SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

| Check the appropriate box: | | | |

| ¨ | Preliminary Proxy Statement | | ¨ | Confidential, for use of the |

| x | Definitive Proxy Statement | | | Commission only |

| ¨ | Definitive Additional Materials | | | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | | | |

CADUS CORPORATION

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-ll(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: $______________ |

| (2) | Form, Schedule or Registration Statement No.: _________________ |

| (3) | Filing Party: _________________ |

| (4) | Date Filed: __________________ |

CADUS CORPORATION

767 Fifth Avenue

New York, New York 10153

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on January 28, 2015

To the Stockholders of Cadus Corporation:

Notice is hereby given that the Annual Meeting of Stockholders (the “Meeting”) of Cadus Corporation (the "Company") will be held on Wednesday, January 28, 2015, at the offices of Morrison Cohen LLP, 909 Third Avenue, 27th Floor, New York, New York 10022, at 2:30 p.m. local time.

The Meeting will be held for the following purposes:

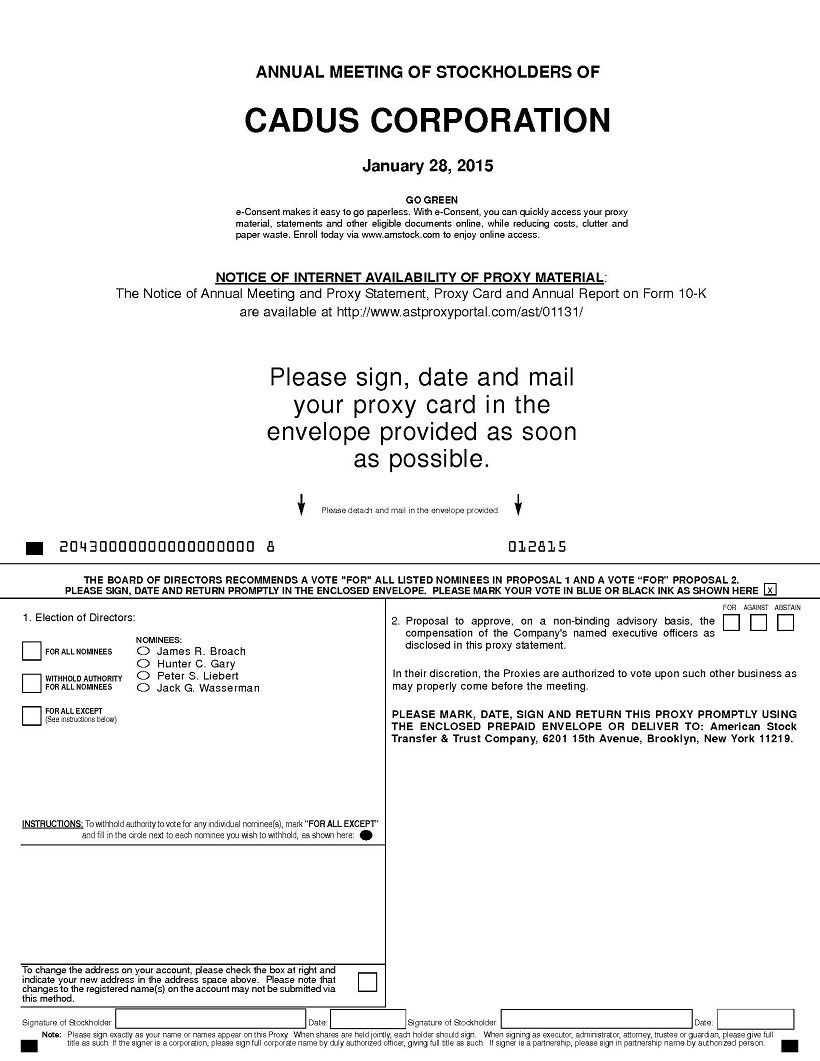

| 1. | To elect four directors of the Company to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified. |

| 2. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in this proxy statement. |

| 3. | To transact such other business as may properly come before the Meeting or any and all adjournments thereof. |

The Board of Directors of the Company fixed the close of business on December 19, 2014 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting and at any and all adjournments thereof. Consequently, only stockholders of record at the close of business on December 19, 2014 are entitled to notice of and to vote at the Meeting and at any and all adjournments thereof.

Enclosed with this notice and the accompanying proxy statement are the proxy card and the Company’s annual report to stockholders on Form 10-K.

Whether or not you plan to attend the Meeting, please complete, date and sign the enclosed proxy card, and return it promptly in the enclosed envelope to ensure your representation at the Meeting. You are cordially invited to attend the Meeting and, if you do so, you may personally vote, regardless of whether you have signed a proxy.

New York, New York

December 29, 2014

By Order of the Board of Directors

Hunter C. Gary

President

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting To Be Held on January 28, 2015

The 2014 Notice of Annual Meeting and Proxy Statement and the Annual Report on form 10-K for the year ended December 31, 2013 are also available at http://www.astproxyportal.com/ast/01131/

Should you need directions to attend and vote at the meeting, please call (212) 702-4300

CADUS CORPORATION

767 Fifth Avenue

New York, New York 10153

(212) 702-4300

________________________________________

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

________________________________________

This Proxy Statement and the accompanying proxy card are being furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors (the “Board”) of Cadus Corporation (the “Company), to be used at the Annual Meeting of Stockholders of the Company (the “Meeting”) to be held on Wednesday, January 28, 2015, at 2:30 p.m. local time, at the offices of Morrison Cohen LLP, 909 Third Avenue, 27th Floor, New York, New York 10022, and at any and all adjournments thereof. This Proxy Statement and the accompanying proxy card are first being mailed on or about December 29, 2014 to the holders of record, as of December 19, 2014, of the Company’s common stock, $.01 par value per share (the “Common Stock”).

