|

| | | |

Phillip R. Mills

212 450 4618 phillip.mills@DPW.COM | 450 LEXINGTON AVENUE NEW YORK, N.Y. 10017

212 450 4000

FAX 212 450 3800

| Menlo Park

Washington, D.C.

London

Paris

Frankfurt

Madrid

Tokyo

Beijing

Hong Kong |

April 7, 2009

| Re: | PartnerRe Ltd. Preliminary Proxy Statement on Form PRE14A Filed March 27, 2009 File No. 001-14536 |

Securities and Exchange Commission

100 F Street, N.E.

Mail Stop 6010

Washington, D.C. 20549

Attention: Bryan Pitko

Jeffrey Riedler

Gentlemen:

On behalf of PartnerRe Ltd. (the “Company”), and in connection with the Preliminary Proxy Statement on Form PRE14A filed by the Company with the Commission (the “Preliminary Proxy Statement”), we write in response to the Staff’s comment on the Preliminary Proxy Statement as transmitted to the Company in a letter dated April 2, 2009. For your convenience, we have restated your comment in bold type below.

Preliminary Proxy Statement

Proposal 6 To Approve Amended and Restated Bye-Laws, page 67

| | 1. | Rule 14a-4(a)(3) as promulgated under the Exchange Act requires that the form of proxy “identify clearly and impartially each separate matter intended to be acted upon, whether or not related to or conditioned on the approval of other matters.” Please revise your proxy statement to “unbundle” the various proposed amendments to the Company's bye-laws so that each amendment is separately identified, discussed and voted on in the proxy statement. |

As discussed with Bryan Pitko on April 6 and in response to your comment, the Company proposes to subdivide Proposal 6 To Approve Amended

| Securities and Exchange Comission | 2 | April 7, 2009 |

and Restated Bye-Laws into the six sub-proposals set out below. Proposals A through E below represent the substantive matters and proposal F addresses the remaining changes. Shareholders will vote on each item separately and the proxy card allows shareholders to vote “for” or “against,” or to “abstain” with respect to each of the proposals relating to the Amended and Restated Bye-Laws of the Company (the “Amended Bye-Laws”).

| | A. | Eliminate supermajority voting requirements for amalgamations; |

| | B. | Advance notice provisions; |

| | C. | Certain limitations on ownership and voting of shares; |

| | D. | Indemnification provisions; |

| | E. | Election, disqualification and removal of directors; and |

| | F. | Other changes to the bye-laws. |

The Amended Bye-Laws reflect a comprehensive and extensive revision of the bye-laws in an effort to reflect amendments to the Bermuda Companies Act and otherwise modernize the bye-laws and bring them closer in line with similarly situated public companies. Accordingly, adoption of the Amended Bye-Laws is conditioned on shareholder approval of each of the above six proposals.

A revised draft of the proxy card as well as revised proxy disclosure for Proposals 6A - 6F is enclosed. The disclosure seeks to achieve a balance between issues that are most important to shareholders and a description of each and every change, in an effort to give appropriate consideration to the most significant changes. Many of the changes are simply to make the bye-laws more readable, but do not have a substantive effect.

As discussed in the Preliminary Proxy Statement, the Company plans to mail its Notice of Internet Availability of Proxy Materials to shareholders on April 10, 2009, at or before which time the Company would also make available to shareholders its final proxy statement and annual report. In order to ensure that such materials are made available to shareholders at least 40 calendar days prior to the date of the annual general meeting of shareholders, as required by Rule 14a-16 under the Exchange Act, the Company needs to finalize its form of proxy and final proxy statement prior to that date. It is our understanding that the notice card and voting materials need to be typeset on April 7, 2009.

