UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| (Mark One) |

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the Fiscal Year Ended December 31, 2008 |

| | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From ____________ to ____________

Commission File No. 000-22400

STRATEGIC DIAGNOSTICS INC.

(Exact name of Registrant as specified in its charter)

| | Delaware | | 56-1581761 | |

| | (State or other jurisdiction of | | (I.R.S. Employer | |

| | incorporation or organization) | | identification no.) | |

| | | | | |

| | 111 Pencader Drive | | | |

| | Newark, Delaware | | 19702 | |

| | (Address of principal executive offices) | | (Zip Code) | |

Registrant’s telephone number, including area code: (302) 456-6789

Securities registered pursuant to Section 12(b) of the Act: None

| | | Title of Each Class | | | Name of Each Exchange on Which Registered | |

| | Common Stock, $0.01 par value | | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o | Smaller Reporting Company x |

| | | (Do not check if a smaller | |

| | | reporting company) | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the common stock held by non-affiliates of the Registrant was $52,166,704, calculated by using the number of shares outstanding and the closing price of the common stock on June 30, 2008 (the last business day of the Registrant’s most recently completed second fiscal quarter).

As of March 31, 2009 there were 20,273,895 shares outstanding of the Registrant’s common stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement (the “Definitive Proxy Statement”) to be filed no later than April 30, 2009 with the Securities and Exchange Commission relative to the Company’s 2009 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

| | | | | |

| PART I | | | 1 |

| | | | | |

| | ITEM 1. | BUSINESS | | 1 |

| | | | | |

| | Overview | | 1 |

| | Life Sciences | | 1 |

| | Industrial BioDetection Tests | | 2 |

| | Antibody Products and Services | | 3 |

| | Food Safety Products | | 4 |

| | Agricultural Testing | | 5 |

| | Water Quality | | 6 |

| | Environmental Contamination Detection Products | | 6 |

| | Sales and Marketing Strategy | | 7 |

| | Competition | | 7 |

| | Markets and Products | | 8 |

| | Geographic and Customer Information | | 8 |

| | Regulatory Approvals | | 8 |

| | Manufacturing | | 9 |

| | Research and Development | | 10 |

| | Proprietary Technology and Patents | | 11 |

| | Employees | | 12 |

| | Organizational History | | 12 |

| | | | | |

| | ITEM 1A. | RISK FACTORS | | 13 |

| | ITEM 1B. | UNRESOLVED STAFF COMMENTS | | 18 |

| | ITEM 2. | PROPERTIES | | 18 |

| | ITEM 3. | LEGAL PROCEEDINGS | | 19 |

| | ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | | 19 |

| | | | | |

| PART II | | | 20 |

| | | | | |

| | ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | | 20 |

| | | | | |

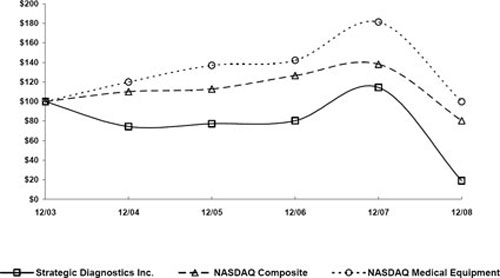

| | | Stock Performance Graph | | 21 |

| | | | | |

| | ITEM 6. | SELECTED FINANCIAL DATA | | 22 |

| | ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 23 |

| | | | | |

| | Forward Looking Statements | | 23 |

| | Overview | | 23 |

| | Results of Operations | | 24 |

| | Year ended December 31, 2008 versus year ended December 31, 2007 | | 24 |

| | Year ended December 31, 2007 versus year ended December 31, 2006 | | 26 |

| | Liquidity and Capital Resources | | 27 |

| | Off-Balance Sheet Arrangements | | 29 |

| | Contractual Obligations | | 30 |

| | Critical Accounting Policies | | 30 |

| | New Accounting Standards and Disclosures | | 32 |

| | | | | |

| | ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 34 |

| | ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | 34 |

| | ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | 34 |

| | ITEM 9A. | CONTROLS AND PROCEDURES | | 34 |

| | ITEM 9B. | OTHER INFORMATION | | 35 |

| | | | | |

| PART III | | | 36 |

| | | | | |

| | ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | 36 |

| | ITEM 11. | EXECUTIVE COMPENSATION | | 37 |

| | ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | | 37 |

| | ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | | 37 |

| | ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 37 |

| | | | | |

| PART IV | | | 38 |

| | | | | |

| | ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | | 38 |

PART I

Item 1. Business

Overview

Strategic Diagnostics Inc. (“SDI” or the “Company”) is a biotechnology company with a core mission of developing, commercializing and marketing innovative and proprietary products, services and solutions that preserve and enhance the quality of human health and wellness.

The Company’s Life Sciences portfolio includes products and custom services that supply critical reagents used across the Life Science research and development markets. The Company’s Genomic Antibody Technology™ (“GAT™”) is gaining wide adoption in proteomic research, disease understanding and drug/biomarker discovery among academic, biotech, in-vitro diagnostic and large pharmaceutical customers.

The Company’s Industrial BioDetection portfolio includes immunoassays which represent advanced technology for rapid, cost-effective detection of food pathogens as well as water and soil contaminants. SDI’s RapidChek® and SELECT ™ kits are experiencing growing adoption for the detection of pathogens such as E. coli, Salmonella and Listeria in the production, processing and manufacturing of food and beverages.

The Company’s technology is also finding potential new applications in strategic emerging markets such as renewable bio-fuel, where the application of the Company’s patent pending phage technology is being developed to increase corn-to-ethanol profits through improvements in plant efficiency that generate higher yields at a lower operational cost, while increasing the value of by-products used in animal feed by eliminating antibiotic contamination of those feeds.

By applying its core competencies of creating proprietary antibodies and assay development, the Company has produced sophisticated testing and reagent systems that are responsive to each customer’s analytical information needs.

SDI is a customer-centric organization. The Company’s goals are to consistently deliver increased value to its customers that facilitate their business results, reduce costs and help in the management of risk. SDI sales professionals focus on delivering a quantifiable “return on investment” to their customers by reducing time and total costs associated with applications for which the Company’s products are used. In addition, the Company believes its tests provide high levels of accuracy and reliability, which deliver more actionable test results to the customer as compared to alternative products. The Company is focused on sustaining profitable growth by leveraging its expertise in antibodies and immuno-technologies to successfully develop proprietary products and services that enhance the competitive advantage of its customers.

The Company believes that its competitive position has been enhanced through the combination of talent, technology and resources resulting from the business development activities it has pursued since its inception. The Company has achieved meaningful economies of scale for the products it offers through the utilization of its facilities in Newark, Delaware for the manufacture of test kits and antibodies, and its facilities located in Dallas, Texas and Windham, Maine for the manufacture of antibodies.

The Company currently meets its customers’ needs and generates revenues through two business units: Life Sciences and Industrial BioDetection Tests, which are described below.

