreements expire on December 31 of each year, subject to automatic renewal on November 1 of each year. On March 1, 2001, the Company entered into an employment agreement with Gary H. Ritondaro, the Company's Senior Vice President, Chief Financial Officer. The terms of this employment agreement are the same as Mr. Petersen's agreement summarized above, with the exception of salary (as set forth in the Summary Compensation Table) and the term of this agreement expires on December 31 of each year, subject to automatic renewal on November 1 of each year.

In July 1995, the Compensation Committee authorized the Company to enter into agreements (the "Severance Agreements") with the Company's President and its other executive officers, including the officers named in the Summary Compensation Table, providing for the payment of certain compensation and other benefits in the event of a covered termination of the executive's employment within two years following a "change in control" involving the Company. No compensation is payable to any executive under the Severance Agreements unless (i) there has been a change in control and (ii) the executive's employment with the Company shall have been terminated (including a substantial reduction in duties or compensation, but excluding termination as a result of the death or permanent disability of the executive or for cause or voluntary retirement). A "change in control" is generally defined as the occurrence of any of the following: (i) any person or group becomes the beneficial owner of securities representing 30% or more of the voting power of the Company's outstanding capital stock having the right to vote in the election of directors (excluding any such transaction that is effected at an actual or implied average valuation of less than $6.75 per share of common stock); (ii) a majority of the members of the Board shall not for any reason be the individuals who at the beginning of such period constitute the Board or persons nominated by such members; (iii) any merger, consolidation or sale of all or substantially all of the assets of the Company (meaning assets representing 30% or more of the net tangible assets of the Company or generating 30% or more of the Company's operating cash flow), excluding a business combination or transaction in which: (a) the stockholders of the Company prior to such transaction continue to represent more than 70% of the voting power of the Company immediately after giving effect to such transaction; (b) no person or

11

group becomes the beneficial owner of 30% or more of the Company's voting stock; or (c) the purchase price results in an actual or implied average valuation of less than $6.75 per share of common stock; (iv) the adoption of any plan or proposal for the liquidation or dissolution of the Company; or (v) the occurrence of any other event that would be required to be reported as a change in control in response to Item 6(e) of Schedule 14A of Regulation 14A of the Exchange Act.

Upon a covered termination, the executive is entitled to receive a lump sum payment equal to the compensation the executive would have received over a 30-month period, a pro rata portion of any bonus the executive would have received for the year in which such termination occurs, any stock options previously granted to the executive will become fully vested, and the executive will be entitled to the continuation of the insurance and other welfare benefits then being received by such executive for a 30-month period. The Severance Agreements contain a covenant not to compete with the Company for a period of six months following a covered termination, and executives are not required to mitigate any termination benefits (nor will such benefits be reduced by compensation received from other employment). The Severance Agreements terminate upon the earlier of: (i) five years (subject to automatic one-year extensions unless the Board otherwise notifies the executive); (ii) the termination of the executive's employment other than pursuant to a covered termination described above; (iii) two years from the date of a change in control of the Company if there has not been a covered termination; and (iv) prior to a change in control upon the executive's ceasing to be an executive officer of the Company.

Stock Options

The following table contains information concerning the grant of stock options during the fiscal year ended December 31, 2001 to the Named Executives.

Option(1) Grants In Fiscal Year 2001

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable

at Assumed Annual

Rates of Stock

Price Appreciation

for Option Term(3)

|

|---|

| |

| | Percent of Total Options/SARs Granted to Employees in 2001 (%)

| |

| |

|

|---|

| | Number of Securities Underlying Options/SARs Granted(#)(2)

| |

| |

|

|---|

Name

| | Exercise or Base Price ($/Sh)

| |

|

|---|

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

|---|

| Scott C. Petersen | | 80,000 | | 18.5 | % | 16.50 | | 12/16/2011 | | 2,149,600 | | 3,423,200 |

| John M. O'Haugherty | | — | | — | | — | | — | | — | | — |

| David M. Bankers | | 35,000 | | 8.1 | % | 16.50 | | 12/16/2011 | | 940,450 | | 1,497,650 |

| Gary H. Ritondaro | | 30,000 | | 6.9 | % | 16.00 | | 02/08/2011 | | 781,800 | | 1,244,700 |

| | | 35,000 | | 8.1 | % | 16.50 | | 12/16/2011 | | 940,450 | | 1,497,650 |

- (1)

- The Company has no plans pursuant to which stock appreciation rights may be granted.