The Company respectfully requests that the Staff advise, in light of the above, whether it objects to the Company proceeding with a definitive proxy statement with the revisions described in this letter; and if so, provide specific suggestions for separate proposals or additional matters that should be the subject further disclosure.

| Securities and Exchange Comission | 3 | April 7, 2009 |

The Company acknowledges that:

| | · | the Company is responsible for the adequacy and accuracy of the disclosure in its proxy statement; |

| | · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the proxy statement; and |

| | · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions or wish to discuss any part of this letter please contact Phillip Mills at (212) 450-4618.

| Amanda Sodergren PartnerRe Ltd. |

PROPOSAL 6 TO APPROVE AMENDED AND RESTATED BYE-LAWS

(Item 6 on the Form of Proxy)

Shareholders are being asked to consider and approve the adoption of each of the six proposals described below (Proposals 6A through 6F) to implement the new Amended and Restated Bye-Laws of the Company (the “Amended Bye-Laws”). The adoption of each of these proposals is conditioned on shareholder approval of all of Proposals 6A through 6F.

Under Section 13 of the Bermuda Companies Act of 1981 (the “Companies Act”) and Bye-Law 131 of the Company’s current Bye-Laws (the “Current Bye-Laws”), any amendments to the Bye-Laws require approval by the affirmative vote of a majority of the votes cast by Shareholders present in person or by proxy at the Annual General Meeting.

Background and Reasons for the Amendments to the Bye-Laws

The Board recently undertook a review of the Current Bye-Laws to determine whether changes were appropriate (1) to reflect recent amendments to the Companies Act, Bermuda’s primary company legislation and (2) to closer align the Bye-Laws in certain respects with those of other Bermudian reinsurance companies and other large U.S. publicly-traded companies.

Following its review, the Board determined, at its meeting held on February 27, 2009, that it is in the best interests of the Company and its Shareholders to make certain amendments to the Current Bye-Laws. As such, the Board approved, and recommends that Shareholders approve, the adoption of the Amended Bye-Laws. The Amended Bye-Laws are included as Appendix V to this Proxy Statement and the following summary of some of the changes to the Current Bye-Laws is qualified in its entirety by reference to them. The Amended Bye-Laws incorporate other changes, including changes to make them easier to read, to clarify the operation of certain provisions, to memorialize certain provisions of the Companies Act in the Bye-Laws and to group like Bye-Laws together for ease of reference.

Shareholders will vote separately on each of the six proposals described below (Proposals 6A through 6F) to amend and restate the Current Bye-Laws. The adoption of the Amended Bye-Laws is conditioned on shareholder approval of each of the proposals below. Failure to approve any of them will lead to none of the proposals being adopted and the Current Bye-Laws will remain in effect without change. Shareholders are urged to carefully review Appendix V.

Proposal 6A: Eliminate supermajority voting requirements for amalgamations

Reason for Change from Current Bye-Laws. Under the Companies Act, business combinations by way of amalgamation require the approval of 75% of shareholders, or, if required by the Companies Act, holders of each class of shares, present in person or voting by proxy, unless a company’s bye-laws provide otherwise. The Current Bye-Laws are silent on this issue. The Board believes that, as with other actions, Shareholders should have the right to act by a majority. In addition, the Board recognizes that there are practical reasons that support majority voting. For example, there are irregularities in the proxy system that may result in proxies never being received by Shareholders or proxies arriving too late for a vote. In addition, Shareholders could experience difficulty in approving a business combination beneficial to them, and recommended

by the Board, in the absence of majority voting. As such, the Amended Bye-Laws provide that a simple majority of votes cast is required to approve an amalgamation.

Expected Effect. The Company will no longer be required to muster a 75% vote to approve an amalgamation, the primary mechanism for the sale of a publicly-traded Bermudian company. Shareholders, or, if required by the Companies Act, holders of each class of shares, can approve an amalgamation with a simple majority vote of those voting at a meeting at which a quorum is present. This amendment thus empowers Shareholders to more easily approve amalgamations that may be beneficial to them, and recognizes the practical difficulties that obtaining a supermajority can present.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6A: ELIMINATE SUPERMAJORITY VOTING REQUIREMENTS FOR AMALGAMATIONS.

