SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant |X|

Filed by a Party other than the Registrant | |

Check the appropriate box:

| | Preliminary Proxy Statement

| | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

|X| Definitive Proxy Statement

| | Definitive Additional Materials

| | Soliciting Material Pursuant toss. 240.14a-11(c) orss. 240.14a-12

Atchison Casting Corporation

- --------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|X| No fee required.

| | Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and

0-11.

(1) Title of each class of securities to which transaction applies:

-----------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

-----------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): (4) Proposed

maximum aggregate value of transaction:

-----------------------------------------------------------------------

(5) Total fee paid:

-----------------------------------------------------------------------

| | Fee paid previously with preliminary materials.

| | Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

(1) Amount Previously Paid:

-----------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

-----------------------------------------------------------------------

(3) Filing Party:

-----------------------------------------------------------------------

(4) Date Filed:

-----------------------------------------------------------------------

[LOGO]

ATCHISON CASTING CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held December 12, 2002

Notice is hereby given that the Annual Meeting of Stockholders of

Atchison Casting Corporation (the "Company") will be held at the offices of the

Company, 400 South Fourth Street, Atchison, Kansas, on Thursday, December 12,

2002, at 11 a.m. (Central Time) for the following purposes:

1. To elect two Class III Directors to serve for a term of three

years.

2. To transact such other business as may properly come before the

meeting.

The Board of Directors has fixed the close of business on October 21,

2002 as the record date for the determination of stockholders entitled to

receive notice of and to vote at the meeting. If you own stock in Atchison

Casting Corporation as of that date, you are cordially invited to attend the

meeting.

Your vote is important. Whether or not you plan to attend the meeting,

please sign and date the enclosed proxy and promptly return it in the envelope

provided. No postage is necessary if mailed in the United States. If you attend

the meeting, we will be glad to return your proxy so that you may vote in

person.

PLEASE RETURN YOUR PROXY - THANKS!

By Order of the Board of Directors,

/s/ Thomas K. Armstrong, Jr.

Thomas K. Armstrong, Jr.

Chairman of the Board and

Chief Executive Officer

Atchison, Kansas

November 6, 2002

ATCHISON CASTING CORPORATION

400 South Fourth Street

Atchison, Kansas 66002-0188

(913) 367-2121

PROXY STATEMENT

for

Annual Meeting of Stockholders

to be held December 12, 2002

GENERAL INFORMATION

This proxy statement is being furnished to you on or about November 6,

2002, in connection with the solicitation of proxies by the Board of Directors

of Atchison Casting Corporation, a Kansas corporation (the "Company"), for use

at the Annual Meeting of Stockholders to be held at the Company's offices, 400

South Fourth Street, Atchison, Kansas, at 11:00 a.m. (Central Time) on Thursday,

December 12, 2002. The Company will use the proxies it receives to: (i) elect

two Class III directors and (ii) to transact other business properly coming

before the Annual Meeting. In order to provide every stockholder with an

opportunity to vote on all matters scheduled to come before the Annual Meeting

and to be able to transact business at the meeting, proxies are being solicited

by the Company's Board of Directors. Upon execution and return of the enclosed

proxy, the shares represented by it will be voted by the persons designated

therein as proxies, in accordance with the stockholder's directions. You may

vote on a matter by marking the appropriate box on the proxy or, if no box is

marked for a specific matter, the shares will be voted as recommended by the

Board of Directors on that matter.

You may revoke the enclosed proxy at any time before it is voted by (i)

notifying the Secretary of the Company in writing before the Annual Meeting,

(ii) exercising a proxy of a later date and delivering such later proxy to the

Secretary of the Company prior to the Annual Meeting or (iii) attending the

Annual Meeting and voting in person. Unless the proxy is revoked or is received

in a form that renders it invalid, the shares represented by it will be voted in

accordance with the instructions contained therein.

The Company will bear the cost of solicitation of proxies, which will

be principally conducted by the use of the mails; however, certain officers and

employees of the Company may also solicit proxies by telephone, telegram or

personal interview. Such expense may also include ordinary charges and expenses

of brokerage firms and others, for forwarding soliciting material to beneficial

owners.

On October 21, 2002, the record date for determining stockholders

entitled to vote at the Annual Meeting, the Company had outstanding and entitled

to vote 7,723,031 shares of common stock, par value $.01 per share (the "Common

Stock"). Each outstanding share of Common Stock entitles the record holder to

one vote.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, elected for terms

of three years and until their successors are elected and qualified. Two Class

III directors are to be elected at the meeting. The proxies named in the

accompanying proxy intend to vote for the election of Vladimir Rada and William

Bullard. In the event Mr. Rada or Mr. Bullard should become unavailable for

election, which is not anticipated, the proxies will be voted for such

substitute nominees as may be nominated by the Board of Directors. The nominees

for election as Class III directors who receive the greatest number of votes

cast for election of the directors at the meeting, a quorum being present, shall

be elected as directors of the Company. Abstentions, broker nonvotes and

instructions on the accompanying proxy card to withhold authority to vote for a

nominee will result in the nominee receiving fewer votes.

Information Concerning Nominees

The following table sets forth information with respect to the nominees

to the Board of Directors.

Class III - Term Expiring 2005

Principal Occupation and

Name Age Five-Year Employment History

- ---- --- ----------------------------

Vladimir Rada 48 Director since July 2002. Since December 2001, Mr.

Rada has been a charter member and partner in

SKOFORGE, s.r.o. From November 1994 to October 2001,

he served as Executive and Director of both SKODA Steel,

konsorcium and SKODA, Kovarny, Plzen, s.r.o.

William Bullard 52 Director since May 2002. Since 1986, Mr. Bullard

has been President of Silver Spring Holdings, Inc.,

a private investment bank From 1989 to 1994, he

served as Chairman, President and Chief Executive

Officer of American Mirrex Corporation.

Information Concerning Directors Continuing in Office

The following table sets forth information with respect to the

directors who are continuing in office for the respective periods and until

their successors are elected and qualified.

Class I - Term Expiring 2003

Principal Occupation and

Name Age Five-Year Employment History

- ---- --- ----------------------------

Thomas K. Armstrong 48 Chairman of the Board, President and Chief Executive

Officer since May 2002. Director since December 2001.

Chief Operating Officer - North America from

March 1999 to May 2002. From 1987 to 1999, Mr.

Armstrong served as President of Texas Steel Co.,

a subsidiary of Citation Corporation. From

1997 to 1999 he has served as President of the

Steel Founders' Society of America.

