UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7994 |

|

Salomon Brothers Global Partners Income Fund Inc. |

(Exact name of registrant as specified in charter) |

|

125 Broad Street, New York, NY | | 10004 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place, 4th Fl.

Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 725-6666 | |

|

Date of fiscal year end: | August 31 | |

|

Date of reporting period: | February 28, 2006 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

Salomon Brothers

Global Partners

Income Fund Inc.

SEMI-ANNUAL REPORT

FEBRUARY 28, 2006

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Salomon Brothers

Global Partners Income Fund Inc.

Semi-Annual Report • February 28, 2006

What’s Inside

Fund Objective

The Fund seeks to maintain a high level of current income by investing primarily in a portfolio of high-yield U.S. and non-U.S. corporate debt securities. As a secondary objective, the Fund seeks capital appreciation.

Letter from the Chairman | I |

| |

Fund at a Glance | 1 |

| |

Schedule of Investments | 2 |

| |

Statement of Assets and Liabilities | 18 |

| |

Statement of Operations | 19 |

| |

Statements of Changes in Net Assets | 20 |

| |

Statement of Cash Flows | 21 |

| |

Financial Highlights | 22 |

| |

Notes to Financial Statements | 23 |

| |

Board Approval of Management Agreement | 30 |

| |

Additional Shareholder Information | 37 |

| |

Dividend Reinvestment Plan | 38 |

“Smith Barney” and “Salomon Brothers” are service marks of Citigroup, licensed for use by Legg Mason as the names of funds and investment managers. Legg Mason and its affiliates, as well as the fund’s investment manager, are not affiliated with Citigroup.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman and Chief Executive Officer

Dear Shareholder,

The U.S. economy was mixed during the six-month reporting period. Early in the period, the economy overcame several headwinds, including high oil prices, rising short-term interest rates and geopolitical issues. After a 3.3% advance in the second quarter of 2005, third quarter gross domestic product (“GDP”)(i) growth was a strong 4.1%. This marked the tenth consecutive quarter that GDP surpassed 3.0%. However, there were conflicting economic signals in the fourth quarter. While the Labor Department announced that the unemployment rate fell to 4.7% in January 2006, its lowest level in four years, the fourth quarter GDP growth was 1.7%. This decline was, in large part, due to slower consumer spending.

Given the economic expansion and inflationary concerns, the Federal Reserve Board (“Fed”)(ii) continued to raise interest rates throughout the period. After raising rates ten times from June 2004 through August 2005, the Fed increased its target for the federal funds rate(iii) in 0.25% increments four additional times over the reporting period. This represents the longest sustained Fed tightening cycle since the 1970s. All told, the Fed’s fourteen rate hikes have brought the target for the federal funds rate from 1.00% to 4.50%. After the end of the Fund’s reporting period, at its March meeting, the Fed raised the federal funds rate by an additional 0.25% to 4.75%.

As expected, both short- and long term yields rose over the reporting period. During the six months ended February 28, 2006, two-year Treasury yields increased from 3.72% to 4.69%. Over the same period, 10-year Treasury yields moved from 4.02% to 4.55%. As these figures show, at the end of the reporting period the yield curve was inverted, as the yield on two-year Treasuries surpassed that

Salomon Brothers Global Partners Income Fund Inc. | I |

of 10-year Treasuries. This anomaly has historically foreshadowed an economic slowdown or recession. However, some experts, including new Fed Chairman Ben Bernanke, believe the inverted yield curve is largely a function of strong foreign demand for longer-term bonds. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers U.S. Aggregate Index(iv), returned –0.11%.

The high yield market generated a modest gain during the reporting period. While corporate balance sheets continued to strengthen and corporate profits were generally strong, these positive developments took a back seat to the highly publicized downgrades of General Motors Corporation and Ford Motor Company. During the six-month period ended February 28, 2006, the Citigroup High Yield Market Index(v) returned 1.45%.

Emerging markets debt continued to produce strong results over the reporting period, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)(vi) returned 7.17%. Improving domestic spending and high energy and commodity prices supported many emerging market countries. In addition, many emerging market countries have strengthened their balance sheets in recent years. This more than offset the potential negatives associated with rising U.S. interest rates.

Performance Review

For the six months ended February 28, 2006, the Salomon Brothers Global Partners Income Fund returned 5.21%, based on its net asset value (“NAV”)(vii) and –1.38% based on its New York Stock Exchange (“NYSE”) market price per share. In comparison, the Fund’s unmanaged benchmarks, the Citigroup High Yield Market Index and EMBI Global returned 1.45% and 7.17%, respectively, for the same time frame. The Lipper Emerging Markets Debt Closed-End Funds Category Average(viii) increased 8.39%. Please note that Lipper performance returns are based on each funds’ NAV per share.

During this six-month period, the Fund made distributions to shareholders totaling $0.4890 per share, (which may have included a return of capital). The performance table shows the Fund’s six-month total return based on its NAV and market price as of February 28, 2006. Past performance is no guarantee of future results.

Performance Snapshot as of February 28, 2006 (unaudited)

Price Per Share | | Six-Month

Total Return | |

| | | |

$13.23 (NAV) | | 5.21 | % |

$12.09 (Market Price) | | -1.38 | % |

All figures represent past performance and are not a guarantee of future results.

Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares.

II | Salomon Brothers Global Partners Income Fund Inc. |

Special Shareholder Notice

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management (“CAM”), to Legg Mason, Inc. (“Legg Mason”). As a result, the Fund’s investment adviser (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, became a wholly-owned subsidiary of Legg Mason. Completion of the sale caused the Fund’s then existing investment management contract to terminate. The Fund’s shareholders previously approved a new investment management contract between the Fund and the Manager, which became effective on December 1, 2005.

As previously described in proxy statements that were mailed to shareholders of the Fund in connection with the transaction, Legg Mason intends to combine the fixed-income operations of the Manager with those of Legg Mason’s wholly-owned subsidiary, Western Asset Management Company, and its affiliates, (“Western Asset”). This combination will involve Western Asset and the Manager sharing common systems and procedures, employees (including portfolio managers), investment trading platforms, and other resources. At a future date Legg Mason expects to recommend to the Boards of Directors of the Fund that Western Asset be appointed as the advisor or sub-advisor to the Fund, subject to applicable regulatory requirements.

The portfolio management team of S. Kenneth Leech, Stephen A. Walsh, Michael C. Buchanan, Timothy J. Settel and Ian R. Edmonds assumed portfolio management responsibilities for the Fund in mid-March 2006. Mr. Leech, Mr. Walsh, Mr. Settel and Mr. Edmonds have been employed by Western Asset for more than five years.

Prior to joining Western Asset as a portfolio manager and head of the U.S. High Yield team in 2005, Mr. Buchanan was a Managing Director and head of U.S. credit products at Credit Suisse Asset Management from 2003 to 2005. Mr. Buchanan served as Executive Vice President and portfolio manager for Janus Capital Management in 2003. Prior to joining Janus Capital Management, Mr. Buchanan was a managing director and head of High Yield Trading at Blackrock Financial Management from 1998 to 2003.

The Board is working with the Manager, Western Asset, and the portfolio managers to implement an orderly combination of the Manager’s fixed-income operations and Western Asset in the best interests of the Fund and its shareholders.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have come under the scrutiny of federal and state regulators. The Fund’s Manager and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the open-end funds’ response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the

Salomon Brothers Global Partners Income Fund Inc. | III |

Manager and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Manager with regard to recent regulatory developments is contained in the Notes to Financial Statements included in this report.

Looking for Additional Information?

The Fund is traded under the symbol “GDF” and its closing market price is available in any newspapers under the NYSE listings. The daily NAV is available on-line under symbol XGDFX. Barron’s and The Wall Street Journal’s Monday editions carry closed-end fund tables that will provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.leggmason.com/InvestorServices.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 or 1-800-SALOMON (toll free), Monday through Friday from 8:00 a.m. to 6:00 p.m. Eastern Time, for the Fund’s current NAV, market price, and other information.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman and Chief Executive Officer

March 30, 2006

IV | Salomon Brothers Global Partners Income Fund Inc. |

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: The Fund may invest in high-yield and foreign securities, including emerging markets, which involve risks beyond those inherent in solely higher-rated and domestic investments. High-yield bonds involve greater credit and liquidity risks than investment grade bonds. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. These risks are magnified in emerging or developing markets. Derivatives, such as options or futures, can be illiquid and harder to value, especially in declining markets. A small investment in certain derivatives may have a potentially large impact on the Fund’s performance.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

(i) Gross domestic product is a market value of goods and services produced by labor and property in a given country.

(ii) The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments.

(iii) The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans.

(iv) The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment grade or higher, and having at least one year to maturity.

(v) The Citigroup High Yield Market Index is a broad-based unmanaged index of high yield securities.

(vi) JPMorgan Emerging Markets Bond Index Global (EMBI Global) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela.

(vii) NAV is calculated by subtracting total liabilities from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is at the Fund’s market price as determined by supply of and demand for the Fund’s shares.

(viii) Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended February 28, 2006, including the reinvestment of distributions, including returns of capital, if any, calculated among the 13 funds in the Fund’s Lipper category, and excluding sales charges.

Salomon Brothers Global Partners Income Fund Inc. | V |

(This page intentionally left blank.)

