QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Steinway Musical Instruments, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

STEINWAY MUSICAL INSTRUMENTS, INC.

800 South Street

Suite 305

Waltham, Massachusetts 02453

(781) 894-9770

April 20, 2006

Dear Stockholder:

Our Annual Meeting of Stockholders will be held on Wednesday, May 17, 2006, at 10:00 a.m., at the Company's corporate office located at 800 South Street, Suite 305, Waltham, Massachusetts 02453. We urge you to attend this meeting to give us an opportunity to meet you personally, to allow us to introduce to you the key personnel responsible for management of your Company and to cover any questions you may have.

The formal Notice of Meeting, the Proxy Statement and the proxy card are enclosed. A copy of the Annual Report to Stockholders describing the Company's operations during the year ended December 31, 2005 is also enclosed.

Your Chairman, Kyle R. Kirkland, and I own 100% of the Class A Common Stock and have advised the Company that we intend to vote our shares of Class A Common Stock consistent with the recommendations of the Board of Directors set forth in the attached Proxy Statement. The Class A Common Stock presently represents over 86% of the combined voting power of the Class A Common Stock and the Ordinary Common Stock. Therefore, stockholder approval in accordance with the Board of Directors' recommendations is assured.

We hope that you will be able to attend the meeting in person. Whether or not you plan to attend the meeting, please sign and return the enclosed proxy card promptly. A prepaid return envelope is provided for this purpose. Your shares will be voted at the meeting in accordance with your proxy.

If you have shares in more than one name or if your stock is registered in more than one way, you may receive more than one copy of the proxy materials. If so, please sign and return each of the proxy cards you receive so that all of your shares may be voted. We look forward to seeing you at the Annual Meeting.

| | | Very truly yours, |

|

|

|

| | | Dana D. Messina

Chief Executive Officer |

STEINWAY MUSICAL INSTRUMENTS, INC.

800 South Street

Suite 305

Waltham, Massachusetts 02453

(781) 894-9770

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 17, 2006

The Annual Meeting of Stockholders of Steinway Musical Instruments, Inc. (the "Company") will be held on Wednesday, May 17, 2006 at 10:00 a.m. at the Company's corporate office at 800 South Street, Suite 305, Waltham, Massachusetts 02453, for the following purposes:

- 1.

- To elect seven (7) directors to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified;

- 2.

- To approve and adopt the Company's 2006 Stock Compensation Plan;

- 3.

- To approve and adopt the Company's 2006 Employee Stock Purchase Plan;

- 4.

- To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2006; and

- 5.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on March 24, 2006 will be entitled to vote at the Annual Meeting or any adjournment or postponement thereof. All stockholders are urged to attend the meeting in person or by proxy.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON, PLEASE SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED PREPAID RETURN ENVELOPE. The proxy is revocable and will not affect your right to vote in person in the event you attend the meeting.

| | | By Order of the Board of Directors, |

|

|

|

| | | John R. Dudek

Secretary |

Waltham, Massachusetts

April 20, 2006 |

|

|

STEINWAY MUSICAL INSTRUMENTS, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

Solicitation and Revocation of Proxies

The enclosed proxy is solicited by and on behalf of the Board of Directors of Steinway Musical Instruments, Inc. (the "Company") for use in connection with the Annual Meeting of Stockholders to be held on the 17th day of May, 2006 at 10:00 a.m. (the "Annual Meeting") and at any and all adjournments thereof.

The persons named as proxies were designated by the Board of Directors and are officers and/or directors of the Company. Any proxy may be revoked or superseded by executing a proxy bearing a later date or by giving notice of revocation in writing prior to, or at, the Annual Meeting, or by attending the Annual Meeting and voting in person. All proxies which are properly completed, signed and returned to the Company prior to the meeting, and not revoked, will be voted in accordance with the instructions given in the proxy. If a choice is not specified in the proxy, the proxy will be voted FOR the election of the director nominees listed below, FOR approval and adoption of the Company's 2006 Stock Compensation Plan, FOR approval and adoption of the Company's 2006 Employee Stock Option Plan and FOR the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2006.

This Proxy Statement and the accompanying proxy are being mailed to stockholders on or about April 20, 2006. The entire cost of the solicitation of proxies will be borne by the Company. Expenses will also include reimbursements paid to brokerage firms and others for their reasonable expenses incurred in forwarding solicitation material regarding the meeting to beneficial owners of the Company's common stock. It is contemplated that this solicitation will be primarily by mail. In addition, some of the officers, directors and employees of the Company may solicit proxies personally or by telephone, facsimile or e-mail.

Messrs. Kirkland and Messina have advised the Company that they intend to vote all of their shares of Class A Common Stock in favor of the election of the seven nominees recommended by the Board of Directors, approval and adoption of the Company's 2006 Stock Compensation Plan, approval and adoption of the Company's 2006 Employee Stock Option Plan and the appointment of Deloitte & Touche LLP to serve as the Company's independent registered public accounting firm to audit the Company's financial statements for 2006 and internal controls over financial reporting as of December 31, 2006. Such action by Messrs. Kirkland and Messina is sufficient to elect such directors, to approve and adopt such plans and to appoint the independent registered public accounting firm without any action on the part of any other holder of common stock.

Voting at the Meeting

Only stockholders of record at the close of business on March 24, 2006 will be entitled to vote at the Annual Meeting or any adjournment or postponement thereof. The Company's Restated Certificate of Incorporation (the "Certificate of Incorporation") authorizes two classes of common stock, designated as Ordinary Common Stock and Class A Common Stock. Each share of Ordinary Common Stock entitles the record holder to one vote while each share of Class A Common Stock entitles the record holder to 98 votes on any action to be taken at the Annual Meeting, unless Delaware law provides otherwise. As of March 24, 2006, there were 7,690,858 shares of Ordinary Common Stock and 477,952 shares of Class A Common

Stock outstanding. As of that date, all shares of Class A Common Stock were owned by Kyle R. Kirkland, Chairman of the Board, and Dana D. Messina, Chief Executive Officer of the Company, representing 86% of the combined voting power of the Class A Common Stock and Ordinary Common Stock. Neither the holders of the Ordinary Common Stock nor the holders of Class A Common Stock have cumulative voting rights. The stockholders of the Company have no dissenters or appraisal rights in connection with any of the items scheduled to be presented to the stockholders at the Annual Meeting.

Vote Required

The election of director nominees requires a plurality of the votes cast in person or by proxy at the Annual Meeting. Under Delaware law, the Certificate of Incorporation and the Company's bylaws, shares as to which a stockholder abstains or withholds from voting on the election of directors and shares as to which a broker indicates that it does not have discretionary authority to vote ("broker non-votes") on the election of directors will not be counted as voting thereon and, therefore, will not affect the election of the nominees receiving a plurality of the votes cast.

Approval and adoption of the Company's 2006 Stock Compensation Plan and 2006 Employee Stock Purchase Plan and the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the 2006 fiscal year requires the affirmative vote of the holders of at least a majority of the aggregate votes cast at the Annual Meeting. Under Delaware law, the Certificate of Incorporation and the Company's bylaws, shares as to which a stockholder abstains or withholds from voting on the ratification of independent registered public accounting firms and broker non-votes have the same effect as a vote against such ratification.

ELECTION OF DIRECTORS

The Certificate of Incorporation fixes the number of directors at not less than three and not more than nine, with the exact number to be set by resolution of the Board of Directors. Except as set forth below, persons named as proxies may not vote for the election of any person to the office of director for which a bona fide nominee is not named in the Proxy Statement. All nominees have consented to serve as directors for the ensuing year and have previously served as directors of the Company. Although the Board of Directors does not contemplate that any of the nominees will be unable to serve, if any nominee withdraws or otherwise becomes unavailable to serve, the persons named in the enclosed proxy will vote for any substitute nominee designated by the Board of Directors.

