Filed by TriQuint Semiconductor, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: RF Micro Devices, Inc.

Commission File No.: 000-22511

Date: November 18, 2014

Safe Harbor Language

Forward-Looking Statements

This communication contains forward-looking statements, including but not limited to those regarding the proposed business combination between RF Micro Devices, Inc. (“RFMD”) and TriQuint Semiconductor, Inc. (“TriQuint”) (the “Business Combination”) and the transactions related thereto. These statements may discuss the anticipated manner, terms and conditions upon which the Business Combination will be consummated, the future performance and trends of the combined businesses, the synergies expected to result from the Business Combination, and similar statements. Forward-looking statements may contain words such as “expect,” “believe,” “may,” “can,” “should,” “will,” “forecast,” “anticipate” or similar expressions, and include the assumptions that underlie such statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statemen ts, including but not limited to: the ability of the parties to consummate the Business Combination in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Business Combination, including the ability to secure regulat ory approvals in a timely manner or at all; the possibility of litigation (including related to the transaction itself); RFMD and TriQuint’s ability to successfully integrate their operations, product lines, technology and employees and realize synergies from the Business Combination; unknown, underestimated or undisclosed commitments or liabilities; the level of demand for the combined companies’ products, which is subject to many factors, including uncertain global economic and industry conditions, demand for electronic products and semiconductors, and customers’ new technology and capacity requirements; RFMD’s and

TriQuint’s ability to (i) develop, deliver and support a broad range of products, expand their markets and develop new markets, (ii) timely align their cost structures with business conditions, and (iii) attract, motivate and retain key employees; and o ther risks described in RFMD’s and TriQuint’s Securities and Exchange Commission (“SEC”) filings. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. Neither RFMD nor TriQuint undertakes any obligation to update any forward-looking statements.

© 2014 Qorvo, Inc. 2

No Offer or Solicitation

This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities, nor shall there be any sale, issuance or transfer of securities in any jurisdictio n in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find It

In connection with the proposed Business Combination, Qorvo, Inc., a newly-formed holding company under RFMD

(“Qorvo”), has filed with the SEC a Form S-4 (the “Registration Statement”), which was declared effective on July 30, 2014 and which includes a registration statement and a prospectus with respect to Qorvo’s shares to be issued in the Business Combination. The Registration Statement contains important information about the proposed Business Combination and related matters. SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE REGISTRATION STATEMENT CAREFULLY. The Registration Statement and other relevant materials and any other documents filed by Qorvo, RFMD or TriQuint with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, security holders of

TriQuint will be able to obtain free copies of the Registration Statement from TriQuint by contacting Investor Relations by mail at TriQuint Semiconductor, Inc., 2300 N.E. Brookwood Parkway, Hillsboro, Oregon 97124, Attn: Investor Relations Department, by telephone at (503) 615-9413, or by going to TriQuint’s Investor Relations page on its corporate website at www.triquint.com; and security holders of RFMD will be able to obtain free copies of the Registration Statement from RFMD by contacting Investor Relations by mail at RF Micro Devices, Inc., 7628 Thorndike Road Greensboro, North Carolina 27409-9421, Attn: Investor Relations Department, by telephone at (336) 678-7088, or by going to RFMD’s Investor Relations page on its corporate web site at www.rfmd.com.

© 2014 Qorvo, Inc. 3

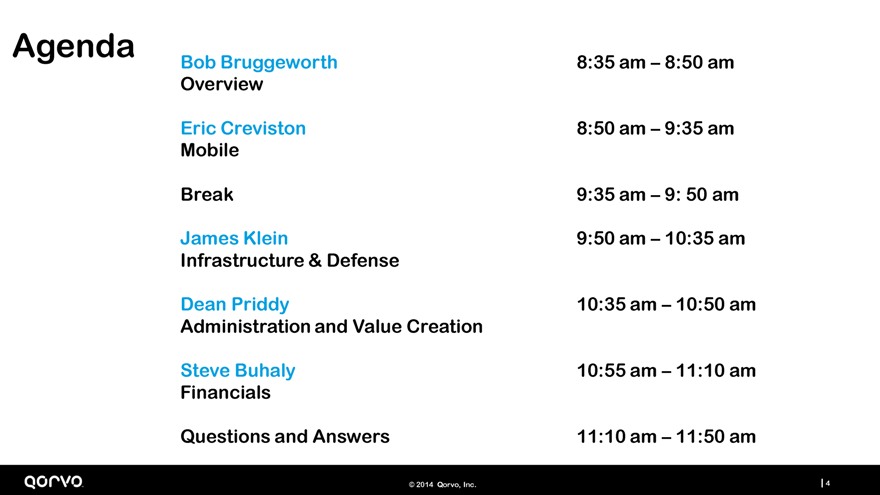

Agenda

Bob Bruggeworth 8:35 am – 8:50 am Overview

Eric Creviston 8:50 am – 9:35 am Mobile

Break 9:35 am – 9: 50 am

James Klein 9:50 am – 10:35 am Infrastructure & Defense

Dean Priddy 10:35 am – 10:50 am Administration and Value Creation

Steve Buhaly 10:55 am – 11:10 am Financials

Questions and Answers 11:10 am – 11:50 am

© 2014 Qorvo, Inc. 4

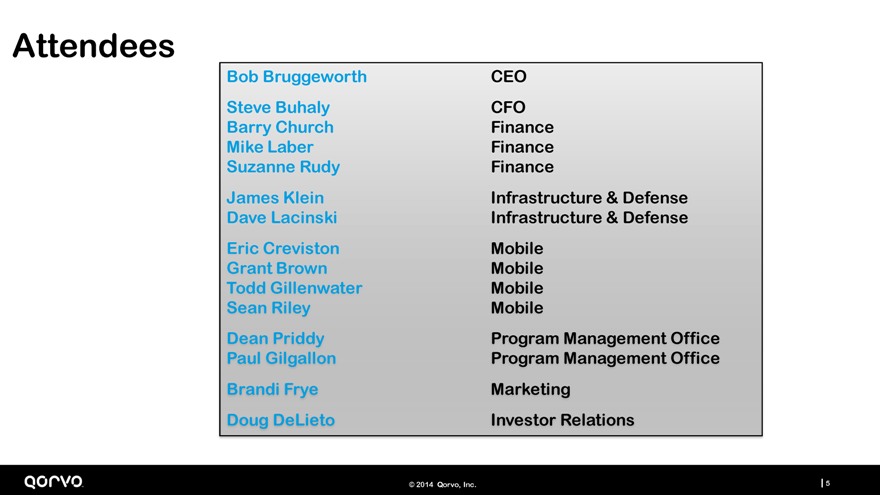

Attendees

Bob Bruggeworth CEO Steve Buhaly CFO Barry Church Finance Mike Laber Finance Suzanne Rudy Finance

James Klein Infrastructure & Defense Dave Lacinski Infrastructure & Defense Eric Creviston Mobile Grant Brown Mobile Todd Gillenwater Mobile Sean Riley Mobile Dean Priddy Program Management Office Paul Gilgallon Program Management Office Brandi Frye Marketing Doug DeLieto Investor Relations

© 2014 Qorvo, Inc. 5

RF at the Heart of Connectivity

Internet of Things Cellular/Wireless Infrastructure

Broadband/CATV

Smart Energy/AMI Wi-Fi Mobile Data Aerospace and Defense

Smartphones / tablets

$10+ Billion RF Market Growing at 10%-15%

© 2014 Qorvo, Inc. 6

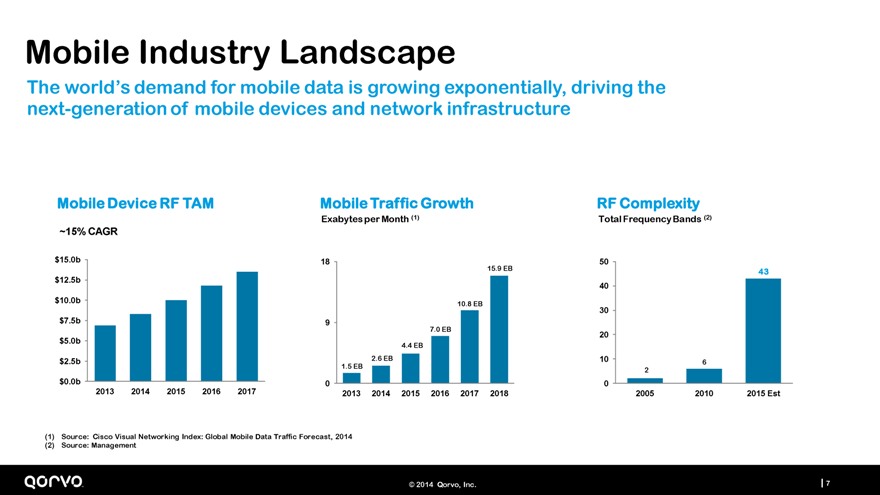

Mobile Industry Landscape

The world’s demand for mobile data is growing exponentially, driving the next-generation of mobile devices and network infrastructure