Stockholders of the Company represented at the Meeting will consider and vote upon (i) the election of four directors to serve until the next annual meeting of stockholders or until their successors have been duly elected and qualified; (ii) advisory approval of the compensation of the Company’s named executive officers; and (iii) such other business as may properly come before the Meeting or any and all adjournments thereof. The Company is not aware of any other business to be presented for consideration at the Meeting.

VOTING AND SOLICITATION OF PROXIES

Only holders of record of shares of Common Stock at the close of business on December 19, 2014 (the “Record Date”) are entitled to vote at the Meeting. As of the Record Date, 26,288,080 shares of Common Stock were outstanding. Each stockholder is entitled to one vote for each share of Common Stock held of record on the Record Date for each proposal submitted for stockholder consideration at the Meeting. The presence, in person or by proxy, of the holders of a majority of the shares of Common Stock entitled to vote at the Meeting is necessary to constitute a quorum for the conduct of business at the Meeting. The election of each nominee for director requires a plurality of the total votes cast. Approval of the advisory vote on the compensation of the Company’s named executive and any other matter (other than the election of directors) submitted to the stockholders for their consideration at the Meeting requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote on the subject matter thereof. Abstentions will be considered shares present for purposes of determining whether a quorum is present at the Meeting and, with respect to a matter other than the election of directors, will have the same effect as a vote against a motion presented at the Meeting. With respect to the election of directors, an abstention will have no effect. Broker non-votes will be considered shares present for purposes of determining whether a quorum is present at the Meeting, but will be considered as shares not entitled to vote and will, therefore, not be considered in the tabulation of votes.

All shares represented by properly executed proxies will, unless such proxies have previously been revoked, be voted at the Meeting in accordance with the directions on the proxies. A proxy may be revoked at any time prior to final tabulation of the votes at the Meeting. Stockholders may revoke proxies by written notice to the Secretary of the Company, by delivery of a proxy bearing a later date, or by personally appearing at the Meeting and casting a contrary vote. The persons named in the proxies will have discretionary authority to vote all proxies with respect to additional matters that are properly presented for action at the Meeting.

The executive officers and directors of the Company as a group own or may be deemed to control approximately 0.10% of the outstanding shares of Common Stock of the Company. Each of the executive officers and directors has indicated his intent to vote all shares of Common Stock owned or controlled by him in favor of the election of the nominees for the Board of Directors of the Company set forth herein and in favor of the advisory approval of the compensation of the Company’s named executives as described herein.

The proxy solicitation is made by and on behalf of the Board. Solicitation of proxies for use at the Meeting may be made in person or by mail, telephone or telegram, by officers and regular employees of the Company. Such persons will receive no additional compensation for any solicitation activities. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. The Company will bear the entire cost of the solicitation of proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders.

COMMON STOCK OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of December 1, 2014, with respect to (i) each person known by the Company to be the beneficial owner of more than 5% of the Common Stock, (ii) each of the Company’s directors and nominees for director, (iii) each Named Executive Officer (as defined below under “EXECUTIVE COMPENSATION - Summary Compensation”) and (iv) all directors and executive officers as a group. All information is based upon ownership filings made by such persons with the Securities and Exchange Commission (the “Commission”) or upon information provided by such persons to the Company.

| Name and Address of Beneficial Owner (1) | | Number of Shares Amount and Nature of Beneficial Ownership | | | Percentage of Common Stock Owned(2) | |

| Carl C. Icahn | | | 17,824,678 | (3) | | | 67.81 | % |

767 Fifth Avenue | | | | | | | | |

| New York, New York 10153 | | | | | | | | |

| James R. Broach | | | 3,300 | (4) | | | * | |

| Hunter C. Gary | | | -- | | | | * | |

| Peter S. Liebert, M.D. | | | 8,834 | | | | * | |

| Jack G. Wasserman | | | 10,000 | (4) | | | * | |

| David Blitz | | | 5,000 | (4) | | | * | |

c/o Joel Popkin & Company, P.C. | | | | | | | | |

1430 Broadway (Suite 1805) | | | | | | | | |

| New York, NY 10018 | | | | | | | | |

| All executive officers and directors as a group (5 persons) | | | 27,134 | | | | 0.10 | % |

_____________________

* Less than one percent

(1) Except as otherwise indicated above, the address of each stockholder identified above is c/o the Company, 767 Fifth Avenue, New York, NY 10153. Except as indicated in the other footnotes to this table, the persons named in this table have sole voting and investment power with respect to all shares of Common Stock.

(2) Share ownership in the case of each person listed above includes shares issuable upon the exercise of options held by such person as of December 1, 2014, that may be exercised within 60 days after such date for purposes of computing the percentage of Common Stock owned by such person, but not for purposes of computing the percentage of Common Stock owned by any other person. None of the persons listed above held options as of December 1, 2014.