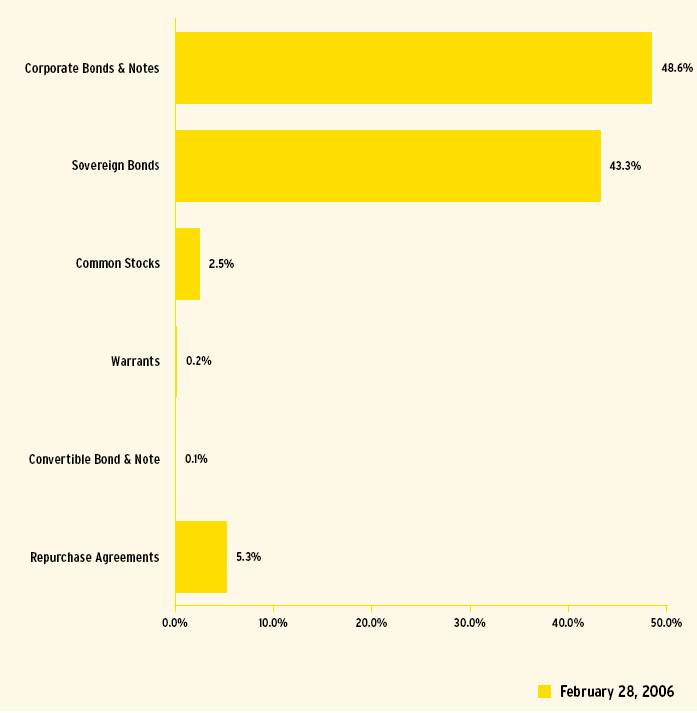

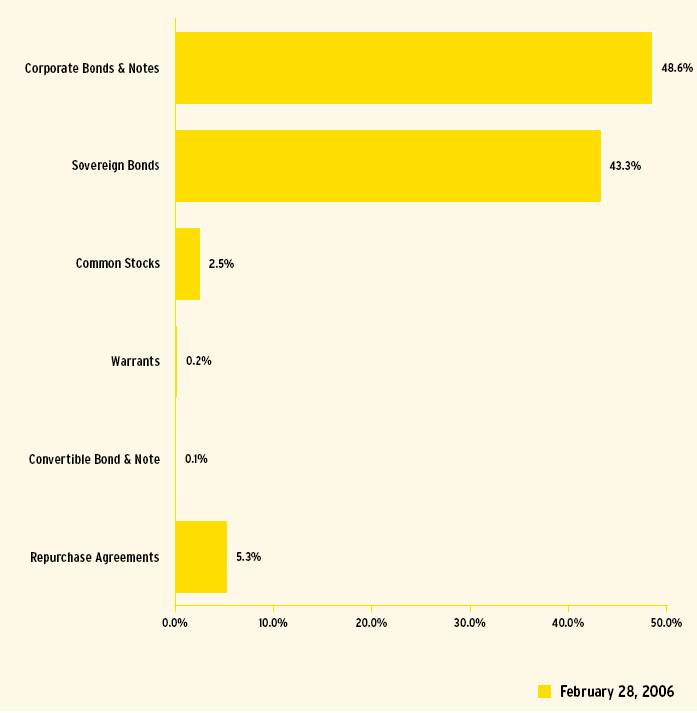

Fund at a Glance (unaudited)

Investment Breakdown

As a Percent of Total Investments

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 1 |

Schedule of Investments (February 28, 2006) (unaudited)

SALOMON BROTHERS GLOBAL PARTNERS INCOME FUND INC.

Face

Amount | | Security(a) | | Value | |

CORPORATE BONDS & NOTES — 48.6% | | | |

| | | |

Aerospace & Defense — 0.7% | | | |

$ | 675,000 | | DRS Technologies Inc., Senior Subordinated Notes, 6.875% due 11/1/13 | | $ | 676,687 | |

750,000 | | L-3 Communications Corp., Senior Subordinated Notes, 7.625% due 6/15/12 | | 789,375 | |

450,000 | | Sequa Corp., Senior Notes, 9.000% due 8/1/09 | | 487,125 | |

| | Total Aerospace & Defense | | 1,953,187 | |

| | | | | |

Airlines — 0.1% | | | |

| | Continental Airlines Inc., Pass-Through Certificates: | | | |

98,856 | | Series 1998-IC, Series B, 6.541% due 9/15/08 | | 93,011 | |

296,645 | | Series 2000-2, Class C, 8.312% due 4/2/11 | | 284,330 | |

| | Total Airlines | | 377,341 | |

| | | | | |

Auto Components — 0.3% | | | |

325,000 | | Keystone Automotive Operations Inc., Senior Subordinated Notes, 9.750% due 11/1/13 | | 285,187 | |

300,000 | | Tenneco Automotive Inc., Senior Secured Notes, Series B, 10.250% due 7/15/13 | | 333,750 | |

| | TRW Automotive Inc.: | | | |

134,000 | | Senior Notes, 9.375% due 2/15/13 | | 146,060 | |

49,000 | | Senior Subordinated Notes, 11.000% due 2/15/13 | | 55,248 | |

| | Total Auto Components | | 820,245 | |

| | | | | |

Automobiles — 1.9% | | | |

| | Ford Motor Co.: | | | |

| | Debentures: | | | |

150,000 | | 6.625% due 10/1/28 | | 101,250 | |

175,000 | | 8.900% due 1/15/32 | | 135,625 | |

4,300,000 | | Notes, 7.450% due 7/16/31 | | 3,074,500 | |

125,000 | | Senior Notes, 4.950% due 1/15/08 | | 115,203 | |

| | General Motors Corp., Senior Debentures: | | | |

200,000 | | 8.250% due 7/15/23 | | 138,500 | |

2,375,000 | | 8.375% due 7/15/33 | | 1,686,250 | |

| | Total Automobiles | | 5,251,328 | |

| | | | | |

Beverages — 0.2% | | | |

650,000 | | Constellation Brands Inc., Senior Subordinated Notes, Series B, 8.125% due 1/15/12 | | 684,125 | |

| | | | | |

Building Products — 0.7% | | | |

1,250,000 | | Associated Materials Inc., Senior Discount Notes, step bond to yield 11.239% due 3/1/14 | | 668,750 | |

625,000 | | Nortek Inc., Senior Subordinated Notes, 8.500% due 9/1/14 | | 626,563 | |

650,000 | | Ply Gem Industries Inc., Senior Subordinated Notes, 9.000% due 2/15/12 | | 588,250 | |

| | Total Building Products | | 1,883,563 | |

| | | | | |

Capital Markets — 0.2% | | | |

423,000 | | BCP Crystal U.S. Holdings Corp., Senior Subordinated Notes, 9.625% due 6/15/14 | | 475,346 | |

| | | | | | | |

See Notes to Financial Statements.

2 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Chemicals — 2.6% | | | |

$ | 375,000 | | Airgas Inc., Senior Subordinated Notes, 9.125% due 10/1/11 | | $ | 399,844 | |

500,000 | | Equistar Chemicals LP, Senior Notes, 10.625% due 5/1/11 | | 546,250 | |

685,000 | | Huntsman International LLC, Senior Subordinated Notes, 10.125% due 7/1/09 | | 705,550 | |

100,000 | | IMC Global Inc., Senior Notes, 10.875% due 8/1/13 | | 115,500 | |

525,000 | | Innophos Inc., Senior Subordinated Notes, 8.875% due 8/15/14 (b) | | 543,375 | |

| | Lyondell Chemical Co., Senior Secured Notes: | | | |

147,000 | | 9.500% due 12/15/08 | | 154,350 | |

325,000 | | 11.125% due 7/15/12 | | 360,750 | |

450,000 | | Methanex Corp., Senior Notes, 8.750% due 8/15/12 | | 498,375 | |

790,000 | | Millennium America Inc., Senior Notes, 9.250% due 6/15/08 | | 815,675 | |

625,000 | | Nalco Co., Senior Subordinated Notes, 8.875% due 11/15/13 | | 657,812 | |

575,000 | | NOVA Chemicals Corp., Senior Notes, 6.500% due 1/15/12 | | 556,313 | |

125,000 | | OM Group Inc., Senior Subordinated Notes, 9.250% due 12/15/11 | | 125,625 | |

350,000 | | PQ Corp., Senior Subordinated Notes, 7.500% due 2/15/13 (b) | | 337,750 | |

475,000 | | Resolution Performance Products LLC, Senior Subordinated Notes, 13.500% due 11/15/10 | | 510,625 | |

250,000 | | Resolution Performance Products LLC/RPP Capital Corp., Senior Secured Notes, 9.500% due 4/15/10 | | 260,000 | |

| | Rhodia SA: | | | |

33,000 | | Senior Notes, 10.250% due 6/1/10 | | 37,290 | |

706,000 | | Senior Subordinated Notes, 8.875% due 6/1/11 | | 736,005 | |

| | Total Chemicals | | 7,361,089 | |

| | | | | |

Commercial Services & Supplies — 1.2% | | | |

275,000 | | Allied Security Escrow Corp., Senior Subordinated Notes, 11.375% due 7/15/11 | | 259,875 | |

| | Allied Waste North America Inc.: | | | |

175,000 | | Senior Notes, 7.250% due 3/15/15 | | 178,500 | |

200,000 | | Senior Secured Debenture Notes, Series B, 9.250% due 9/1/12 | | 218,000 | |

1,025,000 | | Senior Secured Notes, Series B, 7.375% due 4/15/14 | | 1,012,187 | |

350,000 | | Brand Services Inc., Senior Notes, 12.000% due 10/15/12 | | 373,625 | |

| | Cenveo Corp.: | | | |

125,000 | | Senior Notes, 9.625% due 3/15/12 | | 135,000 | |

475,000 | | Senior Subordinated Notes, 7.875% due 12/1/13 | | 472,625 | |

700,000 | | DI Finance/DynCorp International LLC, Senior Subordinated Notes, 9.500% due 2/15/13 | | 728,000 | |

2,000,000 | | Safety-Kleen Services Inc., Senior Subordinated Notes, 9.250% due 6/1/08 (c)(d)(f)* | | 10,000 | |

| | Total Commercial Services & Supplies | | 3,387,812 | |

| | | | | |

Communications Equipment — 0.5% | | | |

1,725,000 | | Lucent Technologies Inc., Debentures, 6.450% due 3/15/29 | | 1,464,094 | |

| | | | | |

Computers & Peripherals — 0.1% | | | |

200,000 | | SunGard Data Systems Inc., Senior Notes, 9.125% due 8/15/13 (b) | | 213,750 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 3 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Containers & Packaging — 1.5% | | | |