Mobile Device RF TAM

~15% CAGR

$15.0b

$12.5b

$10.0b

$7.5b

$5.0b

$2.5b

$0.0b

2013 2014 2015 2016 2017

Mobile Traffic Growth

Exabytes per Month (1)

18

15.9 EB

10.8 EB

9

7.0 EB

4.4 EB

2.6 EB

1.5 EB

0

2013 2014 2015 2016 2017 2018

RF Complexity

Total Frequency Bands (2)

50

43

40

30

20

10 6

2

0

2005 2010 2015 Est

(1) Source: Cisco Visual Networking Index: Global Mobile Data Traffic Forecast, 2014 (2) Source: Management

© 2014 Qorvo, Inc. 7

Infrastructure & Defense Landscape

Base Station

Optical

Defense

Wi-Fi

CATV

GaN

Worldwide 4G cellular infrastructure rollout Network upgrades to support data demand New products and trusted foundry capability Explosion in connected devices Residential data demand, primarily video Leadership in a disruptive growth opportunity

© 2014 Qorvo, Inc. 8

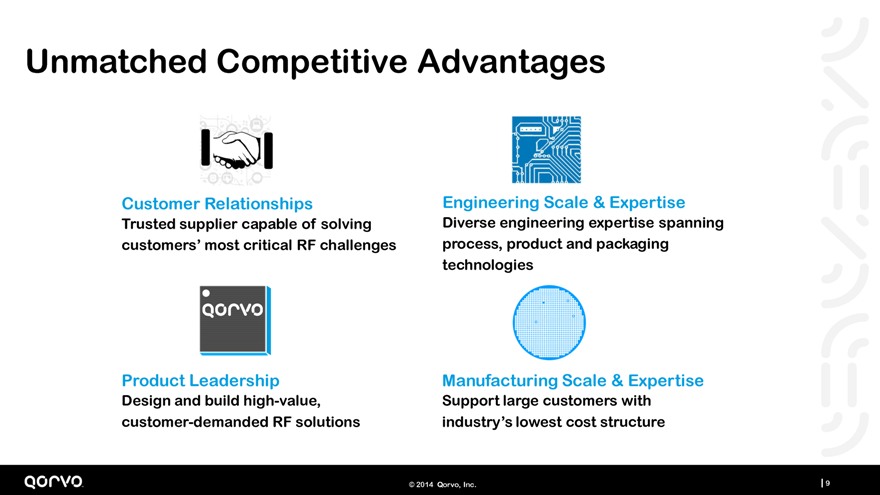

Unmatched Competitive Advantages

Customer Relationships Engineering Scale & Expertise

Trusted supplier capable of solving Diverse engineering expertise spanning customers’ most critical RF challenges process, product and packaging technologies

Product Leadership Manufacturing Scale & Expertise

Design and build high-value, Support large customers with customer-demanded RF solutions industry’s lowest cost structure

© 2014 Qorvo, Inc. 9

Innovation Driving Superior Financial Results

Superior

Financial Invest in Results Innovation

Create New Product &

Growth Technology

Opportunities Leadership

Solve

Customer

Challenges

© 2014 Qorvo, Inc. 10

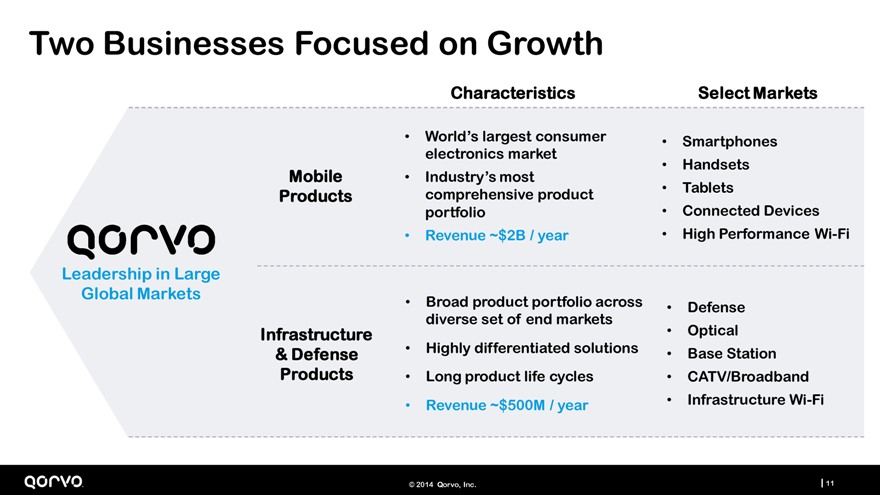

Two Businesses Focused on Growth

Characteristics Select Markets

World’s largest consumer Smartphones electronics market

Handsets

Mobile Industry’s most

Products comprehensive product Tablets portfolio Connected Devices

Revenue ~$2B / year High Performance Wi-Fi

Leadership in Large Global Markets

Broad product portfolio across Defense diverse set of end markets

Infrastructure Optical

& Defense Highly differentiated solutions Base Station Products Long product life cycles CATV/Broadband

Revenue ~$500M / year Infrastructure Wi-Fi

© 2014 Qorvo, Inc. 11

Mobile Products

© 2014 Qorvo, Inc.

Our Market is Transforming

© 2014 Qorvo, Inc. 13

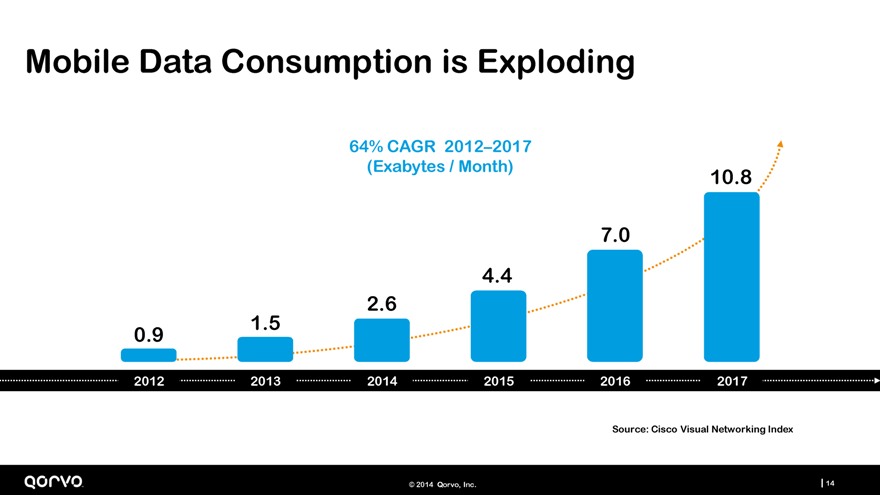

Mobile Data Consumption is Exploding

64% CAGR 2012–2017 (Exabytes / Month)

10.8

7.0

4.4

1.5 2.6

0.9

2012 2013 2014 2015 2016 2017

Source: Cisco Visual Networking Index

© 2014 Qorvo, Inc. 14

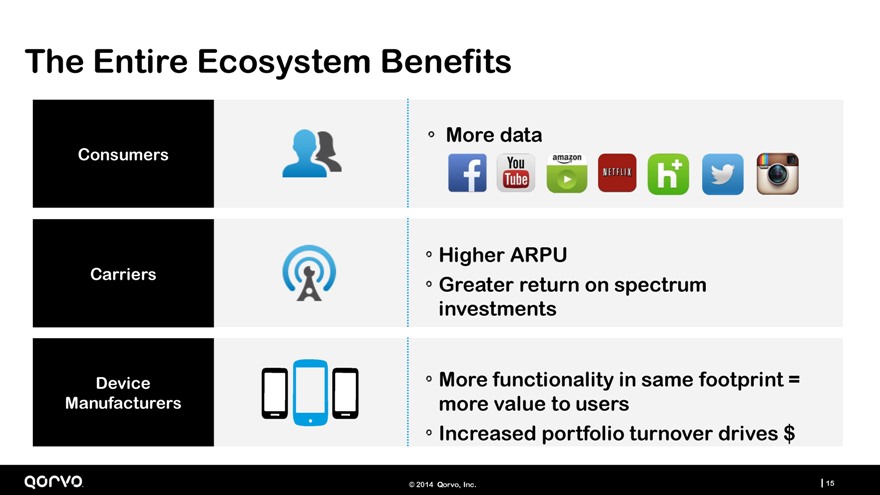

The Entire Ecosystem Benefits

More data

Consumers

Higher ARPU

Carriers

Greater return on spectrum investments

Device More functionality in same footprint = Manufacturers more value to users Increased portfolio turnover drives $

© 2014 Qorvo, Inc. 15

We Enable Mobile Data

Premium Filters

Carrier Aggregation Enables LTE bands, tightened specs, and carrier aggregation

Aggregates multiple frequency bands

(“carriers”) to increase mobile data Antenna Control throughput Solutions

Envelope Optimizes antenna efficiency to increase mobile data throughput, reduce overall footprint, and

Tracking support broader range of frequency bands Optimizes power efficiency in LTE PAs to increase mobile data throughput, High Performance Switching enhance network coverage, and extend battery life across all modes and bands

Maximizes device efficiency, minimizes complexity, and reduces overall footprint to enable LTE band count proliferation and increase mobile data throughput

© 2014 Qorvo, Inc. 16

Solving for Mobile Data

Every increase in mobile data throughput is achieved with enhancements in RF performance

Greater modulation

– New air interface standards

More bandwidth

– LTE band count

– Carrier aggregation

– MIMO

© 2014 Qorvo, Inc.

