MFS® INVESTMENT MANAGEMENT

111 Huntington Avenue, Boston, Massachusetts 02199

Phone 617-954-5000

January 20, 2017

VIA EDGAR (as Correspondence)

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| RE: | Post-Effective Amendment No. 43 to Registration Statement on Form N-1A for MFS Series Trust XI (the "Trust") on behalf of MFS Blended Research Core Equity Fund (the "Fund") (File Nos. 33-68310 and 811-7992) |

Ladies and Gentlemen:

On behalf of the above-mentioned Trust, this letter sets forth our responses to your comments of January 9, 2017, on the above-referenced Post-Effective Amendment to the Registration Statement ("PEA"), filed with the U.S. Securities and Exchange Commission (the "SEC") on November 22, 2016. The PEA for the Fund was filed for the purpose of incorporating certain changes to the Fund's "Principal Investment Strategies" disclosure.

| 1. | Comment: | Please provide your response letter, including a completed fee table, expense example, and performance for the Fund at least five business days prior to the effective date of the PEA. |

| Response: | A completed fee table, expense example, and performance table for the Fund, which will be included in the Fund's final prospectus, is attached to this letter as Exhibit I. |

| 2. | Comment: | Please identify active and frequent trading as a principal investment risk of the Fund if the Fund's portfolio turnover is greater than 100%. |

| Response: | The Fund's portfolio turnover rate was under 100% for its fiscal year ended September 30, 2016. |

Securities and Exchange Commission

January 20, 2017

Page 2

| 3. | Comment: | Please clarify the Fund's investment strategy by explaining the connection between the index and the Fund's strategy as it is unclear whether or not the Fund is an index fund and what the role of tracking error is in the Fund's strategy. |

| Response: | The Fund is an actively managed Fund. MFS selects investments for the Fund based on both fundamental and quantitative analysis. After identifying potential investments, based on fundamental and quantitative analysis, MFS constructs the Fund's portfolio by systematically controlling various risk factors compared to an index that represents the Fund's investment universe. The goal of the portfolio construction process is to have an actively managed portfolio with a predicted tracking error of 2.0% compared to an index that represents the investment universe of the Fund. In order to clarify the Fund's investment strategy description, we will modify the Item 9 principal investment strategy description in the prospectus as follows: |

MFS seeks to achieve the fund's objective by actively selecting potential investments based on fundamental and quantitative analysis and then constructing a portfolio from these potential investments by systematically controlling various risk factors (e.g., issuer, industry, and sector weightings, market capitalization, volatility) compared to an index that represents the fund's investment universe.

MFS normally invests at least 80% of the fund's net assets in equity securities.

In selecting investments for the fund, MFS is not constrained to any particular investment style. MFS may invest the fund's assets in the stocks of companies it believes to have above average earnings growth potential compared to other companies (growth companies), in the stocks of companies it believes are undervalued compared to their perceived worth (value companies), or in a combination of growth and value companies.

While MFS may invest the fund's assets in companies of any size, MFS primarily invests in companies with large capitalizations.

MFS may invest the fund's assets in foreign securities.

MFS normally allocates the fund's investments across different industries and sectors, but MFS may invest a significant percentage of the fund's assets in issuers in a single or small number of industries or sectors.

MFS uses an active bottom-up approach to buying and selling investments for the fund. Investments are selected primarily based on blending fundamental and quantitative research. MFS uses fundamental analysis of individual issuers and their potential in light of their financial condition and market, economic, political, and regulatory conditions to determine a fundamental rating for an issuer. Factors considered may include analysis of an issuer's earnings, cash flows, competitive position, and management ability. MFS uses quantitative analysis, including quantitative models that systematically evaluate an issuer's valuation, price and earnings momentum, earnings quality, and other factors, to determine a quantitative rating for an issuer. When MFS quantitative research is available but MFS fundamental research is not available, MFS considers the issuer to have a neutral fundamental rating.

