UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

RF Micro Devices, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

RF MICRO DEVICES, INC.

7628 THORNDIKE ROAD

GREENSBORO, NORTH CAROLINA 27409-9421

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 27, 2004

Notice of Annual Meeting of Shareholders:

We hereby give notice that the Annual Meeting of Shareholders of RF Micro Devices, Inc. (the “Company”) will be held on Tuesday, July 27, 2004 at 10:00 a.m. local time, at The Greensboro-High Point Airport Marriott, One Marriott Drive, Greensboro, North Carolina, for the following purposes:

| | (1) | To elect eight directors for one-year terms and until their successors are duly elected and qualified; |

| | (2) | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending March 31, 2005; and |

| | (3) | To transact such other business as may properly come before the meeting. |

Under North Carolina law, only shareholders of record at the close of business on the record date, which is June 4, 2004, are entitled to notice of and to vote at the annual meeting or any adjournment. It is important that your shares of common stock be represented at this meeting so that the presence of a quorum is assured.

This proxy statement and the accompanying proxy are being mailed to the shareholders of the Company on or about June 15, 2004.

A copy of our 2004 Annual Report containing our financial statements for the fiscal year ended March 31, 2004 is enclosed.

|

| By Order of the Board of Directors |

|

|

William A. Priddy, Jr. Secretary |

June 15, 2004

Your vote is important. Even if you plan to attend the meeting in person, please date and execute the enclosed proxy and return it promptly in the enclosed postage-paid envelope or vote by using the telephone or Internet as soon as possible. Additional information regarding these voting methods is provided in the proxy statement and in the enclosed proxy. If you attend the meeting, you may revoke your proxy and vote your shares in person.

RF MICRO DEVICES, INC.

7628 THORNDIKE ROAD

GREENSBORO, NORTH CAROLINA 27409-9421

PROXY STATEMENT

GENERAL INFORMATION

Solicitation of Proxies

The enclosed proxy, for use at the Annual Meeting of Shareholders to be held Tuesday, July 27, 2004, at 10:00 a.m. local time at The Greensboro-High Point Airport Marriott, One Marriott Drive, Greensboro, North Carolina, and any adjournment thereof (the “annual meeting” or the “meeting”), is solicited on behalf of the Board of Directors of RF Micro Devices, Inc. (the “Company”). The approximate date that the Company is first sending these proxy materials to shareholders is June 15, 2004. This solicitation is being made by mail and may also be made in person or by fax, telephone or Internet by the Company’s officers or employees. The Company will pay all expenses incurred in this solicitation. The Company will request banks, brokerage houses and other institutions, nominees and fiduciaries to forward the soliciting material to beneficial owners and to obtain authorization for the execution of proxies. The Company will, upon request, reimburse these parties for their reasonable expenses in forwarding proxy materials to beneficial owners.

The accompanying proxy is for use at the meeting if a shareholder either will be unable to attend in person or will attend but wishes to vote by proxy. Shares may be voted by completing the enclosed proxy card and mailing it in the postage-paid envelope provided, voting over the Internet or using a toll-free telephone number. Please refer to the proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available. Shareholders who vote over the Internet may incur costs, such as telephone and Internet access charges, for which the shareholder is responsible. The Internet and telephone voting facilities for eligible shareholders of record will close at 11:59 p.m., Eastern Daylight Time, on Monday, July 26, 2004. Specific instructions to be followed by any shareholder interested in voting via the Internet or telephone are shown on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to vote their shares and confirm that their instructions have been properly recorded. In the event that a shareholder’s proxy does not reference Internet or telephone information, the shareholder should complete and return the paper proxy card in the self-addressed, postage-paid envelope provided. The proxy may be revoked by the shareholder at any time before it is exercised by filing with the Company’s corporate secretary an instrument revoking it, filing a duly executed proxy bearing a later date (including a proxy given over the Internet or by telephone) or by attending the meeting and electing to vote in person. All shares of the Company’s common stock represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified. If no specification is made, properly executed and returned proxies will be voted in favor of electing the eight nominees for directors named herein (or their substitutes) for one-year terms expiring at the 2005 annual meeting of shareholders and for ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending March 31, 2005.

The presence in person or by proxy of a majority of the shares of common stock outstanding on the record date constitutes a quorum for purposes of voting on a particular matter and conducting business at the meeting. Once a share is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting. Abstentions and shares that are withheld as to voting with respect to one or more of the nominees for director will be counted in determining the existence of a quorum, but shares held by a broker, as nominee, and not voted on any matter will not be counted for such purpose.

Assuming the existence of a quorum, the persons receiving a plurality of the votes cast by the shares entitled to vote will be elected as directors. The proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent auditors will be approved if the votes cast in favor of the proposal exceed the votes cast against it. Abstentions, shares that are withheld as to voting with respect to nominees for director and shares held of record by a broker, as nominee, that are not voted with respect to a proposal will not be counted as a vote in favor of or against the proposal and, therefore, will have no effect on any of the proposals presented at the meeting.

Voting Securities Outstanding

In accordance with North Carolina law, June 4, 2004 has been fixed as the record date for determining holders of common stock entitled to notice of and to vote at the meeting. Each share of the Company’s common stock issued and outstanding on June 4, 2004 is entitled to one vote on all proposals at the meeting, except that shares the Company holds in a fiduciary capacity may be voted only in accordance with the instruments creating the fiduciary capacity. Holders of shares of common stock vote together as a voting group on all proposals. At the close of business on June 4, 2004, there were 186,492,245 shares of the Company’s common stock outstanding and entitled to vote.

PROPOSAL 1 - ELECTION OF DIRECTORS

Nominees for Election of Directors

Under the Company’s amended and restated bylaws, the Board of Directors consists of seven to nine members, as determined by the Board or the shareholders from time to time. The Board has determined that the number of directors within the range shall be eight. Directors are elected annually to serve for one-year terms and until their successors are duly elected and qualified. All nominees presently serve as directors. There are no family relationships among any of our directors or officers. The Company intends that the proxyholders named in the accompanying form of proxy will vote properly returned proxies to elect the eight nominees listed below as directors, unless the authority to vote is withheld. Although the Company expects that each of the nominees will be available for election, if any vacancy in the slate of nominees occurs, the Company expects that shares of common stock represented by proxies will be voted for the election of a substitute nominee or nominees recommended by management or for the election of the remaining nominees recommended by management.

The names of the nominees for election to the Board, their principal occupations and certain other information follows:

| | |

Dr. Albert E. Paladino | | Age 71 |

Dr. Paladino was elected Chairman of the Board of Directors of the Company in August 2002 and has served as a director since 1992. He was a general partner of Advanced Technology Ventures, a venture capital firm, from 1981 through 1998. Prior to joining Advanced Technology Ventures, he held senior positions with Raytheon Company, GTE Laboratories, the National Institute of Standards and Technology and the Congressional Office of Technology Assessment. Dr. Paladino is also a member of the Board of Directors of TranSwitch Corporation, a publicly traded developer of highly integrated digital and mixed signal semiconductor solutions for the telecommunications and data communications markets.

| | |

Robert A. Bruggeworth | | Age 43 |

Mr. Bruggeworth became President in June 2002 and Chief Executive Officer in January 2003. He was appointed to the Board of Directors in January 2003. He was Vice President of Wireless Products from September 1999 to January 2002 and President of Wireless Products from January 2002 to June 2002. Mr. Bruggeworth was employed at AMP Inc. (now Tyco Electronics), a supplier of electrical and electronic connection devices, from July 1983 to April 1999. He held a number of manufacturing and engineering management positions from July 1983 to July 1998. From July 1998 to April 1999, Mr. Bruggeworth served first as AMP Inc.’s Divisional Vice President and Area Director of Asia Pacific Operations, then as Vice President of Asia Pacific Operations and then as Divisional Vice President of Global Computer and Consumer Electronics based in Hong Kong, China. Mr. Bruggeworth is a member of the Board of Directors of LightPath Technologies, Inc., a publicly traded manufacturer of high performance fiber-optic components for the telecommunications industry.