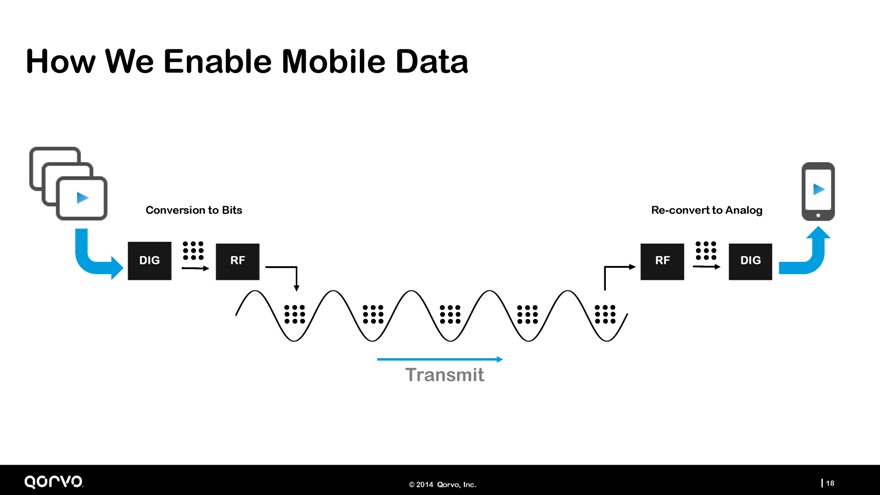

How We Enable Mobile Data

Conversion to Bits Re-convert to Analog

DIG RF RF DIG

Transmit

© 2014 Qorvo, Inc. 18

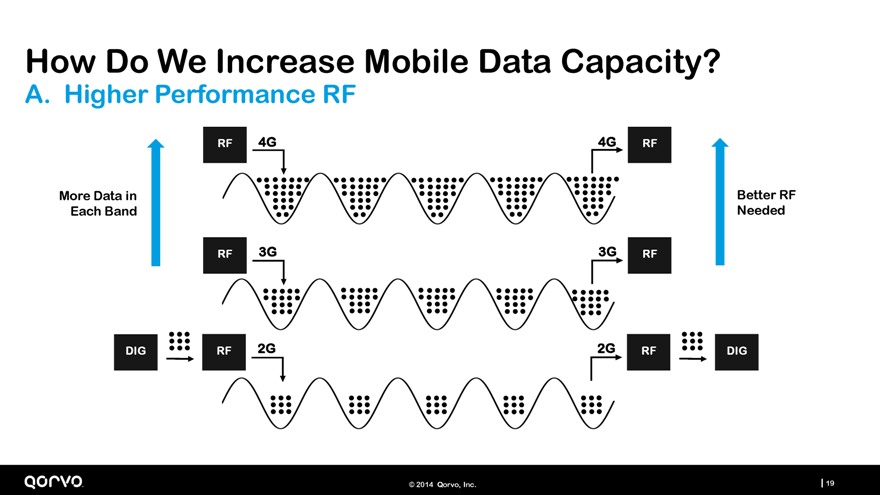

How Do We Increase Mobile Data Capacity?

A. Higher Performance RF

RF 4G 4G RF

More Data in Better RF

Each Band Needed

RF 3G 3G RF

DIG RF 2G 2G RF DIG

© 2014 Qorvo, Inc. 19

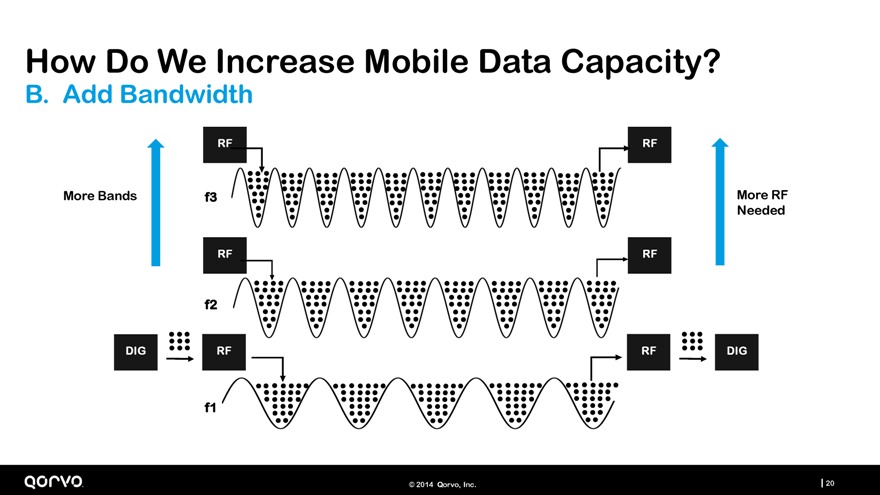

How Do We Increase Mobile Data Capacity?