- (2)

- The options were granted pursuant to the Plan. The options become exercisable in four equal annual installments beginning one year after the date of the grant. Included are options granted in December 2001 as part of the 2002 compensation package as follows: Mr. Petersen, 80,000 options; Mr. Bankers, 35,000 options; and Mr. Ritondaro, 35,000 options.

- (3)

- These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on a variety of factors, including market conditions and the price performance of the Common Stock. There can be no assurance that the rates of appreciation presented in this table can be achieved.

12

Option Exercises and Holdings

The following table provides information with respect to the Named Executives concerning the exercise of options during the fiscal year ended December 31, 2001 and unexercised options held by the Named Executives as of December 31, 2001:

Aggregated Option Exercises in Fiscal Year 2001

and Fiscal Year-End Option Values

| |

| |

| | Number of Securities Underlying Options at 12/31/01 (#)

| | Value of Unexercised

In-the-Money Options

at 12/31/01 ($)(1)

|

|---|

Name

| | Number of Shares Acquired on Exercise(#)

| | Value Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Scott C. Petersen | | 0 | | — | | 367,843 | | 162,500 | | 3,328,329 | | 103,450 |

| John M. O'Haugherty | | 0 | | — | | 132,617 | | 56,500 | | 794,374 | | 126,205 |

| David M. Bankers | | 0 | | — | | 97,000 | | 91,500 | | 590,227 | | 146,855 |

| Gary H. Ritondaro | | 0 | | — | | 0 | | 65,000 | | — | | 53,350 |

- (1)

- Value of unexercised "in-the-money" options is the difference between the market price of the Common Stock on December 31, 2001 ($17.09 per share) and the exercise price of the option, multiplied by the number of shares subject to the option.

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors (the "Committee") is responsible for developing and making recommendations to the Board with respect to the Company's executive compensation policies. In addition, the Committee, pursuant to authority delegated by the Board, determines on an annual basis the compensation to be paid to the Company's chief executive officer and each of the other executive officers of the Company. The Committee consists exclusively of disinterested directors. Set forth below is the Report of the Committee addressing the Company's policies regarding executive compensation for 2001.

Compensation Policies Applicable to Executive Officers

The Report of the Compensation Committee on Executive Compensation shall not be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 (the "Securities Act"), or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Compensation Philosophy and Objectives. The Company's success is dependent upon its ability to attract and retain highly qualified and motivated executives. The Company endorses the philosophy that executive compensation should reflect Company performance and the contribution of such officers to that performance. The Company's compensation policies are designed by the Committee to achieve three fundamental objectives: (i) attract and retain qualified executives, (ii) motivate performance to achieve specific strategic objectives of the Company, and (iii) align the interests of senior management with the long-term interests of the Company's shareholders. The three key interests of senior management with the long-term interests of the Company's shareholders. The three key elements of the Company's compensation program are base salary, an annual performance-based cash bonus, and long-term stock options.

The Company's executive officers are also permitted to participate in the Company's broad based employee benefit plans and receive supplementary payments to enable such executives to purchase

13

additional insurance coverage and other benefits. The incremental cost to the Company of the benefits provided under these plans to the Named Executives averaged approximately 9.8% of their base salaries in 2001.

Base Salaries. The Company's approach to compensating executive officers has been to pay base salaries which are competitive with the salaries paid to executives of other companies in the media and communications industries and general industry, and based upon the Committee's judgment of the particular individual's experience, performance and potential contributions to the Company. The Company believes executive compensation levels must be competitive with those provided to other executives in the media and communications industries in order to attract and retain qualified executives crucial to the Company's long-term success. The group of companies considered by the Committee is broader than the group shown in the performance graph included below because the Company believes that it competes with a broader group of companies for executive talent.