(3) Based on the most recent filings of SEC Form 4 and Schedule 13D by the reporting party. Includes shares of Common Stock held by High River Limited Partnership and shares of Common Stock held by Barberry Corp. Mr. Icahn is the sole shareholder of Barberry Corp. and Barberry Corp. owns 100% of the equity in Hopper Investments L.L.C. which is the general partner of High River Limited Partnership. High River Limited Partnership has sole voting power and sole dispositive power with respect to 7,653,193 shares of Common Stock, and each of Hopper Investments L.L.C., Barberry Corp. and Mr. Carl Icahn has shared voting power and shared dispositive power with respect to such shares. Barberry Corp. has sole voting power and sole dispositive power with respect to 7,538,692 shares of Common Stock, and Mr. Icahn has shared voting power and shared dispositive power with respect to such shares and sole voting power and sole dispositive power with respect to 2,632,793 shares of Common Stock. Mr. Carl Icahn is married to Mr. Hunter C. Gary’s mother-in-law. Mr. Gary is a director of Cadus and the President and Chief Executive Officer of Cadus.

(4) Based on the most recent filing of SEC Form 4 by the reporting party.

ELECTION OF DIRECTORS

(Proposal 1)

The directors to be elected at the Meeting will serve until the next Annual Meeting of Stockholders or until their successors are duly elected and qualified. Properly executed proxies not marked to the contrary will be voted "FOR" the election to the Board of each nominee. Management has no reason to believe that any of the nominees will not be a candidate or will be unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve as a director, the proxy will be voted for the election of such person or persons as shall be designated by the current directors. The nominees for the Board of the Company are as follows:

| James R. Broach | Peter S. Liebert |

| Hunter C. Gary | Jack G. Wasserman |

Information about the foregoing nominees is set forth under “MANAGEMENT” below.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION TO THE BOARD OF ALL NOMINEES NAMED ABOVE.

Board Meetings, Committees and Director Independence

The Board held four meetings in 2013. In 2013, each director attended at least seventy-five percent (75%) of the aggregate of (i) the total number of meetings of the Board, plus (ii) the total number of meetings held by all committees of the Board on which the director served.

The Company does not have a policy with respect to Board members’ attendance at annual meetings of stockholders. One member of the Board attended the Company’s last annual meeting of stockholders in December 2013.

Directors are elected by the stockholders of Cadus at each annual meeting of stockholders and serve until the next annual meeting of stockholders and until their successors are elected and qualified or until their earlier removal or resignation.

The Board has a Compensation Committee, consisting of Messrs. Liebert and Wasserman, which makes recommendations regarding salaries and incentive compensation for employees of and consultants to the Company and which administers the 1996 Incentive Plan. The Compensation Committee does not have a charter. Because the Company had no employees in 2013 and no changes were made during 2013 to the ongoing consultative arrangements with David Blitz, then acting Chief Executive Officer of the Company, and Professor James R. Broach, who provides consulting services to the Company in connection with certain patent and license matters, the Compensation Committee held no formal meetings in 2013, but did have several informal discussions.

The Company does not have a separately-designated standing nominating committee or a committee performing similar functions. Because of the small size of the Board of Directors, the Board of Directors performs this function. The Board of Directors considers certain factors when selecting candidates for director positions, including, but not limited to, the current composition and diversity of skills of the Board of Directors, the expertise and experience of a director leaving the Board of Directors, and the expertise required in connection with a particular corporate need for specific skills. The Board of Directors considers the following characteristics when considering a prospective candidate for the Board: (i) a desire to serve on the Board of Directors primarily to contribute to the growth and prosperity of the Company and help create long-term value for its shareholders; (ii) business or professional knowledge and experience that will contribute to the effectiveness of the Board of Directors; (iii) the ability to understand and exercise sound judgment on issues related to the goals of the Company; and (iv) a willingness and ability to devote the time and effort required to serve effectively on the Board of Directors, including preparation for and attendance at Board meetings.

The Board of Directors will consider stockholder nominations for directors timely given in writing to the Company prior to the annual meeting of stockholders. To be timely, the stockholder’s nomination must be delivered, to the attention of the President of the Company, within the time permitted for submission of a stockholder proposal as described in the Company’s proxy statement and filings with the Securities and Exchange Commission. Such notice shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residential address of each such person, (ii) the principal occupation or employment of such person, (iii) the number of shares of the Company that are beneficially owned by such person and (iv) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, including, without limitation, such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; and (b) as to the stockholder giving the notice (i) the name and address of such stockholder and (ii) the number of shares of the Company that are beneficially owned by such stockholder (and, if the stockholder is not a record holder of the shares, verification of ownership from the record holder). The President of the Company will forward such notice on to one or more of the directors for screening and review and such director’s or directors’ determination whether to recommend that the full Board of Directors consider the nomination contained in such notice.

In the ordinary course, absent special circumstances or a change in the criteria for Board membership, the Board of Directors may renominate incumbent directors who continue to be qualified for Board services and are willing to continue as directors.

The Company does not have a separately-designated standing audit committee or a committee performing similar functions. The entire Board of Directors of the Company acts as the audit committee. The Board of Directors of the Company has determined that it does not have an "audit committee financial expert" as such term is defined in the rules adopted by the Securities and Exchange Commission requiring companies to disclose whether or not at least one member of the audit committee is an "audit committee financial expert." The Board of Directors believes that the aggregate technical, commercial and financial experience of its members, together with their knowledge of the Company, provides the Board with the ability to monitor and direct the goals of the Company and to protect the best interests of its shareholders and that its members are fully qualified to monitor the performance of management, the public disclosures by the Company of its financial condition and performance, the Company's internal accounting operations and its independent auditors. In addition, the Board of Directors is authorized to engage independent financial consultants, auditors and counsel whenever it believes it is necessary and appropriate to do so.