B. Add Bandwidth

RF RF

More Bands f3 More RF Needed

RF RF

f2

DIG RF DIG

f1

© 2014 Qorvo, Inc. 20

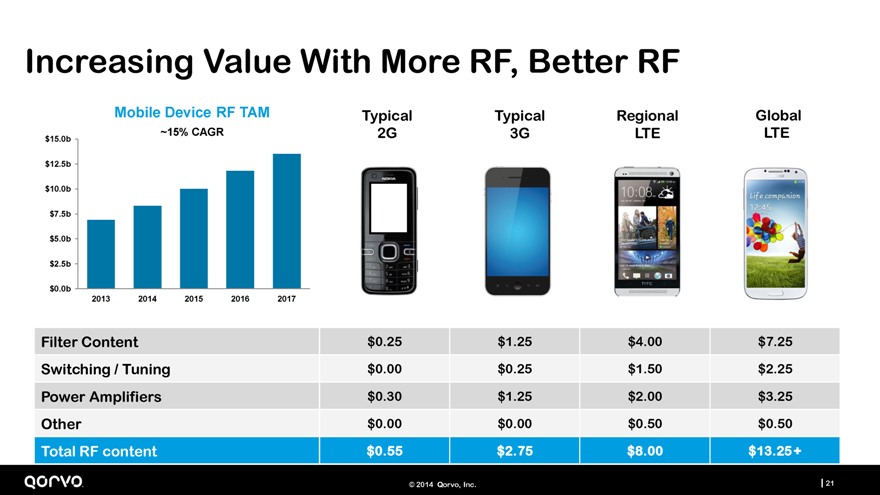

Increasing Value With More RF, Better RF

Mobile Device RF TAM

~15% CAGR

$15.0b

$12.5b

$10.0b

$7.5b

$5.0b

$2.5b

$0.0b

2013 2014 2015 2016 2017

Typical

2G

Typical

3G

Regional

LTE

Global LTE

Filter Content $0.25 $1.25 $4.00 $7.25

Switching / Tuning $0.00 $0.25 $1.50 $2.25

Power Amplifiers $0.30 $1.25 $2.00 $3.25

Other $0.00 $0.00 $0.50 $0.50

Total RF content $ 0.55 $ 2.75 $ 8.00 $13.25 +

© 2014 Qorvo, Inc. 21

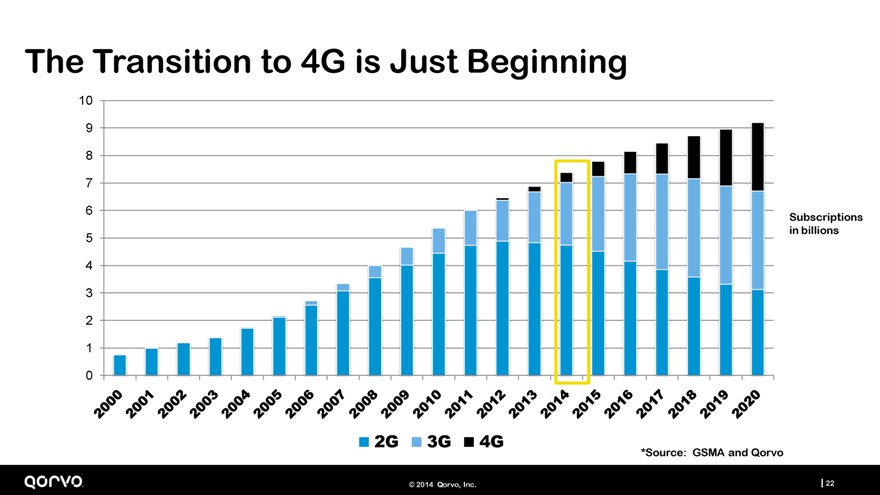

The Transition to 4G is Just Beginning

10

9

0

2G 3G 4G

*Source: GSMA and Qorvo

© 2014 Qorvo, Inc. 22

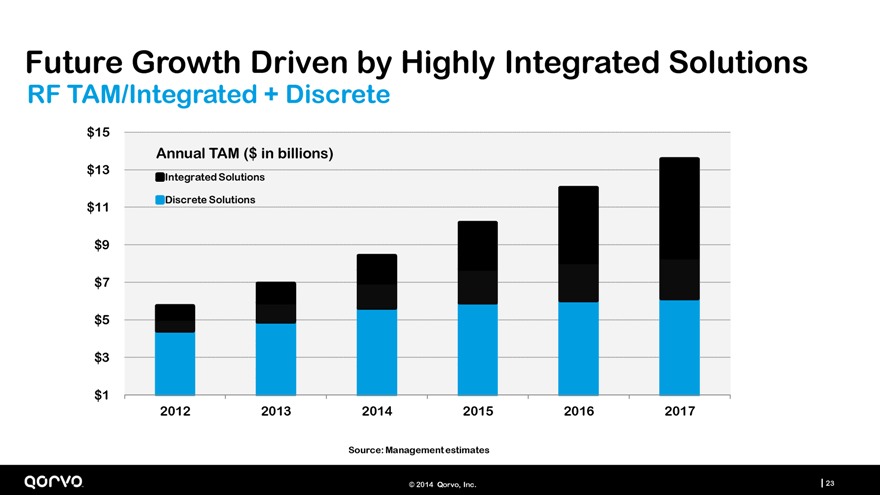

Future Growth Driven by Highly Integrated Solutions

RF TAM/Integrated + Discrete

$15

Annual TAM ($ in billions)

$13 Integrated Solutions

$11 Discrete Solutions

$9

$7

$5

$3

$1

2012 2013 2014 2015 2016 2017

Source: Management estimates

© 2014 Qorvo, Inc. 23

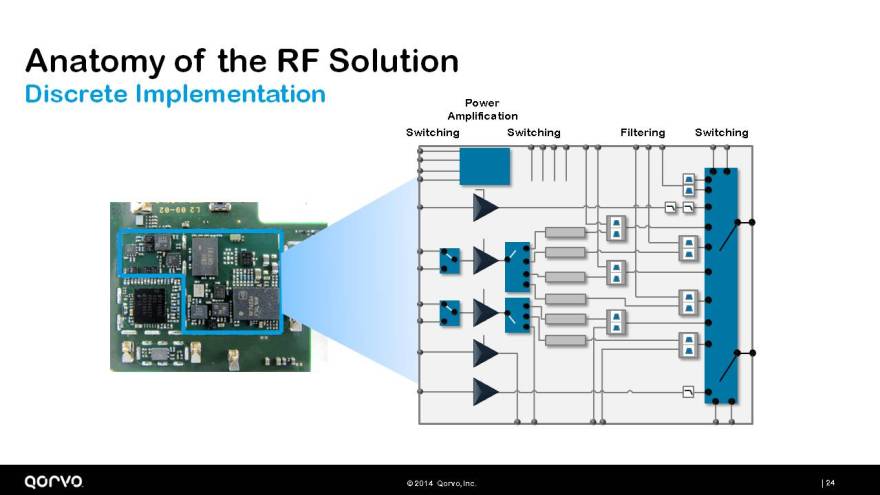

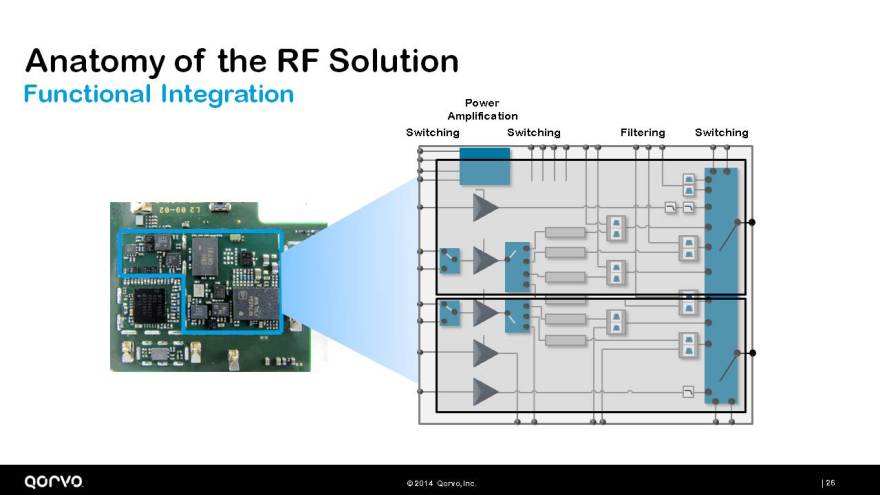

Anatomy of the RF Solution

Discrete Implementation Power

© 2014 Qorvo, Inc. 24

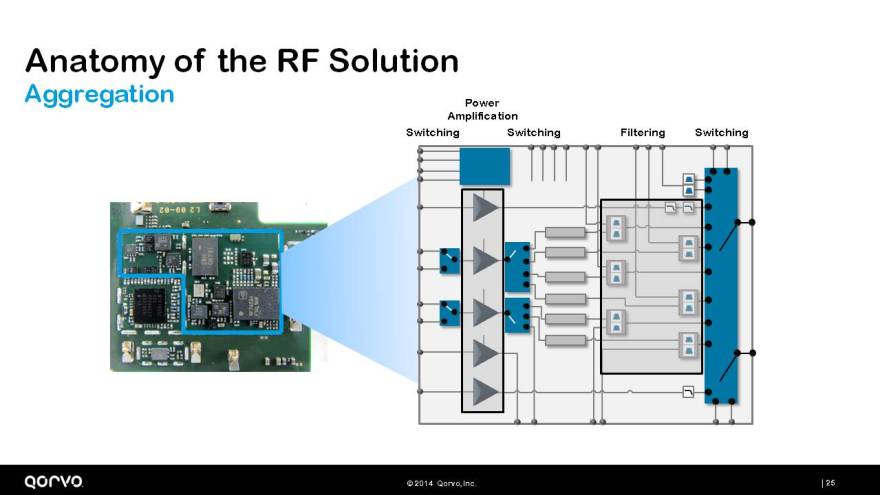

Anatomy of the RF Solution

Aggregation

© 2014 Qorvo, Inc. 25

Anatomy of the RF Solution

Functional Integration Power

© 2014 Qorvo, Inc. 26

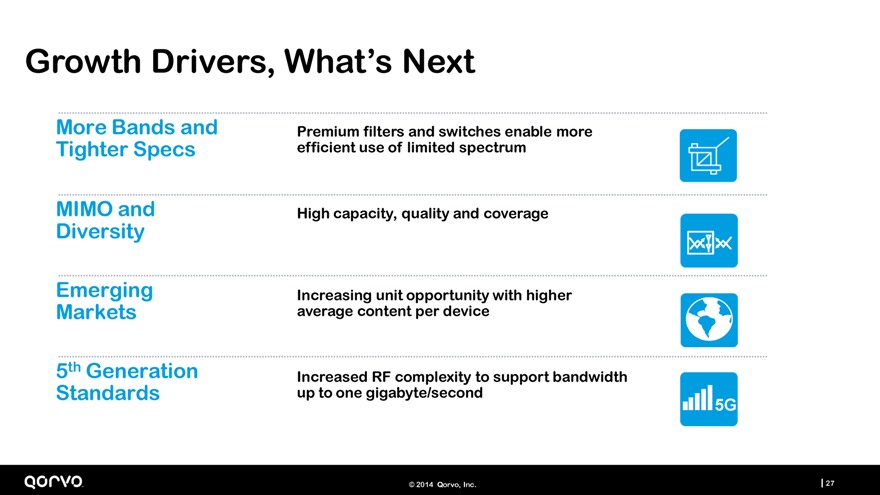

Growth Drivers, What’s Next

More Bands and Premium filters and switches enable more

Tighter Specs efficient use of limited spectrum

MIMO and High capacity, quality and coverage

Diversity

Emerging Increasing unit opportunity with higher Markets average content per device