The Company's Chief Executive Officer, Mr. Petersen, is employed pursuant to an employment contract (the "Employment Contract") dated July 22, 1998. The Employment Contract was for an initial term through June 30, 2000, and automatically extends each year unless either the Company or Mr. Petersen elect not to extend. In approving the Employment Contract, the Board made a subjective assessment of management performance relating to the achievement of financial targets and strategic milestones and considered the salary levels of executive officers of its competitors and other public companies of comparable size. Mr. Petersen's base salary of $375,000 represents an increase of $45,000 from 2000. With respect to the Company's other Named Executive officers, based on the policies and factors described above, including the performance of the Company and peer group compensation, the Committee approved base salary adjustments for 2001 averaging 11.5% for such Named Executive officers. The Company has also entered into employment agreements with such Named Executive officers, namely: David M. Bankers, John M. O'Haugherty and Gary H. Ritondaro. See"EXECUTIVE COMPENSATION—EMPLOYMENT AGREEMENTS."

BONUS COMPENSATION. The Company's officers are eligible to receive annual cash incentive compensation based on achieving specific goals and objectives established by the Committee. In November 2000, the Committee established an executive bonus program for 2001 based on the achievement by the executive of a combination of target goals relating to earnings before interest, expense, income taxes, growth in new Guest Pay interactive rooms; and the achievement of strategic goals, the particular combination of targets and their respective weighting being dependent upon the nature of the participating executive's areas of responsibility. Target bonuses under the program, assuming budgeted expectations were met, could range from 25% to approximately 60% of base salary depending upon the executive's position. If results significantly exceeded budgeted expectations, bonus payments under the program could range from approximately 35% up to 90% of base salary. The Committee met in February 2002 to evaluate the Company's performance and determine the 2001 bonuses for executive officers. The Committee considered whether the target goals for 2001 were attained and reviewed strategic events that occurred during the year. In light of the foregoing, the Committee approved the cash bonus payments to the Named Executives reflected in the Summary Compensation Table.

LONG-TERM STOCK OPTIONS. The Company believes that stock ownership by executive officers and key employees aligns their interests with those of stockholders. Stock options granted to such persons are intended to provide such employees with an incentive to achieve superior performance that will be reflected in the appreciation of the Company's common stock. The terms and conditions of such options are determined and administered by the Committee. Generally, stock options are granted annually with an exercise price equal to the prevailing market value of the Company's common stock at the time of grant, have ten year terms and vest over a four year period. The nature of the long-term stock option compensation means that participating executives will not realize compensation unless the

14

value of the Company's common stock increases. Each executive officer is considered for stock options based on his or her responsibilities in the Company and existing stock option position, as well as stock option award levels of comparable media and communications companies. Option grants made to the Named Executives in 2001 totaled 180,000 shares and are reflected in the Summary Compensation Tables, that total includes 150,000 options granted to the Named Executives in December 2001 as part of the 2002 compensation package.

SEVERANCE AGREEMENTS. The Board believes that it is in the interest of the Company and its stockholders to reinforce and encourage the continued dedication of the Company's executive officers without the distractions occasioned by the possibility of an abrupt change in control of the Company. In July 1995, the Committee authorized the Company to enter into severance agreements with the Company's president and its other executive officers, including the Named Executives, providing for the payment of certain compensation and other benefits in the event of a covered termination of the executive's employment within two years following a "change in control" involving the Company. See"EXECUTIVE COMPENSATION—EMPLOYMENT AGREEMENTS."

