Exhibit 99.1

Press Release

Triad Guaranty Inc. Reports Third Quarter Results

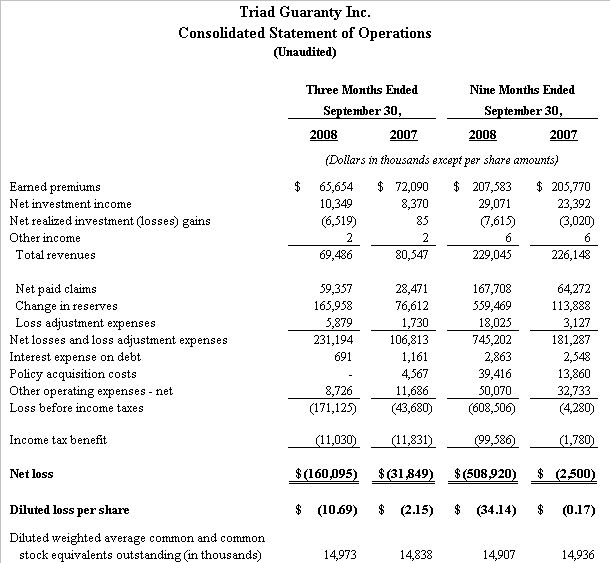

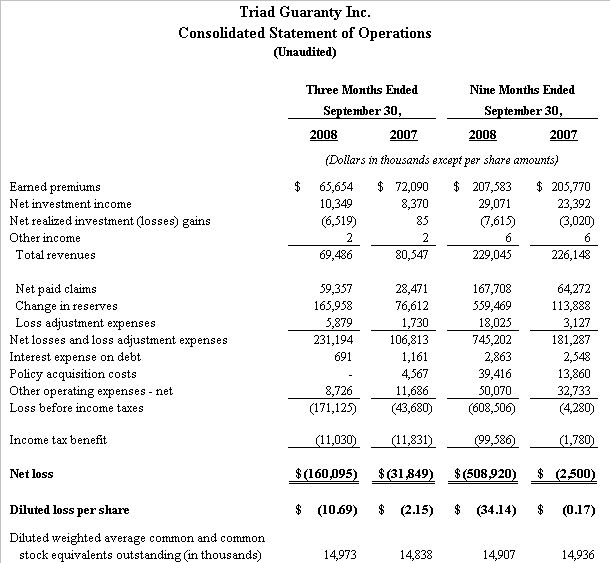

WINSTON-SALEM, N.C., November 10, 2008 -- Triad Guaranty Inc. (NASDAQ GS: TGIC) today reported a net loss for the quarter ended September 30, 2008 of $160.1 million compared with a net loss of $198.8 million for the second quarter of 2008 and a net loss of $31.8 million in the third quarter of 2007. The 2008 third quarter loss per share was $10.69 compared to a net loss per share of $13.36 for the 2008 second quarter and $2.15 for the third quarter of 2007.

The net loss for the nine months ended September 30, 2008 was $508.9 million compared to a net loss of $2.5 million for the nine months ended September 30, 2007. The loss per share was $34.14 for the first nine months of 2008 compared to a loss per share of $0.17 for the same period last year.

