QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| /x/ | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| / / | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

EQUITY MARKETING, INC.

|

|

| (Name of Registrant as Specified In Its Charter) | |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| |

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Equity Marketing, Inc.

NOTICE OF ANNUAL MEETING

and

PROXY STATEMENT

Annual Meeting of Stockholders

Equity Marketing, Inc.

6330 San Vicente Blvd.

Los Angeles, California

May 23, 2002

PRELIMINARY

EQUITY MARKETING, INC.

6330 San Vicente Blvd.

Los Angeles, California 90048

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 23, 2002

TO THE STOCKHOLDERS OF

EQUITY MARKETING, INC.:

Notice is hereby given that the 2002 Annual Meeting of Stockholders (the "Annual Meeting") of Equity Marketing, Inc., a Delaware corporation (the "Company"), will be held at the offices of the Company located at 6330 San Vicente Blvd., Los Angeles, California 90048, on Thursday, May 23, 2002, beginning at 10:00 a.m., local time. The Annual Meeting will be held for the following purposes:

- 1.

- To elect seven members of the Board of Directors, each to hold office until the 2003 Annual Meeting and until his successor is elected and qualified;

- 2.

- To approve an amendment to the Equity Marketing, Inc. 2000 Stock Option Plan;

- 3.

- To approve an amendment to Article Fourth of the Company's Certificate of Incorporation;

- 4.

- To ratify the selection of Arthur Andersen LLP as the Company's independent auditor; and

- 5.

- To transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

The Board of Directors has fixed March 29, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof, and only stockholders of record at the close of business on that date are entitled to such notice and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and at the offices of the Company for ten days prior to the Annual Meeting.

We hope that you will use this opportunity to take an active part in the affairs of the Company by voting on the business to come before the Annual Meeting, either by executing and returning the enclosed Proxy Card or by casting your vote in person at the Annual Meeting.

Los Angeles, California

April 12, 2002

STOCKHOLDERS UNABLE TO ATTEND THE ANNUAL MEETING IN PERSON ARE REQUESTED TO DATE AND SIGN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. A STAMPED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. IF A STOCKHOLDER RECEIVES MORE THAN ONE PROXY CARD BECAUSE HE OR SHE OWNS SHARES REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY CARD SHOULD BE COMPLETED AND RETURNED.

EQUITY MARKETING, INC.

6330 San Vicente Blvd.

Los Angeles, California 90048

(323) 932-4300

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 23, 2002

INTRODUCTION

This Proxy Statement is furnished to the stockholders by the Board of Directors of Equity Marketing, Inc., a Delaware corporation (the "Company"), for solicitation of proxies for use at the 2002 Annual Meeting of Stockholders to be held at the offices of the Company located at 6330 San Vicente Blvd., Los Angeles, California 90048, on Thursday, May 23, 2002, at 10:00 a.m., local time, and at any and all adjournments thereof (the "Annual Meeting").

The purpose of the Annual Meeting and the matters to be acted upon are set forth in the following Proxy Statement. As of the date of this Proxy Statement, the Board of Directors knows of no other business which will be presented for consideration at the Annual Meeting. A stockholder giving a proxy pursuant to the present solicitation may revoke it at any time before it is exercised by submitting a duly executed proxy bearing a later date or by delivering to the Secretary of the Company a written notice of revocation prior to the Annual Meeting, or by appearing at the Annual Meeting and expressing a desire to vote his or her shares in person. Subject to such revocation, all shares represented by a properly executed proxy received prior to or at the Annual Meeting will be voted by the proxy holders whose names are set forth in the accompanying proxy in accordance with the instructions on the proxy. If no instruction is specified with respect to a matter to be acted upon, the shares represented by the proxy will be voted "FOR" the election of the nominees for director set forth herein, "FOR" the approval of the amendment to Article Fourth of the Company's Certificate of Incorporation, "FOR" the approval of the amendment to the Equity Marketing, Inc. 2000 Stock Option Plan and "FOR" the proposal to ratify the appointment of Arthur Andersen LLP as the independent auditor of the Company for the fiscal year ending December 31, 2002. If any other business shall properly come before the meeting, votes will be cast pursuant to said proxies in respect of any such other business in accordance with the judgment of the persons acting under said proxies.

It is anticipated that the mailing to stockholders of this Proxy Statement and the enclosed proxy will commence on or about April 12, 2002.

OUTSTANDING SECURITIES AND VOTING RIGHTS

Only stockholders of record at the close of business on March 29, 2002 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting. At that date there were outstanding shares of common stock, par value $.001 per share, of the Company (the "Common Stock"), and 25,000 outstanding shares of Series A senior cumulative participating convertible preferred stock, par value $.001 per share, of the Company (the "Series A Stock"), the only outstanding voting securities of the Company. At the Annual Meeting, each share of Common Stock will be entitled to one vote. Each share of Series A Stock will be entitled to 67.7966 votes (which represents the number of shares of Common Stock into which each share of Series A Stock is currently convertible), or approximately 1,694,915 votes in the aggregate. Accordingly, an aggregate of votes may be cast at the Annual Meeting by holders of Common Stock and Series A Stock.

The representation, in person or by properly executed proxy, of the holders of a majority of the voting power of the shares of stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Stockholders are not entitled to cumulate their votes. Abstentions and broker non-votes (shares held by a broker or nominee which are represented at the Annual Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) are counted for purposes of determining the presence or absence of a quorum for the transaction of business. In the election of directors, holders of Common Stock are entitled to elect seven directors with the seven candidates who receive the highest number of affirmative votes being elected, and the holders of the Series A Stock, voting separately as a class, are entitled to elect two directors, with the candidates receiving the highest number of affirmative votes being elected. Votes against a candidate and votes withheld have no legal effect. In matters other than the election of directors, abstentions have the effect of votes against a proposal in tabulations of the votes cast on proposals presented to stockholders, whereas broker non-votes do not have any effect for purposes of determining whether a proposal has been approved.

As of the Record Date, all of the outstanding shares of Series A Stock are owned by Crown EMAK Partners, LLC, a Delaware limited liability company ("Crown"), representing the power to vote approximately 22.4% of the voting power of the shares of stock entitled to vote at the Annual Meeting. The Company has been advised that Crown intends to vote all the shares beneficially owned by it "FOR" the approval of the amendment to Article Fourth of the Company's Certificate of Incorporation, "FOR" the approval of the amendment to the Equity Marketing, Inc. 2000 Stock Option Plan and "FOR" the proposal to ratify the appointment of Arthur Andersen LLP as the independent auditor of the Company for the fiscal year ending December 31, 2002.

As of the Record Date, Donald A. Kurz and Stephen P. Robeck possessed the power to vote approximately 32.1% of the voting power of the shares of stock entitled to vote at the Annual Meeting. The Company has been advised that Messrs. Kurz and Robeck intend to vote all of the shares beneficially owned by them "FOR" the election of the nominees for director set forth herein, "FOR" the approval of the amendment to Article Fourth of the Company's Certificate of Incorporation, "FOR" the approval of the amendment to the Equity Marketing, Inc. 2000 Stock Option Plan and "FOR" the proposal to ratify the appointment of Arthur Andersen LLP as the independent auditor of the Company for the fiscal year ending December 31, 2002.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as to the shares of Common Stock and Series A Stock owned as of March 1, 2002 by (i) each person known to the Company to be the beneficial owner of more than 5% of the Common Stock and Series A Stock; (ii) each director and nominee for director; (iii) each executive officer named in the Summary Compensation Table included under "Executive Compensation and Related Matters" (collectively, the "Named Executive Officers"); and (iv) all directors and executive officers of the Company as a group. Unless otherwise indicated in the footnotes following the table, the persons as to whom the information is given had sole voting and investment power over the shares of Common Stock and Series A Stock shown as beneficially owned by them, subject to community property laws where applicable. Unless otherwise indicated, the address of each person shown is c/o Equity Marketing, Inc., 6330 San Vicente Blvd., Los Angeles, California 90048.