Mr. DiLeo was elected to the Board in August 2002. Mr. DiLeo was an Executive Vice President of Agere Systems, Inc., a manufacturer of semiconductor components and optoelectronics, from March 2001 to March 2002. He is currently the principal of Dan DiLeo, LLC, which he founded in March 2002. He served as President of the Optoelectronics Division of Lucent Technologies, Inc., a manufacturer of semiconductor components and

optoelectronics, from November 1999 to February 2001, Vice President and Chief Operating Officer from June 1998 to October 1999 and Vice President of the wireless business unit from January 1995 to May 1998. Mr. DiLeo is a director of Data I/O Corporation, which designs and manufactures equipment to program devices in original equipment manufacturers.

| | |

Dr. Frederick J. Leonberger | | Age 56 |

Dr. Leonberger was elected to the Board in September 2002. He served as Senior Vice President and Vice President and Chief Technology Officer of JDS Uniphase Corp., an optical components supplier, from July 1999 to June 2003, and held the same position with Uniphase Corp., an optical components supplier, from 1997 to 1999 prior to its merger with JDS Fitel Corporation. He is currently the Principal of EOvation Technologies LLC, a technology advisory firm he founded in July 2003 following his retirement from JDS Uniphase Corp. He was co-founder and general manager of United Technologies Photonics Corp., an optical modulator supplier, which was acquired by Uniphase Corp. in 1995. Dr. Leonberger also has held management and staff positions at United Technologies Research Center and MIT Lincoln Laboratory. Dr. Leonberger is a director of Agility Communications, Inc., which designs and manufactures tunable lasers.

Mr. Norbury retired from the Company effective January 10, 2003. He has been a director of the Company since 1992. Mr. Norbury served as Chief Executive Officer from September 1992 to January 2003 and as President from September 1992 to June 2002. Mr. Norbury served as President and Chief Executive Officer of Polylythics, Inc., a developer of semiconductor technology based in Santa Clara, California, from August 1989 to March 1991.

Mr. Pratt, a founder of the Company, served as President from February 1991 to September 1992 and served as Chairman from September 1992 to August 2002. Mr. Pratt has served as Chief Technical Officer and Corporate Vice President since September 1992. He also has been a director of the Company since its inception in 1991. Prior to such time, Mr. Pratt was employed for 13 years with Analog Devices, Inc., an integrated circuit manufacturer, as Engineering Manager and General Manager.

| | |

Erik H. van der Kaay | | Age 64 |

Mr. van der Kaay joined the Board in July 1996. He was Chairman of the Board of Symmetricom Inc., a publicly traded synchronization products company based in Irvine, California, from November 2002 until August 2003, and served as President and Chief Executive Officer of Datum Inc. (which merged with Symmetricom Inc. in October 2002) from April 1998 to October 2002. Mr. van der Kaay was employed with Allen Telecom, a telecommunications company based in Beachwood, Ohio, from June 1990 to March 1998, and last served as its Executive Vice President. He is also a director of Comarco, Inc., a provider of advanced wireless technology tools and engineering services, and TranSwitch Corporation. In 2004, Mr. van der Kaay joined the board of directors of Ball Corporation, a publicly traded supplier of metal and plastic packaging to the beverage and food industries that owns Ball Aerospace & Technologies Corp.

| | |

Walter H. Wilkinson, Jr. | | Age 58 |

Mr. Wilkinson has served as a director of the Company since 1992. He is the founder and a general partner of Kitty Hawk Capital, a venture capital firm established in 1980 and based in Charlotte, North Carolina. He is a member and past director of the National Venture Capital Association and is a past member and Chairman of the National Association of Small Business Investment Companies.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE.

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. and the Company’s Corporate Governance Guidelines, the Company’s Board of Directors must consist of a majority of independent directors. The Board has determined that Drs. Leonberger and Paladino and Messrs. DiLeo, van der Kaay and Wilkinson are independent under these Nasdaq listing standards. Each of the members of the Company’s Audit Committee, Compensation Committee and Governance and Nominating Committee has been determined by the Board to be independent under applicable Nasdaq listing standards and, in the case of the Audit Committee, under the independence requirements established by the Securities and Exchange Commission (the “SEC”).

Corporate Governance Guidelines

Effective July 2003 and amended June 2004, the Board implemented written Corporate Governance Guidelines, which provide the framework for the fulfillment of the Board’s duties and responsibilities. The Corporate Governance Guidelines address a number of matters applicable to directors, including director qualification standards, Board and committee meetings, executive sessions, director compensation, management succession, director continuing education and other matters. These Corporate Governance Guidelines are available in the investor information section of the Company’s website under the heading “Corporate Governance” at http://www.rfmd.com. A shareholder may request a copy of the Corporate Governance Guidelines by contacting Doug DeLieto, the Company’s Director of Investor Relations, at 7628 Thorndike Road, Greensboro, North Carolina 27409-9421.

Codes of Ethics

In February 2004, the Board adopted a Code of Business Conduct and Ethics to provide guidance on maintaining the Company’s commitment to high ethical standards. The Code of Business Conduct and Ethics applies to employees, officers, directors, agents and representatives of the Company and its subsidiaries. The Company also adopted a code of ethics applicable to the Company’s Chief Executive Officer, Chief Financial Officer, principal accounting officer or controller and treasurer.

Copies of both of these codes are available in the investor information section of the Company’s website under the heading “Corporate Governance” at http://www.rfmd.com or may be obtained by contacting Doug DeLieto, the Company’s Director of Investor Relations, at the address set forth above.The Company will disclose any waivers of the codes applicable to the Company’s directors or executive officers on Form 8-K as required by Nasdaq listing standards or applicable law. Any waivers of either code for executive officers or directors may be made only by the Board or by a Board committee.

Committees and Meetings

The Board maintains three standing committees: the Audit Committee, the Compensation Committee and the Governance and Nominating Committee. Each committee operates under a written charter and reports regularly to the Board. A copy of each of these committee charters is available in the investor information section of the Company’s website under the heading “Corporate Governance” at http://www.rfmd.com and may also be obtained by contacting Doug DeLieto, the Company’s Director of Investor Relations, at the address set forth above.

Each of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee must be comprised of no fewer than three members, each of whom must satisfy membership requirements imposed by Nasdaq listing standards and the applicable committee charter. A brief description of the responsibilities of each of these committees, and their current membership, follows.

Compensation Committee

The Compensation Committee operates under a written charter adopted in June 2003. The Compensation Committee is appointed by the Board to exercise the Board’s authority concerning compensation of the Company’s officers and employees, as well as stock-based and incentive compensation plans. In fulfilling its duties, the

Compensation Committee has the authority to (a) evaluate and fix the compensation of the officers of the Company and its subsidiaries; (b) prepare the report on executive compensation that the rules of the SEC require to be included in the Company’s annual proxy statement; (c) approve annual retainer and meeting fees for the Board and committees of the Board, including compensatory stock awards to directors; and (d) discharge certain responsibilities relating to the administration of the Company’s incentive and employee benefit plans. The Compensation Committee may condition its approval of any compensation on ratification by the Board if Board action is required by applicable law or otherwise deemed appropriate. The current members of the Compensation Committee are Drs. Leonberger and Paladino and Messrs. DiLeo, van der Kaay and Wilkinson (Chairman), none of whom is an employee of the Company and each of whom is independent under existing Nasdaq listing standards. See “Executive Compensation - Report of the Compensation Committee,” below.