MFS then constructs the portfolio by considering the blended rating from combining the fundamental rating and the quantitative rating, as well as issuer, industry, and sector weightings, market capitalization, volatility, and other factors. MFS' ,with a goal is to construct of constructing an actively managed portfolio with a target predicted tracking error of approximately 2% compared to the Index. Tracking error generally measures how the differences between the fund's monthly returns and the Index's monthly returns have varied over a specified time period. A higher tracking error means that the difference between the fund's returns and the Index's returns have varied more over time while a A lower tracking error means that there is generally less variation between the fund's returns compared to an index that represents the fund's investment universe. the differences between the fund's returns and the Index's returns have varied less over time.

For purposes of the fund's 80% policy, net assets include the amount of any borrowings for investment purposes.

We will make comparable changes to the Item 4 summary principal investment strategy description.

Securities and Exchange Commission

January 20, 2017

Page 3

| 4. | Comment: | Please confirm whether the Fund intends to concentrate in any single industry. If so, please include disclosure in the "Principal Investment Strategies" and "Principal Risks" sections to reflect this strategy. |

| Response: | The Fund does not invest more than 25% in any single industry as disclosed in the following fundamental investment restriction: |

"As a fundamental investment restriction, the Fund: (6) May not purchase any securities of an issuer in a particular industry if as a result 25% or more of its total assets (taken at market value at the time of purchase) would be invested in securities of issuers whose principal business activities are in the same industry."

| 5. | Comment: | Under "Principal Investment Strategies" in the Summary section of the Fund's prospectus, we note the use of the terms "bottom-up approach" and "fundamental analysis". Please describe the meaning of these terms in accordance with the plain English requirement. |

| Response: | In the context of the description of how MFS selects investments for the Fund, we believe the terms "bottom-up approach" and "fundamental analysis" are described in plain English in the disclosure that satisfies the requirements of Item 9 of Form N-1A. For example, the Item 9 disclosure describes how MFS uses fundamental analysis of individual issuers to select investments and then provides a list of factors that are considered for purposes of our fundamental analysis, such as an issuer's earnings, cash flows, competitive position, and management ability. We believe it is clear from this disclosure that "fundamental" refers to the type of analysis MFS uses to select individual investments considering these factors as compared to quantitative analysis (which MFS also uses to select investments for the Fund) through which MFS systematically considers factors such as an issuer's valuation, price and earnings momentum, and earnings quality. In addition, we believe it is clear from this context that "bottom-up" refers to a focus on the selection of individual securities based on fundamental and quantitative analysis of those securities as opposed to a "top-down" approach, which would focus on an analysis of macroeconomic factors such as interest rates, inflation rates, growth. The Fund's Item 4 disclosure summarizes the disclosure provided to satisfy the Item 9 requirements as required by Form N-1A. |

We believe the disclosure referenced above satisfies the "plain English" requirements of Rule 421 under the Securities Act of 1933 and the requirements of Item 4 of Form N-1A to provide a summary description of the disclosure that is included in the statutory prospectus, as required by Item 9.

1027521

Securities and Exchange Commission

January 20, 2017

Page 4

| 6. | Comment: | The "Additional Information on Fees and Expenses and Performance" section of the Fund's prospectus includes the following sentence: "From time to time, the fund may receive proceeds from litigation settlements, without which performance would be lower." Please confirm that the Fund's prospectus will include disclosure describing "any material pending legal proceedings other than routine litigation incidental to business, to which the Fund or the Fund's investment adviser or principal underwriter is party", as required by Item 10(a)(3) of Form N-1A. |

| Response: | We have reviewed the requirements of Item 10(a)(3) of Form N-1A and do not believe that there is any pending legal proceeding that is likely to have a material adverse effect on the Fund or the ability of MFS or MFS Fund Distributors, Inc., the Fund's principal underwriter, to perform its contract with the Fund. |

| 7. | Comment: | Please include with your response letter, a completed sales charge table as described in the Funds statement of additional information under "Appendix G – Sales Charges" prior to the effective date of the PEA. |

| Response: | A completed sales charge table, which will be included in the Fund's final statement of additional information, is attached to this letter as Exhibit II. |

If you have any questions concerning the foregoing, please call the undersigned at 617-954-5000.

