SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement | | |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

TRIMERIS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x No | | fee required. (14a-6(i)(2)) |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ¨ | | Fee previously paid with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing party:

(4) Date filed:

TRIMERIS, INC.

3518 WESTGATE DRIVE, SUITE 300

DURHAM, NORTH CAROLINA 27707

MAY 14, 2003

To the Stockholders of TRIMERIS, INC.

You are cordially invited to attend the 2003 Annual Meeting of the Stockholders of Trimeris, Inc., to be held at the North Carolina Biotechnology Center, 15 Alexander Drive, Research Triangle Park, North Carolina 27709, on June 18, 2003 at 2:00 p.m. (local time).

We have enclosed details of the business that we will conduct at the Annual Meeting and other information about Trimeris, Inc. in the enclosed Notice of Annual Meeting and Proxy Statement. We urge you to read the Notice of Annual Meeting and Proxy Statement carefully.

If you do not plan to attend the Annual Meeting, please sign, date, and return the enclosed proxy promptly in the accompanying reply envelope. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the Annual Meeting.

We look forward to seeing you at the Annual Meeting.

| Dr. Dani P. Bolognesi |

Chief Executive Officer |

YOUR VOTE IS IMPORTANT. TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE (TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES).

TRIMERIS, INC.

3518 WESTGATE DRIVE, SUITE 300

DURHAM, NORTH CAROLINA 27707

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 18, 2003

The Annual Meeting of Stockholders of Trimeris, Inc. (“Trimeris” or the “Company”) will be held at the North Carolina Biotechnology Center, 15 Alexander Drive, Research Triangle Park, North Carolina 27709, on June 18, 2003 at 2:00 p.m. (local time) (the “Annual Meeting”) to consider and vote upon the following matters, which are more fully described in the accompanying Proxy Statement:

| | 1. | | To elect two members of the Board of Directors for the term of office stated in the Proxy Statement. The Board has nominated the following persons for election for the two Class III Director seats at the Annual Meeting: Dr. Dani P. Bolognesi and Dr. J. Richard Crout; |

| | 2. | | To ratify the appointment of KPMG LLP as the Company’s independent accountants for the fiscal year ending December 31, 2003; |

| | 3. | | To consider and approve an amendment to the Company’s Amended and Restated Stock Incentive Plan (the “Stock Incentive Plan”) to increase the number of authorized shares issuable under the Stock Incentive Plan by 1,300,000 and to provide an annual grant limit; and |

| | 4. | | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. All stockholders of record at the close of business on May 2, 2003 will be entitled to vote at the Annual Meeting and at any adjournments thereof. The transfer books will not be closed. For a period of at least ten days prior to the Annual Meeting, a list of stockholders entitled to vote at the Annual Meeting will be available for inspection during ordinary business hours at the offices of the Company.

By Order of the Board of Directors,

Timothy J. Creech

Secretary

Durham, North Carolina

May 14, 2003

ABSTENTIONS AND BROKER NONVOTES WILL BE COUNTED FOR PURPOSES OF DETERMINING WHETHER A QUORUM IS PRESENT AT THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ACCOMPANYING PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. YOU MAY REVOKE YOUR PROXY IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON, IF YOU WISH TO DO SO, EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY.

TRIMERIS, INC.

3518 WESTGATE DRIVE, SUITE 300

DURHAM, NORTH CAROLINA 27707

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 18, 2003

The enclosed proxy is solicited on behalf of the Board of Directors of Trimeris, Inc., a Delaware corporation (“Trimeris” or the “Company”), for use at the annual meeting of stockholders to be held at 2:00 p.m. (local time) on June 18, 2003, and at any adjournment or postponement of the annual meeting (the “Annual Meeting”). The Annual Meeting will be held at the North Carolina Biotechnology Center, 15 Alexander Drive, Research Triangle Park, North Carolina 27709. All stockholders of record on May 2, 2003 will be entitled to notice of and to vote at the Annual Meeting. This Proxy Statement and accompanying proxy (the “Proxy”) will be first mailed to stockholders on or about May 21, 2003.

The mailing address of the principal executive office of the Company is 3518 Westgate Drive, Suite 300, Durham, North Carolina 27707.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders (collectively, the “Proposals”). Each Proposal is described in more detail in this Proxy Statement.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Voting

May 2, 2003 is the record date for determination of stockholders entitled to vote at the Annual Meeting. On April 24, 2003, there were 21,385,316 shares of common stock outstanding. Each holder of common stock is entitled to one vote on all matters brought before the Annual Meeting.

For the Proposal to elect directors, the two nominees who receive the most votes will be elected. If you withhold authority to vote for a nominee on your proxy card, your vote will not count for or against the nominee. For the Proposal to ratify independent accountants and to amend the Stock Incentive Plan, a majority of the votes cast for that Proposal is required for approval of those Proposals.

Abstentions and broker nonvotes will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions will have no effect on the Proposals. If you are a beneficial owner and do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes. If you hold your shares with a broker and you do not tell your broker how to vote, your broker has the authority to vote on Proposals 1 and 2 scheduled to be presented at this year’s meeting. Proposal 3 is a “non-discretionary item,” which means a broker does not have discretion to vote this item if you do not provide express voting instructions. If you do not provide voting instructions on this item your proxy will be considered a “broker non-vote,” will not be counted in determining the outcome of the vote on Proposal 3 and will have no effect on such outcome. Shares that are subject to broker non-votes are counted for determining the quorum but will not be considered votes cast for the foregoing purpose.

1

Procedure for voting shares received pursuant to the Trimeris, Inc. 401(k) plan.

Participants in the Trimeris, Inc. 401(k) plan (“Participants”) holding shares under the 401(k) plan are entitled to vote on the proposals associated with this year’s annual meeting. Participants will receive a separate proxy statement along with a form for instructing the trustee as to how to vote on their behalf and instructions on voting procedures. The ballots will be tabulated and the votes will be cast on behalf of voting Participants at the annual meeting by the law firm of Poyner and Spruill LLP, Raleigh, NC.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information we know with respect to the beneficial ownership of our common stock as of April 24, 2003, for each person or group of affiliated persons, whom we know to beneficially own more than 5% of our common stock. The table also sets forth such information for our directors and executive officers, individually and as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, or SEC. Except as indicated by footnote, to our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Options to purchase shares of common stock that are exercisable within 60 days of April 24, 2003 are deemed to be beneficially owned by the person holding such options for the purpose of computing ownership of such person, but are not treated as outstanding for the purpose of computing the ownership of any other person. Applicable percentage of beneficial ownership is based on 21,385,316 shares of common stock outstanding as of April 24, 2003.

Unless otherwise indicated in the footnotes, the address for each listed stockholder is: c/o Trimeris, Inc., 3518 Westgate Drive, Suite 300, Durham, North Carolina 27707.

Beneficial Owner

| | Number of Options Beneficially Owned

| | Number of Shares Beneficially Owned

| | Total Number of Options and Shares Beneficially Owned

| | Percentage of Total Number of Shares and Options Owned

| |

Felix J. Baker, Julian C. Baker, Andrew H. Tisch, Daniel R. Tisch, James S. Tisch and Thomas J. Tisch(1) | | — | | 5,516,900 | | 5,516,900 | | 25.8 | % |

T. Rowe Price Associates, Inc.(2) | | — | | 2,288,920 | | 2,288,920 | | 10.7 | % |

AXA Financial Inc.(3) | | — | | 1,726,530 | | 1,726,530 | | 8.1 | % |

Dani P. Bolognesi(4) | | 411,687 | | 56,786 | | 468,473 | | 2.2 | % |

M. Nixon Ellis(5) | | 108,148 | | 7,425 | | 115,573 | | * | % |

Robert R. Bonczek(6) | | 242,721 | | 24,730 | | 267,451 | | 1.3 | |

Timothy J. Creech | | 61,564 | | 15,696 | | 77,260 | | * | |

Jeffrey M. Lipton(7) | | 75,000 | | 152,522 | | 227,522 | | 1.1 | % |

E. Gary Cook(8) | | 45,000 | | 3,500 | | 48,500 | | * | |

J. Richard Crout(9) | | 31,667 | | 6,870 | | 38,537 | | * | |

Charles A. Sanders | | 63,383 | | 7,804 | | 71,187 | | * | |

Kevin C. Tang(10) | | 6,666 | | 102,500 | | 109,166 | | * | |

All executive officers and directors as a group (nine persons)(11) | | 1,045,836 | | 377,833 | | 1,423,669 | | 6.7 | % |

| (1) | | Based on Schedule 13D/A filed with the SEC on October 3, 2002. Each person reported shared voting power and shared dispositive power over certain of the shares listed. Because of certain business and family relationships among the reporting persons, they filed a Schedule 13D/A jointly, but each reporting person disclaimed beneficial ownership of shares owned by any other reporting person. The address of Felix J. Baker and Julian C. Baker is 655 Madison Avenue, New York, New York 10021. The address of Andrew H. |