Audit Committee

The Audit Committee operates under a written charter adopted in May 2000 and amended in June 2003. The Audit Committee is appointed by the Board to assist the Board in its duty to oversee the Company’s accounting, financial reporting and internal control functions and the audit of the Company’s financial statements. The Committee’s responsibilities include, among others, direct responsibility for hiring, firing, overseeing the work of and determining the compensation for the Company’s independent auditors, who report directly to the Audit Committee. The members of the Audit Committee are Dr. Paladino and Messrs. DiLeo, van der Kaay (Chairman) and Wilkinson, none of whom is an employee of the Company and each of whom is independent under existing Nasdaq listing standards and SEC requirements. The Board has examined the SEC’s definition of “audit committee financial expert” and determined that Mr. van der Kaay satisfies this definition. Accordingly, Mr. van der Kaay has been designated by the Board as the Company’s audit committee financial expert. See “Report of the Audit Committee,” below.

Governance and Nominating Committee

The Governance and Nominating Committee operates under a written charter adopted in April 2003. The Governance and Nominating Committee is appointed by the Board to (a) assist the Board in identifying individuals qualified to become Board members and to recommend to the Board the director nominees; (b) recommend to the Board the corporate governance, conflicts of interest and other policies, principles and guidelines applicable to the Company; and (c) lead the Board in its annual review of the Board’s performance. The members of the Governance and Nominating Committee are Drs. Leonberger and Paladino (Chairman) and Messrs. DiLeo, van der Kaay and Wilkinson, none of whom is an employee of the Company and each of whom is independent under existing Nasdaq listing standards. The Governance and Nominating Committee will consider written nominations of candidates for election to the Board properly submitted by shareholders. For information regarding shareholder nominations to the Board, see “Procedures for Director Nominations” and “Proposals for 2005 Annual Meeting,” below.

The Governance and Nominating Committee is also authorized by the Board to serve as the Qualified Legal Compliance Committee for purposes of Section 307 of the Sarbanes-Oxley Act of 2002 and the SEC’s standards for professional conduct for attorneys appearing and practicing before the SEC in the representation of the Company. In addition, the Governance and Nominating Committee is authorized by the Board to serve as the “TIDE” (Three-year Independent Director Evaluation) Committee and is responsible for reviewing and evaluating the Company’s Rights Plan at least once every three years in order to determine whether the maintenance of the Rights Plan is in the best interests of the Company and its shareholders. The Governance and Nominating Committee completed its initial evaluation of the Rights Plan in April 2004 and concluded that the Rights Plan continues to be in the best interests of the Company and its shareholders.

Meeting Attendance

Under the Company’s Corporate Governance Guidelines, all directors are expected to make every effort to attend meetings of the Board, assigned committees and annual meetings of shareholders.

All directors attended at least 75% of the Board meetings and assigned committee meetings during the fiscal year ended March 31, 2004. During fiscal 2004, the Board held ten meetings, the Compensation Committee held ten meetings, the Audit Committee held eight meetings, and the Governance and Nominating Committee held four

meetings. All eight of the Company’s directors in office at the time of the 2003 annual meeting of shareholders attended the annual meeting.

Executive Sessions

Pursuant to the Company’s Corporate Governance Guidelines, independent directors are expected to meet in executive session at all regularly scheduled meetings of the Board with no members of management present. The chairperson of the Governance and Nominating Committee or the Chairman of the Board will preside at each executive session, unless the independent directors determine otherwise. In addition, any Board committee may hold an executive session with any directors who are not members of such committee attending only by invitation. During fiscal 2004, Dr. Paladino, as Chairman, presided at the executive sessions. During fiscal 2004, the independent directors met in executive session at each of the four regularly scheduled Board meetings.

Procedures for Director Nominations

In accordance with the Company’s Corporate Governance Guidelines, members of the Board are expected to collectively possess a broad range of skills, industry and other knowledge and expertise, and business and other experience useful for the effective oversight of the Company’s business. The Governance and Nominating Committee is responsible for identifying, screening and recommending to the Board qualified candidates for membership. All candidates must meet the minimum qualifications and other criteria established from time to time by the Board, and potential nominees will also be evaluated based on the other criteria identified in the Corporate Governance Guidelines. These minimum qualifications include, but are not limited to:

| | • | Substantial or significant business or professional experience or an understanding of technology, finance, marketing, financial reporting, international business or other disciplines relevant to the business of the Company; and |

| | • | Lack of any conflict of interest that would violate any applicable law or regulation or have any other relationship that, in the opinion of the Board, would interfere with the exercise of the individual’s judgment as a member of the Board or of a Board committee. |

The Company also considers the following criteria, among others, in its selection of directors:

| | • | Economic, technical, scientific, academic, financial and other expertise, skills, knowledge and achievements useful to the oversight of the Company’s business; |

| | • | Integrity, demonstrated sound business judgment and high moral and ethical character; |

| | • | Diversity of viewpoints, backgrounds, experiences and other demographics; |

| | • | Business or other relevant professional experience; |

| | • | Capacity and desire to represent the balanced, best interests of the Company and its shareholders as a whole and not primarily a special interest group or constituency; |

| | • | Ability and willingness to devote time to the affairs and success of the Company and in fulfilling the responsibilities of a director; and |

| | • | The extent to which the interplay of the candidate’s expertise, skills, knowledge and experience with that of other Board members will build a Board that is effective, collegial and responsive to the needs of the Company. |

The Governance and Nominating Committee is authorized to develop additional policies regarding Board size, composition and member qualification.

The Governance and Nominating Committee evaluates suggestions concerning possible candidates for election to the Board submitted to the Company, including those submitted by Board members (including self-nominations),

shareholders and third parties. All candidates, including those submitted by shareholders, will be similarly evaluated by the Governance and Nominating Committee using the Board membership criteria described above and in accordance with applicable procedures. Once candidates have been identified, the Governance and Nominating Committee will determine whether such candidates meet the minimum qualifications for director nominees established in the Corporate Governance Guidelines or under applicable laws, rules or regulations. The Board, taking into consideration the recommendations of the Governance and Nominating Committee, is responsible for selecting the nominees for director and for appointing directors to fill vacancies.

The Governance and Nominating Committee has authority to retain and approve the compensation of search firms to be used to identify director candidates. The Governance and Nominating Committee has retained a third-party search firm to assist as necessary in the identification of future director candidates who meet the criteria outlined above.

As noted above, the Governance and Nominating Committee will consider qualified director nominees recommended by shareholders when such recommendations are submitted in accordance with applicable SEC requirements, the Company’s bylaws and Corporate Governance Guidelines and any other applicable law, rule or regulation regarding director nominations. When submitting a nomination to the Company for consideration, a shareholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name and address; age; principal occupation during the past five years; current directorships on publicly held companies and registered investment companies; and number of shares of Company common stock owned, if any. In addition, under the Company’s bylaws, as amended and restated effective June 1, 2004, a shareholder’s notice regarding a proposed nominee must include (a) the name and address of the shareholder and the beneficial owner, if any, on whose behalf the nomination is made; (b) the number of shares of stock owned by the shareholder and beneficial owner; (c) a description of the shareholder’s proposal; (d) any material direct or indirect interest that the shareholder or the beneficial owner may have in the nomination; (e) a representation that the shareholder is a holder of record of the Company’s common stock and intends to appear in person or by proxy to present the nominee; (f) the nominee’s consent to serve if elected; and (g) such additional information concerning the nominee as is deemed sufficient by the Board, or a properly authorized Board committee, to establish that the nominee meets all minimum qualification standards or other criteria as may have been established by the Board or such properly authorized Board committee, or pursuant to applicable law, rule or regulation, for service as a director. Certain specific notice deadlines also apply with respect to submitting director nominees. Effective June 1, 2004, the Board approved an amendment to the Company’s bylaws that modifies the advance notice provisions related to director nominations. The amendment makes the advance notice provisions for shareholder director nominations and other shareholder proposals consistent. See “Proposals for 2005 Annual Meeting,” below.

