- AOS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

A. O. Smith (AOS) 425Business combination disclosure

Filed: 23 Jan 09, 12:00am

Fourth Quarter 2008 January 22, 2009 Filed by A. O. Smith Corporation pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended. Subject Company: A. O. Smith Corporation Subject Company’s Commission File No.: 1-475 Exhibit 99.2 |

2 Forward Looking Statements This presentation contains statements that we believe are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “continue,” or words of similar meaning. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of this release. Factors that could cause such a variance include, among others, the following: significant volatility in raw material prices; competitive pressures on the company’s businesses; inability to implement pricing actions; negative impact of future pension contributions on the company’s ability to generate cash flow; instability in the company’s electric motor and water products markets; further weakening in housing construction; further weakening in commercial construction; a further slowdown in the Chinese economy; expected restructuring savings realized; further adverse changes in customer liquidity and general economic and capital market conditions; any failures to realize the anticipated benefits of the proposed Smith Investment transaction; the failure of A. O. Smith or Smith Investment stockholders to approve the proposed merger; the outcome of the proposed transaction, if completed; the ability to satisfy the conditions to the proposed transaction; the impact of the proposed transaction or any other transaction on A. O. Smith’s or Smith Investment’s respective businesses, and the possibility of adverse publicity or litigation and the outcome thereof and the costs and expenses associated therewith. Forward-looking statements included in this conference call are made only as of the date of this presentation, and the company is under no obligation to update these statements to reflect subsequent events or circumstances. All subsequent written and oral forward-looking statements attributed to the company, or persons acting on its behalf, are qualified entirely by these cautionary statements. This presentation contains certain non-GAAP financial measures as that term is defined by the SEC. Non-GAAP financial measures are generally identified by “Adjusted” (Adj.) or “Before Restructuring”. |

3 2008 Highlights Sales of $2.3 billion; flat with 2007 GAAP EPS of $2.70 or $2.89 adjusted for restructuring Operating cash flow of $107 million Debt to Capital ratio of 34% China water heaters still growing strong: $185 million in sales, up 26% Restructuring activities at motors on track; $5 million in savings realized in 2008 Merger agreement with Smith Investment Company 2009: GAAP EPS of $2.40 to $2.60 |

4 2009 Challenges Headwinds Soft housing market throughout 2009; recession continues Commercial demand expected to be down substantially Slower growth in China Increased pension expense Tailwinds Water heater pricing Restructuring benefits |

5 2008 Results Sales 2,304.9 2,312.1 (7.2) -0.3% Net Earnings (GAAP) 81.9 88.2 (6.3) -7% EPS (reported) 2.70 $ 2.85 $ (0.15) $ -5% Restructuring 0.19 $ 0.33 $ (0.14) $ Tax Benefit - (0.16) 0.16 Adjusted EPS 2.89 $ 3.02 $ (0.13) $ -4% (in millions, except per share) 2008 2007 change % chg. |

6 Fourth Quarter Results Sales 508.6 569.9 (61.3) -11% Net Earnings (GAAP) 6.6 17.0 (10.4) -61% EPS (reported) 0.22 $ 0.55 $ (0.33) $ -60% Restructuring 0.07 0.26 $ (0.19) Tax Benefit - (0.06) 0.06 Adjusted EPS 0.29 $ 0.75 $ (0.46) $ -61% (in millions, except per share) 2008 2007 change % chg. |

7 Water Products 1,451.3 1,423.1 28.2 2% Electrical Products 858.1 894.0 (35.9) -4% Intersegment (4.5) (5.0) 0.5 Total Sales 2,304.9 2,312.1 (7.2) -0.3% 2008 Segment Sales 2008 2007 change % chg. (in millions) |

8 Water Products 346.2 379.0 (32.8) -9% Electrical Products 163.2 192.4 (29.2) -15% Intersegment (0.8) (1.5) 0.7 Total Sales 508.6 569.9 (61.3) -11% Q4 08 Segment Sales 2008 2007 change % chg. (in millions) |

9 Water Products 134.7 150.0 (15.3) -10% Electrical Products 39.1 23.1 16.0 EPC Restructuring 8.7 22.8 (14.1) EPC - adjusted O.P. 47.8 45.9 1.9 4% Corporate (44.7) (46.3) 1.6 Total operating profit 137.8 149.6 (11.8) -8% Margin Water Products 9.3% 10.5% Electrical Products* 5.6% 5.1% * adjusted for restructuring 2008 Operating Profit 2008 2007 change % chg. (in millions, except percentages) |