2

| | Tisch, James S. Tisch and Thomas J. Tisch is 667 Madison Avenue, New York, New York 10021. The address of Daniel R. Tisch is 500 Park Avenue, New York, New York 10022. |

| (2) | | Based on Schedule 13G filed with the SEC on February 4, 2003, T. Rowe Price Associates, Inc. held sole voting power as to 764,420 shares and sole dispositive power as to 2,288,920 shares. T. Rowe Price Associates, Inc.’s address is 100 East Pratt Street, Baltimore, Maryland 21202. |

| (3) | | Based on Schedule 13G/A filed with the SEC on March 28, 2003, AXA Financial, Inc. held sole voting power as to 447,520 shares and sole dispositive power as to 1,726,530 shares. AXA Financial, Inc.’s address is 1290 Avenue of the Americas, New York, New York 10104. |

| (4) | | Includes the following shares as to which Dr. Bolognesi disclaims beneficial ownership: 9,000 shares of common stock owned by Sarah Bolognesi, Dr. Bolognesi’s wife, and 7,153 shares that Mrs. Bolognesi may acquire pursuant to certain stock options exercisable within 60 days after April 24, 2003. |

| (5) | | Includes the following shares as to which Dr. Ellis disclaims beneficial ownership except to the extent of his pecuniary interest therein: 3,500 shares held in a charitable remainder trust for which Dr. Ellis is the sole beneficiary until his death and Dr. Ellis is the sole trustee. |

| (6) | | Includes 3,400 shares of restricted stock that vested on April 17, 2003. |

| (7) | | Includes the following shares as to which Mr. Lipton disclaims beneficial ownership: 7,890 shares beneficially owned by Shelley Lipton, Mr. Lipton’s wife, 270 shares beneficially owned by Caroline Dickens, Mrs. Lipton’s niece who shares Mr. Lipton’s house and 380 shares beneficially owned by Caroline Dickens Trust, for which Caroline Dickens, Mr. Lipton’s niece who shares Mr. Lipton’s house, is the sole beneficiary and Shelley Lipton, Mr. Lipton’s wife, is the sole trustee. |

| (8) | | Includes the following shares as to which Dr. Cook disclaims beneficial ownership: 1,500 shares beneficially owned by Brenda B. Cook, Dr. Cook’s wife. |

| (9) | | Includes the following shares as to which Dr. Crout disclaims beneficial ownership: 1,500 shares beneficially owned by the Keith R. Crout Irrevocable Trust, for which Keith R. Crout, Dr. Crout’s son who shares Dr. Crout’s house, is the sole beneficiary and Linda C. Spevacek, Dr. Crout’s daughter, is the sole trustee; 470 shares beneficially owned by Keith R. Crout, Dr. Crout’s son who shares Dr. Crout’s house; and 900 shares beneficially owned by Carol K. Crout, Dr. Crout’s wife. |

| (10) | | Includes 22,500 shares that Mr. Tang contributed to the Tang Family Trust u/t/d August 27, 2002, of which Mr. Tang is co-trustee. Includes 80,000 shares owned by Tang Capital Partners, LP of which Tang Capital Management, LLC is the general partner. Mr. Tang disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. Mr. Tang is the sole managing member of Tang Capital Management, LLC. |

Revocability Of Proxies

Any person giving a Proxy has the power to revoke it at any time before its exercise. It may be revoked by filing a notice of revocation or another signed Proxy with a later date with the Secretary of Trimeris at our principal executive office, 3518 Westgate Drive, Suite 300, Durham, North Carolina 27707. You may also revoke your Proxy by attending the Annual Meeting and voting in person.

Proxy Solicitation

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy and any additional soliciting materials furnished to stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation materials to such beneficial owners.

To assist in the solicitation process, we have hired Georgeson Shareholder (“GS”) to solicit proxies by mail. We anticipate paying GS an initial fee of $6,500, plus expenses. Additional compensation is expected to be paid to GS for any supplemental solicitations made by telephone or other means. In addition, the original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram or other means by our directors, officers or employees. No additional compensation is expected to be paid to these individuals for any such services.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is currently composed of six members. In accordance with the terms of our Fourth Amended and Restated Certificate of Incorporation, our Board of Directors is divided into three classes, denominated Class I, Class II and Class III, with members of each class holding office for staggered three-year terms. At each annual stockholder meeting, the successors to the Directors whose terms expire will be elected to serve from the time of their election and qualification until the third annual meeting of stockholders following their election or until a successor has been duly elected and qualified. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. Currently, our Board of Directors is divided as follows: members of Class I Director seats are Jeffrey M. Lipton and E. Gary Cook, Ph.D.; members of Class II Director seats are Charles A. Sanders, M.D. and Kevin C. Tang, and members of Class III Director seats are Dani P. Bolognesi, Ph.D. and J. Richard Crout, M.D.

Vote Required

The two candidates for the class of director whose terms begin at the 2003 Annual Meeting of Stockholders receiving the highest number of affirmative votes of the stockholders entitled to vote at the Annual Meeting will be elected directors of Trimeris. Unless otherwise instructed, the proxyholders will vote each returned proxy for the nominees named below for election, or for as many nominees of the Board of Directors as possible, such votes to be distributed among such nominees in the manner as the proxyholders see fit. If any of the nominees is unable or unwilling to stand for election or to serve if elected, the named proxies will vote for such person or persons as the Board in its discretion may choose to replace any such nominees.

Recommendation Of The Board Of Directors

The Board of Directors unanimously recommends a voteFOR the nominees listed below.

Nominees

The following table sets forth information regarding the nominees:

Name

| | Year First Elected Director

| | Age

| | Class Termination Year

| | Position

|

Dani P. Bolognesi, Ph.D. | | 1996 | | 62 | | 2006 | | Director, Chief Executive Officer and Chief Scientific Officer |

J. Richard Crout, M.D. | | 1998 | | 73 | | 2006 | | Director |

Business Experience Of Nominees For Election To Terms Expiring In 2006

Dani P. Bolognesi, Ph.D., a founder of Trimeris, has been a director since its inception and was named Chief Executive Officer and Chief Scientific Officer in March 1999. Dr. Bolognesi held a number of positions at Duke University from 1971 to March 1999, including, James B. Duke Professor of Surgery, Professor of Microbiology/Immunology, Vice Chairman of the Department of Surgery for Research and Development and Director of the Duke University Center for AIDS Research from 1989 to March 1999. From 1988 to March 1999, Dr. Bolognesi was the Director of the Central Laboratory Network that supports all HIV vaccine clinical trials sponsored by the National Institutes of Health. Dr. Bolognesi received his Ph.D. degree in Virology from Duke University.

J. Richard Crout, M.D. has been a director of Trimeris since November 1998. Since 1994, Dr. Crout has been President of Crout Consulting, a firm that provides consulting advice to pharmaceutical and biotechnology companies on the development of new products. From 1984 to 1993, Dr. Crout was Vice President, Medical and

4

Scientific Affairs with Boehringer Mannheim Pharmaceuticals Corp. From 1973 to 1982, Dr. Crout was Director of the Bureau of Drugs, now known as the Center for Drug Evaluation and Research at the U.S. Food and Drug Administration. Dr. Crout serves on the Board of Directors of Genelabs Technologies, Inc., and Biopure Corporation. Dr. Crout received his M.D. degree from Northwestern University Medical School.

Board Meetings And Committees

Our Board of Directors met a total of six times during the year ended December 31, 2002. Each of the directors attended at least 75% of the meetings of the Board and at least 75% of the meetings held by all committees of the Board on which he served.