PROPOSAL 6A WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

Proposal 6B: Advance notice provisions

Reason for Change from Current Bye-Laws. The Current Bye-Laws do not give any procedural guidance to Shareholders who wish to nominate Directors or otherwise propose business at general meetings. The Amended Bye-Laws provide that Shareholders shall give notice of their nomination or other proposal to be brought before annual general meetings between 60 and 90 days prior to the first anniversary of the preceding annual general meeting, and they must give notice of any nomination to be brought before a special general meeting between 60 and 90 days prior to the date of the special general meeting or within 10 days of the notice of such special general meeting. The ability of Shareholders to convene a special general meeting as provided by the Companies Act remains unchanged. Shareholders who submit nominations or other proposals must also provide certain information with regard to their economic and other interests.

Expected Effect. Providing for 60 to 90 days advance notice of Shareholder nominations or other proposals to be brought at an annual or special general meeting provides clarity to the submitting Shareholders on how to properly submit a nomination or proposal. This benefits all Shareholders by enabling the Company to take appropriate steps to evaluate the nomination or proposal so that the Board can properly advise the Shareholders on its purpose. The information provided by the submitting Shareholder will aid the Company in giving all Shareholders information necessary to review the proposal, and will allow the Company to determine that the Shareholders’ motives are aligned with the Company’s interests. In addition, it will provide a consistent basis upon which any Shareholder may submit a proposal or nomination.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6B: ADVANCE NOTICE PROVISIONS.

PROPOSAL 6B WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

Proposal 6C: Voting/ownership limitations

Reason for Change from Current Bye-Laws. The Current Bye-Laws prohibit any Shareholder from acquiring, owning, controlling or voting more than 9.9% of the Company’s share capital or voting power. By so doing, they prevent the Company from being treated as a “controlled foreign corporation” under U.S. tax rules, and thus avoid adverse tax treatment for certain Shareholders. Similar provisions are common in other publicly-traded Bermudian reinsurance companies. To protect Shareholders, the Amended Bye-Laws also provide the Company the right to reduce voting rights to comply with the foregoing limitations in order to avoid non-de minimis adverse tax, legal or regulatory consequences to the Company or Shareholders. These provisions enable the Company to protect against accumulations of its shares that could raise regulatory issues in some jurisdictions. The Amended Bye-Laws also provide additional protection to Shareholders from adverse tax treatment by permitting the Company to purchase shares from a Shareholder if the Board reasonably determines that the 9.9% limitation is exceeded or such reduction is necessary in order to avoid non-de minimis adverse tax, legal or regulatory consequences to the Company or Shareholders. Finally, the Amended Bye-Laws permit the Board to reasonably request certain information from Shareholders necessary to effectuate the Voting/ownership Limitations. The Company will be required to maintain the confidentiality of any information disclosed.

Expected Effect. The Amended Bye-Laws consolidate existing provisions into one bye-law and provide mechanics for applying such limitations for greater clarity. The effect is that the Board will be better able to protect both the Company and its Shareholders from adverse consequences, including, most prominently, those that would result from the Company being deemed a “controlled foreign corporation.” From time to time, the Company may request information from its Shareholders for the purpose of applying the voting/ownership limitations discussed below. The Company will use this information to minimize the likelihood that the Company would be a “controlled foreign corporation” under U.S. tax rules, which in turn will lower the possibility of adverse tax consequences for certain Shareholders. The Company will treat such information as confidential and limit access to it appropriately. If a Shareholder fails to respond to a request for such information or submits incomplete or inaccurate information, the Board may in its reasonable discretion limit such Shareholder’s voting rights.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6C: VOTING/OWNERSHIP LIMITATIONS.