Each non-employee director receives $6,000 in annual compensation, payable quarterly in arrears, and the lead independent director receives an additional $1,500 in annual compensation.

Cadus has the following directors: James R. Broach, Hunter C. Gary, Peter S. Liebert and Jack G. Wasserman, who is also the lead independent director. Each of the directors, other than Hunter C. Gary, meets the standards for independence set forth in the Nasdaq Listing Rules. The entire Board of Directors of the Company acts as the audit committee. Each of the directors, except for James R. Broach and Hunter C. Gary, meets the standards for independence for audit committee members set forth in the Nasdaq Listing Rules.

Stockholder Communications with the Board of Directors

Although the Company does not have a formal procedure for shareholder communication with the Board, the Company’s Board of Directors has always been, and will remain, open to communications from the Company's stockholders. In general, members of the Board and the Chief Executive Officer are accessible by mail in care of the Company. Any matter intended for the Board, or for any individual member or members of the Board, should be directed to the Company's Chief Executive Officer with a request to forward the communication to the intended recipient. Such communications will be screened by the Chief Executive Officer for appropriateness before either forwarding to or notifying the members of the Board of receipt of a communication. Please note that the foregoing procedure does not apply to (i) stockholder proposals pursuant to Exchange Act Rule 14a-8 and communications made in connection with such proposals or (ii) service of process or any other notice in a legal proceeding. For information concerning stockholder proposals, see “Stockholder Proposals for 2015 Annual Meeting.”

MANAGEMENT

Information with respect to the executive officers, directors and nominees for director of the Company as of November 30, 2014 is set forth below:

| Name | Age | Position |

| James R. Broach, Ph.D.** | 66 | Director |

| Hunter C. Gary** | 40 | Director, President and Chief Executive Officer |

| Peter S. Liebert, M.D.**(1) | 78 | Director |

| Jack G. Wasserman**(1)(2) | 77 | Director |

| David Blitz | 83 | Treasurer and Secretary |

_________________________

**Nominee for election to the Board

(1) Member of the Compensation Committee.

(2) Lead independent director.

James R. Broach, Ph.D., a scientific founder of Cadus and inventor of Cadus’s yeast–based drug discovery technology, has been Director of Research of Cadus since its inception. He is currently Chair of the Department of Biochemistry and Molecular Biology at Penn State University College of Medicine and Director of the Penn State Hershey Institute for Personalized Medicine. He is also Professor Emeritus of Molecular Biology at Princeton University, where from 1984 to 2012 he was Professor of Molecular Biology and where he served as Associate Chair and Associate Director of the Lewis Sigler Institute for Integrative Genomics. In 1984, Dr. Broach and his collaborators were the first ones to demonstrate that human genes could be successfully implanted into yeast cells. Dr. Broach was a member of the Scientific Advisory Board of the U.S. Food and Drug Administration from 2009 until 2012, a member of the Board of Trustees of the University of Medicine and Dentistry of New Jersey from 2007 until 2012 and a Commissioner on the New Jersey Commission for Cancer Research from 2004 until 2012. He received his Ph.D. in Biochemistry from University of California at Berkeley and his B.S. from Yale University. The Board of Directors has concluded that Dr. Broach should serve as a director of Cadus because of his role as the inventor of Cadus's yeast-based discovery technology, his continuing association and prominence in academic circles in the field of Molecular Biology and his experience on the Board of Directors of Cadus.

Hunter C. Gary became a director of Cadus in February 2014 and President and Chief Executive Officer of Cadus in March 2014. He has served as Senior Vice President of Icahn Enterprises L.P. (a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, gaming, railcar, food packaging, metals, real estate and home fashion) since November 2010. At Icahn Enterprises L.P., Mr. Gary is responsible for monitoring portfolio company operations, implementing operational value enhancement as well as leads the real estate segment of the firm. Prior to that time, Mr. Gary has been employed by Icahn Associates Corporation, an affiliate of Icahn Enterprises L.P., in various roles since June 2003, most recently as the Chief Operating Officer of Icahn Sourcing LLC. From 1997 to 2002, Mr. Gary worked at Kaufhof Warenhaus AG, a subsidiary of the Metro Group AG, most recently as a Managing Director. Mr. Gary has been a director of: Herbalife Ltd., a nutrition company, since April 2014; Federal-Mogul Corporation, a supplier of automotive powertrain and safety components, since October 2012; Viskase Companies Inc., a meat casing company, since August 2012; PSC Metals Inc., a metal recycling company, since May 2012; XO Holdings, a competitive provider of telecom services, since September 2011; Tropicana Entertainment Inc. and Tropicana Entertainment Cayman Holdings Co. Ltd., companies that are primarily engaged in the business of owning and operating casinos and resorts, since March 2010 and January 2011, respectively; American Railcar Industries, Inc., a railcar manufacturing company, since January 2008; Voltari Corporation, a mobile data services provider, since October 2007; and WestPoint Home LLC, a home textiles manufacturer, since June 2007. Federal-Mogul, Viskase Companies, PSC Metals, XO Holdings, Tropicana Entertainment, American Railcar Industries and WestPoint Home each are indirectly controlled by Carl C. Icahn. Mr. Icahn also has a non-controlling interest in Cadus, Herbalife and Voltari through the ownership of securities. Mr. Gary is married to Mr. Carl Icahn's wife's daughter. Mr. Gary received his B.S. with senior honors from Georgetown University as well as a certificate of executive development from Columbia Graduate School of Business. The Board of Directors has concluded that Mr. Gary should serve as a director of Cadus because of his business experience and familiarity with company operations, corporate finance and real estate generally and his experience as a director of various public companies.