The Board has a standing Compensation and Governance Committee composed of Messrs. Cook, Lipton, Sanders and Tang. In June 2000, the Board elected Dr. Cook as chairman of the Compensation and Governance Committee. In April 2002, Mr. Tang was appointed to the Compensation and Governance Committee. The Compensation and Governance Committee met four times in 2002. The Compensation and Governance Committee reviews and acts on matters relating to compensation levels and benefit plans for our executive officers and key employees, including salary and stock options. The Compensation and Governance Committee is responsible for granting stock awards, stock options and stock appreciation rights and other awards to be made under our existing incentive compensation plans. The Compensation and Governance Committee is also responsible for corporate governance issues, including the nomination of new directors, ongoing evaluation of the executive management team and other related issues.

The Board also has a standing Audit and Finance Committee composed of Messrs. Crout,Lipton and Sanders. The Audit and Finance Committee met a total of six times in 2002. The Audit and Finance Committee’s responsibilities include providing oversight of the quality and integrity of the Company’s regulatory and financial accounting and reporting, risk management, legal and regulatory compliance, the internal and external audit functions and the preparation of the Audit Committee report for the proxy statement. The Audit and Finance Committee also reviews and recommends for Board approval, the engagement of independent auditors for the Company, subject to shareholder ratification. This year, the Audit and Finance Committee was actively involved and recommended to the Board to approve the appointment of KPMG LLP as the Company’s independent auditors, as part of the Committee’s regulatory requirements under the Sarbanes-Oxley Act of 2002. In June 2000, the Board elected Dr. Crout as the chairman of the Audit and Finance Committee.

Director Compensation

We reimburse our directors for all reasonable and necessary travel and other incidental expenses incurred in connection with their attendance at meetings of the Board. Directors do not receive additional compensation in connection with their attendance at meetings. In addition, all eligible non-employee directors, except the Chairman, automatically receive an option to purchase 10,000 shares of common stock at each annual meeting of stockholders, and the Chairman automatically receives an option to purchase 15,000 shares of common stock at each annual meeting of stockholders. In addition, all eligible non-employee directors serving as members of the Compensation and Governance Committee or Audit and Finance Committee, except the director serving as chairman of the committee, receive an option to purchase 1,250 shares of common stock at each annual meeting of stockholders, and the eligible non-employee director serving as chairman of any of these committees receives an option to purchase 2,500 shares of common stock at each annual meeting of stockholders. These options have an exercise price equal to 100% of the fair market value of our common stock on the grant date and become exercisable after the completion of one year of service following the grant. Newly-elected directors are granted an option to purchase 20,000 shares of common stock, with the options vesting ratably over the three years. These options have an exercise price equal to 100% of the fair market value of our common stock on the grant date.

5

PROPOSAL 2

RATIFICATION OF INDEPENDENT ACCOUNTANTS

We are asking the stockholders to ratify the selection of KPMG LLP as our independent accountants for the year ending December 31, 2003.

Vote Required

The affirmative vote of a majority of the stockholders represented and voting at the Annual Meeting will be required to ratify the selection of KPMG LLP as our independent accountants for the year ending December 31, 2003.

Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.

Recommendation Of The Board Of Directors

The Board of Directors unanimously recommends a voteFOR the ratification and approval of the selection of KPMG LLP to serve as our independent accountants for the year ending December 31, 2003.

PROPOSAL 3

THIRD AMENDMENT TO THE TRIMERIS, INC.

AMENDED AND RESTATED STOCK INCENTIVE PLAN

The Company’s Stock Incentive Plan was adopted by the Board and approved by the stockholders in October 1997 and amended in June 2001. A copy of the Stock Incentive Plan is attached to the Proxy Statement as Appendix A. You are being asked to vote on a proposal to approve a set of amendments to the Stock Incentive Plan to (a) increase the number of shares of common stock available for issuance under the Stock Incentive Plan by 1,300,000 shares to a total of 5,402,941 shares of common stock and (b) limit the number of options or restricted shares that any individual can be granted under the Stock Incentive Plan within a calendar year to 500,000 (collectively the “Third Amendment”). The Board adopted the Third Amendment on April 24, 2003, subject to stockholder approval at the Annual Meeting. The Board believes the Third Amendment is necessary to provide us with a sufficient reserve of common stock for future awards of options and/or restricted stock needed to attract, employ and retain employees, directors and consultants of outstanding ability. The Company is establishing a limit on the number of options or shares that any individual can receive under the Stock Incentive Plan within a calendar year to allow the Company to comply with the requirements of Section 162(m) of the Internal Revenue Code (the “Code”) and to obtain possible favorable tax treatment thereunder. The Company has never made total grants to an individual within a calendar year that approaches this limit, and anticipates no material change in its current stock option granting policy. The largest total grant to an individual within a calendar year that the Company has made is less than 50% of this limit.

DESCRIPTION OF THE STOCK INCENTIVE PLAN

Our Stock Incentive Plan provides for the grant of incentive stock options, restricted stock or other stock-based awards to our employees, including directors who are employees, and for the grant of nonstatutory stock options, restricted stock or other stock-based awards to our employees, officers, directors, consultants and advisors. Our Stock Incentive Plan is administered by our Compensation and Governance Committee. A maximum of 4,102,941 shares are authorized for issuance under the Stock Incentive Plan. If the stockholders approve this Proposal, a maximum of 5,402,941 shares of common stock will be authorized for issuance under the Stock Incentive Plan, all of which could be used for incentive stock options, restricted stock or other stock-based awards. On March 31, 2003, there were approximately 365,000 shares authorized and available for grant

6

and there were approximately 134 employees, officers, directors, consultants and advisors eligible to participate under the Stock Incentive Plan. The exercise price of all stock options granted under our Stock Incentive Plan must be at least equal to the fair market value of the common stock on the date of grant. Our plan does not permit a change in the exercise price of any option previously granted except as otherwise permitted pursuant to our Stock Incentive Plan, such as in the event of a stock split or merger, and the applicable section of the Code.

The Stock Incentive Plan permits Common Stock purchased upon the exercise of options to be paid (i) in cash or by check, (ii) through a broker-facilitated cashless exercise procedure to the extent permitted by applicable law, (iii) by delivery of shares owned by the optionee, provided such shares have been held for at least six months, (iv) by delivery of a promissory note secured by valuable collateral, or (v) by payment of such other lawful consideration as the Board may determine, in each case subject to the Sarbanes-Oxley Act of 2002 or other applicable law.

The Board may grant restricted stock awards under the Stock Incentive Plan entitling recipients to acquire shares of Common Stock, subject to the right of the Company to repurchase all or a part of such shares and upon such other terms and conditions as the Board may determine. Stock certificates issued in respect of a restricted stock award are registered in the name of the participant and held in escrow by the Company until expiration of the applicable restriction periods. Any restricted stock award granted to a participant who is subject to the provisions of Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”) shall restrict the release of the shares subject to the award for a period of at least six months following the date of grant. Although not formally required by the Stock Incentive Plan, the Company has adopted an operational rule mandating that all grants of restricted stock have a restricted period of not less than 12 months.

If an optionee ceases to be employed for any reason other than death or disability, each outstanding option held by the optionee will terminate and cease to be exercisable no later than three months after the date the optionee ceases to be employed by us. If an optionee dies, all of his or her options become exercisable immediately. The Stock Incentive Plan provides that any option granted to a participant who is subject to the provisions of Section 16 of the Exchange Act shall not become exercisable for a period of at least six months following the date of grant.

If:

| | • | | we merge with or consolidate into another corporation, which results in our stockholders owning less than 60% of the voting power of the voting securities of the surviving or successor corporation following the transaction, |

| | • | | we sell all or substantially all of our assets, |

| | • | | we completely liquidate, or |

| | • | | someone acquires 50% or more of the voting power of our outstanding securities, except through a merger, consolidation or an acquisition of our securities directly from us, |

then all restricted stock awards shall become fully vested and free of all restrictions and all other stock-based awards shall become fully vested, exercisable or free of all restrictions, as the case may be.

In the event of an acquisition of 50% or more of the voting power of our outstanding securities, except through a merger, consolidation or an acquisition of our securities directly from us, then all options and stock appreciation rights become fully vested and exercisable. If we execute an agreement to:

| | • | | merge or consolidate and our stockholders from before the transaction own less than 60% of the voting power of the voting securities of the surviving or successor corporation following the transaction, |

| | • | | sell all or substantially all of our assets, or |

then all options and stock appreciation rights become fully vested and exercisable and the Board of Directors may, in its discretion, terminate any unexercised awards, or permit the acquiring or succeeding corporation to assume or substitute equivalent options or stock appreciation rights for ours.