Life Sciences

SDI is a leader in the Life Sciences industry in providing a wide range of products and services, including custom antibodies, pre-made catalog antibodies, bulk “diagnostic-grade” antibodies, proprietary critical reagent products, and associated bio-processing services. The Company partners with its customers for the design, development and production of monoclonal and polyclonal antibodies by deploying robust, refined process-oriented traditional methods and its proprietary GAT™ as determined by the customer’s application requirements. The Company’s products and services are sold to, and often embedded in other commercial products used by a wide range of customers including pharmaceutical, biotechnology and diagnostic companies, and major biomedical research centers both domestically and internationally. The Company is fully integrated to deliver a full range of services encompassing its customers’ antibody needs from antigen design and antibody development through large scale production and post production bio-processing and immunoassay design and development. The Company’s Certified Good Manufacturing Practices (cGMP) and ISO9001:2000 accredited facilities employ sophisticated production processes that are reliable and deliver high quality to its customers.

Genomic Antibody Technology™ (GAT™). The human genome project has been a major driving factor in the emergence of the study of proteomics. With a new knowledge of genomes, the biomedical research community is exploring many new proteins, their functions and the clues they reveal about human health. The study of gene and protein functionality often requires the use of antibodies which has created a growing demand; commercially available antibodies exist to less than 10% of the human proteome. GAT™ was developed to address this growing need for high quality reagents and advanced biomolecules in the Life Science industry.

Innovation is a key element of the Company’s Life Science strategy for establishing and maintaining sustainable differentiation in key markets. GAT™ products and services utilize sophisticated bioinformatics and immunization strategies to produce high value antibody reagents and biomolecules. SDI’s application of powerful proprietary algorithms provides GAT™ the ability to “dial in” the precise gene or protein sequence to produce a recombinant protein inside the host animal which elicits an immune response to the encoded protein. This “specificity by design” approach generates antibodies which recognize the conformational epitopes on the native protein. The ability of any antibody to recognize a protein’s naturally folded state has the potential to expand a biomolecule’s utility to advance platforms like flow cytometry and therapeutic candidate generation. Among the many advantages of GAT™ is the technology’s ability to produce reagents and biomolecules against traditionally difficult cellular targets, such as highly conserved and transmembrane proteins. The system is highly efficient and scalable, allowing the generation of custom libraries consisting of hundreds of antibodies for use in the drug discovery, biomarker discovery, diagnostic, and research markets.

Immunoassay Technology. An immunoassay is an analytical test that uses antibodies to detect the presence of a target substance in a complex sample matrix such as blood or other tissue with high degrees of sensitivity, precision and accuracy. In the burgeoning fields of proteomics and biomarker discovery, immunoassays play a central role in the detection and quantification of proteins associated with disease diagnosis, prognosis and progression, and therapeutic toxicity, efficacy and outcome. The Company’s scientists are experts in the design and development of antibodies and immunoassays in all fields of use including medical diagnostics and human healthcare. The Company’s scientific expertise with multiple immunoassay formats, coupled with a thorough understanding of the needs of markets and specific customer applications, has allowed the Company to develop a diverse array of immunoassay products designed to meet the analytical needs of multiple, sizable markets. Recent activities by Company scientists have been focused on developing multiplexed immunoassay tests employing the Company’s genomic antibodies for commercial sale and in the field of biomarker discovery, especially relating to cancer research.

Industrial BioDetection Tests

The Company’s detection technologies allow industrial customers to rapidly and cost-effectively identify the presence of adulterants, such as chemical toxins, biological pathogens and other contaminants, which can compromise human or environmental safety, and/or financially impact efficiencies of production processes. Many of the Company’s products are in the form of single use test devices, sample prep materials and reagents, thus creating recurring revenue opportunities. Specific industry applications include:

| ● | Food and Beverage Manufacturing: Systems for high efficiency testing for the identification of pathogens and toxins in food, water and the manufacturing environment. |

| | |

| ● | Water Utilities: Drinking water facilities test for chemical toxins and pathogens. Wastewater treatment facilities manage pollution control by testing for influent and effluent toxicity, pesticides, metals and efficiency maintenance in biological processing systems. |

| | |

| ● | Environmental Management: On-site testing systems to increase the speed and accuracy of environmental remediation of soil and ground water pollutants. |

| ● | Agriculture and Agro-science: Systems for the detection, identity preservation, and quantification testing of genetically modified organisms, and test systems for feed and grain safety testing, including for the presence of mycotoxins. |

By leveraging its expertise in immunology, proteomics, bio-luminescence and other bio-reactive technologies with innovative application and production capabilities, the Company is able to provide sophisticated diagnostic testing and reagent systems to a diverse customer base serving multiple vertical markets.

Bacteriophage Technology. Bacteriophage, or phage, are viruses that infect bacteria. They are highly specific for the type of bacteria that they infect and do not infect any other living cell from any other organism including animal, plant, fungus or yeast. Because lytic bacteriophage specifically kill their bacterial hosts and not other living cells, purified preparations of phage have been used medicinally to treat bacterial infections of plants and animals, including humans. The use of bacteriophage as a human therapeutic attests to the biological specificity and safety of these viruses. In the last two years, the U.S. Food and Drug Administration (“FDA”) has approved the use of bacteriophage products for direct application to ready-to-eat foods for reduction of Listeria bacteria based on the determination that phage are “generally recognized as safe” (“GRAS”).

The Company is applying its bacteriophage technology in its test kit products for the detection of bacterial food pathogens, including its Salmonella SELECT ™ product and an E. coli SELECT ™ product that is currently in development. The Company has filed patent applications claiming the use of bacteriophage to control competing and cross-reacting bacteria, thereby reducing false positive and negative results and improving analytical test performance.

The Company has also filed patent applications claiming the use of specific lytic bacteriophage to control contaminating bacteria in large scale industrial fermentation processes such as ethanol and lysine production. The Company believes that the use of bacteriophage is a significant improvement over the use of antibiotics and will have an impact on yield and cost associated with the production of ethanol from feedstock. The Company’s scientists are actively engaged in the development of specific bacteriophage reagents together with industry-leading producers of ethanol products.

Bioluminescence Technology. The Company’s Microtox® and Deltatox® tests use a specific strain of luminescent bacteria as biosensors of toxicity, especially in water samples. These bacteria, when exposed to certain chemicals, undergo a chemical reaction resulting in the emission of visible light. Light output is inversely proportional to the toxicity of the sample being tested.

SDI’s solutions include the instrumentation, reagents and technology necessary to employ testing. The Company has developed proprietary technology to analyze the results and calculate toxicity according to industry standard and regulatory methods. These solutions are highly reliable and offer significantly greater precision than other commonly applied measures of toxicity employing small numbers of living organisms (e.g., fish). The Company’s products, reagent kits, instruments and software provide for rapid and inexpensive assessment of toxicity in multiple applications including official regulatory methods in many countries worldwide.