5th Generation

Increased RF complexity to support bandwidth

Standards up to one gigabyte/second

5G

© 2014 Qorvo, Inc. 27

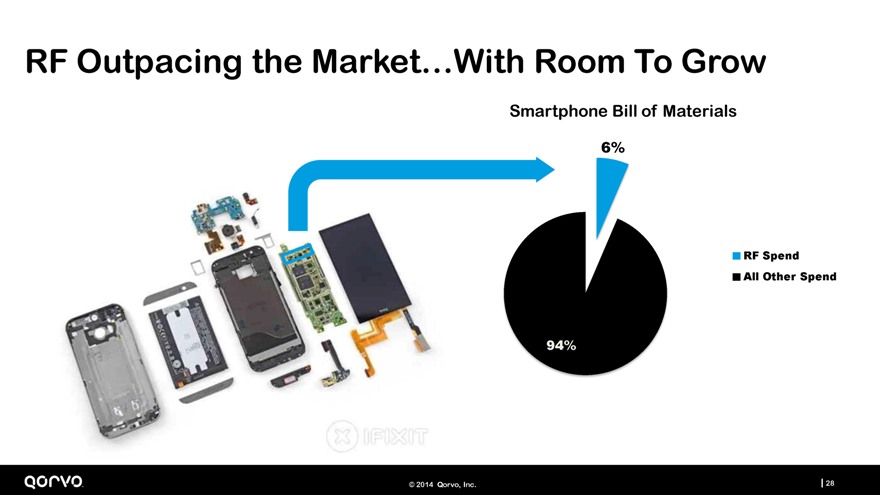

RF Outpacing the Market…With Room To Grow

Smartphone Bill of Materials

6%

RF Spend

All Other Spend

94%

© 2014 Qorvo, Inc. 28

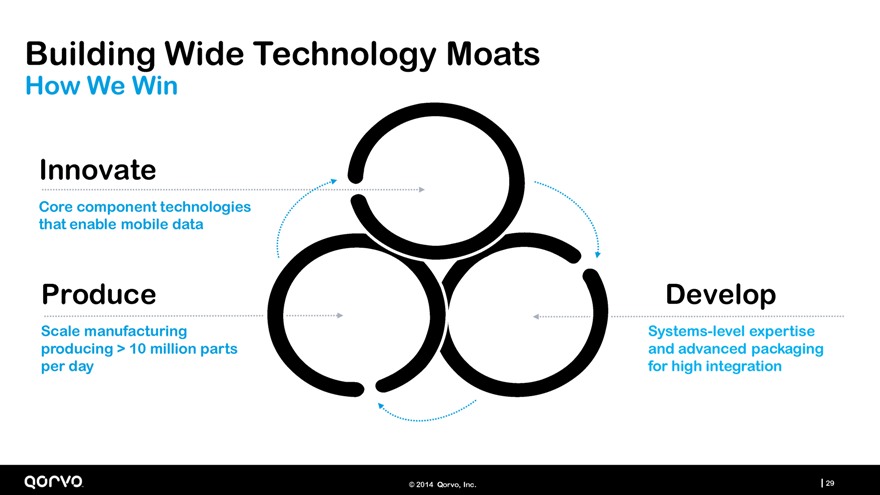

Building Wide Technology Moats

How We Win

Innovate

Core component technologies that enable mobile data

Produce

Scale manufacturing producing > 10 million parts per day

Develop

Systems-level expertise and advanced packaging for high integration

© 2014 Qorvo, Inc. 29

In Summary…

It’s an extraordinary time in RF

Demand for mobile data is exploding Our market is transforming Our business is becoming more profitable Qorvo is uniquely positioned to win

© 2014 Qorvo, Inc. 30

15-Minute Break

Infrastructure and Defense

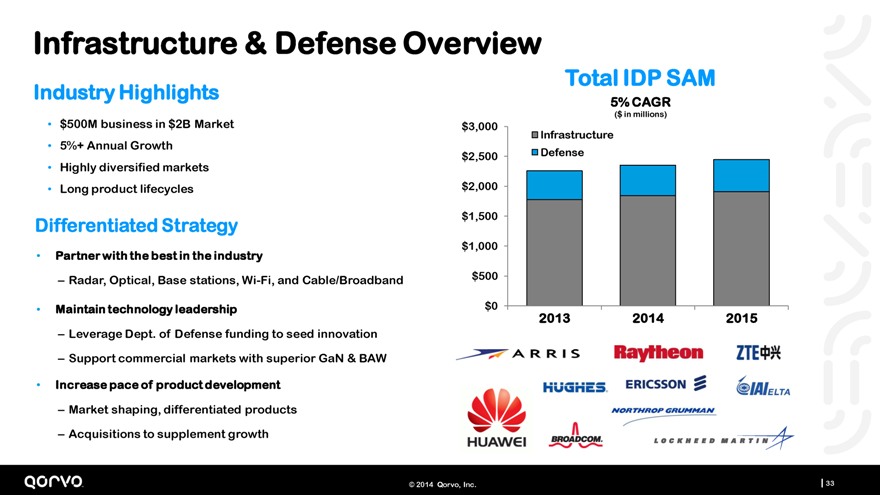

Infrastructure & Defense Overview

Industry Highlights

$500M business in $2B Market 5%+ Annual Growth Highly diversified markets Long product lifecycles

Differentiated Strategy

Partner with the best in the industry

Radar, Optical, Base stations, Wi-Fi, and Cable/Broadband

Maintain technology leadership

Leverage Dept. of Defense funding to seed innovation

Support commercial markets with superior GaN & BAW

Increase pace of product development

Market shaping, differentiated products

Acquisitions to supplement growth

Total IDP SAM

5% CAGR

($ in millions)

$3,000

Infrastructure

$2,500 Defense

$2,000

$1,500

$1,000

$500

$0

2013 2014 2015

© 2014 Qorvo, Inc. 33

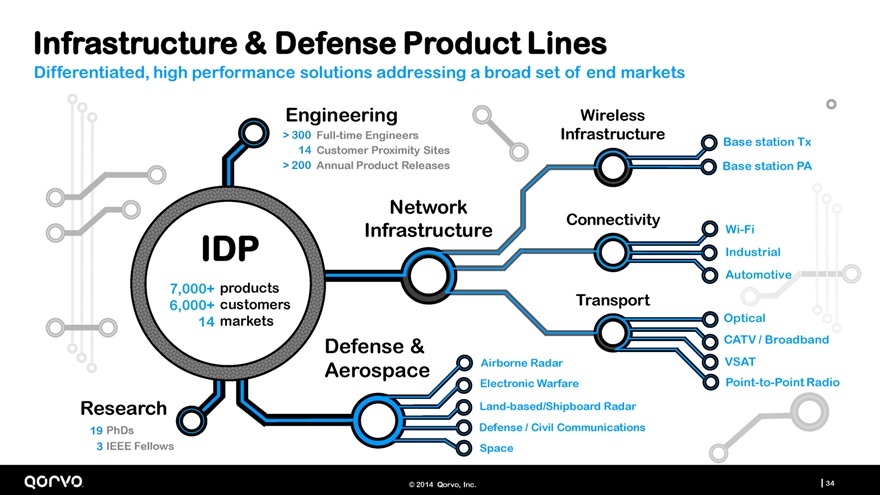

Infrastructure & Defense Product Lines

Differentiated, high performance solutions addressing a broad set of end markets

Engineering Wireless

> 300 Full-time Engineers Infrastructure

Base station Tx

14 Customer Proximity Sites

> 200 Annual Product Releases Base station PA

Network

Connectivity

Infrastructure Wi-Fi

IDP Industrial Automotive

7,000+ products

6,000+ customers Transport

14 markets Optical

Defense & CATV / Broadband

Aerospace Airborne Radar VSAT

Electronic Warfare Point-to-Point Radio

Research Land-based/Shipboard Radar

19 PhDs Defense / Civil Communications

3 IEEE Fellows Space

© 2014 Qorvo, Inc. 34

Comprehensive Product Portfolio

Premium performance spanning the frequency spectrum

Electronic Warfare

Amplifiers

Discrete transistors

Switches

Control products

Navigation

Filters

LNA / filter module

Base Station

Amplifiers

Filters

Variable attenuators

Linear drivers

Mixers

PtP / VSAT

Amplifiers

Converters

Mixers

Filters

Doublers w/amps

Control products

Space / Satellites

Amplifiers

Filters

LNAs

Switches

Control products

Radar

Amplifiers

LNAs

Discrete transistors

Converters

Switches

Control products

Filters

Communications

Amplifiers

LNAs

Discrete transistors

Switches

Filters

Converters / mixers

Control products

Optical

Amplifiers

Control products

TIAs

Connectivity (Wi-Fi)