PROPOSAL 6C WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

Proposal 6D: Indemnification Provisions

Reason for Change from Current Bye-Laws. In addition to other indemnification rights, the Current Bye-Laws require the Company to indemnify its Directors and Officers for any costs they incur in defending themselves in legal proceedings arising as a result of their performance of Company business. An exception is made for any proceedings involving in fraud or dishonesty, in which case the Director or Officer may only be indemnified if he has a judgment in his favor or he is acquitted. In line with recent changes to the Companies Act, the Amended Bye-Laws provide greater protection to Directors and Officers by extending the indemnification to situations

in which a claim involving fraud or dishonesty is settled, compromised or abandoned. They also provide that the Company will pay for such expenses in advance, though if a Director or Officer is found to have engaged in fraud or dishonesty, he must repay the Company. Finally, the Amended Bye-Laws make clear that any further changes to the Bye-Laws will not adversely affect a Director or Officer’s existing indemnification right.

Expected Effect. The Amended Bye-Laws will enable the Company to attract and retain Directors and Officers who might otherwise be concerned about having to bear upfront costs in any potential litigation. It is not expected that this change will result in a significantly greater expense to the Company. In addition, the Amendments also provide assurance to potential Directors and Officers that future adverse amendments to the indemnification provisions will not affect the indemnification rights they are given when they begin service.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6D: INDEMNIFICATION PROVISIONS.

PROPOSAL 6D WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

Proposal 6E: Election, disqualification and Removal of Directors

Reason for Change from Current Bye-Laws. Publicly-traded Bermudian reinsurance companies typically have staggered boards, with approximately one-third of their board up for election at each annual general meeting, and preclude removal of directors except for cause. Furthermore, publicly-traded Bermudian reinsurance companies typically require a supermajority vote of their shareholders (75% of shareholders present in person or voting by proxy) to approve business combinations by way of an amalgamation. As noted above, the Company is proposing to reduce the vote it requires for an amalgamation to a simple majority of votes cast. Integral to the Board’s determination to make such change, and the other changes proposed in the Amended Bye-Laws, is the Board’s determination that the Company and the Shareholders be protected from actions not in their best interests. Unlike most publicly-traded Bermudian reinsurance companies, the Current Bye-Laws allow Shareholders to remove Directors at a special general meeting (not an annual general meeting) called for that purpose. The Amended Bye-laws preserve the Board as a staggered board with three classes of directors and only one class up for re-election at each annual general meeting; and allow Shareholders to remove Directors only at a special general meeting and for cause, which is defined as fraud, embezzlement or felony. Under the Amended Bye-Laws, Shareholder action to elect Directors would require a majority of votes cast (not just a plurality). In order to further protect Shareholders’ interests, the Amended Bye-Laws expand the circumstances in which Directors can be disqualified from continuing to serve (even before their three-year terms have expired). The Current Bye-Laws set out several events that mandate the disqualification of a Director, including bankruptcy and unsound mental health. The Amended Bye-Laws provide two additional disqualification events: (i) an unexcused absence from Board meetings for six consecutive months; and (ii) the written request of at least three-fourths of the other Directors after notice and opportunity to be heard. The Board believes that providing it with the ability to deal with an inattentive or disruptive Director through such additional disqualification mechanisms provides the Company with a more practical and effective mechanism than the extreme mechanism currently provided of having to convene a special shareholder meeting to remove the Director.

Expected Effect. The Company will continue to have a staggered board with three classes of directors and only one class up for re-election at each annual general meeting. Furthermore, Shareholder action to elect Directors requires a majority of votes cast (not just a plurality). While the limitation on the right to remove Directors could have an anti-takeover effect, that effect needs to balanced against the following considerations.