| | Common Stock

| | Series A Stock

| |

|---|

Name and Address of Beneficial Owner

| | Amount Beneficially Owned (1)

| | Precent of

Class (1)

| | Amount Benefically Owned (1)

| | Percent of Class (1)

| |

|---|

| Crown EMAK Partners, LLC (2) | | 2,611,580 | | 30.8% | | 25,000 | | 100 | % |

| Peter Ackerman (2) | | 2,611,580 | | 30.8% | | 25,000 | | 100 | % |

| Donald A. Kurz (3) | | 1,667,203 | | 27.8% | | | | | |

| Stephen P. Robeck (3) | | 939,037 | | 15.8% | | | | | |

| Baron Capital (4) | | 500,000 | | 8.5% | | | | | |

| Bruce Raben (3) | | 258,000 | | 4.3% | | | | | |

| Mitchell H. Kurz (3) | | 131,600 | | 2.2% | | | | | |

| Sanford R. Climan (3) | | 117,650 | | 2.0% | | | | | |

| Gaetano A. Mastropasqua (3) | | 66,263 | | 1.1% | | | | | |

| Kim H. Thomsen (3) | | 40,191 | | * | | | | | |

| Leland P. Smith (3) | | 36,855 | | * | | | | | |

| Jonathan D. Kaufelt (3) | | 12,000 | | * | | | | | |

| Alfred E. Osborne (3) | | 11,000 | | * | | | | | |

| Lawrence J. Madden (3) | | 8,000 | | * | | | | | |

| Jason Ackerman (2) | | 0 | | * | | | | | |

| Jeffrey S. Deutschman (2) | | 0 | | * | | | | | |

Executive Officers and Directors as a Group

(14 persons)(5) | | 5,899,479 | | 64.3% | | 25,000 | | 100 | % |

- *

- Less than one percent.

- (1)

- In accordance with Rule 13d-3(d)(1)(i) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), shares beneficially owned at any date include shares issuable upon the exercise of options, warrants, rights or conversion privileges within sixty days of that date. For the purpose of computing the percentage of outstanding shares beneficially owned by a particular person, any securities not outstanding which are subject to options, warrants, rights or conversion privileges exercisable by that person within sixty days of March 1, 2002 have been deemed to be outstanding, but have not been deemed outstanding for the purpose of computing the percentage of the class beneficially owned by any other person.

- (2)

- As reported on a Schedule 13D dated April 10, 2000 and filed with the Securities and Exchange Commission (the "Commission") by Crown, Peter Ackerman, Jeffrey S. Deutschman, Jason Ackerman and related parties. The address of Mr. Deutschman, Jason Ackerman and Crown is 660 Madison Avenue, 15th Floor, New York, New York 10021. The address of Peter Ackerman is 700 Eleventh Street N.W., Washington, DC 20001. Mr. Deutschman and Jason Ackerman are managers of Crown. Peter Ackerman may be deemed to have shared power to vote or direct the vote, and to dispose or direct the disposition of the shares of Series A Stock.

On March 29, 2000, Crown paid $11.9 million to the Company in exchange for 11,900 shares of Series A Stock with a conversion price of $14.75 per share. In connection with such purchase, the Company granted to Crown five year warrants (collectively, the "Warrants") to purchase 5,712 shares of Series B senior cumulative participating convertible preferred stock, par value $.001 per share, of the Company (the "Series B Stock") at an exercise price of $1,000 per share, and 1,428 shares of Series C senior cumulative participating convertible preferred stock, par value $.001 per share, of the Company (the "Series C Stock") at an exercise price of $1,000 per share. The Warrants are immediately exercisable. The conversion

3

prices of the Series B Stock and the Series C Stock are $16.00 and $18.00, respectively. On June 20, 2000, Crown paid an additional $13.1 million to the Company in exchange for an additional 13,100 shares of Series A Stock with a conversion price of $14.75 per share. In connection with such purchase, the Company granted to Crown Warrants to purchase an additional 6,288 shares of Series B Stock and an additional 1,572 shares of Series C Stock. As of the date hereof, each share of Series A Stock is currently convertible into 67.7966 shares of Common Stock, representing 1,694,915 shares of Common Stock in the aggregate. As of the date hereof, each share of Series B Stock and Series C Stock is currently convertible into 62.5 and 55.5556 shares of Common Stock, respectively, representing 916,666 shares of Common Stock in the aggregate.

- (3)

- Includes shares of Common Stock which the following officers and directors have the right to acquire by exercise of options within 60 days following March 1, 2002: D. Kurz, 125,000; Robeck, 50,000; Raben, 180,000; M. Kurz, 55,000; Climan, 115,000; Mastropasqua, 63,750; Thomsen, 38,333; Smith, 34,500; Kaufelt, 10,000; Osborne, 10,000; and Madden, 8,000.

- (4)

- As reported on a Schedule 13G dated February 4, 2002 and filed with the Commission by Baron Capital. The address of Baron Capital is 767 Fifth Avenue, New York, NY 10153.

- (5)

- The amount stated includes an aggregate of 3,301,163 shares of Common Stock which may be acquired upon the exercise of options or warrants within sixty days following March 1, 2002.

ELECTION OF DIRECTORS

Pursuant to the Certificate of Incorporation of the Company and the Certificate of Designation of the Series A Stock of the Company, the holders of the Series A Stock, voting as a separate class, shall be entitled to elect two directors of the Company at the Annual Meeting (the "Series A Directors"). The holders of the Common Stock, voting separately as a class, shall elect the remaining directors. Accordingly, seven directors are to be elected and qualified at the Annual Meeting. Proxies for the Series A Directors are not being solicited; the Series A Stock will be voted by written ballot or unanimous written consent at the Annual Meeting. Crown, the holder of the Series A Stock, has advised the Company that Jason Ackerman and Jeffrey S. Deutschman will be nominated for election as the Series A Directors for a term commencing on the date of the Annual Meeting and continuing until the next annual meeting of stockholders and until their successors have been duly elected and qualified. All of the incumbent directors are also nominees for election as directors. All nominees have advised the Company that they are able and willing to serve as directors. However, if any nominee is unable to or for good cause will not serve, the persons named in the accompanying proxy will vote for any other person nominated by the Board of Directors.

Except as set forth below, no arrangement or understanding exists between any nominee and any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee. Under his employment agreement, the Company has agreed to use its best efforts to have Mr. Kurz elected as a director of the Company. (See "Employment Agreements" below.) Donald A. Kurz and Mitchell H. Kurz are brothers.

4

The Board Of Directors Recommends A Vote "FOR" The Election

Of The Nominees Listed Below

The following table sets forth the names and ages of the nominees of the Board of Directors.

Name

| | Age

| | Director Since

|

|---|

| Sanford R. Climan | | 46 | | 1998 |

| Jonathan D. Kaufelt | | 50 | | 2000 |

| Donald A. Kurz | | 46 | | 1990 |

| Mitchell H. Kurz | | 50 | | 1999 |

| Alfred E. Osborne, Jr. | | 57 | | 2000 |

| Bruce Raben | | 48 | | 1993 |

| Stephen P. Robeck | | 53 | | 1989 |

Sanford R. Climan is Managing Director of Entertainment Media Ventures, a Los Angeles-based venture capital fund focused on investment in the areas of technology and media. He has been an Equity Marketing director since May 1998. From June 1997 through February 1999, he was a senior executive with Creative Artists Agency ("CAA"). From October 1995 through May 1998, he was an Executive Vice President for Universal Studios and, from June 1986 through September 1995, he was a senior executive with CAA. Mr. Climan holds a bachelor's degree from Harvard College, a master's of science in health policy and management from Harvard School of Public Health and a master's in business administration from Harvard Business School.