7

The Board of Directors may terminate or amend the Stock Incentive Plan at any time. Our stockholders must approve any increase in the total number of shares available under the Stock Incentive Plan. No awards may be made under the Stock Incentive Plan after September 2007.

New Plan Benefits And Option Grant Table

Because the Stock Incentive Plan is discretionary, benefits to be received by individual optionees, other than non-employee Directors, are not determinable. Each of the Directors serving at the Annual Meeting will receive an automatic option grant to purchase 10,000 shares on the date of the Annual Meeting with an exercise price per share equal to the closing price per share of common stock on the date of the Annual Meeting. The Chairman of the Board of Directors will receive an additional 5,000 shares for serving as chairman. In addition, Board members receive options to purchase 1,250 shares for service on each committee of the Board of which they are a member and the director who chairs a committee receives an option to purchase an additional 1,250 shares for serving as committee chair. The table below shows, as to the individual who served as our chief executive officer during 2002 and to our most highly compensated executive officers (other than our chief executive officer) serving as executive officers as well as our chief accounting officer as of December 31, 2002 and whose 2002 compensation exceeded $100,000 named in the Summary Compensation (“Named Executive Officers”), and the various indicated groups, (i) the number of shares of common stock for which options have been granted under the Stock Incentive Plan for the one-year period ending December 31, 2002 plus the period through March 31, 2003 and (ii) the weighted average exercise price per share.

Name and Position

| | Number of Option Shares (1)

| | Weighted Average Exercise Price of Granted Options

|

Dani P. Bolognesi, Ph.D. | | 51,750(2) | | $ | 43.45 |

Chief Executive Officer and Chief Scientific Officer | | | | | |

M. Nixon Ellis, Ph.D. | | 25,875(3) | | | 43.45 |

President | | | | | |

Robet R. Bonczek | | 25,875(4) | | | 43.45 |

Chief Financial Officer and General Counsel | | | | | |

Timothy J. Creech | | 7,125(5) | | | 43.45 |

Vice President of Finance and Chief Accounting Officer | | | | | |

All current executive officers as a group (4 persons) | | 110,625 | | | 43.45 |

All current directors (other than executive officers) as a group (5 persons) | | 66,250 | | | 42.30 |

All employees, including current officers who are not executive officers as a group (131 persons) | | 346,825 | | | 43.49 |

| (1) | | On June 26, 2002, the Compensation and Governance Committee approved an annual option grant of shares of our common stock to all employees, including the Named Executive Officers, pursuant to our Stock Incentive Plan. This annual option grant is designed to be awarded on a quarterly basis at the fair market value of our common stock on the date of grant beginning in June 2002 and thereafter until April 2003, as long as the employee is employed by us on the date of grant. These options become exercisable over a four-year period, with the first grant in June 2002 becoming exercisable in full in June 2003, one year from the date of grant, and the remainder of the grants becoming exercisable ratably over a three-year period beginning in June 2003, the one year anniversary date from the first date of grant. The number represented in this column represents that portion of the number of options to purchase shares of our common stock that the Named Executive Officer received pursuant to our Stock Incentive Plan on a quarterly basis in June 2002, October 2002 and January 2003. The balance of the option grant of shares of our common stock was granted in April 2003, which is not reported on this table. |

| (2) | | Dr. Bolognesi was granted 17,250 options to purchase shares of our common stock in June 2002, October 2002 and January 2003 at the fair market value of our common stock on the date of grant. Dr. Bolognesi was granted an option to purchase 17,250 shares of our common stock in April 2003, which is not reported on this table. |

8

| (3) | | Dr. Ellis was granted 8,625 options to purchase shares of our common stock in June 2002, October 2002 and January 2003 at the fair market value of our common stock on the date of grant. Mr. Bonczek was granted an option to purchase 8,625 shares of our common stock in April 2003, which is not reported on this table. |

| (4) | | Mr. Bonczek was granted 8,625 options to purchase shares of our common stock in June 2002, October 2002 and January 2003 at the fair market value of our common stock on the date of grant. Dr. Ellis was granted an option to purchase 8,625 shares of our common stock in April 2003, which is not reported on this table. |

| (5) | | Mr. Creech was granted 2,375 options to purchase shares of our common stock in June 2002, October 2002 and January 2003 at the fair market value of our common stock on the date of grant. Mr. Creech was granted an option to purchase 2,375 shares of our common stock in April 2003, which is not reported on this table. |

Tax Effects Of Stock Incentive Plan Participation

The following briefly summarizes the federal income tax consequence of the issuance and exercise of stock options and other stock awards under the Stock Incentive Plan. The following discussion does not purport to be complete and does not cover, among other things, the state, local, and foreign tax treatment associated with the grant and exercise of options.

Nonqualified Stock Options. An optionee will not be taxed when he receives a nonqualified stock option (“NQSO”). When the optionee exercises an NQSO, he will generally owe taxes on ordinary income on the difference between the value of the shares he receives and the price he pays, with the “spread” treated like additional salary for an employee. He may then owe taxes again if and when he sells the shares. That tax would be on the difference between the price he received for the shares and his “basis,” which is the sum of the price he originally paid plus the value of the shares on which he originally paid income taxes. Depending upon how long he held the shares before selling, he may be eligible for favorable tax rates for certain kinds of capital gains. In addition, we will receive an income tax deduction for any amounts of “ordinary income” to him.

Incentive Stock Options. An optionee will not be taxed when he receives an incentive stock option (“ISO”) and will not be taxed when he exercises an ISO, unless he is subject to the alternative minimum tax (“AMT”). If he holds the shares purchased upon exercise of the ISO (“ISO Shares”) for more than one year after the date he exercised the option and for more than two years after the option grant date, he generally will realize long-term capital gain or loss (rather than ordinary income or loss) when he sells or otherwise disposes of the ISO Shares. This gain or loss will equal the difference between the amount realized upon such disposition and the amount paid for the ISO Shares.

If the optionee sells the ISO Shares in a “disqualifying disposition” (that is, within one year from the date he exercises the ISO or within two years from the date of the ISO grant), he generally will recognize ordinary compensation income equal to the lesser of (1) the fair market value of the shares on the date of exercise minus the price he paid or (2) the amount he realized on the sale. For a gift or another disqualifying disposition where a loss, if sustained, would not usually be recognized, he will recognize ordinary income equal to the fair market value of the shares on the date of exercise minus the price he paid. Any amount realized on a disqualifying disposition that exceeds the amount treated as ordinary compensation income (or any loss realized) will be a long-term or a short-term capital gain (or loss), depending, under current law, on whether he held the shares for at least 12 months. We can generally take a tax deduction on a disqualifying disposition corresponding to the ordinary compensation income he recognized but cannot deduct the amount of the capital gains.

Alternative Minimum Tax. The difference between the exercise price and the fair market value of the ISO Shares on the date of exercise is an adjustment to income for purposes of AMT. The AMT (imposed to the extent it exceeds the taxpayer’s regular tax) is a certain percentage of an individual taxpayer’s alternative minimum taxable income that is lower than the regular tax rate but covers more income. Taxpayers determine their alternative minimum taxable income by adjusting regular taxable income for certain items, increasing that

9

income by certain tax preference items, and reducing this amount by the applicable exemption amount. If a disqualifying disposition of the ISO Shares occurs in the same calendar year as exercise of the ISO, there is no AMT adjustment with respect to those ISO Shares. Also, upon a sale of ISO Shares that is not a disqualifying disposition, alternative minimum taxable income is reduced when he sells by the excess of the fair market value of the ISO Shares at exercise over the amount paid for the ISO Shares.

Exercise by Delivery of Previously Acquired Shares. Generally, an optionee will not recognize gain or loss upon the transfer to the Company of previously acquired shares of common stock (the “Old Shares”) in payment of all or a portion of the exercise price of shares of common stock (the “New Shares”) acquired through the exercise of an option. The optionee’s basis and holding period in the Old Shares are transferred to that number of New Shares that equals the number of Old Shares tendered in payment of the exercise price. Additional New Shares have a basis equal to any income recognized by the optionee on exercise plus any cash paid in payment of the exercise price. However, if Old Shares are used to exercise an ISO, the disposition of the Old Shares will be taxable generally in accordance with the rules discussed above if the Old Shares were acquired by exercising an ISO and have not been held for the requisite holding period.