Peter S. Liebert, M.D., became a director of Cadus in April 1995. Dr. Liebert has been a pediatric surgeon in private practice since 1968 and is Chief of Pediatric Surgery at the Stamford Hospital in Stamford, Connecticut. He is a past president of the Westchester Surgical Society. He is also a past president of the Westchester County Medical Society and is currently Chairman of its Finance Committee and a member of the Westchester County Board of Health. He is also Chairman of the Board of Rx Vitamins, Inc., a vitamins and supplements company. Dr. Liebert served as a director of ImClone Systems Incorporated, a biotechnology company, from October 2006 to November 2008. Dr. Liebert holds an M.D. from Harvard University Medical School and a B.A. from Princeton University. The Board of Directors has concluded that Dr. Liebert should serve as a director of Cadus because of his experience on the Board of Directors of Cadus and as a director of another public company.

Jack G. Wasserman has served as a director of Cadus since May 1996 and as the lead independent director of its Board of Directors since March 2014. Mr. Wasserman is an attorney and a member of the Bars of New York, Florida, and the District of Columbia. From 1966 until 2001 he was a senior partner of Wasserman, Schneider, Babb & Reed, a New York-based law firm and its predecessors. Since September 2001 Mr. Wasserman has been engaged in the practice of law as a sole practitioner. Since 1993 he has been a director of Icahn Enterprises G.P., Inc. (formerly American Property Investors, Inc.), the general partner of Icahn Enterprises L.P. (formerly American Real Estate Partners, L.P.). Mr. Carl C. Icahn controls Icahn Enterprises G.P. and its subsidiaries. Since Icahn Enterprises L.P. owns the Tropicana hotels and casinos, Mr. Wasserman has been licensed by the gaming regulators of the states of New Jersey, Nevada, Indiana, Louisiana and Mississippi. On March 11, 2004, Mr. Wasserman was appointed to the Board of Directors of Triarc Companies, Inc. and was elected to the Board in June 2004; in 2008 Triarc acquired Wendy’s Inc. and changed its name to Wendy’s/Arby’s Group Inc. which, in turn, became The Wendy's Company after its sale of Arby's in 2011. Mr. Wasserman is a member of Wendy’s audit and compensation committees and is chairman of its ERISA committee. Mr. Wasserman received a B.A. from Adelphi University, a J.D. from Georgetown University Law Center, and a Graduate Diploma from Johns Hopkins University School of Advanced International Studies in Bologna, Italy. In 2007 he received a professional Certificate in Financial Analysis from New York University’s School of Continuing and Professional Studies. The Board of Directors has concluded that Mr. Wasserman should serve as a director of Cadus because of his considerable experience as a lawyer and experience as a director of public companies.

David Blitz became Treasurer and Secretary of Cadus in May 2004. From May 2004 until March 2014, he also served as acting President and Chief Executive Officer of Cadus. Mr. Blitz, a certified public accountant, is a retired partner of Deloitte & Touche and has been employed by Joel Popkin & Co., P.C. since January 1990. Mr. Blitz, as an employee of Joel Popkin & Co., P.C., has been performing Cadus Corporation's internal accounting since March 2000. He earned his B.A. in Economics from Brooklyn College.

EXECUTIVE COMPENSATION

Summary Compensation

The following table sets forth certain information concerning the compensation paid or accrued by Cadus for services rendered to Cadus in all capacities for the fiscal years ended December 31, 2013 and 2012, by (i) all individuals serving as Cadus’s principal executive officer or principal financial officer, or acting in a similar capacity, (ii) the three most highly compensated executive officers other than the executive officers in clause (i), who were serving as executive officers at the end of such fiscal year and (iii) up to two additional most highly compensated executive officers who would have otherwise been included in clause (ii) but for the fact that they were not serving as executive officers at the end of such fiscal year (collectively, the “Named Executive Officers”):

Summary Compensation Table For 2013 and 2012 Fiscal Years

Name and Principal Position | | | Year | | | | Salary ($) | | | | Bonus ($) | | | | All Other Compensation ($) | | | | Total ($) | |

| David Blitz (1) | | | 2013 | | | $ | 25,000 | | | | -- | | | | -- | | | $ | 25,000 | |

| President and Chief Executive Officer | | | 2012 | | | $ | 25,000 | | | | -- | | | | -- | | | $ | 25,000 | |

| | | | | | | | | | | | | | | | | | | | |

| Hunter C. Gary (2) | | | 2013 | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | 2012 | | | | -- | | | | -- | | | | -- | | | | -- | |

___________________

| (1) | Mr. David Blitz had served as the Company’s acting President and Chief Executive Officer, Treasurer and Secretary from May 2004 until March 2014 at the rate of $25,000 per annum. From March 2014, when Hunter C. Gary was appointed President and Chief Executive Officer of the Company, Mr. Blitz has continued to serve as the Company’s Treasurer and Secretary at the rate of $25,000 per annum. |

| (2) | Mr. Hunter C. Gary, from his appointment in March 2014, has served as President and Chief Executive Officer of the Company at the rate of $200,000 per annum. According to Mr. Gary’s employment agreement with the Company, any bonus to Mr. Gary will be determined from time to time by the Company’s Board of Directors in its sole discretion. |

Grants of Plan Based Awards

There were no grants by Cadus of awards to Named Executive Officers during the fiscal year ended December 31, 2013.