No candidates for director nominations were submitted to the Governance and Nominating Committee by any shareholder in connection with the annual meeting. Any shareholder desiring to present a nomination for consideration by the Governance and Nominating Committee prior to the 2005 annual meeting must do so in accordance with the Company’s bylaws and policies. See “Proposals for 2005 Annual Meeting,” below.

Shareholder Communications with Directors

Any shareholder desiring to contact the Board, or any specific director(s), may send written communications to: Board of Directors (Attention: (Name(s) of director(s), as applicable)), c/o the Company’s Secretary, 7628 Thorndike Road, Greensboro, North Carolina 27409-9421. Any proper communication so received will be processed by the Secretary. If it is unclear from the communication received whether it was intended or appropriate for the Board, the Secretary will (subject to any applicable regulatory requirements) use his judgment to determine whether such communication should be conveyed to the Board or, as appropriate, to the member(s) of the Board named in the communication.

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires the Audit Committee to approve all audit and permissible non-audit services to be provided by the independent auditors (and any non-audit service provided by any other accounting firm if the cost of the service is reasonably expected to exceed $100,000). The Audit Committee has established a general pre-approval policy for certain audit and non-audit services, up to a specified

amount for each identified service that may be provided by the independent auditors. The Chairman of the Audit Committee may specifically approve any service within the pre-approved audit and non-audit service category if the fees for such service exceed the maximum set forth in the policy, as long as the excess fees are not reasonably expected to exceed $25,000. Any such approval by the Chairman must be reported to the Audit Committee at its next scheduled meeting. The general pre-approval fee levels for all services to be provided by the independent auditors are reviewed annually by the Audit Committee.

Procedures for Reporting Complaints about Accounting and Auditing Matters

The Audit Committee has adopted procedures for receiving and handling complaints from employees and third parties regarding accounting, internal accounting controls or auditing matters, including procedures for confidential, anonymous submissions by employees of complaints or concerns regarding questionable accounting or auditing matters. Employees or third parties may report their concerns by mail to the attention of the Company’s Compliance Officer, 7628 Thorndike Road, Greensboro, North Carolina 27409-9421 or by e-mail at complianceofficer@rfmd.com. If the Compliance Officer is the subject of the concern or the employee or third party otherwise believes that the Compliance Officer has not given or will not give proper attention to his or her concerns, the employee or third party may report his or her concerns directly to the Chairman of the Audit Committee. An employee or third party may forward concerns on a confidential and/or anonymous basis to the Audit Committee by calling the Company’s toll-free hotline, which is operated by a third-party agency to ensure confidentiality, or by delivering a letter or memorandum setting forth his or her concerns in a sealed envelope addressed to the Chairman of the Audit Committee labeled “Confidential: To be opened by the Audit Committee only.”

Upon receipt of a complaint relating to the matters set forth above, the Compliance Officer will promptly notify the Audit Committee. The Audit Committee will oversee the review of any such complaint and will maintain the confidentiality of an employee complaint to the fullest extent possible, consistent with the need to conduct an adequate review. Prompt and appropriate corrective action will be taken when and as warranted in the judgment of the Audit Committee. The Compliance Officer and the Chairman of the Audit Committee will maintain a log of all complaints received by them, tracking their receipt, investigation and resolution, and shall prepare a periodic report summarizing the complaints for submission by the Audit Committee to the Board. The Compliance Officer and the Chairman of the Audit Committee will maintain copies of complaints and such log for a reasonable time or for any period prescribed by the Company’s document retention policy but in no event for less than five years.

Compensation of Directors

During fiscal 2004, each non-employee director of the Company received an annual retainer of $20,000 for his services as a member of the Board, except for the non-employee Chairman of the Board, who received an annual retainer of $75,000. All non-employee directors also received $2,500 for each Board meeting attended. All non-employee members of the Board, excluding the Chairman of the Board, received $1,000 for each meeting attended for their services on the Compensation Committee, $1,000 for each meeting attended for their services on the Governance and Nominating Committee and $1,500 for each meeting attended for their services on the Audit Committee. The Chairmen of the Audit and Compensation Committees also received $5,000 and $3,000, respectively, for their services as Chairmen in addition to the applicable meeting fees. The Chairman of the Board served as the Chairman of the Governance and Nominating and Governance Committee and received no additional compensation for serving in that capacity. In addition, all directors were reimbursed for expenses incurred in their capacity as directors.

Beginning in fiscal year 2005, each non-employee director of the Company will receive an annual retainer of $26,000, except for the Chairman of the Board, whose annual retainer will be increased to $81,000. This increase is due to the additional demands and responsibilities imposed upon non-employee directors, particularly regarding compliance and regulatory matters, and to compensate such directors for the fact that they are expected to be available for extra assignments as requested by the Board. The remaining aspects of the compensation structure for non-employee directors are expected to remain the same for fiscal year 2005 as they were in fiscal year 2004.

Under the Non-Employee Directors’ Stock Option Plan, as amended, each non-employee director who is first elected or appointed to the Board is eligible to receive an option to purchase 20,000 shares of the Company’s common stock at the market price of the stock at the time of grant. Each participating non-employee director who is reelected receives an annual option grant for 20,000 shares of common stock with an exercise price equal to the

market price at the time of grant. The options have a ten-year term and generally vest in three installments over two years.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of the Company’s common stock as of June 4, 2004 by (a) each person known by the Company to own beneficially more than five percent of the outstanding shares of the Company’s common stock, (b) each director and nominee for director, (c) the Named Executives (as defined in “Summary Compensation Table,” below), and (d) all current directors and executive officers as a group. Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or that are or may become exercisable within 60 days of June 4, 2004 are deemed outstanding. These shares, however, are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name.

| | | | |

| | | Beneficial Ownership

|

Name of Beneficial Owner

| | Number of Shares

| | Percent of Class

|

Robert A. Bruggeworth(1) | | 457,108 | | * |

Steven E. Creviston(2) | | 256,256 | | * |

Daniel A. DiLeo(3) | | 26,666 | | * |

Dr. Frederick J. Leonberger(4) | | 27,566 | | * |

Jerry D. Neal(5) | | 876,365 | | * |

David A. Norbury(6) | | 823,988 | | * |

Dr. Albert E. Paladino(7) | | 238,335 | | * |

William J. Pratt(8) | | 1,719,387 | | * |

William A. Priddy, Jr.(9) | | 495,964 | | * |

Erik H. van der Kaay(10) | | 261,333 | | * |

Walter H. Wilkinson, Jr.(11) | | 406,225 | | * |

Directors and executive officers as a group (15 persons)(12) | | 5,863,194 | | 3.10% |

| * | Indicates less than one percent |

| (1) | Includes 333,858 shares of common stock issuable upon the exercise of stock options. |

| (2) | Includes 97,380 shares of common stock issuable upon the exercise of stock options. |

| (3) | Includes 26,666 shares of common stock issuable upon the exercise of stock options. |

| (4) | Includes 26,666 shares of common stock issuable upon the exercise of stock options. |

| (5) | Includes 777,095 shares of common stock issuable upon the exercise of stock options. |

| (6) | Includes 26,666 shares of common stock issuable upon the exercise of stock options. |

| (7) | Includes 113,335 shares of common stock issuable upon the exercise of stock options. |

| (8) | Includes (a) 302,738 shares of common stock issuable upon the exercise of stock options, (b) 73,164 shares held by the William John Pratt 2001 Grantor Retained Annuity Trust, as to which Mr. Pratt shares voting and dispositive power and (c) 16,000 shares held by Mr. Pratt’s spouse, as to which Mr. Pratt disclaims beneficial ownership. |

| (9) | Includes 261,130 shares of common stock issuable upon the exercise of stock options. |

| (10) | Includes (a) 213,333 shares of common stock issuable upon the exercise of stock options and (b) 48,000 shares of common stock held by The van der Kaay Trust, as to which Mr. van der Kaay shares voting and dispositive power jointly with his spouse. |

| (11) | Includes 273,333 shares of common stock issuable upon the exercise of stock options. |

| (12) | Includes 2,614,112 shares of common stock issuable upon the exercise of stock options. |