Jonathan D. Kaufelt, a prominent tax and business attorney, has been an Equity Marketing director since November 2000. Mr. Kaufelt most recently led the business and tax department at Armstrong, Hirsch, Jackoway, Tyerman & Wertheimer, P.C., a leading entertainment law firm in Los Angeles. He joined the firm in 1986, after nine years at two New York law firms—Kay, Collyer & Boose from 1982 to 1986 and Simpson, Thacher & Bartlett from 1977 to 1982. Mr. Kaufelt earned a juris doctor from Georgetown University, a master of laws in taxation from New York University and a bachelor's degree from the University of Pennsylvania. He serves on the board of Planned Parenthood of Los Angeles and as a trustee of Rutgers Preparatory School in Somerset, New Jersey.

Donald A. Kurz became Chairman and Chief Executive Officer of Equity Marketing in January 1999, after serving as President and Co-CEO from 1991 through 1998. He has also served as a director since 1990, when he joined Equity Marketing as Executive Vice President. Mr. Kurz was previously a management consultant with the general management consulting division of Towers Perrin, where he was a vice president and senior partner and eventually headed the firm's New York office. Mr. Kurz earned a bachelor's degree from Johns Hopkins University and a master's in business administration from Columbia University Graduate School of Business.

Mitchell H. Kurz is the Chairman and founder of Kurz and Friends, a consulting company to the global advertising and marketing services business. He has been an Equity Marketing director since March 1999. Mr. Kurz retired from Young & Rubicam Inc. in December 1998, following a 24-year career during which he held numerous executive positions. His most recent position at Young & Rubicam was Chairman of client services, where he oversaw key global client relationships representing approximately 50% of the company's annual revenues. From 1996 to 1998, he was President and Chief Operating Officer of Young & Rubicam Advertising, and from 1992 to 1996, he was Worldwide Chief Executive Officer of Wunderman Cato Johnson, a Young & Rubicam operating unit. Mr. Kurz received his master's in business administration from Harvard Business School and his bachelor's degree from Dartmouth College.

Alfred E. Osborne, Jr. is the founder and director of the Harold Price Center for Entrepreneurial Studies at UCLA's Anderson Graduate School of Management. He has been an Equity Marketing director since December 2000. Dr. Osborne joined UCLA in 1972, serves as a management professor, and has served as an Associate Dean and the Director of the MBA program before founding the

5

Harold Price Center for Entrepreneurial Studies in 1987. During that time, he was also the Brookings Institution Economic Policy Fellow at the Securities and Exchange Commission. He is currently on the boards of Nordstrom, Inc. and K2, Inc., and is an individual general partner of Technology Funding Venture Partners V and a trustee of the WM Group of Funds. Dr. Osborne holds a doctorate in business-economics, a master's in business administration, a master's in economics and a bachelor's degree all from Stanford University.

Bruce Raben is a managing director with CIBC World Markets, an investment banking firm. He has been an Equity Marketing director since 1993. From 1990 through 1995, he was an Executive Vice President with Jeffries & Company, an investment-banking firm. Mr. Raben received a bachelor's degree from Vassar College and a master's in business administration from Columbia University Graduate School of Business.

Stephen P. Robeck has been an Equity Marketing director since 1989. From January 1999 through December 2001, Mr. Robeck served as a consultant to the Company, and he is currently pursuing other business interests. He was elected Chairman and Co-CEO in September 1991 and served in that role through December 1998. Between 1987 and September 1991, he served as Chief Operating Officer. Mr. Robeck received his bachelor's degree from Lake Forest College.

Series A Directors

Jason Ackerman has been a Managing Director of Crown Capital Group since 1997. He has been an Equity Marketing director since September 2001. Prior to joining Crown Capital Group, he was a Senior Vice President in the Corporate Finance Department of Donaldson Lufkin & Jenrette ("DLJ"), in the Los Angeles office. At DLJ, he specialized in high yield financings and financial restructurings for corporate clients, primarily in the supermarket and specialty retail industries. Before joining DLJ in 1990, he served one year at Drexel Burnham Lambert as a financial analyst in the Corporate Finance Department. Mr. Ackerman received his bachelor's degree from Boston University.

Jeffrey S. Deutschman has been a Managing Director of Crown Capital Group since 1997. He has been an Equity Marketing director since March 2000. Prior to joining Crown, he was a Partner at Aurora Capital Partners, a leveraged buyout fund, from 1992 through 1995, a Partner at Deutschman, Clayton & Company, an investment firm engaged in management buyout transactions, from 1987 through 1991, and a Principal at Spectrum Group, Inc., which specialized in leveraged acquisitions, from 1981 through 1986. Mr. Deutschman received a master's in business administration from UCLA's Anderson Graduate School of Management and his bachelor's degree from Columbia University.

During 2001, the Board of Directors met six times. Other than Dr. Osborne, each nominee for director attended more than 75% of the Board of Directors meetings and the meetings of Board committees on which he served.

Committees of the Board

Audit Committee. The Board has an Audit Committee consisting of Messrs. Deutschman, Raben and Osborne. The Audit Committee reviews the audit and control functions of the Company, the Company's accounting principles, policies and practices and financial reporting, the scope of the audit conducted by the Company's independent auditors, the fees and all non-audit services of the independent auditors and the independent auditors' opinion and letter of comment to management (if any) and management's response thereto. The Audit Committee met four times in 2001. (See "Report of the Audit Committee" below.)

Compensation Committee. The Board has a Compensation Committee consisting of Messrs. Climan, Kaufelt and Osborne. The Compensation Committee has the responsibility to determine and administer the Company's executive compensation programs and make appropriate recommendations concerning matters of executive compensation. In evaluating the performance of members of management, the Compensation Committee consults with the chief executive officer,

6

except when reviewing the chief executive officer's performance, in which case it meets independently. The Compensation Committee reviews with the Board all aspects of compensation for the senior executives, including the Named Executive Officers. The Compensation Committee met once in 2001 in a formal meeting and met periodically in 2001 on an informal basis.

Director Compensation

Standard Compensation. Directors who are not employees of the Company or its subsidiaries ("non-employee directors") receive $20,000 per year. Directors who are employees of the Company or its subsidiaries serve as directors without compensation. The Series A Directors also serve without compensation; provided, however, that the Company has agreed to make available and issue each such Series A Director options to purchase equity securities of the Company on the same terms and conditions as are then available to the Company's other non-employee directors commencing in April, 2003.

Stock Options. Non-employee directors receive additional compensation in the form of stock options granted automatically under the Equity Marketing, Inc. Non-Employee Director Stock Option Plan. Each non-employee director automatically receives an option to purchase 30,000 shares of Common Stock upon the date such non-employee director first joins the Board of Directors, and options to purchase 30,000 shares of Common Stock each third or fourth time thereafter such non-employee director is elected to the Board of Directors by the stockholders, all such options vesting in three equal installments on each of the first, second and third anniversary of the date of grant.

Certain Relationships and Related Transactions

Stephen P. Robeck, formerly Chairman of the Board and Co-Chief Executive Officer, entered into a consulting agreement with the Company commencing on January 1, 1999 and ending on December 31, 2001. The agreement provided that Mr. Robeck would serve as a financial and business consultant to the Company and be available to fulfill his obligations thereunder no less than twenty hours per month. The agreement contained provisions restricting Mr. Robeck's ability to compete with the Company while providing services as a consultant and to solicit the Company's employees through the first anniversary of the end of the consulting period. Under the agreement, Mr. Robeck received a consulting fee of $210,000 per year, a car allowance of $18,000 per year and certain medical, disability and life insurance benefits.