Life Science Products and Services

The Life Science proteomic tools and technologies market is experiencing growth due to the expansion of research in further translating the information of the genomic era into understanding of the role of proteins in biology and medicine. According to Frost & Sullivan and other market researchers, the global market for antibody-based reagents and tools in 2008 was approximately $1.8 billion with estimated growth in the range of 5-7%. Custom reagent development and production account for approximately $450 million with an estimated 10-12% growth rate and premade reagent products comprised approximately $1.4 billion with an estimated growth rate in the 5-7% range. Customers in these markets regard the Company as a leader in the design, development and production of critical tools used to target, differentiate, quantify, and profile the vast number of proteins related to human health. The Company links its historical expertise in immunotools and immunoassays with the speed and agility of its proprietary GAT™ platform. Post-genomics drug development is a rapidly emerging sector for proteomic immunotools. Within this market, investment has largely shifted from discovery activities into more information-rich integrated development activities. Within the past two years, the Company has supplied 20 of the top 30 pharmaceutical and biopharmaceutical companies with proteomic immunotools to further their drug development programs as well as initial clinical candidates for monoclonal antibody therapeutics. The Company produces antibodies to targets and biomarkers of interest allowing customers to quickly assess the feasibility, efficacy and safety of compounds in their developmental pipelines.

The Company sees rapid advances in the use of antibodies as tools to measure biomarkers. The advent of profiling protein biomarkers as predictive, prognostic, diagnostic, and reporters of activity throughout the drug discovery and development workflow has created increased needs for protein identification and quantitation tools. Biomarkers of disease play an important role in medicine and have begun to assume a greater role in drug discovery and development. The Company’s experience in antibodies and immunoassay design together with the GAT™ platform puts it in a strong position to address these needs.

The Company is a supplier to many major manufacturers of antibody-based diagnostic tests. The Company maintains regulatory compliance, industrial scale and efficiencies, and requisite quality systems to assure a secure supply of critical reagents to its partners. The Company provides proprietary reagents as well as large scale Original Equipment Manufacturer (OEM) production of custom antibodies.

The Company supplies research reagents to a large number of academic and government investigators. In 2008, SDI was selected through an open Request for Proposal by Science Applications International Corporation (“SAIC”) in cooperation with the National Cancer Institute to generate a library of monoclonal reagents against cancer biomarkers. These antibodies will become part of a reference set of validated tools for researchers.

The Company has a portfolio of catalog antibodies made using its proprietary GAT™ platform available for sale online. Within the past year, many new customers have benefitted from these oncology-focused research reagents. In many cases, a singular product has been selected by a client to become a critical testing reagent in long term projects, precipitating the transition of a per-unit sale into a critical reagent supply agreement. These antibodies are now a resource for the Company to assess application in novel platforms, assays, and multiplex applications.

Customer service, innovation, and expertise are the foundation of the Company’s competitive advantage. SDI is among the largest custom antibody providers in the United States. The Company’s facilities are purposely built and managed for antibody production. These facilities are ISO 9001:2000 certified and accredited by the Association for the Assessment and Accreditation of Laboratory Animal Care (“AAALAC”), the highest standard in laboratory animal care. The Company is licensed by the U.S. Department of Agriculture (“USDA”) and registered with the National Institute of Health (“NIH”) Office of Laboratory Animal Welfare.

Food Safety Products

The Company’s food safety product line includes enrichment media and rapid tests to detect food pathogens, including E. coli O157 (including H7), Listeria and Salmonella. The Company is a leader in tests for targeted traits in genetically engineered plants, tests to detect Genetically Modified (GM) traits in grain, seeds, food ingredients and food fractions and tests to detect naturally occurring fungi in grains (mycotoxins).

Food Pathogen Testing

Pathogen specific testing is an increasingly important part of microbiology testing performed in the global food industry. The worldwide market for pathogen tests and media is estimated to be between $850 million and $1 billion according to independent studies and the Company’s own market research. According to several independent studies, the market for pathogen tests grew at an average rate of 7% in 2007 and this growth rate is expected to continue for the next several years. Growth in pathogen testing is driven primarily by regulatory changes, customer testing trends, industry consolidation, and globalization of the world’s food supply.

Since 2001, the Company has invested in the development and market introduction of products for the detection of pathogenic microorganisms in food. In 2002, the Company introduced its first test method for the pathogen E. coli O157 (including H7). The RapidChek® E. coli O157:H7 test strips and proprietary media system have received ongoing market acceptance in the United States. In 2005, the Company was notified that its RapidChek® E. coli O157:H7 assay had been selected as the assay method of choice for the National School Lunch Program for screening raw and frozen beef for the organism. The National School Lunch Program is a federally-assisted meal program that operates in over 97,000 public and non-profit private schools and residential childcare institutions. The USDA is responsible for determining that the meat produced for the National School Lunch Program is safe. In addition, the RapidChek® test for detection of E. coli O157:H7 was selected by the Food Safety Inspection Service (“FSIS”), the public health agency in the USDA, as an approved methodology for screening of the organism in raw beef samples. The FSIS section of the USDA conducted a rigorous evaluation of rapid methods that are currently on the market for screening pathogens, including polymerase chain reaction, and automated/manual immunoassays and benchmarked kit performance against the current USDA traditional cultural method. The RapidChek® E. coli O157:H7 method was evaluated and determined to be the “best in class” against the other immunological methods tested. RapidChek® has been included in the USDA Microbiological Laboratory Guidelines as one of only two immunoassays that is recognized for use in screening raw beef for E. coli O157 (including H7). The Company believes that the acceptance of its method by the agencies regulating food safety has increased sales as producers seek to use methods that have been evaluated by the regulatory agencies. The RapidChek® E. coli O157:H7 test system has also received international recognition with regulatory approvals in Canada (Canadian Food Inspection Agency) and Australia (Australian Quarantine and Inspection Service).

In June 2004, the Company launched its test for detection of Listeria. This test system received AOAC Research Institute (“AOAC”, “AOAC-RI”) approval for both food and environmental samples, as opposed to several competitive methods on the market that have AOAC approval for food samples only. As a result of new regulations enacted by the USDA in 2003, environmental samples account for approximately 80% of all Listeria testing. The Listeria test incorporates the use of a proprietary enrichment procedure that provides results in 40 hours, which is 8-12 hours faster than most other methods on the market. In addition, the proprietary enrichment system does not require a transfer step, providing significant labor savings compared to other methods on the market. As with all pathogen systems, food companies require internal evaluations prior to adoption. In these evaluations, the Company’s Listeria test system demonstrated superior performance and improvements in efficiency and productivity compared to most competitive methods on the market. As a result of improvements in performance and cost-in-use, the Company has had the Listeria product adopted by a number of very large food processors. When larger food companies adopt a particular method, the method generally gains credibility in the marketplace.

In August 2006, the Company launched its new RapidChek® SELECT™ Salmonella test with AOAC-RI approval at the International Association of Food Protection Meeting in Calgary, Canada. This novel test is based on a patent pending phage technology combined with SDI’s next generation lateral flow technology and has revolutionized the Salmonella testing arena. The RapidChek® SELECT ™ test was developed to meet some of the challenges faced in Salmonella testing, including high false positive and negative rates, which can be particularly prevalent in high burden samples. The patent claims technology that increases both the specificity and sensitivity of rapid pathogen tests. In September 2006, the RapidChek® SELECT ™ Salmonella test was the first lateral flow test approved for the National Poultry Improvement Plan, and will provide an attractive alternative to current methods used such as labor intensive cultural methodologies. The RapidChek® SELECT ™ Salmonella test was evaluated and adopted by several of the top poultry and beef processors in 2007. The launch and acceptability of RapidChek® SELECT ™ in the market has also facilitated the increase in sales of the RapidChek® Listeria system, as most processors prefer to utilize one platform for multiple testing needs. Customers have cited the use of SELECT ™ contributing to improved laboratory efficiencies and significant savings as compared to what they were previously using to test.