Information Regarding the Nominees

Set forth below are the names, positions held, ages and brief accounts of the business experience for each of the persons to be nominated as a director by the Board of Directors at the Annual Meeting.

NOMINEES FOR DIRECTORS FOR TERMS EXPIRING IN 2007

Kyle R. Kirkland, Chairman of the Board and Director (age 43). Mr. Kirkland has served as a director of the Company since 1993 and as Chairman of the Board since 1996. Mr. Kirkland has been a principal of Kirkland Messina, Inc., since 1994. From 1991 to 1994, Mr. Kirkland was a Senior Vice President of an investment bank where he was responsible for its private placement financing activities. From 1990 to 1991, Mr. Kirkland was employed by Canyon Partners as a Vice President. From 1988 to 1990, he was employed by an investment banking firm in its high yield bond department.

Dana D. Messina, Chief Executive Officer and Director (age 44). Mr. Messina has served as a director of the Company since 1993 and as Chief Executive Officer since 1996. Mr. Messina has been a principal of Kirkland Messina, Inc., since 1994. From 1990 to 1994, Mr. Messina was a Senior Vice President of an investment bank where he was responsible for all of its corporate finance and merchant banking activities. From 1987 to 1990, he was employed by an investment banking firm in its high yield bond department.

2

Bruce A. Stevens, President, Steinway and Director (age 63). Mr. Stevens has served as a director of the Company since 1995. He has served as President of Steinway & Sons, an indirect wholly owned subsidiary of the Company, since 1985 when Steinway & Sons was acquired from Columbia Broadcasting System television network. Prior to that, he was employed by the Polaroid Corporation for 18 years, where he held various positions including Director of Marketing for all of Polaroid's international business. He has served on numerous industry and music education committees.

John M. Stoner, Jr., President, Conn-Selmer and Director (age 53). Mr. Stoner became a director of the Company in November of 2002. He was appointed as President of Conn-Selmer, Inc. ("Conn-Selmer"), a wholly owned subsidiary of the Company in 2002. Prior to that, Mr. Stoner spent 25 years with True Temper, Inc., a manufacturer of non-powered lawn and garden tools, where he held various positions of increasing responsibility. In 1995, he was appointed as True Temper's President and in 1999, after the acquisition of True Temper, became the President and CEO of Ames True Temper.

A. Clinton Allen, Director (age 62). Mr. Allen has served as a director of the Company since 1999 and became lead director in 2003. Currently, Mr. Allen is a director of Brooks Automation, LKQ Corporation and Source Interlinks Companies. He also serves as director and non-executive chairman for Collectors Universe, Inc. Mr. Allen provided original financing for Blockbuster Entertainment Corporation, was a founding director and served on the board until the company was acquired by Viacom/Paramount in September of 1994.

Rudolph K. Kluiber, Director (age 46). Mr. Kluiber has served as a director of the Company since 2001. Presently, Mr. Kluiber is the Managing Director of GRT Capital Partners ("GRT"), an investment management firm located in Boston, Massachusetts. Prior to forming GRT, Mr. Kluiber served as Senior Vice President and Portfolio Manager for State Street Research & Management Company ("State Street") since 1997, where he ran the State Street Aurora Fund and managed the Small-Cap Value effort.

Peter McMillan, Director (age 48). Mr. McMillan has served as a director of the Company since 1996. Currently, Mr. McMillan is the Managing Partner of Willow Brook Capital Group, LLC ("WBCG"), an asset management company based in Los Angeles, California. Mr. McMillan is a director of KBS Real Estate Investment Trust, Inc. Prior to forming WBCG, Mr. McMillan was employed by SunAmerica Investments, Inc., a wholly owned subsidiary of American International Group, Inc., where he served as Executive Vice President and Chief Investment Officer. As Chief Investment Officer, Mr. McMillan had overall investment management responsibility for SunAmerica's asset portfolio. Mr. McMillan joined SunAmerica Investments, Inc. in 1989 after managing the fixed-income portfolio for Aetna Life Insurance and Annuity Company.

Each director of the Company is elected for a period of one year and serves until his successor is duly elected and qualified. For information regarding the beneficial ownership of Ordinary Common Stock and Class A Common Stock by each nominee, see "Principal Stockholders."

Meetings of the Board of Directors

The Company has determined that it is a controlled company, as defined by the rules and regulations of the New York Stock Exchange (the "NYSE"), based on the fact that Messrs. Kirkland and Messina own over 86% of the combined voting power of the Class A Common Stock and Ordinary Common Stock. The Company has chosen to take advantage of the controlled company exemptions to Sections 303A.01, .04 and .05 of the NYSE's Listed Company Manual (the "Manual"). Accordingly, the Board of Directors need not be, nor is it, comprised of a majority of independent directors. The Board has determined that Messrs. Allen, Kluiber and McMillan are all independent according to applicable rules of the Securities and Exchange Commission (the "SEC") and the listing standards of the NYSE. The Board made this determination after discussions with the directors and a review of their responses to questions regarding employment and transaction history, affiliations, and family and other relationships. Mr. Allen has been

3

elected Lead Director. The Board of Directors met on two separate occasions during 2005. Non-management directors' meetings are held regularly throughout the year and Mr. Allen, as Lead Director, presides over these formal meetings of non-management directors. Non-management directors met once during 2005. Shareholders can communicate with Mr. Allen at the Company's annual meeting of stockholders or as described below under the caption "Communications with Stockholders of the Company." In addition to the meetings of the full Board and meetings of non-management directors, directors also took action through Board committees. The Board of Directors has standing Audit, Compensation and Option Committees. None of the members of the Board of Directors participated in less than 75% of the meetings held by the Board of Directors or of the total number of meetings held by all committees of the Board of Directors on which various members served during the year ended December 31, 2005. While the Company does not have a policy requiring the members of the Board of Directors to attend its annual meetings of stockholders, several of its directors do attend the annual meeting. Messrs. Kirkland, Messina, Allen and Kluiber attended last year's annual meeting. The current members of each of the Board of Directors' committees are listed below.

The Audit Committee

The current members of the Audit Committee are Chairman Kluiber and Messrs. Allen and McMillan, each of whom is an "independent director" as defined by the NYSE's listing standards. The Board has determined that Mr. McMillan is an "audit committee financial expert" as defined in the applicable regulations of the SEC. In addition to the relevant experience of Mr. McMillan disclosed above under the caption "Nominees for Directors for Terms Expiring in 2007," Mr. McMillan has an MBA in Finance from Wharton School of Business and the Board deemed Mr. McMillan's experience of over twenty years in the investment business, including analysis of financial statements, review of outside auditors' and management letters and involvement with analysts, rating agencies, auditors and management with respect to quarterly earnings, reserve issues and other accounting matters, as relevant to his financial expert qualifications. The Audit Committee assists the Board of Directors in fulfilling its responsibilities for oversight of the quality and integrity of the accounting, auditing, and financial reporting practices and controls of the Company. The Audit Committee met eleven times and took action by unanimous written consent once during 2005. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is attached hereto as Appendix C and is available on the Company's website at www.steinwaymusical.com.

The Compensation Committee

The current members of the Compensation Committee are Chairman Allen and Messrs. Kluiber and McMillan. The Compensation Committee sets the compensation for the executive officers of the Company and evaluates and administers the Company's compensation programs. The Compensation Committee met once and took action by unanimous written consent twice during 2005. The Company is exempt from Section 303A.05 of the Manual and therefore, need not adopt, nor has it adopted, a charter for the Compensation Committee.