Restricted Stock. With respect to awards granted under the Stock Incentive Plan involving the issuance of shares that are restricted as to transferability and subject to a substantial risk of forfeiture, the participant generally must recognize ordinary income equal to the fair market value of the shares at the first time the shares become transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier. The participant may be able to accelerate the taxation by filing a notice with the Internal Revenue Service to treat the property as taxable even though subject to restrictions. We generally will be entitled to a deduction in an amount equal to the ordinary income recognized by the participant, either eventually or by this acceleration election.

Stock Awards. With respect to awards granted under the Stock Incentive Plan that result in the issuance of shares that are not restricted as to transferability or not subject to a substantial risk of forfeiture, the participant generally must recognize ordinary income equal to the fair market value of shares received. We generally will be entitled to a deduction in an amount equal to the ordinary income recognized by the participants.

Tax Withholding Under the Code. We will be required to withhold taxes in some circumstances associated with the participants’ receiving compensation. Under the Stock Incentive Plan, we may permit the optionee to have us withhold all or a portion of the shares of the Company that the optionee acquires upon the exercise of an option to satisfy estimated or actual federal, state or local income taxes. We may also permit the optionee to delivery other previously acquired shares (other than restricted stock) for the purpose of tax withholding. The election to withhold must be made prior to or on the date on which the tax obligation arises.

Payments Upon Change in Control. The Stock Incentive Plan provides for the acceleration of payment of awards and related shares of common stock in the event of certain acquisition events or other change in control of the Company, as defined in the Stock Incentive Plan. Acceleration of payment may cause part or all of the consideration involved to be treated as a “parachute payment” under the Code, which may subject the recipient to a 20% excise tax and which may not be deductible by the Company for federal income tax purposes.

This is a summary of the general principles of current federal income tax law applicable to the purchase of shares under the Stock Incentive Plan. While we believe that the description accurately summarizes existing provisions of the Code, and its legislative history and regulations, and the applicable administrative and judicial interpretations, theses statements are only summaries, and the rules in question are quite detailed and complicated. Moreover, legislative, administrative, regulatory or judicial changes or interpretations may occur that would modify these statements. Individual financial situations may vary, and state and local tax consequences may be significant. Therefore, no one should act based on this description without consulting his own tax advisors concerning the tax consequences of purchasing shares under the Stock Incentive Plan and disposing of those shares. In addition, different rules may apply if the optionee is subject to foreign tax laws or pays the exercise price using shares he already owns.

10

Recent Changes To The Stock Incentive Plan

While the repricing of Incentive Stock Options is expressly prohibited by the Stock Incentive Plan, prior to April 16, 2003, the Stock Incentive Plan had no provision that prohibited the Compensation and Governance Committee from repricing a previously granted NQSO. Similarly, prior to April 16, 2003, the Stock Incentive Plan had no provision that prohibited the Compensation and Governance Committee from granting discounted NQSOs. While no such repricing or grant has ever occurred or been proposed, current emphasis on corporate governance led the Board to conclude that it is appropriate to specifically prohibit such actions without shareholder approval. Accordingly, the Board of Directors has amended the Stock Incentive Plan, effective April 16, 2003 to effect such prohibitions; these amendments did not require shareholder approval.

In addition, no ISO or NQSO will be exercisable after the date the optionee’s employment with the Company is terminated for cause (as determined in the sole discretion of the Board).

Vote Required

The affirmative vote of a majority of the stockholders represented and voting at the Annual Meeting will be required to approve the amendment to the Stock Incentive Plan.

Recommendation Of The Board Of Directors

The Board of Directors unanimously recommends a voteFOR the approval of the amendment of our Amended and Restated Stock Incentive Plan to increase the number of shares available for grant by 1,300,000 shares with the use of such shares for incentive stock options or other compensatory purposes and to limit the number of options or restricted shares that any individual can be granted under the plan within a calendar year to 500,000.

EXECUTIVE OFFICERS, DIRECTORS AND KEY EMPLOYEES

The following table sets forth the name, age and position of our executive officers, directors and key employees as of April 24, 2003:

Name

| | Age

| | Position

|

Dani P. Bolognesi, Ph.D. | | 62 | | Chief Executive Officer, Chief Scientific Officer and Director |

M. Nixon Ellis, Ph.D. | | 53 | | President |

Robert R. Bonczek | | 58 | | Chief Financial Officer and General Counsel |

M.C. Kang, Ph.D. | | 51 | | Senior Vice President of Development |

Thomas J. Matthews, Ph.D. | | 58 | | Senior Vice President of Research and Development |

M. Lynn Smiley, M.D. | | 50 | | Senior Vice President of Clinical Research |

George Koszalka, Ph.D. | | 52 | | Senior Vice President of Corporate Strategy |

Timothy J. Creech | | 42 | | Vice President of Finance and Secretary |

Jeffrey M. Lipton(1)(2) | | 60 | | Chairman of the Board of Directors |

E. Gary Cook, Ph.D.(2) | | 58 | | Director |

J. Richard Crout, M.D.(1). | | 73 | | Director |

Charles A. Sanders, M.D.(1)(2) | | 71 | | Director |

Kevin C. Tang(2) | | 36 | | Director |

| (1) | | Member of the Audit and Finance Committee. |

| (2) | | Member of the Compensation and Governance Committee. |

Dani P. Bolognesi, Ph.D., a founder of Trimeris, has been a director since its inception and was named Chief Executive Officer and Chief Scientific Officer in March 1999. Dr. Bolognesi held a number of positions at Duke University from 1971 to March 1999, including, James B. Duke Professor of Surgery, Professor of Microbiology/Immunology, Vice Chairman of the Department of Surgery for Research and Development and

11

Director of the Duke University Center for AIDS Research from 1989 to March 1999. From 1988 to March 1999, Dr. Bolognesi was the Director of the Central Laboratory Network that supports all HIV vaccine clinical trials sponsored by the National Institutes of Health. Dr. Bolognesi received his Ph.D. degree in Virology from Duke University.

M. Nixon Ellis, Ph.D. joined Trimeris as Executive Vice President and Chief Business Officer in March 2000 and was promoted to President in November 2002. Prior to joining Trimeris, Dr. Ellis served as a founder and director of Triangle Pharmaceuticals, Inc., a biopharmaceutical company from July 1995 until February 2000 and President and Chief Operating Officer from September 1995 until February 2000. From 1983 to 1995, Dr. Ellis held various positions at Burroughs Wellcome Co., a multinational pharmaceutical company, most recently serving as Global Brand Director, HIV/Retrovir at The Wellcome Foundation Ltd. and Assistant Director, Division of Virology. Dr. Ellis received his Ph.D. degree in Microbiology from the University of Georgia and his M.B.A. from the University of North Carolina.

Robert R. Bonczek joined Trimeris as a consultant in March 1997. He was named Acting Chief Administrative Officer and Acting Chief Financial Officer in September 1999, was named Chief Financial Officer in March 2000 and was named General Counsel in April 2000. From 1991 until 2001, Mr. Bonczek acted in a consulting capacity for Donaldson, Lufkin & Jenrette, an investment bank, and for Wilmer, Cutler & Pickering, a law firm. Since 1991, Mr. Bonczek has served as President of AspenTree Capital, a financial services and investment management company. Prior to 1991, Mr. Bonczek was with E.I. Du Pont de Nemours & Co., a chemical company, for 24 years, holding a number of senior management positions, including Corporate Counsel. Mr. Bonczek received his J.D. degree from the University of North Carolina and his M.B.A. from The Wharton School at the University of Pennsylvania.

M.C. Kang, Ph.D. joined Trimeris as a consultant in October 1995 and was named Director of Chemistry in August 1996, Vice President of Development in September 1998 and Senior Vice President of Development in July 1999. Prior to joining Trimeris, Dr. Kang held various positions at Glaxo plc from 1990 to October 1995, most recently serving as Director of Chemical Development. From 1986 to 1990, Dr. Kang was a Development Chemist in the Medical Products Division at E.I. Du Pont de Nemours & Co. Dr. Kang received his Ph.D. degree in Synthetic Organic Chemistry from Oregon State University. Dr. Kang is expected to retire effective May 1, 2003.