| | · | Firstly, currently (and in the Amended Bye-Laws) there are various prohibitions on any Shareholder acquiring, owning, controlling or voting more than 9.9% of the Company’s share capital or voting power. |

| | · | Secondly, currently Shareholders can only remove a Director at a special general meeting (not an annual general meeting) which would involve the delay and incremental costs of first soliciting Shareholders to requisition a meeting and then separately soliciting proxies to remove and replace the Director. |

| | · | Thirdly, the removal of a Director currently only requires a simple majority of votes cast. Therefore, Shareholders being asked to remove Directors to facilitate a sale of the Company may have considerable uncertainty as to whether shareholders representing 75% of Shareholders present in person or voting by proxy at a future meeting (the required vote for an amalgamation) would approve a sale by way of amalgamation. |

| | · | Fourthly, the Amended Bye-Laws are an integrated proposal. Therefore, failure to approve them would deny the Company and the Shareholders the other benefits contemplated by the Amended Bye-Laws. |

| | · | Fifthly, the Amended Bye-Laws grant the Board the power to remove a Director by action of three-fourths of the other Directors which would avoid the practical impediments, including cost, adverse publicity, disruption and expense, of calling a special general meeting of Shareholders to take that action. |

| | · | Finally, this change is consistent with the requirements currently applicable at most publicly-traded Bermudian reinsurance companies. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6E: ELECTION, DISQUALIFICATION AND REMOVAL OF DIRECTORS.

PROPOSAL 6E WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

Proposal 6F: Other changes to the Bye-Laws.

Reason for Change from Current Bye-Laws. These changes make the Bye-Laws easier to read, clarify the operation of certain provisions, memorialize certain provisions of the Companies Act in the bye-laws and group like bye-laws together for ease of reference. Changes include, among others:

| | · | Under the Amended Bye-Laws, the Company may issue fractional Shares, and Shares may be in certificated or uncertificated form. These provisions provide flexibility to the Company to accommodate advances in technology and depositary arrangements. |

| | · | The Current Bye-Laws provide that an Annual General Meeting may be called by not less than 30 days’ notice in writing, and that a Special General Meeting may be called by not less than seven days’ notice in writing. The Amended Bye-Laws state that both Annual General Meetings and Special General Meetings must be called by not less than ten (10) days’, and not more than ninety (90) days’, notice in writing. These changes harmonize |

the notice periods for annual general and special general meetings and provide greater flexibility by allowing the Company to call an annual general meeting, if necessary, on shorter notice than before or with greater lead time, within the stated limit of (90) days.

| | · | The Amended Bye-Laws provide greater mechanics relating to fixing record dates for the purpose of identifying persons entitled to receive notices of, and to vote at, any general meeting. |

| | · | The Amended Bye-Laws modernize the means by which notices may be sent to Shareholders, including transmissions by electronic means. |

Expected Effect. Expected effects include, among others:

| | · | The Company may issue shares in a fractional denomination that will have, in fractional proportion of the whole share that it represents, all the rights of a whole share, including the right to vote, to receive dividends and distributions and to participate in a winding up. Shares may be issued in certificated or uncertificated form. |

| | · | The Company will be required to provide notice of an upcoming general meeting at least 10 days, but no more than 90 days, in advance. By setting these limits in the Bye-Laws, the Shareholders will be able to more easily anticipate and prepare for meetings, while still preserving the Company’s flexibility to call meetings when necessary within the stated time limits. The notice period is also aligned with the period required for Shareholder notice of any nomination to be brought before a special general meeting. |

| | · | The Company can specify who can receive notice of, vote at, attend, and exercise all the rights or privileges of a Shareholder (or a Shareholder of the relevant class) in relation to, any general meeting. |

| | · | The Company will be provided with the most effective and efficient means to communicate with its Shareholders. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

PROPOSAL 6F: OTHER CHANGES TO THE BYE-LAWS.