In connection with the purchase of preferred stock, the Company agreed to pay Crown a commitment fee in the aggregate amount of $1.25 million, paid in equal quarterly installments of $62,500 commencing on June 30, 2000 and ending on March 31, 2005. In 2001, commitment fee payments by the Company to Crown totaled $250,000. Separately, in April, 2001, the Company contracted to purchase print management services from ISG, a company controlled by Jeffrey S. Deutschman, Jason Ackerman and affiliates. In 2001, the Company paid ISG approximately $460,000 in print management fees. The Company believes that such services were negotiated on an arms length basis. Mr. Deutschman, a director of the Company, is a manager of Crown. Mr. Ackerman, a director of the Company, is a manager of Crown.

7

EXECUTIVE COMPENSATION AND RELATED MATTERS

The following table sets forth the cash compensation (including cash bonuses) paid or accrued by the Company for its fiscal years ended December 31, 1999, 2000 and 2001 to its Chief Executive Officer and its four most highly compensated officers other than the Chief Executive Officer at December 31, 2001.

Summary Compensation Table

| | Year

| | Salary($)

| | Bonus($)(1)

| | Other

Annual

Compensation($)(2)

| | Securities

Underlying

Options

| | All Other

Compensation($)(3)

|

|---|

Donald A. Kurz

Chairman, Chief Executive Officer | | 2001

2000

1999 | | 413,100

397,500

375,500 | | —

257,621

300,000 | | 26,650

24,600

19,200 | | 50,000

50,000

50,000 | | 65,014

20,455

21,924 |

Kim H. Thomsen

President, Marketing and Interactive Services, Chief Creative Officer |

|

2001

2000

1999 |

|

306,000

287,500

250,000 |

|

—

125,000

175,000 |

|

14,950

13,800

12,000 |

|

15,000

200,000

25,000 |

|

72,790

5,250

5,000 |

Gaetano A. Mastropasqua

Executive Vice President, Client Services |

|

2001

2000

1999 |

|

268,850

237,500

187,500 |

|

—

125,000

165,000 |

|

14,950

13,800

12,000 |

|

15,000

100,000

90,000 |

|

30,150

5,250

5,000 |

Lawrence J. Madden

Senior Vice President and

Chief Financial Officer(4) |

|

2001

2000 |

|

230,000

35,048 |

|

—

29,182 |

|

14,950

2,300 |

|

10,000

40,000 |

|

10,300

— |

Leland P. Smith

Senior Vice President, General Counsel and Secretary |

|

2001

2000

1999 |

|

204,000

192,500

168,000 |

|

—

60,000

100,000 |

|

14,950

13,800

12,000 |

|

50,000

10,000

30,000 |

|

25,415

5,250

5,000 |

- (1)

- Amounts were earned in the years indicated. Annual bonuses are generally paid in the first quarter of the following year.

- (2)

- Consists of an automobile and cellular phone allowance unless otherwise indicated.

- (3)

- 2001 amounts consist of: (i) payments of accrued vacation in the following amounts: Mr. Kurz—$42,840; Ms. Thomsen—$67,540; Mr. Mastropasqua—$24,900; Mr. Madden—$5,050; and Mr. Smith—$20,165; (ii) matching payments pursuant to the Company's 401(k) Plan in the following amounts: Mr. Kurz—$5,250; Ms. Thomsen—$5,250; Mr. Mastropasqua—$5,250; Mr. Madden—$5,250; and Mr. Smith—$5,250; (iii) premiums on term life insurance in the following amounts: Mr. Kurz—$6,257; and (iv) loan forgiveness in the following amounts: Mr. Kurz—$10,667.

- (4)

- Mr. Madden commenced employment in November 2000. Mr. Madden received a signing bonus of $20,000.

Employment Agreements

Donald A. Kurz has entered into an employment agreement with the Company. The agreement runs from January 1, 1999 through December 31, 2002, subject to earlier termination upon Mr. Kurz's death or disability or termination by the Company For Cause or Other Than For Cause (each as defined in the agreement). The agreement also terminates upon the first anniversary of a Change of Control (as defined in the agreement). Under the agreement, Mr. Kurz is entitled to a base salary of $375,000 per year, subject to upward annual adjustment at the discretion of the Compensation Committee but in all events in an amount no less than increases in the Consumer Price Index (as defined in the agreement), a car allowance of $19,200 per year and certain medical, disability and life insurance benefits. Pursuant to the agreement, Mr. Kurz received a grant of 50,000 stock options in

8

January 1999 priced at a 50% premium to fair market value on that date and is entitled to receive future stock option grants at the discretion of the Compensation Committee. Mr. Kurz is also entitled to an annual bonus of up to 50% of his base salary based on the attainment of certain corporate earnings goals and, at the discretion of the Compensation Committee, a strategic performance bonus of up to 50% of his base salary after taking into account the Company's long-term prospects and position and the accomplishment of strategic goals devised by Mr. Kurz and the Board of Directors. Upon termination of the employment term, the Company has agreed to retain Mr. Kurz as a consultant for a period of three years, unless the agreement is terminated pursuant to a Change of Control. If the agreement is terminated by reason of death or disability, Mr. Kurz or his estate shall receive his full base salary through the end of the month of his death or disability and a prorated share of any other compensation or benefits required under the agreement. If the agreement is terminated by the Company For Cause, Mr. Kurz's compensation and benefits shall cease as of the date of termination. If the agreement is terminated by the Company Other Than For Cause, Mr. Kurz shall receive his full base salary and any other compensation or benefits required under the agreement through the end of the term of the agreement and double the annual corporate earnings goals bonus he would have been entitled to if he was not terminated. Under the agreement, the Company has agreed to use its best efforts to have Mr. Kurz elected as a director of the Company.

Stock Options

The following table sets forth information with respect to grants of options to purchase Common Stock under the Option Plan to the Named Executive Officers during the fiscal year ended December 31, 2001.

OPTION GRANTS IN 2001

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rate of Stock Appreciation For Option Terms($)(2)

|

|---|

| | Number of Securities Underlying Options Granted(#)

| | % of Total Options Granted to Employees in Fiscal Year

| |

| |

|

|---|

Name

| | Exercise Price

($/SH)(1)

| | Expiration Date

|

|---|

| | 5%

| | 10%

|

|---|

| Donald A. Kurz | | 50,000 | (3) | 8.5 | % | 10.90 | | 5/17/11 | | 342,745 | | 868,588 |

| Kim H. Thomsen | | 15,000 | (3) | 2.6 | % | 10.90 | | 5/17/11 | | 102,824 | | 260,576 |

| Gaetano A. Mastropasqua | | 15,000 | (3) | 2.6 | % | 10.90 | | 5/17/11 | | 102,824 | | 260,576 |

| Lawrence J. Madden | | 10,000 | (3) | 1.7 | % | 10.90 | | 5/17/11 | | 68,549 | | 173,718 |

| Leland P. Smith | | 50,000 | (3) | 8.5 | % | 10.90 | | 5/17/11 | | 342,745 | | 868,588 |

- (1)

- Unless otherwise indicated, the exercise price was market value of the Common Stock on the date of grant.

- (2)

- These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on option exercises are dependent upon other factors, including the future performance of the Common Stock and overall stock market conditions.

- (3)

- Options vest in four equal annual installments commencing on the first anniversary of the date of grant.

9

The following table sets forth with respect to the Named Executive Officers information with respect to options exercised, unexercised options and year-end option values in each case with respect to options to purchase shares of Common Stock.