$ | 525,000 | | Berry Plastics Corp., Senior Subordinated Notes, 10.750% due 7/15/12 | | $ | 573,562 | |

| | Graphic Packaging International Corp.: | | | |

100,000 | | Senior Notes, 8.500% due 8/15/11 | | 101,000 | |

650,000 | | Senior Subordinated Notes, 9.500% due 8/15/13 | | 620,750 | |

7,000 | | Jefferson Smurfit Corp., Senior Notes, 8.250% due 10/1/12 | | 6,878 | |

| | Owens-Brockway Glass Container Inc., Senior Notes: | | | |

75,000 | | 8.250% due 5/15/13 | | 78,563 | |

525,000 | | 6.750% due 12/1/14 | | 517,125 | |

175,000 | | Owens-Illinois Inc., Debentures, 7.500% due 5/15/10 | | 178,062 | |

130,000 | | Pliant Corp., Senior Secured Second Lien Notes, 11.125% due 9/1/09 (d) | | 120,250 | |

325,000 | | Radnor Holdings Corp., Senior Notes, 11.000% due 3/15/10 | | 248,625 | |

1,250,000 | | Stone Container Finance Co. of Canada II, Senior Notes, 7.375% due 7/15/14 | | 1,165,625 | |

| | Tekni-Plex Inc.: | | | |

450,000 | | Senior Secured Notes, 8.750% due 11/15/13 (b) | | 415,125 | |

100,000 | | Senior Subordinated Notes, Series B, 12.750% due 6/15/10 | | 59,000 | |

| | Total Containers & Packaging | | 4,084,565 | |

| | | |

Diversified Consumer Services — 0.1% | | | |

200,000 | | Hertz Corp., Senior Notes, 8.875% due 1/1/14 (b) | | 210,000 | |

| | | |

Diversified Financial Services — 3.1% | | | |

| | Alamosa Delaware Inc.: | | | |

339,000 | | Senior Discount Notes, step bond to yield 13.836% due 7/31/09 | | 368,663 | |

308,000 | | Senior Notes, 11.000% due 7/31/10 | | 344,960 | |

675,000 | | Atlantic Broadband Finance LLC, Senior Subordinated Notes, 9.375% due 1/15/14 | | 631,125 | |

300,000 | | Basell AF SCA, Senior Notes, 8.375% due 8/15/15 (b) | | 303,000 | |

325,000 | | CCM Merger Inc., Notes, 8.000% due 8/1/13 (b) | | 325,000 | |

| | Ford Motor Credit Co., Notes: | | | |

1,775,000 | | 6.625% due 6/16/08 | | 1,653,370 | |

100,000 | | 7.875% due 6/15/10 | | 92,568 | |

3,100,000 | | General Motors Acceptance Corp., Bonds, 8.000% due 11/1/31 | | 2,838,298 | |

600,000 | | Sensus Metering Systems Inc., Senior Subordinated Notes, 8.625% due 12/15/13 | | 577,500 | |

490,854 | | Targeted Return Index Securities (TRAINS), Secured Notes, Series HY-2005-1, 7.651% due 6/15/15 (b) | | 504,555 | |

1,000,000 | | Vanguard Health Holdings Co. I LLC, Senior Discount Notes, step bond to yield 5.952% due 10/1/15 | | 745,000 | |

375,000 | | Vanguard Health Holdings Co. II LLC, Senior Subordinated Notes, 9.000% due 10/1/14 | | 392,812 | |

| | Total Diversified Financial Services | | 8,776,851 | |

| | | | | |

Diversified Telecommunication Services — 1.6% | | | |

600,000 | | Insight Midwest LP/Insight Capital Inc., Senior Notes, 10.500% due 11/1/10 | | 635,250 | |

225,000 | | Intelsat Bermuda Ltd., Senior Notes, 9.609% due 1/15/12 (b)(e) | | 230,625 | |

195,000 | | PanAmSat Corp., Senior Notes, 9.000% due 8/15/14 | | 206,700 | |

| | Qwest Communications International Inc., Senior Notes: | | | |

60,000 | | 7.500% due 2/15/14 | | 61,950 | |

285,000 | | Series B, 7.500% due 2/15/14 | | 294,262 | |

| | | | | | | |

See Notes to Financial Statements.

4 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Diversified Telecommunication Services — 1.6% (continued) | | | |

| | Qwest Corp.: | | | |

$ | 145,000 | | 7.500% due 6/15/23 | | $ | 147,900 | |

1,460,000 | | Debentures, 6.875% due 9/15/33 | | 1,408,900 | |

1,025,000 | | Notes, 8.875% due 3/15/12 | | 1,153,125 | |

450,000 | | Zeus Special, Senior Discount Notes, step bond to yield 9.253% due 2/1/15 (b) | | 310,500 | |

| | Total Diversified Telecommunication Services | | 4,449,212 | |

| | | |

Electric Utilities — 1.5% | | | |

400,000 | | AES Corp., Senior Notes, 8.750% due 6/15/08 | | 420,500 | |

| | Edison Mission Energy, Senior Notes: | | | |

50,000 | | 10.000% due 8/15/08 | | 54,750 | |

1,100,000 | | 7.730% due 6/15/09 | | 1,141,250 | |

300,000 | | 9.875% due 4/15/11 | | 347,250 | |

950,000 | | Mirant Americas Generation LLC, Senior Notes, 9.125% due 5/1/31 | | 1,033,125 | |

| | Reliant Energy Inc., Senior Secured Notes: | | | |

725,000 | | 9.250% due 7/15/10 | | 740,406 | |

550,000 | | 9.500% due 7/15/13 | | 563,750 | |

| | Total Electric Utilities | | 4,301,031 | |

| | | |

Electronic Equipment & Instruments — 0.1% | | | |

400,000 | | Muzak LLC/Muzak Finance Corp., Senior Notes, 10.000% due 2/15/09 | | 350,500 | |

| | | |

Energy Equipment & Services — 0.4% | | | |

507,000 | | Dresser-Rand Group Inc., Senior Subordinated Notes, 7.625% due 11/1/14 (b) | | 529,815 | |

450,000 | | Targa Resources Inc., Senior Notes, 8.500% due 11/1/13 (b) | | 479,250 | |

| | Total Energy Equipment & Services | | 1,009,065 | |

| | | |

Food & Staples Retailing — 0.2% | | | |

675,000 | | Jean Coutu Group Inc., Senior Subordinated Notes, 8.500% due 8/1/14 | | 648,000 | |

| | | |

Food Products — 0.9% | | | |

250,000 | | Ahold Finance USA Inc., Notes, 8.250% due 7/15/10 | | 268,750 | |

500,000 | | Del Monte Corp., Senior Subordinated Notes, 8.625% due 12/15/12 | | 535,000 | |

| | Doane Pet Care Co.: | | | |

100,000 | | Senior Notes, 10.750% due 3/1/10 | | 108,125 | |

300,000 | | Senior Subordinated Notes, 10.625% due 11/15/15 (b) | | 318,750 | |

800,000 | | Dole Food Co. Inc., Senior Notes, 7.250% due 6/15/10 | | 774,000 | |

625,000 | | Pinnacle Foods Holding Corp., Senior Subordinated Notes, 8.250% due 12/1/13 | | 615,625 | |

| | Total Food Products | | 2,620,250 | |

| | | |

Health Care Providers & Services — 2.2% | | | |

600,000 | | AmeriPath Inc., Senior Subordinated Notes, 10.500% due 4/1/13 | | 636,000 | |

725,000 | | DaVita Inc., Senior Subordinated Notes, 7.250% due 3/15/15 | | 743,125 | |

450,000 | | Extendicare Health Services Inc., Senior Subordinated Notes, 9.500% due 7/1/10 | | 477,562 | |

| | HCA Inc.: | | | |

400,000 | | 7.500% due 12/15/23 | | 407,557 | |

| | Notes: | | | |

875,000 | | 6.375% due 1/15/15 | | 878,002 | |

125,000 | | 7.690% due 6/15/25 | | 129,857 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 5 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Health Care Providers & Services — 2.2% (continued) | | | |

$ | 975,000 | | IASIS Healthcare LLC/IASIS Capital Corp., Senior Subordinated Notes, 8.750% due 6/15/14 | | $ | 994,500 | |

75,000 | | InSight Health Services Corp., Senior Subordinated Notes, Series B, 9.875% due 11/1/11 | | 42,000 | |

| | Tenet Healthcare Corp., Senior Notes: | | | |

750,000 | | 7.375% due 2/1/13 | | 691,875 | |

325,000 | | 9.875% due 7/1/14 | | 332,313 | |

300,000 | | 6.875% due 11/15/31 | | 246,000 | |

725,000 | | Triad Hospitals Inc., Senior Subordinated Notes, 7.000% due 11/15/13 | | 734,969 | |

| | Total Health Care Providers & Services | | 6,313,760 | |

| | | |

Hotels, Restaurants & Leisure — 4.7% | | | |

650,000 | | AMF Bowling Worldwide Inc., Senior Subordinated Notes, 10.000% due 3/1/10 | | 669,500 | |

400,000 | | Boyd Gaming Corp., Senior Subordinated Notes, 6.750% due 4/15/14 | | 401,000 | |

425,000 | | Caesars Entertainment Inc., Senior Subordinated Notes, 8.875% due 9/15/08 | | 459,531 | |

125,000 | | Carrols Corp., Senior Subordinated Notes, 9.000% due 1/15/13 | | 127,188 | |

325,000 | | Choctaw Resort Development Enterprise, Senior Notes, 7.250% due 11/15/19 (b) | | 333,125 | |

925,000 | | Cinemark Inc., Senior Discount Notes, step bond to yield 2.226% due 3/15/14 | | 693,750 | |

675,000 | | Denny’s Holdings Inc., Senior Notes, 10.000% due 10/1/12 | | 708,750 | |

575,000 | | Herbst Gaming Inc., Senior Subordinated Notes, 7.000% due 11/15/14 | | 577,875 | |

550,000 | | Hilton Hotels Corp., Notes, 7.625% due 12/1/12 | | 597,225 | |

500,000 | | Inn of the Mountain Gods Resort & Casino, Senior Notes, 12.000% due 11/15/10 | | 530,625 | |

700,000 | | Isle of Capri Casinos Inc., Senior Subordinated Notes, 7.000% due 3/1/14 | | 703,500 | |

525,000 | | Kerzner International Ltd., Senior Subordinated Notes, 6.750% due 10/1/15 | | 523,687 | |