Thomas J. Matthews, Ph.D. is a founder of Trimeris and joined Trimeris as Senior Vice President of Research and Development in July 1999. Dr. Matthews held a number of positions at Duke University from 1977 to July 1999, most recently serving as Associate Professor of Experimental Surgery at the Duke University Medical Center and a member of the Duke University Center for AIDS Research. Dr. Matthews received his Ph.D. degree in Biochemistry from the University of Missouri.

M. Lynn Smiley, M.D. joined Trimeris as Senior Vice President of Clinical Research in January 2001. From January 1997 until January 2001, Dr. Smiley served as Vice President of HIV and Opportunistic Infections Clinical Development at Glaxo Wellcome, Inc., now GlaxoSmithKline plc. From March 1988 to December 1996, Dr. Smiley held several positions in research and development at Burroughs Wellcome Co. and Glaxo Wellcome, Inc., including Director of the Infectious Diseases and Immunology Department. Dr. Smiley has also held teaching positions at the University of North Carolina at Chapel Hill School of Medicine since 1984, and has served as Clinical Professor of Medicine since 1994. Dr. Smiley received her M.D. from Duke University Medical School.

George Koszalka,Ph.D.joined Trimeris as Senior Vice President of Corporate Strategy in June 2002. Dr. Koszalka served as Division Director of Virology at GlaxoSmithKline since January 2001, with global responsibilities for Research and Clinical Virology and serving as a liaison between the commercial, clinical development and research areas in the antiviral franchise. Dr. Koszalka held positions of increasing responsibility within Research and Development with Burroughs Wellcome and Glaxo Wellcome since 1973. Dr. Koszalka holds a Ph.D. in Biochemistry from North Carolina State University.

12

Timothy J. Creech, C.P.A. joined Trimeris as Director of Finance in July 1997, was appointed Secretary in June 1999 and was promoted to Vice President of Finance in November 2002. From July 1996 to June 1997, Mr. Creech was Corporate Controller at Performance Awareness Corporation, a software company. From December 1993 to July 1996, Mr. Creech was Director of Finance at Avant! Corporation, a software company. From 1990 to December 1993, Mr. Creech was a senior manager at KPMG LLP, independent auditors for Trimeris. Mr. Creech received his M.B.A. from the Fuqua School of Business at Duke University.

Jeffrey M. Lipton has been a director of Trimeris since June 1998 and has been Chairman of the Board since June 1999. Since July 1998, Mr. Lipton has been President and Chief Executive Officer of NOVA Chemicals Corporation. Previously, Mr. Lipton served as Senior Vice President and Chief Financial Officer of NOVA Corporation from February 1994 until September 1994. From September 1994 to July 1998 he was President of NOVA Corporation. Prior to NOVA, Mr. Lipton worked with E.I. Du Pont de Nemours & Co. for almost three decades, where he held a number of senior management positions. Mr. Lipton serves on the Board of Directors of NOVA Chemicals Corporation, as a Director of Hercules Incorporated, and is Chairman of the Board of Directors of Methanex Corporation. Mr. Lipton is a Director, a member of the Executive Committee, and Chairman of the Finance and Membership Committee of the American Chemistry Council. He is a member of the Executive Committee and Honorary Secretary of the Society of Chemical Industry and is a member of the Canadian Council of Chief Executives. Mr. Lipton received his M.B.A. from Harvard University.

E. Gary Cook, Ph.D. has been a director of Trimeris since February 2000. From 1996 until his retirement in 1999, Dr. Cook was Chairman of the Board of Directors, President and Chief Executive Officer of Witco Corporation, a global specialty chemicals corporation. From 1994 to 1996, Dr. Cook was President and Chief Operating Officer of Albemarle Corporation, a global specialty chemicals corporation. From 1992 to 1994, Dr. Cook was Senior Vice President, President – Chemicals, and member of the Board of Directors of Ethyl Corporation. Prior to Ethyl, Dr. Cook was with E.I. Du Pont de Nemours & Co. for 23 years, holding a number of senior management positions, including Vice President, Printing and Publishing, Vice President, Medical Products, and Vice President, Corporate Plans. Dr. Cook serves on the Board of Directors of Louisiana-Pacific Corporation. Dr. Cook received his Ph.D. degree in Chemistry from The Virginia Polytechnic Institute and University.

J. Richard Crout,M.D. has been a director of Trimeris since November 1998. Since 1994, Dr. Crout has been President of Crout Consulting, a firm that provides consulting advice to pharmaceutical and biotechnology companies on the development of new products. From 1984 to 1993, Dr. Crout was Vice President, Medical and Scientific Affairs with Boehringer Mannheim Pharmaceuticals Corp. From 1973 to 1982, Dr. Crout was Director of the Bureau of Drugs, now known as the Center for Drug Evaluation and Research at the U.S. Food and Drug Administration. Dr. Crout serves on the Board of Directors of Genelabs Technologies, Inc., and Biopure Corporation. Dr. Crout received his M.D. degree from Northwestern University Medical School.

Charles A. Sanders, M.D. has been a director of Trimeris since October 1996. From 1989 to May 1995, Dr. Sanders was Chairman of the Board of Directors and Chief Executive Officer of Glaxo Inc. and a member of the Board of Directors of Glaxo plc. Prior to joining Glaxo, Dr. Sanders held a number of positions at Squibb Corporation, a multinational pharmaceutical corporation, including Vice Chairman, Chief Executive Officer of the Science and Technology Group and Chairman of the Science and Technology Committee of the Board. Dr. Sanders serves on the Boards of Directors of Vertex Pharmaceuticals Incorporated, Genentech, Inc., Biopure Corporation, and Cephalon, Inc. Dr. Sanders received his M.D. degree from Southwestern Medical College of the University of Texas.

Kevin C. Tang has been a director of Trimeris since August 2001. Mr. Tang is founder and Managing Director of Tang Capital Management, LLC, an investment company dedicated to the creation of long-term value in the Life Sciences industry. From 1993 to July 2001, Mr. Tang held various positions at Deutsche Banc Alex. Brown, Inc., an investment banking firm, most recently serving as a Managing Director and head of the Life Sciences research group. Mr. Tang currently serves as a director of Aclara BioSciences, Inc. and Ambit Biosciences Corp. Mr. Tang received his B.S. degree from Duke University.

13

Executive Compensation

The following table sets forth certain information with respect to the annual and long-term compensation paid by us to our Named Executive Officers during the fiscal years ended December 31, 2002, 2001 and 2000.

Summary Compensation Table

| | | Annual Compensation

| | Long Term Compensation

| |

| | | | Securities Underlying Options(#)

| | | All Other Compensation

| |

Name and Principal Position

| | Year

| | Salary

| | Bonus(1)

| | |

Dani P. Bolognesi, Ph.D.(2) | | 2002 | | $ | 417,300 | | $ | 313,000 | | 69,000 | (5) | | | (8) |

Chief Executive Officer and Chief Scientific Officer | | 2001 2000 | | | 397,320 297,828 | | | 260,000 150,000 | | 66,100 92,500 | (6) (7) | | | (8) (8) |

|

M. Nixon Ellis, Ph.D.(3) | | 2002 | | $ | 294,876 | | $ | 180,000 | | 34,500 | (5) | | — | |

President | | 2001 2000 | | | 265,008 165,852 | | | 127,000 83,500 | | 33,100 117,500 | (6) (7) | | — 25,000 | (3) |

|

Robert R. Bonczek(4) | | 2002 | | $ | 278,604 | | $ | 167,000 | | 34,500 | (5) | | | (8) |

Chief Financial Officer and General Counsel | | 2001 2000 | | | 265,008 219,807 | | | 127,000 83,500 | | 33,100 50,000 | (6) (7) | | 19,790 16,000 | (4)(8) (4) |

|

Timothy J. Creech | | 2002 | | $ | 149,304 | | $ | 57,000 | | 9,500 | (5) | | | (8) |