Hugh H. Aiken 58 Vice President since May 2002. Director since June

1991. Chairman of the Board, President and Chief

Executive Officer from June 1991 to May 2002.

2

Class II - Term Expiring 2004

Principal Occupation and

Name Age Five-Year Employment History

- ---- --- ----------------------------

Michael v.B. Nagel 61 Director since May 2002. Since 2001, Mr. Nagel,

has been a partner with the Tallis Group, an

U.K.-based executive search firm. He served as

Senior Adviser to the Romanian Ministry of SME's

from 2000 to 2001. From 1997 to 1999, he was the

Managing Director of Pricewaterhouse Poland.

Stanley B. Atkins 60 Director since September 2002. Since June 2001,

Mr. Atkins has been President of Highland Sales

Group, Inc., a consulting, sales and marketing

firm. Since November 2000, he has been President

of Omega Business Development, Inc. From 1991 to

2000, Mr. Atkins was employed by Citation

Corporation and during that time he held the

following positions: Vice-President - Sales,

Vice-President - Marketing, Corporate Secretary

and Vice-President - Corporate Planning and

Development.

Committees of the Board of Directors

The standing committees of the Board of Directors are an Audit

Committee and a Compensation Committee.

The Audit Committee consists of Mr. Bullard, Mr. Nagel and Mr. Atkins.

Mr. Bullard is the Chairman of the Audit Committee. The Audit Committee serves

as an independent and objective party to monitor the Company's financial

reporting process and internal control system; reviews and appraises the audit

efforts of the Company's independent auditors and internal auditors; and

provides an open avenue of communication among the independent auditors,

financial and senior management, the internal auditors and the Board of

Directors. Each member of the Audit Committee is independent, as defined in

Sections 303.01(B)(2)(a) and (3) of the listing standards of the New York Stock

Exchange.

The Compensation Committee consists of Mr. Nagel and Mr. Bullard. Mr.

Nagel is the Chairman of the Compensation Committee. The Compensation Committee

annually reviews and makes recommendations to the Board of Directors regarding

compensation arrangements with the executive officers of the Company and reviews

and approves the procedures for administering employee benefit plans of all

types.

During the 2002 fiscal year, the Board of Directors met 7 times, the Audit

Committee met 2 times and the Compensation Committee met 2 times. During the

2002 fiscal year each Director attended all of the meetings of the Board of

Directors and the committees on which they served, that occurred after such

directors' appointment to the Board of Directors.

AUDIT COMMITTEE REPORT

On October 17, 2002, the Board of Directors of the Company amended the

Audit Committee Charter, upon the recommendation of the Audit Committee. The

Audit Committee Charter, as amended, is attached to this Proxy Statement as

Appendix A.

On April 16, 2002, the Board of Directors of the Company, upon

recommendation of the Audit Committee of the Company, adopted resolutions

dismissing Deloitte & Touche LLP as the Company's independent auditor and

engaging KPMG LLP as the new independent auditor of the Company. The reports of

Deloitte & Touche LLP on the consolidated financial statements of the Company

for the years ended June 30, 2001 and 2000 did not contain any adverse opinion

or disclaimer of opinion, nor were such reports qualified or modified as to

audit scope or accounting principles. Deloitte & Touche LLP's audit report on

the consolidated financial statements of the Company for the year ended June 30,

2001 included an explanatory paragraph concerning the Company's ability to

continue as a going concern. Deloitte & Touche LLP's audit report on the

restated consolidated financial statements of the Company for the year ended

June 30, 2000 included explanatory paragraphs emphasizing that the consolidated

financial statements had been restated and that certain debt had been classified

as current due to debt covenant violations.

3

During the years ended June 30, 2001 and 2000, and any subsequent

interim period preceding April 16, 2002, there were no disagreements between the

Company and Deloitte & Touche on any matter of accounting principles or

practices, financial statement disclosure, or auditing scope or procedure, which

would have caused Deloitte & Touche LLP, if not resolved to the satisfaction of

Deloitte & Touche LLP, to make a reference to the subject matter of the

disagreements in connection with its reports.

Following the completion of its audits of the consolidated financial

statements of the Company for the years ended June 30, 2001 and 2000 (as

restated), Deloitte & Touche LLP reported to, and discussed with, the Audit

Committee of the Company that certain matters that it considered to be

reportable conditions under standards established by the American Institute of

Certified Public Accountants were noted in the internal control of the Company.

According to Deloitte, these conditions related to ineffective operation of

established policies and procedures in place for the review of foundry

accounting and reporting information in the years ended June 30, 2001 and 2000,

and to ineffective monitoring of the cash reconciliation process in the year

ended June 30, 2000.

While the Company does not believe that the matters considered to be

reportable conditions by Deloitte & Touche LLP are required to be disclosed

under the rules and regulations promulgated by the Securities and Exchange

Commission, the Company has disclosed them at the request of Deloitte & Touche

LLP. The Company has authorized Deloitte & Touche LLP to respond fully to

inquiries from KPMG LLP, as the successor independent auditor of the Company,

concerning such matters.

During the years ended June 30, 2001 and 2000, and any subsequent

interim period preceding April 16, 2002, the Company did not consult with KPMG

LLP with regard to any matter concerning the application of accounting

principles to any specific transactions, either completed or proposed, the type

of audit opinion that might be rendered with respect to the Company's financial

statements, or any matter that was the subject of a disagreement or a reportable

event.

The Audit Committee has reviewed and discussed the audited financial

statements of the Company with management and has discussed with KPMG LLP, the

Company's independent auditors, the matters required to be discussed by

Statement on Auditing Standards No. 61. In addition, the Audit Committee has

received from KPMG LLP the written disclosures and the letter required by

Independence Standards Board Standard No. 1. The Audit Committee has reviewed

the materials received from the independent auditors and has met with

representatives of KPMG LLP to discuss the auditor's independence. The Audit

Committee has considered whether the non-audit services provided by KPMG LLP to

the Company is compatible with the auditor's independence.

Based on the Audit Committee's review of the above items and the

discussions referred to above, the Audit Committee has recommended to the Board

of Directors that the audited financial statements of the Company be included in

its Annual Report on Form 10-K for the fiscal year ended June 30, 2002 for

filing with the Commission.

This report is submitted by the members of the Audit Committee.