EXECUTIVE OFFICERS

The Company’s current executive officers are as follows:

| | | | |

Name

| | Age

| | Title

|

Robert A. Bruggeworth | | 43 | | President and Chief Executive Officer |

Barry D. Church | | 42 | | Vice President and Corporate Controller |

Steven E. Creviston | | 40 | | Corporate Vice President of Wireless Products |

Jerry D. Neal | | 59 | | Executive Vice President of Marketing and Strategic Development |

William J. Pratt | | 61 | | Chief Technical Officer and Corporate Vice President |

William A. Priddy, Jr. | | 43 | | Chief Financial Officer, Corporate Vice President of Administration and Secretary |

Suzanne B. Rudy | | 49 | | Vice President and Corporate Treasurer |

James D. Stilson | | 57 | | Corporate Vice President of Operations |

Gregory J. Thompson | | 41 | | Vice President of Sales |

Set forth below is certain information with respect to the Company’s executive officers. Officers are appointed to serve at the discretion of the Board. Information regarding Messrs. Bruggeworth and Pratt is included in the director profiles set forth above.

Barry D. Church began his employment with the Company in March 1998. From March 1998 until August 1998, Mr. Church was Manager of Financial Planning, from August 1998 until September 2001 he was Controller, and since September 2001 he has served as Vice President and Corporate Controller of the Company. In addition to his tenure at the Company, Mr. Church has 13 years experience in various financial positions at Sara Lee Corporation and AT&T, Inc.

Steven E. Crevistonbegan his employment with the Company in December 1994. From May 1997 to May 1999, Mr. Creviston was Director of Account Management, from June 1999 to April 2001 he was Product Line Director, from May 2001 to May 2002 he was Divisional Vice President and, since May 2002, he has been the Corporate Vice President of Wireless Products.

Jerry D. Neal, a founder of the Company, served as Vice President of Marketing from May 1991 to January 2000 and was Executive Vice President of Sales, Marketing and Strategic Development from January 2000 to January 2002. In January 2002, Mr. Neal became Executive Vice President of Marketing and Strategic Development. Prior to joining the Company, Mr. Neal was employed for ten years with Analog Devices, Inc. as Marketing Engineer, Marketing Manager and Business Development Manager. Mr. Neal served as a director of the Company from February 1992 to July 1993.

William A. Priddy, Jr. became Chief Financial Officer and Corporate Vice President of Administration in July 1997 and Secretary in July 2003. He was Controller from December 1991 to December 1993, Treasurer from December 1993 to May 1999, and Vice President of Finance from December 1994 to July 1997. Prior to joining the Company, Mr. Priddy was employed for five years with Analog Devices, Inc. in various positions in finance and marketing.

Suzanne B. Rudybecame the Company’s Vice President and Corporate Treasurer in November 2002. She was Corporate Treasurer from May 1999 until November 2002. Prior to joining the Company, Ms. Rudy was employed for eight years at Precision Fabrics Group Inc. as Controller and for six years at BDO Seidman, LLP, most recently as a Tax Manager.

James D. Stilson joined the Company in January 2004 as the Corporate Vice President of Operations. From July 1999 to January 2004, Mr. Stilson was the President of ASE Korea, Inc., a semiconductor assembly and test solution provider. From November 1997 to July 1999, he was the General Manager of Motorola Korea Ltd., which was purchased by the ASE Group to form ASE Korea, Inc. From April 1995 to November 1997, he was the Assistant General Manager of Motorola Korea Ltd.

Gregory J. Thompsonbecame the Company’s Vice President of Sales in January 2003. From October 1993 to October 1996, he was a Marketing Engineer, and from October 1996 to January 2003, he was the Director of

Worldwide Sales for the Company. Prior to joining the Company, Mr. Thompson held various technical sales and management positions with Teledyne Industries and Eaton Corporation.

EXECUTIVE COMPENSATION

Report of the Compensation Committee

The objectives of the Company’s compensation program are to enhance the Company’s ability to recruit and retain qualified management, motivate executives and other employees to achieve established performance goals and ensure an element of congruity between the financial interests of the Company’s management and its shareholders.

In fiscal year 2004, the Compensation Committee considered the following factors in setting the compensation of the Company’s executive officers:

| | • | The overall operating performance of the Company during the previous fiscal year, as well as: (a) the degree of progress that each business unit made in achieving its long-term strategic goals, (b) new products in development, scheduled for introduction or recently introduced, (c) Company performance in relation to its industry competitors and/or (d) productivity improvements. |

| | • | Individual performance appraisals of the executive officers and their contributions toward the Company’s performance goals and other objectives as established by the Board and the Compensation Committee, including a subjective evaluation of each executive officer’s (a) vision and strategy with respect to their individual business responsibilities, (b) energy level and ability to motivate and influence others, (c) self-development and development of subordinates and (d) execution of assigned tasks. |

| | • | The compensation packages for executives who have similar positions and levels of responsibility at other publicly held U.S. manufacturers of integrated circuits and other relevant products in related appropriate markets. |

The Compensation Committee believes that competition for qualified executives in the integrated circuit and wireless products industries is extremely strong and that to attract and retain such persons, the Company must maintain an overall compensation package that is competitive with those offered by its peer companies.

Compensation arrangements under the Company’s current compensation program may include up to four components: (a) a base salary, (b) a discretionary cash bonus program, (c) the grant of equity incentives in the form of stock options and/or restricted stock awards and (d) other compensation and employee benefits generally available to all employees of the Company, such as health insurance and participation in the Company’s 401(k) plan. The Company also has entered into change in control agreements with certain executive and other officers of the Company, including each of the Named Executives. See “Key Employee Retention Arrangements,” below. The Chief Executive Officer’s salary, bonus and equity incentive awards are established by the Compensation Committee. Recommendations regarding the base salary, bonuses and stock option or other equity awards of the Company’s executive officers, other than Mr. Bruggeworth, are made to the Compensation Committee by Mr. Bruggeworth but are subject to Compensation Committee review, modification and approval.

To assist it in overseeing compensation practices, the Compensation Committee periodically requests Company Human Resource Department personnel to gather compensation data for Compensation Committee review. The Company also is a member of certain human resources-focused industry groups that accumulate detailed data regarding position descriptions, responsibilities and compensation for all levels of employees within the technology industries. The Company also purchases databases containing information on public companies. The Compensation Committee, working with Company management, selects a subset of this data that it feels is most applicable to the Company, given its size and certain other industry reporting characteristics, as a peer group for comparative purposes. This information is one of the factors applied in setting the overall base salary, bonus and other performance-based compensation levels for all Company executive officers. During fiscal year 2004, certain members of the Compensation Committee also participated in director education programs focusing on executive compensation. The Compensation Committee did not retain the services of an independent compensation consultant during fiscal year 2004, although it has done so in the past. The Compensation Committee did meet, however, with

representatives of certain independent compensation consulting firms to ensure that Compensation Committee members are informed of current trends and practices in executive compensation.