550,000 | | Las Vegas Sands Corp., Senior Notes, 6.375% due 2/15/15 | | 536,250 | |

| | MGM MIRAGE Inc.: | | | |

| | Senior Notes: | | | |

400,000 | | 6.750% due 9/1/12 | | 408,500 | |

300,000 | | 6.625% due 7/15/15 | | 302,625 | |

750,000 | | Senior Subordinated Notes, 9.750% due 6/1/07 | | 789,375 | |

| | Mohegan Tribal Gaming Authority, Senior Subordinated Notes: | | | |

375,000 | | 7.125% due 8/15/14 | | 388,125 | |

375,000 | | 6.875% due 2/15/15 | | 381,094 | |

700,000 | | Penn National Gaming Inc., Senior Subordinated Notes, 6.750% due 3/1/15 | | 707,000 | |

675,000 | | Pinnacle Entertainment Inc., Senior Subordinated Notes, 8.250% due 3/15/12 | | 705,375 | |

525,000 | | Sbarro Inc., Senior Notes, 11.000% due 9/15/09 | | 539,437 | |

| | Six Flags Inc., Senior Notes: | | | |

200,000 | | 9.750% due 4/15/13 | | 205,500 | |

350,000 | | 9.625% due 6/1/14 | | 357,000 | |

700,000 | | Starwood Hotels & Resorts Worldwide Inc., Senior Notes, 7.875% due 5/1/12 | | 771,750 | |

| | Station Casinos Inc.: | | | |

| | Senior Subordinated Notes: | | | |

475,000 | | 6.500% due 2/1/14 | | 477,375 | |

150,000 | | 6.875% due 3/1/16 | | 153,375 | |

125,000 | | 6.625% due 3/15/18 (b) | | 125,313 | |

| | Total Hotels, Restaurants & Leisure | | 13,173,850 | |

| | | | | | | |

See Notes to Financial Statements.

6 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Household Durables — 0.6% | | | |

$ | 67,000 | | Applica Inc., Senior Subordinated Notes, 10.000% due 7/31/08 | | $ | 65,325 | |

1,250,000 | | Holt Group Inc., Senior Notes, 9.750% due 1/15/06 (c)(d)(f) | | 0 | |

675,000 | | Interface Inc., Senior Subordinated Notes, 9.500% due 2/1/14 | | 695,250 | |

600,000 | | Sealy Mattress Co., Senior Subordinated Notes, 8.250% due 6/15/14 | | 630,000 | |

374,000 | | Tempur-Pedic Inc./Tempur Production USA Inc., Senior Subordinated Notes, 10.250% due 8/15/10 | | 402,050 | |

| | Total Household Durables | | 1,792,625 | |

| | | |

Household Products — 0.0% | | | |

7,012 | | Spectrum Brands Inc., 7.375% due 2/1/15 | | 6,083 | |

| | | |

Independent Power Producers & Energy Traders — 2.0% | | | |

| | AES Corp., Senior Notes: | | | |

175,000 | | 9.500% due 6/1/09 | | 190,094 | |

300,000 | | 9.375% due 9/15/10 | | 330,750 | |

400,000 | | 7.750% due 3/1/14 | | 424,500 | |

| | Calpine Corp.: | | | |

325,000 | | Second Priority Senior Secured Notes, 8.500% due 7/15/10 (b)(d) | | 303,875 | |

215,000 | | Senior Secured Notes, 8.750% due 7/15/13 (b)(d) | | 201,025 | |

375,000 | | Calpine Generating Co. LLC, Senior Secured Notes, 13.216% due 4/1/11 (d)(e) | | 410,625 | |

| | Dynegy Holdings Inc.: | | | |

| | Second Priority Senior Secured Notes: | | | |

650,000 | | 9.875% due 7/15/10 (b) | | 713,375 | |

25,000 | | 10.125% due 7/15/13 (b) | | 28,250 | |

| | Senior Debentures: | | | |

800,000 | | 7.125% due 5/15/18 | | 784,000 | |

750,000 | | 7.625% due 10/15/26 | | 735,000 | |

| | NRG Energy Inc., Senior Notes: | | | |

275,000 | | 7.250% due 2/1/14 | | 282,563 | |

1,225,000 | | 7.375% due 2/1/16 | | 1,264,812 | |

| | Total Independent Power Producers & Energy Traders | | 5,668,869 | |

| | | |

Industrial Conglomerates — 0.2% | | | |

575,000 | | Koppers Inc., Senior Notes, 9.875% due 10/15/13 | | 623,875 | |

500,000 | | Moll Industries Inc., Senior Subordinated Notes, 10.500% due 7/1/08 (c)(d)(f) | | 0 | |

| | Total Industrial Conglomerates | | 623,875 | |

| | | |

Internet & Catalog Retail — 0.2% | | | |

656,000 | | FTD Inc., Senior Subordinated Notes, 7.750% due 2/15/14 | | 649,440 | |

| | | |

IT Services — 0.5% | | | |

1,400,000 | | Iron Mountain Inc., Senior Subordinated Notes, 7.750% due 1/15/15 | | 1,424,500 | |

| | | |

Machinery — 0.9% | | | |

| | Case New Holland Inc., Senior Notes: | | | |

300,000 | | 9.250% due 8/1/11 | | 323,250 | |

50,000 | | 7.125% due 3/1/14 (b) | | 50,375 | |

325,000 | | Invensys PLC, Senior Notes, 9.875% due 3/15/11 (b) | | 338,000 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 7 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Machinery — 0.9% (continued) | | | |

$ | 200,000 | | Mueller Group Inc., Senior Subordinated Notes, 10.000% due 5/1/12 | | $ | 220,000 | |

625,000 | | Mueller Holdings Inc., Discount Notes, step bond to yield 6.229% due 4/15/14 | | 509,375 | |

300,000 | | NMHG Holding Co., Senior Notes, 10.000% due 5/15/09 | | 318,000 | |

700,000 | | Terex Corp., Senior Subordinated Notes, Series B, 10.375% due 4/1/11 | | 742,000 | |

| | Total Machinery | | 2,501,000 | |

| | | |

Media — 6.1% | | | |

475,000 | | AMC Entertainment Inc., Senior Subordinated Notes, 11.000% due 2/1/16 (b) | | 480,344 | |

525,895 | | CanWest Media Inc., Senior Subordinated Notes, 8.000% due 9/15/12 | | 541,672 | |

| | CCH I Holdings LLC: | | | |

619,000 | | 9.920% due 4/1/14 (b) | | 324,975 | |

700,000 | | Senior Accreting Notes, step bond to yield 16.292% due 5/15/14 (b) | | 367,500 | |

1,050,000 | | Senior Notes, step bond to yield 17.231% due 1/15/14 (b) | | 687,750 | |

711,000 | | Senior Secured Notes, 11.000% due 10/1/15 (b) | | 601,684 | |

300,000 | | Charter Communications Operating LLC, Second Lien Senior Notes, 8.375% due 4/30/14 (b) | | 303,750 | |

| | CSC Holdings Inc.: | | | |

900,000 | | Debentures, Series B, 8.125% due 8/15/09 | | 932,625 | |

75,000 | | Senior Debentures, 7.625% due 7/15/18 | | 73,406 | |

| | Senior Notes: | | | |

375,000 | | 7.250% due 4/15/12 (b) | | 364,687 | |

50,000 | | Series B, 7.625% due 4/1/11 | | 50,625 | |

225,000 | | Dex Media East LLC/Dex Media East Finance Co., Senior Notes, 9.875% due 11/15/09 | | 242,438 | |

975,000 | | Dex Media Inc., Discount Notes, step bond to yield 8.367% due 11/15/13 | | 823,875 | |

635,000 | | Dex Media West LLC/Dex Media Finance Co., Senior Subordinated Notes, Series B, 9.875% due 8/15/13 | | 706,437 | |

| | DIRECTV Holdings LLC/DIRECTV Financing Co. Inc., Senior Notes: | | | |

325,000 | | 8.375% due 3/15/13 | | 350,188 | |

825,000 | | 6.375% due 6/15/15 | | 826,031 | |

| | EchoStar DBS Corp., Senior Notes: | | | |

450,000 | | 6.625% due 10/1/14 | | 439,875 | |

1,100,000 | | 7.125% due 2/1/16 (b) | | 1,094,500 | |

325,000 | | Houghton Mifflin Co., Senior Discount Notes, step bond to yield 11.492% due 10/15/13 | | 271,375 | |

300,000 | | Interep National Radio Sales Inc., Senior Subordinated Notes, Series B, 10.000% due 7/1/08 | | 256,875 | |

675,000 | | Lamar Media Corp., Senior Subordinated Notes, 6.625% due 8/15/15 | | 685,969 | |

650,000 | | LodgeNet Entertainment Corp., Senior Subordinated Debentures, 9.500% due 6/15/13 | | 705,250 | |

50,000 | | Mediacom Broadband LLC, Senior Notes, 8.500% due 10/15/15 | | 48,250 | |

50,000 | | Mediacom Broadband LLC/Mediacom Broadband Corp., Senior Notes, 11.000% due 7/15/13 | | 53,750 | |

650,000 | | Mediacom LLC/Mediacom Capital Corp., Senior Notes, 9.500% due 1/15/13 | | 653,250 | |

700,000 | | Nexstar Finance Inc., Senior Subordinated Notes, 7.000% due 1/15/14 | | 659,750 | |

| | | | | | | |

See Notes to Financial Statements.