William Bullard

Michael v.B. Nagel

Stanley B. Atkins

4

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP, the member firms of

Deloitte Touche Tohmatsu, and their respective affiliates (collectively,

"Deloitte") for professional services rendered for the review of the financial

statements included in the Company's Quarterly Reports on Form 10-Q for the

quarters ended September 30, 2001 and December 31, 2001 were $12,000.

The aggregate fees billed by KPMG LLP for professional services

rendered for the review of the financial statements included in the Quarterly

Report on Form 10-Q for the quarter ended March 31, 2002 and the audit of the

Company's annual consolidated financial statements for the fiscal year ended

June 30, 2002 were $430,390.

Financial Information Systems Design and Implementation Fees

There were no fees billed by Deloitte or KPMG for professional services

rendered for information technology services relating to financial information

systems design and implementation for the fiscal year ended June 30, 2002.

All Other Fees

The aggregate fees billed by Deloitte for services rendered to the

Company, other than the services described above under "Audit Fees" and

"Financial Information Systems Design and Implementation Fees", for the fiscal

year ended June 30, 2002 were $748,498, which represents fees for tax services

and audits of certain employee benefit plans.

The aggregate fees billed by KPMG LLP for services rendered to the

Company, other than the services described above under "Audit Fees" and

"Financial Information Systems Design and Implementation Fees", for the fiscal

year ended June 30, 2002 were $87,004, which represents fees for tax services.

Compensation of Directors

Non-employee directors receive a fixed fee of $8,000 each year and

$4,000 for each quarterly meeting of the Board of Directors attended, all or

part of which may be paid in cash or Common Stock, at their election. The

payment of fees in Common Stock has been suspended by the Company. In addition,

the Company reimburses directors for expenses incurred in connection with

attendance at meetings of the Board of Directors and committees thereof. Upon

their initial election, each non-employee director appointed before August 2002

was granted an option to purchase 10,000 shares of Common Stock at an exercise

price per share equal to its fair market value on the date of grant pursuant to

the Atchison Casting Non-Employee Director Option Plan. Options to purchase

shares of Company Common Stock have been granted for the full number of shares

available for issuance under the Plan and therefore, no new grants will be made

pursuant to the Plan.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended June 30, 2002, there were no interlocking

relationships between any executive officers of the Company and any entity whose

directors or executive officers serve on the Board's Compensation Committee, nor

did any current or past officers of the Company serve on the Compensation

Committee.

5

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors of the Company is

responsible for reviewing and approving policies, practices and procedures

relating to executive compensation and the establishment and administration of

employee benefit plans. The overall goal of the Compensation Committee is to

attract and retain strong management and to base incentive compensation on both

individual performance and the Company's overall success. The key elements of

the Company's executive compensation package are discussed below, and include

base salary, annual bonuses, and long-term incentives.

The Company's executive officers are compensated with base salary,

annual bonuses, incentive stock options and by the Company's normal fringe

benefits.

The base salary of most executive officers, including the chief

executive officer (the "CEO"), is determined by a subjective process of

negotiation and evaluation of performance involving the officer, the CEO and the

Compensation Committee. Mr. Armstrong does not have a written employment

agreement with the Company. As of July 1, 2002, Mr. Armstrong's base annual

salary was $220,000. Mr. Aiken, who served as CEO of the Company during fiscal

2002 through May 2002, previously had an employment agreement for his service as

CEO. As part of his transition to Vice President, in June 2002, Mr. Aiken and

the Company entered a new employment agreement with the Company, which

supersedes and replaces the prior agreement. Mr. Aiken's agreement is described

in the section entitled "Employment Contracts."

The annual bonus for executive officers for fiscal 2002 was based on

the return on net assets employed or "ROA" on a quarterly and annual basis.

Targets are set by the Board of Directors for the fiscal year ROA (fiscal 2002)

of each executive's subsidiary or operating group. In the case of the CEO and

the chief financial officer, the targets were based on consolidated earnings for

the entire Company. The amount of bonus which was to be earned if ROA (fiscal

2002) reached 100% of target was also set by the Board, and was 100% of base

salary for the CEO and 25% to 40% of base salary for other corporate officers.

For fiscal 2002, the bonus was calculated based on quarterly and annual targets.

If all of the targets are reached, the officer receives 100% of his bonus. For

any percentage of actual ROA (fiscal 2002) above the target, the amount of the

calculated bonus at 100% of the target is increased by the same percentage. A

minimum level of ROA (fiscal 2002) is also set, below which no bonus is paid. At

ROA (fiscal 2002) above the minimum threshold the bonus is pro-rated based on

the relation of actual ROA (fiscal 2002) to the target and the minimum

threshold. During fiscal 2002, bonuses to executive officers ranged from 0% to

41% of the amount of their bonus set by the Board.

The Compensation Committee may raise or lower a bonus at its

discretion, based on an individual's overall performance.

Incentive stock options are granted by the Company to eligible

employees under the Company's 1993 Incentive Stock Plan. The number of options

granted is determined by the Compensation Committee after considering subjective

criteria such as the employee's performance, the employee's value to the Company

and the use of options at other companies.

This report has been issued over the names of each member of the

Compensation Committee, Michael v.B. Nagel and William Bullard.

6

EXECUTIVE COMPENSATION

The table below sets forth information concerning the annual and

long-term compensation paid to the Chief Executive Officer and the four other

most highly paid executive officers whose compensation exceeded $100,000 during

the last fiscal year.

Summary Compensation Table

Long Term

Compensation

Awards

Securities

Underlying

Name and Annual Compensation Options/ All Other

Principal Position Year Salary($) Bonus($) SARs(#) Compensation($)

Thomas K. Armstrong....... 2002 $ 181,852 None 65,000 $ 8,063(1)

Chairman of the 2001 $ 180,000 None 5,000 $ 7,875

Board, President and 2000 $ 180,000 None 15,000 $ 8,438

Chief Executive

Officer

Hugh H. Aiken............. 2002 $ 277,192 None 20,000 $ 8,063(1)

Vice President(2) 2001 $ 289,000 None 20,000 $ 7,875

2000 $ 271,088 $ 32,288 20,000 $ 7,688

John R. Kujawa............ 2002 $ 156,250 $ 24,750 10,000 $ 8,063(1)

Vice President 2001 $ 150,000 $ 13,875 4,000 $ 7,875

2000 $ 150,000 $ 28,336 4,000 $ 7,100

James Stott............... 2002 $ 129,700 None 4,000 None

Vice President 2001 $ 135,408 None 2,000 $ 7,109

2000 $ 135,408 None None $ 6,094

Kevin T. McDermed......... 2002 $ 106,152 None 8,000 $ 6,342(1)

Vice President, Chief 2001 $ 107,496 None 5,000 $ 6,450

Financial Officer, 2000 $ 107,496 $ 4,703 None $ 6,450

Treasurer and Secretary

_______________________________

(1) Consists solely of Company contributions to the Company's 401(k) savings

plan for the benefit of the executive.