10 Water Products 29.5 45.1 (15.6) -35% Electrical Products (5.2) (18.0) 12.8 EPC Restructuring 2.9 21.2 (18.3) EPC - adjusted O.P. (2.3) 3.2 (5.5) Corporate (10.7) (12.6) 1.9 Total operating profit 16.5 35.7 (19.2) -54% Margin Water Products 8.5% 11.9% Electrical Products* -1.4% 1.6% * adjusted for restructuring Q4 08 Operating Profit 2008 2007 change % chg. (in millions, except percentages) |

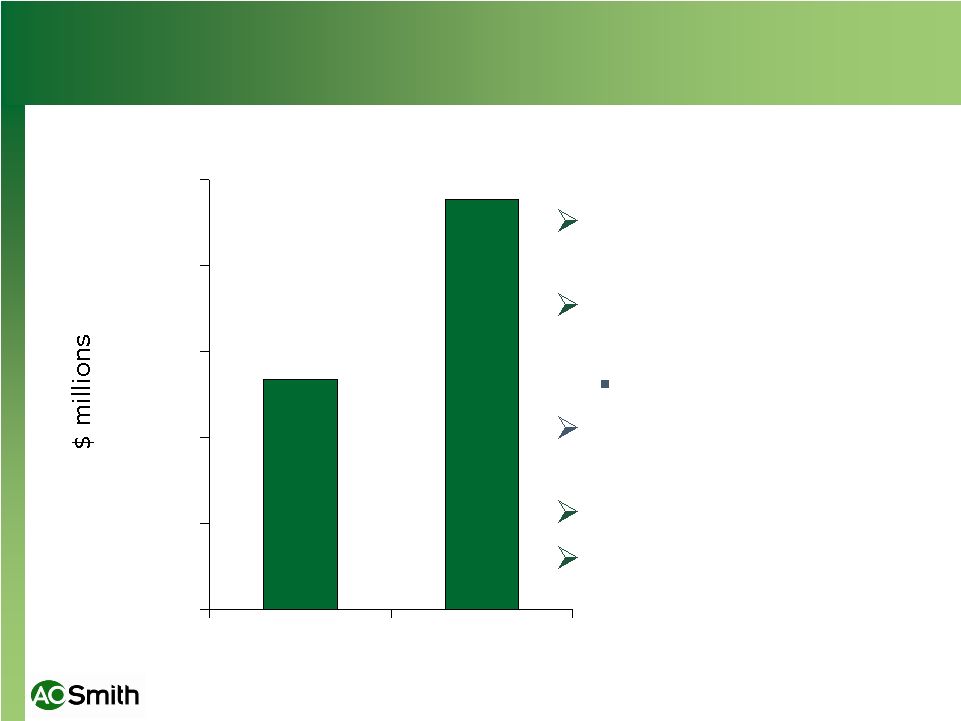

11 Operating Cash Flow of $107M Cash cycle days of 66 vs. 57 last year 8 more inventory days D&A $66M vs. CAPX $66M Debt/Capital 34% Expect operating cash flow of $150 million in 2009 107 191 0.0 40.0 80.0 120.0 160.0 200.0 Operating Cash Flow 12/31/08 12/31/07 |

2009 Outlook |

13 |

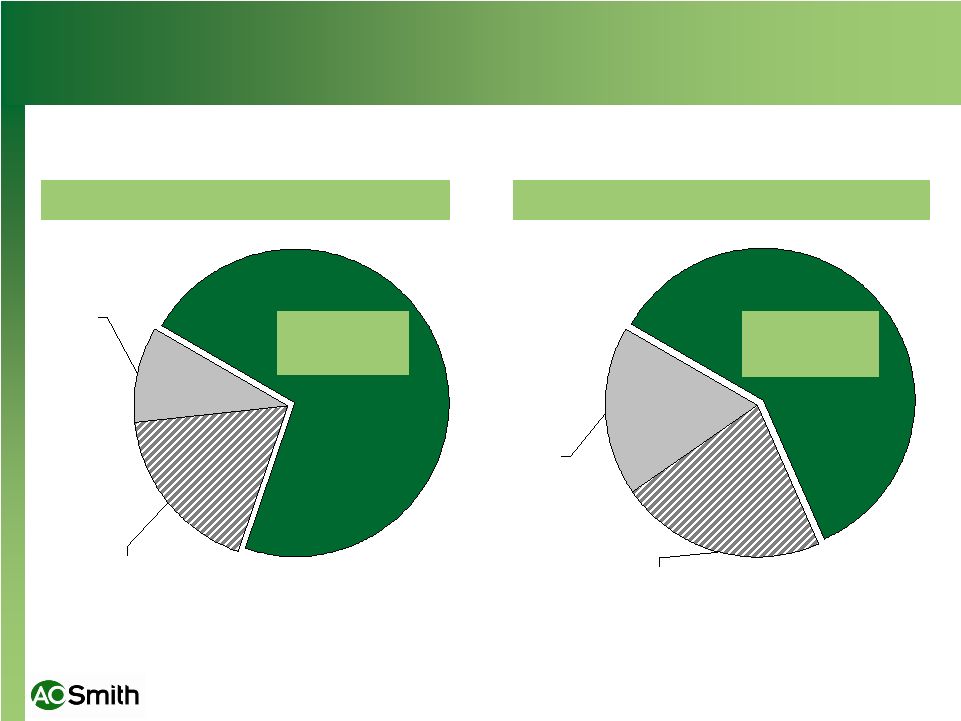

14 Replacement 72% China 10% New Construction 18% New Construction 22% China 18% Replacement 60% Water Products Electrical Products But exposure to economic slowdown is limited |