AGGREGATED OPTION EXERCISES DURING FISCAL 2001 AND

FISCAL YEAR-END OPTION VALUES

| |

| |

| | Number of Securities

Underlying

Unexercised Options at

December 31, 2001

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In The Money Options

At December 31, 2001(1)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)

|

|---|

| | Exercisable(#)

| | Unexercisable(#)

| | Exercisable($)

| | Unexercisable($)

|

|---|

| Donald A. Kurz | | 0 | | 0 | | 82,500 | | 117,500 | | 54,125 | | 236,375 |

| Kim H. Thomsen | | 73,210 | | 817,557 | | 38,333 | | 227,500 | | 167,465 | | 670,775 |

| Gaetano A. Mastropasqua | | 0 | | 0 | | 55,000 | | 160,000 | | 190,350 | | 473,900 |

| Lawrence J. Madden | | 0 | | 0 | | 8,000 | | 42,000 | | 1,600 | | 27,500 |

| Leland P. Smith | | 0 | | 0 | | 29,500 | | 80,500 | | 116,745 | | 215,555 |

- (1)

- Represents the difference between the last reported sale price of the Common Stock on December 31, 2001 and the exercise price of the option multiplied by the applicable number of shares.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee of the Board of Directors are Messrs. Climan, Kaufelt and Osborne. No member of the Board of Directors or the Compensation Committee has any interlocking relationship with any other corporation that requires disclosure under this heading.

10

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The following Report of the Compensation Committee on Executive Compensation and the Performance Graph shall not be deemed to be "soliciting material" or to be "filed" with the Commission or subject to Regulations 14A or 14C of the Commission or the liabilities of Section 18 of the Exchange Act. Such Report and Performance Graph shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other document.

General. The Compensation Committee has the responsibility to determine and administer the Company's executive compensation programs and make appropriate recommendations concerning matters of executive compensation. In evaluating the performance of members of management, the Compensation Committee consults with the chief executive officer except when reviewing the chief executive officer's performance, in which case it meets independently. The Committee reviews with the Board all aspects of compensation for the senior executives, including the Named Executive Officers. The Committee met once in 2001 in a formal meeting and met periodically in 2001 on an informal basis. Set forth below are the principal factors underlying the Committee's philosophy used in overseeing compensation for fiscal 2001.

Compensation Philosophy. At the direction of the Board of Directors, the Compensation Committee endeavors to ensure that the compensation programs for executive officers of the Company are competitive and consistent in order to attract and retain key executives critical to the Company's long-term success. The Compensation Committee believes that the Company's overall financial performance should be an important factor in the total compensation of executive officers. At the executive officer level, the Compensation Committee has a policy that a significant proportion of potential total compensation should consist of variable, performance-based components, such as stock options and bonuses, which can increase or decrease to reflect changes in corporate and individual performance. These incentive compensation programs are intended to reinforce management's commitment to the enhancement of profitability and stockholder value.

The Compensation Committee takes into account various qualitative and quantitative indicators of corporate and individual performance in determining the level and composition of compensation for the Company's chief executive officer and other executive officers. In implementing the Company's executive compensation objectives, the Compensation Committee has designed an executive compensation program consisting of base salary, annual incentive compensation, stock options and other employment benefits.

The Compensation Committee seeks to maintain levels of compensation that are competitive with similar companies in the Company's industry. To that end, the Compensation Committee reviews proxy data and other compensation data relating to companies within the Company's industry. In addition, from time to time, the Compensation Committee also receives assessments and advice regarding the Company's compensation practices from independent compensation consultants.

Base Salary. Base salary represents the fixed component of the executive compensation program. The Company's philosophy regarding base salaries is to maintain salaries for the aggregate group of executive officers at approximately the competitive industry average. Periodic increases in base salary relate to individual contributions evaluated against established objectives and the industry's annual competitive pay practices.

Annual Incentive Compensation. The Company's executive officers are eligible for annual incentive compensation consisting primarily of cash bonuses based on the attainment of corporate earnings goals, as well as divisional and individual performance objectives. While performance against financial objectives is the primary measurement for executive officers' annual incentive compensation, non-financial performance also affects bonus pay. The Compensation Committee considers such

11

corporate performance measures as net income, earnings per common and common equivalent share, return on average common stockholders' equity, gross margin, sales growth and expense and asset management in making bonus decisions. The Compensation Committee also appreciates the importance of achievements that may be difficult to quantify, and accordingly recognizes qualitative factors, such as successful supervision of major corporate projects, demonstrated leadership ability and contributions to industry and community development. The amount of each annual incentive award is recommended for approval by management and approved by the Compensation Committee and the Board.

Stock Options. The Compensation Committee strongly believes that the compensation program should provide employees with an opportunity to increase their equity ownership and potentially gain financially from Company stock price increases. By this approach, the best interests of stockholders, executives and employees will be closely aligned. Therefore, executives and other key employees are eligible to receive stock options, giving them the right to purchase shares of Common Stock of the Company at a specified price in the future. The Compensation Committee believes that the use of stock options as the basis for long-term incentive compensation meets the Compensation Committee's compensation strategy and business needs of the Company by achieving increased value for stockholders and retaining key employees.

Other Employment Benefits. The Company provides health and welfare benefits to executives and employees similar to those provided by other companies in the Company's industry. The Company also provides a 401(k) plan in which all employees are eligible and maintains a restricted stock plan for certain employees who are not executive officers. Certain executives are also eligible for a monthly car and cellular phone allowance.

Internal Revenue Code Section 162(m). To the extent readily determinable and as one of the factors in its consideration of compensation matters, the Compensation Committee considers the anticipated tax treatment to the Company and to the executives of various payments and benefits. Some types of compensation payments and their deductibility depend upon the timing of an executive's vesting or exercise of previously granted rights. Further, interpretations of and changes in the tax laws and other factors beyond the Compensation Committee's control also affect the deductibility of compensation. For these and other reasons, the Compensation Committee will not necessarily limit executive compensation to that deductible under Section 162(m) of the Internal Revenue Code. The Compensation Committee will consider various alternatives to preserve the deductibility of compensation payments and benefits to the extent reasonably practicable and to the extent consistent with its other compensation objectives.

Chief Executive Officer Compensation. The Compensation Committee is responsible for evaluating and establishing the compensation paid to Donald A. Kurz, the Company's chief executive officer. The 2001 base salary for Mr. Kurz was based upon the employment agreement between Mr. Kurz and the Company dated as of January 1, 1999. The Compensation Committee determined not to award Mr. Kurz a bonus for the year ended December 31, 2001. Mr. Kurz received options to purchase 50,000 shares of Common Stock in May 2001 at an exercise price equal to fair market value on the date of grant.

12

PERFORMANCE GRAPH

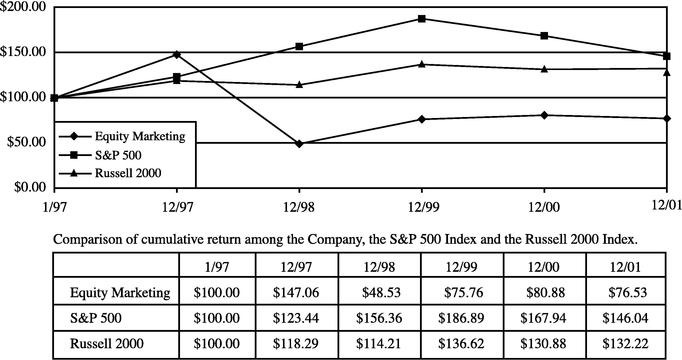

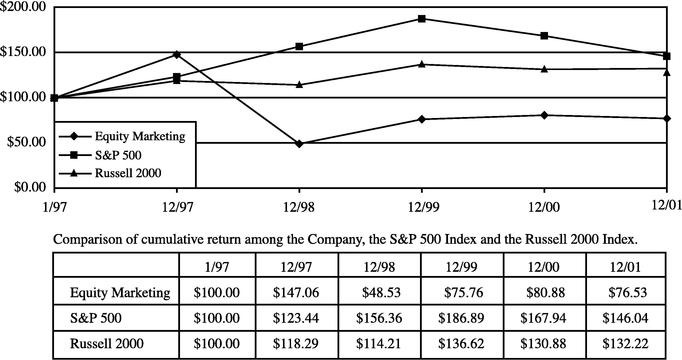

Set forth below is a line graph comparing the percentage change in the cumulative total stockholder return on the Common Stock against the cumulative total return of the Standard & Poors 500 Index ("S&P 500 Index"), and the Russell 2000 Index ("Russell 2000 Index") for the period commencing January 1, 1997 and ended December 31, 2001. The data represented below assumes $100 invested in each of the Common Stock, the S&P 500 Index and the Russell 2000 Index on January 1, 1997. The stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this document into any filing under the Securities Act or under the Exchange Act except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