(2) Mr. Aiken was the Chairman of the Board, President and Chief Executive

Officer of the Company until May 2002.

7

Option/SAR Grants in Last Fiscal Year

Potential Realizable Value

At Assumed Annual Rates

of Stock Price Appreciation

Individual Grants for Option Term

--------------------------------------------------- ---------------------------

Number of % of Total

Securities Options/SARs

Underlying Granted to Exercise or

Options/SARs Employees in Base Expiration

Name Granted(#)(1) Fiscal Year Price ($/Sh) Date 5%($) 10%($)

- ---- ------------- ----------- ------------ ----- ----- ------

Thomas K. Armstrong....... 15,000 7.48% $ 2.90 7/26/11 $27,357 $23,269

50,000 24.94% $ 0.74 5/23/12 $69,328 $58,968

Hugh H. Aiken............. 20,000 9.98% $ 2.85 6/30/11 $ 35,847 $90,843

John R. Kujawa............ 10,000 4.99% $ 2.90 7/26/11 $ 18,238 $46,219

James Stott............... 4,000 2.00% $ 2.90 7/26/11 $ 7,295 $18,487

Kevin T. McDermed......... 8,000 3.99% $ 2.90 7/26/11 $ 14,590 $36,975

(1) All options are rights to buy Common Stock of the Company. The options

granted are subject to a three-year vesting schedule commencing one

year from the date of the grant, with one-third of the grant vesting on

each of the three anniversaries from the grant date.

Aggregated Option/SAR Exercises in Last

Fiscal Year and FY-End Option/SAR Values

Number of Value of

Securities Unexercised

Underlying In-the-Money

Unexercised Options/SARs at

Options/SARs at FY-End($)

FY-End(#) Exercisable/Unexercisable

Name Exercisable/Unexercisable -------------------------

- ---- -------------------------

Thomas K. Armstrong................ 46,667/73,333 $ 0/0

Hugh H. Aiken...................... 120,000/40,000 $ 0/0

John R. Kujawa..................... 20,000/14,000 $ 0/0

James Stott........................ 15,667/5,333 $ 0/0

Kevin T. McDermed.................. 14,667/8,333 $ 0/0

Equity Compensation Plan Information

- ------------------------------ ------------------------------ ----------------------------- ------------------------

Plan category Number of securities to be Weighted average exercise Number of securities

issued upon exercise of price of outstanding options, remaining available for

outstanding options, warrants and rights future issuance

warrants and rights

- ------------------------------ ------------------------------ ----------------------------- ------------------------

Equity compensation plans 597,233 $8.52 340,361

approved by security holders

- ------------------------------ ------------------------------ ----------------------------- ------------------------

Equity compensation plans not 70,000(1) $9.96 10,000

approved by security holders

- ------------------------------ ------------------------------ ----------------------------- ------------------------

Total 667,233 $8.67 350,361

- ------------------------------ ------------------------------ ----------------------------- ------------------------

(1) Does not include shares granted to non-employee directors pursuant to their

election to receive directors' fees in Company Common Stock in lieu of

cash.

8

For a description of the equity compensation plans that have not been

approved for the Company's shareholders, please refer to the section entitled

"Director Compensation" for a discussion of the Atchison Casting Non-Employee

Director Option Plan and the unwritten plan whereby directors have previously

been able to elect to receive their fees in Company Common Stock in lieu of

cash. There are no other equity compensation plans of the Company that have not

been approved by the Company's stockholders.

Employment Contracts

In connection with Mr. Aiken's voluntary change in position with the

Company from Chairman, President and Chief Executive Officer to Vice President,

the Company and Mr. Aiken have entered into a new employment agreement effective

as of July 1, 2002. This agreement replaces and supersedes any prior employment

and change of control agreements between Mr. Aiken and the Company. The

agreement has an initial term of three years, renewable for additional one year

terms, and provides for an annual base salary of $144,500, retention payments of

$12,041.66 payable monthly for 36 months, annual incentive pay at the discretion

of the Board of Directors and stock options to purchase 20,000 shares of the

Company's Common Stock. The agreement also provides for a severance payment in

the amount of two times Mr. Aiken's annual base salary in effect as of June

2002, less the aggregate amount of retention payments paid to Mr. Aiken, in the

event of his death or disability during the initial three year term of the

agreement. If Mr. Aiken's employment with the Company is terminated for a reason

other than cause (as defined in the agreement) or death or disability during the

initial three year term of the agreement, the agreement provides for a severance

payment of three times his annual base salary in effect as of June 2002 less the

aggregate amount of retention payments paid to Mr. Aiken. After the initial

three year term of the agreement, Mr. Aiken is entitled to a severance payment

totaling three months of his annual base salary if he is terminated for any

reason other than for cause, disability or death. Additionally, the agreement

provides for a payment in the amount of three times Mr. Aiken's annual base

salary in effect as of June 2002, less the aggregate amount of retention

payments paid to Mr. Aiken, in the event of a change of control (as defined in

the agreement) of the Company during the term of the agreement.

The Board has approved an arrangement providing for a payment to Mr.

Armstrong of two times his annual salary in the event of a hostile change of

control (as defined by the Board).

Pension Benefits

The Company maintains a qualified defined benefit pension plan, the

Salaried Employees Retirement Plan of Atchison Casting Corporation (the

"Retirement Plan"), of which Mr. Aiken, Mr. Kujawa and Mr. McDermed are

participants. The estimated annual benefits payable under the Retirement Plan

payable upon retirement at various years of credited service and at different

levels of remuneration are as follows:

Remuneration Years of Credited Service at Retirement

- ------------ ----------------------------------------------------

15 20 25 30 35

-- -- -- -- --

$ 50,000 $16,520 $17,088 $17,655 $18,223 $18,791

75,000 26,520 27,713 28,905 30,098 31,291

100,000 36,520 38,338 40,155 41,973 43,791

125,000 46,520 48,963 51,405 53,848 56,291

150,000 56,520 59,588 62,655 65,723 68,791

175,000 66,520 70,213 73,905 77,598 81,291

200,000(1) 76,520 80,838 85,155 89,473 93,791

_______________________________

(1) Section 401(a)(17) of the Internal Revenue Code of 1986, as amended, and

the Omnibus Budget Reconciliation Act of 1993 limit the amount of

compensation that can be considered in computing benefits under a qualified

defined benefit pension plan. For 2002, the maximum amount of compensation

allowed for use in calculating an individual's pension benefits is

$200,000. This limit may be raised in the future by annual cost-of-living

adjustments determined by the U.S. Secretary of the Treasury.