In late 2008, the Company decided to discontinue the distribution of the Lumitester PD-10N and LuciPac W hygiene monitoring system, manufactured by the Kikkoman Corp., with the objective of enhancing focus on the Company’s core products.

Agricultural Testing

Genetically Modified Crops

Tests for GM traits are generally used to determine whether the sample tested contains the protein associated with the genetic modification. Seeds, grain or leaf tissue are typically tested. The tests may be employed by users desiring to ensure that seed or grain lots are either GM-free or, in other cases, that they contain a specified amount of the GM material in order to meet certain GM requirements. Among the commodities typically tested with the Company’s products are corn, soybeans, rice and cotton. The Company estimates that the worldwide demand for protein based testing of genetically modified crops is $15 million per year. To address this market, the Company maintains a small U.S. sales force and distribution in the five principal countries that, in addition to the United States, are responsible for 96% of the GM crop area.

The Company has developed a simple “one-step” test that is used at the point of testing to determine if an individual plant contains the targeted genetic trait. Commercial seed producers use these products to ensure the quality of their products. This type of test also can be used in crops for enforcement purposes to expose unlicensed application of the genetic technology.

Acceptance of GM crops has increased and as the development of new traits has risen, some countries have adopted regulations on biotech crops. In 2004, the European Union (“EU”) adopted regulations regarding labeling and traceability of GM food and feed with enforcement beginning in April 2004. The regulatory tolerance for EU-authorized GM traits is 0.9%, and 0.5% for unauthorized GM traits that have already received a favorable risk assessment from various U.S. regulatory agencies. Traceability systems must be in place and must demonstrate that any traces of GM traits are adventitious and are technically avoidable. The Company no longer believes that the impact of regulations will result in stricter testing of grain and grain exports from countries growing GM crops, or increases in testing to meet these new regulations. Conversely, widespread acceptance of GM crops is generally reducing the practice of grain testing as GM traits are increasingly ubiquitous in the environment.

The Company believes that it continues to be well positioned to provide the analytical tools to allow food companies to purchase such premium products with confidence, due to its existing relationships with large agricultural biotechnology companies and the current success of its technology, particularly in the area of GM traits.

Water Quality

The Company’s water quality product line includes industrial bio-detection kits for water and soil contaminants such as pesticides, explosives, petroleum related products and polychlorinated biphenyls (PCBs); Microtox® toxicity tests used in a wide array of market segments; and products for detecting polymers and corrosion in water. In addition to use by water utilities and related government agencies, the product line is used in many industrial manufacturing segments, environmental remediation, research and ecological studies. The global market for analytical testing associated with the water and environmental industries is estimated at $1.4 billion based on a compilation of market research studies. The overall growth rate in developed markets is estimated at 2-3%, while the growth rate in developing markets, primarily Asia, is estimated at 7-9%. The biggest driver for growth is government regulations associated with water quality and environmental protection.

Toxicity Testing

In 2001, the Company acquired AZUR Environmental Limited to add the Microtox® product line to its portfolio. Microtox® is a unique rapid acute toxicity test that detects a broad range of toxins and chemical agents. The Microtox® brand is the global reference standard for rapid acute toxicity testing. Microtox® makes toxicity analysis simple and easy to perform and results can be generated in as little as 30 minutes. The Company also markets a portable version of the Microtox® technology known as Deltatox®. Many water utilities and emergency response teams are using Deltatox® technology as part of their emergency response programs. Microtox® has been widely accepted by the wastewater treatment industry where managing and controlling costs by accurately assessing the mechanical, operational and chemical performance of these facilities is critical. Microtox® delivers value by helping to improve operating efficiency and by helping facilities stay in compliance with their discharge permits.

In February 2006, the Company announced that its Microtox® bioassay technology was awarded the Designation and Certification as an “Approved Product for Homeland Security” by the Department of Homeland Security. In December 2007, the Company was awarded a Federal Supply Schedule GSA contract. The contract further expands the Company’s reach into federal, state and local agencies, in addition to making it easier for these agencies to do business with the Company.

Environmental Contamination Detection Products

The entrance of pesticides into the water supply is a result of agricultural and residential runoff. In areas of substantial agricultural activity, drinking water is tested for pesticides to protect supplies and to comply with federal and state regulations. The Company’s pesticide test kits are used in situations where field testing, or the testing of one specific pesticide gives the test kit much greater utility than a lab-based analyzer. Users include federal agencies such as the U.S. Geological Survey and USDA, state environmental and health departments, water utilities and environmental engineering companies. The Company also sells immunoassay products in the environmental market. The Company offers three different test formats, each with performance characteristics that make them well suited for a particular customer application. All of the Company’s environmental test kits are capable of analyzing multiple samples in parallel. The Company is currently marketing kits for a variety of contaminant classes and has been able to expand its product offerings through distribution agreements to accommodate new technologies.

Sales and Marketing Strategy

The Company markets and sells products in the life science, food safety, and water quality product categories through a U.S. direct sales force, Internet presence and a network of over 50 distributors in Canada, Mexico, Latin America, Europe and Asia and through the Company’s corporate partners. The Company also has a European office and sales operation near London, England. The Company evaluates various sales and service models that can contribute to the profitable growth of business. Identifying the most effective channels to market will allow the Company to better allocate resources to both new and existing growth opportunities.

In the United States, the primary sales channel is through a direct sales force comprised of geographically based field sales professionals, key segment managers, and inside sales associates. The sales force is augmented by customer service and project management organizations, and applied technical marketing specialists which assure that all elements of the customer’s buying experience meet and exceed their performance expectations.

On the basis of its strengthening market position, the Company continues to develop channels to market and accelerate predictability and sustainability of revenues. The Company is investing in its direct sales force through the addition of new sales representatives and focused sales and technical training. The Company continually measures sales performance and maintains discipline in the balance between the addition of new sales resources and ongoing efforts to continually improve sales efficiency and effectiveness of existing resources.

The Company is also focusing on its network of quality channel partners. In 2006, the Company added its first distributor for its custom antibody offering. The Company is working to add additional channel partners for both its custom and catalog offerings nationally and internationally.

In 2005, the Company signed an exclusive distribution agreement with DuPont Qualicon for the representation of the Company’s immunoassays for food pathogen detection. In 2007, the Company moved to a non-exclusive distribution agreement with DuPont Qualicon and began to add new distribution partners for this product line. The Company expanded its international distribution network for food safety pathogen products, adding and training a total of 15 independent distributors to sell the RapidChek® product line in high growth markets globally, including Southeast Asia, Europe and Latin America. The Company also took a much more aggressive role in marketing these methods. It is anticipated that the additional distributors and international expansions of promotion/sales of the products will increase revenues as they gain acceptability.