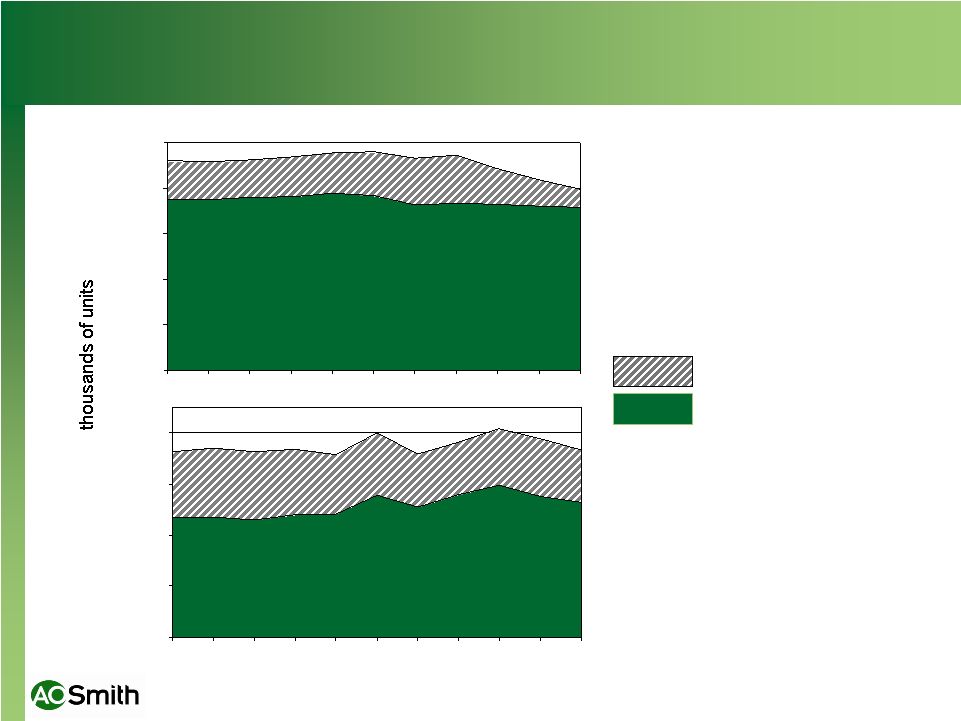

15 Water Heaters Strong Replacement Markets 0 40,000 80,000 120,000 160,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 0 2,000 4,000 6,000 8,000 10,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 New Construction Replacement Residential (N.A.) Commercial (N.A.) |

16 Outlook Volume declines, particularly higher margin commercial business Higher pension expense at approximately $10 million Water heater pricing China growth Water Heaters – 2008 sales increase to $185 M – Sales projected to be up mid-teens in 2009 Commercial hermetic motor business – 2009 sales projected to grow Restructuring benefits |

17 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 2008 2009 Forecast 2009 Forecast $2.70 $2.40 - $2.60 |

18 In connection with the proposed transaction between A. O. Smith and SICO, the parties intend to file a registration statement on Form S-4 with the SEC containing a joint proxy statement/prospectus. Such documents, however, are not currently available. The joint proxy statement/prospectus will be mailed to stockholders of A. O. Smith and SICO. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain a free copy of the joint proxy statement/prospectus filed by A. O. Smith, without charge, at the SEC’s website (http://www.sec.gov) once such documents are filed with the SEC. It will also be available on A. O. Smith’s website (http://www.aosmith.com) by clicking on A. O. Smith Corporation, Investor Relations and then SEC filings. Copies of the joint proxy statement/prospectus can also be obtained, without charge, once they are filed with the SEC, by directing a request to A. O. Smith Corporation, Attention: Investor Relations, 11270 West Park Place, Milwaukee, Wisconsin 53224. A. O. Smith, SICO and their respective directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies from the stockholders of A. O. Smith and SICO in connection with the proposed transaction. Information about the directors and executive officers of A. O. Smith and SICO and their respective interests in the proposed transaction will be available in the joint proxy statement/prospectus. |