9

The remuneration covered by the Retirement Plan is the average of the

highest five consecutive years during all years of service prior to eligibility

to receive benefits under the Retirement Plan of total cash remuneration,

including salary and bonus (both as reported in the Summary Compensation Table)

paid or accrued and payable in the year following accrual. As of the end of

fiscal 2002, Mr. Aiken and Mr. Kujawa each had thirteen years of service

credited under the Retirement Plan and Mr. McDermed had twenty years of service

credited under the Retirement Plan Benefits shown are computed as life-only

annuities beginning at age 65 and are not reduced for Social Security benefits.

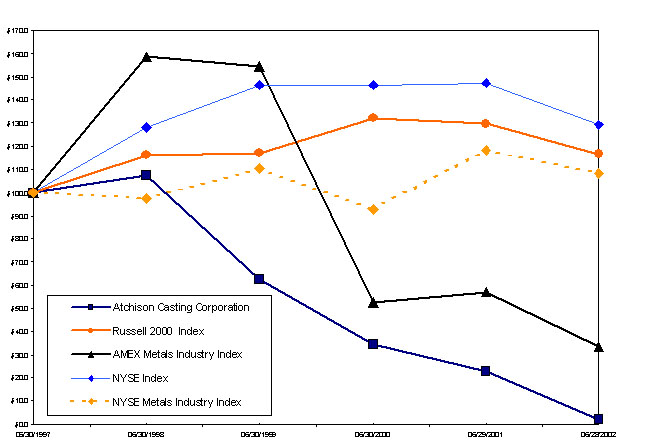

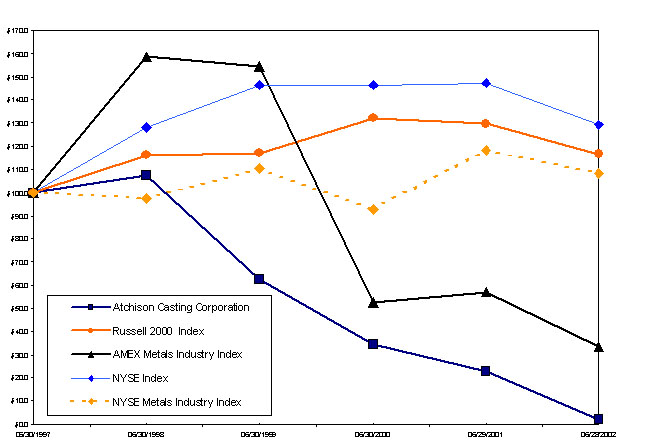

PERFORMANCE OF THE COMPANY'S COMMON STOCK

The graph set forth below compares the percentage change in cumulative

stockholder return of the Company's Common Stock, from June 30, 1997 to June 28,

2002 (the last trading day prior to the Company's fiscal year end), against

certain other indices.

For the prior five years, the Company has used the cumulative return of

the Index for the New York Stock Exchange (U.S. Companies only) (the "NYSE

Index"), and an index prepared by the Center for Research in Security Prices at

the University of Chicago Graduate School of Business consisting of stocks of

U.S. companies traded on the New York Stock Exchange that transact business in

primary metals industries (S.I.C. 3300-3399) (the "NYSE Metals Industry Index")

covering the same time period.

As a result of the change in trading of the Company's Common Stock from

the New York Stock Exchange to the Over-The-Counter Bulletin Board (OTC) in June

2002, the Company has decided to change the indices identified above to the

cumulative return of the Index for the Russell 2000 (the "Russell 2000 Index"),

and an index prepared by the Center for Research in Security Prices at the

University of Chicago Graduate School of Business consisting of stocks of U.S.

companies traded on the American Stock Exchange that transact business in

primary metals industries (S.I.C. 3300-3399) (the "AMEX Metals Industry Index")

covering the same time period. In accordance with SEC regulations, both the

former and current indices are presented in the following graph this year.

10

- ---------------------------- ------------- ---------- ----------- ---------- ----------- ----------

06/30/1997 06/30/1998 06/30/1999 06/30/2000 06/29/2001 06/28/2002

------------ ---------- ---------- ---------- ---------- ----------

Atchison Casting Corporation 100.0 107.5 62.4 34.6 22.6 1.9

Russell 2000 Index 100.0 116.13 117.14 132.38 129.50 116.87

AMEX Metals Industry Index 100.0 158.5 154.5 52.4 56.9 33.5

NYSE Index 100.0 128.2 146.7 146.5 147.2 129.3

NYSE Metals Industry Index 100.0 97.5 110.2 92.9 118.2 108.2

- ---------------------------- ------------- ---------- ----------- ---------- ----------- ----------

Upon written request, we will provide any stockholder, without charge,

a list of the component issues in either of the indexes. The graph is based on

$100 invested on June 30, 1997, in the Company's Common Stock and each of the

indexes, each assuming dividend reinvestment. The historical stock price

performance shown on this graph is not necessarily indicative of future

performance.

11

CERTAIN BENEFICIAL OWNERSHIP OF THE COMPANY'S COMMON STOCK

The following table sets forth information as of October 15, 2002,

concerning the shares of Common Stock beneficially owned by (i) each person

known by the Company to be the beneficial owner of 5% or more of the Company's

outstanding Common Stock, (ii) each of the directors of the Company, (iii) each

of the executive officers of the Company named in the Summary Compensation Table

and (iv) all directors and executive officers of the Company as a group. Unless

otherwise indicated, the named beneficial owner has sole voting and investment

power over the shares listed.