Competition

Many of the Company’s potential competitors are large companies with substantially greater financial and other resources than the Company. To the extent that any such companies enter into one or more of the Company’s markets, the Company’s operations could be materially adversely affected. The Company anticipates increased competition as potential competitors perceive that the Company’s products have become commercially proven, or if the Company cannot maintain competitive differentiation.

In the Ag/GMO market, the Company competes with several small, privately held companies (Agdia, Envirologix) that market very similar, if not identical products.

In food pathogen testing, the Company is among the more recent entrants to the market and faces a broad base of competition. The worldwide market for pathogen tests is estimated to be between $850 million and $1 billion annually and as such has drawn many competitive products. The Company’s RapidChek® E. coli O157:H7, Salmonella and Listeria tests compete globally with numerous competitive rapid testing systems. Instrument-based tests are offered by bioMerieux SA and DuPont Qualicon among others. Competitive strip based tests are offered by Neogen Corp., BioControl Systems, Inc. and others. In addition, traditional lab culture methods offer indirect competition. The Company hopes to gain market share from competitive methods and with new users due to key product advantages such as speed of result, ease-of-use, accuracy and by providing overall cost savings.

The Company believes there are no meaningful direct competitors for the Company’s Microtox® product line in the United States. In Europe and other parts of the world, the Company competes against Checklight, Ltd., an Israeli-based company, and one other instrument-based test method produced by Hach Lange, an affiliate of The Danaher Corporation, which has greater technical and marketing resources than the Company. The Company believes its products have a number of competitive advantages including the comprehensive screening for general toxicity and competes effectively on superior features and functions.

With respect to the environmental contaminant test products, the Company currently receives the greatest competition from fixed site environmental laboratories and several small privately held companies. Traditional analytical methods for environmental contamination are often utilized for confirmation and closure of environmental sites. The Company believes it has detection products which are easy to use and which provide greater value in use than competitive offerings.

In the antibody product category, the competitive landscape is rapidly changing as the Company continues to shift its emphasis to earlier activities in drug and biomarker discovery. The Company will increasingly compete with technology companies that offer products and services for the discovery and advancement of novel antibodies. The Company believes that its proprietary GAT™ platform coupled with its expertise in assay development provides differentiated access to the high value application markets it is targeting.

The Company also competes in its traditional antibody markets with the internal capabilities of some of the Company’s large pharmaceutical, research and diagnostics customers. These customers often have significantly greater revenues than the Company. Generally these customers produce some products internally and purchase similar products from the Company.

Competitors in the market as third party providers of custom, large scale antibody reagent production include Covance (public), Harlan (private), Lampire (private) and Scantibodies (private). Additionally, there are a number of smaller companies that offer competing products. In the custom research reagent market, the Company has identified 49 companies offering some form of traditional antibody production from customer-provided antigens. The Company believes that the scale of its operations and the breadth of its product lines, among other things, are significant competitive advantages against both large and small competitors. In the catalog antibody space, there are over 130 companies competing for this $1.35 billion market.

Markets and Products

The Company sells products in the food safety, water quality and antibody market categories through its U.S. direct sales force, a network of over 50 distributors in Canada, Mexico, Latin America, Europe and Asia and the Company’s corporate partners.

Geographic and Customer Information

The following table sets forth sales by geographic region:

| | | | | | | | | | | | |

| | | | Year Ended December 31, | |

| | | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | | |

| | United States | | $ | 20,744 | | $ | 21,154 | | $ | 19,498 | |

| | Rest of the world | | | 6,915 | | | 6,053 | | | 6,024 | |

| | Total | | $ | 27,659 | | $ | 27,207 | | $ | 25,522 | |

The Company’s basis for identifying sales by country is the ship-to location. There were no individual countries outside of the United States that represented more than 10% of the total revenues of the Company. There are no significant long-lived assets located outside the United States.

Regulatory Approvals

Among other things, the Company is engaged in the development of antibody and immunoassay products for use in the medical and human healthcare fields. Its current products in this market are intended for “research use only.” Tests for bacterial food pathogens, mycotoxins, genetically engineered traits in plants and water treatment polymers are currently unregulated. However, agencies such as the Environmental Protection Agency (“EPA”), the FDA, and the FSIS are engaged in testing and, together with organizations like the AOAC, maintain compilations of official methods for use in testing in certain market segments. Some of these organizations also issue procedures and guidelines for validating new methods. Although not required, official methods adopted by these agencies sometimes have the commercial impact of regulations because the industry and the Company’s customers tend to follow the practices of regulatory agencies.

The Company believes that the validation and acceptance of its products by regulatory agencies plays a significant role in market acceptance. EPA SW-846 is the compendium of test methods published by the EPA’s Office of Solid Waste listing those analytical methods that have been validated by the EPA for a stated purpose. The vast majority of the Company’s analytical methods for environmental soil sample analysts are listed in EPA SW-846. Many federal, state and local environmental programs often refer to and rely on EPA SW-846 methods for purposes of remediation and monitoring.

The environmental legislation and regulations that the Company believes are most applicable to its current business are the Research Conservation and Recovery Act (“RCRA”), Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), Toxic Substances Control Act (“TSCA”), Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) and the Pure Food and Drug Act. For analysis of water and wastewater, the Safe Drinking Water Act, the Clean Water Act and the National Pollution Discharge Elimination System (“NPDES”) permitting program acceptance under the Clean Water Act also will be significant to the Company’s business. As the utility of the Company’s Microtox® products continues to be widely recognized in drinking water security applications, regulations and mandates associated with Homeland Security programs may also have an impact on the Company’s business. Collectively, these programs regulate the management, disposal and clean-up of hazardous substances and protect the nation’s ground and surface water and drinking water supplies.

The Company received ISO 9001:2000 certification in January 2009 for all five of its facilities from American Systems Registrar, an ANSI-ASQ National Accreditation Board (“ANAB”) Accredited International Registrar for the ISO 9001 standards. Recognized and respected worldwide, ISO 9001:2000 standards are put forth by the International Organization for Standardization (“ISO”). This certification demonstrates the Company’s commitment to excellence in product and service quality, and a continued focus on improving the customer experience.

The Company has maintained AAALAC (Association for the Assessment and Accreditation of Laboratory Animal Care) accreditation at its Delaware facility since 1992 and at its Maine facility since 2000. The Company volunteers to participate in the AAALAC program in addition to complying with the local, state and federal laws that regulate animal research. In order to maintain these accreditations, the Company undergoes regular inspections and reviews. The Company also holds approval from the USDA, OLAW (Office of Laboratory Animal Welfare), and the NIH, further validating the stewardship of the Company in proper laboratory animal care.

Manufacturing

The Company manufactures test kits for the detection of a wide array of analytes in five immunoassay formats and one bioluminescence format. The five formats are: one step lateral flow tests; coated tubes; latex particles; magnetic particles; and micro-titer plates. The Company manufactures a biological supplement that enhances the detection of certain analytes and improves overall performance of certain assay formats. In addition to test kits, the Company supplies ancillary equipment and supplies including test evaluation instruments, reagents, sample media, spectrophotometers, pipettes, balances and timers.