13

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the Exchange Act, the Company's directors, its executive officers, and any persons holding more than 10% of the Company's Common Stock are required to report their ownership of the Common Stock and any changes in that ownership to the Commission. Specific due dates for these reports have been established and the Company is required to report herein any failure to file by these dates during the fiscal year ended December 31, 2001. All of these filing requirements were satisfied by its directors, officers and 10% holders, except for Bret Hadley who filed a Form 3 that was one day late disclosing that he had joined the Company as Executive Vice President, Consumer Products and Worldwide Operations. In making these statements, the Company has relied on the written representations of its directors, officers and its 10% holders and copies of the reports that they have filed with the Commission.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee, covering the Company's fiscal year ended December 31, 2001, shall not be deemed to be "soliciting material" or to be "filed" with the Commission or subject to Regulations 14A or 14C of the Commission, or the liabilities of Section 18 of the Exchange Act. Such report shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other document.

Except as discussed below, the Audit Committee of the Company's Board of Directors is comprised of "independent directors" as required by the listing standards of the NASD.

NASD rules require that the Audit Committee be "comprised solely of independent directors." Mr. Deutschman, the manager of Crown, is considered not independent under the NASD rule, because Crown receives an annual commitment fee pursuant to the terms of Crown's 2000 purchase of shares of preferred stock. However, the Company's Board of Directors has determined that Mr. Deutschman qualifies under the exception to the NASD rule. Mr. Deutschman's combination of financial skills, expertise and familiarity with the Company are not possessed by any other member of the Board who is not also disqualified from service on the Audit Committee by the NASD rule. Mr. Deutschman has extensive experience as an investor in private and public companies and is familiar with the types of issues important to audit committees. During his tenure on the Board, Mr. Deutschman has been among the most active board members and is frequently the leading director at board meetings in seeking financial information and testing financial assumptions. In addition, Mr. Deutschman's understanding of financial and accounting issues makes him among the most qualified members of the Board to serve on the Audit Committee. Based on the preceding factors, the Board believes that it is in the best interests of the Company and its stockholders that Mr. Deutschman serve on the Audit Committee.

The Audit Committee operates pursuant to a written charter adopted by the Board of Directors, a copy of which was attached asExhibit A to the Company's Proxy Statement dated July 25, 2001 regarding the 2001 Annual Meeting of Stockholders.

The role of the Audit Committee is to oversee the Company's financial reporting process on behalf of the Board of Directors. Management of the Company has the primary responsibility for the Company's financial statements as well as the Company's financial reporting process, principles and internal controls. The Company's independent auditors are responsible for performing an audit of the Company's financial statements and expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles.

In this context, the Audit Committee has reviewed and discussed the audited financial statements of the Company as of and for the year ended December 31, 2001 with management and the independent auditors. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect. In addition, the Audit Committee has received the written

14

disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as currently in effect, and it has discussed with the auditors their independence from the Company.

The Audit Committee has also considered whether the independent auditors' provision of non-audit services to the Company is compatible with maintaining the auditors' independence.

The members of the Audit Committee are not engaged in the accounting or auditing profession and, consequently, are not experts in matters involving auditing or accounting. In the performance of their oversight function, the members of the Audit Committee necessarily relied upon the information, opinions, reports and statements presented to them by management of the Company and by the independent auditors. As a result, the Audit Committee's oversight and the review and discussions referred to above do not assure that management has maintained adequate financial reporting processes, principles and internal controls, that the Company's financial statements are accurate, that the audit of such financial statements has been conducted in accordance with generally accepted auditing standards or that the Company's auditors meet the applicable standards for auditor independence.

Based on the reports and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Commission.

|

|

Audit Committee

Jeffrey S. Deutschman, Chairman

Alfred E. Osborne, Jr.

Bruce Raben |

Fees Paid to Independent Accountants

The fees paid to Arthur Andersen LLP, the Company's independent accountants, in respect of the 2001 fiscal year are as follows:

| | Fees Paid

|

|---|

| Audit Fees(1) | | $ | 156,400 |

| Financial Information Systems Design and Implementation Fees(2) | | $ | 0 |

| All Other Fees(3) | | $ | 244,809 |

- (1)

- Includes the aggregate fees billed for professional services rendered by Arthur Andersen LLP for the audit of the Company's annual financial statements for the 2001 fiscal year and the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for the 2001 fiscal year.

- (2)

- Includes the aggregate fees billed for professional services rendered by Arthur Andersen LLP for the provision of information technology services of the type described in Rule 2-01(c)(4)(ii) of Regulation S-X during the 2001 fiscal year.

- (3)

- Includes the aggregate fees billed for all services rendered by Arthur Andersen LLP, other than fees for the services which must be reported under "Audit Fees" and "Financial Information Systems Design and Implementation Fees," during the 2001 fiscal year.

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TO

THE EQUITY MARKETING, INC. 2000 STOCK OPTION PLAN

At the Annual Meeting, stockholders are being asked to approve an amendment to the Equity Marketing, Inc. 2000 Stock Option Plan (the "2000 Option Plan") increasing the number of shares of Common Stock which may be issued under the 2000 Option Plan from 750,000 shares to ________

15

shares and increasing the number of shares of Common Stock which may be issued under the 2000 Option Plan to any individual participant as options in a single calendar year from 100,000 to ________ (the "Amendment"). The Amendment was unanimously adopted by the Board on February 21, 2002, subject to stockholder approval at the Annual Meeting. The full text of the 2000 Option Plan as proposed to be amended by the Amendment is incorporated asExhibit A attached to this Proxy Statement.

The 2000 Option Plan was adopted by the Board on June 27, 2000 and became effective on such date, subject to stockholder approval which was obtained on September 7, 2000. When approved by the stockholders, the 2000 Option Plan replaced the Company's most recent stock option plan, the Equity Marketing, Inc. Stock Option Plan (the "Option Plan"), which expired on December 31, 2001. A summary description of the 2000 Option Plan is set forth below. This summary description does not purport to be complete and is qualified in its entirety by reference to the full text of the 2000 Option Plan, which is attached hereto asExhibit A and incorporated herein by this reference. Stockholders are urged to read the 2000 Option Plan in its entirety.

The Amendment

The Amendment increases the number of shares of Common Stock which may be issued under the 2000 Option Plan from 750,000 shares to ________ shares. As of March 31, 2002, options to purchase ________ shares were outstanding under the 2000 Option Plan, ______ shares had been issued pursuant to Options (as defined below) exercised under the 2000 Option Plan and ________ shares had been issued pursuant to awards of Restricted Stock (as defined below) under the 2000 Option Plan. Accordingly, _______ shares were available as of that date for the grant of additional Awards (as defined below) under the 2000 Option Plan. As of March 31, 2002, ___ participants had been granted Awards of Options or Restricted Stock under the 2000 Option Plan.

The Amendment increases the number of shares of Common Stock which may be issued as Options under the 2000 Option Plan to any individual participant in a single calendar year from 100,000 to ________. Section 162(m) of the Internal Revenue Code (the "Code") requires that the 2000 Option Plan incorporate a per-person limit to meet the requirements for the deductibility of executive compensation greater than $1 million. Section 162(m) of the Code also requires that any increase in such per-person limit be subject to stockholder approval.