The Option Committee

The current members of the Option Committee are Chairman Allen and Messrs. Kluiber and McMillan. The Option Committee is responsible for administering the Steinway Musical Instruments, Inc. Amended and Restated 1996 Stock Plan and 1996 Employee Stock Purchase Plan. The Option Committee met once and took action by unanimous written consent three times during 2005.

4

Director Nominations and Nominating Process

Since the Company is a controlled company, as defined in the Manual, and is therefore exempt from Section 303A.04 of the Manual, it does not have a standing Nominations Committee. The entire Board of Directors—Messrs. Kirkland, Messina, Stevens, Stoner, Allen, Kluiber and McMillan—participate in the consideration of director nominees. As controlling shareholders, Messrs. Kirkland and Messina put forth recommendations which are then considered and acted upon by the full Board of Directors.

The Board of Directors does not have a policy with regard to the consideration of any director candidate recommended by a stockholder of the Company. The Board of Directors has determined that, as a controlled company, it is unnecessary to have such a policy. However, the Board will consider any director candidate recommended by a stockholder of the Company when such recommendation is submitted in accordance with the Company's bylaws, the procedures described in this Proxy Statement under the caption "Stockholder Proposals," and the applicable rules of the SEC.

The Board of Directors has identified certain qualifications that a director nominee must possess before the Board recommends the nominee for a position on the Board of Directors. The Board believes that director nominees should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the stockholders of the Company. In addition, Board candidates are considered based upon other various criteria, such as broad-based business skills and experiences, as well as a global business and social perspective. The Board of Directors evaluates such director nominees based on the qualifications described above.

Corporate Governance

The Company has adopted a Code of Ethics and Professional Conduct to provide guidance to its directors, officers and employees on matters of business ethics and conduct, including compliance standards, business conduct, conflicts of interest, and identification, reporting, and resolution of issues. The Company has posted this Code, along with its Corporate Governance Guidelines and Audit Committee Charter, on its Internet website atwww.steinwaymusical.com. This information will be made available in print free of charge to any stockholder who requests it by contacting the Corporate Communications Department at Steinway Musical Instruments, Inc., 800 South Street, Suite 305, Waltham, MA 02453, (781) 894-9770 or at ir@steinwaymusical.com.

Communications with Stockholders of the Company

Any interested stockholder has the opportunity to communicate with the members of the Board of Directors at the Annual Meeting of Stockholders. In addition to attending the Annual Meeting of Stockholders, non-management directors as a group have instructed the Company that interested parties can also communicate directly with the Lead Director, or with the non-management directors as a group, by mail addressed to the Lead Director at the Company's headquarters in Waltham, Massachusetts or by e-mail at smileaddirector@steinwaymusical.com. The Company's website has a section "Contact Lead Director," that reflects such communication methods. The Company's website also has a section "Contact Audit Committee."

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR THE ELECTION

OF EACH OF THE NOMINEES NAMED ABOVE.

Unless a contrary indication is made on the enclosed proxy card, it is the intention of the persons named in the enclosed form of proxy to vote FOR the election of each director.

5

MANAGEMENT

Executive Officers and Directors of the Company

Set forth below are the names, ages, positions held and brief accounts of the business experience for each executive officer, division president and director of the Company.

Name

| | Age

| | Position

|

|---|

| Kyle R. Kirkland | | 43 | | Chairman of the Board and Director |

| Dana D. Messina | | 44 | | Chief Executive Officer and Director |

| Dennis M. Hanson | | 51 | | Senior Executive Vice President |

| Bruce A. Stevens | | 63 | | President, Steinway and Director |

| John M. Stoner, Jr. | | 53 | | President, Conn-Selmer and Director |

| Thomas Kurrer | | 57 | | Managing Director, Steinway-Germany |

| A. Clinton Allen | | 62 | | Director |

| Rudolph K. Kluiber | | 46 | | Director |

| Peter McMillan | | 48 | | Director |

For biographical information concerning Kyle R. Kirkland, Dana D. Messina, Bruce A. Stevens, John M. Stoner, Jr., A. Clinton Allen, Rudolph K. Kluiber and Peter McMillan, see "Nominees for Directors for Terms Expiring in 2007."

Dennis M. Hanson, Senior Executive Vice President. Mr. Hanson serves as the Company's Chief Financial Officer, General Counsel and Assistant Secretary. Mr. Hanson started his career in public accounting at Haskins and Sells in 1976. In 1980, he joined Computervision Corporation, where he held various financial positions including Vice President of Audit. He joined Steinway in 1988 as Vice President Finance and assumed duties as General Counsel in 1993.

Thomas Kurrer, Managing Director, Steinway-Germany. Mr. Kurrer joined Steinway in 1989 as Managing Director of Steinway-Germany and undertook responsibility for Steinway's operations outside the Americas. Mr. Kurrer was employed by the German-American Chamber of Commerce in New York from 1976 to 1978. Between 1978 and 1989, he held various positions of increasing responsibility with the Otto Wolff-Group, a conglomerate of steel and machinery equipment companies. Mr. Kurrer's last position with the Otto Wolff-Group was Managing Director of Wirth GmbH.

6

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table sets forth the annual compensation paid and accrued by the Company for services rendered during the fiscal years ended December 31, 2005, 2004 and 2003 to (i) the Company's Chairman of the Board and the Chief Executive Officer and (ii) the most highly compensated executive officers of the Company and the Managing Director of Steinway-Germany, who were serving at the end of the last completed fiscal year (each a "Named Executive Officer").

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| |

|

|---|

Name and Principal Position

| | Fiscal Year

| | Salary

| | Bonus

| | Other Annual

Compensation(1)

| | Securities

Underlying

Options(#)

| | All Other

Compensation(3)

|

|---|

Kyle R. Kirkland

Chairman of the Board | | 2005

2004

2003 | | $

$

$ | 325,000

316,000

305,000 | | $

$

| 47,000

55,000

— | | —

—

— | | —

—

10,000 | | $

$

$ | 27,735

26,262

10,500 |

Dana D. Messina

Chief Executive Officer |

|

2005

2004

2003 |

|

$

$

$ |

325,000

316,000

305,000 |

|

$

$

|

47,000

90,000

— |

|

—

—

— |

|

—

—

30,000 |

|

$

$

$ |

27,735

26,262

10,500 |

Dennis M. Hanson

Senior Executive Vice President |

|

2005

2004

2003 |

|

$

$

$ |

325,000

315,000

304,500 |

|

$

$

|

55,000

115,000

— |

|

—

—

— |

|

—

—

25,000 |

|

$

$

$ |

40,065

38,732

36,255 |

Bruce A. Stevens

President, Steinway |

|

2005

2004

2003 |

|

$

$

$ |

461,000

454,000

450,000 |

|

$

$

$ |

90,000

136,000

58,500 |

|

—

—

— |

|

—

—

10,000 |

|

$

$

$ |

72,945

71,862

51,150 |

Thomas Kurrer(2)

Managing Director, Steinway—Germany |

|

2005

2004

2003 |

|

$

$

$ |

299,191

288,743

261,094 |

|

$

$

$ |

152,231

139,662

50,846 |

|

—

—

— |

|

—

—

— |

|

|

—

—

— |

John M. Stoner, Jr.

President, Conn-Selmer |

|

2005

2004

2003 |

|

$

$

$ |

340,000

319,603

310,000 |

|

$ |

—

—

50,000 |

|

—

—

— |

|

—

—

30,000 |

|

$

$

$ |

38,777

36,762

6,000 |

- (1)

- The Company provides certain perquisites and other personal benefits to certain Named Executive Officers. However, no Named Executive Officer received a total amount of perquisites or other personal benefits in excess of the lesser of either $50,000 or 10% of the total of annual salary and bonus reported for such officer during any year reported.

- (2)

- Mr. Kurrer's compensation information contained in this statement has been converted from euro to U.S. dollars based upon average foreign exchange rates for the years presented.