Base Salaries

Individual salaries for executive officers are annually reviewed and established by the Compensation Committee. In determining individual salaries, the Compensation Committee considers the scope of job responsibilities, individual contributions, labor market conditions, peer data and the Company’s overall annual budget guidelines for merit and performance increases. The Company’s objective is to deliver base compensation levels for each executive officer at the median for the comparable position of the Company’s peer group. For fiscal year 2004, the Compensation Committee believes that base salaries for the Company’s Named Executives were, as an average for the group, slightly below the median base salaries of the peer group comparable positions.

Annual Cash Incentive

A large part of each executive officer’s potential total cash compensation is intended to be variable and dependent upon Company performance. Annual cash bonus awards are determined directly from two objective performance-based measures: (a) growth of revenues over that of the previous year and (b) the level of operating profit. During fiscal year 2004, each executive officer was eligible for a cash bonus computed using a formula based on these two objective performance-based measures and the individual’s pay tier. Adjustments may be made to operating profit to eliminate the effects of generally non-recurring, one-time events that may include but are not limited to the sale of investments in securities of other companies, acquisition-related expenses and sale or disposal of assets no longer in service. The same criteria are used for executive officers as for all other employees.

Indirectly, performance for fiscal year 2004 was also evaluated based on the success of the executive officers and all employees collectively in accomplishing the four specific goals for fiscal year 2004 that were outlined at the 2003 annual meeting of shareholders: (a) increased power amplifier product line profitability, (b) wireless local area network market share gains, (c) advancing the POLARIS chipset to market and (d) reducing the manufacturing cycle time. These four objectives were achieved in varying degrees during fiscal year 2004. For results achieved during fiscal year 2004, the Company’s Named Executives earned on average as a group approximately 54% of their targeted potential cash bonus.

For fiscal year 2004, the Company’s compensation program was structured to provide each executive officer with the opportunity to earn, through base salary and bonus awards combined, total cash compensation at the 75th percentile level of the peer group comparable position. The Compensation Committee believes that the total cash compensation for the Company’s Named Executives as a group was significantly below the peer group 75th percentile target for comparable positions.

Equity Incentive Awards

The Compensation Committee believes that substantial equity ownership encourages management to take actions favorable to the long-term interests of the Company and its shareholders. Accordingly, equity-based compensation makes up a significant portion of the overall compensation of executive officers. The Company grants unvested equity-based awards to most of its newly hired, full-time employees, and many employees are periodically eligible thereafter for additional awards based on management’s evaluation of their performance.

The 2003 Stock Incentive Plan, which the Company’s shareholders approved at the 2003 annual meeting of shareholders, provides for the issuance of the sum of (i) 9,250,000 shares of common stock, (ii) any shares of common stock remaining available as of the 2003 Stock Incentive Plan effective date for issuance under the Company’s prior stock incentive plans and (iii) any shares of common stock subject to an award granted under a prior plan if the award is forfeited, cancelled, terminated or otherwise lapses or expires. Such shares may be granted through various types of equity awards, including incentive stock options, non-qualified stock options and restricted stock awards. The Company has historically made annual equity awards to a broad base of Company employees. In its fiscal year 2004 annual awards program, the Company granted equity-based performance incentive awards in the form of stock options and restricted stock awards for approximately 3,250,000 shares to over 400 Company employees, including the Named Executives. Stock options and restricted stock awards granted to the Named Executives in fiscal 2004 are included under the headings “Summary Compensation Table” and “Option Grants in

Last Fiscal Year,” below. Stock option awards generally vest over four years and restricted stock awards generally vest over five years, with the objective of encouraging employees to remain employed at the Company and to work diligently to maximize future shareholder value. However, in the event of termination of employment other than for cause, the option grants and restricted stock awards granted in fiscal 2004 to certain executive and other officers of the Company generally will continue to vest pursuant to the same vesting schedule as if such individual had remained an employee of the Company (unless the administrator of the 2003 Stock Incentive Plan determines otherwise). The Compensation Committee determined that such awards were appropriate in recognition of the past performance of certain executive and other officers and to encourage current decision-making that will continue to benefit the Company after such individual has retired. The Company also provides its employees with the opportunity to purchase common stock through an Employee Stock Purchase Plan. See “Employee Benefit Plans,” below. The Compensation Committee believes that equity awards provide important medium-term and long-term incentives for directors, executive officers and all employees to align their interests with the interests of the Company’s shareholders.

Additional Awards

The Compensation Committee may grant, and has done so in the past, additional short-term or long-term cash or equity awards to recognize increased responsibilities or special contributions to the Company, attract new employees to the Company or retain key employees.

Chief Executive Officer Compensation

The Compensation Committee establishes the compensation of Robert A. Bruggeworth, the Chief Executive Officer of the Company, using the same criteria applicable to other executive officers of the Company. In addition, in setting Mr. Bruggeworth’s compensation for fiscal year 2004, the Compensation Committee focused on Mr. Bruggeworth’s ability to communicate effectively with the Board and the Company’s key customers and suppliers, as well as his leadership effectiveness with the other members of the executive management team. During fiscal year 2004, Mr. Bruggeworth earned a base salary of $404,231 and a cash bonus of $174,628. Mr. Bruggeworth was awarded stock options and restricted stock awards as detailed under the headings “Summary Compensation Table” and “Option Grants in Last Fiscal Year,” below. The increases in Mr. Bruggeworth’s base salary, stock options and restricted stock awards for fiscal year 2004 reflect that this was the first full fiscal year in which Mr. Bruggeworth held the positions of both President and Chief Executive Officer of the Company. The Compensation Committee believes, based on its review of publicly available information concerning the Company’s public competitors, as well as the use of the extensive data available from the compensation surveys described above, that Mr. Bruggeworth’s compensation is well within the range of compensation provided to executives of similar rank and responsibility in the Company’s industry.

Code Section 162(m)

In general, compensation in excess of $1,000,000 paid to any of the Named Executives may be subject to limitations on deductibility by the Company under Section 162(m) of the Internal Revenue Code of 1986, as amended. The limits on deduction do not apply to performance-based compensation that satisfies certain requirements. The Compensation Committee has not adopted any specific policies with respect to Section 162(m), although both the 2003 Stock Incentive Plan and the 1999 Stock Incentive Plan are structured to comply with Section 162(m) to the extent practicable.

This report has been prepared by members of the Compensation Committee. Current members of this committee are:

Walter H. Wilkinson, Jr. (Chairman)

Daniel A. DiLeo

Dr. Frederick J. Leonberger

Dr. Albert E. Paladino

Erik H. van der Kaay

Compensation Committee Interlocks and Insider Participation

None of the current members of the Compensation Committee has ever served as an officer or employee of the Company. No interlocking relationships exist between the Company’s current Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

Summary Compensation Table

The summary compensation table presents information relating to total compensation during fiscal years 2004, 2003 and 2002, of the current Chief Executive Officer and the four next most highly compensated executive officers (the “Named Executives”).

| | | | | | | | | | | | |

Name and Principal Positions

| | Year (1)

| | Annual Compensation

| | Long-Term Compensation Awards

| | All Other Compensation ($)(5)

|

| | | Salary ($)

| | Bonus ($)(2)

| | Restricted Stock Awards ($)(3)

| | Securities Underlying Options (#)(4)

| |

Robert A. Bruggeworth President and Chief Executive Officer | | 2004

2003

2002 | | 404,231

297,692

232,654 | | 174,628

137,237

144,900 | | 339,200

287,100

583,350 | | 150,000

372,000

211,000 | | 6,240

6,058

5,420 |

William J. Pratt Chief Technical Officer and Corporate Vice President | | 2004

2003

2002 | | 277,030

264,292

260,000 | | 193,697

121,839

165,600 | | 220,480

100,800

196,625 | | 95,000

127,000

71,000 | | 0

0

0 |

Jerry D. Neal Executive Vice President of Marketing and Strategic Development | | 2004