Outstanding Equity Awards at Fiscal Year-End

No Named Executive Officer had any outstanding Cadus equity awards as of December 31, 2013.

Option Exercises and Stock Vested

During the fiscal year ended December 31, 2013, no Named Executive Officer exercised any stock option, stock appreciation right or similar instrument and no Cadus stock (including any restricted stock, restricted stock unit or similar instrument) vested for any Named Executive Officer.

Director Compensation

The following table sets forth certain information concerning the compensation paid or accrued by Cadus for services rendered to Cadus by its directors in all capacities for the fiscal year ended December 31, 2013:

Director Compensation Table For 2013 Fiscal Year

| Name | | | Fees Earned or Paid in Cash ($) (1) | | | | All Other Compensation ($) | | | | Total ($) | |

| | | | | | | | | | | | | |

| James R. Broach | | $ | 3,000 | | | | $12,000( | 2) | | $ | 15,000 | |

| Brett Icahn | | $ | 3,000 | | | | -- | | | $ | 3,000 | |

| Peter S. Liebert | | $ | 3,000 | | | | -- | | | $ | 3,000 | |

| Jack G. Wasserman | | $ | 3,514 | | | | -- | | | $ | 3,514 | |

___________________

| (1) | In 2013, each non-employee director received $3,000 in annual compensation, payable quarterly in arrears. Jack G. Wasserman received an additional $514 in connection with his preparation for and attendance at the Annual Meeting of Stockholders on December 2, 2013. For 2014, non-employee director annual compensation was increased to $6,000, with $1,500 in additional annual compensation to be paid to the lead independent director. |

| (2) | James R. Broach provides consulting services to the Company for patent and license related matters, for which he was paid $12,000 in the fiscal year ended December 31, 2013. |

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee is composed of Peter Liebert and Jack G. Wasserman. Neither Mr. Liebert nor Mr. Wasserman is or was an officer or employee of the Company.

Compensation Discussion and Analysis

Introduction

The Compensation Committee of the Board of Directors of Cadus is responsible for determining and administering the Company’s compensation policies for the remuneration of Cadus’s officers. The Compensation Committee annually evaluates individual and corporate performance from both a short-term and long-term perspective. In 2013, Cadus had no officers other than its acting Chief Executive Officer who served in a consultative capacity at the rate of $25,000 per annum for the interim period during which the Company continued its search for a new Chief Executive Officer. Accordingly, the following report of the Compensation Committee is not entirely applicable to calendar year 2013 but is presented for an historical perspective.

Philosophy

Cadus’s executive compensation program historically has sought to encourage the achievement of business objectives and superior corporate performance by the Cadus’s executives. The program enables Cadus to reward and retain highly qualified executives and to foster a performance-oriented environment wherein management’s long-term focus is on maximizing stockholder value through equity-based incentives. The program calls for consideration of the nature of each executive’s work and responsibilities, unusual accomplishments or achievements on the Company’s behalf, years of service, the executive’s total compensation and the Company’s financial condition generally.

Components of Executive Compensation

Historically, Cadus’s executive employees have received cash-based and equity-based compensation.

Cash-Based Compensation. Base salary represents the primary cash component of an executive employee’s compensation, and is determined by evaluating the responsibilities associated with an employee’s position at the Company and the employee’s overall level of experience. In addition, the Committee, in its discretion, may award bonuses. The Compensation Committee and the Board believe that the Company’s management and employees are best motivated through stock option awards and cash incentives.

Equity-Based Compensation. Equity-based compensation principally has been in the form of stock options. The Compensation Committee and the Board believe that stock options represent an important component of a well-balanced compensation program. Because stock option awards provide value only in the event of share price appreciation, stock options enhance management’s focus on maximizing long-term stockholder value and thus provide a direct relationship between an executive’s compensation and the stockholders’ interests. No specific formula is used to determine stock option awards for an employee. Rather, individual award levels are based upon the subjective evaluation of each employee’s overall past and expected future contributions to the success of the Company.

Compensation of the Chief Executive Officer

The philosophy, factors and criteria of the Compensation Committee generally applicable to the Company’s officers have historically been applicable to the Chief Executive Officer. However, the Company’s acting President and Chief Executive Officer in 2013, David Blitz, served on a consultative basis at the rate of $25,000 per annum for the interim period during which the Company continued its search for a new Chief Executive Officer. In March 2014, David Blitz resigned as President and Chief Executive Officer, and the Company’s Board of Directors appointed Hunter C. Gary, a director of the Company, as the Company's President and Chief Executive Officer with a salary of $200,000 per annum. According to Mr. Gary’s employment agreement with the Company, any bonus to Mr. Gary will be determined from time to time by the Company’s Board of Directors in its sole discretion. Mr. Gary has not received any equity-based compensation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Since January 1, 2013, except for transactions in respect of the brokerage services of Bayswater Brokerage Florida LLC and the employment of Hunter C. Gary as Chief Executive Officer, in each case, as described below, the Company has not been a participant in any transaction with a “related person” (as defined in Item 404 of Regulation S-K) where the amount involved exceeds the lesser of $120,000 or one percent of the average of the Company’s total assets at year end for the last two completed fiscal years, nor is any such transaction currently proposed. The Company recognizes that related person transactions can present potential or actual conflicts of interest. Accordingly, if a proposed transaction appears to or does involve a related person, and the amount involved exceeds $60,000, the transaction must be presented to the Board of Directors for its review and approval or ratification. The Board of Directors may retain and pay such independent advisors as it deems necessary to properly evaluate the proposed transaction, including, without limitation, outside legal counsel and financial advisors to determine the fair value of the transaction. Related party transactions where the amount involved does not exceed $60,000 do not require formal Board of Directors approval, but must be disclosed to the Board of Directors. The foregoing procedures are designed to ensure that transactions with related persons are fair to the Company and in the Company’s best interests.