- (3)

- The Company provided the Named Executive Officers with certain health, medical and other non-cash benefits generally available to all salaried employees and not included in "All Other Compensation" pursuant to SEC rules. The table below presents the components of "All Other Compensation" for 2005, which represent (a) the value of Company contributions to one of its 401(k) plans, (b) the value of Company contributions to the supplemental executive retirement plan ("SERP") on behalf of the Named Executive Officers, and (c) the value of Company paid premiums on group term life insurance.

| | Company Contributions

| |

|

|---|

| | Life

Insurance

Premium

|

|---|

| | 401(k) Plan

| | SERP

|

|---|

| Kyle R. Kirkland | | $ | 11,025 | | $ | 16,050 | | $ | 660 |

| Dana D. Messina | | $ | 11,025 | | $ | 16,050 | | $ | 660 |

| Dennis M. Hanson | | $ | 11,025 | | $ | 25,680 | | $ | 3,360 |

| Bruce A. Stevens | | $ | 11,025 | | $ | 54,960 | | $ | 6,960 |

| John M. Stoner, Jr | | $ | 11,025 | | $ | 27,200 | | $ | 552 |

7

Option Grants in 2005

There were no options granted to the Named Executive Officers during the year ended December 31, 2005.

Aggregated Option Exercises in 2005 and Year End Option Values

The following table provides information related to the exercise of certain options to purchase the Company's Ordinary Common Stock by the Named Executive Officers during 2005 and the number of options held by the Named Executive Officers as of the year ended December 31, 2005. The closing price of the Company's Ordinary Common Stock on the NYSE on December 31, 2005 was $25.51 per share.

| |

| |

| | Number of Securities Underlying Unexercised

Options at

December 31, 2005

| | Value of Unexercised Options In-the-Money at December 31, 2005

|

|---|

Name

| | Shares Acquired

In Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Kyle R. Kirkland | | — | | | — | | 74,023 | | 22,000 | | $ | 470,651 | | $ | 121,440 |

| Dana D. Messina | | — | | | — | | 115,750 | | 34,000 | | $ | 714,603 | | $ | 156,000 |

| Dennis M. Hanson | | 15,500 | | $ | 141,782 | | 40,500 | | 27,000 | | $ | 220,305 | | $ | 121,320 |

| Bruce A. Stevens | | — | | | — | | 58,000 | | 14,000 | | $ | 366,180 | | $ | 69,360 |

| John M. Stoner, Jr | | — | | | — | | 36,000 | | 34,000 | | $ | 202,680 | | $ | 163,290 |

| Thomas Kurrer | | — | | | — | | 24,000 | | 4,000 | | $ | 157,680 | | $ | 26,040 |

Employment Contracts

On October 17, 2002, Conn-Selmer entered into an Employment Agreement with John M. Stoner, Jr. The agreement provides that Mr. Stoner will serve as President and Chief Executive Officer of Conn-Selmer in consideration of an annual base salary of $310,000, which may be increased following the end of each year of service. In addition to a base salary, Mr. Stoner is eligible to receive bonuses and certain other employment benefits. Mr. Stoner's agreement provides that, in certain circumstances, Conn-Selmer is obligated to pay his base salary and continue his benefits for up to a period of 12 months upon the termination of his employment.

In January 1999, the Company entered into Employment Agreements with Kyle R. Kirkland and Dana D. Messina, which provide that until December 31, 2006, unless earlier terminated in accordance with its terms, they will serve, respectively, as Chairman and Chief Executive Officer of the Company. In addition to a base salary, each may be entitled to receive bonuses and certain other employment benefits each determined annually by the Board of Directors in its discretion. Each of Mr. Kirkland and Mr. Messina's agreements provide that in the event the Company does not renew such agreement, the Company is obligated to pay a lump sum of five years salary or $1,705,000 each to Mr. Kirkland and Mr. Messina.

In July 1996, the Company entered into Non-compete Agreements with Bruce A. Stevens and Dennis M. Hanson. The Non-compete Agreements remain in effect for a period of ten years and bar the individual parties thereto from competing with the Company in any geographic region in which the Company then conducts business. Additionally, provided that the individual party thereto refrains from engaging in certain restricted sales of Ordinary Common Stock, each Non-compete Agreement commits the Company to renew the individual party's employment agreement described below for successive one-year periods over the life of the Non-compete Agreement.

On May 1, 1995, Steinway entered into an Employment Agreement with Bruce A. Stevens. The agreement provides that Mr. Stevens will serve as President of Steinway in consideration of an annual base salary, which may be increased following the end of each year of service. In addition to a base salary, Mr. Stevens is eligible to receive bonuses and certain other employment benefits. Mr. Stevens' agreement

8

provides that, in certain circumstances, the Company is obligated to pay up to $340,000, plus the salary for the remainder of his term, to Mr. Stevens upon termination of his employment. This Agreement was subsequently assigned from Steinway to the Company and thereafter amended to automatically renew on an annual basis unless affirmatively terminated.

On May 1, 1995, Steinway entered into an Employment Agreement with Dennis M. Hanson. The agreement provides that Mr. Hanson will serve as Chief Financial Officer and Secretary in consideration of an annual base salary, which may be increased following the end of each year of service. In addition to a base salary, Mr. Hanson is eligible to receive bonuses and certain other employment benefits. Mr. Hanson's agreement provides that, in certain circumstances, the Company is obligated to pay up to $210,000, plus the salary for the remainder of his term, to Mr. Hanson upon termination of his employment. This Agreement was subsequently assigned from Steinway to the Company and thereafter amended to automatically renew on an annual basis unless affirmatively terminated.

As of May 8, 1989, Steinway entered into an Employment Agreement with Thomas Kurrer. The Agreement provides that Mr. Kurrer will serve as Managing Director of Steinway's German operations in consideration of an annual base salary, which may be increased following the end of each year of service. In addition to a base salary, Mr. Kurrer is eligible to receive bonuses and certain employment benefits. The agreement automatically renews every three years unless at least 12 months notice is given by either party.

Retirement Plans

The Company maintains separate pension plans for each of its major divisions. The benefit formula in the Steinway division domestic plan was frozen as of December 31, 2003. The accrued benefit will be a monthly benefit amount payable in the life annuity form. Mr. Stevens has twenty years of service under the plan with an estimated annual benefit of $30,112. Mr. Hanson has seventeen years of service under the plan with an estimated annual benefit of $15,639. These amounts are based on the pension being paid during the participant's lifetime and would be reduced on an actuarially equivalent basis in the event of a survivor benefit or other optional form of payment.

Mr. Kurrer is entitled to benefits under the Steinway division foreign pension plan. Based on the formula and his seventeen years of credited service, his estimated annual benefit would be $98,972. At age 63 Mr. Kurrer would receive 36.5% of his annual base income earned in the year prior to retirement. Assuming a 3% increase in annual salary, the estimated annual benefit at age 63 would be $129,200. The figures presented have been converted from euro to U.S. dollars based on 2005 average currency exchange rates.

The Company maintains a non-qualified supplemental executive retirement plan, or SERP, for certain key employees. The Company, in its sole and absolute discretion, may make an annual SERP contribution on behalf of the eligible participants. Total contributions and earnings thereon are then payable in the form of fifteen substantially equal yearly installments beginning at age 65. Participants become fully vested upon the completion of five years of service. As of December 31, 2005, all SERP participants except Mr. Stoner were fully vested.

Compensation of Directors

As compensation for services as a director of the Company, Messrs. Kluiber and McMillan are each paid an annual retainer fee of $17,500 and Mr. Allen, as Lead Director, is paid an annual retainer fee of $22,500. In addition, they receive $10,000 for serving on the Audit Committee, $5,000 for every additional Committee and $1,000 for each meeting attended. For the fiscal year ended December 31, 2005, the Company paid Mr. Allen $46,500, Mr. Kluiber $44,250 and Mr. McMillan $43,750.