IRC SECTION 162(m). Section 162(m) of the Internal Revenue Code disallows the deductibility by the Company of any compensation over $1 million per year paid to each of the chief executive officers and the four most highly compensated executive officers (other than the chief executive officer), unless certain criteria are satisfied. No officer of the Company receives compensation in excess of such amount and, accordingly, in 2001 the Board took no action with respect to qualifying for any exemption from such limitation.

| | | THE COMPENSATION COMMITTEE |

|

|

R.F. Leyendecker, Chair

R. Douglas Bradbury

Lawrence Flinn, Jr.

Richard R. Hylland |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee has ever served as an officer of the Company, other than Mr. Leyendecker, who served as the Company's Treasurer from 1988 though 1992. Certain compensation matters were reviewed by the entire Board of Directors, which includes Mr. Petersen, Chairman of the Board, President and Chief Executive Officer of the Company. Mr. Leyendecker, a director and member of the Compensation Committee, is a former officer of NorthWestern Services Group, Inc., a wholly owned subsidiary of NorthWestern Corporation. Mr. Hylland, a director and a member of the Compensation Committee is a director and executive officer of NorthWestern Corporation and a director of Cornerstone Propane GP, Inc. Mr. Bradbury, a director and member of the Compensation Committee, is a director and executive officer of Level 3 Communications, Inc.

15

AUDIT COMMITTEE REPORT

The following report is submitted on behalf of the Audit Committee of the Board of Directors.

We have reviewed and discussed with management the Company's audited financial statements as of and for the year ended December 31, 2001. We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, COMMUNICATION WITH AUDIT COMMITTEES, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. We have received and discussed with the independent auditors the matters required by Independence Standards Board Statement No. 1, INDEPENDENCE DISCUSSIONS WITH AUDIT COMMITTEES, as amended, and have considered the compatibility of non-audit services with the auditors' independence. We have reviewed and discussed with the independent auditors critical accounting policies. Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001. The Board of Directors has adopted an Audit Charter to guide the Audit Committee which is reviewed at least annually. The fees paid to Arthur Andersen LLP in 2001, by category, were as follows:

| Audit Fees | | $ | 137,087 |

| Financial Information Systems Design and Implementation Fees | | $ | -0- |

| All Other Fees | | $ | 23,055 |

| | | THE AUDIT COMMITTEE |

|

|

Richard R. Hylland, Chair

R. Douglas Bradbury

Lawrence Flinn, Jr.

R.F. Leyendecker |

CERTAIN TRANSACTIONS WITH MANAGEMENT AND OTHERS

In October 2000, the Board of Directors reauthorized a loan to Tim C. Flynn, the Company's founder and former Chairman, in an amount not to exceed $1.5 million, secured by various assets including LodgeNet common stock. Interest on the loan accrues at a rate commensurate with the current interest rate of the revolving credit facility. As of the date of this document, Mr. Flynn's outstanding loan balance was approximately $1,360,000. The loan is currently due and payable on July 31, 2002, or upon earlier demand by the Company. Except for that loan, none of the directors or executive officers of the Company or any subsidiary thereof, or any associates or affiliates of any of them, is or has been indebted to the Company at any time since the beginning of the last completed fiscal year in excess of $60,000. None of the directors or executive officers of the Company or any associate or affiliate of such person, had any material financial interest, direct or indirect, in any transaction or any proposed transaction with the Company during the past fiscal year.