8 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Media — 6.1% (continued) | | | |

| | R.H. Donnelley Corp.: | | | |

| | Senior Discount Notes: | | | |

$ | 100,000 | | Series A-1, 6.875% due 1/15/13 (b) | | $ | 94,500 | |

200,000 | | Series A-2, 6.875% due 1/15/13 (b) | | 189,000 | |

650,000 | | Senior Notes, Series A-3, 8.875% due 1/15/16 (b) | | 681,687 | |

100,000 | | R.H. Donnelley Finance Corp. I, Senior Subordinated Notes, 10.875% due 12/15/12 (b) | | 113,000 | |

225,000 | | R.H. Donnelley Inc., Senior Subordinated Notes, 10.875% due 12/15/12 | | 254,250 | |

375,000 | | Radio One Inc., Senior Subordinated Notes, Series B, 8.875% due 7/1/11 | | 395,625 | |

100,000 | | Rainbow National Services LLC, Senior Subordinated Debentures, 10.375% due 9/1/14 (b) | | 113,625 | |

150,000 | | Rogers Cable Inc., Senior Secured Notes, 6.250% due 6/15/13 | | 149,813 | |

700,000 | | Sinclair Broadcast Group Inc., Senior Subordinated Notes, 8.000% due 3/15/12 | | 718,375 | |

650,000 | | Vertis Inc., Senior Second Lien Secured Notes, 9.750% due 4/1/09 | | 676,000 | |

125,000 | | Videotron Ltee., Senior Notes, 6.375% due 12/15/15 | | 124,375 | |

585,000 | | Yell Finance BV, Senior Notes, 10.750% due 8/1/11 | | 643,500 | |

500,000 | | Young Broadcasting Inc., Senior Subordinated Notes, 8.750% due 1/15/14 | | 422,500 | |

| | Total Media | | 17,123,081 | |

| | | |

Metals & Mining — 0.8% | | | |

550,000 | | Aleris International Inc., Senior Secured Notes, 10.375% due 10/15/10 | | 607,750 | |

600,000 | | Corporacion Nacional del Cobre-Codelco, Notes, 5.500% due 10/15/13 (b) | | 607,370 | |

300,000 | | IPSCO Inc., Senior Notes, 8.750% due 6/1/13 | | 329,250 | |

700,000 | | Novelis Inc., Senior Notes, 7.250% due 2/15/15 (b) | | 682,500 | |

| | Total Metals & Mining | | 2,226,870 | |

| | | |

Multiline Retail — 0.3% | | | |

350,000 | | Harry & David Operations, Senior Notes, 9.000% due 3/1/13 | | 341,250 | |

250,000 | | Neiman Marcus Group Inc., Senior Subordinated Notes, 10.375% due 10/15/15 (b) | | 264,375 | |

225,000 | | Saks Inc., Notes, 9.875% due 10/1/11 | | 248,625 | |

| | Total Multiline Retail | | 854,250 | |

| | | |

Office Electronics — 0.3% | | | |

700,000 | | Xerox Capital Trust I Exchange Capital Securities, 8.000% due 2/1/27 | | 728,000 | |

| | | |

Oil, Gas & Consumable Fuels — 4.3% | | | |

| | Chesapeake Energy Corp., Senior Notes: | | | |

1,450,000 | | 6.625% due 1/15/16 | | 1,479,000 | |

50,000 | | 6.875% due 11/15/20 (b) | | 51,625 | |

812,000 | | Cimarex Energy Co., Senior Notes, 9.600% due 3/15/12 | | 881,020 | |

| | El Paso Corp.: | | | |

| | Medium-Term Notes: | | | |

675,000 | | 7.800% due 8/1/31 | | 718,875 | |

875,000 | | 7.750% due 1/15/32 | | 934,063 | |

825,000 | | Notes, 7.875% due 6/15/12 | | 878,625 | |

450,000 | | Hanover Equipment Trust, Secured Notes, 8.750% due 9/1/11 | | 477,000 | |

375,000 | | Inergy LP/Inergy Finance Corp., Senior Notes, 8.250% due 3/1/16 (b) | | 384,375 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 9 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Oil, Gas & Consumable Fuels — 4.3% (continued) | | | |

$ | 700,000 | | Kerr-McGee Corp., Secured Notes, 6.875% due 9/15/11 | | $ | 742,352 | |

375,000 | | Massey Energy Co., Senior Notes, 6.625% due 11/15/10 | | 385,313 | |

1,200,000 | | Pemex Project Funding Master Trust, 6.125% due 8/15/08 | | 1,224,600 | |

1,500,000 | | Petronas Capital Ltd., 7.875% due 5/22/22 (b) | | 1,860,676 | |

200,000 | | Swift Energy Co., Senior Subordinated Notes, 9.375% due 5/1/12 | | 216,000 | |

| | Williams Cos. Inc.: | | | |

| | Notes: | | | |

1,250,000 | | 7.875% due 9/1/21 | | 1,403,125 | |

200,000 | | 8.750% due 3/15/32 | | 243,000 | |

300,000 | | Senior Notes, 7.625% due 7/15/19 | | 331,500 | |

| | Total Oil, Gas & Consumable Fuels | | 12,211,149 | |

| | | |

Paper & Forest Products — 1.2% | | | |

| | Abitibi-Consolidated Inc.: | | | |

560,000 | | Debentures, 8.850% due 8/1/30 | | 494,900 | |

125,000 | | Notes, 7.750% due 6/15/11 | | 118,594 | |

65,000 | | Senior Notes, 8.375% due 4/1/15 | | 61,750 | |

600,000 | | Appleton Papers Inc., Senior Subordinated Notes, Series B, 9.750% due 6/15/14 | | 580,500 | |

300,000 | | Bowater Inc., Debentures, 9.500% due 10/15/12 | | 313,500 | |

700,000 | | Buckeye Technologies Inc., Senior Subordinated Notes, 8.000% due 10/15/10 | | 687,750 | |

625,000 | | Newark Group Inc., Senior Subordinated Notes, 9.750% due 3/15/14 | | 546,875 | |

600,000 | | Smurfit Capital Funding PLC, Debentures, 7.500% due 11/20/25 | | 555,000 | |

| | Total Paper & Forest Products | | 3,358,869 | |

| | | |

Personal Products — 0.4% | | | |

400,000 | | Del Laboratories Inc., Senior Secured Notes, 9.680% due 11/1/11 (b)(e) | | 410,000 | |

650,000 | | Playtex Products Inc., Senior Subordinated Notes, 9.375% due 6/1/11 | | 684,125 | |

| | Total Personal Products | | 1,094,125 | |

| | | |

Pharmaceuticals — 0.7% | | | |

275,000 | | Leiner Health Products Inc., Senior Subordinated Notes, 11.000% due 6/1/12 | | 271,563 | |

775,000 | | Valeant Pharmaceuticals International, Senior Notes, 7.000% due 12/15/11 | | 763,375 | |

840,000 | | WH Holdings Ltd./WH Capital Corp., Senior Notes, 9.500% due 4/1/11 | | 911,400 | |

| | Total Pharmaceuticals | | 1,946,338 | |

| | | |

Real Estate — 1.2% | | | |

290,000 | | Felcor Lodging LP, Senior Notes, 9.000% due 6/1/11 | | 321,900 | |

| | Host Marriott LP, Senior Notes: | | | |

525,000 | | 7.125% due 11/1/13 | | 544,688 | |

125,000 | | Series I, 9.500% due 1/15/07 | | 129,531 | |

1,025,000 | | Series O, 6.375% due 3/15/15 | | 1,027,562 | |

| | MeriStar Hospitality Corp., Senior Notes: | | | |

150,000 | | 9.000% due 1/15/08 | | 159,750 | |

600,000 | | 9.125% due 1/15/11 | | 699,000 | |

600,000 | | Omega Healthcare Investors Inc., Senior Notes, 7.000% due 4/1/14 | | 611,250 | |

| | Total Real Estate | | 3,493,681 | |

| | | | | | | |

See Notes to Financial Statements.

10 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Semiconductors & Semiconductor Equipment — 0.4% | | | |

| | Amkor Technology Inc.: | | | |

$ | 850,000 | | Senior Notes, 9.250% due 2/15/08 | | $ | 867,000 | |

300,000 | | Senior Subordinated Notes, 10.500% due 5/1/09 | | 300,000 | |

| | Total Semiconductors & Semiconductor Equipment | | 1,167,000 | |

| | | |

Specialty Retail — 1.0% | | | |

575,000 | | Buffets Inc., Senior Subordinated Notes, 11.250% due 7/15/10 | | 600,875 | |

625,000 | | Eye Care Centers of America, Senior Subordinated Notes, 10.750% due 2/15/15 | | 614,062 | |

250,000 | | Finlay Fine Jewelry Corp., Senior Notes, 8.375% due 6/1/12 | | 223,750 | |

450,000 | | Hines Nurseries Inc., Senior Notes, 10.250% due 10/1/11 | | 451,687 | |

326,000 | | Jafra Cosmetics International Inc., Senior Subordinated Notes, 10.750% due 5/15/11 | | 356,563 | |

375,000 | | PETCO Animal Supplies Inc., Senior Subordinated Notes, 10.750% due 11/1/11 | | 405,938 | |

200,000 | | Toys “R” Us Inc., Senior Notes, 7.375% due 10/15/18 | | 152,000 | |

| | Total Specialty Retail | | 2,804,875 | |

| | | |

Textiles, Apparel & Luxury Goods — 1.1% | | | |

400,000 | | Collins & Aikman Floor Covering Inc., Senior Subordinated Notes, Series B, 9.750% due 2/15/10 | | 380,000 | |

| | Levi Strauss & Co., Senior Notes: | | | |

175,000 | | 9.280% due 4/1/12 (e) | | 181,562 | |

155,000 | | 12.250% due 12/15/12 | | 177,863 | |

650,000 | | 9.750% due 1/15/15 | | 695,500 | |

325,000 | | Oxford Industries Inc., Senior Notes, 8.875% due 6/1/11 | | 336,375 | |

325,000 | | Quiksilver Inc., Senior Notes, 6.875% due 4/15/15 | | 315,250 | |

425,000 | | Simmons Co., Senior Discount Notes, step bond to yield 9.995% due 12/15/14 | | 257,125 | |

600,000 | | Tommy Hilfiger USA Inc., Notes, 6.850% due 6/1/08 | | 621,000 | |

| | Total Textiles, Apparel & Luxury Goods | | 2,964,675 | |

| | | |

Wireless Telecommunication Services — 1.6% | | | |

200,000 | | American Tower Corp., Senior Notes, 7.500% due 5/1/12 | | 212,000 | |

350,000 | | Centennial Communications Corp., Senior Notes, 10.250% due 1/1/13 (b)(e) | | 363,125 | |