9

Compensation Committee Interlocks and Insider Participation

No interlocking relationships exist between the members of the Compensation Committee or the Board of Directors and the members of any other company's compensation committee or board of directors.

Related Party Transaction

In fiscal 2005, the Company reimbursed Kirkland Messina, LLC, a limited liability corporation controlled by Messrs. Kirkland and Messina, a total of $112,890 for expenses including, but not limited to, airfare, hotel, auto, meals, postage and telephone. In addition, the Company paid annual rent of $85,858 to Kirkland Messina, LLC for office space the Company uses in Santa Monica, California.

Legal Proceedings Involving Directors, Officers, Affiliates or Beneficial Owners

No director, officer, affiliate or beneficial owner of the Company, or any associate thereof, is a party adverse to the Company or any of its subsidiaries in any lawsuit nor has a material adverse interest thereto.

In September of 2001, Kyle R. Kirkland entered into a settlement agreement with the SEC, without admitting or denying any finding or liability. The matter was unrelated to the Company or Mr. Kirkland's position with the Company.

10

REPORT OF THE AUDIT COMMITTEE(1)

The current members of the Audit Committee (the "Committee") are Chairman Kluiber and Messrs. McMillan and Allen, each of whom is an "independent director" as defined by the NYSE listing standards. The Committee operates pursuant to a written charter that meets SEC and NYSE listing standards and adheres to a Code of Ethics and Professional Conduct. The Committee assists the Board of Directors (the "Board") in fulfilling its responsibilities for the oversight of the quality and integrity of the accounting, internal auditing, auditing and financial reporting practices and controls of the Company.

In discharging its oversight responsibility of the audit process, the Committee obtained from the Company's independent registered public accounting firm, Deloitte & Touche LLP ("Deloitte & Touche"), a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1 (Independent Discussion with Audit Committee). The Committee also discussed with the auditors any relationships, including engagements with any subsidiaries, that may impact their objectivity and independence. The Committee also considered the compatibility of audit-related services, tax-services and other non-audit services, and their level and nature of fees, with the auditors' independence. Based on the foregoing, the Committee has satisfied itself as to the auditors' independence.

The Committee also discussed with management and Deloitte & Touche the quality and adequacy of the Company's internal controls, internal audit function and compliance with Section 404 of the Sarbanes-Oxley Act of 2002 ("Section 404"). The Committee reviewed with Deloitte & Touche their audit plans, audit scope and identification of audit risks.

The Committee also met with PricewaterhouseCoopers to discuss and review their activities associated with the Company's internal audit function including: assistance with the Company's Section 404 Certification; a report on the Company's risk management process; and a fraud risk assessment.

The Committee reviewed its charter and the Company's Disclosure Policy. In addition, the Committee insured the Company's Code of Ethics complied with regulations and that the Company complied with the NYSE's listing standards, the Sarbanes-Oxley Act, Regulation G and other rules, regulations and laws. The Committee also reviewed and approved all related party transactions.

The Committee discussed and reviewed with Deloitte & Touche all communications required by generally accepted auditing standards and Securities and Exchange Commission ("SEC") regulations, including those described in Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees) and, with and without management present, discussed and reviewed the results of Deloitte & Touche's examination of the financial statements and internal control over financial reporting.

All services to be performed for the Company by Deloitte & Touche must be pre-approved by the Audit Committee or a designated member of the Audit committee pursuant to the Committee's Pre-Approval Policies and Procedures. The Audit Committee's pre-approval policy prohibits the Company from engaging Deloitte & Touche for any non-audit or audit-related services other than the following tax-related services: tax return preparation and review; advice on income tax, tax accounting, sales/use tax, excise tax and other miscellaneous tax matters; tax advice and implementation assistance on restructurings, mergers and acquisition matters and other tax strategies. Deloitte & Touche has not provided any professional services related to financial systems design and implementation, bookkeeping or internal audit services.

- (1)

- Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933 or the Exchange Act, the Report of the Audit Committee shall not be incorporated by reference in any such filings.

11

The aggregate fees billed to the Company by Deloitte & Touche and member firms of Deloitte Touche Tohmatsu for professional services for fiscal 2005 and 2004 were as follows:

Audit Fees

The aggregate fees billed for the audit of the Company's annual financial statements and attestation services related to the report on internal controls in accordance with Section 404 for the fiscal years ended December 31, 2005 and 2004 and for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q were $1,799,873 and $1,953,583, respectively.

Audit-Related Fees

The aggregate fees billed for audit-related services for the fiscal years ended December 31, 2005 and 2004 were $47,443 and $1,023,958, respectively. These fees relate to Section 404 readiness services, internal control reviews, financial accounting and reporting consultation and agreed-upon procedures engagements.

Tax Fees

The aggregate fees billed for tax services for the fiscal years ended December 31, 2005 and 2004 were $194,069 and $573,004, respectively. These fees relate to the preparation of tax returns and general advice relating to tax planning and compliance.

All Other Fees

There were no other fees for the fiscal years ended December 31, 2005 and 2004.

The Committee has considered the level and nature of non-audit services provided by Deloitte & Touche in its deliberation of auditor independence.

The Committee reviewed the audited consolidated financial statements of the Company as of and for the year ended December 31, 2005 and the examination of Management's Annual Report on Internal Control over Financial Reporting and the effectiveness of the Company's internal controls over financial reporting as of December 31, 2005, with management and Deloitte & Touche. Management has the responsibility for the preparation of the Company's financial statements and Deloitte & Touche has the responsibility for the examination of those statements. Based on these reviews and discussions with management and the Company's independent auditors, the Committee recommended that the Board include the audited consolidated financial statements for the fiscal year ended December 31, 2005 in the Company's Annual Report on Form 10-K for filing with the SEC. The Committee also recommended the reappointment, subject to shareholder approval, of Deloitte & Touche as the Company's independent registered public accounting firm and the Board concurred in such recommendation.

| | | AUDIT COMMITTEE: |

|

|

Rudolph K. Kluiber, Chairman

A. Clinton Allen, Member

Peter McMillan, Member |

12

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION(1)

Compensation Philosophy

The current members of the Compensation Committee are Chairman Allen and Messrs. Kluiber and McMillan, each of whom is an "independent director" as defined by the NYSE's listing standards. The Compensation Committee's executive compensation philosophy is to provide competitive levels of compensation while also establishing a strong, explicit link between executive compensation and the achievement of the Company's annual and long-term performance goals, rewarding above-average corporate performance, recognizing individual initiative and achievement and assisting the Company in attracting and retaining highly skilled management. This philosophy has been adhered to by developing incentive pay programs which provide competitive compensation that mirrors Company performance. Both short-term and long-term incentive compensation are based on direct, explicit links to Company and individual performance and the value received by stockholders.

2005 Executive Compensation

Cash compensation includes base salary and performance bonuses. Base salaries are set at competitive levels, with reference to the level of responsibilities, experience and geographic market conditions. Annual salary adjustments are determined by reference to the Company's and the individual's performance, as well as general marketplace conditions, including comparative industry information.

Performance bonuses are awarded to the Chairman, CEO and other senior executive officers in accordance with the Company's or relevant segment's bonus plan and individual performance with respect to each individual's goals and objectives, as determined by the Compensation Committee. Under the applicable plan, participants are assigned a target bonus for the plan year that is a percentage of their base salary. Bonus payouts under the plan for the participants are based on whether the Company or relevant segment of the business meets or exceeds pre-established performance levels. The primary measure of performance is based on a return on assets percentage, which is calculated using EBITDA (earnings before net interest expense, income tax expense, depreciation and amortization) divided by assets employed as defined in their respective bonus plans. In addition to this formula, the Compensation Committee considers each individual's performance during the year and adjusts the bonus payment as appropriate.