The key critical reagent manufacturing technologies are conjugation chemistries, antibody formulations, calibrator preparation, lateral flow strip production, microbiological and immunoassay processes. Reagent production processes include filling and dispensing liquids, subcomponent and finished goods assembly, in-process testing, quality control, packaging and shipping. The critical reagents and production assembly groups produce test kits in the Newark, Delaware laboratories. Biological materials are primarily developed and produced in-house; however, some reagents are licensed from third parties or purchased from commercial sources. A crucial step in the Company’s manufacturing process is the stabilization of the immunoreagents utilizing proprietary lyophilization techniques. In general, raw materials used by the Company in its products are obtainable from multiple sources. The Company purchases instruments and ancillary equipment from outside vendors. A number of the instruments sold by the Company were developed to be used exclusively with the Company’s products and are subject to specific supply agreements. The Company believes that the raw materials, instruments and equipment used in the manufacture of its products are sufficiently available for the Company’s current and foreseeable manufacturing needs.

The Company manufactures its products in accordance with the FDA’s Good Manufacturing Practices guidelines and has implemented data-driven problem solving, measurement and statistical process controls to troubleshoot and continuously improve quality and output performance. Capital investment and equipment automation have reduced key parameter variation, improved production efficiencies and lowered manufacturing costs. The Company utilizes planning tools to control all elements of the supply chain and manufacturing processes, including raw material procurement, inventory management, capacity planning and production scheduling, work-in-process tracking, order processing and fulfillment, shipping and customer invoicing. The Company believes the existing facilities and equipment are sufficient to support a significantly larger production demand.

The Company also supplies a wide array of custom antibody products and services to the in-vitro diagnostic, academic, pharmaceutical and medical research industries. Antibodies are developed and produced using animals or cell culture methods. Laboratories are maintained to prepare immunogens, perform chemical conjugations, purify antibodies, and perform a range of quality control procedures. The cell culture laboratories support the development of hybridomas and manufacture of monoclonal antibodies. The cell culture laboratories also provide services to enhance the productivity of cell lines, establish Master Cell Banks, and store cell lines in secure fail-safe cryogenic systems. In 2008, the Company increased the capacity to perform Hybridoma development projects to accommodate the increase in demand for these projects. Animal facilities house specific-pathogen-free animals that are tested routinely to assure they are maintained under the highest health standards. Current capacity utilization in antibody production is approximately 70%, and there is additional land and zoning clearance on the 64-acre site in Windham, Maine to double polyclonal operations.

In 2005, the Company established a research and manufacturing center in Dallas, Texas. This facility is designed for gene building and protein chemistry. The GAT™ offering is supported by a robust high throughput operation that is initiated in Dallas and completed in either Maine or Delaware, depending upon the end product. A sophisticated electronic operations management system was established that links the operations seamlessly. Resulting products and information are managed by the Company’s MRP and LIMS systems.

Research and Development

The Company engages in substantial research and development activities (R&D) involving development of products, services and technology platforms for its two primary markets, Life Sciences and Industrial BioDetection Kits. In the years ended December 31, 2008, 2007 and 2006, the Company incurred approximately $3.6 million, $2.9 million, and $2.6 million, respectively, in research and development expenditures. Research and development on the Company’s proprietary GAT™ product offering, bacteriophage technology, and food safety products accounted for 83% of the total R&D effort for the year ended December 31, 2008.

The Company’s primary laboratory facilities located in Newark, Delaware were designed and built specifically for conducting research and development relating to antibody and immunoassay technology. These facilities include state-of-the art, cGMP antibody development and large-scale production facilities. The Company has assembled a scientific staff with extensive experience in the development, production and purification of monoclonal and polyclonal antibodies. The Company also has extensive expertise in the development and production of reagents from the antibodies it produces, as well as commercial immunoassays employing those reagents.

In 2008, the Company developed over 1,000 novel antibodies using GAT™, focusing primarily on cancer protein biomarkers for inclusion in a web-based product catalog and development of test products for the Life Sciences market. Consistent with the vision of applying its core technology to the field of proteomics and biomarker discovery, the Company is developing multiplex immunoassays employing the novel antibodies developed using the GAT™ platform. In addition, the Company entered into agreements with the University of Delaware and the Helen F. Graham Cancer Center in October 2008 to use its genomic antibody platform to discover biomarkers of prostate cancer metastasis and colon cancer stem cells.

In the food safety market, the Company completed the development of a new RapidChek® SELECT ™ product containing its proprietary bacteriophage technology for the detection of E. coli O157 in food. The product was successfully validated in the United States by the AOAC and is currently being validated by Association Française de Normalization in Europe. The use of bacteriophage to improve the specificity and sensitivity of testing methods is unique to the Company and the subject of a recently allowed U.S. patent and pending patent application worldwide.

The Company also has patents pending for the use of bacteriophage to control the growth of harmful bacteria in large scale industrial fermentation production processes including corn-to-ethanol production. In August 2008, the Company tested the bacteriophage technology at pilot scale at the National Corn to Ethanol Research Center in Edwardsville, Illinois. The trial demonstrated the efficacy of the phage treatment and the Company is in the process of exploring commercialization opportunities for the technology.

The Company’s research and development personnel are experts in many advanced research disciplines in life sciences including immunology, immunochemistry, molecular biology, protein chemistry, biochemistry, microbiology, and synthetic organic chemistry. In addition to the technical expertise resident within the research and development organization, the Company’s technical manufacturing organization is expert in large-scale cGMP production, bioprocessing, purification and quality control of antibodies and reagents. The Company’s core expertise is in antibody and immunoassay development and it is a major developer and producer of monoclonal antibodies.

Research and development activities are focused on developing proprietary technology and products to expand the Company’s differentiated market position in Life Science and food safety markets. The Company is a recognized leader in the field of contract antibody and assay development services primarily for large pharmaceutical, biotech, diagnostic and chemical companies, and the development of rapid test kits in the food, water quality and agricultural sectors based on immunoassay technology. In addition, the Company has extensive expertise, facilities and equipment relating to the development and manufacture of one-step lateral flow tests.

The Company’s research and development organization consists of approximately 11 individuals, eight of whom hold advanced academic degrees. In addition, approximately one-third of the Company’s employees are involved in technical job functions.

Proprietary Technology and Patents

The Company’s products are based on the use of proprietary reagents, technology and test systems developed by Company scientists or acquired externally. Accordingly, the Company has implemented a number of procedures to safeguard the proprietary nature of its technology. The Company requires its employees and consultants to execute confidentiality agreements upon the commencement of an employment or consulting relationship with the Company and all employees are required to assign to the Company all rights to any inventions made during their employment or relating to the Company’s activities. Additionally, the Company seeks to protect its technology and processes through the patent process. The Company currently holds 26 issued U.S. patents, as well as three U.S. patents licensed for exclusive use by the Company. One U.S. patent application regarding the use of bacteriophage as selective agents is pending.