50,000 | | Dobson Cellular Systems Inc., Senior Secured Notes, 8.375% due 11/1/11 | | 53,250 | |

2,100,000 | | Nextel Communications Inc., Senior Notes, Series D, 7.375% due 8/1/15 | | 2,222,573 | |

| | SBA Communications Corp.: | | | |

97,000 | | Senior Discount Notes, step bond to yield 9.742% due 12/15/11 | | 92,392 | |

292,000 | | Senior Notes, 8.500% due 12/1/12 | | 322,660 | |

500,000 | | UbiquiTel Operating Co., Senior Notes, 9.875% due 3/1/11 | | 552,500 | |

550,000 | | US Unwired Inc., Second Priority Secured Notes, Series B, 10.000% due 6/15/12 | | 624,250 | |

| | Total Wireless Telecommunication Services | | 4,442,750 | |

| | TOTAL CORPORATE BONDS & NOTES

(Cost — $138,298,185) | | 136,891,019 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 11 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

SOVEREIGN BONDS — 43.3% | | | |

| | | |

Argentina — 1.9% | | | |

| | Republic of Argentina: | | | |

$ | 2,909,375 | | 4.889% due 8/3/12 (e) | | $ | 2,714,875 | |

5,670,000 | | Par Bonds, step bond to yield 3.426% due 12/31/38 | | 2,287,845 | |

5,670,000 | | Series GDP, 0.000% due 12/15/35 (d)(e) | | 438,007 | |

| | Total Argentina | | 5,440,727 | |

| | | |

Brazil — 8.7% | | | |

| | Federative Republic of Brazil: | | | |

325,000 | | 7.875% due 3/7/15 | | 364,894 | |

| | Collective Action Securities: | | | |

11,609,000 | | 8.000% due 1/15/18 | | 13,019,494 | |

2,185,000 | | 8.750% due 2/4/25 | | 2,654,775 | |

6,289,815 | | DCB, Series L, 5.250% due 4/15/12 (e) | | 6,291,387 | |

2,248,073 | | FLIRB, Series L, 5.188% due 4/15/09 (b)(e) | | 2,249,478 | |

| | Total Brazil | | 24,580,028 | |

| | | |

Bulgaria — 0.7% | | | |

1,715,000 | | Republic of Bulgaria, 8.250% due 1/15/15 (b) | | 2,058,000 | |

| | | |

Chile — 0.7% | | | |

1,850,000 | | Republic of Chile, 5.500% due 1/15/13 | | 1,888,439 | |

| | | |

China — 0.2% | | | |

620,000 | | People’s Republic of China, Bonds, 4.750% due 10/29/13 | | 607,256 | |

| | | |

Colombia — 2.3% | | | |

| | Republic of Colombia: | | | |

1,312,000 | | 8.625% due 4/1/08 | | 1,397,280 | |

1,775,000 | | 10.000% due 1/23/12 | | 2,165,056 | |

875,000 | | 10.750% due 1/15/13 | | 1,122,188 | |

130,000 | | 10.375% due 1/28/33 | | 189,800 | |

1,000,000 | | Medium-Term Notes, 11.750% due 2/25/20 | | 1,497,000 | |

| | Total Colombia | | 6,371,324 | |

| | | |

Ecuador — 0.6% | | | |

1,785,000 | | Republic of Ecuador, step bond to yield 3.808% due 8/15/30 (b) | | 1,770,720 | |

| | | |

El Salvador — 0.8% | | | |

| | Republic of El Salvador: | | | |

1,555,000 | | 7.750% due 1/24/23 (b) | | 1,762,981 | |

330,000 | | 8.250% due 4/10/32 (b) | | 387,750 | |

| | Total El Salvador | | 2,150,731 | |

| | | | | |

Malaysia — 0.6% | | | |

| | Federation of Malaysia: | | | |

625,000 | | 8.750% due 6/1/09 | | 691,179 | |

975,000 | | 7.500% due 7/15/11 | | 1,078,949 | |

| | Total Malaysia | | 1,770,128 | |

| | | | | | | |

See Notes to Financial Statements.

12 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

Mexico — 8.4% | | | |

| | United Mexican States: | | | |

$ | 800,000 | | 11.375% due 9/15/16 | | $ | 1,177,200 | |

| | Medium-Term Notes: | | | |

1,795,000 | | 8.300% due 8/15/31 | | 2,355,938 | |

| | Series A: | | | |

1,780,000 | | 6.375% due 1/16/13 | | 1,877,900 | |

1,972,000 | | 5.875% due 1/15/14 | | 2,026,230 | |

10,225,000 | | 6.625% due 3/3/15 | | 11,099,237 | |

3,800,000 | | 8.000% due 9/24/22 | | 4,712,000 | |

245,000 | | Series A, Notes, 7.500% due 4/8/33 | | 298,043 | |

| | Total Mexico | | 23,546,548 | |

| | | |

Panama — 1.7% | | | |

| | Republic of Panama: | | | |

300,000 | | 9.625% due 2/8/11 | | 351,750 | |

3,025,000 | | 7.250% due 3/15/15 | | 3,264,731 | |

1,085,000 | | 6.700% due 1/26/36 | | 1,106,700 | |

| | Total Panama | | 4,723,181 | |

| | | |

Peru — 2.7% | | | |

| | Republic of Peru: | | | |

110,000 | | 9.125% due 2/21/12 | | 127,435 | |

375,000 | | 9.875% due 2/6/15 | | 466,875 | |

2,470,000 | | 8.750% due 11/21/33 | | 3,001,050 | |

2,533,300 | | FLIRB, 5.000% due 3/7/17 (e) | | 2,469,967 | |

| | Global Bonds: | | | |

285,000 | | 8.375% due 5/3/16 | | 330,600 | |

1,225,000 | | 7.350% due 7/21/25 | | 1,295,438 | |

| | Total Peru | | 7,691,365 | |

| | | |

Philippines — 2.1% | | | |

| | Republic of the Philippines: | | | |

500,000 | | 8.250% due 1/15/14 | | 542,500 | |

1,550,000 | | 9.375% due 1/18/17 | | 1,807,610 | |

2,035,000 | | 10.625% due 3/16/25 | | 2,645,500 | |

775,000 | | 9.500% due 2/2/30 | | 929,031 | |

| | Total Philippines | | 5,924,641 | |

| | | |

Poland — 0.5% | | | |

1,320,000 | | Republic of Poland, 5.250% due 1/15/14 | | 1,329,075 | |

| | | |

Russia — 4.5% | | | |

| | Russian Federation: | | | |

1,455,000 | | 11.000% due 7/24/18 (b) | | 2,153,400 | |

540,000 | | 12.750% due 6/24/28 (b) | | 1,000,350 | |

8,520,540 | | Step bond to yield 3.470% due 3/31/30 (b) | | 9,628,210 | |

| | Total Russia | | 12,781,960 | |

| | | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 13 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

South Africa — 0.7% | | | |

$ | 1,775,000 | | Republic of South Africa, 6.500% due 6/2/14 | | $ | 1,919,219 | |

| | | |

Turkey — 3.2% | | | |

| | Republic of Turkey: | | | |

350,000 | | 11.750% due 6/15/10 | | 428,750 | |

1,525,000 | | 11.500% due 1/23/12 | | 1,942,469 | |

900,000 | | 7.250% due 3/15/15 | | 964,125 | |

2,475,000 | | 7.000% due 6/5/20 | | 2,570,906 | |

1,065,000 | | 11.875% due 1/15/30 | | 1,690,687 | |

| | Collective Action Security, Notes: | | | |

550,000 | | 9.500% due 1/15/14 | | 663,438 | |

625,000 | | 7.375% due 2/5/25 | | 667,969 | |

| | Total Turkey | | 8,928,344 | |

| | | |

Ukraine — 0.5% | | | |

1,240,000 | | Republic of Ukraine, 7.650% due 6/11/13 (b) | | 1,339,200 | |

| | | |

Uruguay — 0.5% | | | |

1,350,000 | | Republic of Uruguay, Benchmark Bonds, 7.250% due 2/15/11 | | 1,424,250 | |

| | | |

Venezuela — 2.0% | | | |

| | Bolivarian Republic of Venezuela: | | | |

15,000 | | 5.375% due 8/7/10 (b) | | 14,681 | |

3,575,000 | | 8.500% due 10/8/14 | | 4,075,500 | |

725,000 | | 7.650% due 4/21/25 | | 791,156 | |

675,000 | | Collective Action Securities, 10.750% due 9/19/13 | | 853,538 | |

| | Total Venezuela | | 5,734,875 | |

| | TOTAL SOVEREIGN BONDS

(Cost — $110,877,099) | | 121,980,011 | |

| | | |

CONVERTIBLE BOND & NOTE — 0.1% | | | |

| | | |

Wireless Telecommunication Services — 0.1% | | | |

325,000 | | American Tower Corp., Notes, 5.000% due 2/15/10

(Cost — $179,342) | | 322,969 | |

| | | | | |

ASSET-BACKED SECURITY — 0.0% | | | |

| | | |

Diversified Financial Services — 0.0% | | | |

987,700 | | Airplanes Pass-Through Trust, Subordinated Notes, Series D, 10.875% due 3/15/12 (c)(d)(f)

(Cost — $987,294) | | 0 | |

| | | | | | | |

See Notes to Financial Statements.