Chairman of the Board and Chief Executive Officer Compensation

The Compensation Committee is responsible for determining the compensation of the Chairman and CEO. In reaching its decision, the Compensation Committee examines several factors, such as the Company's performance and relative shareholder return, the value of similar incentive awards to CEOs at comparable public companies, and the awards given to the Chairman and CEO in prior years. The Committee also reviews and approves the corporate and individual goals and objectives of the Chairman and CEO and evaluates their performance in light of those goals and objectives.

Summary

After its review of the Company's existing programs and relative data for comparable positions in similar industries, the Compensation Committee believes that the total compensation program for executives of the Company is competitive with the compensation programs provided by other corporations with which the Company competes for management talent. The Compensation Committee also believes

- (1)

- Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933 or the Exchange Act, the Report of the Compensation Committee on Executive Compensation shall not be incorporated by reference in any such filings.

13

that the annual bonuses provide opportunities to participants that are consistent with the returns that are generated on behalf of the Company's stockholders.

Limitation of Tax Deduction for Executive Compensation

Section 162(m) of the Internal Revenue Code (the "Code") prevents publicly traded companies from receiving a tax deduction on compensation paid to proxy-named executive officers in excess of $1 million annually. This limitation does not apply to compensation that qualifies as "performance-based compensation" under the Code. The Compensation Committee believes at the present time that it is highly unlikely that the compensation paid to any executive officer will exceed $1 million in any fiscal year. In addition, based on the Company's current compensation philosophy and performance-based bonus formula, it does not anticipate that the limitation would have a material effect on the Company.

| | | COMPENSATION COMMITTEE: |

|

|

A. Clinton Allen, Chairman

Rudolph K. Kluiber, Member

Peter McMillan, Member |

14

PERFORMANCE GRAPH(1)

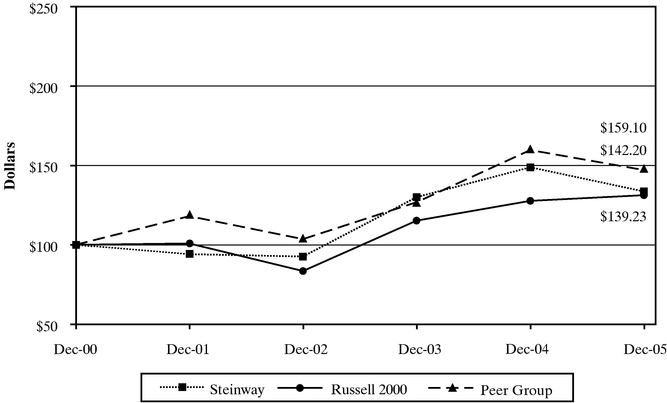

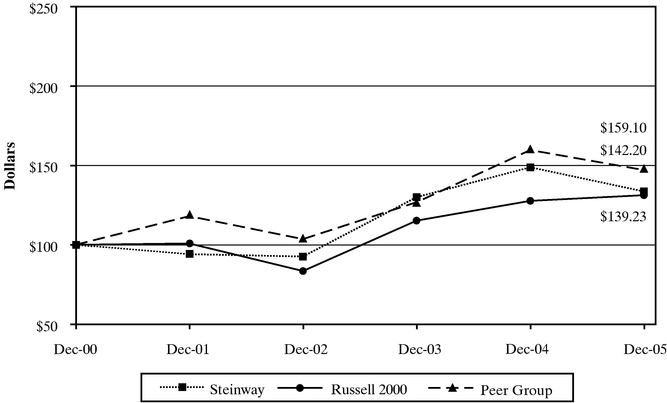

The following graph compares the Company's cumulative total stockholder return on its Ordinary Common Stock for the period from December 31, 2000 to December 31, 2005, with the cumulative total return of the Russell 2000 Stock Index ("Russell 2000") and the cumulative total return of a peer group ("Peer Group") consisting of Guitar Center, Inc., Harley-Davidson, Inc., Callaway Golf Company and Fleetwood Enterprises.

The Peer Group was selected by management based on the status of each as a manufacturer and/or distributor of consumer goods in the luxury or musical instrument categories. The performance graph assumes a $100 investment on December 31, 2000 in each of the Company's Ordinary Common Stock, the Russell 2000 and the common stock of the Peer Group. The stock price performance shown in this graph is neither necessarily indicative of, nor intended to suggest, future stock price performance.

COMPARATIVE STOCK PRICE PERFORMANCE

AMONG STEINWAY MUSICAL INSTRUMENTS, INC.,

THE RUSSELL 2000 AND THE PEER GROUP

Comparison of Cumulative Total Returns

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

| | 12/31/05

|

|---|

| Steinway Musical Instruments, Inc. | | $ | 100.00 | | $ | 92.59 | | $ | 90.69 | | $ | 137.68 | | $ | 161.32 | | $ | 142.20 |

| The Russell 2000 | | $ | 100.00 | | $ | 101.03 | | $ | 79.23 | | $ | 119.11 | | $ | 134.75 | | $ | 139.23 |

| Peer Group | | $ | 100.00 | | $ | 122.64 | | $ | 104.49 | | $ | 133.67 | | $ | 174.93 | | $ | 159.10 |

- (1)

- Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933 or the Exchange Act, this Performance Graph shall not be incorporated by reference in any such filings.

15

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of voting securities of the Company as of March 24, 2006 by (i) each person known by the Company to be the beneficial owner of more than 5% of any class of the Company's voting securities, (ii) each of the directors and Named Executive Officers of the Company, and (iii) all executive officers and directors of the Company as a group.

| | Amount and Nature of Beneficial Ownership of Ordinary

Common Stock(1)

| | Percent(2)

| | Amount and Nature of Beneficial Ownership of

Class A

Common Stock(1)

| | Percent

| |

|---|

Babson Capital Management LLC

One Memorial Drive

Cambridge, MA 02142 | | 1,127,359 | | 14.7 | % | — | | — | |

Dimensional Fund Advisors Inc.

1299 Ocean Avenue, Ste 650-11th Floor

Santa Monica, CA 90401 |

|

660,500 |

(3) |

8.6 |

% |

— |

|

— |

|

David M. Silfen

717 Fifth Avenue, 19th Floor

New York, NY 10022 |

|

543,300 |

|

7.1 |

% |

— |

|

— |

|

Royce & Associates, LLC

1414 Avenue of the Americas

New York, NY 10019 |

|

415,500 |

|

5.4 |

% |

— |

|

— |

|

American International Group, Inc.

70 Pine Street

New York, NY 10270 |

|

412,079 |

|

5.4 |

% |

— |

|

— |

|

Bank of America Corp

100 North Tryon Street

Charlotte, NC 28255 |

|

408,529 |

|

5.3 |

% |

— |

|

— |

|

Steven Heinemann

c/o First New York Securities LLC

850 Third Avenue, 17th floor

New York, NY 10022 |

|

402,000 |

(4) |

5.2 |

% |

— |

|

— |

|

Directors |

|

|

|

|

|

|

|

|

|

| | A. Clinton Allen | | 13,000 | (5) | ** | | — | | — | |

| | Rudolph K. Kluiber | | 15,000 | (6) | ** | | — | | — | |

| | Kyle R. Kirkland | | 189,354 | (7)(8) | 2.4 | % | 226,948 | | 47.5 | % |

| | Peter McMillan | | 13,000 | (9) | ** | | — | | — | |

| | Dana D. Messina | | 333,321 | (7)(10) | 4.3 | % | 251,004 | | 52.5 | % |

| | Bruce A. Stevens | | 144,273 | (11) | 1.9 | % | — | | — | |

| | John M. Stoner, Jr | | 37,500 | (12) | ** | | — | | — | |

Other Executive Officers |

|

|

|

|

|

|

|

|

|

| | Dennis M. Hanson | | 84,400 | (13) | 1.1 | % | — | | — | |

| | Thomas Kurrer | | 66,601 | (14) | ** | | — | | — | |

All directors and executive officers as a group (9 persons) |

|

895,318 |

(7)(15) |

11.6 |

% |

477,952 |

|

100.0 |

% |

- **

- Less than 1 percent.