There can be no assurance that the Company’s patent applications will result in the issuance of any patent or that any patents issued to the Company would provide protection that is sufficiently broad to protect the Company’s technology and products. In addition, the Company cannot be certain that it was the first creator of inventions covered by pending patent applications or that it was the first to file patent applications for such inventions. In addition to seeking patent protection for the Company’s proprietary information, the Company also relies upon trade secrets, know-how and continuing technical innovation to maintain competitiveness for its products and services. The Company has developed a number of proprietary technologies which it has chosen not to patent, including immunization protocols, DNA and plasmid constructs, stabilization systems for reagents, chemical syntheses, and strategies relating to antibody development.

| | | |

| U.S. Patent | | Title |

| 5,426,035 | | Method for compensating toxicity test data for the measured toxicity of a reference sample |

| 5,427,955 | | Photochemical determination of organic compounds (license) |

| 5,429,952 | | Marking of products to establish identity and source (license) |

| 5,449,611 | | Polyaromatic hydrocarbon (PAH) immunoassay method, its components and a kit for use in performing the same |

| 5,541,079 | | Monoclonal and polyclonal antibodies and test method for determination of organophosphates (license) |

| 5,547,877 | | Methods for the rapid detection of toxic halogenated hydrocarbons and kits useful in performing the same |

| 5,593,850 | | Monitoring of industrial water quality using monoclonal antibodies to polymers |

| 5,618,681 | | Polyaromatic hydrocarbon (PAH) immunoassay method, its components and a kit for use in performing the same |

| 5,679,574 | | Quantitative test for oils, crude oil, hydrocarbon, or other contaminants in soil and a kit for performing the same |

| 5,691,148 | | A petroleum immunoassay method, its components and a kit for performing the same |

| 5,780,250 | | Immunoassay standards for polyaromatic hydrocarbon detection |

| 5,834,222 | | Polychlorinated Biphenyls (PCB) immunoassay method |

| 5,858,692 | | PCB immunoassay |

| 5,874,216 | | Indirect label assay device for detecting small molecules and method of use thereof |

| 5,891,657 | | Immunoassay standards for volatile analytes with benzene rings |

| 5,919,645 | | Method for the direct determination of the toxicity of particulate solids |

| 6,096,563 | | Dual particle immunoassay method & kit |

| 6,146,903 | | Method for determination of water treatment polymers |

| 6,190,922 | | Substrate supported liquid extraction |

| 6,376,195 | | Indirect label assay device for detecting small molecules and method of use thereof |

| 6,420,530 | | Determination method |

| 6,524,810 | | Method of making bioluminescent assay reagent based on non-viable E. coli |

| 6,663,833 | | Integrated Assay Device and Methods of Production and Use |

| 6,750,328 | | Antibodies for detection of water treatment polymers |

| 6,911,534 | | Method for determination of water treatment polymers |

| 7,189,520 | | Compositions and methods for detecting animal byproduct in feed |

| 7,214,505 | | Cell-based assay for the detection of toxic analytes |

| 7,241,626 | | Isolation and confirmation of analytes from test devices |

| Allowed | | Bacteriophages as Selective Agents |

Employees

As of December 31, 2008, the Company employed 166 full time and three part time employees. The workforce was supplemented by six agency-provided contractors. All of the Company’s employees have executed agreements with the Company agreeing not to disclose the Company’s proprietary information and assigning to the Company all rights to inventions made during their employment. Key personnel have signed agreements prohibiting them from competing with the Company. None of the Company’s employees are covered by collective bargaining agreements. The Company believes that its relations with its employees are good.

Organizational History

Strategic Diagnostics Inc. is a Delaware corporation formed in 1990.

Item 1A. Risk Factors

The following is a discussion of certain significant risk factors that could have an adverse impact on our financial condition, performance and prospects.

Our products must gain market acceptance for us to increase revenue.

Any product that we sell or develop must compete for market acceptance and market share. An important factor will be the timing of market introduction of competitive products. Accordingly, the relative speed with which we and competing companies can develop products, complete any required approval processes, and supply commercial quantities of the products to the market will be an important element of market success.

Significant competitive factors include:

| | | |

| | ● | timing and scope of regulatory approval; |

| | | |

| | ● | product availability; |

| | | |

| | ● | awareness and acceptance of our products and their application; |

| | | |

| | ● | channels to market; |

| | | |

| | ● | marketing and sales capabilities; |

| | | |

| | ● | product attributes relative to their cost; |

| | | |

| | ● | price; and |

| | | |

| | ● | exclusivity, through patent protection or otherwise. |

The Company may have future capital needs and may not be able to obtain additional financing on acceptable terms.

As a result of market conditions, the cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets. Concern about the general stability of the markets has led many lenders and institutional investors to reduce, and in some cases, cease to provide, funding to borrowers. Our ability to utilize our current credit facility and to secure additional financing, as necessary, and to satisfy our financial obligations under indebtedness outstanding from time to time, will depend upon our future operating performance, which is subject to then prevailing general economic and credit market conditions, including the availability of credit generally, and financial, business and other factors, many of which are beyond our control. The prolonged continuation or worsening of current credit market conditions would have a material adverse effect on our ability to secure financing on favorable terms, if at all.

We may be unable to secure additional financing or financing on favorable terms or our operating cash flow may be insufficient to satisfy our financial obligations under indebtedness outstanding from time to time (if any). Furthermore, if financing is not available when needed, or is not available on favorable terms, we may be unable to develop new or enhance our existing products or otherwise take advantage of business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our business, financial condition and results of operations.

The current U.S. and global economic crisis may have a significant adverse effect on our business.

With the recent and significant deterioration of economic conditions in the United States and elsewhere, there has been considerable pressure on demand for the products of many businesses, and the resulting impact on spending has had and may continue to have a material adverse effect on the demand for our products. This decline in demand may have a significant adverse effect on our business.

Our research, development and commercialization efforts may not succeed or our competitors may develop and commercialize more effective or successful diagnostic products.

In order to remain competitive, we must regularly commit substantial resources to research and development and the commercialization of new products and/or antibody services.

The research and development process generally takes a significant amount of time from inception to commercial product launch. This process is conducted in various stages. During each stage there is a substantial risk that we will not achieve our goals on a timely basis, or at all, and we may have to abandon a product or technology platform in which we have invested substantial amounts.

Other companies have products that compete with our products, and also may develop effective and commercially successful products. Our competitors may succeed in developing or commercializing products that are either more effective than ours, or that they market before we market new products that we may develop.

There may be additional competitive products about which we are not aware. If our competitors are able to reach the commercial market before we are, this could have a material adverse effect on our ability to reach the commercial market and sell our products.

Many of the organizations competing with us have substantially greater capital resources, larger research and development staffs and facilities, greater experience in product development and in obtaining regulatory approvals, and greater manufacturing and marketing capabilities than we do. These organizations also compete with us to license proprietary technology.

If we fail to obtain or maintain the regulatory approvals necessary to sell our products, sales could be negatively impacted.

Generally, at this time, our test kits do not require pre-market approval by the FDA or any other regulatory agency. However, agencies such as the EPA, FDA and the FSIS are engaged in testing environmental samples and, together with the AOAC, maintain compilations of official methods for use in testing for environmental contaminants in certain market segments, along with procedures and guidelines for validating new methods. The failure of these programs to accept the Company’s products could have an adverse impact on our business. The environmental legislation and regulations that the Company believes are most applicable to its current business are RCRA, CERCLA, TSCA, FIFRA and the Pure Food and Drug Act. For analysis of water and wastewater, the Safe Drinking Water Act, the Clean Water Act and the NPDES permitting program under the Clean Water Act also will be significant to the Company’s business. As the utility of the Company’s Microtox® products continues to be widely recognized in drinking water security applications, regulations and mandates associated with Homeland Security programs may also have an impact on our business.