Adoption of the Amendment has been recommended by the Board of Directors. In the opinion of the Board of Directors, it is in the best interests of the Company and its stockholders to provide, through the 2000 Option Plan, a comprehensive incentive compensation program designed to enable the Company to attract, retain and reward key employees and other eligible participants through performance-based incentives in shares of Common Stock. Accordingly, the Board of Directors believes that an increase in the number of shares which may be issued pursuant to the 2000 Option Plan and an increase in the number of shares of Common Stock which may be issued as Options under the 2000 Option Plan to any individual participant in a single calendar year are in the best interests of the Company and its stockholders.

Summary Description of the 2000 Option Plan

Purpose of the 2000 Option Plan. The purpose of the 2000 Option Plan is to enable the Company and its stockholders to secure the benefits of Common Stock ownership by key personnel of the Company and its subsidiaries, including furthering the Company's ability to attract, retain and motivate the people who will be largely responsible for the profitability and long-term future growth of the Company and its subsidiaries. The 2000 Option Plan provides for the granting to such personnel of (a) options to purchase shares of Common Stock ("Options"), (b) shares of Common Stock that are subject to risks of forfeiture and restrictions on transfer ("Restricted Stock"), and (c) shares of Common Stock as a bonus, or in lieu of other compensatory obligations of the Company ("Bonus Grants") (Options, Restricted Stock and Bonus Grants are collectively referred to as "Awards").

16

Eligibility. The persons who are eligible to receive Awards under the 2000 Option Plan are present or future key employees, non-employee consultants and non-employee directors of the Company and its subsidiaries. A person who holds an Award is herein referred to as a "Participant," and more than one Award may be granted to any Participant.

Administration. The 2000 Option Plan is to be administered by the Board or a committee (the "Committee") consisting of at least two directors appointed by the Board. If the 2000 Option Plan is administered by the Board, references to the Committee shall mean the Board of Directors. The Committee has the authority to interpret the 2000 Option Plan and to supervise the administration of the 2000 Option Plan. Under the 2000 Option Plan, the Committee also is authorized to (a) grant Awards, (b) select Participants, (c) determine the number of shares covered by each Award, and (d) establish the terms and conditions of each Award, including (i) the exercise price of an Option, (ii) the restrictions on exercisability of an Option or grant of Restricted Stock and on the disposition of each Award, and (iii) whether or not an Option is to be treated as an incentive stock option, as defined in Section 422 of the Code. The Committee also has the power to prescribe, amend and rescind the rules relating to the 2000 Option Plan, as discussed below.

Shares Subject to the 2000 Option Plan. Assuming stockholder approval of the Amendment, Awards covering an aggregate of ___________ shares of Common Stock may be granted pursuant to the 2000 Option Plan, subject to adjustments to reflect certain corporate transactions or events, as discussed below. Such shares of Common Stock may be either authorized and unissued or held by the Company in its treasury. In the event that a Participant pays part of the exercise price of an Award with Options or Restricted Stock, only the net shares issued are counted against the shares available for issuance. Upon the expiration or termination of outstanding Options, or any portion thereof which are not exercised in full, the remaining unissued shares of Common Stock under such Options shall again become available for issuance under the 2000 Option Plan. Similarly, upon the forfeiture of shares of Restricted Stock, the forfeited shares shall again become available for issuance.

Options. Options granted under the 2000 Option Plan will either qualify for treatment as incentive stock options under the Code and be designated "Incentive Stock Options," or not qualify for such treatment and be designated "Nonqualified Stock Options." Incentive Stock Options may only be granted to employees. Assuming stockholder approval of the Amendment, a Participant may not be granted Options to purchase more than ________ shares of Common Stock in any single calendar year. The aggregate fair market value (determined as of the time an Option is granted) of the Common Stock with respect to which Incentive Stock Options are exercisable for the first time by any Participant in any calendar year under the 2000 Option Plan and any other incentive stock option plans of the Company or any subsidiary shall not exceed $100,000. To the extent a Participant's Options exceed the limit, such Options will be treated as Nonqualified Stock Options.

Option Price. The exercise price per share (the "Option Price") of the shares of Common Stock underlying each Option cannot be less than the par value per share of the Common Stock in the case of Nonqualified Stock Options or less than 100% of the fair market value (as defined in the 2000 Option Plan) of each share of Common Stock on the date of grant of the Option in the case of Incentive Stock Options. If the Participant is a ten-percent stockholder (determined using the constructive ownership rules of the Code) of the Company or a subsidiary immediately before the grant of an Incentive Stock Option, the Option Price shall be not less than 110% of the fair market value on the date of grant.

Option Period. The period during which an Option may be exercised will be determined by the Committee, but cannot exceed ten years from the date such Option is granted, except that with respect to Incentive Stock Options, the Option period cannot exceed five years from the date of grant if the Participant is a ten-percent stockholder of the Company.

17

Exercise of Options. The Committee may determine any vesting or other restrictions on the exercisability of an Option, subject to any earlier termination provided for under the 2000 Option Plan. Options may be exercised by a Participant upon transmitting to the Company a written notice setting forth the number of shares to be purchased and payment of the Option Price of the shares to be exercised.

Dissolution, Liquidation, Sale of All or Substantially All the Assets or Merger. If the outstanding shares of Common Stock of the Company are exchanged for different securities of the Company through a recapitalization, merger, consolidation or reclassification or other similar transaction, or if the number of outstanding shares is changed through a stock split or stock dividend, the Committee will make adjustments as it deems appropriate with respect to the number, exercise price with respect to Options, or kind of securities subject to any outstanding Award. The Committee may also make such adjustments in the event of a spinoff or other distribution to stockholders of assets of the Company, other than normal cash dividends. No issuance of shares of capital stock, securities convertible into shares of capital stock, or options or warrants to purchase any shares of capital stock will affect the number, exercise price with respect to Options or kind of securities subject to any Award other than as set forth above. Upon a dissolution, liquidation or sale of all or substantially all of the assets of the Company or a merger or similar transaction in which the holders of outstanding voting securities of the Company would own 50 percent or less of the voting power of the surviving corporation existing after such transaction, assuming the conversion of all equity securities convertible into shares entitled to vote, all Participants will be permitted to exercise their outstanding Options, whether exercisable or not, immediately prior to such transaction, and all restrictions and conditions on Awards of Restricted Stock will be deemed satisfied immediately prior to such transaction. Any unexercised Options after the date of any such transaction will terminate.

Termination of Service. If a Participant ceases employment or ceases performing services in a capacity other than as an employee with the Company or any subsidiary for any reason other than death, disability or cause, each Option granted to him or her under the 2000 Option Plan will terminate six months after the date of such cessation of employment or service, or three months in the case of any Incentive Stock Option. If a Participant's employment or service ceases as a result of death or disability, each outstanding Option will terminate one year after the date of such cessation of employment or service. If a Participant's employment or service is terminated by reason of cause, each outstanding Option will terminate on the date of such termination of employment or service for cause. Unless otherwise determined by the Committee, a Participant shall forfeit to the Company all non-vested shares of Restricted Stock immediately upon termination of such Participant's employment or service with the Company or any subsidiary for any reason.

Cancellation of Grants. The Committee may cancel any unexpired, unpaid or deferred Award of any Participant at any time if the Participant does not comply with all of the terms of the Award, and one or more of the following conditions occur: (a) the Participant provides services for an organization or engages in any business which, in the judgement of the chief executive officer of the Company, is or becomes competitive with the Company or which is or becomes prejudicial to or conflicts with the interests of the Company; (b) the Participant discloses to anyone outside of the Company confidential information or material relating to the Company; and (c) the Participant fails to disclose and assign to the Company all right, title and interest in any invention or idea made or conceived by the Participant during his or her employment by the Company, relating in any manner to the business or work of the Company and shall assist the Company in securing a patent for the invention or idea. The occurrence of any of these conditions prior to or during the six months after any exercise, payment or delivery pursuant to an Award may result in the recission of such exercise, payment or delivery.