Amplifiers / LNAs

Switches

Converters

Integrated products

Filters & duplexers

Cable / Broadband

Amplifiers

Filters

TIAs / analog TIAs

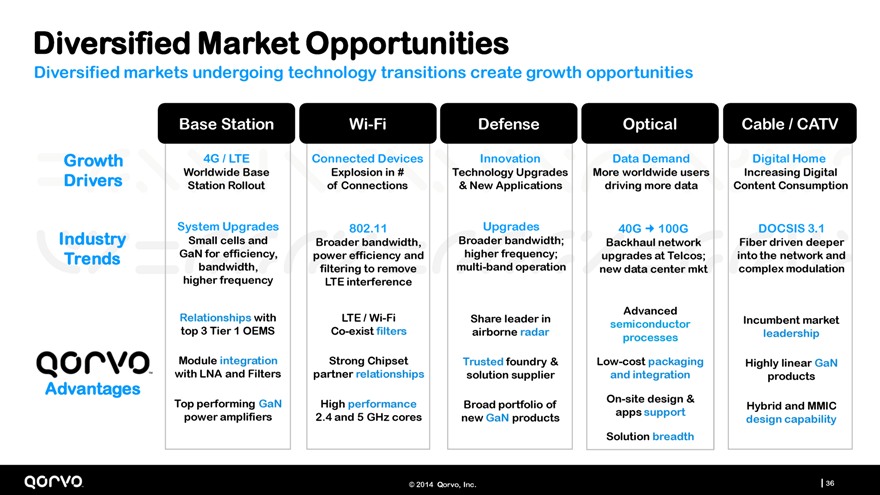

Diversified Market Opportunities

Diversified markets undergoing technology transitions create growth opportunities

Growth Drivers

Industry Trends

Advantages

Base Station

4G / LTE

Worldwide Base Station Rollout

System Upgrades

Small cells and GaN for efficiency, bandwidth, higher frequency

Relationships with top 3 Tier 1 OEMS

Module integration with LNA and Filters

Top performing GaN power amplifiers

Wi-Fi

Connected Devices

Explosion in # of Connections

802.11

Broader bandwidth, power efficiency and filtering to remove LTE interference

LTE / Wi-Fi Co-exist filters

Strong Chipset partner relationships

High performance 2.4 and 5 GHz cores

Defense

Innovation

Technology Upgrades

& New Applications

Upgrades

Broader bandwidth; higher frequency; multi-band operation

Share leader in airborne radar

Trusted foundry & solution supplier

Broad portfolio of new GaN products

Optical

Data Demand

More worldwide users

driving more data

40G 100G

Backhaul network

upgrades at Telcos;

new data center mkt

Advanced

semiconductor

processes

Low-cost packaging

and integration

On-site design &

apps support

Solution breadth

Cable / CATV

Digital Home

Increasing Digital Content Consumption

DOCSIS 3.1

Fiber driven deeper into the network and complex modulation

Incumbent market leadership

Highly linear GaN products

Hybrid and MMIC design capability

© 2014 Qorvo, Inc.

36

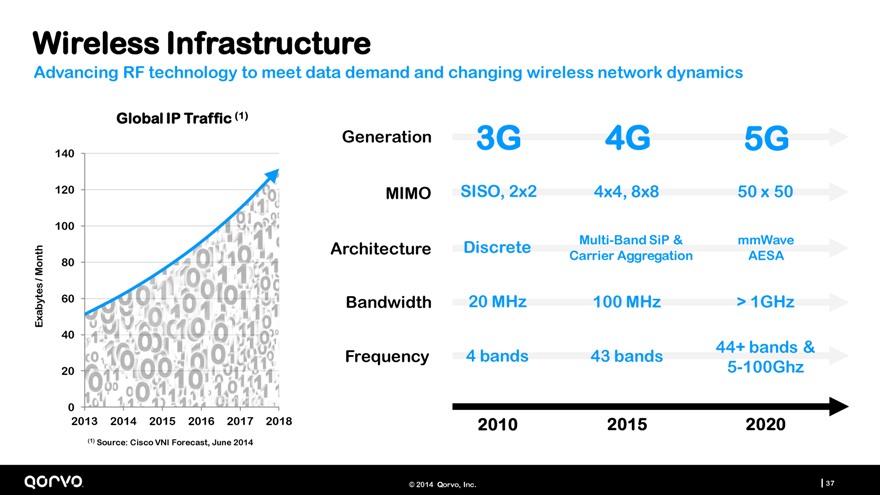

Wireless Infrastructure

Advancing RF technology to meet data demand and changing wireless network dynamics

Global IP Traffic (1)

Generation 3G 4G 5G

MIMO SISO, 2x2 4x4, 8x8 50 x 50

Architecture Discrete Multi-Band SiP & mmWave

Carrier Aggregation AESA

Bandwidth 20 MHz 100 MHz > 1GHz

Frequency 4 bands 43 bands 44+ bands &

5-100Ghz

2010 2015 2020

140

120

100

Month 80

/

Exabytes 60

40

20

0

2013 2014 2015 2016 2017 2018

(1) Source: Cisco VNI Forecast, June 2014

© 2014 Qorvo, Inc.

37

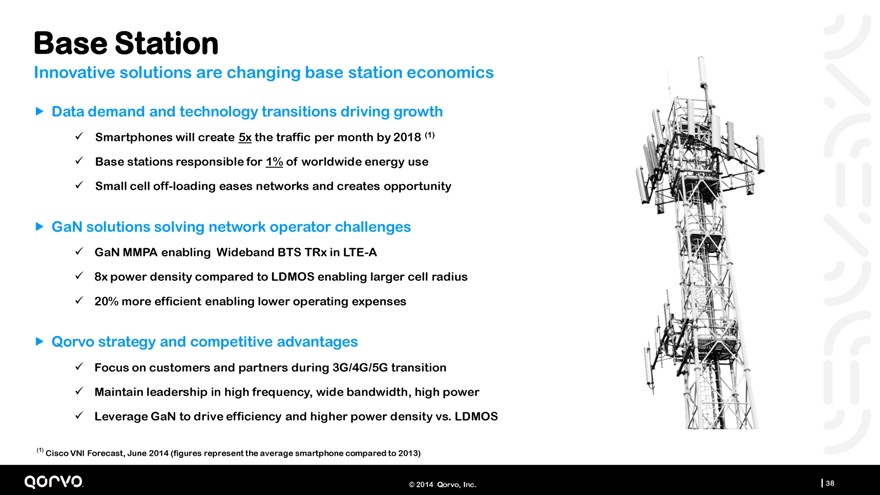

Base Station

Innovative solutions are changing base station economics

Data demand and technology transitions driving growth

Smartphones will create 5x the traffic per month by 2018 (1) Base stations responsible for 1% of worldwide energy use Small cell off-loading eases networks and creates opportunity

GaN solutions solving network operator challenges

GaN MMPA enabling Wideband BTS TRx in LTE-A

8x power density compared to LDMOS enabling larger cell radius 20% more efficient enabling lower operating expenses

Qorvo strategy and competitive advantages

Focus on customers and partners during 3G/4G/5G transition Maintain leadership in high frequency, wide bandwidth, high power Leverage GaN to drive efficiency and higher power density vs. LDMOS

(1) Cisco VNI Forecast, June 2014 (figures represent the average smartphone compared to 2013)

© 2014 Qorvo, Inc.

38

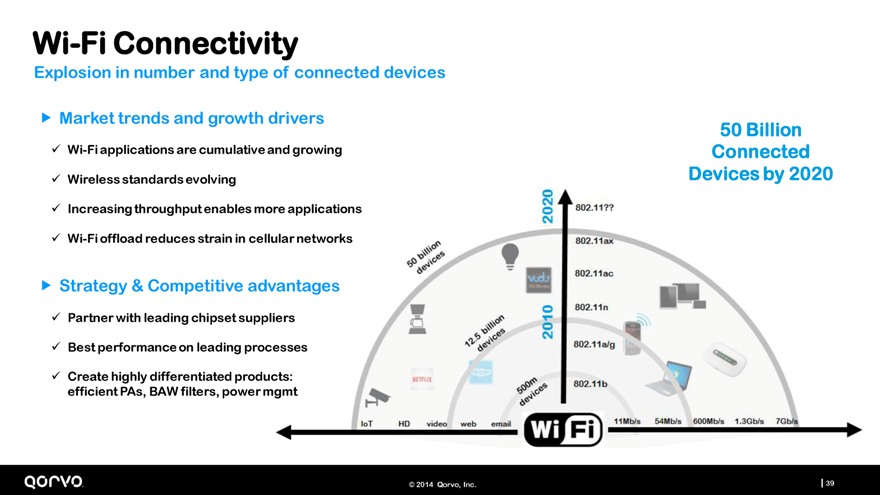

Wi-Fi Connectivity

Explosion in number and type of connected devices

Market trends and growth drivers

Wi-Fi applications are cumulative and growing Wireless standards evolving Increasing throughput enables more applications Wi-Fi offload reduces strain in cellular networks

Strategy & Competitive advantages

Partner with leading chipset suppliers

Best performance on leading processes

Create highly differentiated products: efficient PAs, BAW filters, power mgmt

50 Billion Connected Devices by 2020

© 2014 Qorvo, Inc.