Vice President of Finance,

Principal Accounting Officer | | 2001 2000 | | | 139,308 132,384 | | | 35,000 31,700 | | 10,400 14,800 | (6) (7) | | | (8) (8) |

| (1) | | In January 2001, 2000 bonuses were awarded and paid to the Named Executive Officers for achievement in 2000; however, such bonuses are reported with the 2000 compensation. In February 2002, 2001 bonuses were awarded and paid to the Named Executive Officers for achievement in 2001; however, such bonuses are reported with the 2001 compensation. In February 2003, 2002 bonuses were awarded and paid to the Named Executive Officers for achievement in 2002; however, such bonuses are reported with the 2002 compensation. |

| (2) | | Dr. Bolognesi was named Chief Executive Officer and Chief Scientific Officer in March 1999. |

| (3) | | Dr. Ellis joined Trimeris as Executive Vice President and Chief Business Officer in March 2000 with compensation at an annual rate of $220,000. In addition, he received a signing bonus of $25,000, and received an option grant in the amount of 100,000 shares in connection with his appointment as Executive Vice President and Chief Business Officer. Dr. Ellis was promoted to President in November of 2002. |

| (4) | | Mr. Bonczek was named Chief Financial Officer in March 2000 and General Counsel in April 2000. In 2000, Mr. Bonczek received a one-time payment of $16,000 for reimbursement of lost income in connection with his appointment as Chief Financial Officer. In 2001, Mr. Bonczek received a one-time payment of $19,790 for reimbursement for moving and miscellaneous expenses pursuant to his contractual arrangement. |

| (5) | | On June 26, 2002, the Compensation and Governance Committee approved an aggregate number of options to purchase shares of our common stock to be granted on a quarterly basis over four quarters to all eligible employees, including the Named Executive Officers pursuant to our Stock Incentive Plan. These option grants were designed to be awarded at the fair market value of our common stock on the date of that particular quarterly grant. These quarterly option grants began in June 2002 and continued thereafter until April 2003, as long as the employee was employed by us on the date of grant. Once granted, the aggregate number of options become exercisable over a four-year period, with the first grant in June 2002 exercisable |

14

| | in full in June 2003 and the remainder of the grants exercisable ratably over a three-year period beginning in June 2003. The number in this column represents the number of options to purchase shares of our common stock that the Named Executive Officer received pursuant such grant on a quarterly basis in June 2002, October 2002, January 2003 and April 2003. |

| (6) | | On June 27, 2001, the Compensation and Governance Committee approved an aggregate number of options to purchase shares of our common stock to be granted on a quarterly basis over four quarters to all eligible employees, including the Named Executive Officers pursuant to our Stock Incentive Plan. These option grants were designed to be awarded at the fair market value of our common stock on the date of that particular quarterly grant. These quarterly option grants began in June 2001 and continued thereafter until April 2002, as long as the employee was employed by us on the date of grant. Once granted, the aggregate number of options become exercisable over a four-year period, with the first grant in June 2001 exercisable in full in June 2002 and the remainder of the grants exercisable ratably over a three-year period beginning in June 2002. The number in this column represents the number of options to purchase shares of our common stock that the Named Executive Officer received pursuant such grant on a quarterly basis in June 2001, October 2001, January 2002 and April 2002. |

| (7) | | On June 22, 2000, the Compensation and Governance Committee approved an aggregate number of options to purchase shares of our common stock to be granted on a quarterly basis over four quarters to all eligible employees, including the Named Executive Officers pursuant to our Stock Incentive Plan. These option grants were designed to be awarded at the fair market value of our common stock on the date of that particular quarterly grant. These quarterly option grants began in June 2000 and continued thereafter until April 2001, as long as the employee was employed by us on the date of grant. Once granted, the aggregate number of options became exercisable over a four-year period, with the first grant in June 2000 exercisable in full in June 2001 and the remainder of the grants exercisable ratably over a three-year period beginning in June 2001. The number in this column represents the number of options to purchase shares of our common stock that the Named Executive Officer received pursuant to such grant on a quarterly basis in June 2000, October 2000, January 2001 and April 2001. |

| (8) | | Beginning in 1998, we matched 100% of a participant’s annual contributions to the Trimeris Employee 401(k) Plan with common stock, provided the participant was employed on the last day of the year. The number of shares issued is based on the annual contributions to be matched divided by the closing price of the common stock on the last trading day of the year. On December 31, 2000, December 31, 2001, and December 31, 2002, Dr. Bolognesi received 191, 233 and 254 shares of stock, respectively, and as of April 24, 2003, is vested in 889 of those shares of stock. Based upon the closing price of $54.875 per share of the Company’s common stock on December 31, 2000, the closing price of $44.97 per share of the Company’s common stock on December 31, 2001 and the closing price of $43.17 per share of the Company’s common stock on December 31, 2002, the value of the Company’s 401(k) contribution to Dr. Bolognesi for years 2000, 2001 and 2002 were approximately $10,500, $10,500 and $11,000, respectively. On December 31, 2001, and December 31, 2002 Mr. Bonczek received 233 and 277 shares of stock, respectively, pursuant to this matching plan and as of April 24, 2003, is vested in 244 of those shares of stock. Based upon the closing price of $44.97 per share of the Company’s common stock on December 31, 2001, the value of the Company’s 401(k) contribution to Mr. Bonczek for 2001 was approximately $10,500. Based upon the closing price of $43.17 per share of the Company’s common stock on December 31, 2002, the value of the Company’s 401(k) contribution to Mr. Bonczek for 2002 was approximately $12,000. On December 31, 2000, December 31, 2001, and December 31, 2002, Mr. Creech received 191, 233 and 254 shares of stock, respectively, and as of April 24, 2003, is vested in all of those shares of stock. Based upon the closing price of $54.875 per share of the Company’s common stock on December 31, 2000, the closing price of $44.97 per share of the Company’s common stock on December 31, 2001 and the closing price of $43.17 per share of the Company’s common stock on December 31, 2002, the value of the Company’s 401(k) contribution to Mr. Creech for years 2000, 2001 and 2002 were approximately $10,500, $10,500 and $11,000, respectively. |

15

Equity Compensation Plans

The following table provides information as of December 31, 2002 regarding shares authorized for issuance under our equity compensation plans.

The equity compensation plans approved by our stockholders are the Stock Incentive Plan and our 1997 Trimeris, Inc. Employee Stock Purchase Plan. As of December 31, 2002, we did not have any equity compensation plans not approved by our stockholders.

Equity Compensation Plan Information as of December 31, 2002

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a)

| | Weighted-average exercise price of outstanding options, warrants and rights (b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)

| |

Equity compensation plans approved by security holders | | 2,484,000 | | $ | 31.32 | | 584,000 | (1) |

Equity compensation plans not approved by security holders | | — | | | — | | — | |

| | |

| |

|

| |

|

|

Total | | 2,484,000 | | $ | 31.32 | | 584,000 | |

| | |

| |

|

| |

|

|

| (1) | | Includes 457,000 options remaining available for grant under the Stock Incentive Plan and 127,000 shares issuable under the Trimeris, Inc. Employee Stock Purchase Plan. |

Stock Option Information

The following table contains information concerning stock options granted during the fiscal year ended December 31, 2002 to the Named Executive Officers. We have never granted any stock appreciation rights.

OPTIONS GRANTED IN THE YEAR ENDED DECEMBER 31, 2002

| | | Individual Grants

| | |

| | | Number Of Securities Underlying Options

| | | Percent Of Total Options Granted To Employees In 2002

| | | Exercise Price Per Share

| | Expiration Date

| | Potential Realizable Value At Assumed Annual Rates Of Stock Price Appreciation For Option Term(3)

|

Name

| | | | | | 5%

| | 10%

|

Dani P. Bolognesi, Ph.D. | | 16,525 | (1) | | 3.9 | % | | 42.09 | | 6/27/2011 | | 410,000 | | 1,026,000 |

| | | 16,525 | (1) | | 3.9 | % | | 43.90 | | 6/27/2011 | | 414,000 | | 1,028,000 |

| | | 17,250 | (2) | | 4.1 | % | | 42.30 | | 6/26/2012 | | 459,000 | | 1,163,000 |

| | | 17,250 | (2) | | 4.1 | % | | 45.23 | | 6/26/2012 | | 476,000 | | 1,197,000 |