16

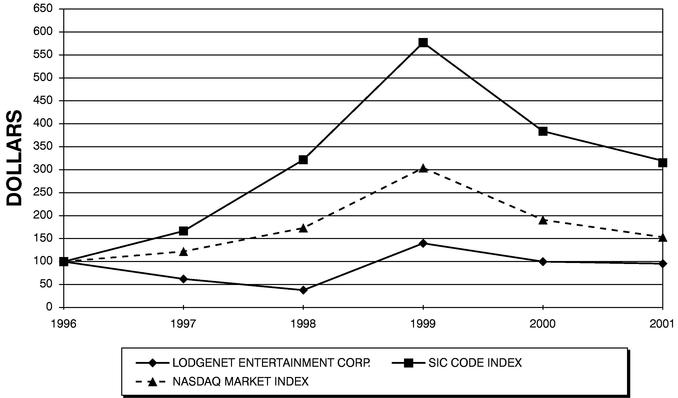

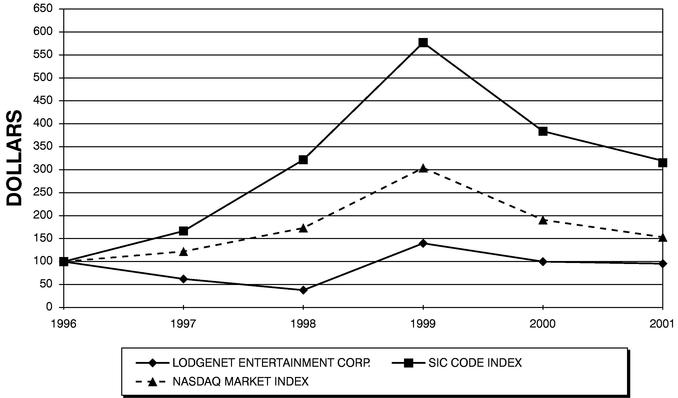

PERFORMANCE GRAPH

The following graph compares the percentage change in the Company's cumulative total shareholder return on its common stock with (i) the cumulative total return of the NASDAQ Market Index and (ii) the cumulative total return of all companies (the "Peer Group") with the same four-digit standard industrial code (SIC) as the Company (SIC Code 4841—Cable and Other Pay Television Services) over the period from December 31, 1996 through December 31, 2001. The graph assumes an initial investment of $100 in each of the Company, the NASDAQ Market Index and the Peer Group and reinvestment of dividends. The Company did not declare or pay any dividends in 2001. The graph is not necessarily indicative of future price performance.This graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG THE COMPANY, NASDAQ MARKET INDEX AND PEER GROUP*

ASSUMES $100 INVESTED ON JAN. 1, 1997

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2001

| | December 31

|

|---|

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

|

|---|

| LodgeNet Entertainment | | $ | 100.00 | | 61.97 | | 38.73 | | 140.14 | | 99.30 | | 96.28 |

| Cable, Other Pay TV Services | | | 100.00 | | 167.48 | | 322.39 | | 577.03 | | 384.51 | | 318.93 |

| NASDAQ Market Index | | | 100.00 | | 122.32 | | 172.52 | | 304.29 | | 191.25 | | 152.46 |

- *

- Source: Media General Financial Services, Inc.

17

APPOINTMENT OF INDEPENDENT ACCOUNTANTS

Historically the Company has submitted the appointment of Arthur Andersen LLP as the Company's independent public accountants for stockholder ratification, but given the uncertainty and the pace of developments related to Arthur Andersen's recent challenges, the Board of Directors does not believe it is appropriate to seek stockholder ratification of the appointment of the independent public accountants at this time. The Audit Committee has been authorized by the Board of Directors to engage the Company's independent public accountants for the fiscal year ending December 31, 2002. The Audit Committee will report such engagement at the Meeting, or publicly through the filing of a Report on Form 8-K with the Securities and Exchange Commission, when it occurs.

ANNUAL REPORT

The Company's Annual Report to Shareholders, incorporating its Annual Report on Form 10-K for the fiscal year ended December 31, 2001 accompanies this Proxy Statement. The Form 10-K contains consolidated financial statements of the Company and its subsidiaries and the report thereon of Arthur Andersen LLP, the Company's independent public accountants.

PROPOSALS OF STOCKHOLDERS

Under certain circumstances, stockholders are entitled to present proposals at stockholder meetings. The 2003 Annual Meeting of Stockholders will be held on or about May 14, 2003. Proposals of stockholders intended to be included in the proxy materials for the 2001 Annual Meeting of Stockholders must be received by the Secretary of the Company, 3900 West Innovation Street, Sioux Falls, South Dakota 57107, by December 12, 2002, in a form that complies with the Company's Bylaws and applicable requirements.