14 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Shares | | Security(a) | | Value | |

COMMON STOCKS — 2.5% | | | |

| | | |

CONSUMER DISCRETIONARY — 1.1% | | | |

| | | |

Household Durables — 0.1% | | | |

1,349,235 | | Home Interiors Restricted (c)(f)* | | $ | 364,294 | |

10,194 | | Mattress Discounters Corp. (c)(f)* | | 0 | |

| | Total Household Durables | | 364,294 | |

| | | |

Media — 1.0% | | | |

20,158 | | Liberty Global Inc., Series A Shares * | | 409,409 | |

20,158 | | Liberty Global Inc., Series C Shares * | | 391,065 | |

29,465 | | NTL Inc. * | | 1,940,270 | |

| | Total Media | | 2,740,744 | |

| | TOTAL CONSUMER DISCRETIONARY | | 3,105,038 | |

| | | |

CONSUMER STAPLES — 0.0% | | | |

| | | |

Food Products — 0.0% | | | |

688 | | Imperial Sugar Co. * | | 18,025 | |

| | | |

INDUSTRIALS — 0.0% | | | |

| | | |

Machinery — 0.0% | | | |

5 | | Glasstech Inc. (c)(f)* | | 0 | |

| | | |

INFORMATION TECHNOLOGY — 0.0% | | | |

| | | |

Computers & Peripherals — 0.0% | | | |

12,166 | | Axiohm Transaction Solutions Inc. (c)(f)* | | 0 | |

| | | |

MATERIALS — 0.0% | | | |

| | | |

Chemicals — 0.0% | | | |

12,121 | | Applied Extrusion Technologies Inc., Class A Shares * | | 106,059 | |

| | | |

TELECOMMUNICATION SERVICES — 1.4% | | | |

| | | |

Diversified Telecommunication Services — 0.5% | | | |

57,202 | | NTL Inc. (g)* | | 1,364,268 | |

| | | |

Wireless Telecommunication Services — 0.9% | | | |

79,753 | | American Tower Corp., Class A Shares * | | 2,538,538 | |

| | TOTAL TELECOMMUNICATION SERVICES | | 3,902,806 | |

| | TOTAL COMMON STOCKS

(Cost — $6,320,588) | | 7,131,928 | |

| | | |

PREFERRED STOCK (f) — 0.0% | | | |

| | | |

CONSUMER DISCRETIONARY — 0.0% | | | |

| | | |

Textiles, Apparel & Luxury Goods — 0.0% | | | |

12 | | Anvil Holdings Inc., Class B, 13.000% | | 63 | |

| | | | | | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 15 |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Shares | | Security(a) | | Value | |

FINANCIALS — 0.0% | | | |

| | | |

Diversified Financial Services — 0.0% | | | |

4,091 | | TCR Holdings Corp., Class B Shares, 0.000% (c)(f)* | | $ | 4 | |

2,250 | | TCR Holdings Corp., Class C Shares, 0.000% (c)(f)* | | 2 | |

5,932 | | TCR Holdings Corp., Class D Shares, 0.000% (c)(f)* | | 6 | |

12,271 | | TCR Holdings Corp., Class E Shares, 0.000% (c)(f)* | | 13 | |

| | TOTAL FINANCIALS | | 25 | |

| | | |

INDUSTRIALS — 0.0% | | | |

| | | |

Machinery — 0.0% | | | |

5 | | Glasstech Inc., 0.000% (c)(f) | | 0 | |

| | TOTAL PREFERRED STOCK

(Cost — $1,471) | | 88 | |

| | | |

ESCROWED SHARES (f) — 0.0% | | | |

1,750,000 | | Breed Technologies Inc. (c)* | | 0 | |

625,000 | | Pillowtex Corp. * | | 0 | |

397,208 | | Vlasic Foods International Inc. (c)* | | 7,944 | |

| | TOTAL ESCROWED SHARES

(Cost — $0) | | 7,944 | |

| | | | | |

Warrant | | | | | |

| | | |

WARRANTS — 0.2% | | | |

365 | | American Tower Corp., Class A Shares, Expires 8/1/08 (b)* | | 163,787 | |

9,125 | | Bolivarian Republic of Venezuela, Oil-linked payment obligations, expires 4/15/20* | | 292,000 | |

1,837,246 | | ContiFinancial Corp., Liquidating Trust, Units of Interest (Represents interest in a trust in the liquidation of ContiFinancial Corp. and its affiliates) (c)(f)* | | 6 | |

1,000 | | Mattress Discounters Co., expires 7/15/07 (b)(c)(f)* | | 0 | |

300 | | Mueller Holdings Inc., expires 4/15/14 (b)(f)* | | 3 | |

4,202 | | Pillowtex Corp., expires 11/24/09 (b)(c)(f)* | | 42 | |

750 | | UbiquiTel Inc., expires 4/15/10 (b)(c)(f)* | | 7 | |

| | TOTAL WARRANTS

(Cost — $66,586) | | 455,845 | |

| | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $256,730,565) | | 266,789,804 | |

| | | | | | |

See Notes to Financial Statements.

16 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Schedule of Investments (February 28, 2006) (unaudited) (continued)

Face

Amount | | Security(a) | | Value | |

SHORT-TERM INVESTMENTS — 5.3% | | | |

| | | |

Repurchase Agreements — 5.3% | | | |

$ | 4,798,000 | | Interest in $460,617,000 joint tri-party repurchase agreement dated 2/28/06 with Morgan Stanley, 4.560% due 3/1/06; Proceeds at maturity — $4,798,608; (Fully collateralized by various U.S. government agency obligations, 0.000% to 6.375% due 8/1/11 to 10/15/28; Market value — $4,900,004) | | $ | 4,798,000 | |

5,000,000 | | Interest in $597,866,000 joint tri-party repurchase agreement dated 2/28/06 with Merrill Lynch, Pierce, Fenner & Smith Inc., 4.550% due 3/1/06; Proceeds at maturity — $5,000,632; (Fully collateralized by U.S. Treasury obligations, 0.000% due 4/13/06 to 7/20/06; Market value — $5,100,032) | | 5,000,000 | |

5,000,000 | | Interest in $598,216,000 joint tri-party repurchase agreement dated 2/28/06 with Deutsche Bank Securities Inc., 4.560% due 3/1/06; Proceeds at maturity — $5,000,633; (Fully collateralized by various U.S. government agency obligations, 0.000% to 6.875% due 4/21/06 to 12/11/20; Market value — $5,100,005) | | 5,000,000 | |

| | TOTAL SHORT-TERM INVESTMENTS

(Cost — $14,798,000) | | 14,798,000 | |

| | TOTAL INVESTMENTS — 100.0% (Cost — $271,528,565#) | | $ | 281,587,804 | |

| | | | | | | |

* Non-income producing security.

(a) All securities segregated as collateral pursuant to loan agreement, swap contracts and/or reverse repurchase agreements.

(b) Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted.

(c) Illiquid security.

(d) Security is currently in default.

(e) Variable rate security. Interest rate disclosed is that which is in effect at February 28, 2006.

(f) Security is valued in good faith at fair value by or under the direction of the Board of Directors (See Note 1).

(g) Name changed on March 3, 2006 from Telewest Global Inc. to NTL Inc.

# Aggregate cost for federal income tax purposes is substantially the same.

Abbreviations used in this schedule: |

DCB | – Debt Conversion Bond |

FLIRB | – Front-Loaded Interest Reduction Bonds |

GDP | – Gross Domestic Product |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 17 |

Statement of Assets and Liabilities (February 28, 2006) (unaudited)

ASSETS: | | | |

Investments, at value (Cost — $271,528,565) | | $ | 281,587,804 | |

Cash | | 885 | |

Interest receivable | | 4,700,097 | |

Receivable for securities sold | | 109,350 | |

Prepaid expenses | | 1,377 | |

Total Assets | | 286,399,513 | |

| | | |

LIABILITIES: | | | |

Loan Payable (Note 4) | | 59,124,414 | |

Payable for open reverse repurchase agreement (Notes 1 and 3) | | 22,949,188 | |

Payable for securities purchased | | 954,713 | |

Interest payable (Notes 3 and 4) | | 718,313 | |

Investment management fee payable | | 157,433 | |

Accrued expenses | | 145,094 | |

Total Liabilities | | 84,049,155 | |

| | | |

Total Net Assets | | $ | 202,350,358 | |

| | | |

NET ASSETS: | | | |

Par value ($0.001 par value; 15,289,720 shares issued and outstanding; 100,000,000 shares authorized) | | $ | 15,290 | |

Paid-in capital in excess of par value | | 205,937,505 | |

Overdistributed net investment income | | (1,372,723 | ) |

Accumulated net realized loss on investments and swap contracts | | (12,288,953 | ) |

Net unrealized appreciation on investments | | 10,059,239 | |

Total Net Assets | | $ | 202,350,358 | |

| | | |

Shares Outstanding | | 15,289,720 | |

Net Asset Value | | $ | 13.23 | |

See Notes to Financial Statements.

18 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Statement of Operations (For the six months ended February 28, 2006) (unaudited)

INVESTMENT INCOME: | | | |

Interest | | $ | 10,487,084 | |

Dividends | | 35,831 | |

Total Investment Income | | 10,522,915 | |

| | | |

EXPENSES: | | | |

Interest expense (Notes 3 and 4) | | 2,018,534 | |

Investment management fee (Note 2) | | 1,029,188 | |

Shareholder reports | | 44,586 | |

Custody fees | | 32,933 | |

Audit and tax | | 32,440 | |

Directors’ fees | | 25,113 | |

Transfer agent fees | | 16,089 | |

Legal fees | | 13,765 | |

Stock exchange listing fees | | 9,454 | |

Loan fees | | 2,968 | |

Insurance | | 2,478 | |

Miscellaneous expenses | | 3,140 | |

Total Expenses | | 3,230,688 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | (4,385 | ) |

Net Expenses | | 3,226,303 | |

Net Investment Income | | 7,296,612 | |

| | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND SWAP CONTRACTS

(NOTES 1 AND 3): | | | |

Net Realized Gain From: | | | |

Investment transactions | | 5,035,179 | |

Swap contracts | | 12,448 | |

Net Realized Gain | | 5,047,627 | |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | (2,105,074 | ) |

Swap contracts | | (109,920 | ) |

Change in Net Unrealized Appreciation/Depreciation | | (2,214,994 | ) |

Net Gain on Investments and Swap Contracts | | 2,832,633 | |

Increase in Net Assets From Operations | | $ | 10,129,245 | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 19 |

Statements of Changes in Net Assets

For the six months ended February 28, 2006 (unaudited)

and the year ended August 31, 2005

| | 2006 | | 2005 | |

| | | | | |

OPERATIONS: | | | | | |

Net investment income | | $ | 7,296,612 | | $ | 16,290,709 | |

Net realized gain | | 5,047,627 | | 10,356,507 | |

Change in net unrealized appreciation/depreciation | | (2,214,994 | ) | 5,096,351 | |

Increase in Net Assets From Operations | | 10,129,245 | | 31,743,567 | |

| | | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (7,476,673 | ) | (18,167,280 | ) |

Decrease in Net Assets From Distributions to Shareholders | | (7,476,673 | ) | (18,167,280 | ) |

| | | | | |

FUND SHARE TRANSACTIONS: | | | | | |

Proceeds from shares issued on reinvestment of distributions (89,072 shares issued) | | — | | 1,185,386 | |

Increase in Net Assets From Fund Share Transactions | | — | | 1,185,386 | |

Increase in Net Assets | | 2,652,572 | | 14,761,673 | |

| | | | | |

NET ASSETS: | | | | | |

Beginning of period | | 199,697,786 | | 184,936,113 | |

End of period* | | $ | 202,350,358 | | $ | 199,697,786 | |

| | | | | |

|

* Includes overdistributed net investment income of: | | $ | (1,372,723 | ) | $ | (1,192,662 | ) |

See Notes to Financial Statements.