Sincerely,

/s/ Brian E. Langenfeld

Brian E. Langenfeld

Senior Counsel and Vice President

MFS Investment Management

1027521

Securities and Exchange Commission

January 20, 2017

Page 5

Exhibit I

Fees and Expenses

This table describes the fees and expenses that you may pay when you buy and hold shares of the fund. Expenses have been adjusted to reflect the current management fee set forth in the fund's Investment Advisory Agreement.

You may qualify for sales charge reductions if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in MFS Funds. More information about these and other waivers and reductions is available from your financial intermediary and in "Sales Charges and Waivers or Reductions" on page 8 of the fund's Prospectus and "Waivers of Sales Charges" on page H-1 of the fund's Statement of Additional Information ("SAI").

| Shareholder Fees (fees paid directly from your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 | |

| | Maximum Sales Charge (Load)

Imposed on Purchases (as a percentage of offering price) | | 5.75% | | None | | None | | None | | None | | None | | None | | None | | None | |

| | Maximum Deferred Sales Charge (Load)

(as a percentage of original purchase price or redemption proceeds, whichever is less) | | 1.00%# | | 4.00% | | 1.00% | | None | | None | | None | | None | | None | | None | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment): |

| | Share Class | | A | | B | | C | | I | | R1 | | R2 | | R3 | | R4 | | R6 |

| | Management Fee | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| | Distribution and/or Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | None | | 1.00% | | 0.50% | | 0.25% | | None | | None |

| | Other Expenses | | 0.20% | | 0.20% | | 0.20% | | 0.20% | | 0.20% | | 0.20% | | 0.20% | | 0.20% | | 0.08% |

| | Total Annual Fund Operating Expenses | | 0.85% | | 1.60% | | 1.60% | | 0.60% | | 1.60% | | 1.10% | | 0.85% | | 0.60% | | 0.48% |

| | Fee Reductions and/or Expense Reimbursements1 | | (0.11)% | | (0.11)% | | (0.11)% | | (0.11)% | | (0.11)% | | (0.11)% | | (0.11)% | | (0.11)% | | (0.06)% |

| | Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | | 0.74% | | 1.49% | | 1.49% | | 0.49% | | 1.49% | | 0.99% | | 0.74% | | 0.49% | | 0.42% |

| # | This contingent deferred sales charge (CDSC) applies to shares purchased without an initial sales charge and redeemed within 18 months of purchase. |

| 1 | Massachusetts Financial Services Company has agreed in writing to bear the fund's expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as interest and borrowing expenses incurred in connection with the fund's investment activity), such that "Total Annual Fund Operating Expenses" do not exceed 0.74% of the class' average daily net assets annually for each of Class A and Class R3 shares, 1.49% of the class' average daily net assets annually for each of Class B, Class C, and Class R1 shares, 0.49% of the class' average daily net assets annually for each of Class I and Class R4 shares, 0.99% of the class' average daily net assets annually for Class R2 shares, and 0.42% of the class' average daily net assets annually for Class R6 shares. This written agreement will continue until modified by the fund's Board of Trustees, but such agreement will continue until at least January 31, 2018 |

1027521

Securities and Exchange Commission

January 20, 2017

Page 6

Example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that: you invest $10,000 in the fund for the time periods indicated and you redeem your shares at the end of the time periods (unless otherwise indicated); your investment has a 5% return each year; and the fund's operating expenses remain the same.