39

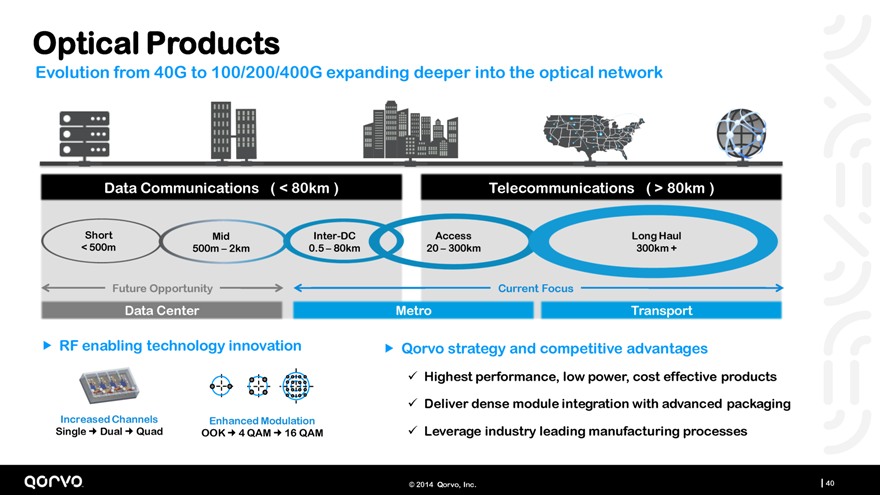

Optical Products

Evolution from 40G to 100/200/400G expanding deeper into the optical network

Data Communications ( < 80km )

Short Mid Inter-DC Access Long Haul

< 500m 500m – 2km 0.5 – 80km 20 – 300km 300km +

Telecommunications ( > 80km )

Future Opportunity

Current Focus

Data Center Metro Transport

RF enabling technology innovation

Increased Channels Enhanced Modulation Single Dual Quad OOK 4 QAM 16 QAM

Qorvo strategy and competitive advantages

Highest performance, low power, cost effective products

Deliver dense module integration with advanced packaging Leverage industry leading manufacturing processes

© 2014 Qorvo, Inc.

40

CATV / Broadband

Data consumption and video pushing bandwidth demands closer to the home

The race is on for broadband subscribers

Carrier competition creating pressure to upgrade networks

IP video will be 79% of all traffic by 2018 (66% in 2013)

Fiber is moving closer to the home

DOCSIS 3.1 being deployed to support demand

Sizable GaN opportunity

GaN addresses power efficiency and increased bandwidth

Same linearity performance as GaAs with 20% less current

Qorvo strategy and competitive advantages

Market and product leadership

Highly linear GaN-based products

Leverage hybrid and MMIC design capabilities

Consumer IP Video Traffic

Exabytes per month

100 90 80 70 60 50 40 30 20 10

0

2013 2014 2015 2016 2017 2018

(Cisco VNI Forecast, 2014)

© 2014 Qorvo, Inc.

41

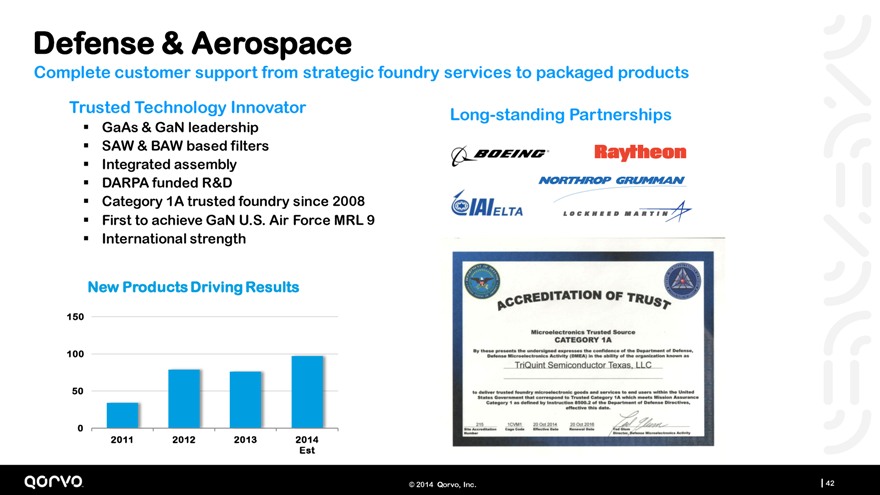

Defense & Aerospace

Complete customer support from strategic foundry services to packaged products

Trusted Technology Innovator

GaAs & GaN leadership SAW & BAW based filters Integrated assembly DARPA funded R&D

Category 1A trusted foundry since 2008 First to achieve GaN U.S. Air Force MRL 9 International strength

New Products Driving Results

150

100

50

0

2011 2012 2013 2014

Est

Long-standing Partnerships

© 2014 Qorvo, Inc.

42

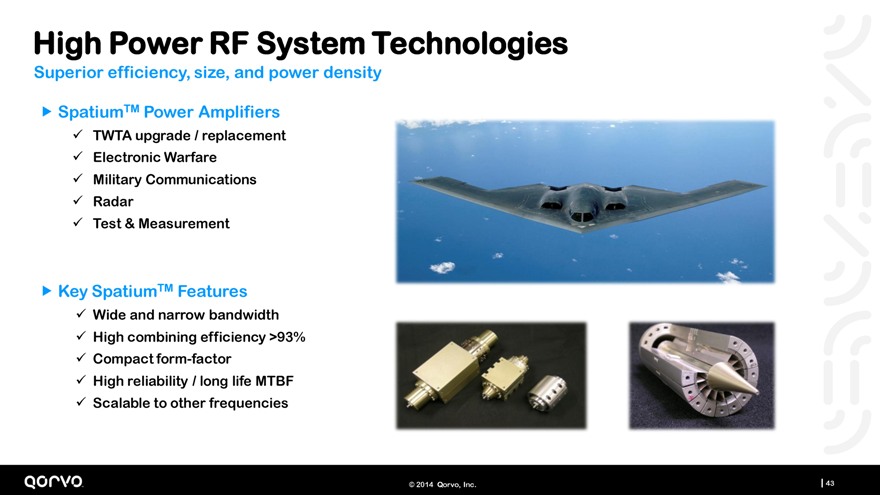

High Power RF System Technologies

Superior efficiency, size, and power density

SpatiumTM Power Amplifiers

TWTA upgrade / replacement Electronic Warfare Military Communications Radar Test & Measurement

Key SpatiumTM Features

Wide and narrow bandwidth High combining efficiency >93% Compact form-factor High reliability / long life MTBF Scalable to other frequencies

© 2014 Qorvo, Inc.

43

Creating the Infrastructure and Defense Market Leader

Diversified end markets Long-standing partnerships Comprehensive product portfolio Best performance & leading processes Trusted technology leadership

© 2014 Qorvo, Inc.

44

Value Creation

EVP Administration and Value Creation

Human Resources Information Technology Integration Value Creation

© 2014 Qorvo, Inc.

46

Human Resources

Retaining, attracting and inspiring our most valuable asset – our employees Advancing careers, talent, and corporate culture

Information Technology

Making all tomorrows better Single source of the truth

Uniformity model: Common platforms, unlimited freedom to innovate Acquisition-ready

© 2014 Qorvo, Inc.

47

Value Creation: Program Management Office

Where product and technology leadership intersect with the lowest possible cost structure

Synergies

$ 150 Million in Cost Synergies

Execution Track Record, Proven Techniques

Best-of-Best Benchmarking Zero-Based Analysis Should-Cost Models PEA Analysis Global RFQs

© 2014 Qorvo, Inc.

48

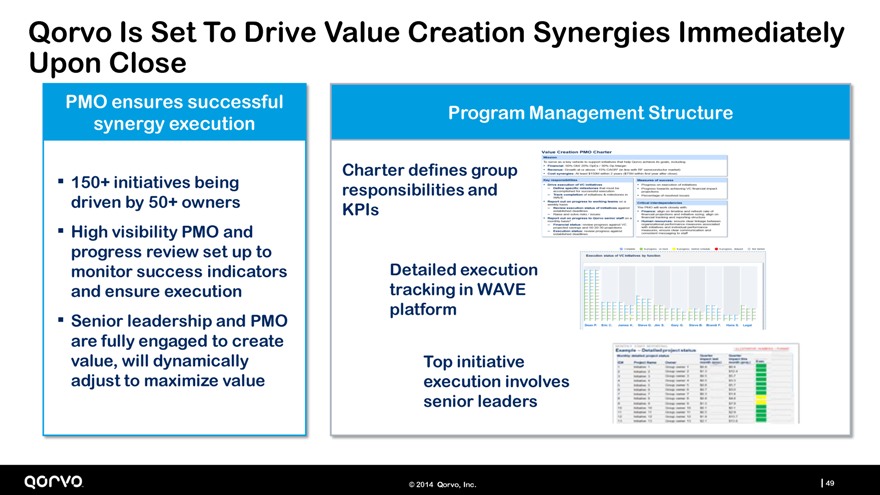

Qorvo Is Set To Drive Value Creation Synergies Immediately Upon Close

PMO ensures successful synergy execution

150+ initiatives being driven by 50+ owners

High visibility PMO and progress review set up to monitor success indicators and ensure execution

Senior leadership and PMO are fully engaged to create value, will dynamically adjust to maximize value

Program Management Structure

Charter defines group responsibilities and KPIs

Detailed execution tracking in WAVE platform

Top initiative execution involves senior leaders

© 2014 Qorvo, Inc.