Bayswater Brokerage Florida LLC (“Bayswater”) is providing brokerage services to the Company on a non-exclusive basis. Carl C. Icahn, the controlling shareholder of Cadus, is also indirectly the principal shareholder of Bayswater; Jack Wasserman, a director and the lead independent director of Cadus is a director of Bayswater’s indirect parent; and Hunter C. Gary, a director and President and Chief Executive Officer of Cadus, is a senior vice president of Bayswater’s indirect parent and Vice President, Secretary and Treasurer of Bayswater. Barberry Corp., of which Carl Icahn is the sole shareholder, is a significant shareholder of Cadus. Pursuant to an agreement between Barberry Corp. and Cadus, to the extent Bayswater receives any compensation for such brokerage services, Barberry Corp. will make capital contributions to Cadus for the full amount of any such compensation received by Bayswater. Barberry Corp. will not be issued stock of the Company or any other consideration in connection with any such capital contributions. The cash contributed by Barberry Corp. through November 30, 2014 pursuant to this arrangement is $728,900.

In March 2014, the Company’s Board of Directors appointed Hunter C. Gary, a director of the Company, as the Company's President and Chief Executive Officer with a salary of $200,000 per annum. According to Mr. Gary’s employment agreement with the Company, any bonus to Mr. Gary will be determined from time to time by the Company’s Board of Directors in its sole discretion. Mr. Gary has not received any equity-based compensation.

James Broach provides consulting services to the Company for patent and license related matters for which he was paid $12,000 in each of calendar years 2013 and 2012.

In May 2004, the Board of Directors appointed David Blitz the acting President, Chief Executive Officer, Treasurer and Secretary of the Company at the rate of $25,000 per annum for the period during which the Company continued its search for a new Chief Executive Officer. In 2013 and until March 2014, the Company paid Mr. Blitz at a rate of $25,000 per annum in such capacities. From March 2014, when Hunter C. Gary was appointed President and Chief Executive Officer of the Company, Mr. Blitz has continued to serve as the Company’s Treasurer and Secretary at the rate of $25,000 per annum. Mr. Blitz remains an employee of Joel Popkin & Co., P.C., in which capacity he will continue to perform the Company’s internal accounting as he has done since March 2000. The Company paid Joel Popkin & Co. $47,080 for such accounting services and $4,500 for tax preparation services performed in 2013 and currently anticipates that it will pay similar amounts for such services in 2014.

Report of the Board of Directors in Lieu of Report of an Audit Committee

The Company does not have an audit committee and the Board has not adopted a written charter for an audit committee. The entire Board of Directors of the Company acts as the audit committee. The members of the Board of Directors are James R. Broach, Hunter C. Gary, Peter S. Liebert and Jack G. Wasserman.

The Board of Directors has reviewed and discussed the Company’s audited financial statements for the year ended December 31, 2013 and management’s assessment of the effectiveness of the Company’s internal controls over financial reporting as of December 31, 2013 with both management and the independent accountants, Baker Tilly Virchow Krause, LLP. The Board also discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The Board received the written disclosures and the letter from the independent accountants, Baker Tilly Virchow Krause, LLP, required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountants’ communication with the Board concerning independence; and has discussed with the independent accountants the independent accountants’ independence.

The following table sets forth the aggregate fees incurred by the Company for the services of its principal accountants in 2013 and 2012:

| | | 2013 | | | 2012 | |

| Audit Fees | | $ | 36,522 | | | $ | 35,500 | |

| Audit-Related Fees | | $ | -- | | | $ | -- | |

| Tax Fees | | $ | -- | | | $ | -- | |

| All Other Fees | | $ | -- | | | $ | 16,319 | (1) |

___________________

| (1) | Fees incurred in connection with the Company’s abandoned acquisitions. |

Audit fees consist of services rendered to the Company for the audit of the Company’s annual consolidated financial statements, reviews of the Company’s quarterly financial statements and related services.

The Company’s policy is that, before accountants are engaged by the Company to render audit or non-audit services, the engagement is approved by Cadus’s Board of Directors. Cadus’s Board of Directors approved Holtz Rubenstein Reminick LLP’s (and following its merger into Baker Tilly Virchow Krause, LLP, Baker Tilly Virchow Krause, LLP’s) engagement as the Company’s independent auditors for the fiscal year ending December 31, 2013 before Holtz Rubenstein Reminick LLP (and following its merger into Baker Tilly Virchow Krause, LLP, Baker Tilly Virchow Krause, LLP) was so engaged. All of the 2013 services described above were approved by the Board of Directors.

The Board of Directors has considered the compatibility of fees paid to its principal accountants in connection with its principal accountants’ independence.

Based on the foregoing review and discussions, the Board of Directors approved that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 to be filed with the Securities and Exchange Commission.