OTHER BUSINESS

The Board of Directors knows of no business which will be presented for consideration at the Meeting other than as stated in the Notice of Meeting. If, however, other matters are properly brought before the Meeting, it is the intention of the Proxyholders to vote the shares represented thereby on such matters in accordance with the recommendations of the Board of Directors and authority to do so is included in the Proxy.

DATED: April 8, 2002

| | | By Order of the Board of Directors, |

|

|

|

| | | Daniel P. Johnson

Secretary |

18

Version A

| | | LodgeNet Entertainment Corporation | | 000000 0000000000 0 0000

000000000.000 ext

000000000.000 ext

000000000.000 ext

000000000.000 ext |

| | | [BARCODE]

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6 | | 000000000.000 ext

000000000.000 ext

000000000.000 ext

Holder Account Number

C 1234567890 J N T

[BARCODE] |

Use ablack pen. Print in CAPITAL letters inside the grey areas as shown in this example. |

|

A

|

|

B

|

|

C

|

|

1

|

|

2

|

|

3

|

|

X

|

|

o |

|

Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card

|

(A) Election of Director for a term of 3 years

1. The Board of Directors recommends a voteFORthe listed nominee.

| | For

| | Withhold

| |

| |

|

|---|

| 01—R. F. Leyendecker | | o | | o | | | | |

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting and any and all adjournments thereof. The Board of Directors at present knows of no other business to be presented by or on behalf of the Company or the Board of Directors at the Annual Meeting.

|

|

|

PLEASE MARK, SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY

USING THE ENCLOSED ENVELOPE

(B) Authorized Signatures—Sign Here—This section must be completed for your instructions to be executed.

Please sign exactly as name appears hereon. Joint owners should each sign. Where applicable, indicate official position or representative capacity.

| Signature 1 | | Signature 2 | | Date (dd/mm/yyyy) |

| |

| |

/ /

|

| | | 1 U P X | | A584 |

Proxy—LodgeNet Entertainment Corporation

|

This Proxy is Solicited on Behalf of the Board of Directors

for the Annual Meeting of Stockholders to be held May 8, 2002

The undersigned hereby appoints Mr. Scott C. Petersen and Mr. Gary H. Ritondaro, and each of them, the attorneys, agents and proxies of the undersigned, with full powers of substitution to each (the "Proxies"), to attend and act as proxy or proxies of the undersigned at the Annual Meeting of Stockholders (the "Annual Meeting") of LodgeNet Entertainment Corporation (the "Company") to be held at the Company's Headquarters and Distribution Center, 3900 W. Innovation Street, Sioux Falls, South Dakota 57107 on Wednesday, May 8, 2002 at 9:00 a.m. Central Daylight Time or any adjournment thereof, and to vote as specified herein the number of shares which the undersigned, if personally present, would be entitled to vote.

This Proxy when properly executed will be voted as specified. If no instruction is specified with respect to a matter to be acted upon, the shares represented by the Proxy will be voted "FOR" the election of Mr. R. F. Leyendecker. If any other business is presented at the Annual Meeting, this Proxy confers authority to and shall be voted in accordance with the recommendation of the Board of Directors. This Proxy is solicited on behalf of the Board of Directors and may be revoked prior to its exercise by filing with the Corporate Secretary of the Company a duly executed proxy bearing a later date or an instrument revoking this Proxy, or by attending and electing to vote in person.

PLEASE MARK, SIGN, DATE AND MAIL PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE

(Continued and to be signed on reverse side)

QuickLinks

GENERAL INFORMATIONELECTION OF DIRECTORSummary Compensation TableOption(1) Grants In Fiscal Year 2001Aggregated Option Exercises in Fiscal Year 2001 and Fiscal Year-End Option ValuesREPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATIONCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONAUDIT COMMITTEE REPORTCERTAIN TRANSACTIONS WITH MANAGEMENT AND OTHERSPERFORMANCE GRAPHAPPOINTMENT OF INDEPENDENT ACCOUNTANTSANNUAL REPORTPROPOSALS OF STOCKHOLDERSOTHER BUSINESS