PROPOSAL 6F WILL ONLY BE ADOPTED IF SHAREHOLDERS APPROVE EACH

OF PROPOSALS 6A THROUGH 6F.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF

THE AMENDED BYE-LAWS BY VOTING FOR EACH OF PROPOSALS 6A

THROUGH 6F.

| |  | |

| VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Standard Time on May 21, 2009. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

Electronic Delivery of Future PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on May 21, 2009. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |  |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

| KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

02 0000000000

0000021895_1 R2.09.03.17

| | For

All | Withhold

All | For All

Except | | To withhold authority to vote for any individual nominee(s), mark "For All Except" and write the number(s) of the nominee(s) on the line below. | |

| The Board of Directors recommends that you vote FOR the following: | | | | | |

| 1. Election of Directors | 0 | 0 | 0 | | |

| Nominees | | | | | |

| | | | | | | |

| 01 Jan H. Holsboer 02 Kevin M. Twomey | | | | | | |

| The Board of Directors recommends you vote FOR the following proposal(s): | For | Against | Abstain |

| | | | | |

| 2 | To re-appoint Deloitte & Touche, the independent registered public accounting firm, as our independent auditors, to serve until the 2010 annual meeting, and to refer decisions about the auditors' compensation to the Board of Directors. | 0 | 0 | 0 |

| | | | | |

| 3 | To approve our 2009 Employee Share Plan. | 0 | 0 | 0 |

| | | | | |

| 4 | To approve amendments to our 2003 Non-Employee Director Share Plan, as amended and restated; | 0 | 0 | 0 |

| | | | | |

| 5 | To approve the extension of the term applicable to the shares remaining under our Swiss Share Purchase Plan; and | 0 | 0 | 0 |

| | | | | |

| 6A | PROPOSALS 6A-6F ARE CROSS-CONDITIONED UPON SHAREHOLDER APPROVAL OF ALL OF PROPOSALS 6A-6F. To eliminate supermajority voting requirements for amalgamations in our Bye Laws. | 0 | 0 | 0 |

| | | | | |

| 6B | To approve advance notice provisions in our Bye-Laws. | 0 | 0 | 0 |

| | | | | |

| 6C | To approve certain limitations on voting/ownership in our Bye-Laws. | 0 | 0 | 0 |

| | | | | |

| 6D | To approve indemnification provisions in our Bye-Laws. | 0 | 0 | 0 |

| | | | | |

| 6E | To approve election, disqualification and removal provisions in our Bye-Laws. | 0 | 0 | 0 |

| | | | | |

| 6F | To approve other changes to our Bye-Laws. | 0 | 0 | 0 |

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer.

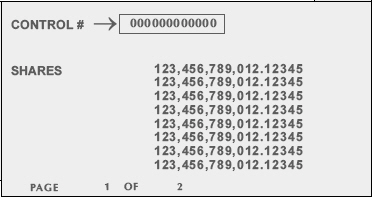

| | | | | | SHARES |

| | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | JOB # | Signature (Joint Owners) | Date | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Annual Report, Notice & Proxy Statement is/ are available at www.proxyvote.com .

| | | | |

| | | | |

| | | PROXY - PartnerRe Ltd. | |

| | | | |

| | | | |

| | | This Proxy is solicited on behalf of the Board of Directors of PartnerRe Ltd

in connection with our Annual General Meeting of Shareholders

to be held on May 22, 2009 | |

| | | | |

| | | The undersigned shareholder of PartnerRe Ltd. hereby appoints John A. Rollwagen and Patrick A. Thiele, each the true and lawful attorney, agent and proxy of the undersigned, with full power of substitution to vote all of our Common Shares, $1.00 par value per share, which the undersigned may be entitled to vote at the Annual General Meeting of Shareholders to be held May 22, 2009 and at any adjournment or postponement of such meeting with all powers which the undersigned would possess if personally present, for the purposes set forth on the reverse side hereof.

This Proxy will be voted as directed or, if no direction is indicated, it will be voted FOR the election of nominees and the approval of the proposals described on the reverse side.

| |

| | | Please complete, sign and date and return this proxy card promptly, using the enclosed evelope. | |

| | | | |