Although your actual costs will likely be higher or lower, under these assumptions your costs would be:

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

| | Class A Shares | | $646 | | $820 | | $1,009 | | $1,554 | |

| | Class B Shares assuming | | | | | | | | | |

| | redemption at end of period | | $552 | | $794 | | $1,060 | | $1,690 | |

| | no redemption at end of period | | $152 | | $494 | | $860 | | $1,690 | |

| | Class C Shares assuming | | | | | | | | | |

| | redemption at end of period | | $252 | | $494 | | $860 | | $1,891 | |

| | no redemption at end of period | | $152 | | $494 | | $860 | | $1,891 | |

| | Class I Shares | | $50 | | $181 | | $324 | | $740 | |

| | Class R1 Shares | | $152 | | $494 | | $860 | | $1,891 | |

| | Class R2 Shares | | $101 | | $339 | | $596 | | $1,330 | |

| | Class R3 Shares | | $76 | | $260 | | $461 | | $1,039 | |

| | Class R4 Shares | | $50 | | $181 | | $324 | | $740 | |

| | Class R6 Shares | | $43 | | $148 | | $263 | | $598 | |

Performance Information

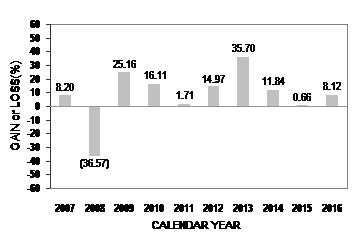

The bar chart and performance table below are intended to provide some indication of the risks of investing in the fund by showing changes in the fund's performance over time and how the fund's performance over time compares with that of a broad measure of market performance.

Performance information prior to June 1, 2008, reflects time periods when the fund had a policy of investing at least 80% of its net assets in union- and labor-sensitive companies. This policy was eliminated effective June 1, 2008. The fund's past performance (before and after taxes) does not necessarily indicate how the fund will perform in the future. Updated performance is available online at mfs.com or by calling 1-800-225-2606.

Class A Bar Chart. The bar chart does not take into account any sales charges (loads) that you may be required to pay upon purchase or redemption of the fund's shares. If these sales charges were included, they would reduce the returns shown.

During the period(s) shown in the bar chart, the highest quarterly return was 15.30% (for the calendar quarter ended June 30, 2009) and the lowest quarterly return was (21.23)% (for the calendar quarter ended December 31, 2008).

1027521

Securities and Exchange Commission

January 20, 2017

Page 7

Performance Table.

| Average Annual Total Returns | | | | | | |

| (For the Periods Ended December 31, 2016) | | | | | | |

| | Share Class | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| | Returns Before Taxes |

| | B Shares | | 3.32% | | 12.58% | | 6.15% | |

| | C Shares | | 6.33% | | 12.83% | | 6.00% | |

| | I Shares | | 8.36% | | 13.97% | | 7.05% | |

| | R1 Shares | | 7.28% | | 12.83% | | 6.00% | |

| | R2 Shares | | 7.81% | | 13.40% | | 6.53% | |

| | R3 Shares | | 8.10% | | 13.67% | | 6.80% | |

| | R4 Shares | | 8.39% | | 13.96% | | 7.06% | |

| | R6 Shares | | 8.51% | | 14.08% | | 7.10% | |

| | A Shares | | 1.91% | | 12.35% | | 6.15% | |

| | Returns After Taxes on Distributions | | | | | | |

| | A Shares | | 1.67% | | 11.75% | | 5.72% | |

| | Returns After Taxes on Distributions and Sale of Fund Shares | | | | | | |

| | A Shares | | 1.28% | | 9.80% | | 4.90% | |

| | Index Comparison (Reflects no deduction for fees, expenses, or taxes) | | | | | | |

| | Standard & Poor's 500 Stock Index | | 11.96% | | 14.66% | | 6.95% | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your own tax situation, and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. The after-tax returns are shown for only one of the fund's classes of shares, and after-tax returns for the fund's other classes of shares will vary from the returns shown.