16

- (1)

- Each share of Ordinary Common Stock has one vote. Each share of Class A Common Stock has 98 votes.

- (2)

- For purposes of determining beneficial ownership, owners of options exercisable within sixty days of March 24, 2006 are considered the beneficial owners of the shares of Ordinary Common Stock for which such options are exercisable, and the reporting herein is based on the assumption (as provided in the applicable rules of the SEC) that only the person or persons whose ownership is being reported will exercise such options for Ordinary Common Stock. As of March 24, 2006, there were 7,690,858 shares of Ordinary Common Stock issued and outstanding, less treasury stock.

- (3)

- Dimensional Fund Advisors Inc. ("Dimensional"), an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are the "Funds." In its role as investment advisor or manager, Dimensional possesses investment and/or voting power over the securities of the Company described herein that are owned by the funds, and may be deemed to be the beneficial owner of the shares of the Company held by the Funds. However, all securities reported herein are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. In addition, the filing of a Schedule 13G shall not be construed as an admission that the reporting person or any of its affiliates is the beneficial owner of any securities covered by such Schedule 13G for any other purposes than Section 13(d) of the Securities Exchange Act of 1934.

- (4)

- Includes shares owned by First New York Securities LLC as to which Mr. Heinemann may be deemed to share dispositive power.

- (5)

- Includes 13,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (6)

- Includes 13,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (7)

- Includes 1,131 shares Ordinary Common Stock owned by Kirkland Messina, Inc, which may be deemed to be beneficially owned by both Kyle R. Kirkland and Dana D. Messina. While Messrs. Kirkland and Messina may constitute a "group" for purposes of the Securities Exchange Act of 1934, as amended, they each disclaim beneficial ownership of all shares of Ordinary Common Stock and Class A Common Stock held by the other person.

- (8)

- Includes 74,023 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (9)

- Includes 13,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (10)

- Includes 115,750 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (11)

- Includes 58,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (12)

- Includes 36,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (13)

- Includes 40,500 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (14)

- Includes 24,000 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

- (15)

- Includes 387,273 shares of Ordinary Common Stock issuable in connection with outstanding stock options exercisable within the next sixty days.

17

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's executive officers and directors and persons who own more than 10% of the Company's Ordinary Common Stock to file reports of ownership on Forms 3, 4 and 5 with the SEC. Executive officers, directors and 10% stockholders are required by the SEC to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely on the Company's review of the copies of such forms it has received, the Company believes that all its executive officers, directors and greater than 10% beneficial owners complied with all the filing requirements applicable to them with respect to transactions during fiscal 2005.

PROPOSAL TO APPROVE AND ADOPT THE 2006 STOCK COMPENSATION PLAN

THE COMPANY'S 2006 STOCK COMPENSATION PLAN

We are asking our stockholders to approve the Steinway Musical Instruments, Inc. 2006 Stock Compensation Plan (the "2006 Stock Plan") so that the Company may continue to attract and retain talented employees necessary for its continued growth and success. On March 30, 2006, the Board of Directors of the Company (the "Board") adopted the 2006 Stock Plan, subject to approval by the Company's stockholders at the Annual Meeting. The 2006 Stock Plan is integral to the Company's compensation strategies and programs for directors, employees and independent contractors. The Board believes that the 2006 Stock Plan will provide the flexibility the Company needs to keep pace with its competitors and effectively recruit, motivate, and retain the caliber of employees and directors essential for the Company's success.

The 2006 Stock Plan provides for grants of stock options, stock appreciation rights ("SARs"), restricted stock, restricted stock units, and other stock awards (collectively, the "Awards"). Stockholder approval of the 2006 Stock Plan, among other things, is intended to: (i) comply with applicable securities law requirements, (ii) permit the performance-based awards discussed below to qualify for deductibility under Section 162(m) of the Internal Revenue Code; and (iii) allow for the issuance of "incentive stock options" described below. Individuals eligible to receive Awards under the 2006 Stock Plan include employees, directors, and independent contractors of the Company and its subsidiaries and other entities controlled by the Company ("affiliates"). However, incentive stock options may be granted only to an employee of the Company or a subsidiary of the Company.

Description of the 2006 Stock Plan

The following is a summary of certain principal features of the 2006 Stock Plan. This summary is qualified in its entirety by reference to the complete text of the 2006 Stock Plan, which is attached to this Proxy Statement as Appendix A. Stockholders are urged to read the actual text of the 2006 Stock Plan in its entirety.

Purpose

The purpose of the 2006 Stock Plan is to further the growth and profitability of the Company by increasing incentives and encouraging ownership of shares of the Company's common stock ("Shares") by the Company's employees, independent contractors and directors. The 2006 Stock Plan provides a means through which the Company and its subsidiaries and affiliates may attract key personnel (collectively, the "Participants") to enter into and remain in the employ of the Company and its subsidiaries and affiliates, as well as to provide a means whereby those key persons upon whom the responsibilities of the successful administration and management of the Company rest, can acquire and maintain ownership of Shares, thereby strengthening their commitment to the success of the Company and promoting the mutuality of interests between Participants and the Company's stockholders.

18

Eligibility

The persons eligible to receive Awards under the 2006 Stock Plan are the directors, employees and independent contractors of the Company and any its subsidiaries and affiliates who are designated by the Committee. As of the Record Date, there are approximately 2,400 employees and three independent directors. Persons receiving Awards will enter into individual Award Agreements with the Company that contain the terms and conditions of the Award established by the Committee.

Administration

The 2006 Stock Plan will be administered by the Option Committee of the Board (the "Committee"). References to the Committee shall refer to the Board if the Option Committee ceases to exist and the Board does not appoint a successor Committee. It is intended that each member of the Committee will qualify as a "non-employee director" as defined under Rule 16b-3 under the Securities Exchange Act of 1934, as amended, an "outside director" for purposes of Section 162(m) of the Code and an "independent director" under the rules of any national securities exchange or national securities association, as applicable. The initial Committee will be the Option Committee of the Board. Subject to the terms of the 2006 Stock Plan, the Committee is authorized to select persons eligible to receive Awards and to determine the form, amount, timing and other terms of the Awards to be granted. The Committee may delegate to one or more members of the Board or to officers of the Company its authorities regarding awards to individuals not subject to Section 16 of the Securities Exchange Act of 1934 or Section 162(m) of the Internal Revenue Code. The Committee is authorized to interpret the 2006 Stock Plan and any Award Agreements issued under the Plan, to adopt such rules and procedures as it may deem necessary or advisable for the administration of the 2006 Stock Plan, to interpret and amend any of such rules or procedures and to make all other decisions and determinations required pursuant to the Plan or any Award Agreement or as the Committee deems necessary or advisable to administer the Plan. The Committee's determinations under the 2006 Stock Plan need not be uniform and may be made selectively among Participants, whether or not such Participants are similarly situated. Each member of the Committee is entitled to, in good faith, rely or act upon any report or other information furnished to that member by any employee of the Company or any of its subsidiaries or affiliates, the Company's registered public accounting firm or any executive compensation consultant or other professional retained by the Company to assist in the administration of the 2006 Stock Plan.

Shares Available under the 2006 Stock Plan

Subject to adjustment as described below under the heading "Changes in Capital Structure," the maximum number of Shares that will be available for the grant of Awards under the 2006 Stock Plan will be 1,000,000 Shares.