2003

2002 | | 272,031

259,292

255,000 | | 117,517

119,534

162,400 | | 220,480

100,800

275,275 | | 95,000

127,000

91,000 | | 4,958

4,787

4,583 |

William A. Priddy, Jr. Chief Financial Officer, Corporate Vice President of Administration and Secretary | | 2004

2003

2002 | | 247,846

219,538

209,999 | | 107,070

101,207

133,728 | | 228,960

134,400

314,600 | | 100,000

135,000

91,000 | | 4,983

4,806

4,617 |

Steven E. Creviston Corporate Vice President of Wireless Products(6) | | 2004

2003

2002 | | 206,923

169,617

*** | | 89,391

78,193

*** | | 220,480

106,400

*** | | 95,000

76,000

*** | | 4,708

4,012

*** |

| (1) | The Company uses a 52-week or 53-week fiscal year ending on the Saturday closest to March 31 in each year. The 2004 fiscal year was a 53-week year, and each of the 2002 and 2003 fiscal years was a 52-week year. For purposes of this proxy statement, each fiscal year is described as ending on March 31. |

| (2) | The Compensation Committee has implemented a discretionary bonus program pursuant to which bonuses may be awarded to executive officers from time to time in amounts based on the attainment of specified performance goals and reflecting the Compensation Committee’s evaluation of each executive officer’s contributions. See “Report of the Compensation Committee,” above. |

| (3) | The value shown is the number of shares subject to each Named Executive’s restricted stock awards multiplied by the closing market price of the common stock on the day of grant. Restricted stock awards generally vest over a period of five years and any unvested portion of such awards is generally forfeited upon termination of employment. However, in the event of termination of employment other than for cause, the fiscal year 2004 restricted stock awards granted to each Named Executive generally will continue to vest over a period of five years as if the Named Executive had remained an employee of the Company (unless |

| | the administrator of the 2003 Stock Incentive Plan determines otherwise). At fiscal 2004 year end, the total number and value (based on the closing market price of the common stock on the last trading day of the fiscal year) of shares subject to restricted stock awards which were held by the Named Executives were as follows: Mr. Bruggeworth, 123,250 shares valued at $1,075,973; Mr. Pratt, 58,625 shares valued at $511,796; Mr. Neal, 69,562 shares valued at $607,276; Mr. Priddy, 79,233 shares valued at $691,704; and Mr. Creviston, 66,875 shares valued at $583,819. The values given do not reflect the fact that the shares subject to such awards are restricted. Any dividends paid on the common stock would not be paid on the restricted shares prior to vesting, and the shares may not be voted prior to vesting. |

| (4) | These options have an exercise price equal to the fair market value of the common stock at the time of grant and generally vest and become exercisable in four equal installments on the first four anniversaries of the date of grant. However, in the event of termination of employment other than for cause, the fiscal year 2004 stock options granted to each Named Executive generally will continue to vest over a period of four years as if the Named Executive had remained an employee of the Company (unless the administrator of the 2003 Stock Incentive Plan determines otherwise). |

| (5) | Reflects amounts contributed by the Company during the applicable fiscal year to the accounts of the Named Executives under the Company’s 401(k) plan. |

| (6) | Mr. Creviston was not an executive officer during fiscal year 2002. |

Stock Options

The following table provides information concerning options for the Company’s common stock exercised by each of the Named Executives during fiscal year 2004 and the value of the options held by each Named Executive at the end of the fiscal year.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | | | |

Name

| | Shares

Acquired on Exercise (#)

| | Valued

Realized ($)(1)

| | Number of Shares Underlying Unexercised Options at Fiscal Year-End (#)(2)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(3)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Robert A. Bruggeworth | | 0 | | 0 | | 313,206 | | 587,054 | | 195,260 | | 623,430 |

William J. Pratt | | 0 | | 0 | | 273,241 | | 256,495 | | 579,709 | | 202,255 |

Jerry D. Neal | | 76,200 | | 848,718 | | 749,459 | | 262,773 | | 3,824,110 | | 202,255 |

William A. Priddy, Jr. | | 16,243 | | 138,400 | | 304,915 | | 266,330 | | 890,837 | | 236,375 |

Steven E. Creviston | | 50,680 | | 392,753 | | 97,380 | | 207,300 | | 95,971 | | 202,255 |

| (1) | Value represents the difference between the option price and the market value of the common stock on the date of exercise. |

| (2) | These options have an exercise price equal to the fair market value of the common stock at the time of grant and generally vest and become exercisable in four equal installments on the first four anniversaries of the date of grant. |

| (3) | Value represents the difference between the option price and the market value of the common stock at fiscal year-end. |

The following table sets forth certain information concerning stock options granted to each of the Named Executives during fiscal year 2004.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option Term(1)

|

Name

| | Number of

Securities

Underlying

Options

Granted (#)(2)

| | % of Total

Options

Granted to

Employees

in Fiscal Year

| | Exercise or

Base Price ($/Sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

Robert A. Bruggeworth | | 150,000 | | 3.85 | | 8.479 | | 8/19/2013 | | 812,321 | | 2,046,843 |

William J. Pratt | | 95,000 | | 2.44 | | 8.479 | | 8/19/2013 | | 514,470 | | 1,296,334 |

Jerry D. Neal | | 95,000 | | 2.44 | | 8.479 | | 8/19/2013 | | 514,470 | | 1,296,334 |

William A. Priddy | | 100,000 | | 2.56 | | 8.479 | | 8/19/2013 | | 541,547 | | 1,364,562 |

Steven E. Creviston | | 95,000 | | 2.44 | | 8.479 | | 8/19/2013 | | 514,470 | | 1,296,334 |

| (1) | The potential realizable value is calculated based on the term of the option at its time of grant (generally ten years) and is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate compounded annually for the entire term of the option and that the option is exercised and sold on the last day of its term for the appreciated price. The five percent and ten percent assumed rates of appreciation are derived from the rules of the SEC and do not represent the Company’s estimate or projection of the future common stock price. |

| (2) | These options have an exercise price equal to the fair market value of the common stock at the time of grant and generally vest and become exercisable in four equal installments on the first four anniversaries of the date of grant. However, these stock options were granted to each Named Executive pursuant to a special arrangement where, in the event of termination of employment other than for cause, the options generally will continue to vest over a period of four years as if the Named Executive had remained an employee of the Company (unless the administrator of the 2003 Stock Incentive Plan determines otherwise). |

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes information as of March 31, 2004 relating to the Company’s equity compensation plans, under which grants of stock options, restricted stock and other rights to acquire shares of the Company’s common stock may be granted from time to time.

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for future

issuance under equity

compensation plans (excluding

securities reflected in

column(a))

| |

Equity compensation plans approved by security holders | | 24,160,439 | | $ | 14.43 | | 6,833,123 | (1) |

Equity compensation plans not approved by security holders(2) | | 465,873 | | $ | 2.95 | | 242,079 | |

Total | | 24,626,312 | | $ | 14.21 | | 7,075,202 | |

| (1) | The total shares available for future grant may be issued pursuant to restricted stock awards granted under the Company’s 2003 Stock Incentive Plan and the Company’s 1999 Stock Incentive Plan. The shares shown in column (c) may be the subject of awards other than options, warrants or rights granted under the 2003 Stock Incentive Plan and the 1999 Stock Incentive Plan. |

| (2) | In connection with the Company’s acquisition of RF Nitro Communications, Inc., the Company assumed options to purchase an aggregate of 34,767 shares of common stock and a restricted stock award for 17,356 shares of common stock under the RF Nitro Communications, Inc. 2001 Stock Incentive Plan. These options have a weighted average exercise price of $7.29. In connection with the Company’s acquisition of Resonext Communications, Inc., the Company assumed options to purchase an aggregate of 621,753 shares of common stock under the Resonext Communications, Inc. 1999 Stock Plan. These options have a weighted average exercise price of $2.65. |

Non-Shareholder Approved Plans

Individual Option Agreements with Certain Non-Employee Directors. In October 1998, the Company granted options to purchase an aggregate of 120,000 shares (as adjusted for stock splits) to certain directors outside of the Non-Employee Directors’ Stock Option Plan. The weighted average exercise price for the outstanding options is $2.61. These options were granted at an option price equal to the fair market value at the time of grant, have ten-year terms and vest in three annual installments.