20 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Statements of Cash Flows (For the six months ended February 28, 2006) (unaudited)

CASH FLOWS PROVIDED (USED) BY OPERATING ACTIVITIES: | | | |

Interest and dividends received | | $ | 10,321,264 | |

Operating expenses paid | | (1,243,631 | ) |

Net purchases of short-term investments | | (8,066,000 | ) |

Realized gain on swap contracts | | 12,448 | |

Purchases of long-term investments | | (81,095,274 | ) |

Proceeds from disposition of long-term investments | | 84,529,789 | |

Interest paid | | (1,776,295 | ) |

Net Cash Flows Provided By Operating Activities | | 2,682,301 | |

| | | |

CASH FLOWS PROVIDED (USED) BY FINANCING ACTIVITIES: | | | |

Cash distributions paid on Common Stock | | (8,791,683 | ) |

Proceeds from reverse repurchase agreements | | 6,109,813 | |

Net Cash Flows Used By Financing Activities | | (2,681,870 | ) |

Net Increase in Cash | | 431 | |

Cash, Beginning of period | | 454 | |

Cash, End of period | | $ | 885 | |

| | | |

RECONCILIATION OF INCREASE IN NET ASSETS FROM OPERATIONS TO NET CASH FLOWS PROVIDED (USED) BY OPERATING ACTIVITIES: | | | |

Increase in Net Assets From Operations | | $ | 10,129,245 | |

Accretion of discount on investments | | (823,910 | ) |

Amortization of premium on investments | | 299,623 | |

Increase in investments, at value | | (7,202,913 | ) |

Decrease in payable for securities purchased | | (3,170,763 | ) |

Decrease in interest receivable | | 322,636 | |

Decrease in receivable for securities sold | | 2,922,006 | |

Decrease in prepaid expenses | | 11,563 | |

Increase in interest payable | | 242,239 | |

Decrease in accrued expenses | | (47,425 | ) |

Total Adjustments | | (7,446,944 | ) |

Net Cash Flows Provided By Operating Activities | | $ | 2,682,301 | |

See Notes to Financial Statements.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 21 |

Financial Highlights

For a share of common stock outstanding throughout each year ended August 31, unless otherwise noted:

| | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

Net Asset Value, Beginning of Period | | $ | 13.06 | | $ | 12.17 | | $ | 11.55 | | $ | 8.88 | | $ | 10.77 | | $ | 11.94 | |

Income (Loss) From Operations: | | | | | | | | | | | | | |

Net investment income | | 0.48 | | 1.07 | | 1.15 | | 1.30 | | 1.36 | (2) | 1.38 | |

Net realized and unrealized gain (loss) | | 0.18 | | 1.01 | | 0.89 | | 2.79 | | (1.83 | )(2) | (1.12 | ) |

Total Income (Loss) From Operations | | 0.66 | | 2.08 | | 2.04 | | 4.09 | | (0.47 | ) | 0.26 | |

Less Distributions From: | | | | | | | | | | | | | |

Net investment income | | (0.49 | ) | (1.19 | ) | (1.43 | ) | (1.43 | ) | (1.38 | ) | (1.42 | ) |

Return of capital | | — | | — | | — | | — | | (0.05 | ) | (0.01 | ) |

Total Distributions | | (0.49 | ) | (1.19 | ) | (1.43 | ) | (1.43 | ) | (1.43 | ) | (1.43 | ) |

Increase in Net Asset Value Due to shares Issued on Reinvestment of distributions | | — | | — | | 0.01 | | 0.01 | | 0.01 | | — | |

Net Asset Value, End of Period | | $ | 13.23 | | $ | 13.06 | | $ | 12.17 | | $ | 11.55 | | $ | 8.88 | | $ | 10.77 | |

Market Price, End of Period | | $ | 12.09 | | $ | 12.78 | | $ | 14.03 | | $ | 13.11 | | $ | 10.43 | | $ | 11.88 | |

Total Return, Based on NAV(3) | | 5.21 | % | 17.88 | % | 18.63 | % | 49.79 | % | (4.85 | )% | 2.66 | % |

Total Return, Based on Market Price(3) | | (1.38 | )% | (0.39 | )% | 18.86 | % | 42.71 | % | (0.25 | )% | 16.26 | % |

Net Assets, End of Period (000s) | | $ | 202,350 | | $ | 199,698 | | $ | 184,936 | | $ | 174,351 | | $ | 132,851 | | $ | 159,797 | |

Ratios to Average Net Assets: | | | | | | | | | | | | | |

Gross expenses | | 3.30 | (4)% | 2.68 | % | 2.11 | % | 2.37 | % | 3.24 | % | 4.90 | % |

Gross expenses, excluding interest expense | | 1.24 | (4) | 1.26 | | 1.27 | | 1.36 | | 1.43 | | 1.28 | |

Net expenses | | 3.29 | (4)(5) | 2.68 | | 2.11 | | 2.37 | | 3.24 | | 4.90 | |

Net expenses, excluding interest expense | | 1.23 | (4)(5) | 1.26 | | 1.27 | | 1.36 | | 1.43 | | 1.28 | |

Net investment income | | 7.44 | (4) | 8.43 | | 9.64 | | 12.76 | | 13.80 | (2) | 12.53 | |

Portfolio Turnover Rate | | 29 | % | 49 | % | 69 | % | 91 | % | 129 | % | 92 | % |

Supplemental Data: | | | | | | | | | | | | | |

Loans Outstanding, End of Period (000s) | | $ | 59,124 | | $ | 59,124 | | $ | 59,124 | | $ | 59,124 | | $ | 59,124 | | $ | 75,000 | |

Weighted Average Loan (000s) | | $ | 59,124 | | $ | 59,124 | | $ | 59,124 | | $ | 59,124 | | $ | 72,423 | | $ | 75,000 | |

Weighted Average Interest Rate on Loans | | 5.44 | % | 3.79 | % | 2.41 | % | 2.65 | % | 3.71 | % | 7.86 | % |

(1) For the six months ended February 28, 2006 (unaudited).

(2) Effective September 1, 2001, the Fund adopted a change in the accounting method that requires the Fund to amortize premiums and accrete all discounts. Without the adoption of the change, for the year ended August 31, 2002, the ratio of net investment income to average net assets would have been 13.87%. The impact of this change to net investment income and net realized and unrealized loss was $0.01 per share. Per share information, ratios and supplemental data for the periods prior to September 1, 2001 have not been restated to reflect this change in presentation.

(3) For the purpose of this calculation, distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan and the broker commission paid to purchase or sell a share is excluded. Performance figures may reflect a voluntary fee waiver. Past performance is no guarantee of future results. In the absence of this waiver, the total return would have been lower. Total returns for periods less than one year are not annualized.

(4) Annualized.

(5) The investment manager voluntarily waived a portion of their fees.

See Notes to Financial Statements.

22 | Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report |

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

The Salomon Brothers Global Partners Income Fund Inc. (the “Fund”) was incorporated in Maryland on September 3, 1993 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, (the “1940 Act”). The Fund seeks to maintain a high level of current income by investing primarily in a portfolio of high-yield U.S. and non-U.S. corporate debt securities. As a secondary objective, the Fund seeks capital appreciation.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment Valuation. Debt securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various relationships between securities. Equity securities for which market quotations are available are valued at the last sale price or official closing price on the primary market or exchange on which they trade. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market, and are valued at the mean between the bid and asked prices as of the close of business of that market. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates market value.

(b) Repurchase Agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian take possession of the underlying collateral securities, the market value of which at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Reverse Repurchase Agreements. The Fund may enter into reverse repurchase agreements in which the Fund sells portfolio securities and agrees to repurchase them from the buyer at a specified date and price. Whenever the Fund enters into a reverse repurchase agreement, the Fund’s custodian delivers liquid assets to the counterparty in an amount at least equal to the repurchase price (including accrued interest). The Fund pays interest on amounts obtained pursuant to reverse repurchase agreements. Reverse repurchase agreements are considered to be borrowings, which may create leverage risk to the Fund.

Salomon Brothers Global Partners Income Fund Inc. 2006 Semi-Annual Report | 23 |

Notes to Financial Statements (unaudited) (continued)

(d) Credit Default Swaps. The Fund may enter into credit default swap contracts for investment purposes, to manage its credit risk or to add leverage. As a seller in a credit default swap contract, the Fund is required to pay the notional or other agreed-upon value to the counterparty in the event of a default by a third party, such as a U.S. or foreign corporate issuer, on the referenced debt obligation. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the contract provided that no event of default has occurred. If no default occurs, the Fund keeps the stream of payments and has no payment obligations. Such periodic payments are accrued daily and accounted for a realized gain.

The Fund may also purchase credit default swap contracts in order to hedge against the risk of default of debt securities held, in which case the Fund functions as the counterparty referenced in the preceding paragraph. As a purchaser of a credit default swap contract, the Fund receives the notional or other agreed upon value from the counterparty in the event of a default by a third party, such as a U.S. or foreign corporate issuer, on the referenced debt obligation. In return, the Fund makes periodic payments to the counterparty over the term of the contract provided no event of default has occurred. Such periodic payments are accrued daily and accounted for a realized loss.