The Shares awarded or acquired upon the exercise of Awards under the 2006 Stock Plan may be authorized but unissued Shares, authorized and issued Shares reacquired and held as treasury Shares, or any combination thereof. If any Award granted under the 2006 Stock Plan should expire, terminate, or be forfeited or canceled, the Shares subject thereto shall be released and shall again be available for the grant of new Awards under the 2006 Stock Plan. To the extent permitted by applicable law or exchange rules, Shares issued in assumption of, or in substitution for, any outstanding Awards of any entity acquired in any form of combination by the Company or any of its subsidiaries or affiliates will not be counted against the Shares available for issuance under the 2006 Stock Plan.

Subject to adjustment as described below under the heading "Changes in Capital Structure," the number of Shares with respect to which Awards (other than restricted stock, restricted stock units and other stock awards that are not subject to the achievement of performance goals established by the Committee in accordance with Section 162(m) of the Code) may be made during any year to any person may not exceed 1,500,000 Shares.

19

The closing price of Shares of the Company's stock on April 13, 2006 was $33.49.

Term of the 2006 Stock Plan

Unless earlier terminated by the Board, as described below under the heading "Amendment and Termination," the 2006 Stock Plan will terminate ten years after adoption by the Board, and no further Awards may be granted under the 2006 Stock Plan after that date. The termination (or early termination) of the 2006 Stock Plan will not affect any Awards granted prior to the termination (or early termination) of the 2006 Stock Plan.

Stock Options

The Committee is authorized to grant stock options, including both incentive stock options under Section 422 of the Code ("ISO"), which can result in potentially favorable tax treatment to the Participant, and non-qualified stock options. The exercise price per Share subject to an option is determined by the Committee, but must not be less than 100% of the fair market value of a Share on the date of grant; provided, however, that with respect to a Participant that owns stock representing more than 10% of the voting power of all class of stock of the Company, the exercise price per share subject to an ISO shall not be less than 110% of the fair market value of a Share on the date of grant. For purposes of the 2006 Stock Plan, the term "fair market value" shall mean, except as otherwise specified in a particular Award agreement, (i) while the Shares are traded on an established national or regional securities exchange, the closing transaction price of such Shares as reported by the principal exchange on which such Shares are traded on the date as of which such value is being determined or, if there is no reported transaction for such date, on the next preceding date for which a transaction was reported, (ii) if the Shares are not traded on an established national or regional securities exchange, the average of the bid and ask prices for such a Share as reported by NASDAQ or a successor quotation system. However, if "fair market value" cannot be determined under clause (i) or clause (ii) above, or if the Committee determines in its sole discretion that the Shares are too thinly traded for "fair market value" to be determined pursuant to clause (i) or clause (ii), "fair market value" shall be the value determined by the Committee, in its sole discretion, on a good faith basis.

The maximum term of each option, the times at which each option will be exercisable, and the provisions requiring forfeiture of unexercised options at or following termination of employment generally will be established by the Committee in the individual Award Agreements, except that no ISO may have a term exceeding 10 years and no ISO granted to a Participant who owns stock representing more than 10% of the voting power of all class of stock of the Company may have a term exceeding 5 years. Options may be exercised by payment of the exercise price in cash or, in the discretion of the Committee, either (i) by tendering previously acquired Shares which have been held by the holder of the option for at least six months having an aggregate fair market value at the time of exercise equal to the aggregate exercise price of the Shares with respect to which the option is to be exercised, or (ii) by any other means that the Committee, in its sole discretion, determines to both provide legal consideration for the Shares and to be consistent with the purposes of the 2006 Stock Plan.

SARs

The Committee is authorized to grant SARs entitling the Participant to receive the amount by which the fair market value of a Share on the date of exercise exceeds the grant price of the SAR. The grant price of a SAR is determined by the Committee but must not be less than 100% of the fair market value of a Share on the date of grant. SARs may be granted by themselves or in tandem with grants of stock options. The maximum term of each SAR, the times at which each SAR will be exercisable, and the provisions requiring forfeiture of unexercised SARs at or following termination of employment generally are established by the Committee in the individual Award Agreements, except that each SAR shall terminate no later than the tenth anniversary of the date of grant and no SAR granted in tandem with an option may

20

have a term exceeding the term of the related option. SARs may be exercised by (i) delivery of a written notice of exercise, (ii) in the case of a tandem SAR, by surrendering any options which would be canceled by reason of the exercise of such SAR, or (iii) by executing such documents as the Company may reasonably request. Payment of the amount by which the fair market value of each SAR exercised exceeds the grant price shall be made, as determined by the Committee in its discretion, in cash, Shares, or a combination thereof, as set forth in the individual Award Agreement.

Restricted Stock

The Committee is authorized to grant awards of restricted stock. A grant of restricted stock is an Award of Shares which may not be sold or disposed of prior to the end of a restricted period specified by the Committee. The Committee may set additional restrictions on restricted stock as it may deem advisable or appropriate in the individual Award Agreements. A Participant who has been granted restricted stock generally has the right to vote the Shares, unless otherwise provided in the Award Agreement. During the restricted period, Participants holding Shares of restricted stock are entitled to receive all dividends and other distributions paid with respect to such Shares, unless otherwise provided in the Award Agreement. However, dividends and other distributions with respect to restricted stock that are paid in Shares will be held by the Company subject to the same restrictions that apply to the restricted Shares.

Performance-Based Awards

The Committee may make Awards that are subject to the achievement of performance goals as may be determined by the Committee and specified in the relevant Award Agreement to covered employees, as defined below. Awards contingent on performance goals granted to persons whom the Committee expects will, for the year in which a deduction arises, be "covered employees" will, if and to the extent intended by the Committee, be subject to provisions that should qualify such Awards as "performance-based compensation" not subject to the limitation on tax deductibility by the Company under Section 162(m) of the Code. For purposes of Section 162(m) of the Code, the term "covered employee" means the Company's chief executive officer and each other person whose compensation is required to be disclosed in the Company's filings with the SEC by reason of that person being among the four highest compensated officers of the Company on the last day of a taxable year.

No later than ninety (90) days following the commencement of any fiscal year in question or any other designated fiscal period or period of service, the Committee shall, in writing, (i) designate one or more covered employees, (ii) select the performance criteria applicable to the performance period, (iii) establish the performance goals, and amounts of such Awards, as applicable, which may be earned for such performance period, and (iv) specify the relationship between the performance criteria and the performance goals and the amounts of such Awards, as applicable, to be earned by each covered employee for such performance period. The performance goals may be based on such factors including but not limited to: (a) revenue, (b) earnings per Share, (c) net income per Share, (d) Share price, (e) pre-tax profits, (f) net earnings, (g) net income, (h) operating income, (i) cash flow, (j) earnings before interest, taxes, depreciation and amortization, (k) sales, (l) total stockholder return relative to assets, (m) total stockholder return relative to peers, (n) financial returns (including, without limitation, return on assets, return on equity and return on investment), (o) cost reduction targets, (p) customer satisfaction, (q) customer growth, (r) employee satisfaction, (s) gross margin, (t) revenue growth, or (u) any combination of the foregoing, or such other criteria as the Committee may determine. The Committee may determine performance goals in respect of the performance of the Company, any of its subsidiaries or affiliates or any combination thereof on either a consolidated, business unit or divisional level. Performance goals may be absolute or relative and may be expressed in terms of a progression within a specified range.

21

Other Stock Awards

The Committee is authorized to grant other types of Awards that are denominated or payable in, valued by reference to, or otherwise based on or related to the Shares on such terms and conditions as may be established by the Committee in the relevant Award Agreement.

Tax Withholding; Other Terms of Awards