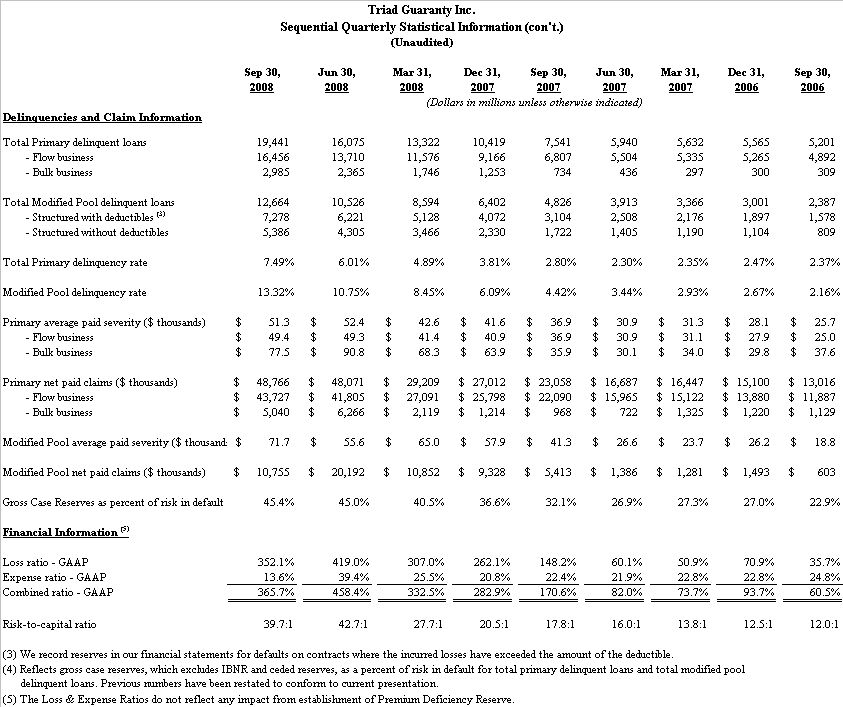

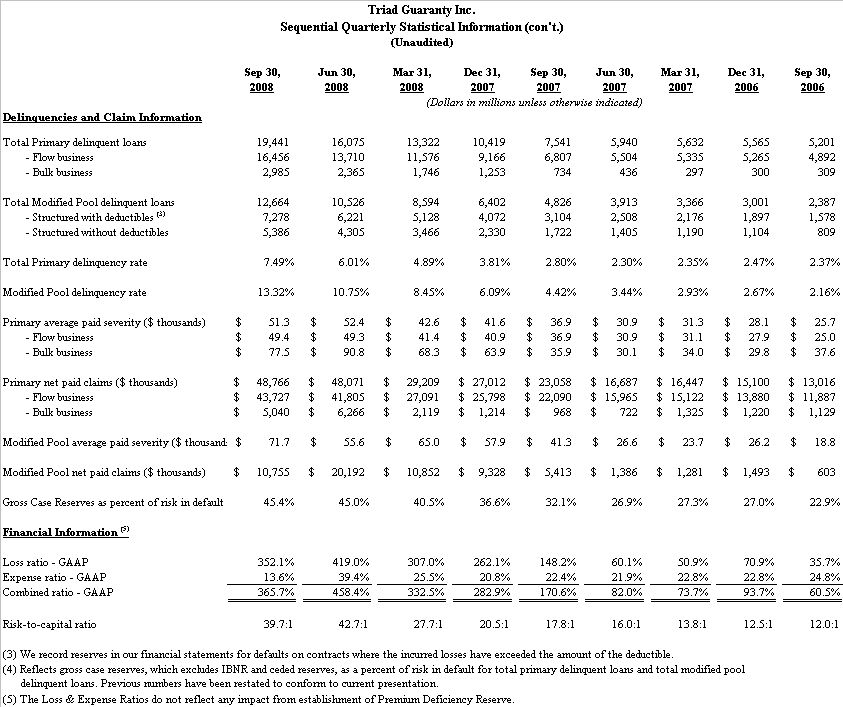

Ken Jones, President and CEO, said, “Our focus is now strictly on the efficient and effective servicing of our insured portfolio, particularly around loss mitigation. We continue to improve our processes in this area by examining and refining all aspects of our default management and claims process, including enhancing our processes for investigating potential misrepresentation and fraud in the mortgage commitment process. The amount of risk in default or in the foreclosure process continues to increase and, as a result, our loss reserves increased significantly again in the third quarter. The distressed markets of California, Florida, Arizona and Nevada continue to be adversely impacted by declining home prices, and reserves for defaults in these states comprised approximately 65% of the increase in our gross reserves for the quarter.”

Mr. Jones noted, “We continue to work closely with our primary regulator, the Illinois Division of Insurance, as well as with Fannie Mae and Freddie Mac. We have obtained the approval of our run-off plan from the Illinois insurance regulators and have reviewed it with the GSEs. Due to the continued increase in defaults and the related provision for expected future paid losses, we are now reporting a deficiency in assets at September 30, 2008. Since much of the decline in stockholders’ equity during 2008 is from increases in our reserve for losses, cash and invested assets have actually increased during 2008, with positive cash flow from operations for the nine months ended September 30, 2008 amounting to $151 million.”