Restricted Stock. The Committee may issue Awards of Restricted Stock upon such terms and conditions as it may deem appropriate, which terms need not be identical for all such Awards. The Committee may issue Awards for consideration or the Awards may be issued without the receipt of

18

consideration by the Company. If any Awards are issued for consideration, the Committee may determine the forms of consideration that are acceptable. A Participant shall not have a vested right to the Restricted Stock until the satisfaction of the vesting requirements specified in the Award. The Restricted Stock may not be assigned or transferred prior to its vesting. The Participant shall have all of the other rights of a stockholder of the Company, including the right to vote the shares of Common Stock underlying the Restricted Stock and to receive any dividends on such Common Stock.

Bonus Grants. The 2000 Option Plan authorizes the Committee to issue shares of Common Stock on such terms and conditions as it may decide as a bonus, or shares of Common Stock, Restricted Stock or Options in lieu of the Company's obligation to pay cash or deliver other property under the 2000 Option Plan or under other plans or compensatory arrangements.

Amendment and Termination of the 2000 Option Plan. The Board may at any time make any amendments to or terminate the 2000 Option Plan. Such amendments shall include, but not be limited to, acceleration of the time at which an Option may be exercised. Such amendments may not, without the approval of the stockholders (a) increase the maximum number of shares of Common Stock that may be issued under the 2000 Option Plan, except as set forth under "Dissolution, Liquidation, Sale of All or Substantially All the Assets or Merger," or (b) change the designation of the class of individuals eligible to receive Incentive Stock Options. Notwithstanding the foregoing, the 2000 Option Plan shall terminate on June 27, 2010, the date which is ten years after the date of the adoption of the 2000 Option Plan. Subject to the provisions under "Dissolution, Liquidation, Sale of All or Substantially All the Assets or Merger," the amendment or termination of the 2000 Option Plan may not adversely affect any outstanding Award.

Substitute Options. In the event the Company acquires another entity, the Committee may authorize the issuance of Options to individuals who perform services for such acquired entity in substitution of stock options previously granted to those individuals by such acquired entity for the performance of services. In order to allow the Committee to preserve the economic benefit, if any, inherent in the options previously granted by an acquired entity, substitute Options which are intended to qualify as Incentive Stock Options may be granted with an exercise price less than 100 percent of the fair market value of each share of Common Stock on the date of grant by the Company. Additionally, grants of substitute Options which are intended to qualify as Incentive Stock Options are not subject to the limitation that the aggregate fair market value (determined at the time of grant by the Company) of the Common Stock with respect to which Incentive Stock Options are exercisable for the first time by any Participant in any calendar year not exceed $100,000.

Federal Income Tax Consequences of the 2000 Option Plan

The following summary of the effects of federal income taxation upon the Participants and the Company with respect to shares of Common Stock issued under the 2000 Option Plan does not purport to be complete and reference is made to the applicable provisions of the Code.

Incentive Stock Options. No taxable income will be recognized by a Participant upon the grant or exercise of any Incentive Stock Option. However, the amount by which the fair market value of shares of Common Stock purchased upon exercise of an Incentive Stock Option exceeds the exercise price of such stock constitutes an "item of adjustment" that could then be subject to the alternative minimum tax in the year that the Option is exercised. Furthermore, the Internal Revenue Service has issued proposed regulations that, if finalized, would require the Company to withhold employment taxes (e.g. FICA and FUTA) at the time of exercise of an Incentive Stock Option. If the proposed regulations are finalized, this new rule is anticipated to apply to Incentive Stock Options that are exercised on or after January 1, 2003. Additionally, the Company will not be entitled to any federal income tax deduction as the result of the grant or exercise of any Incentive Stock Option.

Any gain or loss resulting from the subsequent sale of shares of Common Stock acquired upon exercise of any Incentive Stock Option will be capital gain or loss if such sale is made after the later of

19

(a) two years from the date of the grant of the Incentive Stock Option, and (b) one year after the transfer of such stock to the Participant upon exercise, so long as the Participant is an employee of the Company from the date of grant until three months before the date of exercise. In the event of the Participant's death or disability prior to exercise of an Incentive Stock Option, special rules apply in determining whether gain or loss upon sale of the shares of Common Stock acquired upon exercise of such Option will be taxable as capital gain or loss or ordinary income.

If the sale of stock is made prior to the expiration of such two-year and one-year periods, the Participant will recognize ordinary income in the year of the sale in an amount equal to the difference between the exercise price and the fair market value of the shares of Common Stock on the date of exercise. However, if such sale is a transaction in which a loss (if sustained) would have been recognized by the Participant, the amount of ordinary income recognized by the Participant will not exceed the excess (if any) of the amount realized on the sale over the exercise price. The Company will then be entitled to an income tax deduction of like amount. Any excess gain recognized by the Participant upon such a disqualifying disposition would then be taxable as a capital gain.

If an individual sale of shares of Common Stock received through the exercise of an Incentive Stock Option qualifies for capital gain treatment, the federal capital gains tax rate from such sale will be determined based on the holding period of the Common Stock in accordance with the tax rates then in effect under the Code.

Nonqualified Stock Options. At the time of the grant of a Nonqualified Stock Option, no taxable income will be recognized by the Participant and the Company will not be entitled to a deduction. Upon the exercise of such an Option, the Participant will recognize taxable income, and the Company will then be entitled to a deduction, in the amount by which the then fair market value of the shares of Common Stock issued to such Participant exceeds the exercise price. Income recognized by the Participant upon exercise of a Nonqualified Stock Option will be taxed as ordinary income with respect to which the Company is required to deduct and withhold federal and state income and employment taxes. Pursuant to the 2000 Option Plan, the exercise of each Nonqualified Stock Option will be subject to the Company's determination that all withholding taxes relating to the Nonqualified Stock Option have been satisfied. Upon the subsequent disposition of shares of Common Stock acquired upon the exercise of a Nonqualified Stock Option, the Participant will recognize capital gain or loss in an amount equal to the difference between the proceeds received upon disposition and the fair market value of such shares at the time of exercise. If the gain recognized in connection with such disposition qualifies for capital gain treatment, the federal capital gain tax rate for such sale will be determined based on the holding period of the Common Stock in accordance with the tax rates then in effect under the Code.

Restricted Stock. Generally, at the time of the grant of Restricted Stock, no taxable income will be recognized by the Participant and the Company will not be entitled to a deduction. Upon the lapse of the forfeiture restrictions imposed by the Committee on Restricted Stock (i.e., "vesting"), the Participant generally will recognize taxable income, and the Company will be entitled to a deduction, in the amount by which the fair market value of the shares granted to the Participant at the time of vesting exceeds the purchase price, if any.

Alternatively, if the Participant timely files an election under Section 83(b) of the Code at the time of the grant of Restricted Stock (a "Section 83(b) Election"), the Participant generally will recognize income, and the Company will be entitled to a deduction, at the date of grant in the amount by which the fair market value of the shares on the date of grant exceeds the purchase price, if any. If the Participant forfeits the Restricted Stock subsequent to the filing of a Section 83(b) Election, the Participant will not be able to deduct any part of the amount previously included in income. Income recognized by the Participant upon the vesting of the Restricted Stock, or at the earlier time of grant if the Participant timely files a Section 83(b) Election, will be taxed as ordinary income. Such income

20

constitutes "wages" with respect to which the Company is required to deduct and withhold federal and state income and employment taxes.