Although our products may not be regulated, the industry segments into which products are sold may be regulated, and demand for our products may be driven by these regulations or the lack thereof. These regulations vary from country to country. The regulatory environments in which we compete could change dramatically, which may require us to incur significant costs in obtaining or maintaining regulatory approvals. If we do not obtain or maintain regulatory approvals to enable us to market our products in the United States or elsewhere, or if the approvals are subject to significant restrictions, the demand for our products may be negatively impacted.

If we do not match our product manufacturing capability to customer demand in a cost-effective manner, our product sales may suffer.

Our product sales depend upon, among other things, our ability to manufacture our products in commercial quantities and in a cost-effective manner. To the extent there is a dramatic increase in demand for our products, we may not be able to manufacture the products in a quick and cost-effective manner. Our manufacturing success also depends, in part, on our ability to transition products from research and development into commercial scale manufacturing. If we are not successful in this transition, our ability to produce products may suffer.

Our business could suffer if we cannot attract, retain and motivate skilled personnel.

Our success depends on our continued ability to attract, retain and motivate highly qualified personnel, including our current executive officers and other key employees. If such executive officers or other key employees were to leave and we were unable to obtain adequate replacements, operating results could be adversely affected. In addition, the Company’s growth depends on its ability to attract, retain and motivate skilled employees, and on the ability of its officers and key employees to manage growth successfully.

It is difficult and costly to protect our intellectual property rights, and we cannot ensure the protection of these rights; we may be sued by others for infringing their intellectual property rights.

Our commercial success will depend in part on obtaining patent protection on our products and successfully defending these patents against third party challenges. The patent positions of technology driven companies can be highly uncertain and involve complex legal and factual questions. Accordingly, we cannot predict the breadth of claims allowed in our patents.

Others have filed, and in the future are likely to file, patent applications covering products and technologies that are similar, identical or competitive to ours, or important to our business. We cannot be certain that any patent application owned by a third party will not have priority over patent applications filed or licensed by us, or that we or our licensors will not be involved in interference proceedings before the United States Patent and Trademark Office.

Although no third party claims of infringement are outstanding against the Company, others may hold proprietary rights that will prevent our product candidates from being marketed unless we can obtain a license to those proprietary rights. Any patent related legal action against our collaborators or us claiming damages and seeking to enjoin commercial activities relating to our products and processes could subject us to potential liability for damages and require us to obtain a license to continue to manufacture or market the affected products and processes. We cannot predict whether we would prevail in any of these actions or that any license required under any of these patents would be made available on commercially acceptable terms, if at all. If we become involved in litigation, it could consume substantial managerial and financial resources.

We rely on trade secrets to protect technology in cases where we believe patent protection is not appropriate or obtainable. However, trade secrets are difficult to protect. While we require certain employees and suppliers to enter into confidentiality agreements, we may not be able to protect adequately our trade secrets or other proprietary information. If we cannot maintain the confidentiality of our technology, our ability to receive patent protection or protect our proprietary information may be imperiled.

If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may have to limit or cease commercialization of our products.

The testing and marketing of our products gives rise to an inherent risk of product liability. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit or cease commercialization of our products. We currently carry product liability insurance at a level we believe is commercially reasonable, although there is no assurance that it will be adequate to cover claims that may arise. In certain customer contracts we indemnify third parties for certain product liability claims related to our products. These indemnification obligations may cause us to pay significant sums of money for claims that are covered by these indemnification obligations.

If we do not produce future taxable income, our ability to realize the benefits of our net operating loss carryforwards could be significantly reduced.

As of December 31, 2008, the Company had U.S. federal net operating loss carryforwards, including those acquired in the Company’s past acquisitions, of approximately $15.2 million, which, if not utilized, begin to expire as follows:

| | | | | | |

| | Year | | NOL (in thousands) | |

| | | | | | |

| | 2010 | | $ | 4,478 | |

| | 2017 | | | 760 | |

| | 2018 | | | 1,327 | |

| | 2019 | | | 550 | |

| | 2020 | | | 66 | |

| | 2021 | | | 56 | |

| | 2022 | | | 2,268 | |

| | 2024 | | | 2,033 | |

| | 2025 | | | 3 | |

| | 2026 | | | 1 | |

| | 2027 | | | 1 | |

| | 2028 | | | 3,638 | |

| | Total | | $ | 15,181 | |

The Tax Reform Act of 1986 (the “Act”) limits the annual use of net operating loss and income tax credit carryforwards (after certain ownership changes, as defined by the Act). The application of these limits could significantly restrict our ability to utilize carryforwards. Certain of our total net operating loss carryforwards from 2001 and prior years are subject to limitations on their annual use since a cumulative change in ownership of more than 50% has occurred within a three year period with respect to those net operating loss carryforwards. The Company is currently evaluating recent changes in ownership. If it is determined that an ownership change of more than 50% within a three year period did occur, as determined pursuant to the Internal Revenue Code and Regulations, substantially all of the net operating loss carryforwards and income tax credit carryforwards could be subject to annual limitations on usage. Because U.S. tax laws limit the time period during which these carryforwards may be applied against future taxable income, we may not be able to take full advantage of these attributes for federal and state income tax purposes due to the annual limitation usage.

Based on the best information available to us today, we may not have sufficient future taxable income to utilize the net operating loss carryforwards and income tax credit carryforwards prior to their expiration, and we have established a full valuation allowance against these net operating loss and income tax credit carryforwards for financial reporting purposes.

Our results of operations may fluctuate, which could cause volatility in our stock price.

Our results of operations may fluctuate significantly in the future as a result of a number of factors, many of which are outside of our control. These factors include, but are not limited to:

| | |

| ● | unanticipated events associated with regulatory changes; |

| | |

| ● | general economic conditions; |

| | |

| ● | acceptance of our products; |

| | |

| ● | the success of products competitive with ours; |

| | |

| ● | expenses associated with development and protection of intellectual property matters; |

| | |

| ● | establishing or maintaining commercial scale manufacturing capabilities; |

| | |

| ● | the timing of expenses related to commercialization of new products; |

| | |

| ● | seasonality; and |

| | |

| ● | the timing and success in building our distribution channels. |

The results of our operations may fluctuate significantly from quarter to quarter and may not meet expectations of securities analysts and investors. This may cause our stock price to be volatile.

If we use hazardous materials in a manner that causes injury or violates laws, we may be liable for damages.

Our research and development activities involve the controlled use of potentially harmful biological materials as well as hazardous materials, chemicals and various radioactive compounds. We use radioactivity in conducting biological assays and we use solvents that could be flammable in conducting our research and development activities. We cannot completely eliminate the risk of accidental contamination or injury from the use, storage, handling or disposal of these materials. We do not maintain a separate insurance policy for these types of risks. In the event of contamination or injury, we could be held liable for damages that result, and any liability could exceed our resources. We are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. The cost of compliance with these laws and regulations could be significant.

Our antibody production process utilizes various species of animals that could contract disease or die, interrupting business operations.