Following a review of the independent accounting firm’s performance and qualifications, the Board of Directors approved the reappointment of Baker Tilly Virchow Krause, LLP as the Company’s independent accounting firm for the fiscal year 2014.

By the Board of Directors:

James R. Broach

Hunter C. Gary

Peter S. Liebert

Jack G. Wasserman

INDEPENDENT ACCOUNTANTS

The Board of Directors of the Company has engaged Baker Tilly Virchow Krause, LLP as the Company's independent accountants for the 2014 fiscal year.

Representatives of Baker Tilly Virchow Krause, LLP will be present at the Meeting, will be afforded an opportunity to make a statement, and will be available to respond to appropriate inquiries from stockholders.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's directors, executive officers, and persons who own more than ten percent of the Common Stock to file with the Securities and Exchange Commission initial reports of beneficial ownership on Form 3 and reports of changes in beneficial ownership on Form 4 or Form 5. Reporting persons are required to furnish the Company with copies of all such forms that they file. To the Company’s knowledge, based solely on a review of copies of such filed reports furnished to the Company, all of the Company’s directors, officers and greater than ten percent beneficial owners made all required filings during or with respect to fiscal year 2013 in a timely manner.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Company’s chief executive officer is a director, but does not act as a chairman of the Board of Directors. The Company’s Board of Directors does not include a chairman, but does include a lead independent director who, in consultation with the chief executive officer, prepares the agendas for meetings of the Board of Directors, presides at meetings of the Board of Directors, is apprised of inquiries from shareholders and, when necessary and appropriate, is involved in responding to any such inquiries. The lead independent director may also request that certain documents be sent to all other directors, and is responsible for signing engagement letters for accountants, auditors, legal counsel, and such other persons as the Company or the Board of Directors may engage.

The Board of Directors takes an active role in risk oversight related to the Company and much of this role has been in overseeing the protection of the Company's intellectual property, the development and implementation of cash management policies, and the acquisition of residential properties in connection with the development of its real estate business.

ADVISORY VOTE TO APPROVE THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

AS DISCLOSED IN THIS PROXY STATEMENT

(Proposal 2)

The Company is providing its stockholders with an opportunity to approve or not approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers as disclosed in this proxy statement. This proposal, which is often referred to as a “say-on-pay” proposal, is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

This vote is not intended to address any particular component of any compensation package, but rather the overall compensation of the Company’s named executive officers and the Company’s compensation philosophy, policies and practices, as disclosed under the “Executive Compensation” section of this Proxy Statement. The Company has two officers: (i) its President and Chief Executive Officer and (ii) its Treasurer and Secretary who serves in a consultative capacity. The Company urges stockholders to read the section on Executive Compensation, including the Compensation Discussion and Analysis and the compensation table. The approval or disapproval of this proposal by the stockholders will not require the Board of Directors or the Compensation Committee to take any action regarding the Company’s executive compensation practices. The final decision on the compensation and benefits of the Company’s executive officers and on whether, and if so, how, to address shareholder disapproval remains with the Board of Directors and the Compensation Committee. Although this resolution is non-binding, the Board of Directors will review and consider the voting results when making future executive compensation decisions. The affirmative vote of a majority of the votes properly cast on this proposal at the Annual Meeting is required to approve the proposal.

RESOLUTION TO APPROVE THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation table and narrative discussion is hereby APPROVED.

THE BOARD RECOMMENDS THAT YOU VOTE

FOR THE RESOLUTION APPROVING THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

STOCKHOLDER PROPOSALS FOR 2015 ANNUAL MEETING

Stockholders who wish to present proposals at the annual meeting of stockholders with respect to the 2014 fiscal year and who wish to have their proposals presented in the proxy statement distributed by the Board in connection with such annual meeting must submit their proposals in writing, to the attention of the President of the Company, on or before August 31, 2015. If the date of next year’s annual meeting of stockholders is changed by more than 30 days from the date of this year’s meeting, then the deadline is a reasonable time before the Company begins to print and mail proxy materials. In addition, if the Company receives notice of a shareholder proposal after November 14, 2015, it will be considered untimely pursuant to Rules 14a-4(c) under the Securities Exchange Act of 1934, and the persons named in the proxies solicited by the Board of Directors for the annual meeting of stockholders with respect to the 2014 fiscal year may exercise discretionary voting power with respect to the proposal. If the date of next year’s annual meeting of stockholders has been changed by more than 30 days from the date of the annual meeting of stockholders with respect to the 2013 fiscal year, written notice of a shareholder proposal must be received by the Company a reasonable time before the Company begins to print and mail proxy materials for next year’s annual meeting of stockholders to be considered timely pursuant to Rule 14a-4(c) under the Securities Exchange Act of 1934.

ADDITIONAL INFORMATION

The Company’s Annual Report, including certain financial statements, is being mailed concurrently with this Proxy Statement to all persons who were stockholders of record at the close of business on December 19, 2014, which is the record date for voting purposes. The Annual Report does not constitute a part of the proxy soliciting material.

Upon the written request of any stockholder, the Company will provide, without charge, a copy of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Written requests for such report should be directed to the Company, 767 Fifth Avenue, New York, New York 10153.

GENERAL

The Board knows of no other matters which are likely to be brought before the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the enclosed proxy or their substitutes shall vote thereon in accordance with their judgment pursuant to the discretionary authority conferred by the form of proxy.

By Order of the Board of Directors

Hunter C. Gary

President

New York, New York

December 29, 2014