Number of Shares Percentage of Common

Name of Individual or Group Beneficially Owned Stock Owned

- --------------------------- ------------------ -----------

Edmundson International, Inc. (1)..................... 925,157 12.0%

227 West Monroe Street, Suite 3000

Chicago, IL 60606

Liberty Wanger Asset Management, L.P. (2)..............543,400 7.0%

227 West Monroe Street, Suite 3000

Chicago, IL 60606

Dimensional Fund Advisors, Inc. (3)....................701,800 9.1%

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401

Ingalls & Snyder LLC (4)...............................327,866 4.2%

61 Broadway

New York, NY 10006

Royce & Associates, Inc. (5)...........................591,800 7.7%

1414 Avenue of the Americas

New York, NY 10019

Benson Associates, LLC (6)............................499,600 6.5%

111 S.W. Fifth Avenue, Suite 2130

Portland, OR 97204

Thomas K. Armstrong(7).................................114,280 1.5%

Hugh H. Aiken (8)..................................... 532,204 6.8%

Michael v.B. Nagel (9)..................................20,130 *

William Bullard(10).....................................30,870 *

Vladimir Rada(11).......................................10,000 *

Stanley B. Atkins(12) .......................................0 0%

John R. Kujawa(13)......................................51,753 *

James Stott(14).........................................17,667 *

Kevin T. McDermed(15)...................................48,161 *

All directors and executive............................710,785 8.9%

officers as a group (10 persons)(16)

- -------------------

* Less than 1% of Common Stock outstanding.

(1) Based on a Schedule 13D Amendment No. 1 dated September 29, 2000, (a)

Edmundson International Inc., Consolidated Electrical Distributors, Inc.,

Portshire Corp., Lincolnshire Associates, Ltd. and David D. Colburn,

President of Portshire Corp., share voting and dispositive power over

40,000 of shares or approximately .5% of the outstanding shares of Common

Stock, (b) Employees' Retirement Plan of Consolidated Electrical

Distributors, Inc. and David D. Colburn, a member of the investment

committee of the Employees' Retirement Plan of Consolidated Electrical

Distributors, Inc., share voting and dispositive power over 506,512

shares or approximately 6.6% of the outstanding shares of Common Stock,

(c) Employees' Retirement Plan of Hajoca Corporation has sole voting and

dispositive power over 169,600 shares or approximately 2.2% of the

outstanding shares of Common Stock, (d) Dunton Foundries, LLC, of which

David D. Colburn is the sole manager, has sole voting and dispositive

power over 189,500 shares or approximately 2.5% of the outstanding shares

of Common Stock, (e) David D. Colburn has sole voting and dispositive

power over 23,966 shares or 0.3% of the outstanding

12

shares of Common Stock, (f) Keith W. Colburn Retirement Plan has sole

voting and dispositive power over 2,000 shares of Common Stock, and (g)

Keith W. Colburn Trust has sole voting and dispositive power over 2,000

shares of Common Stock. The reporting persons, although disclaiming

membership in a group, have nonetheless authorized Edmundson International,

Inc. to file this Amendment No. 1 to Schedule 13D as a group on behalf of

each of them.

(2) Based on a Schedule 13G Amendment No. 7 dated February 13, 2002, Liberty

Wanger Asset Management, L.P. ("WAM") is an investment adviser, which

shares voting and dispositive powers with WAM Acquisition GP, Inc., its

general partner. WAM also shares voting and dispositive powers with

certain of its clients, including Liberty Acorn Investment Trust, an

investment company that shares voting and dispositive powers over 420,000

shares or approximately 5.5% of the outstanding shares of Common Stock.

(3) Based on a Schedule 13G Amendment No. 1 dated January 30, 2002,

Dimensional Fund Advisors, Inc. ("DFA") is an investment adviser to

certain investment companies and in such role possesses sole voting and

dispositive powers over the shares; however, DFA disclaims beneficial

ownership of such shares which are owned by certain of its advisory

clients.

(4) Based on a Schedule 13G Amendment No. 8 dated December 31, 2001, Ingalls

& Snyder LLC is a broker-dealer which shares voting and dispositive

powers over 309,565 of such shares.

(5) Based on a Schedule 13G Amendment No. 1 dated February 7, 2002, Royce &

Associates, Inc. ("Royce") an investment adviser has sole voting and

dispositive power over the shares. Charles M. Royce is a controlling

person of Royce but disclaims beneficial ownership of the shares owned by

Royce.

(6) Based on a Schedule 13G dated February 13, 2002, Benson Associates, LLC

is an investment adviser, which shares voting and dispositive powers with

certain of its clients who do not beneficially own 5% of more of the

outstanding shares of Common Stock.

(7) Includes 58,334 shares subject to exercisable options and 390 shares

pursuant to the Company's 401(k) Plan.

(8) Includes 140,000 shares subject to exercisable options, 500 shares owned

by each of Mr. Aiken's three children, and 28,592 shares pursuant to the

Company's 401(k) Plan.

(9) Includes 10,000 shares subject to exercisable options, which Mr. Nagel

received pursuant to the Atchison Casting Non-Employee Director Option

Plan and 10,130 shares received in lieu of cash for directors' fees.

(10) Includes 10,000 shares subject to exercisable options, which Mr. Bullard

received pursuant to the Atchison Casting Non-Employee Director Option

Plan and 20,870 shares received in lieu of cash for directors' fees.

(11) Includes 10,000 shares subject to exercisable options, which Mr. Rada

received pursuant to the Atchison Casting Non-Employee Director Option

Plan.

(12) Stanley B. Atkins owns no shares of Common Stock and holds no shares

subject to exercisable options. (13) Includes 25,999 shares subject to

exercisable options. (14) Includes 17,667 shares subject to exercisable

options.

(15) Includes 19,001 shares subject to exercisable options and 1,804 shares

pursuant to the Company's 401(k) Plan.

(16) Includes 30,786 shares pursuant to the Company's 401(k) Plan and 291,001

shares subject to exercisable options.

13

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

To the Company's knowledge, all Section 16(a) filing requirements

applicable to its directors, executive officers and ten percent holders were

satisfied during the fiscal year ended June 30, 2002 except that Mr. Armstrong

filed a late Form 4 on July 31, 2002 with respect to an open-market purchase of

33,000 shares of Common Stock on May 31, 2002.

Other Business

As of the date of this proxy statement, management knows of no other

matters to be presented at the Annual Meeting. However, if any other matters

shall properly come before the meeting, it is the intention of the persons named

in the enclosed proxy to vote in accordance with their best judgment.

Relationship with Independent Accountants

The Board of Directors, on the recommendation of the Audit Committee,

has selected the firm of KPMG LLP as independent auditors to examine the

financial statements of the Company and its subsidiaries for the fiscal year

2003. Representatives of KPMG LLP will be present at the Annual Meeting, will

have an opportunity to make a statement if they so desire, and will be available

to respond to appropriate questions.