1027521

Securities and Exchange Commission

January 20, 2017

Page 8

Exhibit II

APPENDIX G - SALES CHARGES

The following sales charges were paid during the specified periods:

| | | | Class A Initial Sales Charges: | CDSC Paid to MFD On: | | | |

| Fund | Fiscal Year Ended | Total | Retained by MFD | Reallowed to Financial Intermediaries | Class A Shares | Class B Shares | Class C Shares | | | |

| | | | | | | | | | | | |

| MFS Blended Research Core Equity Fund | September 30, 2016 | $2,045,433 | $342,795 | $1,702,638 | $15,569 | $32,653 | $20,550 | | | |

| | | September 30, 2015 | $1,624,212 | $266,442 | $1,357,770 | $3,042 | $12,750 | $7,881 | | | |

| | | September 30, 2014 | $436,515 | $72,266 | $364,249 | $181 | $2,985 | $2,454 | | | |

| | | | | | | | | | | | |

| MFS International New Discovery Fund | September 30, 2016 | $2,371,232 | $400,324 | $1,970,908 | $5,580 | $17,738 | $9,209 | | | |

| | | September 30, 2015 | $3,988,619 | $682,438 | $3,306,181 | $3,996 | $24,443 | $9,510 | | | |

| | | September 30, 2014 | $5,279,098 | $894,833 | $4,384,265 | $4,354 | $27,454 | $12,452 | | | |

| | | | | | | | | | | | |

| MFS Mid Cap Value Fund | September 30, 2016 | $5,738,390 | $969,879 | $4,768,511 | $9,769 | $27,585 | $17,400 | | | |

| | | September 30, 2015 | $4,146,117 | $709,878 | $3,436,239 | $2,037 | $26,945 | $15,012 | | | |

| | | September 30, 2014 | $4,596,298 | $782,983 | $3,813,315 | $11,619 | $17,475 | $8,425 | | | |

| | | | | | | | | | | | |

| MFS Research Fund | September 30, 2016 | $860,020 | $142,742 | $717,278 | $2,672 | $30,581 | $8,265 | | | |

| | | September 30, 2015 | $995,508 | $163,005 | $832,503 | $9,659 | $29,062 | $6,297 | | | |

| | | September 30, 2014 | $1,139,907 | $185,417 | $954,490 | $2,024 | $26,164 | $10,319 | | | |

| | | | | | | | | | | | |

| MFS Total Return Fund | September 30, 2016 | $9,726,463 | $1,618,516 | $8,107,947 | $13,669 | $212,925 | $74,387 | | | |

| | | September 30, 2015 | $9,230,096 | $1,538,795 | $7,691,301 | $9,601 | $251,490 | $75,340 | | | |

| | | September 30, 2014 | $8,139,829 | $1,343,526 | $6,796,303 | $13,303 | $237,923 | $46,948 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

1027521

Securities and Exchange Commission

January 20, 2017

Page 9

| | | | Class 529A Initial Sales Charges: | CDSC Paid to MFD On: |

| Fund | Fiscal Year Ended | Total | Retained by MFD | Reallowed to Financial Intermediaries | Class 529A Shares | Class 529B Shares | Class 529C Shares |

| | | | | | | | | |

| MFS International New Discovery Fund | September 30, 2016 | $16,383 | $2,461 | $13,922 | Not Applicable | $0 | $21 |

| | | September 30, 2015 | $17,511 | $2,525 | $14,986 | Not Applicable | $403 | $20 |

| | | September 30, 2014 | $16,247 | $2,424 | $13,823 | Not Applicable | $0 | $107 |

| | | | | | | | | |

| MFS Mid Cap Value Fund | September 30, 2016 | $21,188 | $3,194 | $17,994 | Not Applicable | $374 | $33 |

| | | September 30, 2015 | $25,419 | $3,915 | $21,504 | Not Applicable | $0 | $17 |

| | | September 30, 2014 | $23,158 | $3,443 | $19,715 | Not Applicable | $0 | $4 |

| | | | | | | | | |

| MFS Total Return Fund | September 30, 2016 | $66,171 | $10,080 | $56,091 | Not Applicable | $555 | $114 |

| | | September 30, 2015 | $61,581 | $9,679 | $51,902 | Not Applicable | $66 | $106 |

| | | September 30, 2014 | $64,157 | $9,966 | $54,191 | Not Applicable | $668 | $96 |

| | | | | | | | | |

1027521