49

Financials

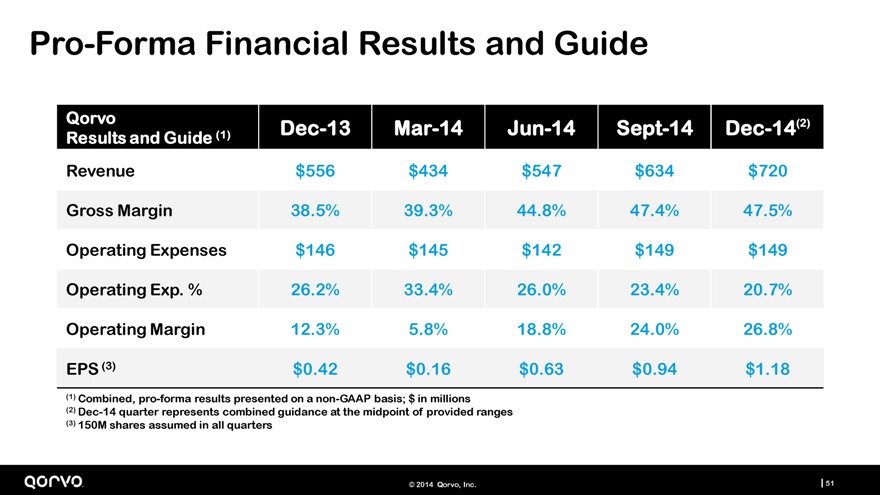

Pro-Forma Financial Results and Guide

Qorvo Dec-13 Mar-14 Jun-14 Sept-14 Dec-14(2)

Results and Guide (1)

Revenue $556 $434 $547 $634 $720

Gross Margin 38.5% 39.3% 44.8% 47.4% 47.5%

Operating Expenses $146 $145 $142 $149 $149

Operating Exp. % 26.2% 33.4% 26.0% 23.4% 20.7%

Operating Margin 12.3% 5.8% 18.8% 24.0% 26.8%

EPS (3) $0.42 $0.16 $0.63 $0.94 $1.18

(1) Combined, pro-forma results presented on a non-GAAP basis; $ in millions

(2) Dec-14 quarter represents combined guidance at the midpoint of provided ranges

(3) 150M shares assumed in all quarters

© 2014 Qorvo, Inc.

51

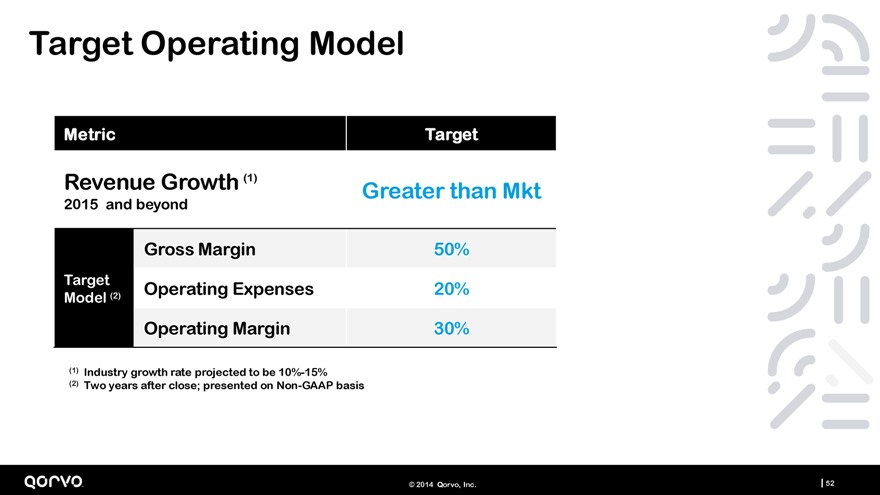

Target Operating Model

Metric Target

Revenue Growth (1)

2015 and beyond

Greater than Mkt

Gross Margin 50%

Target Operating Expenses 20%

Model (2)

Operating Margin 30%

Industry growth rate projected to be 10%-15%

Two years after close; presented on Non-GAAP basis

© 2014 Qorvo, Inc.

52

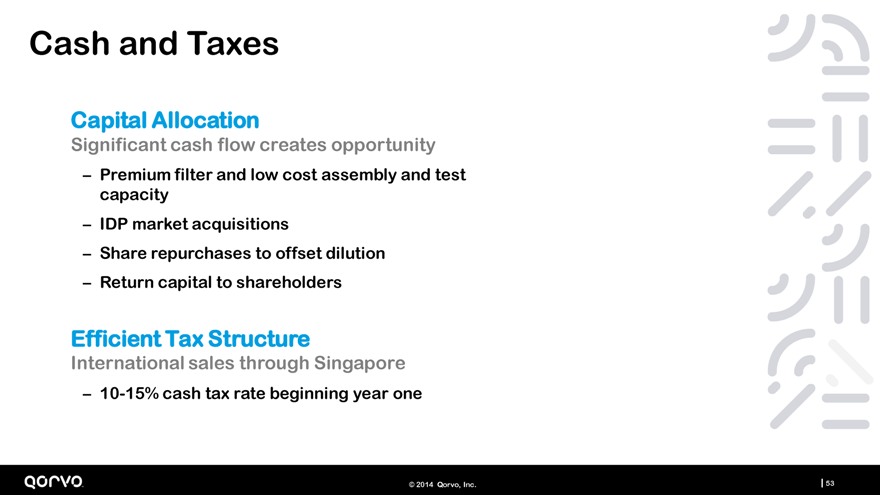

Cash and Taxes

Capital Allocation

Significant cash flow creates opportunity

Premium filter and low cost assembly and test capacity

IDP market acquisitions

Share repurchases to offset dilution

Return capital to shareholders

Efficient Tax Structure

International sales through Singapore

10-15% cash tax rate beginning year one

© 2014 Qorvo, Inc.

53

Summary

© 2014 Qorvo, Inc.

Summary

Qorvo is leveraged to today’s growth opportunities and is uniquely positioned to win

Building A New Leader in RF Growing 10%-15% per year

Diversified by markets, customers, and products New operating model (50/20/30) Investing in wide, defensible technology moats Cash flow to support share repurchases, M&A, etc.

© 2014 Qorvo, Inc.

55

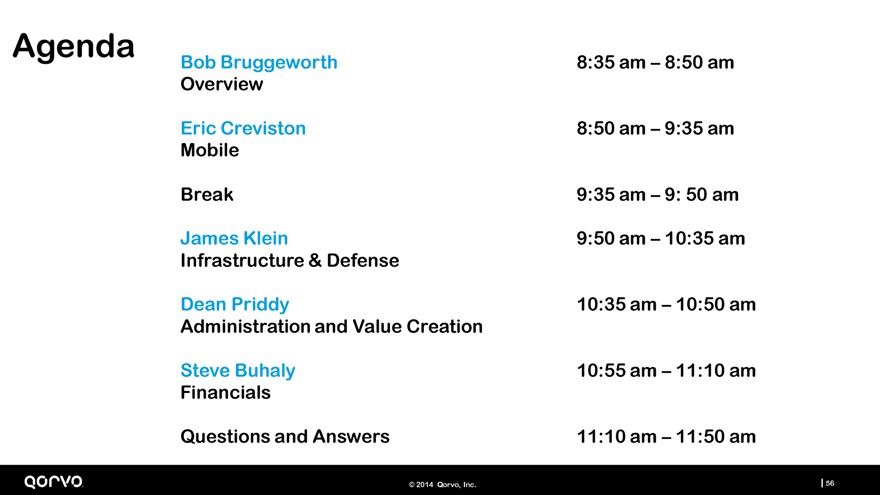

Agenda

Bob Bruggeworth 8:35 am – 8:50 am

Overview

Eric Creviston 8:50 am – 9:35 am

Mobile

Break 9:35 am – 9: 50 am

James Klein 9:50 am – 10:35 am

Infrastructure & Defense

Dean Priddy 10:35 am – 10:50 am

Administration and Value Creation

Steve Buhaly 10:55 am – 11:10 am

Financials

Questions and Answers 11:10 am – 11:50 am

© 2014 Qorvo, Inc.

56

Thank You