“Our underlying performance during the quarter was generally consistent with our run-off plan, as the plan projected significant losses in the early stages of the run-off period. Additionally, we have not realized a significant portion of the structured benefits on the modified pool stop losses and captive reinsurance benefits that we anticipate in the subsequent years of the run-off. Finally, it should be noted that no benefit has been

1

recognized in these financial statements from our $95 million excess of loss reinsurance policy that is presently in arbitration.”

Triad is no longer issuing commitments for new mortgage insurance; therefore, production during the third quarter was insignificant. Total insurance in force amounted to $64.3 billion at September 30, 2008, a 3.0% decline from June 30, 2008 and a 5.4% decline since last year. The primary reason for the lack of any significant decline in our insurance in force is high persistency rates as reduced credit availability and declining home prices limit the opportunities for borrowers to refinance existing mortgages.

Net losses and loss adjustment expenses amounted to $231.2 million for the third quarter of 2008, compared to $292.7 million for the second quarter of 2008. Paid losses for the 2008 third quarter totaled $59.8 million compared to $68.2 million for the second quarter of this year, with the decline from the second quarter reflecting increased loss mitigation efforts, servicer delays in filing claims, and foreclosure moratoriums. The increase in reserves of $166.0 million in the third quarter of 2008 was less than the increase in reserves of $218.6 million during the second quarter of this year. The 2008 second quarter growth in reserves included an increase in both the frequency and severity factors utilized in the reserve model that added approximately $59 million, while no such changes in either the frequency or severity factors were made during the third quarter.

Operating expenses were down significantly compared to the second quarter of 2008, which included accruals for severance and other exit costs of approximately $12 million. The third quarter results reflect the downsizing of Triad’s workforce as well as other operating efficiencies. During the third quarter of 2008, pre-tax investment losses included other-than-temporary impairments of investments of $9.6 million, which was largely attributable to adverse events in the overall capital markets during the quarter. The effective tax rate for both the quarter and nine months ended September 30, 2008 reflects the inability to recognize the full tax benefit on the pre-tax loss as the Company expects to be in a net operating loss carry forward position for the foreseeable future.

2

We have updated the supplemental information for the 2008 third quarter results related to product differentiation, risk structures, additional portfolio characteristics and performance on our web site at www.triadguaranty.com. The supplemental information can be found under “Investors” and then under “Webcasts and Presentations” by the title “Supplemental Information – Third Quarter 2008”.

(Relevant Triad Guaranty Inc. financial and statistical information follows)

Triad Guaranty Inc.'s wholly owned subsidiary, Triad Guaranty Insurance Corporation, is a nationwide mortgage insurer pursuing a voluntary run-off of its existing in-force book of business. For more information, please visit the Company's web site at www.triadguaranty.com.

Certain of the statements contained in this release are "forward-looking statements" and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include estimates and assumptions related to economic, competitive, regulatory, operational and legislative developments. These forward-looking statements are subject to change, uncertainty and circumstances that are, in many instances, beyond our control and they have been made based upon our current expectations and beliefs concerning future developments and their potential effect on us. Actual developments and their results could differ materially from those expected by us, depending on the outcome of a number of factors, including our ability to complete the run-off of our existing in-force book of business, the possibility of general economic and business conditions that are different than anticipated, legislative, regulatory, and other similar developments, the appointment of FHFA as the conservator of Fannie Mae and Freddie Mac, our ability to satisfy the continued listing requirements of the NASDAQ stock market, changes in interest rates, the housing market, the mortgage industry and the stock market, as well as the factors described under "Risk Factors" and under "Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995" in our Annual Report on Form 10-K for the year ended December 31, 2007 and in other reports and statements that we file with the Securities and Exchange Commission. Forward-looking statements are based upon our current expectations and beliefs concerning future events and we undertake no obligation to update or revise any forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements are made. .

SOURCE: Triad Guaranty Inc.

CONTACT: Bob Ogburn, Vice President and Treasurer, at 336.723.1282 ext. 1167 or bogburn@tgic.com

###