RF Nitro Communications, Inc. 2001 Stock Incentive Plan. In connection with the Company’s acquisition of RF Nitro, the Company assumed outstanding options and an outstanding restricted stock award issued under the RF Nitro Communications, Inc. 2001 Stock Incentive Plan. The 2001 Stock Incentive Plan provides for the grant of incentive and nonqualified options and restricted stock awards to key employees, non-employee directors and consultants. The weighted average exercise price for the outstanding options is $7.29. The terms may be adjusted upon certain events affecting the Company’s capitalization.

Resonext Communications, Inc. 1999 Stock Plan. In connection with the Company’s acquisition of Resonext, the Company assumed outstanding options issued under the Resonext Communications, Inc. 1999 Stock Plan. The 1999 Stock Plan provides for the grant of incentive options and nonqualified options to key employees and consultants. The weighted average exercise price for the outstanding options is $2.65. The terms may be adjusted upon certain events affecting the Company’s capitalization.

Other Employee Benefit Plans

The discussion which follows describes the material terms of the Company’s principal equity plans (in addition to those described above).

2003 Stock Incentive Plan. The 2003 Stock Incentive Plan, which the Company’s shareholders approved at the 2003 annual meeting of shareholders, provides for the issuance of the sum of (i) 9,250,000 shares of common stock, (ii) any shares of common stock remaining available as of the 2003 Stock Incentive Plan effective date for issuance under the Company’s prior stock incentive plans and (iii) any shares of common stock subject to an award granted under a prior plan if the award is forfeited, cancelled, terminated or otherwise lapsed or expired. Awards that may be granted under the plan include incentive options and nonqualified options, stock appreciation rights, restricted stock awards and restricted units, and performance awards and performance units. The number of shares reserved for issuance under the plan and the terms of awards may be adjusted upon certain events affecting the Company’s capitalization. No awards may be granted under the plan after July 21, 2013. The plan is administered by the Compensation Committee upon delegation from the Board. Under the terms of the plan, the Compensation Committee has authority to take action with respect to the plan, including selection of individuals to be granted awards, the types of awards and the number of shares of common stock subject to an award, and determination of the terms, conditions, restrictions and limitations of each award.

1999 Stock Incentive Plan.The 1999 Stock Incentive Plan provides for the issuance of a maximum of 16,000,000 shares of common stock (as adjusted to reflect stock splits) pursuant to awards granted under the plan. Awards may include incentive options and nonqualified options, stock appreciation rights, and restricted stock awards and restricted units. The number of shares reserved for issuance under the plan and the terms of awards may be adjusted upon certain events affecting the Company’s capitalization. This plan is also administered by the Compensation Committee.

1997 Key Employees’ Stock Option Plan. The Company’s 1997 Key Employees’ Stock Option Plan provides for the grant of incentive options and nonqualified options to purchase common stock to key employees and independent contractors in the Company’s service. The aggregate number of shares of common stock that may be issued pursuant to options granted under the plan may not exceed 10,400,000 shares (as adjusted to reflect stock splits), subject to adjustment upon certain events affecting the Company’s capitalization. This plan is also administered by the Compensation Committee.

As of March 31, 2004, the Company had granted options to employees, including the Named Executives, and consultants, for 40,455,986 shares of common stock under the Company’s stock incentive plans, of which options for 14,851,388 shares have been exercised and options for 3,249,860 shares have been forfeited. The exercise prices for outstanding options granted to employees under the plans range from $0.02 to $87.50 per share, with a weighted average exercise price of $14.31 per share. The weighted average exercise price of all outstanding options under the Company’s stock option plans (including those that the Company assumed in the RF Nitro and Resonext mergers) is $14.21. The Company also has granted restricted stock awards for a total of 2,421,584 shares of restricted stock under the 2003 Stock Incentive Plan, the 1999 Stock Incentive Plan and the RF Nitro Communications, Inc. 2001 Stock Incentive Plan.

Employee Stock Purchase Plan. The Company’s Employee Stock Purchase Plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Code. This plan is intended to encourage stock ownership through means of payroll deductions. All U.S. full-time employees (including officers) and all other employees (except for certain part-time and seasonal employees) are eligible to participate after being employed for three months. Directors who are not employees are not eligible to participate. An aggregate of 4,000,000 shares of common stock (as adjusted to reflect stock splits) has been reserved for offering under the stock purchase plan, subject to anti-dilution adjustments in the event of certain changes in the Company’s capital structure.

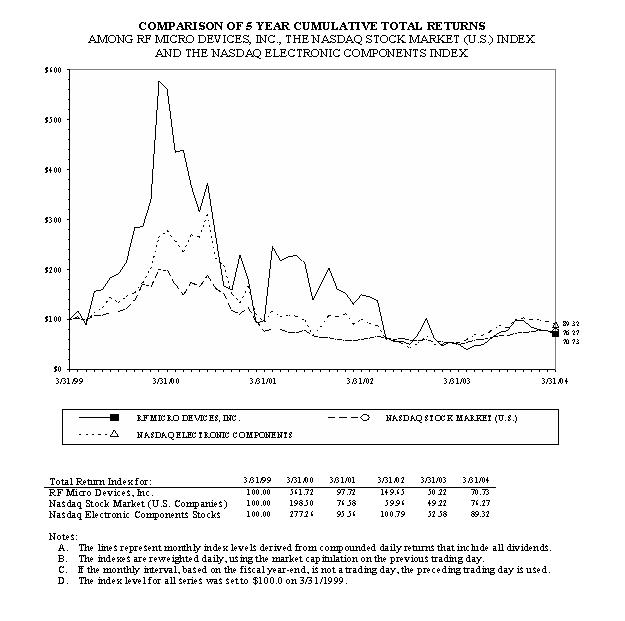

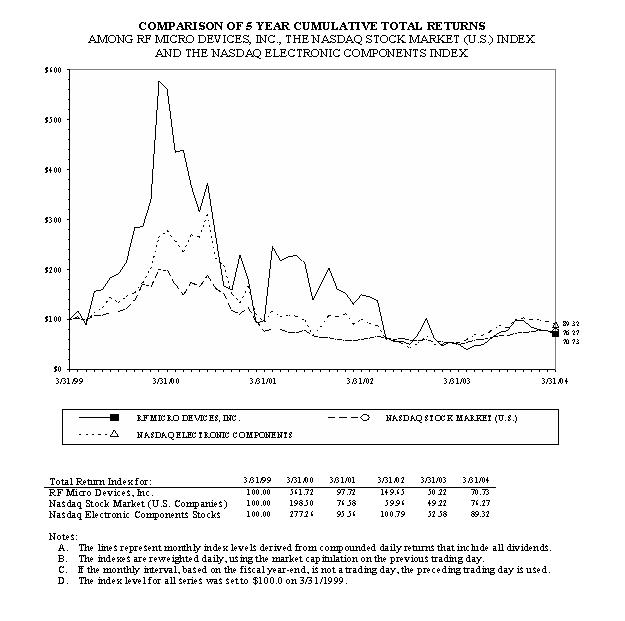

The Company makes no cash contributions to the stock purchase plan but bears the expenses of its administration. The plan is administered by the Compensation Committee, which has authority, among other things, to establish the number and duration of the purchase periods during the term of the plan and to interpret the terms of the plan.