PROPOSALS OF SECURITY HOLDERS

The Company currently plans to hold the 2003 Annual Meeting in

Atchison, Kansas, on or around November 21, 2003. Pursuant to the Company's

By-Laws, stockholders desiring to bring business before the annual meeting must

provide written notice of each matter to the Company's Secretary not less than

60 days nor more than 120 days prior to the date of the annual meeting. Such

notice must contain certain information specified in the Company's By-Laws. If a

stockholder desires his or her proposal to be considered for inclusion in the

proxy statement for the 2003 annual meeting, it must be received by the

Company's Secretary no later than July 9, 2003 and must comply with the process

described in Rule 14a-8 of the Securities Exchange Act of 1934, as amended.

ATCHISON CASTING CORPORATION

/s/ Thomas K. Armstrong, Jr.

Thomas K. Armstrong, Jr.

Chairman of the Board and

Chief Executive Officer

Dated: November 6, 2002

Atchison, Kansas

14

APPENDIX A

AUDIT COMMITTEE CHARTER

I. ORGANIZATION

There shall be a committee of the Board of Directors to be known as the Audit

Committee. The Audit Committee shall consist of three or more directors, as

determined by the Board of Directors, each of whom shall have no relationship to

the Company that may interfere with the exercise of their independence from

management and the Company.

A. Definition of Independence

1. Employees. A director who is an employee (including non-employee

executive officers) of the Company or any of its affiliates may

not serve on the Audit Committee until three years following the

termination of his or her employment. In the event the employment

relationship is with a former parent or predecessor of the

Company, the director could serve on the Audit Committee after

three years following the termination of the relationship between

the Company and the former parent or predecessor;

2. Business Relationship. A director (i) who is a partner,

controlling stockholder, or executive officer of an organization

that has a business relationship with the Company, or (ii) who

has a direct business relationship with the Company (e.g., a

consultant) may serve on the Audit Committee only if the

Company's Board of Directors determines in its business judgment

that the relationship does not interfere with the director's

exercise of independent judgment or such relationship is not in

violation of any SEC regulation. In making a determination

regarding the independence of a director pursuant to this

paragraph, the Board of Directors should consider, among other

things, the materiality of the relationship to the Company, to

the director, and, if applicable, to the organization with which

the director is affiliated. "Business relationships" can include

commercial, industrial, banking, consulting, legal, accounting

and other relationships. A director can have this relationship

directly with the Company, or the director can be a partner,

officer or employee of an organization that has such a

relationship. The director may serve on the Audit Committee

without the above-referenced Board of Directors' determination

after three years following the termination of, as applicable,

either (1) the relationship between the organization with which

the director is affiliated and the Company, (2) the relationship

between the director and his or her partnership status,

stockholder interest or executive officer position, or (3) the

direct business relationship between the director and the

Company;

3. Cross Compensation Committee Link. A director who is employed as

an executive of another company where any of the Company's

executives serves on that company's compensation committee may

not serve on the Audit Committee; and

4. Immediate Family. A director who is an Immediate Family member of

an individual who is an executive officer of the Company or any

of its affiliates cannot serve on the Audit Committee until three

years following of the termination of such employment

relationship. "Immediate Family" includes a person's spouse,

parents, children, siblings, mothers-in-law and fathers-in-law,

sons and daughters-in-law, brothers and sisters-in-law, and

anyone (other than employees) who shares such person's home.

All members of the Audit Committee shall be financially literate, as such

qualification is interpreted by the Company's Board of Directors in its business

judgment, or must become financially literate within a reasonable period of time

after their appointment to the Audit Committee, and at least one member of the

Audit Committee shall be a "financial expert" (as that term is defined by SEC

regulation), as the Board of Directors interprets such qualification in its

business judgment.

The members of the Audit Committee shall be elected by the Board of Directors at

the annual meeting of the Board of Directors to serve a term of one year or

until their successors shall be duly elected and qualified. The Board of

Directors will appoint a Chair to preside at the Audit Committee meetings and

schedule meetings as appropriate.

A-1

II. PURPOSE

The primary function of the Audit Committee is to assist the Board of Directors

in fulfilling its oversight responsibilities by reviewing the financial reports

and other financial information provided by the Company to any governmental body

or the public; the Company's systems of internal controls regarding finance,

accounting, legal compliance and ethics that management and the Board of

Directors has established; and the Company's auditing, accounting and financial

reporting processes generally. Consistent with this function, the Audit

Committee should encourage continuous improvement of, and should foster

compliance with, the Company's policies, procedures and practices at all levels.

The Audit Committee's primary duties and responsibilities are as follows:

o To serve as an independent and objective party to monitor the Company's

financial reporting process and internal control system.

o To review and appraise the audit efforts of the Company's independent

auditors and internal auditing department.

o To provide an open avenue of communication among the independent auditors,

financial and senior management, the internal auditing department, and the

Board of Directors.

The Audit Committee will primarily fulfill these responsibilities by carrying

out the activities enumerated in Section IV of this Charter.

III. MEETINGS

The Audit Committee shall meet at least two times a year and at such times as

requested by the Chair, or a Director or Officer of the Company, or by the

Company's independent auditors. The Chair of the Audit Committee shall prepare

or approve an agenda in advance of each meeting. The Chief Executive Officer,

Chief Financial Officer, Director of Internal Audit, outside legal counsel,

representative from independent auditors and other parties may be invited to all

meetings. Non-committee members may be excused from attendance at any meeting or

portion of any meeting by the Chair.

As part of its job to foster open communication, the Audit Committee may meet

at, in person or by telephone, at any time with management with, the head of the

Company's internal auditing department and the independent auditors in separate

sessions to discuss any matter that the Audit Committee or each of these groups

believes should be discussed privately. The Audit Committee shall meet at least

annually with the Company's financial management and independent auditors in

separate executive sessions. In addition, the Audit Committee or its Chair may

meet or speak with the independent auditors and management at any time to review

the Company's financial statements and significant findings based upon the

auditor's limited review procedures.

IV. RESPONSIBILITIES

To fulfill its duties and responsibilities the Audit Committee shall:

Review Procedures

1. Review and reassess the adequacy of this Charter at least annually and

recommend any proposed changes to the Board of Directors for approval.

2. Review the Company's audited financial statements with management and

the independent auditors prior to the release of year-end earnings and

prior to filing the Company's Annual Report on Form 10-K or 10-KSB.