|

M. Nixon Ellis, Ph.D. | | 8,275 | (1) | | 1.9 | % | | 42.09 | | 6/27/2011 | | 206,000 | | 514,000 |

| | | 8,275 | (1) | | 1.9 | % | | 43.90 | | 6/27/2011 | | 207,000 | | 515,000 |

| | | 8,625 | (2) | | 2.0 | % | | 42.30 | | 6/26/2012 | | 229,000 | | 581,000 |

| | | 8,625 | (2) | | 2.0 | % | | 45.23 | | 6/26/2012 | | 238,000 | | 599,000 |

|

Robert R. Bonczek | | 8,275 | (1) | | 1.9 | % | | 42.09 | | 6/27/2011 | | 206,000 | | 514,000 |

| | | 8,275 | (1) | | 1.9 | % | | 43.90 | | 6/27/2011 | | 207,000 | | 515,000 |

| | | 8,625 | (2) | | 2.0 | % | | 42.30 | | 6/26/2012 | | 229,000 | | 581,000 |

| | | 8,625 | (2) | | 2.0 | % | | 45.23 | | 6/26/2012 | | 238,000 | | 599,000 |

|

Timothy J. Creech | | 2,600 | (1) | | 0.6 | % | | 42.09 | | 6/27/2011 | | 65,000 | | 162,000 |

| | | 2,600 | (1) | | 0.6 | % | | 43.90 | | 6/27/2011 | | 65,000 | | 162,000 |

| | | 2,375 | (2) | | 0.6 | % | | 42.30 | | 6/26/2012 | | 63,000 | | 160,000 |

| | | 2,375 | (2) | | 0.6 | % | | 45.23 | | 6/26/2012 | | 65,000 | | 165,000 |

16

| (1) | | Each option represents the right to purchase one share of common stock. The options shown in this row were all granted pursuant to our Stock Incentive Plan. These options were granted in January 2002 and April 2002 based upon an aggregate option number determined in June 2001 that was designed to be granted on a quarterly basis over four quarters at the fair market value of our common stock on the date of grant. These January 2002 and April 2002 options become exercisable ratably over a three-year period that began in June 2002. Upon the occurrence of certain events that result in a change of control, all outstanding options granted to all employees, including executive officers, will become fully exercisable. |

| (2) | | Each option represents the right to purchase one share of common stock. The options shown in this row were all granted pursuant to our Stock Incentive Plan. These options were granted in June 2002 and October 2002 and collectively become exercisable over a four-year period. The grant in June 2002 is exercisable in full in June 2003. The October 2002 grant is exercisable ratably over a three-year period that begins in June 2003. The number of option shares granted in each instance was based upon an aggregate option number that was determined in June 2002 and that was designed to be granted on a quarterly basis over four quarters at the fair market value of our common stock on the date of grant. Upon the occurrence of certain events that result in a change of control, all outstanding options granted to all employees, including executive officers, will become fully exercisable. |

| (3) | | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by the rules of the SEC and do not represent an estimate or projection of our future common stock prices. These amounts represent certain assumed rates of appreciation in the value of our common stock from the fair market value on the date of grant. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall stock market conditions. The amounts reflected in the table may not necessarily be achieved. |

Year-End Option Table

The following table contains information regarding stock options held by our Named Executive Officers, and the number of and value of any unexercised in-the-money options, as of December 31, 2002. The value of unexercised in-the-money options at December 31, 2002 is based on a value of $43.17 per share, the fair market value of our common stock as reflected by the closing price on the Nasdaq National Market on December 31, 2002, less the per share exercise price, multiplied by the number of shares issuable upon exercise of the option.

AGGREGATED OPTION EXERCISES IN THE YEAR ENDED DECEMBER 31, 2002 AND YEAR-END

OPTION VALUES

| | | Shares Acquired on Exercise (#)

| | Value Realized(1)

| | Number of Securities Underlying Unexercised Options as of December 31, 2002 (#)

| | Value of Unexercised in the Money Options at December 31, 2002

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Dani P. Bolognesi, Ph.D. | | — | | — | | 373,656 | | 147,336 | | $ | 9,904,000 | | $ | 930,000 |

M. Nixon Ellis, Ph.D. | | — | | — | | 92,098 | | 84,377 | | | 44,000 | | | 105,000 |

Robert R. Bonczek | | — | | — | | 216,358 | | 86,147 | | | 5,374,000 | | | 720,000 |

Timothy J. Creech | | — | | — | | 55,058 | | 22,751 | | | 1,398,000 | | | 162,000 |

| (1) | | Value realized is calculated as the fair market value of our common stock as reflected by the closing price on the Nasdaq National Market on the date of exercise, less the per share exercise price, multiplied by the number of shares issuable upon exercise of the option. |

17

Employment Agreements

In April 1999, we entered into an employment arrangement with Dr. Bolognesi, our Chief Executive Officer and Chief Scientific Officer. Under this arrangement, Dr. Bolognesi is entitled to receive minimum annual compensation of $285,000, an annual bonus based upon the achievement of certain milestones and all health insurance and other benefits generally made available to our employees. He also received in 1999 a one-time payment of $40,000 for replacement of lost income. In connection with the agreement, Dr. Bolognesi received a grant of options to purchase 235,000 shares of common stock at $11.625 per share. If Dr. Bolognesi’s employment is terminated for any reason other than for cause, Dr. Bolognesi’s employment arrangement provides that he is entitled to his base salary and benefits for two years from the date of termination. In April 2003, Dr. Bolognesi’s employment arrangement was automatically renewed until April 2005, unless terminated earlier in accordance with its terms.

In March 2000, we entered into an employment arrangement with Dr. Ellis, our President. Under this arrangement, Dr. Ellis is entitled to receive minimum annual compensation of $220,000, an annual bonus based upon the achievement of certain milestones and all health insurance and other benefits generally made available to our employees. He also received in 2000 a one-time payment of $25,000 as a signing bonus. In connection with the agreement, Dr. Ellis received a grant of options to purchase 100,000 shares of common stock at $49.938 per share. If Dr. Ellis’ employment is terminated for any reason other than for cause, Dr. Ellis’ employment arrangement provides that he is entitled to his base salary and benefits for two years from the date of such termination. In March 2003, Dr. Ellis’ employment arrangement was automatically renewed until March 2004, unless terminated earlier in accordance with its terms.

In January 2000, we entered into a contractual arrangement with Mr. Bonczek, our Chief Financial Officer and General Counsel. Under this arrangement, Mr. Bonczek is entitled to receive minimum annual compensation of $210,000 and an annual bonus based upon the achievement of certain milestones. Pursuant to his contractual arrangement, he also received in 2000 a one-time payment of $16,000 for replacement of lost income and in 2001 a one-time payment of $19,790 for reimbursement for moving and miscellaneous expenses. In October 1999, Mr. Bonczek received a grant of options to purchase 100,000 shares of common stock at $17.625 per share. If Mr. Bonczek’s contractual arrangement is terminated for any reason other than for cause, Mr. Bonczek’s arrangement provides that he is entitled to his base salary and benefits for two years from the date of such termination. In January 2002, Mr. Bonczek’s contractual arrangement was automatically renewed until January 2004, unless terminated earlier in accordance with its terms.

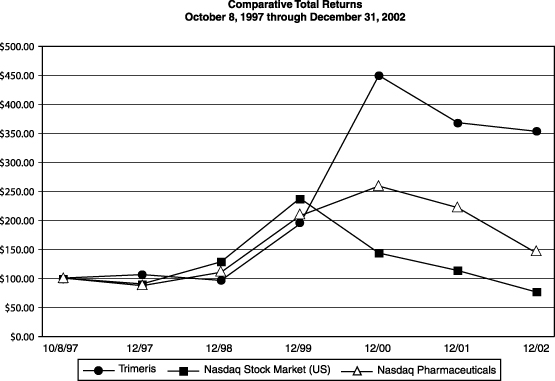

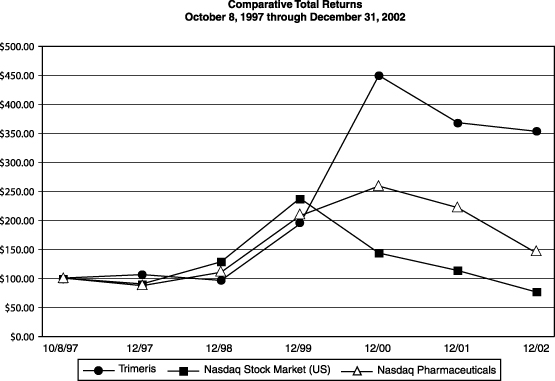

Compensation And Governance Committee Interlocks And Insider Participation