3. Review the Company's quarterly financial results with management and

the independent auditors prior to the release of quarterly earnings

and/or the Company's financial statement and prior to filing the

Company's Quarterly Report on Form 10-Q or 10-QSB.

4. Review, as appropriate, any other material financial information

submitted to any governmental or public body, including any

certification, report, opinion, or review rendered by the independent

auditors.

A-2

Independent Auditors

5. The independent auditors are ultimately accountable to the Audit

Committee and the Board of Directors, as representatives of the

Company's stockholders. The Audit Committee and the Board of Directors

have the ultimate authority and responsibility to select, compensate,

evaluate the performance of and, where appropriate, replace the

independent auditors (or to nominate the independent auditors to be

proposed for stockholder approval in any proxy statement).

6. Ensure that the independent auditors submit on a periodic basis to the

Audit Committee a formal written statement delineating all

relationships between the auditor and the Company, consistent with

Independence Standards Board Standard No. 1.

7. Actively engage in dialogue with the independent auditors and legal

counsel with respect to any disclosed relationships or services that

may impact the objectivity and independence of the independent

auditors.

8. Recommend that the Board of Directors take appropriate action in

response to the independent auditors' report to satisfy itself of the

independent auditors' independence.

9. Following each audit by the independent auditors, obtain from the

independent auditors assurance that Section 10A of the Private

Securities Litigation Reform Act of 1995 has not been implicated.

10. Review and discuss with the independent auditors their audit

procedures, including the scope, fees and timing of the audit, and the

results of the annual audit examination and any accompanying

management letters, and any reports of the independent auditors with

respect to interim periods.

11. In connection with the Company's year-end financials, discuss with

financial management and the independent auditors significant issues

regarding accounting principals, practices and judgments and any items

required to be communicated by the independent auditors in accordance

with Statement on Accounting Standards No. 61.

12. In connection with the Company's interim financials, discuss with

financial management and independent auditors any significant changes

to the Company's accounting principles and any items required to be

communicated by the independent auditors in accordance with Statement

on Accounting Standards No. 71. The Chair of the Audit Committee may

represent the entire Audit Committee for purposes of the quarterly

review and communication.

13. Review and discuss with financial management and the independent

auditors: (a) any material financial or non-financial arrangements of

the Company which do not appear on the financial statements of the

Company; and (b) any transactions or courses of dealing with any party

related to the Company that are relevant to an understanding of the

Company's financial statements.

14. Review and discuss with financial management and the independent

auditors the adequacy of the Company's internal controls.

15. Review and discuss with financial management and the independent

auditors the accounting policies of the Company which may be viewed as

critical.

16. Consider and approve, if appropriate, significant changes to the

Company's auditing and accounting principles, policies and practices

as suggested by the independent auditors, financial management, or the

internal auditing department.

Improvement Process

17. Meet periodically, no less than annually, with financial management to

review the Company's major financial risk exposure and the steps

management has taken to monitor and control such exposures.

Proxy Statement

18. Prepare and approve the report of the Audit Committee required by the

rules of the SEC to be included in the Company's annual proxy

statement.

A-3

19. Oversee the publication of this Charter at least every three years in

the Company's annual proxy statement in accordance with SEC

regulations.

Miscellaneous

20. Retain, if appropriate, special legal, accounting or other consultants

to advise the Audit Committee.

21. Review with the Company's general counsel legal matters that may have

a material impact on the financial statements, the Company's

compliance policies related to financial matters and any material

reports or inquiries related to financial matters that are received

from regulators or governmental agencies.

22. Periodically conduct a self-assessment of the Audit Committee's

performance.

23. Advise the Board of Directors on the Company's policies and procedures

regarding compliance with applicable laws and regulations related to

financial matters.

24. Submit the minutes of all meetings of the Audit Committee to, and

discuss the matters discussed at each Audit Committee meeting with,

the Board of Directors, as appropriate.

25. Perform any other activities consistent with this Charter, the

Company's Bylaws and governing law, as the Audit Committee or the

Board of Directors deems necessary or appropriate.

While the Audit Committee has the responsibilities and powers set forth in this

Charter, it is not the duty of the Audit Committee to plan or conduct audits or

to determine that the Company's financial statements are complete and accurate

and are in accordance with generally accepted accounting principles. This is the

responsibility of management and the independent auditors. Nor is it the duty of

the Audit Committee to conduct investigations, to resolve disagreements, if any,

between management and the independent auditors or to assure compliance with

laws and regulations.

A-4

- --------------------------------------------------------------------------------

PROXY PROXY

ATCHISON CASTING CORPORATION

400 South Fourth Street

Atchison, Kansas 66002

This Proxy is Solicited on Behalf of the Board of Directors.

The undersigned hereby appoints Kevin T. McDermed and Thomas K.

Armstrong, Jr., or either of them, as Proxies, each with the power to appoint

his substitute, and hereby authorizes them to represent and to vote, as

designated below, all the shares of Common Stock of Atchison Casting Corporation

the undersigned is entitled to vote at the Annual Meeting of Stockholders to be

held on December 12, 2002, or any adjournment or postponement thereof. This

proxy revokes all prior proxies given by the undersigned.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY

USING THE ENCLOSED PREPAID ENVELOPE.

(Continued and to be signed on the reverse side)

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

ATCHISON CASTING CORPORATION

PLEASE MARK VOTE IN OVAL IN THE FOLLOWING MANNER USING DARK INK ONLY. |X|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ELECTION OF THE NOMINEES.

1. PROPOSAL ONE: ELECTION OF DIRECTORS --

Nominee: Vladimir Rada For Withhold For All To withhold authority to vote, mark

All All Except "For All Except" and write the

Nominee: William Bullard | | | | | | nominee's name on the line below.

__________________________________

2. In their discretion, the Proxies This Proxy, when properly executed, will

are authorized to vote upon such be voted in the manner directed herein by

other business as may properly the undersigned stockholder. If no

come before the meeting and all direction is made, this proxy will be

all matters incident to the conduct voted FOR the nominees in Proposal One.

of the meeting.

Dated:___________________________, 2002

Signature(s)___________________________

_______________________________________

Please sign exactly as name appears at

left. When shares are held by joint

tenants, both should sign. When signing

as attorney, executor, administrator,

trustee or guardian, please give full

title as such. If a corporation, please

sign in full corporate name by President

or other authorized officer. If a

partnership, please sign in partnership

name by an authorized person.

- --------------------------------------------------------------------------------